UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD |

Commission File Number

(Exact name of Registrant as specified in its Charter)

|

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

|

(I.R.S. Employer Identification No.) |

|

( |

|

|

(Address including zip code, and telephone number, including areas code, of principal executive offices) |

|

(Title of each class) |

|

Securities registered pursuant to Section 12(b) of the Act: Trading Symbol(s) |

|

(Name of each exchange on which registered) |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

|

☒ |

|

|

|

|

|

|||

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

The aggregate market value of Common Stock held by non-affiliates of the registrant (13,907,131 shares) based on the last reported sale price of the registrant’s Common Stock on the Nasdaq Global Select Market on October 31, 2023, which was the last business day of the registrant’s most recently completed second fiscal quarter, was $

The number of shares of Registrant’s Common Stock outstanding as of June 24, 2024 was

DOCUMENTS INCORPORATED BY REFERENCE

AMERICAN OUTDOOR BRANDS, INC. AND SUBSIDIARIES

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended April 30, 2024

TABLE OF CONTENTS

|

|

|

|

Page |

|

|

PART I |

|

|

ITEM 1. |

|

|

6 |

|

ITEM 1A. |

|

|

22 |

|

ITEM 1B. |

|

|

43 |

|

ITEM 1C. |

|

|

43 |

|

ITEM 2. |

|

|

44 |

|

ITEM 3. |

|

|

45 |

|

ITEM 4. |

|

|

45 |

|

|

|

|

|

|

|

|

PART II |

|

|

ITEM 5. |

|

|

46 |

|

ITEM 6. |

|

|

48 |

|

ITEM 7. |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

49 |

ITEM 7A. |

|

|

56 |

|

ITEM 8. |

|

|

56 |

|

ITEM 9. |

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

|

56 |

ITEM 9A. |

|

|

56 |

|

ITEM 9B. |

|

|

57 |

|

ITEM 9C. |

|

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

|

57 |

|

|

|

|

|

|

|

PART III |

|

|

ITEM 10. |

|

|

58 |

|

ITEM 11. |

|

|

58 |

|

ITEM 12. |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

|

58 |

ITEM 13. |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

|

58 |

ITEM 14. |

|

|

58 |

|

|

|

|

|

|

|

|

PART IV |

|

|

ITEM 15. |

|

|

59 |

|

ITEM 16. |

|

|

60 |

|

|

61 |

|||

|

F-1 |

|||

|

|

|

|

|

EX-21.1 |

|

|

|

|

EX-23.1 |

|

|

|

|

EX-31.1 |

|

|

|

|

EX-31.2 |

|

|

|

|

EX-32.1 |

|

|

|

|

EX-32.2 |

|

|

|

|

Accumax®, BOG®, BUBBA®, Caldwell®, Deadshot®, Deathgrip®, Delta Series®, E-MAX®, F.A.T. Wrench®, Fieldpod®, Frankford Arsenal®, Golden Rod®, Hooyman®, Imperial®, Intellidropper®, Lead Sled®, Lockdown®, Mag Charger®, Old Timer®, Schrade®, Sharpfinger®, Tipton®, Grilla®, Grilla Grills®, Uncle Henry®, ust®, Wheeler®, XLA Bipod®, Crimson Trace®, Lasergrips®, Laserguard®, Laserlyte®, Lasersaddle®, Lightguard®, Rail Master®, are some of the registered U.S. trademarks of our company or one of our subsidiaries. AOB Products Company™, Dock and Unlock ™, Don’t Be Outdoorsy – Be Outdoors™, Engineered for the Unknown™, From Niche to Known™, Lockdown Puck™, MEAT!™, MEAT Your Maker!™, Secure Your Lifestyle™, The Ultimate Lifestyle™, Unmatched Accuracy at the Bench and in the Field™, Water to Plate™, Your Land. Your Legacy™, are some of the unregistered trademarks of our company or one of our subsidiaries. Trademarks licensed to us by Smith & Wesson Brands, Inc. in connection with the manufacture, distribution, marketing, advertising, promotion, merchandising, shipping, and sale of certain licensed accessory product categories include M&P®, Performance Center®, and Smith & Wesson®, among others. This report also may contain trademarks and trade names of other companies.

This report includes market and industry data that we obtained from industry publications, third-party studies and surveys, government agency sources, filings of public companies in our industry, and internal company surveys. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the foregoing industry and market data to be reliable at the date of the report, this information could prove to be inaccurate as a result of a variety of matters.

Statement Regarding Forward-Looking Information

The statements contained in this Annual Report on Form 10-K that are not historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements other than statements of historical facts contained or incorporated herein by reference in this Annual Report on Form 10-K, including statements regarding our future operating results, future financial position, business strategy, objectives, goals, plans, prospects, markets, and plans and objectives for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “suggests,” “targets,” “contemplates,” “projects,” “predicts,” “may,” “might,” “plan,” “would,” “should,” “could,” “may,” “can,” “potential,” “continue,” “objective,” or the negative of those terms, or similar expressions intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. Specific forward-looking statements in this Annual Report on Form 10-K include statements regarding the following:

A number of factors could cause our actual results to differ materially from those indicated by the forward-looking statements. Such factors include, among others, the following:

All forward-looking statements included herein are based on information available to us as of the date hereof and speak only as of such date. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. The forward-looking statements contained in or incorporated by reference into this Annual Report on Form 10-K reflect our views as of the date of this Annual Report on Form 10-K about future events and are subject to risks, uncertainties, assumptions, and changes in circumstances that may cause our actual results, performance, or achievements to differ significantly from those expressed or implied in any forward-looking statement. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future events, results, performance, or achievements.

We are subject to the informational requirements of the Exchange Act, and we file or furnish reports, proxy statements, and other information with the SEC. Such reports and other information we file with the SEC are available free of charge at https://ir.aob.com/financial-information/sec-filings as soon as practicable after such reports are available on the SEC’s website at sec.gov. The SEC’s website contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

PART I

Item 1. Business

General

We are a leading provider of outdoor lifestyle products and shooting sports accessories encompassing hunting, fishing, outdoor cooking, camping, shooting, and personal security and defense products for rugged outdoor enthusiasts. We conceive, design, source, and sell our outdoor lifestyle products, including premium sportsman knives and tools for fishing and hunting; land management tools for hunting preparedness and for use in the backyard; harvesting products for post-hunt or post-fishing activities; outdoor cooking products; and camping, survival, and emergency preparedness products. We conceive, design, produce or source, and sell our shooting sports accessories, such as rests, vaults, and other related accessories; electro-optical devices, including hunting optics, firearm aiming devices, flashlights, and laser grips; and reloading, gunsmithing, and firearm cleaning supplies. We develop and market all our products as well as manufacture some of our electro-optics products at our facility in Columbia, Missouri. We also contract for the manufacture and assembly of most of our products with third parties located in Asia.

