| Delaware (State or other jurisdiction of incorporation or organization) |

6770 (Primary Standard Industrial Classification Code Number) |

83-0974996 (I.R.S. Employer Identification Number) |

| Michael J. Aiello Brian Parness Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, NY 10153 (212) 310-8000 |

Thomas D. Logan, CEO Mirion Technologies, Inc. 1218 Menlo Drive Atlanta, GA 30318 (470) 870-2700 |

Alan F. Denenberg Stephen Salmon Bryan M. Quinn Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, CA 94025 (650) 752-2000 |

Valerie Ford Jacob Freshfields Bruckhaus Deringer LLP 601 Lexington Avenue New York, NY 10022 (212) 277 4000 |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| ☒ | Smaller reporting company | |||||

| Emerging growth company | ||||||

| | ||||||||

Title of each class of securities to be registered |

Amount to be registered (1) (2) |

Proposed maximum offering price per unit |

Proposed maximum aggregate offering price (3) |

Amount of registration fee (4) | ||||

| GSAH Class A Common Stock, $0.0001 par value per share |

24,878,039 (2) |

$10.00 | $248,780,390.00 | $27,141.94 (5) | ||||

| | ||||||||

| | ||||||||

| (1) | Based on the maximum number of shares of Class A common stock, par value $0.0001 per share, of the registrant estimated to be issuable in connection with the Business Combination described herein, excluding (1) the portion of such shares issuable to certain funds affiliated with Charterhouse Capital Partners LLP and (2) any shares of Class B common stock, par value $0.0001 per share, issuable to certain members of management of Mirion Technologies (TopCo), Ltd. |

| (2) | Pursuant to Rule 416(a) of the Securities Act, there are also being registered an indeterminable number of additional securities as may be issued to prevent dilution resulting from stock splits, stock dividends or similar transactions. |

| (3) | Computed in accordance with Rule 457 of the Securities Act. |

| (4) | Calculated pursuant to Rule 457 of the Securities Act by calculating the product of (i) the proposed maximum aggregate offering price and (ii) 0.0001091. |

| (5) | The registrant previously paid the registration fee in connection with a prior filing of this Registration Statement. |

• |

a proxy statement/prospectus for the special meeting of the Company, where the GSAH stockholders will vote on, among other things, proposals to (i) approve the Business Combination Agreement and the transactions contemplated thereby, including the Business Combination, (ii) approve the issuance of GSAH Common Stock in connection with (x) the Transactions (including as may be required under the NYSE) and (y) the PIPE Investment; (iii) adopt the Company’s second amended and restated certificate of incorporation (excluding the Class A Common Stock Proposal), (iv) approve, on a non-binding basis, certain governance provisions in the Company’s second amended and restated certificate of incorporation; (v) approve the Mirion Technologies, Inc. Omnibus Incentive Plan; (vi) elect the directors constituting the board of directors of the post-combination company; (vii) approve the increase in the number of authorized shares of GSAH Class A common stock of the Company; and (viii) approve the adjournment of the Special Meeting, if necessary, to permit further solicitation of proxies because there are not sufficient votes to approve and adopt any of the foregoing; and |

• |

a prospectus for the shares of GSAH Class A common stock (other than to certain funds affiliated with Charterhouse Capital Partners LLP and GSAH Class B common stock that certain of Mirion’s shareholders will receive as consideration in the Transactions). |

Sincerely, |

| /s/ Thomas R. Knott |

Thomas R. Knott |

Chief Executive Officer, Chief Financial Officer and Secretary |

• |

Proposal No. 1—Approval of the Business Combination Business Combination Agreement Mirion Co-Investment LP and CCP IX Co-Investment No. 2 LP (collectively, the “Charterhouse Parties |

• |

Proposal No. 2—The NYSE Proposal NYSE NYSE Proposal |

• |

Proposal No. 3—The Charter Proposal New Mirion Charter Charter Proposal |

• |

Proposal No. 4—The Governance Proposals non-binding advisory basis, certain governance provisions in the New Mirion Charter, presented separately in accordance with the United States Securities and Exchange Commission (“SEC Governance Proposal |

• |

Proposal No. 5—The Director Election Proposal Director Election Proposal |

• |

Proposal No. 6—The Incentive Plan Proposal Incentive Plan Incentive Plan Proposal |

• |

Proposal No. 7— Class A Common Stock Proposal |

• |

Proposal No. 8—The Adjournment Proposal |

| event that there are insufficient votes for, or for any other reason in connection with, the approval of one or more of the other proposals at the Special Meeting (we refer to this proposal as the “ Adjournment Proposal |

By Order of the Board of Directors |

| /s/ Thomas R. Knott |

Thomas R. Knott Chief Executive Officer, Chief Financial Officer and Secretary |

Page |

||||

1 |

||||

7 |

||||

10 |

||||

15 |

||||

33 |

||||

70 |

||||

72 |

||||

131 |

||||

155 |

||||

163 |

||||

209 |

||||

211 |

||||

213 |

||||

215 |

||||

216 |

||||

223 |

||||

224 |

||||

225 |

||||

236 |

||||

240 |

||||

264 |

||||

269 |

||||

295 |

||||

297 |

||||

305 |

||||

312 |

||||

324 |

||||

326 |

||||

332 |

||||

343 |

||||

344 |

||||

344 |

||||

345 |

||||

345 |

||||

345 |

||||

346 |

||||

F-1 |

||||

| Annex A-1 |

A-1 | |||

| Annex A-2 |

A-89 | |||

| Annex B |

B-1 | |||

| Annex C |

C-1 | |||

| Annex D |

D-1 | |||

| Annex E |

E-1 | |||

| Annex F |

F-1 | |||

| Annex G |

G-1 | |||

| Annex H |

H-1 | |||

| Annex I |

I-1 |

| • | “ A Ordinary Shares |

| • | “ Amended and Restated Registration Rights Agreement |

| • | “ Amended and Restated Sponsor Agreement |

| • | “ ASC 480 480-10-S99-3A |

| • | “ ASC 815 |

| • | “ Available Closing Cash |

| • | “ B Ordinary Shares |

| • | “ Backstop Agreement |

| • | “ Board Board of Directors GSAH Board |

| • | “ Business Combination |

| • | “ Business Combination Agreement |

| • | “ Cash Consideration Cash Consideration |

| • | “ Cash Shortfall |

| • | “ Charterhouse Demand Period 90-day period beginning on the 181st day after the Closing to exercise a single demand right; |

| • | “ Charterhouse Director Nomination Agreement |

| • | “ Charterhouse Holders Charterhouse Parties Co-Investment LP and CCP IX Co-Investment No. 2 LP (each acting by its general partner, Charterhouse General Partners (IX) Limited); |

| • | “ Closing |

| • | “ Closing Date |

| • | “ Code |

| • | “ Common Stock |

| • | “ Company GSAH we us our |

| • | “ Condition Precedent Proposal |

| • | “COVID-19” are to SARS-CoV-2 COVID-19, and any evolutions thereof or any other epidemics, pandemics or disease outbreaks; |

| • | “ Demanding Holders |

| • | “ DGCL |

| • | “ DTC |

| • | “ DWAC |

| • | “ Exchange Act |

| • | “ Existing Mirion Articles |

| • | “ Existing Mirion Shares |

| • | “ Exit |

| • | “ Exit Bonuses |

| • | “ FATCA |

| • | “ FDI |

| • | “ fiscal 2021 |

| • | “ fiscal 2020 |

| • | “ FCPA |

| • | “ founder shares |

| • | “ Freed Employment Agreement |

| • | “ FTC |

| • | “ GAAP |

| • | “ Goldman Sachs |

| • | “ GSAH |

| • | “ GSAH Certificate of Incorporation |

| • | “ GSAH Class A common stock |

| • | “ GSAH Class B common stock |

| • | “ GSAH common stock |

| • | “ GSAM |

| • | “ GSAM Holdings |

| • | “ GS Director Nomination Agreement |

| • | “ GS Employee Participation |

| • | “ GS Holders |

| • | “ HSR Act |

| • | “ Incentive Plan |

| • | “ Initial Stockholders |

| • | “ Insiders |

| • | “ IntermediateCo |

| • | “ IntermediateCo Charter |

| • | “ IntermediateCo Class A common stock |

| • | “ IntermediateCo Class B common stock |

| • | “ Investment Company Act |

| • | “ IPO initial public offering |

| • | “ JOBS Act |

| • | “ Joining Sellers |

| • | “ Logan Employment Agreement |

| • | “ management management team |

| • | “Management Notes” |

| • | “ maximum redemption scenario pro-rata allocation along with the proceeds from the PIPE Investment are sufficient to satisfy the Minimum Cash Condition. Based on the amount of $750.1 million in our trust account as of June 30, 2021, including accrued dividends, and taking into account the anticipated gross proceeds of approximately $900.0 million from the PIPE Investment, approximately 36.8 million shares of GSAH Class A common stock may be redeemed and still enable GSAH to have sufficient cash to satisfy the cash closing conditions in the Business Combination Agreement; |

