Table of Contents

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

☒ |

Smaller reporting company | |||||

Emerging growth company |

||||||

Table of Contents

BENITEC BIOPHARMA INC.

INDEX TO FORM 10-Q

| 1 | ||||||

| 2 | ||||||

| ITEM 1. |

2 | |||||

| Consolidated Balance Sheets as of March 31, 2024 (Unaudited) and June 30, 2023 |

2 | |||||

| 3 | ||||||

| 4 | ||||||

| Consolidated Statements of Cash Flows for the Nine Months Ended March 31, 2024 and 2023 (Unaudited) |

5 | |||||

| 6 | ||||||

| ITEM 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

21 | ||||

| ITEM 3. |

66 | |||||

| ITEM 4. |

66 | |||||

| ITEM 1. |

67 | |||||

| ITEM 1A. |

67 | |||||

| ITEM 2. |

67 | |||||

| ITEM 3. |

67 | |||||

| ITEM 4. |

67 | |||||

| ITEM 5. |

67 | |||||

| ITEM 6. |

68 | |||||

| 69 | ||||||

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Our forward-looking statements relate to future events or our future performance and include, but are not limited to, statements concerning our business strategy, future commercial revenues, market growth, capital requirements, new product introductions, expansion plans and the adequacy of our funding. All statements, other than statements of historical fact included in this Report, are forward-looking statements. When used in this Report, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project,” or the negative of these terms, and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements.

Some of the risks and uncertainties that may cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include the following:

| • | the success of our plans to develop and potentially commercialize our product candidates; |

| • | the timing of the initiation and completion of our preclinical studies and clinical trials; |

| • | the timing and sufficiency of patient enrollment and dosing in our clinical trials; |

| • | the timing of the availability of data from clinical trials; |

| • | the timing and outcome of regulatory filings and approvals; |

| • | unanticipated delays; |

| • | sales, marketing, manufacturing and distribution requirements; |

| • | market competition and the acceptance of our products in the marketplace; |

| • | regulatory developments in the United States of America, France and Canada; |

| • | the development of novel AAV vectors; |

| • | the plans of licensees of our technology; |

| • | the clinical utility and potential attributes and benefits of ddRNAi and our product candidates, including the potential duration of treatment effects and the potential for a “one shot” cure; |

| • | our dependence on our relationships with collaborators and other third parties; |

| • | expenses, ongoing losses, future revenue, capital needs and needs for additional financing, and our ability to access additional financing given market conditions and other factors, including our capital structure; |

| • | our ability to continue as a going concern; |

| • | the length of time over which we expect our cash and cash equivalents to be sufficient to execute on our business plan; |

| • | our intellectual property position and the duration of our patent portfolio; |

| • | the impact of local, regional, and national and international economic conditions and events; and |

| • | the impact of the COVID-19 pandemic, the disease caused by the SARS-CoV-2 virus and similar events, which may adversely impact our business and preclinical and clinical trials; |

as well as other risks detailed under the caption “Risk Factors” in this Report and in other reports filed with the SEC. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Report, we caution you that these statements are based on a combination of facts and important factors currently known by us and our expectations of the future, about which we cannot be certain. Such statements are based on assumptions and the actual outcome will be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control or ability to predict. We have based the forward-looking statements included in this Report on information available to us on the date of this Report or on the date thereof. Except as required by law we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to consult any additional disclosures that we may make directly to you or through reports that we, in the future, may file with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

All forward-looking statements included herein or in documents incorporated herein by reference are expressly qualified in their entirety by the cautionary statements contained or referred to elsewhere in this Report.

1

Table of Contents

| March 31, 2024 |

June 30, 2023 |

|||||||

| (Unaudited) | ||||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash at bank |

$ | $ | ||||||

| Restricted cash |

||||||||

| Trade and other receivables |

||||||||

| Prepaid and other assets |

||||||||

| |

|

|

|

|||||

| Total current assets |

||||||||

| Property and equipment, net |

||||||||

| Deposits |

||||||||

| Prepaid and other assets |

||||||||

| Right-of-use |

||||||||

| |

|

|

|

|||||

| Total assets |

$ | $ | ||||||

| |

|

|

|

|||||

| Liabilities and stockholders’ equity |

||||||||

| Current liabilities: |

||||||||

| Trade and other payables |

$ | $ | ||||||

| Accrued employee benefits |

||||||||

| Lease liabilities, current portion |

||||||||

| |

|

|

|

|||||

| Total current liabilities |

||||||||

| Lease liabilities, less current portion |

||||||||

| |

|

|

|

|||||

| Total liabilities |

||||||||

| |

|

|

|

|||||

| Commitments and contingencies (Note 11) |

||||||||

| Stockholders’ equity: |

||||||||

| Common stock, $ |

||||||||

| Additional paid-in capital |

||||||||

| Accumulated deficit |

( |

) | ( |

) | ||||

| Accumulated other comprehensive loss |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Total stockholders’ equity |

||||||||

| |

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | $ | ||||||

| |

|

|

|

|||||

| Three Months Ended | Nine Months Ended | |||||||||||||||

| March 31, | March 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

Revenue: |

||||||||||||||||

Licensing revenues from customers |

$ | $ | $ | $ | ||||||||||||

Total revenues |

||||||||||||||||

Operating expenses: |

||||||||||||||||

Royalties and license fees |

( |

) | ( |

) | ||||||||||||

Research and development |

||||||||||||||||

General and administrative |

||||||||||||||||

Total operating expenses |

||||||||||||||||

Loss from operations |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

Other income (loss): |

||||||||||||||||

Foreign currency transaction loss |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

Interest expense, net |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

Other income (expense), net |

( |

) | ( |

) | ||||||||||||

Unrealized loss on investment |

( |

) | ( |

) | ( |

) | ||||||||||

Total other income (loss), net |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

Net loss |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

Other comprehensive income (loss): |

||||||||||||||||

Unrealized foreign currency translation gain (loss) |

( |

) | ||||||||||||||

Total other comprehensive income (loss) |

( |

) | ||||||||||||||

Total comprehensive loss |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

Net loss |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

Net loss per share: |

||||||||||||||||

Basic and diluted |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

Weighted average number of shares outstanding: basic and diluted |

||||||||||||||||

| Common Stock | Additional Paid-in |

Accumulated | Accumulated Other Comprehensive |

Total Stockholders’ |

||||||||||||||||||||

| Shares | Amount | Capital | Deficit | Loss | Equity | |||||||||||||||||||

Balance at June 30, 2022 |

$ | $ | $ | ( |

) | $ | ( |

) | $ | |||||||||||||||

Issuance of common stock, pre-funded warrants, andSeries 2 warrants sold for cash, net of offering costs of $ |

— | — | ||||||||||||||||||||||

Stock-based compensation |

— | — | ||||||||||||||||||||||

Foreign currency translation gain |

— | — | — | — | ||||||||||||||||||||

Net loss |

— | — | — | ( |

) | — | ( |

) | ||||||||||||||||

Balance at September 30, 2022 |

( |

) | ( |

) | ||||||||||||||||||||

Exercise of pre-funded warrants |

— | — | — | — | — | |||||||||||||||||||

Share-based compensation |

( |

) | ( |

) | ||||||||||||||||||||

Foreign currency translation loss |

— | — | — | — | ( |

) | ( |

) | ||||||||||||||||

Net loss |

— | — | — | ( |

) | — | ( |

) | ||||||||||||||||

Balance at December 31, 2022 |

$ | $ | $ | ( |

) | $ | ( |

) | $ | |||||||||||||||

Share-based compensation |

— | — | ||||||||||||||||||||||

Foreign currency translation gain |

— | — | — | |||||||||||||||||||||

Net loss |

— | — | ( |

) | — | ( |

) | |||||||||||||||||

Balance at March 31, 2023 |

$ | $ |

$ | ( |

$ | ( |

$ | |||||||||||||||||

Balance at June 30, 2023 |

$ | $ | $ | ( |

) | $ | ( |

) | $ | |||||||||||||||

Issuance of common stock, pre-funded warrants, andcommon warrants sold for cash, net of offering costs of $ |

||||||||||||||||||||||||

Share-based compensation |

— | — | — | — | ||||||||||||||||||||

Foreign currency translation gain |

— | — | — | — | ||||||||||||||||||||

Net loss |

— | — | — | ( |

) | — | ( |

) | ||||||||||||||||

Balance at September 30, 2023 |

( |

) | ( |

) | ||||||||||||||||||||

Exercise of pre-funded warrants |

— | — | — | — | — | |||||||||||||||||||

Exercise of Series 2 warrants |

— | — | — | |||||||||||||||||||||

Share-based compensation |

— | — | — | — | ||||||||||||||||||||

Foreign currency translation loss |

— | — | — | — | ( |

) | ( |

) | ||||||||||||||||

Net loss |

— | — | — | ( |

) | — | ( |

) | ||||||||||||||||

Balance at December 31, 2023 |

$ | $ | $ | ( |

) | $ | ( |

) | $ | |||||||||||||||

Exercise of pre-funded warrants |

— | — | — | — | — | |||||||||||||||||||

Share-based compensation |

— | — | — | — | ||||||||||||||||||||

Foreign currency translation gain |

— | — | — | — | ||||||||||||||||||||

Net loss |

— | — | — | ( |

) | — | ( |

) | ||||||||||||||||

Balance at March 31, 2024 |

$ | $ | $ | ( |

$ ( |

$ |

||||||||||||||||||

| Nine Months Ended March 31, |

||||||||

| 2024 | 2023 | |||||||

| Cash flows from operating activities: |

||||||||

| Net loss |

$ | ( |

) | $ | ( |

) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

| Depreciation and amortization |

||||||||

| Amortization of right-of-use |

||||||||

| Unrealized loss on investment |

||||||||

| Share-based compensation expense |

||||||||

| Changes in operating assets and liabilities: |

||||||||

| Trade and other receivables |

( |

) | ||||||

| Prepaid and other assets |

( |

) | ||||||

| Trade and other payables |

( |

) | ||||||

| Accrued employee benefits |

||||||||

| Lease liabilities |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Net cash used in operating activities |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Purchase of property and equipment |