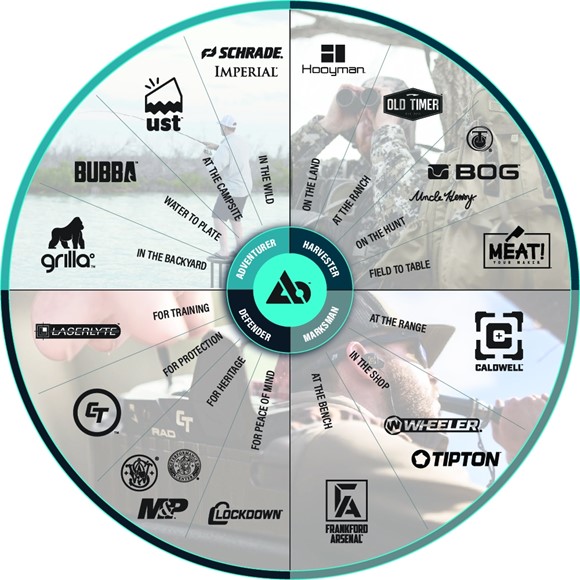

We focus on our brands and the establishment of product categories in which we believe our brands will resonate strongly with the activities and passions of consumers and enable us to capture an increasing share of our overall addressable markets. Our owned brands include BOG, BUBBA, Caldwell, Crimson Trace, Frankford Arsenal, Grilla, Hooyman, Imperial, LaserLyte, Lockdown, MEAT! Your Maker, Old Timer, Schrade, Tipton, Uncle Henry, ust, and Wheeler, and we license additional brands for use in association with certain products we sell, including M&P, Smith & Wesson, Performance Center by Smith & Wesson, and Thompson/Center. In focusing on the growth of our brands, we organize our product development and marketing teams into four brand lanes, each of which focuses on one of four distinct consumer verticals – Adventurer, Harvester, Marksman, and Defender – with each of our brands included in one of the brand lanes.

Our sales activities are focused on how we go to market within the e-commerce and traditional distribution channels. These two channels involve distinct strategies intended to increase revenue and enhance market share by placing our products where the consumer expects to find them. Our sales team is built around the two distribution channels and is organized into product categories and regions within the e-commerce and traditional channels and sells our products across all four of our brand lanes. We measure our success through sales performance in these distribution channels against prior results and our own expectations.

Our objective is to enhance our position as a leading provider of high-quality and innovative outdoor lifestyle products and shooting sports accessories for the hunting, fishing, outdoor cooking, camping, shooting, personal security and defense, and other rugged outdoor markets and to expand our addressable market into carefully selected new product arenas.

Key elements of our strategy to achieve this objective and deliver long-term stockholder value are as follows:

6

We believe that throughout our history, we have been able to utilize our understanding of consumer needs to develop and introduce innovative new disruptive products with strong intellectual property protection that have continually increased our market share in their product categories, such as our BUBBA Electric Fillet Knife, which we believe represents a substantial portion of the market share in the electric fillet knife category. We have enhanced our product development capabilities, developed a multi-faceted marketing approach, improved our multi-channel distribution platform, and expanded and diversified our business through organic growth and strategic acquisitions.

Our net sales were $201.1 million for the fiscal year ended April 30, 2024; $191.2 million for the fiscal year ended April 30, 2023; and $247.5 million for the fiscal year ended April 30, 2022. Results reported include net sales related to acquisitions for the period subsequent to their respective acquisition dates. Our gross profit for the fiscal years ended April 30, 2024, 2023, and 2022 totaled $88.4 million, $88.1 million, and $114.2 million, respectively. Total assets were $240.6 million as of April 30, 2024 and $243.6 million as of April 30, 2023.

Spin-Off Transaction

On August 24, 2020, Smith & Wesson Brands, Inc., or our former parent company, completed the spin-off of its outdoor products and accessories business to us, or the Separation. The Separation was effected through the transfer of all of the assets and legal entities, subject to any related liabilities, associated with its outdoor products and accessories business to us, and the distribution of all the outstanding shares of our common stock to the holders of the common stock of our former parent company, as of the close of business on August 10, 2020.

Corporate Information

We were incorporated in Delaware on January 28, 2020 and we maintain our principal executive offices at 1800 North Route Z, Columbia, Missouri 65202. Our telephone number is (800) 338-9585. Our website is located at AOB.com. Through our website, we make available free of charge our annual reports on Form 10-K, our proxy statements, our ESG report, our quarterly reports on Form 10-Q, our current reports on Form 8-K, and amendments to any of these documents filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. These documents are available as soon as reasonably practicable after we electronically file them with the SEC. We also post on our website the charters of our Audit, Compensation, and Nominations and Corporate Governance Committees; our Corporate Governance Guidelines, our Code of Conduct, and any amendments or waivers thereto; and any other corporate governance materials contemplated by the regulations of the SEC and Nasdaq. These documents are also available in print by contacting our corporate secretary at our executive offices. Our website and the information contained therein or connected thereto is not incorporated into this Annual Report on Form 10-K.

Market Opportunity

Our primary target customers are outdoor-oriented consumers who enjoy active lifestyles with a focus on outdoor activities. The primary users of our products consist of a wide range of outdoor enthusiasts, including those who engage in recreational target shooting, personal security and defense, hunting, archery, fishing, outdoor cooking, camping, and hiking.

Driven in part by the start of the COVID-19 pandemic, outdoor recreation consumer participation trends have been favorable since 2020, resulting in 14.5 million new participants since January 2020. A report issued in 2023 by the Outdoor Industry Association outlined that the outdoor recreation participant base grew by 2.3 percent in calendar 2022 to a record 168.1 million participants, or 55 percent of the United States population ages six and older. In addition, 80% of outdoor activity categories experienced participation growth, including camping and fishing, large categories in which we participate. According to various other industry studies published by the Outdoor Industry Association, National Shooting Sports Foundation, or NSSF, Southwick Associates, and the Recreational Boating and Fishing Foundation, participation has increased in hunting, camping, and fishing. According to the Outdoor Foundation and Recreational Boating & Fishing Foundation, as of 2022, there are an estimated 54 million anglers in the United States, with nearly 42 million of those anglers participating in freshwater and 14 million anglers participating in saltwater. Our acquisition of Grilla in March 2022 gave us entry into the estimated $7 billion outdoor cooking industry. In addition, strong participation in firearm ownership led to approximately 19 million new entrants into shooting sports since calendar 2019, according to the NSSF. According to a study in 2017, the NSSF estimates roughly 50 million people visit a shooting range each year, and in a more recent report, an estimated 20 million people participate in target shooting on a regular basis. Finally, the Outdoor Industry Association estimated that roughly 15 million people engaged in hunting in 2022.

7

Competitive Strengths

Portfolio of Leading Brands and Products Focused on the Rugged Outdoor Market

We currently sell our products under 21 distinct brands that we believe focus on the desires of our consumers and have a reputation for superior quality and product innovation. We believe we have built loyalty and brand recognition over our history by understanding our core consumers and delivering innovative products that they desire.

Four Brand Lanes with Significant Runway for Growth

Our brands are organized into four brand lanes focused on specific consumer verticals that are based on consumer behaviors and desires. This structure organizes our business in a manner intended to deploy specific resources dedicated to designing and marketing products directed at these respective consumer verticals. We have developed our “Dock and Unlock” formula, where we take an existing brand and apply the proper strategy and these dedicated brand lane resources to unlock the brand’s potential value. We use the defined methodologies to determine the types of products desired by that specific consumer and then design products in both existing and new categories that meet those desires. We believe this approach helps us drive growth from opportunities in new product categories and expand our footprint in existing categories.

