UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report ___________

For the transition period from ___________ to ___________

Commission file number: 000-56154

GUARDFORCE AI CO., LIMITED

(Exact Name of Registrant as Specified in Its Charter)

Not Applicable

(Translation of Registrant’s Name Into English)

Cayman Islands

(Jurisdiction of Incorporation or Organization)

Lei WANG (olivia.wang@guardforceai.com)

96 Vibhavadi Rangsit Road, Talad Bangkhen, Laksi, Bangkok 10210, Thailand

(Address of Principal Executive Offices)

96 Vibhavadi Rangsit Road, Talad Bangkhen, Laksi, Bangkok 10210, Thailand

Tel: +66 (0) 2973 6011

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| Not applicable | Not applicable | Not applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

ordinary shares, $0.001 par value per share

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 52,068,959 ordinary shares outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | Non-Accelerated Filer | ☐ | Emerging growth company | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting ☒ | Other ☐ | ||

| Standards as issued by the International Accounting Standards Board |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ Yes ☐ No

Annual Report on Form 20-F

TABLE OF CONTENTS

i

ii

INTRODUCTORY NOTES

Use of Certain Defined Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

| ● | “Guardforce,” “we,” “us,” “our” and the “Company” are to the combined business of Guardforce AI Co., Limited, a Cayman Islands company, its subsidiaries and other consolidated entities; |

| ● | “AI Holdings” are to Guardforce AI Holdings Limited (BVI), a BVI company; |

| ● | “AI Robots” are to Guardforce AI Robots Limited (BVI), a BVI company; |

| ● | “AI Hong Kong” are to Guardforce AI Hong Kong Co., Limited, a Hong Kong company; |

|

● | “AI Technology” are to Guardforce AI Technology Limited, a BVI company |

| ● | “Horizon Dragon” are to Horizon Dragon Limited (BVI), a BVI company; |

| ● | “Southern Ambition” are to Southern Ambition Limited (BVI), a BVI company; |

| ● | “AI Thailand” are to Guardforce AI Group Co., Limited (Thailand), a Thailand company; |

| ● | “GF Cash (CIT)” are to Guardforce Cash Solutions Security (Thailand) Co., Ltd., a Thailand company; |

|

|

● | “Handshake” are to Handshake Networking Limited, a Hong Kong company; |

| ● | “BVI” are to the British Virgin Islands; |

| ● | “Cayman Islands” are to the Cayman Islands; |

| ● | “Hong Kong” are to the Hong Kong Special Administrative Region of the People’s Republic of China; |

| ● | “PRC” and “China” are to the People’s Republic of China; |

| ● | “Thailand” are to the Kingdom of Thailand; |

|

● | “SEC” are to the Securities and Exchange Commission; |

| ● | “FINRA” are to the Financial Industry Regulatory Authority; |

| ● | “Exchange Act” are to the Securities Exchange Act of 1934, as amended; |

| ● | “Securities Act” are to the Securities Act of 1933, as amended; |

| ● | “Baht” and “THB” are to the legal currency of Thailand; |

| ● | “Bank of Thailand” or “BOT” are to Thailand’s central bank; |

| ● | “CIT” are to cash-in-transit or cash/valuables-in-transit; |

| ● | “U.S. dollars,” “dollars,” “USD” and “$” are to the legal currency of the United States; and |

| ● | “VCAB” are to VCAB Eight Corporation. |

| ● | “Companies Law” are to the Companies Law (2018 Revision) of the Cayman Islands. |

iii

Forward-Looking Information

This Annual Report on Form 20-F contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; and any statements regarding future economic conditions or performance, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements. Potential risks and uncertainties include, among other things, the possibility that third parties hold proprietary rights that preclude us from marketing our products, the emergence of additional competing technologies, changes in domestic and foreign laws, regulations and taxes, changes in economic conditions, uncertainties related to legal system and economic, political and social events in Thailand, a general economic downturn, a downturn in the securities markets, and other risks and uncertainties which are generally set forth under Item 3 “Key information—D. Risk Factors” and elsewhere in this annual report.

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation, except as required by law, to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

iv

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

| NAME | Position | Address | ||

| Wing Khai Terence Yap | Director, Chairman and CFO | 96 Vibhavadi Rangsit Road, Talad Bangkhen, Laksi, Bangkok 10210, Thailand | ||

| Lei Wang | Director and CEO | 96 Vibhavadi Rangsit Road, Talad Bangkhen, Laksi, Bangkok 10210, Thailand | ||

| Feng Dai | Director | 1A, Meiya, Meichen Garden, Fuqiang Road, Futian District, Shenzhen, China. | ||

| Jingyi Tu | Director | B, Building 12, Yangchou Garden, Yangchou Road, Dapeng New District, Shenzhen, Guangdong, China | ||

| Konki Lo | Director | Flat E, 18/F, BLK 2, The Victoria Towers, 188 Canton RD, Tsim Sha Tsui, Kowloon, Hong Kong | ||

| John Fletcher | Director | 1501 Broadway, Suite 1515, New York, NY 10036 | ||

| David Ian Viccars | Director | 33/63 Soi 2/3, Mooban Ladawan, Srinakarin Road, Bangkok, Thailand 10540 |

For the sake of clarity, this annual report follows the English naming convention of given name followed by surname name, regardless of whether an individual’s name is Chinese or English. For example, the name of our Director and CEO will be presented as “Lei Wang,” even though, in Chinese, her name is presented as “Wang Lei.”

Our legal adviser with respect to US securities laws and the filing of this annual report on Form 20-F is Bevilacqua PLLC, with a business address at 1050 Connecticut Avenue, NW, Suite 500, Washington, DC 20036.

Our independent registered public accounting firm with respect to the audits of the Company’s consolidated financial statements as of December 31, 2020 and 2019 and for the years then ended included in this Annual Report on Form 20-F is Wei, Wei & Co., LLP, with a business address at 133-10 39th Avenue, Flushing, New York 11354.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

B. Method and Expected Timetable

Not applicable.

Guardforce was incorporated on April 20, 2018 in the Cayman Islands as a holding company to acquire the business of GF Cash (CIT) which operates as our indirect subsidiary. GF Cash (CIT) was incorporated in 1982 in Thailand and has been operating in the cash-in-transit, or CIT, industry since that time.

1

Not applicable.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this annual report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our ordinary shares could decline, and you may lose all or part of your investment.

