UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2022

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the Transition Period from to

Commission file Number. 1-39628

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I. R. S. Employer Identification No.) | ||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||||||||

Registrant’s telephone number, including area code: (385 ) 351-1369

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| ý | Accelerated Filer | ☐ | |||||||||||||||

| Non-Accelerated Filer | ☐ | Smaller Reporting Company | |||||||||||||||

| Emerging Growth Company | |||||||||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act | ☐ | ||||||||||||||||

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the common stock held by non-affiliates of the registrant as of June 30, 2022 was $580,775,300 based on the closing price on that date as reported by the New York Stock Exchange. Solely for the purpose of this calculation and for no other purpose, the non-affiliates of the registrant are assumed to be all shareholders of the registrant other than (i) directors of the registrant, (ii) executive officers of the registrant, and (iii) any shareholder that beneficially owns 10% or more of the registrant’s common shares.

As of February 17, 2023, there were 48,035,766 shares of the Company’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

1

2

Cautionary Note Regarding Forward Looking Statements

This Annual Report on Form 10-K (this "Form 10-K") contains forward-looking statements within the meaning of the Securities Act of 1933, the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. These statements include, among others, statements that involve expectations, plans or intentions, such as those relating to management strategies, future business, future results of operations or financial condition, mergers or acquisitions, capital allocation, an increasing rate of inflation, increasing interest rates, the possible impacts to our businesses of a prolonged recession, and any further impacts of the COVID-19 pandemic. These forward-looking statements may be identified by words such as "may," "will," "would," "should," "could," "expect," "anticipate," "believe," "estimate," "intend," "strategy," "future," "opportunity," "plan," "project," "forecast," and other similar expressions. These forward-looking statements involve risks and uncertainties that may cause our actual results and financial condition to differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include, among others, those discussed in the Risk Factor Summary below, Part I, "Item 1A. Risk Factors" and Part II, "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operation" of this Form 10-K, as well as in our consolidated financial statements, related notes, and the other information appearing in this Form 10-K and our other filings with the Securities and Exchange Commission (the "SEC"). We do not intend, and undertake no obligation except as required by law, to update any of our forward-looking statements after the date of this Form 10-K to reflect actual results or future events or circumstances. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements.

Risk Factor Summary

Our businesses are subject to certain risks and uncertainties. Any of the following risk factors may cause our actual results to differ materially from historical or anticipated results. These risks and uncertainties are not all inclusive, but represent the risks that we currently believe are material. There may be additional risks that we do not currently consider to be material or of which we are not currently aware. Any of these risks, as well as the risks described below, could cause our actual results to differ materially from historical or anticipated results and could materially and adversely affect several aspects of our performance.

Risks Related to our Businesses, Regulatory Environment and Industry

•Our businesses are subject to extensive laws and regulations, including laws and regulations unique to the industries in which our businesses operate, that may subject them to government investigations and significant monetary penalties and compliance-related burdens.

•Progressive Leasing serves subprime consumers, and its lease-to-own business model poses inherent risks that may have an adverse impact on our financial performance.

•Inflation, rising interest rates, and other adverse macro-economic conditions, including a prolonged recession, may adversely affect consumer confidence and demand for the products and services offered by our Progressive Leasing, Vive and Four businesses.

•Our customers' inability to make the payments they owe our Progressive Leasing, Vive and Four businesses due to inflation, rising interest rates and other adverse macro-economic conditions may unfavorably impact our overall financial performance.

•Given the deteriorating macro-economic environment, our proprietary algorithms and decisioning tools used in approving Progressive Leasing and Vive customers may no longer be indicative of their ability to perform.

•A large percentage of Progressive Leasing’s revenue, which represents approximately 97% of PROG Holdings' consolidated revenue, is concentrated with several key point-of-sale partners (whom we refer to as our "POS partners)."

•Progressive Leasing may be unable to attract additional POS partners and consumers and to retain and grow its existing POS and consumer relationships.

•The business models for our Vive and Four businesses differ significantly from Progressive Leasing’s lease-to-own business, which creates specific and unique risks including significantly different regulatory risks, particularly at the federal level.

•Interruptions, inventory shortages and other factors affecting the supply chains of our retail partners may have a material and adverse effect on several aspects of our performance.

•The COVID-19 pandemic has had, and is expected to continue to have, a material and adverse effect on several aspects of our performance.

3

•Our capital allocation strategy and financial policies, including our current stock repurchase program, as well as any potential debt repurchase or dividend programs, may not be effective at enhancing shareholder value, or providing other benefits we expect.

•Our cost reduction initiatives may not be adequate or may have unintended consequences that could be disruptive to our businesses.

•The loss of the services of our key executives or our inability to attract and retain key talent, particularly with respect to our information technology function, may have a material adverse impact on our operations.

•Our failure to successfully compete in our highly competitive industry may harm several aspects of our performance.

•The effects of Progressive Leasing’s 2020 settlement with the FTC are not certain.

•The transactions offered to consumers by Progressive Leasing, Vive and Four may be negatively characterized by government officials, consumer advocacy groups and the media.

•Any significant disruption in, or errors in, service on Progressive Leasing’s, Vive’s or Four’s platforms or relating to vendors, including events beyond their control, may prevent Progressive Leasing, Vive or Four from processing transactions (including making accurate lease and loan decisioning).

•Our business continuity and disaster recovery plans may not be sufficient to prevent losses in the event we experience a significant disruption in, or errors in, service on Progressive Leasing’s, Vive’s or Four’s platforms.

•Real or perceived software errors, failures, bugs, defects, or outages may adversely affect Progressive Leasing, Vive and/or Four.

•The ability of Progressive Leasing, Vive and Four to protect confidential, proprietary, or sensitive information, including the confidential information of their customers, may be adversely affected by cyber-attacks, employee or other internal misconduct, computer viruses, physical or electronic break-ins, or similar disruptions.

•Consumer identity fraud may adversely affect the performance of our businesses' lease and loan portfolios.

•E-commerce lease and loan origination processes may give rise to greater risks than in-store originations and processes.

•The geographic concentration of Progressive Leasing’s POS partners may magnify the impact of conditions in a particular region, including economic downturns and other occurrences.

•Our results largely depend on prominent presentation, integration, and support of Progressive Leasing and Vive's products and services by POS partners.

Risks Related to Our Indebtedness

•We may not be able to generate sufficient cash to service all of our indebtedness, and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

•The terms of our indebtedness may restrict our current and future business plans and strategies, particularly our ability to respond to changes or to take certain actions.

•The portion of our indebtedness that is variable in nature subjects us to interest rate risk, which may cause our debt service obligations to increase significantly.

Risks Related to the Spin-Off of The Aaron’s Company, Inc.

•In connection with the spin-off of The Aaron’s Company, Inc. in November 2020 (the "Spin-Off"), The Aaron’s Company agreed to indemnify us for certain liabilities, and we agreed to indemnify The Aaron’s Company for certain liabilities.

•If the Spin-Off does not ultimately qualify as a transaction that is generally tax free for U.S. federal income tax purposes, we or our shareholders may be subject to significant tax liabilities.

•Potential liabilities in connection with the Spin-Off may arise under fraudulent conveyance and transfer laws and legal capital requirements.

4

PART I

ITEM 1. BUSINESS

Unless otherwise indicated or unless the context otherwise requires, all references in this Annual Report on Form 10-K to the "Company," "we," "us," "our" and similar expressions are references to PROG Holdings, Inc. ("PROG Holdings") and its consolidated subsidiaries.

