As filed with the Securities and Exchange Commission on May 23, 2022

Registration No. 333-262672

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

TO

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact Name of Registrant as Specified in Its Charter)

Delaware |

| 2834 |

| 84-4730610 |

(State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer Identification Number) |

501 Boylston Street, Suite 6102

Boston, MA 02116

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Yishai Zohar

Chief Executive Officer

Gelesis Holdings, Inc.

501 Boylston Street, Suite 6102

Boston, MA 02116

(617) 456-4718

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

James Barrett, Esq. | David Abraham |

Ettore Santucci, Esq. | General Counsel and Secretary |

Jocelyn Arel, Esq. | Gelesis Holdings, Inc. |

Goodwin Procter LLP | 501 Boylston Street, Suite 6102 |

100 Northern Avenue | Boston, MA 02116 |

Boston, MA 02210 | (617) 456-4718 |

(617) 570-1000 |

Approximate date of commencement of proposed sale of the securities to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 (the “Securities Act”) check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the SEC, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 23, 2022

PROSPECTUS FOR

132,857,109 SHARES OF COMMON STOCK

24,333,365 WARRANTS TO PURCHASE SHARES OF COMMON STOCK AND

24,333,365 SHARES OF COMMON STOCK UNDERLYING WARRANTS OF

GELESIS HOLDINGS, INC.

This prospectus relates to (i) the resale of 9,000,000 shares of common stock, par value $0.0001 per share (the “Common Stock”) originally purchased in the PIPE Financing (as defined below) by certain of the selling securityholders named in this prospectus (the “Selling Securityholders”) at a purchase price of $10.00 per share, (ii) the resale of an aggregate of 2,727,967 shares of Common Stock originally issued pursuant to the Backstop Agreement (as defined below) to certain of the Selling Securityholders at an effective purchase price of approximately $2.73 per share, (iii) the resale of 4,916,250 Founder Shares (as defined below) by certain of the Selling Securityholders previously acquired by our predecessor’s sponsor at an effective purchase price of $0.0051 per share, (iv) the resale of 54,990,973 shares of Common Stock by Legacy Gelesis shareholders originally issued as consideration in connection with the Business Combination (as defined below) at a per share value of $10.00 per share; (v) up to an aggregate of 7,520,000 shares of Common Stock that may be issued upon exercise of the Private Placement Warrants (as defined in this prospectus) held by the Selling Securityholders that were originally purchased at a purchase price of $1.00 per warrant; (vi) up to an aggregate of 13,800,000 shares of Common Stock that may be issued upon exercise of the Public Warrants (as defined in this prospectus) held by the Selling Securityholders that were originally issued as part of the units sold by our predecessor, Capstar Special Purpose Acquisition Corp. (“CPSR”) at a purchase price of $10.00 per unit on July 7, 2020 as part of its initial public offering; (vii) up to 3,013,365 shares of Common Stock that may be issued upon exercise of Rollover Warrants (as defined in this prospectus) held by the Selling Securityholders; (viii) up to 13,405,709 shares of Common Stock issuable upon exercise of the Rollover Options (as defined in this prospectus) held by the Selling Securityholders; and (ix) up to 23,482,845 Earnout Shares (defined below) reserved for issuance to certain of the Selling Securityholders, subject to certain market price-based target requirements. This prospectus also relates to the resale of up to 24,333,365 Warrants (as defined in this prospectus) held by the Selling Securityholders. Additional details regarding the securities to which this prospectus relates and the Selling Securityholders is set forth in this prospectus under “Information Related to Offered Securities” and “Selling Securityholders”.

We will not receive any proceeds from the sale of the Common Stock or the Warrants by the Selling Securityholders. We could receive up to an aggregate of $251.0 million if all of the Warrants registered hereby are exercised for cash. However, we will only receive such proceeds if and when the Warrant holders exercise the Warrants. The exercise of the Warrants, and any proceeds we may receive from their exercise, are highly dependent on the price of our Common Stock and the spread between the exercise price of the Warrant and the price of our Common Stock at the time of exercise. We have 13,800,000 outstanding Public Warrants to purchase 13,800,000 shares of our Common Stock, exercisable at an exercise price of $11.50 per share; (ii) 7,520,000 outstanding Private Warrants to purchase 7,520,000 shares of our Common Stock, exercisable at an exercise price of $11.50 per share; and (iii) 3,013,365 exercisable Rollover Warrants, 1,353,062 of which are exercisable at an exercise price of $4.26 and 1,660,303 of which are exercisable at an exercise price of $0.02. If the market price of our Common Stock is less than the exercise price of a holder’s Warrants, it is unlikely that holders will exercise their Warrants. As of May 20, 2022, the closing price of our Common Stock was $4.97 per share. There can be no assurance that all of our Warrants will be in the money prior to their expiration. Our Public Warrants under certain conditions, as described in the warrant agreement, are redeemable by the Company at a price of $0.01 per Warrant or on a cashless basis. Our Private Warrants are not redeemable so long as they are held by the initial stockholders and are exercisable on a cashless basis. Our Rollover Warrants are not redeemable and are exercisable on a cashless basis only with respect to the 1,660,303 Rollover Warrants that have an exercise price of $0.02. As such, it is possible that we may never generate any cash proceeds from the exercise of our Warrants. We will bear all costs, expenses and fees in connection with the registration of the securities. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their respective sales of the securities.

Trading of our Common Stock and Public Warrants began on the New York Stock Exchange (“NYSE”) on January 14, 2022, under the ticker symbols “GLS” and “GLS WS”, respectively. Prior to the consummation of the Business Combination, CPSR’s Class A common stock, par value $0.0001 per share (the “CPSR Class A Common Stock”), and CPSR warrants to purchase CPSR Class A Common Stock traded on the NYSE under the ticker symbols “CPSR” and “CPSR WS”, respectively. On May 20, 2022, the closing prices of our Common Stock and Public Warrants as reported by the NYSE were $4.97 and $0.2762, respectively.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 20 of this prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022.

TABLE OF CONTENTS

1 | ||

2 | ||

3 | ||

7 | ||

9 | ||

16 | ||

20 | ||

56 | ||

57 | ||

58 | ||

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION | 59 | |

68 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 92 | |

114 | ||

120 | ||

126 | ||

129 | ||

135 | ||

139 | ||

147 | ||

148 | ||

152 | ||

152 | ||

152 | ||

F-1 |

You should rely only on the information contained in this prospectus. No one has been authorized to provide you with information that is different from that contained in this prospectus. This prospectus is dated as of the date set forth on the cover hereof. You should not assume that the information contained in this prospectus is accurate as of any date other than that date.

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC using the “shelf” registration process. Under the shelf registration process, the Selling Securityholders may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale by such Selling Securityholders of the securities offered by them described in this prospectus. This prospectus also relates to the issuance by us of shares of Common Stock issuable upon the exercise of stock options and warrants. We will receive proceeds from any exercise of the Warrants for cash.

Neither we nor the Selling Securityholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Securityholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Securityholders will make an offer to sell these securities in any jurisdiction where such offer or sale are not permitted. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. You should assume that the information appearing in this prospectus or any prospectus supplement is accurate as of the date on the front of those documents only, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

The Selling Securityholders and their permitted transferees may use this shelf registration statement to sell securities from time to time through any means described in the section titled “Plan of Distribution”. More specific terms of any securities that the Selling Securityholders and their permitted transferees offer and sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the securities being offered and the terms of the offering.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement or post-effective amendment modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should read both this prospectus and any applicable prospectus supplement or post- effective amendment to the registration statement together with the additional information to which we refer you in the sections of this prospectus titled “Where You Can Find More Information”.