Risks Relating to our Business

The effect of the coronavirus, or the perception of its effects, on our operations and the operations of our customers and suppliers could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We have been closely monitoring the outbreak of the Coronavirus (“COVID-19”) that is now spreading all over the world, including to Thailand. The duration and extent of the coronavirus pandemic and related government actions may impact many aspects of our business, including creating workforce limitations, travel restrictions and impacting our customers and suppliers. If a significant percentage of our workforce is unable to work, either because of illness or travel or government restrictions in connection with the coronavirus outbreak, our operations may be negatively impacted. The Company’s response strategy in areas of high impact may result in a temporary reduced workforce as a result of self-isolation or other government or Company imposed measures to quarantine impacted employees and prevent infections at the workplace.

In addition, the coronavirus may result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, including Thailand, resulting in an economic downturn that could affect demand for our products and services. Imposed government regulations could adversely impact the Company’s results of operations, business, financial condition, or prospects derived from its operations in Thailand or other affected areas. Further, the outbreak of the coronavirus may negatively impact our customers and related service providers, which would likely impact our revenues and operating results. Any of these events could have a material adverse effect on the Company’s business, financial condition, results of operations and cash flows. At this point, the extent to which the coronavirus may impact our results is uncertain.

Our negative operating profits may raise substantial doubt regarding our ability to continue as a going concern.

As of December 31, 2020, we had a deficit of approximately $4.7 million and negative equity of $2.2 million. Our recurring operating losses raise substantial doubt about our ability to continue as a going concern. Our financial statements include a note describing the conditions which raise this substantial doubt. Our ability to continue as a going concern will require us to obtain additional financing to fund our operations. The perception of our ability to continue as a going concern may make it more difficult for us to obtain financing or obtain financing on favorable terms for the continuation of our operations and could result in the loss of confidence by investors, suppliers and employees. If we are not successful in raising capital through equity offerings, debt financings, collaborations, licensing arrangements or any other means or are not successful in reducing our expenses, we may exhaust our cash resources and be unable to continue our operations. If we cannot continue as a viable entity, our shareholders would likely lose most or all of their investment in us.

We operate in highly competitive industries.

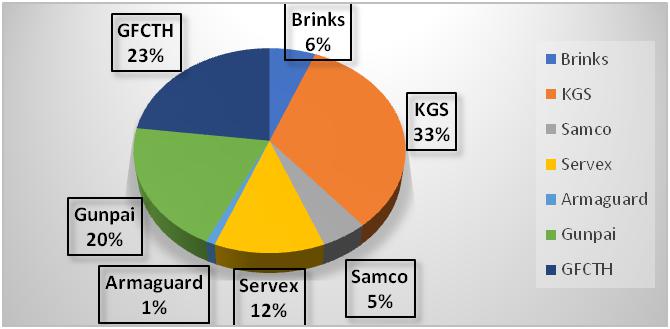

We compete in industries that are subject to significant competition and pricing pressures in most markets. The competition mainly comes from international companies liked Brinks and Armaguard. There are also a number of local CIT companies having very good relationships with their clients. Additionally, we are facing potential competition from the commercial banks which market their own cash management solutions to their customers and hire CIT companies as their subcontracted CIT suppliers. Furthermore, many banks have their own CIT subsidiaries to serve them exclusively.

Our business model requires significant fixed costs associated with offering many of our services including, but not limited to, costs to operate a fleet of armored vehicles. Because we believe we have competitive advantages such as brand name recognition and a reputation for a high level of service and security, we resist competing on price alone. However, continued pricing pressure from competitors or failure to achieve pricing based on the competitive advantages identified above could result in lost volume of business and could have an adverse effect on our business, financial condition, results of operations and cash flows. In addition, given the highly competitive nature of our industry, it is important to develop new solutions and product and service offerings to help retain and expand our customer base. Failure to develop, sell and execute new solutions and offerings in a timely and efficient manner could also negatively affect our ability to retain our existing customer base or pricing structure and have an adverse effect on our business, financial condition, results of operations and cash flows.

2

We have substantial customer concentration, with a limited number of customers accounting for a substantial portion of our recent revenues.

Historically, we have derived a significant portion of our revenues from our top five customers, four of which are commercial banks and one of which is a state-owned bank. For the year ended December 31, 2020, the state-owned bank (the Government Savings Bank) accounted for approximately $10.2 million in revenue or 27.2% of our revenue.

For the year ended December 31, 2020, revenues from the next four largest customers combined were approximately $17.0 million or 45.2% of our revenue. Our top five customers combined accounted for approximately 72.4% of our revenue.

There are inherent risks whenever a large percentage of total revenues are concentrated with a limited number of customers. It is not possible for us to predict the future level of demand for our services that will be generated by these customers. In addition, revenues from these larger customers, especially our two largest customers, may fluctuate from time to time based on the commencement and completion of projects, the timing of which may be affected by market conditions or other facts, some of which may be outside of our control. Further, some of our contracts with these larger customers permit them to terminate our services at any time (subject to notice and certain other provisions). If any of these customers experience declining or delayed sales due to market, economic or competitive conditions, we could be pressured to reduce the prices we charge for our services which could have an adverse effect on our margins and financial position, and could negatively affect our revenues and results of operations and/or trading price of our ordinary shares. If either of our two largest customers terminates our services, such termination would negatively affect our revenues and results of operations and/or trading price of our ordinary shares.

Changes to legislation in Thailand may negatively affect our business.

The legislation in Thailand relating to the security industry is not fully developed and may change depending on the government and a new prime minister. Also, new security acts which were launched in 2017 have applied very strict control on staff issues such as recruitment standards, training criteria and firearms. These developments could have an adverse effect on our business, financial condition and results of operations.

Unexpected increases in minimum wages in Thailand would reduce our net profits.

The government of Thailand does not have a regular system to review minimum wages and may enact, on very short notice, when, for example, the local political environment changes or there is a new prime minister, new laws and regulations to increase minimum wages. Any material increase in minimum wages will directly impact the cost of services of the Company and reduce net profits.

Increases in fuel cost would negatively impact our cost of operations.

As the CIT industry relies on a large consumption of fuel for the operation of its vehicles, an increase in oil prices will negatively impact the operating costs of the Company.

Our strategy may not be successful.

If we are unable to achieve our strategic objectives and anticipated operating profit improvements, our results of operations and cash flows may be adversely affected.

We might not have sufficient cash to fully execute our growth strategy.

