0001805385DEF 14Afalse00018053852023-01-012023-12-31iso4217:USD00018053852022-01-012022-12-3100018053852021-01-012021-12-310001805385nhic:EquityAwardsGrantDateFairValueMemberecd:PeoMember2023-01-012023-12-310001805385nhic:EquityAwardsGrantDateFairValueMemberecd:PeoMember2022-01-012022-12-310001805385nhic:EquityAwardsGrantDateFairValueMemberecd:PeoMember2021-01-012021-12-310001805385ecd:PeoMembernhic:ChangeInPensionValueMember2023-01-012023-12-310001805385ecd:PeoMembernhic:ChangeInPensionValueMember2022-01-012022-12-310001805385ecd:PeoMembernhic:ChangeInPensionValueMember2021-01-012021-12-310001805385nhic:PensionAdjustmentsServiceCostMemberecd:PeoMember2023-01-012023-12-310001805385nhic:PensionAdjustmentsServiceCostMemberecd:PeoMember2022-01-012022-12-310001805385nhic:PensionAdjustmentsServiceCostMemberecd:PeoMember2021-01-012021-12-310001805385nhic:EquityAwardsGrantedDuringTheYearOutstandingAndUnvestedMemberecd:PeoMember2023-01-012023-12-310001805385nhic:EquityAwardsGrantedDuringTheYearOutstandingAndUnvestedMemberecd:PeoMember2022-01-012022-12-310001805385nhic:EquityAwardsGrantedDuringTheYearOutstandingAndUnvestedMemberecd:PeoMember2021-01-012021-12-310001805385nhic:EquityAwardsGrantedInPriorYearsOutstandingAndUnvestedMemberecd:PeoMember2023-01-012023-12-310001805385nhic:EquityAwardsGrantedInPriorYearsOutstandingAndUnvestedMemberecd:PeoMember2022-01-012022-12-310001805385nhic:EquityAwardsGrantedInPriorYearsOutstandingAndUnvestedMemberecd:PeoMember2021-01-012021-12-310001805385nhic:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2023-01-012023-12-310001805385nhic:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2022-01-012022-12-310001805385nhic:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2021-01-012021-12-310001805385nhic:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2023-01-012023-12-310001805385nhic:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2022-01-012022-12-310001805385nhic:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2021-01-012021-12-310001805385ecd:PeoMembernhic:EquityAwardsThatFailedToMeetVestingConditionsMember2023-01-012023-12-310001805385ecd:PeoMembernhic:EquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310001805385ecd:PeoMembernhic:EquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310001805385ecd:PeoMembernhic:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2023-01-012023-12-310001805385ecd:PeoMembernhic:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2022-01-012022-12-310001805385ecd:PeoMembernhic:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2021-01-012021-12-310001805385nhic:EquityAwardsGrantDateFairValueMemberecd:NonPeoNeoMember2023-01-012023-12-310001805385nhic:EquityAwardsGrantDateFairValueMemberecd:NonPeoNeoMember2022-01-012022-12-310001805385nhic:EquityAwardsGrantDateFairValueMemberecd:NonPeoNeoMember2021-01-012021-12-310001805385ecd:NonPeoNeoMembernhic:ChangeInPensionValueMember2023-01-012023-12-310001805385ecd:NonPeoNeoMembernhic:ChangeInPensionValueMember2022-01-012022-12-310001805385ecd:NonPeoNeoMembernhic:ChangeInPensionValueMember2021-01-012021-12-310001805385nhic:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-310001805385nhic:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310001805385nhic:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310001805385nhic:EquityAwardsGrantedDuringTheYearOutstandingAndUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001805385nhic:EquityAwardsGrantedDuringTheYearOutstandingAndUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001805385nhic:EquityAwardsGrantedDuringTheYearOutstandingAndUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001805385nhic:EquityAwardsGrantedInPriorYearsOutstandingAndUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001805385nhic:EquityAwardsGrantedInPriorYearsOutstandingAndUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001805385nhic:EquityAwardsGrantedInPriorYearsOutstandingAndUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001805385nhic:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001805385nhic:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001805385nhic:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001805385ecd:NonPeoNeoMembernhic:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001805385ecd:NonPeoNeoMembernhic:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310001805385ecd:NonPeoNeoMembernhic:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310001805385ecd:NonPeoNeoMembernhic:EquityAwardsThatFailedToMeetVestingConditionsMember2023-01-012023-12-310001805385ecd:NonPeoNeoMembernhic:EquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310001805385ecd:NonPeoNeoMembernhic:EquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310001805385ecd:NonPeoNeoMembernhic:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2023-01-012023-12-310001805385ecd:NonPeoNeoMembernhic:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2022-01-012022-12-310001805385ecd:NonPeoNeoMembernhic:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2021-01-012021-12-31000180538512023-01-012023-12-31000180538522023-01-012023-12-31000180538532023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

| | |

| Evolv Technologies Holdings, Inc. |

| (Name of Registrant as Specified in its Charter) |

| | |

|

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| x | No fee required. |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Evolv Technologies Holdings, Inc.

NOTICE & PROXY STATEMENT

Annual Meeting of Stockholders

May 31, 2024

10:00 a.m. (Eastern time)

EVOLV TECHNOLOGIES HOLDINGS, INC.

500 Totten Pond Road, 4th Floor

Waltham, Massachusetts 02451

__________________

April 15, 2024

To Our Stockholders:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Evolv Technologies Holdings, Inc. at 10:00 a.m. Eastern time, on Friday, May 31, 2024. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast.

The Notice of Meeting and Proxy Statement on the following pages describe the matters to be presented at the Annual Meeting. Please see the section called “Who can attend the Annual Meeting?” on page 3 of the proxy statement for more information about how to attend the meeting online.

Whether or not you attend the Annual Meeting online, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy by phone, via the Internet, or, if you received paper copies of these materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. If you have previously received our Notice of Internet Availability of Proxy Materials, then instructions regarding how you can vote are contained in that notice. If you have received a proxy card, then instructions regarding how you can vote are contained on the proxy card. If you decide to attend the Annual Meeting virtually, you will be able to vote online, even if you have previously submitted your proxy.

Thank you for your support.

Sincerely,

Peter George

President and Chief Executive Officer

Director

Table of Contents

EVOLV TECHNOLOGIES HOLDINGS, INC.

500 Totten Pond Road, 4th Floor

Waltham, Massachusetts 02451

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD FRIDAY, MAY 31, 2024

The Annual Meeting of Stockholders (the “Annual Meeting”) of Evolv Technologies Holdings, Inc., a Delaware corporation (the “Company”), will be held at 10:00 a.m. Eastern time on Friday, May 31, 2024. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting https://www.cstproxy.com/evolvtechnology/2024 and entering your 12-digit control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials. The Annual Meeting will be held for the following purposes:

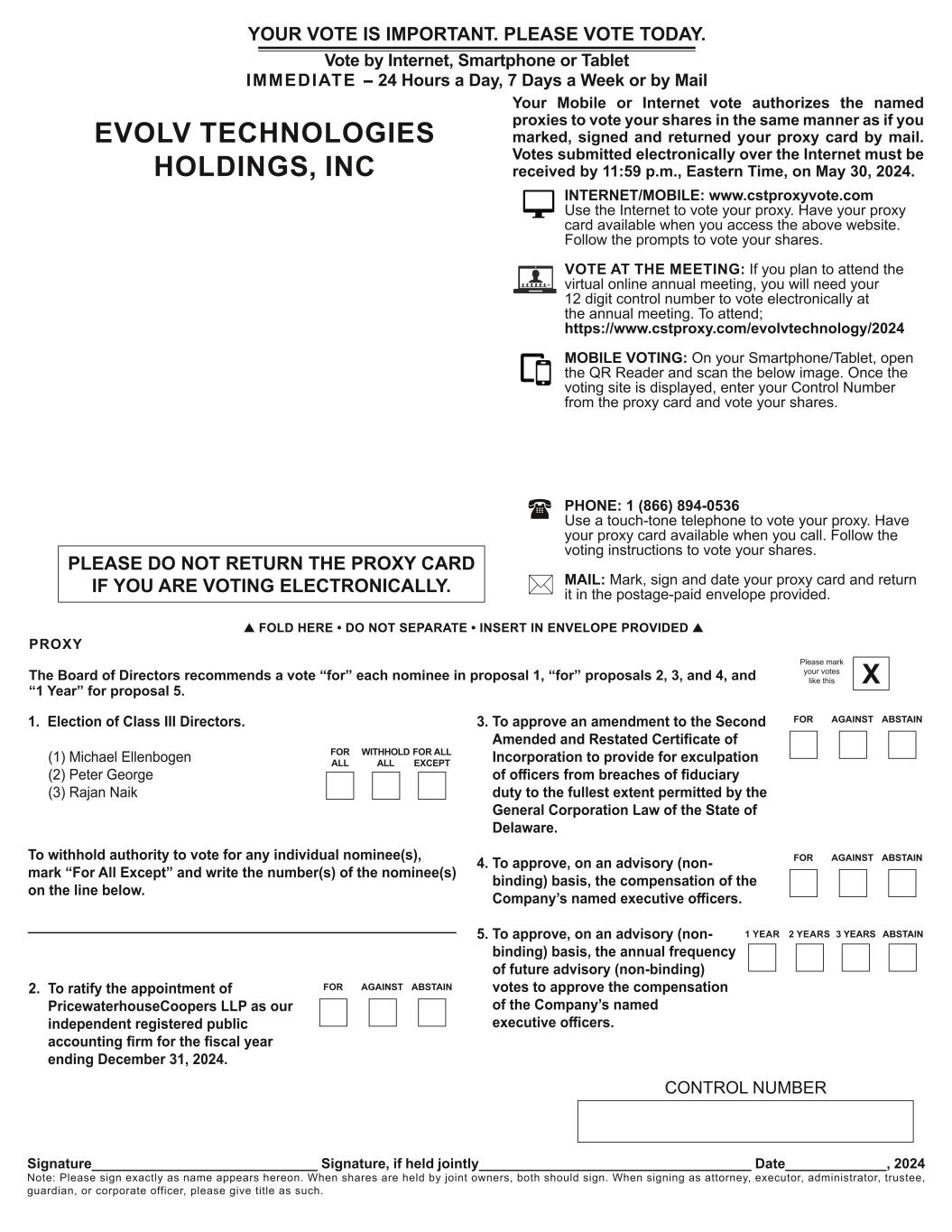

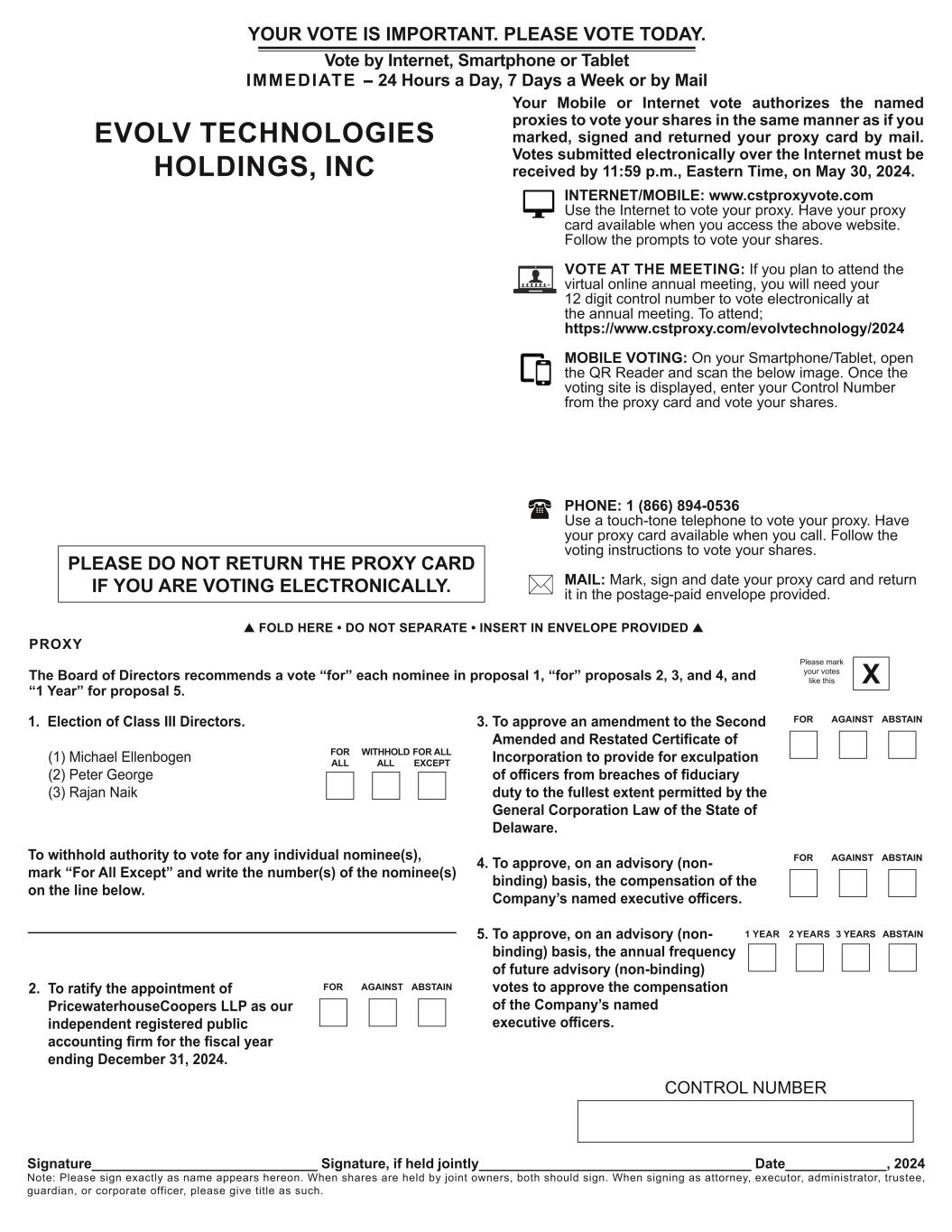

•To elect Michael Ellenbogen, Peter George, and Rajan Naik as Class III Directors to serve until the 2027 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified;

•To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024;

•To approve an amendment to our Second Amended and Restated Certificate of Incorporation to provide for exculpation of officers from breaches of fiduciary duty to the fullest extent permitted by the General Corporation Law of the State of Delaware;

•To approve, on an advisory (non-binding) basis, the compensation of our named executive officers (the “Say-on-Pay Vote”);

•To approve, on an advisory (non-binding) basis, the annual frequency of future Say-on-Pay Votes; and

•To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting.

Holders of record of our Class A common stock as of the close of business on April 2, 2024 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. A complete list of such stockholders will be open to the examination of any stockholder for a period of ten days prior to the Annual Meeting for a purpose germane to the meeting during ordinary business hours at the Company’s principal offices or by sending an email to Eric Pyenson, General Counsel and Secretary, at epyenson@evolvtechnology.com stating the purpose of the request and providing proof of ownership of Company stock. The list of these stockholders will also be available on the bottom of your screen during the Annual Meeting after entering the 12-digit control number included on your Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting online, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the enclosed materials. If you received a copy of the proxy card by mail, you may sign, date and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

By Order of the Board of Directors

Eric Pyenson

General Counsel and Secretary

Waltham, Massachusetts

April 15, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON FRIDAY, MAY 31, 2024

This Notice and Proxy Statement and our 2023 Annual Report to Stockholders are available at https://www.cstproxy.com/evolvtechnology/2024

EVOLV TECHNOLOGIES HOLDINGS, INC.