( |

) | ||||||

| |

|

|

|

|||||

| Net cash used in investing activities |

( |

) | ||||||

| |

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Proceeds from issuance and exercise of common stock, pre-funded warrants, Series 2 warrants, and common warrants |

||||||||

| Shares and pre-funded warrant issuance costs |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Net cash provided by financing activities |

||||||||

| |

|

|

|

|||||

| Effects of exchange rate changes on cash, cash equivalents, and restricted cash |

( |

) | ||||||

| |

|

|

|

|||||

| Net increase in cash, cash equivalents, and restricted cash |

||||||||

| Cash, cash equivalents, and restricted cash, beginning of period |

||||||||

| |

|

|

|

|||||

| Cash, cash equivalents, and restricted cash, end of period |

$ | $ | ||||||

| |

|

|

|

|||||

Principal place of business/country of incorporation | ||

Benitec Biopharma Proprietary Limited (“BBL”) |

||

Benitec Australia Proprietary Limited |

||

Benitec Limited |

||

Benitec, Inc. |

||

Benitec LLC |

||

RNAi Therapeutics, Inc. |

||

Tacere Therapeutics, Inc. |

||

Benitec IP Holdings, Inc. |

| Level 1: | Observable inputs such as quoted prices (unadjusted) in active markets for identical assets or liabilities. | |||

| Level 2: | Inputs, other than quoted prices that are observable, either directly or indirectly. These include quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or liabilities in markets that are not active. | |||

| Level 3: | Unobservable inputs in which little or no market data exists, therefore developed using estimates and assumptions developed by us, which reflect those that a market participant would use. | |||

Software |

||||

Lab equipment |

||||

Computer hardware |

||||

Leasehold improvements |

| (US$’000) | March 31, 2024 |

June 30, 2023 |

||||||

| Cash at bank |

$ | $ | ||||||

| Restricted cash |

||||||||

| |

|

|

|

|||||

| Total |

$ | $ | ||||||

| |

|

|

|

|||||

| (US$’000) | March 31, 2024 |

June 30, 2023 |

||||||

| Prepaid expenses |

$ | $ | ||||||

| Market value of listed shares |

||||||||

| |

|

|

|

|||||

| Total other assets |

||||||||

| Less: non-current portion |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Current portion |

$ | $ | ||||||

| |

|

|

|

|||||

| (US$’000) | March 31, 2024 |

June 30, 2023 |

||||||

| Software |

$ | $ | ||||||

| Lab equipment |

||||||||

| Computer hardware |

||||||||

| Leasehold improvements |

||||||||

| |

|

|

|

|||||

| Total property and equipment, gross |

||||||||

| Accumulated depreciation and amortization |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Total property and equipment, net |

$ | $ | ||||||

| |

|

|

|

|||||

| (US$’000) | March 31, 2024 |

June 30, 2023 |

||||||

| Trade payable |

$ | $ |

||||||

| Accrued license fees |

||||||||

| Accrued consultant fees |

||||||||

| Accrued professional fees |

||||||||

| Accrued clinical development project costs |

||||||||

| Other payables |

||||||||

| |

|

|

|

|||||

| Total |

$ | $ | ||||||

| |

|

|

|

|||||

| (US$’000) | Operating lease right- of- use assets |

|||

Balance at July 1, 2023 |

$ | |||

Amortization of right of use asset |

( |

) | ||

Operating lease right-of-use |

$ | |||

| (US$’000) | Operating lease liabilities |

|||

Balance at July 1, 2023 |

$ | |||

Principal payments on operating lease liabilities |

( |

) | ||

Operating lease liabilities at March 31, 2024 |

||||

Less: non-current portion |

( |

) | ||

Current portion at March 31, 2024 |

$ | |||

| (US$’000) | March 31, 2024 |

|||

2024 |

$ | |||

2025 |

||||

Total operating lease payments |

||||

Less imputed interest |

( |

) | ||

Present value of operating lease liabilities |

$ | |||

| Common Stock from Warrants |

Weighted- average Exercise Price (per share) |

|||||||

| Outstanding at July 1, 2023 |

$ | |||||||

| Pre-funded warrants issued August 11, 2023 |

$ | |||||||

| Common warrants issued August 11, 2023 |

$ | |||||||

| |

|

|

|

|||||

| Outstanding at September 30, 2023 |

$ | |||||||

| Pre-funded warrants exercised |

$ | |||||||

| Series 2 warrants exercised |

$ | |||||||

| |

|

|

|

|||||

| Outstanding and exercisable at December 31, 2023 |

$ | |||||||

| Pre-funded warrants exercised |

$ | |||||||

| |

|

|

|

|||||

| Outstanding and exercisable at March 31, 2024 |

$ | |||||||

| Stock Options |

Weighted- average Exercise Price |

Weighted- average Remaining Contractual Term |

Aggregate Intrinsic Value |

|||||||||||||

| Outstanding at June 30, 2023 |

$ | $ | ||||||||||||||

| Granted |

$ | — | ||||||||||||||

| Expired |

( |

) | $ | — | — | |||||||||||

| Forfeited |

( |

) | $ | — | — | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Outstanding at March 31, 2024 |

$ | $ | ||||||||||||||

| Exercisable at March 31, 2024 |

$ | $ | ||||||||||||||

| Three Months Ended |

Nine Months Ended |

|||||||||||||||

| March 31, | ||||||||||||||||

| (US$’000) | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Research and development |

$ | $ | $ | $ | ||||||||||||

| General and administrative |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total share-based compensation expense |

$ | $ | $ | $ | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

Table of Contents

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis of financial condition and operating results together with our consolidated financial statements and the related notes and other financial information included elsewhere in this document.

Company Overview

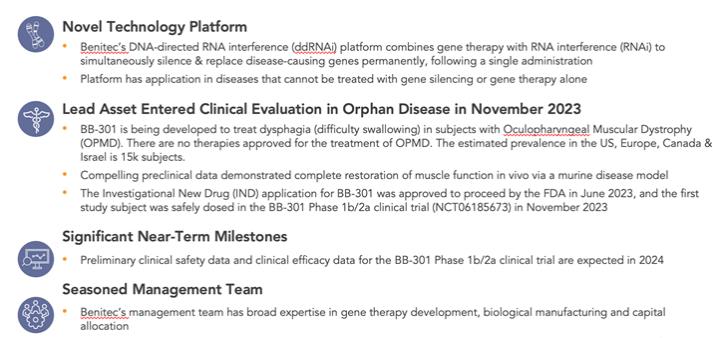

We endeavor to become the leader in discovery, development, and commercialization of therapeutic agents capable of addressing significant unmet medical need via the application of the silence and replace approach to the treatment of genetic disorders.

Benitec Biopharma Inc. (“Benitec” or the “Company” or in the third person, “we” or “our”) is a clinical-stage biotechnology company focused on the advancement of novel genetic medicines with headquarters in Hayward, California. The proprietary platform, called DNA-directed RNA interference, or ddRNAi, combines RNA interference, or RNAi, with gene therapy to create medicines that facilitate sustained silencing of disease-causing genes following a single administration. The unique therapeutic constructs also enable the simultaneous delivery of wildtype replacement genes, facilitating the proprietary “silence and replace” approach to the treatment of genetically defined diseases. The Company is developing a silence and replace-based therapeutic (BB-301) for the treatment of Oculopharyngeal Muscular Dystrophy (OPMD), a chronic, life- threatening genetic disorder.

