mktw-20221231FALSE2022FY00018056510.5100018056512022-01-012022-12-3100018056512022-06-30iso4217:USD0001805651us-gaap:CommonClassAMember2023-03-27xbrli:shares0001805651us-gaap:CommonClassBMember2023-03-2700018056512022-12-3100018056512021-12-310001805651us-gaap:CommonClassAMember2021-12-31iso4217:USDxbrli:shares0001805651us-gaap:CommonClassAMember2022-12-310001805651us-gaap:CommonClassBMember2022-12-310001805651us-gaap:CommonClassBMember2021-12-3100018056512021-01-012021-12-3100018056512020-01-012020-12-3100018056512021-07-222021-12-310001805651us-gaap:CostOfSalesMember2022-01-012022-12-310001805651us-gaap:CostOfSalesMember2021-01-012021-12-310001805651us-gaap:CostOfSalesMember2020-01-012020-12-310001805651us-gaap:SellingAndMarketingExpenseMember2022-01-012022-12-310001805651us-gaap:SellingAndMarketingExpenseMember2021-01-012021-12-310001805651us-gaap:SellingAndMarketingExpenseMember2020-01-012020-12-310001805651us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001805651us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001805651us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310001805651us-gaap:MemberUnitsMember2019-12-310001805651us-gaap:CommonStockMemberus-gaap:CommonClassAMember2019-12-310001805651us-gaap:CommonClassBMemberus-gaap:CommonStockMember2019-12-310001805651us-gaap:PreferredStockMember2019-12-310001805651us-gaap:AdditionalPaidInCapitalMember2019-12-310001805651us-gaap:RetainedEarningsMember2019-12-310001805651us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001805651us-gaap:ParentMember2019-12-310001805651us-gaap:NoncontrollingInterestMember2019-12-3100018056512019-12-310001805651us-gaap:MemberUnitsMember2020-01-012020-12-310001805651us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001805651us-gaap:ParentMember2020-01-012020-12-310001805651us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001805651us-gaap:MemberUnitsMember2020-12-310001805651us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-12-310001805651us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-12-310001805651us-gaap:PreferredStockMember2020-12-310001805651us-gaap:AdditionalPaidInCapitalMember2020-12-310001805651us-gaap:RetainedEarningsMember2020-12-310001805651us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001805651us-gaap:ParentMember2020-12-310001805651us-gaap:NoncontrollingInterestMember2020-12-3100018056512020-12-310001805651us-gaap:MemberUnitsMember2021-01-012021-07-210001805651us-gaap:NoncontrollingInterestMember2021-01-012021-07-2100018056512021-01-012021-07-210001805651us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-07-210001805651us-gaap:ParentMember2021-01-012021-07-210001805651us-gaap:AdditionalPaidInCapitalMember2021-07-212021-07-210001805651us-gaap:ParentMember2021-07-212021-07-2100018056512021-07-212021-07-210001805651us-gaap:MemberUnitsMember2021-07-212021-07-210001805651us-gaap:RetainedEarningsMember2021-07-212021-07-210001805651us-gaap:NoncontrollingInterestMember2021-07-212021-07-210001805651us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-07-212021-07-210001805651us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-07-212021-07-210001805651us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-212021-07-210001805651us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-07-222021-12-310001805651us-gaap:AdditionalPaidInCapitalMember2021-07-222021-12-310001805651us-gaap:ParentMember2021-07-222021-12-310001805651us-gaap:NoncontrollingInterestMember2021-07-222021-12-310001805651us-gaap:RetainedEarningsMember2021-07-222021-12-310001805651us-gaap:MemberUnitsMember2021-12-310001805651us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-12-310001805651us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-12-310001805651us-gaap:PreferredStockMember2021-12-310001805651us-gaap:AdditionalPaidInCapitalMember2021-12-310001805651us-gaap:RetainedEarningsMember2021-12-310001805651us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001805651us-gaap:ParentMember2021-12-310001805651us-gaap:NoncontrollingInterestMember2021-12-310001805651us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001805651us-gaap:ParentMember2022-01-012022-12-310001805651us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-01-012022-12-310001805651us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001805651us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001805651us-gaap:RetainedEarningsMember2022-01-012022-12-310001805651us-gaap:MemberUnitsMember2022-12-310001805651us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001805651us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-12-310001805651us-gaap:PreferredStockMember2022-12-310001805651us-gaap:AdditionalPaidInCapitalMember2022-12-310001805651us-gaap:RetainedEarningsMember2022-12-310001805651us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001805651us-gaap:ParentMember2022-12-310001805651us-gaap:NoncontrollingInterestMember2022-12-310001805651mktw:MarketwiseLLCMember2021-07-22xbrli:pure0001805651mktw:MarketwiseLLCMember2022-12-310001805651us-gaap:CommonClassAMembermktw:AscendantDigitalAcquisitionCorpMember2021-07-2100018056512021-07-210001805651us-gaap:CommonClassAMember2021-07-210001805651us-gaap:CommonClassBMember2021-07-212021-07-210001805651us-gaap:CommonClassBMember2021-07-210001805651mktw:SponsorMember2021-07-210001805651mktw:PrivatePlacementWarrantsMember2021-07-210001805651mktw:MarketWiseIncMembermktw:AscendantDigitalAcquisitionCorpPublicShareholdersMember2021-07-210001805651mktw:MarketWiseIncMembermktw:MarketWiseMembersMember2021-07-210001805651mktw:MarketWiseIncMembermktw:AscendantSponsorLpMember2021-07-210001805651mktw:MarketWiseIncMembermktw:PIPEInvestorsMember2021-07-210001805651mktw:IncentiveAwardPlan2021Member2021-07-210001805651us-gaap:EmployeeStockMember2022-12-310001805651us-gaap:CommonClassAMember2022-01-012022-01-010001805651us-gaap:EmployeeStockMember2022-01-012022-01-010001805651us-gaap:CommonClassBMember2022-01-012022-12-310001805651mktw:ManagementMembersMember2021-07-210001805651mktw:ReverseRecapitalizationContingentConsiderationEquityEarnoutPeriodOneMember2021-07-212021-07-21mktw:tradingDay0001805651mktw:ReverseRecapitalizationContingentConsiderationEquityEarnoutPeriodTwoMember2021-07-212021-07-210001805651srt:RestatementAdjustmentMember2021-01-012021-12-31mktw:segment0001805651us-gaap:TransferredOverTimeMemberus-gaap:SubscriptionAndCirculationMember2022-01-012022-12-310001805651us-gaap:AdvertisingMemberus-gaap:TransferredOverTimeMember2022-01-012022-12-310001805651us-gaap:TransferredOverTimeMember2022-01-012022-12-310001805651mktw:RevenueShareThirdPartyMemberus-gaap:TransferredOverTimeMember2022-01-012022-12-310001805651us-gaap:TransferredAtPointInTimeMemberus-gaap:SubscriptionAndCirculationMember2022-01-012022-12-310001805651us-gaap:TransferredAtPointInTimeMemberus-gaap:AdvertisingMember2022-01-012022-12-310001805651us-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001805651us-gaap:TransferredAtPointInTimeMembermktw:RevenueShareThirdPartyMember2022-01-012022-12-310001805651us-gaap:SubscriptionAndCirculationMember2022-01-012022-12-310001805651us-gaap:AdvertisingMember2022-01-012022-12-310001805651mktw:RevenueShareThirdPartyMember2022-01-012022-12-310001805651us-gaap:TransferredOverTimeMemberus-gaap:SubscriptionAndCirculationMember2021-01-012021-12-310001805651us-gaap:AdvertisingMemberus-gaap:TransferredOverTimeMember2021-01-012021-12-310001805651us-gaap:TransferredOverTimeMember2021-01-012021-12-310001805651mktw:RevenueShareThirdPartyMemberus-gaap:TransferredOverTimeMember2021-01-012021-12-310001805651us-gaap:TransferredAtPointInTimeMemberus-gaap:SubscriptionAndCirculationMember2021-01-012021-12-310001805651us-gaap:TransferredAtPointInTimeMemberus-gaap:AdvertisingMember2021-01-012021-12-310001805651us-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001805651us-gaap:TransferredAtPointInTimeMembermktw:RevenueShareThirdPartyMember2021-01-012021-12-310001805651us-gaap:SubscriptionAndCirculationMember2021-01-012021-12-310001805651us-gaap:AdvertisingMember2021-01-012021-12-310001805651mktw:RevenueShareThirdPartyMember2021-01-012021-12-310001805651us-gaap:TransferredOverTimeMemberus-gaap:SubscriptionAndCirculationMember2020-01-012020-12-310001805651us-gaap:AdvertisingMemberus-gaap:TransferredOverTimeMember2020-01-012020-12-310001805651us-gaap:TransferredOverTimeMember2020-01-012020-12-310001805651mktw:RevenueShareThirdPartyMemberus-gaap:TransferredOverTimeMember2020-01-012020-12-310001805651us-gaap:TransferredAtPointInTimeMemberus-gaap:SubscriptionAndCirculationMember2020-01-012020-12-310001805651us-gaap:TransferredAtPointInTimeMemberus-gaap:AdvertisingMember2020-01-012020-12-310001805651us-gaap:TransferredAtPointInTimeMember2020-01-012020-12-310001805651us-gaap:TransferredAtPointInTimeMembermktw:RevenueShareThirdPartyMember2020-01-012020-12-310001805651us-gaap:SubscriptionAndCirculationMember2020-01-012020-12-310001805651us-gaap:AdvertisingMember2020-01-012020-12-310001805651mktw:RevenueShareThirdPartyMember2020-01-012020-12-310001805651mktw:MembershipSubscriptionsMember2022-01-012022-12-310001805651mktw:MembershipSubscriptionsMember2021-01-012021-12-310001805651mktw:MembershipSubscriptionsMember2020-01-012020-12-310001805651mktw:TermSubscriptionsMember2022-01-012022-12-310001805651mktw:TermSubscriptionsMember2021-01-012021-12-310001805651mktw:TermSubscriptionsMember2020-01-012020-12-310001805651mktw:NonSubscriptionRevenueMember2022-01-012022-12-310001805651mktw:NonSubscriptionRevenueMember2021-01-012021-12-310001805651mktw:NonSubscriptionRevenueMember2020-01-012020-12-310001805651country:US2022-01-012022-12-310001805651country:US2021-01-012021-12-310001805651country:US2020-01-012020-12-310001805651us-gaap:NonUsMember2022-01-012022-12-310001805651us-gaap:NonUsMember2021-01-012021-12-310001805651us-gaap:NonUsMember2020-01-012020-12-3100018056512023-01-012022-12-310001805651mktw:ButtonwoodPublishingMember2022-09-300001805651mktw:ButtonwoodPublishingMember2022-07-012022-09-300001805651mktw:ButtonwoodPublishingMember2022-12-310001805651us-gaap:TradeNamesMembermktw:ButtonwoodPublishingMember2022-12-310001805651mktw:ButtonwoodPublishingMemberus-gaap:CustomerRelationshipsMember2022-12-310001805651us-gaap:TradeNamesMembermktw:ButtonwoodPublishingMember2022-07-012022-09-300001805651mktw:ButtonwoodPublishingMemberus-gaap:CustomerRelationshipsMember2022-07-012022-09-300001805651mktw:ButtonwoodPublishingMember2022-01-012022-12-310001805651mktw:ChaikinHoldingsLLCMember2021-01-210001805651mktw:ChaikinHoldingsLLCMember2021-01-212021-01-210001805651mktw:ChaikinHoldingsLLCMemberus-gaap:CustomerRelationshipsMember2021-01-210001805651us-gaap:TradeNamesMembermktw:ChaikinHoldingsLLCMember2021-01-210001805651mktw:ChaikinHoldingsLLCMemberus-gaap:ComputerSoftwareIntangibleAssetMember2021-01-210001805651us-gaap:TradeNamesMembermktw:ChaikinHoldingsLLCMember2021-01-212021-01-210001805651mktw:ChaikinHoldingsLLCMemberus-gaap:CustomerRelationshipsMember2021-01-212021-01-210001805651mktw:ChaikinHoldingsLLCMember2022-01-012022-12-310001805651mktw:ChaikinHoldingsLLCMember2021-01-012021-12-310001805651mktw:ChaikinHoldingsLLCMember2022-09-300001805651mktw:ChaikinHoldingsLLCMember2022-07-012022-09-300001805651mktw:TradeSmithMember2020-01-050001805651mktw:TradeSmithMember2020-01-052020-01-050001805651mktw:TradeSmithMember2020-12-31mktw:reporting_unitmktw:reportableSegment0001805651mktw:A1729ResearchMember2022-12-310001805651mktw:A1729ResearchMember2021-12-310001805651mktw:LegacyResearchMember2022-12-310001805651mktw:LegacyResearchMember2021-12-310001805651mktw:AtlaMember2022-12-310001805651mktw:AtlaMember2021-12-310001805651us-gaap:CustomerRelationshipsMember2022-12-310001805651us-gaap:CustomerRelationshipsMember2022-01-012022-12-310001805651us-gaap:TradeNamesMember2022-12-310001805651us-gaap:TradeNamesMember2022-01-012022-12-310001805651us-gaap:SoftwareDevelopmentMember2022-12-310001805651us-gaap:SoftwareDevelopmentMember2022-01-012022-12-310001805651us-gaap:InternetDomainNamesMember2022-12-310001805651us-gaap:CustomerRelationshipsMember2021-12-310001805651us-gaap:CustomerRelationshipsMember2021-01-012021-12-310001805651us-gaap:TradeNamesMember2021-12-310001805651us-gaap:TradeNamesMember2021-01-012021-12-310001805651us-gaap:SoftwareDevelopmentMember2021-12-310001805651us-gaap:SoftwareDevelopmentMember2021-01-012021-12-310001805651us-gaap:InternetDomainNamesMember2021-12-310001805651us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001805651us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001805651us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001805651us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001805651us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001805651us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001805651us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001805651us-gaap:FairValueMeasurementsRecurringMember2022-12-310001805651us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherContractMember2022-12-310001805651us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherContractMember2022-12-310001805651us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherContractMember2022-12-310001805651us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherContractMember2022-12-310001805651us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2021-12-310001805651us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2021-12-310001805651us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2021-12-310001805651us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2021-12-310001805651us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001805651us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001805651us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001805651us-gaap:FairValueMeasurementsRecurringMember2021-12-310001805651us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherContractMember2021-12-310001805651us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherContractMember2021-12-310001805651us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherContractMember2021-12-310001805651us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherContractMember2021-12-310001805651us-gaap:FairValueInputsLevel1Membermktw:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001805651mktw:PublicWarrantsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001805651mktw:PublicWarrantsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001805651mktw:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001805651us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMembermktw:PrivatePlacementWarrantsMember2021-12-310001805651us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembermktw:PrivatePlacementWarrantsMember2021-12-310001805651us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMembermktw:PrivatePlacementWarrantsMember2021-12-310001805651us-gaap:FairValueMeasurementsRecurringMembermktw:PrivatePlacementWarrantsMember2021-12-310001805651us-gaap:MeasurementInputPriceVolatilityMember2022-12-310001805651us-gaap:MeasurementInputDiscountRateMember2022-12-310001805651us-gaap:MeasurementInputCreditSpreadMember2022-12-310001805651us-gaap:MeasurementInputRiskFreeInterestRateMember2022-12-310001805651us-gaap:OtherContractMember2020-01-012020-12-310001805651us-gaap:EquityContractMember2020-01-012020-12-310001805651us-gaap:OtherContractMember2021-01-012021-12-310001805651us-gaap:EquityContractMember2021-01-012021-12-310001805651us-gaap:OtherContractMember2022-01-012022-12-310001805651us-gaap:CommonClassBMemberus-gaap:CostOfSalesMember2022-01-012022-12-310001805651us-gaap:CommonClassBMemberus-gaap:CostOfSalesMember2021-01-012021-12-310001805651us-gaap:CommonClassBMemberus-gaap:CostOfSalesMember2020-01-012020-12-310001805651us-gaap:CommonClassBMemberus-gaap:SellingAndMarketingExpenseMember2022-01-012022-12-310001805651us-gaap:CommonClassBMemberus-gaap:SellingAndMarketingExpenseMember2021-01-012021-12-310001805651us-gaap:CommonClassBMemberus-gaap:SellingAndMarketingExpenseMember2020-01-012020-12-310001805651us-gaap:CommonClassBMemberus-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001805651us-gaap:CommonClassBMemberus-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001805651us-gaap:CommonClassBMemberus-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310001805651us-gaap:CommonClassBMember2021-01-012021-12-310001805651us-gaap:CommonClassBMember2020-01-012020-12-310001805651us-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001805651us-gaap:FurnitureAndFixturesMember2022-12-310001805651us-gaap:FurnitureAndFixturesMember2021-12-310001805651mktw:ComputersSoftwareAndEquipmentMember2022-01-012022-12-310001805651mktw:ComputersSoftwareAndEquipmentMember2022-12-310001805651mktw:ComputersSoftwareAndEquipmentMember2021-12-310001805651us-gaap:LeaseholdImprovementsMember2022-12-310001805651us-gaap:LeaseholdImprovementsMember2021-12-310001805651us-gaap:NondesignatedMembermktw:WarrantContractMember2021-01-012021-12-310001805651us-gaap:NondesignatedMembermktw:WarrantContractMember2020-01-012020-12-310001805651us-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:OtherContractMember2022-01-012022-12-310001805651us-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:OtherContractMember2021-01-012021-12-310001805651us-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:OtherContractMember2020-01-012020-12-310001805651us-gaap:NondesignatedMemberus-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:OtherContractMember2022-01-012022-12-310001805651us-gaap:NondesignatedMemberus-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:OtherContractMember2021-01-012021-12-310001805651us-gaap:NondesignatedMemberus-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:OtherContractMember2020-01-012020-12-310001805651us-gaap:NondesignatedMemberus-gaap:StockOptionMember2022-01-012022-12-310001805651us-gaap:NondesignatedMemberus-gaap:StockOptionMember2021-01-012021-12-310001805651us-gaap:NondesignatedMemberus-gaap:StockOptionMember2020-01-012020-12-310001805651us-gaap:NondesignatedMember2022-01-012022-12-310001805651us-gaap:NondesignatedMember2021-01-012021-12-310001805651us-gaap:NondesignatedMember2020-01-012020-12-310001805651us-gaap:LineOfCreditMember2021-10-290001805651us-gaap:LetterOfCreditMember2021-10-290001805651us-gaap:LineOfCreditMember2021-10-292021-10-290001805651srt:MinimumMember2022-12-310001805651srt:MaximumMember2022-12-310001805651mktw:LeaseOneMember2022-12-310001805651mktw:LeaseTwoMember2022-12-310001805651mktw:IncentiveAwardPlan2021Member2022-01-012022-12-310001805651mktw:IncentiveAwardPlan2021Member2021-01-012021-12-310001805651mktw:IncentiveAwardPlan2021Member2020-01-012020-12-310001805651us-gaap:EmployeeStockMember2022-01-012022-12-310001805651us-gaap:EmployeeStockMember2021-01-012021-12-310001805651us-gaap:EmployeeStockMember2020-01-012020-12-310001805651mktw:ClassBShareBasedCompensationExpenseVestedAndChangeInFairValueMember2022-01-012022-12-310001805651mktw:ClassBShareBasedCompensationExpenseVestedAndChangeInFairValueMember2021-01-012021-12-310001805651mktw:ClassBShareBasedCompensationExpenseVestedAndChangeInFairValueMember2020-01-012020-12-310001805651mktw:ClassBShareBasedCompensationExpenseProfitsDistributionsToUnitholdersMember2022-01-012022-12-310001805651mktw:ClassBShareBasedCompensationExpenseProfitsDistributionsToUnitholdersMember2021-01-012021-12-310001805651mktw:ClassBShareBasedCompensationExpenseProfitsDistributionsToUnitholdersMember2020-01-012020-12-310001805651mktw:A2021IncentiveAwardPlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-05-162022-05-160001805651mktw:A2021IncentiveAwardPlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-06-022022-06-020001805651mktw:A2021IncentiveAwardPlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-12-162022-12-160001805651mktw:RSUAndSARMember2022-01-012022-12-310001805651us-gaap:RestrictedStockUnitsRSUMember2021-12-310001805651us-gaap:StockAppreciationRightsSARSMember2021-12-310001805651us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001805651us-gaap:StockAppreciationRightsSARSMember2022-01-012022-12-310001805651us-gaap:RestrictedStockUnitsRSUMember2022-12-310001805651us-gaap:StockAppreciationRightsSARSMember2022-12-310001805651mktw:RSUAndSARMember2021-01-012021-12-310001805651us-gaap:EmployeeStockMember2022-01-010001805651us-gaap:CommonClassBMember2022-01-012022-01-010001805651us-gaap:EmployeeStockMember2022-01-012022-12-310001805651mktw:ClassBShareBasedCompensationExpenseMember2021-01-012021-12-310001805651mktw:ClassBShareBasedCompensationExpenseMember2020-01-012020-12-310001805651us-gaap:CostOfSalesMembermktw:ClassBShareBasedCompensationExpenseMember2022-01-012022-12-310001805651us-gaap:CostOfSalesMembermktw:ClassBShareBasedCompensationExpenseMember2021-01-012021-12-310001805651us-gaap:CostOfSalesMembermktw:ClassBShareBasedCompensationExpenseMember2020-01-012020-12-310001805651us-gaap:SellingAndMarketingExpenseMembermktw:ClassBShareBasedCompensationExpenseMember2022-01-012022-12-310001805651us-gaap:SellingAndMarketingExpenseMembermktw:ClassBShareBasedCompensationExpenseMember2021-01-012021-12-310001805651us-gaap:SellingAndMarketingExpenseMembermktw:ClassBShareBasedCompensationExpenseMember2020-01-012020-12-310001805651us-gaap:GeneralAndAdministrativeExpenseMembermktw:ClassBShareBasedCompensationExpenseMember2022-01-012022-12-310001805651us-gaap:GeneralAndAdministrativeExpenseMembermktw:ClassBShareBasedCompensationExpenseMember2021-01-012021-12-310001805651us-gaap:GeneralAndAdministrativeExpenseMembermktw:ClassBShareBasedCompensationExpenseMember2020-01-012020-12-310001805651mktw:ClassBShareBasedCompensationExpenseMember2022-01-012022-12-310001805651us-gaap:CommonClassBMember2020-12-310001805651us-gaap:NondesignatedMembermktw:WarrantContractMember2022-01-012022-12-310001805651mktw:PublicWarrantsMember2021-07-222021-12-310001805651mktw:PrivatePlacementWarrantsMember2021-07-222021-12-310001805651mktw:SponsorEarnOutSharesMember2022-01-012022-12-310001805651mktw:MemberEarnOutSharesMember2022-01-012022-12-310001805651us-gaap:DomesticCountryMember2022-12-310001805651us-gaap:DomesticCountryMember2021-12-310001805651us-gaap:StateAndLocalJurisdictionMember2022-12-310001805651us-gaap:StateAndLocalJurisdictionMember2021-12-310001805651mktw:RelatedPartyOwnerAndAffiliatesMembermktw:RevenueShareExpensesMember2022-01-012022-12-310001805651mktw:RelatedPartyOwnerAndAffiliatesMembermktw:RevenueShareExpensesMember2021-01-012021-12-310001805651mktw:RelatedPartyOwnerAndAffiliatesMembermktw:RevenueShareExpensesMember2020-01-012020-12-310001805651mktw:CallCenterSupportAndOtherServicesExpenseMembermktw:RelatedPartyOwnerAndAffiliatesMember2022-01-012022-12-310001805651mktw:CallCenterSupportAndOtherServicesExpenseMembermktw:RelatedPartyOwnerAndAffiliatesMember2021-01-012021-12-310001805651mktw:CallCenterSupportAndOtherServicesExpenseMembermktw:RelatedPartyOwnerAndAffiliatesMember2020-01-012020-12-310001805651srt:DirectorMembermktw:FeesForBoardOfDirectorsMember2022-01-012022-12-310001805651srt:DirectorMembermktw:FeesForBoardOfDirectorsMember2021-01-012021-12-310001805651srt:DirectorMembermktw:FeesForBoardOfDirectorsMember2020-01-012020-12-310001805651mktw:RelatedPartyOwnerMembermktw:CorporateFunctionsMember2022-01-012022-12-310001805651mktw:RelatedPartyOwnerMembermktw:CorporateFunctionsMember2021-01-012021-12-310001805651mktw:RelatedPartyOwnerMembermktw:CorporateFunctionsMember2020-01-012020-12-310001805651mktw:RelatedPartyOwnerMembermktw:CorporateFunctionsMember2022-12-310001805651mktw:RelatedPartyOwnerMembermktw:CorporateFunctionsMember2021-12-310001805651mktw:ClassBUnitholdersMembermktw:FeesAndAccountingAndMarketingServicesRevenueMember2022-01-012022-12-310001805651mktw:ClassBUnitholdersMembermktw:FeesAndAccountingAndMarketingServicesRevenueMember2021-01-012021-12-310001805651mktw:ClassBUnitholdersMembermktw:FeesAndAccountingAndMarketingServicesRevenueMember2020-01-012020-12-310001805651mktw:ClassBUnitholdersMembermktw:FeesAndAccountingAndMarketingServicesRevenueMember2022-12-310001805651mktw:ClassBUnitholdersMembermktw:FeesAndAccountingAndMarketingServicesRevenueMember2021-12-310001805651mktw:RelatedPartyOwnerMember2022-01-012022-12-310001805651mktw:RelatedPartyOwnerMember2021-01-012021-12-310001805651mktw:RelatedPartyOwnerMember2020-01-012020-12-310001805651mktw:RelatedPartyOwnerMember2022-12-310001805651mktw:RelatedPartyOwnerMember2021-12-310001805651mktw:ClassAUnitholderNoteIssuedApril2020Membermktw:ClassAUnitholdersMember2020-04-300001805651mktw:ClassAUnitholderNoteIssuedApril2020Membermktw:ClassAUnitholdersMember2022-01-012022-12-310001805651mktw:ClassAUnitholderNoteIssuedApril2020Membermktw:ClassAUnitholdersMember2021-01-012021-12-310001805651mktw:ClassAUnitholderNoteIssuedApril2020Membermktw:ClassAUnitholdersMember2021-12-310001805651mktw:FounderMembermktw:OneTimeBonusPaymentMember2021-07-012021-07-310001805651mktw:LeadGenerationMarketingExpenseMembermktw:RelatedPartyVendorMember2020-01-012020-12-310001805651mktw:ClassBUnitholdersMembermktw:ClassBUnitholderNoteIssuedAugust2019Member2019-08-310001805651mktw:ClassBUnitholdersMembermktw:ClassBUnitholderNoteIssuedAugust2019Member2020-01-012020-12-310001805651us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001805651us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001805651mktw:SponsorEarnOutSharesMember2022-12-310001805651mktw:ManagementEarnOutSharesMember2022-12-31mktw:vote00018056512021-11-0400018056512021-11-042022-12-310001805651mktw:WarrantExchangeOfferTotalMemberus-gaap:CommonClassAMember2022-12-310001805651us-gaap:CommonClassAMembermktw:WarrantExchangeOfferMember2022-08-1700018056512022-09-140001805651us-gaap:CommonClassAMembermktw:WarrantExchangeOfferMember2022-09-190001805651us-gaap:CommonClassAMembermktw:WarrantExchangeOfferMember2022-09-150001805651us-gaap:CommonClassAMembermktw:WarrantExchangeOfferMember2022-09-300001805651mktw:WarrantExchangeOfferMember2022-09-300001805651mktw:WarrantExchangeOfferMember2022-12-310001805651us-gaap:SubsequentEventMembermktw:A2021IncentiveAwardPlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-39405