Overview

PROG Holdings is a financial technology holding company that provides transparent and competitive payment options to consumers. PROG Holdings' operating segments include Progressive Leasing, an in-store, app-based, and e-commerce point-of-sale lease-to-own solutions provider, Vive Financial ("Vive"), an omnichannel provider of second-look revolving credit products, and Four Technologies, Inc. ("Four"), which offers Buy Now, Pay Later payment options to consumers through the Four platform. The Progressive Leasing segment comprised approximately 97% of our consolidated revenues for the year ended December 31, 2022. Progressive Leasing provides consumers with lease-purchase solutions for merchandise, including furniture, appliances, electronics, jewelry, mobile phones and accessories, mattresses, and automobile electronics and accessories from leading traditional and e-commerce retailers (whom we refer to as our point-of-sale partners, "POS partners," or "retail partners"). Many of our customers fall within the near-prime or subprime Fair Isaac and Company ("FICO") score categories and may have difficulty purchasing big-ticket and other durable goods they desire. Progressive Leasing's technology-based, proprietary decisioning platform offers prompt lease decisioning at the point-of-sale and is integrated with both traditional and e-commerce POS partners’ systems. Progressive Leasing provides customers with transparent and competitive lease payment options along with flexible terms that are designed to help customers achieve merchandise ownership, including through low initial payments and early buyout options. Lease-to-own transactions facilitated through our Company also benefit our POS partners by generating incremental sales to credit-challenged consumers, who typically would not have qualified for financing offers traditionally provided by these retailers.

Strategy

Our strategy to drive growth in our business, which we believe positions us for success over the long-term, includes the following:

5

•Grow our gross merchandise volume ("GMV") through existing merchant partners, new partners, and direct-to-consumer initiatives - We plan to grow GMV through strategic collaboration and marketing efforts with our existing POS partners. We remain focused on converting our pipeline of retailers into new POS partners. Our ability to maintain and strengthen new and existing relationships, including addressing the changing needs of our POS partners, is critical to the long-term growth of our business. We will also continue to expand our direct-to-consumer marketing efforts to attract new customers and drive more GMV through in-store and online retailers.

•Enhance our industry-leading consumer experience - We are investing in technology platforms that promote customer engagement and simplify the lease application, origination and servicing experience. We are committed to providing our customers with transparency, flexibility, and greater choice on how and where they choose to shop. We are expanding and innovating our e-commerce capabilities to benefit existing and new POS partners and customers.

•Expand our ecosystem to increase access and deliver more value to our consumers - We expect to broaden our financial technology product ecosystem through research and development ("R&D") efforts and strategic acquisitions that will result in a more loyal and engaged customer base. We will leverage our extensive database of lease agreements to offer current and previous customers products that meet their needs.

Operating Segments

As of December 31, 2022, the Company has three operating segments: Progressive Leasing, Vive and Four. The Company’s two reportable segments are Progressive Leasing and Vive, which is consistent with the current organizational structure and how the chief operating decision maker regularly reviews results to analyze performance and allocate resources.

The operating results of our two reportable segments may be found in (i) Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations and (ii) Item 8. Financial Statements and Supplementary Data.

Progressive Leasing

Progressive Leasing is our largest operating segment, which empowers consumers and businesses with transparent and flexible lease-to-own options to help consumers achieve ownership of durable goods. Progressive Leasing provides e-commerce, app-based, and in-store point-of-sale lease-to-own solutions through approximately 24,000 third-party POS partner locations and e-commerce websites in 46 states, the District of Columbia and Puerto Rico. It does so by purchasing the desired merchandise from POS partners and, in turn, leasing that merchandise to customers through a cancellable lease-to-own transaction. Progressive Leasing consequently has no stores of its own, but rather offers lease-purchase solutions to the customers of traditional and e-commerce retailers. The Progressive Leasing segment comprised approximately 97% of our consolidated revenues for the year ended December 31, 2022.

Vive

Vive primarily serves customers who may not qualify for traditional prime lending offers and desire to purchase goods and services from participating merchants. Vive offers customized programs with services that include revolving loans through private label and Vive-branded credit cards. Vive's current network of over 6,500 POS partner locations and e-commerce websites includes furniture, mattresses, fitness equipment, and home improvement retailers, as well as medical and dental service providers. The Vive segment comprised approximately 3% of our consolidated revenues for the year ended December 31, 2022.

Four

Four provides consumers of all credit backgrounds with Buy Now, Pay Later ("BNPL") options through four interest-free installments. Four's proprietary platform capabilities provide our base of customers and POS partners with another payment solution as part of the PROG Holdings financial technology offerings. Shoppers use Four's platform to purchase furniture, clothing, electronics, health and beauty, footwear, jewelry, and other consumer goods from retailers across the United States. Four was not a reportable segment for the year ended December 31, 2022 as its financial results were not material to the Company’s results of operations or financial condition. Four's financial results are reported within "Other" for segment reporting purposes.

6

Operations

Operating Strategy

Our operating strategy is based on distinguishing our Progressive Leasing, Vive, and Four brands from those of our competitors, along with maximizing our operational efficiencies. At every interaction with our POS partners and customers, we strive to combine our service and advanced technology-based solutions to deliver a best-in-class experience. We believe this strategy allows us to grow incremental sales for our POS partners, while realizing operating efficiencies at scale. Importantly, our ability to service our POS partners and our customers while effectively managing labor costs allows us to offer lease-purchase solutions that are generally lower cost and otherwise more attractive than many other options available in the market.

| Legacy finance solution shortfall | Progressive Leasing’s answer | ||||

| Approximately 40% of United States population has a near or below prime FICO score and may not have a convenient solution to finance the purchase of big-ticket items. | Progressive Leasing offers a technology-based, proprietary decisioning platform with transparent and competitive lease payment options. | ||||

| Consumers may not be able to qualify for traditional products due to low credit score or no traditional credit file/score. | Approvals are determined by various credit underwriting factors beyond traditional credit scores. | ||||

| Traditional products have high denial rates for non-prime customers and retailer staff have minimal training or program support to enable the purchase. | Progressive Leasing brand loyalty, marketing and POS partner support efforts help drive incremental business to our POS partners and facilitate sales to customers that are otherwise unable to purchase. | ||||

