BUSINESS

Overview

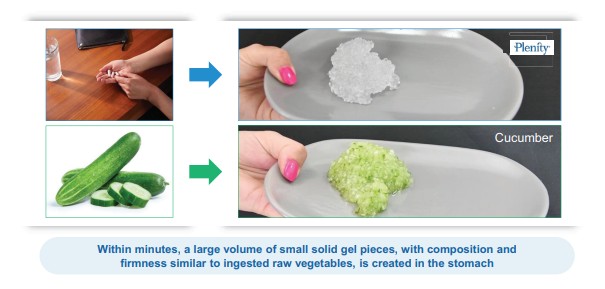

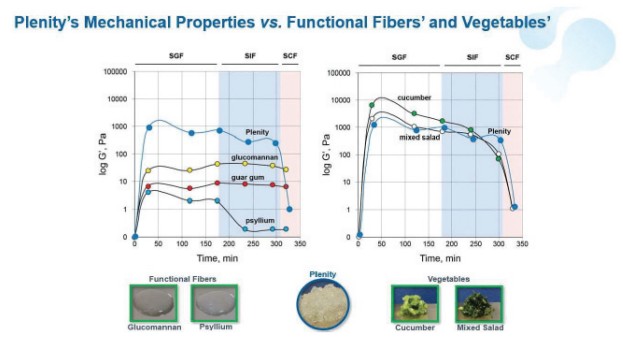

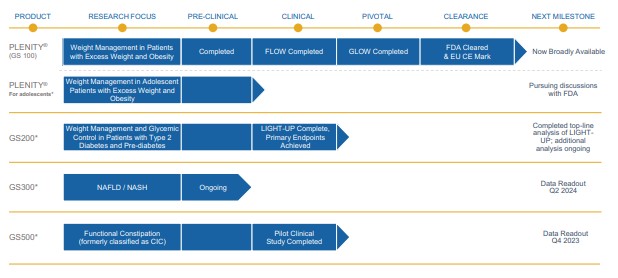

Gelesis is a commercial stage biotherapeutics company built for consumer engagement. We are focused on advancing first-in-class superabsorbent hydrogel therapeutics for chronic gastrointestinal, or GI, diseases including excess weight, type 2 diabetes, NAFLD/NASH, functional constipation, and inflammatory bowel disease. Our biomimetic superabsorbent hydrogels are inspired by the composition and mechanical properties (e.g. firmness) of raw vegetables. They are conveniently administered in capsules taken with water to create a much larger volume of small, non-aggregating hydrogel pieces that become an integrated part of the meals, and act locally in the digestive system.

Our first product, Plenity, and our other product candidates are based on a proprietary hydrogel technology that works mechanically, as opposed to via a chemical mode of action, and exclusively in the gastrointestinal, or GI, tract rather than systemically or through surgical intervention. Plenity is indicated for over 150 million Americans, the largest number of adults struggling with excess weight (i.e., a body mass index (kg/m2), or BMI, of 25 – 40) of any prescription oral weight-management aid and the only one indicated for the entire range of overweight population, including those without co-morbidities such as diabetes and cardiovascular diseases. Plenity is marketed directly to potential members, who access it through telehealth and traditional healthcare provider services. We refer to those who are prescribed Plenity as our members — not customers — because we view our relationship with them as a long-term journey of support, not as a transactional relationship. This consumer-directed model is uniquely enabled by Plenity’s strong safety and tolerability profile. Our business is built on a subscription model, as monthly Plenity kits are delivered to our members’ homes. We leverage the latest technologies with telehealth, mail-order distribution, consumer engagement, and our native digital technology platform. Plenity is an orally administered capsule that employs multiple mechanisms of action along the GI tract to aid in weight management by creating small firm 3D structures, similar to ingested raw vegetables, which create a sensation of feeling fuller. Using a biomimetic approach, we developed the first-of-its-kind superabsorbent hydrogel technology, inspired by the composition (e.g., water and cellulose) and mechanical properties (e.g. elasticity or firmness) of ingested raw vegetables. We designed Plenity and our other hydrogels to address several critical challenges of the modern diet: portion size, caloric density, and food composition. For optimal safety and efficacy, these hydrogel particles are engineered to rapidly absorb and release water at specific

68