MarketWise, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | |

| Delaware | 87-1767914 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification Number) |

| | | | | |

1125 N. Charles Street Baltimore, Maryland | 21201 |

| (Address of principal executive offices) | (Zip Code) |

(Address of principal executive offices, including zip code)

(888) 261-2693

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, $0.0001 par value per share | MKTW | The Nasdaq Stock Market LLC |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☑

No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d). ☐ Yes ☑ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☑ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☑ Yes ☐ No

Indicate by check mark whether the registrant is large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| | | | |

| Non-accelerated filer | ☑ | | Smaller reporting company | ☑ |

| | | | |

| | | Emerging growth company | ☑ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 12 (a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☑ No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the closing price of the registrant’s shares of Class A common stock as reported by The Nasdaq Global Market on June 30, 2022 was approximately $48.2 million.

As of March 27, 2023, there were 34,827,077 shares of the registrant’s Class A common stock and 291,092,303 shares of the registrant’s Class B common stock, each with a par value of $0.0001 per share, outstanding.

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| PART I. | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| PART II. | | |

| Item 5. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| PART III. | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| PART IV. | | |

| Item 15. | | |

| Item 16. | | |

| | |

Summary Risk Factors

The following is a summary of some of the risks, uncertainties, and assumptions that could materially adversely affect our business, financial position, results of operations, and cash flows. In particular, the following considerations, among others, may offset our competitive strengths or have a negative effect on our business strategy, which could cause a decline in the price of our securities. You should read this summary together with the more detailed description of each risk factor contained below.

•Our business depends on our ability to attract new subscribers and to persuade existing subscribers to renew their subscription agreements with us and to purchase additional products and services from us. If we are unable to attract new subscribers, or continue to engage existing subscribers, our revenue and operating results may be adversely affected.

•If we fail to adequately market our products and services, or to monitor and manage our use of social media platforms as marketing tools, it could have a material adverse effect on our business, results of operations, and financial condition.

•Failure to maintain and protect our reputation for trustworthiness and independence may harm our business. In addition, in the event the reputation of any of our current or former directors, officers, key contributors, editors, or staff were harmed for any reason, our business, results of operations, and financial condition could suffer.

•If we fail to effectively manage our growth, our business, results of operations, and financial condition could be harmed.

•Our future success depends on attracting, developing, and retaining capable management, editors, and other key personnel.

•Our success depends on our ability to respond to and adapt to changes in technology and consumer behavior.

•If we are unable to successfully integrate acquisitions, identify and integrate future acquisitions, or dispose of assets and businesses, our results of operations could be adversely affected.

•Because we recognize revenue from subscriptions for our services over the term of the subscription, downturns or upturns in new business may not be immediately reflected in our operating results.

•Our business, products, and facilities are at risk of a number of material disruptive events that our operational risk management and business continuity programs may not be adequate to address.

•Disruptions to our third-party technology providers and management systems could harm our business and lead to loss of subscribers.

•We are subject to payment processing risk.

•Failure to comply with laws and regulations or other regulatory action or investigations, including with respect to the federal and state securities laws, could adversely affect our business.

•We could face liability for the information and data we collect and distribute or the reports and other documents produced by our software products.

•Any failure of our internal security measures or breach of our privacy protections could cause us to lose subscribers and subject us to liability.

•We are subject to laws, regulations, and industry standards related to data privacy, data protection, and information security, including industry requirements such as the Payment Card Industry Data Security Standard. Our actual or perceived failure to comply with such obligations could harm our business.

•Changes in our provision for income taxes or adverse outcomes resulting from examination of our income or other tax returns or changes in tax legislation could adversely affect our business, financial condition, and results of operations.

