| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

Large accelerated filer |

☐ |

Accelerated filer |

☐ | |||

☒ |

Emerging growth company |

|||||

U.S. GAAP ☐ |

Other ☐ | |||||||

by the International Accounting Standards Board |

☒ |

Page |

||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

| 114 | ||||

| 114 | ||||

| 115 | ||||

| 115 | ||||

| 116 | ||||

| 123 | ||||

| 126 | ||||

| 126 | ||||

| 127 | ||||

| 128 | ||||

| 128 | ||||

| 134 | ||||

| 146 | ||||

| 148 | ||||

| 148 | ||||

| 148 | ||||

| 148 | ||||

| 150 | ||||

| 151 | ||||

| 151 | ||||

| 151 | ||||

| 152 | ||||

| 152 | ||||

| 152 | ||||

| 152 | ||||

| 152 | ||||

| 152 | ||||

| 152 | ||||

| 152 | ||||

| 152 | ||||

| 152 | ||||

| 153 | ||||

| 153 | ||||

Page |

||||

| 153 | ||||

| 153 | ||||

| 173 | ||||

| 173 | ||||

| 173 | ||||

| 174 | ||||

| 174 | ||||

| 175 | ||||

| 175 | ||||

| 175 | ||||

| 175 | ||||

| 175 | ||||

| 176 | ||||

| 176 | ||||

| 176 | ||||

| 176 | ||||

| 176 | ||||

| 176 | ||||

| 176 | ||||

| 177 | ||||

| 177 | ||||

| 177 | ||||

| 177 | ||||

| 178 | ||||

| 178 | ||||

| 178 | ||||

| 178 | ||||

| 178 | ||||

| 179 | ||||

| 179 | ||||

| 180 | ||||

| 180 | ||||

| 180 | ||||

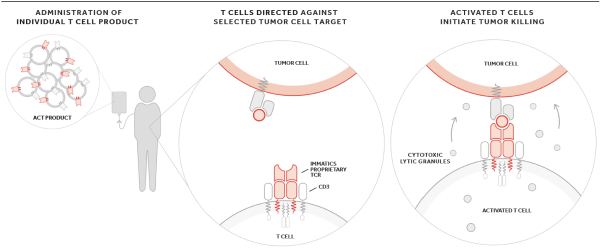

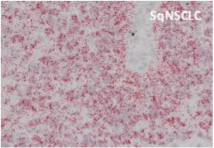

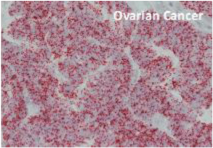

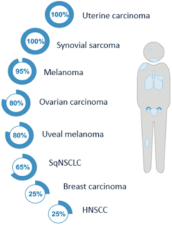

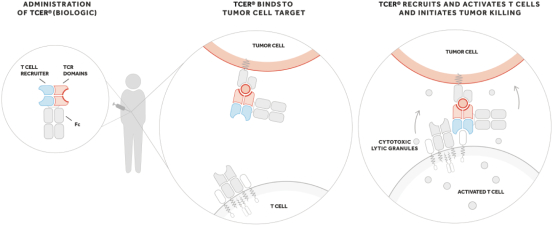

| • | the commencement, timing, progress and results of our research and development programs, preclinical studies and clinical trials, including our Adoptive Cell Therapy (“ACT”) and bispecific T cell engaging receptor (“TCR Bispecific”) trials; |

| • | the timing of investigational new drug application (“IND”) or clinical trial application (“CTA”), biologics license application (“BLA”), Marketing Authorization Application (“MAA”) and other regulatory submissions with the U.S. Food and Drug Administration (“FDA”), the European Medicines Agency (“EMA”) or comparable regulatory authorities; |

| • | the proposed clinical development pathway for our product candidates and the acceptability of the results of clinical trials for regulatory approval of such product candidates by the FDA, the EMA or comparable regulatory authorities; |

| • | assumptions relating to the identification of serious adverse, undesirable or unacceptable side effects related to our product candidates; |

| • | the timing of and our ability to obtain and maintain regulatory approval for our product candidates; |

| • | the potential advantages and differentiated profile of ACT and TCER Bispecific product candidates compared to existing therapies for the applicable indications; |

| • | our ability to successfully manufacture or have manufactured drug product for clinical trials and commercialization; |

| • | our expectations regarding the size of the patient populations amenable to treatment with our product candidates, if approved; |

| • | assumptions relating to the rate and degree of market acceptance of any approved product candidates; |

| • | the pricing and reimbursement of our product candidates; |

| • | our ability to identify and develop additional product candidates; |

| • | the ability of our competitors to discover, develop or commercialize competing products before or more successfully than we do; |

| • | our competitive position and the development of and projections relating to our competitors or our industry; |

| • | our estimates of our expenses, ongoing losses, future revenue, capital requirements and our needs for or ability to obtain additional financing; |

| • | our ability to raise capital when needed in order to continue our research and development programs or commercialization efforts; |

| • | our ability to identify and successfully enter into strategic collaborations or licensing opportunities in the future, and our assumptions regarding any potential revenue that we may generate thereunder; |

| • | our ability to obtain, maintain, protect and enforce intellectual property protection for our product candidates, and the scope of such protection; |

| • | our ability to operate our business without infringing, misappropriating or otherwise violating the intellectual property rights of third parties; |

| • | our expectations regarding the impact of the COVID-19 pandemic; |

| • | our expectations regarding geo-political actions and conflict, war and terrorism, including the recent conflict between Russia and Ukraine and resulting sanctions, retaliatory measures, changes in the availability and price of various materials and effects on global financial markets; |

| • | our ability to attract and retain qualified key management and technical personnel; and |

| • | our expectations regarding the time during which we will be an emerging growth company under the Jumpstart our Business Startups Act of 2012 (“JOBS Act”) and a foreign private issuer. |

ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE |

ITEM 3. |

KEY INFORMATION |

| • | We have a history of operating losses and expect to continue to incur losses and will need additional capital to fund our operations and complete the development and commercialization of our product candidates. |

| • | Our product candidates represent novel approaches to the treatment of diseases, and there are many uncertainties regarding the development of our product candidates. |

| • | Our current product candidates are in various stages of development, and it is possible that none of our product candidates will ever become commercial products. |

| • | Delays in the commencement and completion of clinical trials could increase costs and delay or prevent regulatory approval and commercialization of our product candidates. |

| • | Clinical trials are expensive, time-consuming and difficult to design and implement, and our clinical trial costs may be higher than for more conventional therapeutic technologies or drug products. |

| • | Our product candidates may cause undesirable side effects or have other properties that may delay or prevent their development or regulatory approval or limit their commercial potential. |

| • | The regulatory review and approval processes of the FDA, the EMA and comparable regulatory authorities are lengthy, time-consuming and uncertain. If we are unable to obtain, or if there are delays in obtaining, regulatory approval for our product candidates, we will not be able to commercialize our product candidates and our ability to generate revenue will be materially impaired. |

| • | The regulatory landscape that will govern our product candidates is still evolving. Regulations relating to more established gene therapy and cell therapy products and TCR Bispecific products are still developing, and changes in regulatory requirements could result in delays or discontinuation of development of our product candidates or unexpected costs in obtaining regulatory approval. |

| • | Our product candidates are complex and difficult to manufacture. We could experience manufacturing problems that result in delays in our development or commercialization programs. |

| • | We rely on third parties to conduct preclinical studies and/or clinical trials of our product candidates. If they do not properly and successfully perform their obligations to us, we may not be able to obtain regulatory approvals for our product candidates. |

| • | We rely on third parties for the manufacture of our product candidates. Our dependence on these third parties may impair the clinical advancement and commercialization of our product candidates. |

| • | We face substantial competition, which may result in others discovering, developing or commercializing products, treatment methods and/or technologies before or more successfully than we do. |

| • | progress, timing, scope and costs of our clinical trials, including the ability to timely initiate clinical sites, enroll subjects and manufacture ACT and TCR Bispecific product candidates for our ongoing, planned and potential future clinical trials; |

| • | time and cost to conduct IND- or CTA-enabling studies for our preclinical programs; |

| • | time and costs required to perform research and development to identify and characterize new product candidates from our research programs; |

| • | time and cost necessary to obtain regulatory authorizations and approvals that may be required by regulatory authorities to execute clinical trials or commercialize our products; |

| • | our ability to successfully commercialize our product candidates, if approved; |

| • | our ability to have clinical and commercial products successfully manufactured consistent with FDA, the EMA and comparable regulatory authorities’ regulations; |

| • | amount of sales and other revenues from product candidates that we may commercialize, if any, including the selling prices for such potential products and the availability of adequate third-party coverage and reimbursement for patients; |

| • | sales and marketing costs associated with commercializing our products, if approved, including the cost and timing of building our marketing and sales capabilities; |

| • | cost of building, staffing and validating our manufacturing processes, which may include capital expenditure; |

| • | terms and timing of our current and any potential future collaborations, licensing or other arrangements that we have established or may establish; |