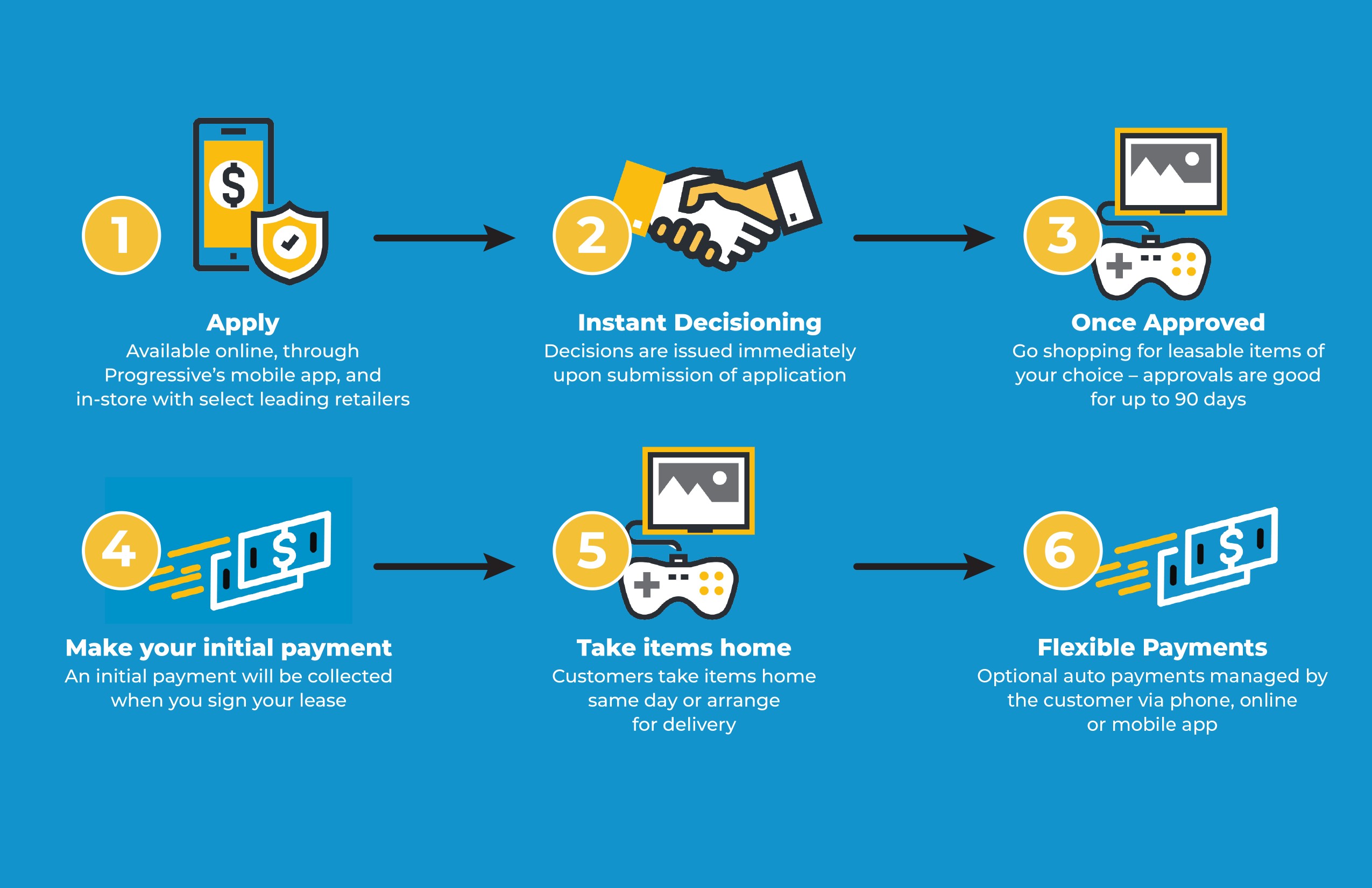

Lease Agreement Customer Experience

We offer simplified and transparent lease application and payment processes:

7

Lease Agreement Decisioning Process

Progressive Leasing uses proprietary decisioning algorithms to determine which applicants meet our leasing qualifications and the lease amount for which customers are approved. The Company leverages a large decisioning data set with mature lease performance data and other information provided from third party sources. Progressive Leasing's proprietary algorithms utilize the customer application, customer history, known fraud attributes, retailer/vertical performance and other information in the decision-making process.

Lease Agreement and Collection

The Progressive Leasing customer has the option to acquire ownership of merchandise over a fixed term, usually 12 months, by making weekly, bi-weekly, semi-monthly, or monthly lease payments. The customer may cancel the agreement at any time without penalty by returning the merchandise to Progressive Leasing. If the customer leases the item through the completion of the full term, ownership of the item transfers to the customer. The customer may also purchase the item at any time by making the contractually specified payment.

Contractual payments are usually based on a customer's pay frequency and are typically processed through automated clearing house payments. If a payment is not made in a timely manner, collections are managed in-house through our call centers and proprietary lease management system. The call center contacts customers within a few days after the due date to encourage them to keep their agreement current. If the customer chooses to return the merchandise, arrangements may be made to receive the merchandise from the customer by either scheduling a pick-up or shipping the merchandise to our warehouse in Draper, Utah.

For customer agreements that are past due, the Company's policy is to write off lease merchandise after 120 days. The provision for lease merchandise write-offs as a percentage of lease revenues was 7.7%, 4.8% and 5.4% for the years ended December 31, 2022, 2021, and 2020, respectively.

Vive's Credit Decisioning and Collection

Vive partners with merchants to provide a variety of revolving credit products originated through third-party federally insured banks to customers that may not qualify for traditional prime lending offers (referred to as "second-look" financing programs). We believe Vive provides the following strategic benefits:

•Enhanced product for POS partners - Vive is able to drive more sales for its POS partners through its revolving credit products. Vive has a centralized, scalable underwriting model with a long operating history, deployed through its third-party bank partners, and a proprietary receivable management system.

•Expanded customer base - PROG Holdings is able to serve a broader base of consumers through Vive. Vive primarily serves customers with FICO scores between 580 and 700, which make up approximately a quarter of the United States population. These customers generally have credit profiles that are typically stronger than Progressive Leasing's current customers. Additionally, Vive's revolving credit products can be used for the purchase of services in addition to merchandise.

•Proprietary decision algorithm and collection - Vive uses an underwriting model that provides standardized credit decisions, including borrowing limit amounts. Credit decisions are primarily based on a proprietary underwriting algorithm. Loans receivable are unsecured, and collections on loans receivable are managed in-house through Vive's call center and proprietary loans receivable management system.

Customer Service

8

A critical component of the success of our operations is the commitment to develop good relationships with our customers. We consistently monitor consumer preferences and trends to ensure that our business models are aligned with our customers' needs. We believe that building a relationship with the customer that ensures customer satisfaction is critical to our long-term success. Our goal, therefore, is to develop a positive experience with our customers, and for our products, service and support in the minds of our customers from the moment they enter the stores, e-commerce websites or mobile apps of our POS partners, or access our website or mobile app.

We believe the strong focus on customer satisfaction generates repeat business from our customers and long-lasting relationships with our POS partners. Our customers are given access to products through multiple channels, including a network of POS partner store locations and e-commerce sites. Our customers benefit from Progressive Leasing's flexible payment alternatives, including early purchase options, reinstatement options, product replacement, discounts and other benefits. In addition, we offer payment deferral options and other payment adjustment options to customers who are experiencing financial difficulties, such as to those customers who have been adversely impacted by financial hardships and other qualifying events. We foster relationships with POS partners to better serve new and existing customers. Our Progressive Leasing segment offers centralized customer and retailer support through call centers located in Draper, Utah; Glendale, Arizona; and virtual servicing operations in El Paso and San Antonio, Texas. Additionally, we utilize a third-party service provider in Cali, Colombia to assist us with our customer support efforts. Our call centers for Vive are located in Draper, Utah and Fayetteville, Arkansas. Since early 2020, substantially all call center representatives for Progressive Leasing and Vive have transitioned to working remotely.

Our commitment to our customers is ongoing throughout their lease term. Progressive Leasing customers have the option to cancel their lease-to-own agreement and return the merchandise at any time. We provide customers the convenience to return merchandise by either scheduling a pick-up or shipping the merchandise to our warehouse in Draper, Utah. Progressive Leasing partners with multiple third-party vendors to sell its returned merchandise.

