Table of Contents

As filed with the Securities and Exchange Commission on October 1, 2020

Registration No. 333-246314

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Benitec Biopharma Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 84-462-0206 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

3940 Trust Way Hayward, California 94545 (510) 780-0819

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Dr. Jerel Banks

Chief Executive Officer

3940 Trust Way

Hayward, California 94545

(510) 780-0819

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Ben D. Orlanski, Esq. Matthew S. O’Loughlin, Esq. Proskauer Rose LLP 2029 Century Park East, Suite 2400 Los Angeles, CA 90067-3010 (310) 557-2900 (310) 557-2193–Facsimile |

Steven M. Skolnick, Esq. Lowenstein Sandler LLP 1251 Avenue of the Americas New York, NY 10020 (212) 262-6700 (212) 262-7402-Facsimile |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee | ||

| Common stock, $0.0001 par value per share(2)(3) |

$11,500,000 | $1,493 | ||

| Pre-funded warrants to purchase shares of common stock and common stock issuable upon exercise thereof(3) |

$10,000,000 | $1,298 | ||

| Total(4) |

$21,500,000 | $2,791 | ||

|

| ||||

|

| ||||

| 1) | Estimated solely for purposes of determining the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. Pursuant to Rule 416(a) under the Securities Act of 1933, as amended, this registration statement shall also cover an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions. |

| 2) | Includes the additional shares of common stock that the underwriter has the option to purchase to cover over-allotments, if any. |

| 3) | The proposed maximum aggregate offering price of the common stock proposed to be sold in the offering will be reduced on a dollar-for-dollar basis based on the aggregate offering price of the pre-funded warrants offered and sold in the offering (plus the aggregate exercise price of the common stock issuable upon exercise of the pre-funded warrants), and as such the proposed aggregate maximum offering price of the common stock and pre-funded warrants (including the common stock issuable upon exercise of the pre-funded warrants), if any, is $11,500,000 (including the underwriter’s option to purchase additional shares of common stock). |

| 4) | The Registrant previously paid a fee of $2,596 in connection with the initial filing of the registration statement on August 14, 2020. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 1, 2020

Preliminary Prospectus

1,666,666 Shares of Common Stock,

Pre-funded Warrants to Purchase 1,666,666 Shares of Common Stock

1,666,666 Shares of Common Stock underlying the Pre-funded Warrants

We are offering 1,666,666 shares of our common stock.

We are also offering to certain purchasers whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if such purchasers so choose, pre-funded warrants in lieu of shares of common stock that would otherwise result in any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. Each pre-funded warrant will be exercisable for one share of our common stock and will be exercisable at any time after its original issuance until exercised in full. The purchase price of each pre-funded warrant will be equal to the price at which a share of common stock are sold to the public in this offering, minus $0.01, and the exercise price of each pre-funded warrant will be $0.01 per share. This offering also relates to the shares of common stock issuable upon exercise of any pre-funded warrants sold in this offering. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis.

Our common stock is listed on The Nasdaq Capital Market under the symbol “BNTC.” On September 29, 2020, the last reported sale price of our common stock on The Nasdaq Capital Market was $6.00. There is no established public trading market for the pre-funded warrants, and we do not expect a market to develop. We do not intend to apply for listing of the pre-funded warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the pre-funded warrants will be limited.

The public offering price per share will be determined between us, the underwriter and purchasers based on market conditions at the time of pricing, and may be at a discount to the current market price of our common stock. Therefore, the recent market price used throughout this prospectus may not be indicative of the actual public offering price.

We are an “emerging growth company,” as that term is used in the Jumpstart Our Business Startups Act of 2012, and, as such, we have elected to comply with certain reduced public company reporting requirements.

You should read this prospectus, together with additional information described under the heading “Where You Can Find More Information,” carefully before you invest in any of our securities.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 19.

| Per Share of Common Stock |

Per Pre-Funded Warrant |

Total | ||||||||||

| Public offering price |

$ | $ | $ | |||||||||

| Underwriting discounts and commissions(1) |

$ | $ | $ | |||||||||

| Proceeds to us (before expenses) |

$ | $ | $ | |||||||||

| (1) | We have agreed to reimburse certain expenses of the underwriter, including a management fee equal to 1% of the gross proceeds of this offering, which are not included in the table above. See “Underwriting” for a description of the compensation payable to the underwriter. |

We have granted the underwriter a 30-day option to purchase an aggregate of up to 249,999 additional shares of our common stock from us at the public offering price per share, less the underwriting discounts and commissions. The underwriter may exercise its option to acquire additional shares for the sole purpose of covering over-allotments. See “Underwriting.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Delivery of the securities offered hereby is expected to be made on or about , 2020.

Sole Book-Running Manager

H.C. Wainwright & Co.

The date of this prospectus is , 2020

Table of Contents

| Page | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 5 | ||||

| 15 | ||||

| 17 | ||||

| 19 | ||||

| 21 | ||||

| 22 | ||||

| Market Price of Our Common Stock and Related Stockholder Matters |

23 | |||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 30 | ||||

| 38 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

i

Table of Contents

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (“SEC”). You should rely only on the information contained in this prospectus or contained in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We have not, and the underwriter has not, authorized anyone to provide you with information that is different from that contained in such prospectuses. We and the underwriter are offering to sell shares of our common stock and pre-funded warrants which may be exercised for shares of common stock, and seeking offers to buy shares of our common stock and our pre-funded warrants, only in jurisdictions where such offers and sales are permitted. For investors outside the United States: We have not, and the underwriter has not, taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside the United States. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock.

This prospectus and the information incorporated herein by reference contain summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find Additional Information.” We urge you to read carefully this prospectus, together with the information incorporated herein by reference before deciding whether to participate in the offering hereunder.

We further note that the representations, warranties and covenants made by us in any document that is filed as an exhibit to the registration statement of which this prospectus is a part and in any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless the context otherwise requires, the terms “Benitec,” the “Company,” “we,” “us,” “our” and similar terms used in this prospectus refer (i), prior to the Re-domiciliation (as defined herein) to Benitec Biopharma Limited (BBL), an Australian corporation, and its subsidiaries, and (ii), following the Re-domiciliation, to Benitec Biopharma Inc., a Delaware corporation, and its subsidiaries (including Benitec Limited). Any references to “Benitec Limited” or “BBL” refer to Benitec Biopharma Limited, an Australian corporation.

All references to “$” in this prospectus refer to U.S. dollars. All references to “A$” in this prospectus mean Australian dollars. As of June 30, 2020, the rate of exchange of U.S. dollars to Australian dollars was 1.4541 AUD.

Our fiscal year-end is June 30. References to a particular “fiscal year” are to our fiscal year ended June 30 of that calendar year.

