☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Co mmis sion Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material Under Rule 240.14a-12 |

☒ |

No fee required |

☐ |

Fee paid previously with preliminary materials |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On behalf of the Board of Directors and management of Driven Brands Holdings Inc., we cordially invite you to attend our 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Monday, May 8, 2023, at 12:00 p.m., Eastern Daylight Time. We will be holding the Annual Meeting in a virtual-only format to maximize your ability to participate in the meeting. You will be able to attend, vote, and submit questions during the live webcast of the Annual Meeting by visiting www.virtualshareholdermeeting.com/DRVN2023 and entering the 16-digit control number included in your Notice of Internet Availability of Proxy Materials, proxy card, or in the instructions that accompanied your proxy materials.

Enclosed are the Notice of Annual Meeting of Stockholders and Proxy Statement, which describe the business that will be acted upon at the meeting or any adjournment or postponement thereof, as well as our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (“2022 Annual Report”).

On or about March 29, 2023, we will begin mailing proxy materials, including a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and 2022 Annual Report and how to vote over the Internet, to request and return a proxy card by mail, or to vote by telephone. For information on how to vote your shares, please refer to the proxy materials you received.

Your vote is important. Even if you plan to attend the Annual Meeting, please follow the instructions provided to you in your proxy materials and vote your shares as soon as possible. This will not prevent you from voting your shares during the Annual Meeting if you are able to attend. Thank you for your continued support of, and interest in, Driven Brands.

Sincerely,

Jonathan Fitzpatrick

President and Chief Executive Officer

March 29, 2023

|

|

| ||||||||||||||||||

| Driven Brands Holdings Inc. 440 S. Church Street, Suite 700 Charlotte, NC 28202 |

||||||||||||||||||

| Meeting Information | ||||||||||||||||||

| DATE | TIME | VIRTUAL MEETING | RECORD DATE | |||||||||||||||

| May 8, 2023 | 12:00 p.m., Eastern Daylight Time |

www.virtualshareholdermeeting.com/DRVN2023 | March 15, 2023 | |||||||||||||||

How to Vote

The vote of every stockholder is very important! Please place your vote one of the following ways:

|

|

|

| |||||||||||||||

| ONLINE | BY PHONE | BY MAIL | IN PERSON | |||||||||||||||

| www.proxyvote.com | Call the telephone number in your proxy materials | Mark, sign, and return proxy card | Attend the annual meeting and cast your vote. |

Your vote is important. Whether or not you plan to attend the Annual Meeting of Stockholders, we encourage you to read our Proxy Statement and submit your proxy or voting instructions as soon as possible.

Proposals

| PROPOSAL #1 | PROPOSAL #2 | PROPOSAL #3 | ||||||||||||||||||||||||

|

Election of the three Class III director nominees named in this proxy statement, each for a term of three years. |

An advisory non-binding vote to approve the compensation of our named executive officers. |

Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 30, 2023. |

||||||||||||||||||||||||

Shareholders will also transact such other business as may be properly brought before the meeting or any adjournment thereof by or at the direction of the Board.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 8, 2023:

This notice and the accompanying Proxy Statement and 2022 Annual Report are available here at www.proxyvote.com.

By order of the Board of Directors,

Scott O’Melia

Executive Vice President, General Counsel, and Secretary

|

|

DRIVEN BRANDS HOLDINGS INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 8, 2023

VOTING MATTERS

This Proxy Statement is furnished to the holders of our common stock in connection with the solicitation of proxies on behalf of our Board of Directors (“Board”) for use at Driven Brands Holdings Inc.’s (“Driven Brands” or the “Company”) 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 8, 2023 at 12:00 p.m., Eastern Daylight Time (“EDT”), virtually via live webcast at www.virtualshareholdermeeting.com/DRVN2023, or for use at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of 2023 Annual Meeting of Stockholders. Only stockholders of record at the close of business on March 15, 2023, the record date, are entitled to notice of and to vote at our Annual Meeting.

Stockholders are being asked to vote on the following matters at our Annual Meeting:

| Management Proposal: | For More Information |

Board Recommendation |

Vote Required for Approval | |||||

| 1. | Election of the three Class III director nominees named in this proxy statement, each for a term of three years | Page 2 |

FOR ALL

FOR ALL |

Plurality of votes cast | ||||

| 2. | Approval, on a non-binding advisory basis, of the compensation of our named executive officers | Page 23 |

FOR

FOR |

Majority of shares present and entitled to vote | ||||

| 3. | Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 30, 2023 | Page 54 |

FOR

FOR |

Majority of shares present and entitled to vote | ||||

You may cast your vote in any of the following ways:

|

|

|

| |||||||||||||||

| ONLINE | BY PHONE | BY MAIL |

IN PERSON | |||||||||||||||

| Please log on to www.proxyvote.com and submit a proxy to vote your shares of the Company’s common stock by 11:59 p.m., EDT, on May 7, 2023. | Please call the telephone number in your proxy materials until 11:59 p.m., EDT, on May 7, 2023. | Send your completed and signed proxy card or voting instruction form to the address on your proxy card or voting instruction form so that it is received by the Company prior to the Annual Meeting. | You may attend the virtual Annual Meeting and cast your vote at www.virtualshareholder meeting.com/DRVN2023. |

| 2023 Proxy Statement |

|

1 |

PROPOSAL ONE: ELECTION OF DIRECTORS

At the Annual Meeting, stockholders will vote to elect Chadwick Hume, Karen Stroup, and Peter Swinburn as the three nominees named in this Proxy Statement as Class III directors (the “Class III Nominees”). Our Board of Directors has nominated the Class III Nominees to serve as directors for a term expiring at the 2026 Annual Meeting of Stockholders or until their successor has been duly elected and qualified. The persons named as proxies will vote to elect the Class III Nominees unless a stockholder indicates on their proxy that such stockholder’s shares should be withheld with respect to any of the nominees.

If any Class III Nominee becomes unavailable or declines to serve as a director at the time of the Annual Meeting, the persons named as proxies will vote the proxies in their discretion for any nominee who is designated by the Board of Directors to fill the vacancy. All the nominees are currently serving as directors, and we do not expect that the nominees will be unavailable or will decline to serve.

OUR BOARD OF DIRECTORS RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR ALL” OF THE THREE CLASS III DIRECTOR NOMINEES NAMED IN THIS PROXY STATEMENT.

| 2 |

|

2023 Proxy Statement |

OUR BOARD OF DIRECTORS

The following table sets forth certain information about our directors and committees as of March 24, 2023.

| Skills and Experience | ||||||||||||||||||||||||||||||

| Neal Aronson* |

Jonathan Fitzpatrick |

Catherine Halligan |

Chadwick Hume |

Rick Puckett |

Karen Stroup |

Peter Swinburn |

Michael Thompson |

Jose Tomás | ||||||||||||||||||||||

| Executive Leadership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| Board Experience |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

| Retail Experience |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

| Strategy and Innovation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

| Franchise Experience |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||

| Financial/Accounting Expertise |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Technology / Digital / Cybersecurity |

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Human Capital |

|

|

|

|

|

|

|

| ||||||||||||||||||||||

| Tenure and Independence | ||||||||||||||||||||||||||||||

| Tenure (years) |

3 | 5 | 3 | 3 | 3 | 3 | 3 | 3 | 1 | |||||||||||||||||||||

| Class |

I | I | II | III | II | III | III | II | I | |||||||||||||||||||||

| Current Term Expiration |

2024 | 2024 | 2025 | 2023 | 2025 | 2023 | 2023 | 2025 | 2024 | |||||||||||||||||||||

| Independence |

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

| Committee Membership | ||||||||||||||||||||||||||||||

| Audit |

C |

|

|

|

|

|

|

|||||||||||||||||||||||

| Compensation |

C |

|

|

|

| |||||||||||||||||||||||||

| Nominating and Corporate Governance |

|

|

|

C |

| |||||||||||||||||||||||||

| Demographics | ||||||||||||||||||||||||||||||

| Age |

58 | 52 | 59 | 36 | 69 | 47 | 70 | 40 | 55 | |||||||||||||||||||||

| Gender Identity |

M | M | F | M | M | F | M | M | M | |||||||||||||||||||||

| African American or Black |

||||||||||||||||||||||||||||||

| Alaskan Native or Native American |

||||||||||||||||||||||||||||||

| Asian |

||||||||||||||||||||||||||||||

| Hispanic or Latinx |

| |||||||||||||||||||||||||||||

| White |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

| Two or More Races or Ethnicities |

||||||||||||||||||||||||||||||

| LGBTQ+ |

|

|

|

|||||||||||||||||||||||||||

| Did Not Disclose Demographic Background |

||||||||||||||||||||||||||||||

* Chairman of the Board

| 2023 Proxy Statement |

|

3 |

Set forth below is a brief biography of each of our directors, including our director nominees. There are no family relationships among our directors and executive officers.