Repeatable Process for Innovating and Rejuvenating Mature Product Categories

We have approximately 30 product designers, engineers, and software developers situated across five in-house state-of-the-art product development labs who are capable of delivering over 200 new products, annually. We recognize the importance of innovation and protecting our intellectual property. We currently have more than 390 patents and patents pending and have registered and unregistered trademarks related to our products. Our designers and engineers come from diverse industry backgrounds, including medical and laboratory equipment, defense, home goods, and automotive. We believe this diversity yields a unique combination of methods and perspectives that fosters innovation within traditionally mature rugged outdoor product categories. One example of this innovation is our entry into the large, underserved "catch and release" market with our BUBBA tournament-grade Pro Series Smart Fish Scale, or Pro SFS, which is integrated with smart technology that consumers can access through a BUBBA smartphone application. This smart technology allows anglers to log their catches, record detailed information, and connect with other anglers to share information about their catches and their excursions. We believe the BUBBA Pro SFS is the first product of its kind and is intended to reinvent the way anglers pursue their sport. In addition to fostering enhanced competition and enabling the gamification of freshwater fishing through its tournament functionality, the BUBBA Pro SFS supports conservation and sustainability in fishing by allowing anglers to catch, weigh, and immediately release their catch, reducing the fish out-of-the-water time.

Because we have such a wide breadth of products that span 21 brands, our product development teams frequently leverage our products to “cross-pollinate” technology across brand lanes and bring new insights into mature product categories. An example of this ‘cross-pollination’ can be found in our BUBBA Pro SFS, which we launched in 2023 and which incorporates technology or design from products that are situated across all four brand lanes. The BUBBA Pro SFS incorporates lithium battery pack technology from our Caldwell EMax Pro hearing protection line (Marksman brand lane), Bluetooth connection capability to a smart phone with live data monitoring and logging through a cloud server system from our Lockdown Puck (Defender brand lane), interactive LCD screen and menu system from our BOG Bloodmoon Game camera products (Harvester brand lane), and waterproof storage system and BUBBA-Rubba non-slip grip technology from our BUBBA Multi-Flex products (Adventurer brand lane).

Leverageable Platform for Acquisitions with Demonstrated Acquisition Execution

We believe our brand lanes and sales organization provide us with a leverageable platform from which to integrate acquisitions quickly, achieve cost savings, provide immediate brand support, and add sales expertise to drive brand penetration within our customer base. In addition, our senior management team brings significant acquisition experience, having completed a total of 24 transactions over the last 17 years, ranging from $1 million to approximately $1 billion in enterprise value. In conjunction with reviewing potential acquisition candidates, we believe that our long-standing industry relationships facilitate the identification of future potential acquisition targets.

Experienced, Entrepreneurial Management Team

Our senior management team has substantial knowledge and experience in the rugged outdoor industry. This team is responsible for defining and executing our business strategies with a “brand-first” orientation supported by our brand lanes. We strive to promote a collaborative and supportive environment for our employees. This approach allows employees within our brand lanes to pursue new ideas and experimentations, leading to a highly entrepreneurial culture.

8

Strategy

Introduce a Continuing Stream of New and Differentiated High-Quality Rugged Outdoor Products that Drive Customer Satisfaction and Loyalty

We plan to continue conceiving, designing, producing or sourcing, and marketing in a timely manner a continuing stream of innovative new and differentiated high-quality rugged outdoor products and product extensions that appeal to consumers, achieve market acceptance, and drive customer satisfaction and loyalty to our product groups. Our tradition of innovation and our ongoing research and development, product engineering, product and component sourcing, marketing, and distribution activities are critical components of our ability to continue to offer successful products and help grow our business through increased market share in the product categories in which we participate.

We believe our track record of understanding consumer desires, introducing flagship products in our core product categories, and then strategically expanding within those categories will enable us to continue to expand our existing product offerings. We recently received the following awards:

We also devote significant time and energy to expand the reach of our brands into targeted new rugged outdoor markets that are aligned with the positioning of our brands. We “cross-pollinate” technology across brands, such as transporting the non-slip grip from our BUBBA fishing products onto the handles of Hooyman’s line of hand-held land management tools to provide further product differentiation.

Expand Our Addressable Market through New Categories, Markets, and Distribution

We plan to continue to expand the size of our addressable market beyond the shooting, hunting, and rugged outdoor markets and thereby enlarge our customer base and customer relationships through entry into new product categories, new markets, and new distribution channels. We believe our Caldwell Claymore family of clay throwers represents our organic entry into the broader shotgun shooting sports category. We believe our innovative BUBBA Pro SFS represents our organic entry into a large freshwater "catch and release" market. We believe our innovative Hooyman seed spreaders represent our organic expansion in the farm, home, and hardware distribution channels. We believe the acquisition of Grilla represents our inorganic entry into an estimated $7 billion outdoor cooking market by providing high-quality, barbecue grills; Wi-Fi-enabled wood pellet grills; smokers; accessories; and modular outdoor kitchens. We expect, by expanding our addressable market through new product categories, markets, and distribution channels, we will further increase and diversify our customer base.

Cultivate and Enhance Direct-to-Consumer Relationships through Our Digital Platforms

We plan to continue to cultivate and enhance our direct relationships with consumers by addressing the growing desire of consumers to deal directly with the product and brand source and by recognizing the changing retail landscape and the trend to two-day or next-day delivery. We have established dedicated websites for all of our key brands, and each of our brands has access to marketing and e-commerce resources that work to support online marketing and delivery methods that foster direct-to-consumer efforts. We also expect that our direct-to-consumer efforts will generate pull-through for our products at retail locations for those consumers who prefer a traditional retail approach rather than purchasing directly from our online platform. In addition, our e-commerce platform allows consumers to purchase our products direct from our warehouse, which is not constrained by inventory management efforts at retail. Our e-commerce platform and digital systems also provide opportunities to support the launch of entirely new brands and products to meet the needs of our consumers. For example, we leveraged our e-commerce platform and digital ecosystem to organically enter the meat processing market with our MEAT! Your Maker brand, which includes grinders, mixers, vacuum sealers, sausage stuffers, dehydrators, and slicers. Although we began selling these brands into the traditional channel in fiscal 2024, we have sold and expect to continue to sell these products directly to consumers through our website MEATyourmaker.com. In addition, we sell Grilla branded products, acquired in fiscal 2022, directly to consumers primarily through our website grillagrills.com.

9

Expand and Enhance Our Supply Chain

We plan to continue to expand and enhance our supply chain by identifying, qualifying, attracting, and maintaining contract manufacturers and other suppliers of finished products and components made to our specifications and the raw materials needed for products and components that meet our efficiency, quality, cost, delivery, and other requirements. Qualifying additional suppliers reduces our dependence on any one or small group of suppliers and helps protect us against supplier financial, operational, performance, or capacity issues.

Pursue Acquisitions that Financially and Strategically Complement our Current Business

We plan to continue to complement our organic growth initiatives by pursuing strategic acquisitions that will enable us to expand our product offerings, add new brands, penetrate adjacent and complementary markets, increase our customer base, expand our supply chain, increase our marketing and distribution capabilities, and enhance our operating results through improved acquired company performance, especially when we believe we can improve the performance and profitability of an acquired company through the implementation of our operating methods, strategies, flexible technology platforms, and services. We believe our latest acquisition of Grilla in fiscal 2022 demonstrated the above criteria. We believe the architecture of our brand lanes, sales organization, distribution capabilities, and flexible technology platforms provide us with a leverageable structure from which to integrate acquisitions quickly, achieve cost savings, provide immediate brand support, and add sales expertise to drive brand penetration within our existing customer base.

