Exhibit 10.4

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THE EXHIBIT BECAUSE IT IS BOTH NOT MATERIAL AND WOULD LIKELY CAUSE COMPETITIVE HARM TO THE REGISTRANT IF PUBLICLY DISCLOSED. [***] INDICATES THAT INFORMATION HAS BEEN REDACTED.

EXECUTION

AMENDMENT NO. 4

TO THIRD AMENDED AND RESTATED

MASTER REPURCHASE AGREEMENT

TO THIRD AMENDED AND RESTATED

MASTER REPURCHASE AGREEMENT

Amendment No. 4 to Third Amended and Restated Master Repurchase Agreement, dated as of April 26, 2022 (this “Amendment”), among CREDIT SUISSE FIRST BOSTON MORTGAGE CAPITAL LLC (the “Administrative Agent”), CREDIT SUISSE AG, a company incorporated in Switzerland, acting through its Cayman Islands Branch (“CS Cayman” and a “Buyer”), ALPINE SECURITIZATION LTD (“Alpine” and a “Buyer”) and other Buyers from time to time party to the Master Repurchase Agreement (collectively, the “Buyers”), QUICKEN LOANS, LLC (f/k/a QUICKEN LOANS INC.) (“Quicken Loans” and a “Seller”) and ONE REVERSE MORTGAGE, LLC (“One Reverse” and a “Seller”, and together with Quicken Loans, the “Sellers”).

RECITALS

The Administrative Agent, Buyers and the Sellers are parties to that certain Third Amended and Restated Master Repurchase Agreement, dated as of May 24, 2017 (as amended, restated, supplemented or otherwise modified from time to time other than by this Amendment, the “Existing Master Repurchase Agreement”; and as further amended by this Amendment, the “Master Repurchase Agreement”). Capitalized terms used but not otherwise defined herein shall have the meanings given to them in the Existing Master Repurchase Agreement.

The Administrative Agent, the Buyers and the Sellers have agreed, subject to the terms and conditions of this Amendment, that the Existing Master Repurchase Agreement be amended to reflect certain agreed upon revisions to the terms of the Existing Master Repurchase Agreement.

Accordingly, the Administrative Agent, the Buyers and the Sellers hereby agree, in consideration of the mutual promises and mutual obligations set forth herein, that the Existing Master Repurchase Agreement is hereby amended as follows:

Section 1.Amendment to the Existing Master Repurchase Agreement. Effective as of April 25, 2022, the Existing Master Repurchase Agreement is hereby amended to delete the stricken text (indicated textually in the same manner as the following example: stricken text) and to add the double-underlined text (indicated textually in the same manner as the following example: double-underlined text) as set forth in Exhibit A hereto. The parties hereto further acknowledge and agree that Exhibit A constitutes the Master Repurchase Agreement as amended and modified by the terms set forth herein.

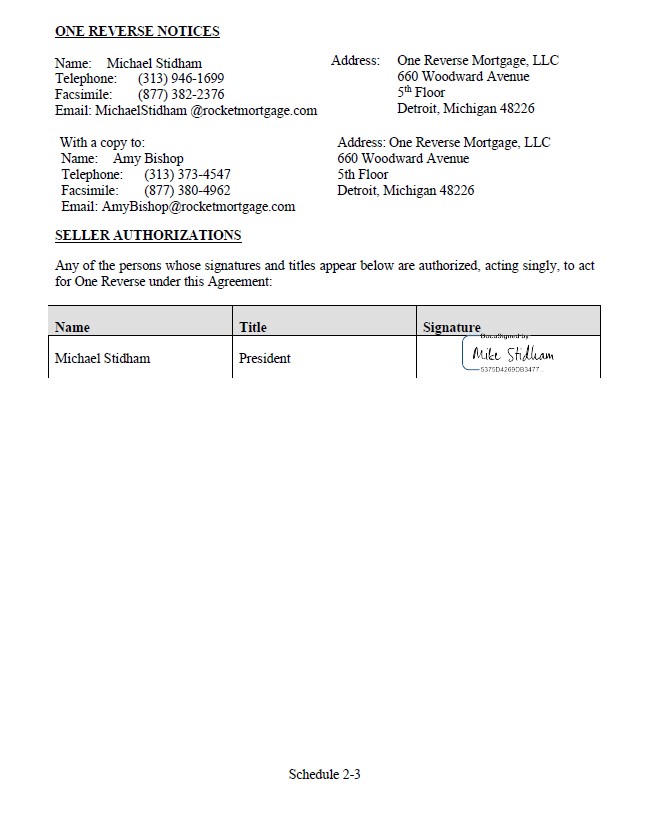

Section 2.One Reverse Authorized Representatives. Schedule 2 to the Existing Master Repurchase Agreement is hereby amended by deleting One Reverse’s Authorized Representatives in their entirety and replacing them with Exhibit B hereto.

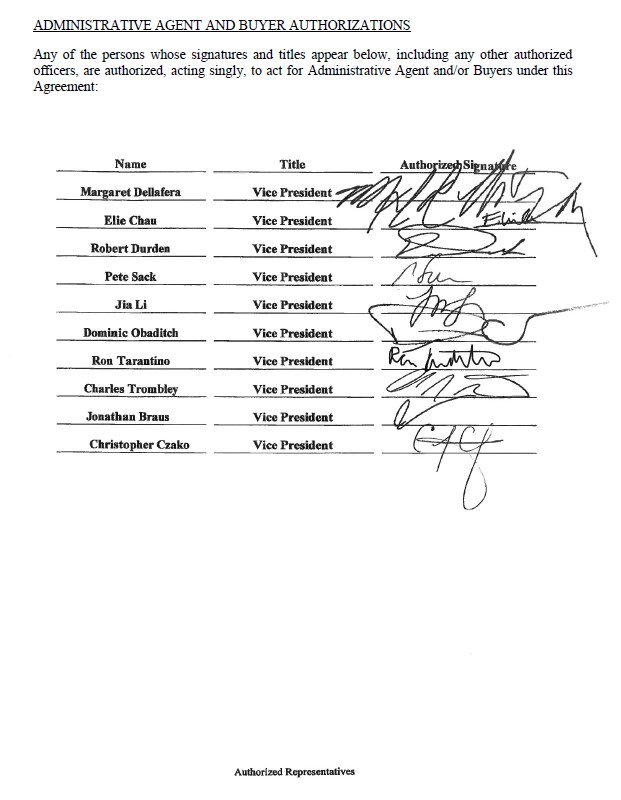

Section 3.Administrative Agent Authorized Representatives. Schedule 2 to the Existing Master Repurchase Agreement is hereby amended by deleting Administrative Agent’s Authorized Representatives in their entirety and replacing them with Exhibit C hereto.

Section 4.Effectiveness of Amendment. This Amendment shall become effective as of April 25, 2022 (the “Amendment Effective Date”), subject to the satisfaction of the following conditions precedent:

LEGAL02/40752140v4

4.1Delivered Documents. On the Amendment Effective Date, the Administrative Agent on behalf of Buyers shall have received the following documents, each of which shall be satisfactory to the Administrative Agent in form and substance:

(a)this Amendment, executed and delivered by duly authorized officers, as applicable, of the Administrative Agent, Buyers and Sellers; and

(b)such other documents as the Administrative Agent or counsel to the Administrative Agent may reasonably request.

Section 5.Representations and Warranties. Each Seller hereby represents and warrants to the Administrative Agent and Buyers that it is in compliance with all the terms and provisions set forth in the Master Repurchase Agreement on its part to be observed or performed, and that no Event of Default has occurred or is continuing, and hereby confirms and reaffirms the representations and warranties contained in Section 13 of the Master Repurchase Agreement.

Section 6.Limited Effect. Except as expressly amended and modified by this Amendment, the Existing Master Repurchase Agreement shall continue to be, and shall remain, in full force and effect in accordance with its terms.

Section 7.Counterparts. This Amendment may be executed by each of the parties hereto on any number of separate counterparts, each of which shall be an original and all of which taken together shall constitute one and the same instrument. Delivery of an executed counterpart of a signature page of this Amendment in a Portable Document Format (PDF) or by facsimile shall be effective as delivery of a manually executed original counterpart of this Amendment. The parties agree that this Amendment, any addendum or amendment hereto or any other document necessary for the consummation of the transactions contemplated by this Amendment may be accepted, executed or agreed to through the use of an electronic signature in accordance with the E-Sign, UETA and any applicable state law. Any document accepted, executed or agreed to in conformity with such laws will be binding on all parties hereto to the same extent as if it were physically executed and each party hereby consents to the use of any secure third party electronic signature capture service providers with appropriate document access tracking, electronic signature tracking and document retention as may be approved by the Administrative Agent in its sole discretion, including but not limited to DocuSign.

Section 8.Severability. Each provision and agreement herein shall be treated as separate and independent from any other provision or agreement herein and shall be enforceable notwithstanding the unenforceability of any such other provision or agreement.

Section 9.GOVERNING LAW. THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK WITHOUT REFERENCE TO THE CHOICE OF LAW PROVISIONS THEREOF.