500 Totten Pond Road, 4th Floor

Waltham, Massachusetts 02451

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation by the Board of Directors of Evolv Technologies Holdings, Inc. of proxies to be voted at our Annual Meeting of Stockholders to be held on Friday, May 31, 2024 (the “Annual Meeting”), at 10:00 a.m. Eastern time, and at any continuation, postponement, or adjournment of the Annual Meeting. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit questions during by visiting https://www.cstproxy.com/evolvtechnology/2024 and entering your 12-digit control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials.

Holders of record of shares of our Class A common stock, par value $0.001 per share (“Class A common stock”), as of the close of business on April 2, 2024 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement, or adjournment of the Annual Meeting. As of the Record Date, there were 155,579,300 shares of Class A common stock outstanding and entitled to vote at the Annual Meeting. Each share of Class A common stock is entitled to one vote on any matter presented to stockholders at the Annual Meeting.

This proxy statement and the Company’s Annual Report to Stockholders for the year ended December 31, 2023 (the “2023 Annual Report”) will be released on or about April 15, 2024 to our stockholders on the Record Date.

In this proxy statement, “Evolv”, “Company”, “we”, “us”, and “our” refer to Evolv Technologies Holdings, Inc.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON THURSDAY, MAY 31, 2024

This Notice and Proxy Statement and our 2023 Annual Report to Stockholders are available at https://www.cstproxy.com/evolvtechnology/2024

Proposals

At the Annual Meeting, our stockholders will be asked:

•To elect Michael Ellenbogen, Peter George, and Rajan Naik as Class III Directors to serve until the 2027 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified;

•To ratify the appointment of PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm for the fiscal year ending December 31, 2024;

•To approve an amendment to our Second Amended and Restated Certificate of Incorporation to provide for exculpation of officers from breaches of fiduciary duty to the fullest extent permitted by the General Corporation Law of the State of Delaware (the “Exculpation Proposal”);

•To approve, on an advisory (non-binding) basis, the compensation of our named executive officers (the “Say-on-Pay Vote”);

•To approve, on an advisory (non-binding) basis, the annual frequency of future Say-on-Pay Votes; and

•To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting.

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Recommendations of the Board

The Board of Directors (the “Board”) recommends that you vote your shares as indicated below. If you return a properly completed proxy card, or vote your shares by telephone or Internet, your shares of Class A common stock will be voted on your behalf as you direct. If not otherwise specified, the shares of Class A common stock represented by the proxies will be voted, and the Board of Directors recommends that you vote:

•FOR the election of Michael Ellenbogen, Peter George, and Rajan Naik as Class III Directors;

•FOR the ratification of the appointment of PwC as our independent registered public accounting firm for the fiscal year ending December 31, 2024;

•FOR the approval of the Exculpation Proposal;

•FOR the approval of, on an advisory (non-binding) basis, the Say-on-Pay Vote; and

•FOR the approval of, on an advisory (non-binding) basis, the annual frequency of future Say-on-Pay Votes.

If any other matter properly comes before the stockholders for a vote at the Annual Meeting, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Information About This Proxy Statement

Why you received this proxy statement. You are viewing or have received these proxy materials because Evolv’s Board of Directors is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and that is designed to assist you in voting your shares.

Notice of Internet Availability of Proxy Materials. As permitted by SEC rules, Evolv is making this proxy statement and its 2023 Annual Report available to its stockholders electronically via the Internet. On or about April 15, 2024, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) containing instructions on how to access this proxy statement and our 2023 Annual Report and vote online. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them. Instead, the Internet Notice instructs you on how to access and review all of the important information contained in the proxy statement and 2023 Annual Report. The Internet Notice also instructs you on how you may submit your proxy over the Internet. If you received an Internet Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Internet Notice.

Printed Copies of Our Proxy Materials. If you received printed copies of our proxy materials, then instructions regarding how you can vote are contained on the proxy card included in the materials.

Householding. The SEC’s rules permit us and intermediaries (e.g., brokers, banks, and other agents) to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we and a number of intermediaries with account holders who are our stockholders have delivered only one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. A proxy card or voting instruction form will be delivered for each of the stockholders sharing an address. We agree to deliver promptly, upon written or oral request, a separate copy of the proxy materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the proxy materials or if you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future proxy materials for your household, please contact Broadridge, either by calling (800) 579-1639 or by writing to 51 Mercedes Way, Edgewood, NY 11717.

QUESTIONS AND ANSWERS ABOUT THE 2024 ANNUAL MEETING OF STOCKHOLDERS

Who is entitled to vote at the Annual Meeting?

The Record Date for the Annual Meeting is April 2, 2024. You are entitled to vote at the Annual Meeting only if you were a stockholder of record at the close of business on that date, or if you hold a valid proxy for the Annual Meeting. Each outstanding share of Class A common stock is entitled to one vote for all matters before the Annual Meeting. At the close of business on the Record Date, there were 155,579,300 shares of Class A common stock outstanding and entitled to vote at the Annual Meeting.

What is the difference between being a “record holder” and holding shares in “street name”?

A record holder holds shares in his or her name. Shares held in “street name” means shares that are held in the name of a bank or broker on a person’s behalf.

Am I entitled to vote if my shares are held in “street name”?

Yes. If your shares are held by a bank or a brokerage firm, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials are being provided to you by your bank or brokerage firm, along with a voting instruction card if you received printed copies of our proxy materials. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions. If your shares are held in street name, you may not vote your shares online at the Annual Meeting, unless you obtain a legal proxy from your bank or brokerage firm.

How many shares must be present to hold the Annual Meeting?

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting online or by proxy, of the holders of a majority in voting power of the Class A common stock issued and outstanding and entitled to vote, present in person, or by remote communication, if applicable, or represented by proxy, on the Record Date will constitute a quorum.

Who can attend the Annual Meeting?

Evolv has decided to hold the Annual Meeting entirely online this year to allow greater participation. You may attend the Annual Meeting online only if you are a Evolv stockholder who is entitled to vote at the Annual Meeting, or if you hold a valid proxy for the Annual Meeting. You may attend and participate in the Annual Meeting by visiting the following website:

https://www.cstproxy.com/evolvtechnology/2024

To attend and participate in the Annual Meeting, you will need the 12-digit control number included in your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 12-digit control number or otherwise vote through the bank or broker. If you lose your 12-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. The meeting webcast will begin promptly at 10:00 a.m. Eastern time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 9:55 a.m., Eastern time, and you should allow ample time for the check-in procedures.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present at the scheduled time of the Annual Meeting, the Chairperson of the Annual Meeting is authorized by our Amended and Restated Bylaws to adjourn the meeting, without the vote of stockholders.

What does it mean if I receive more than one Internet Notice or more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each Internet Notice or set of proxy materials, please submit your proxy by phone, via the Internet, or, if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

How do I vote?

Stockholders of Record. If you are a stockholder of record, you may vote by:

•Internet (including by scanning your QR code on your Notice and/or Proxy Card with your mobile device) — You can vote over the Internet at https://www.cstproxy.com/evolvtechnology/2024 by following the instructions on the Internet Notice or proxy card;

•Telephone — You can vote by telephone by calling 1-866-894-0536. Use a touch-tone telephone to vote your proxy. Have your proxy card available when you call. Follow the voting instructions to vote your shares.

•Mail — You can vote by mail by signing, dating and mailing the proxy card, which you may have received by mail; or

•Electronically at the Meeting — If you attend the meeting online, you will need the 12-digit control number included in your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials to vote electronically during the meeting.

Internet and telephone voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern time, on May 30, 2024. To participate in the Annual Meeting, including to vote via the Internet or telephone, you will need the 12-digit control number included on your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials.