| • | “ Ministry |

| • | “ Minimum Cash Condition |

| • | “ Mirion Mirion TopCo |

| • | “ Mirion Articles Amendment |

| • | “ Mirion Credit Agreement |

| • | “ Mirion Debt Refinancin |

| • | “ Monitoring Act |

| • | “ New Mirion |

| • | “ New Mirion Board |

| • | “ New Mirion Bylaws |

| • | “ New Mirion Charter |

| • | “ New Mirion Class A common stock |

| • | “ New Mirion Class B common stock |

| • | “ New Mirion common stock |

| • | “ New Mirion Organizational Documents |

| • | “ NYSE |

| • | “ no redemption scenario |

| • | “ Non-Reliance Periods8-K filed July 9, 2020, Quarterly Report on Form 10-Q filed November 13, 2020 and Annual Report on Form 10-K filed on March 31, 2021, respectively; |

| • | “ NPP |

| • | “ Option Agreement |

| • | “ PIPE Investment PIPE Investment |

| • | “ PIPE Investors accredited investors |

| • | “ PIPE Shares |

| • | “PIK Notes” |

| • | “ post-business combination company |

| • | “ primary capital |

| • | “ private placement warrants |

| • | “ public shares |

| • | “ public stockholders public stockholder |

| • | “ public warrants |

| • | “ redemption |

| • | “ RRA Parties |

| • | “ Sarbanes-Oxley Act |

| • | “ Schopfer Employment Agreement |

| • | “ Schopfer Severance Period |

| • | “ SEC |

| • | “ Securities Act |

| • | “ Sellers |

| • | “Shareholder Notes” |

| • | “ Special Meeting |

| • | “ Sponsor |

| • | “ Subscription Agreements |

| • | “ Supporting Mirion Holders |

| • | “ Total Consideration |

| • | “ Transaction Payments |

| • | “ Transactions |

| • | “ transfer agent Continental |

| • | “ trust account |

| • | “ trustee |

| • | “ UKBA |

| • | “ UKTopco |

| • | “ units one-third of one redeemable warrant to acquire one share of GSAH Class A common stock, that were initially offered and sold by GSAH in its IPO (less the number of units that have been separated into the underlying public shares and underlying warrants upon the request of the holder thereof); |

| • | “ warrants |

| • | GSAH’s ability to complete the Business Combination or, if GSAH does not complete the Business Combination, any other initial business combination; |

| • | satisfaction or waiver (if applicable) of the conditions to the Business Combination, including, among other things: the satisfaction or waiver of certain customary closing conditions, including, among others, the Minimum Cash Condition, receipt of approvals from governmental authorities in certain foreign jurisdictions (or expiration of applicable waiting periods in those jurisdictions), the existence of no material adverse effect at the Company or Mirion and receipt of certain stockholder approvals contemplated by this proxy statement/prospectus; |

| • | the occurrence of any other event, change or other circumstances that could give rise to the termination of the Business Combination Agreement; |

| • | the projected financial information, anticipated growth rate, and market opportunity of Mirion; |

| • | the ability to obtain or maintain the listing of the post-business combination company’s Class A common stock, warrants and units on the NYSE following the Business Combination; |

| • | our public securities’ potential liquidity and trading; |

| • | our ability to consummate the PIPE Investment or raise financing in the future; |

| • | our success in retaining or recruiting, or changes required in, our officers, key employees or directors following the completion of the Business Combination; |

| • | members of GSAH’s management team allocating their time to other businesses and potentially having conflicts of interest with GSAH’s business or in approving the Business Combination; |

| • | the use of proceeds not held in the trust account or available to us from interest income on the trust account balance; |

| • | factors relating to the business, operations and financial performance of Mirion and its subsidiaries, including: |

| • | global economic weakness and uncertainty; |

| • | risks relating to the continued growth of Mirion’s customers’ markets; |

| • | failure to meet or anticipate technology changes; |

| • | the unpredictability of Mirion’s future operational results; |

| • | disruption of Mirion’s customers’ orders or Mirion’s customers’ markets; |

| • | less favorable contractual terms with large customers; |

| • | risks associated with governmental contracts; |

| • | failure to mitigate risks associated with long-term fixed price contracts; |

| • | risks associated with information technology disruption or security; |

| • | risks associated with the implementation and enhancement of information systems; |

| • | failure to properly manage Mirion’s supply chain or difficulties with third-party manufacturers; |

| • | competition in the infrastructure technologies industry; |

| • | failure to realize the expected benefit from any rationalization and improvement efforts; |

| • | disruption of, or changes in, Mirion’s independent sales representatives, distributors and original equipment manufacturers; |

| • | failure to obtain performance and other guarantees from financial institutions; |

| • | failure to realize sales expected from Mirion’s backlog of orders and contracts; |

| • | changes to law, including tax law; |

| • | ongoing tax audits; |

| • | risks associated with future legislation and regulation of Mirion’s customers’ markets both in the United States and abroad; |

| • | costs or liabilities associated with product liability; |

| • | Mirion’s ability to attract, train and retain key members of its leadership team and other qualified personnel; |

| • | the adequacy of Mirion’s insurance coverage; |

| • | a failure to benefit from future acquisitions; |

| • | failure to realize the value of goodwill and intangible assets; |

| • | the global scope of Mirion’s operations; |

| • | risks associated with Mirion’s sales and operations in emerging markets; |

| • | exposure to fluctuations in foreign currency exchange rates; |

| • | Mirion’s ability to comply with various laws and regulations and the costs associated with legal compliance; |

| • | adverse outcomes to any legal claims and proceedings filed by or against us; |

| • | Mirion’s ability to protect or enforce its proprietary rights on which its business depends; |

| • | third party intellectual property infringement claims; |

| • | liabilities associated with environmental, health and safety matters; |

| • | risks associated with Mirion’s limited history of operating as an independent company; |

| • | potential net losses in future periods; and |

| • | other factors detailed under the section entitled “Risk Factors.” |

| • | GS Acquisition Holdings Corp II, a Delaware corporation, (the “ Company GSAH |

| • | On July 2, 2020, we completed our IPO of 75,000,000 units, including 5,000,000 units issued pursuant to the partial exercise by the underwriters of their option to purchase additional units in full, at a price of $10.00 per unit, generating proceeds to us of $750,000,000 before underwriting discounts and expenses. Each unit consisted of one share of GSAH Class A common stock and one-quarter of one redeemable warrant, with each whole warrant exercisable for one share of GSAH Class A common stock at a price of $11.50 per share. Simultaneously with the closing of the IPO, we closed the private placement of an aggregate of 8,500,000 warrants, each exercisable to purchase one share of GSAH Class A common stock at an exercise price of $11.50 per share, to the Sponsor, at a price of $2.00 per private placement warrant, generating proceeds of $17,000,000. Each warrant sold in the IPO and the private placement will become exercisable 30 days after the completion of our initial business combination, and will expire at 5:00 p.m., New York City time, five years after the completion of our initial business combination or earlier upon redemption or liquidation. Subject to the terms and conditions contained in the warrant agreement governing the warrants (the “warrant agreement Description of New Mirion Securities. |