Unless the context indicates otherwise, references in this prospectus to the “company”, “Gelesis”, “Gelesis Holdings”, “we”, “us”, “our” and similar terms refer to Gelesis Holdings, Inc. (f/k/a Capstar Special Purpose Acquisition Corp.) and its consolidated subsidiaries. References to “Capstar Special Purpose Acquisition Corp.” and “CPSR” refer to our predecessor company prior to the consummation of the Business Combination (the “Closing”, and the date of the consummation of the Business Combination, the “Closing Date”). References to “Legacy Gelesis” refer to Gelesis, Inc. prior to the Closing.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information”.

1

TRADEMARKS

This document contains references to trademarks and service marks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of it by, any other companies.

2

SELECTED DEFINITIONS

Unless otherwise stated in this prospectus or the context otherwise requires, references to:

“2006 Plan” means the Legacy Gelesis 2006 Stock Incentive Plan assumed by Gelesis Holdings in connection with the Business Combination.

“2016 Plan” means the Legacy Gelesis 2016 Stock Option and Grant Plan assumed by Gelesis Holdings in connection with the Business Combination.

“ASC” means Accounting Standards Codification.

“Backstop Agreement” means the Backstop Agreement, dated as of December 30, 2021, by and among CPSR and the Backstop Purchasers.

“Backstop Purchasers” means PureTech Health LLC and SSD2, LLC.

“Backstop Shares” means (i) the 744,217 shares of CPSR Class A Common Stock purchased by the Backstop Purchasers and (ii) the 1,983,750 shares of CPSR Class A Common Stock issued to the Backstop Purchasers, in connection with the Closing pursuant to the terms of the Backstop Agreement.

“Board” means the board of directors of Gelesis Holdings, unless the context otherwise requires.

“Bridge Financing” means the bridge financing arrangement in the amount of $27.0 million entered into by Legacy Gelesis on December 13, 2021.

“Business Combination” means the transactions contemplated by the Business Combination Agreement. “Business Combination Agreement” means the Business Combination Agreement, dated as of July 19, 2021, by and among CPSR, Merger Sub and Legacy Gelesis, as amended on November 8, 2021 and December 30, 2021.

“Bylaws” means the Gelesis Holdings amended and restated bylaws.

“Certificate of Incorporation” means the Gelesis Holdings amended and restated certificate of incorporation.

“Capstar Stockholder Redemption” means the right of the holders of CPSR Class A Common Stock to redeem all or a portion of their CPSR Class A Common Stock prior to the Closing (in connection with the transactions contemplated by the Business Combination Agreement or otherwise) as was set forth in CPSR’s certificate of incorporation.

“Closing” means the closing of the Business Combination.

“Closing Date” means January 13, 2022.

“Code” means the United States Internal Revenue Code of 1986, as amended.

“Common Stock” means the common stock, par value $0.0001 per share, of Gelesis Holdings.

“Continental” means Continental Stock Transfer & Trust Company.

“CPSR” means Capstar Special Purpose Acquisition Corp., a Delaware corporation.

“CPSR Class A Common Stock” means the Class A Common Stock, par value $0.0001 per share, of CPSR, which automatically converted into an equal number of shares of our Common Stock in connection with the Business Combination.

“CPSR Class B Common Stock” or “Founder Shares” means the Class B Common Stock, par value $0.0001 per share; of CPSR, which were initially issued to the Sponsor (a portion of which were subsequently transferred to the other Initial Shareholders or issued

3

as Backstop Shares) in a private placement prior to the CPSR Initial Public Offering, and, in connection with the Business Combination, which automatically converted into an equal number of shares of Common Stock.

“CPSR Initial Public Offering” means the initial public offering of CPSR, which closed on July 7, 2020.

“CPSR Initial Stockholders” means the Sponsor, Kathryn Cavanaugh, John Ghiselli and James Whittenburg, who collectively own all of the CPSR Class B Common Stock.

“CPSR Units” means the units of CPSR, each consisting of one (1) share of CPSR Class A Common Stock and one-half (1/2) of one Public Warrant of CPSR that were offered and sold by CPSR in the CPSR Initial Public Offering (less the number of units that have been separated into the underlying public shares and underlying warrants upon the request of the holder thereof).

“DGCL” means the General Corporation Law of the State of Delaware, as amended.

“Dollars” or “$” means U.S. dollars, except where otherwise noted.

“Earn Out Period” means the five (5) year period immediately following the Closing.

“Earnout Shares” means the twenty-three million four hundred eighty-three thousand two hundred and fifty (23,483,250) restricted shares of Gelesis Holdings Common Stock to be issued to Legacy Gelesis stockholders, holders of Legacy Gelesis Warrants and holders of Legacy Gelesis Options, pro rata with the portion of the Transaction Share Consideration allocated to each Legacy Gelesis Stockholder, holder of Legacy Gelesis Options and holder of Legacy Gelesis Warrants, subject to certain vesting conditions as set forth in the Business Combination Agreement.

“Effective Time” means the effective time of the Business Combination.

“Equity Incentive Plan” means the Gelesis Holdings, Inc. 2021 Stock Option and Incentive Plan.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“FDA” means the United States Food and Drug Administration.

“Founder Shares” means the shares of CPSR Class B Common Stock purchased by the Sponsor in a private placement prior to the CPSR Initial Public Offering, which were converted into shares of CPSR Class A Common Stock and automatically exchanged for Common Stock.

“FTC” means the United States Federal Trade Commission.

“GAAP” means accounting principles generally accepted in the United States of America.

“Gelesis” or “Gelesis Holdings” means Gelesis Holdings, Inc., a Delaware corporation.

“Legacy Gelesis” means Gelesis, Inc., a Delaware corporation.

“Gelesis Equityholders” means the holders of Common Stock, Gelesis Holdings Options and Gelesis Holdings Warrants.

“Gelesis Holdings Equity Plan” means the 2016 Plan and the 2006 Plan.

“Gelesis Holdings Options” means options to purchase shares of Common Stock.

“Gelesis Holdings Warrants” means warrants to purchase Common Stock.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012.

“Legacy Gelesis” means Gelesis, Inc., a Delaware corporation, prior to the consummation of the Business Combination.

4

“Legacy Gelesis Stockholders” means the stockholders of Legacy Gelesis and holders of Legacy Gelesis equity awards prior to the Business Combination.

“Merger” means the merger of Merger Sub with and into Gelesis, with Gelesis surviving the merger as a wholly owned subsidiary of Gelesis Holdings, Inc.

“Merger Sub” means CPSR Gelesis Merger Sub, Inc., a Delaware corporation and subsidiary of CPSR, prior to the consummation to the Business Combination.

“NYSE” means the New York Stock Exchange.

“PIPE Financing” means the private placement of an aggregate of 9,000,000 shares of CPSR Class A Common Stock to the PIPE Investors pursuant to Section 4(a)(2) of the Securities Act and Regulation D promulgated thereunder, for a purchase price of $10.00 per share, resulting in an aggregate amount of $90 million to CPSR, pursuant to Subscription Agreements with the PIPE Investors, including the PIMCO Private Funds.

“PIPE Investors” means those investors who participated in the PIPE Financing.

“Preferred Stock” means the preferred stock, par value $0.0001 per share, of Gelesis Holdings.