Purchasing and POS Partner Relationships

The following table details the percentage of Progressive Leasing's revenues attributable to different categories of merchandise offered by its POS partners:

| Year Ended December 31, | |||||||||||||||||

Progressive Leasing POS Partner Merchandise Category1 | 2022 | 2021 | 2020 | ||||||||||||||

Furniture, Appliances and Electronics2 | 57 | % | 57 | % | 57 | % | |||||||||||

| Jewelry | 17 | % | 17 | % | 14 | % | |||||||||||

| Mobile Phones and Accessories | 14 | % | 12 | % | 13 | % | |||||||||||

| Mattresses | 6 | % | 7 | % | 9 | % | |||||||||||

| Automobile Electronics and Accessories | 3 | % | 4 | % | 5 | % | |||||||||||

| Other | 3 | % | 3 | % | 2 | % | |||||||||||

1Revenues from a POS partner are attributed to a single category even if the POS partner may carry merchandise across multiple categories.

2Progressive Leasing also classifies some electronics within mobile phones and accessories, automobile electronics and accessories, and other.

The following table details the percentage of Vive's revenues attributable to different categories of services and merchandise offered by its POS partners:

| Year Ended December 31, | |||||||||||||||||

Vive POS Partner Services and Merchandise Category1 | 2022 | 2021 | 2020 | ||||||||||||||

| Furniture and Mattresses | 55 | % | 48 | % | 41 | % | |||||||||||

| Medical and Dental | 20 | % | 26 | % | 34 | % | |||||||||||

| Home Exercise and Home Improvement | 11 | % | 8 | % | 9 | % | |||||||||||

| Other | 14 | % | 18 | % | 16 | % | |||||||||||

1Revenues from a POS partner are attributed to a single category even if the POS partner may offer services or merchandise across multiple categories.

During 2022, four POS partners each individually provided customer relationships that generated greater than 10% of our consolidated revenues.

Marketing and Advertising

Progressive Leasing actively markets its leasing services to help increase the purchasing power of its customers and drive new shoppers and incremental revenue for our POS partners. To accomplish these goals, we invest in digital, traditional, and in-store

9

marketing, and our internal marketing and data science teams continually evaluate and optimize this investment to maximize the benefit for our POS partners.

Our robust digital media program is comprised of paid search, digital display, mobile, video, and paid social advertising. Through a variety of media testing methods, we can verify the impact of our paid digital media on in-store and online shopping trips and lease origination activity. In addition, targeted, personalized email and SMS marketing campaigns leverage our large customer database, educating customers about lease-to-own offerings, and driving lease conversion and sales for our POS partners. In addition, in cooperation with our POS partners, Progressive Leasing leverages a variety of in-store marketing materials to drive awareness at the point of sale.

These efforts drive new and returning customers online and into retail locations, generating incremental sales for our POS partners.

Competition

Our Progressive Leasing segment competes with other lease-to-own companies (virtual and traditional store based), and to a lesser extent, consumer finance companies, and traditional and online sellers of merchandise that provide customers with various types of payment options. The virtual lease-to-own market is highly competitive. The industry is also experiencing an increase in new products and services designed to compete for the traditional lease-to-own consumer. The emergence of these new products and services has resulted in consumers having various payment alternatives for the goods and services they desire, resulting in a highly competitive environment. Vive competes with banks, consumer finance companies, and other financial technology companies for customers desiring to purchase merchandise or services. Four also competes with these same financial service providers for customers desiring to purchase merchandise or services for cash or credit. Competition is based primarily on product selection and availability, customer service, lease rates, interest rates, promotional rates, and other terms.

Working Capital

Progressive Leasing's most significant working capital asset is merchandise on lease. The need for additional lease merchandise is expected to remain a major working capital requirement. Vive's most significant working capital assets are loans receivable. Four's most significant working capital assets are loans receivable. Consistent and dependable sources of liquidity are required for Progressive Leasing and Four to purchase such merchandise, and for Vive to acquire new loans through its third-party bank partners. Failure to maintain adequate sources of liquidity to purchase lease merchandise and originate loans may materially adversely affect our Progressive Leasing, Vive, and Four businesses. We believe our cash on hand, operating cash flows, and availability under our revolving credit facility are adequate to meet our normal liquidity requirements.

Human Capital

Diversity, equity and inclusion ("DE&I") is integral to our ability to grow and thrive. We respect the dignity and diversity of all people. We strive to nurture a culture of inclusion, holding all employees accountable for advancing our culture of belonging while supporting a diverse environment free from discrimination, harassment and bullying.

By supporting a diverse and inclusive workplace, our employee resource groups help to ensure the many experiences of our diverse employees, customers and communities are reflected in our decisions and actions. We continue to focus on hiring, retention and advancement of women and underrepresented groups. Our vision is to cultivate a welcoming and nurturing workplace that will activate the next generation of innovators. One of the ways we strive to achieve these goals is by providing executive, monetary and other support to our Employee Resource Groups ("ERGs"), all of which encourage and welcome participation from all employees in all positions and locations. Our ERGs work to ensure their members have a voice in the Company’s on-going conversations about DE&I matters, including strategy. Currently, our ERGs include:

•The Black Inclusion Group ("BIG"), whose mission is to enrich the experience of our African American employees by providing professional and leadership development, networking, mentoring and social opportunities, while also promoting understanding of their concerns and views among all of our employees. BIG is focused on inclusion, engagement, learning and advancement initiatives intended to foster recruitment, development, advancement and retention of African American employees.

•Women In Leadership ("WIL"), is an organization created to inspire female employees to develop their leadership abilities, prepare for and take advantage of career growth opportunities, and increase their knowledge of the Company for organizational and personal success. This organization is focused on fostering the recruitment, development, advancement and retention of female employees, and helping all employees gain an appreciation of issues and topics of importance to our female employees.

10

•Adelante! provides a platform for highlighting and celebrating the richness of the Hispanic and Latino communities’ heritages to promote cultural and issue awareness among all of our employees. This organization also facilitates professional and leadership development, networking, mentoring and social opportunities for Hispanic and Latino employees, with the aim of fostering recruitment, development, advancement and retention of those employees.

•PROGPeople Respecting Individuality, Diversity and Equality ("PRIDE") seeks to foster a culture of understanding, diversity, inclusion and equality with our LGBTQ+ employees and allies, and encourages individuality, respect, professional development, and awareness of the challenges faced by, and issues that are important to, the LGBTQ+ community.

•Veterans and Allies Leading the Organization Responsibly ("VALOR") has developed a mission that embraces the proud military community of employee veterans and brings together the unique background of military service to harness their strengths to better serve the company, community and customers.

In addition to providing support to our ERGs, our efforts to promote DE&I practices include:

•Hosting internal and guest speakers to discuss topics relevant to DE&I matters;

•Conducting training to educate our employees about various DE&I themes, racial justice, disability inclusion and LGBTQ+ allyship, among other themes;

•Improving and formalizing mentorship programs targeted towards our female, minority and LGBTQ+ employees, which we expect to implement during 2023;

•Implementing a talent review process that is designed to utilize a multi-factor approach to understanding the talents of our employees and the potential they have to be future leaders of the Company; and

•Providing the ERGs with financial resources to target donations from the PROG Foundation to non-profit organizations that support DE&I, the missions of the ERGs and the communities in which we serve our customers.

As of December 31, 2022, our employee count was 1,491 for Progressive Leasing, 184 for Vive, and 17 for Four, the majority of which were full time employees. None of our employees are covered by a collective bargaining agreement, and we believe that our relations with employees are good.