[SIGNATURE PAGES FOLLOW]

2

LEGAL02/40752140v4

IN WITNESS WHEREOF, the parties have caused their names to be signed hereto by their respective officers thereunto duly authorized as of the day and year first above written.

Administrative Agent: CREDIT SUISSE FIRST BOSTON MORTGAGE CAPITAL LLC

By: _/s/ Margaret Dellafera

Name: Margaret Dellafera

Title: Vice President

Name: Margaret Dellafera

Title: Vice President

Buyers: CREDIT SUISSE AG, CAYMAN ISLANDS BRANCH

By: _/s/ Margaret Dellafera

Name: Margaret Dellafera

Title: Vice President

Name: Margaret Dellafera

Title: Vice President

By: _/s/ Elie Chau

Name: Elie Chau

Title: Vice President

Name: Elie Chau

Title: Vice President

ALPINE SECURITIZATION LTD, by Credit Suisse AG, New York Branch as Attorney-in-Fact

By: _/s/ Elie Chau

Name: Elie Chau

Title: Vice President

Name: Elie Chau

Title: Vice President

By: _/s/ Patrick Duggan

Name: Patrick Duggan

Title: Director

Name: Patrick Duggan

Title: Director

Signature Page to Amendment No. 4 to Third Amended and Restated Master Repurchase Agreement

Sellers: ONE REVERSE MORTGAGE, LLC

By: _/s/ Michael Stidham

Name: Michael Stidham

Title: President

Name: Michael Stidham

Title: President

ROCKET MORTGAGE, LLC

By: _/s/ Brian Brown

Name: Brian Brown

Title: Treasurer, Rocket Mortgage, LLC

Name: Brian Brown

Title: Treasurer, Rocket Mortgage, LLC

Signature Page to Amendment No. 4 to Third Amended and Restated Master Repurchase Agreement

Exhibit A

MASTER REPURCHASE AGREEMENT

(See attached)

Exhibit A

CONFORMED THRU AMENDMENT NO. 4

THIRD AMENDED AND RESTATED MASTER REPURCHASE AGREEMENT

CREDIT SUISSE FIRST BOSTON MORTGAGE CAPITAL LLC, as administrative agent

(“Administrative Agent”),

(“Administrative Agent”),

CREDIT SUISSE AG, a company incorporated in Switzerland, acting through its CAYMAN ISLANDS BRANCH, as buyer (“Buyer”), ALPINE SECURITIZATION LTD, as buyer and other Buyers from time to time party to this Agreement (“Buyers”)

and

ROCKET MORTGAGE, LLC (F/K/A QUICKEN LOANS, LLC) AND ONE REVERSE MORTGAGE, LLC, as sellers (“Sellers”)

Dated May 24, 2017

LEGAL02/41216309v6

TABLE OF CONTENTS

Page

-i-

LEGAL02/41216309v6

SCHEDULES

Schedule 1 – Representations and Warranties with Respect to Purchased Mortgage Loans

Schedule 2 – Authorized Representatives

Schedule 3 – Litigation of Sellers

Schedule 4 – Executive Management and Offices

Schedule 5 – Trade Names of Rocket Mortgage

EXHIBITS

Exhibit A – Reserved

Exhibit B – Reserved

Exhibit C – Form of Mortgage Loan Schedule

Exhibit D – Reserved

Exhibit E – Form of Power of Attorney

Exhibit F – Reserved

Exhibit G – Underwriting Guidelines

Exhibit H – Reserved

Exhibit I – Sellers’ Tax Identification Number

Exhibit J – Existing Indebtedness

Exhibit K – Form of Escrow Instruction Letter

Exhibit L – Form of Notice of Additional Buyer

Exhibit M – Form of Servicer Notice

-ii-

LEGAL02/41216309v6

This is a THIRD AMENDED AND RESTATED MASTER REPURCHASE AGREEMENT, dated as of May 24, 2017, among CREDIT SUISSE FIRST BOSTON MORTGAGE CAPITAL LLC (“Administrative Agent”), as administrative agent on behalf of Buyers, Credit Suisse AG, a company incorporated in Switzerland, acting through its Cayman Islands Branch (“CS Cayman” and a “Buyer”), Alpine Securitization LTD (“Alpine” and a “Buyer”), ROCKET MORTGAGE, LLC (f/k/a Quicken Loans, LLC) (“Rocket Mortgage”) and ONE REVERSE MORTGAGE, LLC (“One Reverse”, and together with Rocket Mortgage, each a “Seller”, and collectively, the “Sellers”).

The Administrative Agent, as a Buyer and the Sellers previously entered into a Master Repurchase Agreement, dated as of August 8, 2003, as amended by that certain Amended and Restated Master Repurchase Agreement, dated as of November 30, 2007, as amended by that certain Second Amended and Restated Master Repurchase Agreement, dated as of September 27, 2013, as amended (the “Existing Master Repurchase Agreement”).

Pursuant to that certain Assignment, Assumption and Appointment Agreement, dated as of June 16, 2016 among Administrative Agent and CS Cayman, as a Buyer (the “Assignment, Assumption and Appointment Agreement”), Administrative Agent sold and assigned its right, title and interest in the Transactions and the related Purchased Mortgage Loans hereunder to CS Cayman and was designated by Buyers as their Administrative Agent.

The parties hereto have requested that the Existing Master Repurchase Agreement be amended and restated, in its entirety, on the terms and subject to the conditions set forth herein.

NOW, THEREFORE, in consideration of the mutual agreements contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

1.Applicability

From time to time the parties hereto may enter into transactions in which Sellers agree to transfer to Administrative Agent on behalf of Buyers Mortgage Loans (as hereinafter defined) on a servicing released basis against the transfer of funds by Administrative Agent, with a simultaneous agreement by Administrative Agent on behalf of Buyers to transfer to Sellers such Mortgage Loans on a servicing released basis at a date certain or on demand, against the transfer of funds by Sellers. This Agreement is a commitment by Administrative Agent on behalf of Committed Buyer to engage in the Transactions as set forth herein on or before the Termination Date up to the Maximum Committed Purchase Price; provided, that the Administrative Agent on behalf of Buyers shall have no commitment to enter into any Transaction requested which would result in the aggregate Purchase Price of then outstanding Transactions to exceed the Maximum Committed Purchase Price. Each such transaction shall be referred to herein as a “Transaction” and, unless otherwise agreed in writing, shall be governed by this Agreement, including any supplemental terms or conditions contained in any annexes identified herein, as applicable hereunder. For the avoidance of doubt, and for administrative and tracking purposes, (a) the purchase and sale of each Purchased Mortgage Loan shall be deemed a separate Transaction and (b) with respect to each Designated Asset, such Designated Asset may, at Buyers’ option, be sold to different Buyers on a pro rata basis, such that one Buyer pays the Purchase Price-Base and other Buyers pay the Purchase Price-Incremental 1 and Purchase Price-Incremental 2, as applicable, and, in which case, the Administrative Agent shall own the Designated Asset, for the benefit of the purchasing Buyers, on a pro rata, pari passu basis, subject to the terms set forth herein.

LEGAL02/41216309v6

2.Definitions

Whenever used in this Agreement, the following words and phrases, unless the context otherwise requires, shall have the following meanings; provided that any terms used but not otherwise defined herein shall have the meanings given to them in the Pricing Side Letter:

“1934 Act” means the Securities Exchange Act of 1934, as amended from time to time.

“Accepted Servicing Practices” means, with respect to any Mortgage Loan, those mortgage servicing practices of prudent mortgage lending institutions which service mortgage loans of the same type as such Mortgage Loan in the jurisdiction where the related Mortgaged Property is located.

“Act of Insolvency” means, with respect to any Person, (i) the filing by such Person of a petition, commencing, or authorizing the commencement of any case or proceeding, or the voluntary joining of any case or proceeding under any bankruptcy, insolvency, reorganization, liquidation, dissolution or similar law relating to the protection of creditors, or suffering any such petition or proceeding to be commenced by another which is consented to, not timely contested or results in entry of an order for relief; (ii) the seeking by such Person of the appointment of a receiver, trustee, custodian or similar official for such party; (iii) the appointment of a receiver, conservator, or manager for such Person by any governmental agency or authority having the jurisdiction to do so (provided, however, if such appointment is the result of the commencement of involuntary proceedings or the filing of an involuntary petition against such Person and such appointment is dismissed within sixty (60) days after the initial date thereof, an Act of Insolvency shall not be deemed to have occurred); (iv) the making or offering by such Person of a composition with its creditors or a general assignment for the benefit of creditors; (v) the admission in writing by an Executive Management officer of such Person of its inability to pay its debts or discharge its obligations as they become due or mature; or (vi) that any governmental authority or agency or any person, agency or entity acting or purporting to act under governmental authority shall have taken any action to condemn, seize or appropriate, or to assume custody or control of, all or any substantial part of the property of such Person, or shall have taken any action to displace the Executive Management of such Person or to materially curtail its authority in the conduct of the business of such Person, and any such action described in this clause (vi) is determined by the Administrative Agent in its sole good faith discretion to be materially adverse to Administrative Agent and the Buyers taken as a whole, Sellers taken as a whole, the Repurchase Assets or Rocket Mortgage’s ability to perform under this Agreement.