Directors

Class I Directors

The term of the following three Class I directors will expire at the 2024 Annual Meeting.

| Neal Aronson | ||||||||||||||||||||

|

Neal Aronson became a member of our Board of Directors in December 2020, previously served as a member of the board of managers of Driven Investor LLC, and has served as chairman of our Board of Directors since the consummation of our initial public offering in January 2021 (“IPO”). Mr. Aronson founded Roark Capital Management, LLC, a private equity firm (“Roark”), and serves as its Managing Partner, a position he has held since 2001. Prior to founding Roark, Mr. Aronson was Co-Founder and Chief Financial Officer for U.S. Franchise Systems, Inc., or USFS, a franchisor of hotel chains. Prior to USFS, Mr. Aronson was a private equity professional at Rosecliff (a successor company to Acadia Partners), Odyssey Partners (a private | |||||||||||||||||||

| equity firm), and Acadia Partners (now Oak Hill, an investment firm). Mr. Aronson began his career in the corporate finance department at Drexel, Burnham, Lambert Inc. (a former investment bank). Mr. Aronson received a B.A. from Lehigh University. Mr. Aronson is a designated director nominee by Driven Equity Sub LLC, Driven Equity LLC, RC IV Cayman ICW Holdings Sub LLC and RC IV Cayman ICW Holdings LLC (collectively, our “Principal Stockholders”) under the Stockholders Agreement (as defined below).

Qualifications: Mr. Aronson’s experience as a private equity partner, chief financial officer, and in other senior executive leadership roles working with franchise companies in the retail, consumer, and business services industries, and knowledge of complex financial matters provide him with valuable and relevant experience in franchise administration, strategic planning, corporate finance, financial reporting, mergers and acquisitions, and leadership of complex organizations, and provide him with the qualifications and skills to serve as a director. |

||||||||||||||||||||

| BOARD MEMBER SINCE | AGE | BOARD COMMITTEES | ||||||||||||||

| 2020 | 58 | None | ||||||||||||||

| 4 |

|

2023 Proxy Statement |

| Jonathan Fitzpatrick | ||||||||||||||||||||

|

|

Jonathan Fitzpatrick serves as our President, Chief Executive Officer, and a member of our Board of Directors. Mr. Fitzpatrick has served as our President and Chief Executive Officer since July 2012, as a member of our Board of Directors since April 2018, and previously served as a member of the board of managers of Driven Investor LLC. Mr. Fitzpatrick currently serves as a member of the board of directors of Nothing Bundt Cakes, a gourmet bakery, privately held by affiliates of Roark Capital Management, LLC. Prior to joining the Company, Mr. Fitzpatrick served in various capacities with Burger King Corporation (a fast food restaurant company) both prior to and after its acquisition by 3G Capital (a global investment firm). Between February | |||||||||||||||||||

| 2011 and June 2012, he was Executive Vice President, Chief Brand and Operations Officer for Burger King. From October 2010 to February 2011, he was Executive Vice President of Global Operations and between August 2009 and October 2010, Senior Vice President of Operations, Europe, Middle East, and Africa. Prior to this role, he was Senior Vice President, Development and Franchising from July 2007 through August 2009. Mr. Fitzpatrick earned a Bachelor’s and Graduate degree from University College in Dublin, Ireland.

Qualifications: Mr. Fitzpatrick’s experience as the President and Chief Executive Officer of Driven Brands, as well as his extensive knowledge and leadership experience with franchise companies, provide him with the qualifications and skills to serve as a director. |

||||||||||||||||||||

| BOARD MEMBER SINCE | AGE | BOARD COMMITTEES | ||||||||||||||

| 2018 | 52 | None | ||||||||||||||

| Jose Tomás | ||||||||||||||||||||

|

|

Jose Tomás became a member of our Board of Directors in July 2022. Since 2021, Mr. Tomás has served as the Chief Administrative Officer at TelevisaUnivision Inc., the leading Spanish-language media and content company in the world. In this role, he oversees strategic functions essential to TelevisaUnivision’s success, including Human Resources; Corporate Communications; Facilities/Real Estate; Social Impact; Diversity, Equity and Inclusion; and Corporate Safety, Health and Security. Prior to TelevisaUnivision, from 2018 to 2021, he served as co-founder and managing partner of BrandSparc, a global communications, branding and human resources firm. From 2017 to 2018, he was a member of General Motors’ global senior executive leadership |

|||||||||||||||||||

| team where he served as Senior Vice President of Global Human Resources.

Mr. Tomás also served as Executive Vice President and Chief Human Resources Officer at Anthem, Inc. from 2013 to 2017. In this role, he was responsible for Human Resources; Corporate Communications; Diversity, Equity and Inclusion; and Corporate Security.

Previously, Mr. Tomás held senior operations and administrative roles at Burger King Corporation, where he served as both president, Latin America and Caribbean region, and Global Chief People Officer. Mr. Tomás has also held human resources positions with Ryder System Inc., and operations and Human Resources roles at Publix Super Markets.

Mr. Tomás holds a bachelor’s degree in business administration and a master’s in management from Florida International University.

Qualifications: Mr. Tomás’s experience as a leader with large organizations with expertise in operations, people, and culture provide him with the qualifications to be a director. |

||||||||||||||||||||

| BOARD MEMBER SINCE | AGE | BOARD COMMITTEES | ||||||||||||||

| 2022 | 55 | Compensation Nominating and Corporate Governance |

||||||||||||||

| 2023 Proxy Statement |

|

5 |

Class II Directors

The term of the following three Class II directors will expire at the 2025 Annual Meeting.

| Catherine (Cathy) Halligan | ||||||||||||||||||||

|

Catherine (Cathy) Halligan became a member of our Board of Directors in December 2020 and previously served as a member of the board of managers of Driven Investor LLC. Ms. Halligan has served as an advisor to Narvar Inc. (a software provider) since 2013 and Chanel (a fashion company) since 2014. Ms. Halligan served as an Advisor from January to April 2012 and Senior Vice President, Sales & Marketing from July 2010 to December 2011 of PowerReviews Inc. (a leading SaaS software for customer reviews and social commerce) and prior to joining PowerReviews Inc., from 2005 to 2010, she held senior marketing and e-commerce roles at Walmart, including Chief Marketing Officer of Walmart.com from 2007 to 2009 and as Vice President Market Development, | |||||||||||||||||||

| Global eCommerce from 2009 to 2010. Ms. Halligan also serves as a director for Ferguson plc (a North American value-added distributor of infrastructure, plumbing, and HVAC products) where she serves on the Audit, Compensation, and Nominating and Governance Committees, Ulta Beauty Inc. (a retailer of All Things Beauty All In One Place), where she chairs the Compensation Committee and is a member of the Nominating and Governance Committee, and Jeld-Wen Holding, Inc. (a leading global manufacturer of high performance interior and exterior building products) where she serves on the Compensation and Nominating and Governance Committees. She previously served as a director of FLIR Systems Inc. (a producer of thermal imaging cameras, components, and imaging sensors), where she chaired the Compensation Committee and was a member of the Audit Committee from 2014 to 2021. Ms. Halligan received a B.S. from Northern Illinois University.