Product Design and Development

We believe that innovation is key to our long-term success. To be successful as a leading provider of outdoor lifestyle products and shooting sports accessories, we must continue to conceive, design, produce or source, and market a continuing stream of innovative new products and product extensions that appeal to consumers and achieve market acceptance and drive customer satisfaction and loyalty to our brands and product groups.

We believe that we will drive customer satisfaction and loyalty by offering high-quality, innovative products on a timely and cost-effective basis, as well as providing world-class customer service, training, and support. We regard our high-quality, innovative products as the most important aspect of our customer satisfaction and loyalty, but we also offer customer service and support with various programs, such as customer support numbers, e-mail customer question and answer communications, broad service policies, and product warranties. We have developed unique brand-specific content on our websites to help maximize the consumers’ experience with our products.

Through our research and development personnel, we conceive, design, and develop potential products that we believe will be attractive to our customers and help address the needs, wants, and desires of our target consumer base. In so doing, we must seek to anticipate and respond to trends and shifts in consumer preferences by continually adjusting our product mix with innovative features and designs and marketing them in an effective manner. Prior to introducing any product, we assess its cost of production and delivery, estimate its potential sales volume and margin, and conduct vigorous prototype and production-quality sample testing.

As noted previously, our outdoor lifestyle products include premium sportsmen knives and tools for fishing and hunting; land management tools for hunting preparedness; harvesting products for post-hunt or post-fishing activities; outdoor cooking products; and camping, survival, and emergency preparedness products, while our shooting sports accessories products include rests, and other related accessories; electro-optical devices, including hunting optics, firearm aiming devices, flashlights, and laser grips; and reloading, gunsmithing, and firearm cleaning supplies.

We typically launch over 200 new outdoor products and accessories stock keeping units, or SKUs, each year. We generally strive to bring a new product from concept to market within 6 to 12 months, depending on product complexity and other matters. Our extensive product portfolio includes highly regarded brands, such as Caldwell, our line of shooting and range supplies, BOG, our line of hunting accessories; BUBBA, our line of fishing tools and knives; MEAT! Your Maker, our line of meat processing equipment; and Grilla, our line of outdoor cooking products.

Approximately 15% of our employees are focused on research and development activities. In fiscal 2024, 2023, and 2022, our gross spending on research and development activities relating to the development of new products was $6.9 million, $6.4 million, and $5.5 million, respectively. We expense research and development costs as incurred.

10

Our Brands

We currently sell our products under 21 distinct brands organized under four brand lanes.

Adventurer Brands

Harvester Brands

11

Marksman Brands

Defender Brands

We own all of our brands with the exception of those brands and trademarks that we license, which includes the Smith & Wesson logo, the script “Smith & Wesson,” the “M&P” logo, the “T/C” logo, and the script “Performance Center,” which are well-known and have a reputation for quality, value, and trustworthiness in the accessories industry.

12

Brand Lanes

Our Brand Lanes are the foundation for our distinctive product development and marketing functions. Our brand-first approach is combined with passionate personnel to deliver authentic experiences to our consumers. Our knowledgeable employees develop a deep understanding of our brands and understand precisely what our customers and consumers desire most in new products. Dedicated management, marketing, creative, digital support, and engineering resources supporting each brand lane allow us to strategically and efficiently approach our development roadmap and marketing efforts. We currently market our products under 21 distinct brands, organized into four brand lanes aligned with our specific consumer verticals:

|

The Adventurer is at home when away from home. Whether conquering a mountain, navigating the open ocean, trekking through a valley, or taking on any other outdoor escapade, the Adventurer’s thrill is the comfort zone. It is more than a connection with the outdoors; it is about being a part of it. |

|

|

To the Harvester, it’s not a job. It’s not about harvesting or mounting a trophy. It’s a passion to create, to grow, to conserve, and to ensure that the hunger to hunt and experience the most inaccessible terrain is passed down for future generations. Being a Harvester is not about taking, it’s about giving back. |

|

|

|

|

|

|

For the Defender, security is above all else. It starts with the peace of mind that comes with confidently knowing your belongings are safe, and becomes complete with determination to train and prepare yourself for life’s biggest adversaries. The Defender protects – it makes up the fabric of their DNA. |

|

|

Marksmen are shooters, from the beginner to the skilled competitor. Whether at the workbench, in the workshop, in the field, or on the range, and no matter the choice of handgun, rifle, shotgun, or archery, a Marksman’s success is measured in hours of trigger time, the smell of burnt powder, and bullseyes. |

13

Marketing

We deploy a multi-faceted strategy to engage with consumers and to deliver positive consumer experiences. Our marketing approach begins with our team utilizing digital, television, print, and other advertising media to assure that our customers and consumers connect with our brands and to the products we offer.

In order to help convert at the point of purchase, increase the likelihood of loyal consumer relationships, and build advocacy with our consumer base, we market our products to consumers using focused campaigns that align with each brand’s core characteristics. In this regard, we utilize what we believe are the most impactful mediums, such as in-store retail merchandising, online merchandising, grassroots events, digital advertising campaigns, influencer marketing, and robust distribution of content across most social media channels, to encourage enthusiasts to continue exploring our brand offerings and ultimately lead to purchases. Our influencers participate on a variety of social media platforms, regularly posting brand imagery, lifestyle content, instructional material, and detailed reviews of our products to help promote our brands. To further our message, we frequently participate in various earned media across a full spectrum of digital and print publications, which drives authenticity back to our consumer base as they read about the latest information regarding our suite of new products. This multifaceted approach is intertwined with the brand lane structure that we believe differentiates us from our competition and offers a significant advantage in efficiency.

For the fiscal years ended April 30, 2024, 2023, and 2022, advertising and promotion expenses were $11.1 million, $11.9 million, and $13.3 million, respectively, excluding the cost of rebates and promotions reflected in gross profit.

Original Content

We utilize content as the engine to drive our strategic approach to marketing. In the past year, we continued to emphasize the enhancement of our content capture and editing capabilities. Our team of producers and external resources has provided an accessible outlet for regularly distributed fresh content for each of our brands. The deployment of this content assists us in positioning our brands, garnering the attention of our customers, establishing a lifestyle connection with those discovering our brands for the first time, and educating our consumer base about the features and benefits of the products that fall within each brand. By owning the development and distribution of our content, we are able to ensure that each message is consistent with our brands’ positioning and strategy.

Our Digital Platform

We believe social media platforms, such as Facebook, Instagram, and YouTube, are effective in enabling us to showcase content, educate our customer base about our products, and generate enthusiasm for most of our brands. Our direct-to-consumer e-mail marketing helps us to further engage our consumers and communicate the value of our brands. We continue to invest in new digital marketing capabilities designed by our e-commerce and marketing teams to provide favorable customer experiences. Utilizing our digital platform, we operate branded e-commerce websites designed to inform, inspire, and prepare our customers for the rugged outdoors. We believe our digital platform supports our core business and facilitates future sales growth and profitability.