“Private Placement Warrants” means the warrants to purchase shares of Common Stock outstanding as of the date of this prospectus that were issued at the time of the Business Combination in exchange for the private placement warrants previously sold in a private placement to the Sponsor concurrently with the CPSR Initial Public Offering.

“Private Placement Warrants” means the private placement warrants issued to the Sponsor concurrently with the CPSR Initial Public Offering, or the warrants of Gelesis Holdings issued in exchange thereof at the time of the Business Combination, as context requires.

“Public Stockholders” means holders of CPSR Class A Common Stock issued in the CPSR Initial Public Offering.

“Public Warrants” means the redeemable warrants that were offered and sold by CPSR in the CPSR Initial Public Offering as part of the CPSR Units or the redeemable warrants of Gelesis Holdings issued in exchange thereof at the time of the Business Combination, as context requires.

“Registration Rights Agreement” means the Registration and Stockholder Rights Agreement, dated January 13, 2022, by and among Gelesis Holdings, Inc., certain former stockholders of Gelesis, the Sponsor and certain directors and officers of CPSR prior to the Effective Time.

“Rollover Option” means each vested and unvested Legacy Gelesis option which, at the Effective Time, by virtue of the Merger and without any action of any party or any other person, but subject to the terms of the Business Combination Agreement, ceased to represent the right to purchase shares of Legacy Gelesis common stock and was canceled in exchange for an option to purchase shares of Common Stock. Each Rollover Option is subject to the same terms and conditions (including applicable vesting, expiration and forfeiture provisions) that applied to the corresponding Legacy Gelesis option immediately prior to the Effective Time, except for (i) terms (A) rendered inoperative by reason of the transactions contemplated by the Business Combination Agreement (including any anti-dilution or other similar provisions that adjust the number of underlying shares that could become exercisable subject to the options) or (B) to the extent they conflict with the Gelesis Holding Equity Plan and (ii) such other immaterial administrative or ministerial changes as the CPSR board of directors (or the compensation committee of the CPSR board of directors) may have determined in good faith are appropriate to effectuate the administration of the Rollover Options.

“Rollover Warrant” means each Legacy Gelesis warrant which, at the Effective Time, by virtue of the Merger and without any action of any party or any other person, ceased to represent the right to purchase shares of Legacy Gelesis common stock and was canceled in exchange for a warrant to purchase shares of Common Stock. Each Rollover Warrant is subject to the same terms and conditions that applied to the corresponding Legacy Gelesis warrant immediately prior to the Effective Time, except for (i) terms rendered inoperative by reason of the transactions contemplated by the Business Combination Agreement (including any anti-dilution or other similar provisions that adjust the number of underlying shares that could become exercisable subject to the warrants) and (ii)

5

such other immaterial administrative or ministerial changes as the CPSR board of directors (or the compensation committee of the CPSR board of directors) may have determined in good faith are appropriate to effectuate the administration of the Rollover Warrants.

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002.

“SEC” means the United States Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“Sponsor” means Capstar Sponsor Group, LLC, a Delaware limited liability company.

“Subscription Agreements” means the subscription agreements pursuant to which the PIPE Financing was consummated.

“Transactions” mean the Business Combination, the PIPE Financing, the Bridge Financing, the Backstop Agreement and related adjustments.

“Trust Account” means the trust account maintained by Continental, acting as trustee, that holds the proceeds from the CPSR Initial Public Offering and the private placement of the Private Placement Warrants and established for the benefit of holders of CPSR Class A Common Stock in connection with the CPSR Initial Public Offering.

“Warrants” means the Private Placement Warrants, the Public Warrants and the Rollover Warrants.

6

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this prospectus may constitute “forward-looking statements” for purposes of the federal securities laws. Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. The information included in this prospectus has been provided by us and our management, and such forward- looking statements include statements relating to the expectations, hopes, beliefs, intentions or strategies regarding the future of Gelesis and its management team. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this prospectus may include, for example, statements about:

| ● | our ability to raise financing in the future, if and when needed; |

| ● | our ability to continue as a going concern; |

| ● | our ability to achieve and maintain widespread market acceptance of Plenity, including building brand recognition and loyalty, increasing sales, and achieving commercial success; |

| ● | the impact of current and future applicable laws and regulations, whether in the United States or foreign countries, and our ability to comply with such laws and regulations; |

| ● | our ability to produce adequate supply of Plenity, including its ability to continue to invest in manufacturing capacity and to build additional manufacturing sites; |

| ● | risks related to the development of the telehealth market and regulations related to remote healthcare; |

| ● | global economic, political and social conditions and uncertainties in the markets that we serve, including risks and uncertainties caused by the COVID-19 pandemic or other natural or man-made disasters; |

| ● | our ability to enter into additional strategic collaborations with third parties, to acquire businesses or products or form strategic alliances in the future and to realize the benefits of such collaborations, acquisitions and alliances; |

| ● | our ability to adequately protect our proprietary technology or maintain issued patents that are sufficient to protect Plenity and our ability to prevent third parties from infringing on our proprietary technology; |

| ● | the risk that a third-party’s activities, including with respect to third parties that we have granted outlicenses to or granted limited exclusive or non-exclusive commercial rights, may overlap or interfere with the commercialization of Plenity or that we become dependent on such arrangements; |

| ● | our ability to successfully develop and expand our operations and manufacturing and to effectively manage such growth; |

| ● | risks related to our suppliers and distributors, including the loss of such suppliers or distributors, or their inability to provide adequate supply of materials or distribution; |

| ● | our ability to retain our senior executive officers and to attract and keep senior management and key scientific and commercial personnel; |

| ● | our ability to identify and discover additional product candidates and to obtain and maintain regulatory approval for such candidates; |

| ● | risks related to potential product liability exposure for Plenity or other future product candidates; |

7

| ● | risks related to adverse publicity in the weight management industry, changes in the perception of our brands, and the impact of negative information or inaccurate information about us on social media; |

| ● | our ability to generate product sales and to reduce operating losses going forward; |

| ● | our ability to accurately forecast revenue and appropriately monitor its associated expenses in the future; |

| ● | our ability to compete against other weight management and wellness industry participants or other more effective or more favorably perceived weight management methods, including pharmaceuticals, devices and surgical procedures; |

| ● | foreign currency fluctuations and inflation; |

| ● | failure to maintain adequate operational and financial resources or raise additional capital or generate sufficient cash flows; |

| ● | our ability to successfully protect against security breaches and other disruptions to our information technology structure; and |

| ● | other factors detailed under the section entitled “Risk Factors.” |

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. As a result of these factors, we cannot assure you that the forward- looking statements in this prospectus will prove to be accurate. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances, or otherwise.

You should read this prospectus and the documents that we reference in this prospectus and have filed with the SEC as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward- looking statements by these cautionary statements.

This prospectus also contains estimates, projections and other information concerning our industry, our business, and the markets for our products, including data regarding the estimated size of those markets.

Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from reports, research surveys, studies and similar data prepared by market research firms and other third parties.

8

PROSPECTUS SUMMARY

This summary highlights selected information from this prospectus and may not contain all of the information that is important to you in making an investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” See also the section titled “Where You Can Find More Information”.

Unless context otherwise requires, references in this prospectus to the “Gelesis”, “company”, “we”, “us” or “our” refer to the business of Legacy Gelesis, which became the business of Gelesis Holdings following the Closing of the Business Combination.