BB-301 is a silence and replace-based genetic medicine currently under development by Benitec. BB-301 is an AAV-based gene therapy designed to permanently silence the expression of the disease-causing gene (to slow, or halt, the biological mechanisms underlying disease progression in OPMD) and to simultaneously replace the mutant gene with a wildtype gene (to drive restoration of function in diseased cells). This fundamental therapeutic approach to disease management is called “silence and replace.” The silence and replace mechanism offers the potential to restore the normative physiology of diseased cells and tissues and to improve treatment outcomes for patients suffering from the chronic, and potentially fatal, effects of OPMD. BB-301 has been granted Orphan Drug Designation in the United States and the European Union.

The targeted gene silencing effects of RNAi, in conjunction with the durable transgene expression achievable via the use of modified viral vectors, imbues the silence and replace approach with the potential to produce permanent silencing of disease-causing genes along with simultaneous replacement of the wild type gene function following a single administration of the proprietary genetic medicine. We believe that this novel mechanistic profile of the current and future investigational agents developed by Benitec could facilitate the achievement of robust and durable clinical activity while greatly reducing the frequency of drug administration traditionally expected for medicines employed for the management of chronic diseases. Additionally, the achievement of permanent gene silencing and gene replacement may significantly reduce the risk of patient non-compliance during the course of medical management of potentially fatal clinical disorders.

We will require additional financing to progress our product candidates through to key inflection points.

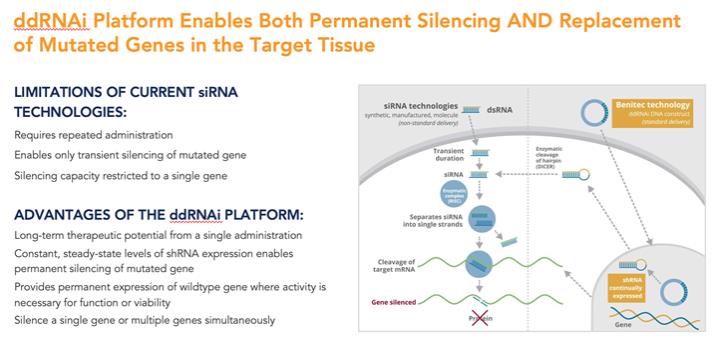

Our proprietary technology platforms are designated as DNA-directed RNA interference, or “ddRNAi”, and “silence and replace.” ddRNAi is designed to produce permanent silencing of disease-causing genes, by combining RNA interference, or RNAi, with viral delivery agents typically associated with the field of gene therapy (i.e., viral vectors). Modified AAV vectors are employed to deliver genetic constructs which encode short hairpin RNAs that are, then, serially expressed and processed to produce siRNA molecules within the transduced cell for the duration of the life of the target cell. These newly introduced siRNA molecules drive

21

Table of Contents

permanent silencing of the expression of the disease-causing gene. The silence and replace approach further bolsters the biological benefits of permanent silencing of disease-causing genes by incorporating multifunctional genetic constructs within the modified AAV vectors to create an AAV-based gene therapy agent that is designed to silence the expression of disease-causing genes (to slow, or halt, the underlying mechanism of disease progression) and to simultaneously replace the mutant genes with normal, “wildtype” genes (to drive restoration of function in diseased cells). This fundamentally distinct therapeutic approach to disease management offers the potential to restore the underlying physiology of the treated tissues and, in the process, improve treatment outcomes for patients suffering from the chronic and, potentially, fatal effects of diseases like Oculopharyngeal Muscular Dystrophy (OPMD).

Traditional gene therapy is defined by the introduction of an engineered transgene to correct the pathophysiological derangements derived from mutated or malfunctioning genes. Mutated genes can facilitate the intracellular production of disease-causing proteins or hamper the production of critical, life-sustaining, proteins. The introduction of a new transgene can facilitate the restoration of production of normal proteins within the diseased cell, thus restoring natural biological function. Critically, the implementation of this traditional method of gene therapy cannot eliminate the expression, or the potential deleterious effects of, the underlying mutant gene (as mutant proteins may be continually expressed and aggregate or drive the aggregation of other native proteins within the diseased cell). In this regard, the dual capabilities of the proprietary silence and replace approach to silence a disease-causing gene via ddRNAi and simultaneously replace the wild type activity of a mutant gene via the delivery of an engineered transgene could facilitate the development of differentially efficacious treatments for a range of genetic disorders.

Overview of RNAi and the siRNA Approach

The mutation of a single gene can cause a chronic disease via the resulting intracellular production of a disease-causing protein (i.e., an abnormal form of the protein of interest), and many chronic and/or fatal disorders are known to result from the inappropriate expression of a single gene or multiple genes. In some cases, genetic disorders of this type can be treated exclusively by “silencing” the intracellular production of the disease-causing protein through well-validated biological approaches like RNA interference (“RNAi”). RNAi employs small nucleic acid molecules to activate an intracellular enzyme complex, and this biological pathway temporarily reduces the production of the disease-causing protein. In the absence of the disease-causing protein, normal cellular function is restored and the chronic disease that initially resulted from the presence of the mutant protein is partially or completely resolved. RNAi is potentially applicable to over 20,000 human genes and a large number of disease-causing microorganism-specific genes.

22

Table of Contents

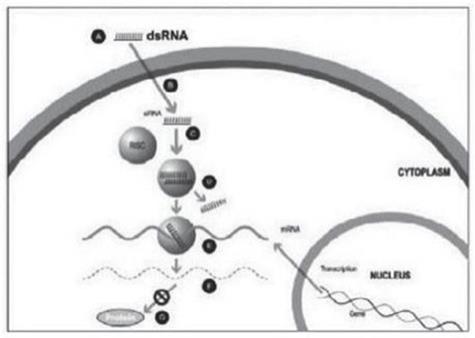

Figure 1

A small double stranded RNA, or dsRNA, molecule (A, Figure 1), comprising one strand known as the sense strand and another strand known as the antisense strand, which are complementary to each other, is synthesized in the laboratory. These small dsRNAs are called small interfering RNAs, or siRNAs. The sequence of the sense strand corresponds to a short region of the target gene mRNA. The siRNA is delivered to the target cell (B, Figure 1), where a group of enzymes, referred to as the RNA-Induced Silencing Complex, or RISC, process the siRNA (C, Figure 1), where one of the strands (usually the sense strand) is released (D, Figure 1). RISC uses the antisense strand to find the mRNA that has a complementary sequence (E, Figure 1) leading to the cleavage of the target mRNA (F, Figure 1). As a consequence, the output of the mRNA (protein production) does not occur (G, Figure 1). Several companies, including Alnylam Pharmaceuticals Inc. (“Alnylam”), utilize this approach in their RNAi product candidates.

Importantly, many genetic disorders are not amenable to the traditional gene silencing approach outlined in Figure 1, as the diseased cells may produce a mixture of the wild type protein of interest and the disease-causing mutant variant of the protein, and the underlying genetic mutation may be too small to allow for selective targeting of the disease-causing variant of the protein through the use of siRNA-based approaches exclusively. In these cases, it is extraordinarily difficult to selectively silence the disease-causing protein without simultaneously silencing the wild type intracellular protein of interest whose presence is vital to the conduct of normal cellular functions.

Our proprietary silence and replace technology utilizes the unique specificity and robust gene silencing capabilities of RNAi while overcoming many of the key limitations of siRNA-based approaches to disease management.

In the standard RNAi approach, double-stranded siRNA is produced synthetically and, subsequently, introduced into the target cell via chemical modification of the RNA or alternative methods of delivery. While efficacy has been demonstrated in several clinical indications through the use of this approach, siRNA-based approaches maintain a number of limitations, including:

| • | Clinical management requires repeat administration of the siRNA-based therapeutic agent for multiple cycles to maintain efficacy; |

23

Table of Contents

| • | Long-term patient compliance challenges due to dosing frequencies and treatment durations; |

| • | Therapeutic concentrations of siRNA are not stably maintained because the levels of synthetic siRNA in the target cells decrease over time; |

| • | Novel chemical modifications or novel delivery materials are typically required to introduce the siRNA into the target cells, making it complicated to develop a broad range of therapeutics agents; |

| • | Potential adverse immune responses, resulting in serious adverse effects; |

| • | Requirement for specialized delivery formulations for genetic disorders caused by mutations of multiple genes; and |

| • | siRNA acts only to silence genes and cannot be used to replace defective genes with normally functioning genes. |

Our Approach to the Treatment of Genetic Diseases—ddRNAi and Silence and Replace

Our proprietary silence and replace approach to the treatment of genetic diseases combines RNAi with wild type gene replacement to drive permanent silencing of disease-causing genes and concomitant restoration of functional wild type genes following a single administration of the therapeutic agent. Benitec employs ddRNAi in combination with classical gene therapy (i.e., transgene delivery via viral vectors) to overcome several of the fundamental limitations of RNAi.