1

Table of Contents

This prospectus includes information with respect to market and industry conditions and market share from third-party sources or based upon estimates using such sources when available. We believe that such information and estimates are reasonable and reliable. We also believe the information extracted from publications of third-party sources has been accurately reproduced. However, we have not independently verified any of the data from third-party sources. Similarly, our internal research is based upon our understanding of industry conditions, and such information has not been verified by any independent sources.

We have proprietary and licensed rights to trademarks used in this prospectus which are important to our business, many of which are registered under applicable intellectual property laws. These trademarks include:

| • | BENITEC BIOPHARMA® |

| • | BENITEC® |

| • | GIVING DISEASE THE SILENT TREATMENT® |

| • | SILENCING GENES FOR LIFE® |

Solely for convenience, trademarks and trade names referred to in this prospectus appear without the “®” or “™” symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Each trademark, trade name or service mark of any other company appearing in this prospectus is the property of its respective holder.

2

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. All statements, other than statements of historical fact included in this prospectus, regarding our strategy, future operations, financial position, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this prospectus, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project,” or the negative of these terms, and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. These risks, uncertainties and factors include:

| • | the success of our plans to develop and potentially commercialize our product candidates; |

| • | the timing of the initiation and completion of preclinical studies and clinical trials; |

| • | the timing and sufficiency of patient enrollment and dosing in any future clinical trials; |

| • | the timing of the availability of data from clinical trials; |

| • | the timing and outcome of regulatory filings and approvals; |

| • | unanticipated delays; |

| • | sales, marketing, manufacturing and distribution requirements; |

| • | market competition and the acceptance of our products in the marketplace; |

| • | regulatory developments in the United States; |

| • | the development of novel AAV vectors; |

| • | the plans of licensees of our technology; |

| • | the clinical utility and potential attributes and benefits of ddRNAi and our product candidates, including the potential duration of treatment effects and the potential for a “one shot” cure; |

| • | our dependence on our relationships with collaborators and other third parties; |

| • | expenses, ongoing losses, future revenue, capital needs and needs for additional financing; |

| • | our intellectual property position and the duration of our patent portfolio; |

| • | the impact of local, regional, and national and international economic conditions and events; and |

| • | the impact of the current COVID-19 pandemic, the disease caused by the SARS-CoV-2 virus, which may adversely impact our business and preclinical and future clinical trials; |

as well as other risks detailed under the caption “Risk Factors” in this prospectus and in other reports filed with the SEC. Although we believe that we have a reasonable basis for each forward-looking statement contained in this prospectus, we caution you that these statements are based on a combination of facts and important factors currently known by us and our expectations of the future, about which we cannot be certain.

We have based the forward-looking statements included in this prospectus and in the documents incorporated herein by reference on information available to us on the date of this prospectus or on the date thereof. Except as required by law we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to consult any additional disclosures that we may make directly to you or through reports that we, in the future, may file with

3

Table of Contents

the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

All forward-looking statements included herein or in documents incorporated herein by reference are expressly qualified in their entirety by the cautionary statements contained or referred to elsewhere in this prospectus.

4

Table of Contents

This summary highlights information contained in other parts of this prospectus and in the documents incorporated by reference herein and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus and the documents incorporated by reference herein, including our consolidated financial statements and the related notes, and the information set forth under the section titled “Risk Factors,” as well as those risk factors included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2020 and any subsequent Quarterly Report on Form 10-Q. Some of the statements in this prospectus and the documents incorporated by reference herein constitute forward-looking statements that involve risks and uncertainties. See the information set forth under the section “Cautionary Note Regarding Forward-Looking Statements.”

Company Overview

We endeavor to become the leader in discovery, development, and commercialization of therapeutic agents capable of addressing significant unmet medical need via the application of the silence and replace approach to the treatment of genetic disorders.

Benitec Biopharma Inc. (“Benitec” or the “Company” or in the third person, “we” or “our”) is a development-stage biotechnology company focused on the advancement of novel genetic medicines with headquarters in Hayward, California. The proprietary platform, called DNA-directed RNA interference, or ddRNAi, combines RNA interference, or RNAi, with gene therapy to create medicines that facilitate sustained silencing of disease-causing genes following a single administration. The Company is developing ddRNAi-based therapeutics for chronic and life-threatening human conditions including Oculopharyngeal Muscular Dystrophy (OPMD), and Chronic Hepatitis B.

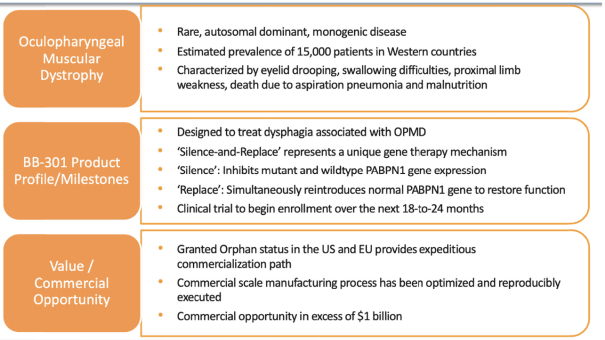

BB-301 is the most advanced ddRNAi-based genetic medicine currently under development by Benitec. BB-301 is an internally optimized, adeno-associated virus (“AAV”) -based gene therapy agent that is designed to both silence the expression of mutated, disease-causing genes (to slow, or halt, the underlying mechanism of disease progression) and replace the mutant genes with normal, “wild type” genes (to drive restoration of function in diseased cells). This fundamental approach to disease management is called “silence and replace” and this biological mechanism offers the potential to restore the underlying physiology of the treated tissues and, in the process, improve treatment outcomes for patients suffering from the chronic and, potentially, fatal effects of Oculopharyngeal Muscular Dystrophy (OPMD). BB-301 has been granted Orphan Drug Designation in the United States and the European Union.

Through the combination of the targeted gene silencing effects of RNAi and the durable transgene expression achievable via the use of modified viral vectors, the silence and replace approach has the potential to produce long-term silencing of disease-causing genes along with simultaneous replacement of wild type gene function following a single administration of the proprietary genetic medicine. We believe this novel attribute of the investigational agents under development by Benitec may facilitate the achievement of robust clinical activity while greatly reducing the dosing frequencies traditionally expected for medicines employed for the management of chronic diseases. Additionally, the establishment of chronic gene silencing and gene replacement may significantly reduce the risk of patient non-compliance during the course of medical management of potentially fatal clinical disorders.

We will require additional financing to progress our product candidates through to key inflection points.