•MarketWise, Inc.’s sole material asset is its interest in MarketWise, LLC, and, accordingly, it will depend on distributions from MarketWise, LLC to pay its taxes and expenses, including payments under the Tax Receivable Agreement. MarketWise, LLC’s ability to make such distributions may be subject to various limitations and restrictions.

•The Tax Receivable Agreement requires MarketWise, Inc. to make cash payments to the members of the MarketWise, LLC, other than MarketWise, Inc. (the “MarketWise Members”) in respect of certain tax benefits to which MarketWise, Inc. may become entitled, and no such payments will be made to any holders of our Class A common stock unless such holders are also MarketWise Members. The payments MarketWise, Inc. will be required to make under the Tax Receivable Agreement may be substantial.

•The MarketWise Members have significant influence over us, including control over decisions that require the approval of MarketWise, Inc. stockholders.

•The MarketWise Members have the right to have their MarketWise Units redeemed or exchanged into shares of Class A common stock, which, if exercised, will dilute your economic interest in MarketWise, Inc.

•A significant portion of the total outstanding shares of our Class A common stock (or shares of our Class A common stock that may be issued in the future pursuant to the exchange or redemption of MarketWise Units) are restricted from immediate resale but may be sold into the market in the near future. This could cause the market price of our securities to drop significantly, even if our business is doing well.

•Under certain circumstances, the Sponsor and certain members of our management team will be entitled to the Sponsor Earnout Shares and the Management Member Earnout Shares, as applicable, which will increase the number of shares eligible for future resale in the public market and result in dilution to our stockholders.

•We have identified material weaknesses in our internal control over financial reporting and may identify additional material weaknesses in the future that may cause us to fail to meet our reporting obligations or result in material misstatements of our financial statements. If we fail to remediate any material weaknesses or if we fail to establish and maintain effective control over financial reporting, our ability to accurately and timely report financial results could be adversely affected.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K contains forward-looking statements within the meaning of federal securities law, and as such are not historical facts. This includes, without limitation, statements regarding our financial position and business strategy, and the plans and objectives of management for our future operations. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this report, words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections, and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this report, including, but not limited to:

•our ability to attract new subscribers and to persuade existing subscribers to renew their subscription agreements with us and to purchase additional products and services from us;

•our ability to adequately market our products and services, and to develop additional products and product offerings;

•our ability to manage our growth effectively, including through acquisitions;

•failure to maintain and protect our reputation for trustworthiness and independence;

•our ability to attract, develop, and retain capable management, editors, and other key personnel;

•our ability to grow market share in our existing markets or any new markets we may enter;

•adverse or weakened conditions in the financial sector, global financial markets, and global economy;

•our ability to respond to and adapt to changes in technology and consumer behavior;

•failure to successfully identify and integrate acquisitions, or dispose of assets and businesses;

•our public securities’ potential liquidity and trading;

•the impact of the regulatory environment and complexities with compliance related to such environment;

•the impact of the COVID-19 pandemic;

•our future capital needs;

•our ability to maintain an effective system of internal control over financial reporting, and to address and remediate existing material weaknesses in our internal control over financial reporting;

•our ability to maintain and protect our intellectual property; and

•other factors detailed under the section of this report entitled “Risk Factors.”

These forward-looking statements are based on information available as of the date of this report and current expectations, forecasts, and assumptions, and involve a number of judgments, risks, and uncertainties. Additionally, as a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements for any reason, except as may be required under applicable securities laws.

PART I

Item 1. Business.

Unless the context otherwise requires, all references in this subsection to “MarketWise,” “we,” “us,” or “our” refer to the business of MarketWise, LLC and its subsidiaries prior to the Closing, and to the business of MarketWise Inc. and its subsidiaries after the Closing.

We started in 1999 with the simple idea that, if we could publish intelligent, independent, insightful, and in-depth investment research and treat the subscriber the way we would want to be treated, then subscribers would renew their subscriptions and stay with us. That simple idea worked and has guided our decisions ever since.

Today, we are a leading multi-brand platform of subscription businesses that provides premium financial research, software, education, and tools for self-directed investors. We provide our subscribers with the research, education, and tools that they need to navigate the financial markets.

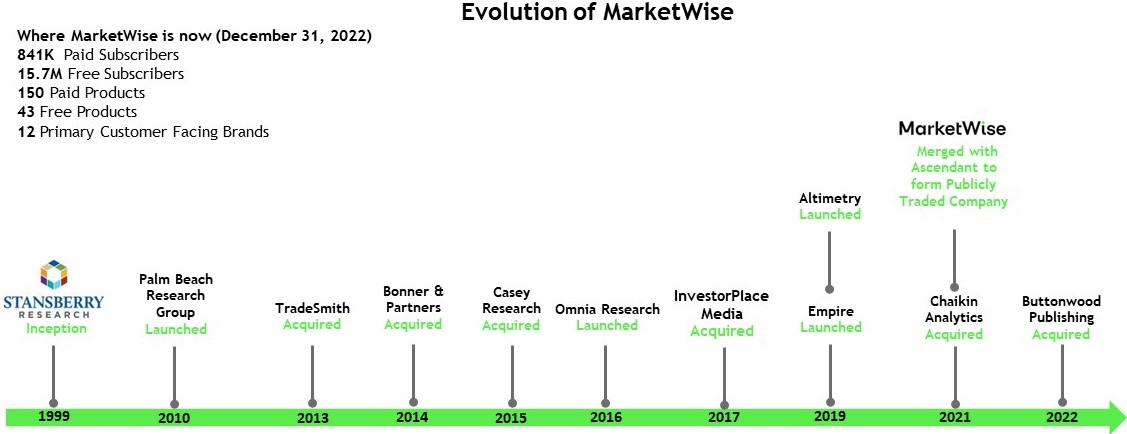

We have evolved significantly since our inception in 1999.

Over the years, we have expanded our business into a comprehensive suite of investment research products and solutions. We now produce a diversified product portfolio from a variety of financial research brands such as Stansberry Research, Palm Beach Research Group, Chaikin Analytics, InvestorPlace, and Empire Financial Research. Our entire investment research product portfolio is 100% digital and channel agnostic. We offer our research across a variety of platforms, including desktop, laptop, and mobile devices, including tablets and mobile phones.

As a result of the expansion of the business, we now have 93 editors and analysts covering a broad spectrum of investments, ranging from commodities to equities, to distressed debt and cryptocurrencies. We offer 43 free and 150 paid products on multiple platforms through our 12 primary customer-facing brands. This diversity of content has allowed our business to succeed and our subscription base to grow through the many economic cycles in our over 20-year history.

We have an engaged subscriber base of approximately 841 thousand Paid Subscribers and a large and growing audience of over 15.7 million Free Subscribers.

Millions of Investors are Taking Control of Their Finances, and We Have the Content and Tools to be Their Guide

The nature of retail investing is rapidly changing, and we are taking advantage of these trends.

Rise of the self-directed investor. Years ago, and even today, retail investors sought advice from traditional investment managers. But over the past two decades, retail investors have increasingly taken control of their own portfolios. There are several reasons for this trend. In the aftermath of the 2008 financial crisis, investor skepticism increased toward large financial institutions and advisors. Meanwhile, the development of online trading and the proliferation of financial information on the Internet has made it easier for investors to take control of their finances and self-direct their investments. Online brokerage platforms have slashed the cost to manage a personal trading account, so investors can now make trades for free or at a fraction of the historical cost.

As a result, the U.S. self-directed investor population is approximately 88 million people in 2022. And this self-directed population is growing by nearly 15% each year, and is expected to increase to approximately 115 million investors by 2024.1

These factors have combined to motivate individual investors to take control of their investment decision-making. These self-directed investors tend to lag the market indices so they seek the expert information to educate

1 Source: Celent Wealth Management, Self-Directed Retail Investment Market Study, March 2021

and empower themselves to manage their own portfolios. As more investors take the self-directed approach to managing their financial future, there is significant demand for investment ideas, education, and market intelligence.

