| Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| Transition Report under Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) |

(Zip Code) |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

Large Accelerated Filer |

☐ |

Accelerated Filer |

☐ | |||

☒ |

Smaller Reporting Company |

|||||

Emerging Growth Company |

||||||

Page |

||||||

PART I |

||||||

| Item 1. |

3 |

|||||

| Item 1A. |

39 |

|||||

| Item 1B. |

82 |

|||||

| Item 2. |

83 |

|||||

| Item 3. |

83 |

|||||

| Item 4. |

83 |

|||||

PART II |

||||||

| Item 5. |

84 |

|||||

| Item 6. |

84 |

|||||

| Item 7. |

85 |

|||||

| Item 7A. |

94 |

|||||

| Item 8. |

F-1 |

|||||

| Item 9. |

F-27 |

|||||

| Item 9A. |

F-27 |

|||||

| Item 9B. |

F-27 |

|||||

PART III |

||||||

| Item 10. |

III-1 |

|||||

| Item 11. |

III-5 |

|||||

| Item 12. |

III-11 |

|||||

| Item 13. |

III-12 |

|||||

| Item 14. |

III-13 |

|||||

PART IV |

||||||

| Item 15. |

IV-1 |

|||||

| Item 16. |

IV-2 |

|||||

IV-3 |

||||||

| • | BENITEC BIOPHARMA ® |

| • | BENITEC ® |

| • | GIVING DISEASE THE SILENT TREATMENT ® |

| • | SILENCING GENES FOR LIFE ® |

| • | the success of our plans to develop and potentially commercialize our product candidates; |

| • | the timing of the initiation and completion of preclinical studies and clinical trials; |

| • | the timing and sufficiency of patient enrollment and dosing in any future clinical trials; |

| • | the timing of the availability of data from clinical trials; |

| • | the timing and outcome of regulatory filings and approvals; |

| • | unanticipated delays; |

| • | sales, marketing, manufacturing and distribution requirements; |

| • | market competition and the acceptance of our products in the marketplace; |

| • | regulatory developments in the United States; |

| • | the development of novel AAV vectors; |

| • | the plans of licensees of our technology; |

| • | the clinical utility and potential attributes and benefits of ddRNAi and our product candidates, |

| • | including the potential duration of treatment effects and the potential for a “one shot” cure; |

| • | our dependence on our relationships with collaborators and other third parties; |

| • | expenses, ongoing losses, future revenue, capital needs and needs for additional financing; |

| • | the length of time over which we expect our cash and cash equivalents to be sufficient to execute on our business plan; |

| • | our intellectual property position and the duration of our patent portfolio; |

| • | the impact of local, regional, and national and international economic conditions and events; and |

| • | the impact of the current COVID-19 pandemic, the disease caused by the SARS-CoV-2 |

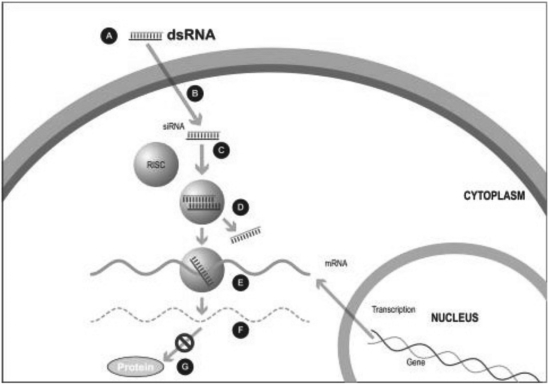

| • | Clinical management requires repeat administration of the siRNA-based therapeutic agent for multiple cycles to maintain efficacy; |

| • | Long-term patient compliance challenges due to dosing frequencies and treatment durations; |

| • | Therapeutic concentrations of siRNA are not stably maintained because the levels of synthetic siRNA in the target cells decrease over time; |

| • | Novel chemical modifications or novel delivery materials are typically required to introduce the siRNA into the target cells, making it complicated to develop a broad range of therapeutics agents; |

| • | Potential adverse immune responses, resulting in serious adverse effects; |

| • | Requirement for specialized delivery formulations for genetic disorders caused by mutations of multiple genes; and |

| • | siRNA acts only to silence genes and cannot be used to replace defective genes with normally functioning genes. |

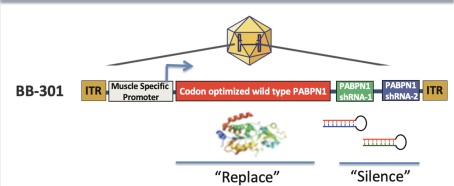

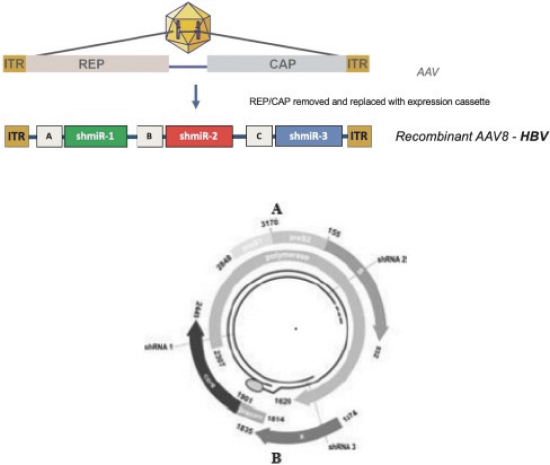

| • | Chronically express RNAi molecules inside of the target, diseased, cells (to serially silence the intracellular production of mutant, disease-causing, protein and the wildtype protein of interest); |

| • | Simultaneously drive the expression of a wildtype variant of the protein of interest (to restore native intracellular biological processes); and |

| • | AAV vectors can accommodate the multi-functional DNA expression cassettes containing the engineered wildtype transgenes and the novel genes encoding short hairpinRNA/microRNA molecules (shRNA/miRNA) that are required to support the development of therapeutic agents capable of the achievement of the goals of the silence and replace approach to therapy. |

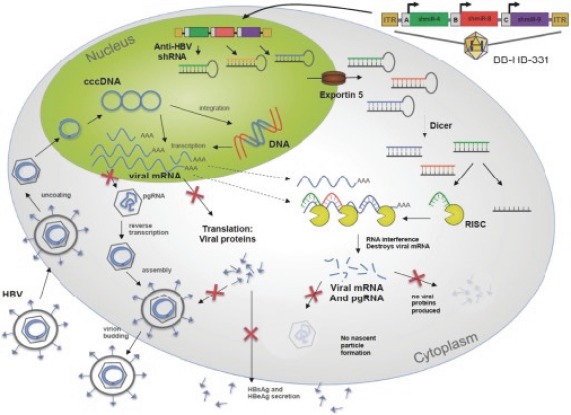

| • | A DNA construct is delivered to the nucleus of the target cell by a gene therapy vector (A) such as an AAV vector; |

| • | Once inside of the nucleus, the DNA construct drives the continuous production of shRNA molecules (B) which are processed by an enzyme called Dicer into siRNAs (C); |

| • | The processed siRNA is incorporated into RISC and silences the target gene using the same mechanism shown in Figure 1; and |

| • | When the DNA expression cassette is additionally comprised of a wildtype transgene, upon entry of the DNA construct into the nucleus of the target cell via the use of the AAV vector, the DNA construct also drives the continuous production of wildtype protein (to restore native intracellular biological processes). |

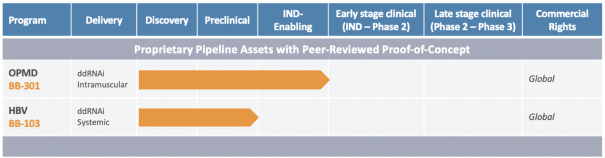

| • | A first mover advantage for ddRNAi-based therapeutics; |

| • | A proprietary ddRNAi-based silence and replace technology platform that may potentially enable the serial development of single-administration therapeutics capable of facilitating sustained, long-term silencing of disease-causing genes and concomitant replacement of wildtype gene function; |

| • | A proprietary AAV vector technology which improves the endosomal escape capability of virus produced in insect cells using a baculovirus system. This technology has broad application in AAV-based gene therapies; |

