| 2021 | 2022 | |||||||||||||||

| Adjustments |

Mr. Scholl | Average non-CEO NEOs |

Mr. Scholl | Average non-CEO NEOs |

||||||||||||

| Add/Subtract: Change in fair value of outstanding and unvested awards granted during prior FY |

$ | 656,068 | $ | 1,793,510 | $ | 13,020,231 | $ | 1,108,212 | ||||||||

| Add/Subtract: Change in fair value of awards granted during prior FY that vested during applicable FY |

$ | 0 | $ | 0 | $ | (1,568,000 | ) | $ | (228,922 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| TOTAL ADJUSTMENTS |

$ | (7,379,918 | ) | $ | (5,526,459 | ) | $ | 11,040,600 | $ | 720,808 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (3) | TSR in fiscal year 2021 is cumulative for the measurement period beginning on July 6, 2021, our first day of trading following the Business Combination, and ending on December 31, 2021. TSR in fiscal year 2022 covers the period beginning January 1, 2022 and ending December 31, 2022. Both TSR values are calculated in accordance with Item 201(e) of Regulation S-K, assuming an initial investment of $100. The Russell 2000 Index is the index we use in our Annual Report on Form 10-K pursuant to Item 201(e) of Regulation S-K, reflecting our belief that we cannot reasonably identify an industry index or specific peer group that would offer a meaningful comparison. |

| (4) | “Adjusted EBITDA” is defined as earnings before interest, taxes, depreciation and intangible amortization adjusted for the impact of certain non-cash and other items that we do not consider in the evaluation of ongoing operational performance. The Company selected Adjusted EBITDA as the most important financial measure it used to link Company performance to CAP to our PEO and Non-PEO NEOs in 2022. This performance measure may not have been the most important financial performance measure for years 2021 and 2020 and we may determine a different financial performance measure to be the most important financial performance measure in future years. |

Description of the Relationship Between Pay and Performance

Relationship between Financial Performance Measures

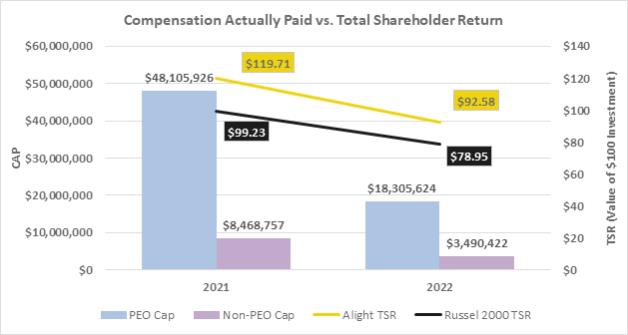

The line graphs below compare (i) the compensation actually paid to our CEO and the average of the compensation actually paid to our remaining NEOs, with (ii) our cumulative TSR, (iii) the Comparator Group TSR, (iv) our Net Income, and (v) our Adjusted EBITDA, in each case, for the fiscal years ended December 31, 2021 and 2022.

TSR amounts reported in the graph assume an initial fixed investment of $100, and that all dividends, if any, were reinvested.

Pay Versus Performance Tabular List

The following performance measures represent the most important performance measures used by us to link compensation actually paid to our NEOs to performance for the fiscal year ended December 31, 2022:

| • | Adjusted EBITDA; |

| • | Revenue; and |

| • | BPaaS Revenue. |

96