“Additional Buyers” has the meaning set forth in Section 37 hereof.

“Adjusted Daily Simple SOFR” means an interest rate per annum equal to (i) Daily Simple SOFR, plus (ii) the Benchmark Adjustment.

“Adjusted Tangible Net Worth” has the meaning assigned to such term in the Pricing Side Letter.

“Administrative Agent” means CSFBMC or, subject to Section 22 hereof, any successor thereto that is an Affiliate of CSFBMC or is approved by Sellers; provided, that such approval shall not be unreasonably withheld.

“Affiliate” means, with respect to any Person, any “affiliate” of such Person, as such term is defined in the Bankruptcy Code, which shall also include, for the avoidance of doubt, with respect to Administrative Agent only, any CP Conduit.

2

LEGAL02/41216309v6

“Agency” means Freddie Mac, Fannie Mae or GNMA, as applicable.

“Agency Mortgage Loan” means, collectively, Conforming High CLTV Loan, Conforming Mortgage Loans, FHA Loans, VA Loans, RHS Loans and HECM Loans.

“Agency-Required eNote Legend” means the legend or paragraph required by Fannie Mae or Freddie Mac, as applicable, to be set forth in the text of an eNote, which includes the provisions set forth on Exhibit A to the Custodial Agreement, as may be amended from time to time by Fannie Mae or Freddie Mac, as applicable.

“Agency Security” means a mortgage-backed security issued or guaranteed by an Agency.

“Aggregate Purchase Price-Base” means, as of any date of determination, the aggregate outstanding Purchase Price-Base for a Purchased Mortgage Loan.

“Aggregate Purchase Price-Incremental 1” means, as of any date of determination, the aggregate outstanding Purchase Price-Incremental 1 for a Purchased Mortgage Loan.

“Aggregate Purchase Price-Incremental 2” means, as of any date of determination, the aggregate outstanding Purchase Price-Incremental 2 for a Purchased Mortgage Loan.

“Agreement” means this Third Amended and Restated Master Repurchase Agreement, as it may be amended, restated, supplemented or otherwise modified from time to time.

“Allocated Percentage” means, with respect to a Purchased Mortgage Loan, the percentage obtained by (a) with respect to the Purchase Price-Base, the Purchase Price Percentage-Base divided by the Purchase Price Percentage-Total; (b) with respect to the Purchase Price-Incremental 1, the Purchase Price Percentage-Incremental 1 divided by the Purchase Price Percentage-Total; (c) with respect to the Purchase Price-Incremental 2, the Purchase Price Percentage-Incremental 2 divided by the Purchase Price Percentage-Total.

“Appraised Value” means the value set forth in an appraisal made in connection with the origination of the related Mortgage Loan as the value of the Mortgaged Property.

“Asset Matrix” has the meaning assigned to such term in the Pricing Side Letter.

“Asset Tape” means a remittance report on a monthly basis or requested by Administrative Agent pursuant to Section 17.d hereof containing servicing information, including, without limitation, those fields reasonably requested by Administrative Agent from time to time, on a loan-by-loan basis and in the aggregate, with respect to the Purchased Mortgage Loans serviced by either Seller or any Servicer for the month (or any portion thereof) prior to the Reporting Date.

“Asset Value” means with respect to any Purchased Mortgage Loan, the sum of the Asset Value-Base, the Asset Value-Incremental 1 and the Asset Value-Incremental 2.

“Asset Value-Base” means, with respect to any Purchased Mortgage Loan as of any date of determination, an amount equal to the product of (a) the applicable Purchase Price Percentage-Base, and (b) the applicable Maximum Value Amount; provided that the Asset

3

LEGAL02/41216309v6

Value-Base of a Purchased Mortgage Loan may be reduced to zero by Administrative Agent or a Buyer if any Value Reduction Event shall occur.

“Asset Value-Incremental 1” means, with respect to any Purchased Mortgage Loan as of any date of determination, an amount equal to the product of (a) the applicable Purchase Price Percentage-Incremental 1, and (b) the applicable Maximum Value Amount; provided, that, the Asset Value-Incremental 1 of a Purchased Mortgage Loan may be reduced to zero by Administrative Agent or a Buyer if any Value Reduction Event shall occur.

“Asset Value-Incremental 2” means, with respect to any Purchased Mortgage Loan as of any date of determination, an amount equal to the product of (a) the applicable Purchase Price Percentage-Incremental 2, and (b) the applicable Maximum Value Amount; provided, that, the Asset Value-Incremental 2 of a Purchased Mortgage Loan may be reduced to zero by Administrative Agent or a Buyer if any Value Reduction Event shall occur.

“Assignment and Acceptance” has the meaning assigned to such term in Section 22.a hereof.

“Assignment of Mortgage” means an assignment of the Mortgage, notice of transfer or equivalent instrument in recordable form, sufficient under the laws of the jurisdiction wherein the related Mortgaged Property is located to reflect the sale of the Mortgage.

“Authoritative Copy” means, with respect to an eNote, the unique copy of such eNote that is within the Control of the Controller.

“Bankruptcy Code” means the United States Bankruptcy Code of 1978, as amended from time to time.

“Benchmark Adjustment” means, for any day, the spread adjustment for such Pricing Period that has been selected or recommended by the Relevant Governmental Body for the tenor of 1 month. For the avoidance of doubt, the “Benchmark Adjustment” means, for any day, the value as reported on the display designated as “YUS0001M” on Bloomberg, or such other display as may replace “YUS0001M”.

“BPL – Long” means a Business Purpose Mortgage Loan with respect to which (a) the related Mortgaged Property consists of (i) eight (8) units or less or (ii) between nine (9) and twenty-nine (29) units and with an original outstanding principal amount less than $3,000,000 and (b) the related maturity date is five (5) years or more from the date of the Mortgage Note.

“BPO” means an opinion of the fair market value of a Mortgaged Property given by a licensed real estate agent or broker in conformity with customary and usual business practices, which includes three (3) comparable sales and three (3) comparable listings and complies with the criteria set forth in the Financial Institutions Reform, Recovery and Enforcement Act of 1989 for an “appraisal” or an “evaluation” as applicable.

“Business Day” means any day other than (i) a Saturday or Sunday; (ii) a day on which the New York Stock Exchange, the Federal Reserve Bank of New York or the Custodian is authorized or obligated by law or executive order to be closed or (iii) a public or bank holiday in New York City.

“Business Purpose Mortgage Loan” means a Mortgage Loan with respect to which the related Mortgaged Property (a) is non-owner occupied; (b) is primarily used for business or commercial purposes (as referenced in the Truth and Lending Act and its

4

LEGAL02/41216309v6

implementing regulation, Regulation Z); and (c) has been acquired or originated in accordance with applicable Underwriting Guidelines.

“Buyer” means CS Cayman, Alpine and each assignee of Buyer pursuant to Section 22.

“Change in Control” means:

(A)any transaction or event as a result of which Permitted Holders cease to directly or indirectly own beneficially or of record, more than fifty percent (50%) of the voting stock of Rocket Mortgage;

(B)the sale, transfer, or other disposition of all or substantially all Rocket Mortgage’s assets (excluding any such action taken in connection with any securitization transaction), which sale, transfer, or other disposition occurs without Administrative Agent’s prior written consent;

(C)the consummation of a merger or consolidation of Rocket Mortgage with or into another entity or any other corporate reorganization (which merger or consolidation occurs without Administrative Agent’s prior written consent; provided that such consent shall be deemed to have been given if Administrative Agent does not respond within ten (10) Business Days after Rocket Mortgage’s written notice to Administrative Agent of the consummation of any such events), if more than fifty percent (50%) of the combined voting power of the continuing or surviving entity’s stock outstanding immediately after such merger, consolidation or such other reorganization is owned by Persons who were not stockholders of Rocket Mortgage immediately prior to such merger, consolidation or other reorganization; or

(D)if such Seller is a Delaware limited liability company, such Seller enters into any transaction or series of transactions to adopt, file, effect or consummate a Division, or otherwise permits any such Division to be adopted, filed, effected or consummated;

provided, however, that notwithstanding anything herein to the contrary, it is understood and agreed that, so long as it does not otherwise create a Default or Event of Default hereunder, any sale, transfer, or other disposition of all or substantially all of One Reverse’s assets or equity interests in One Reverse, any consummation of a share exchange, merger or consolidation of One Reverse with or into another entity, any liquidation of One Reverse or any other corporate reorganization after which Permitted Holders continue to directly or indirectly own beneficially or of record more than fifty percent (50%) of the voting equity interests of Rocket Mortgage or its successor shall not be deemed to be a Change of Control.

“Code” means the Internal Revenue Code of 1986, as amended.

“Collection Account” means the account established in connection with the Collection Account Control Agreement, into which all collections and proceeds on or in respect of the Mortgage Loans shall be deposited by Servicer.

“Collection Account Control Agreement” means that certain Treasury Management Services Controlled Collateral Account Service Agreement, dated as of June 1, 2011, among Administrative Agent, Rocket Mortgage and JPMorgan Chase Bank, N.A., as the same may be amended or restated from time to time.