The silence and replace approach to the treatment of genetic disorders employs adeno-associated viral vectors (“AAVs”) to deliver genetic constructs which may, after a single administration to the target tissues:

| • | Chronically express RNAi molecules inside of the target, diseased, cells (to serially silence the intracellular production of mutant, disease-causing, protein and the wild type protein of interest); |

| • | Simultaneously drive the expression of a wild type variant of the protein of interest (to restore native intracellular biological processes); and |

| • | AAV vectors can accommodate the multi-functional DNA expression cassettes containing the engineered wild type transgenes and the novel genes encoding short hairpinRNA/microRNA molecules (shRNA/miRNA) that are required to support the development of therapeutic agents capable of the achievement of the goals of the silence and replace approach to therapy. |

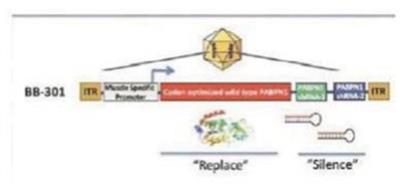

Our silence and replace technology utilizes proprietary DNA expression cassettes to foster continuous production of gene silencing shRNAs and wild type proteins (via expression of the wild type transgene). A range of viral and non-viral gene therapy vectors can be used to deliver the DNA construct into the nucleus of the target cell and, upon delivery, shRNA molecules are expressed and subsequently processed by intracellular enzymes into siRNA molecules that silence the expression of the mutant, disease-causing protein (Figure 2).

In the silence and replace approach (Figure 2):

| • | A DNA construct is delivered to the nucleus of the target cell by a gene therapy vector (A) such as an AAV vector; |

| • | Once inside of the nucleus, the DNA construct drives the continuous production of shRNA molecules (B) which are processed by an enzyme called Dicer into siRNAs (C); |

| • | The processed siRNA is incorporated into RISC and silences the target gene using the same mechanism shown in Figure 1; and |

| • | When the DNA expression cassette is additionally comprised of a wild type transgene, upon entry of the DNA construct into the nucleus of the target cell via the use of the AAV vector, the DNA construct also drives the continuous production of wild type protein (to restore native intracellular biological processes). |

24

Table of Contents

Figure 2

Our strategy is to discover, develop and commercialize treatments that leverage the capabilities of ddRNAi and the silence and replace approach to disease management.

For selected product candidates, at the appropriate stage, we may collaborate with large biopharmaceutical companies to further co-develop and, if approved, commercialize our ddRNAi-based and silence and replace-based products to achieve broad clinical and commercial distribution. For specific clinical indications that we deem to be outside of our immediate areas of focus, we will continue to out-license, where appropriate, applications of our ddRNAi and silence and replace technology to facilitate the development of differentiated therapeutics, which could provide further validation of our proprietary technology and approach to disease management.

Our cash and cash equivalents will be deployed for the advancement of our product candidate BB-301 for the treatment of OPMD-derived dysphagia, including the natural history lead-in study and the Phase 1b/2a BB-301 treatment study, for the continued advancement of development activities for other existing and new product candidates, for general corporate purposes and for strategic growth opportunities.

Oculopharyngeal Muscular Dystrophy—OPMD

OPMD is an insidious, autosomal-dominant, late-onset degenerative muscle disorder that typically presents in patients at 40-to-50 years of age. The disease is characterized by progressive swallowing difficulties (dysphagia) and eyelid drooping (ptosis). OPMD is caused by a specific mutation in the poly(A)-binding protein nuclear 1, or PABPN1, gene. OPMD is a rare disease; however, patients have been diagnosed with OPMD in at least 33 countries. Patient populations suffering from OPMD are well-identified, and significant geographical clustering has been noted for patients with this disorder, which could simplify clinical development and global commercialization efforts.

BB-301 is an AAV-based gene therapy designed to silence the expression of disease-causing genes (to slow, or halt, the underlying mechanism of disease progression) and to simultaneously replace the mutant genes with normal, “wildtype” genes (to drive restoration of function in diseased cells). This fundamental therapeutic approach to disease management is called “silence and replace” and this biological mechanism offers the potential to restore the underlying physiology of the treated tissues and, in the process, improve treatment outcomes for patients suffering from the chronic and, potentially, fatal effects of Oculopharyngeal Muscular Dystrophy (OPMD). BB-301 has been granted Orphan Drug Designation in the United States and the European Union.

25

Table of Contents

Our Strengths

We believe that the combination of our proprietary ddRNAi and silence and replace technology, and our deep expertise in the design and development of genetic medicines, will enable us to achieve and maintain a leading position in gene silencing and gene therapy for the treatment of human disease. Our key strengths include:

| • | A first mover advantage for silence and replace-based therapeutics; |

| • | A proprietary ddRNAi-based silence and replace technology platform that may potentially enable the serial development of single-administration therapeutics capable of facilitating sustained, long-term silencing of disease-causing genes and concomitant replacement of wild type gene function; |

| • | A proprietary AAV vector technology which improves the endosomal escape capability of virus produced in insect cells using a baculovirus system. This technology has broad application in AAV-based gene therapies; |

| • | The capabilities to drive the development of a pipeline of programs focused on chronic diseases with either large patient populations, or rare diseases, which may potentially support the receipt of Orphan Drug Designation, including OPMD; and |

| • | A growing portfolio of patents protecting improvements to our ddRNAi, and silence and replace, technology and product candidates through at least 2036, with additional patent life anticipated through at least 2040. |

Our Strategy

We endeavor to become the leader in discovery, development, and commercialization of silence and replace-based therapeutic agents. We apply the following general strategy to drive the Company towards these goals:

| • | Selectively develop proprietary and partnered programs; and |

| • | Continue to explore and secure research and development partnerships with global biopharmaceutical companies supported by the differentiated nature of our scientific platform and intellectual property portfolio. |

Our senior leadership team will continue to explore partnership opportunities with global biopharmaceutical companies, as we expect that the unique attributes of the proprietary ddRNAi and silence and replace approaches, and the breadth of potential clinical indications amenable to our proprietary methods, to support the formation of collaborations over a broad range of diseases with significant unmet medical need.

We seek to actively protect our intellectual property and proprietary technology. These efforts are central to the growth of our business and include:

| • | Seeking and maintaining patents claiming our ddRNAi and silence and replace technologies and other inventions relating to our specific products in development or that are otherwise commercially and/or strategically important to the development of our business; |

| • | Protecting and enforcing our intellectual property rights; and |

| • | Strategically licensing intellectual property from third parties to advance development of our product candidates. |

26

Table of Contents

Our Pipeline

The following table sets forth our current product candidate and the development status:

Table 1. Pipeline: Oculopharyngeal Muscular Dystrophy

We are developing BB-301 for the treatment of Oculopharyngeal Muscular Dystrophy (OPMD). The Investigational New Drug (IND) application for BB-301 was approved to proceed by the U.S. Food and Drug Administration in June 2023. The first study subject was safely dosed in the BB-301 Phase 1b/2a clinical trial (NCT06185673) in November 2023, and the second study subject was safely dosed in February 2024. BB-301 is the lead investigational agent under development by Benitec, and the key attributes of BB-301 are outlined in Figure 3.

27

Table of Contents

Figure 3

28

Table of Contents

BB-301 is a first-in-class genetic medicine employing the “silence and replace” approach for the treatment of OPMD. OPMD is an insidious, autosomal-dominant, late-onset, degenerative muscle disorder that typically presents in patients at 40-to-50 years of age. The disease is characterized by progressive swallowing difficulties (dysphagia) and eyelid drooping (ptosis). OPMD is caused by a specific mutation in the poly(A)-binding protein nuclear 1 gene (PABPN1).

OPMD is a rare disease, however, patients have been diagnosed with OPMD in at least 33 countries. Patient populations suffering from OPMD are well-identified, and significant geographical clustering has been noted for patients with this disorder. Each of these attributes could facilitate efficient clinical development and global commercialization of BB-301.

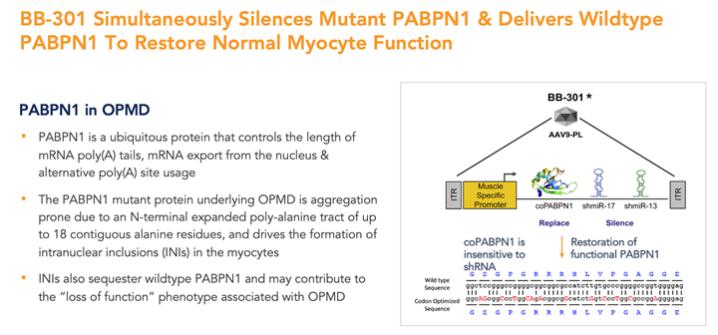

PABPN1 is a ubiquitous factor that promotes the interaction between the poly(A) polymerase and CPSF (cleavage and polyadenylation specificity factor) and, thus, controls the length of mRNA poly(A) tails, mRNA export from the nucleus, and alternative poly(A) site usage. The characteristic genetic mutation underlying OPMD results in trinucleotide repeat expansion(s) within exon 1 of PABPN1 and results in an expanded poly-alanine tract at the N-terminal end of PABPN1. The mutation generates a protein with an N-terminal expanded poly-alanine tract of up to 18 contiguous alanine residues, and the mutant protein is prone to the formation of intranuclear aggregates designated as intranuclear inclusions (INIs). The INIs that sequester wildtype PABPN1 may contribute to the “loss of function” phenotype associated with OPMD.