| • | cash requirements of any future acquisitions or the development of other product candidates; |

| • | costs of operating as a public company; |

| • | time and cost necessary to respond to technological, regulatory, political and market developments; |

| • | costs of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights; and |

| • | costs associated with any potential business or product acquisitions, strategic collaborations, licensing agreements or other arrangements that we may establish. |

| • | negative preclinical data; |

| • | delays in receiving the required regulatory clearance from the appropriate regulatory authorities to commence clinical trials or amend clinical trial protocols, including any objections to our INDs or CTAs or protocol amendments from regulatory authorities; |

| • | delays in reaching, or a failure to reach, a consensus with regulatory authorities on study design; |

| • | delays in reaching, or a failure to reach, an agreement on acceptable terms with prospective independent clinical investigators, CROs and clinical trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different investigators, CROs and clinical trial sites; |

| • | difficulties in obtaining required Institutional Review Board (“IRB”) or ethics committee approval at each clinical trial site; |

| • | challenges in recruiting and enrolling suitable patients that meet the study criteria to participate in clinical trials; |

| • | the inability to enroll a sufficient number of patients in clinical trials to ensure adequate statistical power to detect statistically significant treatment effects; |

| • | imposition of a clinical hold by regulatory authorities or IRBs for any reason, including safety concerns and non-compliance with regulatory requirements; |

| • | failure by independent clinical investigators, CROs, other third parties or us to adhere to clinical trial requirements; |

| • | failure to perform in accordance with the FDA’s good clinical practices (“GCP”) or applicable regulatory guidelines in other jurisdictions; |

| • | the inability to manufacture adequate quantities of a product candidate or other materials necessary in accordance with current Good Manufacturing Practices (“cGMPs”) and current Good Tissue Practices (“cGTPs”) to conduct clinical trials; |

| • | lower than anticipated patient retention rates; |

| • | difficulties in maintaining contact with patients after treatment, resulting in incomplete data; |

| • | ambiguous or negative interim results; |

| • | our independent clinical investigators, CROs or clinical trial sites failing to comply with regulatory requirements or meet their contractual obligations to us in a timely manner, or at all, deviating from the protocol or dropping out of a clinical trial; |

| • | unforeseen safety issues, including occurrence of adverse events associated with the product candidate that are viewed to outweigh the product candidate’s potential benefits; |

| • | changes in regulatory requirements and guidance that require amending or submitting new clinical protocols; |

| • | lack of adequate funding to continue the clinical trial; or |

| • | delays and disruptions as a result of the COVID-19 pandemic. |

| • | the size and nature of the patient population; |

| • | the severity and incidence of the disease under investigation; |

| • | the eligibility criteria for the study in question, including any misjudgment of, and resultant adjustment to, the appropriate ranges applicable to the exclusion and inclusion criteria; |

| • | the size of the study population required for analysis of the trial’s primary endpoints; |

| • | the ability to recruit clinical trial investigators with the appropriate competencies and experience; |

| • | the number of clinical trial sites and the proximity of prospective patients to those sites; |

| • | the design of the trial and the complexity for patients and clinical sites; |

| • | the nature, severity and frequency of adverse side effects associated with our product candidates; |

| • | the screening procedures and the rate of patients failing screening procedures; |

| • | the ability to provide appropriate screening assays; |

| • | the risk that patients’ general health conditions do not allow the conduct of study/screening procedures (for example, tumor biopsy, or leukapheresis) or application of lymphodepletion regimen; |

| • | the ability to manufacture patient products appropriately (for example, at a sufficient high dose, or with sufficiently active T cells); |

| • | the efforts to facilitate timely enrollment in clinical trials and the effectiveness of recruiting publicity; |

| • | the patient referral practices of physicians within the same hospital as well as within other hospitals or private practices; |

| • | competing clinical trials for similar therapies, other new therapeutics, new combination treatments, new medicinal products; |

| • | approval of new indications for existing therapies or approval of new therapies in general or changes in standard of care; |

| • | clinicians’ and patients’ perceptions as to the potential advantages and side effects of the product candidate being studied in relation to other available therapies, including any new drugs or treatments that may be approved or become standard of care for the indications we are investigating; |

| • | the ability to obtain and maintain patient consents; and |

| • | inability of clinical sites to enroll patients as healthcare capacities are required to cope with natural disasters, epidemics or other health system emergencies, such as the COVID-19 pandemic. |

| • | we may encounter delays or difficulties in enrolling patients for our clinical trials due to a negative perception of our product candidates’ safety and tolerability profile; |

| • | we and/or regulatory authorities may temporarily or permanently put our clinical trials on hold; |

| • | we may be unable to obtain regulatory approval for our product candidates; |

| • | regulatory authorities may withdraw or limit their approvals of our product candidates; |

| • | regulatory authorities may require the addition of labeling statements, such as a contraindication, boxed warnings or additional warnings; |

| • | the FDA may require development of a Risk Evaluation and Mitigation Strategy with Elements to Assure Safe Use as a condition of approval; |

| • | we may decide to remove our product candidates from the marketplace; |

| • | we may be subject to regulatory investigations and government enforcement actions; |

| • | we could be sued and held liable for harm caused to patients, including as a result of hospital errors; and |

| • | our reputation may suffer. |

| • | the FDA, the EMA or comparable regulatory authorities may disagree with the number, design or implementation of our clinical trials; |

| • | the population studied in the clinical trial may not be considered sufficiently broad or representative to assure safety in the full population for which we seek approval; |

| • | the FDA, the EMA or comparable regulatory authorities may disagree with our interpretation of data from preclinical studies or clinical trials; |

| • | the data collected from clinical trials of our product candidates may not meet the level of statistical or clinical significance required by the FDA, the EMA or comparable regulatory authorities or may otherwise not be sufficient to support the submission of a BLA, MAA or other submission or to obtain regulatory approval in the United States, the European Union or elsewhere; |

| • | the FDA, the EMA or comparable regulatory authorities may not accept data generated by our preclinical service providers and clinical trial sites; |

| • | the FDA, the EMA or comparable regulatory authorities may require us to conduct additional preclinical studies and clinical trials; |

| • | the FDA, the EMA or comparable regulatory authorities may fail to approve the manufacturing processes, test procedures and specifications applicable to the manufacture of our product candidates, the facilities of third-party manufacturers with which we contract for clinical or commercial supplies may fail to maintain a compliance status acceptable to the FDA, the EMA or comparable regulatory authorities or the EMA or comparable regulatory authorities may fail to approve facilities of third-party manufacturers with which we contract for clinical and commercial supplies; |

| • | we or any third-party service providers may be unable to demonstrate compliance with cGMPs and cGTPs to the satisfaction of the FDA, the EMA or comparable regulatory authorities, which could result in delays in regulatory approval or require us to withdraw or recall products and interrupt commercial supply of our products; |

| • | the approval policies or regulations of the FDA, the EMA or comparable regulatory authorities may change in a manner rendering our clinical data insufficient for approval; or |

| • | political factors surrounding the approval process, such as government shutdowns and political instability. |

| • | additional foreign regulatory requirements; |

| • | foreign exchange fluctuations; |

| • | compliance with foreign manufacturing, customs, shipment and storage requirements; |

| • | an inability to negotiate the terms of clinical trial agreements at arms’ length in countries where a template agreement for such trials is required by law; |

| • | cultural differences in medical practice and clinical research; and |

| • | diminished protection of intellectual property in some countries. |

| • | the clinical trial(s) required to verify the predicted clinical benefit of a product candidate fails to verify such benefit or does not demonstrate sufficient clinical benefit to justify the risks associated with the product candidate; |

| • | other evidence demonstrates that a product candidate is not shown to be safe or effective under the conditions of use; |

| • | we fail to conduct any required post-marketing confirmatory clinical trial with due diligence; or |

| • | we disseminate false or misleading promotional materials relating to the relevant product candidate. |

| • | restrictions on the marketing or manufacturing of the product; |

| • | withdrawal of the product from the market or voluntary or mandatory product recalls; |

| • | fines, restitution or disgorgement of profits or revenues; |

| • | warning or untitled letters; |

| • | requirements to conduct post-marketing studies or clinical trials; |

| • | holds on clinical trials; |

| • | refusal by the FDA, the EMA or comparable regulatory authorities to approve pending applications or supplements to approved applications filed by us, or suspension or revocation of product license approvals; |

| • | product seizure or detention; |

| • | refusal to permit the import or export of products; and |

| • | injunctions or the imposition of civil or criminal penalties. |

| • | have staffing difficulties; |

| • | fail to comply with contractual obligations; |

| • | experience regulatory compliance issues; |

| • | undergo changes in priorities or become financially distressed; or |

| • | form relationships with other entities, some of which may be our competitors. |

| • | may not perform their obligations as expected; |

| • | may encounter production difficulties that could constrain the supply of the companion diagnostic; |

| • | may encounter difficulties in obtaining regulatory approval; |

| • | may have difficulties gaining acceptance of the use of the companion diagnostic in the clinical community; |