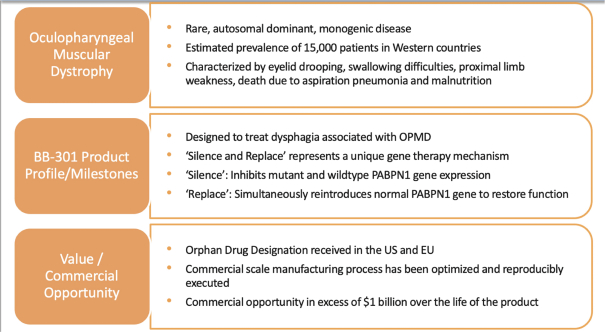

| • | The capabilities to drive the development of a pipeline of programs focused on chronic diseases with either large patient populations, or rare diseases, which may potentially support the receipt of Orphan Drug Designation, including OPMD; and |

| • | A growing portfolio of patents protecting improvements to our ddRNAi, and silence and replace, technology and product candidates through at least 2036, with additional patent life anticipated through at least 2040. |

| • | Selectively develop proprietary and partnered programs; and |

| • | Continue to explore and secure research and development partnerships with global biopharmaceutical companies supported by the differentiated nature of our scientific platform and intellectual property portfolio. |

| • | Seeking and maintaining patents claiming our ddRNAi and silence and replace technologies and other inventions relating to our specific products in development or that are otherwise commercially and/or strategically important to the development of our business; |

| • | Protecting and enforcing our intellectual property rights; and |

| • | Strategically licensing intellectual property from third parties to advance development of our product candidates. |

| • | Intravenous administration of trehalose; and |

| • | The use of autologous myoblast transplant. |

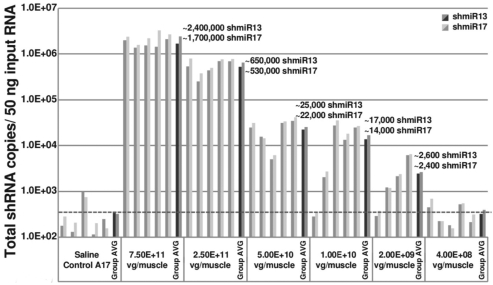

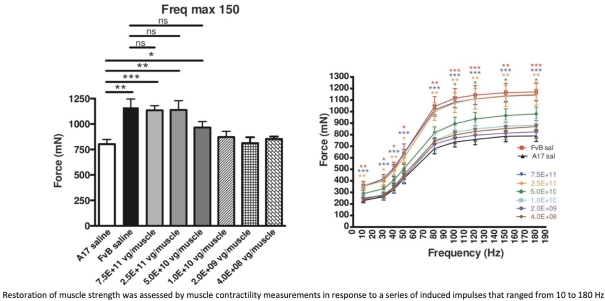

| • | Multiple A17 animal cohorts received single doses of BB-301 (over a range of doses spanning 4x108 vg/muscle-to-7.5x10 11 vg/muscle) and, following BB-301 administration, each cohort was observed for 14-weeks |

| • | BB-301 was injected into the Tibialis Anterior (TA) muscle of 10 week old-to-12 14-weeks post administration, each A17 cohort was anesthetized and the contractile properties of the injected TA muscles were analyzed via in-situ muscle electrophysiology |

| • | Intermediate doses of BB-301 resulted in 75% silencing of PABPN1 and 26% replacement of wild type PABPN1 activity, leading to full restoration of muscle strength, clearance of INIs, and a reduction of fibrosis |

| • | An additional experiment conducted over the course of 20-weeks demonstrated that more modest doses of BB-301 (which supported only partial resolution of the disease phenotype at week-14) were, |

| surprisingly, able to facilitate significant benefit at 20-weeks, as evidenced by full restoration of all parameters relating to muscle strength, weight and INI formation |

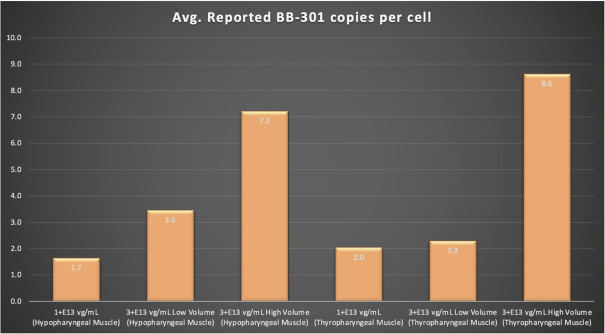

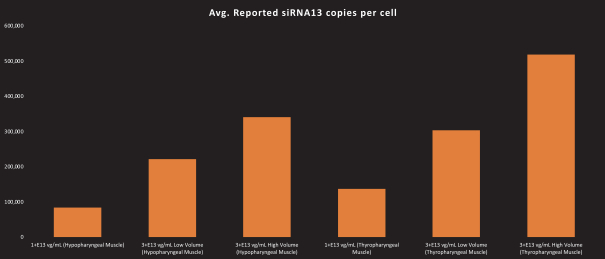

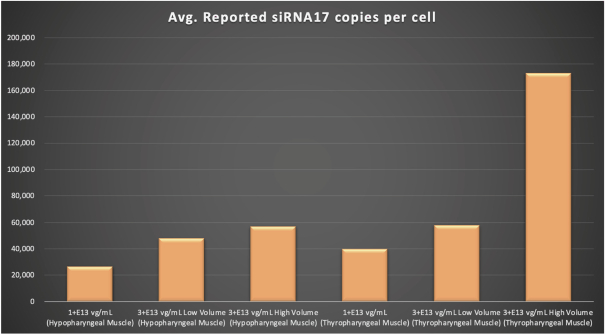

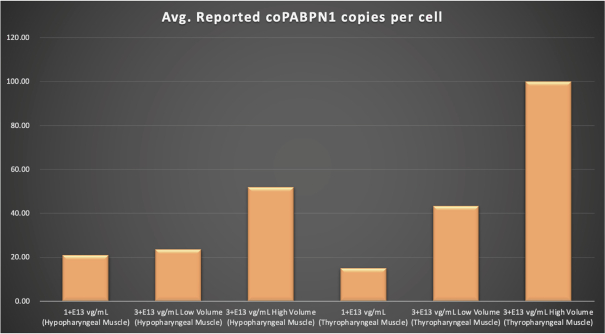

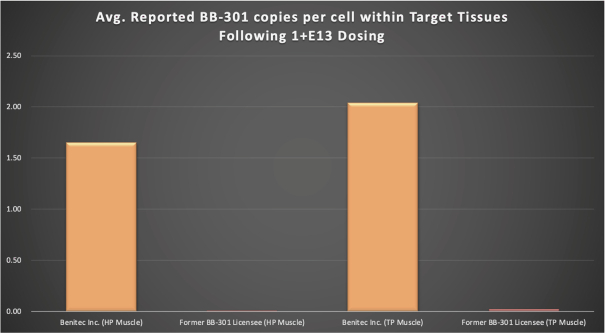

| • | Biologically significant and dose-dependent levels of BB-301 tissue transduction (i.e., delivery of the multi-functional BB-301 genetic construct into the target pharyngeal muscle cells); |

| • | Broad-based and dose-dependent expression of the three distinct genes comprising the BB-301 gene construct within the pharyngeal muscle cells; and |

| • | Durable and biologically significant levels of target gene knock-down (i.e., inhibition of the expression of the gene of interest) within the pharyngeal muscle cells. |

| • | BB-301 encodes two distinct siRNA species (i.e., siRNA13 and siRNA17) which are each, independently, capable of inhibiting (i.e., “silencing”) the expression of the mutant form of the PABPN1 protein and the wildtype (i.e., endogenous) form of the PABPN1 protein (importantly, the mutant form of the PABPN1 protein underlies the development and progression of OPMD). |

| • | BB-301 also codes for a wildtype version of the PABPN1 protein whose intracellular expression is unaffected by the inhibitory activities of siRNA13 and siRNA17, and this codon optimized PABPN1 protein (i.e., coPABPN1) serves to replenish the endogenous form of the PABPN1 protein and to replace the mutant form of PABPN1 that underlies the development and progression of OPMD in diseased tissues. |

| • | For comparative purposes, is should be noted that the average range of expression for wild type PABPN1 within the pharyngeal muscle cells of Beagle dogs is 4.5 copies per cell-to-7.8 |

| • | As noted above, BB-301 encodes two distinct siRNA species (i.e. siRNA13 and siRNA17) which are each, independently, capable of inhibiting (i.e., “silencing”) the expression of all forms of the PABPN1 protein (siRNA13 and siRNA17 silence the expression of both wildtype PABPN1 [wtPABPN1] and mutant PABPN1). |

| • | While the Beagle dog subjects treated in the current BB-301 Pilot Dosing Study do not express mutant PABPN1, the level of BB-301-driven |

| • | Thus, the wtPABPN1 silencing activity observed in the current BB-301 Pilot Dosing Study serves as a surrogate for the activity that would be anticipated in the presence of mutant PABPN1. |

| • | BB-301 has been evaluated in prior non-clinical studies in animals that express mutant PABPN1 and manifest the key signs and symptoms of OPMD and, in these animal models of OPMD, the achievement of PABPN1 silencing levels of 31% inhibition or higher led to complete resolution of OPMD disease symptoms and correction of the histological hallmarks of OPMD. |