5

LEGAL02/41216309v6

“Commitment Fee” has the meaning assigned to such term in the Pricing Side Letter.

“Committed Buyer” means CS Cayman.

“Committed Mortgage Loan” means a Mortgage Loan which is the subject of a Take-Out Commitment with a Take-Out Investor.

“Conforming High CLTV Loan” means an otherwise Conforming Mortgage Loan (i) originated using Desktop Underwriter for underwriting pursuant to the FNMA DU Refi Plus™ program with a LTV of more than [***] as more specifically described in the then current Fannie Mae guidelines and any updates, amendments or supplements; (ii) originated for underwriting pursuant to the FNMA Refi Plus™ program with a LTV of more than [***] as more specifically described in the then current Fannie Mae guidelines and any updates, amendments or supplements; (iii) originated for underwriting pursuant to the Freddie Mac’s Relief Refinance MortgageSM program with a LTV of more than [***] as more specifically described in the then current Freddie Mac guidelines and any updates, amendments or supplements, as amended by variances agreed to between Freddie Mac and Rocket Mortgage and approved by Administrative Agent; or (iv) originated pursuant to Fannie Mae’s Home Affordable Refinance Program as announced in Fannie Mae Announcement SEL 2011 12, including the Refi Plus option applicable to “same servicers”, as set forth in subsequent Announcements, FAQs, Selling Guide updates and Servicing Guide updates issued by Fannie Mae in connection with such program, as amended by variances agreed to between Fannie Mae and Rocket Mortgage and approved by Administrative Agent.

“Conforming Mortgage Loan” means a first lien Mortgage Loan originated in accordance with the criteria of an Agency for purchase of Mortgage Loans, including, without limitation, conventional Mortgage Loans, Pooled Mortgage Loans, FHA Loans, VA Loans and RHS Loans, and (a) with respect to purchase money Mortgage Loans and all FHA Loans, VA Loans and RHS Loans, with a LTV of up to [***] and (b) with respect to refinanced Mortgage Loans, with a LTV of up to [***], except that refinanced Mortgage Loans that are also FHA Loans, VA Loans or RHS Loans shall be a Conforming Mortgage Loan only if they have a LTV of up to [***].

“Control” means, with respect to an eNote, the “control” of such eNote within the meaning of UETA and/or, as applicable, E-Sign, which is established by reference to the MERS eRegistry and any party designated therein as the Controller.

“Control Failure” means, with respect to an eNote, (i) if the Controller status of the eNote shall not have been transferred to Administrative Agent, (ii) Administrative Agent shall otherwise not be designated as the Controller of such eNote in the MERS eRegistry as a result of an unauthorized Transfer of Control in contravention of the terms of this Agreement (other than pursuant to a Bailee Letter, a Request for Release of Documents, or Administrative Agent’s written request or instruction), (iii) if the eVault shall have released the Authoritative Copy of an eNote in contravention of the requirements of the Custodial Agreement, or (iv) if the Custodian initiated any changes on the MERS eRegistry in contravention of the terms of the Custodial Agreement.

“Controller” means, with respect to an eNote, the party designated in the MERS eRegistry as the “Controller”, and who in such capacity shall be deemed to be “in control” or to be the “controller” of such eNote within the meaning of UETA or E-Sign, as applicable.

6

LEGAL02/41216309v6

“CP Conduit” means a commercial paper conduit, including but not limited to Alpine, that is an Affiliate of CSFBMC or whose obligations under the Program Agreements are otherwise also the obligations of CS Cayman.

“CSFBMC” means Credit Suisse First Boston Mortgage Capital LLC, or any successors or permitted assigns.

“Custodial Agreement” means the second amended and restated custodial agreement, dated as of October 27, 2020, among Sellers, Administrative Agent, Buyers and Custodian as the same may be amended, restated, supplemented or otherwise modified from time to time.

“Custodial Mortgage Loan Schedule” has the meaning assigned to such term in the Custodial Agreement.

“Custodian” means Deutsche Bank National Trust Company or such other party specified by Administrative Agent and agreed to by Sellers, which approval shall not be unreasonably withheld.

“Daily Simple SOFR” means, for any day, SOFR, with conventions (including, without limitation, a lookback) established by the Administrative Agent in its sole discretion in accordance with the conventions for this rate selected or recommended by the Relevant Governmental Body for determining “Daily Simple SOFR”; provided that, if the Administrative Agent determines that any such convention is not administratively, operationally, or technically feasible for the Administrative Agent, then the Administrative Agent may establish another convention in its sole discretion.

“Default” means an Event of Default or an event that with notice or lapse of time or both would become an Event of Default.

“Delegatee” means, with respect to an eNote, the party designated in the MERS eRegistry as the “Delegatee” or “Delegatee for Transfers”, and in such capacity is authorized by the Controller to perform certain MERS eRegistry transactions on behalf of the Controller such as Transfers of Control and Transfers of Control and Location.

“Designated Asset” means a Purchased Mortgage Loan that is identified on the Asset Matrix or otherwise by Administrative Agent as eligible for a Purchase Price-Base, a Purchase Price-Incremental 1 and/or a Purchase Price-Incremental 2.

“Disqualification Event” means, with respect to a Designated Asset which has Purchase Price-Incremental 2, the occurrence of any of the following events: (a) a Participant materially breaches the applicable Participation Agreement, (b) an Act of Insolvency occurs with respect to a Participant, (c) the failure of a Participant to purchase the participation interest pursuant to a Participation Agreement with respect to a Designated Asset, (d) the Administrative Agent, a Participant or a Buyer shall have determined that the introduction of or a change in any Requirement of Law or in the interpretation or administration of any Requirement of Law applicable to Administrative Agent, any Participant or any Buyer has made it unlawful, for Administrative Agent, any Participant or any Buyer to purchase Purchased Mortgage Loan or participations in Transactions, or (e) the Administrative Agent determines in its sole discretion, that it will no longer enter into Transactions comprised of Purchase Price-Incremental 2 on account of a Purchased Mortgage Loan.

7

LEGAL02/41216309v6

“Division” means the division of a limited liability company into two or more limited liability companies pursuant to and in accordance with Section 18-217 of Chapter 18 of the Delaware Limited Liability Company Act, 6 Del. C. §§ 18-101 et seq., as amended.

“Dollars” and “$” means dollars in lawful currency of the United States of America.

“E-Sign” means the Electronic Signatures in Global and National Commerce Act, 15 U.S.C. § 7001 et seq.

“E&O Insurance” means insurance coverage with respect to employee errors, omissions, dishonesty, forgery or alteration, theft, disappearance and destruction, robbery and safe burglary, property (other than money and securities) and computer fraud in an aggregate amount acceptable to Fannie Mae, Freddie Mac and GNMA, to the extent a Seller sells Mortgage Loans to such Agency.

“Electronic Agent” means MERSCORP Holdings, Inc., or its successor in interest or assigns.

“Electronic Tracking Agreement” means one or more Electronic Tracking Agreements with respect to (x) the tracking of changes in the ownership, mortgage servicers and servicing rights ownership of Purchased Mortgage Loans held on the MERS System, and (y) the tracking of the Control of eNotes held on the MERS eRegistry, each in a form acceptable to Administrative Agent.

“Electronic Record” means, as the context requires, (i) “Record” and “Electronic Record,” both as defined in E-Sign, and shall include but not be limited to, recorded telephone conversations, fax copies or electronic transmissions, including without limitation, those involving the Warehouse Electronic System, and (ii) with respect to an eMortgage Loan, the related eNote and all other documents comprising the Mortgage File electronically created and that are stored in an electronic format, if any.

“eMortgage Loan” means a Mortgage Loan that is a Conforming Mortgage Loan (other than an FHA Loan or VA Loan) with respect to which there is an eNote and as to which some or all of the other documents comprising the related Mortgage File may be created electronically and not by traditional paper documentation with a pen and ink signature.

“eNote” means, with respect to any eMortgage Loan, the electronically created and stored Mortgage Note that is a Transferable Record.

“eNote Delivery Requirement” shall have the meaning set forth in Section 3(c) hereof.

“eNote Replacement Failure” shall have the meaning set forth in the Custodial Agreement.

“EO13224” has the meanings specific in Section 13(a)(27) hereof.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended from time to time and any successor thereto, and the regulations promulgated and administrative rulings issued thereunder.

“ERISA Affiliate” means any corporation or trade or business that, together with Sellers, is treated as a single employer under Section 414(b) or (c) of the Code or solely for

8

LEGAL02/41216309v6

purposes of Section 302 of ERISA and Section 412 of the Code is treated as single employer described in Section 414 of the Code.

“Escrow Instruction Letter” means the Escrow Instruction Letter from the applicable Seller to the Settlement Agent, in the form of Exhibit K hereto, as the same may be modified, supplemented and in effect from time to time.

“eVault” means an electronic repository established and maintained by Custodian for delivery and storage of eNotes.

“Event of Default” has the meaning specified in Section 15 hereof.