We utilize our websites, including AOB.com, BUBBA.com, SCHRADE.com, grillagrills.com, ustgear.com, BOGhunt.com, Hooyman.com, OldTimerKnives.com, MEATyourmaker.com, CaldwellShooting.com, FrankfordArsenal.com, WheelerTools.com, TiptonClean.com, CrimsonTrace.com, Lockdown.com, Laserlyte.com, store.smith-wesson.com, and accessories.tcarms.com, to market our products and to provide a wide range of information regarding our company to customers, consumers, dealers, distributors, investors, and government agencies.

Industry and Consumer Events

We sponsor a number of events and organizations in support of outdoor activities that our consumers enjoy. We typically attend various trade shows, including the Shooting, Hunting, Outdoor Trade (SHOT) Show; Archery Trade Association Show (ATA Show); Outdoor Retailer (OR Show); the National Association of Sporting Goods Wholesalers Show (NASGW); the International Convention of Allied Sportfishing Trades (ICAST); the IWA Outdoor Classics Show in Europe; and various distributor, buying group, and consumer shows. We also seek to establish relationships with professionals and influencers for each of our brands to help evaluate, promote, and establish product performance and authenticity with customers and consumers.

14

Distribution Channels and Customers

We distribute our products through e-commerce and traditional distribution channels. Our e-commerce channels include net sales from customers that do not traditionally operate a physical brick and mortar store but rather generate the majority of their revenues from consumer purchases from their retail websites. This also includes our own e-commerce platform, including our websites. Our traditional channels include net sales from customers that primarily operate out of physical brick and mortar stores and generate the large majority of revenues from consumer purchases inside their brick-and-mortar locations. These traditional distribution channels include sports specialty stores, sporting goods stores, dealers and distributors, mass market, home and auto retailers, and original equipment manufacturers. Our go-to-market strategies for these two channels are tailored very differently, with e-commerce initiatives focused on digital advertising and consumer awareness, while traditional channel initiatives include in-store displays, focused advertising, and tailored promotional programs. The world’s largest e-commerce retailer, through its very extensive customer base and consumer-driven product offerings, accounted for 22.1% and 25.4% of our net sales for fiscal 2024 and 2023, respectively.

Our sales team is built around the two distribution channels and is organized into product categories and regions within the e-commerce and traditional channels and sells our products across all four of our brand lanes. We believe the structure of our sales organization allows us to accomplish four very important goals. First, it gives us the ability to consistently focus on the unique needs and requirements of each product category. Second, it allows us to bring brand expertise and awareness to our customers. Third, and most importantly, it allows us to develop and execute strategic plans based on how each channel conducts business as well as how it targets the primary and secondary consumers within those channels. Finally, our sales organization is designed to be able to adapt to acquisitions and the expansion of our brands into new categories without having to alter our sales structure. We believe this will allow us to integrate new categories into our teams with minimal disruption to our existing business and, more importantly, allow us to quickly begin leveraging our size and scope with the new additions.

Although we have long-established relationships with many of our customers, we generally do not have long-term supply or binding contracts or guaranties of minimum purchase arrangements with our customers. Instead, our customers generally purchase from us through individual purchase orders. As a result, these customers may cancel their orders, change purchase quantities from forecasted volumes, delay purchases for a number of reasons, or change other terms of our business relationship. We grant payment terms to most commercial customers ranging from 30 to 90 days. However, in some instances, we provide longer payment terms.

We believe consumers favor multiple purchasing options between online and traditional brick and mortar retailers. As a result, traditional brick and mortar retail stores are evolving to remain competitive. Traditional brick and mortar retailers have also been expanding their own e-commerce retail platforms and assortment of products as well as expanding their online advertising and promotional programs.

Retailers are reducing lead time for product delivery and reducing their inventory levels, and in certain circumstances, require suppliers to ship orders directly to consumers for purchases on their e-commerce platforms.

The ultimate users of our products consist of outdoor enthusiasts, including shooting and hunting enthusiasts, fishing enthusiasts, outdoor cooking enthusiasts, campers, hikers, and other sports enthusiasts.

Service and Support

In order to provide consumers with positive experiences involving our products, we maintain a dedicated team of trained customer support representatives who seek to successfully address customer questions or issues that may arise across our product offerings. We utilize a customer service number and resources on our website to answer questions and resolve issues. We stand behind the quality of our products by offering a variety of warranties, ranging from limited lifetime, four-year, three-year, two-year, or one-year warranty programs, depending on the product. We also will repair or replace with an item of equivalent value, at our option, certain products or parts that are found to be defective under normal use and service, without charge during the warranty period.

Sourcing, Assembly, and Production

Except for certain assembly operations performed at our Columbia, Missouri facility, we generally utilize third-party contract manufacturers and suppliers for our finished products and components. Third-party contract manufacturers and suppliers provide finished products and components to us in accordance with our product and component specifications. Third parties also supply us and our contract manufacturers with the raw materials used in our products and components, including steel, plastic, aluminum, copper, lead, and packaging materials. Most of our third-party contract manufacturers and suppliers are in Asia, primarily China, and, to a lesser extent, Taiwan, Vietnam, Myanmar, and the Philippines.

15

We generally provide these suppliers with short-term advance forecasts of our production requirements, however, when we anticipate delays in our supply chain or congestion at shipping ports, we will order in advance to mitigate supply chain risk. Our suppliers must meet our quality and other standards and have the ability to produce our finished products and components and supply our raw materials in a timely and efficient manner. We continue to expand our supply base to maintain competitive pricing and quality standards and to better position ourselves to respond rapidly to changes in customer demand and market trends to mitigate supply chain risk. For certain products and components, we utilize a dual sourcing supply chain to mitigate risks associated with sourcing key components from only one supplier.

We do not have long-term contractual arrangements with any of our suppliers that guarantee us production capacity, prices, lead times, or delivery schedules. Our reliance on these independent parties exposes us to vulnerability because of our dependence on a few sources of supply. We believe, however, that other sources of supply are available. In addition, we continually strive to develop relationships with other sources of supply in order to reduce our dependence on any one source of supply. As a result, we believe that our current and other available suppliers will ensure that we obtain a sufficient supply of goods built to our specifications in a timely manner and on satisfactory economic terms.

Facilities and Distribution

We lease approximately 632,000 square feet of building and surrounding property located at 1800 North Route Z, Columbia, Boone County, Missouri, or the Building, through a Lease Agreement, dated October 26, 2017, as amended by the First Amendment of Lease Agreement, dated October 25, 2018, and as further amended by the Second Amendment to Lease Agreement, dated January 31, 2019 (collectively, the "Lease"). The Lease provides us with an option to expand the Building by up to 491,000 additional square feet. The Lease term ends on November 26, 2038 and does not provide for an extension of the term of the Lease. We receive related tax and other incentives from federal, state, and local governmental authorities.

We also lease 5,000 square feet of office space in Chicopee, Massachusetts; 2,500 square feet of office space in Shenzhen, People's Republic of China; and 2,500 square feet of office space in Yanjiang, People's Republic of China.

Our Missouri facility includes our principal executive, administrative, financial, sales, marketing, R&D, production, assembly, and distribution operations. Our Massachusetts facility houses certain administrative and finance staff. Our China facilities house certain R&D staff.

Patents, Trademarks, and Copyrights

We recognize the importance of innovation and protecting our intellectual property. We currently have more than 390 patents and patents pending and have registered and unregistered trademarks related to our products. We apply for patents whenever we develop innovative new products, unique designs, or processes of commercial importance and seek trademark protection when we believe they provide a marketing advantage. We do not believe that our business is materially dependent on any single patent or trademark.