Qualifications: Ms. Halligan’s extensive board experience and experience in digital transformation, marketing, and retail provide her with the qualifications and skills to serve as a director. |

||||||||||||||||||||

| BOARD MEMBER SINCE | AGE | BOARD COMMITTEES | ||||||||||||||

| 2020 | 59 | Compensation Nominating and Corporate Governance |

||||||||||||||

| Rick Puckett | ||||||||||||||||||||

|

Rick Puckett became a member of our Board of Directors in December 2020 and previously served as a member of the board of managers of Driven Investor LLC. From December 2006 to December 2016, Mr. Puckett was the Executive Vice President, Chief Financial Officer and Chief Administrative Officer of Snyder’s-Lance, Inc. (a snack food products company). Prior to Snyder’s-Lance, Mr. Puckett was Executive Vice President, Chief Financial Officer and Treasurer of United Natural Foods, Inc. (a North American food wholesaler). Mr. Puckett serves as a director, chairman of the Audit Committee, and a member of the Compensation Committee for SPX Corporation (a supplier of highly engineered infrastructure equipment technologies) and as a | |||||||||||||||||||

| director, chairman of the Audit Committee, and a member of the Compensation and Nominating and Corporate Governance Committees of Whitehorse Finance, Inc. (an investment company), positions he has held since May 2016 and December 2012, respectively. Mr. Puckett has served as a member of the Board of Directors for Pet Valu, Inc., (a pet specialty retailer company, since August 2019) where he serves on the Audit Committee. He also served on the Board of Directors for Late July Brands, a privately-held food company, from 2007 through 2010. Mr. Puckett is a Certified Public Accountant, and he received a B.S. in accounting and an M.B.A. from the University of Kentucky.

Qualifications: Mr. Puckett’s experience in leadership roles at his past companies, significant knowledge and understanding of corporate finance and financial reporting, and his expert background as a Certified Public Accountant provide him with the qualifications and skills to serve as a director. |

||||||||||||||||||||

| BOARD MEMBER SINCE | AGE | BOARD COMMITTEES | ||||||||||||||

| 2020 | 69 | Audit | ||||||||||||||

| 6 |

|

2023 Proxy Statement |

| Michael Thompson | ||||||||||||||||||||

|

Michael Thompson became a member of our Board of Directors in December 2020 and previously served as a member of the board of managers of Driven Investor LLC. Mr. Thompson joined Roark in 2010 and currently serves as a Managing Director. Prior to joining Roark, Mr. Thompson worked at Montage Partners (Phoenix-based private equity firm). Before Montage, Mr. Thompson served as a Senior Associate at Kroll Zolfo Copper (a financial advising company). Mr. Thompson received a B.A. from Pomona College and an M.B.A. from the University of Chicago Booth School of Business. Mr. Thompson is a designated director nominee by our Principal Stockholders under the Stockholders Agreement. | |||||||||||||||||||

| Qualifications: Mr. Thompson’s involvement with his respective firms’ investments in various companies, in-depth knowledge, and industry experience, coupled with his skills in private financing and strategic planning, provide him with the qualifications and skills to serve as a director. | ||||||||||||||||||||

| BOARD MEMBER SINCE | AGE | BOARD COMMITTEES | ||||||||||||||

| 2020 | 40 | None | ||||||||||||||

Class III Directors

The term of the following three Class III directors will expire at the Annual Meeting. The Class III Nominees are the only nominees for election at the Annual Meeting, for a term that will expire at the 2026 Annual Meeting of Stockholders or until each of their successors has been duly elected and qualified.

| Chadwick (Chad) Hume | ||||||||||||||||||||

|

Chadwick (Chad) Hume became a member of our Board of Directors in December 2020 and previously served as a member of the board of managers of Driven Investor LLC. Mr. Hume joined Roark in 2009 and currently serves as a Principal. Prior to joining Roark, Mr. Hume worked at Houlihan Lokey (an investment bank) and Bank of America (a financial services company). Mr. Hume received a B.B.A. from the Terry College of Business at the University of Georgia. Mr. Hume is a designated director by our Principal Stockholders under the Stockholders Agreement.

Qualifications: Mr. Hume’s experience with his firm’s investments in branded consumer companies, expertise in corporate strategy and organization, and relevant experience in the industry provide him with the qualifications and skills to serve as a director. |

|||||||||||||||||||

| BOARD MEMBER SINCE | AGE | BOARD COMMITTEES | ||||||||||||||

| 2020 | 36 | None | ||||||||||||||

| 2023 Proxy Statement |

|

7 |

| Karen Stroup | ||||||||||||||||||||

|

Karen Stroup became a member of our Board of Directors in December 2020 and previously served as a member of the board of managers of Driven Investor LLC. Ms. Stroup currently serves as the Chief Digital Officer of WEX, Inc. (a payments technology company), where she leads product management, design, data & analytics, and WEX’s customer and digital transformation. Prior to WEX, Ms. Stroup was the Chief Digital Officer at Thomson Reuters (a multinational media conglomerate) from 2019-2021, where she led Thomson Reuters’s end-to-end transformation to be a global digital company, leveraging data and shared capabilities to improve Net Promoter Score, grow revenue and improve sales and marketing efficiency. Prior to joining Thomson Reuters, Ms. Stroup has also served as Director, Digital BCG Accelerator for The Boston Consulting Group, Chief | |||||||||||||||||||

| Digital Officer at TreeHouse (a home upgrade company) in 2018, as Senior Vice President, The Garage at Capital One Financial Corporation (a bank holding company) from 2016 to 2018, and as Vice President, Product Management at Intuit, Inc. (a financial software company) from 2007 to 2016. Ms. Stroup received a B.B.A. from the University of Notre Dame and an M.B.A. from Dartmouth College.

Qualifications: Ms. Stroup’s experience in leading digital transformations and delivering results leveraging customer-driven innovation provide her with the qualifications and skills to serve as a director. |

||||||||||||||||||||

| BOARD MEMBER SINCE | AGE | BOARD COMMITTEES | ||||||||||||||

| 2020 | 47 | Audit Compensation |

||||||||||||||

| Peter Swinburn | ||||||||||||||||||||

|

Peter Swinburn became a member of our Board of Directors in December 2020 and previously served as a member of the board of managers of Driven Investor LLC. Mr. Swinburn served as the Chief Executive Officer of Molson Coors (a multinational drink and brewing company) from 2008 to 2014.

He currently serves on the boards of Express Inc. (a specialty retail apparel chain) where he is the Chair of the Compensation and Nominating and Governance Committee Mr. Swinburn also sits on the boards of Wales Millennium Centre (an arts center), and The Rise (a housing development company) each, a privately-held |

|||||||||||||||||||

| company. Mr. Swinburn previously served as a director for Cabela’s Inc. (a specialty retailer of outdoor recreation merchandise), from 2015 to 2021, High Level Software Ltd (a software company), and Fuller Smith & Turner (a brewing company). Mr. Swinburn received a B.Sc. from University of Wales, Cardiff.

Qualifications: Mr. Swinburn’s extensive board experience and significant knowledge and understanding of business development, strategic planning, and consumer brand marketing provide him with the qualifications and skills to serve as a director. |

||||||||||||||||||||

| BOARD MEMBER SINCE | AGE | BOARD COMMITTEES | ||||||||||||||

| 2020 | 70 | Audit Nominating and Corporate Governance |

||||||||||||||

| 8 |

|

2023 Proxy Statement |

CORPORATE GOVERNANCE

Information about our Board

The composition of our board of directors is strategically designed to effectively guide our strategy and oversee our operations. We believe that an effective board should be made up of individuals who collectively provide an appropriate balance of diverse occupational and personal backgrounds and perspectives, and who have a range of skills and expertise sufficient to provide guidance and oversight with respect to the Company’s strategy and operations.

Our Board of directors currently has nine members, including five independent members and is divided into three classes, each serving staggered three-year terms of office, in accordance with our Amended and Restated Certificate of Incorporation and our Amended and Restated Bylaws (our “Bylaws”). Each director is to hold office until such director’s term expires, their successor is duly elected and qualified, or until the director’s earlier death, resignation, or removal.

Selection of Nominees for our Board of Directors

The evaluation and selection of qualified director nominees is a key aspect of the Nominating and Corporate Governance Committee’s (the “NCGC”) regular evaluation of the composition of, and criteria for membership on, the Board. The NCGC also recommends to our Board of Directors for approval director nominees consistent with such director qualification criteria, applicable law, and the requirements of the Nasdaq Stock Market (“Nasdaq”), and any obligations under our contractual arrangements, including the Stockholders Agreement.