Overview

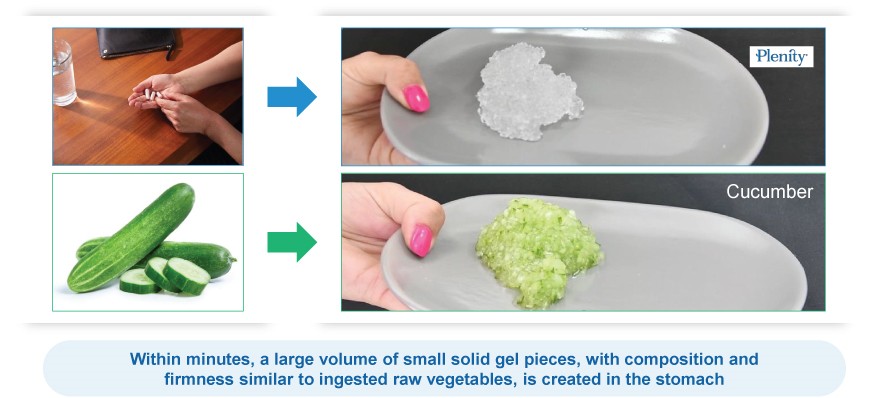

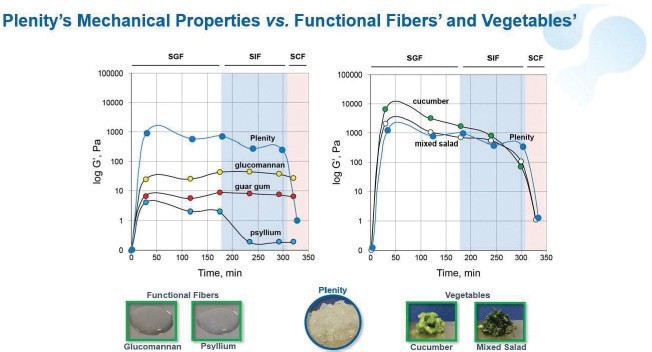

We are a commercial stage biotherapeutics company built for consumer engagement. We are focused on advancing first-in-class superabsorbent hydrogel therapeutics for chronic gastrointestinal, or GI, diseases including excess weight, type 2 diabetes, NAFLD/NASH, functional constipation, and inflammatory bowel disease. Our biomimetic superabsorbent hydrogels are inspired by the composition and mechanical properties (e.g., firmness) of raw vegetables. They are conveniently administered in capsules taken with water to create a much larger volume of small, non-aggregating hydrogel pieces that become an integrated part of the meals, and act locally in the digestive system.

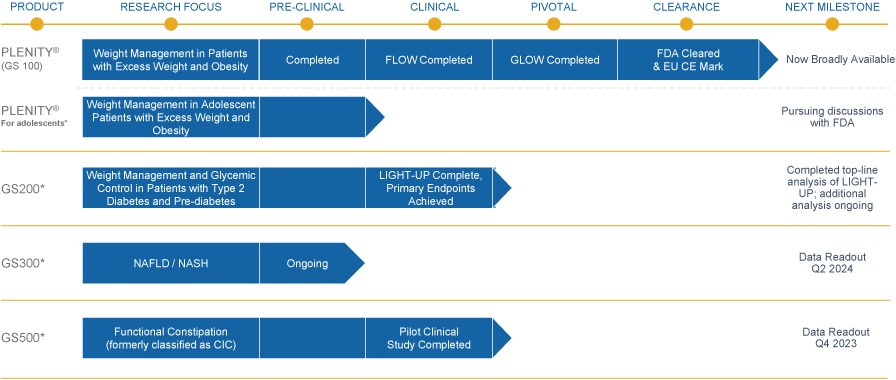

Our first product, Plenity, and our other product candidates are based on a proprietary hydrogel technology that works mechanically, as opposed to via a chemical mode of action, and exclusively in the gastrointestinal, or GI, tract rather than systemically or through surgical intervention. Plenity is indicated for over 150 million Americans, the largest number of adults struggling with excess weight (i.e., a body mass index (kg/m2), or BMI, of 25 – 40) of any prescription oral weight-management aid and the only one indicated for the entire range of overweight population, including those without co-morbidities such as diabetes and cardiovascular diseases. Plenity is marketed directly to potential members, who access it through telehealth and traditional healthcare provider services. We refer to those who are prescribed Plenity as our members — not customers — because we view our relationship with them as a long-term journey of support, not as a transactional relationship. This consumer-directed model is uniquely enabled by Plenity’s strong safety and tolerability profile. Our business is built on a subscription model, as monthly Plenity kits are delivered to our members’ homes. We leverage the latest technologies with telehealth, mail-order distribution, consumer engagement, and our native digital technology platform. Plenity is an orally administered capsule that employs multiple mechanisms of action along the GI tract to aid in weight management by creating small firm 3D structures, similar to ingested raw vegetables, which create a sensation of feeling fuller. Using a biomimetic approach, we developed the first-of-its-kind superabsorbent hydrogel technology, inspired by the composition (e.g., water and cellulose) and mechanical properties (e.g. elasticity or firmness) of ingested raw vegetables. We designed Plenity and our other hydrogels to address several critical challenges of the modern diet: portion size, caloric density, and food composition. For optimal safety and efficacy, these hydrogel particles are engineered to rapidly absorb and release water at specific locations in the GI tract. Plenity does not act systemically and is not absorbed by the body. Instead, it acts locally in the GI tract by changing the volume, firmness, and reducing the caloric density of ingested meals. Because it acts mechanically and it is the first of its kind, Plenity is regulated as a novel medical device (de novo pathway). Our product pipeline also includes multiple other potential therapeutic candidates for common chronic conditions affected by gut health that are currently in clinical and preclinical testing, including diabetes, nonalcoholic fatty liver disease, or NAFLD, nonalcoholic steatohepatitis, or NASH, and functional constipation, or FC, all based on our hydrogel technology.

Obesity and obesity-related metabolic diseases represent a global health challenge for which there are few safe and effective interventions. These conditions are associated with comorbidities such as type 2 diabetes, hypertension, and heart disease.

There are limited available treatments that address the overweight and obesity epidemic safely and effectively. Available therapies include pharmaceuticals and surgical interventions, including device implantation. These approaches are associated with safety concerns that limit their use. Conversely, we believe our hydrogel technology presents a breakthrough in material science as it is the first and only superabsorbent hydrogel that is constructed from building blocks used in foods and specifically engineered to achieve its medical purpose. Our first commercial product based on this technology, Plenity, is clinically validated and was granted de novo classification by the FDA to aid in weight management in adults with overweight or obesity, when used in conjunction with diet and exercise. The types of FDA marketing authorization available to a medical device are premarket notification (also called 510(k) when a predicate device exists) and premarket approval (also called PMA) for higher risk Class III devices. The de novo classification is a pathway to market for low to medium risk novel devices for which there is no predicate. Plenity’s de novo clearance included clinical trials and other data that demonstrated assurance of safety and effectiveness. Plenity has the broadest label of any FDA-

9

regulated weight management approach as it is indicated for the largest number of adults struggling with excess weight, offering a safe, convenient and effective oral treatment option.