We rely on a combination of patents, copyrights, trade secrets, trademarks, trade dress, customer records, monitoring, brand protection services, confidentiality agreements, and other contractual provisions to protect our intellectual property.

Because of the significance of our brand names, our trademarks, service marks, trade dress, and copyrights are also important to our business. We have an active global program of trademark registration, monitoring, and enforcement. We market our products and accessories under 21 distinct brands, including the brands sold under a license agreement.

We vigorously pursue and challenge infringements of our patents, trademarks, service marks, trade dress, and copyrights, as we believe the goodwill associated with them is a cornerstone of our branding strategy.

Legal Proceedings

From time to time, we can become involved in lawsuits, claims, investigations, and proceedings, including those relating to product liability, intellectual property, commercial relationships, employment issues, and governmental matters. Litigation, regardless of the merits, can be expensive, time consuming, and divert the time and attention of management personnel, and unfavorable outcomes and prolonged litigation can harm our business. We actively monitor the status of litigation and, depending on the circumstances, intend to vigorously defend claims and assert all appropriate defenses to litigation against us.

16

Information Systems

Our information systems utilize leading software enterprise resource platforms, including procurement, inventory management, receivables management, and accounting. During fiscal 2023, we implemented a new ERP system, Microsoft D365, that utilizes leading software enterprise resource platforms, including procurement, inventory management, receivables management, and accounting.

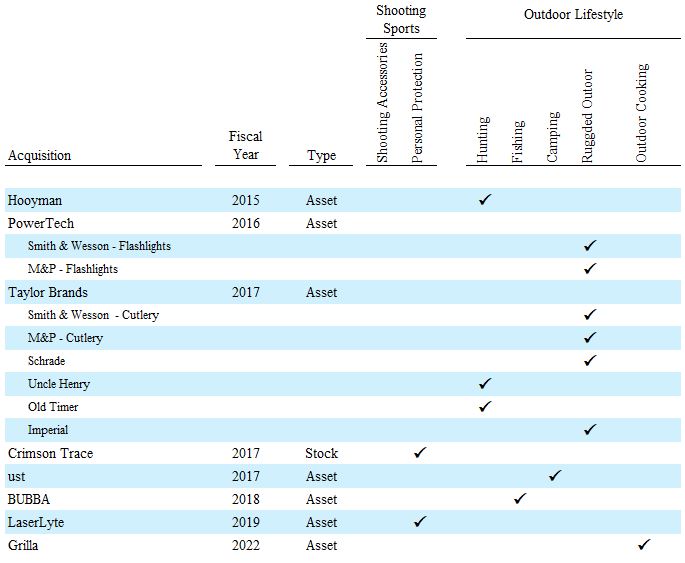

Acquisitions

As noted above, we are building our business both organically and inorganically. The following table sets forth information regarding the brands and products added to our operations through acquisitions in the fiscal years indicated:

Shooting Competition

We operate in a highly competitive market and encounter competition from both domestic and foreign participants. We believe we can effectively compete with all of our present competitors. We compete primarily based upon innovation, performance, price, quality, reliability, durability, consumer brand awareness, and customer service and support. Our competitors include Vista Outdoor Inc. and a large number of private companies that directly compete with a number of our brands. Certain of our competitors may have more established brand names and stronger distribution channels than we do and have, or have through their owners, access to financial and marketing resources that are greater than we possess that may afford them the ability to invest more than we can in product development, intellectual property, and marketing. In addition, we compete with many other sporting and recreational products and activities companies for discretionary spending of consumers.

17

Inventory Management

Inventory management is key to the cash flows and operating results of our business. We manage our inventory levels based on supply chain delivery requirements, existing orders, anticipated sales, and the delivery requirements of our customers, which requires close coordination with our customers. For new product introductions, which often require large initial launch shipments, we may commence production before receiving orders for those products. Key areas of focus include added discipline around the purchasing of product, inventory optimization and channel placement, as well as better planning and execution in disposition of excess inventory through our various channels. Our inventory strategy focuses on mitigating certain risks in the supply chain and continuing to meet consumer demand, while improving our inventory efficiency over the long term through the ongoing implementation of inventory optimization tools.

Seasonality

Our business is typically seasonal, especially because many of our products are used in outdoor-based activities. Our sales are typically the highest between August and October because of demand relating to prime hunting season, seasonal cutlery promotions, the timing of industry trade shows, and holiday season demand. As a result of seasonal and quarterly operating fluctuations, we do not believe that comparisons between different quarters within a single year are relevant or can be relied upon as indicators of performance for any fiscal year. In addition, the sale of our products may also be affected by unseasonal weather conditions.

Government Regulation

Like other manufacturers and distributors of consumer products, we are required to comply with a wide variety of federal, state, and international laws, rules, and regulations, including those related to consumer products and consumer protection, advertising and marketing, labor and employment, data protection and privacy, intellectual property, workplace health and safety, the environment, the import and export of products, and tax matters. Our failure to comply with applicable federal, state, and international laws, rules, and regulations may result in our being subject to claims, lawsuits, fines, and adverse publicity that could have a material adverse effect on our business, operating results, and financial condition. These laws, rules, and regulations currently impose significant compliance requirements on our business, and more restrictive laws, rules, and regulations may be adopted in the future. In addition, the U.S. Food and Drug Administration, or FDA, regulates certain of our electro-optical products, grilling, and meat processing products.

Human Capital

We believe that our employees are an indispensable contributor to our success and are critical to our ability to execute our strategy. As such, we are committed to a strong, healthy culture that provides respect for all employees, focuses on creating and sustaining an atmosphere of collaboration and innovation, and rewards team and individual successes. We embrace diverse viewpoints and perspectives, recognizing that greater inclusion fosters innovation and improves decision-making and financial results. We invest in our people accordingly.

Equal Opportunity & Employment

We are committed to hiring qualified candidates without regard to race, religion, color, sex, sexual orientation, pregnancy, gender identity, age, national origin, ancestry, physical or mental disability, genetic information, or any other status. This commitment extends to all levels of our organization, including senior management and our Board of Directors (the "Board of Directors"). We focus on ensuring that our workforce remains open and welcoming to everyone.

The ability to attract, develop and retain a diverse workforce is integral to the long-term success of the Company. We seek to hire and retain talented personnel to support our business. As of April 30, 2024, we had 289 employees, nearly all of whom were located in the United States. None of our employees are represented by a union in collective bargaining with us. We consider relations with our employees to be good.

We are committed to creating an inclusive culture that attracts and values diversity of thought, experience, background, skills and ideas, driving a sense of belonging. Over the past few years, we have renewed and accelerated our actions and activities in support of diversity, equity & inclusion or DE&I, including the development of a women’s Resource Group in Summer of 2023. This group is dedicated to engaging women within our organization and helping them to develop the mindsets and skill sets to advance and attain leadership positions in an industry that historically possesses low gender participation. In 2024, the company held several events for this group, including organizing external speakers and developmental training. We engage with our employees in a variety of forums to elicit feedback for continuous improvement in areas throughout our

18

company. We continue to provide career opportunities to diverse applicants and our internal talent pool, optimize teamwork, and enhance the company’s focus on clear communication of business and organizational changes in this dynamic environment.