5

Table of Contents

Our Strengths

We believe that the combination of our proprietary ddRNAi technology and our deep expertise in the design and development of genetic medicines, and specifically ddRNAi-based therapeutics, will enable us to achieve and maintain a leading position in gene silencing and gene therapy for the treatment of human disease. Our key strengths include:

| • | A first mover advantage for ddRNAi-based therapeutics; |

| • | A proprietary ddRNAi-based silence and replace technology platform that may potentially enable the serial development of single-administration therapeutics capable of facilitating sustained, long-term silencing of disease-causing genes and concomitant replacement of wildtype gene function; |

| • | A proprietary AAV vector technology which improves the endosomal escape capability of virus produced in insect cells using a baculovirus system. This technology has broad application in AAV-based gene therapies; |

| • | The capabilities to drive the development of a pipeline of programs focused on chronic diseases with either large patient populations, including Chronic Hepatitis B virus infection, or rare diseases, which may potentially support the receipt of Orphan Drug Designation, including OPMD; and |

| • | A growing portfolio of patents protecting improvements to our ddRNAi, and silence and replace, technology and product candidates through at least 2036, with additional patent life anticipated through at least 2040. |

Our Strategy

We endeavor to become the leader in discovery, development, and commercialization of therapeutic agents capable of addressing significant unmet medical need via the application of the silence and replace approach to the treatment of genetic disorders. We apply the following general strategy to drive the Company towards these goals:

| • | Selectively develop proprietary and partnered programs; and |

| • | Continue to explore and secure research and development partnerships with global biopharmaceutical companies supported by the differentiated nature of our scientific platform and intellectual property portfolio. |

Our senior leadership team will continue to explore partnership opportunities with global biopharmaceutical companies, as we expect that the unique attributes of the proprietary ddRNAi and silence and replace approaches, and the breadth of potential clinical indications amenable to our proprietary methods, to support the formation of collaborations over a broad range of diseases with significant unmet medical need.

We seek to actively protect our intellectual property and proprietary technology. These efforts are central to the growth of our business and include:

| • | Seeking and maintaining patents claiming our ddRNAi and silence and replace technologies and other inventions relating to our specific products in development or that are otherwise commercially and/or strategically important to the development of our business; |

| • | Protecting and enforcing our intellectual property rights; and |

| • | Strategically licensing intellectual property from third parties to advance development of our product candidates. |

6

Table of Contents

Our Technology—ddRNAi and Silence and Replace

Our proprietary technology platforms are designated as DNA-directed RNA interference, or ddRNAi, and “silence and replace.” ddRNAi is designed to produce long-term silencing of disease-causing genes, by combining RNA interference, or RNAi, with viral delivery agents typically associated with the field of gene therapy (i.e. viral vectors). Modified AAV vectors are employed to deliver genetic constructs which encode short hairpin RNAs that are, then, serially expressed and processed, to produce small interfering RNA, or siRNA, molecules within the transduced cell for the duration of the life of the target cell. These newly introduced siRNA molecules drive long-term, and potentially permanent, silencing of the expression of the disease-causing gene. The silence and replace approach further bolsters the biological benefits of long-term silencing of disease-causing genes by incorporating multifunctional genetic constructs within the modified AAV vectors to create an AAV-based gene therapy agent that is designed to both silence the expression of mutated, disease-causing genes (to slow, or halt, the underlying mechanism of disease progression) and, simultaneously, replace the mutant genes with normal, “wild type” genes (to drive restoration of function in diseased cells). This fundamentally distinct approach to disease management offers the potential to restore the underlying physiology of the treated tissues and, in the process, improve treatment outcomes for patients suffering from the chronic and, potentially, fatal effects of diseases like Oculopharyngeal Muscular Dystrophy (OPMD).

Traditional gene therapy is defined by the introduction of an engineered transgene to correct the pathophysiological derangements derived from mutated or malfunctioning genes. Mutated genes can facilitate the intracellular production of disease-causing proteins or hamper the production of critical, life-sustaining, proteins, and the introduction of a new transgene can facilitate the restoration of production of normal proteins within the diseased cell, thus, restoring natural biological function. Critically, the implementation of this traditional method of gene therapy cannot eliminate the expression, or the potential deleterious effects of, the underlying mutant gene (as mutant proteins may be continually expressed and aggregate or drive the aggregation of other native proteins within the diseased cell). In this regard, the dual capabilities of the proprietary silence and replace approach to silence a disease-causing gene via ddRNAi and simultaneously replace the wildtype activity of a mutant gene via the delivery of an engineered transgene could facilitate the development of differentially efficacious treatments for a range of genetic disorders.

Overview of RNAi and the siRNA Approach

The mutation of a single gene can cause a chronic disease via the resulting intracellular production of a disease-causing protein (i.e. an abnormal form of the protein of interest), and many chronic and/or fatal disorders are known to result from the inappropriate expression of a single gene or multiple genes. In some cases, genetic disorders of this type can be treated exclusively by “silencing” the intracellular production of the disease-causing protein through well-validated biological approaches like RNA interference (“RNAi”). RNAi employs small nucleic acid molecules to activate an intracellular enzyme complex, and this biological pathway temporarily reduces the production of the disease-causing protein. In the absence of the disease-causing protein, normal cellular function is restored and the chronic disease that initially resulted from the presence of the mutant protein is partially or completely resolved. RNAi is potentially applicable to over 20,000 human genes and a large number of disease-causing microorganism-specific genes.

7

Table of Contents

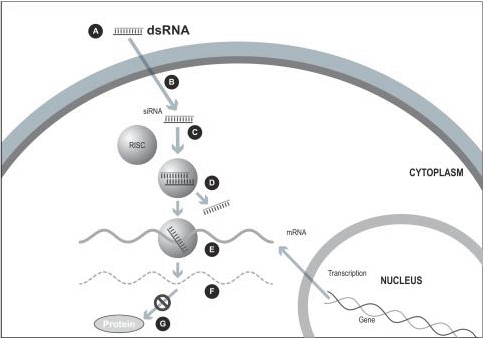

Figure 1. The siRNA Approach

A small double stranded RNA, or dsRNA, molecule (A, Figure 1), comprising one strand known as the sense strand and another strand known as the antisense strand, which are complementary to each other, is synthesized in the laboratory. These small dsRNAs are called small interfering RNAs, or siRNAs. The sequence of the sense strand corresponds to a short region of the target gene mRNA. The siRNA is delivered to the target cell (B, Figure 1), where a group of enzymes, referred to as the RNA-Induced Silencing Complex, or RISC, process the siRNA (C, Figure 1), where one of the strands (usually the sense strand) is released (D, Figure 1). RISC uses the antisense strand to find the mRNA that has a complementary sequence (E, Figure 1) leading to the cleavage of the target mRNA (F, Figure 1). As a consequence, the output of the mRNA (protein production) does not occur (G, Figure 1). Several companies, including Alnylam Pharmaceuticals Inc. (“Alnylam”), Arbutus Biopharma Corp. (“Arbutus”), and Dicerna Pharmaceuticals Inc. (“Dicerna”), utilize this approach in their RNAi product candidates.