We expect that we will need approximately U.S. $3.0 million per year (approximately 8% of our annual revenue) to execute the growth strategy outlined elsewhere in this annual report. We expect that we will have sufficient cash on hand and cash in the bank, generated from our annual cash flows, to fund our planned growth strategy capital expenditures. To the extent that there may be shortfalls in internal cash available for our growth plans, we expect to be able to access commercial banking credit facilities as the need arises. There can be no assurance, however, that we will have or be able to acquire the necessary capital to accomplish our listed strategic objectives. If we are not able to fully execute our growth strategy, our business could suffer.

3

We might not have sufficient cash to repay a related party loan obligation.

As discussed elsewhere in this annual report, we have a loan outstanding in the principal amount of $13.51 million due and payable in full on December 31, 2022, to Profit Raider Investment Limited, or Profit Raider. We will require an extension of the maturity date of this loan and we cannot be sure whether or not Profit Raider will extend the maturity date of the loan. If Profit Raider does not extend the loan, we will need to seek an alternative source of funding to replace the loan. There can be no assurance, however, that we would be able to find such alternative funding on terms acceptable to us, if at all. If we cannot obtain an extension of the maturity date of the loan and are not otherwise able to refinance the loan, we may default on the loan and such default would have a material adverse effect on our financial condition, cash flows and results of operations and could result in an action by Profit Rader against us to collect the amount due under the loan along with interest, fees and any other applicable chargers.

Our business success depends on retaining our leadership team and attracting and retaining qualified personnel.

Our future success depends, in part, on the continuing services and contributions of our leadership team to execute on our strategic plan and to identify and pursue new opportunities. Our future success also depends, in part, on our continued ability to attract and retain highly skilled and qualified personnel. Any turnover in senior management or inability to attract and retain qualified personnel could have a negative effect on our results of operations. Turnover in key leadership positions within the Company may adversely affect our ability to manage the company efficiently and effectively, could be disruptive and distracting to management and may lead to additional departures of current personnel, any of which could have a material adverse effect on our business and results of operations.

In the future we may not be able to use the Guardforce trademark, which could have a negative impact on our business.

We license the “Guardforce” name and trademark from Guardforce Security Thailand Company Limited (THAI SP) under the terms of a binding memorandum of understanding effective March 2, 2020 between GF Cash (CIT) and Guardforce Security Thailand Company Limited (THAI SP). Under the terms of this license we can use, at no cost and on a non-exclusive, non-transferable basis, the “Guardforce” name and related trademark(s) in promoting GF Cash (CIT)’s business and selling any goods and services solely related to the business of cash-in-transit and other ancillary services provided by GF Cash (CIT) in Thailand, solely in the manner approved by THAI SP from time to time. This license has a term of three years and will renew automatically for additional three-year periods unless either party gives written notice to terminate the agreement no less than 30 days prior to the next upcoming renewal period start date. Additionally, the license may be cancelled by either party at any time with six months’ prior written notice to the other party.

If for any reason our license with THAI SP is terminated or expires, our business may suffer and the value that we believe we have built in our brand name throughout Thailand will be lost. In such event, we would have to market our business under a new brand, and it may take significant time before our existing customers and future customers recognize our new brand. The loss of our ability to continue to utilize the Guardforce name and related trademarks could have a material adverse effect on our business.

We may be subject to service quality or liability claims, which may cause us to incur litigation expenses and to devote significant management time to defending such claims, and if such claims are determined adversely to us we may be required to pay significant damage awards.

We may be subject to legal proceedings and claims from time to time relating to the quality of our services. The defense of these proceedings and claims could be both costly and time-consuming and significantly divert the efforts and resources of our management. An adverse determination in any such proceeding could subject us to significant liability. In addition, any such proceeding, even if ultimately determined in our favor, could damage our reputation and prevent us from maintaining or increasing revenues and market share. Protracted litigation could also result in our customers or potential customers limiting their use of our service.

4

Decreasing use of cash could have a negative impact on our business.

The proliferation of payment options other than cash, including credit cards, debit cards, stored-value cards, mobile payments and on-line purchase activity and digital currencies, could result in a reduced need for cash in the marketplace and a decline in the need for physical bank branches and retail stores. To mitigate this risk, we are developing new lines of business, including, among other things, cash management solutions for retail chains and banks, multi-function machines (for cash and digital cash) and coins solutions for minting facilities. In addition, we are developing non-cash security technology related solutions such as robotics, cybersecurity and data analytics (including artificial intelligence) but there is a risk that these initiatives may not offset the risks associated with our traditional cash-based business and that our business, financial condition, results of operations and cash flows could be negatively impacted.

Implementation of our robotics solution has required, and may continue to require, significant capital and other expenditures, which we may not recoup.

We have made, and intend to continue to make, capital investments to develop and launch our robotics solution. In 2020, we utilized our existing resources to build and develop our robotics solution. We plan to make further capital investments related to our robotics solution in the future. Our robotics related investment plans are subject to change, and will depend, in part, on market demand for robotic services, the competitive landscape for provision of such services and the development of competing technologies. There is no assurance of the success of our entry into the robotics business as there may not be sufficient demand for our robotics solution, as a result of competition or otherwise, to permit us to recoup or profit from our robotics related capital investments.

We may fail to successfully integrate our acquisition of Handshake Networking Ltd. and may fail to realize the anticipated benefits.

In March 2021, we completed the acquisition of 51% of Handshake Networking Ltd. While we are hoping to benefit from a range of synergies from this acquisition, including by offering our customers bundled physical and cybersecurity services, we may not be able to integrate this new business and may fail to realize the expected benefits in the near term, or at all. Handshake operates in a highly competitive cybersecurity industry. Its business success will depend, in part, on market demand for its cybersecurity services, the competitive landscape for the provision of such service and the development of competing technologies. Our business and financial condition may be adversely affected if the business of Handshake fails or we fail to manage our investment in Handshake successfully.

We may not be able to obtain the necessary funding for our future capital or refinancing needs.

We may be required to raise additional funds for our future capital needs or to refinance our current indebtedness and future indebtedness through public or private financing, strategic relationships or other arrangements. There can be no assurance that the funding, if needed, will be available to us or provided on acceptable terms.

5

Any compromise of the cyber security of our platform could materially and adversely affect our business, operations and reputation.

Our products and services involve the storage and transmission of users’ and other customers’ information, and security breaches expose us to a risk of loss of this information, litigation and potential liability. Our security measures may also be breached due to employee error, malfeasance or otherwise. Additionally, outside parties may attempt to fraudulently induce employees, users or other customers to disclose sensitive information in order to gain access to our data or our users’ or other customers’ data or accounts, or may otherwise obtain access to such data or accounts. Because the techniques used to obtain unauthorized access, disable or degrade service or sabotage systems change frequently and often are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. If an actual or perceived breach of our security occurs, the market perception of the effectiveness of our security measures could be harmed, we could lose users and other customers, and may be exposed to significant legal and financial risks, including legal claims and regulatory fines and penalties. Any of these actions could have a material and adverse effect on our business, reputation and results of operations.