Whether or not you expect to attend the Annual Meeting online, we urge you to vote your shares as promptly as possible to ensure your representation and the presence of a quorum at the Annual Meeting. If you submit your proxy, you may still decide to attend the Annual Meeting and vote your shares electronically.

Beneficial Owners of Shares Held in “Street Name.” If your shares are held in “street name” through a bank or broker, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted. Internet and telephone voting also may be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you would like to vote your shares online at the Annual Meeting, you should contact your bank or broker to obtain your 12-digit control number or otherwise vote through the bank or broker. If you lose your 12-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. You will need to obtain your own Internet access if you choose to attend the Annual Meeting online and/or vote over the Internet.

Can I change my vote after I submit my proxy?

Yes.

If you are a registered stockholder, you may revoke your proxy and change your vote:

•by submitting a duly executed proxy bearing a later date;

•by granting a subsequent proxy through the Internet or telephone;

•by giving written notice of revocation to the Secretary of Evolv prior to or at the Annual Meeting; or

•by voting online at the Annual Meeting.

Your most recent proxy card or Internet or telephone proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Secretary before your proxy is voted or you vote online at the Annual Meeting.

If you are a beneficial owner and your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote online at the Annual Meeting by obtaining your 12-digit control number or otherwise voting through the bank or broker.

Who will count the votes?

A representative of Continental Stock Transfer & Trust, our inspector of election, will tabulate and certify the votes.

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions on the Company’s proxy card, the persons named as proxies will vote in accordance with the recommendations of the Board of Directors. The Board of Directors’

recommendations are indicated on page 2 of this proxy statement, as well as with the description of each proposal in this proxy statement. Will any other business be conducted at the Annual Meeting?

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Why hold a virtual meeting?

We believe that hosting a virtual meeting this year is in the best interest of the Company and its stockholders. A virtual meeting also enables increased stockholder attendance and participation because stockholders can participate from any location around the world. A virtual meeting can also provide cost savings for our stockholders and us, and it is more environmentally friendly.

You will be able to attend the Annual Meeting online and submit your questions by visiting

https://www.cstproxy.com/evolvtechnology/2024. You also will be able to vote your shares electronically at the Annual Meeting by following the instructions above.

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. Information for assistance can be found at https://www.cstproxy.com/evolvtechnology/2024.

Will there be a question-and-answer session during the Annual Meeting?

As part of the Annual Meeting, we will hold a live Q&A session, during which we intend to answer questions submitted online during the meeting that are pertinent to the Company and the meeting matters, for up to 10 minutes after the completion of the Annual Meeting. Appropriate questions submitted by stockholders will be read during the Q&A session of the Annual Meeting. Only stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “Who can attend the Annual Meeting?” will be permitted to submit questions during the Annual Meeting. Each stockholder is limited to no more than two questions. Questions should be succinct and only cover a single topic. We will not address questions that are, among other things:

•irrelevant to the business of the Company or to the business of the Annual Meeting;

•related to material non-public information of the Company, including the status or results of our business since our last Quarterly Report on Form 10-Q;

•related to any pending, threatened or ongoing litigation;

•related to personal grievances;

•derogatory references to individuals or that are otherwise in bad taste;

•substantially repetitious of questions already made by another stockholder;

•in excess of the two question limit;

•in furtherance of the stockholder’s personal or business interests; or

•out of order or not otherwise suitable for the conduct of the Annual Meeting as determined by the Chair or Secretary in their reasonable judgment.

Additional information regarding the Q&A session will be available in the “Rules of Conduct” available on the Annual Meeting webpage for stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “Who can attend the Annual Meeting?”.

How many votes are required for the approval of the proposals to be voted upon and how will abstentions and broker non-votes be treated?

| | | | | | | | | | | | | | |

| Proposal | | Votes required | | Effect of Votes Withheld / Abstentions and Broker Non-Votes |

Proposal 1: Election of Class III Directors | | The plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative “FOR” votes will be elected as Class III Directors. | | Votes withheld and broker non-votes will have no effect. |

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | | The affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes) on such matter. | | Abstentions will have no effect. We do not expect any broker non-votes on this proposal. |

Proposal 3: Approval of the Exculpation Proposal | | The affirmative vote of the holders of at least two-thirds (66 and 2/3%) of the total voting power of all the then outstanding shares of stock of the Company entitled to vote thereon. | | Abstentions and broker non-votes will have the same effect as votes against the proposal. |

Proposal 4: Approval of, on an advisory (non-binding) basis, the Say-on-Pay Vote | | The affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes) on such matter. | | Abstentions and broker non-votes will have no effect. |

Proposal 5: Approval of, on an advisory (non-binding) basis, the annual frequency of future Say-on-Pay Votes | | The affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes) on such matter. If no frequency receives the foregoing vote, then we will consider the option of ONE YEAR, TWO YEARS, or THREE YEARS that receives the highest number of votes cast to be the frequency recommended by stockholders. | | Abstentions and broker non-votes will have no effect. |

What is a “vote withheld” and an “abstention” and how will votes withheld and abstentions be treated?

A “vote withheld,” in the case of Proposal 1, or an “abstention,” in the case of Proposal 2, Proposal 3, Proposal 4, and Proposal 5 represent a stockholder’s affirmative choice to decline to vote on a proposal. Votes withheld and abstentions are counted as present and entitled to vote solely for purposes of determining a quorum. Votes withheld will have no effect on the election of directors and abstentions will have no effect on the ratification of the appointment of PwC, approval on an advisory (non-binding) basis of the compensation of our named executive officers, or approval on an advisory (non-binding) basis of the frequency of future advisory votes on the compensation of our named executive officers. Abstentions will have the same effect as a vote against the proposal to approve an amendment to our Second Amended and Restated Certificate of Incorporation to provide for exculpation of officers from breaches of fiduciary duty to the extent permitted by the General Corporation Law of the State of Delaware.

What are broker non-votes and do they count for determining a quorum?

Generally, broker non-votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters, without instructions from the beneficial owner of those shares. The only routine matter presented at the Annual Meeting is Proposal 2, relating to the ratification of the appointment of PwC as our independent registered public

accounting firm for the year ending December 31, 2024. On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on non-routine matters, such as the election of directors, the approval of an amendment to our Second Amended and Restated Certificate of Incorporation to provide for exculpation of officers from breaches of fiduciary duty to the extent permitted by the General Corporation Law of the State of Delaware, approval on an advisory (non-binding) basis of the compensation of our named executive officers, or approval on an advisory (non-binding) basis of the frequency of future advisory votes on the compensation of our named executive officers. Broker non-votes count for purposes of determining whether a quorum is present.

Where can I find the voting results of the Annual Meeting?

We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC after the Annual Meeting.

PROPOSALS TO BE VOTED ON

Proposal 1: Election of Directors

At the Annual Meeting, three (3) Class III Directors are to be elected to hold office until the Annual Meeting of Stockholders to be held in 2027 and until each such director’s respective successor is elected and qualified or until each such director’s earlier death, resignation or removal.

We currently have ten (10) directors on our Board. Our current Class III Directors are Michael Ellenbogen, Peter George, and Rajan Naik, who have served on our Board since 2021, 2021, and 2023 respectively. The Board has nominated Michael Ellenbogen, Peter George, and Rajan Naik for election as Class III Directors at the Annual Meeting.

As set forth in our Second Amended and Restated Certificate of Incorporation, the Board of Directors is currently divided into three classes with staggered, three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. The current class structure is as follows: Class I, whose term will expire at the 2025 Annual Meeting of Stockholders (the “2025 Annual Meeting”); Class II, whose term will expire at the 2026 Annual Meeting of Stockholders; and Class III, whose current term will expire at the 2024 Annual Meeting of Stockholders and, if elected at the Annual Meeting, whose subsequent term will expire in 2027. The current Class I Directors are Kevin Charlton, Kimberly Sheehy, and Bilal Zuberi; the current Class II Directors are Neil Glat, David Mounts Gonzales, Merline Saintil, and Mark Sullivan; and the current Class III Directors are Michael Ellenbogen, Peter George, and Rajan Naik.