With respect to director nominee procedures, the NCGC utilizes a broad approach for identification of director nominees and may seek recommendations from our directors, officers, or stockholders, or it may choose to engage a search firm. The NCGC actively seeks to achieve a diversity of professional and personal backgrounds on our board. Additionally, the NCGC selects potential candidates based on their independence, demonstrated leadership ability, and ability to exercise sound judgment. It also takes into account the backgrounds and qualifications of the Board of Directors as a group to provide a significant breadth of experience, knowledge, and abilities that will assist the Board of Directors in fulfilling its responsibilities. Ultimately, the NCGC seeks to recommend to our Board of Directors only those nominees whose specific qualities, experience, and expertise will augment the skills, experiences and qualities on our Board of Directors and whose past experience evidences that they will: (1) dedicate sufficient time, energy, and attention to support the diligent performance of Board of Directors’ duties; (2) comply with the duties and responsibilities of directors set forth in our Bylaws; (3) comply with all duties of care, loyalty, and confidentiality applicable to them as directors; and (4) adhere to our Code of Conduct and Ethics, including, but not limited to, the policies on conflicts of interest expressed therein.

In connection with our IPO, we entered into the Stockholders Agreement (the “Stockholders Agreement”) with the Principal Stockholders, each of which is a related entity of Roark Capital Management, LLC. The Stockholders Agreement provides our Principal Stockholders the right to nominate to our Board of Directors a number of designees equal to: (i) a majority of the total number of directors comprising our Board of Directors at such time as long as affiliates of our Principal Stockholders beneficially own at least 50% of the shares of our common stock outstanding and entitled to vote generally in the election of our directors; (ii) 40% of the total number of directors comprising our Board of Directors at such time as long as affiliates of our Principal Stockholders beneficially own at least 40% but less than 50% of the shares of our common stock outstanding and entitled to vote generally in the election of our directors; (iii) 30% of the total number of directors comprising our Board of Directors at such time as long as affiliates of our Principal Stockholders beneficially own at least 30% but less than 40% of the shares of our common stock outstanding and entitled to vote generally in the election of our directors; (iv) 20% of the total number of directors comprising our Board of Directors at such time as long as affiliates of our Principal Stockholders beneficially own at least 20% but less than 30% of the shares of our common stock outstanding and entitled to vote generally in the election of our directors; and (v) 10% of the total number of directors comprising our Board of Directors at such time as long as affiliates of our Principal Stockholders beneficially own at least 5% but less than 20% of the shares of our common stock outstanding and entitled to vote generally in the election of our directors. Pursuant to the Stockholders Agreement, the Principal

| 2023 Proxy Statement |

|

9 |

Stockholders currently have the ability to designate up to five director nominees and have a consent right over changes to the current size of our Board of Directors. Consistent with these rights, the Principal Stockholders have designated Chadwick Hume as a Class III director nominee, and have previously designated Neal Aronson, a Class I director, and Michael Thompson, a Class II director, as director nominees.

Other than designees nominated pursuant to the Stockholders Agreement described above, the NCGC considers stockholder recommendations of qualified nominees that are submitted in accordance with the procedures described in our Bylaws. Each notice of nomination submitted in this manner must contain the information specified in our Bylaws, including, but not limited to, information with respect to the beneficial ownership of our common stock and any agreement, arrangement, or understanding with respect to the nomination or similar agreement the proposing stockholder has entered into with respect to our common stock. To be timely, a stockholder’s notice shall be delivered to our Secretary at our principal executive offices not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting; provided, however, that in the event that the date of the annual meeting is advanced by more than 30 days, or delayed by more than 70 days, from the anniversary date of the previous year’s meeting, or if no annual meeting was held in the preceding year, then stockholders must provide notice within the time periods specified in our Bylaws. See our Bylaws for additional information regarding stockholder director nominees. Other than the Company’s contractual obligations under the Stockholders Agreement, mentioned above, the NCGC does not have a policy with regard to the consideration of any director candidates recommended by stockholders because the committee considers candidates proposed by stockholders and evaluates them using the same criteria as for other candidates.

Our Board’s Leadership Structure

Our board regularly reviews its leadership structure to confirm that it remains appropriate for the Company as the business grows and the environment in which we operate evolves. As of the date hereof, Mr. Fitzpatrick serves as our Chief Executive Officer and Mr. Aronson serves as our Chairman of the Board of Directors. Our Board of Directors believes that this leadership structure, separating the Chairman and Chief Executive Officer roles, is appropriate for the Company at this time, since it allows Mr. Fitzpatrick to focus on the day-to-day operation of the business, operational leadership, and strategic direction of the Company. At the same time, Mr. Aronson can focus on leadership of the Board of Directors, including calling and presiding over Board meetings, preparing meeting agendas in collaboration with the Chief Executive Officer, and serving as a liaison and supplemental channel of communication between the Board of Directors and the Chief Executive Officer.

Executive Sessions of our Board of Directors

Executive sessions, which are meetings of the non-management members of the Board, are regularly scheduled. In addition, at least once a year, the independent directors are afforded the opportunity to meet in a private session that excludes management and non-independent directors. At each of these meetings, the non-management and independent directors in attendance, as applicable, will determine which member will preside at such session. Committees of the Board also meet periodically in executive session.

Director Independence

As our Principal Stockholders control more than 50% of our combined voting power, we are considered a controlled company under Nasdaq and the Securities and Exchange Commission (“SEC”) rules. Under the applicable rules and regulations of the SEC and Nasdaq, we are not required to have a majority of independent directors, as such term is defined by the applicable rules and regulations of Nasdaq. Nevertheless, currently five of our nine directors are independent. Our independent directors are Mses. Halligan and Stroup and Messrs. Puckett, Swinburn, and Tomás.

Each of our committees is chaired by, and composed solely of, independent directors. Mr. Puckett is the Chair of the Audit Committee, Ms. Halligan is the Chair of the Compensation Committee, and Mr. Swinburn is the Chair of the NCGC.

| 10 |

|

2023 Proxy Statement |

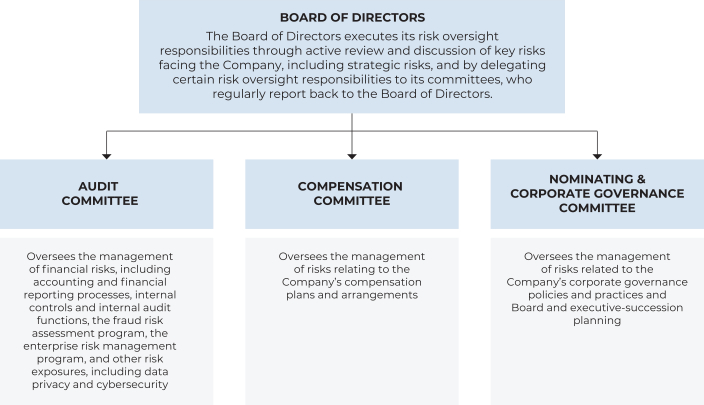

Our Board’s Oversight of Risk

Risk oversight is a critical aspect of the Company meeting its strategic objectives.

Our Board and its Committees

The committees of our Board of Directors are the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. The Board may also establish other committees in the future as it deems necessary. In the past, but not currently, we have availed ourselves of the controlled company exception under the Nasdaq rules, which exempts us from certain requirements, including the requirements that we have a majority of independent directors on our Board of Directors and that we have a compensation committee and a nominating and corporate governance committee composed entirely of independent directors. We are, however, currently subject to the requirement that we have an audit committee composed entirely of independent members.

If at any time we cease to be a controlled company under the Nasdaq rules, to the extent the Company and its Board are not already compliant with the Nasdaq rules, they will take all action necessary to comply with the applicable rules, including appointing a majority of independent directors to the Board of Directors and establishing certain committees composed entirely of independent directors, subject to a permitted phase-in period.