No therapeutic agents are approved for the treatment of OPMD. Additionally, there are no surgical interventions available to OPMD patients that modify the natural history of the disease, which is principally comprised of chronic deterioration of swallowing function. BB-301 has received Orphan Drug Designation in the United States and the European Union and, upon achievement of regulatory approval for BB-301 in these respective jurisdictions, the Orphan Drug Designations would provide commercial exclusivity independent of intellectual property protection. While OPMD is a rare medical disorder, we believe the commercial opportunity for a safe and efficacious therapeutic agent in this clinical indication exceeds $1 billion over the course of the commercial life of the product.

Investigational therapies that have been explored, unsuccessfully, in the past include:

| • | Intravenous administration of trehalose; and |

| • | The use of autologous myoblast transplant. |

BB-301 is our Lead, Silence and Replace-Based, OPMD Therapeutic Agent

BB-301 is composed of a modified AAV serotype 9 (AAV9) capsid that expresses a bifunctional construct under the control of a single muscle specific Spc5-12 promoter to achieve co-expression of both the codon-optimized PABPN1 mRNA and two shmiR molecules directed against wild type and mutant PABPN1. BB-301 is designed to correct the genetic defect underlying OPMD following a single localized administration.

BB-301—Design and Mechanism of Action

BB-301 is designed to target two distinct regions of the PABPN1 mRNA to accomplish gene silencing via the concomitant expression of two distinct shmiRs from a single DNA construct (Figure 4). BB-301 is also engineered to drive the simultaneous expression of a codon-optimized, siRNA-resistant, version of the wild type PABPN1 gene (Figure 4).

29

Table of Contents

Figure 4

In collaboration with researchers at the Royal Holloway University of London and the Institut de Myologie in Paris, we developed a ddRNAi construct expressing three shRNAs against three distinct regions of PABPN1 mRNA and observed effective silencing of the PABPN1 gene in vitro using this ddRNAi construct. Furthermore, as part of this collaboration, we have generated a gene expression construct that produces a siRNA-resistant version of the wild type PABPN1 gene.

In subsequent studies undertaken exclusively by Benitec, a second set of target regions within PABPN1 were identified for therapeutic development and shmiRs designed against these regions. Additional shmiRs have also been designed for the original shRNA developed in collaboration with Royal Holloway University of London and the Institut de Myologie. The ‘silence and replace’ construct, designated BB-301, incorporates the two best performing shmiRs, and the gene expression construct that produces a siRNA-resistant version of the wild type PABPN1 gene, under the control of a muscle-specific promoter. The mechanism of action of BB-301 is shown in Figure 5.

Figure 5

30

Table of Contents

In initial in vivo studies evaluating the use of direct intramuscular injection of AAV-based constructs with the potential to facilitate the desired silence and replace approach in the A17 transgenic mouse model of OPMD at the Royal Holloway University of London and the Institut de Myologie, we observed decreases in muscle fibrosis, increases in cross sectional area of the treated muscles, decreases in intranuclear inclusions, and normalization of muscle strength. These nonclinical results were published in Nature Communications in April 2017.

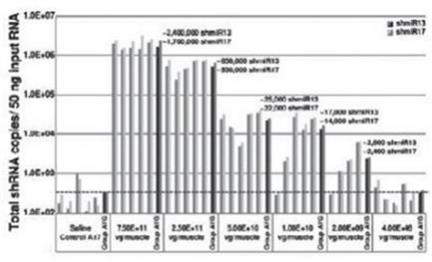

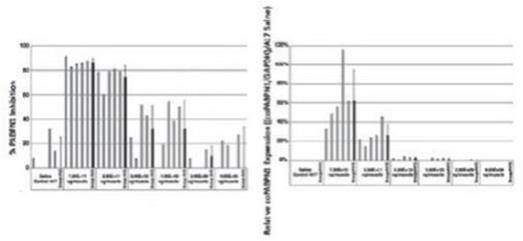

In subsequent studies, Benitec demonstrated in a key nonclinical model (the A17 mouse model) that a single intramuscular injection of BB-301 results in robust intracellular silencing of PABPN1 protein production and concomitant expression of the normal, biologically functional PABPN1 protein. In the A17 mouse model, the treatment restores muscle strength and muscle weight to wild type levels and improves other physiological hallmarks of the disease (Figure 6a, Figure 6b, Figure 6c, Figure 6d):

| • | Multiple A17 animal cohorts received single doses of BB-301 (over a range of doses spanning 4x108 vg/muscle-to-7.5x1011 vg/muscle) and, following BB-301 administration, each cohort was observed for 14-weeks |

| • | BB-301 was injected into the Tibialis Anterior (TA) muscle of 10 week old-to-12 week old animals and, 14-weeks post administration, each A17 cohort was anesthetized and the contractile properties of the injected TA muscles were analyzed via in-situ muscle electrophysiology |

| • | Intermediate doses of BB-301 resulted in 75% silencing of PABPN1 and 26% replacement of wild type PABPN1 activity, leading to full restoration of muscle strength, clearance of INIs, and a reduction of fibrosis |

| • | An additional experiment conducted over the course of 20-weeks demonstrated that more modest doses of BB-301 (which supported only partial resolution of the disease phenotype at week-14) were, surprisingly, able to facilitate significant benefit at 20-weeks, as evidenced by restoration of parameters relating to muscle strength, weight and INI formation |

Figure 6a. Dose-Dependent shRNA Expression

31

Table of Contents

Figure 6b. Dose-Dependent PABPN1 Inhibition and Transgene Expression

Figure 6c. Dose-Dependent Decreases in Intranuclear Inclusions

32

Table of Contents

Figure 6d. Dose-Dependent Increases in Muscle Force

Restoration of muscle strength was assessed by muscle contractility measurements in response to a series of induced impulses that ranged from 10 to 180 Hz

Ongoing Development Activities for BB-301

On July 8, 2020, Benitec announced the initiation of the BB-301 Pilot Dosing Study in large animal subjects.

The BB-301 Pilot Dosing Study was the first of two planned CTA-enabling and IND-enabling studies that were designed to be conducted in large animals. The BB-301 Pilot Dosing Study was carried out under the guidance of the scientific team at Benitec, with key elements of the study design and execution conducted in close collaboration with a team of leading experts in both medicine and surgery that have been deeply engaged in the treatment of OPMD patients for several decades. The BB-301 Pilot Dosing Study, along with the subsequent GLP Toxicology and Biodistribution Study, were conducted in canine subjects and were carried out to support the validation and optimization of the newly designed method of BB-301 administration, confirm the efficiency of vector transduction and transgene expression in the key tissue compartments underlying the natural history of OPMD, confirm the optimal drug doses in advance of initiation of human clinical studies, and facilitate observation of key toxicological data-points.

The BB-301 Pilot Dosing Study was designed as an 8-week study in Beagle dogs to confirm the transduction efficiency of BB-301 upon administration via direct intramuscular injection into specific anatomical regions of the pharynx through the use of an open surgical procedure. This new route of BB-301 administration was developed in collaboration with key surgical experts in the field of Otolaryngology, and this novel method of BB-301 dosing was implemented to significantly enhance the ability of a treating physician to accurately administer the AAV-based investigational agent to the muscles that underlie the characteristic deficits associated with the progression of OPMD. It is important to note that prior nonclinical studies of BB-301 have reproducibly validated the robust biological activity achieved following direct intramuscular injection. As an example, direct injection of BB-301 into the tibialis anterior muscles of A17 mice facilitated robust transduction of the targeted skeletal muscle cells and supported complete remission of the OPMD disease phenotype in this animal model.