Our Second Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the authorized number of directors may be changed from time to time by the Board of Directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our Board of Directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our Company. Our directors may be removed only for cause by the affirmative vote of the holders of at least two-thirds (66 and 2∕3%) of our outstanding voting stock entitled to vote in the election of directors.

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of Class A common stock represented thereby in accordance with the Board’s recommendations for the election as Class III Directors of the persons whose names and biographies appears below. Proxies cannot be voted for a greater number of persons than the number of nominees named in this proposal. In the event that any of Michael Ellenbogen, Peter George, and Rajan Naik should become unable to serve, or for good cause will not serve, as a director, it is intended that votes will be cast for a substitute nominee designated by the Board of Directors or the Board may elect to reduce its size. The Board of Directors has no reason to believe that any of Michael Ellenbogen, Peter George, and Rajan Naik will be unable to serve if elected. Each of Michael Ellenbogen, Peter George, and Rajan Naik has consented to being named in this proxy statement and to serve if elected.

Vote required

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative “FOR” votes will be elected as Class III Directors.

Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

Recommendation of the Board of Directors

| | | | | |

| The Board of Directors unanimously recommends a vote FOR the election of each of the below Class III Director nominees. |

Nominees For Class III Director (terms to expire at the 2024 Annual Meeting)

The current members of the Board of Directors who are also nominees for election to the Board of Directors as Class III Directors are as follows:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Served as a Director Since | | Position with Evolv |

| Michael Ellenbogen | | 59 | | 2021 | | Co-Founder, Chief Innovation Officer, and Director |

| Peter George | | 65 | | 2021 | | CEO, President, and Director |

| Rajan Naik | | 52 | | 2023 | | Director |

The principal occupations and business experience, for at least the past five years of each Class III Director nominee for election at the 2024 Annual Meeting are as follows:

Michael Philip Ellenbogen

Michael Philip Ellenbogen has been our Chief Innovation Officer and a director since July 2021. Prior to that, Mr. Ellenbogen co-founded Legacy Evolv with Anil R. Chitkara in July 2013 and served as Legacy Evolv’s Head of Advanced Technology since January 2020. Prior to that, Mr. Ellenbogen served as the Legacy Evolv’s Chief Executive Officer from August 2013 to January 2020. Prior to co-founding Evolv, Mr. Ellenbogen was the founder, President and Chief Executive Officer of Reveal Imaging Technologies, an X-ray imaging systems company focusing on automated explosives detection, from 2002 to 2010. Prior to joining Reveal, Mr. Ellenbogen was the Vice President of Research & Development and Business Development of PerkinElmer Detection Systems, a provider of X-ray-based security technologies, from 1994 to 2002. During his 25-plus year career in the security industry, Mr. Ellenbogen has proven his expertise in product and business development, as well as stakeholder value creation. In addition, Mr. Ellenbogen is an inventor with over 20 awarded patents. Mr. Ellenbogen received a Bachelor of Arts degree in Physics from Colgate University in 1986. We believe that Mr. Ellenbogen is qualified to serve on Evolv’s Board based on his broad technical background, including his experience as founder and officer of Evolv.

Peter G. George

Peter G. George has served as our President and Chief Executive Officer and director since July 2021. Prior to that, Mr. George served as Chief Executive Officer and President of Legacy Evolv since January 2020. Prior to assuming the role of Chief Executive Officer at Legacy Evolv, Mr. George served as Chief Commercial Officer of Legacy Evolv from February 2019 to December 2019. Prior to joining Legacy Evolv, Mr. George served as President, Chief Executive Officer, and Chairman of Fidelis Cybersecurity, a company focused on threat and data breach detection, from March 2008 to August 2019. Mr. George also served as the Chief Executive Officer of Empow Cybersecurity, a company offering intelligent, Al and natural language processing solutions to reduce false positives during threat detection, from March 2018 to November 2018. Mr. George serves on the Board of Directors of Corero Network Security PLC (LON: CNS), including its Compensation Committee, since January 2019. Mr. George received a Bachelor of Arts degree in History from the College of the Holy Cross in 1981. We believe that Mr. George is qualified to serve on Evolv’s Board based on his experience serving as chief executive officer of many technology-driven companies, including Evolv.

Rajan Naik

Rajan Naik, Ph.D., has been a director on our Board since November 2023. He has served as senior vice president, Strategy & Ventures, for Motorola Solutions, Inc. (NYSE: MSI) since 2016. He is responsible for the corporate strategy organization, mergers and acquisitions, venture capital portfolio and competitive and market intelligence. Prior to joining Motorola, Dr. Naik was senior vice president and chief strategy officer at Advanced Micro Devices and before that was a partner in the technology practice at McKinsey & Company. Dr. Naik has served on the board of directors for CSG Systems International Inc. (Nasdaq: CSG) since August 2018. He earned a bachelor's degree in engineering from Cornell University and a doctorate in engineering from the Massachusetts Institute of Technology. We believe that Dr. Naik is qualified to serve on Evolv’s Board based on his broad experience in strategy and technology as well as extensive M&A experience having led over 30 acquisitions in the safety and security industry.

Continuing members of the Board of Directors:

Class I Directors (terms to expire at the 2025 Annual Meeting)

The current members of the Board of Directors who are Class I Directors are as follows:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Served as a Director Since | | Position with Evolv |

| Kevin Charlton | | 58 | | 2021 | | Director |

| Kimberly Sheehy | | 59 | | 2021 | | Director |

| Bilal Zuberi | | 48 | | 2021 | | Director |

The principal occupations and business experience, for at least the past five years, of each Class I Director are as follows:

Kevin Charlton

Kevin Charlton has been a director on our Board since July 2021 and also serves as Chairman of Give Evolv LLC. He previously served as the Chief Executive Officer of NewHold Investment Company, the special purpose acquisition corporation that merged with Evolv in 2021. Mr. Charlton has been the Co-Chairman of NewHold Enterprises LLC since 2017 and has spent more than 20 years in private equity. Prior to NewHold, Mr. Charlton was with JPMorgan (NYSE: JPM), Investcorp, and Macquarie (ASX: MQG). Mr. Charlton has served on more than 25 Boards of Directors in all relevant roles, and in almost all cases as Chairman or Lead Director on behalf of the majority owner. Prior to his career in private equity, Mr. Charlton was with McKinsey and Company in New York and NASA Headquarters in Washington, DC. Mr. Charlton currently serves as Chairman of American AllWaste LLC since May 2018; and serves on the Boards of Macro Energy LLC, a high efficiency lighting company and F&S Tools, a high-end tooling manufacturer. In addition, from January 2014 through October 2019, Mr. Charlton served in various roles for Hennessy Capital Acquisition Corp I, II, and III, including as President, Chief Operating Officer, and Vice Chairman. From September 2012 to January 2024, Mr. Charlton served on the Board of Spirit Realty Capital (NYSE: SRC). Mr. Charlton received his Bachelor’s degree in Aerospace Engineering cum laude from Princeton University in 1988, his Master of Science in Aerospace Engineering with Distinction from the University of Michigan in 1990, and his Master of Business Administration with Honors from the Kellogg School at Northwestern University in 1995. We believe that Mr. Charlton is qualified to serve on Evolv’s Board based on his broad private equity and public company experience.

