UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 |

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report |

Commission file number: 001-39519

Vitru Limited

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

Rodovia José Carlos Daux, 5500, Torre

Jurerê A,

2nd floor, Saco Grande, Florianópolis, State of Santa Catarina,

Brazil

88032-005

+55 (11) 3047-2699

(Address of principal executive offices)

Carlos Henrique Boquimpani de Freitas, Chief

Financial Officer

Rodovia José Carlos Daux, 5500, Torre Jurerê A,

2nd floor, Saco Grande, Florianópolis, State of Santa Catarina,

Brazil

88032-005

+55 (11) 3047-2699

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Copies to:

Manuel Garciadiaz

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

Phone: (212) 450-4000

Fax: (212) 450-6858

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common shares, par value U.S.$0.00005 per share | VTRU | The NASDAQ Global Select Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

The number of outstanding shares as of December 31, 2020 was 23,058,053 common shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Yes ☐ | No ☒ |

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

| Yes ☐ | No ☒ |

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Yes ☒ | No ☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

| Yes ☒ | No ☐ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer ☐ | Accelerated Filer ☐ | Non-accelerated Filer ☒ | Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report: ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| ☐ | U.S. GAAP |

| ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board |

| ☐ | Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

| ☐ Item 17 | ☐ Item 18 |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Yes ☐ | No ☒ |

VITRU LIMITED

Page

i

ii

Presentation of Financial and Other Information

Unless otherwise indicated or the context otherwise requires, all references in this annual report to “Vitru” or the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to Vitru Limited, together with its subsidiaries.

All references to “Vitru Brasil” refer to Vitru Brasil Empreendimentos, Participações e Comércio S.A., our Brazilian principal operating subsidiary.

The term “Brazil” refers to the Federative Republic of Brazil and the phrase “Brazilian government” refers to the federal government of Brazil. “Brazilian Central Bank” refers to the Brazilian Central Bank (Banco Central do Brasil). References in the annual report to “real,” “reais” or “R$” refer to the Brazilian real, the official currency of Brazil and references to “U.S. dollar,” “U.S. dollars” or “U.S.$” refer to U.S. dollars, the official currency of the United States.

All references to the “Companies Act” are to the Cayman Islands’ Companies Act (As Revised) as the same may be amended from time to time, unless the context otherwise requires.

All references to “IFRS” are to International Financial Reporting Standards, as issued by the IASB.

Financial Statements

Vitru was incorporated on March 5, 2020, as a Cayman Islands exempted company with limited liability, under incorporation number 360670, duly registered with the Cayman Islands Registrar of Companies. Vitru became the parent company of Vitru Brasil Empreendimentos, Participações e Comércio S.A., or Vitru Brasil, through the corporate reorganization described under “—Corporate Events,” “Item 4. Information on the Company—A. History and Development of the Company—Our Pre-IPO Corporate Reorganization” and in note 1 to our audited consolidated financial statements.

Until the contribution of Vitru Brasil’s shares to us, we had not commenced operations and had only nominal assets and liabilities and no material contingent liabilities or commitments. Subsequent to the completion of the corporate reorganization, we began to consolidate financial information in order to reflect the operations of Vitru Brasil. As a result, the audited consolidated financial statements prepared by Vitru subsequent to the completion of the reorganization are presented “as if” Vitru Brasil is the predecessor of Vitru. Accordingly, our audited consolidated financial statements included elsewhere in this annual report reflect: (i) the historical operating results of Vitru Brasil prior to such reorganization; (ii) the consolidated results of Vitru and Vitru Brasil following the reorganization; and (iii) the assets and liabilities of Vitru Brasil at their historical cost.

The consolidated financial information of Vitru contained in this annual report is derived from our audited consolidated financial statements as of December 31, 2020 and 2019 and for the three years ended December 31, 2020, 2019 and 2018, together with the notes thereto. All references herein to “our financial statements,” “our audited consolidated financial information,” and “our audited consolidated financial statements” are to Vitru’s consolidated financial statements included elsewhere in this annual report.

Vitru is a holding company, and as such, the primary source of revenue derives from its interest on its operational companies in Brazil. As a result, Vitru’s functional currency as well as of its subsidiaries is the Brazilian real. We prepare our annual consolidated financial statements in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB.

This financial information should be read in conjunction with “Item 5. Operating and Financial Review and Prospects” and our consolidated financial statements, including the notes thereto, included elsewhere in this annual report.

Our fiscal year ends on December 31. References in this annual report to a fiscal year, such as “fiscal year 2020,” relate to our fiscal year ended on December 31 of that calendar year.

iii

Corporate Events

We are a Cayman Islands exempted company incorporated with limited liability on March 5, 2020 for purposes of effectuating our initial public offering. Prior to the consummation of our initial public offering, our controlling shareholders, funds and accounts advised by The Carlyle Group, or Carlyle, funds and accounts advised by Vinci Partners, or Vinci Partners, and funds and accounts advised by Neuberger Berman, or the NB Funds, or, collectively, the Controlling Shareholders, held 522,315,196 shares of Vitru Brasil. Prior to the consummation of our initial public offering, our Controlling Shareholders contributed all of their shares in Vitru Brasil to us. In return for this contribution, we issued new common shares to our Controlling Shareholders in a one-to-31 exchange for the shares of Vitru Brasil contributed to us, or the Share Contribution. Until the contribution of Vitru Brasil shares to us, we had not commenced operations and had only nominal assets and liabilities and no material contingent liabilities or commitments.

After accounting for the new common shares that were issued and sold by us in our initial public offering, we had a total of 23,058,053 common shares issued and outstanding as of December 31, 2020. 16,848,874 of these shares were common shares beneficially owned by our Controlling Shareholders, 209,179 of these shares were common shares beneficially owned by members of our management and other shareholders who acquired shares prior to our initial public offering, and 6,000,000 of these shares were common shares beneficially owned by investors who acquired shares in our initial public offering.

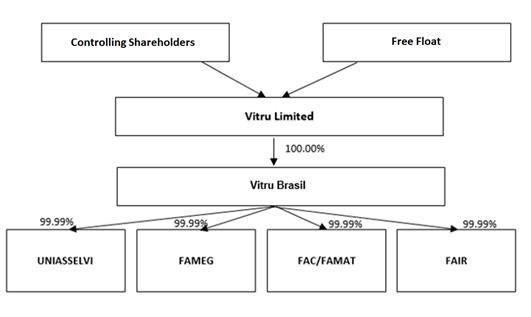

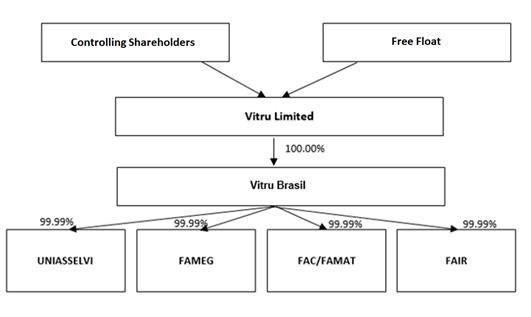

The diagram below depicts our organizational structure as of the date of this annual report:

Below is a brief description of our subsidiaries:

Vitru Brasil (Vitru Brasil Empreendimentos, Participações e Comércio S.A.)

Vitru Brasil is an operating subsidiary and was incorporated on June 27, 2014 in Florianópolis, state of Santa Catarina. It is a primarily a holding company through which we hold our remaining subsidiaries listed below, and through which we provide our postgraduate courses.

Uniasselvi – Sociedade Educacional Leonardo da Vinci S/S Ltda. (“Uniasselvi”)

Uniasselvi is our largest subsidiary and was incorporated on January 30, 2004 in Indaial, state of Santa Catarina. Vitru Brasil acquired sole control of Uniasselvi from Kroton on February 28, 2016. We conduct most of our distance learning undergraduate courses through Uniasselvi. Its activities also include conducting on-campus undergraduate and continuing education courses in seven different cities. Uniasselvi holds the following educational entities authorized by the MEC: Sociedade Educacional Leonardo da Vinci S/S Ltda., Centro Universitário Leonardo da

iv

Vinci – Uniasselvi, Centro Universitário Dante – Unidante, Faculdade Leonardo da Vinci – Santa Catarina, Faculdade Metropolitana de Rio do Sul – Famesul, Faculdade do Vale do Itajaí Mirim – Favim, Faculdade Metropolitana de Lages – Famelages.