| • | Mirion provides products, services and software that allow its customers to safely leverage the power of ionizing radiation for the greater good of humanity. Mirion’s solutions have critical applications in the medical, nuclear energy and defense markets, as well as in laboratories and scientific research, analysis and space exploration. Many of Mirion’s markets are characterized by the need to meet rigorous regulatory standards, design qualifications and operating requirements. Throughout Mirion’s history, Mirion has successfully leveraged the strength of its expertise in ionizing radiation to continually drive innovation and expand the commercial applications of its core technology competencies. Through its facilities in 12 countries, Mirion supplies its solutions in the Americas, Europe, Africa, the Middle East and Asia Pacific regions. |

| • | On June 17, 2021, the Company, Mirion, for the limited purpose set forth therein, the Charterhouse Parties, for the limited purpose set forth therein, the other Supporting Mirion Holders and, for the limited purpose set forth therein, the other holders of Existing Mirion Shares from time to time becoming a party thereto by executing a Joinder Agreement, entered into the Business Combination Agreement, a copy of which is attached to this proxy statement/prospectus as Annex A. |

| • | Pursuant to the terms of the Business Combination Agreement, the parties thereto will enter into a business combination transaction pursuant to which Mirion will combine with a subsidiary of the Company. |

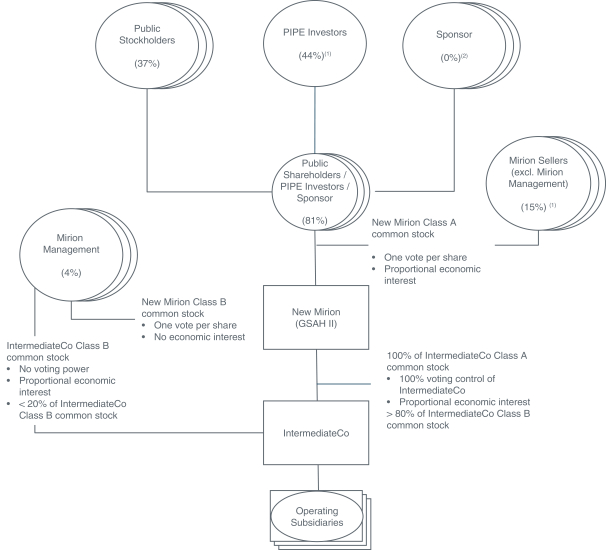

| • | The proposed Business Combination will establish the Company as the corporate parent of Mirion. At the Closing, in order to implement a structure similar to that of an “Up-C,” the Company will establish a Delaware corporation (“IntermediateCo |

| have a redemption right for such shares to be settled, at the option of the Company, with (i) shares of GSAH Class A common stock (on a one-for-one |

| • | In accordance with the terms of the Business Combination Agreement, and subject to the adjustments set forth therein, the consideration to be paid in connection with the Business Combination is $1,700,000,000 and will be paid in a combination of equity and cash consideration. The cash consideration will be an amount equal to $1,310,000,000; provided, that if the Minimum Cash Condition is not met, and Mirion and the Charterhouse Parties elect to waive the Minimum Cash Condition, then the Cash Consideration will be equal to $1,310,000,000 less the amount by which $1,310,000,000 exceeds the Available Closing Cash. In exchange for the A Ordinary Shares, the B Ordinary Shares and certain loan notes due 2026 issued by Mirion Technologies (HoldingSub1), Ltd, each Seller may elect to receive cash or equity consideration or a combination thereof, which equity consideration shall be in the form of either shares of GSAH Class A common stock or shares of GSAH Class B common stock combined with shares of IntermediateCo Class B common stock that will be majority owned by the Company. The Available Closing Cash will be an amount equal to (i) the amount of funds contained in the Company’s trust account (after reduction for the aggregate amount of payments required to be made in connection with any valid stockholder redemptions), plus (ii) the aggregate amount of cash that has been funded to and remains with the Company pursuant to the Subscription Agreements as of immediately prior to the Closing, plus (iii) the amounts delivered pursuant to the Mirion Debt Refinancing, plus (iv) the cash and cash equivalents of Mirion and its subsidiaries on a consolidated basis as of the Closing Date, plus (v) the proceeds, if any, from the sale by the Company to GSAM Holdings of shares of GSAH Class A common stock, pursuant to the Backstop Agreement, less (vi) the total amount required to be paid to fully satisfy all obligations related to Mirion’s credit agreement as of the Closing Date, less (vii) certain transaction expenses, less (viii) $50,000,000. |

| • | Concurrently with the execution of the Business Combination Agreement, the Company entered into the Subscription Agreements with the PIPE Investors, pursuant to, and on the terms and subject to the conditions of which, the PIPE Investors have collectively subscribed for 90,000,000 shares of GSAH Class A common stock for an aggregate purchase price equal to $900,000,000. The PIPE Investment will be consummated substantially concurrently with the Closing. |

| • | the PIPE Investors (including GSAM Holdings, assuming no syndication of its subscription) will own approximately 44% of the outstanding GSAH common stock; |

| • | our public stockholders will own approximately 37% of the outstanding GSAH common stock; |

| • | the Sellers, other than current members of Mirion management, will own approximately 15% of outstanding GSAH common stock; |

| • | Sellers who are current members of Mirion management will own approximately 4% of the outstanding GSAH common stock; and |

| • | the GS Sponsor will own 0% of the outstanding GSAH common stock (assuming, for this purpose, that none of the founder shares’ performance vesting conditions have been satisfied at the time of completion of the Business Combination). Holders of the founder shares are entitled to vote such founder shares and receive dividends and other distributions with respect to such |

| founder shares prior to vesting, but such dividends and other distributions with respect to unvested founder shares will be set aside by the Company and shall only be paid to the holders of the founder shares upon the vesting of such founder shares. |

| • | In evaluating the Business Combination, our Board considered a number of factors, including Mirion’s highly attractive business model, Mirion’s deep relationships with a diverse customer base, Mirion’s strong recurring revenue, Mirion’s experienced and proven management team, Mirion’s strong balance sheet, other alternatives, terms of the Business Combination Agreement, continued ownership by sellers and the role of the independent directors. For more information about our decision-making process, as well as other factors, uncertainties and risks considered, see the section entitled “ Proposal No. 1—Approval of the Business Combination— GSAH’s Board of Directors’ Reasons for the Approval of the Business Combination. |

| • | Pursuant to the GSAH Certificate of Incorporation, a public stockholder may request that we redeem all or a portion of such stockholder’s public shares for cash if the Business Combination is consummated. Holders of units must elect to separate the units into the underlying public shares and warrants prior to exercising redemption rights with respect to the public shares. If holders hold their units through a broker, bank or other nominee, holders must notify their broker, bank or other nominee that they elect to separate the units into the underlying public shares and warrants, or if a holder holds units registered in its own name, the holder must contact Continental Stock Transfer & Trust Company, N.A., our transfer agent, directly and instruct it to do so. Public stockholders may elect to redeem their public shares even if they vote “FOR” the Business Combination Proposal or any other proposal. If the Business Combination is not consummated, the public shares will be returned to the respective holder, broker, bank or other nominee. If the Business Combination is consummated, and if a public stockholder properly exercises its right to redeem all or a portion of the public shares that it holds, including by timely delivering its shares to our transfer agent, we will redeem such public shares for a per-share price, payable in cash, equal to the pro rata portion of the trust account, calculated as of two business days prior to the consummation of the Business Combination, including interest (net of taxes payable). For illustrative purposes, as of [●], 2021, this would have amounted to approximately $10.25 per outstanding public share. If a public stockholder properly exercises its redemption rights in full, then it will be electing to exchange all of its public shares for cash and will not own any public shares of the post-business combination company. Holders of our outstanding warrants do not have redemption rights in connection with the Business Combination. Please see the section entitled “Special Meeting of GSAH Stockholders—Redemption Rights |

| • | In addition to voting on the proposal to approve and adopt the Business Combination Agreement and approve the Business Combination (we refer to this proposal as the “ Business Combination Proposal |