Our transfer pricing decisions may result in uncertain tax exposures for our group.

We have entered into transfer pricing arrangements that establish transfer prices for our inter-company operations in relations to the purchase of robotics equipment for our robotics solutions businesses in the region. However, our transfer pricing procedures are not binding on the applicable taxing authorities. No official authority in any countries has made a binding determination as to whether or not we are operating in compliance with its transfer pricing laws. Accordingly, taxing authorities in any of the countries in which we operate could challenge our transfer prices and require us to adjust them to reallocate our income and potentially to pay additional taxes for prior tax periods. We expect that the issue of the validity of our transfer pricing procedures will become of greater importance as we continue our expansion in markets in which we currently have a limited presence and attempt to penetrate new markets. Any change to the allocation of our income as a result of reviews by taxing authorities could have a negative effect on our financial condition and results of operations. In addition, there maybe challenges involved in complying with local pertinent tax rules and regulations.

Risks Relating to our Corporate Structure

We rely upon structural arrangements to establish control over certain entities and government authorities may determine that these arrangements do not comply with existing laws and regulations.

The laws and regulations in Thailand place restrictions on foreign investment in and ownership of entities engaged in a number of business activities. The Thai Foreign Business Act B.E. 2542 (1999), or FBA, requires foreigners to obtain approval under the FBA in order to engage in most service businesses. A company registered in Thailand will be considered a foreigner under the FBA if foreigners hold 50% or more of the shares in the company. The Security Guard Business Act B.E. 2558 (2015), or SGBA, also requires that companies applying for approval to engage in the business of providing security guard services by providing licensed security guards to protect people or personal property must have more than half of its shares owned by shareholders of Thai nationality and must have more than half of its directors being of Thai nationality.

We conduct our business activities in Thailand using a tiered shareholding structure in which direct foreign ownership in each Thai entity is less than 50%. See “Item 4. Information on the Company—C. Organizational Structure—Thailand Shareholding Structure.” The FBA considers the immediate level of shareholding of a company to determine the number of shares held by foreigners in that company for the purposes of determining whether the company is a foreigner within the meaning of the FBA, and will have regard to the shareholdings of a corporate shareholder which holds shares in that company to determine whether that corporate shareholder is a foreigner, however no cumulative calculation is applied to determine the foreign ownership status of a company when it has several levels of foreign shareholding. Such shareholding structure has allowed us to consolidate our Thai operating entities as our subsidiaries.

We have engaged legal counsel Watson Farley & Williams (Thailand) Limited in Thailand, and they are of the opinion that the shareholding structure of GF Cash (CIT) does not result in GF Cash (CIT) being a foreigner within the meaning of the FBA or failing to comply with the nationality requirements imposed by the SGBA. However, the local or national authorities or regulatory agencies in Thailand may reach a different conclusion, which could lead to an action being brought against us by administrative orders or in local courts. The FBA prohibits Thai nationals and non-foreigner companies from assisting, aiding and abetting or participating in the operation of a foreigner’s business if the foreigner would require approval under the FBA to engage in that business, or to act as a nominee in holding shares in a company to enable a foreigner to operate a business in contravention of the FBA. The FBA does not provide detailed guidance on what degree of assistance contravenes the FBA, however Thai shareholders are likely to be regarded as nominees under the FBA if they do not have sufficient funds to acquire their shares or did not pay for their shares, or if they have agreed to not to be paid the dividends to which they would be entitled under the company’s articles of association.

6

Documentation filed with the Ministry of Commerce includes supporting evidence that the Thai nationals holding shares in AI Thailand had sufficient financial resources to acquire their shares and confirms that AI Thailand has received the amount payable for those shares. If the authorities in Thailand find that our arrangements do not comply with their prohibition or restrictions on foreign investment in our lines of business, or if the relevant government entity otherwise finds that we or any of our subsidiaries is in violation of the relevant laws or regulations or lack the necessary registrations, permits or licenses to operate our businesses in Thailand, they would have broad discretion in dealing with such violations or failures, including:

| ● | revoking the business licenses and/or operating licenses of such entities; |

|

● | imposing penalties of up to THB 1 million and imprisonment of up to three years plus penalties of THB 50,000 (approximately $1,560) for every day of a continuing offence; |

| ● | ordering the cessation of any aiding or abetting contrary to the FBA; |

| ● | discontinuing or placing restrictions or onerous conditions on the operations of our Thai subsidiaries, or on our operations through any transactions between our Company or our Cayman Islands or BVI subsidiaries on the one hand and our Thai subsidiaries on the other hand; |

| ● | confiscating income from us, our BVI subsidiaries, or Thai subsidiaries, or imposing other requirements with which such entities may not be able to comply; |

| ● | imposing criminal penalties, including fines and imprisonment on our Thai subsidiaries, their shareholders or directors; |

| ● | requiring us to restructure our ownership structure or operations, including the sale of shares in GF Cash (CIT), which in turn would affect our ability to consolidate, derive economic interests from, or exert effective control over our Thai subsidiaries; or |

| ● | restricting or prohibiting our use of the proceeds of any public offering we may conduct to finance our business and operations in Thailand. |

Any of these actions could cause significant disruption to our business operations and severely damage our reputation, which would in turn materially and adversely affect our business, financial condition and results of operations. If any of these occurrences results in our inability to direct the activities of our Thai subsidiaries that most significantly impact their economic performance, or prevent us from receiving the economic benefits or absorbing losses from these entities, we may not be able to consolidate these entities in our consolidated financial statements in accordance with IFRS.

Risks Relating to Doing Business in Thailand

A severe or prolonged downturn in the global economy or the markets that we primarily operate in could materially and adversely affect our revenues and results of operations.

We primarily operate in Thailand. Weak economic conditions as a result of a global economic downturn and decreased demand and prices due to the increased popularity of digital cash across the world may have a negative impact on our business. Decreased demand and prices would reduce our income and weaken our business. There are still great uncertainties regarding economic conditions and the demand for cash processing services. Any turbulence in global economies and prolonged declines in demand and prices in Thailand may adversely affect our business, revenues and results of operations. Apart from the above, the following factors may also affect our business: (1) the threat of terrorism is high within Thailand; (2) the political situation is not stable especially under the military rule and governance; (3) currency exchange rates; (4) bribery and corruption; (5) high tax rates; and (6) unstable energy prices.