Kimberly Sheehy

Kimberly Sheehy has been a director on our Board since July 2021. From March 2019 to May 2020, she was the Chief Financial Officer of ResMan LLC, a privately-owned software company providing software solutions to multi-family residential property managers. Previously, from April 2018 to March 2019, she served as Chief Financial Officer of Lori's Gifts, Inc., a privately-owned retail company serving hospitals throughout the United States. From November 2015 to October 2017, Ms. Sheehy served as the Chief Financial Officer of StackPath, LLC, an edge computing platform provider, and from November 2012 to October 2015, Ms. Sheehy served as Chief Financial & Administrative Officer of CyrusOne Inc. (NASDAQ: CONE), a public high-growth real estate investment trust specializing in engineering, building and managing data center properties. She has also held various senior roles at Cincinnati Bell Inc. Ms. Sheehy serves on the Board of Directors of Shift Technologies Inc. (Nasdaq: SFT) and the Board of Directors and as the Chair of the Audit Committee and member of the Compensation Committee and Nominating and Corporate Governance Committee of CVB Financial Corp (NASDAQ: CVBF). In addition, Ms. Sheehy has been a Certified Public Accountant since 1990. Ms. Sheehy earned a Bachelor of Science degree in accounting from the University of Cincinnati in 1989. We believe that Ms. Sheehy is qualified to serve on Evolv's board based on her extensive executive, managerial, accounting and public company experience.

Bilal Zuberi

Bilal Zuberi has been a director on our Board since July 2021. Since May 2013, Mr. Zuberi has been a partner at Lux Capital, a firm that invests in technology start-ups. At Lux Capital, Mr. Zuberi has led Lux’s investments in Applied Intuition, OpenSpace, Saildrone, Nozomi Networks, DesktopMetal (NYSE: DM), Zededa, Ironclad, Aurora Solar, Fiddler, Commure, Copia Automation, Cloaked, Kinetic Automation, Happiest Baby, Lumafield, Paradigm Inc, and Tendo. Prior to joining Lux Capital, Mr. Zuberi was a principal at General Catalyst Partners from October 2008 to May 2013, where he led the firm’s investments in deep tech, including energy, robotics, medtech, and hardware and software systems. Before becoming an investor, he co-founded GEO2 Technologies in January 2004. Earlier in his career, Mr. Zuberi was a

management consultant at The Boston Consulting Group from September 2003 to May 2004, where he advised management teams in complex business and strategy issues. Mr. Zuberi is a member of the Advisory Board of the Lemelson Foundation and has served on the boards of multiple private companies, including serving as a member of certain of such companies’ audit and compensation committees. Mr. Zuberi has also served as a member of Desktop Metal Inc.’s (NYSE: DM) Board of Directors and Audit Committee since December 2020. Mr. Zuberi received a Bachelor of Science degree in Chemistry from The College of Wooster in 1998 and a Ph.D. in Physical Chemistry (with a focus in materials and analytical chemistry) from the Massachusetts Institute of Technology in 2003. We believe Mr. Zuberi is qualified to serve on Evolv’s Board based on his experience working with physical infrastructure and technology companies.

Class II Directors (terms to expire at the 2026 Annual Meeting)

The current members of the Board of Directors who are Class II Directors are as follows:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Served as a Director Since | | Position with Evolv |

| Neil Glat | | 56 | | 2021 | | Director |

| David Mounts Gonzales | | 60 | | 2023 | | Director |

| Merline Saintil | | 47 | | 2021 | | Director |

| Mark Sullivan | | 69 | | 2021 | | Director |

The principal occupations and business experience, for at least the past five years, of each Class II Director are as follows:

Neil Glat

Neil Glat has been a director on our Board since July 2021 and Chairman of our Board since November 2023. He was appointed in December 2021 as Co-President, Americas for SPORTFIVE, a global sports, entertainment, and marketing agency and operated in that role until February 2024. From September 2019 to Present, Mr. Glat has been the Managing Member of NG Strategies, LLC and has been serving on advisory boards and providing strategic advice to sports, media, and technology businesses. From April 2012 through August 2019, Mr. Glat served as President of the New York Jets, and, from September 2019 to March 2020, he was a Senior Advisor to the New York Jets. Prior to that, Mr. Glat was a senior executive at the National Football League for 15 years, where he oversaw corporate development and strategy, and has previous experience in management consulting at McKinsey & Company and investment banking at Dillon, Read & Co. Mr. Glat is currently a Senior Advisor for Arctos Sports Partners, a private equity platform focused on the professional sports industry. He also is on the Board of ASM Global, a privately-held company which is the world’s largest stadium, arena, convention center, and venue management company and which was formed by the merger of SMG and AEG Facilities. Mr. Glat previously served on the board of NewHold Investment Corp. I, a publicly-traded SPAC, from July 2020 to July 2021. In addition, Mr. Glat serves on many philanthropic boards. Mr. Glat has extensive operating and strategic experience in sports, entertainment, media, and hospitality. During his more than 25 years in combined tenures at the New York Jets, the National Football League, SPORTFIVE, and professional service firms, Mr. Glat has consistently focused on, among other things, driving revenue growth, increasing consumer engagement, identifying new businesses, encouraging innovation, developing forward-looking strategies, and executing strategic transactions and deals. Mr. Glat earned a Bachelor of Sciences in Economics from The Wharton School at the University of Pennsylvania and a JD from Harvard Law School. We believe that Mr. Glat is qualified to serve on Evolv’s Board based on his experience in sports (in particular with professional sports franchises) and related industries and the leadership roles he has had.

David Mounts Gonzales

David Mounts Gonzales has been a director on our Board since November 2023. He retired from Inmar Intelligence, Inc. (“Inmar”) in April 2022 and completed 6 months of transition, leaving Inmar in October 2022. He joined Inmar as Chief Executive Officer in April 2010 and assumed the additional role of Chairman in February 2014. During his tenure he transformed Inmar from a small business service company to a market leading data platform and software business for nearly 20,000 retail and healthcare companies. Mr. Mounts Gonzales is currently a managing partner at Aero X Ventures, a venture fund focused on Advanced Air Mobility. Prior to joining Inmar, Mr. Mounts Gonzales served as Executive Vice President of Supply Chain for Domino’s Pizza, Inc. (“Domino’s”) from October 2007 to April 2010. He also served as Domino’s Chief Financial Officer from 2005 to 2007. Mr. Mounts Gonzales was part of the leadership team

that transformed Domino's product taste, e-commerce, and supply chain. Prior to Domino’s, Mr. Mounts Gonzales held several positions of increasing seniority during his 23-year tenure at UPS, which he joined in July 1983. Mr. Mounts Gonzales holds an MBA from The Wharton School, University of Pennsylvania, and a Bachelor of Science from University of Nevada, Las Vegas. Mr. Mounts Gonzales previously served on the boards of Papa Murphy’s Holdings, Inc. from 2014 to 2019 and Inmar Intelligence, Inc. from 2010 to 2022. He was past Chairman of the Wharton Alumni Executive Board and currently serves on the Wharton Graduate Executive Board, the Elliott Aviation Board, and is an Advisor to Corridor Capital. He previously served on the Board of Visitors for the Wake Forest University School of Business, and is a founding member of the Advisory Board for Wake Forest Innovation Quarter. We believe Mr. Mounts Gonzales is qualified to serve on the Board based on his broad experience and the executive leadership roles he has held.