| • | a proposal to approve, for purposes of complying with applicable listing rules of NYSE, (a) the issuance of more than 20% of the Company’s outstanding Class A common stock in connection with the Business Combination, including the PIPE Investment, and (b) the issuance of shares of the Company’s Class A common stock and the Company’s Class B common stock to a Related Party (as defined in Section 312.03 of the NYSE’s Listed Company Manual) in connection with the Business Combination (we refer to this proposal as the “ NYSE Proposal |

| • | a proposal relating to adopting the New Mirion Charter (other than the Class A Common Stock Proposal), which, if approved, would take effect upon the closing of the Business Combination (we refer to this proposal as the “ Charter Proposal |

| • | a proposal to approve, on a non-binding basis, certain governance provisions in the New Mirion Charter, in accordance with SEC requirements (we refer to this proposal as the “Governance Proposal |

| • | a proposal to elect nine directors to serve, effective upon the closing of the Business Combination, with each director on our Board having a term that expires at the post-business combination company’s annual meeting of stockholders in 2022, and until their respective successors are duly elected and qualified, or until their earlier resignation, removal or death (we refer to this proposal as the “ Director Election Proposal |

| • | a proposal to approve the Incentive Plan, including the authorization of the initial share reserve under the Incentive Plan (we refer to this proposal as the “ Incentive Plan Proposal |

| • | a proposal to increase the total number of authorized shares of GSAH Class A common stock from 500,000,000 to 2,000,000,000; and |

| • | a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event there are insufficient votes for, or for any other reason in connection with, the approval of one or more of the other proposals at the Special Meeting (we refer to this proposal as the “ Adjournment Proposal |

| • | Upon consummation of the Business Combination, our Board anticipates increasing its initial size from five directors to nine directors, with each director on our Board having a term that expires at the post-business combination company’s annual meeting of stockholders in 2022, and until their respective successors are duly elected and qualified, or until their earlier resignation, removal or death. Please see the sections entitled “ Proposal No. 5—The Director Election Proposal Management of New Mirion Following the Business Combination |

| • | Unless waived by the parties to the Business Combination Agreement, and subject to applicable law, the closing of the Business Combination is subject to a number of conditions set forth in the Business Combination Agreement including, among others, (i) the Company having at least an aggregate of $1.310 billion in cash available at Closing; (ii) the registration statement becoming effective in accordance with the Securities Act; (iii) customary bringdown conditions; (iv) no material adverse effect of either the Company or Mirion having occurred; and (v) to the extent requested by the Company, Mirion having issued a notice of suspension or termination of business with certain partners. There can be no assurance that the parties to the Business Combination Agreement would waive any such provision of the Business Combination Agreement. For more information about the closing conditions to the Business Combination, please see the section entitled “ Proposal No. 1—Approval of the Business Combination—The Business Combination Agreement—Conditions to Closing of the Business Combination |

| • | The proposed Business Combination, including our business following the Business Combination, involves numerous risks. For more information about these risks, please see the section entitled “ Risk Factors. |

| • | When you consider the recommendation of our Board in favor of approval of the Business Combination Proposal and the other proposals included herein, you should keep in mind that the Sponsor and our directors have interests in such proposal that are different from, or in addition to, those of our stockholders and warrant holders generally. Our Board was aware of and considered these interests, among other matters, in evaluating and negotiating the Business Combination and transaction agreements and in recommending to our stockholders that they vote in favor of the proposals presented at the Special Meeting, including the Business Combination Proposal. GSAH stockholders should take these interests into account in deciding whether to approve the proposals presented at the Special Meeting, including the Business Combination Proposal. See “ Proposal No. 1—Approval of the Business Combination—Interests of Goldman Sachs Parties and Certain Other Persons in the Business Combination. |

Q: |

Why am I receiving this proxy statement/prospectus? |

| A: | Our stockholders are being asked to consider and vote upon, among other proposals, a proposal to approve and adopt the Business Combination Agreement and approve the Business Combination. The Business Combination Agreement provides for, among other things, the parties thereto entering into a business combination transaction pursuant to which Mirion will combine with a subsidiary of the Company. |

Q: |

When and where is the Special Meeting? |

| A: | The Special Meeting will be held via live webcast on [●], 2021 at [●]:00 a.m. [Eastern Time], or at such other time, on such other date and at such other place to which the meeting may be adjourned or postponed. The special meeting can be accessed by visiting [●], where you will be able to listen to the meeting live and vote during the meeting. |

Q: |

What are the specific proposals on which I am being asked to vote at the Special Meeting? |

| A: | In addition to voting on a proposal to approve and adopt the Business Combination Agreement and approve the Business Combination, at the Special Meeting, GSAH is asking holders of its common stock to consider and vote upon: |

| • | a proposal to approve, for purposes of complying with applicable listing rules of the NYSE, (a) the issuance of more than 20% of the Company’s outstanding Class A common stock in connection with the Business Combination, including the PIPE Investment, and (b) the issuance of shares of the Company’s Class A common stock and the Company’s Class B common stock to a Related Party (as defined in Section 312.03 of the NYSE’s Listed Company Manual) in connection with the Business Combination; |

| • | a proposal relating to adopting the New Mirion Charter, which, if approved, would take effect upon the closing of the Business Combination; |

| • | a proposal to approve, on a non-binding basis, certain governance provisions in the New Mirion Charter; |

| • | a proposal to elect nine directors to serve, effective upon the closing of the Business Combination, with each director on our Board having a term that expires at the post-business combination company’s annual meeting of stockholders in 2022, and until their respective successors are duly elected and qualified, or until their earlier resignation, removal or death; |

| • | a proposal to approve the Incentive Plan, including the authorization of the initial share reserve under the Incentive Plan; and |

| • | a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event there are insufficient votes for, or for any other reason in connection with, the approval of one or more of the other proposals at the Special Meeting. |

Q: |

Are the proposals conditioned on one another? |

| A: | Yes. The Business Combination is conditioned on the approval of each of the Condition Precedent Proposals at the Special Meeting. Each of the Condition Precedent Proposals is cross-conditioned on the approval of each other. The Adjournment Proposal is not conditioned upon the approval of any other proposal. |

Q: |

Why is GSAH proposing the Business Combination? |

| A: | GSAH was organized to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. |

Q: |

What will Mirion stockholders receive in return for GSAH’s acquisition of all of the outstanding equity interests of Mirion? |

| A: | As a result of and upon the consummation of the Business Combination, among other things, all outstanding equity interests of Mirion will be cancelled in exchange for the right to receive the Transaction Consideration. |

Q: |

What equity stake will current stockholders of GSAH and the PIPE Investors, including GSAM Holdings, hold in us after the closing? |

| A: | As of June 30, 2021, there were 93,750,000 shares of GSAH common stock outstanding, which includes the 18,750,000 founder shares held by the GS Sponsor and the 75,000,000 public shares. As of June 30, 2021, there are outstanding warrants to purchase an aggregate of 27,250,000 shares of GSAH common stock, which includes 8,500,000 private placement warrants held by the Sponsor and approximately 18,750,000 public warrants. Therefore, as of June 30, 2021 (without giving effect to the Business Combination), our fully diluted share capital would be approximately 121,000,000 shares of GSAH common stock. |

| • | the PIPE Investors (including GSAM Holdings, assuming no syndication of its subscription) will own approximately 44% of the outstanding GSAH common stock; |

| • | our public stockholders will own approximately 37% of the outstanding GSAH common stock; |

| • | the Sellers, other than current members of Mirion management, will own approximately 15% of outstanding GSAH common stock; |

| • | Sellers who are current members of Mirion management will own approximately 4% of the outstanding GSAH common stock; and |

| • | the GS Sponsor will own 0% of the outstanding GSAH common stock (assuming, for this purpose, that none of the founder shares’ performance vesting conditions have been satisfied at the time of completion of the Business Combination). Holders of the founder shares are entitled to vote such founder shares and receive dividends and other distributions with respect to such founder shares prior to vesting, but such dividends and other distributions with respect to unvested founder shares will be set aside by the Company and shall only be paid to the holders of the founder shares upon the vesting of such founder shares. |