| • | may not commit sufficient resources to the marketing and distribution of such product; and |

| • | may terminate their relationship with us. |

| • | the scope of rights granted under the license agreement and other interpretation-related issues; |

| • | whether and the extent to which our technology and processes infringe on intellectual property of the licensor that is not subject to the licensing agreement; |

| • | our right to sublicense patent and other rights to third parties under collaborative development relationships; |

| • | our diligence obligations with respect to the use of the licensed technology in relation to our development and commercialization of our product candidates, and what activities satisfy those diligence obligations; and |

| • | the ownership of inventions and know-how resulting from the joint creation or use of intellectual property by us, our licensors, and our collaborators. |

| • | we may not be able to detect infringement of our issued patents; |

| • | others may be able to develop products that are similar to our products or product candidates, or any future product candidates we may develop, but that are not covered by the claims of the patents that we may in-license in the future or own; |

| • | we, or our current or future collaborators or license partners, might not have been the first to make the inventions covered by the issued patents or patent application that we may in-license in the future or own; |

| • | we, or our current or future collaborators or license partners, might be found not have been the first to file patent applications covering certain of our or their inventions; |

| • | others may independently develop similar or alternative technologies or duplicate any of our technologies without infringing our intellectual property rights; |

| • | it is possible that the pending patent applications we may in-license in the future or own will not lead to issued patents; |

| • | it is possible that there are prior public disclosures that could invalidate our patents, or parts of our patents, for which we are not aware; |

| • | issued patents that we hold rights to may be held invalid or unenforceable, as a result of legal challenges by our competitors; |

| • | issued patents may not have sufficient term or geographic scope to provide meaningful protection; |

| • | our competitors might conduct research and development activities in countries where we do not have patent rights and then use the information learned from such activities to develop competitive products for sale in our major commercial markets; |

| • | we may not develop additional proprietary technologies that are patentable; |

| • | the patents of others may have an adverse effect on our business; and |

| • | we may choose not to file a patent in order to maintain certain trade secrets, and a third party may subsequently file a patent covering such intellectual property. |

| • | our available capital resources or capital constraints we experience; |

| • | the rate of progress, costs and results of our clinical trials and research and development activities, including the extent of scheduling conflicts with participating clinicians and collaborators; |

| • | our ability to identify and enroll patients who meet clinical trial eligibility criteria; |

| • | our receipt of approvals by the FDA, the EMA and comparable regulatory authorities, and the timing thereof; |

| • | other actions, decisions or rules issued by regulators; |

| • | our ability to access sufficient, reliable and affordable supplies of materials used in the manufacture of our product candidates; |

| • | our ability to manufacture and supply clinical trial materials to our clinical sites on a timely basis; |

| • | the efforts of our collaborators with respect to the commercialization of our products; and |

| • | the securing of, costs related to, and timing issues associated with, commercial product manufacturing as well as sales and marketing activities. |

| • | The federal Anti-Kickback Statute, which prohibits any person or entity from, among other things, knowingly and willfully soliciting, receiving, offering or paying any remuneration, directly or indirectly, overtly or covertly, in cash or in kind, to induce or reward either the referral of an individual |

| for, or the purchase, order or recommendation of an item or service reimbursable, in whole or in part, under a federal healthcare program, such as the Medicare and Medicaid programs. The term “remuneration” has been broadly interpreted to include anything of value. The federal Anti-Kickback Statute has also been interpreted to apply to arrangements between pharmaceutical manufacturers on the one hand and prescribers, purchasers, and formulary managers on the other hand. There are a number of statutory exceptions and regulatory safe harbors protecting some common activities from prosecution, but the exceptions and safe harbors are drawn narrowly and require strict compliance in order to offer protection. |

| • | Federal civil and criminal false claims laws, such as the False Claims Act (“FCA”), which can be enforced by private citizens through civil qui tam actions, and civil monetary penalty laws prohibit individuals or entities from, among other things, knowingly presenting, or causing to be presented, false, fictitious or fraudulent claims for payment of federal funds, and knowingly making, using or causing to be made or used a false record or statement material to a false or fraudulent claim to avoid, decrease or conceal an obligation to pay money to the federal government. For example, pharmaceutical companies have been prosecuted under the FCA in connection with their alleged off-label promotion of drugs, purportedly concealing price concessions in the pricing information submitted to the government for government price reporting purposes, and allegedly providing free product to customers with the expectation that the customers would bill federal healthcare programs for the product. In addition, a claim including items or services resulting from a violation of the federal Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the FCA. As a result of a modification made by the Fraud Enforcement and Recovery Act of 2009, a claim includes “any request or demand” for money or property presented to the U.S. government. In addition, manufacturers can be held liable under the FCA even when they do not submit claims directly to government payors if they are deemed to “cause” the submission of false or fraudulent claims. |

| • | HIPAA, among other things, imposes criminal liability for executing or attempting to execute a scheme to defraud any healthcare benefit program, including private third-party payors, knowingly and willfully embezzling or stealing from a healthcare benefit program, willfully obstructing a criminal investigation of a healthcare offense, and creates federal criminal laws that prohibit knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statement or representation, or making or using any false writing or document knowing the same to contain any materially false, fictitious or fraudulent statement or entry in connection with the delivery of or payment for healthcare benefits, items or services. |

| • | HIPAA, as amended by HITECH, and their implementing regulations, which impose privacy, security and breach reporting obligations with respect to individually identifiable health information upon entities subject to the law, such as health plans, healthcare clearinghouses and certain healthcare providers, known as covered entities, and their respective business associates that perform services for them that involve individually identifiable health information. HITECH also created new tiers of civil monetary penalties, amended HIPAA to make civil and criminal penalties directly applicable to business associates, and gave state attorneys general new authority to file civil actions for damages or injunctions in U.S. federal courts to enforce HIPAA laws and seek attorneys’ fees and costs associated with pursuing federal civil actions. |

| • | Federal and state consumer protection and unfair competition laws, which broadly regulate marketplace activities and activities that potentially harm consumers. |

| • | The federal transparency requirements under the Physician Payments Sunshine Act, created under the Health Care Reform Act, which requires, among other things, certain manufacturers of drugs, devices, biologics and medical supplies reimbursed under Medicare, Medicaid, or the Children’s Health Insurance Program to report annually to CMS information related to payments and other transfers of value provided to physicians, as defined by such law, and teaching hospitals and physician ownership and investment interests, including such ownership and investment interests held by a physician’s immediate family members. |

| • | State and foreign laws that are analogous to each of the above federal laws, such as anti-kickback and false claims laws, that may impose similar or more prohibitive restrictions, and may apply to items or services reimbursed by non-governmental third-party payors, including private insurers. |

| • | State and foreign laws that require pharmaceutical companies to implement compliance programs, comply with the pharmaceutical industry’s voluntary compliance guidelines and the relevant compliance guidance promulgated by the federal government, or to track and report gifts, compensation and other remuneration provided to physicians and other healthcare providers; state laws that require the reporting of marketing expenditures or drug pricing, including information pertaining to and justifying price increases; state and local laws that require the registration of pharmaceutical sales representatives; state laws that prohibit various marketing-related activities, such as the provision of certain kinds of gifts or meals; state laws that require the posting of information relating to clinical trials and their outcomes; and other federal, state and foreign laws that govern the privacy and security of health information or personally identifiable information in certain circumstances, including state health information privacy and data breach notification laws which govern the collection, use, disclosure, and protection of health-related and other personal information, many of which differ from each other in significant ways and often are not preempted by HIPAA, thus requiring additional compliance efforts. |

| • | decreased demand for our product candidates or products that we may develop; |

| • | injury to our reputation and significant negative media attention; |

| • | withdrawal of clinical trial sites and/or study participants; |

| • | significant costs to defend the related litigations; |

| • | a diversion of management’s time and our resources to pursue our business strategy; |

| • | substantial monetary awards to study participants or patients; |

| • | product recalls, withdrawals or labeling, marketing or promotional restrictions; |

| • | loss of revenue; |

| • | the inability to commercialize our product candidates that we may develop; and |

| • | a decline in the price of our securities. |

| • | high acquisition costs; |

| • | the need to incur substantial debt or engage in dilutive issuances of equity securities to pay for acquisitions; |

| • | the potential disruption of our historical business and our activities under our collaboration agreements; |

| • | the strain on, and need to expand, our existing operational, technical, financial and administrative infrastructure; |

| • | our lack of experience in late-stage product development and commercialization; |

| • | the difficulties in assimilating employees and corporate cultures; |

| • | the difficulties in hiring qualified personnel and establishing necessary development and/or commercialization capabilities; |

| • | the failure to retain key management and other personnel; |

| • | the challenges in controlling additional costs and expenses in connection with and as a result of the acquisition; |

| • | the need to write down assets or recognize impairment charges; |

| • | the diversion of our management’s attention to integration of operations and corporate and administrative infrastructures; and |

| • | any unanticipated liabilities for activities of or related to the acquired business or its operations, products or product candidates. |

