As filed with the Securities and Exchange Commission on March 30, 2023

Registration No. 333-268972

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact Name of Registrant as Specified in Its Charter)

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

18455 S. Figueroa Street

Gardena,

CA 90248

(424) 276-7616

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Yun Han

Interim

Chief Financial Officer

18455 S. Figueroa Street

Gardena, CA 90248

(310) 415-4807

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Vijay S. Sekhon

Michael P. Heinz

Sidley Austin LLP

555 California Street, Suite 2000

San Francisco, CA 94104

Tel: (415) 772-1200

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

On August 20, 2021, Faraday Future Intelligent Electric Inc. (the “Company”) filed a registration statement on Form S-1 (File No. 333-258993). Such registration statement was amended by Amendment Nos. 1, 2, 3, 4, 5 and 6 thereto, filed on October 4, 2021, June 9, 2022, August 30, 2022, October 7, 2022, November 3, 2022 and November 8, 2022, respectively (the registration statement, as amended by Amendment Nos. 1, 2, 3, 4, 5 and 6 thereto, the “First Registration Statement”). The First Registration Statement, which registered the resale by the selling securityholders identified in the prospectus therein of (i) 201,218,630 shares of Class A common stock, par value $0.0001 per share, of the Company (the “Class A Common Stock”), (ii) up to 284,070,555 shares of Class A Common Stock issuable upon exercise of certain warrants and conversion of certain convertible notes, and (iii) up to 276,131 warrants identified in the prospectus therein, was subsequently declared effective by the Securities and Exchange Commission (the “SEC”) on November 10, 2022.

On December 23, 2022, the Company filed a registration statement on Form S-1 (File No. 333-268972), and on February 7, 2023, the Company filed Amendment No. 1 to such registration statement (as amended, the “Second Registration Statement”), which was a new registration statement that registered the resale by the selling securityholder identified in the prospectus therein of an additional 85,500,000 shares of Class A Common Stock issuable upon the conversion of certain convertible notes, and which was subsequently declared effective by the SEC on February 8, 2023. The Second Registration Statement (i) combined the prospectuses included in the First Registration Statement and the Second Registration Statement (together, the “Registration Statements”), pursuant to Rule 429 under the Securities Act of 1933, as amended (the “Securities Act”), and (ii) included an updated prospectus relating to the offering and sale of the shares of Class A Common Stock that were registered for resale on the Registration Statements. Upon effectiveness, the Second Registration Statement constituted a post-effective amendment to the First Registration Statement, pursuant to Rule 429 under the Securities Act.

We are filing this Post-Effective Amendment No. 1 to Form S-1 (“Post-Effective Amendment No. 1”) to (i) incorporate by reference information contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, including portions of our Definitive Proxy Statement on Schedule 14A for our 2023 annual meeting of stockholders specifically incorporated by reference therein and (ii) include an updated combined prospectus relating to the offering and sale from time to time of shares of Class A Common Stock that were registered for resale pursuant to the Registration Statements.

No additional securities are being registered under this Post-Effective Amendment No. 1. All applicable registration fees were paid at the time of the original filings of the Registration Statements.

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling securityholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION — DATED MARCH 30, 2023 |

536,944,398 Shares of Class A Common Stock

Up to 33,678,698 Shares of Class A Common Stock

Issuable Upon Exercise of the Warrants and Conversion of the SPA Notes

Up to 111,131 Private Warrants

This prospectus relates to the offer and sale from time to time by the selling securityholders named in this prospectus (the “Selling Securityholders”) of (i) 27,733,421 shares of the Class A common stock, par value $0.0001 per share, of Faraday Future Intelligent Electric Inc. (“FFIE” and such Class A common stock, the “Class A Common Stock”) originally purchased in the PIPE Financing (as defined below) by certain of the Selling Securityholders at a purchase price of $10.00 per share, (ii) 213,366 Founder Shares (as defined below) by certain of the Selling Securityholders previously acquired by our predecessor’s sponsor at an effective purchase price of $0.0043 per share, (iii) 170,131 shares of Class A Common Stock issued to designees of EarlyBirdCapital, Inc. as underwriters’ compensation in connection with the initial public offering of PSAC (as defined below) (collectively, the “Representative Shares”) at an effective purchase price of $0.0041 per share, (iv) 586,000 shares of Class A Common Stock issued on July 22, 2022 as consideration for consulting and advisory services pursuant to an omnibus transaction services fee agreement and acknowledgement, as amended, with RMG (as defined below) in connection with the Business Combination (as defined below), (v) 86,395,848 shares of Class A Common Stock originally issued to Season Smart Limited (“Season Smart”) and Founding Future Creditors Trust as consideration in connection with the Business Combination at a per share value of $10.00 per share, (vi) 64,000,588 shares of Class A Common Stock underlying the shares of FFIE’s Class B common stock, par value $0.0001 per share (“Class B Common Stock”) originally issued to FF Top Holding LLC (“FF Top”) as consideration in connection with the Business Combination at a per share value of $10.00 per share, (vii) 21,263,758 Earnout Shares not currently beneficially owned that Season Smart, FF Top and certain FF executives have the contingent right to receive pursuant to the Merger Agreement, (viii) 150,322 shares of Class A Common Stock issued to certain FF executives in satisfaction of deferred compensation owed by FF to such FF executives prior to the closing of the Business Combination, (ix) 484,856 shares of Class A Common Stock issued to certain FF executives upon such FF executives’ exercise of options, (x) 54,252 shares of Class A Common Stock issued to Chui Tin Mok upon closing of the Business Combination in satisfaction of his related party note payable, (xi) 23,557,189 shares of Class A Common Stock issued upon exercise of certain warrants issued in a private placement to certain institutional investors pursuant to a Second Amended and Restated Note Purchase Agreement, dated October 9, 2020 (as amended from time to time, the “NPA,” and such warrants, the “ATW NPA Warrants”), and (xii) 272,686,805 shares of Class A Common Stock issued upon conversion of certain convertible notes and 39,647,862 shares of Class A Common Stock issued upon exercise of certain warrants, in each case issued in a private placement to certain institutional investors pursuant to a Securities Purchase Agreement, dated as of August 14, 2022, as amended on September 23, 2022 (the “SPA”), pursuant to the Joinder and Amendment Agreement to the SPA (the “Joinder”), dated as of September 25, 2022, pursuant to the Limited Consent and Third Amendment to the SPA (the “Third Amendment”), dated as of October 24, 2022, pursuant to the Limited Consent and Amendment to the SPA (the “Fourth Amendment”), dated as of November 8, 2022, pursuant to the Letter Agreement and Amendment to the SPA (the “Senyun Amendment”), dated as of December 28, 2022, pursuant to the Limited Consent and Amendment No. 5 (the “Fifth Amendment”), dated as of January 25, 2023, pursuant to the Amendment No. 6 to Securities Purchase Agreement (the “Sixth Amendment”), dated as of February 3, 2023, and pursuant to the Amendment No. 7 to Securities Purchase Agreement (the “Seventh Amendment”), dated as of March 23, 2023 (such notes and warrants under the SPA and Joinder, the “SPA Notes” and the “SPA Warrants”).

This prospectus also relates to the offer and sale from time to time by the Selling Securityholders of up to 111,131 warrants (the “Private Warrants”), all of which were included in the private units purchased by our predecessor’s sponsor and EarlyBirdCapital, Inc. in connection with the initial public offering of PSAC at a price of $10.00 per unit.