Our biomimetic hydrogel, which is engineered to rapidly absorb and release water at specific locations in the GI tract, is synthesized through a multi-step, proprietary process using a specific form of modified cellulose and citric acid, both of which are generally recognized as safe, or GRAS, by the Food and Drug Administration, or FDA, and are commonly used in the food industry. In our manufacturing process, we crosslink the modified cellulose with citric acid to form a three-dimensional matrix, resulting in the desired properties of Plenity. Each Plenity capsule contains thousands of hydrogel particles, with each particle approximately the size of a grain of salt. We designed the Plenity capsule to be ingested with water before a meal. In the stomach, the hydrogel particles are released from the capsules and rapidly absorb water, hydrating to approximately 100 times their original size. When fully hydrated, each gel particle is, on average, approximately 2 mm in diameter and its elastic response (a measurement of the ability of matter to recover its original shape after deformation) is similar to that of ingested raw vegetables. The hydrogel particles mix homogeneously with food and travel through the GI tract and are designed to induce satiety and improve glycemic control through multiple mechanisms of action. Once in the large intestine, the particles partially degrade and release most of the water, which is reabsorbed by the body. The remaining degraded particles are then eliminated by the body in the same manner as raw vegetables.

Corporate Information

We were incorporated on February 14, 2020 as a special purpose acquisition company and a Delaware corporation under the name Capstar Special Purpose Acquisition Corp. On July 7, 2020, CPSR completed its initial public offering. On January 13, 2022, CPSR consummated the Business Combination with Gelesis, Inc. pursuant to the Business Combination Agreement. In connection with the Business Combination, CPSR changed its name to Gelesis Holdings, Inc.

Our principal executive offices are located at 501 Boylston Street, Suite 6102, Boston, Massachusetts 02116 and our telephone number is (617) 456-4718. Our corporate website address is https://www.gelesis.com. Our website and the information contained on, or that can be accessed through, the website is not deemed to be incorporated by reference in, and is not considered part of, this prospectus.

Risk Factors Summary

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this prospectus summary, which illuminate challenges that we face in connection with the successful implementation of our strategy and the growth of our business. The following considerations, among others, may offset our competitive strengths or have a negative effect on our business strategy, which could cause a decline in the price of shares of our securities and result in a loss of all or a portion of any investment in our securities:

Risks Related to Product Development, Regulatory Approval and Commercialization

| ● | Gelesis is dependent on the success of its hydrogel technology for Plenity, which is currently its only marketed and FDA authorized product. |

| ● | Plenity may cause undesirable side effects that could result in significant negative consequences, including product liability or other litigation, that may be costly to Gelesis and/or adversely impact the commercial success of Plenity. The broad prescription pharmaceutical and medical device market for overweight and obesity is strictly regulated. Several competitors have attempted unsuccessfully to generate significant, sustainable sales in that market. |

| ● | Gelesis is, and will continue to be, subject to ongoing and extensive regulatory requirements. Any failure to comply with applicable laws and regulations, including those pertaining to the advertising and promotion of healthcare products, could expose Gelesis to criminal sanctions, civil penalties, contractual damages, reputational harm and diminished profits and future earnings, and substantially harm Gelesis’ business. |

| ● | Plenity is currently regulated as a medical device by the FDA and may become subject to similar or other therapeutic regulatory requirements outside the United States. |

| ● | Recently enacted and future legislation may increase the difficulty and cost for us to further commercialize Plenity and any other products Gelesis may develop in the future and decrease the prices Gelesis may obtain for its approved products. |

10

| ● | Gelesis is responsible for manufacturing Plenity and it currently has a validated and active commercial scale manufacturing facility that it is currently expanding, a fully functional pilot manufacturing site that can be quickly activated and land owned and zoned for commercial capacity expansion. Gelesis will continue to invest in manufacturing capacity at these sites and possibly build additional manufacturing sites to meet increased demand as Plenity is launched through new channels or in new markets. Gelesis’ inability to produce an adequate supply of Plenity, due to the loss of these facilities or other future facilities or any material limitation of production at these facilities, could materially and adversely impact the commercial growth and success of Plenity and, consequently, could cause Gelesis’ revenue, earnings or reputation to suffer. |

| ● | There is no guarantee that Gelesis will be able to successfully commercialize Plenity through the channels, or in the markets, it is targeting or at all. |

| ● | The telehealth market is immature and volatile, and if it does not develop, if it develops more slowly than Gelesis expects, or if it encounters negative publicity, Gelesis’ ability to fully commercialize Plenity and grow its business will be harmed. |

| ● | Successful commercialization of Plenity is dependent on the willingness of the ultimate patient to pay out-of-pocket. If there is not sufficient patient demand for Plenity, Gelesis’ financial results and future prospects will be harmed. |

| ● | Competing products and technologies could emerge, including pharmaceuticals, devices, and surgical procedures, that adversely affect Gelesis’ opportunity to generate sales of Plenity and achieve profitability. |

Risks Relating to Intellectual Property Rights

| ● | If Gelesis is unable to adequately protect its proprietary technology or maintain issued patents that are sufficient to protect Plenity, or if competitors are able to market competitive products without infringing Gelesis’ protected intellectual property rights, others could compete against Gelesis in ways that would have a material adverse impact on Gelesis’ business, results of operations, financial condition and prospects. |

| ● | Gelesis has licensed Plenity to third party partners (e.g. for launch in Greater China, including Mainland China, Hong Kong, Macau, and Taiwan) and has also granted limited licenses to practice patent rights for noncommercial, research purposes. Gelesis may continue to outlicense its intellectual property and may agree under certain circumstances to grant limited exclusive or non-exclusive commercial rights as well. There can be no guarantee that the third party’s activities will not in any way overlap or interfere with the commercialization of Plenity. Additionally, there is always the possibility that Gelesis may become dependent on obtaining access to third party intellectual property in connection with the commercialization of Plenity or for other new product candidates in the future. |

| ● | Gelesis may infringe the intellectual property rights of others, which may prevent or delay its development efforts or stop Gelesis from commercializing or increase the costs of commercializing Plenity. |

| ● | Gelesis may be involved in lawsuits to protect or enforce its patents, which could be expensive, time-consuming, and unsuccessful. |

| ● | Issued patents covering Plenity could be found invalid or unenforceable if challenged in court. |

| ● | Changes in U.S. patent law could diminish the value of patents in general, thereby impairing Gelesis’ ability to protect its products. |

Risks Related to Our Business and Strategy

| ● | Gelesis will need to continue to develop and expand its company, and if it fails to manage such development and expansion effectively, its expenses could increase more than expected, its revenue may not increase sufficiently to generate sustainable profits and it may be unable to successfully execute on its growth initiatives, business strategies or operating plans. |

| ● | Gelesis’ ability to identify, engage with, and retain Plenity patients is essential to its ability to grow and sustain its sales. |

| ● | Gelesis relies on a limited number of channels for the distribution of Plenity, with a few qualified distributors currently accounting for substantially all of its revenue. The loss of one or more of such qualified distributors would materially harm its business. |

11

| ● | Gelesis’ future success depends on its ability to retain its senior executive officers, and to attract and keep senior management and key scientific and commercial personnel. |

| ● | Gelesis may not be successful in its efforts to identify or discover additional product candidates. |

| ● | Gelesis faces potential product liability exposure and, if claims are brought against Gelesis, it may incur substantial liability. |

| ● | If Gelesis does not continually enhance its brand recognition, increase distribution of Plenity, attract new patients and introduce new and innovative products, either on a timely basis or at all, its business may suffer. |

| ● | Gelesis’ international operations for the supply chain of Plenity pose certain political, legal and compliance, operational, regulatory, economic and other risks to its business that may be different from or more significant than risks associated with its U.S. operations. |

| ● | Inflation could adversely affect Gelesis’ financial results. |

| ● | Competition from other weight management and wellness industry participants or the development of more effective or more favorably perceived weight management methods could result in decreased demand for Plenity. |