Importantly, many genetic disorders are not amenable to the traditional gene silencing approach outlined in Figure 1, as the diseased cells may produce a mixture of the wildtype protein of interest and the disease-causing, mutant variant of the protein, and the underlying genetic mutation may be too small to allow for selective targeting of the disease-causing variant of the protein through the use of siRNA-based approaches exclusively. In these cases, it is extraordinarily difficult to selectively silence the disease-causing protein without simultaneously silencing the wildtype intracellular protein of interest whose presence is vital to the conduct of normal cellular functions.

Our proprietary silence and replace technology utilizes the unique specificity and robust gene silencing capabilities of RNAi while overcoming many of the key limitations of siRNA-based approaches to disease management.

8

Table of Contents

Our Approach to the Treatment of Genetic Diseases—ddRNAi and Silence and Replace

Our proprietary silence and replace approach to the treatment of genetic diseases combines RNAi with wildtype gene replacement to drive sustained silencing of disease-causing genes and concomitant restoration of functional wildtype genes following a single administration of the therapeutic agent. Benitec employs ddRNAi in combination with classical gene therapy (i.e. transgene delivery via viral vectors) to overcome several of the fundamental limitations of RNAi.

The silence and replace approach to the treatment of genetic disorders employs adeno-associated viral vectors (“AAVs”) to deliver genetic constructs which may, after a single administration to the target tissues:

| • | Chronically express RNAi molecules inside of the target, diseased, cells (to serially silence the intracellular production of mutant, disease-causing, protein and the wildtype protein of interest); |

| • | Simultaneously drive the expression of a wildtype variant of the protein of interest (to restore native intracellular biological processes); and |

| • | AAV vectors can accommodate the multi-functional DNA expression cassettes containing the engineered wildtype transgenes and the novel genes encoding short hairpinRNA/microRNA molecules (shRNA/miRNA) that are required to support the development of therapeutic agents capable of the achievement of the goals of the silence and replace approach to therapy. |

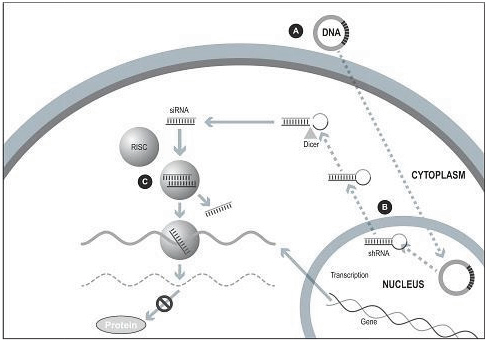

Our silence and replace technology utilizes proprietary DNA expression cassettes to foster continuous production of gene silencing shRNAs and wildtype proteins (via expression of the wildtype transgene). A range of viral and non-viral gene therapy vectors can be used to deliver the DNA construct into the nucleus of the target cell and, upon delivery, shRNA molecules are expressed and subsequently processed by intracellular enzymes into siRNA molecules that silence the expression of the mutant, disease causing protein (Figure 2).

In the silence and replace approach (Figure 2):

| • | A DNA construct is delivered to the nucleus of the target cell by a gene therapy vector (A) such as an AAV; |

| • | Once inside of the nucleus, the DNA construct drives the continuous production of shRNA molecules (B) which are processed by an enzyme called Dicer into siRNAs (C); |

| • | The processed siRNA is incorporated into RISC and silences the target gene using the same mechanism shown in Figure 1; and |

| • | When the DNA expression cassette is additionally comprised of a wildtype transgene, upon entry of the DNA construct into the nucleus of the target cell via the use of the AAV vector, the DNA construct also drives the continuous production of wildtype protein (to restore native intracellular biological processes). |

9

Table of Contents

Figure 2. The Silence and Replace Approach

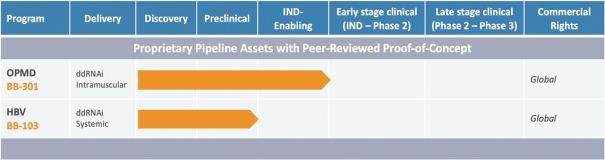

Our Pipeline

The following table sets forth our current product candidates and their development status:

Table 1. Pipeline: Oculopharyngeal Muscular Dystrophy and Chronic Hepatitis B Virus Infection

BB-301

BB-301 is a late-stage nonclinical investigational agent currently in development for the treatment of Oculopharyngeal Muscular Dystrophy. BB-301 is the lead pipeline program for Benitec, and IND-enabling studies are currently being conducted. A summary of the BB-301 program is provided in Figure 3.

10

Table of Contents

Figure 3. Overview of the BB-301 Program

BB-103

BB-103 has demonstrated robust nonclinical activity during the evaluation of this agent for the treatment of Chronic Hepatitis B Virus infection. Benitec is currently seeking strategic partners to advance BB-103 through IND-enabling studies.

Risk Factors

An investment in our securities involves a high degree of risk. Any of the factors set forth herein under “Risk Factors” and the risk factors included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2020 and any subsequent Quarterly Report on Form 10-Q may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and in the documents incorporated by reference herein and, in particular, should evaluate the specific factors set forth herein under “Risk Factors” and the risk factors included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2020 and any subsequent Quarterly Report on Form 10-Q in deciding whether to invest in our securities. These risk factors include, among others:

| • | We have incurred significant losses since inception and anticipate that we will continue to incur losses for the foreseeable future. If we are unable to achieve or sustain profitability, the market value of our common stock will likely decline; |

| • | We have never generated any revenue from product sales and may never be profitable; |

| • | Even if this offering is successful, we will need to continue our efforts to raise additional funding, which may not be available on acceptable terms, or at all. Failure to obtain capital when needed may negatively impact our ability to continue as a going concern; |

| • | Our product candidates are based on ddRNAi and silence and replace technology. Currently, no product candidates utilizing ddRNAi technology or silence and replace technology have been approved |

11

Table of Contents

| for commercial sale, and our approach to the development of ddRNAi technology and silence and replace technology may not result in safe, effective or marketable products; |

| • | We are early in our product development efforts and our current product candidates are still in preclinical development. We may not be able to obtain regulatory approvals for the commercialization of our product candidates; |

| • | Issues that may impact delivery of our therapeutics into the cell could adversely affect or limit our ability to develop and commercialize product candidates; |

| • | We face competition from entities that have developed or may develop product candidates for our target disease indications, including companies developing novel treatments and technology platforms based on modalities and technology similar to ours; and |

| • | If we are unable to obtain or protect sufficient intellectual property rights related to our product candidates, we may not be able to obtain exclusivity for our product candidates or prevent others from developing similar competitive products. |

Recent Developments

Re-domiciliation

On April 15, 2020, or the Implementation Date, the re-domiciliation, or the Re-domiciliation, of Benitec Biopharma Limited, a public company incorporated under the laws of the State of Western Australia, or Benitec Limited, was completed in accordance with the Scheme Implementation Agreement, as amended and restated as of January 30, 2020, between Benitec Limited and us. As a result of the Re-domiciliation, our jurisdiction of incorporation was changed from Australia to Delaware, and Benitec Limited became our wholly owned subsidiary.