| Country or Territory |

Trade Mark (program) |

Application or Registration number |

Status | |||

| USA | BENITEC BIOPHARMA | 86190065 | Registered | |||

| USA | SILENCING GENES FOR LIFE | 86488147 | Registered | |||

| Australia | SILENCING GENES FOR LIFE | 1448041 | Registered | |||

| Australia | BENITEC BIOPHARMA | 1448046 | Registered | |||

| Australia | BENITEC - logo  |

1448052 | Registered | |||

| Australia | Nervarna | 1526478 | Registered | |||

| Australia | TRIBETARNA | 1526479 | Registered | |||

| Australia | HEPBARNA | 1526483 | Registered | |||

| International Bureau (WIPO) – designating EU; UK and US | GIVING DISEASE THE SILENT TREATMENT | 1389399 | Registered | |||

| USA | BENITEC | 86795296 | Registered | |||

| USA | GIVING DISEASE THE SILENT TREATMENT | 79226988 | Registered | |||

| European Union | BENITEC | 14680003 | Registered | |||

| Australia | BENITEC | 1728797 | Registered | |||

| Australia | BENITEC | 1103049 | Registered | |||

| Australia | BENITEC | 1103300 | Registered | |||

| Australia | GIVING DISEASE THE SILENT TREATMENT | 1851660 | Registered | |||

| United Kingdom | BENITEC | 3238275 | Registered |

| • | nonclinical pharmacology and toxicology laboratory and animal tests according to good laboratory practices, or GLPs, and applicable requirements for the humane use of laboratory animals or other applicable regulations; |

| • | submission of an IND application which must become effective before human clinical trials may begin; |

| • | adequate and well-controlled human clinical trials according to GCPs and any additional requirements for the protection of human research subjects and their health information to establish the safety and efficacy of the investigational product for each targeted indication; |

| • | submission of a biologics license application, or BLA, to the FDA; |

| • | FDA’s pre-approval inspection of manufacturing facilities to assess compliance with cGMPs and, if applicable, the FDA’s good tissue practices, or GTPs, for the use of human cellular and tissue products to prevent the introduction, transmission, or spread of communicable diseases; |

| • | FDA’s audit of clinical trial sites that generated data in support of the BLA; and |

| • | FDA approval of a BLA, which must occur before a product can be marketed or sold. |

| • | Phase I includes the initial introduction of an investigational product into humans. Phase I clinical trials may be conducted in patients with the target disease or condition or on healthy volunteers. These studies are designed to evaluate the safety, metabolism, pharmacokinetics and pharmacologic actions of the investigational product in humans, the side effects associated with increasing doses, and if possible, to gain early evidence on effectiveness. During Phase I clinical trials, sufficient information about the investigational product’s pharmacokinetics and pharmacological effects may be obtained to permit the design of Phase II clinical trials. The total number of participants included in Phase I clinical trials varies, but is generally in the range of 20 to 80. |

| • | Phase II includes the controlled clinical trials conducted to evaluate the effectiveness of the investigational product for a particular indication(s) in patients with the disease or condition under study, to determine dosage tolerance and optimal dosage, and to identify possible adverse side effects and safety risks associated with the product. Phase II clinical trials are typically well- controlled, closely monitored, and conducted in a limited patient population, usually involving no more than several hundred participants. Phase IIa trials provide information on the impact of dose ranging on safety, biomarkers and proof of concept, while Phase IIb trials are patient dose-ranging efficacy trials. |

| • | Phase III clinical trials are controlled clinical trials conducted in an expanded patient population at geographically dispersed clinical trial sites. They are performed after preliminary evidence suggesting effectiveness of the investigational product has been obtained, and are intended to further evaluate dosage, clinical effectiveness and safety, to establish the overall benefit-risk relationship of the product, and to provide an adequate basis for product approval. Phase III clinical trials usually involve several hundred to several thousand participants. In most cases, the FDA requires two adequate and well controlled Phase III clinical trials to demonstrate the efficacy of the product. FDA may accept a single Phase III trial with other confirmatory evidence in rare instances where the trial is a large multicenter trial demonstrating internal consistency and a statistically very persuasive finding of a clinically meaningful effect on mortality, irreversible morbidity or prevention of a disease with a potentially serious outcome and confirmation of the result in a second trial would be practically or ethically impossible. |

| • | the second applicant can establish that its product, although similar, is safer, more effective or otherwise clinically superior; |

| • | the applicant consents to a second orphan medicinal product application; or |

| • | the applicant cannot supply enough orphan medicinal product. |

| • | We have incurred significant losses since inception and anticipate that we will continue to incur losses for the foreseeable future. If we are unable to achieve or sustain profitability, the market value of our common stock will likely decline; |

| • | We have never generated any revenue from product sales and may never be profitable; |

| • | We will need to continue our efforts to raise additional funding, which may not be available on acceptable terms, or at all. Failure to obtain capital when needed may negatively impact our ability to continue as a going concern; |

| • | Our product candidates are based on ddRNAi and silence and replace technology. Currently, no product candidates utilizing ddRNAi technology or silence and replace technology have been approved for commercial sale and our approach to the development of ddRNAi technology and silence and replace technology may not result in safe, effective or marketable products; |

| • | We are early in our product development efforts and our current product candidates are still in preclinical development. We may not be able to obtain regulatory approvals for the commercialization of our product candidates; |

| • | Issues that may impact delivery of our therapeutics to the cell could adversely affect or limit our ability to develop and commercialize product candidates; |

| • | We face competition from entities that have developed or may develop product candidates for our target disease indications, including companies developing novel treatments and technology platforms based on modalities and technology similar to ours; and |

| • | If we are unable to obtain or protect sufficient intellectual property rights related to our product candidates, we may not be able to obtain exclusivity for our product candidates or prevent others from developing similar competitive products. |

| • | continue our research and preclinical development of our product candidates; |

| • | expand the scope of our current preclinical studies for our product candidates or initiate clinical, additional preclinical or other studies for product candidates; |

| • | seek regulatory and marketing approvals for any of our product candidates that successfully complete clinical trials; |

| • | further develop the manufacturing process for our product candidates; |

| • | change or add additional manufacturers or suppliers; |

| • | seek to identify and validate additional product candidates; |

| • | acquire or in-license other product candidates and technologies, which may or may not include those related to our ddRNAi technology and delivery vectors for our therapeutic candidates; |

| • | maintain, protect and expand our intellectual property portfolio; |

| • | create additional infrastructure to support our operations as a public company in the United States and our product development and future commercialization efforts; and |

| • | experience any delays or encounter issues with any of the above. |

| • | establishing proof of concept in preclinical studies and clinical trials for our product candidates; |

| • | successfully initiating and completing clinical trials of our product candidates; |

| • | obtaining regulatory and marketing approvals for product candidates for which we complete clinical trials; |

| • | maintaining, protecting and expanding our intellectual property portfolio, and avoiding infringing on intellectual property of third parties; |

| • | establishing and maintaining successful licenses, collaborations and alliances with third parties; |

| • | developing a sustainable, scalable, reproducible and transferable manufacturing process for our product candidates; |

| • | establishing and maintaining supply and manufacturing relationships with third parties that can provide products and services adequate, in amount and quality, to support clinical development and commercialization of our product candidates, if approved; |

| • | launching and commercializing any product candidates for which we obtain regulatory and marketing approval, either by collaborating with a partner or, if launched independently, by establishing a sales, marketing and distribution infrastructure; |

| • | obtaining market acceptance of any product candidates that receive regulatory approval as viable treatment options; |

| • | obtaining favorable coverage and reimbursement rates for our products from third-party payers; |

| • | addressing any competing technological and market developments; |

| • | identifying and validating new product candidates; and |

| • | negotiating favorable terms in any collaboration, licensing or other arrangements into which we may enter. |

| • | the FDA or comparable foreign regulatory authorities may disagree with the design or implementation of any future clinical trials; |

| • | we may be unable to demonstrate to the satisfaction of the FDA or comparable foreign regulatory authorities that a product candidate is safe and effective for its proposed indication; |

| • | the results of any future clinical trials may not meet the level of statistical or clinical significance required by the FDA or comparable foreign regulatory authorities for approval; |

| • | the patients recruited for a particular clinical program may not be sufficiently broad or representative to assure safety and effectiveness in the full population for which we seek approval; |

| • | the results of any future clinical trials may not confirm the positive results from earlier preclinical studies or clinical trials; |

| • | we may be unable to demonstrate that a product candidate’s clinical and other benefits outweigh its safety risks; |

| • | the FDA or comparable foreign regulatory authorities may disagree with our interpretation of data from preclinical studies or clinical trials; |

| • | the data collected from any future clinical trials of our product candidates may not be sufficient to the satisfaction of FDA or comparable foreign regulatory authorities to support the submission of a biologics license application, or BLA, or other comparable submission in foreign jurisdictions or to obtain regulatory approval in the United States or elsewhere; |

| • | the FDA or comparable foreign regulatory authorities may only agree to approve a product candidate under conditions that are so restrictive that the product is not commercially viable; |

| • | regulatory agencies might not approve or might require changes to our manufacturing processes or facilities; or |