This prospectus also relates to the issuance by us, and the offer and sale from time to time by the Selling Securityholders, of up to an aggregate of 33,678,698 shares of Class A Common Stock which consists of (i) 111,131 shares of Class A Common Stock that are issuable upon the exercise of the Private Warrants, (ii) 23,540,988 shares of Class A Common Stock that are issuable upon the exercise of the 23,540,988 warrants (the “Public Warrants”) originally issued in the initial public offering of PSAC (or otherwise originally included in the private units purchased in connection with the initial public offering of PSAC, and subsequently sold), (iii) 4,874,446 shares of Class A Common Stock issuable upon exercise of NPA Warrants, and (iv) 100,003 shares of Class A Common Stock issuable upon conversion of SPA Notes and 5,052,130 shares of Class A Common Stock issuable upon exercise of SPA Warrants. We refer to the Private Warrants, the Public Warrants, the ATW NPA Warrants and the SPA Warrants collectively in this prospectus as the “Warrants.” Additional details regarding the securities to which this prospectus relates and the Selling Securityholders is set forth in this prospectus under “Information Related to Offered Securities” and “Description of Securities.”

We will not receive any proceeds from the sale of the shares of Class A Common Stock or the Private Warrants by the Selling Securityholders. We could receive up to an aggregate of approximately $273.1 million if all of the Warrants offered by the Selling Securityholders are exercised for cash. However, we will only receive such proceeds if and when the holders of the Warrants exercise the Warrants for cash. The exercise of the Warrants, and any proceeds we may receive from their exercise, are highly dependent on the price of our shares of Class A Common Stock and the spread between the exercise price of the Warrants and the price of our Class A Common Stock at the time of exercise. As of February 27, 2023, we have (i) 23,540,988 outstanding Public Warrants to purchase 23,540,988 shares of our Class A Common Stock, exercisable at an exercise price of $11.50 per share; (ii) 111,131 outstanding Private Warrants to purchase 111,131 shares of our Class A Common Stock, exercisable at an exercise price of $11.50 per share; and (iii) 66,815,087 outstanding SPA Warrants, which are exercisable at an exercise price of $0.2275 or $1.05 per share. If the market price of our Class A Common Stock is less than the exercise price of a holder’s Warrants, it is unlikely that holders will exercise their Warrants. As of March 29, 2023, the closing price of our Class A Common Stock was $0.3550 per share. There can be no assurance that all of our Warrants will be in the money prior to their expiration. Our Public Warrants under certain conditions, as described in the warrant agreement, are redeemable by FFIE at a price of $0.01 per Warrant. Our Private Warrants are not redeemable so long as they are held by the initial stockholders and are exercisable on a cashless basis. Our SPA Warrants are redeemable under certain conditions for $0.01 per warrant and exercisable on a cash or cashless basis. As such, it is possible that we may never generate any cash proceeds from the exercise of our Warrants.

Our registration of the securities covered by this prospectus does not mean that the Selling Securityholders will offer or sell any of the shares. The Selling Securityholders may sell the shares of Class A Common Stock covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Securityholders may sell the shares in the section entitled “Plan of Distribution.”

We are registering the securities for resale pursuant to the Selling Securityholders’ registration rights under certain agreements between us and the Selling Securityholders. Our registration of the securities covered by this prospectus does not mean that the Selling Securityholders will offer or sell any of the shares of Class A Common Stock or Warrants. The Selling Securityholders may offer, sell or distribute all or a portion of their shares of Class A Common Stock or Warrants publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any proceeds from the sale of shares of Class A Common Stock or Warrants by the Selling Securityholders pursuant to this prospectus. We provide more information about how the Selling Securityholders may sell the shares or Warrants in the section entitled “Plan of Distribution.”

Sales of a substantial number of shares of Class A Common Stock in the public market, including the resale of the shares of common stock held by FFIE stockholders pursuant to this prospectus or pursuant to Rule 144, could occur at any time. These sales, or the perception in the market that the holders of a large number of shares of common stock intend to sell shares, could reduce the market price of the Class A Common Stock and make it more difficult for you to sell your holdings at times and prices that you determine are appropriate. Furthermore, we expect that, because there is a large number of shares being registered pursuant to the registration statement of which this prospectus forms a part, the Selling Securityholders will continue to offer the securities covered thereby pursuant to this prospectus or pursuant to Rule 144 for a significant period of time, the precise duration of which cannot be predicted. Accordingly, the adverse market and price pressures resulting from an offering pursuant to the registration statement may continue for an extended period of time.

Our shares of Class A Common Stock and our Public Warrants are listed on The Nasdaq Stock Market (“Nasdaq”), under the symbols “FFIE” and “FFIEW.” On March 29, 2023, the closing price of our Class A Common Stock was $0.3550 per share and the closing price of our Public Warrants was $0.1049 per Public Warrant.

The shares of Class A Common Stock and Warrants being offered pursuant to this prospectus are shares and warrants of Faraday Future Intelligent Electric Inc. (“FFIE”), a holding company incorporated in the State of Delaware. As a holding company with no material operations of its own, FFIE conducts its operations through its operating subsidiaries. We currently have a majority of our operations in the U.S. conducted through our U.S.-domiciled operating subsidiaries. We also operate our business in the People’s Republic of China and plan to have significant operations in the future in both Mainland China and Hong Kong (together, “PRC” or “China”) through our subsidiaries organized in the PRC (collectively, the “PRC Subsidiaries”). Investors in our Class A Common Stock and our Warrants should be aware that they are purchasing equity solely in FFIE, a Delaware holding company. There are various risks associated with our current operating presence in China and the potential expansion of our operations in China (including Hong Kong), which is subject to political and economic influence from China. Recently, the Chinese government initiated a series of regulatory actions and made statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies that seek to conduct offshore securities offerings or be listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation-making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated if any, and the potential impact such modified or new laws and regulations will have on our business operations, our ability to accept foreign investments and to maintain FFIE’s listing on a U.S. exchange. The Chinese government may intervene or influence the operations of our PRC Subsidiaries, or at any time exert more control over offerings conducted overseas and foreign investment in China-based issuers in accordance with PRC laws and regulations, which could result in a material change in our operations and/or a material reduction in the value of our Class A Common Stock and Warrants. Additionally, the governmental and regulatory interference could significantly limit or completely hinder our and the Selling Securityholders’ ability to offer or continue to offer our shares of Class A Common Stock and Warrants to investors and cause the value of such securities to significantly decline or be worthless. For a detailed description of risks related to our PRC operations, see “Risk Factors – Risks Related to FF’s Operations in China.”

We are an “emerging growth company” under federal securities laws and are subject to reduced public company reporting requirements. Investing in our Class A Common Stock involves a high degree of risks. See the section entitled “Risk Factors” beginning on page 23 of this prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

You should rely only on the information provided in this prospectus, as well as the information incorporated by reference into this prospectus and any applicable prospectus supplement. Neither we nor the Selling Securityholders have authorized anyone to provide you with different information. Neither we nor the Selling Securityholders are making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus, any applicable prospectus supplement or any documents incorporated by reference is accurate as of any date other than the date of the applicable document. Since the respective dates of this prospectus and the documents incorporated by reference into this prospectus, our business, financial condition, results of operations and prospects may have changed.