The information in the tables below summarizes our gender, ethnicity and race diversity metrics as of December 31, 2022:

| December 31, 2022 | ||||||||||||||||||||

| Male | Female | |||||||||||||||||||

| Vice Presidents and Above | 76.3 % | 23.7 % | ||||||||||||||||||

| All Other Employees | 47.0 % | 53.0 % | ||||||||||||||||||

| December 31, 2022 | |||||||||||||||||||||||

| Hispanic or Latino | White | Black or African American | Native Hawaiian or Pacific Islander | Asian | American Indian or Alaskan Native | Two or More Races | |||||||||||||||||

| Vice Presidents and Above | 2.7 % | 86.8 % | 7.9 % | — | 2.6 % | — | — | ||||||||||||||||

| All Other Employees | 27.1 % | 53.9 % | 9.3 % | 1.4 % | 4.4 % | 1.0 % | 2.9 % | ||||||||||||||||

We foster a culture of learning that provides employees with development opportunities to support their unique career paths. We support our employees in owning their development and growth, and we provide development training and resources to empower employees to achieve their personal best at work. In 2023, we are launching a career development framework tool that links employees to online learning curricula in multiple delivery formats as a way to further aid employees in their development. The tool will provide content on topics such as compliance and specific business-related needs, as well as assessments, videos and digital learning modules, which will be available live, in-person and online.

We empower our employees to give to causes they feel passionately about, through volunteering, making financial donations, which we match up to certain limits, serving as nonprofit board members, and participating in our Company-sponsored Day of Service.

We work to ensure that our employment practices comply with all applicable local, state and federal laws, including those concerning equal opportunity, compensation and safe working conditions. We strive to achieve shared, meaningful goals and commit to open communication through which individuals have no fear of expressing themselves freely and respectfully where, for example, they in good faith believe they need to raise a concern regarding a potential violation of law or Company policies.

11

We offer our employees fair and competitive wages and benefits which include (i) health benefits consisting of medical, dental, vision, life insurance, short-term and long-term disability insurance; (ii) paid parental leave; (iii) Company matched 401(k); (iv) paid time off, paid holidays, and paid volunteer hours; (v) an employee stock purchase program; (vi) tuition reimbursement; and (vii) charitable gift matching.

For the years ended December 31, 2022, 2021, and 2020, personnel expenses were $194.2 million, $189.6 million, and $170.3 million, respectively.

Seasonality

Progressive Leasing's revenue mix is moderately seasonal. Adjusting for growth, the first quarter of each year generally has higher revenues than any other quarter. This is primarily due to realizing the benefit of our POS partners' increases in business and higher lease originations during the fourth quarter holiday season, as well as increased liquidity for our customers in the first quarter due to receipt of federal and state income tax refunds. Our customers will more frequently exercise the early purchase option on their existing lease agreements during the first quarter of the year. We expect these trends to continue in future periods.

Industry Overview

The Lease-to-Own Industry

The lease-to-own industry offers customers an alternative to traditional methods of obtaining home furnishings, electronics, appliances, computers, jewelry, and other consumer goods and services. In a standard industry lease-to-own transaction, the customer has the option to acquire ownership of merchandise over a fixed term by making periodic lease payments. The customer may cancel the agreement at any time without penalty by returning the merchandise to the lessor. If the customer leases the item through the completion of the full term, ownership of the item transfers to the customer. The customer may also purchase the item at any time by tendering the contractually specified payment.

The lease-to-own model is particularly attractive to customers who are unable to pay the full purchase price for merchandise upfront and lack the credit to qualify for conventional financing programs. Other individuals who find the lease-to-own model attractive are customers who, despite access to credit, do not wish to incur additional debt or have only a temporary need for the merchandise.

Government Regulation

Our Progressive Leasing, Vive and Four businesses are extensively regulated by and subject to the requirements of various federal, state and local laws and regulations. Violations of these laws and regulations may subject them to government investigations and significant monetary penalties, remediation expenses and compliance-related burdens.

Federal regulatory authorities are increasingly focused on alternative consumer financial services and products that our Progressive Leasing, Vive and Four businesses provide. For example, in April 2020, Progressive Leasing entered into the Federal Trade Commission ("FTC") Settlement in order to resolve allegations by the FTC that certain of Progressive Leasing’s advertising and marketing practices violated the FTC Act. Even though Progressive Leasing believed it was in compliance with the FTC Act, and thus, did not admit any violations of the FTC Act or any other laws, under the terms of the FTC Settlement, Progressive Leasing paid $175 million to the FTC and agreed to enhance certain of its compliance-related activities, including augmenting disclosures to its customers and expanding its POS partner monitoring programs. Furthermore, our Vive business, through its bank partners, offers Vive branded credit cards and other private label credit card products for subprime and near-prime consumers. Accordingly, it is subject to federal laws and regulations with respect to cardholder agreement terms and disclosures (e.g., the Truth In Lending Act), credit discrimination (e.g., the Equal Credit Opportunity Act), credit reporting (e.g., the Fair Credit Reporting Act), and servicing and collection activities. The BNPL industry is also under increasing scrutiny from federal regulators as the Consumer Financial Protection Bureau ("CFPB") is currently reviewing the business practices of a number of companies that offer BNPL services and has alleged several areas of perceived risks of consumer harm, including inconsistent consumer protections and the risk of borrowers becoming overextended. We expect applicable federal regulatory agencies will continue their increased focus on alternative consumer financial services and products, and, as a result, businesses such as ours may be held to higher standards of monitoring, disclosure and reporting, regardless of whether new laws or regulations governing our industry are adopted.

In addition to federal regulatory oversight, currently, nearly every state specifically regulates lease-to-own transactions via state statutes, and are holding businesses like Progressive Leasing to higher standards of training, monitoring and compliance. Most state lease purchase laws require lease-to-own companies to disclose to their customers the total number of payments, total amount and timing of all payments to acquire ownership of any item, any other charges that may be imposed and miscellaneous other items. The more restrictive state lease purchase laws limit the retail price for an item, limit the total amount that a

12

customer may be charged for an item, or regulate the "cost-of-rental" amount that lease-to-own companies may charge on lease-to-own transactions. With respect to the regulation of the "cost-of-rental" amount, such laws generally define "cost-of-rental" as lease fees paid in excess of the "retail" price of the goods. Progressive Leasing’s long-established policy in all states is to disclose the terms of its lease purchase transactions as a matter of good business ethics and customer service. From time to time, state attorneys general have directed investigations, regulatory initiatives and/or legal actions toward us, our industry, or certain companies within the industry, including states in which our Progressive Leasing business has POS partners. For example, in August 2022, the Pennsylvania Attorney General filed a complaint against Progressive Leasing alleging, among other things, that Progressive Leasing was operating in Pennsylvania in violation of the Pennsylvania Rental Purchase Agreement Act by failing to disclose certain terms and conditions of rent-to-own ("RTO") transactions on "hang tags" physically attached to RTO merchandise. Although the Company believes the Pennsylvania Attorney General’s claims are without merit and intends to vigorously defend itself, we may incur substantial costs, including legal fees, penalties, and remediation expenses in the matter.

Intellectual Property

Intellectual property and proprietary rights are important to the success of our business. We rely on a combination of trademark, service mark, trade name and copyright laws in the United States and other jurisdictions, as well as license agreements, confidentiality procedures, non-disclosure agreements, and other contractual protections, to establish and protect our intellectual property and proprietary rights, including our proprietary technology, software, know-how, and brand. However, these laws, agreements, and procedures provide only limited protection. We own, or are otherwise entitled to use, the various trademarks, trade names, and service marks used in our businesses, including those used with the operations of Progressive Leasing, Vive, and Four. We intend to file for additional trade name and trademark protection when appropriate.