| • | regulatory agencies may change their approval policies or adopt new regulations in a manner rendering our clinical data insufficient for approval. |

| • | restrictions on our ability to conduct clinical trials, including full or partial clinical holds on ongoing or planned trials; |

| • | restrictions on the products, manufacturers or manufacturing process; |

| • | warning letters; |

| • | civil and criminal penalties; |

| • | injunctions; |

| • | suspension or withdrawal of regulatory approvals; |

| • | product seizures, detentions or import bans; |

| • | voluntary or mandatory product recalls and publicity requirements; |

| • | total or partial suspension of production; |

| • | imposition of restrictions on operations, including costly new manufacturing requirements; and |

| • | refusal to approve pending BLAs or supplements to approved BLAs. |

| • | finding and diagnosing patients; |

| • | severity of the disease under investigation; |

| • | design of the clinical trial protocol; |

| • | size and nature of the patient population; |

| • | eligibility criteria for the trial in question; |

| • | perceived risks and benefits of the product candidate under study; |

| • | proximity and availability of clinical trial sites for prospective patients; |

| • | availability of competing therapies and clinical trials; |

| • | clinicians’ and patients’ perceptions of the potential advantages of the product being studied in relation to other available therapies, including any new products that may be approved for the indications we are investigating; |

| • | patient referral practices of physicians; |

| • | ability to monitor patients adequately during and after treatment; and |

| • | the COVID-19 pandemic. |

| • | difficulty in establishing or managing relationships with contract research organizations, or CROs, clinical sites and physicians; |

| • | different standards for the conduct of clinical trials; |

| • | our inability to locate and engage qualified local consultants, physicians and partners; and |

| • | the potential burden of complying with a variety of foreign laws, medical standards and regulatory requirements, including the regulation of biopharmaceutical and biotechnology products and treatments. |

| • | inability to generate sufficient preclinical, toxicology or other data to support the initiation of human clinical trials; |

| • | delays in reaching consensus with regulatory agencies on trial design; |

| • | identifying, recruiting and training suitable clinical investigators; |

| • | delays in reaching agreement on acceptable terms with prospective CROs and clinical trial sites; |

| • | delays in obtaining required IRB or IBC approval at each clinical trial site; |

| • | delays in recruiting suitable patients to participate in our clinical trials, including as a result of the current COVID-19 pandemic; |

| • | imposition of a clinical hold by regulatory agencies, including after an inspection of our clinical trial operations or trial sites; |

| • | failure by our CROs, other third parties or us to adhere to clinical trial requirements; |

| • | failure to perform in accordance with the FDA’s good clinical practices, or GCP, or applicable regulatory requirements in other countries; |

| • | inability to manufacture, test, release, import or export for use sufficient quantities of our product candidates for use in clinical trials; |

| • | failure to manufacture our product candidate in accordance with cGMP requirements or applicable regulatory guidelines in other countries; |

| • | delays in the testing, validation and manufacturing of our product candidates; |

| • | delays in the delivery of our product candidates to the clinical trial sites; |

| • | delays in having patients complete participation in a trial or return for post-treatment follow-up; |

| • | clinical trial sites dropping out of a trial; |

| • | occurrence of serious adverse events associated with the product candidate that are viewed to outweigh its potential benefits; |

| • | changes in regulatory requirements and guidance that require amending or submitting new clinical trial protocols; |

| • | clinical trials of our product candidates may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional clinical trials or discontinue product development programs; or |

| • | the severity, duration and impact of the COVID-19 pandemic. |

| • | fail to obtain, or be delayed in obtaining, marketing approval for our product candidates; |

| • | obtain approval for indications or patient populations that are not as broad as intended or desired; |

| • | obtain approval with labeling that includes significant use or distribution restrictions or safety warnings; |

| • | need to change the way the product is administered; |

| • | be required to perform additional clinical trials to support approval or be subject to additional post-marketing testing requirements; |

| • | have regulatory authorities withdraw their marketing approval of the product after granting it; |

| • | have regulatory authorities impose restrictions on distribution of the product in the form of a risk evaluation and mitigation strategy, or REMS, or modified REMS, that limit our ability to commercialize the product; |

| • | be subject to the addition of labeling statements, such as warnings or contraindications; |

| • | be sued and held liable for harm caused to patients; or |

| • | experience damage to our reputation. |

| • | regulatory authorities may withdraw approvals of such product candidate; |

| • | regulatory authorities may require additional warnings on the label; |

| • | we may be required to create a medication guide outlining the risks of such side effects for distribution to patients; |

| • | we may be required to change the way a product candidate is administered or conduct additional clinical trials; |

| • | we could be sued and held liable for harm caused to patients; and |

| • | our reputation may suffer. |

| • | the development of relevant product candidates may be delayed or impaired altogether if we are unable to appropriately select patients for enrollment in our clinical trials; |

| • | our relevant therapeutic product candidate may not receive marketing approval if its effective use depends on a related diagnostic in the regulatory authority’s judgment; and |

| • | we may not realize the full commercial potential of any therapeutic product candidates that receive marketing approval if, among other reasons, we are unable to appropriately identify patients with the specific genetic alterations targeted by our therapeutic product candidates. |

| • | issue a warning letter asserting that we are in violation of the law; |

| • | seek an injunction or impose civil or criminal penalties or monetary fines; |

| • | suspend or withdraw regulatory approval; |

| • | suspend any ongoing clinical trials; |

| • | refuse to permit government reimbursement of our product by government-sponsored third-party payers; |

| • | refuse to approve a pending BLA or supplements to a BLA submitted by us for other indications or new product candidates; |

| • | seize our product; or |

| • | refuse to allow us to enter into or continue supply contracts, including government contracts. |

| • | a collaborator may shift its priorities and resources away from our programs due to a change in business strategies, or a merger, acquisition, sale or downsizing of its company or business unit; |

| • | a collaborator may cease development in an area that is the subject of a collaboration agreement; |

| • | a collaborator may change the success criteria for a particular program or product candidate in development, thereby delaying or ceasing development of such program or product candidate in development; |

| • | a collaborator with development or commercialization obligations may not commit sufficient financial or human resources to the development, marketing, distribution or sale of a product, or may otherwise fail in development or commercialization efforts; |

| • | a collaborator with manufacturing responsibilities may encounter regulatory, resource or quality issues and be unable to meet demand requirement; |

| • | a collaborator could independently develop, or develop with unrelated parties, products that compete directly or indirectly with our product candidates; |

| • | a collaborator may exercise its rights under the agreement to discontinue our collaboration; |

| • | a dispute may arise between us and a collaborator concerning the development or commercialization of a product candidate, resulting in a delay in milestones, royalty payments, or discontinuation of a program and possibly resulting in costly litigation or arbitration that may divert management attention and resources; |

| • | a collaborator may not adequately protect the intellectual property rights associated with a product candidate; |

| • | a collaborator may use our proprietary information or intellectual property in such a way as to expose us actual or threatened litigation from a third party, patent office proceedings or other risks that could jeopardize or invalidate our intellectual property or proprietary information or expose us to potential liability; and |

| • | a collaborator may own or co-own, or have a license to use, intellectual property rights associated with a product candidate that results from our collaborating with them, and in such cases, we would not have the exclusive right to commercialize such intellectual property rights. |

| • | an inability to conduct necessary preclinical studies to progress our product candidates to clinical trials; |

| • | an inability to initiate or continue any future clinical trials of product candidates under development; |

| • | delay in submitting regulatory applications, or receiving regulatory approvals, for product candidates; |

| • | loss of the cooperation of a collaborator; |

| • | subjecting our product candidates to additional inspections by regulatory authorities; |

| • | requirements to cease distribution or to recall batches of our product candidates; and |

| • | in the event of approval to market and commercialize a product candidate, an inability to meet commercial demands for our products. |

| • | the safety and efficacy of our product candidates; |

| • | our ability to offer our products for sale at competitive prices; |

| • | the relative convenience and ease of administration of our product candidates; |

| • | the prevalence and severity of any adverse side effects associated with our product candidates; |

| • | the terms of any approvals and the countries in which approvals are obtained; |

| • | limitations or warnings contained in any labeling approved by the FDA or comparable foreign regulatory authorities; |

| • | conditions upon the approval imposed by FDA or comparable foreign regulatory authorities, including, but not limited to, a REMS; |

| • | the willingness of patients to try new treatments and of physicians to prescribe these treatments; |

| • | the availability of government and other third-party payer coverage and adequate reimbursement; and |

| • | the availability of alternative effective treatments for the disease indications our product candidates are intended to treat and the relative risks, benefits and costs of those treatments. |

| • | different regulatory requirements for approval of biopharmaceutical products in foreign countries; |

| • | reduced protection for intellectual property rights; |

| • | unexpected changes in tariffs, trade barriers and regulatory requirements; |

| • | economic weakness, including inflation, or political instability in particular foreign economies and markets; |