The Re-domiciliation was effected pursuant to a statutory scheme of arrangement under Australian law, or the Scheme, whereby on the Implementation Date, all of the issued and outstanding ordinary shares of Benitec Limited were exchanged for newly issued shares of our common stock, on the basis of one share of our common stock, par value $0.0001 per share, for every 300 ordinary shares of Benitec Limited issued and outstanding. Holders of Benitec Limited’s American Depository Shares, or ADSs (each of which represented 200 ordinary shares), received two shares of our common stock for every three ADSs held.

Our common stock began trading on The Nasdaq Capital Market, or Nasdaq, at the start of trading on the Implementation Date under the symbol “BNTC.”

COVID-19

In December 2019, an outbreak of a novel strain of coronavirus was identified in Wuhan, China. This virus continues to spread globally, has been declared a pandemic by the World Health Organization and has spread to nearly every country, including Australia and the United States. The impact of this pandemic has been and will likely continue to be extensive in many aspects of society, which has resulted in and will likely continue to result in significant disruptions to businesses and capital markets around the world. The extent to which the coronavirus impacts us will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the coronavirus and the actions to contain the coronavirus or treat its impact, among others.

Certain of our research and development efforts are conducted globally, including the ongoing development of our silence and replace therapeutic for the treatment of Oculopharyngeal Muscular Dystrophy (OPMD), and

12

Table of Contents

will be dependent upon our ability to initiate preclinical and clinical studies despite the ongoing COVID-19 pandemic. As we continue to actively advance our preclinical programs, including our ongoing tissue transduction studies for BB-301, we are in close contact with our principal investigators and preclinical trial sites, which are primarily located in the France, and are assessing the impact of COVID-19 on our studies and the expected development timelines and costs of all of our product candidates, on an ongoing basis. In light of recent developments relating to the COVID-19 global pandemic, the focus of healthcare providers and hospitals on fighting the virus, and consistent with the FDA’s updated industry guidance for conducting clinical trials issued on March 18, 2020, we have experienced delays to the original timeline regarding the initiation and anticipated completion of the ongoing BB-301 IND-enabling development work. The initiation of the BB-301 tissue transduction study, which represents a key component of the IND-enabling work, was delayed by several months, however, the study has been recently initiated and the dosing of the initial preclinical cohorts has proceeded without incident. We will continue to evaluate the impact of the COVID-19 pandemic on our business and expect to reevaluate the timing of our anticipated preclinical and clinical milestones as we learn more and the impact of COVID-19 on our industry becomes more clear.

We had also implemented work-from-home measures for the majority of our employees between March 2020 and June 2020, resulting in a reduction of laboratory work and a halt of non-essential business travel. As we transition our employees back to our premises, there is a risk that COVID-19 infections occur at our offices or laboratory facilities and significantly affect our operations. Additionally, if any of our critical vendors are impacted, our business could be affected if we become unable to timely procure essential equipment, supplies or services in adequate quantities and at acceptable prices.

Corporate Information

We were incorporated as a Delaware corporation on November 22, 2019 and completed the Re-domiciliation on April 15, 2020. Our predecessor, Benitec Limited, was incorporated under the laws of Australia in 1995. Our stock is traded on The Nasdaq Capital Market under the symbol “BNTC.” Our principal executive offices are located at 3940 Trust Way, Hayward, California 94545. Our telephone number is (510) 780-0819, and our Internet website is www.benitec.com. The information on, or that can be accessed through, our website is not part of this prospectus and is not incorporated by reference herein.

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended (JOBS Act). We will remain an emerging growth company until the earliest to occur of: the last day of the fiscal year in which we have more than $1.07 billion in annual revenue; the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates; the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities; and June 30, 2021. As a result of this status, we have taken advantage of reduced reporting requirements in this prospectus and may elect to take advantage of other reduced reporting requirements in our future filings with the SEC. In particular, in this prospectus and the documents incorporated by reference herein, we have not included all of the executive compensation related information that would be required if we were not an emerging growth company. In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards, delaying the adoption of these accounting standards until they would apply to private companies. We have irrevocably elected not to avail ourselves of this exemption and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies that are not emerging growth companies. We intend to rely on other exemptions provided by the JOBS Act, including without limitation, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act.

13

Table of Contents

We are also a “smaller reporting company” and will remain a smaller reporting company while either (i) the market value of our stock held by non-affiliates was less than $250 million as of the last business day of our most recently completed second fiscal quarter or (ii) our annual revenue was less than $100 million during our most recently completed fiscal year and the market value of our stock held by non-affiliates was less than $700 million as of the last business day of our most recently completed second fiscal quarter. If we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies, including many of the same exemptions from disclosure requirements as those that are available to emerging growth companies, such as reduced disclosure obligations regarding executive compensation in our registration statements, prospectus and our periodic reports and proxy statements. For so long as we remain a smaller reporting company, we are permitted and intend to rely on exemptions from certain disclosure and other requirements that are applicable to other public companies that are not smaller reporting companies.