We are vulnerable to foreign currency exchange risk exposure.

The value of the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions.

7

Our consolidated financial statements are expressed in U.S. dollars, which is our reporting currency. Most of the revenues and expenses of GF Cash (CIT) are denominated in the THB. Meanwhile, our functional currency of our various other subsidiaries, is the U.S. dollar. To the extent that we need to convert THB into U.S. dollars for our operations, appreciation of the U.S. dollar against the THB would adversely affect the U.S. dollar amounts we recognize from the conversion. Fluctuations in the exchange rate will also affect the relative value of the U.S. dollar-denominated loan that we have borrowed from a related party.

The ability of our subsidiaries to distribute dividends to us may be subject to restrictions under the laws of their respective jurisdictions.

We are a holding company, and our main operating subsidiary is located in Thailand. Part of our primary internal sources of funds to meet our cash needs is our share of the dividends, if any, paid by our subsidiaries. The distribution of dividends to us from the subsidiaries in these markets as well as other markets where we operate is subject to restrictions imposed by the applicable laws and regulations in these markets. See “Item 4. Information on the Company—B. Business Overview—Regulation—Thailand—Regulations on Dividend Distributions.” Companies remitting payments to recipients outside of Thailand must obtain approval from the Bank of Thailand at the time of the remittance if the remittance exceeds the equivalent of US$50,000. In practice, this approval is managed by the Bank of Thailand and is typically granted if copies of the supporting documentation showing the need for the transaction can be provided. In addition, although there are currently no foreign exchange control regulations which restrict the ability of our subsidiaries in Thailand to distribute dividends to us, the relevant regulations may be changed and the ability of these subsidiaries to distribute dividends to us may be restricted in the future.

Risks Relating to the Market for our Common Shares

There is no active public trading market for our common shares and you may not be able to resell our common shares.

Our common shares have only recently been approved for quotation on the OTC Markets Group, Inc. Pink tier and, currently, there is no established public trading market for our common shares. In the absence of an active trading market, you may not be able to liquidate your investment, which could result in the loss of your investment.

We are controlled by a small group of shareholders, whose interests may differ from other shareholders.

As of the date of this Form 20-F, our principal shareholder, Mr. Jingyi Tu, beneficially owned 67% of our total outstanding shares. This concentration of ownership may discourage, delay or prevent a change in control of our Company, which could deprive our shareholders of an opportunity to receive a premium for their shares as part of a sale of our Company and might reduce the price of our ordinary shares. In addition, because this shareholder effectively controls our Company, he would be able to take actions that may not be in the best interests of other shareholders. These actions may be taken even if they are opposed by our other shareholders. We do not have any existing arrangements with any of our shareholders to address potential conflicts of interests between this shareholder and our Company, and none of our shareholders, other than our officers pursuant to the terms of their service agreements, has entered into non-compete agreements. There is a risk that our existing shareholders may not always act in the best interests of our Company.

Future issuances of our shares would dilute the interests of existing shareholders.

We are authorized to issue a total of 300,000,000 ordinary shares. As of the date of this annual report, we have an aggregate of 52,762,637 outstanding shares, including 562,620 ordinary shares that we recently issued in connection with the Merger (as defined below) with VCAB and 131,105 ordinary shares that we issued in connection with our acquisition of a controlling interest in Handshake. This means that we could potentially issue up to an additional 247,237,363 ordinary shares.

We may determine to issue additional shares in the future. The issuance of a substantial amount of shares would have the effect of substantially diluting the interests of our shareholders. In addition, the sale of a substantial amount of shares in the public market, either in the initial issuance or in a subsequent resale could have an adverse effect on the market price of our shares.

8

Acquisitions in the future may result in the demand for significant additional funding which may result in substantial dilution to existing shareholders.

If we engage in any acquisition activity in the future, we may require funding generated through the sale of additional shares or other equity which could result in significant dilution to our existing shareholders. The financial results of acquired businesses may not achieve expectations which may have a significant impact on our per share earnings, and thus, the value of our shares.

Future acquisitions or divestitures could materially change our business and materially and adversely affect our results of operations and financial condition.

We plan to focus our efforts on future strategic priorities in pursuing strategic acquisitions and strategic partnerships. Presented with appropriate opportunities, we may acquire businesses or assets that we believe complement our existing business. Any such acquisitions are invariably subject to associated execution risk including issues relating to the integration of new operations and personnel, geographical coordination, retention of key management personnel, systems integration and the integration of corporate cultures. The acquisition and integration could cause the diversion of management’s attention or resources from our existing business or cause a temporary interruption of, or loss of momentum in, our current business. We could also lose key personnel from the acquired companies. There may be unforeseen or unknown liabilities, or we may not be able to generate sufficient revenue to offset new costs of any acquisitions and strategic partnerships. The execution of international expansion of our operations exposes us to a number of additional risks including difficulties in staffing and managing overseas operations, fluctuations in foreign currency exchange rates, increased costs associated with maintaining the ability to understand local trends, difficulties and costs relating to compliance with the different commercial, legal and regulatory requirements of the overseas locations in which we operate, failure to develop appropriate risk management and internal control structures tailored to overseas operations, inability to obtain, maintain or enforce intellectual property rights, unanticipated changes in economic conditions and regulatory requirements in overseas operations. These risks associated with strategic repositioning, future acquisitions and strategic partnerships could have a material and adverse effect on our business, results of operations, financial condition and liquidity.

We have no plans to pay dividends.

To date, we have paid no cash dividends on our shares. For the foreseeable future, earnings generated from our operations will be retained for use in our business and not to pay dividends.

You may have difficulty enforcing judgments obtained against us.