| • | compliance with tax, employment, immigration and labor laws for employees living or traveling abroad; |

| • | foreign currency fluctuations, which could result in increased operating expenses and reduced revenue, and other obligations incident to doing business in another country; |

| • | workforce uncertainty in countries where labor unrest is more common than in Australia or the United States; |

| • | production shortages resulting from any events affecting raw material supply or manufacturing capabilities abroad; and |

| • | business interruptions resulting from geopolitical actions, including war and terrorism, natural disasters, including earthquakes, typhoons, floods and fires and disease pandemics and epidemics, including the current COVID-19 pandemic. |

| • | the federal Anti-Kickback Statute, which prohibits, among other things, persons and entities from knowingly and willfully soliciting, offering, receiving or providing remuneration, directly or indirectly, in cash or in kind, to induce or reward, or in return for, either the referral of an individual for, or the purchase, order or recommendation of, any good or service, for which payment may be made under federal and state healthcare programs such as Medicare and Medicaid; |

| • | federal civil and criminal false claims laws and civil monetary penalty laws, including the federal False Claims Act, which impose criminal and civil penalties, including civil whistleblower or qui tam actions, against individuals or entities for knowingly presenting, or causing to be presented, to the federal government, including the Medicare and Medicaid programs, claims for payment that are false or fraudulent or making a false statement to avoid, decrease or conceal an obligation to pay money to the federal government; |

| • | the federal Health Insurance Portability and Accountability Act of 1996, or HIPAA, which imposes criminal and civil liability for, among other things, executing a scheme to defraud any healthcare benefit program or making false statements relating to healthcare matters; |

| • | HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act of 2009, or HITECH, and their respective implementing regulations, which impose obligations on covered healthcare providers, health plans and healthcare clearinghouses, as well as their business associates that create, receive, maintain or transmit individually identifiable health information for or on behalf of a covered entity, with respect to safeguarding the privacy, security and transmission of individually identifiable health information; |

| • | the federal Open Payments program, created under the ACA, and its implementing regulations, which requires certain manufacturers of drugs, devices, biologics and medical supplies for which payment is available under Medicare, Medicaid or the Children’s Health Insurance Program, with specific exceptions, to report annually to the CMS information related to payments or other transfers of value made to physicians, and applicable group purchasing organizations to report annually to CMS ownership and investment interests held by the physicians and their immediate family members by the 90th day of each subsequent calendar year, and disclosure of such information will be made by CMS on a publicly available website; and |

| • | analogous state and foreign laws and regulations, such as state anti-kickback and false claims laws, which may apply to sales or marketing arrangements and claims involving healthcare items or services reimbursed by non-governmental third-party payers, including private insurers; state and foreign laws that require biopharmaceutical or biotechnology companies to comply with the industry voluntary compliance guidelines and the relevant compliance guidance promulgated by the federal government or otherwise restrict payments that may be made to healthcare providers; state and foreign laws that |

| require biopharmaceutical or biotechnology manufacturers to report information related to payments and other transfers of value to physicians and other healthcare providers or marketing expenditures; and state and foreign laws governing the privacy and security of health information in certain circumstances, many of which differ from each other in significant ways and often are not preempted by HIPAA, thus complicating compliance efforts. |

| • | impairment of our business reputation; |

| • | withdrawal of clinical trial participants; |

| • | costs due to related litigation; |

| • | distraction of management’s attention from our primary business; |

| • | substantial monetary awards to patients or other claimants; |

| • | the inability to commercialize our product candidates; |

| • | decreased demand for our product candidates, if approved for commercial sale; and |

| • | increased cost, or impairment of our ability, to obtain or maintain product liability insurance coverage. |

| • | the scope of rights granted under the license agreement and other interpretation-related issues; |

| • | the extent to which our technology and processes infringe on intellectual property of a licensor that is not subject to the licensing agreement; |

| • | the sublicensing of patent and other rights under any collaborative relationships we might enter into in the future; |

| • | our diligence obligations under the license agreement and what activities satisfy those diligence obligations; |

| • | the ownership of inventions and know-how resulting from the joint creation or use of intellectual property by our licensors and us and our partners; and |

| • | the priority of invention of patented technology. |

| • | results of our clinical trials; |

| • | regulatory actions; |

| • | actual or expected fluctuations in our operating results; |

| • | changes in market valuations of similar companies; |

| • | changes in our key personnel; |

| • | changes in financial estimates or recommendations by securities analysts; |

| • | strategic decisions by us or our competitors, such as acquisitions, collaborations, divestitures, spin-offs, joint ventures, strategic investments or changes in business strategy; |

| • | the passage of legislation or other regulatory developments in the United States and other countries affecting us or our industry; |

| • | changes in trading volume of our common stock on Nasdaq; |

| • | sales of our common stock by us, our executive officers or our shareholders in the future; and |

| • | conditions in the financial markets or changes in general economic conditions, including as a result of the current COVID-19 pandemic. |

| Year Ended June 30, | ||||||||

2021 |

2020 |

|||||||

(US$’000) |

||||||||

| Revenues: |

||||||||

| Revenues from customers |

$ | 59 | $ | 97 | ||||

| Government research and development grants |

— | 5 | ||||||

| |

|

|

|

|||||

| Total revenues |

$ | 59 | $ | 102 | ||||

| |

|

|

|

|||||

| Year Ended June 30, | ||||||||

2021 |

2020 |

|||||||

(US$’000) |

||||||||

| Expenses: |

||||||||

| Royalties and license fees |

$ | 123 | $ | (185 | ) | |||

| Research and development |

7,020 | 3,001 | ||||||

| General and Administrative |

6,512 | 5,567 | ||||||

| |

|

|

|

|||||

| Total expenses |

13,655 | 8,383 | ||||||

| |

|

|

|

|||||

| Year Ended June 30, | ||||||||

2021 |

2020 |

|||||||

(US$’000) |

||||||||

| Other Income (Loss): |

||||||||

| Foreign currency transaction loss |

(333 | ) | (88 | ) | ||||

| Interest income (expense), net |

(6 | ) | 62 | |||||

| Other income, net |

37 | 34 | ||||||

| Unrealized gain (loss) on investment |

16 | (1 | ) | |||||

| |

|

|

|

|||||

| Total other income (loss) |

(286 | ) | 7 | |||||

| |

|

|

|

|||||

| Year Ended June 30, | ||||||||

2021 |

2020 |

|||||||

(US$’000) |

||||||||

| Net cash provided by (used in): |

||||||||

| Operating activities |

$ | (12,832 | ) | $ | (7,535 | ) | ||

| Investing activities |

(221 | ) | (94 | ) | ||||

| Financing activities |

22,522 | 1,770 | ||||||

| |

|

|

|

|||||

| Net increase (decrease) in cash |

$ | 9,469 | $ | (5,859 | ) | |||

| |

|

|

|

|||||

| • | the timing and costs of our planned clinical trials for our ddRNAi and silence and replace product candidates; |

| • | the timing and costs of our planned preclinical studies for our ddRNAi and silence and replace product candidates; |

| • | the number and characteristics of product candidates that we pursue; |

| • | the outcome, timing and costs of seeking regulatory approvals; |

| • | revenue received from commercial sales of any of our product candidates that may receive regulatory approval; |

| • | the terms and timing of any future collaborations, licensing, consulting or other arrangements that we may establish; |

| • | the amount and timing of any payments we may be required to make, or that we may receive, in connection with the licensing, filing, prosecution, defense and enforcement of any patents or other intellectual property rights; |

| • | the costs of preparing, filing and prosecuting patent applications, maintaining and protecting our intellectual property rights and defending against intellectual property related claims; and |

| • | the extent to which we need to in-license or acquire other products and technologies. |

Item 8. |

Financial Statements and Supplementary Data. |

F-2 |

||||

F-4 |

||||

F-5 |

||||

F-6 |

||||

F-7 |

||||

F-8 |

| • | Obtaining an understanding and evaluating the design of certain internal controls related to the critical audit matter. This included controls over the development of the estimated amount of accrued costs incurred by the contract research organizations and contract manufacturing organizations (the “R&D service providers”) during the period. |

| • | Inquiring with Company personnel responsible for overseeing the research and development activities to understand progress of the activities completed to date for selected R&D service providers. |

| • | Confirming with selected R&D service providers or inspecting the key terms and conditions of the contracts between the Company and the respective R&D service providers, the documentation of the Company as to the completion status and arriving at an estimate of the accrual amounts based thereon and comparing it to the amounts recorded by the Company. |

| • | Performing an analysis by comparing the estimated accrual balances at year end to the actual amounts that were ultimately invoiced by the R&D service providers and/or paid by the Company for selected R&D service providers. |