“Event of Termination” means with respect to either Seller (a) with respect to any Plan, a reportable event, as defined in Section 4043 of ERISA, as to which the PBGC has not by regulation waived the requirement of Section 4043(a) of ERISA that it be notified within thirty (30) days of the occurrence of such event, or (b) the withdrawal of either Seller or any ERISA Affiliate thereof from a Plan during a plan year in which it is a substantial employer, as defined in Section 4001(a)(2) of ERISA, or (c) the failure by either Seller or any ERISA Affiliate thereof to meet the minimum funding standard of Section 412 of the Code or Section 302 of ERISA with respect to any Plan, including, without limitation, the failure to make on or before its due date a required installment under Section 412(m) of the Code (or Section 430(j) of the Code as amended by the Pension Protection Act) or Section 302(e) of ERISA (or Section 303(j) of ERISA, as amended by the Pension Protection Act), or (d) the distribution under Section 4041 of ERISA of a notice of intent to terminate any Plan or any action taken by either Seller or any ERISA Affiliate thereof to terminate any plan, or (e) the failure to meet requirements of Section 436 of the Code resulting in the loss of qualified status under Section 401(a)(29) of the Code, or (f) the institution by the PBGC of proceedings under Section 4042 of ERISA for the termination of, or the appointment of a trustee to administer, any Plan, or (g) the receipt by either Seller or any ERISA Affiliate thereof of a notice from a Multiemployer Plan that action of the type described in the previous clause (f) has been taken by the PBGC with respect to such Multiemployer Plan, or (h) any event or circumstance exists which may reasonably be expected to constitute grounds for either Seller or any ERISA Affiliate thereof to incur liability under Title IV of ERISA or under Sections 412(b) or 430(k) of the Code with respect to any Plan.

“Excess Margin Notice” has the meaning specific in Section 6(d) hereof.

“Excluded Taxes” means any of the following Taxes imposed on or with respect to a Buyer or other recipient of any payment under any Program Agreement or required to be withheld or deducted from a payment to such Buyer or such other recipient: (a) Taxes based on (or measured by) net income or net profits, or gross receipts, franchise Taxes and branch profits Taxes that are imposed on a Buyer or other recipient of any payment hereunder as a result of (i) being organized under the laws of, or having its principal office or its applicable lending office located in the jurisdiction imposing such Tax (or any political subdivision or Taxing authority thereof), or (ii) a present or former connection between such Buyer or other recipient and the jurisdiction of the Governmental Authority imposing such Tax or any political subdivision or Taxing authority thereof (other than connections arising from such Buyer or other recipient having executed, delivered, become a party to, performed its obligations under, received payments under, received or perfected a security interest under, engaged in any other transaction pursuant to or enforced under this Agreement or any Program Agreement, or sold or assigned an interest in any Purchased Mortgage Loan pursuant to this Agreement, excluding any assignment made at the request of Seller); (b) any Tax imposed on a Buyer or other recipient of a payment hereunder that is attributable to such Buyer’s or other recipient’s failure to comply with relevant requirements set forth in Section 11(e)(ii); (c) any U.S. federal withholding Tax that is imposed on amounts payable to or for the account of such Buyer or other recipient of a payment

9

LEGAL02/41216309v6

hereunder pursuant to a law in effect on the date such person becomes a party to or under this Agreement, or such person changes its lending office, except in each case to the extent that amounts with respect to Taxes were payable either to such person’s assignor immediately before such person became a party hereto or to such person immediately before it changed its lending office; and (d) any U.S. federal withholding Taxes imposed under FATCA.

“Executive Management” means, with respect to any Person, such Person’s chairman of the board of directors, chief executive officer, president, treasurer and chief financial officer/controller.

“Existing Indebtedness” has the meaning specified in Section 13(a)(23) hereof.

“Fannie Mae” means Fannie Mae, the government sponsored enterprise formerly known as the Federal National Mortgage Association, or any successor thereto.

“FATCA” means Sections 1471 through 1474 of the Code, as of the date of this Agreement (or any amended or successor version that is substantively comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof and any agreements entered into pursuant to Section 1471(b)(1) of the Code.

“FDIA” has the meaning set forth in Section 26.c hereof.

“FDICIA” has the meaning set forth in Section 26.d hereof.

“FHA” means the Federal Housing Administration, an agency within the United States Department of Housing and Urban Development, or any successor thereto, and including the Federal Housing Commissioner and the Secretary of Housing and Urban Development where appropriate under the FHA Regulations.

“FHA Approved Mortgagee” means a corporation or institution approved as a mortgagee by the FHA under the National Housing Act, as amended from time to time, and applicable FHA Regulations, and eligible to own and service mortgage loans such as the FHA Loans.

“FHA Loan” means a Mortgage Loan which is the subject of an FHA Mortgage Insurance Contract.

“FHA Mortgage Insurance Contract” means the contractual obligation of the FHA respecting the insurance of a Mortgage Loan.

“FHA Regulations” means the regulations promulgated by the Department of Housing and Urban Development under the National Housing Act, as amended from time to time and codified in 24 Code of Federal Regulations, and other Department of Housing and Urban Development issuances relating to FHA Loans, including the related handbooks, circulars, notices and mortgagee letters.

“FICO” means Fair Isaac & Co., or any successor thereto.

“Freddie Mac” means the Federal Home Loan Mortgage Corporation or any successor thereto.

10

LEGAL02/41216309v6

“Freddie Mac Assignment Agreement” means the Assignment Agreement, dated as of December 20, 2012, among the Administrative Agent, Rocket Mortgage and Freddie Mac, as the same may be amended from time to time.

“GAAP” means generally accepted accounting principles in effect from time to time in the United States of America and applied on a consistent basis.

“GNMA” means the Government National Mortgage Association and any successor thereto.

“Good Faith Dispute” means a bona fide, good faith dispute being pursued by any Seller through appropriate proceedings, written notice of which dispute has been given by such Seller to all applicable parties, and against which adequate reserves are being maintained by such Seller.

“Governmental Authority” means any nation or government, any state or other political subdivision thereof, or any entity exercising executive, legislative, judicial, regulatory or administrative functions over either Seller, Administrative Agent or any Buyer, as applicable.

“Governmental Order” has the meaning set forth in Section 32(b) hereof.

“Guarantee” means, as to any Person, any obligation of such Person directly or indirectly guaranteeing any Indebtedness of any other Person or in any manner providing for the payment of any Indebtedness of any other Person or otherwise protecting the holder of such Indebtedness against loss (whether by virtue of partnership arrangements, by agreement to keep-well, to purchase assets, goods, securities or services, or to take-or-pay or otherwise); provided that the term “Guarantee” shall not include (i) endorsements for collection or deposit in the ordinary course of business, or (ii) obligations to make servicing advances for delinquent taxes and insurance or other obligations in respect of a Mortgaged Property, to the extent required by Administrative Agent. The amount of any Guarantee of a Person shall be deemed to be an amount equal to the stated or determinable amount of the primary obligation in respect of which such Guarantee is made or, if not stated or determinable, the maximum reasonably anticipated liability in respect thereof as determined by such Person in good faith. The terms “Guarantee” and “Guaranteed” used as verbs shall have correlative meanings.

“Hash Value” means, with respect to an eNote, the unique, tamper-evident digital signature of such eNote that is stored in the MERS eRegistry.

“HECM Loan” means a home equity conversion Mortgage Loan which is secured by a first lien and is eligible to be insured by FHA.

“HELOC” has the meaning set forth in the definition of Second Lien Mortgage Loan.

“High Cost Mortgage Loan” means a Mortgage Loan (a) classified as a “high cost” loan under the Home Ownership and Equity Protection Act of 1994; or (b) classified as a “high cost,” “threshold,” “covered,” or “predatory” loan under any other applicable state, federal or local law (or a similarly classified loan using different terminology under a law, regulation or ordinance imposing heightened regulatory scrutiny or additional legal liability for residential mortgage loans having high interest rates, points and/or fees).

“HUD” means the United States Department of Housing and Urban Development or any successor thereto.

11

LEGAL02/41216309v6

“Income” means with respect to any Purchased Mortgage Loan at any time until repurchased by the Sellers, any principal received thereon or in respect thereof and all interest, dividends or other distributions thereon.

“Indebtedness” has the meaning assigned to such term in the Pricing Side Letter.

“Indemnified Taxes” means (a) Taxes, other than Excluded Taxes, imposed on or with respect to any payment made by or on account of any obligation of the Sellers hereunder or under any Program Agreement and (b) Other Taxes.

“Index” means, with respect to any adjustable rate Mortgage Loan, the index identified on the Mortgage Loan Schedule and set forth in the related Mortgage Note for the purpose of calculating the applicable Mortgage Interest Rate.

“Indemnified Amounts” has the meaning set forth in Section 30(a) hereof.

“Indemnified Party” has the meaning set forth in Section 30(a) hereof.

“Intercreditor Agreement” means the Intercreditor Agreement, dated as of April 4, 2012, among the Administrative Agent, the Sellers, UBS AG, by and through its branch office at 1285 Avenue of the Americas, New York, New York, JPMorgan Chase Bank, National Association, Royal Bank of Canada, Bank of America, N.A., Morgan Stanley Bank, N.A. and Morgan Stanley Mortgage Capital Holdings LLC, as the same may be amended or restated from time to time.