Although we rely on intellectual property and proprietary rights, copyrights, trademarks and trade secrets, as well as contractual protections, in our business, we also seek to preserve the integrity and confidentiality of our intellectual property and proprietary rights through appropriate technological restrictions, such as physical and electronic security measures. We believe that factors such as the technological and creative skills of our personnel and frequent enhancements to our network are also essential to establishing and maintaining our competitive position.

Available Information

Our primary internet address is www.progholdings.com. The information contained on our website is not included as part of, or incorporated by reference into, this Annual Report on Form 10-K or any other reports we file with or furnish to the Securities and Exchange Commission ("SEC"). On our website, we make available, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements, director and officer reports on Forms 3, 4, and 5, and any amendments to these reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. We also make available on our website our Code of Ethics, our corporate governance principles, and the charters for the Audit, Compensation and Nominating and Corporate Governance Committees of the Board of Directors. The SEC maintains an internet site, www.sec.gov, containing reports, proxy and information statements, and other information regarding issuers, including us, that file electronically with the SEC.

13

ITEM 1A. RISK FACTORS

Our businesses are subject to a number of risks and uncertainties that may affect our businesses, results of operations and financial condition, or the trading price of our common stock, some of which are described below. These risk factors may not be all of the risks our businesses face because we operate in a continually changing regulatory and macroeconomic environment, and new risks and uncertainties may emerge from time to time. We cannot predict such new risks and uncertainties, nor can we assess the extent to which any of the risk factors below or any such new risks and uncertainties, or any combination thereof, may impact our businesses.

Risk Factors

Risks Related to our Businesses, Regulatory Environment and Industry

Our businesses are subject to extensive federal, state and local laws and regulations, including certain laws and regulations unique to the industries in which our businesses operate, that may subject them to government investigations and significant monetary penalties, remediation expenses and compliance-related burdens that may result in them changing the manner in which they operate, which may be materially adverse to several aspects of our performance.

In April 2020, our Progressive Leasing business entered into a settlement with the FTC (the "FTC Settlement") to resolve allegations by the FTC that certain of Progressive Leasing’s advertising and marketing practices violated the FTC Act, even though Progressive Leasing believed it was in compliance with the FTC Act, and thus, did not admit any violations of that act or any other laws. Under the FTC Settlement, Progressive Leasing paid $175 million to the FTC and agreed to enhance certain of its compliance-related activities, including augmenting disclosures to its customers and expanding its POS partner monitoring programs. Federal regulatory authorities are increasingly focused on alternative consumer financial services products, including consumer protection within the subprime financial marketplace in which our Progressive Leasing, Vive and Four businesses operate. For example, the Consumer Financial Protection Bureau ("CFPB") is currently reviewing the business practices of a number of companies that offer buy-now-pay-later ("BNPL") services and has alleged several areas of perceived risk of consumer harm, including inconsistent consumer protections and the risk of borrowers becoming overextended. We believe the CFPB’s review is illustrative of the greater focus federal regulatory authorities are putting on alternative consumer financial services products, including within the industries in which our businesses operate, which may result in increased compliance costs and the possibility of significant monetary penalties, remediation expenses and costly changes to the manner in which we conduct our businesses.

Any of these federal agencies may propose and adopt new regulations (or interpret existing regulations) that may result in significant adverse changes in the regulatory landscape for Progressive Leasing, Vive and Four. We expect federal regulatory agencies will continue their increased focus on alternative consumer financial services products, and, as a result, businesses transacting with subprime consumers, for example, may be held to higher standards of monitoring, disclosure and reporting, regardless of whether new laws or regulations governing our industry are adopted. This increased attention may increase Progressive Leasing’s, Vive’s and Four’s compliance costs significantly, result in additional fines or monetary penalties or settlements due to future government investigations, and materially and adversely impact the manner in which they operate, which may be materially adverse to several aspects of our performance.

In recent years, state regulatory authorities have been increasingly focused on the subprime financial marketplace, including the lease-to-own industry. For example, in August 2022, a complaint was filed by the Pennsylvania Attorney General against the Company's Progressive Leasing business alleging, among other things, that Progressive Leasing was operating in the Commonwealth of Pennsylvania in violation of the Pennsylvania Rental Purchase Agreement Act by failing to disclose certain terms and conditions of rent-to-own ("RTO") transactions on "hang tags" physically attached to RTO merchandise. Although the Company believes the Pennsylvania Attorney General's claims are without merit and intends to vigorously defend itself, we may incur substantial costs, including legal fees, fines, penalties, and remediation expenses in the matter. Additionally, in early 2021, a number of lease-to-own companies, including the Company's Progressive Leasing business, received a subpoena from the California Department of Financial Protection and Innovation (the "DFPI"). The subpoena received by Progressive Leasing in January 2021 from the DFPI requested the production of documents regarding Progressive Leasing's operations and its compliance with state consumer protection laws, including new legislation that went into effect on January 1, 2021. Although the Company believes Progressive Leasing is in compliance with all applicable consumer financial laws and regulations in California, this inquiry may lead to an enforcement action and/or a consent order and substantial costs, including legal fees, fines, penalties, and remediation expenses. While the Company intends to preserve defenses surrounding the jurisdiction of DFPI in this matter, the Company has fully cooperated and anticipates that it will continue cooperating with the DFPI in responding to its inquiry. We are currently unable to predict the ultimate timing or outcome of either the complaint filed by the Pennsylvania Attorney General or the investigation undertaken by the DFPI. In addition, the FTC Settlement may lead to investigations and enforcement actions by, and/or consent orders with, state Attorneys General or other state regulatory agencies.

14

Furthermore, in November 2021, Rent-A-Center, Inc. announced that its Acima division ("Acima"), which is a large virtual lease-to-own business that competes with Progressive Leasing, had received a letter from the Nebraska Attorney General’s office stating that the Attorney General of Nebraska, along with a coalition of thirty-eight state Attorneys General, had initiated a multistate investigation into the business acts and practices of Acima. As of the date of this Annual Report on Form 10-K, we have not received a similar communication from the Nebraska Attorney General’s office and are not aware of any intention by any state Attorneys General involved in the Acima matter to broaden their investigation to include Progressive Leasing in their investigation. However, there can be no assurance that Progressive Leasing will not be included in such matter and, if it is, that it would not lead to an enforcement action and/or a consent order, or substantial costs, including legal fees, fines, penalties, and remediation expenses. We cannot predict whether any state Attorneys General or state regulatory agencies will direct other investigations or regulatory investigations towards us or our industry in the future, or what the impact of any such future regulatory investigation may be.

In addition, certain aspects of Progressive Leasing’s, Vive’s and Four’s businesses, such as the content of their advertising and other disclosures to customers about transactions, their respective data collection practices, the manner in which they may contact their customers, the decisioning process regarding whether to enter into a transaction with a potential customer, their credit reporting practices, and the manner in which they process and store certain customer, employee and other information are subject to federal and state laws and regulatory oversight. For example, the California Consumer Privacy Act of 2018 (the "CCPA"), which became effective on January 1, 2020, gives residents of California expanded rights to access and delete their personal information, opt out of certain personal information sharing, and receive detailed information about how their personal information is used, and also provides for civil penalties for violations and private rights of action for data breaches. In addition, the California Privacy Rights Act ("CPRA"), which became effective on January 1, 2023, significantly modifies the CCPA, including by expanding consumers’ rights with respect to certain personal information and creating a new state agency to oversee implementation and enforcement efforts. The CCPA, CPRA, and other applicable state and federal privacy laws now require Progressive Leasing, Vive and Four to design, implement and maintain different types of privacy-related compliance controls and programs simultaneously in multiple states, thereby further increasing the complexity and cost of compliance. In addition, certain states' laws limit the total cost that Progressive Leasing may charge a customer in order for the customer to achieve ownership of the leased merchandise at the end of the lease term.