14

Table of Contents

| Common stock offered by us |

1,666,666 shares (or 1,916,665 shares, if the underwriter’s option to purchase additional shares is exercised in full). |

| Pre-funded warrants offered by us |

We are also offering to certain purchasers whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if such purchasers so choose, pre-funded warrants in lieu of shares of common stock that would otherwise result in any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. The exercise price of each pre-funded warrant will equal $0.01 per share. Each pre-funded warrant will be exercisable upon issuance and will not expire prior to exercise. We are offering up to 1,666,666 shares of common stock and up to 1,666,666 pre-funded warrants, in the aggregate not exceeding more than a total of 1,666,666 shares of common stock and pre-funded warrants. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the pre-funded warrants. |

| Option to purchase additional shares |

We have granted the underwriter a 30-day option to purchase an aggregate of up to 249,999 additional shares of our common stock from us at the public offering price per share, less the underwriting discounts and commissions. The underwriter may exercise its option to acquire additional shares for the sole purpose of covering over-allotments. See “Underwriting.” |

| Common stock to be outstanding immediately following this offering |

2,775,040 shares (or 3,025,039 shares, if the underwriter’s option to purchase additional shares is exercised in full) assuming we sell only shares of common stock in this offering. |

| Use of proceeds |

We estimate that the net proceeds from this offering will be approximately $8.5 million ($9.8 million if the underwriter’s option to purchase additional shares is exercised in full), based on an assumed public offering price per share of common stock of $6.00, the last reported sale price of our common stock on the Nasdaq Capital Market on September 29, 2020, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us and assuming we sell only shares of common stock in this offering. We intend to use the net proceeds from this financing for the continued advancement of development activities for our product pipeline, general corporate purposes, and strategic growth opportunities. See “Use of Proceeds.” |

| Dividend policy |

For the foreseeable future, we currently intend to retain all available funds and any future earnings to support our operations and to finance the growth and development of our business. |

15

Table of Contents

| Risk factors |

An investment in our securities involves a high degree of risk. You should read the “Risk Factors” section of this prospectus, as well as those risk factors included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2020 and any subsequent Quarterly Report on Form 10-Q, for a discussion of factors to consider carefully before deciding to invest in our securities. |

| Nasdaq symbol |

“BNTC.” |

| No listing of pre-funded warrants |

We do not intend to apply for listing of the pre-funded warrants on any national securities exchange or trading system. |

The number of shares of common stock to be outstanding after this offering is based on 1,108,374 shares of common stock outstanding at September 28, 2020 and excludes as of such date the following:

| • | 70,161 shares of common stock issuable upon exercise of stock options outstanding as of September 28, 2020 at a weighted-average exercise price of $60.42 per share; and |

| • | 145,421 shares of common stock issuable upon the exercise of warrants exercisable for shares of common stock outstanding as of September 28, 2020 at a weighted-average exercise price of $29.48 per share. |

Unless otherwise indicated, all information in this prospectus assumes no purchaser elects to purchase pre-funded warrants and no exercise by the underwriter of its option to purchase additional shares.

16

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following summary consolidated financial data as of and for the years ended June 30, 2020 and 2019 are derived from our audited consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2020, which is incorporated by reference herein. You should read this data together with our consolidated financial statements and related notes included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2020, which is incorporated by reference herein. Our historical results are not necessarily indicative of our future results, and are not necessarily indicative of the results that may be expected for any interim periods, or any future year or period.

| Year ended June 30, | ||||||||

| (in thousands) | 2020 | 2019 | ||||||

| Statements of operations data: |

||||||||

| Revenues: |

||||||||

| Revenues from customers |

$ | 97 | $ | 11,551 | ||||

| Government research and development grants |

5 | 648 | ||||||

|

|

|

|

|

|||||

| Total revenues |

102 | 12,199 | ||||||

|

|

|

|

|

|||||

| Operating Expenses: |

||||||||

| Royalties and license fees |

(185 | ) | 435 | |||||

| Research and development |

3,001 | 4,567 | ||||||

| General and administrative |

5,567 | 4,614 | ||||||

|

|

|

|

|

|||||

| Total operating expenses |

8,383 | 9,616 | ||||||

|

|

|

|

|

|||||

| Income (Loss) from Operations |

(8,281 | ) | 2,583 | |||||

| Other Income (Loss): |

||||||||

| Foreign currency transaction loss |

(88 | ) | (75 | ) | ||||

| Interest income, net |

62 | 122 | ||||||

| Other income, net |

34 | — | ||||||

| Unrealized loss on investment |

(1 | ) | (21 | ) | ||||

|

|

|

|

|

|||||

| Total other income, net |

7 | 26 | ||||||

|

|

|

|

|

|||||

| Net Income (Loss) |

(8,274 | ) | 2,609 | |||||

| Other Comprehensive Loss: |

||||||||

| Unrealized foreign currency translation loss |

(89 | ) | (531 | ) | ||||

|

|

|

|

|

|||||

| Total Other Comprehensive Loss |

(89 | ) | (531 | ) | ||||

|

|

|

|

|

|||||

| Total Comprehensive Income (Loss) |

$ | (8,363 | ) | $ | 2,078 | |||

|

|

|

|

|

|||||

| Net Income (Loss) |

$ | (8,274 | ) | $ | 2,609 | |||

|

|

|

|

|

|||||

| Basic and Diluted Weighted-Average Number of Shares Outstanding |

1,021,193 | 856,765 | ||||||

|

|

|

|

|

|||||

| Basic and Diluted Income (Loss) Per Share of Common Stock |

$ | (8.10 | ) | $ | 3.05 | |||

|

|

|

|

|

|||||

17

Table of Contents

| June 30, | ||||||||

| 2020 | 2019 | |||||||

| Balance sheet data: |

||||||||

| Cash and cash equivalents |

$ | 9,801 | $ | 15,718 | ||||

| Working capital |

9,673 | 16,115 | ||||||

| Total assets |

11,587 | 19,235 | ||||||

| Total long-term liabilities |

213 | — | ||||||

| Total stockholders’ equity |

10,238 | 16,594 | ||||||

18

Table of Contents

Investing in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties described below, as well as those risk factors included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2020 and any subsequent Quarterly Report on Form 10-Q, together with all of the other information contained in this prospectus and incorporated by reference herein, including our consolidated financial statements and the related notes, before deciding to invest in our securities. The risks and uncertainties described below and in the documents incorporated by reference herein are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that affect us. If any of the following risks actually occurs, our business, financial condition, results of operations and prospects could be materially and adversely affected, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks Related to Our Financial Condition, Capital Requirements and Largest Shareholder

Even if this offering is successful, we will need to continue our efforts to raise additional funding, which may not be available on acceptable terms, or at all. Failure to obtain capital when needed may negatively impact our ability to continue as a going concern.

Developing ddRNAi products is expensive, and we expect our research and development expenses to increase substantially in connection with our ongoing activities, particularly as we advance our product candidates in preclinical studies and in future clinical trials and as we undertake preclinical studies of new product candidates.

As of June 30, 2020, our cash and cash equivalents were $9.8 million. We estimate that the net proceeds from this offering will be approximately $8.5 million ($9.8 million assuming the full exercise of the underwriter’s option to purchase additional common stock), assuming a public offering price of $6.00 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on September 29, 2020, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, and assuming we sell only shares of common stock in this offering. We estimate that these net proceeds, together with our existing cash and cash equivalents, will be sufficient to fund our operations until approximately the first quarter of 2022. However, our operating plan may change as a result of many factors currently unknown to us, and we may need to seek additional funds sooner than planned, through public or private equity or debt financings, government grants or other third-party funding, strategic alliances and licensing arrangements or a combination of these approaches. In addition, because the length of time and activities associated with successful development of our product candidates is highly uncertain, we are unable to estimate the actual funds we will require for development and any approved marketing and commercialization activities. In any event, we will require additional capital to obtain regulatory approval for our product candidates and to commercialize any product candidates that receive regulatory approval.