“Interest Rate Protection Agreement” means, with respect to any or all of the Purchased Mortgage Loans, any short sale of a U.S. Treasury Security, or futures contract, or mortgage related security, or eurodollar futures contract, or options related contract, or interest rate swap, cap or collar agreement or Take-Out Commitment, or similar arrangement providing for protection against fluctuations in interest rates or the exchange of nominal interest obligations, either generally or under specific contingencies, entered into by a Seller.

“Joint Account Control Agreement” means the Joint Account Control Agreement, dated as of April 4, 2012, among the Administrative Agent, the Sellers, UBS AG, by and through its branch office at 1285 Avenue of the Americas, New York, New York, JPMorgan Chase Bank, National Association, Royal Bank of Canada, Bank of America, N.A., Morgan Stanley Bank, N.A., Morgan Stanley Mortgage Capital Holdings LLC and Deutsche Bank National Trust Company, as paying agent, as the same may be amended or restated from time to time.

“Joint Securities Account Control Agreement” means the Joint Securities Account Control Agreement, dated as of April 4, 2012, among the Administrative Agent, the Sellers, UBS AG, by and through its branch office at 1285 Avenue of the Americas, New York, New York, JPMorgan Chase Bank, National Association, Royal Bank of Canada, Bank of America, N.A., Morgan Stanley Bank, N.A., Morgan Stanley Mortgage Capital Holdings LLC and Deutsche Bank National Trust Company, as securities intermediary, as the same may be amended or restated from time to time.

“Lien” means any mortgage, lien, pledge, charge, security interest or similar encumbrance.

“Loan to Value Ratio” or “LTV” means with respect to any Mortgage Loan, the ratio of the original outstanding principal amount of the Mortgage Loan, to the lesser of (a) the Appraised Value of the related Mortgaged Property at origination or (b) if the Mortgaged

12

LEGAL02/41216309v6

Property was purchased within twelve (12) months of the origination of such Mortgage Loan, the purchase price of the related Mortgaged Property.

“Location” means, with respect to an eNote, the location of such eNote which is established by reference to the MERS eRegistry.

“Margin Call” has the meaning specified in Section 6(a) hereof.

“Margin Deadline” has the meaning specified in Section 6(b) hereof.

“Margin Deficit” has the meaning specified in Section 6(a) hereof.

“Margin Excess” has the meaning specific in Section 6(d) hereof.

“Market Value” has the meaning assigned to such term in the Pricing Side Letter.

“Master Servicer Field” means, with respect to an eNote, the field entitled, “Master Servicer” in the MERS eRegistry.

“Material Adverse Effect” means (a) a material adverse change in, or a material adverse effect upon, the operations, business, properties or condition (financial or otherwise) of the Sellers and any Affiliate that is a party to any Program Agreement taken as a whole; (b) a material impairment of the ability of the Sellers and any Affiliate that is a party to any Program Agreement taken as a whole to perform under any Program Agreement and to avoid any Event of Default; or (c) a material adverse effect upon the legality, validity, binding effect or enforceability of any Program Agreement against the Sellers and any Affiliate that is a party to any Program Agreement, taken as a whole. Notwithstanding the foregoing, a “Material Adverse Effect” shall not include any effect caused by or attributable solely to the gross negligence or willful misconduct on the part of Administrative Agent or any Buyer.

“Maximum Aggregate Purchase Price” has the meaning assigned to such term in the Pricing Side Letter.

“Maximum Committed Purchase Price” has the meaning assigned to such term in the Pricing Side Letter.

“Maximum Value Amount” means, on each date of determination, an amount equal to the lesser of (a) the Market Value of the applicable Purchased Mortgage Loan or (b) the unpaid principal balance of such Purchased Mortgage Loan (which, with respect to Business Purpose Loans, for the avoidance of doubt, the unpaid principal balance thereof includes amounts actually disbursed to the Mortgagor.

“MERS” means Mortgage Electronic Registration Systems, Inc., a corporation organized and existing under the laws of the State of Delaware, or any successor thereto.

“MERS eDelivery” means the transmission system operated by the Electronic Agent that is used to deliver eNotes, other Electronic Records and data from one MERS eRegistry member to another using a system-to-system interface and conforming to the standards of the MERS eRegistry.

“MERS eRegistry” means the electronic registry operated by the Electronic Agent that acts as the legal system of record that identifies the Controller and Location of the Authoritative Copy of registered eNotes and the Delegatee and the Master Servicer Field and Subservicer Field (if any) with respect thereto.

13

LEGAL02/41216309v6

“MERS Org ID” means a number assigned by the Electronic Agent that uniquely identifies MERS members, or, in the case of a MERS Org ID that is a “Secured Party Org ID”, uniquely identifies MERS eRegistry members, which assigned numbers for each of Administrative Agent, Seller and Custodian have been provided to the parties hereto.

“MERS System” means the mortgage electronic registry system operated by the Electronic Agent that tracks changes in Mortgage ownership, mortgage servicers and servicing rights ownership.

“Monthly Payment” means the scheduled monthly payment of principal and interest on a Mortgage Loan.

“Moody’s” means Moody’s Investors Service, Inc. or any successors thereto.

“Mortgage” means each mortgage, assignment of rents, security agreement and fixture filing, or deed of trust, assignment of rents, security agreement and fixture filing, deed to secure debt, assignment of rents, security agreement and fixture filing, or similar instrument creating and evidencing a lien on real property and other property and rights incidental thereto.

“Mortgage File” means, with respect to a Mortgage Loan, the documents and instruments relating to such Mortgage Loan and set forth in Exhibit E-1 to the Custodial Agreement.

“Mortgage Interest Rate” means the rate of interest borne on a Mortgage Loan from time to time in accordance with the terms of the related Mortgage Note.

“Mortgage Loan” means any residential, business or commercial mortgage loan (including a home equity loan and HECM Loans) evidenced by a Mortgage Note and secured by a first or second lien mortgage, which satisfies the requirements set forth in the applicable Underwriting Guidelines and Section 13(b) hereof; provided, however, that Mortgage Loans shall not include any High Cost Mortgage Loans.

“Mortgage Loan Documents” means the documents in the related Mortgage File to be delivered to the Custodian.

“Mortgage Loan Schedule” means with respect to any Transaction as of any date, a mortgage loan schedule in the form of either (a) Exhibit C attached hereto or (b) a computer tape or other electronic medium generated by the applicable Seller, and delivered to Administrative Agent and Custodian, which provides information (including, without limitation, the information set forth on Exhibit C attached hereto) relating to the Purchased Mortgage Loans in a format acceptable to Administrative Agent.

“Mortgage Note” means the promissory note or other evidence of the indebtedness of a Mortgagor secured by a Mortgage.

“Mortgaged Property” means the real property securing repayment of the debt evidenced by a Mortgage Note.

“Mortgagor” means the obligor or obligors on a Mortgage Note, including any person who has assumed or guaranteed the obligations of the obligor thereunder.

“Multiemployer Plan” means a multiemployer plan defined as such in Section 3(37) of ERISA to which contributions have been or are required to be made by a Seller or any ERISA Affiliate and that is covered by Title IV of ERISA.

14

LEGAL02/41216309v6

“Netting Agreement” means the Amended and Restated Margin, Setoff and Master Netting Agreement, dated as of May 24, 2017, among the Administrative Agent, CS Cayman, Alpine, Credit Suisse Securities (USA) LLC and Rocket Mortgage, as the same may be amended or restated from time to time.

“Non-Affiliate Buyer” has the meaning specified in Section 19 hereof.

“Non-Affiliate MRA” has the meaning specified in Section 19 hereof.

“Non-Affiliate Transactions” has the meaning specified in Section 19 hereof.

“Non-Agency Mortgage Loan” means a Mortgage Loan that (a) is not a Non-Agency Non-QM Mortgage Loan; (b) either (i) does not meet the criteria for an Agency Mortgage Loan or (ii) is an Agency Mortgage Loan that is aggregated for placement into a private label securitization or for sale to a Take-out Investor other than an Agency; (c) meets all applicable criteria as set forth in the Underwriting Guidelines and (d) is identified as a Non-Agency Mortgage Loan by Administrative Agent and Seller.

“Non-Agency Non-QM Mortgage Loan” means a Mortgage Loan that (a) does not meet the criteria for a Qualified Mortgage Loan; (b) meets all applicable criteria as set forth in the Underwriting Guidelines; and (c) is otherwise acceptable to Administrative Agent in its sole discretion.

“Non-Performing Mortgage Loan” has the meaning assigned to such term in the Pricing Side Letter.

“Non-QM – Low FICO Mortgage Loan” means a Mortgage Loan (a) that is a Non-Agency Non-QM Mortgage Loan and (b) for which the Mortgagor’s FICO score at the time of origination was at least 575 but not greater than 640.

“Notice Date” has the meaning given to it in Section 3(b) hereof.