Merline Saintil

Merline Saintil has been a director on our Board since July 2021. Ms. Saintil has served as a technology and business executive at Fortune 500 and privately-held companies, including Intuit, Yahoo, PayPal, Adobe, Joyent, and Sun Microsystems. From 2019 to 2020, she was the Chief Operating Officer, R&D-IT of Change Healthcare Inc. Prior to that, Ms. Saintil held the position of Head of Operations, Product & Technology with Intuit Inc. from November 2014 until August 2018. Ms. Saintil has served on the Boards of Directors of TD Synnex Corp. (NYSE: SNX) since 2021, Rocket Lab USA, Inc. (NASDAQ: RKLB) since 2021, Symbotic Inc. (NASDAQ: SYM) since 2021, GitLab Inc. (NASDAQ: GTLB) since 2020, Lightspeed Commerce Inc. (NYSE: LSPD) from 2020 to 2022, Alkami Technology, Inc. (NASDAQ: ALKT) from 2020 to 2022, ShotSpotter Inc. (NASDAQ: SSTI) from 2019 to 2021, and Banner Corporation (NASDAQ: BANR) from 2017 to 2022. She is a member of the Audit Committee at TD Synnex. She is the Chair of the Compensation Committee at Rocket Lab and member of the Compensation Committee at Gitlab. She is the Chair of the Nominating and Corporate Governance Committee at Symbotic. Ms. Saintil has received numerous accolades during her career, most recently being named Women lnc.'s 2019 Most Influential Corporate Board Director. In prior years, she was ranked one of the Most Powerful Women Engineers in the World by Business Insider magazine, she was recognized as a Women of Influence 2017 by Silicon Valley Business Journal and she has earned a Lifetime Achievement Award from Girls in Tech. She is certified in Cybersecurity Oversight by the National Association of Corporate Directors and the Carnegie Mellon Software Engineering Institute. Ms. Saintil earned a Bachelor of Science degree in Computer Science from Florida A&M University in 1998 and a Master of Science degree in Software Engineering Management from Carnegie Mellon University in 2005, and has completed Stanford Directors' College and Harvard Business School's executive education program. We believe Ms. Saintil is qualified to serve on Evolv's Board based on her broad corporate background and service on the boards of directors of technology public companies. Our Board of Directors do not believe that Ms. Saintil's outside boards (5 in total, including Evolv's Board) or other commitments limit her ability to devote sufficient time and attention to her duties as a director of the Company. Ms. Saintil has demonstrated that she has effectively balanced her responsibilities of serving on the Board of Directors.

Mark Sullivan

Mark Sullivan has been a director on our Board since July 2021. Since January 2018, Mr. Sullivan has been the owner of Mark Sullivan Consulting in St. Petersburg Beach, Florida. Prior to that, Mr. Sullivan was a Principal at Global Security and Innovative Strategies from February 2013 to December 2017. Before entering the private sector, Mr. Sullivan was a federal agent for 35 years, 30 years as a special agent with the U.S. Secret Service, serving in a variety of leadership roles. He was appointed Director of the Secret Service by the President in May 2006 and served in that position until February 2013. Mr. Sullivan served on the Board of Directors of Command Security Corporation (now known as Prosegur Compania de Seguridad SA (BME:PSG)), a full-service security solutions company, from July 2013 to January 2019. Mr. Sullivan received his Bachelor of Science degree in Criminal Justice from St. Anselm College in 1977. We believe Mr. Sullivan is qualified to serve on Evolv’s Board based on his experience working in security services, both in the public and private sectors.

Board Diversity Matrix

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Board Diversity Matrix (As of April 2, 2024) |

| Total Number of Directors | | 10 |

| | | | | | | | |

| | Female | | Male | | Non-Binary | | Did Not Disclose Gender |

| Part I: Gender Identity | | | | | | | | |

| Directors | | 2 | | 8 | | 0 | | 0 |

| Part II: Demographic Background | | | | | | | | |

| African American or Black | | 1 | | 0 | | 0 | | 0 |

| Alaskan Native or American Indian | | 0 | | 1 | | 0 | | 0 |

| Asian | | 0 | | 2 | | 0 | | 0 |

| Hispanic or Latinx | | 0 | | 1 | | 0 | | 0 |

| Native Hawaiian or Pacific Islander | | 0 | | 0 | | 0 | | 0 |

| White | | 1 | | 5 | | 0 | | 0 |

| Two or More Races or Ethnicities | | 0 | | 1 | | 0 | | 0 |

| LGBTQ+ | | 0 | | 0 | | 0 | | 0 |

| Did Not Disclose Demographic Background | | 0 | | 0 | | 0 | | 0 |

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm

Our Audit Committee has appointed PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm for the fiscal year ending December 31, 2024. Our Board has directed that this appointment be submitted to our stockholders for ratification at the Annual Meeting. Although ratification of our appointment of PwC is not required, we value the opinions of our stockholders and believe that stockholder ratification of our appointment is a good corporate governance practice.

While PwC has been retained as the Legacy Evolv’s, and the Company’s independent registered public accounting firm continuously since 2015, in accordance with SEC rules and PwC policies, the firm’s lead engagement partner rotates every five years. Neither PwC nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors, providing audit and non-audit services. A representative of PwC is expected to attend the 2024 Annual Meeting and be available to respond to appropriate questions from stockholders.

In the event that the appointment of PwC is not ratified by the stockholders, the Audit Committee will consider this fact when it appoints the independent auditors for the fiscal year ending December 31, 2024. Even if the appointment of PwC is ratified, the Audit Committee retains the discretion to appoint a different independent auditor at any time if it determines that such a change is in the interest of the Company.

Vote Required

This proposal requires the affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes) on such matter. Abstentions are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal. Because brokers have discretionary authority to vote on the ratification of the appointment of PwC, we do not expect any broker non-votes in connection with this proposal.

Recommendation of the Board of Directors

| | | | | |

| The Board of Directors unanimously recommends a vote FOR the Ratification of the Appointment of PwC as our Independent Registered Public Accounting Firm for the fiscal year ending December 31, 2024. |

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee has reviewed the audited consolidated financial statements of Evolv Technologies Holdings, Inc. (the “Company”) for the fiscal year ended December 31, 2023 and has discussed these financial statements with management and the Company’s independent registered public accounting firm. The Audit Committee has also received from, and discussed with, the Company’s independent registered public accounting firm various communications that such independent registered public accounting firm is required to provide to the Audit Committee, including the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the Securities and Exchange Commission.

The Company’s independent registered public accounting firm also provided the Audit Committee with a formal written statement required by PCAOB Rule 3526 (Communications with Audit Committees Concerning Independence) describing all relationships between the independent registered public accounting firm and the Company, including the disclosures required by the applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence. In addition, the Audit Committee discussed with the independent registered public accounting firm its independence from the Company.

Based on its discussions with management and the independent registered public accounting firm, and its review of the representations and information provided by management and the independent registered public accounting firm, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Kimberly Sheehy (Chair)

David Mounts Gonzales

Merline Saintil

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES AND OTHER MATTERS

The following table summarizes the fees of PwC, our independent registered public accounting firm, billed to us for each of the last two fiscal years for audit services and billed to us in each of the last two fiscal years for other services:

| | | | | | | | | | | | | | |

| Fee Category | | 2023 | | 2022 |

| Audit Fees | (1) | $ | 2,426,078 | | | $ | 1,778,497 | |

| Tax Fees | (2) | 25,000 | | | 151,000 | |

| All Other Fees | (3) | 956 | | | 2,125 | |

| Total Fees | | $ | 2,452,034 | | | $ | 1,931,622 | |

___________________

(1)Audit fees consist of fees for the audit of our financial statements and the review of the interim financial statements included in our quarterly reports on Form 10-Q.

(2)Tax fees consist of fees for tax-related services, including tax compliance and tax advice.

(3)All other fees consist of fees for services other than those described above. For fiscal 2023, this relates to a subscription to a disclosure checklist tool. For fiscal 2022, this relates to a subscription to an online accounting research tool.