June 30, 2021 |

June 30, 2020 |

|||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | $ | ||||||

| Trade and other receivables |

||||||||

| Prepaid and other assets |

||||||||

| |

|

|

|

|||||

| Total current assets |

||||||||

| Property and equipment, net |

||||||||

| Deposits |

||||||||

| Other assets |

— | |||||||

| Right-of-use |

||||||||

| |

|

|

|

|||||

| Total assets |

$ | $ | ||||||

| |

|

|

|

|||||

| Liabilities and Stockholders’ Equity |

||||||||

| Current liabilities: |

||||||||

| Trade and other payables |

$ | $ | ||||||

| Accrued employee benefits |

||||||||

| Lease liabilities, current portion |

||||||||

| |

|

|

|

|||||

| Total current liabilities |

||||||||

| Lease liabilities, less current portion |

— | |||||||

| |

|

|

|

|||||

| Total liabilities |

||||||||

| Commitments and contingencies (Note 12) |

||||||||

| Stockholders’ equity: |

||||||||

| Common stock, $ |

||||||||

| Additional paid-in capital |

||||||||

| Accumulated deficit |

( |

) | ( |

) | ||||

| Accumulated other comprehensive loss |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Total stockholders’ equity |

||||||||

| |

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | $ | ||||||

| |

|

|

|

|||||

Year Ended June 30, |

||||||||

2021 |

2020 |

|||||||

| Revenue: |

||||||||

| Revenues from customers |

$ | $ | ||||||

| Government research and development grants |

— | |||||||

| |

|

|

|

|||||

| Total revenues |

||||||||

| Operating expenses |

||||||||

| Royalties and license fees |

( |

) | ||||||

| Research and development |

||||||||

| General and administrative |

||||||||

| |

|

|

|

|||||

| Total operating expenses |

||||||||

| |

|

|

|

|||||

| Loss from operations |

( |

) | ( |

) | ||||

| Other income (loss): |

||||||||

| Foreign currency transaction loss |

( |

) | ( |

) | ||||

| Interest income (expense), net |

( |

) | ||||||

| Other income, net |

||||||||

| Unrealized gain (loss) on investment |

( |

) | ||||||

| |

|

|

|

|||||

| Total other income (loss), net |

( |

) | ||||||

| |

|

|

|

|||||

| Net loss |

$ | ( |

) | $ | ( |

) | ||

| |

|

|

|

|||||

| Other comprehensive income (loss): |

||||||||

| Unrealized foreign currency translation gain (loss) |

( |

) | ||||||

| |

|

|

|

|||||

| Total other comprehensive income (loss) |

( |

) | ||||||

| |

|

|

|

|||||

| Total comprehensive loss |

$ | ( |

) | $ | ( |

) | ||

| |

|

|

|

|||||

| Net loss |

$ | ( |

) | $ | ( |

) | ||

| |

|

|

|

|||||

| Net loss per share: |

||||||||

| Basic and diluted |

$ | ( |

) | $ | ( |

) | ||

| |

|

|

|

|||||

| Weighted-average shares outstanding: |

||||||||

| Basic and diluted |

||||||||

| |

|

|

|

|||||

| Common Stock |

Additional Paid-in Capital |

Accumulated Deficit |

Accumulated Other Comprehensive Loss |

Total Stockholders’ Equity |

||||||||||||||||||||

Shares |

Amount |

|||||||||||||||||||||||

| Balance at June 30, 2019 |

$ |

$ |

$ |

( |

) | $ |

( |

) | $ |

|||||||||||||||

| Common stock sold for cash, net of offering costs $ |

— | — | — | |||||||||||||||||||||

| Issuance and exercise of pre-funded warrants, net of transaction costs of $240 |

— | — | — | |||||||||||||||||||||

| Cashless exercise of purchase warrants |

— | — | — | — | — | |||||||||||||||||||

| Share-based compensation |

— | — | — | — | ||||||||||||||||||||

| Forfeitures of share-based payments |

— | — | ( |

) | — | — | ||||||||||||||||||

| Foreign currency translation loss |

— | — | — | — | ( |

) | ( |

) | ||||||||||||||||

| Net loss |

— | — | — | ( |

) | — | ( |

) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at June 30, 2020 |

$ | $ | $ | ( |

) | $ | ( |

) | $ | |||||||||||||||

| Common stock sold for cash, net of offering costs of $ |

— | — | ||||||||||||||||||||||

| Exercise of pre-funded warrants |

— | — | — | |||||||||||||||||||||

| Share-based compensation |

— | — | — | — | ||||||||||||||||||||

| Forfeitures of share-based payments |

— | — | ( |

) | — | — | ||||||||||||||||||

| Foreign currency translation gain |

— | — | — | — | ||||||||||||||||||||

| Net loss |

— | — | — | ( |

) | — | ( |

) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at June 30, 2021 |

$ | $ | $ | ( |

) | $ | ( |

) | $ | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Year Ended June 30, |

||||||||

2021 |

2020 |

|||||||

| Cash flows from operating activities: |

||||||||

| Net loss |

$ | ( |

) | $ | ( |

) | ||

| Adjustments to reconcile net loss to net cash from operating activities: |

||||||||

| Depreciation and amortization |

||||||||

| Amortization of right-of-use |

||||||||

| Loss on disposal of fixed assets |

— | |||||||

| Unrealized (gain) loss on investment |

( |

) | ||||||

| Share-based compensation expense |

||||||||

| Changes in operating assets and liabilities: |

||||||||

| Trade and other receivables |

||||||||

| Prepaid and other assets |

( |

) | ( |

) | ||||

| Trade and other payables |

( |

) | ||||||

| Accrued employee benefit payable |

||||||||

| Lease liability |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Net cash used in operating activities |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Purchases of property and equipment |

( |

) | ( |

) | ||||

| Proceeds from disposal of property and equipment |

— | |||||||

| |

|

|

|

|||||

| Net cash used in investing activities |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Proceeds from issues of shares and pre-funded warrants |

||||||||

| Share issue transaction costs |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Net cash provided by financing activities |

||||||||

| |

|

|

|

|||||

| Net increase (decrease) in cash and cash equivalents |

( |

) | ||||||

| Cash and cash equivalents, beginning of year |

||||||||

| Effects of exchange rate changes on cash and cash equivalents |

( |

) | ||||||

| |

|

|

|

|||||

| Cash and cash equivalents, end of year |

$ | $ | ||||||

| |

|

|

|

|||||

| Supplemental disclosure of cash flow information: |

||||||||

| Initial measurement of operating lease right-of-use |

$ | — | $ | ( |

) | |||

| |

|

|

|

|||||

Principal place of business/country of incorporation | ||

| Benitec Biopharma Proprietary Limited (“BBL”) |

||

| Benitec Australia Proprietary Limited |

||

| Benitec Limited |

||

| Benitec, Inc. |

||

| Benitec LLC |

||

| RNAi Therapeutics, Inc. |

||

| Tacere Therapeutics, Inc. |

||

| Benitec IP Holdings, Inc. |

June 30, 2021 |

June 30, 2020 |

|||||||

| Exchange rate on balance sheet dates |

||||||||

| USD: AUD Exchange Rate |

||||||||

| Average exchange rate for the period |

||||||||

| USD: AUD Exchange Rate |

||||||||

| Level 1: | Observable inputs such as quoted prices (unadjusted) in active markets for identical assets or liabilities. | |

| Level 2: | Inputs, other than quoted prices that are observable, either directly or indirectly. These include quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or liabilities in markets that are not active. | |

| Level 3: | Unobservable inputs in which little or no market data exists, therefore developed using estimates and assumptions developed by us, which reflect those that a market participant would use. | |

Software |

||

Lab equipment |

||

Computer hardware |

||

Leasehold improvements |

Revenues from customers (US$’000) |

Year ended June 30, 2021 |

Year ended June 30, 2020 |

||||||

Licensing revenue |

$ | $ | ||||||

Royalty revenue |

||||||||

Service revenue* |

||||||||

Total |

$ | $ | ||||||

* |

On July 9, 2018, the Company entered into a License and Collaboration Agreement with Axovant. Pursuant to the Agreement, the Company granted Axovant an exclusive worldwide license to develop, manufacture, and commercialize products containing the Company’s product known as BB-301, which was designed for the potential treatment of Oculopharyngeal Muscular Dystrophy. Licensing revenue consists of payments for the Company’s intellectual property related to BB-301 and the transfer of the right to use the intellectual property of the Company’s BB-301 license to Axovant. Service revenue consists of payments for services provided to Axovant during the term of the license agreement signed in July 2018. On June 6, 2019, the termination of the License and Collaboration Agreement with Axovant was announced. The termination of the Agreement was effective as of September 3, 2019. The termination discharges all future performance obligations under the contract at the termination date. |