“Obligations” means (a) all of each Seller’s obligations to pay the Repurchase Price on the Repurchase Date, the Price Differential on each Price Differential Payment Date, and other obligations, indebtedness and liabilities, to Administrative Agent and Buyers or Custodian arising under, or in connection with, the Program Agreements, whether now existing or hereafter arising; (b) any and all sums paid by Administrative Agent, Buyers or Administrative Agent on behalf of Buyers in order to preserve any Purchased Mortgage Loan or its interest therein; (c) in the event of any proceeding for the collection or enforcement of any of each Seller’s obligations, indebtedness and liabilities referred to in clause (a), the reasonable out-of-pocket expenses of retaking, holding, collecting, preparing for sale, selling or otherwise disposing of or realizing on any Purchased Mortgage Loan, or of any exercise by Administrative Agent or Buyers of their rights under the Program Agreements, including, without limitation, reasonable attorneys’ fees and disbursements and court costs; (d) all of each Seller’s indemnity obligations to Administrative Agent, Buyers and Custodian or both pursuant to the Program Agreements and (e) all of each Seller’s obligations under the Servicing Facility Agreement and the other Servicing Facility Documents, (i) as long as Administrative Agent or an Affiliate of Administrative Agent is the “Administrative Agent” as defined in such Servicing Facility Agreement, or (ii) until all outstanding aggregate “Repurchase Price” under such Servicing Facility Agreement have been paid in full and all “Transactions” under the Servicing Facility Agreement have terminated.

“OFAC” has the meaning set forth in Section 13(a)(27) hereof.

15

LEGAL02/41216309v6

“Officer’s Compliance Certificate” has the meaning assigned to such term in the Pricing Side Letter.

“One Reverse” means One Reverse Mortgage, LLC, a Delaware limited liability company and a Seller.

“One Reverse Termination Trigger Event” means the occurrence of any of the following:

(1)While One Reverse is a Seller hereunder, any transaction or event as a result of which [***] cease to directly or indirectly own beneficially or of record, at least fifty-one percent (51%) of the membership interests of One Reverse; provided, however, so long as it does not otherwise create a Default or Event of Default hereunder, any transaction, event, sale, transfer, or other disposition of all or substantially all of One Reverse’s assets or equity interests in One Reverse, any consummation of a share exchange, merger or consolidation of One Reverse with or into another entity, or any other corporate reorganization after which Permitted Holders continue to directly or indirectly own beneficially or of record more than fifty percent (50%) of the voting equity interests of Rocket Mortgage or its successor shall not be deemed to be a One Reverse Termination Trigger Event; provided, that One Reverse shall be deemed removed from this Agreement and all applicable Program Agreements;

(2)the sale, transfer, or other disposition of all or substantially all of One Reverse’s assets (excluding any such action taken in connection with any securitization transaction or any action that complies with clause (1) above), which sale, transfer, or other disposition occurs without Administrative Agent’s prior written consent;

(3)a material impairment of the ability of One Reverse to perform under any Program Agreement and to avoid any Event of Default or a material adverse effect upon the legality, validity, binding effect or enforceability of any Program Agreement against One Reverse;

(4)One Reverse is insolvent, or is rendered insolvent by any Transaction and, after giving effect to such Transaction, is left with an unreasonably small amount of capital with which to engage in its business;

(5)One Reverse incurs, or believes that it has incurred, debts beyond its ability to pay such debts as they mature or is contemplating the commencement of insolvency, bankruptcy, liquidation or consolidation proceedings or the appointment of a receiver, liquidator, conservator, trustee or similar official in respect of such entity or any of its assets;

(6)One Reverse enters into any transaction to liquidate, wind up or dissolve itself (or suffers any liquidation, winding up or dissolution); provided, however, that if such liquidation, winding up or dissolution results in Rocket Mortgage owning all of the Purchased Mortgage Loans subject to rights hereunder, such action shall not constitute a One Reverse Termination Trigger Event and One Reverse shall be deemed removed from this Agreement and all applicable Program Agreements;

(7)One Reverse fails to maintain its status with GNMA as an approved lender in good standing (unless such failure is an independent decision

16

LEGAL02/41216309v6

of One Reverse and in no way attributed to a disapproval or other adverse action taken against One Reverse specifically (as opposed to all approved lenders generally) by GNMA), if such failure is not cured within ten (10) Business Days following receipt of written notice of such failure;

(8)any material adverse change in the Property, business, financial condition or operations of One Reverse, in each case as determined by Administrative Agent in its sole good faith discretion, or any other condition exists which, in Administrative Agent’s sole good faith discretion, constitutes a material impairment of One Reverse’s ability to perform its obligations under this Agreement or any other Program Agreement; or

(9)any Governmental Authority or any person, agency or entity acting or purporting to act under governmental authority shall have taken any action to condemn, seize or appropriate, or to assume custody or control of, all or any substantial part of the Property of One Reverse or shall have taken any action to displace the Executive Management of One Reverse or to materially curtail its authority in the conduct of the business of One Reverse, or takes any action in the nature of enforcement to remove, limit or restrict the approval of One Reverse as an issuer or buyer of Mortgage Loans or securities backed thereby, and such action (i) is determined by Administrative Agent in its sole good faith discretion to be materially adverse to Administrative Agent and Buyers taken as a whole, One Reverse, the Repurchase Assets or One Reverse's ability to perform under this Agreement and (ii) shall not have been discontinued or stayed within thirty (30) days.

“Other Taxes” means any and all present or future stamp, court or documentary, intangible, recording, filing or similar Taxes or any excise, sales, goods and services or transfer taxes, charges or similar levies arising from any payment made hereunder or from the execution, delivery, performance, enforcement or registration of, from the receipt or perfection of a security interest under, or otherwise with respect to, any Program Agreement.

“Participant” means any participant as contemplated by Section 22.b of this Agreement which has entered into a Participation Agreement.

“Participation Agreement” means a participation agreement by and among a Participant, the Administrative Agent and the Buyers in form and substance acceptable to Administrative Agent, as the same may be amended, restated, supplemented or otherwise modified from time to time.

“PBGC” means the Pension Benefit Guaranty Corporation or any entity succeeding to any or all of its functions under ERISA.

“Pension Protection Act” means the Pension Protection Act of 2006.

“Permitted Holders” means any or all of the following: (i) Dan Gilbert, together with (a) his spouse and children (natural or adopted) and (b) the estate, heirs, executors, personal representatives, successors or administrators upon or as a result of the death, incapacity or incompetency of such person for purposes of the protection and management of such person’s assets), and (ii) any Person the equity interests of which are owned 80% by the Persons specified in clause (i), or in the case of a trust, the beneficial interests in which are owned 80% by, or the majority of the trustees of which are, Persons specified in clause (i).

17

LEGAL02/41216309v6

“Person” means an individual, partnership, corporation (including a business trust), limited liability company, joint stock company, trust, unincorporated association, joint venture or other entity, or a government or any political subdivision or agency thereof.

“Plan” means an employee pension benefit or other plan as defined in Section 3(2) of ERISA, established or maintained by any Seller or any ERISA Affiliate and covered by Title IV of ERISA, other than a Multiemployer Plan.

“Pool” means a subset of Purchased Mortgage Loans subject to Transactions which shall be identified from time to time by the Administrative Agent.

“Pool Subdivision Notice” means a written notice delivered by Administrative Agent to Sellers, which shall identify the discrete Purchased Mortgage Loans which shall be allocated to different Pools.

“Pooled Mortgage Loan” means any (i) Purchased Mortgage Loan that is subject to a Transaction hereunder and is part of a pool of Purchased Mortgage Loans certified by Custodian to an Agency to be either (a) purchased by such Agency or (b) swapped for an Agency Security backed by such pool, in each case, in accordance with the terms of the guidelines issued by the applicable Agency, and (ii) the portion of any Agency Security to the extent received in exchange for, and backed by a pool of, Purchased Mortgage Loans subject to a Transaction hereunder.

“Post-Default Rate” has the meaning assigned to such term in the Pricing Side Letter.

“Power of Attorney” means a Power of Attorney substantially in the form of Exhibit E hereto.

“Price Differential” means, for each Purchased Mortgage Loan, and each Pricing Period, the sum of the Price Differential-Base, Price Differential-Incremental 1 and Price Differential-Incremental 2 for such Pricing Period.

“Price Differential-Base” means, with respect to each Purchased Mortgage Loan as of any date of determination, an amount equal to the product of (a) the applicable Pricing Rate-Base and (b) the Aggregate Purchase Price-Base.

“Price Differential-Incremental 1” means, with respect to each Purchased Mortgage Loan as of any date of determination, an amount equal to the product of (a) the applicable Pricing Rate-Incremental 1 and (b) the Aggregate Purchase Price-Incremental 1.

“Price Differential-Incremental 2” means, with respect to each Purchased Mortgage Loan as of any date of determination, an amount equal to the product of (a) the applicable Pricing Rate-Incremental 2 and (b) the Aggregate Purchase Price-Incremental 2.