Unless the context indicates otherwise, references in this prospectus to “FFIE” refer to Faraday Future Intelligent Electric Inc. (f/k/a Property Solutions Acquisition Corp.), a holding company incorporated in the State of Delaware, and not to its subsidiaries, and references herein to the “Company,” “FF,” “we,” “us,” “our” and similar terms refer to FFIE and its consolidated subsidiaries. We refer to our primary operating subsidiary in the U.S., Faraday&Future Inc., as “FF U.S.” We refer to all our subsidiaries organized in China (including Hong Kong) collectively as the “PRC Subsidiaries,” a complete list of which is set forth in Exhibit 21.1 to the registration statement of which this prospectus forms a part. References to “PSAC” refer to Property Solutions Acquisition Corp., a Delaware corporation, our predecessor company prior to the consummation of the Business Combination (as defined herein), and “Legacy FF” refers to FF Intelligent Mobility Global Holdings Ltd., an exempted company with limited liability incorporated under the laws of the Cayman Islands, together with its consolidated subsidiaries, prior to the Business Combination (as defined herein).

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf registration process, the Selling Securityholders may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale by such Selling Securityholders of the securities offered by them described in this prospectus. This prospectus also relates to the issuance by us of the shares of Class A Common Stock issuable upon the conversion of any Notes or exercise of any Warrants. We will receive the proceeds from any exercise of the Warrants for cash.

Neither we nor the Selling Securityholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus, or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Securityholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Securityholders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the section of this prospectus entitled “Where You Can Find More Information.”

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein and therein may contain forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and assumptions of management. Although the Company believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, the Company cannot assure you that it will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning the Company’s possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends” or similar expressions.

Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements which speak only as of the date hereof. You should understand that the following important factors, among others, could affect the Company’s future results and could cause those results or other outcomes to differ materially from those expressed or implied in the Company’s forward-looking statements:

| ● | the Company’s ability to raise sufficient funds to continue its operations and carry out its business plan; |

| ● | whether stockholders will approve an amendment to FFIE’s second amended and restated certificate of incorporation to increase FFIE’s authorized shares for FFIE to have sufficient shares to satisfy future equity financing; |

| ● | the Company’s ability to attract and retain qualified officers and directors; |

| ● | changes adversely affecting the business in which the Company is engaged; |

| ● | the implementation of the Special Committee’s remediation actions and the Company’s related follow-up actions, and the ability of the Company to attract and retain employees; |

| ● | the Company’s ability to execute on its plans to develop and market its vehicles and the timing and cost of these development and marketing programs; |

| ● | the Company’s ability to manage its indebtedness, including its ability to refinance its current indebtedness; |

iii

| ● | the ability of the Company’s suppliers to deliver necessary components for the Company’s products; |

| ● | the Company’s ability to successfully develop or obtain licenses and other rights to certain technology to reach production for its vehicles; |

| ● | the Company’s ability to remediate the identified material weaknesses in its internal control over financial reporting; |

| ● | the Company’s ability to navigate economic, operational and legal risks specific to operations based in China; |

| ● | the Company’s estimates of the size of the markets for its vehicles and the costs to bring its vehicles to market; |

| ● | the rate and degree of market acceptance of the Company’s vehicles; |

| ● | the success of other competing manufacturers; |

| ● | the performance and security of the Company’s vehicles; |

| ● | ongoing and potential litigation involving PSAC or the Company and the outcome of the SEC and the United States Department of Justice (the “DOJ”) investigations; |

| ● | general economic conditions; |

| ● | the impact of the COVID-19 pandemic and its effect on the business and financial conditions of the Company; |

| ● | the possibility that any stockholder litigation or dispute may result in significant costs of defense, indemnification or liability; and |

| ● | the price and trading volume of the Company’s Class A Common Stock. |

These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this prospectus are more fully described in the “Risk Factors” section. The risks described in “Risk Factors” are not exhaustive. New risk factors emerge from time to time, and it is not possible for us to predict all such risk factors, nor can the Company assess the impact of all such risk factors on its business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. The Company undertakes no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

iv

SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus, or the documents incorporated by reference herein. Because it is a summary, it may not contain all of the information that may be important to you. To understand this offering fully, you should read this entire prospectus, the registration statement of which this prospectus is a part and the documents incorporated by reference herein carefully, including the information set forth under the heading “Risk Factors” and our financial statements.

The Company

Faraday Future Intelligent Electric, Inc. (“FFIE,” and with its consolidated subsidiaries, “FF,” “the Company,” “we,” “us” or “our”) is a California-based global shared intelligent mobility ecosystem company with a vision to disrupt the automotive industry.

With headquarters in Los Angeles, California, FF designs and engineers next-generation intelligent, connected, electric vehicles. FF manufactures vehicles at its production facility in Hanford, California, with additional future production capacity needs addressed through a contract manufacturing agreement with Myoung Shin Co., Ltd., an automotive manufacturer headquartered in South Korea. FF has additional engineering, sales, and operational capabilities in China and is exploring opportunities for potential manufacturing capabilities in China through a joint venture or other arrangement.

Since its founding, FF has created major innovations in technology and products, and a user centered business model. We believe these innovations will enable FF to set new standards in luxury and performance that will enhance quality of life and redefine the future of intelligent mobility.

Background

Property Solutions Acquisition Corp., a special purpose acquisition company incorporated in Delaware, completed its initial public offering in July 2020. On July 21, 2021, Faraday Future Intelligent Electric Inc. (f/k/a Property Solutions Acquisition Corp.), a Delaware corporation, consummated the previously announced business combination pursuant to that certain Agreement and Plan of Merger, dated as of January 27, 2021 (as amended, the “Merger Agreement”), by and among FFIE, PSAC Merger Sub Ltd., an exempted company with limited liability incorporated under the laws of the Cayman Islands and wholly-owned subsidiary of PSAC (“Merger Sub”), and FF Intelligent Mobility Global Holdings Ltd., an exempted company with limited liability incorporated under the laws of the Cayman Islands (“Legacy FF”). Pursuant to the terms of the Merger Agreement, Merger Sub merged with and into Legacy FF, with Legacy FF surviving the merger as a wholly-owned subsidiary of FFIE (the “Business Combination”). Upon the consummation of the Business Combination, the registrant changed its name from “Property Solutions Acquisition Corp.” to “Faraday Future Intelligent Electric Inc.” Legacy FF is considered FFIE’s accounting acquirer.

Pursuant to the terms of the Merger Agreement, the Business Combination was effected on July 21, 2021 through the merger of Merger Sub with and into Legacy FF, with Legacy FF surviving as the surviving company and a wholly-owned subsidiary of FFIE. Upon closing the Business Combination, FFIE received $229.6 million in gross proceeds, of which FFIE received $206.4 million in cash, after payment of PSAC’s transaction costs related to the Business Combination and redemptions of $0.2 million. At the closing of the Business Combination, the outstanding Legacy FF Class A ordinary shares, par value $0.00001 per share, Legacy FF Class B ordinary shares, par value $0.00001 per share, Legacy FF Class A-1 preferred shares, par value $0.00001 per share, Legacy FF Class A-2 preferred shares, par value $0.00001 per share, Legacy FF Class A-3 preferred shares, par value $0.00001 per share and Legacy FF redeemable preferred shares, par value $0.00001 per share were cancelled and converted into a right to receive a pro rata portion of the 127.9 million Class A Common Stock, and the outstanding Legacy FF converting debt and certain other outstanding liabilities of Legacy FF were canceled and converted into the right to receive pro rata portions of approximately 24.5 million shares of Class A Common Stock and the outstanding Legacy FF Class B preferred shares, par value $0.00001 per share were canceled and converted into the right to receive pro rata portions of approximately 64.0 million shares of Class B common stock, par value $0.0001 per share, of FFIE (the “Class B Common Stock,” and together with the Class A Common Stock, the “Common Stock”). Additionally, Legacy FF options and Legacy FF warrants that were outstanding immediately prior to the closing of the Business Combination (and by their terms did not terminate upon the closing of the Business Combination) remained outstanding and converted into the right to purchase pro rata portions of approximately 44.9 million shares of Class A Common Stock. Holders of the Legacy FF shares issued and outstanding as of immediately prior to the closing of the Business Combination also have the contingent right to receive up to 25.0 million shares of Common Stock in two tranches upon the occurrence of certain stock price-based triggering events as set forth in the Merger Agreement (“Earnout Shares”).