Other revenues (US$’000) |

Year ended June 30, 2021 |

Year ended June 30, 2020 |

||||||

Government research and development grants |

$ | $ | ||||||

Total |

$ | $ | ||||||

Disaggregated revenue (US$’000) |

Year ended June 30, 2021 |

|||||||||||||||

Licensing |

Royalties |

Development activities |

Total |

|||||||||||||

Services transferred over time |

$ | $ | $ | $ | ||||||||||||

Total |

$ | $ | $ | $ | ||||||||||||

Disaggregated revenue (US$’000) |

Year ended June 30, 2020 |

|||||||||||||||

Licensing |

Royalties |

Development activities |

Total |

|||||||||||||

Services transferred at a point in time |

$ | $ | $ | $ | ||||||||||||

Services transferred over time |

||||||||||||||||

Total |

$ | $ | $ | $ | ||||||||||||

(US$’000) |

June 30, 2021 |

June 30, 2020 |

||||||

Cash at Bank |

$ | $ | ||||||

Term Deposit |

||||||||

Total |

$ | $ | ||||||

| (US$’000) | June 30, 2021 |

June 30, 2020 |

||||||

Prepaid expenses |

$ | $ | ||||||

Security deposit |

||||||||

Other deposit |

— | |||||||

Market value of listed shares |

||||||||

Total other assets |

||||||||

Less: non-current portion |

( |

) | — | |||||

Current portion |

$ | $ | ||||||

(US$’000) |

June 30, 2021 |

June 30, 2020 |

||||||

Software |

$ | $ | ||||||

Lab equipment |

||||||||

Computer hardware |

||||||||

Leasehold improvements |

||||||||

Total property and equipment, gross |

||||||||

Accumulated depreciation and amortization |

( |

) | ( |

) | ||||

Total property and equipment, net |

$ | $ | ||||||

(US$’000) |

June 30, 2021 |

June 30, 2020 |

||||||

Trade payable |

$ | $ | ||||||

Accrued license fees |

||||||||

Accrued professional fees |

||||||||

Accrued CRO fees |

||||||||

Other payables |

||||||||

Total |

$ | $ | ||||||

| • | The Company need not reassess whether any expired or existing contracts are or contain leases. |

| • | The Company need not reassess the lease classification for any expired or existing leases (that is, all existing leases that were classified as operating leases in accordance with the previous guidance will be classified as operating leases, and all existing leases that were classified as capital leases in accordance with the previous guidance will be classified as finance leases). |

| • | The Company need not reassess initial direct costs for any existing leases. |

| • | The Company elected the hindsight practical expedient in determining the lease term (that is, when considering lessee options to extend or terminate the lease and to purchase the underlying asset) and in assessing impairment of the Company’s right-of-use |

(US$’000) |

Operating lease right-of- use assets |

|||

| Initial measurement at July 1, 2019 |

$ | |||

| Amortization of right of use asset |

( |

) | ||

| |

|

|||

| Balance at June 30, 2020 |

||||

| Amortization of right of use asset |

( |

) | ||

| |

|

|||

| Operating lease right-of-use |

$ | |||

(US$’000) |

Operating lease liabilities |

|||

| Initial measurement at July 1, 2019 |

$ | |||

| Principal payments on operating lease liabilities |

( |

) | ||

| |

|

|||

| Operating lease liabilities at June 30, 2020 |

||||

| Principal payments on operating lease liabilities |

( |

) | ||

| |

|

|||

| Operating lease liabilities at June 30, 2021 |

||||

| Less: non-current portion |

||||

| |

|

|||

| Current portion at June 30, 2021 |

$ | |||

| |

|

|||

(US$’000) |

June 30, 2021 |

|||

| 2022 |

||||

| |

|

|||

| Less imputed interest |

( |

) | ||

| |

|

|||

| Present value of operating lease liabilities |

$ | |||

| |

|

|||

Common Stock from Warrants |

Weighted- average Exercise Price (per share) |

|||||||

| Outstanding at July 1, 2019 |

$ | |||||||

| Granted |

||||||||

| Exercised |

( |

) | ||||||

| Cashless exercise |

( |

) | ||||||

| Forfeited |

— | — | ||||||

| |

|

|||||||

| Outstanding and exercisable at June 30, 2020 |

||||||||

| |

|

|||||||

| Granted |

||||||||

| Exercised |

( |

) | ||||||

| Forfeited |

( |

) | ||||||

| |

|

|||||||

| Outstanding and exercisable at June 30, 2021 |

$ | |||||||

| |

|

|||||||

Stock Options |

Weighted- average Exercise Price |

Weighted- average Remaining Contractual Term |

Aggregate Intrinsic Value |

|||||||||||||

| Outstanding at July 1, 2019 |

$ | — | ||||||||||||||

| Forfeited |

( |

) | ||||||||||||||

| |

|

|||||||||||||||

| Outstanding at June 30, 2020 |

— | |||||||||||||||

| Exercisable at June 30, 2020 |

— | |||||||||||||||

| Granted |

||||||||||||||||

| Forfeited |

( |

) | ||||||||||||||

| |

|

|||||||||||||||

| Outstanding at June 30, 2021 |

— | |||||||||||||||

| |

|

|||||||||||||||

| Exercisable at June 30, 2021 |

$ | $ | — | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

Fiscal Year Ended June 30, |

||||||||

2021 |

2020 |

|||||||

| Expected volatility |

% | % | ||||||

| Expected term |

||||||||

| Risk-free interest rate |

% | % | ||||||

| Expected dividend yield |

— | % | — | % | ||||

| |

|

|

|

|||||

(US$’000) |

June 30, |

|||||||

2021 |

2020 |

|||||||

| Research and development |

$ | $ | ||||||

| General and administrative |

||||||||

| |

|

|

|

|||||

| Total share-based compensation expense |

$ | $ | ||||||

| |

|

|

|

|||||

(US$’000) |

Year Ended June 30, |

|||||||

2021 |

2020 |

|||||||

| United States |

$ |

( |

) |

$ |

( |

) | ||

| International |

( |

) |

( |

) | ||||

| |

|

|

|

|||||

| Total |

$ |

( |

) |

$ |

( |

) | ||

| |

|

|

| |||||

(US$’000) |

Year Ended June 30, |

|||||||

2021 |

2020 |

|||||||

| Deferred tax assets: |

||||||||

| Net operating losses |

$ | $ | ||||||

| Other |

||||||||

| Lease liability |

||||||||

| Share-based compensation |

||||||||

| Intangible assets |

||||||||

| |

|

|

|

|||||

| Gross deferred tax assets |

||||||||

| Less valuation allowance |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Deferred tax liabilities: |

||||||||

| Right-of-use |

( |

) | ( |

) | ||||

| Fixed assets |

( |

) | ( |

) | ||||

| Prepaid expenses |

( |

) | ||||||

| |

|

|

|

|||||

| Total deferred tax liabilities |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Net deferred taxes |

$ | $ | ||||||

| |

|

|

|

|||||

(US$’000) |

Amount |

Expiration Years |

||||||

| Net operating losses, federal (post-December 31, 2017) |

$ | |||||||

| Net operating losses, federal (post-December 31, 2017) |

— | — | ||||||

| Net operating losses, state |

||||||||

| Net operating losses, Australia |

||||||||

Year Ended June 30, |

||||||||

2021 |

2020 |

|||||||

| Statutory rate |

% | % | ||||||

| Permanent differences |

( |

%) | ( |

%) | ||||

| Share-based payments |

( |

%) | ( |

%) | ||||

| Change in valuation allowance |

( |

%) | ( |

%) | ||||

| Foreign tax rate differential |

% | % | ||||||

| |

|

|

|

|||||

| Total |

( |

%) | ( |

%) | ||||

| |

|

|

|

|||||

(US$’000) |

Year Ended June 30, |

|||||||

2021 |

2020 |

|||||||

| Net loss attributable to common stockholders |

($ | ) | ($ | ) | ||||

| Weighted average number of shares used in calculating basic and diluted earnings per share |

||||||||

| |

|

|

|

|||||

| Basic and diluted loss per share |

($ | ) | ($ | ) | ||||

| |

|

|

|

|||||

Name |

Age |

Position | ||

| Jerel Banks | 46 | Chief Executive Officer, Director | ||

| Megan Boston | 49 | Executive Director, Director | ||

| J. Kevin Buchi(1)(2)(3) | 66 | Director | ||

| Peter Francis(1)(2)(3) | 65 | Director | ||

| Edward Smith (1)(2)(3) | 50 | Director |

| (1) | Member of the audit committee. |

| (2) | Member of the compensation committee. |

| (3) | Member of the nominating and corporate governance committee. |

| • | Mr. Smith is a Class I director, and his current term will expire at the annual meeting of stockholders to be held in 2023; |

| • | Messrs. Buchi and Francis are Class II directors, and their initial terms will expire at the annual meeting of stockholders to be held in 2021; and |

| • | Mr. Banks and Ms. Boston are Class III directors, and their terms will expire at the annual meeting of stockholders to be held in 2022. |

| • | comply with all laws that govern us and our operations; |

| • | act honestly and with integrity and fairness in all dealings with others and each other; |