FAMEG – Sociedade Educacional do Vale do Itapocu S/S Ltda (“FAMEG”); FAC Educacional Ltda. (“FAC/FAMAT”) and FAIR Educacional Ltda. (“FAIR”)

FAMEG, FAC/FAMAT and FAIR are the subsidiaries through which we provide on-campus undergraduate and continuing education courses. These subsidiaries were incorporated on July 8, 2008, October 21, 2014 and October 21, 2014, respectively, and were also acquired by us from Kroton in 2016 and 2017. FAMEG, FAC/FAMAT and FAIR hold the following educational entities authorized by the MEC: Sociedade Educacional do Vale do Itapocu S.S. Ltda., Centro Universitário Leonardo da Vinci – Univinci, FAC Educacional Ltda., Instituto de Ensino Superior de Cuiabá, Faculdade de Mato Grosso.

Additional Information

See note 2.2 to our audited consolidated financial statements included elsewhere in this annual report for additional information on our subsidiaries.

Financial Information in U.S. Dollars

Solely for the convenience of the reader, we have translated some of the real amounts included in this annual report from reais into U.S. dollars. You should not construe these translations as representations by us that the amounts actually represent these U.S. dollar amounts or could be converted into U.S. dollars at the rates indicated or any other rate. Unless otherwise indicated, we have translated real amounts into U.S. dollars using a rate of R$5.197 to U.S.$1.00, the commercial selling rate for U.S. dollars as of December 31, 2020 as reported by the Brazilian Central Bank. The rate at December 31, 2020, which is the rate used for currency translations of certain amounts in this annual report, may differ materially from the exchange rate as of the date of this annual report or any other date.. See “Item 3. Key Information—A. Selected financial data—Exchange Rates” for more detailed information regarding translation of reais into U.S. dollars and for historical exchange rates for the Brazilian real.

Special Note Regarding Non-GAAP Financial Measures

This annual report presents our Adjusted EBITDA, Adjusted Net Income and Adjusted Cash Flow Conversion from Operations information for the convenience of investors, which are non-GAAP financial measures. A non-GAAP financial measure is generally defined as one that purports to measure financial performance but excludes or includes amounts that would not be so adjusted in the most comparable GAAP measure.

We calculate Adjusted EBITDA as net income (loss) for the year plus:

| · | deferred and current income tax, which is calculated based on our income, adjusted based on certain additions and exclusions provided for in applicable legislation. The income taxes in Brazil consist of corporate income taxes (Imposto de Renda Pessoa Jurídica), or IRPJ, and, social contribution taxes (Contribuição Social sobre o Lucro Líquido), or CSLL; |

| · | financial results, which consists of interest expenses less interest income; |

| · | depreciation and amortization; |

| · | interest on tuition fees paid in arrears, which refers to interest received from students on late payments of monthly tuition fees and which is added back; |

| · | impairment of non-current assets, which consists of impairment charges associated with our on-campus undergraduate courses segment, given the deterioration in the prospects of this business; |

| · | share-based compensation plan, which consists of non-cash expenses related to the grant of share-based compensation, as well as fair value adjustments for share-based compensation expenses classified as a liability in our consolidated financial statements; |

v

| · | other income (expenses), net, which consists of other expenses such as contractual indemnities and deductible donations among others; |

| · | M&A, pre-offering expenses and restructuring expenses, which consists of adjustments that we believe are appropriate to provide additional information to investors about certain material non-recurring items. Such M&A, pre-offering expenses and restructuring expenses comprise: (i) mergers and acquisitions, or M&A, and pre-offering expenses, which are expenses related to mergers, acquisitions and divestments (including due diligence, transaction and integration costs), as well as the expenses related to the preparation of offerings; and (ii) restructuring expenses, which refers to expenses related to employee severance costs in connection with organizational and academic restructurings. |

We calculate Adjusted Net Income as net income (loss) for the year plus:

| · | share-based compensation plan, as defined above; |

| · | M&A, pre-offering expenses and restructuring expenses, as defined above; |

| · | impairment of non-current assets, as defined above; |

| · | amortization of intangible assets recognized as a result of business combinations, which refers to the amortization of the following intangible assets from business combinations: software, trademark, distance learning operation licenses, non-compete agreements, customer relationship and teaching-learning material. For more information, see note 15 to our audited consolidated financial statements, each included elsewhere in this annual report; |

| · | interest accrued at the original effective interest rate (excluding restatement as a result of inflation) on the accounts payable from the acquisition of subsidiaries, related to the acquisition of our operating units from Kroton in 2016 and 2017. See note 18 to our audited consolidated financial statements, each included elsewhere in this annual report; and |

| · | corresponding tax effects on adjustments, which represents the tax effect of pre-tax items excluded from adjusted net income (loss). The tax effect of pre-tax items excluded from adjusted net income (loss) is computed using the statutory rate related to the jurisdiction that was impacted by the adjustment after taking into account the impact of permanent differences and valuation allowances. |

We calculate Adjusted Cash Flow Conversion from Operations as adjusted cash flow from operations (which we calculate as cash from operations plus income tax paid) divided by Adjusted EBITDA (as defined above but without taking M&A, pre-offering expenses and restructuring expenses into consideration).

Adjusted EBITDA, Adjusted Net Income and Adjusted Cash Flow Conversion from Operations are the key performance indicators used by us to measure the financial performance of our core operations and we believe that these measures facilitate period-to-period comparisons on a consistent basis. As a result, our management believes that these Non-GAAP financial measures provide useful information to investors and shareholders. The non-GAAP financial measures described in this annual report are not a substitute for the IFRS measures of earnings. Additionally, our calculations of Adjusted EBITDA, Adjusted Net Income and Adjusted Cash Flow Conversion from Operations may be different from the calculations used by other companies, including our competitors in the education services industry, and therefore, our measures may not be comparable to those of other companies. For a reconciliation of Adjusted EBITDA, Adjusted Net Income and Adjusted Cash Flow Conversion from Operations to the most directly comparable IFRS measure, see “Item 3. Key Information—A. Selected Financial Data.”

Market Share and Other Information

This annual report contains data related to economic conditions in the market in which we operate. The information contained in this annual report concerning economic conditions is based on publicly available information from third-party sources that we believe to be reasonable. Market data and certain industry forecast data used in this annual report were obtained from internal reports and studies, where appropriate, as well as estimates, market research, publicly available information (including information available from the United States Securities and Exchange Commission, or the SEC, website) and industry publications. We obtained the information included