1

On July 21, 2021, a number of purchasers (each, a “Subscriber”) purchased from FFIE an aggregate of 76.1 million shares of Class A Common Stock (the “PIPE Shares”), for a purchase price of $10.00 per share and an aggregate purchase price of $761.4 million, out of which FFIE received $692.4 million after payment of FFIE’s transaction costs of $69.0 million), pursuant to separate subscription agreements entered into effective as of January 27, 2021 (each, a “Subscription Agreement” and such investment in the PIPE Shares by the Subscribers collectively, the “Private Placement”). Pursuant to the Subscription Agreements, FFIE gave certain registration rights to the Subscribers with respect to the PIPE Shares. The sale of the PIPE Shares was consummated concurrently with the closing of the Business Combination.

Our shares of Class A Common Stock and our Public Warrants are currently listed on The Nasdaq Stock Market (“Nasdaq”) under the symbols “FFIE” and “FFIEW,” respectively.

The rights of holders of our Common Stock, Private Warrants and Public Warrants are governed by our second amended and restated certificate of incorporation (the “Amended and Restated Charter”), our amended and restated bylaws (the “Amended and Restated Bylaws”) and the Delaware General Corporation Law (the “DGCL”), and in the case of the Private Warrants and Public Warrants, the Warrant Agreement dated as of July 21, 2020, duly executed and delivered by FFIE to Continental Stock Transfer & Trust Company, a New York limited liability trust company, as warrant agent. The ATW NPA Warrants were issued pursuant to, and are governed by, the terms of the Second Amended and Restated Note Purchase Agreement, dated as of October 9, 2020 (as amended from time to time, the “NPA”), among certain subsidiaries of FFIE and guarantors party thereto, U.S. Bank National Association, as the notes agent, Birch Lake Fund Management, LP, as the collateral agent, and the purchasers party thereto, and related forms of notes and warrants issued thereunder. The SPA Warrants and SPA Notes were issued pursuant to the Securities Purchase Agreement, dated as of August 14, 2022, as amended on September 23, 2022 (the “SPA”), between FFIE and FF Simplicity Ventures LLC (“FF Simplicity”), an entity affiliated with ATW Partners LLC, the Joinder and Amendment Agreement to the SPA (the “Joinder”), dated as of September 25, 2022, by and among FFIE, Senyun International Ltd., an affiliate of Daguan International Limited (“Senyun”), FF Simplicity and RAAJJ Trading LLC (“RAAJJ”), the Limited Consent and Third Amendment to the SPA (the “Third Amendment”), dated as of October 24, 2022, by and among the parties thereto, the Limited Consent and Amendment to the SPA (the “Fourth Amendment”), dated as of November 8, 2022, by and among the parties thereto, the Letter Agreement and Amendment to the SPA (the “Senyun Amendment”), dated as of December 28, 2022, by and among FFIE, FF Simplicity, and Senyun, the Limited Consent and Amendment No. 5 (the “Fifth Amendment”), dated as of January 25, 2023, by and among FFIE, Senyun, FF Simplicity and other purchasers, the Amendment No. 6 to Securities Purchase Agreement (the “Sixth Amendment”), dated as of February 6, 2023, by and among FFIE, Senyun, FF Top, FF Simplicity, FF Prosperity Ventures LLC (“FF Prosperity”), an entity affiliated with ATW Partners LLC, Acuitas Capital, LLC (“Acuitas”) and other purchasers, and the Amendment No. 7 to Securities Purchase Agreement (the “Seventh Amendment”), dated as of March 23, 2023, by and among FFIE, Senyun, FF Prosperity and FF Simplicity. For more information, see the section entitled “Description of Securities.”

Recent Developments

Governance Changes — Governance Agreement and Amended Shareholder Agreement with FF Top and FF Global and Director Resignations

FF Global Partners LLC (“FF Global”), through its subsidiary FF Global Partners Investment LLC, formerly FF Top Holding LLC (“FF Top”), the Company’s largest stockholder, has the ability to control the Company’s management and operations, including the composition of the FFIE Board of Directors (the “Board”). From June 2022 through September 2022, FF Top asserted that it had the right to remove Mr. Brian Krolicki from the Board pursuant to a Shareholder Agreement entered into by FFIE and FF Top, dated July 21, 2021 (the “Shareholder Agreement”). However, the Company disagreed that FF Top had the right under the Shareholder Agreement to remove Mr. Krolicki. Nevertheless, the Company agreed to hold a special meeting of stockholders after FF Top sought Mr. Krolicki’s removal but made no recommendation to stockholders with respect to such proposal. On August 8, 2022, the Company filed a preliminary proxy statement with the SEC in connection with such special stockholder meeting, and on August 17, 2022, FF Global filed a preliminary proxy statement soliciting votes in favor of removing Mr. Krolicki’s removal from the Board. On August 29, 2022, the Company filed a Current Report on Form 8-K responding to what it believes to be misstatements in FF Global’s preliminary proxy statement. Beginning in September 2022, FF Top began seeking the removal of Ms. Susan Swenson, also pursuant to the Shareholder Agreement. Pursuant to the Shareholder Agreement, both Mr. Krolicki and Ms. Swenson were FF Top director designees.

On September 19, 2022, FF Global filed a lawsuit in the Chancery Court of the State of Delaware seeking the removal of Mr. Krolicki and Ms. Swenson from the Board, among other things.

On September 23, 2022, the Company entered into a Heads of Agreement (the “Heads of Agreement”) with FF Global and FF Top, pursuant to which the Company agreed to and implemented significant changes to the Board and Company governance. Effective as of September 23, 2022, the Company (a) increased the size of the Board from nine to ten; (b) appointed Mr. Adam (Xin) He to fill the vacancy resulting from such increase in the size of the Board until the next annual meeting of stockholders of the Company (for which the Company filed a definitive proxy statement on March 17, 2023, for its 2023 annual meeting of stockholders to be held on April 14, 2023) (the “Annual Meeting”); (c) appointed Mr. He to the Audit Committee and the Nominating and Corporate Governance Committee of the Board; and (d) agreed to not remove Mr. He from either committee prior to the Annual Meeting.

Pursuant to the Heads of Agreement, FF Top and FF Global caused all actions in the Court of Chancery of the State of Delaware, and any other forum, filed by FF Top, FF Global and/or any of their respective controlled affiliates as of the effective date of the Heads of Agreement, naming the Company or any of its directors or officers to be dismissed without prejudice as of September 27, 2022.

2

Pursuant to the Heads of Agreement, the Company, FF Global and FF Top agreed that Ms. Swenson would step down from her role as Executive Chairperson and all non-director positions, Board leadership and committee positions at the Company, and subject to the satisfaction of certain financing and funding conditions, Ms. Swenson and Mr. Krolicki would resign as directors of the Company. On March 17, 2023, FFIE filed a definitive proxy statement for its 2023 annual meeting of stockholders, scheduled to be held on April 14, 2023, at which each of its seven current directors will be standing for re-election.