We are a Cayman Islands company and substantially all of our assets are located outside of the United States. Virtually all of our assets and a substantial portion of our current business operations are conducted in Thailand. In addition, almost all of our directors and officers are nationals and residents of countries other than the United States. A substantial portion of the assets of these persons are located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. It may also be difficult for you to enforce the U.S. courts judgments obtained in U.S. courts including judgments based on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, many of whom are not residents in the United States, and whose significant assets are located outside of the United States. The courts of the Cayman Islands would recognize as a valid judgment, a final and conclusive judgment in personam obtained in the federal or state courts in the United States against the Company, under which a sum of money is payable (other than a sum of money payable in respect of multiple damages, taxes or other charges of a like nature or in respect of a fine or other penalty) or, in certain circumstances, an in personam judgment for non-monetary relief, and would give a judgment based thereon provided that (a) such courts had proper jurisdiction over the parties subject to such judgment, (b) such courts did not contravene the rules of natural justice of the Cayman Islands, (c) such judgment was not obtained by fraud, (d) the enforcement of the judgment would not be contrary to the public policy of the Cayman Islands, (e) no new admissible evidence relevant to the action is submitted prior to the rendering of the judgment by the courts of the Cayman Islands, and (f) there is due compliance with the correct procedures under the laws of the Cayman Islands. In addition, there is uncertainty as to whether the courts of the Cayman Islands or Thailand, respectively, would recognize or enforce judgments of U.S. courts against us or such persons predicated upon the civil liability provisions of the securities laws of the United States or any state. In addition, it is uncertain whether such Cayman Islands or Thailand courts would entertain original actions brought in the courts of the Cayman Islands or Thailand, against us or such persons predicated upon the securities laws of the United States or any state.

9

Because we are incorporated under the laws of the Cayman Islands, it may be more difficult for our shareholders to protect their rights than it would be for a shareholder of a corporation incorporated in another jurisdiction.

Our corporate affairs are governed by our Memorandum and Articles of Association, by the Companies Law and by the common law of the Cayman Islands. Principles of law relating to such matters as the validity of corporate procedures, the fiduciary duties of management, and the rights of our shareholders differ from those that would apply, if we were incorporated in the United States or another jurisdiction. The rights of shareholders under Cayman Islands law may not be as clearly established as the rights of shareholders are in the United States or other jurisdictions. Under the laws of most jurisdictions in the United States, majority and controlling shareholders generally have certain fiduciary responsibilities to the minority shareholders. Shareholders’ actions must be taken in good faith. Obviously unreasonable actions by controlling shareholders may be declared null and void. Cayman Islands law protecting the interests of minority shareholders may not be as protective in all circumstances as the law protecting minority shareholders in United States or other jurisdictions. Although a shareholder of a Cayman Islands company may sue the company derivatively, the procedures and defenses available to the company may result in the rights of shareholders of a Cayman Islands company being more limited than those of shareholders of a company organized in the United States. Furthermore, our directors have the power to take certain actions without shareholders’ approval, or which would require shareholders’ approval under the laws of most of the states in the United States or other jurisdictions. Thus, our shareholders may have more difficulty protecting their interests in the face of actions by our board of directors or our controlling shareholders than they would have as shareholders of a corporation incorporated in another jurisdiction.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

General Information

The legal and commercial name of the Company is Guardforce AI Co., Limited. The Company was incorporated in the Cayman Islands under the Companies Law on April 20, 2018. The address of our principal place of business is 96 Vibhavadi Rangsit Road, Talad Bangkhen, Laksi, Bangkok 10210, Thailand. Our telephone number is +66 (0) 2973 6011. The name and address of our agent for service is Cricket Square, Hutchins Drive, P.O. Box 2681, Grand Cayman KY1-1111, Cayman Islands.

Guardforce was incorporated in 2018 to acquire, indirectly, GF Cash (CIT) which is an operating company providing cash solutions and cash handling services located in Thailand. Please refer to our group chart for the description of shareholdings of the whole group.

Corporate History and Structure

AI Holdings was incorporated in the British Virgin Islands under the BVI Business Companies Act, 2004, on May 22, 2018. AI Holdings is a 100% owned subsidiary of Guardforce. AI Holdings’ registered office is located at P.O. Box 905, Quastisky Building, Road Town, Tortola, British Virgin Islands.

AI Robots was incorporated in the British Virgin Islands under the BVI Business Companies Act, 2004, on May 22, 2018. AI Robots is a 100% owned subsidiary of Guardforce.

AI Hong Kong was incorporated in Hong Kong under the Hong Kong Companies’ Ordinance (Chapter 622), on May 30, 2018. AI Hong Kong is a 100% owned subsidiary of Guardforce.

Southern Ambition was incorporated in the British Virgin Islands under the BVI Business Companies Act, 2004, on August 3, 2018. Southern Ambition is a 100% owned subsidiary of AI Robots.

Horizon Dragon was incorporated in the British Virgin Islands under the BVI Business Companies Act, 2004, on July 3, 2018. Horizon Dragon is a 100% owned subsidiary of AI Holdings.

10

AI Thailand was incorporated in Thailand under the Civil and Commercial Code at the Registry of partnerships and Companies, Bangkok Metropolis, Thailand, on September 21, 2018 and has 100,000 outstanding shares with a par value of THB 10 per share. 48,999 of the outstanding shares in AI Thailand are owned by Southern Ambition and one of the outstanding shares is owned by Horizon Dragon, for an aggregate of 49,000 shares, or 49%, and 51,000 shares, or 51%, are owned by two citizens of Thailand.

With respect to the two Thai citizens’ economic rights in and to the GF Cash (CIT) operating business, pursuant to articles 6(1) to (3) of the Articles of Association of Al Thailand, the holders of Class B preferred shares of AI Thailand are entitled to (i) dividends at the rate of 10% of the par value of the preferred shares held before dividends are issued to holders of ordinary shares, (ii) cumulative dividends for years in which Al Thailand has made profit but has not declared a dividend and (iii) the return of their paid up capital on the dissolution or liquidation of Al Thailand before any assets are distributed to the holders of ordinary shares. As the par value of shares in Al Thailand is THB 10, the aggregate dividend entitlement of the two Thai nationals on any declaration of dividends by AI Thailand is approximately 0.01%, with 99.99% of the balance of dividends being payable to Southern Ambition.

Originally, each of the two Thai Nationals had entered into shareholders agreements with Southern Ambition, which, among other things, vested the management and administration of AI Thailand in the hands of Southern Ambition. Being that the two Thai citizens hold only nominal voting rights and economic interests in AI Thailand in accordance with the relevant provisions of the Articles of Association of Al Thailand, these shareholder agreements have been terminated and are no longer in effect and we do not have any other contractual agreements in place with the two Thai citizens.

Pursuant to Article 17 of the Articles of Association of AI Thailand, the holder of an ordinary share may cast one vote per share at a general meeting of shareholders and the holder of preferred shares may cast one vote for every 20 preferred shares held at a general meeting of shareholders. As a result of this voting structure, Southern Ambition is entitled to cast more than 95% of the votes of AI Thailand at a general meeting of its shareholders. This voting control at a general meeting of shareholders is sufficient to remove, replace and appoint all or any of the directors of AI Thailand. Being that under Section 1144 of the Civil and Commercial Code of Thailand, limited companies are managed by the directors, Southern Ambition has the right of management of AI Thailand by exercising its rights to convene general meetings of shareholders to determine the composition of the AI Thailand board of directors and to pass resolutions to be observed by the directors.