vi

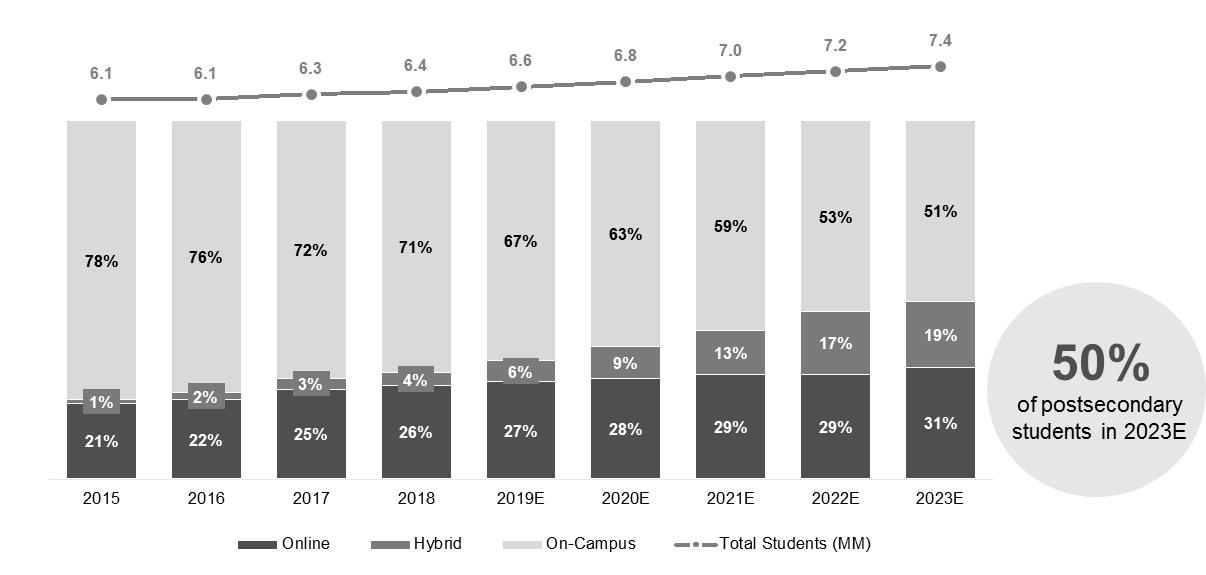

in this annual report relating to the industry in which we operate, as well as the estimates concerning market shares, through internal research, a report dated February 27, 2020 by Educa Insights commissioned by us, public information and publications on the industry prepared by official public sources, such as the Brazilian Central Bank, the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística), or the IBGE, the United Nations Educational, Scientific and Cultural Organization, or UNESCO, the Organisation for Economic Cooperation and Development, or OECD, the Brazilian Ministry of Education (Ministério da Educação), or the MEC, the Anísio Teixeira National Institute of Educational Studies and Research (Instituto Nacional de Estudos e Pesquisas Educacionais Anísio Teixeira), or the INEP, the Secretariat of Specialized Modalities in Education (Secretário de Modalidades Especializadas de Educação), or Semesp, as well as private sources, such as Educa Insights, Hoper Consultoria and Gismarket, consulting and research companies in the Brazilian education industry, the Brazilian Economic Institute of Fundação Getúlio Vargas (Instituto Brasileiro de Economia da Fundação Getúlio Vargas), or FGV/IBRE, among others.

Industry publications generally state that the information they include has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Although we have no reason to believe any of this information or these reports are inaccurate in any material respect and believe and act as if they are reliable, we have not independently verified it. Governmental publications and other market sources, including those referred to above, generally state that their information was obtained from recognized and reliable sources, but the accuracy and completeness of that information is not guaranteed. In addition, the data that we compile internally and our estimates have not been verified by an independent source. Except as disclosed in this annual report, none of the publications, reports or other published industry sources referred to in this annual report were commissioned by us or prepared at our request. Except as disclosed in this annual report, we have not sought or obtained the consent of any of these sources to include such market data in this annual report.

Rounding

We have made rounding adjustments to some of the figures included in this annual report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

vii

This annual report on Form 20-F contains statements that constitute forward-looking statements. Many of the forward-looking statements contained in this annual report can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “is designed to,” “may,” “predict,” “continue,” “estimate” and “potential,” or the negative of these words, among others.

Forward-looking statements appear in a number of places in this annual report and include, but are not limited to, statements regarding our intent, belief or current expectations. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including, but not limited to, those identified under the section entitled “Risk Factors” in this annual report. These risks and uncertainties include factors relating to:

| · | the impact of the 2019 novel coronavirus, or COVID-19, outbreak on general economic and business conditions in Brazil and globally and any restrictive measures imposed by governmental authorities in response to the outbreak (see “Item 3. Key Information–D. Risk Factors—Certain Risks Relating to Our Business and Industry—The COVID-19 outbreak may cause an adverse effect in our operations, including the partial closure of our business. The extension of the COVID-19 pandemic, the perception of its effects, or the way in which such pandemic will impact our business, either on a microeconomic or on a macroeconomic level, are subject to uncertain and unforeseeable future developments, which may have a material adverse effect on our business, financial condition, operating results and cash flow,” “Item 4. Information on the Company—A. History and Development of the Company—Recent Events—COVID-19 Pandemic” and “Item 5. Operating and Financial Review and Prospects—Impact of COVID-19”); |

| · | our ability to implement, in a timely and efficient manner, any measure necessary to respond to, or reduce the impacts of the COVID-19 outbreak on our business, operations, cash flow, prospects, liquidity and financial condition; |

| · | our ability to efficiently predict and react to temporary or long-lasting changes in consumer behavior resulting from the COVID-19 outbreak, including after the outbreak has been sufficiently controlled; |

| · | the downgrading of Brazil’s investment ratings; |

| · | general economic, financial, political, demographic and business conditions in Brazil, as well as any other countries we may serve in the future and their impact on our business; |

| · | fluctuations in interest, inflation and exchange rates in Brazil and any other countries we may serve in the future; |

| · | our ability to implement our business strategy; |

| · | our ability to adapt to technological changes in the educational sector; |

| · | the availability of government authorizations on terms and conditions and within periods acceptable to us; |

| · | our ability to continue attracting and retaining new students; |

| · | our ability to maintain the academic quality of our programs; |

| · | our ability to maintain the relationships with our hub partners; |

| · | our ability to collect tuition fees; |

| · | our ability to grow our business; |

| · | the availability of qualified personnel and the ability to retain such personnel; |

1

| · | changes in the financial condition of the students enrolling in our schools in general and in the competitive conditions in the education industry, or changes in the financial condition of our schools; |

| · | our capitalization and level of indebtedness; |

| · | the interests of our controlling shareholders; |

| · | changes in government regulations applicable to the education industry in Brazil; |

| · | government interventions in education industry programs, that affect the economic or tax regime, the collection of tuition fees or the regulatory framework applicable to educational institutions; |

| · | a decline in the number of students enrolled in our programs or the amount of tuition we can charge; |

| · | our ability to compete and conduct our business in the future; |

| · | the success of operating initiatives, including advertising and promotional efforts and new product, service and concept development by us and our competitors; |

| · | changes in consumer demands and preferences and technological advances, and our ability to innovate to respond to such changes; |

| · | changes in labor, distribution and other operating costs; |

| · | our compliance with, and changes to, government laws, regulations and tax matters that currently apply to us; |

| · | other factors that may affect our financial condition, liquidity and results of operations; and |

| · | risk factors discussed under “Item 3. Key Information—D. Risk Factors.” |

Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

2

Item 1. Identity of Directors, Senior Management and Advisers

| A. | Directors and Senior Management |

Not applicable.

| B. | Advisers |

Not applicable.

| C. | Auditors |

Not applicable.

Item 2. Offer Statistics and Expected Timetable

| A. | Offer Statistics |

Not applicable.

| B. | Method and Expected Timetable |

Not applicable.

| A. | Selected Financial Data |

You should read the following selected financial data together with “Item 5. Operating and Financial Review and Prospects” and our Consolidated Financial Statements and the related notes appearing elsewhere in this annual report.

The following tables set forth our summary financial and operating data as of December 31, 2020 and 2019 and statement of operations for the years ended December 31, 2020, 2019 and 2018. The summary consolidated statements of financial position as of December 31, 2020 and 2019 and the summary consolidated statements of profit or loss and other comprehensive income for the years ended December 31, 2020, 2019 and 2018 have been derived from our audited consolidated financial statements included elsewhere in this annual report, prepared in accordance with IFRS, as issued by the IASB.

For convenience purposes only, amounts in reais, as of December 31, 2020, have been translated to U.S. dollars using an exchange rate of R$5.197 to U.S.$1.00, the commercial selling rate for U.S. dollars, as of December 31, 2020, as reported by the Brazilian Central Bank. These translations should not be considered representations that any such amounts have been, could have been or could be converted at that or any other exchange rate. See “—Exchange Rates” for further information about recent fluctuations in exchange rates.