| • | differing regulatory requirements in non-U.S. countries; |

| • | unexpected changes in tariffs, trade barriers, price and exchange controls and other regulatory requirements; |

| • | differing standards for the conduct of clinical trials; |

| • | increased difficulties in managing the logistics and transportation of storing and shipping product candidates produced in the United States or elsewhere and shipping the product candidate to patients in other countries; |

| • | import and export requirements and restrictions; |

| • | economic weakness, including inflation, or political instability in foreign economies and markets; |

| • | compliance with tax, employment, immigration and labor laws for employees living or traveling abroad; |

| • | foreign taxes, including withholding of payroll taxes; |

| • | foreign currency fluctuations, which could result in increased operating expenses and reduced revenue, and other obligations incident to doing business in another country; |

| • | difficulties staffing and managing foreign operations; |

| • | workforce uncertainty in countries where labor unrest is more common than in the United States or Germany; |

| • | differing payor reimbursement regimes, governmental payors or patient self-pay systems, and price controls; |

| • | potential liability under the FCPA or comparable foreign regulations; |

| • | challenges enforcing our contractual and intellectual property rights, especially in those foreign countries that do not respect and protect intellectual property rights to the same extent as the United States or Germany; |

| • | production shortages resulting from any events affecting raw material supply or manufacturing capabilities abroad; and |

| • | business interruptions resulting from geo-political actions and conflict, war and terrorism, including the recent conflict between Russia and Ukraine and resulting sanctions, retaliatory measures, changes in the availability and price of various materials and effects on global financial markets; and |

| • | business interruptions resulting from natural disasters including earthquakes, typhoons, floods and fires. |

| • | results and timing of preclinical studies and clinical trials of our product candidates; |

| • | results of clinical trials of our competitors’ products; |

| • | public concern relating to the commercial value or safety of any of our product candidates; |

| • | our inability to adequately protect our proprietary rights, including patents, trademarks and trade secrets; |

| • | our inability to raise additional capital and the terms on which we raise it; |

| • | commencement or termination of any strategic collaboration or licensing arrangement; |

| • | regulatory developments, including actions with respect to our products or our competitors’ products; |

| • | actual or anticipated fluctuations in our financial condition and operating results; |

| • | publication of research reports by securities analysts about us or our competitors or our industry; |

| • | our failure or the failure of our competitors to meet analysts’ projections or guidance that we or our competitors may give to the market; |

| • | additions and departures of key personnel; |

| • | strategic decisions by us or our competitors, such as acquisitions, divestitures, spin-offs, joint ventures, strategic investments or changes in business strategy; |

| • | the passage of legislation or other regulatory developments affecting us or our industry, including changes in the structure of healthcare payment systems; |

| • | fluctuations in the valuation of companies perceived by investors to be comparable to us; |

| • | sales of our securities by us, our insiders or our other shareholders; |

| • | speculation in the press or investment community; |

| • | announcement or expectation of additional financing efforts; |

| • | changes in market conditions for biopharmaceutical stocks; and |

| • | changes in general market and economic conditions. |

| • | if any of our product candidates receives regulatory approval, the timing and the terms of such approval and market acceptance and demand for such product candidates; |

| • | variations in the level of expense related to the ongoing development of our product candidates or research pipeline; |

| • | results of clinical trials, or the addition or termination of clinical trials or funding support by us, or existing or future collaborators or licensing partners; |

| • | our execution of any additional collaboration, licensing or similar arrangements, and the timing of payments we may make or receive under existing or future arrangements, or the termination or modification of any such existing or future arrangements; |

| • | developments or disputes concerning patents or other proprietary rights, including patents, litigation matters and our ability to obtain patent protection for our products; |

| • | any intellectual property infringement lawsuit or any opposition, interference, cancellation or other intellectual-property-related proceeding in which we may become involved; |

| • | additions and departures of key personnel; |

| • | strategic decisions by us or our competitors, such as acquisitions, divestitures, spin-offs, joint ventures, strategic investments or changes in business strategy; |

| • | fluctuations in the price of our ordinary shares; |

| • | regulatory developments affecting our product candidates or those of our competitors; and |

| • | changes in general market and economic conditions. |

| • | a provision that our directors can only be appointed on the basis of a binding nomination prepared by the Board or by one or more shareholders who individually or jointly represent at least 10% of our issued share capital, which can be overruled by a two-thirds majority of votes cast representing more than half of our issued share capital; |

| • | a provision that our directors can only be dismissed by the general meeting by a two-thirds majority of votes cast representing more than half of our issued share capital, unless the dismissal was proposed by the Board, in which latter case a simple majority of votes cast would be sufficient; |

| • | a requirement that certain matters, including an amendment of our articles of association, may only be resolved upon by our general meeting if proposed by the Board; and |

| • | a provision implementing a staggered board, pursuant to which only one class of Directors, will be elected at each general meeting, with the other classes continuing for the remainder of their respective terms. |

| • | the Board, in light of the circumstances at hand when the cooling-off period was invoked, could not reasonably have concluded that the relevant proposal or hostile offer constituted a material conflict with the interests of our company and its business; |

| • | the Board cannot reasonably believe that a continuation of the cooling-off period would contribute to careful policy-making; or |

| • | other defensive measures, having the same purpose, nature and scope as the cooling-off period, have been activated during the cooling-off period and have not since been terminated or suspended within a reasonable period at the relevant shareholders’ request (i.e., no ‘stacking’ of defensive measures). |

ITEM 4. |

INFORMATION ON THE COMPANY |

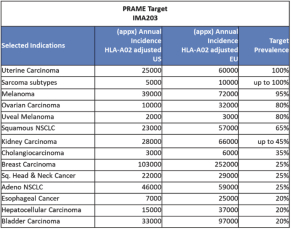

| • | IMA203: |

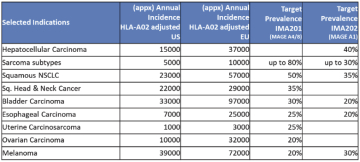

| • | IMA201 and IMA202: |

| • | IMA401: co-fund U.S. development in exchange for enhanced U.S. royalty payments and/or to co-promote IMA401 in the U.S.. |

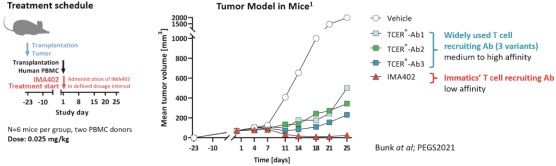

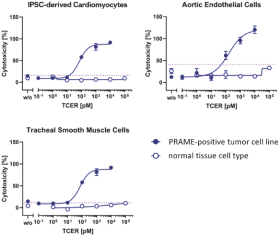

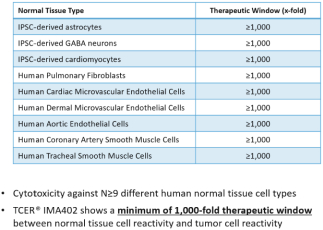

| • | IMA402: pre-clinical models, we initiated GMP manufacturing development for the lead candidate and we anticipate production of the clinical GMP batch in 2022 and initiation of Phase 1 in 2023. |