Benitec conducted the BB-301 Pilot Dosing Study in Beagle dog subjects to demonstrate that direct intramuscular injection of BB-301 via the use of a proprietary dosing device in an open surgical procedure could safely achieve the following goals:

| • | Biologically significant and dose-dependent levels of BB-301 tissue transduction (i.e., delivery of the multi-functional BB-301 genetic construct into the target pharyngeal muscle cells); |

33

Table of Contents

| • | Broad-based and dose-dependent expression of the three distinct genes comprising the BB-301 gene construct within the pharyngeal muscle cells; and |

| • | Durable and biologically significant levels of target gene knock-down (i.e., inhibition of the expression of the gene of interest) within the pharyngeal muscle cells. |

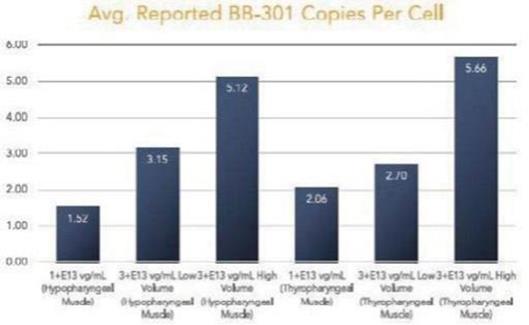

The Pilot Dosing Study evaluated the safety and biological activity of two concentrations of BB-301 (1.0+E13 vg/mL and 3.0+E13 vg/mL) across three distinct doses (1.0+E13 vg/mL, 3.0+E13 vg/mL with a low injection volume, and 3.0+E13 vg/mL with a high injection volume) following direct intramuscular injection into the Hypopharyngeal (HP) muscles and the Thyropharyngeal (TP) muscles of Beagle dogs via the use of a proprietary delivery device employed in an open surgical procedure. The HP muscle in Beagle dogs corresponds to the Middle Pharyngeal Constrictor muscle in human subjects, and the TP muscle in Beagle dogs corresponds to the Inferior Pharyngeal Constrictor muscle in human subjects. Atrophy, fibrosis, and the presence of intranuclear inclusions characterize the Middle Pharyngeal Constrictor muscles and the Inferior Pharyngeal Constrictor muscles of human subjects diagnosed with OPMD. BB-301 was injected into the pharyngeal muscles of the Beagle dog subjects only on Day 1 of the Pilot Dosing Study, and the corresponding canine pharyngeal muscles were harvested for analysis after 8 weeks of observation post-dosing. BB-301 dosing was carried out independently by both a veterinary surgeon and a practicing Otolaryngologist who has extensive experience with the provision of palliative surgical care for OPMD patients.

The key results are summarized here:

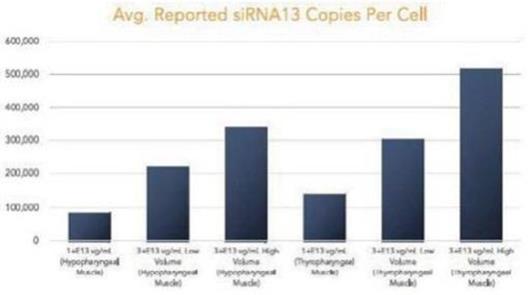

Figure 7. Pharyngeal Muscle Tissue Transduction Levels for BB-301

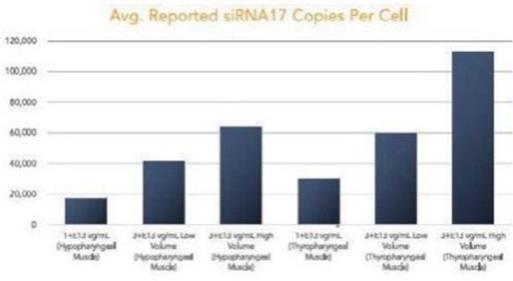

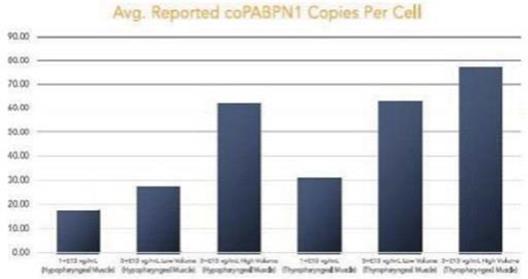

Regarding Gene Expression Levels Observed for BB-301 Within the Pharyngeal Muscle Tissues (Figure 8, Figure 9, Figure 10):

| • | BB-301 encodes two distinct siRNA species (i.e., siRNA13 and siRNA17) which are each, independently, capable of inhibiting (i.e., “silencing”) the expression of the mutant form of the PABPN1 protein and the wild type (i.e., endogenous) form of the PABPN1 protein (importantly, the mutant form of the PABPN1 protein underlies the development and progression of OPMD). |

34

Table of Contents

| • | BB-301 also codes for a wild type version of the PABPN1 protein whose intracellular expression is unaffected by the inhibitory activities of siRNA13 and siRNA17, and this codon optimized PABPN1 protein (i.e., coPABPN1) serves to replenish the endogenous form of the PABPN1 protein and to replace the mutant form of PABPN1 that underlies the development and progression of OPMD in diseased tissues. |

| • | For comparative purposes, it should be noted that the average range of expression for wild type PABPN1 within the pharyngeal muscle cells of Beagle dogs is 4.5 copies per cell-to-7.8 copies per cell. |

Figure 8. siRNA13 Expression Levels for BB-301 within Pharyngeal Muscle Tissues

Figure 9. siRNA17 Expression Levels for BB-301 within Pharyngeal Muscle Tissues

35

Table of Contents

Figure 10. coPABPN1 Expression Levels for BB-301 within Pharyngeal Muscle Tissues

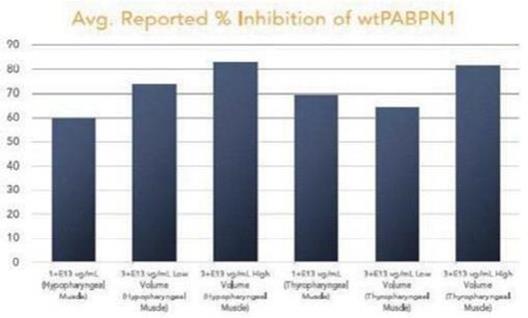

Regarding Wild Type PABPN1 Silencing (i.e. target “knock-down”) Observed for BB-301 Within the Pharyngeal Muscle Tissues (Figure 11):

| • | As noted above, BB-301 encodes two distinct siRNA species (i.e., siRNA13 and siRNA17) which are each, independently, capable of inhibiting (i.e., “silencing”) the expression of all forms of the PABPN1 protein (siRNA13 and siRNA17 silence the expression of both wild type PABPN1 [wtPABPN1] and mutant PABPN1). |

| • | While the Beagle dog subjects treated in the BB-301 Pilot Dosing Study did not express mutant PABPN1, the level of BB-301-driven gene silencing for the PABPN1 target can be accurately assessed due to the equivalent inhibitory effects of siRNA13 and siRNA17 on both wtPABPN1 and mutant PABPN1. |

| • | Thus, the wtPABPN1 silencing activity observed in the BB-301 Pilot Dosing Study served as a surrogate for the activity that would be anticipated in the presence of mutant PABPN1. |

| • | BB-301 has been evaluated in prior nonclinical studies in animals that express mutant PABPN1 and manifest the key signs and symptoms of OPMD and, in these animal models of OPMD, the achievement of PABPN1 silencing levels of 31% inhibition or higher led to resolution of OPMD disease symptoms and correction of the histological hallmarks of OPMD. |

36

Table of Contents

Figure 11. PABPN1 Silencing (i.e., “target knock-down”) within Pharyngeal Muscle Tissues

Finally, it is critical to highlight the key methodological distinctions between the BB-301 Pilot Dosing Study in Beagle dogs conducted by Benitec (i.e., the study described above) and the prior Beagle dog dosing study carried out independently by the previous BB-301 licensee. The BB-301 dosing study conducted by the prior BB-301 licensee employed non-ideal routes and methods of BB-301 administration to the target pharyngeal muscle tissues and employed similarly limited analytical methods at the completion of the dosing phase of the study. The Benitec team worked to optimize the route and method of administration of BB-301 and to refine the core analytical methods employed following the completion of dosing.

Following the implementation of these methodological modifications, Benitec demonstrated a 248-fold improvement (+24,650%) in BB-301 transduction of the HP muscle and a 111-fold improvement (+11,027%) in BB-301 transduction of the TP muscle relative to the levels of BB-301 transduction observed by the previous BB-301 licensee (Figure 12).

37

Table of Contents

Figure 12. Impact of Benitec-Initiated Methodological Improvements on the Relative Pharyngeal Muscle Tissue Transduction Levels Achieved for BB-301

Following the disclosure of the positive interim BB-301 Pilot Dosing Study results, Benitec completed pre-CTA and pre-IND meetings with regulatory agencies in France, Canada, and the United States. Summary of Regulatory Interactions:

| • | In June 2023 the U.S. Food and Drug Administration (FDA) cleared the Investigational New Drug (IND) application for BB-301 which allowed dosing of BB-301 to begin for OPMD subjects that are eligible for enrollment into the Phase 1b/2a treatment study (NCT06185673) described below. |

Operational Updates

The key milestones related to the development of BB-301 for the treatment of OPMD, along with other corporate updates, are outlined below:

BB-301 Clinical Development Program Overview:

| • | The BB-301 clinical development program will be conducted in the United States, and the primary elements of the program are summarized below: |

| • | The program will comprise approximately 76 weeks of follow-up which we anticipate will consist of: |

| • | The OPMD Natural History (NH) Study: 6-month pre-treatment observation periods for the evaluation of baseline disposition and natural history of OPMD-derived dysphagia (swallowing impairment) in each study participant. |

| • | Dosing with BB-301: 1-day of BB-301 dosing to initiate participation in the Phase 1b/2a single-arm, open-label, sequential, dose-escalation cohort study (NCT06185673). BB-301 will be delivered directly to the pharyngeal muscles of each study subject. |

| • | Phase 1b/2a Treatment Evaluation: 52-weeks of post-dosing follow-up for conclusive evaluation of the primary and secondary endpoints of the BB-301 Phase 1b/2a treatment study (NCT06185673), with interim safety and efficacy results expected to be available at the end of each 90-day period following the administration of BB-301. |