As a result of the governance settlement described above and other recent developments, the composition of the Board has substantially changed and may continue to further change. See “Risk Factors – Risks Related to FF’s Business and Industry – The composition of FFIE’s Board has changed, and may further change.” In addition, as a result of these developments, Mr. Yueting Jia and FF Global have strengthened their already significant influence over the Company. See “Risk Factors – Risks Related to FF’s Business and Industry – Yueting Jia and FF Global, over which Mr. Jia exercises significant influence, have control over the Company’s management, business and operations, and may use this control in ways that are not aligned with the Company’s business or financial objectives or strategies or that are otherwise inconsistent with the Company’s interests.” and “Management – Governance Agreement with FF Top and FF Global.”

The above is only a summary of the Heads of Agreement. See “Management – Governance Agreement with FF Top and FF Global” for a more fulsome discussion of the Heads of Agreement and other related agreements among the Company, FF Top and FF Global.

Shortly following the execution of the Heads of Agreement, FF Global began making additional demands of the Company which were beyond the scope of the terms contemplated by the Heads of Agreement and pertained to, among other things, the Company’s management reporting lines and certain governance matters. On September 30, 2022, FF Global alleged that the Company was in material breach of the spirit of the Heads of Agreement. The Company believes it has complied with the applicable terms of the Heads of Agreement, and disputes any characterization to the contrary. Such disputes divert management and Board resources and are costly. There can be no assurance that this or any other dispute between the Company and FF Global will not result in litigation. See “Risk Factors – Risks Related to FF’s Business and Industry – Disputes with our stockholders are costly and distracting.”

On October 3, 2022, Ms. Swenson tendered her resignation from her role as both Executive Chairperson and member of the Board effective immediately, and Mr. He was appointed to serve as Interim (non-Executive) Chairman of the Board effective as of the same date. The Company expects that the Board seated after the Annual Meeting will select a permanent Chairperson of the Board. On the same date, Jordan Vogel, the Company’s former Lead Independent Director, and Scott Vogel, a member of the Board, also provided notice of their intent to resign as members of the Board and from all other positions that they hold at the Company and its subsidiaries. Mr. Scott Vogel resigned effective immediately. Mr. Jordan Vogel’s resignation was effective on October 5, 2022 upon his receipt of a supplemental release from the Company and its subsidiaries, FF Global, the executive committee members of FF Global and their controlled affiliates, and FF Global’s controlled affiliates (including FF Top) (collectively, the “Non-Director Parties”) as contemplated by the Mutual Release, dated as of September 23, 2022, by and among the Non-Director Parties and the directors of the Company and their controlled affiliates, described under “Management – Governance Agreement with FF Top and FF Global” (the “Mutual Release”). Effective as of October 3, 2022, Mr. He was appointed Interim Chairman of the Board.

Following the completion of the previously disclosed investigation by a special committee of independent directors (“Special Committee”), the Company and certain of its directors and officers have received numerous e-mail communications from a group of self-described “employee whistleblowers” and from various individuals and entities who represented themselves as current investors of the Company. These communications have included various allegations (including, for example, that certain directors have conspired to push the Company into bankruptcy for their own personal gain) and requests for certain organizational and governance changes. The Company engaged an independent law firm to conduct a thorough independent external investigation with respect to these allegations. The independent investigation found that all such allegations have been without merit. In September 2022, certain members of the Board received threats of physical violence and death threats, which the Company has referred to appropriate law enforcement authorities, including state and local police, the Federal Bureau of Investigation, the SEC, the U.S. Department of Justice and relevant international authorities. Each of Ms. Swenson and Messrs. Jordan Vogel, Scott Vogel and Brian Krolicki cited such threats and their fear that their continued association with the Company might heighten the risk to themselves and their respective families as the reasons for their resignations.

3

Following the resignation of Ms. Swenson, all Company management (including Mr. Yueting Jia) reported directly or indirectly to the Global CEO of the Company (previously Dr. Breitfeld and currently Mr. Xuefeng Chen) indefinitely while the Board continued to evaluate the appropriate FF management reporting lines. Effective as of October 4, 2022, Mr. Jia was also appointed as Founder Advisor, in which capacity he acts as an advisor to the Board (with no change to his current compensation).

On October 22, 2022, the Company and FF Top entered into an amendment (the “FF Top Amendment”) to the Letter Agreement Regarding Advanced Approval, dated as of September 23, 2022, between the Company and FF Top (the “FF Top Voting Agreement”). Pursuant to the FF Top Amendment, FF Top (among other things) reaffirmed its commitment under the FF Top Voting Agreement, in light of the extension of the maturity date of the SPA Notes under the Third Amendment, to vote all of its shares of FFIE voting stock in favor of the proposal to approve (for purposes of the Nasdaq listing rules) the issuance, in the aggregate, of shares in excess of 19.99% of the total issued and outstanding shares of FFIE Common Stock pursuant to the SPA and related financing documents at the special meeting of FFIE stockholders held on November 3, 2022. FF Top’s obligations pursuant to the FF Top Amendment are conditioned on (i) the appointment of Mr. Chad Chen (or a substitute nominee, as applicable), to the Board as the fourth FF Top designee no later than October 27, 2022 (provided that Mr. Chad Chen or a substitute nominee, as applicable, is reasonably acceptable to the Nominating and Corporate Governance Committee of the Board with respect to the Nasdaq independence rules and legal compliance and criminal compliance) (provided that if Mr. Chad Chen is not so reasonably acceptable to the Nominating and Corporate Governance Committee of the Board, then FF Top will be permitted to nominate another individual to the Board); and (ii) constructive engagement by Mr. Adam (Xin) He, the Chairman of the Board, directly with representatives of FF Top on certain additional governance and management matters and, to the extent the Chairman of the Board so determines, in his discretion, such matters will be put to a discussion and a vote of the full Board. See “Certain Relationships and Related Person Transactions – Certain Relationships and Related Person Transactions — the Company – Voting Agreements by FF Top Holding LLC and Season Smart Limited” for more information.

On October 27, 2022, Mr. Chad Chen was appointed to the Board. On October 28, 2022, Mr. Brian Krolicki tendered his resignation from the Board effective immediately.

On December 15, 2022, Mr. Lee Liu tendered his resignation from the Board, which resignation was effective on December 18, 2022. On December 18, 2022, Mr. Jie Sheng was appointed to the Board, effective immediately, following the resignation of Mr. Liu. On December 25, 2022, Mr. Edwin Goh tendered his resignation from the Board, which resignation was effective on December 26, 2022. On December 27, 2022, Ms. Ke Sun was appointed to the Board, effective immediately, following the resignation of Mr. Goh. Mr. Sheng and Ms. Sun are designees of FF Top pursuant to the Shareholder Agreement. On December 26, 2022, Dr. Carsten Breitfeld tendered his resignation from the Board, which resignation was effective immediately. On December 27, 2022, Mr. Xuefeng Chen was appointed to the Board, effective immediately, following the resignation of Dr. Breitfeld.