3

| For the Year Ended December 31, | ||||||||||||||||

| 2020 | 2020 | 2019 | 2018 | |||||||||||||

| U.S.$ millions(1) | R$ millions | |||||||||||||||

| Statement of Profit or Loss Data | ||||||||||||||||

| Net revenue | 99.9 | 519.2 | 461.1 | 383.4 | ||||||||||||

| Revenue from distance-learning undergraduate courses | 81.4 | 423.0 | 336.3 | 259.6 | ||||||||||||

| Revenue from continuing education courses | 7.8 | 40.6 | 47.1 | 33.0 | ||||||||||||

| Revenue from on-campus undergraduate courses | 10.7 | 55.6 | 77.6 | 90.8 | ||||||||||||

| Cost of services rendered | (42.6 | ) | (221.5 | ) | (211.5 | ) | (184.2 | ) | ||||||||

| Gross profit | 57.3 | 297.7 | 249.5 | 199.3 | ||||||||||||

| Selling expenses | (16.7 | ) | (86.6 | ) | (100.9 | ) | (70.6 | ) | ||||||||

| General and administrative expenses | (14.2 | ) | (73.9 | ) | (125.3 | ) | (90.7 | ) | ||||||||

| Net impairment losses on financial assets | (14.8 | ) | (76.8 | ) | (58.2 | ) | (44.6 | ) | ||||||||

| Other income (expenses), net | 0.1 | 0.5 | (0.9 | ) | (1.0 | ) | ||||||||||

| Operating expenses | (45.6 | ) | (236.8 | ) | (285.4 | ) | (206.9 | ) | ||||||||

| Operating profit (loss) | 11.7 | 60.9 | (35.9 | ) | (7.6 | ) | ||||||||||

| Financial income | 7.0 | 36.5 | 19.2 | 22.0 | ||||||||||||

| Financial expenses | (12.4 | ) | (64.4 | ) | (60.4 | ) | (64.6 | ) | ||||||||

| Financial results | (5.4 | ) | (27.9 | ) | (41.2 | ) | (42.6 | ) | ||||||||

| Profit (loss) before taxes | 6.3 | 33.0 | (77.1 | ) | (50.2 | ) | ||||||||||

| Current income taxes | (3.8 | ) | (19.5 | ) | (14.8 | ) | (10.6 | ) | ||||||||

| Deferred income taxes | 7.4 | 38.6 | 25.7 | 15.7 | ||||||||||||

| Income tax | 3.7 | 19.1 | 10.9 | 5.0 | ||||||||||||

| Net income (loss) for the year | 10.0 | 52.1 | (66.2 | ) | (45.2 | ) | ||||||||||

| Basic earnings per share—R$ (unless otherwise indicated)(2) | ||||||||||||||||

| Common Shares | 0.53 | 2.79 | (3.93 | ) | (2.78 | ) | ||||||||||

| Diluted earnings per share—R$ (unless otherwise indicated)(3) | ||||||||||||||||

| Common Shares | 0.53 | 2.68 | (3.93 | ) | (2.78 | ) | ||||||||||

| (1) | For convenience purposes only, amounts in reais as of December 31, 2020 have been translated to U.S. dollars using an exchange rate of R$5.197 to U.S.$1.00, the commercial selling rate for U.S. dollars as of December 31, 2020 as reported by the Brazilian Central Bank. These translations should not be considered representations that any such amounts have been, could have been or could be converted at that or any other exchange rate. See “—Exchange Rates” for further information about recent fluctuations in exchange rates. |

| (2) | Calculated by dividing the profit (loss) attributable to the shareholders by the weighted average number of common shares outstanding during the year. |

| (3) | Calculated by dividing the profit (loss) attributable to the shareholders by the weighted average number of common shares outstanding during the year plus the weighted average number of common shares that would be issued on conversion of all potential common shares with dilutive effects. |

4

| As of December 31, | ||||||||||||||||

| 2020 | 2020 | 2019 | 2018 | |||||||||||||

| U.S.$ millions(1) | R$ millions | |||||||||||||||

| Statement of Financial Position Data: | ||||||||||||||||

| Assets | ||||||||||||||||

| Current assets | ||||||||||||||||

| Cash and cash equivalents | 16.5 | 85.9 | 2.5 | 2.4 | ||||||||||||

| Short-term investments | 99.1 | 515.2 | 72.3 | 164.8 | ||||||||||||

| Trade receivables | 22.1 | 115.1 | 88.1 | 71.4 | ||||||||||||

| Income taxes recoverable | 0.4 | 2.2 | 4.7 | 5.5 | ||||||||||||

| Prepaid expenses | 2.0 | 10.2 | 8.9 | 7.2 | ||||||||||||

| Other current assets | 0.6 | 3.1 | 1.9 | 1.2 | ||||||||||||

| 140.8 | 731.7 | 178.4 | 252.5 | |||||||||||||

| Assets classified as held for sale(2) | — | 36.5 | — | |||||||||||||

| Total current assets | 140.8 | 731.7 | 214.9 | 252.5 | ||||||||||||

| Non-current assets | ||||||||||||||||

| Trade receivables | 1.3 | 6.9 | 3.8 | 5.4 | ||||||||||||

| Indemnification assets | 1.8 | 9.2 | 14.8 | 16.5 | ||||||||||||

| Deferred tax assets | 9.8 | 50.8 | 37.1 | 29.9 | ||||||||||||

| Other non-current assets | 0.7 | 3.6 | 1.4 | 1.2 | ||||||||||||

| Right-of-use assets | 24.6 | 127.9 | 88.5 | 74.8 | ||||||||||||

| Property and equipment | 18.6 | 96.7 | 70.0 | 63.4 | ||||||||||||

| Intangible assets | 127.2 | 661.0 | 658.2 | 735.3 | ||||||||||||

| Total non-current assets | 184.0 | 956.1 | 873.8 | 926.5 | ||||||||||||

| Total assets | 324.8 | 1,687.8 | 1,088.7 | 1,179.0 | ||||||||||||

| Liabilities and Equity | ||||||||||||||||

| Current liabilities | ||||||||||||||||

| Trade payables | 6.2 | 32.2 | 30.0 | 17.1 | ||||||||||||

| Loans and financing | 29.2 | 151.8 | — | — | ||||||||||||

| Lease liabilities | 4.5 | 23.4 | 17.3 | 15.4 | ||||||||||||

| Labor and social obligations | 5.1 | 26.7 | 16.8 | 16.1 | ||||||||||||

| Income tax payable | — | — | — | — | ||||||||||||

| Taxes payable | 0.5 | 2.4 | 1.6 | 1.7 | ||||||||||||

| Prepayments from customers | 1.9 | 9.7 | 3.2 | 1.2 | ||||||||||||

| Accounts payable from acquisition of subsidiaries | 26.0 | 135.0 | 128.9 | 123.3 | ||||||||||||

| Other current liabilities | 0.3 | 1.4 | 0.3 | 0.3 | ||||||||||||

| 73.6 | 382.6 | 198.1 | 175.1 | |||||||||||||

| Liabilities directly associated with assets classified as held for sale(2) | — | — | 23.3 | — | ||||||||||||

| Total current liabilities | 73.6 | 382.6 | 221.4 | 175.1 | ||||||||||||

| Non-current liabilities | ||||||||||||||||

| Loans and financing | — | — | — | |||||||||||||

| Lease liabilities | 24.2 | 126.0 | 85.9 | 73.3 | ||||||||||||

| Share-based compensation | 8.9 | 46.2 | 35.0 | 7.0 | ||||||||||||

| Accounts payable from acquisition of subsidiaries | 26.9 | 139.9 | 250.7 | 335.2 | ||||||||||||

| Provisions for contingencies | 2.8 | 14.4 | 18.4 | 18.0 | ||||||||||||

| Deferred tax liabilities | — | 25.0 | 43.4 | |||||||||||||

| Other non-current liabilities | 0.1 | 0.7 | 1.1 | 7.5 | ||||||||||||

| Total non-current liabilities | 63.0 | 327.2 | 416.0 | 484.5 | ||||||||||||

| Total liabilities | 136.6 | 709.8 | 637.4 | 659.6 | ||||||||||||

| Equity | ||||||||||||||||

| Share capital | — | — | 548.4 | 546.5 | ||||||||||||

| Capital reserves | 196.7 | 1,022.1 | (1.3 | ) | 2.5 | |||||||||||

| Revenue reserves | — | — | 0.4 | 0.4 | ||||||||||||

| Retained earnings (accumulated losses) | (8.5 | ) | (44.1 | ) | (96.2 | ) | (30.1 | ) | ||||||||

| Total equity | 188.2 | 978.0 | 451.3 | 519.4 | ||||||||||||

| Total liabilities and equity | 324.8 | 1,687.8 | 1,088.7 | 1,179.0 | ||||||||||||

| (1) | For convenience purposes only, amounts in reais as of December 31, 2020 have been translated to U.S. dollars using an exchange rate of R$5.197 to U.S.$1.00, the commercial selling rate for U.S. dollars as of December 31, 2020 as reported by the Brazilian Central Bank. These translations should not be considered representations that any such amounts have been, could have been or could be converted at that or any other exchange rate. See “—Exchange Rates” for further information about recent fluctuations in exchange rates. |

| (2) | In December 2019, we decided to sell our subsidiaries FAC/FAMAT and FAIR and the undergraduate operations on the campuses of Assevim and Famesul, which account for a portion of our on-campus undergraduate courses segment. As a result of this decision we classified the related assets and liabilities as “held for sale” in 2019, since we understood that these assets available for immediate sale in their present condition subject only to terms that are usual and customary for these types of transactions, that this sale was likely to occur given then existing plans and was expected to occur within the next six months, and that an active program to locate a buyer and complete the plan had been initiated. However, in September 2020, as a result of our receipt of the proceeds from our initial public offering and the course of events during 2020, we came to the conclusion that there was no further reason to sell these assets immediately. For more information, see note 12 to our audited consolidated financial statements, included elsewhere in this annual report. |