Any additional fundraising efforts may divert our management from their day-to-day activities, which may compromise our ability to develop and commercialize our product candidates. In addition, we cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. Moreover, the terms of any financing may adversely affect the holdings or the rights of our shareholders, and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our common stock to decline. If we incur indebtedness we may be required to agree to restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could compromise our ability to conduct our business. We could also seek financing through arrangements with collaborative partners at an earlier stage than would otherwise be desirable and we may be required to relinquish rights to some or all of our technologies or product candidates or otherwise agree to terms unfavorable to us.

19

Table of Contents

If we are unable to obtain funding on a timely basis or on acceptable terms, we may be required to significantly curtail, delay or discontinue one or more of our research or development programs or the commercialization of any approved product candidates.

Risk Relating to this Offering

There is no public market for the pre-funded warrants being offered by us in this offering.

There is no established public trading market for the pre-funded warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the pre-funded warrants on any national securities exchange or other nationally recognized trading system, including The Nasdaq Capital Market. Without an active market, the liquidity of the pre-funded warrants will be limited.

Holders of the pre-funded warrants offered hereby will have no rights as common stockholders with respect to the common stock underlying the pre-funded warrants until such holders exercise their pre-funded warrants and acquire our common stock, except as otherwise provided in the pre-funded warrants.

Until holders of the pre-funded warrants acquire our common stock upon exercise thereof, such holders will have no rights with respect to the common stock underlying such pre-funded warrants, except to the extent that holders of such pre-funded warrants will have certain rights to participate in distributions or dividends paid on our common stock as set forth in the pre-funded warrants. Upon exercise of the pre-funded warrants, the holders will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

Future sales of our common stock, or the perception that such sales may occur, could depress the trading price of our common stock.

After the completion of this offering, we expect to have 2,775,040 shares (3,025,039 shares if the underwriter exercises its option to purchase additional shares in full) of our common stock outstanding, which may be resold in the public market immediately after this offering. We and all of our directors and executive officers have signed lock-up agreements for a period of 90 days following the date of this prospectus, subject to specified exceptions. See “Underwriting.”

The underwriter may, in its sole discretion and without notice, release all or any portion of the shares of our common stock subject to lock-up agreements. As restrictions on resale end, the market price of our common stock could drop significantly if the holders of these shares of our common stock sell them or are perceived by the market as intending to sell them. These factors could also make it more difficult for us to raise additional funds through future offerings of our common stock or other securities.

We have broad discretion in the use of the net proceeds we receive from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds we receive in this offering, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity as part of your investment decision to assess whether our management is using the net proceeds appropriately. Because of the number and variability of factors that will determine our use of our net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. The failure by our management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business and cause the price of our common stock to decline. Pending their use, we may invest our net proceeds from this offering in short-term, investment-grade, interest-bearing securities. These investments may not yield a favorable return to our stockholders.

20

Table of Contents

We estimate that the net proceeds from this offering will be approximately $8.5 million, or $9.8 million if the underwriter exercises its option to purchase additional shares of common stock in full, assuming a public offering price of $6.00 per share, the last reported sale price per share of our common stock on September 29, 2020 as reported on Nasdaq, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us and assuming no sale of any pre-funded warrants in this offering. The public offering price per share will be determined between us, the underwriter and investors based on market conditions at the time of pricing and may be at a discount to the current market price of our common stock.

Each $1.00 increase or decrease in the assumed public offering price of $6.00 per share would increase or decrease the net proceeds from this offering by $1.5 million, assuming the number of shares and pre-funded warrants offered by us, as set forth on the cover of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares and pre-funded warrants we are offering. An increase or decrease of 100,000 in the number of shares (or the common stock underlying the pre-funded warrants) offered by us, as set forth on the cover of this prospectus, would increase or decrease the net proceeds from this offering by approximately $0.5 million, assuming the assumed public offering price per share remains the same, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We do not expect that a change by these amounts in either the public offering price per share or in the number of shares offered by us would have a material effect on our use of the proceeds from this offering, although it may accelerate the time at which we will need to seek additional capital.

We intend to use the net proceeds from this financing for the continued advancement of development activities for our product pipeline, general corporate purposes and strategic growth opportunities.

The amount and timing of these expenditures will depend on a number of factors, including the progress of our research and development efforts, the progress of any partnering efforts, technological advances and the competitive environment for our product candidates. Accordingly, you will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that the proceeds will be used in a way that does not yield a favorable, or any, return for us. Pending application of the net proceeds as described above, we intend to invest the proceeds in investment grade interest bearing instruments, or will hold the proceeds in interest bearing or non-interest bearing bank accounts.

21

Table of Contents

The following table sets forth our cash and cash equivalents and capitalization, each as of June 30, 2020:

| • | on an actual basis; and |

| • | on an as adjusted basis to give effect to the issuance of shares of common stock in the offering at an assumed public offering price of $6.00 per share, the last reported sale price per share of our common stock on September 29, 2020, as reported on Nasdaq, assuming no sale of any pre-funded warrants in this offering and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

You should consider this table in conjunction with our financial statements and the notes to those financial statements included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2020, which is incorporated by reference herein. The as adjusted information set forth in the table below is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing.

| As of June 30, 2020 | ||||||||

| (in thousands) | Actual | As Adjusted(1) | ||||||

| Cash and cash equivalents |

$ | 9,801 | $ | 18,278 | ||||

| Total debt obligations |

1,349 | 1,349 | ||||||

|

|

|

|

|

|||||

| Stockholders’ equity: |

||||||||

| Common stock, par value $0.0001 per share: |

||||||||

| 10,000,000 shares authorized; 1,108,374 actual; 2,775,040 as adjusted |

1 | 3 | ||||||

| Additional paid-in capital |

128,826 | 137,303 | ||||||

| Accumulated deficit |

(116,636 | ) | (116,636 | ) | ||||

| Accumulated other comprehensive loss |

(1,953 | ) | (1,953 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

10,238 | 18,717 | ||||||

|

|

|

|

|

|||||

| Total capitalization |

$ | 11,587 | $ | 20,066 | ||||

| (1) | The number of shares in the table above is based on 1,108,374 shares of common stock outstanding as of June 30, 2020 and does not include: |

| • | 70,161 shares of common stock issuable upon exercise of stock options outstanding as of June 30, 2020 at a weighted-average exercise price of $60.42 per share; and |

| • | 145,421 shares of common stock issuable upon the exercise of warrants exercisable for shares of common stock outstanding as of June 30, 2020 at a weighted-average exercise price of $29.48 per share. |

22

Table of Contents

MARKET PRICE OF OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

Our common stock trades on Nasdaq under the symbol “BNTC”. Prior to the Re-domiciliation, the American Depositary Shares of Benitec Limited traded on Nasdaq under the same trading symbol and the ordinary shares of Benitec Limited traded on the Australian Stock Exchange (“ASX”). In connection with the Re-domiciliation, Benitec Limited’s ordinary shares were delisted from the ASX. On September 29, 2020, the closing sale price of our common stock as reported on Nasdaq was $6.00 per share.