Audit Committee Pre-Approval Policy and Procedures

The Audit Committee has adopted a policy (the “Pre-Approval Policy”) that sets forth the procedures and conditions pursuant to which audit and non-audit services proposed to be performed by the independent auditor may be pre-approved. The Pre-Approval Policy generally provides that we will not engage PwC to render any audit, audit-related, tax or permissible non-audit service unless the service is either (i) explicitly approved by the Audit Committee (“specific pre-approval”) or (ii) entered into pursuant to the pre-approval policies and procedures described in the Pre-Approval Policy (“general pre-approval”). Unless a type of service to be provided by PwC has received general pre-approval under the Pre-Approval Policy, it requires specific pre-approval by the Audit Committee or by a designated member of the Audit Committee to whom the committee has delegated the authority to grant pre-approvals. Any proposed services exceeding pre-approved cost levels or budgeted amounts will also require specific pre-approval. For both types of pre-approval, the Audit Committee will consider whether such services are consistent with the SEC’s rules on auditor independence. The Audit Committee will also consider whether the independent auditor is best positioned to provide the most effective and efficient service, for reasons such as its familiarity with the Company’s business, people, culture, accounting systems, risk profile and other factors, and whether the service might enhance the Company’s ability to manage or control risk or improve audit quality. All such factors will be considered as a whole, and no one factor should necessarily be determinative. On a periodic basis, the Audit Committee reviews and generally pre-approves the services (and related fee levels or budgeted amounts) that may be provided by PwC without first obtaining specific pre-approval from the Audit Committee. The Audit Committee may revise the list of general pre-approved services from time to time, based on subsequent determinations. The Audit Committee pre-approved all services performed since the pre-approval policy was adopted.

Proposal 3: Approval of an amendment to the Second Amended and Restated Certificate of Incorporation to provide for exculpation of officers from breaches of fiduciary duty to the fullest extent permitted by the General Corporation Law of the State of Delaware.

As part of its continuing review of our corporate governance standards and practices, the Board unanimously approved and declared advisable, subject to stockholder approval, the Officer Exculpation Amendment, to update the current exculpation and liability provisions in Article VIII of our Second Amended and Restated Certificate of Incorporation (the “Charter”) to reflect developing law (the “Officer Exculpation Amendment”). The form of the proposed Certificate of Amendment to our Charter setting forth the Officer Exculpation Amendment, which would be filed with the Secretary of State of the State of Delaware if Proposal 3 is approved by stockholders, is attached to this Proxy Statement as Appendix A-1 and a copy of the Officer Exculpation Amendment marked to show changes is attached hereto as Appendix A-2.

Effective August 1, 2022, Section 102(b)(7) of the DGCL was amended (as amended, “Amended Section 102(b)(7)”) to enable a corporation to include in its certificate of incorporation a provision exculpating certain corporate officers from liability for breach of the fiduciary duty of care in certain circumstances. Previously, Section 102(b)(7) of the DGCL provided for the ability to exculpate directors only, and our Charter currently limits the monetary liability of our directors in certain circumstances consistent with Section 102(b)(7) of the DGCL. Amended Section 102(b)(7) allows for the exculpation of certain officers only in connection with direct claims brought by stockholders, including class actions, but would not eliminate officers’ monetary liability for breach of fiduciary duty claims brought by the corporation itself or for derivative claims brought by stockholders in the name of the corporation. Further, Amended Section 102(b)(7) does not permit a corporation to exculpate covered officers from liability for breach of the duty of loyalty, acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law, or any transaction in which the officer derived an improper personal benefit. Under Amended Section 102(b)(7), the officers who may be exculpated include a person who (i) is the president, chief executive officer, chief operating officer, chief financial officer, chief legal officer, controller, treasurer or chief accounting officer of the corporation at any time during the course of conduct alleged in the action or proceeding to be wrongful, (ii) is or was identified in the corporation’s public filings with the SEC because such person is or was one of the most highly compensated executive officers of the corporation, or (iii) has consented to services of process in Delaware by written agreement (collectively, “Covered Officers”).

Effect of the Amendment

The proposed Officer Exculpation Amendment would allow for the exculpation of our Covered Officers to the fullest extent permitted by the DGCL, as it currently exists or as it may hereafter be amended. This currently means that the proposed Officer Exculpation Amendment would allow for the exculpation of Covered Officers only in connection with direct claims brought by stockholders, including class actions, but would not eliminate officers’ monetary liability for breach of fiduciary duty claims brought by the corporation itself or for derivative claims brought by stockholders in the name of the corporation. Further, the Officer Exculpation Amendment would not limit the liability of Covered Officers for any breach of the duty of loyalty to the corporation or its stockholders, any acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of the law, or any transaction from which a Covered Officer derived an improper personal benefit.

Rationale for Adoption of the Officer Exculpation Amendment

Our Board believes that adopting the Officer Exculpation Amendment would better position the Company to attract top officer candidates and retain our current officers. The Officer Exculpation Amendment would also more closely align the protections available to our officers with those already available to our directors. We believe that failing to adopt the Officer Exculpation Amendment could impact our recruitment and retention of exceptional officer candidates who conclude that the potential exposure to liabilities, costs of defense, and other risks of proceedings exceeds the benefits of serving as an officer of the Company.

In addition, adopting the Officer Exculpation Amendment would enable the officers to exercise their business judgment in furtherance of the interests of the stockholders without the potential for distraction posed by the risk of personal liability. The nature of the role of officers often requires them to make decisions on crucial matters. Frequently, officers must make decisions in response to time-sensitive opportunities and challenges, which can create substantial risk of investigations, claims, actions, suits, or proceedings seeking to impose liability based on hindsight, especially in the current litigious environment and regardless of merit. Limiting our current and prospective officers’ concern about personal risk would empower officers to best exercise their business judgment in furtherance of stockholder interests and better position the Company to retain our current officers and attract top officer candidates. Enhancing our ability to retain and

attract experienced officers is in the best interests of the Company and its stockholders and we should seek to assure such persons that exculpation under certain circumstances is available.

If our stockholders approve the Officer Exculpation Amendment, our Board has authorized our officers to file a Certificate of Amendment with the Delaware Secretary of State, which we anticipate doing as soon as practicable following stockholder approval of the Officer Exculpation Amendment at the 2024 Annual Meeting, and the Certificate of Amendment would become effective upon acceptance by the Delaware Secretary of State.

If our stockholders do not approve the Officer Exculpation Amendment, the Company’s current exculpation provisions relating to directors will remain in place, and the Certificate of Amendment will not be filed with the Delaware Secretary of State. However, even if our stockholders approve the Officer Exculpation Amendment, our Board retains discretion under Delaware law to determine when to file the Certificate of Amendment with the Delaware Secretary of State and to abandon the Officer Exculpation Amendment notwithstanding prior stockholder approval of the Officer Exculpation Amendment.

Vote Required

The affirmative vote of the holders of at least two-thirds (66 and 2/3%) of the total voting power of all the then outstanding shares of stock of the Company entitled to vote thereon. Abstentions and broker non-votes will have the same effect as votes against the proposal.

Recommendation of the Board of Directors

| | | | | |

| The Board of Directors unanimously recommends a vote FOR the approval of an amendment to the Second Amended and Restated Certificate of Incorporation to provide for exculpation of officers from breaches of fiduciary duty to the fullest extent permitted by the General Corporation Law of the State of Delaware. |

Proposal 4: Approval of, on an advisory (non-binding) basis, the Say-on-Pay Vote

In accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and Rule 14a-21 under the Exchange Act, we request that our stockholders cast a non-binding, advisory vote to approve the compensation of our named executive officers identified in the section titled “Executive and Director Compensation” set forth below in this proxy statement. This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on our named executive officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement.

Accordingly, we ask our stockholders to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s stockholders approve, by a non-binding advisory vote, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the 2024 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables and narrative discussion.”

We believe that our compensation programs and policies for the year ended December 31, 2023 were an effective incentive for the achievement of our goals, aligned with stockholders’ interest and worthy of stockholder support. Additional details concerning how we structure our compensation programs to meet the objectives of our compensation program are provided in the section titled “Executive and Director Compensation” set forth below in this proxy statement.