| Pro Forma Class A Share Ownership in the Company | ||||||||||||||||

| No Redemptions | Maximum Redemptions (1) |

|||||||||||||||

| Number of Shares (millions) |

Percentage of Outstanding Shares |

Number of Shares (millions) |

Percentage of Outstanding Shares |

|||||||||||||

| PIPE Investors (2) |

90.0 | 44 | % | 90.0 | 50 | % | ||||||||||

| Public Stockholders |

75.0 | 37 | % | 38.2 | 21 | % | ||||||||||

| Mirion Sellers (excluding Mirion Management (3) |

30.0 | 15 | % | 30.0 | 17 | % | ||||||||||

| GS Sponsor (4) |

— | 0 | % | — | 0 | % | ||||||||||

| GS Backstop (5) |

— | 0 | % | 12.5 | 7 | % | ||||||||||

| Pro Forma Class B Share Ownership in the Company | ||||||||||||||||

| No Redemptions | Maximum Redemptions | |||||||||||||||

| Number of Shares (millions) |

Percentage of Outstanding Shares |

Number of Shares (millions) |

Percentage of Outstanding Shares |

|||||||||||||

| Mirion Management (3)(4) |

9.0 | 4 | % | 9.0 | 5 | % | ||||||||||

| (1) | Assumes that approximately 36.8 million public shares (being our estimate of the maximum number of public shares that could be redeemed in connection with the Business Combination in order to satisfy the related Minimum Cash Condition contained in the Business Combination Agreement) are redeemed in connection with the Business Combination. |

| (2) | Includes 20 million GSAH Class A shares subscribed for by GSAM Holdings, assuming no syndication of its subscription. |

| (3) | Mirion Sellers have the option of receiving either shares of GSAH Class A common stock or Paired Interests at closing. We have assumed that all Mirion Sellers with the exception of members of Mirion management will elect to receive GSAH Class A common stock. |

| (4) | Excludes 18,750,000 founder shares that convert from shares of GSAH Class B common stock to shares of GSAH Class A common stock upon the closing of the Business Combination and are subject to certain vesting and forfeiture conditions described above. |

| (5) | Neither the Backstop Agreement nor the Option Agreement is exercisable in the no redemptions scenario because there will not be a Cash Shortfall. The maximum redemptions scenario assumes there is a Cash Shortfall such that GSAM Holdings will purchase 12,500,000 shares of GSAH Class A common stock from GSAH under the Backstop Agreement. If GSAH exercises its rights under the Backstop Agreement for less than 12,500,000 shares of GSAH Class A common stock, GSAM Holdings has the right, but not the obligation, under the Option Agreement to purchase from the Mirion Sellers party to the Option Agreement up to the difference of 12,500,000 shares of GSAH Class A common stock and the amount of shares purchased under the Backstop Agreement. The Option Agreement is not exercisable in the maximum redemptions scenario because this scenario assumes the Backstop Agreement is exercised in full and the Option Agreement is only exercisable if the Backstop Agreement is exercised for less than 12,500,000 shares of GSAH Class A common stock. See “ Summary of the Proxy Statement/Prospectus—Related Agreements—Backstop Agreement Summary of the Proxy Statement/Prospectus—Related Agreements—Option Agreement |

Q: |

What will happen in the Business Combination? |

| A: | Pursuant to the Business Combination Agreement, among other things and subject to the terms and conditions contained therein, the parties thereto will enter into a business combination transaction, pursuant to which Mirion will combine with a subsidiary of the Company as described below. |

Q: |

Following the Business Combination, will the Company’s securities continue to trade on a stock exchange? |

| A: | Yes. We intend to apply to continue the listing of GSAH Class A common stock and warrants on the NYSE under the symbols “MIR” and “MIR.WS,” respectively, upon the closing of the Business Combination, though such securities may not be listed, for instance if there is not a sufficient number of round lot holders. At the closing of the Business Combination, each unit will separate into its components consisting of one share of GSAH Class A common stock and one-fourth of one warrant. GSAH is currently awaiting preliminary listing approval from NYSE in order to submit its listing application and believes the combined entity will satisfy all criteria for listing upon completion of the Business Combination. As such, GSAH expects to obtain NYSE listing approval prior to the Closing notwithstanding, GSAH can provide no assurances that NYSE will approve the listing application. NYSE’s determination may not be known at the time stockholders are asked to vote on the Business Combination and the closing is not conditioned on NYSE’s approval of the continued listing, but the closing of the PIPE Investment is conditioned on the PIPE Shares being listed on the NYSE. |

Q: |

How has the announcement of the Business Combination affected the trading price of GSAH Class A common stock? |

| A: | On June 16, 2021, the trading date before the public announcement of the Business Combination, GSAH’s public units, GSAH Class A common stock and warrants closed at $10.43, $10.00 and $1.81, respectively. On September 2, 2021, the most recent practicable date prior to the date of this proxy statement/prospectus, the Company’s public units, Class A common stock and warrants closed at $10.36, $9.96 and $1.65, respectively. |

Q: |

Is the Business Combination the first step in a “going private” transaction? |

| A: | No. The Company does not intend for the Business Combination to be the first step in a “going private” transaction. One of the primary purposes of the Business Combination is to provide a platform for Mirion to access the U.S. public markets. |

Q: |

Will the management of Mirion change in the Business Combination? |

| A: | We anticipate that all of the executive officers of Mirion will remain with the post-business combination company. |

Q: |

Will the Company obtain new financing in connection with the Business Combination? |

| A: | Yes. The PIPE Investors have agreed to purchase in the aggregate approximately 90,000,000 shares of GSAH Class A common stock, for approximately $900,000,000 of gross proceeds, in the PIPE Investment. The PIPE Investment is contingent upon, among other things, stockholder approval of the Business Combination Proposal and the closing of the Business Combination. See “ Proposal No. 1—Approval of the Business Combination—Related Agreements—Subscription Agreements Description of New Mirion Indebtedness |

Q: |

What conditions must be satisfied to complete the Business Combination? |

| A: | The Business Combination Agreement is subject to the satisfaction or waiver of certain customary closing conditions, including, among others, (i) the Minimum Cash Condition; (ii) the registration statement becoming effective in accordance with the Securities Act; (iii) customary bringdown conditions; (iv) no material adverse effect having occurred; and (v) to the extent requested by the Company, Mirion having issued a notice of suspension or termination of business with certain partners. Any of the conditions to the obligations of GSAH, Mirion and the Sellers may be waived in writing by mutual agreement of GSAH, Mirion and the Charterhouse Parties. Any of the conditions to the obligations of GSAH may only be waived in writing by GSAH. In addition, any of the conditions to the obligations of Mirion and the Sellers may only be waived in writing by mutual agreement of Mirion and the Charterhouse Parties. For more information about conditions to the consummation of the Business Combination, see “ Proposal No. 1—Approval of the Business Combination—The Business Combination Agreement |

Q: |

When do you expect the Business Combination to be completed? |

| A: | It is currently expected that the Business Combination will be consummated in the second half of 2021. This date depends, among other things, on the approval of the proposals to be put to GSAH’s stockholders at the Special Meeting and certain regulatory approvals. However, such meeting could be adjourned if the Adjournment Proposal is adopted by GSAH’s Stockholders at the Special Meeting and GSAH elects to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of |

| proxies in the event there are insufficient votes for, or for any other reason in connection with, the approval of one or more of the other proposals at the Special Meeting. For a description of the conditions for the completion of the Business Combination, see “ Proposal No. 1—Approval of the Business Combination—The Business Combination Agreement |

Q: |

What happens if the Business Combination is not consummated? |

| A: | If GSAH is not able to complete the Business Combination with Mirion by July 2, 2022 (or if such date is extended at a duly called meeting of stockholders, such later date) and is not able to complete another business combination by such date, GSAH will (1) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but no more than ten business days thereafter redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account including interest but less taxes payable (less up to $100,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidating distributions, if any), and (iii) as promptly as reasonably possible following such redemption, subject to the approval of GSAH’s remaining stockholders and GSAH’s Board, dissolve and liquidate, subject in each case to GSAH’s obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law. |