“Price Differential Payment Date” means, with respect to a Purchased Mortgage Loan, the fifth (5th) day of the month following the related Purchase Date and each succeeding fifth (5th) day of the month thereafter; provided, that, with respect to such Purchased Mortgage Loan, the final Price Differential Payment Date shall be the related Repurchase Date; and provided, further, that if any such day is not a Business Day, the Price Differential Payment Date shall be the next succeeding Business Day.

“Pricing Floor” has the meaning assigned to such term in the Pricing Side Letter.

18

LEGAL02/41216309v6

“Pricing Period” means, with respect to each Price Differential Payment Date, the period commencing on (and including) the date that is the first calendar day of the preceding month and terminating on (and including) the earlier of (i) the Repurchase Date and (ii) last calendar day of the preceding month; provided, that the initial Pricing Period shall commence on the initial Purchase Date.

“Pricing Rate” means with respect to each Purchased Mortgage Loan, the sum of (a) with respect to the Purchase Price-Base, the Pricing Rate-Base; (b) with respect to the Purchase Price-Incremental 1, if any, the Pricing Rate-Incremental 1 and (c) with respect to the Purchase Price-Incremental 2, if any, the Pricing Rate-Incremental 2.

“Pricing Rate-Base” means with respect to the Purchase Price-Base, the sum of (a) the greater of (i) the Reference Rate and (ii) the Pricing Floor plus (b) the applicable percentage listed in the Asset Matrix.

“Pricing Rate-Incremental 1” means with respect to the Purchase Price-Incremental 1, the sum of (a) the greater of (i) the Reference Rate and (ii) the Pricing Floor plus (b) the applicable percentage listed in the Asset Matrix.

“Pricing Rate-Incremental 2” means with respect to the Purchase Price-Incremental 2, the sum of (a) the greater of (i) the Reference Rate and (ii) the Pricing Floor plus (b) the applicable percentage listed in the Asset Matrix.

“Pricing Side Letter” means the letter agreement, dated as of the date hereof, among the Administrative Agent, the Buyers and the Sellers, as the same may be amended, restated, supplemented or otherwise modified from time to time.

“Program Agreements” means, collectively, the Pricing Side Letter, the Servicing Agreement, the Servicer Notice, the Custodial Agreement, this Agreement, the Collection Account Control Agreement, the Netting Agreement, the Intercreditor Agreement, the Joint Account Control Agreement, the Joint Securities Account Control Agreement, the Freddie Mac Assignment Agreement, the Takeout Commitment Letter Agreement, as applicable, each Electronic Tracking Agreement, if entered into, and each Power of Attorney.

“Prohibited Distribution” has the meaning set forth in Section 14(o) hereof.

“Prohibited Person” has the meaning set forth in Section 13(a)(27) hereof.

“Property” means any right or interest in or to property of any kind whatsoever, whether real, personal or mixed and whether tangible or intangible.

“Purchase Date” means the date on which Purchased Mortgage Loans are to be transferred by the applicable Seller to Administrative Agent for the benefit of Buyers and the Purchase Price is to be paid by Administrative Agent to the applicable Seller.

“Purchase Price” means the price at which each Mortgage Loan is transferred by or contributed to a Seller, as applicable, to Administrative Agent for the benefit of Buyers, which shall equal:

(a) on the applicable Purchase Date, the applicable Purchase Price-Base plus the Purchase Price-Incremental 1, if any plus the Purchase Price-Incremental 2, if any;

19

LEGAL02/41216309v6

(b) on any day after the Purchase Date, except where Administrative Agent for the benefit of Buyers and such Seller agrees otherwise, the amount determined under the immediately preceding clause (a), (i) increased by the amount of any additional Purchase Price-Incremental 1 and additional Purchase Price-Incremental 2 advanced pursuant to this Agreement and (ii) decreased by the amount of any cash transferred by Seller and applied to reduce each Seller’s Obligations in accordance with this Agreement.

“Purchase Price-Base” means, with respect to any Purchased Mortgage Loan: (a) on the applicable Purchase Date, the amount remitted by Administrative Agent, on behalf of Buyers, to Sellers which shall not exceed the product of (i) the applicable Purchase Price Percentage-Base, and (ii) the applicable Maximum Value Amount, and (b) on any day after the applicable Purchase Date, the amount determined in the immediately preceding clause (a) and increased or decreased in accordance with the definition of Purchase Price set forth herein.

“Purchase Price-Incremental 1” means, with respect to any Purchased Mortgage Loan: (a) on the applicable Purchase Date, the amount remitted by Administrative Agent, on behalf of Buyers, to Sellers which shall not exceed the product of (i) the applicable Purchase Price Percentage-Incremental 1, and (ii) the applicable Maximum Value Amount, and (b) on any day after the applicable Purchase Date, the amount determined in the immediately preceding clause (a) and increased or decreased in accordance with the definition of Purchase Price set forth herein.

“Purchase Price-Incremental 2” means, with respect to any Purchased Mortgage Loan: (a) on the applicable Purchase Date, the amount remitted by Administrative Agent, on behalf of Buyers, to Sellers which shall not exceed the product of (i) the applicable Purchase Price Percentage-Incremental 2, and (ii) the applicable Maximum Value Amount, and (b) on any day after the applicable Purchase Date, the amount determined in the immediately preceding clause (a) and increased or decreased in accordance with the definition of Purchase Price set forth herein.

“Purchase Price Percentage” means, (a) with respect to the Purchase Price-Base, the Purchase Price Percentage-Base; (b) with respect to the Purchase Price-Incremental 1, if any, the Purchase Price Percentage-Incremental 1 and (c) with respect to the Purchase Price-Incremental 2, if any, the Purchase Price Percentage-Incremental 2.

“Purchase Price Percentage-Base” has the meaning set forth in the Asset Matrix.

“Purchase Price Percentage-Incremental 1” has the meaning set forth in the Asset Matrix.

“Purchase Price Percentage-Incremental 2” has the meaning set forth in the Asset Matrix.

“Purchase Price Percentage - Total” means, with respect to each Purchased Mortgage Loan, the sum of (a) the Purchase Price Percentage-Base, plus (b) the Purchase Price Percentage-Incremental 1 and (c) the Purchase Price Percentage-Incremental 2.

“Purchased Mortgage Loans” means the collective reference to Mortgage Loans together with the Repurchase Assets related to such Mortgage Loans transferred by the

20

LEGAL02/41216309v6

applicable Seller to Administrative Agent for the benefit of Buyers in a Transaction hereunder, and/or listed on the related Mortgage Loan Schedule attached to the related Transaction Request, which such Mortgage Loans the Custodian has been instructed to hold for the benefit of Administrative Agent pursuant to the Custodial Agreement.

“Qualified Insurer” means a mortgage guaranty insurance company duly authorized and licensed where required by law to transact mortgage guaranty insurance business and approved as an insurer by Fannie Mae or Freddie Mac or GNMA, as applicable.

“Qualified Mortgage Loan” means a Mortgage Loan which is a “Qualified Mortgage” as defined in 12 CFR 1026.43(e) including all applicable official staff interpretations, or any successor rule, regulation or interpretation, or which is a refinancing of a non-standard mortgage as set forth in 12 CFR 1026.43(d) including all applicable official staff interpretations, or any successor rule, regulation or interpretation.

“Records” means all instruments, agreements and other books, records, and reports and data generated by other media for the storage of information maintained by Sellers or any other person or entity with respect to a Purchased Mortgage Loan. Records shall include the Mortgage Notes, any Mortgages, the Mortgage Files, the credit files related to the Purchased Mortgage Loan and any other instruments necessary to document or service a Mortgage Loan; provided that the “Records” of an eMortgage Loan include the eMortgage Loan’s related Electronic Records, including the related eNote, rather than their paper equivalents.

“Reference Rate” means Adjusted Daily Simple SOFR, or a Successor Rate pursuant to Section 5(d) of this Agreement.

“Register” has the meaning assigned to such term in Section 22 hereof.

“Relevant Governmental Body” means the Federal Reserve Board and/or the Federal Reserve Bank of New York, or a committee officially endorsed or convened by the Federal Reserve Board and/or the Federal Reserve Bank of New York, or any successor of any of the foregoing.

“Repledge Transaction” has the meaning set forth in Section 18 hereof.

“Repledgee” has the meaning set forth in Section 18 hereof.

“Reporting Date” means the fifth (5th) day of each month or, if such day is not a Business Day, the next succeeding Business Day.

“Repurchase Assets” has the meaning assigned thereto in Section 8 hereof.

“Repurchase Date” means the earlier of (i) the Termination Date, (ii) the date determined by the time periods set forth in paragraph (iv) of the definition of Asset Value, (iii) the date determined by application of Section 16 hereof or (iv) the date identified to Administrative Agent by the applicable Seller as the date that the related Mortgage Loan is to be sold pursuant to a Take-Out Commitment.

“Repurchase Price” means the price at which Purchased Mortgage Loans are to be transferred from Administrative Agent on behalf of Buyers to the applicable Seller upon termination of a Transaction, which will be determined in each case (including Transactions terminable upon demand) as the sum of the Purchase Price and the accrued but unpaid Price Differential as of the date of such determination.

21

LEGAL02/41216309v6