Taking into account the AI Thailand voting structure, the Company, which indirectly wholly owns Southern Ambition through its ownership of AI Robots, is able to maintain control of the GF Cash (CIT) operating business without GF Cash (CIT) being regarded as a foreigner under Thailand’s foreign ownership laws.

GF Cash (CIT) was incorporated in Thailand under the Civil and Commercial Code at the Registry of partnerships and Companies, Bangkok Metropolis, Thailand, on July 27, 1982 and has 3,857,144 outstanding shares with a par value of THB 70 per share. 3,821,143 of the outstanding shares in GF Cash (CIT) (approximately 99.07% of the shares in GF Cash (CIT)) are owned by AI Thailand with one share being held by Southern Ambition and 36,000 shares (approximately 0.933% of the shares in GF Cash (CIT)) being held by Bangkok Bank Public Company Limited. GF Cash (CIT)’s head office is located at No. 96 Vibhavadi-Rangsit Road, Talad Bang Khen Sub-District, Laksi District, Bangkok, Thailand.

The shares in GF Cash (CIT) currently owned by AI Thailand and Southern Ambition were previously held by Guardforce TH Group Co Ltd and Guardforce 3 Limited. As AI Thailand owns more than 95% of the shares in GF Cash (CIT), AI Thailand has effective control over GF Cash (CIT) at the shareholder level.

AI Thailand acquired its shares in GF Cash (CIT) from Guardforce TH Group Co Ltd on September 26, 2018, and on the same day Southern Ambition acquired one share of GF Cash (CIT) from Guardforce 3 Limited. These share transfers have been recorded in the share register of GF Cash (CIT) and have also been registered with the Ministry of Commerce of Thailand.

Bangkok Bank Public Company Limited has been a minority shareholder in GF Cash (CIT) since 1982. Bangkok Bank Public Company Limited was invited to become a strategic partner in GF Cash (CIT) to facilitate GF Cash (CIT)’s local business expansion in the banking sector.

On March 25, 2021, we completed the acquisition from a third party of 51% of the outstanding ordinary shares of Handshake, a Hong Kong company.

11

The following diagram illustrates our corporate structure as of the date of this annual report.

Merger of VCAB Eight Corporation into Guardforce AI Co., Limited

On March 10, 2020, we completed a merger (which we refer to herein as the Merger) in which VCAB Eight Corporation, a Texas corporation, or VCAB, merged with and into us. VCAB was subject to a bankruptcy proceeding in the United States Bankruptcy Court for the Northern District of Texas, or the Bankruptcy Court, and had no assets, no equity owners and no liabilities, except for approximately 1,300 holders of Class 5 Allowed General Unsecured Claims and one holder of allowed administrative claims who we collectively refer to as the Claim Holders. Pursuant to the terms of the Merger agreement, and in accordance with the VCAB bankruptcy plan, we have issued an aggregate of 2,631,579 of our ordinary shares, which we refer to as the Plan Shares, to the Claim Holders as full settlement and satisfaction of their respective claims. As provided in the bankruptcy plan, the Plan Shares have been issued pursuant to Section 1145 of the United States Bankruptcy Code. As a result of the Merger, the separate corporate existence of VCAB was terminated. We consummated the Merger to increase our shareholder base to, among other things, assist us in qualifying for quotation on one of the listing tiers of OTC Markets Group, Inc.

12

The 2,631,579 Plan Shares are exempt from the registration requirements of the Securities Act and freely tradeable upon issuance, pursuant to Section 1145 of the U.S. Bankruptcy Code. The issued Plan Shares may be resold without registration pursuant to Section 4(a)(1) of the Securities Act, provided that the reseller is not an underwriter within the meaning of Section 1145(b) of the U.S. Bankruptcy Code.

The Merger did not have a material impact on our consolidated financial statements as of and for the year ended December 31, 2020. During 2020, we had issued 2,068,959 shares and we had issued the remaining 562,620 in April 2021. The total calculated fair value was approximately $19,000, and we recorded the related charge as a share-based compensation expense. Our net loss for the year ended December 31, 2020 was reduced by this charge of approximately $19,000.

We engaged HFG Capital Investments, L.L.C., or HFG, to provide us with advisory services and assist us in our efforts to consummate the Merger. Under this agreement which terminated on October 31, 2020, we paid HFG an advisory fee of $325,000. Separately, HFG, acting as the principal of VCAB, introduced us to VCAB. HFG was a holder of a confirmed administrative expense claim in the VCAB bankruptcy proceeding and was authorized by the Plan to coordinate a merger transaction such as the Merger. HFG’s claim as well as claims held by other VCAB creditors were exchanged for our ordinary shares upon completion of the Merger. We did not pay HFG any compensation for its participation in the Merger.

Principal Capital Expenditures

As discussed in more detail below, the Company operates in Thailand in the cash logistics business. During the past three years, the Company’s capital investments in Thailand have been concentrated in the acquisition of armored vehicles, business office rentals, security equipment and software systems. The major categories of our capital expenditures for the past three years are set forth below along with U.S. dollar amounts and percentages spent in each category. The sources of funds for these expenditures have been internal operating funds and bank financing.

| Principal Capital Expenditures | 2020 (U.S.$) | Percentage of Total Expenditures | 2019 (U.S.$) | Percentage of Total Expenditures | 2018 (U.S.$) | Percentage of Total Expenditures | ||||||||||||||||||

| Leasehold improvements | 38,876 | 2.8 | % | - | - | % | 28,271 | 0.9 | % | |||||||||||||||

| Machinery and equipment | 62,626 | 4.4 | % | 122,942 | 15.7 | % | 259,424 | 8 .1 | % | |||||||||||||||

| Office decoration and equipment | 136,497 | 9.7 | % | 53,015 | 6.8 | % | 803,285 | 25.1 | % | |||||||||||||||

| Vehicles | 25,237 | 1.8 | % | 85,919 | 10.9 | % | 1,197,559 | 37.4 | % | |||||||||||||||

| Assets under construction | - | - | % | 521,817 | 66.6 | % | 912,525 | 28.5 | % | |||||||||||||||

| GDM machines | 285,510 | 20.3 | % | - | - | % | - | - | % | |||||||||||||||

| Robots | 860,026 | 61.0 | % | - | - | % | - | - | % | |||||||||||||||

| TOTAL | 1,408,772 | 783,693 | 3,201,064 | |||||||||||||||||||||

Principal Capital Expenditures Currently in Progress

Currently, the Company is involved in the Thai market with capital expenditures in the following areas. The Company expects that sources of funds for these ongoing expenditures will be derived from available operating funds, bank financing and, if necessary, debt and equity financing from third-party investors:

| Principal Capital Expenditures | Estimate for Year 2021(U.S.$) | Percentage of Total Expenditures | ||||||

| Leasehold improvements | 909,000 | 44 ..1 | % | |||||

| Machinery and equipment | 206,000 | 10 .0 | % | |||||

| Office decoration and equipment | 249,000 | 12 .1 | % | |||||

| Vehicles | 397,000 | 19 .3 | % | |||||

| Assets under construction | 300,000 | 14 .5 | % | |||||

| TOTAL | 2,061,000 | |||||||

13

General

We were founded in 2018 to acquire our operating subsidiary GF Cash (CIT). The principal office of our Company is located in Bangkok, Thailand.