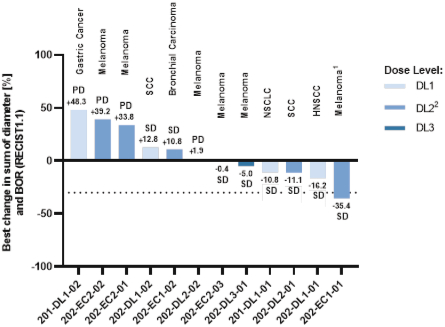

| • | IMA40X: |

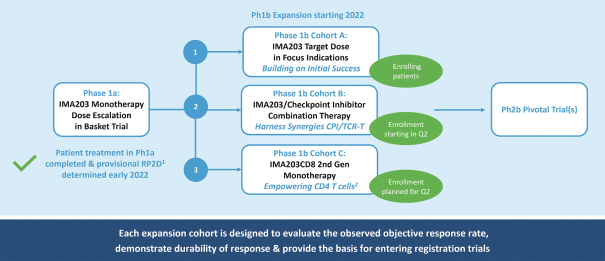

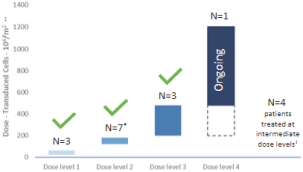

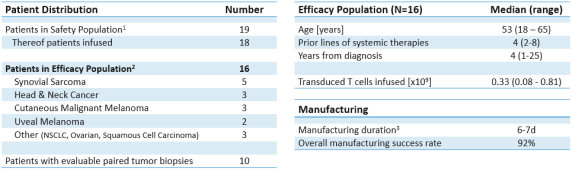

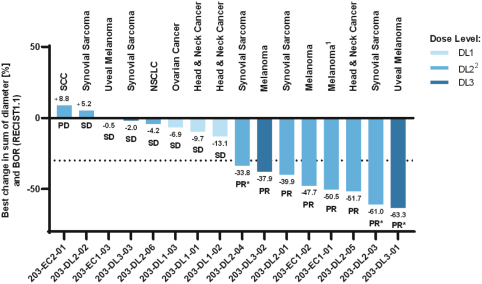

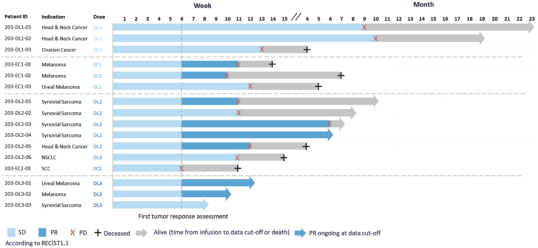

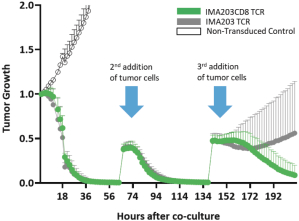

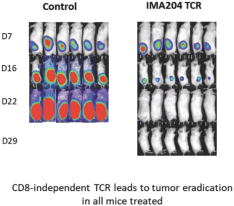

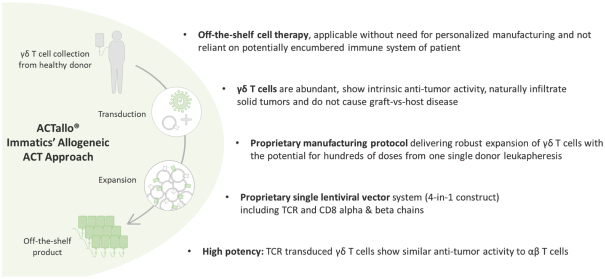

| • | Advance our pipeline of ACTengine product candidates through clinical development. TCR-T programs include three product candidates (IMA201, IMA202, IMA203) in Phase 1 clinical trials investigating safety, tolerability, biological and clinical activity in patients with various types of solid tumors. In November 2021, we reported interim data from the ongoing Phase 1 dose-escalation stage of these clinical trials. We showed biological activity, a manageable safety profile, and early signs of anti-tumor activity. For IMA203, we demonstrated objective responses in 62% of evaluable patients treated at intermediate dose levels. Three partial responses were confirmed thereafter. As a next step, we plan to complete the dose escalation phase of the trial, evaluate the objective response rate (“ORR”) and assess duration of response at target dose in three cohorts: IMA203 monotherapy; IMA203 combination with checkpoint inhibition; and monotherapy with our 2nd generation IMA203CD8 product candidate engaging both CD8 and CD4 cells. We also intend to complete dose escalation for the IMA201 and IMA202 trials and move our IMA204 preclinical product candidate towards CTA or IND. Upon completion of the dose escalation phase, we will reevaluate whether to continue pursing IMA202 and IMA201 as product candidates. Moreover, we continue to actively investigate multiple next-generation enhancement and combination strategies beyond CD8 co-transduction to render ACTengine T cells even more potent to combat solid tumors. |

| • | Advance our preclinical TCR Bispecifics pipeline towards clinical application IND-enabling activities for IMA402 in 2022, targeting manufacturing of the clinical batch in 2H2022 and CTA submission in 1H2023. Moreover, we will continue development of IMA40X which is preclinical stage. |

| • | Leverage the full potential of PRAME HLA-A*02:01 patient population that might benefit from an anti-PRAME therapy by developing an off-the-shelf HLA-A*02 by investigating new target-TCR pairs for PRAME epitopes binding to other HLA types. |

| • | Further enhance our manufacturing capabilities. |

| activity of IMA203, we will now evaluate our future manufacturing strategy including but not limited to building or acquiring a fully integrated in-house manufacturing facility to maintain full control over drug supply in the future. |

| • | Leverage the full potential of strategic collaborations |

| • | Strengthen our intellectual property portfolio. |

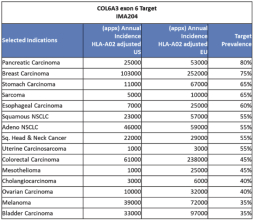

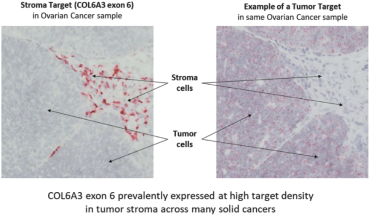

| • | Enhance the competitive edge of our technology platforms. TCR-based therapies. After having demonstrated objective responses against the well-known cancer testis antigen PRAME, we now plan to leverage the full potential of our technology platforms by developing TCR-based therapeutics against novel, less described targets (such as COL6A3) with different risk benefit profiles in our proprietary pipeline and together with our partners. |

| • | Extend the impact of immunotherapy through dual targeting of tumor cells and tumor stroma. multi-TCR-T Proof-of-concept multi-TCR-T, |

• |

Utilizing True Cancer Targets & Matching Right TCRs |

• |

Enhancing T Cell Characteristics to Improve Clinical Outcome |

• |

Targeting Tumor Protective Barriers in Addition to Tumor Cells |

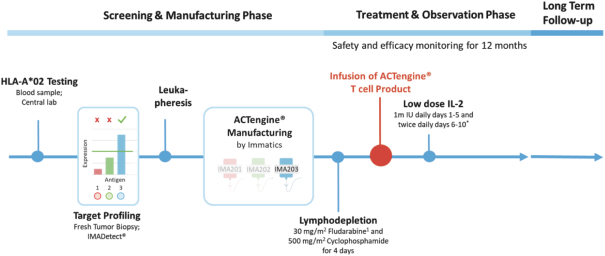

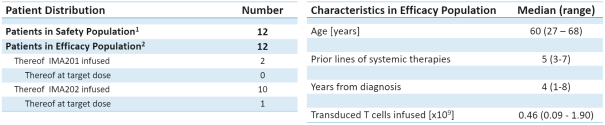

| • | Phase 1a – Dose Escalation: 0.04-0.06 x 109 / m2 , dose level 2: 0.12-0.18 x 109 / m2 , dose level 3: 0.20-0.48 x 109 / m2 and dose level 4: up to 1.2 x 109 / m2 ). The product candidate is infused after lymphodepleting chemotherapy to determine the RP2D. After a dose level is cleared, the subsequent patients will be treated on the next higher dose level until reaching the target dose. |

| • | Phase 1b – Cohort A: IMA203 Monotherapy Dose Expansion: |

| • | Phase 1b – Cohort B: IMA203 Checkpoint Inhibitor Combination: PD-1 immune checkpoint inhibitor and to evaluate the initial anti-tumor activity of the combinatorial approach, as measured by tumor response according to RECIST1.1 or irRECIST. We plan to treat up to 18 additional patients in this cohort. |

| • | Phase 1b – Cohort C: IMA203CD8 Monotherapy: b co-receptor. We will also evaluate the initial anti-tumor activity, as measured by tumor response according RECIST1.1 or irRECIST. We plan to treat up to 24 patients in this cohort starting with slightly reduced dose levels compared to IMA203 target dose. |

1 |

Exploration of higher dose (DL5) planned; |

2 |

Demonstrated to be important for long term remission: Melenhorst et al. |

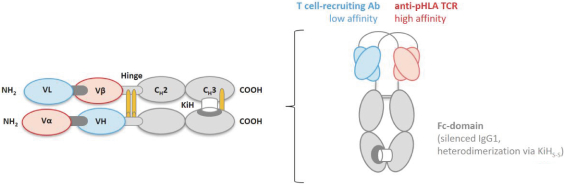

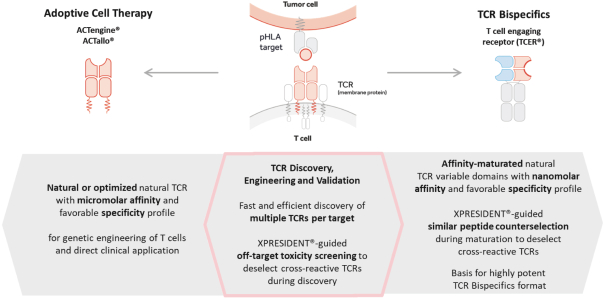

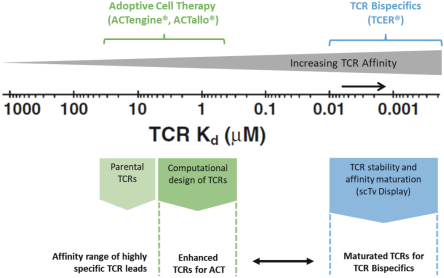

| • | In the case of ACT, XCEPTOR either picks high-affinity TCRs from the natural repertoire or modestly enhances these TCRs, aiming for single-digit micromolar affinities mirroring naturally occurring TCR affinities in viral infections. Additionally, we could pursue engineering TCRs to address alpha/beta chain pairing and/or CD8 independency. |