| • | avoid or manage conflicts of interest; |

| • | use our assets responsibly and in the best interests of the company; and |

| • | be responsible and accountable for our actions. |

Named Executive Officer and Principal Position |

Fiscal Year |

Salary ($)(1) |

Bonus ($)(2) |

Option Awards ($)(3) |

All Other Compensation ($) |

Total ($)(7) |

||||||||||||||||||

| Dr. Jerel A. Banks, M.D. Ph.D. |

2021 | 439,583 | — | 705,375 | 33,105 | (5) | 1,178,063 | |||||||||||||||||

| Executive Chairman and Chief Executive Officer |

2020 | 400,000 | 200,000 | — | 31,704 | (5) | 631,704 | |||||||||||||||||

| Megan Boston |

2021 | 269,837 | — | 352,686 | 17,928 | (6) | 640,451 | |||||||||||||||||

| Executive Director |

2020 | 221,430 | 110,715 | (4) | — | 16,775 | (6) | 348,920 | ||||||||||||||||

| (1) | Ms. Boston’s salary was paid in Australian dollars and has been converted to U.S. dollars using a conversion rate of A$1.00 to $0.747, and A$1.00 to $0.671, for the fiscal years ended June 30, 2021 and June 30, 2020, respectively. From July 1, 2020 through September 15, 2020, Dr. Banks’s and Ms. Boston’s salary was $400,000 and $246,510 respectively. As of September 16, 2020 through the remainder of the fiscal year ended June 30, 2021, Dr. Banks’s and Ms. Boston’s salary was, $450,000 and $284,831, respectively. |

| (2) | In respect of the fiscal year ended June 30, 2020, the Compensation Committee paid discretionary annual bonuses to Dr. Banks and Ms. Boston. The amount of such bonuses was paid in the fiscal year ended June 30, 2021. The amount of cash bonuses earned in respect of the fiscal year ended June 30, 2021 is not calculable through the latest practicable date. The Compensation Committee expects to determine such bonuses in November 2021, and the amounts of these bonuses will be disclosed in a filing by the Company in a Current Report on Form 8-K under Item 5.02(f) once the amounts are determined. |

| (3) | Amount represents the aggregate grant date fair value of stock and option awards granted by the Company in the fiscal year ended June 30, 2021, computed in accordance with FASB ASC Topic 718. For further information on how we account for stock-based compensation, see Note 10 to the Company’s consolidated financial statements for the year ended June 30, 2021 included in this Annual Report. These amounts reflect the Company’s accounting expense for these awards and do not correspond to the actual amounts, if any, that will be recognized by the NEOs. |

| (4) | Ms. Boston’s performance-based cash bonus was paid in Australian dollars and has been converted to U.S. dollars using a conversion rate of A$1.00 to $0.671. |

| (5) | Amounts reflect company-paid health and life insurance premiums. |

| (6) | Amounts reflect the Company’s compulsory contributions to Ms. Boston’s superannuation account. The superannuation contributions were paid in Australian dollars and were converted to U.S. dollars using a conversion rate of A$1.00 to $0.747, and A$1.00 to $0.671, for the fiscal years ended June 30, 2021 and June 30, 2020, respectively. |

| (7) | The amounts reported in this table include compensation paid by Benitec Limited prior to the completion of the Re-domiciliation. |

Option Awards |

||||||||||||||||||||

Named Executive Officer |

Grant Date |

Number of Securities Underlying Unexercised Options (#)—Exercisable |

Number of Securities Underlying Unexercised Options (#)—Unexercisable |

Option Exercise Price ($) |

Option Expiration Date |

|||||||||||||||

| Dr. Jerel A. Banks, M.D. Ph.D. |

12/9/2020 | (1)(2) | — | 284,345 | 2.98 | 12/9/2030 | ||||||||||||||

| Executive Chairman and Chief Executive Officer |

6/26/2018 | (2)(3) | 33,333 | — | 50.73 | 6/26/2023 | ||||||||||||||

| Megan Boston |

12/9/2020 | (1)(2) | — | 142,172 | 2.98 | 12/9/2030 | ||||||||||||||

| Executive Director |

3/12/2019 | (2)(3) | 11,111 | 5,555 | 42.33 | 3/12/2024 | ||||||||||||||

| (1) | The option awards were granted under the 2020 Plan. |

| (2) | The shares subject to each of the option awards vest in substantially equal installments on each of the first, second and third anniversaries of the grant date, generally subject to continued employment through the applicable vesting date. |

| (3) | The option awards were granted under the Benitec Officers’ and Employees’ Share Option Plan prior to the Re-domiciliation. The share amounts and exercise prices of the awards shown in this table have been adjusted to reflect the terms of the Re-domiciliation. |

Name |

Fees Earned or Paid in Cash ($)(2) |

Option Awards ($)(3) |

All Other Compensation ($)(4) |

Total ($) |

||||||||||||

| J. Kevin Buchi |

62,939 | 58,547 | — | 121,486 | ||||||||||||

| Peter Francis |

59,173 | 58,547 | 5,231 | 122,951 | ||||||||||||

| Edward F. Smith |

53,057 | 58,547 | — | 111,604 | ||||||||||||

| (1) | For information regarding the compensation of Dr. Banks and Ms. Boston, see “Summary Compensation Table.” |

| (2) | Fees paid to Mr. Buchi (until February 2021) and Francis were paid in Australian dollars and has been converted to U.S. dollars using a conversion rate of A$1.00 to $0.747 for the fiscal year ended June 30, 2021. Fees paid between February 2021 and June 2021 were paid in USD. |

| (3) | Amount represents the aggregate grant date fair value of stock and option awards granted by the Company in the fiscal year ended June 30, 2021, computed in accordance with FASB ASC Topic 718. For further information on how we account for stock-based compensation, see Note 10 to the Company’s consolidated financial statements for the year ended June 30, 2021 included in this Annual Report. These amounts reflect the Company’s accounting expense for these awards and do not correspond to the actual amounts, if any, that will be recognized by the directors. |

| (4) | For information regarding other compensation of all directors, see “Narrative Disclosure to Director Compensation Table” |

Name |

Option Awards (#) |

|||

| J. Kevin Buchi |

23,601 | |||

| Peter Francis |

23,601 | |||

| Edward F. Smith |

23,601 | |||

| • | an annual cash retainer of $40,000; |

| • | an additional annual cash retainer of $15,000 to the chair of the Audit Committee; |

| • | an additional annual cash retainer of $10,000 to the chair of the Compensation Committee; |

| • | an additional annual cash retainer of $7,500 to the chair of the Nominating Committee; |

| • | an additional annual cash retainer of $7,500 to a non-chair member of the Audit Committee; |

| • | an additional annual cash retainer of $5,000 to a non-chair member of the Compensation Committee; and |

| • | an additional annual cash retainer of $4,000 to a non-chair member of the Nominating Committee. |

Name of Beneficial Owner |

Number of Shares Beneficially Owned |

Percentage of Shares Beneficially Owned |

||||||

| 5% or Greater Stockholders: |

||||||||

| Entities affiliated with Suvretta Capital Management, LLC(1) |

769,000 | 9.4 | % | |||||

| Entities affiliated with Lincoln Park Capital, LLC(2) |

423,529 | 5.1 | % | |||||

| Directors and Named Executive Officers: |

||||||||

| Jerel A. Banks(3) |

33,333 | * | ||||||

| Megan Boston(4) |

11,444 | * | ||||||

| Kevin Buchi(5) |

4,827 | * | ||||||

| Peter Francis(6) |

5,037 | * | ||||||

| Edward Smith |

— | * | ||||||

| All Executive Officers and Directors As a Group |

54,641 | |||||||

| * | Represents beneficial ownership of less than one percent of the Company’s outstanding common stock. |

| (1) | Based on the information included in the Schedule 13G filed by Suvretta Capital Management, LLC (“Suvretta”) on May 7, 2021, Averill Master Fund, Ltd. (“Averill”) and Aaron Cowen. The address of the principal business office of Suvretta and Mr. Cowen is c/o Suvretta Capital Management, LLC, 540 Madison Avenue, 7 th Floor, New York, New York 10022. The address of the principal business office of Averill is c/o Maples Corporate Services Limited, P.O. Box 309, Ugland House, Grand Cayman KY1-1104, Cayman Islands. |

| (2) | Based on information included in the Schedule 13G filed by Lincoln Park Capital, LLC and its affiliates on April 28, 2021. Represents 423,529 shares held directly by Lincoln Park Capital Fund, LLC (“LPC Fund”). Alex Noah and Joshua B. Scheinfeld have shared voting and shared investment power over the shares held by LPC Fund. The address of the principal business office of Lincoln Park Capital, LLC and its affiliates is 440 North Wells, Suite 410, Chicago, Illinois 60654. |

| (3) | Represents stock options to acquire 33,333 that have vested or will vest within 60 days of September 7, 2021. |