38

Table of Contents

| • | The OPMD NH Study will characterize the level of dysphagia borne by each OPMD subject at baseline and assess subsequent progression of dysphagia via the use of the following quantitative radiographic measures (i.e., videofluoroscopic swallowing studies or “VFSS”). The VFSS outlined below collectively provide objective assessments of global swallowing function and the function of the pharyngeal constrictor muscles (i.e., the muscles whose functional deterioration drives disease progression in OPMD): |

| • | Total Pharyngeal Residue %(C2-4)2 |

| • | Pharyngeal Area at Maximum Constriction (PhAMPC) |

| • | Dynamic Imaging Grade of Swallowing Toxicity Scale (DIGEST) |

| • | Vallecular Residue %(C2-4)2, Pyriform Sinus Residue %(C2-4)2, and Other Pharyngeal Residue %(C2-4)2 |

| • | Normalized Residue Ratio Scale (NRRSv, NRRSp) |

| • | Pharyngeal Construction Ratio (PCR) |

| • | The NH study will also employ clinical measures of global swallowing capacity and oropharyngeal dysphagia, along with two distinct patient-reported outcome instruments targeting the assessment of oropharyngeal dysphagia. |

| • | Upon the achievement of 6-months of follow-up in the NH Study, participants will, potentially, be eligible for enrollment into the BB-301 Phase 1b/2a treatment study (NCT06185673). |

| • | BB-301 Phase 1b/2a Treatment Study (NCT06185673): |

| • | This first-in-human (FIH) study will evaluate the safety and clinical activity of intramuscular doses of BB-301 administered to subjects with OPMD. |

| • | The primary endpoint of the FIH study will be safety. |

| • | Secondary endpoints are designed to determine the impact of BB-301 on swallowing efficiency, swallowing safety, and pharyngeal constrictor muscle function in subjects diagnosed with OPMD with dysphagia via the use of serial clinical and videofluoroscopic assessments. Critically, each of the clinical and videofluoroscopic assessments employed in the FIH study will be equivalent to those employed for the NH study to facilitate comparative clinical and statistical analyses for each study subject. |

| • | The primary and secondary endpoints will be evaluated during each 90-day period following BB-301 intramuscular injection (Day 1). |

| • | The NH of dysphagia observed for each OPMD NH Study participant, as characterized by the VFSS and clinical swallowing assessments carried out during the NH Study, will serve as the baseline for comparative assessments of safety and efficacy of BB-301 upon rollover from the NH Study onto the BB-301 Phase 1b/2a Treatment Study (NCT06185673). |

| • | In December 2022, Benitec began screening OPMD subjects at the lead clinical study site in the United States. |

| • | In January 2023, Benitec announced the enrollment of the first OPMD subject into the NH Study in the United States. |

| • | In November 2023, Benitec announced the completion of the administration of BB-301 to the first study subject in the Phase 1b/2a clinical study (NCT06185673) in the United States. The second study subject was dosed with BB-301 in February 2024. |

| • | As of January 2024, 23 subjects had enrolled into the NH study in the United States. |

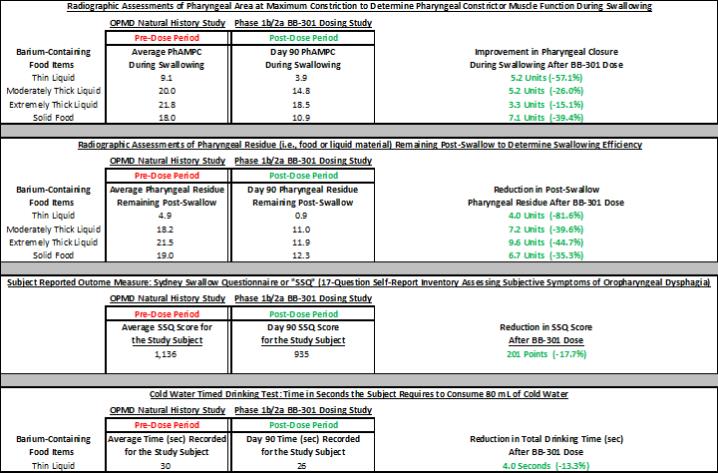

| • | On April 18, 2024 Benitec reported positive interim clinical trial data for the first study subject dosed with BB-301 (i.e., “Subject 1”) in the BB-301 Phase 1b/2a Treatment Study (NCT06185673) |

| • | BB-301 facilitated improvements across multiple measures of swallowing function in the first Phase 1b/2a clinical study subject as compared to pretreatment assessments conducted during the observational natural history portion of the study |

39

Table of Contents

| • | During the OPMD Natural History Study, which represents the pre-dose observational period for each subject, Subject 1 experienced progressive worsening of dysphagia as demonstrated by the results of the videofluoroscopic swallowing studies (VFSS), the cold water timed drinking test, and the key subject-reported outcome measure (the Sydney Swallow Questionnaire). |

| • | Videofluoroscopic swallowing studies represent the gold standard analytical method for the quantitative assessment of dysphagia (swallowing difficulty) in the clinical setting. |

| • | At the 90-day timepoint following the administration of BB-301, Subject 1 demonstrated improvements in key videofluoroscopic assessments which correlated with the observation of similar improvement in the key subject-reported outcome measure as compared to the average values for the respective assessments completed during the pre-dose observational period (as summarized in Figure 13). |

| • | Notably, the results of many assessments completed at the 90-day timepoint demonstrated improvements over the initial measurements assessed at the subject’s first visit for the natural history observational study which occurred more than 12 months prior to the 90-day assessment. |

| • | The most significant VFSS improvements at Day 90 were observed for swallowing tasks centered on the evaluation of pharyngeal constrictor muscle function and swallowing efficiency in the context of the consumption of thin liquids, solid foods and thick, non-solid foods (e.g., yogurt or pudding) (Figure 13). |

| • | The VFSS improvements correlated with an improvement in the key subject-reported outcome measure the Sydney Swallow Questionnaire, indicating an improvement in swallowing function as reported by Subject 1 (Figure 13). |

Figure 13. Improvement in all Outcome Measures 90-Days Post-BB-301 Administration

40

Table of Contents

Closing of Private Placement and Entry into Board Designation Letter.

On April 18, 2024 we closed a private investment in public equity (PIPE) financing (the “April 2024 private placement”) in which we sold 5,749,152 shares of common stock at a price per share of $4.80 and, in lieu of shares of common stock, pre-funded warrants to purchase up to an aggregate of 2,584,239 shares of common stock at a price per pre-funded warrant of $4.7999, to certain institutional accredited investors. The pre-funded warrants were immediately exercisable until exercised in full at an exercise price of $0.0001 per share of common stock. Gross proceeds from the financing totaled $40.0 million. Net proceeds, net of commissions and other offering expenses, totaled approximately $ 37.2 million.

In connection with the April 2024 private placement, we entered into a Voting Commitment Agreement with the purchasers in the private placement (the “Voting Commitment Agreement”). Pursuant to the Voting Commitment Agreement, the Company is obligated to use its reasonable best efforts to obtain stockholder approval of the exercise of the Pre-Funded Warrants issued in the private placement and the warrants issued in the Company’s underwritten public offerings on September 15, 2022 and August 11, 2023 (the “Existing Warrants,” and together with the Pre-Funded Warrants, the “Warrants”) in accordance with the rules of the Nasdaq Stock Market which otherwise would be subject to the Beneficial Ownership Limitation (the “Stockholder Approval”) at the Company’s 2024 annual meeting of stockholders (the “Annual Meeting”), provided that the Company may elect to call a special meeting of its stockholders (the “Special Meeting”) before the Annual Meeting to obtain the Stockholder Approval. If the Stockholder Approval is not obtained at the Annual Meeting (or at a Special Meeting called prior to the Annual Meeting, at the election of the Company), the Company is obligated to use its reasonable best efforts to obtain the Stockholder Approval at its 2025 annual meeting of stockholders (the “2025 Annual Meeting”). If the Stockholder Approval is not obtained before or at the 2025 Annual Meeting, then the Company would no longer be obligated to seek to obtain the Stockholder Approval. The purchasers agreed that the Company will not be liable for any penalty, damages, or other remedy if the Company fails, after using its reasonable best efforts in accordance with the Voting Commitment Agreement, to obtain the Stockholder Approval. Pursuant to the Voting Commitment Agreement, the purchasers agreed to vote or cause to be voted any and all shares of the Company’s Common Stock over which it or its affiliates has or shares voting control on the record date for shares eligible to vote at any Company Special Meeting or Annual Meeting seeking the Stockholder Approval where such proposal is presented in favor of approving the proposal or proposals seeking the Stockholder Approval.