5

Non-GAAP Financial Measures

Adjusted EBITDA, Adjusted Net Income and Free Cash Flow

| For the Year Ended December 31, | ||||||||||||||||

| 2020 | 2020 | 2019 | 2018 | |||||||||||||

| U.S.$ millions(1) | R$ millions | |||||||||||||||

| Net revenue | 99.9 | 519.2 | 461.1 | 383.4 | ||||||||||||

| Net income (loss) for the year | 10.0 | 52.1 | (66.2 | ) | (45.2 | ) | ||||||||||

| Adjusted EBITDA(2) | 28.2 | 146.7 | 117.6 | 107.8 | ||||||||||||

| Adjusted Net Income(3) | 18.9 | 98.2 | 57.7 | 55.4 | ||||||||||||

| Cash flow from operations | 27.2 | 141.6 | 98.0 | 88.0 | ||||||||||||

| Adjusted Cash Flow Conversion from Operations(4) | 88% | 88% | 75% | 79% | ||||||||||||

| (1) | For convenience purposes only, amounts in reais as of December 31, 2020 have been translated to U.S. dollars using an exchange rate of R$5.197 to U.S.$1.00, the commercial selling rate for U.S. dollars as of December 31, 2020 as reported by the Brazilian Central Bank. These translations should not be considered representations that any such amounts have been, could have been or could be converted at that or any other exchange rate. See “—Exchange Rates” for further information about recent fluctuations in exchange rates. |

| (2) | For information on how we define Adjusted EBITDA, see “Presentation of Financial and Other Information—Special Note Regarding Non-GAAP Financial Measures.” For a reconciliation of Adjusted EBITDA to our loss for the year, see “—Reconciliations of Non-GAAP Financial Measures—Reconciliation between Adjusted EBITDA and loss for the year.” |

| (3) | For information on how we define Adjusted Net Income, see “Presentation of Financial and Other Information—Special Note Regarding Non-GAAP Financial Measures.” For a reconciliation of Adjusted Net Income, see “—Reconciliations of Non-GAAP Financial Measures—Reconciliation of Adjusted Net Income.” |

| (4) | For information on how we define Adjusted Cash Flow Conversion from Operations, see “Presentation of Financial and Other Information—Special Note Regarding Non-GAAP Financial Measures.” For a reconciliation of Adjusted Cash Flow Conversion from Operations, see “—Reconciliations of Non-GAAP Financial Measures—Reconciliation of Adjusted Cash Flow Conversion from Operations.” |

6

Operating Data

The following table below sets forth certain of our operating data for each of the years indicated:

| As of December 31, | ||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||

| Number enrolled students | 309,560 | 240,946 | 189,295 | 140,363 | 115,325 | |||||||||||||||

| Number of distance learning undergraduate students | 256,953 | 195,613 | 148,711 | 106,576 | 81,406 | |||||||||||||||

| Number of distance learning graduate students | 44,570 | 35,952 | 30,227 | 22,910 | 21,108 | |||||||||||||||

| Number of hubs | 709 | 545 | 370 | 221 | 72 | |||||||||||||||

Reconciliations for Non-GAAP Financial Measures

The following tables set forth reconciliations of Adjusted EBITDA and Adjusted Net Income to our net income (loss) for the years ended December 31, 2020, 2019 and 2018, our most recent directly comparable financial measures calculated and presented in accordance with IFRS.

For further information on why our management chooses to use these non-GAAP financial measures, and on the limits of using these non-GAAP financial measures, please see “Presentation of Financial and Other Information—Special Note Regarding Non-GAAP Financial Measures.”

Reconciliation between Adjusted EBITDA and Loss for the Year

The following table below sets forth a reconciliation of our Adjusted EBITDA to our loss for each of the years indicated:

| For the Year Ended December 31, | ||||||||||||||||

| 2020 | 2020 | 2019 | 2018 | |||||||||||||

| U.S.$ millions(1) | R$ millions | |||||||||||||||

| Net income (loss) for the year | 10.0 | 52.1 | (66.2 | ) | (45.2 | ) | ||||||||||

| (+) Deferred and current income tax | (3.7 | ) | (19.1 | ) | (10.9 | ) | (5.0 | ) | ||||||||

| (+) Financial results | 5.4 | 27.9 | 41.2 | 42.6 | ||||||||||||

| (+) Depreciation and amortization | 9.9 | 51.5 | 62.4 | 56.3 | ||||||||||||

| (+) Interest on tuition fees paid in arrears | 3.0 | 15.7 | 8.3 | 8.9 | ||||||||||||

| (+) Impairment of non-current assets | — | — | 51.0 | 33.5 | ||||||||||||

| (+) Share-based compensation plan | 2.3 | 11.9 | 26.4 | 7.5 | ||||||||||||

| (+) Other income (expenses), net | (0.1 | ) | (0.5 | ) | 0.9 | 1.0 | ||||||||||

| (+) M&A, pre-offering expenses and restructuring expenses | 1.4 | 7.2 | 4.5 | 8.2 | ||||||||||||

| Adjusted EBITDA(2) | 28.2 | 146.7 | 117.6 | 107.8 | ||||||||||||

| (1) | For convenience purposes only, amounts in reais for the year ended December 31, 2020 have been translated to U.S. dollars using an exchange rate of R$5.197 to U.S.$1.00, the commercial selling rate for U.S. dollars as of December 31, 2020 as reported by the Brazilian Central Bank. These translations should not be considered representations that any such amounts have been, could have been or could be converted at that or any other exchange rate. See “—Exchange Rates” for further information about recent fluctuations in exchange rates. |

| (2) | We calculate Adjusted EBITDA as net income (loss) for the year plus deferred and current income tax plus financial results plus depreciation and amortization plus interest on tuition fees paid in arrears plus impairment of non-current assets plus share-based compensation plan plus other income (expenses), net, plus M&A, pre-offering expenses and restructuring expenses. Adjusted EBITDA is a non-GAAP measure. Our calculation of Adjusted EBITDA may be different from the calculation used by other companies, including our competitors in the industry, and therefore, our measures may not be comparable to those of other companies. For further information see “Presentation of Financial and Other Information—Special Note Regarding Non-GAAP Financial Measures.” |