4

On January 13, 2023, the Company entered into an Amended and Restated Shareholder Agreement (the “Amended Shareholder Agreement”) with FF Top and, solely for purposes of certain amendments to the Heads of Agreement, FF Global, which amended and restated the Shareholder Agreement, as amended by the Heads of Agreement. Pursuant to the Amended Shareholder Agreement, (a) FF Top has the right to nominate certain designees to the Board, (b) the Company agreed not to elect to be treated as a “controlled company” as defined under Nasdaq rules, (c) the Company agreed to cooperate with any written requests by FF Top relating to any pledge, hypothecation or grant of shares of Common Stock, (d) FF Top informed the Company that FF Top expects certain proposals to be submitted to Company stockholders for approval to amend provisions of the Company’s Amended and Restated Charter related to voting power of Class B Common Stock, FF Top designees to the Board and written consent of stockholders, (e) the Company agreed not to enter into any transaction or series of related transactions that would require a stockholder vote under Nasdaq Listing Rule 5635(d) (without giving effect to Section 5635(f) thereof) without FF Top’s prior written consent, which written consent shall not be unreasonably withheld, conditioned or delayed, (f) the Company agreed that investors under the SPA shall have the right to enter into any voting agreement or grant a voting proxy, at any time and on any terms, with or to FF Top with respect to any shares of Common Stock held by such investors, (g) FF Top agreed (i) to vote all shares of Common Stock that it beneficially owns in favor of an increase in the Company’s authorized shares of Class A Common Stock from 815.0 million to 1.69 billion (as such number may be adjusted due to any stock split, reverse stock split or other similar corporate action after January 13, 2023) at the next meeting of the Company’s stockholders held to consider such proposal (as such meeting may be adjourned or postponed) and (ii) not to transfer, convert or otherwise take any action that would result in the conversion of any shares of Class B Common Stock into Class A Common Stock of the Company prior to the Company’s receipt of stockholder approval for an increase in the number of authorized shares of Class A Common Stock in accordance with the foregoing, (h) (i) FF Top released and waived claims it or any other “FF Top Parties” (i.e., FF Top, FF Peak Holding LLC, a Delaware limited liability company, Pacific Technology Holding LLC, a Delaware limited liability company, FF Global and each of their affiliates, and their respective successors and assigns) may have had against the Company and the Company Parties (described below; such claims, the “FF Top Claims”) relating to matters occurring at any time after September 23, 2022 but prior to the execution of the Amended Shareholder Agreement (the “FF Top Release”), and (ii) the Company released and waived any and all claims it or any other “Company Parties” (i.e., the Company and each of the Company’s controlled affiliates, each individual currently serving as a director or on the management team of the Company or any of its controlled affiliates, and the respective successors and assigns of any of the foregoing) may have against FF Top Parties relating to any matters occurring at any time after September 23, 2022 but prior to the execution of the Amended Shareholder Agreement, and (i) the Company, FF Top and FF Global agreed that certain conditions in the Heads of Agreement have been satisfied, that there are no Definitive Documents (as such term is defined in the Heads of Agreement) beyond the Heads of Agreement and the Amended Shareholder Agreement, and to certain other amendments of the Heads of Agreement. See “Management – Governance Agreement with FF Top and FF Global” for more information.

On January 20, 2023, Mr. Qing Ye tendered his resignation from the Board, which resignation was effective immediately. Mr. Ye remains a consultant of the Company as an independent contractor until November 18, 2023, at which time both parties will mutually reassess the relationship. On January 25, 2023, Mr. Chui Tin Mok was appointed to the Board, effective immediately, following the resignation of Mr. Ye.

On March 9, 2023, Mr. Matthias Aydt tendered his resignation from the Board, effective upon the nomination and approval by the Board of a replacement director. On March 13, 2023, upon the recommendation of the Nominating and Corporate Governance Committee, the Board appointed Li Han to fill the vacancy on the Board due to Mr. Aydt’s resignation.

Interim CFO Transition and Appointment of New Independent Auditor

On October 12, 2022, Becky Roof, FFIE’s former Interim Chief Financial Officer (“CFO”), resigned from the Company effective immediately. Ms. Roof’s departure from the Company followed the successful completion of key milestones in FFIE’s SEC reporting and fundraising activities, and was not a result of any disagreement with the Company’s independent auditors or any member of Company management on any matter of accounting principles or practices, financial statement disclosure, or internal controls. On October 22, 2022, the Board appointed Yun Han as Chief Accounting Officer and Interim CFO of the Company, reporting to the Global CEO of the Company (previously Dr. Breitfeld and currently Mr. Xuefeng Chen) (or, following the appointment of a permanent CFO, reporting to the CFO of the Company), effective as of October 25, 2022. The Company is continuing its search to identify and appoint a permanent CFO of the Company.

5

Effective as of October 28, 2022, Mazars USA LLP was appointed as the Company’s independent registered public accounting firm as of and for the year ending December 31, 2022. The appointment of Mazars USA LLP follows the notification by PricewaterhouseCoopers LLP to FFIE on August 23, 2022 that it was declining to stand for re-election as FFIE’s independent registered public accounting firm for the year ending December 31, 2022 and, effective immediately, was no longer FFIE’s independent registered public accounting firm.

Committed Equity Financing

On November 11, 2022, FFIE entered into a Standby Equity Purchase Agreement (the “SEPA”) with YA II PN, Ltd., a Cayman Islands exempt limited partnership (“Yorkville”). Pursuant to the SEPA, FFIE has the right to sell to Yorkville up to $200.0 million of shares of Class A Common Stock (which commitment amount may be increased to up to $350.0 million at FFIE’s election), subject to certain limitations and conditions set forth in the SEPA, including an effective registration statement for the resale of shares under the SEPA, from time to time during the term of the SEPA. Sales of Class A Common Stock to Yorkville under the SEPA, and the timing of any such sales, are at FFIE’s option, and FFIE is under no obligation to sell any securities to Yorkville under the SEPA.

Special Meetings of Stockholders

At a special meeting of FFIE stockholders held on November 3, 2022, FFIE stockholders approved the following three proposals: (1) a proposal to approve, as is required by the applicable Nasdaq rules and regulations, transactions involving notes and warrants issued to ATW Partners LLC, RAAJJ, Senyun and/or their affiliates as committed under the SPA, the Joinder and the Third Amendment, including the issuance of any shares in excess of 19.99% of the issued and outstanding shares of Common Stock; (2) a proposal to increase FFIE’s total authorized shares from 825,000,000 to 900,000,000 (the “Share Authorization Proposal”); and (3) a proposal to approve an amendment to the Amended and Restated Charter to effect a reverse stock split of the Common Stock by a ratio of any whole number in the range of 1-for-2 to 1-for-10, and a corresponding reduction in the number of authorized shares of Common Stock (after adjustment of the number of authorized shares, if applicable, resulting from stockholder approval of the Share Authorization Proposal), with such ratio to be determined in the discretion of the Board and with such action to be effected at such time and date, if at all, as determined by the Board within one year after the conclusion of such special meeting of stockholders. On November 22, 2022, FFIE filed an amendment to its Amended and Restated Charter with the Delaware Secretary of State increasing FFIE’s total authorized shares to 900,000,000.

At a special meeting of FFIE stockholders held on February 28, 2023, FFIE stockholders approved the following two proposals: (1) a proposal to approve, as is required by the applicable Nasdaq rules and regulations, advances of Class A Common Stock issued or to be issued to Yorkville, pursuant to the SEPA, including the issuance of any shares in excess of 19.99% of the issued and outstanding shares of Common Stock; and (2) a proposal to increase the number of authorized shares of Class A Common Stock from 815,000,000 to 1,690,000,000, increasing the total number of authorized shares of stock from 900,000,000 to 1,775,000,000. On March 1, 2023, FFIE filed an amendment to its Amended and Restated Charter with the Delaware Secretary of State increasing FFIE’s authorized shares of Class A Common Stock to 1,690,000,000 and its total authorized shares to 1,775,000,000.

At a special meeting of FFIE stockholders held on March 30, 2023, FFIE stockholders approved the following two proposals: (1) a proposal to approve, as is required by the applicable Nasdaq rules and regulations, transactions involving Tranche C and D Notes (as defined below) and accompanying warrants of FFIE issued or to be issued to FF Simplicity, Senyun, Acuitas, RAAJJ and/or their affiliates as contemplated by the Sixth Amendment to the SPA, including the issuance of any shares in excess of 19.99% of the issued and outstanding shares of Common Stock in respect of such notes and warrants; and (2) a proposal to ratify the selection of Mazars USA LLP as the independent registered public accounting firm of FFIE for the year ended December 31, 2022.