| • | In the case of TCR Bispecifics, affinity of the target TCR is required to be much higher to achieve functional activity, thus the naturally occurring, specific TCRs need to be strongly affinity maturated using yeast display. Stable, high-affinity single-chain TCR variable fragments (scTvs) are serving as building blocks for the generation of the TCER compound. |

| • | Companies such as Adaptimmune, Gritstone, Immunocore, Adaptive Biotechnologies, pureMHC, BioNTech, and Genentech are also seeking to identify HLA targets. |

| • | Companies such as Adaptimmune, Kite Pharma (a Gilead company), Tmunity, T-knife, Juno Therapeutics (a BMS company), GSK, 2seventybio, Medigene, BioNTech, PACT Pharma, T-scan Therapeutics, Ziopharm oncology are investigating novel autologous TCR-T therapeutics. Their TCR-T programs are partially directed against peptide targets derived from the same proteins but not necessarily against the same peptide target as used by us. |

| • | Companies such as Immunocore, Amgen, Genmab, Eureka Therapeutics, Molecular Partners, Harpoon Therapeutics, MacroGenics, Abbvie and Roche are developing TCR Bispecific compounds or TCR mimetic antibodies. |

| • | IMA201: Four issued patents in the U.S., four issued foreign patents in Australia, South Korea, Colombia and Morocco, 170 pending patent applications in Argentina, Australia, Brazil, Canada, Chile, China, Colombia, Costa Rica, Algeria, Eurasia, Egypt, Europe, Hong Kong, Indonesia, Israel, India, Japan, South Korea, Mexico, Malaysia, Morocco, New Zealand, Peru, Philippines, Singapore, Thailand, Taiwan, the Ukraine, the U.S., Vietnam and South Africa as well as 4 International applications (PCT) and 2 US provisional applications relating to IMA201 (MAGEA4/8). These patents and patent applications, if issued, are expected to expire between 2037 and 2042, in each case without taking into account any possible patent term adjustment or extensions and assuming payment of all appropriate maintenance, renewal, annuity or other governmental fees. |

| • | IMA202: Three issued patents in the U.S., forty-seven (47) issued foreign patents in Germany, Australia, Colombia, Algeria, Indonesia, Taiwan, and Europe (validated in 41 countries), 142 pending patent applications in Argentina, Australia, Brazil, Canada, Chile, China, Costa Rica, Eurasia, Egypt, Europe, Gulf |

| Cooperation Council, Hong Kong, Israel, India, Japan, South Korea, Mexico, Malaysia, Morocco, New Zealand, Peru, Philippines, Singapore, Thailand, Taiwan, the Ukraine, the U.S., Vietnam and South Africa as well as 4 International applications (PCT) and 2 US provisional applications relating to IMA202 (MAGEA1). These patents and patent applications, if issued, are expected to expire between 2037 and 2042, in each case without taking into account any possible patent term adjustment or extensions and assuming payment of all appropriate maintenance, renewal, annuity or other governmental fees. |

| • | IMA203: Four issued patents in the U.S., two issued foreign patents in Taiwan and Algeria, hundred-and-forty-five |

| • | IMA204: Seven issued patents in the U.S., ninety (90) issued foreign patents in, Japan, Hong Kong, South Korea, Mexico, New Zealand, Taiwan, Algeria, South Africa and Europe (two European patents each validated in 40 countries), hundred-and-seventy-six |

| • | IMA401: Four issued patents in the U.S., four issued foreign patents in Australia, South Korea, Colombia and Morocco, two-hundred-and-two |

| • | IMA402: Four issued patents in the U.S., two issued foreign patents in Taiwan and Algeria, ninety-one (91) pending patent applications in Argentina, Australia, Brazil, Canada, Chile, China, Colombia, Costa Rica, Germany, Eurasia, Egypt, Europe, Gulf Cooperation Council, Hong Kong, Indonesia, Israel, India, Japan, South Korea, Mexico, Malaysia, New Zealand, Peru, Philippines, Singapore, Thailand, Taiwan, the Ukraine, the U.S., Vietnam and South Africa as well as 4 International applications (PCT) and 2 US provisional applications relating to the clinical candidates for IMA402 (PRAME). These patents and patent applications, if issued, are expected to expire between 2038 and 2042, in each case without taking into account any possible patent term adjustment or extensions and assuming payment of all appropriate maintenance, renewal, annuity or other governmental fees. |

| • | preclinical testing including laboratory tests, animal studies, and formulation studies, which must be performed in accordance with the FDA’s GLP regulations, as applicable; |

| • | submission to the FDA of an IND for human clinical testing, which must become effective before human clinical trials may begin; |

| • | approval by an IRB representing each clinical site before each clinical trial may be initiated; |

| • | performance of adequate and well-controlled human clinical trials to establish the safety, and efficacy of the product candidate for each proposed indication, in accordance with current GCP; |

| • | preparation and submission to the FDA of a BLA for a biological product; |

| • | FDA acceptance and substantive review of the BLA; |

| • | review of the product candidate by an FDA advisory committee, where appropriate or if applicable; |

| • | satisfactory completion of an FDA inspection of the manufacturing facility or facilities, including those of third parties, at which the product candidate or components thereof are manufactured to assess compliance with cGMP requirements and to assure that the facilities, methods, and controls are adequate to preserve the product’s identity, strength, quality, and purity; |

| • | satisfactory completion of any FDA audits of clinical trial sites to assure compliance with GCP and the integrity of clinical data in support of the BLA; and |

| • | securing FDA approval of the BLA to allow marketing of the new biological product. |

| • | Phase 1 clinical trials are initially conducted in a limited population to test the product candidate for safety, including adverse effects, dose tolerance, absorption, metabolism, distribution, excretion, and pharmacodynamics in healthy humans or in patients. During Phase 1 clinical trials, information about the investigational biological product’s pharmacokinetics and pharmacological effects may be obtained to permit the design of well-controlled and scientifically valid Phase 2 clinical trials. |

| • | Phase 2 clinical trials are generally conducted in a limited patient population to identify possible adverse effects and safety risks, evaluate the efficacy of the product candidate for specific targeted indications, and determine dose tolerance and optimal dosage. |

| • | Phase 3 clinical trials are undertaken within an expanded patient population to further evaluate dosage, provide substantial evidence of clinical efficacy, and further test for safety. A well-controlled, statistically robust Phase 3 trial may be designed to deliver the data that regulatory authorities will use to decide whether or not to license, and, if licensed, how to appropriately label a biologic. |

| • | restrictions on the marketing or manufacturing of the product, complete withdrawal of the product from the market, or product recalls; |

| • | fines, warning letters, or holds on post-licensing clinical trials; |

| • | refusal of the FDA to approve pending applications or supplements to licensed applications, or suspension or revocation of product licenses; |

| • | product seizure or detention, or refusal to permit the import or export of products; or |

| • | injunctions or the imposition of civil or criminal penalties. |

| • | the applicant must complete an identified program of studies within a time period specified by the competent authority, the results of which form the basis of a reassessment of the benefit/risk profile; |

| • | the medicinal product in question may be supplied on medical prescription only and may in certain cases be administered only under strict medical supervision, possibly in a hospital and in the case of a radiopharmaceutical, by an authorized person; and |

| • | the package leaflet and any medical information must draw the attention of the medical practitioner to the fact that the particulars available concerning the medicinal product in question are as yet inadequate in certain specified respects. |

| • | compliance with the European Union’s stringent pharmacovigilance or safety reporting rules must be ensured. These rules can impose post-authorization studies and additional monitoring obligations; |

| • | the manufacturing of authorized medicinal products, for which a separate manufacturer’s license is mandatory, must also be conducted in strict compliance with the applicable EU laws, regulations and guidance, including Directive 2001/83/EC, Directive 2003/94/EC, Regulation (EC) No 726/2004 and the European Commission Guidelines for Good Manufacturing Practice. These requirements include compliance with EU cGMP standards when manufacturing medicinal products and active pharmaceutical ingredients, including the manufacture of active pharmaceutical ingredients outside of the EU with the intention to import the active pharmaceutical ingredients into the EU; and |

| • | the marketing and promotion of authorized drugs, including industry-sponsored continuing medical education and advertising directed toward the prescribers of drugs and/or the general public, are strictly regulated in the EU notably under Directive 2001/83EC, as amended, and EU Member State laws. Direct-to-consumer |

| Company |

Jurisdiction of Incorporation |

Percentage Ownership and Voting Interest |

||||

| Immatics Biotechnologies GmbH |

Germany | 100 | % | |||

| Immatics US, Inc. |

Delaware, United States | 100 | % | |||

| • | The corporate headquarters are located at Paul-Ehrlich-Straße 15 in 72076 Tübingen. It comprises approximately 2,600 square meters of office space as well as research and laboratory space. It houses Operations, Immunology, TCR Discovery and Validation, TCR Engineering & Bispecifics, Immunomonitoring, Discovery, Companion Diagnostics and CMC. |

| • | Our operations facility is approximately 1,050 square meters and is located at Aischbachstraße 1 in 72070 Tübingen. It houses Operations, HR, IT, Finance, Translational Development, Regulatory Affairs and Clinical Development. |

| • | Our third facility is approximately 1,040 square meters and is located in Machtlfinger Straße 5-15 in 81379 Munich. It houses Intellectual Property, IT, Communications and Business Development. |

| • | The administrative office is a 6,690 square foot facility located at 2201 West Holcombe, Houston, TX 77030, and houses Operations, Human Resources, Finance, Clinical Operations, Regulatory, Bioinformatics and Program Management. |

| • | The research and laboratory facility is a 15,694 square foot facility located in the Life Science Plaza building at 2130 West Holcombe, Suite 1100, Houston, Texas 77030. The research and laboratory facility is comprised primarily of laboratory space, with limited office seating that houses CMC, Immunology, Biomarkers, Quality Assurance and Quality Control. Our sublease on the space will expire in August 2023. |