Risks Related to Financial Position and Financing Needs

| ● | Gelesis is a commercial stage biotherapeutics company, but to date has generated limited product sales. Gelesis has incurred significant operating losses since its inception and anticipates that it will continue to incur continued losses for the next several years. |

| ● | Gelesis may be unable to accurately forecast revenue and appropriately plan its expenses in the future. |

| ● | In order to support its business, Gelesis has and may need to incur additional indebtedness or seek capital through new equity or debt financings, which sources of additional indebtedness or capital may not be available on acceptable terms, if at all, and the failure to obtain this additional funding when needed may force Gelesis to delay, limit or terminate its product development efforts or other operations. |

Risks Related to Ownership of Our Common Stock

| ● | The price of our Common Stock has been and may continue to be volatile, and you could lose all or part of your investment. |

| ● | There can be no assurance that we will be able to comply with the continued listing standards of the NYSE. |

| ● | Future sales and issuances of our Common Stock or rights to purchase our Common Stock, including pursuant to the Gelesis Holdings, Inc. 2021 Stock Option and Incentive Plan and future exercise of warrants or registration rights, could result in additional dilution of the percentage ownership of our shareholders and could cause our share price to fall. |

| ● | If certain holders of our Common Stock sell a significant portion of their securities, it may negatively impact the market price of the shares of our Common Stock and such holders still may receive significant proceeds. |

| ● | We are an emerging growth company, and it cannot be certain if the reduced reporting requirements applicable to emerging growth companies will make our Common Stock less attractive to investors. |

| ● | We have incurred and will continue to incur significant increased costs as a result of operating as a public company, and our management has and will be required to devote substantial time to new compliance initiatives. |

| ● | If we fail to maintain proper and effective internal control over financial reporting, our operating results and our ability to operate our business could be harmed. |

| ● | The exercise of our Warrants for shares of our Common Stock would increase the number of shares eligible for future resale in the public market and result in dilution to our stockholders. |

12

| ● | There can be no assurance that the Warrants will be in the money at the time they become exercisable; they may expire worthless and therefore we may not receive cash proceeds from the exercise of warrants. |

Recent Developments

The Business Combination and Related Transactions

On January 13, 2022 (the “Closing Date”), Capstar Special Purpose Acquisition Corp., a Delaware corporation and our predecessor company (“CPSR”), consummated the previously announced business combination (the “Business Combination”), pursuant to the terms of the Business Combination Agreement, dated as of July 19, 2021 (as amended on November 8, 2021 and December 30, 2021, the “Business Combination Agreement”), by and among CPSR, CPSR Gelesis Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of CPSR (“Merger Sub”), and Gelesis, Inc., a Delaware corporation (together with its consolidated subsidiaries, “Legacy Gelesis”).

Pursuant to the Business Combination Agreement, on the Closing Date, (i) Merger Sub merged with and into Legacy Gelesis (the “Merger”), with Gelesis as the surviving company in the Merger, and, after giving effect to such Merger, Legacy Gelesis became a wholly-owned subsidiary of CPSR and (ii) CPSR changed its name to “ Gelesis Holdings, Inc.” (together with its consolidated subsidiaries, “Gelesis Holdings”).

In accordance with the terms and subject to the conditions of the Business Combination Agreement, at the effective time of the Merger (the “Effective Time”), based on an implied Legacy Gelesis equity value of $675 million, (i) each share of Legacy Gelesis common stock outstanding as of immediately prior to the Effective Time was exchanged for shares of the common stock, par value $0.0001 per share, of Gelesis Holdings (“Common Stock”); (ii) all vested and unvested options of Legacy Gelesis were assumed by Gelesis Holdings exercisable for shares of Common Stock; (iii) each outstanding warrant of Legacy Gelesis was assumed by Gelesis Holdings and became a warrant to purchase shares of Common Stock; (iv) each share of Class A common stock, par value $0.0001 per share, of CPSR (“CPSR Class A Common Stock”) and each share of Class B common stock, par value $0.0001 per share, of CPSR (“CPSR Class B Common Stock”), that was issued and outstanding immediately prior to the Effective Time became one share of Common Stock following the consummation of the Business Combination; (v) each outstanding redeemable public warrant of CPSR was automatically converted into a redeemable public warrant to purchase a share of Common Stock; and (vi) each outstanding Private Placement Warrant of CPSR was automatically converted into a Private Placement Warrant to purchase a share of Common Stock.

The Business Combination, together with the PIPE Financing and the sale of the Backstop Purchase Shares, as described below, generated approximately $105 million in gross proceeds, which will be mainly used to support the broad launch of Plenity.

PIPE Financing

On July 19, 2021, concurrently with the execution of the Business Combination Agreement, CPSR entered into subscription agreements (the “Subscription Agreements”) with certain investors (the “PIPE Investors”), pursuant to which the PIPE Investors agreed to subscribe for and purchase, and CPSR agreed to issue and sell to the PIPE Investors, an aggregate of 9,000,000 shares of CPSR Class A Common Stock at a price of $10.00 per share, for aggregate gross proceeds of $90,000,000 (the “PIPE Financing”). The PIPE Financing was consummated concurrently with the Closing of the Business Combination. Pursuant to the Subscription Agreements, we are obligated to file a registration statement registering the resale of the shares of common stock sold in the PIPE Financing within 45 days after the Closing and use its reasonable best efforts to have the registration statement declared effective as soon as practicable after the filing thereof. The registration statement of which this prospectus forms a part has been filed to satisfy Gelesis Holding’s obligations under the Subscription Agreements.

Bridge Financing

On December 13, 2021, the Company entered into a bridge financing arrangement (the “Bridge Financing”), executing convertible promissory note agreements with two existing investors in the aggregate amount of $27.0 million. These convertible promissory notes bore interest at 10.0% and were settled in cash for principal plus accrued interest on January 19, 2022.

Backstop Agreement

On December 30, 2021, CPSR entered into a Backstop Agreement (the “Backstop Agreement”) with PureTech Health LLC (“PureTech”) and SSD2, LLC (“SSD2” and together with PureTech, the “Backstop Purchasers”), pursuant to which the Backstop Purchasers agreed to purchase an aggregate of up to 1,500,000 shares of CPSR Class A Common Stock immediately prior to the

13

Closing at a cash purchase price of $10.00 per share (the “Backstop Purchase Shares”), resulting in aggregate proceeds of up to $15.0 million, which amount, when added to the proceeds from the PIPE Financing, would ensure that the Minimum Cash Condition would be satisfied. Pursuant to the terms and conditions of the Backstop Agreement, the Backstop Purchasers were obligated to purchase Backstop Purchase Shares in such number that resulted in gross proceeds to CPSR equal to the amount by which $15.0 million exceeded the available funds remaining in CPSR’s trust account following all Capstar Stockholder Redemptions (the “Available Funds”), subject to the other terms and conditions of the Backstop Agreement. Based on the number of Capstar Stockholder Redemptions, the Backstop Purchasers became obligated to purchase an aggregate 744,217 Backstop Purchase Shares for an aggregate purchase price of $7,442,170, which is the amount by which $15.0 million exceeded the Available Funds. In addition, at the closing of the sale of the Backstop Purchase Shares, CPSR issued to the Backstop Purchasers 1,983,750 shares of CPSR Class A Common Stock (the “Backstop Sponsor Shares,” and together with the Backstop Purchase Shares, the “Backstop Shares”).