Global Chief Executive Officer Transition

On November 26, 2022, the Board appointed Mr. Xuefeng Chen as Global CEO, effective as of November 27, 2022. Mr. Xuefeng Chen replaced Dr. Carsten Breitfeld, who was removed from the Global CEO position by the Board on November 26, 2022 and who tendered his resignation as a director of the Board on December 26, 2022.

PRC Subsidiaries

FFIE is a holding company incorporated in the State of Delaware. Faraday&Future Inc. (“FF U.S.”), FF’s primary U.S. operating subsidiary, was incorporated and founded in the State of California in May 2014. We refer to all our subsidiaries organized in China (including Hong Kong) collectively as the “PRC Subsidiaries,” a complete list of which is set forth in Exhibit 21.1 to the registration statement of which this prospectus forms a part. As of the date of this prospectus, our only operating subsidiaries in China (including Hong Kong) are FF Automotive (China) Co. Ltd., Ruiyu Automotive (Beijing) Co., Ltd. and Shanghai Faran Automotive Technology Co., Ltd., each of which was organized in the PRC. For additional information regarding FF’s corporate history, see “Business – Corporate History and Milestones.”

6

How Cash is Transferred Through Our Corporate Organization

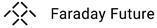

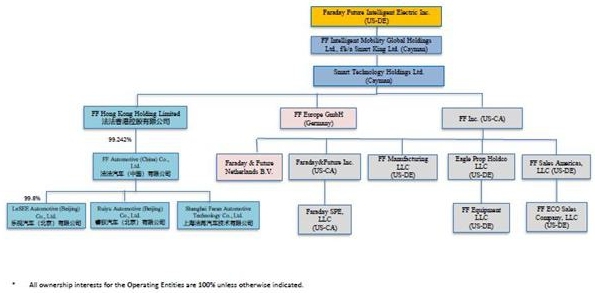

The organizational chart below shows FFIE’s operating subsidiaries* as of the date hereof:

| * | Excludes subsidiaries with immaterial operations. FF Hong Kong Holding Limited is a holding company subsidiary organized in Hong Kong. As of the date hereof, LeSEE Automotive (Beijing) Co. Ltd., a subsidiary organized in China, has immaterial operations. |

The PRC has currency and capital transfer regulations that require us to comply with certain requirements for the movement of capital in and out of the PRC. FFIE is able to transfer cash (U.S. Dollars) to the PRC Subsidiaries through capital contributions (increasing FFIE’s capital investment in the PRC Subsidiaries). FFIE may receive cash or assets declared as dividends from the PRC Subsidiaries. The PRC Subsidiaries can transfer funds to each other when necessary, by way of intercompany loans in the following manners:

| ● | FF Hong Kong Holding Limited, as the holding company of all the other PRC Subsidiaries, can transfer cash to any PRC Subsidiary through capital contribution. We note Hong Kong’s banking system is outside PRC mainland’s banking system. As a result, when FF Hong Kong Holding Limited transfers cash to a PRC Subsidiary, it is required to follow the SAFE (as defined below) process and regulation. |

| ● | FF Hong Kong Holding Limited, as the holding company of all the other PRC Subsidiaries, may receive cash or assets declared as dividends from the other PRC Subsidiaries. |

| ● | Among PRC Subsidiaries other than FF Hong Kong Holding Limited, one PRC Subsidiary can provide funds through intercompany loan to another PRC Subsidiary and each such PRC Subsidiary is required to follow the rules of China Banking Regulatory Commission and other relevant Chinese authorities. Additionally, one PRC Subsidiary can transfer cash to its subsidiary through capital contribution, and any PRC Subsidiary may receive cash or assets declared as dividends from any of its subsidiaries. |

7

During 2019, FF Inc., a U.S.-based subsidiary incorporated in California, issued a loan to FF Hong Kong Holding Limited, a holding company subsidiary established in Hong Kong, in the aggregate amount of $1.2 million, which was the only transaction that involved the transfer of cash or assets throughout our corporate structure during 2019. During 2020, LeSee Automotive (Beijing) Co. Ltd., a PRC Subsidiary, assigned to Legacy FF its obligation to pay certain notes issued by a third party in the aggregate principal and accrued interest amount of $26.5 million. Also during 2020, Smart Technology Holdings Ltd., a subsidiary incorporated in the Cayman Islands, transferred to FF Hong Kong Holding Limited $1.7 million in cash, in the aggregate, by way of capital contributions to fund the PRC Subsidiaries’ operations. During 2021, Smart Technology Holdings Ltd. transferred to FF Hong Kong Holding Limited $32.1 million, in the aggregate, by way of capital contributions to fund the operations of the PRC Subsidiaries, including $10.0 million proceeds from the sale of PIPE Shares. In August 2021, Legacy FF extended a loan of $50.0 million to FF Automotive (Zhuhai) Co. Ltd., a PRC Subsidiary, for the purpose of acquiring a technology license agreement with a third party. We transferred cash or assets of $9.1 million from Smart Technology Holdings Ltd. to FF Hong Kong Holding Limited during the fourth quarter of 2021. In 2022 and 2023 to date, FF U.S. extended loans in an aggregated amount of $8.0 million and $3.0 million, respectively, to FF Hong Kong Holding Limited to fund the operations of the PRC Subsidiaries. We will continue to assess the PRC Subsidiaries’ requirements to fund their operations and intend to effect additional contributions as appropriate. As of the date hereof, our only operating subsidiaries in China (including Hong Kong) are FF Automotive (China) Co. Ltd., Ruiyu Automotive (Beijing) Co., Ltd. and Shanghai Faran Automotive Technology Co., Ltd., each of which was organized in the PRC. The PRC Subsidiaries have not transferred cash or other assets to FFIE, including by way of dividends. FFIE does not currently plan or anticipate transferring cash or other assets from our operations in China to any non-Chinese entity.

Capital contributions to PRC companies are mainly governed by the Company Law and Foreign Investment Law of the People’s Republic of China, and the dividends and distributions from the PRC Subsidiaries are subject to regulations and restrictions of the PRC on dividends and payment to parties outside of the PRC. Applicable PRC law permits payment of dividends to FFIE by our PRC Subsidiaries only out of their net income, if any, determined in accordance with PRC accounting standards and regulations. Our operating PRC Subsidiaries are required to set aside a portion of their net income, if any, each year to fund general reserves for appropriations until such reserves have reached 50% of the relevant entity’s registered capital. These reserves are not distributable as cash dividends. A PRC company is not permitted to distribute any profits until any losses from prior fiscal years have been offset. Profits retained from prior fiscal years may be distributed together with distributable profits from the current fiscal year. In addition, registered share capital and capital reserve accounts are also restricted from withdrawal in the PRC, up to the amount of net assets held in each operating subsidiary.

PRC Restrictions on Foreign Exchange and Transfer of Cash

Under PRC laws, if certain procedural requirements are satisfied, the payment of current account items, including profit distributions and trade and service related foreign exchange transactions, can be made in foreign currencies between entities, across borders, and to U.S. investors without prior approval from State Administration of Foreign Exchange (the “SAFE”) or its local branches. However, where Chinese Yuan (“CNY”) is to be converted into foreign currency and remitted out of China to pay capital expenses, such as the repayment of loans denominated in foreign currencies, approval from or registration with SAFE or its authorized banks is required. The PRC government may take measures at its discretion from time to time to restrict access to foreign currencies for current account or capital account transactions. If the foreign exchange control system prevents our PRC Subsidiaries from obtaining sufficient foreign currencies to satisfy their foreign currency demands, our PRC Subsidiaries may not be able to pay dividends in foreign currencies to FFIE. Further, we cannot assure you that new regulations or policies will not be promulgated in the future that would have the effect of further restricting the remittance of CNY into or out of the PRC. We cannot assure you, in light of the restrictions in place, or any amendment thereof, that the PRC Subsidiaries will be able to fund their future activities which are conducted in foreign currencies, including the payment of dividends.