Committees of our Board of Directors

Our Board of Directors adopted written charters for each of its standing committees, all of which are available in the Governance—Documents & Charters section of our website at https://investors.drivenbrands.com. Committee members and committee chairs are appointed by the Board of Directors. Pursuant to the Stockholders Agreement, the Principal Stockholders have the right to designate members to each committee of our Board of Directors in proportion to their representation on the Board of Directors, except where prohibited by applicable laws or stock exchange regulations, in which case our Principal Stockholders are entitled to appoint observer members of any such restricted committee. Presently, directors designated by the Principal Stockholders do not serve on any committees of the Board.

| 2023 Proxy Statement |

|

11 |

Audit Committee

Our Audit Committee consists of Rick Puckett, Karen Stroup, and Peter Swinburn, each of whom qualifies as an “independent director.” Our Board of Directors determined that Rick Puckett qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K and that all Audit Committee members are independent as independence is defined in Rule 10A-3 of the Exchange Act and under the Nasdaq listing standards. The principal duties and responsibilities of our Audit Committee are as follows:

| • | to prepare the annual audit committee report to be included in our annual proxy statement; |

| • | to oversee and monitor our financial reporting process; |

| • | to oversee and monitor the integrity of our financial statements and internal control system; |

| • | to appoint, oversee and review the retention, performance, and compensation of our independent registered public accounting firm; |

| • | to oversee the independence of our independent registered public accounting firm; |

| • | to oversee and monitor the performance, appointment, and retention of our senior internal audit staff person; |

| • | to discuss, oversee, and monitor policies with respect to risk assessment and risk management; |

| • | to oversee and monitor our compliance with legal and regulatory matters; and |

| • | to provide regular reports to the Board of Directors. |

The Audit Committee also has the authority to retain counsel and advisors to fulfill its responsibilities and duties and to form and delegate authority to subcommittees.

Compensation Committee

Our Compensation Committee consists of Cathy Halligan, Karen Stroup, and Jose Tomás. The principal duties and responsibilities of the Compensation Committee are as follows:

| • | to review our compensation policies and programs; |

| • | to review and make recommendations to the Board of Directors regarding the corporate goals and objectives relevant to the compensation of the Company’s chief executive officer on an annual basis; |

| • | to review and approve the corporate goals and objectives relevant to the compensation of the Company’s executive officers, other than chief executive officer, on an annual basis; |

| • | to review and approve our incentive compensation plans, equity-based compensation plans, and retirement plans; |

| • | to administer incentive compensation and equity-related plans; and |

| • | to prepare an annual compensation committee report and take such other actions as are necessary and consistent with the governing law and our organizational documents. |

The Compensation Committee has the authority to retain or terminate, at its sole discretion, compensation consultants, independent legal counsel, or other advisors to assist the Compensation Committee in its responsibilities, such as a compensation consultant to assist in the evaluation of employee compensation, and to approve the consultant’s fees and the other terms and conditions of the consultant’s retention. The Compensation Committee may form and delegate authority to subcommittees as it sees fit, provided that the subcommittees are composed entirely of directors who satisfy the applicable independence requirement of the Nasdaq listing rules, subject to any applicable controlled company or other exemption.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Cathy Halligan, Peter Swinburn, and Jose Tomás. The principal duties and responsibilities of the Nominating and Corporate Governance Committee are as follows:

| • | to identify candidates qualified to become directors of the Company, consistent with criteria approved by our Board of Directors; |

| • | to recommend to our Board of Directors nominees for election as directors at the next annual meeting of stockholders or a special meeting of stockholders at which directors are to be elected, as well as to recommend directors to serve on the other committees of the board; |

| 12 |

|

2023 Proxy Statement |

| • | to recommend to our Board of Directors candidates to fill vacancies and newly created directorships on the Board of Directors; |

| • | to identify best practices and recommend corporate governance principles, including giving proper attention and making effective responses to stockholder concerns regarding corporate governance; |

| • | to develop and recommend to our Board of Directors guidelines setting forth corporate governance principles applicable to the Company; |

| • | to recommend to our Board of Directors the compensation of non-executive directors for their service to the Board; |

| • | to develop and recommend to our Board of Directors a succession plan for the chief executive officer and other executive officers as deemed necessary from time to time; and |

| • | to oversee the annual evaluation of our Board of Directors and its committees. |

Board and Committee Meetings and Attendance

During fiscal year 2022, our Board of Directors held five meetings. All of our directors attended at least 80% of all meetings of our Board of Directors and 80% of the meetings of the committees on which they serve that were held during the period that the director served on the Board and committee. All of our directors then serving attended the annual meeting held in 2022. All of our directors are expected to attend the upcoming Annual Meeting.

Hedging and Pledging Policy

The Company’s Securities Trading Policy prohibits our directors, officers, and other employees, and their designees, from purchasing any financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds) or otherwise engaging in transactions that are designed to or have the effect of hedging or offsetting any decrease in the market value of the Company’s equity securities.

Additionally, the Board of Directors, generally in its discretion, prohibits its directors, officers, employees, and their household and immediate family from engaging in transactions regarding purchasing, or pledging, the Company’s stock on margin, short sales, buying or selling puts, calls, options, or other derivatives in respect of securities of the Company.

Communicating with our Board of Directors

Any stockholder or other interested party may contact our Board of Directors as a group, our independent directors as a group, or any individual director by sending written correspondence to them in care of our Secretary and General Counsel at our principal executive offices at 440 S. Church Street, Suite 700, Charlotte, NC 28202. All communications are reviewed by the Secretary and General Counsel and provided to the members of our Board of Directors as appropriate. Unsolicited items, sales materials, abusive, threatening, or otherwise inappropriate materials, and other routine items and items unrelated to the duties and responsibilities of our Board of Directors will not be provided to directors.

Code of Conduct and Ethics

Our Board of Directors adopted a Code of Conduct and Ethics that applies to all of our directors, officers, and employees and is intended to comply with the relevant listing requirements for a code of conduct as well as qualify as a “code of ethics” as defined by SEC rules. The Code of Conduct and Ethics contains general guidelines for conducting our business consistent with the highest standards of business ethics. Our Code of Conduct and Ethics is supported by underlying policies. The Code of Conduct and Ethics is available under the Governance—Documents & Charters section of our website at https://investors.drivenbrands.com.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee was, at any time during fiscal year 2022 or at any other time, an officer or employee of the Company. None of our executive officers serves, or in the past has served, as a member of the Board of Directors or compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of our Board of Directors or our compensation committee.

| 2023 Proxy Statement |

|

13 |

Director Compensation

The following table sets forth information concerning the compensation earned by our non-employee directors during the fiscal year ended December 31, 2022.

| Name | Cash Payments ($) |

Stock Awards(1) ($) |

Total ($) | |||||||

| Neal Aronson(2) |

— | — | — | |||||||

| Cathy Halligan |

98,000 | 115,001 | 213,001 | |||||||

| Chad Hume(2) |

— | — | — | |||||||

| Rick Puckett |

100,000 | 115,001 | 215,001 | |||||||

| Karen Stroup |

89,000 | 115,001 | 204,001 | |||||||

| Peter Swinburn |

100,000 | 115,001 | 215,001 | |||||||

| Michael Thompson(2) |

— | — | — | |||||||

| Jose Tomás(3) |

44,500 | 115,008 | 159,508 | |||||||

(1) Amounts set forth in the Stock Awards column for fiscal year 2022 represent the fair value of restricted stock units (“RSUs”) granted to certain of our non-employee directors in 2022.

(2) Directors who are affiliated with Roark do not receive any compensation in connection with their service as directors.

(3) Mr. Tomás was elected to the Board on July 11, 2022.