7

Reconciliation of Adjusted Net Income

The following table below sets forth a reconciliation of our profit to Adjusted Net Income for each of the years indicated:

| For the Year Ended December 31, | ||||||||||||||||

| 2020 | 2020 | 2019 | 2018 | |||||||||||||

| U.S.$(1) | R$ | |||||||||||||||

| (in millions) | ||||||||||||||||

| Net income (loss) for the year | 10.0 | 52.1 | (66.2 | ) | (45.2 | ) | ||||||||||

| (+) M&A, pre-offering expenses and restructuring expenses | 1.4 | 7.2 | 4.5 | 8.2 | ||||||||||||

| (+) Impairment of non-current assets | — | — | 51.0 | 33.5 | ||||||||||||

| (+) Share-based compensation plan | 2.3 | 11.9 | 26.4 | 7.5 | ||||||||||||

| (+) Amortization of intangible assets from business combinations | 2.8 | 14.6 | 37.3 | 37.3 | ||||||||||||

| (+) Interest accrued on accounts payable from the acquisition of subsidiaries | 3.5 | 18.0 | 23.4 | 27.1 | ||||||||||||

| (+) Corresponding tax effects on adjustments | (1.1 | ) | (5.6 | ) | (18.7 | ) | (13.0 | ) | ||||||||

| Adjusted Net Income(2) | 18.9 | 98.2 | 57.7 | 55.4 | ||||||||||||

| (1) | For convenience purposes only, amounts in reais for the year ended December 31, 2020 have been translated to U.S. dollars using an exchange rate of R$5.197 to U.S.$1.00, the commercial selling rate for U.S. dollars as of December 31, 2020 as reported by the Brazilian Central Bank. These translations should not be considered representations that any such amounts have been, could have been or could be converted at that or any other exchange rate. See “—Exchange Rates” for further information about recent fluctuations in exchange rates. |

| (2) | We calculate Adjusted Net Income as net income (loss) for the year plus share-based compensation plan plus M&A, pre-offering expenses and restructuring expenses, plus impairment of non-current assets plus amortization of intangible assets recognized as a result of business combinations plus interest accrued at the original effective interest rate (excluding restatement as a result of inflation) on the accounts payable from the acquisition of subsidiaries plus corresponding tax effects on adjustments. Adjusted Net Income is a non-GAAP measure. Our calculation of Adjusted Net Income may be different from the calculation used by other companies, including our competitors in the industry, and therefore, our measures may not be comparable to those of other companies. For further information see “Presentation of Financial and Other Information—Special Note Regarding Non-GAAP Financial Measures.” |

8

Reconciliation of Adjusted Cash Flow Conversion from Operations

The following table below sets forth a reconciliation of our Adjusted Cash Flow Conversion from Operations for each of the years indicated:

| For the Year Ended December 31, | ||||||||||||||||

| 2020 | 2020 | 2019 | 2018 | |||||||||||||

| U.S.$(1) | R$ | |||||||||||||||

| (in millions) | ||||||||||||||||

| Cash flow from operations | 27.2 | 141.6 | 98.0 | 88.0 | ||||||||||||

| (+) Income tax paid | (3.6 | ) | (18.7 | ) | (12.7 | ) | (9.4 | ) | ||||||||

| Adjusted Cash Flow from Operations | 23.6 | 122.9 | 85.3 | 78.6 | ||||||||||||

| Adjusted EBITDA(2) | 28.2 | 146.7 | 117.6 | 107.8 | ||||||||||||

| (-) M&A, pre-offering expenses and restructuring expenses | (1.4 | ) | (7.2 | ) | (4.5 | ) | (8.2 | ) | ||||||||

| Adjusted EBITDA excluding M&A, pre-offering expenses and restructuring expenses | 26.8 | 139.5 | 113.1 | 99.6 | ||||||||||||

| Adjusted Cash Flow Conversion from Operations(3) (2) | 88% | 88% | 75% | 79% | ||||||||||||

| (1) | For convenience purposes only, amounts in reais for the year ended December 31, 2020 have been translated to U.S. dollars using an exchange rate of R$5.197 to U.S.$1.00, the commercial selling rate for U.S. dollars as of December 31, 2020 as reported by the Brazilian Central Bank. These translations should not be considered representations that any such amounts have been, could have been or could be converted at that or any other exchange rate. See “—Exchange Rates” for further information about recent fluctuations in exchange rates. |

| (2) | For information on how we define Adjusted EBITDA, see “Presentation of Financial and Other Information—Special Note Regarding Non-GAAP Financial Measures.” For a reconciliation of Adjusted EBITDA to our net income (loss) for the year, see “—Reconciliation between Adjusted EBITDA and loss for the year.” |

| (3) | We calculate Adjusted Cash Flow Conversion from Operations as adjusted cash flow from operations (which we calculate as cash from operations plus income tax paid) divided by Adjusted EBITDA (as defined above but without taking M&A, pre-offering expenses and restructuring expenses into consideration). Adjusted Cash Flow Conversion from Operations is a non-GAAP measure. Our calculation of Adjusted Cash Flow Conversion from Operations may be different from the calculation used by other companies, including our competitors in the industry, and therefore, our measures may not be comparable to those of other companies. For further information see “Presentation of Financial and Other Information—Special Note Regarding Non-GAAP Financial Measures.” |

Exchange Rates

The Brazilian foreign exchange system allows the purchase and sale of foreign currency and the international transfer of reais by any person or legal entity, regardless of the amount, subject to certain regulatory procedures.

The real depreciated against the U.S. dollar from mid-2011 to early 2016. In particular, during 2015, due to the poor economic conditions in Brazil, including as a result of political instability, the real depreciated at a rate that was much higher than in previous years. On September 24, 2015, the real fell to its lowest level since the introduction of the currency, at R$4.1945 per U.S.$1.00. Overall in 2015, the real depreciated 47.0%, reaching R$3.9048 per U.S.$1.00 on December 31, 2015. In 2016, the real fluctuated significantly, primarily as a result of Brazil’s political instability, appreciating 16.5% to R$3.2591 per U.S.$1.00 on December 31, 2016. In 2017, the real depreciated 1.5% against the U.S. dollar, ending the year at an exchange rate of R$3.308 per U.S.$1.00. The real/U.S. dollar exchange rate reported by the Brazilian Central Bank was R$3.8748 per U.S.$1.00 on December 31, 2018, which reflected a 17.1% depreciation in the real against the U.S. dollar during 2018, primarily as a result of lower interest rates in Brazil, which reduced the volume of foreign currency deposited in Brazil in the “carry trade,” as well as uncertainty regarding the results of the Brazilian presidential elections held in October 2018. On December 31, 2019 and 2020, the period-end real/U.S. dollar exchange rate was R$4.031 and R$5.197, respectively, per U.S.$1.00, which represented depreciation of 4.0% and 28.9%, respectively, during the corresponding years. There can be no assurance that the real will not depreciate or appreciate further against the U.S. dollar.

The Brazilian Central Bank has intervened occasionally in the foreign exchange market to attempt to control instability in foreign exchange rates. We cannot predict whether the Brazilian Central Bank or the Brazilian government will continue to allow the real to float freely or will intervene in the exchange rate market by re-implementing a currency band system or otherwise. The real may depreciate or appreciate substantially against the U.S. dollar in the future. Furthermore, Brazilian law provides that, whenever there is a serious imbalance in Brazil’s balance of payments or there are serious reasons to foresee a serious imbalance, temporary restrictions may be imposed on remittances of foreign capital abroad. We cannot assure you that the Brazilian government will not place restrictions on remittances of foreign capital abroad in the future.

9

The following table sets forth, for the periods indicated, the high, low, average and period-end exchange rates for the purchase of U.S. dollars expressed in Brazilian reais per U.S. dollar. The average rate is calculated by using the average of reported exchange rates by the Brazilian Central Bank on each day during a monthly period and on the last day of each month during an annual period. The real/dollar exchange rate fluctuates and, therefore, the selling rate at April 23, 2021 may not be indicative of future exchange rates.

| Year | Period-End | Average(1) | Low | High | ||||||||||||

| 2016 | 3.259 | 3.483 | 3.119 | 4.156 | ||||||||||||

| 2017 | 3.308 | 3.193 | 3.051 | 3.381 | ||||||||||||

| 2018 | 3.875 | 3.656 | 3.139 | 4.188 | ||||||||||||

| 2019 | 4.031 | 3.946 | 3.652 | 4.260 | ||||||||||||

| 2020 | 5.197 | 5.158 | 4.021 | 5.937 | ||||||||||||

| Month | Period-End | Average(2) | Low | High | ||||||||||||

| October 2020 | 5.772 | 5.626 | 5.521 | 5.780 | ||||||||||||

| November 2020 | 5.332 | 5.418 | 5.282 | 5.693 | ||||||||||||

| December 2020 | 5.197 | 5.146 | 5.058 | 5.279 | ||||||||||||

| January 2021 | 5.476 | 5.356 | 5.163 | 5.509 | ||||||||||||

| February 2021 | 5.530 | 5.416 | 5.342 | 5.530 | ||||||||||||

| March 2021 | 5.697 | 5.646 | 5.495 | 5.840 | ||||||||||||

| April 2021 (through April 23, 2021) | 5.479 | 5.612 | 5.479 | 5.706 | ||||||||||||

Source: Central Bank.

| (1) | Represents the average of the exchange rates on the closing of each business day during the year. |

| (2) | Represents the average of the exchange rates on the closing of each business day during the month. |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

This section is intended to be a summary of more detailed discussions contained elsewhere in this registration statement. The risks described below are not the only ones we face. Our business, results of operations or financial condition could be harmed if any of these risks materializes and, as a result, the trading price of our common shares could decline.