Demographic shifts are increasing demand for our products. Approximately 17% of the U.S. population are individuals over the age of 65.2 And that cohort is growing rapidly, with roughly 10,000 Americans reaching retirement age every day.3 Many of these people have significant retirement accounts on which they rely.

In addition, 65% of Millennials—people born between 1980 and 1994—identify themselves as “self-directed” investors.4 As the Millennials continue to age and grow their investment portfolios, we have a significant opportunity to serve that demographic and grow our business.

Financial markets are becoming more complex. The historical approach toward managing a personal portfolio with a mix of blue-chip stocks, corporate bonds, and cash has become antiquated. The rapid growth of investment opportunities—including products such as exchange-traded funds (“ETFs”), cryptocurrencies, options strategies, and distressed corporate debt—has given self-directed investors today many different and sophisticated ways to invest their money. And those choices continue to specialize and multiply.

As investment options in the global financial markets increase, it becomes harder and harder for investors to stay informed and keep up with the strategies available to them. We and our teams of editors and analysts are constantly surveying the markets for new strategies to help subscribers stay current with the changing markets.

Financial research content is fragmented and price points vary. The landscape of financial research providers is fragmented, with hundreds of publications, platforms, and tools for investment research directed at distinct segments of the investing community.

Financial research providers range from free, advertising-supported platforms or crowdsourced investment websites to low-cost, “mom and pop” newsletter subscription services, many of which do not produce content at scale. There are also extremely expensive, subscription-based software platforms with data and tools designed for highly sophisticated institutional investors.

Our Value Proposition

We empower retail investors with institutional-quality research at a price point that is accessible.

Experienced analysts, with their own unique investment strategies and philosophies, lead our brands. As a result, we do not promote a single, unified view of the markets, but instead we publish a mosaic of opinions, recommendations, and strategies.

This multi-brand approach gives our work far greater breadth, creating more diverse opportunities for our subscribers. Our brands are linked, however, by a continuous commitment to risk management and a contrarian approach to identifying investment opportunities.

Across all our brands, we focus on investments that are unloved, ignored, or unknown. Having an informed perspective in these situations gives our subscribers the best risk-to-reward opportunities.

We recognize that self-directed investors do not have the same research budget and resources at their disposal as institutional investors do. So we strive to provide them with institutional quality research at affordable price points. Unlike traditional institutional research, our offerings are significantly less expensive and more accessible. They are designed to be less technical and therefore more easily understood by the subscribers who aren’t finance professionals. At the same time, our offerings have premium content that is highly actionable.

2 Statista, U.S. - seniors as a percentage of the population 1950-2050, https://www.statista.com/statistics/457822/share-of-old-age-population-in-the-total-us-population/

3 Federal Reserve Bank of St. Louis, How Many People Will Be Retiring in the Years to Come? May 30, 2019, https://www.stlouisfed.org/on-the-economy/2019/may/how-many-people-will-be-retiring-in-the-years-to-come

4 Broadridge Study: 2 in 3 Millenials Likely to Begin Working With FAs: August 2021

We believe that if we publish research to help our subscribers succeed in the financial markets, they will progressively become better investors, renew their subscriptions, and become long-term customers. We have proven out this thesis throughout our over 20-year history. We have formed lifelong relationships with our subscribers by providing superior value through our offerings.

We provide a comprehensive suite of research and software solutions.

Through 12 primary customer facing brands, we have 43 free products and 150 paid products. We cover various investment strategies, such as value investing, income, growth, commodities, cryptocurrencies, venture, crowdfunded investing, biotechnology, mutual funds, options, and trading. We find that our subscribers develop personal affinities for specific writers and certain investment styles, and specific brands. When we acquire brands or form joint ventures, which we engage in periodically, we typically maintain the existing brands because we want to avoid disrupting those relationships by interjecting a new company name or persona, since subscribers may not have any prior relationship with us.

We typically publish our research reports on a monthly basis, although some of our products publish more frequently. We offer our entire investment research product portfolio across a variety of media, including desktops, laptops, tablets, and mobile.

During third quarter 2022, we acquired 100% ownership of certain assets and liabilities from Crowdability, Inc. (“Buttonwood Publishing”), a provider of financial newsletters. We acquired Buttonwood Publishing primarily to expand our copy and editorial talent base.

We also offer financial software and analytical tools.

We continue to expand our research portfolio with software and analytical tool solutions, which include the Chaikin Power Gauge, TradeStops and the Altimeter. Our software and analytical tool solutions represented 8% of our Billings on average from 2020 to 2022.

Our Chaikin Analytics brand offers a suite of stock research tools and portfolio management services that help investors pick winning stocks and drop losing stocks ahead of market shifts. Our TradeSmith brand provides a full suite of portfolio management software tools that enable individual investors to manage their portfolios using algorithms that have been back tested for results and designed to help investors manage their emotions. Our Altimetry brand offers a user-friendly database showing uniform, accounting-based financial summaries for more than 4,900 companies.

We have developed screeners, monitors, portfolio management tools, and a set of proprietary indicators that produce a composite score to rank several thousand publicly traded companies in the United States. Our various digital research platforms integrate our content with public financial data in well-designed user interfaces to provide our users with valuable tools to easily consume our research, keep track of investments, import their portfolios and more.

Our product offerings reinforce each other and produce a strong flywheel effect across our organization. As we launch or add more products, we increase the tools available to our readers and the value we provide to our existing subscribers. This allows us to gather insights and feedback and helps us create new products and solutions.

We are dedicated to honoring our long-term commitment to subscribers.

We believe investing is a lifelong endeavor—one that requires constant learning, course corrections, openness to change, and emotional discipline. In keeping with this core belief, we strive to build long-term relationships with our subscribers.

We believe in publishing content that is educational, informative, and easy to understand, and therefore helps our subscribers become better investors over time. This reinforces our lifelong relationships with our subscribers as they can grow with our platform. This forms a “virtuous cycle” of learning and improving through our offerings. As subscribers learn more about how to manage their investments, that makes them more comfortable with

investigating the more specialized content covered in our high-end services, which further encourages them to continue broadening their investing skill set.

Our market leadership, scale, and access to a wide set of subscribers creates strong network effects. As we grow, we have larger budgets, which allows us to reinvest back into our research platform by hiring more analysts, developing more software and tools, and launching new products, which, in turn, helps us attract more subscribers to our platform.

We are committed and continue to invest in our subscriber experience.

Our relationship with our subscribers is our most precious asset, and we strive to put the customer first in everything that we do. This customer-centric focus drives us to constantly upgrade the quality, breadth, and depth of our research in our existing products without materially increasing the cost of the subscription.

This approach also greatly affects how our customer service groups treat our subscribers when issues arise. We instill in our teams that if we cannot reasonably meet the subscriber’s expectations, then we should ask the customer how we failed them, seek a mutually agreeable solution, and, if one cannot be found, offer them a refund or other form of compensation and find a way to part as friends. This has resulted in over 80% net revenue retention for the three-year period ended December 31, 2022 across our products.

Our Growth Strategy

We are committed to growing our business by deepening our relationship with existing customers and attracting new subscribers to our platform. We did both last year. We will also pursue strategic growth as opportunities arise. Here’s how we grow our business:

Attract more subscribers. We typically acquire new subscribers through an omni-channel marketing strategy that includes display ads, email, external subscriber lists, and direct mail, as well as television and radio at times. We primarily market in these channels through free-to-paid and direct-to-paid content.

We measure our customer-acquisition performance by a matrix of new customer counts and the cost to acquire customers. The mix of our marketing spend across these channels varies among our primary customer-facing brands and depends on how well individual marketing campaigns succeed, the nature of the product, and the type of offer.

We have invested significant resources into our efforts around consumer marketing, including enterprise-wide customer relationship management (“CRM”) systems, the leveraging of artificial intelligence (“AI”) to analyze this data, and a robust database of customer information.

In all of our marketing efforts, we collect and analyze customer response data by channel and effort, down to the individual advertisement in a marketing campaign. Using this data-driven and time-tested approach, we have developed proprietary practices for customer acquisition that we believe set us apart from other companies.