ITEM 4A. |

UNRESOLVED STAFF COMMENTS |

ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

| • | advancing the proprietary pipeline of product candidates focusing on ACTengine and TCR Bispecifics; |

| • | enhancing ACT manufacturing capabilities; |

| • | disrupting the tumor microenvironment through combination therapies, next-generation technologies and novel target classes; |

| • | developing novel personalized multi-TCR-T |

| • | maintaining and enhancing the competitive edge of our target and TCR technology platforms; |

| • | leveraging existing collaborations with BMS, Genmab and GSK and establish additional value-maximizing strategic collaborations and |

| • | expanding our intellectual property portfolio. |

| • | after reviewing trial results, we or our collaborators may abandon projects previously believed to be promising; |

| • | we, our collaborators, or regulators may suspend or terminate clinical trials if the participating subjects or patients are being exposed to unacceptable health risks; |

| • | our potential products may not achieve the desired effects or may include undesirable side effects or other characteristics that preclude regulatory approval or limit their commercial use if approved; |

| • | manufacturers may not meet the necessary standards for the production of the product candidates or may not be able to supply the product candidates in a sufficient quantity; |

| • | regulatory authorities may find that our clinical trial design or conduct does not meet the applicable approval requirements; and |

| • | safety and efficacy results in various human clinical trials reported in scientific and medical literature may not be indicative of results we obtain in our clinical trials. |

Year ended December 31, |

||||||||

2021 |

2020 |

|||||||

(Euros in thousands, except share and per share data) |

||||||||

| Revenue from collaboration agreements |

€ | 34,763 | € | 31,253 | ||||

| Research and development expenses |

(87,574 | ) | (67,085 | ) | ||||

| General and administrative expenses |

(33,808 | ) | (34,186 | ) | ||||

| Other income |

325 | 303 | ||||||

| |

|

|

|

|||||

| Operating result |

(86,294 |

) |

(69,715 |

) | ||||

| Financial income |

5,675 | 2,949 | ||||||

| Financial expenses |

(1,726 | ) | (10,063 | ) | ||||

| Change in fair value of warrant liabilities |

(10,990 | ) | 17,775 | |||||

| Share listing expense |

— | (152,787 | ) | |||||

| Financial result |

(7,041 |

) |

(142,126 |

) | ||||

| |

|

|

|

|||||

| Loss before taxes |

(93,335 |

) |

(211,841 |

) | ||||

| Taxes on income |

— | — | ||||||

| Net loss |

(93,335 |

) |

(211,841 |

) | ||||

| |

|

|

|

|||||

| Net loss per share – basic and diluted |

(1.48 |

) |

(4.40 |

) | ||||

| Weighted average shares outstanding – basic and diluted |

62,912,921 | 48,001,228 | ||||||

Year ended December 31, |

||||||||

2021 |

2020 |

|||||||

(Euros in thousands) |

||||||||

| Revenue from collaboration agreements: |

||||||||

| Amgen |

€ | 10,228 | € | 4,865 | ||||

| Genmab |

6,929 | 11,204 | ||||||

| BMS |

13,138 | 11,489 | ||||||

| GSK |

4,468 | 3,695 | ||||||

| |

|

|

|

|||||

| Total revenue from collaboration agreements |

€34,763 |

€31,253 |

||||||

| |

|

|

|

|||||

Year ended December 31, |

||||||||

2021 |

2020 |

|||||||

(Euros in thousands) |

||||||||

| Direct external research and development expenses by program: |

||||||||

| ACT Programs |

€14,897 | € | 8,153 | |||||

| TCR Bispecifics Programs |

6,679 | 5,166 | ||||||

| Other programs |

3,114 | 2,857 | ||||||

| |

|

|

|

|||||

| Sub-total direct external expenses |

€24,690 |

€16,176 |

||||||

| |

|

|

|

|||||

| Indirect research and development expenses: |

||||||||

| Personnel related (excluding share-based compensation) |

€25,543 | €17,912 | ||||||

| Share-based compensation expense |

15,564 | 14,546 | ||||||

| IP Expenses |

9,701 | 9,294 | ||||||

| Facility and depreciation |

5,325 | 5,385 | ||||||

| Other indirect expenses |

6,751 | 3,772 | ||||||

| |

|

|

|

|||||

| Sub-total indirect expenses |

€62,884 |

€50,909 |

||||||

| |

|

|

|

|||||

| Total research and development expenses |

€87,574 |

€67,085 |

||||||

| |

|

|

|

|||||

Year ended December 31, |

||||||||

2021 |

2020 |

|||||||

(Euros in thousands) |

||||||||

| Share-based compensation expense |

€ | 10,839 | € | 10,973 | ||||

| Personnel related (excluding stock-based compensation) |

8,641 | 7,983 | ||||||

| Professional and consulting fees |

6,805 | 9,918 | ||||||

| Other external general and administrative expenses |

7,524 | 5,312 | ||||||

| |

|

|

|

|||||

| Total general and administrative expenses |

€ |

33,808 |

€ |

34,186 |

||||

| |

|

|

|

|||||

Year ended December 31, |

||||||||

2021 |

2020 |

|||||||

(Euros in thousands) |

||||||||

| Net cash provided by / (used in): |

||||||||

| Operating activities |

€ | (81,784 | ) | € | (85,610 | ) | ||

| Investing activities |

7,493 | (15,949 | ) | |||||

| Financing activities |

(2,613 | ) | 207,883 | |||||

| Total cash flow |

€ |

(76,904 |

) |

€ |

106,324 |

|||

| 1. | progress, timing, scope and costs of our clinical trials, including the ability to timely initiate clinical sites, enroll patients and manufacture ACT and TCR Bispecific product candidates for our ongoing, planned and potential future clinical trials; |

| 2. | time and cost to conduct IND- or CTA-enabling studies for our preclinical programs; |

| 3. | time and costs required to perform research and development to identify and characterize new product candidates from our research programs; |

| 4. | time and cost necessary to obtain regulatory authorizations and approvals that may be required by regulatory authorities to execute clinical trials or commercialize our products; |

| 5. | our ability to successfully commercialize our product candidates, if approved; |

| 6. | our ability to have clinical and commercial products successfully manufactured consistent with FDA, the EMA and comparable regulatory authorities’ regulations; |

| 7. | amount of sales and other revenues from product candidates that we may commercialize, if any, including the selling prices for such potential products and the availability of adequate third-party coverage and reimbursement for patients; |

| 8. | sales and marketing costs associated with commercializing our products, if approved, including the cost and timing of building our marketing and sales capabilities; |

| 9. | cost of building, staffing and validating our manufacturing processes, which may include capital expenditure; |

| 10. | terms and timing of our current and any potential future collaborations, licensing or other arrangements that we have established or may establish; |

| 11. | cash requirements of any future acquisitions or the development of other product candidates; |

| 12. | costs of operating as a public company; |

| 13. | time and cost necessary to respond to technological, regulatory, political and market developments; |

| 14. | costs of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights; and |

| 15. | costs associated with any potential business or product acquisitions, strategic collaborations, licensing agreements or other arrangements that we may establish. |

ITEM 6. |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

| Name |

Age |

Position | ||

| Harpreet Singh, Ph.D. | 47 | Chief Executive Officer | ||

| Arnd Christ | 55 | Chief Financial Officer | ||

| Cedrik Britten, M.D. | 47 | Chief Medical Officer | ||

| Carsten Reinhardt, M.D., Ph.D. | 54 | Chief Development Officer | ||

| Toni Weinschenk, Ph.D. | 49 | Chief Innovation Officer | ||

| Rainer Kramer, Ph.D. | 58 | Chief Business Officer | ||

| Steffen Walter, Ph.D. | 45 | Chief Technology Officer |

| Name |

Age |

Term Served |

Year in which Term Expires |

Position | ||||

| Harpreet Singh, Ph.D. | 47 | July 1, 2020 – Present | 2023 | Executive director and Chief Executive Officer | ||||

| Peter Chambré | 66 | July 1, 2020 – Present | 2022 | Non-executive director and Chairman | ||||

| Michael G. Atieh | 68 | July 1, 2020 – Present | 2024 | Non-executive director | ||||

| Paul R. Carter | 61 | July 1, 2020 – Present | 2024 | Non-executive director | ||||

| Eliot Forster, Ph.D. | 55 | September 14, 2020 – Present | 2023 | Non-executive director | ||||

| Friedrich von Bohlen und Halbach, Ph.D. | 59 | June 17, 2021 – Present | 2023 | Non-executive director | ||||

| Heather L. Mason | 61 | July 1, 2020 – Present | 2022 | Non-executive director | ||||

| Adam Stone | 42 | July 1, 2020 – Present | 2023 | Non-executive director | ||||

| Nancy Valente* | 63 | March 22, 2022-Present | 2023 | Temporary non-executive director |

| * | Mrs. Valente has been appointed by our Board as a temporary non-executive director as of March 22, 2022 and has been nominated for appointment as a non-executive director at our annual general meeting to be held in 2022. If elected by our shareholders at our annual general meeting to be held in 2022, Ms. Valente would serve a term that expires at our annual general meeting in 2023. |