As of September 29, 2020, we had approximately 3,348 record holders of our common stock. The number of record holders is based on the actual number of holders registered on the books of our transfer agent and does not reflect holders of shares in “street name” or persons, partnerships, associations, corporations or other entities identified in security position listings maintained by depository trust companies.

We never have declared or paid any cash dividends on our capital stock. Currently, we anticipate that we will retain all available funds for use in the operation and expansion of our business and do not anticipate paying any cash dividends for the foreseeable future. Any future determination relating to dividend policy will be made at the discretion of our Board and will depend on our future earnings, capital requirements, financial condition, prospects, applicable Delaware law, which provides that dividends are only payable out of surplus or current net profits, and other factors that our Board deems relevant.

23

Table of Contents

The following table sets forth certain information regarding the beneficial ownership of the Company’s common stock as of September 28, 2020 by (i) each person or group of persons known by us to beneficially own more than five percent of our common stock, (ii) each of our named executive officers, (iii) each of our directors and (iv) all of our directors and executive officers as a group.

The following table gives effect to the shares of common stock issuable within 60 days of September 28, 2020 upon the exercise of all options and other rights beneficially owned by the indicated stockholders on that date. Beneficial ownership is determined in accordance with Rule 13d-3 promulgated under Section 13 of the Securities Exchange Act and includes voting and investment power with respect to shares. Percentage of beneficial ownership is based on 1,108,374 shares of common stock outstanding at the close of business on September 28, 2020. Except as otherwise noted below, each person or entity named in the following table has sole voting and investment power with respect to all shares of our common stock that he, she or it beneficially owns.

Unless otherwise indicated below, the address for each beneficial owner listed is c/o 3940 Trust Way, Hayward, California 94545.

| Name of Beneficial Owner |

Number of Shares Beneficially Owned |

Percentage of Shares Beneficially Owned |

||||||||||

| Before Offering | After Offering | |||||||||||

| 5% or Greater Stockholders: |

||||||||||||

| Nant Capital, LLC(1) |

293,058 | 26.4 | % | 10.6 | % | |||||||

| Directors and Named Executive Officers: |

||||||||||||

| Jerel A. Banks(2) |

22,222 | 2.0 | % | * | ||||||||

| Megan Boston(3) |

5,888 | * | * | |||||||||

| J. Kevin Buchi(4) |

7,627 | * | * | |||||||||

| Peter Francis(5) |

9,704 | * | * | |||||||||

| Edward Smith |

— | * | * | |||||||||

| All Executive Officers and Directors As a Group |

45,441 | 4.1 | % | 1.6 | % | |||||||

| * | Represents beneficial ownership of less than one percent of the Company’s outstanding common stock. |

| (1) | Based on the information included in the Form 3 filed by Nant Capital, LLC on April 24, 2020. Represents 195,372 shares held directly by Nant Capital, LLC and 97,686 shares of common stock held by Merrill Lynch (Australia) Nominees Pty Limited for the account of Nant Capital, LLC. The address of the principal business office of Nant Capital, LLC is 9922 Jefferson Blvd, Culver City, CA, 90232. |

| (2) | Represents stock options to acquire 22,222 that have vested or will vest within 60 days of September 28, 2020. |

| (3) | Includes 333 shares held by Boston Super Invest Pty A/C Boston Family Super that Megan Boston has sole voting power over and stock options to acquire 5,555 shares of common stock that have vested or will vest within 60 days of September 28, 2020. |

| (4) | Includes 4,827 shares of common stock and stock options to acquire 2,800 shares of common stock that have vested or will vest within 60 days of September 28, 2020. |

| (5) | Includes 4,738 shares of common stock held by the Francis Family Superannuation Fund, 300 shares held directly by Mr. Francis, and stock options to acquire 4,666 shares of common stock that have vested or will vest within 60 days of September 28, 2020. |

| (6) | Includes 10,198 shares of common stock and stock options to acquire 35,243 shares of common stock that have vested or will vest within 60 days of September 28, 2020. |

24

Table of Contents

The following description of our securities is intended as a summary only. We refer you to our Annual Report on Form 10-K for the fiscal year ended June 30, 2020, amended and restated certificate of incorporation and restated bylaws, which are incorporated by reference into this prospectus, and to the applicable provisions of the Delaware General Corporation Law (“DGCL”). This description may not contain all of the information that is important to you and is subject to, and is qualified in its entirety by reference to, our Annual Report on Form 10-K for the fiscal year ended June 30, 2020, certificate of incorporation, our by-laws and the applicable provisions of the DGCL. For information on how to obtain copies of our Annual Report on Form 10-K for the fiscal year ended June 30, 2020, certificate of incorporation and by-laws, see “Where You Can Find More Information.”

General

Our authorized capital stock consists of 10,000,000 shares of our common stock, par value $0.0001 per share. During the Re-domiciliation, all of the issued and outstanding ordinary shares of Benitec Limited were exchanged for newly issued shares of common stock of the Company, on the basis of one share of the Company’s common stock for every 300 ordinary shares issued and outstanding. As a result of the Re-domiciliation, Benitec Limited is a wholly-owned subsidiary of the Company.

Common Stock

Dividend Rights. Subject to preferences that may be applicable to any then outstanding preferred stock, holders of the Company’s common stock are entitled to receive dividends, if any, as may be declared from time to time by the Company’s Board out of legally available funds. Dividends may be paid in cash, in property or in shares of common stock, subject to the provisions of the Certificate and applicable law. Declaration and payment of any dividend will be subject to the discretion of the Board. The time and amount of dividends will be dependent upon the Company’s financial condition, operations, cash requirements and availability, debt repayment obligations, capital expenditure needs, restrictions in the Company’s debt instruments, industry trends, the provisions of Delaware law affecting the payment of distributions to stockholders and any other factors the Board may consider relevant.

Voting Rights. Each holder of common stock is entitled to one vote for each share on all matters submitted to a vote of the stockholders, including the election of directors. The Company’s stockholders do not have cumulative voting rights in the election of directors.