Health and Safety

We believe the physical and mental health and well-being of our employees is important to our success. Our employee health care benefits are competitive, and include medical insurance, as well as dental and vision care programs. We support the mental well-being of our employees through our employee assistance program, which provides employee assistance for a range of mental health issues including stress and anxiety, as well as chemical dependence, legal questions, parenting matters, financial counseling, and the sourcing of dependent care resources.

We prioritize the health, safety, and fair treatment of our employees. We have effective oversight of our health and safety programs and perform regular health and safety reviews intended to ensure that proper policies are in place.

Competitive Compensation

Our compensation program aims to attract, retain, and reward talent at all levels of the organization through a pay-for-performance philosophy. We offer competitive and comprehensive compensation and benefit programs to our employees that provide for pay and service recognition, health and wellness, financial well-being, work/life balance, culture and community, and learning and development. During 2024, we further improved the competitiveness of our associate benefit offerings in various ways. Our program features the following:

We are committed to ensuring that all of our employees are paid a fair wage. To that end, we offer competitive wages and benefits to our employees. We base annual pay increases and incentive compensation on merit, which is communicated to employees upon hire and documented through our performance management program. Our executive compensation program is designed to align incentives with achievement of our strategic plan and both short- and long-term operating objectives. We utilize a variety of external, third-party, market data sources to ensure that our compensation practices remain fair and competitive. Benefit trends are reviewed regularly, and plans are adjusted accordingly to remain competitive.

Training and Development

The ability to attract, retain, and develop employees is critical to our success. We offer training and development programs to encourage professional growth and advancement from within, including the following:

We also provide access to self-directed online courses taught with curated learning paths that are designed specifically for the needs of the company and its employees. We believe that this training and development leads to more valuable

19

contributions from our employees, while improving their satisfaction within existing roles and positioning them for potential future advancement.

Sustainability

As a core component of our broader Environmental, Social, and Governance, or ESG, efforts, our key human capital objective is to promote sustainability throughout our organization. In 2023, we expanded, the scope of and renamed the “ESG Committee” of the Board of Directors to the “Sustainability Committee” to better reflect the committee’s enhanced oversight of sustainability policies, practices, and goals including climate change, cybersecurity, DE&I, and human capital. We have an Executive Sustainability Committee comprised of leaders of the company that is overseen by the Sustainability Committee of the Board of Directors to further align our values and drive recurring sustainable growth. The Executive Sustainability Committee typically meets monthly.

Our management team and Board of Directors recognize that sustainability is an imperative and has created an internal working team that is tasked with driving progress. We continue to identify opportunities to reduce our environmental impact across our operations by reducing raw material waste, designing efficient work locations, and conserving our natural resources through recycling programs. We emphasize a culture of accountability and conduct our business in a manner that is fair, ethical, and responsible to earn the trust of our stakeholders.

The Company’s Sustainability Report, published each year, aligns with the Sustainability Accounting Standards Board (SASB). Our most recent Sustainability Report was published in September 2023, and we expect to publish our 2024 Sustainability Report in the summer of calendar 2024. The current sustainability information is posted on our website. Our Sustainability Report highlights the work we are doing across the company and within the ten tenets of our sustainability strategy.

Backlog

We had a backlog of orders for our products totaling $4.0 million and $7.0 million as of April 30, 2024 and 2023, respectively. Our backlog consists of orders for which purchase orders have been received and which are generally scheduled for shipment within six months or subject to capacity constraints, including lack of available product. Although we generally fulfill our order backlog, we allow orders received that have not yet shipped to be cancelled; therefore, our backlog may not be indicative of future sales.

Information About Our Executive Officers

The following table sets forth information regarding our executive officers:

Name |

|

|

Age |

|

|

Position |

Brian D. Murphy |

|

|

40 |

|

|

President and Chief Executive Officer |

H. Andrew Fulmer |

|

|

49 |

|

|

Chief Financial Officer |

James E. Tayon |

|

|

34 |

|

|

Chief Product Officer |

Brent A. Vulgamott |

|

|

40 |

|

|

Chief Operating Officer |

Brian D. Murphy has served as our President and Chief Executive Officer and a member of our Board of Directors since the Separation. Mr. Murphy served as Co-President and Co-Chief Executive Officer of Smith & Wesson Brands, Inc. from January 2020 until the Separation. Mr. Murphy served as President of the Outdoor Products & Accessories Division of Smith & Wesson Brands, Inc. from May 2017 to January 2020. From December 2016 until May 2017, he was President of the Outdoor Recreation Division of Smith & Wesson Brands, Inc., the activities of which were collapsed into Outdoor Product & Accessories. From February 2015 until December 2016, he was Vice President, Corporate Development of Vista Outdoor Inc., a publicly held designer, manufacturer, and marketer of outdoor sports and recreation products. From April 2013 until February 2015, Mr. Murphy was Director of Mergers & Acquisitions and Director of Financial Planning & Analysis for Alliant Techsystems, an aerospace, defense, and outdoor sporting goods company. Mr. Murphy held various management roles at McMaster-Carr Supply Company, a supplier of maintenance, repair, and operations materials to industrial and commercial facilities worldwide, from April 2011 until March 2013. From May 2006 until October 2010, he served as an investment banker with the publicly held firm Houlihan Lokey, where he advised companies in the areas of strategy, acquisitions, divestitures, recapitalizations, and restructuring.

H. Andrew Fulmer has served as Executive Vice President, Chief Financial Officer, and Treasurer of our company since the Separation. Mr. Fulmer served as Vice President, Financial Planning & Analysis of Smith & Wesson Brands, Inc. from 2016 until the Separation. Mr. Fulmer was Senior Director of Financial Planning & Analysis of Smith & Wesson Brands, Inc. from January 2015 until March 2016, Director of Financial Planning & Analysis from October 2011 until January 2015,

20

and Assistant Controller from September 2010 until October 2011. From May 2006 until September 2010, Mr. Fulmer was Controller for Steeltech Building Products, a privately held construction company. From June 1996 until May 2006, Mr. Fulmer held various roles at PricewaterhouseCoopers LLP in both audit and tax. Mr. Fulmer is a licensed CPA in the Commonwealth of Massachusetts.

James E. Tayon has served as our Chief Product Officer since December 2023. Prior to his promotion, he served as our Vice President of Marketing & Product Development since March 2022. Mr. Tayon served as our Vice President of Product Development from the Separation until March 2022. Before the Separation, Mr. Tayon served as Vice President of Product Development of the Outdoor Products & Accessories Division of Smith & Wesson Brands, Inc. from May 2020 until the Separation; Director of Product Development of the Outdoor Products & Accessories Division of Smith & Wesson Brands, Inc. from March 2019 to May 2020; Product Engineering Manager of the Outdoor Products & Accessories Division of Smith & Wesson Brands, Inc. from July 2017 until March 2019; Engineering Supervisor from August 2016 until July 2017; and a Product Development Engineer from 2012 until 2016. From 2008 until 2012, Mr. Tayon was a Product Development Engineer for J2 Scientific, a laboratory automation equipment designer and manufacturer, where he worked with Los Alamos National Labs developing custom automation solutions for nuclear sampling.