Q: |

How many votes do I have at the Special Meeting? |

| A: | Our stockholders are entitled to one vote on each proposal presented at the Special Meeting for each share of our common stock held of record as of [●], 2021 the record date for the Special Meeting. As of the close of business on the record date, there were [●] outstanding shares of our common stock. |

Q: |

Did GSAH’s Board obtain a third-party valuation or fairness opinion in determining whether or not to proceed with the Business Combination? |

| A: | No. Neither the GSAH Board nor any committee thereof is required to obtain an opinion from an independent investment banking or accounting firm that the price that we are paying for Mirion is fair to us from a financial point of view. Neither the GSAH Board nor any committee thereof obtained a third party valuation in connection with the Business Combination. In analyzing the Business Combination, the GSAH Board conducted due diligence on Mirion and reviewed comparisons of selected financial data of Mirion with certain of its peers in the industry and the financial terms set forth in the Business Combination Agreement. Based on the foregoing, the GSAH Board concluded that the Business Combination was in the best interest of GSAH’s stockholders. |

Q: |

Do I have redemption rights? |

| A: | If you are a holder of public shares, you have the right to request that we redeem all or a portion of your public shares for cash provided that you follow the procedures and deadlines described elsewhere in this proxy statement/prospectus. Public stockholders may elect to redeem all or a portion of the public shares held by them regardless of if or how they vote in respect of the Business Combination Proposal or any other proposal set forth herein. If you wish to exercise your redemption rights, see the answer to the next question: “ How do I exercise my redemption rights? |

Q: |

How do I exercise my redemption rights? |

| A: | If you are a public stockholder and wish to exercise your right to redeem the public shares, you must: |

| (1) | (a) hold public shares, or (b) if you hold public shares through units, elect to separate your units into the underlying public shares and warrants prior to exercising your redemption rights with respect to the public shares; |

| (2) | prior to 5:00 p.m. Eastern Time on [●], 2021 (two business days before the scheduled date of the Special Meeting) submit a written request to Continental Trust & Transfer Company N.A., our transfer agent, that we redeem all or a portion of your public shares for cash, affirmatively certifying in your request if you “ARE” or “ARE NOT” acting in concert or as a “group” (as defined in Section 13d-3 of the Exchange Act) with any other stockholder with respect to shares of our common stock at the following address: |

| (3) | deliver your public shares either physically or electronically through the Deposit Withdrawal at Custodian (“ DWAC DTC |

Q: |

If I am a holder of units, can I exercise redemption rights with respect to my units? |

| A: | No. Holders of outstanding units must elect to separate the units into the underlying public shares and warrants prior to exercising redemption rights with respect to the public shares. If you hold your units through a broker, bank or other nominee, you must notify your broker, bank or other nominee that you elect to separate the units into the underlying public shares and warrants, or if you hold units registered in your own name, you must contact our transfer agent directly and instruct them to do so. You are requested to cause your public shares to be separated and delivered to our transfer agent, by 5:00 p.m., Eastern Time, on [●], 2021 (two business days before the scheduled date of the Special Meeting) in order to exercise your redemption rights with respect to your public shares. |

Q: |

What are the U.S. federal income tax consequences of exercising my redemption rights? |

| A: | The U.S. federal income tax consequences to a stockholder of exercising its redemption rights will depend on the particular facts and circumstances. Please see the section entitled “ Proposal No. 1—Approval of the Business Combination—United States Federal Income Tax Considerations to Stockholders Exercising Redemption Rights |

Q: |

Can the Sponsor or our officer and directors redeem their founder shares in connection with consummation of the Business Combination? |

| A: | No. The Sponsor and GS Employee Participation have each agreed to waive their redemption rights with respect to all of the founder shares in connection with the consummation of the Business Combination. The founder shares will be excluded from the pro rata calculation used to determine the per-share redemption price. |

Q: |

Is there a limit on the number of shares I may redeem? |

| A: | Yes. A public stockholder, together with any affiliate of such public stockholder or any other person with whom such public stockholder is acting in concert or as a “group” (as defined in Section 13(d)(3) of the Exchange Act), will be restricted from redeeming its public shares with respect to more than an aggregate of 15% of the public shares. Accordingly, if a public stockholder, alone or acting in concert or as a group, seeks to redeem more than 15% of the public shares, then any such shares in excess of that 15% limit would not be redeemed for cash. However, in no event is your ability to vote all of your shares (including those shares held by you or by a “group” in excess of 15% of the shares sold in our IPO) for or against our Business Combination restricted. |

Q: |

Is there a limit on the total number of shares that may be redeemed? |

| A: | Yes. Pursuant to the GSAH Certificate of Incorporation, in no event will we redeem public shares in an amount that would cause our net tangible assets (as determined in accordance with Rule 3a51-1(g)(1) of the Exchange Act) to be less than $5,000,001. In such case, we would not proceed with the redemption of our public shares and the Business Combination, and instead may search for an alternate initial business combination. |

Q: |

Will how I vote affect my ability to exercise redemption rights? |

| A: | No. Stockholders may elect to redeem all or a portion of the public shares held by them regardless of if or how they vote in respect of the Business Combination Proposal or any other proposal set forth herein. As a result, the Business Combination Agreement can be approved by stockholders who will redeem their shares and no longer remain stockholders, leaving stockholders who choose not to redeem their shares holding shares in a company with a potentially less-liquid trading market, fewer stockholders, potentially less cash and the potential inability to meet the listing standards of the NYSE. |

Q: |

If I am a Company warrant holder, can I exercise redemption rights with respect to my warrants? |

| A: | No. The holders of our warrants have no redemption rights with respect to our warrants. |

Q: |

Do I have appraisal rights in connection with the proposed Business Combination? |

| A: | No. Neither our stockholders nor our warrant holders have appraisal rights in connection with the Business Combination under the DGCL. |

Q: |

What happens to the funds deposited in the trust account after consummation of the Business Combination? |

| A: | Following the closing of the IPO, an amount equal to $750 million ($10.00 per unit) of the net proceeds from the IPO and the sale of the private placement warrants was placed in the trust account. As of the record date, [●], 2021, funds in the trust account totaled $[●], including $[●] of accrued dividends. These funds will remain in the trust account, except for the withdrawal of interest to pay taxes, if any, until the earliest of (1) the completion of a business combination (including the closing of the Business Combination), (2) the redemption of any public shares properly tendered in connection with a stockholder vote to amend the |

| GSAH Certificate of Incorporation to modify the substance or timing of GSAH’s obligation to redeem 100% of its public shares if it does not complete its initial business combination by July 2, 2022; and (3) the redemption of all of the public shares if GSAH is unable to complete its initial business combination by July 2, 2022 (or if such date is extended at a duly called meeting of stockholders, such later date), subject to applicable law. |

Q: |

What do I need to do now? |

| A: | You are urged to read this proxy statement/prospectus, including the Annexes and the accompanying financial statements of the Company and Mirion, carefully and in its entirety and to consider how the Business Combination will affect you as a stockholder or warrant holder. Our stockholders should then vote as soon as possible in accordance with the instructions provided in this proxy statement/prospectus and on the enclosed proxy card. |

Q: |

How do I vote? |

| A: | If you are a holder of record of shares of our common stock on the record date for the Special Meeting, you may vote during the Special Meeting via the meeting website or by submitting a proxy for the Special Meeting. You may submit your proxy by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed postage-paid envelope. If you hold your shares in “street name,” which means your shares are held of record by a broker, bank or other nominee, you should contact your broker, bank or other nominee to ensure that votes related to the shares you beneficially own are properly counted. In this regard, you must provide the broker, bank or other nominee with instructions on how to vote your shares or, if you wish to attend the Special Meeting and vote via the special meeting website, obtain a valid proxy from your broker, bank or other nominee. |