We have incurred and will continue to incur substantial costs to comply with federal, state and local laws and regulations, including rapidly evolving expected consumer protection standards. In addition to compliance costs, we may continue to incur substantial expenses to respond to regulatory and other third-party investigations and enforcement actions, proposed fines and penalties, criminal or civil sanctions, and private litigation, as well as potential "headline risks" that may negatively impact our business and may adversely affect our share price. Consumer complaints with respect to our industry have resulted in, and may in the future result in, state, federal and local regulatory and other investigations. In addition, while we are not aware of any whistleblower claims regarding Progressive Leasing’s, Vive’s or Four’s specific business practices, such claims are on the rise generally. We believe these claims will likely continue, in part because of the provisions enacted by the Dodd-Frank Act that provide for cash awards to persons who report alleged wrongdoing to the U.S. Securities and Exchange Commission, and because competitors may use it as a method to weaken their competitors, and others, like former personnel or other constituencies, may use it as means to extract payment or otherwise retaliate.

Additionally, as we execute on our strategic plans, we may continue to expand into complementary businesses that engage in financial, consumer credit transactions or lending services, or lease-to-own or rent-to-rent transactions involving products that we do not currently offer our customers, all of which may be subject to a variety of statutes and regulatory requirements in addition to those regulations currently applicable to our operations, which may impose significant costs, limitations or prohibitions on the manner in which we currently conduct our businesses as well as those we may acquire in the future.

Progressive Leasing serves subprime consumers. Its lease-to-own business model poses inherent risks that may have a material and adverse effect on our results, financial condition, and prospects.

Progressive Leasing offers lease-to-own solutions to subprime consumers through point-of-sale retail partners via in-store, mobile, and online solutions. While this model allows Progressive Leasing to address an underserved, credit-challenged segment of the population with an innovative lease-to-own solution that integrates seamlessly with the traditional and e-commerce retailers with whom Progressive Leasing partners (whom we refer to as our point of sale or "POS" partners), it creates specific and unique risks including, among others:

•reliance on POS partners (over whom Progressive Leasing does not exercise full control and oversight) for many important business functions, from advertising through assistance with lease transaction applications, including, for example, explaining the nature of the lease-to-own transaction when asked to do so by a consumer;

•the potential that federal, state and local regulators will continue to focus on alternative financial services products, including consumer protection with respect to such products within the subprime financial marketplace, and impact lease-to-own transactions by adopting new regulations (or applying existing laws and regulations that were never

15

intended to apply to lease-to-own transactions) that require Progressive Leasing to change its business practices in a materially adverse manner;

•indemnification obligations to POS partners for losses stemming from, among other matters, Progressive Leasing’s violation of federal, state or local laws or regulations or failure to take the appropriate steps to protect its POS partners’ and customers’ information from being accessed or stolen by unauthorized third parties through cyber-attacks or "hacking" or similar occurrences;

•reliance on automatic bank account drafts for lease payments, which may become disfavored as a payment method by regulators and/or providers, or may otherwise become unavailable; and

•an increase in the risk of consumer fraud since lease decisions are made through remote technology-based platforms and, because transactions are consummated through the Internet, there is a risk customers may challenge, among other potential claims, the authenticity of their documents and whether their electronic signatures are valid.

These risks, which may have a material and adverse effect on several aspects of our performance in the future, are described further below.

Inflation, rising interest rates, and other adverse macro-economic conditions, including a prolonged recession, may adversely affect consumer confidence and demand for the products and services offered by our Progressive Leasing, Vive and Four businesses.

We derive our revenue from the products and services offered by our Progressive Leasing, Vive and Four businesses. Consumer confidence is affected by inflation, rising interest rates, and other macro-economic conditions, including a prolonged recession. A deterioration in consumer confidence could adversely affect our business in many ways, including reducing demand for our products and services. As a result, a sustained decline in macro-economic conditions could result in lower revenue and negatively impact our businesses and the Company's overall financial results.

Our customers' inability to make the payments they owe our Progressive Leasing, Vive and Four businesses due to inflation, rising interest rates and other adverse macro-economic conditions, including a prolonged recession, may unfavorably impact our overall financial performance.

Inflation has recently increased at the fastest pace in over forty years. In response to these concerns, the Federal Reserve has raised interest rates multiple times over the past year, and will likely continue to raise them again in the near term, which could lead to a prolonged economic recession. Food, energy, residential rent and other costs of living have also increased significantly over the last twelve months, which we believe disproportionately negatively affects the customers we serve and therefore may unfavorably impact our customers' ability to make the payments they owe the Company, resulting in increased customer payment delinquencies, lease merchandise write-offs, loan loss provisioning and loan write-offs.

Given the deteriorating macro-economic environment, our proprietary algorithms and decisioning tools used in approving Progressive Leasing and Vive customers may no longer be indicative of their ability to perform, which in turn may limit the ability of our Progressive Leasing, Vive and Four businesses to manage risk, avoid lease and loan charge-offs and may result in insufficient reserves to cover actual losses.

We believe our proprietary lease and loan decisioning processes to be a key to the success of our Progressive Leasing and Vive businesses. These decisioning processes assume behavior and attributes observed for prior customers, among other factors, are indicative of performance by our future customers. Unexpected changes in customer behavior caused by deteriorating macroeconomic conditions, including, for example, widespread supply chain disruptions and/or the significant increase in inflation in the U.S., which has reached levels not seen since before Progressive Leasing was founded, the U.S. economy experiencing a prolonged recession and/or job losses or increased job absenteeism for hourly employees who are our customers may lead to increased incidences and costs related to lease merchandise write-offs. In addition, we believe that deteriorating macroeconomic conditions such as these lead to general declines in discretionary spending levels and disproportionately negatively impact the customers we serve. As a result, our decisioning process has required, and will likely continue to require, frequent adjustments (including tightening) and the application of greater management judgment in the interpretation of the results produced by our decisioning tools, which could have an unfavorable impact on our GMV, margins and earnings. These decisioning tools may be unable to accurately predict and respond to the impact of a prolonged economic downturn or changes to customer behaviors, which in turn may limit the ability of our Progressive Leasing and Vive businesses to manage risk, avoid lease and loan charge-offs and may result in insufficient reserves to cover actual losses (which Progressive Leasing records as accounts receivable allowance and allowance for lease merchandise write-offs and Vive and Four record as provision for loan losses).

16

A large percentage of Progressive Leasing’s revenue is concentrated with several key POS partners, and the loss of any of these POS partner relationships would materially and adversely affect several aspects of our performance.

Progressive Leasing’s relationship with its largest POS partners will have a significant impact on our operating revenues in future periods. The loss of any key POS partners would have a material adverse effect on our business.