41

Table of Contents

We also entered into a Board Designation Side Letter (the “Board Designation Agreement”) with Suvretta Capital Management, LLC (“Suvretta”) at the closing of the private placement. Pursuant to the Board Designation Agreement, the Company agreed to consider for appointment and appoint Kishen Mehta to the Company’s Board of Directors (the “Board”) upon consummation of the transactions contemplated by the Securities Purchase Agreement, and in such board class as determined by the Company prior to his appointment. Suvretta will be entitled to propose additional candidates for appointment to the Board to the extent the Board does not appoint Mr. Mehta for one or more of the reasons set forth in the Board Designation Agreement. Pursuant to the Board Designation Agreement, Suvretta agreed that (1) in connection with the closing of the Private Placement, (i) the Company and Suvretta will take such action as may be required to permit Suvretta to exercise its Warrants up to the 19.99% Beneficial Ownership Limitation, and (ii) Suvretta will vote all of its shares of Common Stock owned on the record date for such votes in favor of (1) all of the Company’s director nominees for election to the Board at the Company’s annual meetings of stockholders to be held during the term of the Board Designation Agreement, and (2) the proposal seeking the Stockholder Approval pursuant to the Voting Commitment Agreement at any annual or special meeting of the Company where such proposal is presented.

42

Table of Contents

Intellectual Property

Benitec seeks to actively procure rights to and protect the intellectual property and proprietary technology that it believes is important to its business. Such intellectual property rights include patents claiming our ddRNAi and silence and replace technologies, as well as know-how and trade secrets related to our product candidates and proprietary technology.

ddRNAi-based treatment for OPMD

Benitec’s patent portfolio for OPMD includes five patent families relating to shRNA and shmiRs targeting PABPN1 (the causative gene for OPMD), as well as ‘silence and replace’ therapeutics and treatment strategies for OPMD. These five families cover the OPMD therapeutic candidate, BB-301, under development at Benitec, treatment strategies for OPMD that silence PABPN1 which is causative for OPMD and replace with functional PABPN1, and Benitec’s AAV patent family which covers the delivery system for BB-301. BB-301 is a ‘silence and replace’ construct encoding two shmiRs targeting the endogenous PABPN1 (including variants causative of OPMD) internally designated shmiR-13 and shmiR-17, as well as a codon-optimized PABPN1 replacement construct, the transcript of which is not targeted by shmiR-13 and shmiR-17. Both shmiRs and the codon-optimized PABPN1 replacement construct are under the control of a muscle-specific promoter.

The first patent family, entitled “Reagents for treatment of oculopharyngeal muscular dystrophy (OPMD) and use thereof (OPMD family #1)”, arose out of a collaboration with Royal Holloway University of London (RHUL) and relates to three shRNA target regions within PABPN1. RHUL assigned its ownership interests in this patent family to Benitec, and the PCT application and the related U.S. priority document were filed solely in the name of Benitec. This patent family is directed to RNAi agents targeting specific regions within mutant PABPN1 variants causative of OPMD, as well as use of those RNAi agents in combination with PABPN1 replacement constructs to treat OPMD. More specifically, this family includes claims covering shmiR17 of BB-301 This patent family entered the national/regional phase in October/November 2018.

The second patent family, entitled “Reagents for treatment of oculopharyngeal muscular dystrophy (OPMD) and use thereof (OPMD family #2)” relates to a second set of target gene sequences within PABPN1 as well as ‘silence and replace’ construct BB-301 under development at Benitec. The PCT application and the related U.S. priority document were filed solely in the name of Benitec, and this family entered the national/regional phase in June/July 2019. This patent family is directed to RNAi agents targeting specific regions within mutant PABPN1 variants causative of OPMD, as well as ‘silence and replace’ constructs and use of same for treatment of OPMD. More specifically, this family includes claims covering shmiR13 and shmiR17 of BB-301 separately, as well as the full BB-301 ‘knockdown and replacement’ construct.

A third patent family, entitled “Methods for Treating Oculopharyngeal Muscular Dystrophy (OPMD) (OPMD family #3)” has been filed to pursue claims which are broadly directed to the ‘silence and replace’ treatment concept for OPMD, relying on RNAi agents to knockdown PABPN1 and replacement with functional PABPN1 which is not targeted by the RNAi agents. The claims in this application are not limited to BB-301. This patent family exists as a PCT application and was filed solely in the name of Benitec.

43

Table of Contents

A fourth patent family, entitled “Methods for Treating Oculopharyngeal Muscular Dystrophy (OPMD) (OPMD family #4)” has been filed to specifically claim the OPMD therapeutic candidate developed by Benitec, BB-301 (described herein). This patent family exists as a PCT application and was filed solely in the name of Benitec.

AAV with modified phospholipase domain

The Benitec patent portfolio includes a single patent family, entitled “Adeno-associated virus (AAV) with modified phospholipase domain,” which relates to an AAV having a modified phospholipase (PLA2) domain in the capsid. The modified AAV will be used as the delivery system for the OPMD therapeutic.

We are aware of a third party patent directed to AAV vectors that expires in 2026. In the event we receive regulatory marketing approval before the expiration date it may be necessary for us to obtain a license to the patent in order to commercialize. We cannot guarantee the availability of the license or that it can be obtained on commercially reasonable terms.

Know-How

In addition to patent protection of ddRNAi and other technology and our product candidates, we also rely on proprietary know-how that is not patentable or that we elect not to patent, as valuable intellectual property for our business. This know-how is related to the areas of, among others, identifying nucleic acid targets for ddRNAi technology and designing ddRNAi constructs for targeting preferred genes. We have implemented a number of security measures designed to safeguard our know-how including limiting access to our research facilities, databases and networks. We also seek to protect our know-how by way of confidentiality agreements when engaging with external providers for progressing our pipeline of therapeutic candidates.

Laws and Regulations Regarding Patent Terms

The term of individual patents depends upon the legal terms of the patents in the countries in which they are obtained. In most countries in which we file, the patent term is 20 years from the earliest date of filing a non-provisional patent application. In the United States, a patent term may be shortened if a patent is terminally disclaimed over another patent or as a result of delays in patent prosecution by the patentee. A patent’s term may be lengthened by a patent term adjustment, which compensates a patentee for administrative delays by the USPTO in granting a patent. The patent term of a European patent is 20 years from its filing date, which, unlike in the United States, is not subject to patent term adjustments.

The term of a patent that covers an FDA-approved biologic may also be eligible for patent term extension, which permits patent term restoration as compensation for the patent term lost during the FDA regulatory review process. The Drug Price Competition and Patent Term Restoration Act of 1984, or the Hatch-Waxman Act, permits a patent term extension of up to five years beyond the expiration of the patent. The length of the patent term extension is related to the length of time the biologic is under clinical testing regulatory review. Patent extension cannot extend the remaining term of a patent beyond a total of 14 years from the date of product approval and only one patent applicable to an approved biologic may be extended. Similar provisions are available in Europe and other jurisdictions to extend the term of a patent that covers an approved biologic although the eligibility requirements for any duration of such extension vary. In the future, if and when our products receive FDA approval, or approval from an equivalent regulatory body in another jurisdiction in which patent protection is sought or obtained, we expect to apply for patent term extensions on patents covering those products.

44

Table of Contents

Trademarks

Our trademarks include registrations for company branding and product names for our pipeline in development. The trademarks that we use in connection with our business include the following:

| Country or Territory |

Trademark (program) |

Application or Registration number |

Status | |||

| USA | BENITEC | |||||

| BIOPHARMA | 86190065 | Registered | ||||

| USA | SILENCING GENES | 86488147 | Registered | |||

| FOR LIFE | ||||||

| Australia | SILENCING GENES | 1448041 | Registered | |||

| FOR LIFE | ||||||

| Australia | BENITEC | |||||

| BIOPHARMA | 1448046 | Registered | ||||

| Australia | BENITEC—logo | 1448052 | Registered | |||

| Australia | Nervarna | 1526478 | Registered | |||

| Australia | TRIBETARNA | 1526479 | Registered | |||

| Australia | HEPBARNA | 1526483 | Registered | |||

| International Bureau | GIVING DISEASE THE | 1389399 | Registered | |||

| (WIPO) – | SILENT TREATMENT | |||||

| designating EU; UK and US | ||||||

| USA | BENITEC | 86795296 | Registered | |||

| USA | GIVING DISEASE THE | 79226988 | Registered | |||

| SILENT TREATMENT | ||||||

| European Union | BENITEC | 14680003 | Registered | |||

| Australia | BENITEC | 1728797 | Registered | |||

| Australia | BENITEC | 1103049 | Registered | |||

| Australia | BENITEC | 1103300 | Registered | |||

| Australia | GIVING DISEASE THE | 1851660 | Registered | |||

| SILENT TREATMENT | ||||||

| United Kingdom | BENITEC | 3238275 | Registered |

Manufacturing