Q: |

If my shares are held in “street name,” will my broker, bank or other nominee automatically vote my shares for me? |

| A: | No. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial holder” of the shares held for you in what is known as “street name.” If this is the case, this proxy statement/prospectus may have been forwarded to you by your broker, bank or other nominee, or its agent, and you may need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker, bank or other nominee as to how to vote your shares. Under the rules of various national and regional securities exchanges, your broker, bank or other nominee cannot vote your shares with respect to non-discretionary matters unless you provide instructions on how to vote in accordance with the information and procedures provided to you by your broker, bank or other nominee. We believe all of the proposals presented to our stockholders will be considered non-discretionary and therefore your broker, bank or other nominee will not vote your shares without your instruction. Your broker, bank or other nominee can vote your shares only if you provide instructions on how to vote. As the beneficial holder, you have the right to direct your broker, bank or other nominee as to how to vote your shares and you should instruct your broker, bank or other nominee to vote your shares in accordance with directions you provide. If you do not provide voting instructions to your broker, bank or other nominee on a particular proposal on which your broker, bank or other nominee does not have discretionary authority to vote, your shares will not be voted on that proposal. This is called a “broker non-vote.” An abstention will be counted towards the quorum requirement for each of the proposals |

| presented at the Special Meeting but a broker non-vote will not. In connection with (i) the Business Combination Proposal and the Adjournment Proposal, abstentions and broker non-votes will have no effect, (ii) the NYSE Proposal and the Incentive Plan Proposal, abstentions will be counted as a vote cast at the Special Meeting and will have the same effect as a vote “AGAINST” the proposal but broker non-votes will have no effect and (iii) the Charter Proposal, abstentions and broker non-votes will have the same effect as voting “AGAINST” the proposal. |

Q: |

Who is entitled to vote at the Special Meeting? |

| A: | GSAH has fixed [●], 2021 as the record date for the Special Meeting. If you were a stockholder of GSAH at the close of business on the record date, you are entitled to vote on matters that come before the Special Meeting. However, a stockholder may only vote his, her or its shares if he, she or it is present at the Special Meeting by attendance via the virtual meeting website or is represented by proxy at the Special Meeting. |

Q: |

What happens if I sell my shares of common stock before the Special Meeting? |

| A: | The record date for the Special Meeting is earlier than the date of the Special Meeting and earlier than the date that the Business Combination is expected to be completed. If you transfer your shares of common stock after the applicable record date, but before the Special Meeting, unless you grant a proxy to the transferee, you will retain your right to vote at the Special Meeting with respect to such shares but the transferee, and not you, will have the ability to redeem such shares (if time permits). |

Q: |

What constitutes a quorum at the Special Meeting? |

| A: | A majority of the outstanding shares of our common stock entitled to vote as of the record date at the Special Meeting must be present by attendance via the virtual meeting website or represented by proxy, at the Special Meeting to constitute a quorum and in order to conduct business at the Special Meeting. Abstentions will be counted as present for purposes of determining a quorum but broker non-votes will not. Our Initial Stockholders, who currently own approximately 20% of our outstanding shares of common stock, will count towards this quorum. In the absence of a quorum, the chairman of the Special Meeting has power to adjourn the Special Meeting. Based on the number of outstanding shares of our common stock as of the record date for the Special Meeting, [●] shares of our common stock will be required to achieve a quorum at the Special Meeting. |

Q: |

What vote is required to approve each proposal at the Special Meeting? |

| A: | The following votes are required for each proposal at the Special Meeting: |

| • | The approval of each of the Business Combination Proposal, the Governance Proposal, the Incentive Plan Proposal and the Adjournment Proposal requires the affirmative vote of a majority of the votes cast by holders of our outstanding shares of common stock represented by attendance via the virtual meeting website or by proxy and entitled to vote thereon at the Special Meeting. Generally, only votes “FOR” or “AGAINST” are considered to be votes cast. Accordingly, a Company stockholder’s failure to vote by proxy or to vote during the Special Meeting, as well as an abstention from voting and a broker non-vote with regard to the such proposals, will have no effect on such proposals. Abstentions will be counted in connection with the determination of whether a valid quorum is established but will have no effect on such proposals. |

| • | NYSE Proposal: non-vote with regard to the NYSE Proposal will have no effect on the NYSE Proposal. The NYSE considers abstentions to be votes cast and included in the number of shares of which a majority is required to vote in favor. |

| Accordingly, abstentions will have the same effect as a vote “AGAINST” the NYSE Proposal. |

| • | Charter Proposal: non-vote with regard to the Charter Proposal will have the same effect as a vote “AGAINST” the Charter Proposal. |

| • | Director Election Proposal: non-votes will have no effect on the election of directors. |

| • | Class A Common Stock Proposal: |

Q: |

Why is GSAH proposing the governance proposal? |

| A: | As required by applicable SEC guidance, GSAH is requesting that its stockholders vote upon, on a non-binding advisory basis, a proposal to approve certain governance provisions contained in the New Mirion Charter that materially affect stockholder rights. This separate vote is not otherwise required by Delaware law separate and apart from the Charter Proposal, but pursuant to SEC guidance, GSAH is required to submit these provisions to its stockholders separately for approval. However, the stockholder vote regarding this proposal is an advisory vote, and is not binding on GSAH and the Board (separate and apart from the approval of the Charter Proposal). Furthermore, the Business Combination is not conditioned on the separate approval of the governance proposal (separate and apart from approval of the Charter Proposal). Please see the section entitled “Proposal No. 4—The Governance Proposal |

Q: |

What are the recommendations of GSAH’s Board? |

| A: | GSAH’s Board believes that the Business Combination Proposal and the other proposals to be presented at the Special Meeting are in the best interest of GSAH’s stockholders and unanimously recommends that its stockholders vote “FOR” the Business Combination Proposal, “FOR” the NYSE Proposal, “FOR” the Charter Proposal, “FOR” the Governance Proposal, “FOR” each of the director nominees set forth in the Director Election Proposal, “FOR” the Incentive Plan Proposal, “FOR” the Class A Common Stock Proposal and “FOR” the Adjournment Proposal, in each case, if presented to the Special Meeting. |

Q: |

How do the Initial Stockholders intend to vote their shares? |

| A: | The Sponsor and GS Employee Participation have each agreed to, among other things, vote in favor of the Business Combination Proposal and the other proposals described herein to be presented at the Special Meeting (other than the Class A Common Stock Proposal). As of the date of this proxy statement/prospectus, the Initial Stockholders own approximately 20% of the outstanding shares of our common stock. |

Q: |

May I change my vote after I have mailed my signed proxy card? |

| A: | Yes. GSAH stockholders may send a later-dated, signed proxy card to GSAH’s Secretary at GSAH’s address set forth below so that it is received by GSAH’s Secretary prior to the vote at the Special Meeting (which is scheduled to take place on [●], 2021) or attend the Special Meeting via the virtual Special Meeting website and vote. GSAH stockholders also may revoke their proxy by sending a notice of revocation to GSAH’s Secretary, which must be received by GSAH’s Secretary prior to the vote at the Special Meeting. However, if your shares are held in “street name” by your broker, bank or other nominee, you must contact your broker, bank or other nominee to change your vote. |

Q: |

If I am not going to attend the Special Meeting via the virtual Special Meeting website, should I return my proxy card instead? |

| A: | Yes. Whether you plan to attend the Special Meeting or not, please read the enclosed proxy statement/prospectus carefully and in its entirety, and vote your shares by completing, signing, dating and returning the enclosed proxy card in the postage-paid envelope provided. |

Q: |

What will happen if I sign and return my proxy card without indicating how I wish to vote? |

| A: | If you sign and return your proxy card without indicating how you wish to vote, your proxy will be voted “FOR” each of the proposals presented at the Special Meeting. |

Q: |

What happens if I fail to take any action with respect to the Special Meeting? |

| A: | If you fail to take any action with respect to the Special Meeting and the Business Combination is approved by stockholders and the Business Combination is consummated, you will become a stockholder or warrant holder of the post-business combination company, as applicable. If you fail to take any action with respect to the Special Meeting and the Business Combination is not approved, you will remain a stockholder or warrant holder of GSAH, as applicable. However, if you fail to vote with respect to the Special Meeting, you will nonetheless be able to elect to redeem your public shares in connection with the Business Combination (if time permits). |