The following table shows the number of RSUs outstanding and the total number of stock options outstanding for each non-employee director as of December 31, 2022:

| Name |

Number of Outstanding Restricted Stock Units |

Number of Outstanding Stock Options |

||||||

| Cathy Halligan |

4,242 | — | ||||||

| Rick Puckett |

4,242 | 23,629 | ||||||

| Karen Stroup |

4,242 | — | ||||||

| Peter Swinburn |

4,242 | 23,629 | ||||||

| Jose Tomás |

3,812 | — | ||||||

| 14 |

|

2023 Proxy Statement |

Our Board of Directors has approved and implemented the following director compensation program, which includes the following for each of our non-employee directors. The following table sets forth the cash component of our non-employee director compensation policy:

| Recipient(s) |

Annual Cash Compensation ($) | |||

| Non-employee directors |

75,000 | |||

| Audit Committee chair |

25,000 | |||

| Audit Committee members (excluding chair) |

10,000 | |||

| Compensation Committee chair |

20,000 | |||

| Compensation Committee members (excluding chair) |

8,000 | |||

| Nominating and Corporate Governance committee chair |

15,000 | |||

| Nominating and Corporate Governance committee members (excluding chair) |

6,000 | |||

In addition to the annual cash retainers set forth above, each of our non-employee directors receives an annual equity award of RSUs. In 2022, the grant date fair value of the RSU grant was approximately $115,000 and in 2023, the grant date fair value of the RSU grant was approximately $145,000. Annual RSU unit awards to our non-employee directors generally vest on the first anniversary of the date of grant, subject to such director’s continued service through such date.

| 2023 Proxy Statement |

|

15 |

CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS

Other than compensation arrangements with our named executive officers (“NEOs”) and directors, we describe below each transaction or series of similar transactions, since December 26, 2021 to which we were a party or will be a participant, in which:

| • | the amounts involved exceeded or will exceed $120,000; and |

| • | any of our directors (or director nominees), executive officers, beneficial owners of more than 5% of the Company stock, any immediate family member of the foregoing, and any entity in which any of the foregoing persons is employed, or is a partner or principal or in which that person has a 10% or greater beneficial ownership interest) had, has, or will have a direct or indirect material interest. |

Compensation arrangements with our NEOs and directors are described in the sections entitled “Executive Compensation” and “Corporate Governance—Director Compensation,” respectively.

Policies and Procedures for Related Person Transactions

We have adopted a written Related Person Transaction Policy (the “RPT Policy”), which sets forth our policy with respect to the review, approval, ratification, and disclosure of all related person transactions by our Audit Committee. In accordance with the RPT Policy, our Audit Committee has overall responsibility for implementation of and compliance with the RPT Policy.

For purposes of the RPT Policy, a “related person transaction” is a transaction, arrangement, or relationship (or any series of similar transactions, arrangements, or relationships) in which we were, are, or will be a participant and the amount involved exceeded, exceeds, or will exceed $120,000 and in which any related person (as defined in the policy) had, has, or will have a direct or indirect material interest. A “related person transaction” does not include any employment relationship or transaction involving an executive officer and any related compensation resulting solely from that employment relationship that has been reviewed and approved by our Board of Directors or Audit Committee.

The RPT Policy requires that notice of a proposed related person transaction be provided to our Legal Department prior to entering into such transaction. If our Legal Department determines that such transaction is a related person transaction, the proposed transaction will be submitted to our Audit Committee for consideration. Under the RPT Policy, our Audit Committee will be permitted to approve only those related person transactions that are in, or not inconsistent with, our best interests and the best interests of our stockholders. In the event we become aware of a related person transaction that has not been previously reviewed, approved, or ratified under the RPT Policy and that is ongoing or is completed, the transaction will be submitted to our Audit Committee so that it may determine whether to ratify, rescind, or terminate the related person transaction.

The RPT Policy also provides that our Audit Committee will review certain previously approved or ratified related person transactions that are ongoing to determine whether the related person transaction remains in our best interests and the best interests of our stockholders. Additionally, we will make periodic inquiries of directors and executive officers with respect to any potential related person transaction of which they may be a party or of which they may be aware.

Related Person Transactions

Stockholders Agreement

In connection with our IPO, on January 15, 2021, we entered into a Stockholders Agreement with the Principal Stockholders, which, as further described below, contains certain rights for the Principal Stockholders.

| 16 |

|

2023 Proxy Statement |

Consent Rights

For so long as the Principal Stockholder Entities collectively beneficially own at least 25% of our common stock, the Principal Stockholders will have approval rights over the following actions:

| • | entering into or effecting a Change in Control (as defined in the Stockholders Agreement); |

| • | entering into any agreement providing for the acquisition or divestiture of assets or equity security of any Person (as defined in the Stockholders Agreement), in each case providing for aggregate consideration in excess of $50 million; |

| • | entering into any joint venture or similar business alliance having a fair market value as of the date of formation thereof (as reasonably determined by the Board of Directors) in excess of $50 million; |

| • | initiating a voluntary liquidation, dissolution, receivership, bankruptcy, or other insolvency proceeding involving the Company or any Subsidiary (as defined in the Stockholders Agreement) of the Company that is a “significant subsidiary” as defined in Rule 1-02 of Regulation S-X under the Exchange Act; |

| • | any material change in the nature of the business of the Company or any Subsidiary, taken as a whole; |

| • | any redemption, acquisition, or other purchase of any shares of common stock (a “Repurchase”) other than Repurchases in accordance with any existing compensation plan of the Company or any Subsidiary or a Repurchase from an employee in connection with such employee’s termination of employment with the Company or any Subsidiary; |

| • | any payment or declaration of any dividend or other distribution on any shares of common stock or entering into any recapitalization transaction, the primary purpose of which is to pay a dividend; |

| • | the incurrence of indebtedness for borrowed money (including through capital leases, the issuance of debt securities, or the guarantee of indebtedness of another Person) in an aggregate principal amount in excess of $50 million, other than (x) the incurrence of trade payables arising in the ordinary course of business of the Company and its Subsidiaries or (y) borrowings under the Company’s variable funding notes (or amendments, extensions, or replacements thereof); |

| • | terminating the employment of the Chief Executive Officer of the Company or hiring a new Chief Executive Officer of the Company; |

| • | increasing or decreasing the size of the Board of Directors; and |

| • | any transaction with or involving any Affiliate (as defined in the Stockholders Agreement) of the Company or any Affiliate of any stockholder of the Company that beneficially owns in excess of 10% of the voting power of the Company (in each case, other than any Principal Stockholder Entity), other than any transaction or series of related transactions in the ordinary course of business and on arms-length third-party terms and in an amount less than $5 million. |

Composition of our Board of Directors

Under the Stockholders Agreement, the Principal Stockholders have the right to designate as nominees a certain percentage of director nominees for election to our Board of Directors based on their beneficial ownership. See the “Corporate Governance—Information about our Board” section of this Proxy Statement for additional information.

Registration Rights Agreement

In connection with the completion of the IPO, we entered into a registration rights agreement with Driven Equity LLC and RC IV Cayman ICW Holdings LLC on January 20, 2021. On December 29, 2021, we entered into joinder agreements to the registration rights agreement with Driven Equity Sub LLC and RC IV Cayman ICW Holdings Sub LLC. Consequently, these entities became transferees of registrable securities under the registration rights agreement.

The registration rights agreement granted our Principal Stockholders and certain of their affiliates the right to cause us to register shares of our common stock held by it under the Securities Act of 1933, as amended (the “Securities Act”) and, if requested, to use our reasonable best efforts (if we are not eligible to use an automatic shelf registration statement at the time of filing) to maintain a shelf registration statement effective with respect to such shares. Certain affiliates of our Principal Stockholders are also entitled to participate on a pro rata basis in any registration of our

| 2023 Proxy Statement |

|

17 |

common stock under the Securities Act that we may undertake. The registration rights agreement also provides that we will pay certain expenses relating to such registrations and indemnify certain affiliates of our Principal Stockholders and members of management participating in any offering against certain liabilities which may arise under the Securities Act, the Exchange Act, any state securities law, or any rule or regulation thereunder applicable to us.

Income Tax Receivable Agreement

We entered into an income tax receivable agreement on January 16, 2021 pursuant to which certain current and prior stockholders, including our Principal Stockholders, and our senior management team, have the right to receive payment by us of 85% of the amount of cash savings, if any, in U.S. and Canadian federal, state, local, and provincial income tax that we and our subsidiaries actually realize (or are deemed to realize in the case of a change of control and certain subsidiary dispositions, as discussed below) as a result of the realization of Pre-IPO and IPO-Related Tax Benefits. The “Pre-IPO and IPO-Related Tax Benefits,” include: (i) all depreciation and amortization deductions, and any offset to taxable income and gain or increase to taxable loss, resulting from the tax basis that we have in our and our subsidiaries’ intangible assets, (ii) the utilization of certain of our and our subsidiaries’ U.S. federal and Canadian federal and provincial net operating losses, non-capital losses, disallowed interest expense carryforwards, and tax credits, if any, attributable to periods prior to the IPO, (iii) deductions in respect of debt issuance costs associated with certain of our and our subsidiaries’ financing arrangements, and (iv) deductions in respect of our and our subsidiaries’ offering-related expenses.