Brent A. Vulgamott, has served as our Chief Operating Officer since October 2023. Prior to his promotion, he served as our Vice President of Sales, Operations & Analytics since March 2022. Mr. Vulgamott served as our Vice President of Operations & Analytics from the Separation until March 2022. Before the Separation, Mr. Vulgamott served as Vice President of Operations of the Outdoor Products & Accessories Division of Smith & Wesson Brands, Inc. from March 2020 until the Separation. From November 2018 to March 2020, Mr. Vulgamott was the Director of Finance for Lockton Companies, a privately held insurance broker. From November 2015 to November 2018, Mr. Vulgamott was Division Controller for the Outdoor Products & Accessories Division of Smith & Wesson Brands Inc. From April 2011 to October 2015, Mr. Vulgamott held finance leadership and management roles at Ford Motor Company and Piston Automotive, a publicly held automotive company and privately held automotive sub-supplier. From August 2007 to March 2011, Mr. Vulgamott held various accounting and financial planning and analysis roles with companies, including State Street Bank & Trust Co and Cerner Corporation.

Other Key Employees

The following sets forth information regarding individuals other than our Chief Executive Officer, Chief Financial Officer, Chief Product Officer, and Chief Operating Officer who serve as key employees of our company.

Douglas V. Brown, age 45, has served as our Chief Counsel and Corporate Secretary since the Separation. Before the Separation, Mr. Brown served as Chief Counsel of the Outdoor Products & Accessories Division of Smith & Wesson Brands, Inc. from May 2020 until the Separation. Mr. Brown previously was Associate General Counsel at Vista Outdoor Inc. from April 2018 to September 2019 and as Senior Counsel from August 2015 to April 2018. Prior to joining Vista Outdoor Inc., Mr. Brown practiced corporate and securities law at the law firm Morgan, Lewis & Bockius LLP as a Corporate Associate from August 2011 to August 2015 and at the Division of Corporation Finance of the SEC as an Attorney Advisor from August 2008 to August 2011. Since May 2024, Mr. Brown also has served on the Board of Regents of the American Knife & Tool Institute, a non-profit organization representing the knife industry.

Kyle M. Carter, age 42, has served as our Corporate Controller and Assistant Secretary since the Separation. Before the Separation, Mr. Carter served as Assistant Corporate Controller of Smith & Wesson Brands Inc. from October 2010 until the Separation. Prior to joining Smith & Wesson Brands, Inc., Mr. Carter served as Senior Audit Associate at Cherry Bekaert LLP, with a focus on public registrant clients, from May 2006 to September 2010.

Elizabeth A. Sharp, age 62, has served as our Vice President of Investor Relations since the Separation. Before the Separation, Ms. Sharp served as Vice President, Investor Relations of Smith & Wesson Brands, Inc. from May 2005 until the Separation. From June 1996 until May 2005, Ms. Sharp was Vice President of Corporate Relations for Three-Five Systems, Inc., a multi-national company providing a broad range of electronics manufacturing services, where she was responsible for investor relations, public relations, marketing communications, and media relations. From June 1986 until June 1996, Ms. Sharp served in leadership positions in Human Resources, Communications, and Administration.

21

Item 1A. Risk Factors

Investors should carefully consider the following risk factors, together with all the other information included in the Form 10-K, in evaluating our company, our business, and our prospects. The most significant risks that could materially and adversely affect our business operations, financial condition, and cash flows include the risk factors described below.

We have summarized the below risk factors as follows:

Risks Related to Our Business

22

Risks Related to Our Common Stock

Risks related to Us as a Public Company

Risks Related to Our Business

We are dependent on the proper functioning of our critical facilities, our supply chain, and distribution networks as well as the financial stability of our customers.

A reduction or interruption in any of our supply chain could adversely affect us. The failure of our suppliers to perform to our expectations could result in supply shortages or delays for certain products and components and harm our business. Our suppliers may encounter difficulties and other issues in obtaining the materials necessary to produce the components and parts that we use in our products. Political and economic instability in countries in which foreign suppliers are located, the financial and managerial instability of suppliers, the failure by suppliers to meet our standards, failure to meet production deadlines, insufficient quality control, problems with production capacity, labor problems experienced by our suppliers, the availability of raw materials to our suppliers, product quality issues, currency exchange rates, transport availability and cost, inflation, and other factors relating to suppliers and the countries in which they are located may exist and could adversely affect our business. Damage or disruption to manufacturing and distribution capabilities of, or the disruption of deliveries from, our suppliers

23

because of severe or catastrophic events, including weather, natural disaster, fire or explosion, terrorism, pandemics, or labor disruptions, including at ports or at our suppliers, could impair our product sales.

We may experience reductions in demand for certain products if our customers or vendors experience financial or other difficulties that adversely impact their ability to purchase or pay for our products. Significant or numerous cancellations, reductions, or delays in purchases or changes in business practices by our customers could have a material adverse effect on our business, operating results, and financial condition. A significant deterioration in the financial condition of our major customers could have a material adverse effect on our sales and profitability.

We must continue to introduce new products that are successful in the marketplace.

Our success depends on our ability to continue to conceive, design, produce or source, and market in a timely manner a continuing stream of innovative new products that appeal to consumers and achieve market acceptance and drive customer satisfaction and loyalty. The development of new products is a lengthy and costly process. Any new products that we develop and introduce to the marketplace may be unsuccessful in achieving customer or market acceptance or may achieve success that does not meet our expectations for a variety of reasons, including delays in introduction, unfavorable cost comparisons with alternative products, unfavorable customer or consumer acceptance, and unfavorable performance. Our business, operating results, and financial condition could be adversely affected if we fail to introduce new products that consumers want to buy or we incur significant expenses related to proposed new products that prove to be unsuccessful for any reason.

We rely to a significant extent on outsourcing for a substantial portion of our production, and any interruptions in these arrangements could disrupt our ability to fill our customers’ orders.

We source a significant portion of our made-to-order finished products and components from third-party contract manufacturers and other suppliers located primarily in Asia. We depend on our contract manufacturers and other suppliers to maintain high levels of productivity and satisfactory delivery schedules. Our ability to secure qualified suppliers that meet our quality and other standards and to receive from them these products and components in a timely and efficient manner represents a challenge, especially with suppliers located and products and components sourced outside of the United States. The ability of our suppliers to effectively satisfy our production requirements could also be impacted by their financial difficulty or damage to their operations caused by fire, pandemic, terrorist attack, natural disaster, or other events. The failure of any supplier to perform to our expectations could result in supply shortages or delays for certain products and components and harm our business. If we experience significantly increased demand, or if we need to replace an existing supplier as a result of a lack of performance, we may be unable to supplement or replace our production capacity on a timely basis or on terms that are acceptable to us, which may increase our costs, reduce our margins, and harm our ability to deliver our products on time. For certain of our products, it may take a significant amount of time to identify and qualify a supplier that has the capability and resources to meet our product specifications in sufficient volume and satisfy our service and quality control standards. Political and economic instability in countries in which foreign suppliers are located, the financial and managerial instability of suppliers, the failure by suppliers to meet our standards, failure to meet production deadlines, insufficient quality control, problems with production capacity, labor problems experienced by our suppliers, the availability of raw materials to our suppliers, product quality issues, currency exchange rates, transport availability and cost, inflation, and other factors relating to suppliers and the countries in which they are located may exist and could adversely affect our business.

The U.S. foreign trade policies, tariffs, and other impositions on imported goods, trade sanctions imposed on certain countries, the limitation on the importation of certain types of goods or of goods containing certain types of materials from other countries, and other factors relating to foreign trade may affect our suppliers and our access to products and adversely affect our business.