Earnout Shares

In addition to the above, if the trading price of the Common Stock is greater than or equal to $12.50, $15.00 and $17.50, respectively, for any twenty (20) trading days within any thirty (30)-trading day period on or prior to the date that is five years following the Closing (the “Earnout Period”), the holders of Legacy Gelesis common stock outstanding as of immediately prior to the Effective Time, as well as holders of Legacy Gelesis options and warrants outstanding immediately prior to the Effective Time will be entitled to their pro rata portion of 23,483,250 restricted earnout shares of Common Stock, which will vest in equal thirds (the “Earnout Shares”), and will also vest in connection with any change of control transaction with respect to Gelesis Holdings if the applicable thresholds are met in such change of control transaction during the Earnout Period.

Launch of Broad Consumer Awareness Campaign

On January 31, 2022, we debuted our broad consumer awareness campaign which included TV, digital, social, and Out of Home (OOH) media channels to grow awareness of Plenity. Following the launch of the campaign:

| ● | we acquired approximately 4,700 new members per week, a 3.5-fold increase, within the first three weeks of the launch, compared to the previous months before campaign launch; |

| ● | within the first two weeks of campaign launch, Plenity became one of our telehealth partner Ro’s most sought-after offerings and Ro’s fastest growing offering, bringing on more new consumers than any other treatment or product during the period; |

| ● | traditional physician prescriptions of Plenity increased 100% within the first three weeks of campaign launch and over 40% of those treatment requests were driven by the consumer (a 60% increase from the pre-campaign baseline); and |

| ● | our digitally native platform enables live results, and within seconds of launching the campaign search interest and website traffic increased significantly, scaling from seven to ten thousand visitors per day prior to the campaign to between thirty to forty thousand website visitors per day. |

Following the success of the initial wave of this campaign, we are evaluating optimal media channels, timing, pulse frequency, and investment levels going forward.

Emerging Growth Company

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes- Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

Further, Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. Our predecessor company elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or

14

revised standard at the time private companies adopt the new or revised standard. This may make comparison of our financial statements with certain other public companies difficult or impossible because of the potential differences in accounting standards used.

We will remain an emerging growth company until the earlier of: (i) the last day of the fiscal year (a) following the fifth anniversary of the closing of our predecessor company’s initial public offering, (b) in which we have total annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common equity that is held by non-affiliates exceeds $700 million as of the last business day of its most recently completed second fiscal quarter; and (ii) the date on which we have issued more than $1.00 billion in non-convertible debt securities during the prior three (3)-year period. References herein to “emerging growth company” have the meaning associated with it in the JOBS Act.

Smaller Reporting Company

Additionally, we are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of the fiscal year in which (i) the market value of our Common Stock held by non-affiliates exceeds $250 million as of the prior June 30, or (ii) our annual revenues exceeded $100 million during such completed fiscal year and the market value of our Common Stock held by non-affiliates exceeds $700 million as of the prior June 30.

15

THE OFFERING

Issuer | Gelesis Holdings, Inc. | |

Shares of common stock offered by the Selling Securityholders | 132,857,109 shares consisting of: | |

● up to 9,000,000 PIPE Shares; | ||

● 2,727,967 Backstop Shares; | ||

● 4,916,250 Founder Shares held by the Sponsor and its members; | ||

● 54,990,973 shares of common stock issued to Gelesis, Inc. holders at the consummation of the Business Combination; | ||

● 7,520,000 shares of common stock underlying the Private Placement Warrants, which are exercisable at a price of $11.50 per share and expire on January 13, 2027; | ||

● 13,800,000 shares of common stock underlying the Public Warrants, which are exercisable at a price of $11.50 per share, and expire on January 13, 2027; | ||

● 3,013,365 shares of common stock underlying the Rollover Warrants, 1,353,062 of which are exercisable at an exercise price of $4.26 and expire on October 21, 2030 and 1,660,303 of which are exercisable at an exercise price of $0.02 and expire on February 15, 2025; | ||

● up to 13,405,709 shares of common stock issuable upon exercise of the Rollover Options; and | ||

● up to 23,482,845 Earnout Shares. | ||

The above includes: (i) 11,710,240 shares of Common Stock issued to Legacy Gelesis shareholders at the consummation of the Business Combination, (ii) 525,685 Rollover Warrants and 525,685 shares of Common Stock underlying the Rollover Warrants, (iii) 13,800,000 Public Warrants and 13,800,000 shares of Common Stock underlying the Public Warrants, (iv) 2,864,278 shares of Common Stock issuable upon exercise of Rollover Options and (v) 4,986,795 Earnout shares, which may be offered by unnamed Selling Securityholders. | ||

Warrants offered by the Selling Securityholders | 24,333,365 Warrants. | |

Terms of the offering | The Selling Securityholders will determine when and how they will dispose of the securities registered under this prospectus for resale. See “Plan of Distribution”. | |

Use of proceeds | We will not receive any proceeds from the sale of the shares of Common Stock registered hereunder by the Selling Securityholders. | |

16

We could receive up to an aggregate of $251.0 million if all of the Warrants registered hereunder are exercised for cash. | ||

The exercise of the Warrants, and any proceeds we may receive from their exercise, are highly dependent on the price of our Common Stock and the spread between the exercise price of the warrant and the price of our Common Stock at the time of exercise. For example, to the extent that the price of our Common Stock exceeds $11.50 per share, it is more likely that holders of our Public Warrants and Private Warrants will exercise their warrants. If the price of our Common Stock is less than $11.50 per share, it is unlikely that such holders will exercise their warrants. As of May 20, 2022, the closing price of our Common Stock was $4.97 per share. There can be no assurance that all of our Warrants will be in the money prior to their expiration. Our Public Warrants under certain conditions, as described in the warrant agreement, are redeemable by the Company at a price of $0.01 per warrant or on a cashless basis. Our Private Warrants are not redeemable so long as they are held by the initial stockholders and are exercisable on a cashless basis. Our Rollover Warrants are not redeemable and are exercisable on a cashless basis only with respect to the 1,660,303 warrants that have an exercise price of $0.02. As such, it is possible that we may never generate any cash proceeds from the exercise of our Warrants. | ||

We expect to use the net proceeds we receive from the exercise of the Warrants, if any, for general corporate purposes, including the commercialization of our product Plenity. | ||

Lock-up restrictions | Certain of our stockholders are subject to certain restrictions on transfer until the termination of applicable lock-up periods. | |

Risk factors | See “Risk Factors” and the other information included in this prospectus for a discussion of factors you should consider before investing in our securities. | |

NYSE symbols | Our Common Stock and Public Warrants are listed on NYSE under the symbols “GLS” and “GLS WS”, respectively. |

17

INFORMATION RELATED TO OFFERED SECURITIES

This prospectus relates to:

| ● | the resale of 9,000,000 PIPE Shares; |

| ● | the resale of 2,727,967 Backstop Shares; |

| ● | the resale of 4,916,250 Founder Shares held by the Sponsor and its members; |

| ● | the resale of 54,990,973 shares of Common Stock issued to Gelesis, Inc. holders at the consummation of the Business Combination; |

| ● | the resale of 7,520,000 shares of Common Stock underlying the Private Placement Warrants, exercisable at an exercise price of $11.50 per share, which expire on the earlier to occur of January 13, 2027 or redemption; |

| ● | the resale of 13,800,000 shares of Common Stock underlying the Public Warrants, exercisable at an exercise price of $11.50 per share, which expire on the earlier to occur of January 13, 2027 or redemption; |

| ● | the resale of 3,013,365 shares of Common Stock underlying the Rollover Warrants, 1,353,062 of which are exercisable at an exercise price of $4.26 and expire on October 21, 2030 and 1,660,303 of which are exercisable at an exercise price of $0.02 and expire on February 15, 2025; |

| ● | the resale of up to 13,405,709 shares of Common Stock issuable upon exercise of the Rollover Options; |

| ● | the resale of up to 23,482,845 Earnout Shares; and |

| ● | the resale of 24,333,365 Warrants. |

The following table includes information relating to the shares of Common Stock and Warrants offered hereby, including the purchase price each Selling Securityholder paid for its securities, the potential profit relating to such securities, the date the Warrants are exercisable, the exercise price of the Warrants and any applicable lock-up restrictions.