Q: |

What should I do with my stock certificates, warrant certificates or unit certificates? |

| A: | Our stockholders who exercise their redemption rights must deliver (either physically or electronically) their stock certificates to our transfer agent prior to the Special Meeting. |

Q: |

What should I do if I receive more than one set of voting materials? |

| A: | GSAH stockholders may receive more than one set of voting materials, including multiple copies of this proxy statement/prospectus and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a holder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return each proxy card and voting instruction card that you receive in order to cast a vote with respect to all of your shares of our common stock. |

Q: |

Who will solicit and pay the cost of soliciting proxies for the Special Meeting? |

| A: | We will pay the cost of soliciting proxies for the Special Meeting. GSAH has engaged Innisfree M&A Incorporated (“ Innisfree out-of-pocket |

Q: |

Who can help answer my questions? |

| A: | If you have questions about the proposals or the Business Combination or if you need additional copies of the proxy statement/prospectus or the enclosed proxy card, you should contact: |

| (1) | Includes 20,000,000 GSAH Class A shares subscribed for by GSAM Holdings, assuming no syndication of its subscription. Neither the Backstop Agreement nor the Option Agreement is exercisable in the no redemptions scenario as shown above because there will be not be a Cash Shortfall. See “ —Related Agreements—Backstop Agreement —Related Agreements—Option Agreement |

| (2) | Excludes 18,750,000 founder shares that convert from shares of GSAH Class B common stock to shares of GSAH Class A common stock upon the closing of the Business Combination and are subject to certain vesting and forfeiture conditions described elsewhere in this prospectus. |

| • | No provision of law, and no judgment, injunction, order or decree of any applicable governmental authority, will prohibit the consummation of the Closing. |

| • | Any applicable waiting period under the HSR Act (and any extensions thereof or any timing agreements, understandings or commitments obtained by request or other action of the United States Federal Trade Commission or the Antitrust Division of the United States Department of Justice, as applicable) will have expired or been terminated. |

| • | The parties to the Business Combination Agreement will have received specified pre-Closing authorizations, consents, clearances, waivers and approvals of certain governmental authorities in connection with the execution, delivery and performance of the Business Combination Agreement and the transactions contemplated thereunder. |

| • | The Registration Statement will have become effective in accordance with the Securities Act, no stop order shall have been issued by the SEC with respect to the Registration Statement and no action seeking such stop order shall have been threatened or initiated. |

| • | The required vote of GSAH’s stockholders to approve the Business Combination Proposal, the NYSE Proposal, the Charter Proposal, the Director Election Proposal, the Incentive Plan Proposal, and the Adjournment Proposal shall have been duly obtained in accordance with the DGCL, the GSAH Certificate of Incorporation and bylaws, and the rules and regulations of the NYSE. |

| • | GSAH will have at least $5,000,001 of net tangible assets following the exercise of any redemption rights by the Company’s holders of Class A common stock in accordance with the GSAH Certificate of Incorporation and bylaws. |

| • | Mirion and the Sellers will have performed in all material respects all of their respective obligations under the Business Combination Agreement required to be performed thereby on or prior to the Closing Date. |

| • | (i) The representations and warranties of Mirion contained in Section 4.09(b) of the Business Combination Agreement must be true and correct in all respects as of the date of the Business Combination Agreement and as of the Closing Date, as if made at and as of the Closing Date; (ii) the fundamental representations and warranties of Mirion (i.e., representations related to organization and qualification, capitalization, authority and brokers) must be true and correct in all but de minimis respects (without giving effect to any limitations as to “materiality” or “Material Adverse Effect” or any similar limitation set forth therein) as of the date of the Business Combination Agreement and as of the Closing Date, as if made at and as of the Closing Date (except to the extent such representations and warranties expressly relate to an earlier date, and in such case, shall be so true and correct in all but de minimis respects at and as of such earlier date); and (iii) each other representation and warranty of Mirion contained in Article 4 of the Business Combination Agreement must be true and correct (without giving effect to any limitations as to “materiality” or “Material Adverse Effect” or any similar limitation set forth therein) as of the date of the Business Combination Agreement and as of the Closing Date, as if made at and as of the Closing Date (except to the extent such representations and |

| warranties expressly relate to an earlier date, and in such case, shall be true and correct at and as of such earlier date), except, in the case of this clause (iii), where the failure to be so true and correct, individually or in the aggregate, has not had, and would not reasonably be expected to have, a Material Adverse Effect. |

| • | The representations and warranties of the Sellers contained in Article 3 of the Business Combination Agreement must be true and correct (without giving effect to any limitations as to “materiality” or “Material Adverse Effect” or any similar limitation set forth therein) as of the date of the Business Combination Agreement and as of the Closing Date, as if made at and as of such date (except to the extent such representations and warranties expressly relate to an earlier date, and in such case, shall be true and correct at and as of such earlier date), except where the failure to be so true and correct, individually or in the aggregate, has not had, and would not reasonably be expected to have, a Seller Material Adverse Effect. |

| • | GSAH will have received a certificate signed by an officer of Mirion, dated the Closing Date, certifying that the conditions specified in the three immediately preceding bullet points have been fulfilled. |

| • | A majority of the holders of the A Ordinary Shares and the B Ordinary Shares of Mirion will have delivered the drag along notice, which they have agreed to do within five business days of the effectiveness of this registration statement. |

| • | No Material Adverse Effect will have occurred since the date of the Business Combination Agreement. |

| • | Mirion and its subsidiaries will have issued notice of suspension or termination of any contracts to certain sales channel partners and otherwise ceased doing business with such sales channel partners as requested in writing by GSAH. |

| • | GSAH will have performed in all material respects all of its obligations under the Business Combination Agreement required to be performed by it on or prior to the Closing Date. |

| • | (i) The representations and warranties of GSAH contained in Section 5.09(b) of the Business Combination Agreement must be true and correct in all respects as of the Closing Date, as if made at and as of such date; (ii) the fundamental representations and warranties of GSAH (i.e., representations related to organization and qualification, capitalization, authority and brokers) must be true and correct (without giving effect to any limitations as to “materiality” or “material adverse effect” or any similar limitation set forth therein) in all but de minimis respects as of the Closing Date, as if made at and as of such date (except to the extent such representations and warranties expressly relate to an earlier date, and in such case, shall be so true and correct in all but de minimis respects at and as of such earlier date); and (iii) each other representation and warranty of GSAH contained in Article 5 of the Business Combination Agreement shall be true and correct (without giving effect to any limitations as to “materiality” or “material adverse effect” or any similar limitation set forth therein) as of the Closing Date, as if made at and as of such date (except to the extent such representations and warranties expressly relate to an earlier date, and in such case, shall be true and correct at and as of such earlier date), except, in the case of this clause (iii), where the failure to be so true and correct has not had, and would not reasonably be expected to have, a SPAC Material Adverse Effect. |

| • | Mirion will have received a certificate signed by an officer of GSAH, dated the Closing Date, certifying that the conditions specified in the two immediately preceding bullets have been fulfilled. |

| • | The Available Closing Cash will not be less than $1,310,000,000. |

| • | Since the date of the Business Combination Agreement, there will have been no development, effect, change, circumstance, event or occurrence, that, individually or in the aggregate, has had, or would reasonably be expected to have a SPAC Material Adverse Effect. |

| • | Mirion has agreed to, and to cause its subsidiaries to, from the date of the Business Combination Agreement until the earlier of the Closing or the termination of the Business Combination Agreement in accordance with its terms, operate in the ordinary course of business consistent with past practice. |

| • | Subject to certain exceptions, from the date of the Business Combination Agreement until the earlier of the Closing or the termination of the Business Combination Agreement in accordance with its terms, Mirion will not, and will cause its subsidiaries not to: |

| • | change or amend its organizational documents; |

| • | make, declare, set aside, establish a record date for or pay any dividend or distribution; |