Country of Principal Executive Offices : The Netherlands | ||||||||

Foreign Private Issuer : Yes | ||||||||

Disclosure Prohibited under Home Country Law : Yes | ||||||||

Total Number of Directors : 8 |

||||||||

| Part I: Gender Identity |

Female | Male | Non-Binary |

Did Not Disclose | ||||

| 1 | 7 | 0 | 0 | |||||

| Part II: Demographic Background |

||||||||

| Underrepresented individual in home country jurisdiction | ||||||||

| LGBTQ+ | ||||||||

| Did not disclose | ||||||||

(Euros in thousands) (1) |

Harpreet Singh, Ph.D. |

All other executives |

||||||

| Periodically-paid remuneration |

€ | 484 | € | 1,997 | ||||

| Bonuses |

€ | 285 | € | 1,032 | ||||

| Share-based compensation expense |

€ | 7,946 | € | 9,070 | ||||

| Total compensation |

€ |

8,715 |

€ |

12,099 |

||||

(1) |

Amounts paid in U.S. dollars have been converted to Euros using an average exchange rate for 2021 of 1.17893 to one U.S. dollar. |

(Euros in thousands) |

Peter Chambré |

Friedrich von Bohlen |

Michael G. Atieh |

Paul Carter |

Heather L. Mason |

Adam Stone |

Christoph Hettich |

Eliot Forster |

Total |

|||||||||||||||||||||||||||

| Board compensation |

80 | 20 | 55 | 53 | 40 | 40 | 20 | 40 | 348 |

|||||||||||||||||||||||||||

| Share-based compensation expense |

1,143 | 30 | 114 | 114 | 114 | 114 | — | 122 | 1,751 |

|||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total board compensation |

1,223 |

51 |

169 |

167 |

154 |

154 |

20 |

162 |

2,099 |

|||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Beneficiary |

Type of options |

Grant date |

Vesting date (1) |

Number of options outstanding |

Strike price in USD |

Expiration date | ||||||||||

Harpreet Singh, Ph.D. |

Performance-based options | June 30, 2020 | 1,598,000 options will vest quarterly until the options are fully vested if the performance condition shall be deemed satisfied in three equal tranches as follows: a) One third (1/3) of the Option Shares shall satisfy the Performance Condition upon the Company’s achievement of market capitalization equal to $1.5 billion prior to the Expiration Date, subject to the Optionee’s continuous Service Relationship through such date b) One third (1/3) of the Option Shares shall satisfy the Performance Condition upon the Company’s achievement of market capitalization equal to $2.0 billion prior to the Expiration Date, subject to the Optionee’s continuous Service Relationship through such date c) One third (1/3) of the Option Shares shall satisfy the Performance Condition upon the Company’s achievement of market capitalization equal to |

1,598,000 | 10.00 | June 30, 2030 | ||||||||||

| Beneficiary |

Type of options |

Grant date |

Vesting date (1) |

Number of options outstanding |

Strike price in USD |

Expiration date | ||||||||||

| $3.0 billion prior to the Expiration Date, subject to the Optionee’s continuous Service Relationship through such date | ||||||||||||||||

| Service options | June 30, 2020 | 63,000 options vested as of March 31, 2022, and an additional 105,000 will vest quarterly thereafter until the options are fully vested | 168,000 | 10.00 | June 30, 2030 | |||||||||||

| Matching Stock options | June 30, 2020 | 264,624 options vested fully as of July 31, 2021 | 264,624 | 10.00 | June 30, 2030 | |||||||||||

| Converted Stock options III | June 30, 2020 | 15,470 options vested as of March 31, 2022, and an additional 15,469 will vest quarterly thereafter until the options are fully vested | 30,939 | 1.06 | July 1, 2027 | |||||||||||

| Converted Stock options IV | June 30, 2020 | 72,686 options vested as of March 31, 2022, and an additional 72,685 will vest quarterly thereafter until the options are fully vested | 145,371 | 1.17 | January 1, 2028 | |||||||||||

| Service options | December 17, 2020 | 63,000 options vested as of March 31, 2022, and an additional 105,000 will vest quarterly thereafter until the options are fully vested | 168,000 | 9.70 | December 17, 2030 | |||||||||||

| Service options | December 9, 2021 | 168,000 options will vest quarterly until the options are fully vested | 168,000 | 11.00 | December 09, 2031 | |||||||||||

Arnd Christ |

Performance-based options | September 14, 2020 | 255,000 options will vest quarterly until the options are fully vested if the performance condition shall be deemed satisfied in three equal tranches as follows: a) One third (1/3) of the Option Shares shall satisfy the Performance Condition upon the Company’s achievement of market capitalization equal to $1.5 billion prior to the Expiration Date, subject to the Optionee’s continuous Service Relationship through such date |

255,000 | 10.00 | September 14, 2030 | ||||||||||

| Beneficiary |

Type of options |

Grant date |

Vesting date (1) |

Number of options outstanding |

Strike price in USD |

Expiration date | ||||||||||

| b) One third (1/3) of the Option Shares shall satisfy the Performance Condition upon the Company’s achievement of market capitalization equal to $2.0 billion prior to the Expiration Date, subject to the Optionee’s continuous Service Relationship through such date c) One third (1/3) of the Option Shares shall satisfy the Performance Condition upon the Company’s achievement of market capitalization equal to $3.0 billion prior to the Expiration Date, subject to the Optionee’s continuous Service Relationship through such date |

||||||||||||||||

| Service options | September 14, 2020 | 15,313 options vested as of March 31, 2022, and an additional 33,687 will vest quarterly thereafter until the options are fully vested | 49,000 | 10.00 | September 14, 2030 | |||||||||||

| Service options | December 17, 2020 | 15,313 options vested as of March 31, 2022, and an additional 33,687 will vest quarterly thereafter until the options are fully vested | 49,000 | 9.70 | December 17, 2030 | |||||||||||

| Service options | December 9, 2021 | 98,000 options will vest quarterly until the options are fully vested | 98,000 | 11.00 | December 9, 2031 | |||||||||||

Cedrik Britten, M.D. |

Performance-based options | June 30, 2020 | 255,000 options will vest quarterly until the options are fully vested if the performance condition shall be deemed satisfied in three equal tranches as follows: a) One third (1/3) of the Option Shares shall satisfy the Performance Condition upon the Company’s achievement of market capitalization equal to |

255,000 | 10.00 | June 30, 2030 | ||||||||||

| Beneficiary |

Type of options |

Grant date |

Vesting date (1) |

Number of options outstanding |

Strike price in USD |

Expiration date | ||||||||||

| $1.5 billion prior to the Expiration Date, subject to the Optionee’s continuous Service Relationship through such date b) One third (1/3) of the Option Shares shall satisfy the Performance Condition upon the Company’s achievement of market capitalization equal to $2.0 billion prior to the Expiration Date, subject to the Optionee’s continuous Service Relationship through such date |

||||||||||||||||

| c) One third (1/3) of the Option Shares shall satisfy the Performance Condition upon the Company’s achievement of market capitalization equal to $3.0 billion prior to the Expiration Date, subject to the Optionee’s continuous Service Relationship through such date | ||||||||||||||||

| Converted Stock options VI | June 30, 2020 | 47,165 options vested as of March 31, 2022, and an additional 47,164 will vest quarterly thereafter until the options are fully vested | 94,329 | 10.00 | June 1, 2030 | |||||||||||

| Service options | December 17, 2020 | 18,375 options vested as of March 31, 2022, and an additional 30,625 will vest quarterly thereafter until the options are fully vested | 49,000 | 9.70 | December 17, 2030 | |||||||||||

| Service options | December 9, 2021 | 98,000 options will vest quarterly until the options are fully vested | 98,000 | 11.00 | December 9, 2031 | |||||||||||

Carsten Reinhardt, M.D., Ph.D. |

Performance-based options | June 30, 2020 | 255,000 options will vest quarterly until the options are fully vested if the performance condition shall | 255,000 | 10.00 | June 30, 2030 | ||||||||||

| Beneficiary |

Type of options |

Grant date |