Offered Shares* |

| Exercise Price |

| Number of |

| Effective |

| Lock-Up |

| |||

Founder Shares(2) | 4,916,250 | $ | 0.0051 | January 13, 2023 | ||||||||

PIPE Shares(3) | 9,000,000 | $ | 10.00 | None | ||||||||

Backstop Shares(4): | ||||||||||||

Backstop Purchase Shares | 744,217 | $ | 10.00 | None | ||||||||

Backstop Sponsor Shares | 1,983,750 | $ | 0.00 | July 13, 2022 | ||||||||

Common Stock issued in exchange for shares of Legacy Gelesis in connection with the Business Combination(5) | 54,990,973 | $ | 10.00 | July 13, 2022 | ||||||||

Common Stock issuable upon exercise of the Rollover Options | 13,405,709 | — | (6) | July 13, 2022 | ||||||||

Earnout Shares | 23,482,845 | — | (7) | July 13, 2022 | ||||||||

Shares Issuable Upon Exercise of the following Warrants: | ||||||||||||

Public Warrants(8) | 13,800,000 | $ | 11.50 | None | ||||||||

Private Warrants(9) | 7,520,000 | $ | 11.50 | January 13, 2023 | ||||||||

2020 Rollover Warrants(10) | 1,353,062 | $ | 4.26 | July 13, 2022 | ||||||||

2015 Rollover Warrants(11) | 1,660,303 | $ | 0.02 | July 13, 2022 | ||||||||

Offered Warrants | ||||||||||||

Public Warrants | $ | 11.50 | 13,800,000 | — | (8) | None | ||||||

Private Warrants(9) | $ | 11.50 | 7,520,000 | $ | 1.00 | January 13, 2023 | ||||||

2020 Rollover Warrants | $ | 4.26 | 1,353,062 | — | (10) | July 13, 2022 | ||||||

2015 Rollover Warrants | $ | 0.02 | 1,660,303 | — | (11) | July 13, 2022 | ||||||

| (1) | Reflects the effective purchase price per security paid or, in the case of the shares issuable upon exercise of Warrants, to be paid upon such exercise by the purchaser of such securities. The closing prices of our Common Stock and Public Warrants on May 20, 2022 were $4.97 and $0.2762, respectively. |

18

| (2) | Founder Shares were originally sold by CPSR to its Sponsor at an aggregate purchase price of $25,000 in a private placement prior to our predecessor’s initial public offering. Following the consummation of our Business Combination, the founder Shares were distributed to affiliates of the Sponsor. All Founder Shares are subject to the 12-month lock-up set forth in the Registration Rights Agreement. |

| (3) | Consists of 9,000,000 shares of Common Stock originally sold by CPSR prior to the Business Combination to certain investors pursuant to which such investors agreed to subscribe for and purchase, and CPSR agreed to issue and sell an aggregate of 9,000,000 shares of CPSR Class A Common Stock at a price of $10.00 per share. In connection with our Business Combination, each such share of CPSR Class A Common Stock was automatically converted into a share of our Common Stock. |

| (4) | Consists of an aggregate 744,217 Backstop Purchase Shares purchased by the Backstop Purchasers prior to the Business Combination for an aggregate purchase price of $7,442,170, and an additional 1,983,750 Backstop Sponsor Shares issued to the Backstop Purchasers pursuant to the terms of the Backstop Agreement. All Backstop Sponsor Shares are subject to the 180-day lock-up set forth in the Registration Rights Agreement. |

| (5) | The per share value of common stock issued to Legacy Gelesis shareholders as consideration in the Business Combination is reflected at $10.00 share. July 13, 2022. 42,668,860 of such shares are subject to the 180-day lock-up set forth in the Registration Rights Agreement. |

| (6) | Consists of up to 13,405,709 shares of Common Stock issuable upon the exercise of option awards previously issued by Legacy Gelesis prior to the Business Combination which, in connection with the Business Combination, were assumed by us and became exercisable for shares of our Common Stock in the amounts and exercise prices, and subject to the terms and conditions, in each case, as set forth on the Allocation Schedule attached to the Business Combination Agreement. 10,463,670 of such shares are subject to the 180-day lock-up set forth in the Registration Rights Agreement. |

| (7) | If the trading price of our Common Stock is greater than or equal to $12.50, $15.00 and $17.50, respectively, for any twenty (20) trading days within any thirty (30)-trading day period on or prior to the date that is five years following the closing of our Business Combination (the “Earnout Period”), holders of Legacy Gelesis common stock outstanding as of immediately prior to the Business Combination, as well as holders of Legacy Gelesis options and warrants outstanding immediately prior to the Business Combination will be entitled to a pro rata portion of 23,482,845 restricted Earnout Shares that will vest in equal thirds (the “Earnout Shares”), and will also vest in connection with any change of control transaction with respect to us if the applicable thresholds are met in such change of control transaction during the Earnout Period. 18,299,688 of such shares are subject to the 180-day lock-up set forth in the Registration Rights Agreement. |

| (8) | Consists of Public Warrants to purchase 13,800,000 shares of Common Stock that were originally issued as part of CPSR units sold by CPSR at a purchase price of $10.00 per unit on July 7, 2020 as part of its initial public offering of 27,600,000 units, each such unit consisting of one share of CPSR Class A Common Stock and one-half of one warrant. These Warrants are exercisable at a price of $11.50 per share of our Common Stock. In connection with our Business Combination, each such Warrant was automatically converted into a redeemable Public Warrant to purchase a share of our Common Stock. |

| (9) | Consists of Private Placement Warrants to purchase 7,520,000 shares of Common Stock that were originally sold by CPSR to its Sponsor at a purchase price of $1.00 per warrant in a private placement in connection with CPSR’s initial public offering. In connection with our Business Combination, each such Warrant was automatically converted into a Private Placement Warrant to purchase a share of our Common Stock. These Warrants are exercisable at a price of $11.50 per share of our Common Stock. All such Private Placement Warrants and the shares issuable upon exercise thereof are subject to the 12-month lock-up set forth in the Registration Rights Agreement. |

| (10) | Consists of Rollover Warrants to purchase 1,353,062 shares Common Stock that were originally issued by Legacy Gelesis. These Warrants are exercisable at a price of $4.26 per share of our Common Stock. In connection with our Business Combination, each such Warrant was automatically converted into a Rollover Warrant to purchase a share of our Common Stock. 974,206 of such Rollover Warrants and the shares issuable upon exercise thereof are subject to the 180-day lock-up set forth in the Registration Rights Agreement. |

| (11) | Consists of Rollover Warrants to purchase 1,660,303 shares Common Stock that were originally issued by Legacy Gelesis. These Warrants are exercisable at a price of $0.02 per share of our Common Stock. In connection with our Business Combination, each such Warrant was automatically converted into a Rollover Warrant to purchase a share of our Common Stock. 1,513,474 of such Rollover Warrants and the shares issuable upon exercise thereof are subject to the 180-day lock-up set forth in the Registration Rights Agreement. |