For purposes of the income tax receivable agreement, cash savings in income tax will be computed by reference to the reduction in the liability for income taxes resulting from the Pre-IPO and IPO-Related Tax Benefits. The term of the income tax receivable agreement commenced upon consummation of IPO and will continue until all relevant Pre-IPO and IPO-Related Tax Benefits have been utilized, accelerated, or expired.

Our counterparties under the income tax receivable agreement will not reimburse us for any payments previously made if such Pre-IPO and IPO-Related Tax Benefits are subsequently disallowed (although future payments would be adjusted to the extent possible to reflect the result of such disallowance). As a result, in such circumstances we could make payments under the income tax receivable agreement that are greater than our and our subsidiaries’ actual cash tax savings.

While the actual amount and timing of any payments under the income tax receivable agreement will vary depending upon a number of factors, including the amount and timing of the taxable income we and our subsidiaries generate in the future, and our and our subsidiaries’ use of the Pre-IPO and IPO-Related Tax Benefits, we expect that during the term of the income tax receivable agreement, the payments that we may make could be material. Assuming no material changes in the relevant tax law and that we and our subsidiaries earn sufficient taxable income to realize the full Pre-IPO and IPO-Related Tax Benefits, we would expect that future payments under the income tax receivable agreement will aggregate to approximately $160 million to $180 million.

Any future changes in the realizability of the Pre-IPO and IPO-Related Tax Benefits will impact the amount that will be paid under the income tax receivable agreement to our existing stockholders. Based on our current taxable income estimates, we expect to pay the majority of this obligation by the end of our 2025 fiscal year. We expect to pay between $160 million and $180 million in cash related to the income tax receivable agreement, based on our current taxable income estimates. We plan to use cash flow from operations and availability under our debt facilities to fund this obligation.

If we undergo a change of control, payments under the income tax receivable agreement for each taxable year after such event would be based on certain valuation assumptions, including the assumption that we and our subsidiaries have sufficient taxable income to fully utilize the Pre-IPO and IPO-Related Tax Benefits. Additionally, if we sell or otherwise dispose of any of our subsidiaries in a transaction that is not a change of control, we will be required to make a payment equal to the present value of future payments under the income tax receivable agreement attributable to the Pre-IPO and IPO-Related Tax Benefits of such subsidiary that is sold or disposed of, applying the assumptions described above.

The income tax receivable agreement provides that in the event that we breach any of our material obligations under it, whether as a result of our failure to make any payment when due (subject to a specified cure period), failure to honor any other material obligation under it or by operation of law as a result of the rejection of it in a case

| 18 |

|

2023 Proxy Statement |

commenced under the United States Bankruptcy Code or otherwise, then all our payment and other obligations under the income tax receivable agreement will be accelerated and will become due and payable and we will be required to make a payment equal to the present value of future payments under the income tax receivable agreement, applying the same assumptions described above. Such payments could be substantial and could exceed our and our subsidiaries’ actual cash tax savings from the Pre-IPO and IPO-Related Tax Benefits.

Because we are a holding company with no operations of our own, our ability to make payments under the income tax receivable agreement is dependent on the ability of our subsidiaries to make distributions to us. Our debt agreements may restrict the ability of our subsidiaries to make distributions to us, which could affect our ability to make payments under the income tax receivable agreement. To the extent that we are unable to make payments under the income tax receivable agreement because of restrictions under our outstanding indebtedness, such payments will be deferred and will generally accrue interest at a rate of the London Interbank Offering Rate (“LIBOR”) plus 1.00% per annum until paid. To the extent that we are unable to make payments under the income tax receivable agreement for any other reason, such payments will generally accrue interest at a rate of LIBOR plus 5.00% per annum until paid.

Divisions Maintenance Group

Following the completion of a bidding process, we entered into an agreement and have made payments for facilities maintenance services in the aggregate amount of approximately $6.0 million during the year ended December 31, 2022 to Divisions Maintenance Group, an entity owned by affiliates of Roark Capital Management, LLC, which is related to our Principal Stockholders. The agreement was reviewed and approved by the Audit Committee of the Company’s Board of Directors in accordance with our Related Person Transactions Policy.

| 2023 Proxy Statement |

|

19 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common stock as of March 15, 2023 unless otherwise noted below for the following:

| • | each person, or group of affiliated persons, who we know to beneficially own more than 5% of our common stock; |

| • | each of our NEOs; |

| • | each of our directors and director nominees; and |

| • | all of our executive officers, directors, and director nominees as a group. |

The percentage of ownership is based on 167,440,413 shares of common stock outstanding as of March 15, 2023.

Beneficial ownership is determined in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to such securities or have the right to acquire such powers within 60 days. Except as otherwise indicated, all persons listed below have sole voting and investment power with respect to the shares beneficially owned by them, subject to applicable community property laws.

|

|

Shares Beneficially Owned Membership | |||||||

|

|

Number | Percent | ||||||

| 5% Stockholders |

|

|

|

|

|

| ||

| Roark Entities(1) |

101,591,523 | 60.7 | % | |||||

| NEOs and Directors |

|

|

|

|

|

| ||

| Jonathan Fitzpatrick(2) |

2,457,352 | 1.5 | % | |||||

| Tiffany Mason(3) |

243,668 | * | ||||||

| Daniel Rivera(4) |

535,550 | * | ||||||

| Michael Macaluso(5) |

365,827 | * | ||||||

| Scott O’Melia(6) |

139,640 | * | ||||||

| Neal Aronson(1) |

— | — | ||||||

| Michael Thompson |

— | — | ||||||

| Chad Hume |

— | — | ||||||

| Cathy Halligan(7) |

12,398 | * | ||||||

| Rick Puckett(8) |

156,485 | * | ||||||

| Karen Stroup(9) |

14,998 | * | ||||||

| Peter Swinburn(10) |

223,317 | * | ||||||

| Jose Tomás(11) |

— | * | ||||||

| All directors and executive officers as a group (17 persons)(11) |

4,334,328 | 2.6 | % | |||||

* Represents less than 1%.

(1) Information regarding the beneficial ownership of the Principal Stockholders is based on the Schedule 13G/A filed with the SEC on January 27, 2023. Driven Equity Sub LLC directly owns 39,297,463 shares of common stock. Driven Equity LLC directly owns 29,535,108 shares of common stock. RC IV Cayman ICW Holdings Sub LLC directly owns 18,702,537 shares of common stock. RC IV Cayman ICW Holdings LLC directly owns 14,056,415 shares of common stock.

Driven Equity Sub LLC is controlled by Driven Equity LLC. Driven Equity LLC, a Delaware limited liability company, is controlled by RC Driven Holdco LLC, a Georgia limited liability company. RC Driven Holdco LLC is controlled by Roark Capital Partners III AIV LP, a Delaware limited partnership,

| 20 |

|

2023 Proxy Statement |

which is in turn controlled by its general partner, Roark Capital GenPar III LLC, a Delaware limited liability company. Roark Capital GenPar III LLC is controlled by its managing member, Neal K. Aronson. Each of RC Driven Holdco LLC, Roark Capital Partners III AIV LP, Roark Capital GenPar III LLC, and Mr. Aronson may be deemed to have voting and dispositive power with respect to the common stock directly owned by Driven Equity LLC and Driven Equity Sub LLC and therefore be deemed to be the beneficial owner of the common stock held by these entities, but each disclaim beneficial ownership of such common stock.

RC IV Cayman ICW Holdings Sub LLC is controlled by RC IV Cayman ICW Holdings LLC. RC IV Cayman ICW Holdings LLC, a Cayman Islands limited liability company, is controlled by RC IV Cayman ICW Equity LLC, a Cayman Islands limited liability company. RC IV Cayman ICW Equity LLC is controlled by Roark Capital Partners IV Cayman AIV LP, a Cayman Islands limited partnership, which is in turn controlled by its general partner, Roark Capital GenPar IV Cayman AIV LP, a Cayman Islands limited partnership. Roark Capital GenPar IV Cayman AIV LP is controlled by its general partner, Roark Capital GenPar IV Cayman AIV Ltd., an exempted company incorporated in the Cayman Islands with limited liability. Each of RC IV Cayman ICW Equity LLC, Roark Capital Partners IV Cayman AIV LP, Roark Capital GenPar IV Cayman AIV LP, and Roark Capital GenPar IV Cayman AIV Ltd. may be deemed to have voting and dispositive power with respect to the common stock directly owned by RC IV Cayman ICW Holdings Sub LLC and RC IV Cayman ICW Holdings LLC and therefore be deemed to be the beneficial owner of the common stock held by these entities, but each disclaim beneficial ownership of such common stock.