Furthermore, under PRC laws, dividends may be paid only out of distributable profits. Distributable profits are the net profit as determined under PRC GAAP, less any recovery of accumulated losses and appropriations to statutory and other reserves required to be made. Our PRC Subsidiaries shall appropriate 10% of the net profits as reported in their statutory financial statements (after offsetting any prior year’s losses) to the statutory surplus reserves until the reserves have reached 50% of their registered capital. As a result, our PRC Subsidiaries may not have sufficient, or any, distributable profits to pay dividends to us. See “Risk Factors – Risks Related to FF’s Operations in China – FFIE is a holding company and, in the future, may rely on dividends and other distributions on equity paid by the PRC Subsidiaries to fund any cash and financing requirements that FFIE may have, and the restrictions on PRC Subsidiaries’ ability to pay dividends or make other payments to FFIE could restrict FFIE’s ability to satisfy its liquidity requirements and have a material adverse effect on FFIE’s ability to conduct its business” for a more detailed discussion of the relevant risks relating to restrictions on foreign exchange and transfer of cash.

Requirements Under PRC Laws and Regulations

Under current PRC laws and regulations, each of our PRC Subsidiaries is required to obtain a business license to operate in the PRC. Our PRC Subsidiaries have all received the requisite business license to operate, and no application for business license had been denied.

8

As our operations in the PRC expand, our PRC Subsidiaries will be required to obtain approvals, licenses, permits and registrations from PRC regulatory authorities, such as the State Administration for Market Regulation, the National Development and Reform Commission, Ministry of Commerce (“MOFCOM”), and the Ministry of Industry and Information Technology (“MIIT”), which oversee different aspects of the electric vehicle business. As of the date hereof, no application by our PRC Subsidiaries for any such approvals, licenses, permits and registrations that are currently applicable to them had been denied, but there can be no assurance that the PRC Subsidiaries will be able to maintain their existing licenses or obtain new ones. See “Risk Factors – Risks Related to FF’s Operations in China – FF may be adversely affected by the complexity, uncertainties and changes in PRC regulations on internet-related business, automotive businesses and other business carried out by FF’s PRC Subsidiaries.” for a more detailed discussion of the risks relevant to the regulations relating to the operations of the PRC Subsidiaries.

We do not believe any permission is required from any Chinese authorities (including the China Securities Regulatory Commission (the “CSRC”) and the Cyberspace Administration of China (the “CAC”)) in connection with this offering. We do not and immediately prior to the consummation of this offering, will not possess over one million of PRC-based individual’s personal information. After consulting our PRC counsel, Fangda Partners, we believe we are currently not subject to the requirement under the Cybersecurity Review Measures that a network platform operator which possesses more than one million users’ personal information must apply for a cybersecurity review with CAC before listing abroad. In addition, as of the date of this prospectus, after consulting our PRC counsel, we are not aware of any other laws or regulations currently effective in the PRC which explicitly require us to obtain any permission from the CSRC or other Chinese authorities to consummate this offering, nor had we received any inquiry, notice, or warning from the CSRC or any other Chinese authorities in such respects. The PRC authorities have promulgated new or proposed laws and regulations recently to further regulate securities offerings or listings that are conducted overseas by PRC domestic companies and/or foreign investment in China-based issuers. According to these new laws and regulations and the draft laws and regulations if enacted in their current forms, in connection with our future securities offering activities, we may be required to fulfill filing, reporting procedures with the CSRC, and may be required to go through cybersecurity review by the PRC authorities. However, there are uncertainties with respect to whether we will be able to fully comply with requirements to obtain such permissions and approvals from, or complete such reporting or filing procedures with PRC authorities. For more detailed information, see “Risk Factors – Risks Related to FF’s Operations in China – The approval of, or filing or other administrative procedures with, the CSRC or other PRC governmental authorities may be required in connection with certain of our financing activities, and, if required, we cannot predict if we will be able to obtain such approval or complete such filing or other administrative procedures” and “Risk Factors – Risks Related to FF’s Operations in China – We face challenges from the evolving regulatory environment regarding cybersecurity, information security, privacy and data protection. Many of these laws and regulations are subject to change and uncertain interpretation, and any actual or alleged failure to comply with related laws and regulations regarding cybersecurity, information security, data privacy and protection could materially and adversely affect our business and results of operations” for a more detailed discussion of the relevant risks relating to the applicable of PRC laws and Regulations.

Summary Risk Factors

An investment in our Class A Common Stock involves substantial risk. The occurrence of one or more of the events or circumstances described in the section entitled “Risk Factors,” alone or in combination with other events or circumstances, may have a material adverse effect on our business, cash flows, financial condition and results of operations. Important factors and risks that could cause actual results to differ materially from those in the forward-looking statements include, among others, the following:

Risks Related to FF’s Business and Industry

| ● | FF has a limited operating history and faces significant barriers to growth in the electric vehicle industry.

| |

| ● | FF has incurred losses in its business operations and anticipates that it will continue to incur losses in the future. It may never achieve or sustain profitability.

| |

| ● | FF expects its operating expenses to increase significantly in the future, which may impede its ability to achieve profitability.

| |

| ● | FF needs to raise additional capital to support the production and delivery of the FF 91 Futurist and satisfy its other capital needs.

| |

| ● | FF has historically incurred substantial indebtedness and may continue to do so.

| |

| ● | Start of production of FF’s first vehicle, the FF 91 Futurist, has been recently announced, and the production and delivery of the FF 91 Futurist has experienced, and may continue to experience, significant delays.

| |

| ● | For the audits of the years ended December 31, 2022 and 2021, FF’s current and former independent auditor’s reports included an explanatory paragraph relating to FF’s ability to continue as a going concern.

| |

| ● | FF is taking remedial measures in response to the Special Committee findings. There can be no assurance that such remedial measures will be successful. In addition, there can be no assurance that such remedial measures will be fully implemented in light of the recent corporate governance agreements with FF Top and FF Global, and the recent assessment by the Board of FF’s management structure, including management roles, responsibilities and reporting lines, and recent changes to the Board.

| |

| ● | FF is involved in an SEC investigation, and may be further subject to investigations and legal proceedings related to the matters underlying the Special Committee investigation.

| |

| ● | FF will depend on revenue generated from a single model of vehicles in the foreseeable future. |

9

|

● | The market for FF’s vehicles is nascent and not established. FF had 356 non-binding, fully refundable pre-orders as of February 27, 2023 and other non-binding indications of interest, and there can be no assurance that such pre-orders and other indications of interest will be converted into actual binding orders or sales.

|

| ● | FF is dependent on its suppliers, the majority of which are single-source suppliers. The inability of these suppliers to timely deliver necessary components for FF products, and disruption of supply or increases in costs of materials could harm FF’s business.

| |

| ● | FF may not develop the complex software and technology systems necessary for the production of its electric vehicles.

| |

| ● | FF identified material weaknesses in its internal control over financial reporting.

| |

| ● | FF’s decision to manufacture its own vehicles in its leased Hanford, California facility does not guarantee FF will not incur significant delays in the production of the vehicles.

| |

| ● | FF’s contract manufacturer or other future contract manufacturer may fail to timely produce and deliver vehicles.

| |