Summary of Risks Relating to Our Business and Industry

| · | The COVID-19 outbreak may cause an adverse effect in our operations, including the partial closure of our business. The extension of the COVID-19 pandemic, the perception of its effects, or the way in which such pandemic will impact our business, either on a microeconomic or on a macroeconomic level, are subject to uncertain and unforeseeable future developments, which may have a material adverse effect on our business, financial condition, operating results and cash flow. |

| · | If we are unable to enter into agreements and maintain good relationships with, and/or increase the number of, our hub partners, our business and growth may be adversely affected. Failure by our hub partners to comply with the terms of agreements with them, and any failure by us to enforce such terms, may also adversely affect us. In addition, failure by our hub partners to maintain their existing levels of profitability may result in them ceasing to view their relationships with us as advantageous. |

10

| · | We are subject to various federal laws and extensive government regulation, and changes in such laws and regulation could have a material adverse effect on our business and our growth strategy. |

| · | Any change or review of the tax treatment of our activities, or the loss or reduction in tax benefits on the sale of books (including digital content) may materially adversely affect us. |

| · | We face significant competition in each program we offer and each geographic region in which we operate. If we fail to compete effectively, we may lose market share and our profitability may be adversely affected. |

| · | We operate in markets that are dependent on Information Technology (IT) systems and technological change. Failure to maintain and support customer-facing services, systems, and platforms, including addressing quality issues and execution on time of new products and enhancements, could negatively impact our revenues and reputation. |

| · | We may not be able to appropriately manage the expansion of our business and staff, the increased complexity of our software and platforms, or grow in our addressable market. |

| · | We may be adversely affected if we are unable to maintain consistent educational quality throughout our network, including the education materials of our campuses and hubs, or keep or adequately train our faculty, or ensure that our hub partners will maintain their facilities, equipment and team compatible with our required standards at all time. |

| · | Our business depends on the continued success of our brand “Uniasselvi,” and if we fail to maintain and enhance recognition of our brand, we may face difficulty enrolling new students, and our reputation and operating results may be harmed. Failure to protect or enforce our intellectual property and other proprietary rights could adversely affect our business and financial condition and results of operations. |

| · | Failure to protect or enforce our intellectual property and other proprietary rights could adversely affect our business and financial condition and results of operations. In addition, we may in the future be subject to intellectual property claims, which are costly to defend and could harm our business, financial condition and operating results. |

| · | The quality of the pedagogical content we deliver to our clients is significantly dependent upon the quality of our editors, publishers and purchased content. Any issues related to obtaining this content or regarding the quality of this content may have an adverse effect on our business. |

| · | If we lose key personnel our business, financial condition and results of operations may be adversely affected. |

| · | Material weaknesses in our internal control over financial reporting have been identified, and if we fail to establish and maintain proper and effective internal controls over financial reporting, our results of operations and our ability to operate our business may be harmed. |

| · | Public health threats or outbreaks of communicable diseases could have an adverse effect on our operations and financial results. |

Summary of Risks Relating to Brazil

| · | The Brazilian federal government has exercised, and continues to exercise, significant influence over the Brazilian economy. This involvement as well as Brazil’s political and economic conditions could harm us and the price of our common shares. |

| · | Economic uncertainty and political instability in Brazil may harm us and the price of our common shares. |

| · | Inflation and certain measures by the Brazilian government to curb inflation have historically harmed the Brazilian economy and Brazilian capital markets, and high levels of inflation in the future would harm our business and the price of our common shares. |

11

| · | Exchange rate instability may have adverse effects on the Brazilian economy, us and the price of our common shares. |

| · | Infrastructure and workforce deficiency in Brazil may impact economic growth and have a material adverse effect on us. |

| · | Developments and the perceptions of risks in other countries, including other emerging markets, the United States and Europe, may harm the Brazilian economy and the price of our common shares. |

Summary of Risks Relating to Our Common Shares

| · | Our Controlling Shareholders’ ownership and voting power may limit your ability to influence corporate matters. |

| · | Our Articles of Association contain anti-takeover provisions that may discourage a third party from acquiring us and adversely affect the rights of holders of our common shares. |

| · | If securities or industry analysts do not publish research, or publish inaccurate or unfavorable research, about our business, the price of our common shares and our trading volume could decline. |

| · | We do not anticipate paying any cash dividends in the foreseeable future. |

| · | We are a Cayman Islands exempted company with limited liability. The rights of our shareholders, including with respect to fiduciary duties and corporate opportunities, may be different from the rights of shareholders governed by the laws of U.S. jurisdictions. |

| · | As a foreign private issuer and an “emerging growth company” (as defined in the JOBS Act), we have different disclosure and other requirements than U.S. domestic registrants and non-emerging growth companies. |

| · | We may lose our foreign private issuer status, which would then require us to comply with the Exchange Act’s domestic reporting regime and cause us to incur significant legal, accounting and other expenses. |

| · | Judgments of Brazilian courts to enforce our obligations with respect to our common shares may be payable only in reais. The exchange rate in force at the time may not offer non-Brazilian investors full compensation for any claim arising from our obligations. |

| · | Our common shares may not be a suitable investment for all investors, as investment in our common shares presents risks and the possibility of financial losses. |

Certain Risks Relating to Our Business and Industry

The COVID-19 outbreak may cause an adverse effect in our operations, including the partial closure of our business. The extension of the COVID-19 pandemic, the perception of its effects, or the way in which such pandemic will impact our business, either on a microeconomic or on a macroeconomic level, are subject to uncertain and unforeseeable future developments, which may have a material adverse effect on our business, financial condition, operating results and cash flow.

COVID-19 is an infectious disease caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The disease was first identified in 2019 in Wuhan, the capital of Hubei province in central China, and has since spread globally. On March 11, 2020, the World Health Organization revised the classification of COVID-19 from an epidemic (when a disease spreads through a specific community or region) to a pandemic, which according to the World Health Organization’s definition is when there is a worldwide spread of a new disease. By that time, COVID-19 had already reached Brazil. On March 20, 2020 the Brazilian federal government declared a national emergency with respect to COVID-19. The classification of the disease as a pandemic was motivated by the rapid increase in the number of cases and the number of affected countries on all continents, triggering measures by governments, companies and societies to contain the advances of COVID-19. The measures vary from country to country in quantity and degree of severity but basically involve: (1) vaccination programs; (2) recommendations to adopt

12

voluntary isolation (avoid going out on the streets, avoiding crowds, avoiding physical contact with other people, etc.); (3) internal restrictions regarding the movement of people; (4) closing of schools and other public places, such as parks and leisure centers, as well as closures of shopping malls, bars and restaurants; (5) adoption of remote working practices (home office) by companies, whenever possible and permitted by their activities; (6) closing borders between countries; (7) restriction and/or suspension of trade in non-essential goods and services in the context of COVID-19 (while supermarkets, drugstores, gas stations and other essential services remain available); (8) purchase restrictions for certain essential items to avoid scarcity; (9) interruption of production activities of consumer items not essential to combat the pandemic; (10) restriction on the delivery of products to homes other than essentials; (11) compulsory reduction of working hours; (12) cancellation of public events; and (13) other restrictive measures.

Such events have adversely impacted the global economy as well as national and regional economies (including the Brazilian economy), and have caused disruption of regional or global economic activity. In particular and in the interest of public health and safety, state and local governments in Brazil have required mandatory school closures in certain cities in 2020 and 2021, which has resulted in the closure of our on-campus learning facilities and hubs. The COVID-19 pandemic is still evolving in Brazil, and authorities may maintain the school closures for a longer or undefined extended of period of time, impose a more severe lockdown, among other measures, all of which are outside of our control and may adversely affect our business, financial condition, operating results and cash flow. The COVID-19 pandemic is expected to cause a material and adverse effect on the general economic, financial, political, demographic and business conditions in Brazil, which may reduce the disposable income of our students and their families, and consequently (1) result in an adverse impact on the ability of our students (current and/or prospective) to pay our tuition fees and/or (2) trigger an increase in our attrition rates.