For example, during 2022, we derived 49.3% of our consolidated revenues from customers of Progressive Leasing's top three POS partners, and 77.3% of our consolidated revenues from customers of Progressive Leasing's top ten POS partners. Any extended discontinuance of Progressive Leasing’s relationship with any of those POS partners or other high visibility retailers would have a material adverse impact on several aspects of our performance. In addition, in the event that Progressive Leasing enters into new or amended business or contractual terms or conditions with any of its largest POS partners that are less favorable than its current arrangements with those POS partners, including with respect to the prices it pays those POS partners for merchandise that it leases to consumers and/or exclusivity, rebate or other incentive payments it may make to those POS partners, our business and prospects may be materially and adversely effected.

Any publicity associated with the loss of any of Progressive Leasing’s large POS partners may harm its reputation, making it more difficult to attract and retain consumers and other POS partners and could lessen its negotiating power with its remaining and prospective POS partners. Our operating revenues and operating results may also suffer if any of Progressive Leasing’s POS partners experiences a significant decline in sales for any reason, including, for example, due to increased inflation and/or a prolonged recession reducing or eliminating many consumers’ discretionary incomes, and/or supply chain interruptions unfavorably impacting the inventories of our POS partners.

There can be no assurance that Progressive Leasing will be able to continue its relationships with its largest POS partners on the same or more favorable terms in future periods or that its relationships will continue beyond the terms of its existing contracts with them. Our operating revenues and operating results may suffer if, among other things, any of Progressive Leasing’s POS partners renegotiate, terminate or fail to renew, or fail to renew on similar or favorable terms, their agreements or otherwise choose to modify the level of support they provide for Progressive Leasing’s products and services.

If Progressive Leasing is unable to attract additional POS partners and retain and grow its relationships with its existing POS partners, several aspects of our performance would be materially and adversely affected.

Our continued success is dependent on the ability of Progressive Leasing to maintain its relationship with its existing POS partners and grow its gross merchandise volume, or "GMV", (which we define as the retail price of merchandise acquired by Progressive Leasing, which we then lease to our customers) from those existing POS partners through their in-store and e-commerce platforms, and also to expand its POS partner base. Progressive Leasing’s ability to retain and grow its relationships with POS partners depends on the willingness of POS partners to partner with it. Depending on the severity of the COVID-19 pandemic, and the seriousness and number of infections resulting from any resurgences in or new variants of the virus, potential POS partners’ focus and resources may be diverted to responding to the pandemic, and thus, potential POS partners and their resources may be delayed in, or unavailable for, evaluating and/or implementing our lease-to-own or other offerings in their store locations and/or e-commerce platforms, which may unfavorably impact our efforts to add new POS partners to our business. The attractiveness of Progressive Leasing’s platform to POS partners depends upon, among other things: its brand and reputation; its ability to sustain its value proposition to POS partners for consumer acquisition; the attractiveness to POS partners of its virtual and data-driven platform; the services, products and customer decisioning standards offered by Progressive Leasing's competitors; the amount of rebates or other incentive payments offered to those POS partners by Progressive Leasing, and its ability to perform under, and maintain, its POS partner agreements, most of which have terms that do not exceed three years.

In addition, competition for smaller POS partners has intensified significantly in recent years, with many such POS partners simultaneously offering several products and services that compete directly with the products and services offered by Progressive Leasing. Having a diversified mix of POS partners is important to mitigate risk associated with changing consumer spending behavior, economic conditions and other factors that may affect a particular type of retailer. If Progressive Leasing fails to retain any of its larger POS partners or a substantial number of its smaller POS partners, if it does not acquire new POS partners, if it does not continually grow its GMV from its POS partners, or if it is not able to retain a diverse mix of POS partners, several aspects of our performance would be materially and adversely affected.

If Progressive Leasing is unable to attract new consumers and retain and grow its relationships with its existing consumers, several aspects of our performance would be materially and adversely affected.

Our continued success depends on the ability of Progressive Leasing to generate repeat use and increased GMV from existing customers and to attract new consumers to its platform. Its ability to retain and grow its relationships with its consumers depends on the willingness of consumers to use its products and services. The attractiveness of Progressive Leasing’s data-driven platform to consumers depends upon, among other things: the number and variety of its POS partners and the mix of products and services available through its platform; its brand and reputation; customer experience and satisfaction; trust and

17

perception of the value it provides; technological innovation; and the services, products and customer decisioning standards offered by its competitors. If Progressive Leasing fails to retain its relationship with existing customers, if it does not attract new consumers to its platform, products and services, or if it does not continually expand usage and GMV, including, for example, due to a failure to successfully and timely enhance the features of our existing products or create and launch innovative new products, several aspects of our performance would be materially and adversely affected.

Vive also serves subprime and near-prime consumers, but Vive’s business model differs significantly from Progressive Leasing’s lease-to-own business, as does Four’s business model.

Through its Vive branded credit cards and other private label credit card products, Vive offers POS partners a variety of revolving loans for subprime and near-prime consumers. Therefore, Vive’s business model differs significantly from Progressive Leasing’s lease-to-own business, which creates specific and unique risks including, among others:

•Vive's reliance on two bank partners to issue its Vive branded credit cards and other credit products. Vive’s agreements with its issuing bank partners give those partners the right to terminate those agreements without cause by providing Vive with a non-renewal notice within a specified number of days prior to the dates on which those agreements are scheduled to automatically renew. If those agreements both were terminated or otherwise disrupted, there is a risk that Vive would not be able to replace those banks with an alternative bank provider on terms that Vive would consider favorable or in a timely manner without disruption of its business.

•Vive has significantly different regulatory risks as compared to Progressive Leasing, including those applicable to consumer credit card transactions. For example, Vive may have compliance obligations with respect to federal and state laws and regulations, including pursuant to its agreements with its issuing bank partners, that govern, among other areas, cardholder agreement terms and disclosures (e.g., the Truth In Lending Act), credit discrimination (e.g., the Equal Credit Opportunity Act), credit reporting (e.g., the Fair Credit Reporting Act), and servicing and collection activities. As a result, Vive is or may be subject to different regulations and different regulators than Progressive Leasing, particularly at the federal level, including the Consumer Financial Protection Bureau.

In addition, through its BNPL offerings, Four allows shoppers to pay for merchandise through four interest-free installments, which enables its customers to purchase furniture, clothing, electronics, health and beauty, footwear, jewelry, and other consumer goods from retailers across the United States. Thus, Four’s business model differs significantly from Progressive Leasing’s and Vive’s business models, which also creates different risks than those faced by Progressive Leasing and Vive, including, for example, different regulatory requirements and related risks.

The risks that are specific to Vive may also have a material and adverse effect on several aspects of our performance in the future.

Interruptions, inventory shortages and other factors affecting the supply chains of our retail partners may have a material and adverse effect on several aspects of our performance.

The POS partners with whom our Progressive Leasing, Vive and Four businesses partner are critical to our success. Any extended supply chain interruptions, inventory shortages or other operational disruptions affecting any of our POS partners may have a material adverse impact on our business. We depend on our POS partners’ abilities to deliver products to customers at the right time and in the right quantities. Accordingly, it is important for our POS partners to maintain optimal levels of inventory and respond rapidly to shifting demands. For example, during the first half of 2022, global supply chain issues attributable to the COVID-19 pandemic negatively impacted inventory and stocking levels in the retail industry. Future increases in the number and/or severity of COVID-19 infections in countries from which our POS partners source merchandise, such as China, could result in similar supply chain disruptions and inventory shortages for our POS partners in future periods, which could adversely affect their sales and Progressive Leasing’s GMV, revenue and earnings.

The COVID-19 pandemic has had, and may continue to have, among other risks, a material and adverse effect on several aspects of our performance.