The Principal Stockholders are a “group” for purposes of Section 13(d) of the Exchange Act and each of the Principal Stockholders may be deemed to beneficially own the shares of common stock held by the other Principal Stockholder. The principal business address of each of the entities and persons identified in this paragraph is c/o Roark Capital Management, LLC, 1180 Peachtree Street, Suite 2500, Atlanta, GA, 30309.

(2) Includes vested options to purchase 250,017 shares of common stock.

(3) Includes vested options to purchase 67,497 shares of common stock.

(4) Includes vested options to purchase 44,958 shares of common stock.

(5) Includes options to purchase 52,583 shares of common stock that are vested and exercisable or will become vested and exercisable within 60 days.

(6) Includes options to purchase 56,128 shares of common stock that are vested and exercisable or will become vested and exercisable within 60 days.

(7) Includes vested options to purchase 6,061 shares of common stock.

(8) Includes vested options to purchase 11,508 shares of common stock.

(9) Includes vested options to purchase 6,061 shares of common stock.

(10) Includes vested options to purchase 10,456 shares of common stock.

(11) Includes options to purchase 469,145 shares of common stock that are vested and exercisable or will become vested and exercisable within 60 days.

Equity Compensation Plan Information

| Plan category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

|||||||||

| (a) | (b) | (c) | ||||||||||

| Equity Compensation plans approved by security holders(1) |

7,784,070 | (2) | $ | 24.47 | 6,284,852 | (3) | ||||||

| Equity compensation plans not approved by security holders |

— | — | — | |||||||||

| Total |

7,784,070 | $ | 24.47 | 6,284,852 | ||||||||

(1) The following plans have been approved by our stockholders and are currently in effect: the Omnibus Incentive Plan and the Employee Stock Purchase Plan.

(2) Reflects performance-based awards assuming target performance.

(3) Reflects 4,749,914 shares available under the Omnibus Incentive Plan and 1,534,938 shares available under the Employee Stock Purchase Plan.

| 2023 Proxy Statement |

|

21 |

HUMAN CAPITAL MANAGEMENT

Our Workforce

As of December 31, 2022, we employed approximately 11,000 full-time employees, including approximately 9,200 employees at company-operated locations. Our team members are a key competitive advantage that is critical to the delivery of our strategic growth plans and exceptional business results that benefit our stockholders. We have built a culture that values openness, results, and boldness, where our team members are encouraged to take calculated risks, overcome challenges others may shy away from, and achieve great things.

Importantly, we believe that cultivating an inclusive, equitable, and diverse environment is not only the right thing to do, but it makes our business stronger. By embracing and leveraging our diverse backgrounds, skills, and perspectives, we foster greater innovation and deliver a superior experience for the communities that we serve.

Our human capital resources objectives include, as applicable, identifying, recruiting, retaining, incentivizing, and integrating our existing and prospective employees. The principal purposes of our incentive plans are to attract, retain, and motivate our employees, executive officers, and directors through the granting of stock-based compensation awards and cash-based performance bonus awards. We strive for exceptional performance and results, which is why meritocracy is one of our core values.

Succession Planning

The NCGC periodically reviews the Company’s CEO succession plan, including the identification of any qualified internal candidates along with the process by which the Company would identify external candidates. The NCGC reports on succession planning to the Board at least annually.

| 22 |

|

2023 Proxy Statement |

PROPOSAL TWO: ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

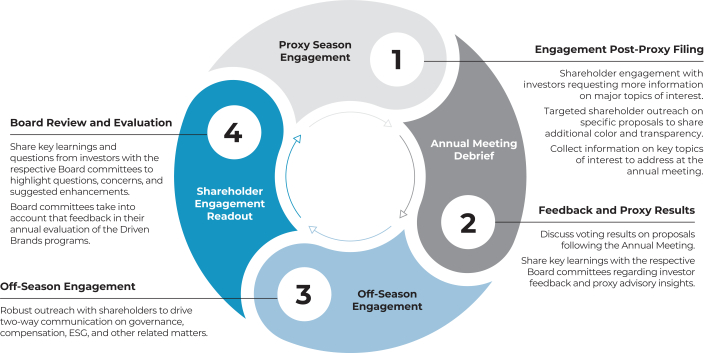

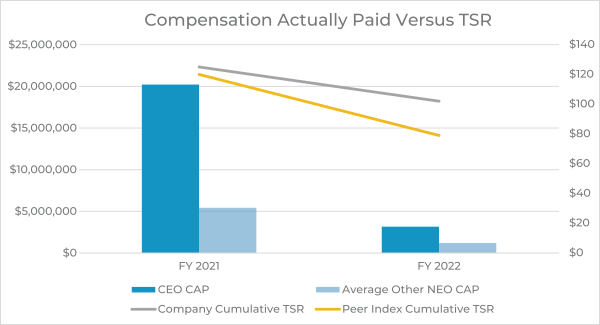

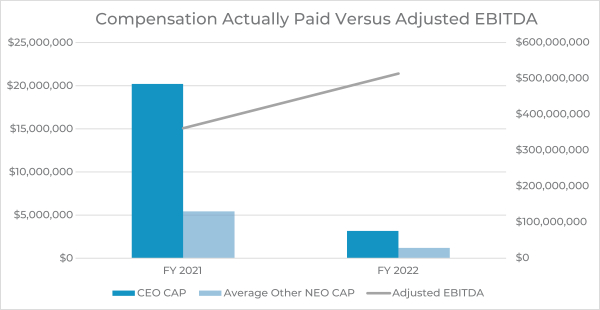

In accordance with Section 14A of the Exchange Act and the related rules of the SEC and as a matter of good corporate governance, the below resolution will be presented at the Annual Meeting asking our stockholders to approve, on an advisory basis, the compensation of the Company’s NEOs as disclosed in the Compensation Discussion and Analysis (“CD&A”), the Summary Compensation Table, and the related compensation tables, notes, and narrative in the Proxy Statement for the Company’s Annual Meeting.

As set forth in the CD&A below, the Company has designed its compensation programs to: (i) align executives’ pay with the Company’s performance and focus on producing sustainable long-term growth, (ii) attract and retain executives with the experience necessary to achieve our business goals, and (iii) align executives’ interests with those of our stockholders and to encourage the creation of long-term value. Although the vote to approve executive compensation is purely advisory and non-binding, the Compensation Committee and Board of Directors values the opinions of our stockholders and will consider the results of the vote in determining the compensation of the NEOs and the Company’s compensation programs generally. The vote is not intended to address any specific item of compensation but rather the overall compensation of our NEOs and the policies and practices described in this Proxy Statement.

Accordingly, we are asking for stockholder approval, on an advisory basis, of the following resolution:

“RESOLVED, that the compensation of the Company’s NEOs, as disclosed pursuant to Item 402 of Regulation S-K, including the “Compensation Discussion and Analysis,” the compensation tables and the narrative discussion associated with the compensation tables in the Company’s proxy statement for its 2023 Annual Meeting of Stockholders is hereby APPROVED.”

We currently hold an annual advisory vote to approve the compensation of our named executive officers. Accordingly, the next such vote is expected to be held at our 2024 annual meeting of stockholders.

THE BOARD OF DIRECTORS RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NEOs.

| 2023 Proxy Statement |

|

23 |

EXECUTIVE COMPENSATION

Compensation Discussion & Analysis

The following CD&A provides information regarding the objectives and elements of our executive compensation philosophy, practices, and programs with respect to the compensation of our NEOs. The following should be read together with the compensation tables and related disclosures set forth below.

This CD&A details the continued evolution of our executive compensation program since we became a publicly- traded company in January 2021. We have established a number of policies and practices to support our compensation philosophy, improve our compensation governance, and drive performance that align executives’ and stockholders’ interests.

Our NEOs for the fiscal year ended December 31, 2022, were:

| Name | Title | |