We cannot predict the extent of the pandemic, and consequently, its direct and indirect impacts on local and world economies in the short, medium and long terms. In a prolonged contraction scenario, the virus could spread globally without a seasonal decline and the impacts could include: (1) increased number of deaths; (2) demand shock; (3) overloading healthcare systems in many countries, especially in less developed areas; (4) large-scale human and economic impact; (5) layoffs and bankruptcies in the most affected sectors rising sharply throughout 2020; (6) severe global economic impact, with significant gross domestic product contraction in most major economies in 2020 and a slow-moving recovery; (7) infrastructure collapse and lack of basic services, particularly in less developed countries; and (8) compromised government planning, coordination and reaction capacity according to the speed that the disease progresses.

Despite the measures adopted to contain the progress of COVID-19, such as vaccination campaigns, and aid measures announced by governments around the world, including the Brazilian government, as of the date hereof, we cannot predict the extent, duration and impacts of such containment measures, or the results of aid measures in Brazil. Accordingly, we cannot predict the direct and indirect effects of the COVID-19 pandemic and governments’ responses to it on our business, results of operations and financial condition, including: (1) the impact of COVID-19 on our financial condition and results of operations, including trends and the overall economic outlook, capital, investments and financial resources or liquidity position; (2) how future operations could be impacted; (3) the impact on our costs or access to capital and funding resources; (4) if we could incur any material COVID-19-related contingencies; (5) how COVID-19 could affect assets on our balance sheet and our ability to timely record those assets; (6) the anticipation of any material impairments, increases in allowances for credit losses, restructuring charges or other expenses; (7) any changes in accounting judgements that have had or are reasonably likely to have a material impact on our financial statements; (8) the decline in demand for our products; (9) the impact on our materials production chain; (10) the impact on the relationship between costs and revenues; (11) general economic and social uncertainty, including increases in interest rates, variations in foreign exchange rates, inflation and unemployment; and (12) other unforeseen impacts and consequences.

In addition, COVID-19 poses risks that our employees, contractors, suppliers, students, hub partners and other business partners may be prevented from conducting business activities for an indefinite period of time, including shutdowns that may be requested or mandated by governmental authorities and could have a material adverse effect on our results of operations, financial condition and liquidity. The mandatory closure of schools in 2020 and 2021 may result in delays in students enrollments in postsecondary education courses and, therefore, affect our future operations, financial condition and liquidity. The extent to which COVID-19 impacts our results will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of COVID-19 and the actions to contain COVID-19 or mitigate its impact, among others.

13

We are not aware of comparable events that could provide us with guidance as to the effect of the spread of the COVID-19 pandemic and, as a result, the final impact of the COVID-19 outbreak is highly uncertain. Further, these adverse events occurred after the issuance of our audited consolidated financial statements included elsewhere in this annual report. As of the date hereof, there is no additional information available to enable us to carry out an assessment of the impacts of the COVID-19 pandemic on our business, other than the considerations presented herein and in this annual report under the sections “Item 3. Key Information—D. Risk Factors—Certain Risks Relating to Our Business and Industry—Public health threats or outbreaks of communicable diseases could have an adverse effect on our operations and financial results.” Although as of the date of this annual report there has been no material impact on our operations, as most of our services are already delivered remotely or capable of being delivered remotely, we are not able to assure you if, and to what extent, in the future, our operations will be impacted by COVID-19.

Furthermore, to the extent the COVID-19 pandemic adversely affects our business, results of operations, financial condition and liquidity, it may also have the effect of heightening many of the other risks described in this “Risk Factors” section.

See also “Item 4. Information on the Company—A. History and Development of the Company—Recent Events—COVID-19 Pandemic” and “Item 5. Operating and Financial Review and Prospects— Impact of COVID-19.”

We are subject to various federal laws and extensive government regulation, and changes in such laws and regulation could have a material adverse effect on our business and our growth strategy.

We are subject to various federal laws and extensive government regulations by the MEC, the National Education Council (Conselho Nacional de Educação), or the CNE, the INEP, and the National Postsecondary Education Assessment Commission (Comissão Nacional de Avaliação da Educação Superior), or CONAES.

The Brazilian government may review and change the laws and regulations to which we are subject at any time. In addition, the MEC may also promulgate additional rules and regulations applicable to postsecondary education institutions, particularly with respect to distance learning programs. Any significant changes to the regulatory framework within which we currently operate could have a material adverse effect on us, in particular changes relating to:

| · | any revocation of accreditation of private educational institutions; |

| · | the imposition of controls on monthly tuition payments or restrictions on profitability of private educational institutions; |

| · | faculty credentials; |

| · | academic requirements for courses and curricula, including bans on offering certain subjects in a distance learning format; |

| · | changes to the situations in which distance learning education is authorized, requirements to be met to open new distance learning educational hubs or in the accreditation requirements to operate distance learning educational hubs; |

| · | changes to the evaluation criteria of private educational institutions; and |

| · | infrastructure requirements applicable campuses and/or hubs, such as libraries, laboratories and administrative support. |

The postsecondary education sector is highly regulated, and our failure to comply with existing or future laws and regulations could have a material adverse effect on our business.

The offer of postsecondary education is subject to the prior issuance of an authorization by the MEC. The authorizing acts issued by the MEC for postsecondary education are: accreditation and re-accreditation, authorization, recognition and renewal of recognition. Accreditation and re-accreditation refer to the educational institution; while authorization, recognition and renewal of recognition refer to the courses offered by the institution.

14

Brazilian education regulations define three types of postsecondary education institutions: (i) colleges; (ii) university centers; and (iii) universities. Each of these requires prior accreditation from the MEC to operate. Courses offered by colleges depend on prior authorizations from the MEC to be implemented, while courses offered by university centers and universities are not subject to such requirements, except for courses in law, medicine, psychology, nursing and dentistry, which do require the prior authorization from the MEC. For courses in law and medicine, prior to the authorization from the MEC, it is necessary to obtain formal opinion issued by Federal Council of the Brazilian Bar Association or the National Health Council, respectively.

In addition to the authorization, courses must be recognized by the MEC. Pursuant to article 101 of Ordinance No. 23/2017, issued by the MEC, courses may be considered valid even if the recognition request is not formally recognized by the MEC until the date that the first class has concluded the course and as long as the educational institution has filed a request for accreditation within the established legal deadline. Lastly, all postsecondary education institutions must be accredited by the MEC.

The MEC must authorize our campuses located outside our headquarters before they can start operating and providing programs. Any authorization to open new distance learning educational hubs is contingent on our Institutional Concept (Conceito Institucional), or CI. For further information, see “Item 4. Information on the Company—B. Business Overview—Regulatory Overview.” Distance learning programs, as well as on-campus learning programs, are also subject to strict accreditation requirements for their implementation and operation. We must comply with all such requirements in order to obtain and renew all authorizations.

We cannot assure you we will be able to comply with these regulations and maintain the validity of our authorizations, recognition and accreditations in the future. If we fail to comply with these regulatory requirements, the MEC could place limitations on our operations, including cancellation of programs, restrictions on the number of enrollments we offer to students, termination of our ability to issue degrees and certificates and revocation of our accreditation, any of which could adversely affect our reputation, financial condition and results of operations. We cannot assure you that we will obtain accreditation or re-accreditation of our postsecondary education institutions, or that our courses will receive authorization or recognition and renewal of recognition as scheduled, or that such courses will have all of the accreditations, re-accreditations, authorizations, recognition and renewal of recognition required by the MEC. The absence of such authorizations and recognitions or any delays in obtaining them could adversely affect our financial condition and results of operations. We may be materially adversely affected if we are unable to obtain authorizations, accreditations and course recognitions in a timely manner, if we cannot introduce new courses as quickly as our competitors or if we are not able to or do not comply with any new rules or regulations promulgated by the MEC.

If we are unable to enter into agreements and maintain good relationships with, and/or increase the number of, our hub partners, our business and growth may be adversely affected. Failure by our hub partners to comply with the terms of agreements with them, and any failure by us to enforce such terms, may also adversely affect us. In addition, failure by our hub partners to maintain their existing levels of profitability may result in them ceasing to view their relationships with us as advantageous.