As we develop our relationship with the customer, we collect information from our subscribers about what products they are purchasing, their customer experience, and any feedback they have on our free and paid products. We use this information to deepen the customer experience and present offers to our subscribers for other products that they are likely to find interesting and useful.

Deepen our relationship with our existing subscribers. In addition to our Paid Subscribers, all of our Free Subscribers have access to our extensive library of free and educational content. As our subscribers learn and gain confidence as investors, they understand the need to deploy diverse investment strategies for different market

conditions and they explore our broad and diverse product offerings. They gain an understanding of the high quality of research that we strive to provide, and they tend to purchase additional research and software products.

Our free subscription products serve as a significant source of new Paid Subscribers, with an average annual free-to-paid conversion rate of approximately 1% to 2% between 2020 and 2022.

Launch new products and target new markets. Over our greater than 20-year history, we have developed a breadth of products and services that are designed to educate, empower, and entertain our subscribers and provide them with actionable investment ideas.

We offer a wide array of paid subscription products, ranging from lower priced products (e.g., subscriptions that cost $100 annually) to more expensive products (e.g., subscriptions that can cost up to $5,000 annually). The length of our subscriptions can vary from one year to what we refer to as “membership subscriptions,” where subscribers pay upfront for access to our specific products, and then only pay an annual maintenance fee ranging from $49 to $500 per year for the rest of their investing lives.

We have also developed various software applications that provide customers with algorithmic tools to search for trading ideas and manage portfolio risk. We will continue to enhance our value proposition and create additional selling opportunities through an expanded product portfolio.

We also offer members-only investing conferences where subscribers interact with our editors and analysts and can network with each other. We have a strong track record of cultivating these relationships with our subscribers, and we intend to continue that going forward.

Selectively pursue strategic growth. Over the past ten years, we have developed several joint ventures and executed strategic acquisitions to accelerate our growth, as well as increase the value of our offerings to our subscribers.

We have a strong track record of driving growth and delivering value through the successful integration of acquisitions and joint ventures. We believe our large subscriber base, easy scalability, marketing expertise, technology-based platform, and integration capabilities provide opportunities for us to drive value-added growth through acquisitions.

We have also made key investments across our platform to create a repeatable, low-cost, and scalable business model. We have invested in business functions from marketing to technology which allow us to scale rapidly.

We plan to continue investing in cutting-edge AI and advanced analytics-driven marketing tools to further optimize our marketing channels. Additionally, we have invested in our finance, technology, human resources, and other general and administrative functions to support our growth.

Competition

The market for investment research and financial information software is evolving and is highly fragmented. As the markets in which we operate continue to mature and new technologies and competitors enter those markets, we expect competition to intensify. Our competitor categories include:

•free online financial news aggregators or customer content platforms, like Yahoo! Finance and Seeking Alpha;

•traditional financial news publishers, like the Wall Street Journal, Investor’s Business Daily, and Barron’s;

•consumer-focused online subscription businesses, such as The Motley Fool;

•institutional financial software providers, such as Bloomberg, FactSet, and IHS Markit;

•low-cost, “mom and pop” newsletter subscription services, and

•online investing tools, such as Atom Finance and Stocktwits.

For additional information regarding the competitive environment in which we operate, see Item 1A. Risk Factors —“We face significant competition. Many of our competitors and potential competitors have larger customer bases, more established brand recognition, and greater financial, marketing, technological, and personnel resources than we do, which could put us at a competitive disadvantage. Additionally, some of our competitors and potential competitors are better capitalized than we are and able to obtain capital more easily, which could put us at a competitive disadvantage.”

Our Technology

We use technology to run our business efficiently and to better serve our customers. Our technology combines three cloud-based systems: software-as-a-service (“SaaS”); platform-as-a-service (“PaaS”); and infrastructure-as-a-service (“IaaS”).

While we have changed providers in the past and may do so in the future, we currently use top-tier, industry leading service providers for our CRM and marketing, email delivery, subscription billing, data warehouse, and for our data center.

Our infrastructure is highly scalable and allows us to serve all of our subscribers simultaneously and consistently. Our technology architecture is scalable based on overall traffic and capacity. As a result, we do not believe that growth in the number of subscribers hinders or slows down our platform.

We also employ data redundancy solutions on the cloud to reduce the possibility that our customer data will be lost and to ensure that our platform will not experience material downtime. We apply industry-standard data security measures to protect against potential vulnerabilities in our technology.

We have invested heavily in providing a reliable and secure global platform and infrastructure. Our investments in technology, including engineers, online security, customer privacy, reliable infrastructure, and data science capabilities, enable us to efficiently innovate and deliver solutions to our customers. Our cloud platform allows our developers to build and deploy in a lean and agile fashion with a focus on quality and solution adoption.

We continue to build out our AI tools and predictive analytics capacity through identification of additional business cases and additional data features. While partnering with a nationally recognized provider, we have applied highly targetable demographic and behavioral attributes to new models and in existing models to further enhance our business value.

Our data center is cloud-based, and through this platform we have been able to integrate the various SaaS and PaaS applications within our technology ecosystem and ensure that we have high availability and redundancy with business continuity in mind in an auto-scaling architecture.

Human Capital Resources

As of December 31, 2022, we had 732 full-time employees across all of our businesses. Our employees and independent contractors work from our U.S. offices or remote locations. None of our employees are represented by a labor organization or are party to any collective bargaining arrangement.

Our success depends on our relationships with our subscribers, as well as our employees. Our employees play a key role in delivering valuable content to our subscribers, which in turn, creates long-term value for our shareholders. We truly believe we have the best employees in the market.

We seek to attract, engage, and retain top talent through competitive compensation and benefit programs, and by fostering a culture of high performance, creativity and idea exchange as well as inviting diverse perspectives that will enable our employees to thrive and be successful.

Our compensation programs include both fixed and variable components, an incentive award plan providing for equity grants, and an employee stock purchase plan, all of which we believe incentivizes our employees to perform at high levels, helps them establish long-term financial security, and encourages them to remain with us.

Our benefits package includes health and welfare plans that provide medical, dental, and vision coverage, health savings accounts, medical and dependent care flexible spending accounts, life insurance, disability insurance, 401(k) savings plan with a company match, paid time off and other assistance, fitness and wellness programs.

We have grown our workforce organically and acquisitively over recent years, up from 275 employees in 2017 to 732 in 2022. We consistently have interest from the applicant community as demonstrated by our high offer acceptance yield. We are also proud that all four of our eligible subsidiaries are repeatedly recognized as top workplaces by the Baltimore Sun and Sun Sentinel.

Intellectual Property

We rely on a combination of trademark and copyright to protect our intellectual property. We have registered certain of our trademarks and service marks in the United States with the U.S. Patent and Trademark Office and in Canada and China, and have registered copyrights on certain publications. In addition, we have registered our domain names, including MarketWise.com, with MarkMonitor. We believe the names and marks associated with our brands are of significant value and are important to our business. Accordingly, as a general policy, we monitor the use of our marks and vigorously oppose any unauthorized use of the marks. We do not hold any patents.

We seek to control access to and distribution of our proprietary information. We enter into confidentiality, nondisclosure, and non-interference agreements with our employees, consultants, customers, and vendors that generally provide that any confidential or proprietary information developed by us or on our behalf be kept confidential, and we limit access to our confidential and proprietary information to a “need to know” basis. In the normal course of business, we provide our intellectual property to third parties through licensing or restricted use agreements. In addition, our internal policies seek to protect our intellectual property against misappropriation, infringement, and unfair competition. We intend to pursue additional intellectual property protection to the extent we believe it would be beneficial and cost effective.

The Transactions

On July 21, 2021, we consummated the transactions contemplated by that Business Combination Agreement, dated as of March 1, 2021, by and among Ascendant Digital Acquisition Corp., (“ADAC”), MarketWise, LLC, and the MarketWise Members, (as amended, the “Transaction Agreement”), which provided for: (1) the domestication of ADAC as a Delaware corporation; (2) ADAC’s capital contribution to MarketWise, LLC in exchange for certain units and warrants in MarketWise, LLC; and (3) the issuance of shares of Class B common stock, par value $0.0001 per share, of MarketWise, Inc. to the MarketWise Members (the “Class B common stock” and, together with the Class A common stock, the “common stock”) (the transactions described above and all transactions contemplated by or pursuant to the Transaction Agreement collectively, the “Transactions”). Upon the closing of the Transactions, ADAC changed its name to “MarketWise, Inc.” and became the sole manager of MarketWise, LLC. MarketWise, Inc.’s only direct assets consist of MarketWise Units and warrants of MarketWise, LLC, and substantially all of the assets and the business of MarketWise, Inc. are held by MarketWise, LLC and its subsidiaries. Upon the consummation of the Transactions, ADAC’s Class A ordinary shares, warrants, and units ceased trading on The New York Stock Exchange, and MarketWise, Inc.’s Class A common stock and warrants began trading on the Nasdaq under the symbols “MKTW” and “MKTW W,” respectively. See also Note 1, Organization — Reverse Recapitalization with Ascendant Digital Acquisition Corp., to our audited consolidated financial statements included in this report.

Available Information

Our website address is MarketWise.com. The information contained on, or that can be accessed through, our website is deemed not to be incorporated in this Annual Report on Form 10-K or to be part of this Annual Report on Form 10-K or any other report filed with the SEC. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as any amendments to those reports, are available free of charge through our website as soon as reasonably practicable after we file them with, or furnish them to, the SEC. The SEC maintains a website at www.sec.gov that contains reports, proxy statements, and other information regarding SEC registrants, including MarketWise, Inc.

Item 1A. Risk Factors.

The risks described below could have a material adverse impact on our business, financial condition, or operating results. Although it is not possible to predict or identify all such risks and uncertainties, they may include, but are not limited to, the factors discussed below. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business or results of operations

Risks Related to Our Business and Industry

Our business depends on our ability to attract new subscribers and to persuade existing subscribers to renew their subscription agreements with us and to purchase additional products and services from us. If we are unable to attract new subscribers, or continue to engage existing subscribers, our revenue and operating results may be adversely affected.

To increase our revenue and maintain profitability, we must attract new subscribers and retain, and expand the subscriptions of, existing subscribers. Our ability to successfully attract and retain subscribers to our subscription products depends in part on the quality of the content, including the performance of any investment ideas published. To the extent the returns on such investments fail to meet or exceed the expectations of our subscribers or the performance of relevant benchmarks, our ability to attract new subscribers or retain existing subscribers to such services will be adversely affected.

A substantial amount of our revenue is typically generated from existing subscribers through their recurring subscriptions. Our subscribers have no obligation to renew their subscriptions for products after the expiration of the subscription period, which is typically one year, and in the normal course of business some subscribers have elected not to renew their subscriptions. In addition, our subscribers may renew for lower subscription amounts or for shorter contract lengths. We may not accurately predict renewal rates for our subscribers, and our renewal rates may decline or fluctuate as a result of a number of factors, including subscribers usage, pricing changes, expiration of temporary product promotions, number of products or services used by our subscribers, customer satisfaction or dissatisfaction with our products or services, pricing or capabilities of the products and services offered by our competitors, increased competition, reduction in customer spending levels, changes in our renewal policies or practices for subscribers, and deteriorating general economic conditions. If our subscribers do not renew their subscriptions, buy additional content, or maintain or increase the amount they spend with us, our revenue will decline and our business will suffer.

Our success also depends on our ability to sell additional products, more subscriptions, or higher-priced and premium editions of our products and services to our current subscribers, which requires increasingly sophisticated and costly sales efforts. We seek to expand existing subscriptions by deepening customer engagement through new touchpoints and expanding our portfolio of tools and products for purchase. The rate at which our existing subscribers purchase new or enhanced services depends on a number of factors, including the quality of our content, general economic conditions, the level of interest and investment in individual stocks and other self-directed investment vehicles versus index funds, exchange-traded funds and other passive investment vehicles, and our subscribers’ receptiveness to higher-priced and premium tools and products.

If we fail to adequately market our products and services, or to monitor and manage our use of social media platforms as marketing tools, it could have a material adverse effect on our business, results of operations, and financial condition.

Our marketing efforts are designed to identify and attract prospective subscribers primarily within our target market and ultimately convert them into long term subscribers. We also employ marketing to promote our content, drive conversation about our content and services, and promote visits by our subscribers. We utilize a broad mix of marketing programs and platforms, including social media sites, to promote our services and content to current and prospective subscribers.

In order to successfully reach a larger number of prospective subscribers and attract new subscribers, we must continually assess the manner and platforms on which we are marketing our products and services. Rapid changes in

technology and the ways in which people are reached can make this process more difficult. If we are unable to effectively and efficiently market our products and services, our business, results of operations, and financial condition may be adversely affected.

For example, historically one of our primary means of communicating with our subscribers and keeping them engaged with our products has been via email communication. Our ability to communicate via email enables us to keep our subscribers updated on new products and present discount and promotional offers, among other things. As consumer habits evolve in the era of web-enabled mobile devices and messaging/social networking apps, usage of email, particularly among the younger demographic, has declined. In addition, deliverability and other restrictions imposed by third-party email providers and/or applicable law could limit or prevent our ability to send emails to our current or prospective users. While we continually work to find new means of communicating and connecting with our subscribers, there is no assurance that such alternative means of communication will be as effective as email has been. Any failure to develop or take advantage of new means of communication or limitations on those means of communications imposed by laws, device manufacturers, or other sources could have an adverse effect on our business, financial condition, and results of operations.

We may also limit or discontinue use or support of certain marketing sources or activities if advertising rates increase or if we become concerned by perceptions that certain marketing platforms or practices are intrusive or damaging to our brand. If available marketing channels are restricted, our ability to engage with and attract subscribers may be adversely affected. In addition, companies that promote our services or permit us to use their marketing platforms may decide that their relationship with us negatively impacts their business, or they may make business decisions that negatively impact us. For example, if a company that currently promotes our business decides to compete directly with us, enter a similar business, deny us access to its platform, or exclusively support our competitors, we may no longer have access to their marketing channels.

Such companies may also disagree with, or choose to take a public stance against, the editorial content produced by certain of our operating brands, or otherwise decide to publicly cease providing services to us. This may result in, among other things, loss of access to the marketing channels provided by these companies, copycat behavior by other of our vendors, difficulty retaining or attracting employees, or negative media attention.

Furthermore, if we are unable to cost-effectively use social media platforms or ad networks as marketing tools, our ability to acquire new subscribers and our financial condition may suffer. Unauthorized or inappropriate use of our social media channels could result in harmful publicity or negative customer experiences, which could have an adverse impact on the effectiveness of our marketing in these channels. In addition, substantial negative commentary by others on social media platforms could have an adverse impact on our ability to successfully connect with consumers.

Furthermore, there are extensive and rapidly evolving regulations governing our ability to market to subscribers, whether via post, email, or social media platforms, and our marketing is subject to the rules and regulations of the U.S. Federal Trade Commission (the “FTC”) and state consumer protection agencies. The failure by us, our employees, or third parties acting at our direction to comply with applicable laws and regulations could subject us to regulatory investigations, lawsuits, including class actions, liability, fines, or other penalties and could result in a material adverse effect on our business, results of operations, and financial condition. In addition, an increase in the use of social media platforms for product promotion and marketing may cause an increase in our burden to monitor compliance of such platforms, and increase the risk that such materials could contain problematic product or marketing claims in violation of applicable regulations.

To the extent we promote our content inefficiently or ineffectively, we may not be able to obtain expected subscriber acquisition and retention benefits, and our business, results of operations, and financial condition may be adversely affected.

Failure to maintain and protect our reputation for trustworthiness and independence may harm our business. In addition, in the event the reputation of any of our current or former directors, officers, key contributors, editors, or editorial staff were harmed for any reason, our business, results of operations, and financial condition could suffer.