Our operating subsidiary, GF Cash (CIT), was founded in 1982 (the Company was formerly named Securicor (Thailand) Limited) and was renamed G4S Cash Service (Thailand) Limited in 2005. The Company was renamed again as Guardforce Cash Solution (Thailand) Limited in 2016 and then according to the new security laws in 2018, the name was further changed to “Guardforce Cash Solution Security (Thailand) Company Limited. The principal office of GF Cash (CIT) is located in Bangkok, Thailand.

We are a market leader with almost 40 years of experience in the cash logistics business in Thailand and our services include cash-in-transit, dedicated vehicles to banks, ATM management, cash center operations, cash processing, coin processing, cheque center, and cash deposit machine solutions (cash deposit management and express cash service). Our customers include local commercial banks, chain retailers, coin manufacturing mints, and government authorities. Our five major customers are Government Savings Bank, Bank of Ayudhya, TMB Bank, Thanachart Bank and CP All Public Company. A few global customers also retain our services under temporary contract. As of December 31, 2020, we have employed 1779 staff located in 21 branches and have 477 vehicles.

Substantially all of our revenues are derived from GF Cash (CIT)’s secure logistic business and gross revenue for the years ended December 31, 2020 and 2019 was approximately $37.65 million and $38.57 million, respectively.

In 2020, in addition to our secure logistics business, we began to develop other non-cash related solutions and services. In view of the pace of global robotics development and in response to the more automated requirements, driven in part by the COVID-19 pandemic, we have begun to rollout robotic solutions for our clients in Thailand and the rest of the Asia Pacific region. We have also begun to rollout other technologically related solutions in response to the changing needs of our clients. As of December 31, 2020, we have generated approximately $0.2 million in revenue from our robotic solutions business.

Industry Overview

Secure logistics Industry

GF Cash (CIT) operates within the Secure logistics industry. Demand for GF Cash (CIT) services is expected to continue in the coming years even though some local banks have started to promote plastic money solutions in the market.

Currently, the secure logistics market in Thailand is large and the demand for the commercial movement of both banknotes and coins is not showing signs of reduction.

Competition is high from international and local companies. We expect the competition to increase and this could affect our pricing strategies.

With industry applicable security laws in place since 2016, the entrance barrier for potential competitors will be higher and this will slow down the deployment and market entry plans of other international players.

Some of the major Thai banks still have hesitation and reluctance with respect to outsourcing their operations. However, following the government policy of increasing the minimum wage as well as the aging of existing staff, certain banks are now willing to discuss the possible cash management outsourcing plans.

Service Robots Industry

To mitigate the risk associated with increased competition, we have begun to introduce more technologically related services. During the third quarter of 2020, we introduced our robotics solutions as a competitive point of differentiation.

14

According to Mondor Intelligence report, the Asia Pacific market for service robots is expected to register a CAGR of 46.6% during the forecast period (2020-2025), The demand and utilization of service robots is expected to increase in the region, owing to the rapid development of robotic systems by Chinese and Japanese companies. Asian institutions and companies are gaining strong financial and regulatory support from governments to add these technologies in personal and professional applications. In addition, the significant outbreak of the COVID-19 pandemic has boosted the market for service robots, as most of the enterprises, hospitals, and other institutions believe that robotic interaction could facilitate more socially distanced models of operation, to enable a safer and faster reopening and recovery of some hotels impacted by the COVID-19 outbreak.

Competition is high from Chinese robotics manufacturing companies. We expect the competition to increase and this could affect our pricing strategies and business model. However, we believe that our long-standing client relations and brand name within the local markets will provide us with a competitive point of differentiation.

Cybersecurity Industry

In addition, to further expand our technological service offerings, during the third quarter of 2020, we introduced cybersecurity solutions to complement our existing security solutions to our clients. Asia Pacific’s cybersecurity market was valued at US$30.5 billion in 2019, and it is expected to register a CAGR of 18.3%, during the period of 2020-2025, according to a report from research firm Mordor Intelligence. Cyber criminals have become increasingly active as companies of all sizes move more and more of their businesses online, forcing SMEs and large corporations alike to dedicate more resources to fight potential online threats.

Competition is high from other international companies. We expect the competition to increase and this could affect our pricing strategies and business model. However, we believe that our long-standing client relations and brand name within the local markets will provide us with a competitive point of differentiation.

Our Products and Services

Our principal business is Secure Logistics Solutions. This includes: (i) Cash-In-Transit – Non Dedicated Vehicle (Non-DV); (ii) Cash-In-Transit – Dedicated Vehicle (DV); (iii) ATM management; (iv) Cash Processing (CPC); (v) Cash Center Operations (CCT); (vi) Cheque Center Service (CDC); (vii) Express Cash; (viii) Coin Processing Service; (ix) Cash Deposit Management Solutions;

Secure Logistics Solutions collects cash from its clients’ sites, then delivers the collected cash to its cash processing centers for counting, checking and packing in bundles, after which the cash is transported to the Clients’ designated depository banks and deposited into the clients’ bank accounts. We enter into contracts with our customers to establish pricing and other terms of service. We charge customers based on activities (service performed) as well as based on the value of the consignment. The followings are descriptions of our services:

In 2020, in addition to our secure logistics business, we began to develop other non-cash related solutions and services. In view of the pace of global robotics development and in response to the more automated requirements, driven in part by the COVID-19 situation, we have begun to rollout robotics solutions for our clients in Thailand and the rest of the Asia Pacific region. We have also begun to rollout other technologically related solutions in response to the changing needs of our clients. As of December 31, 2020, we have generated $220,787 in revenue from our robotic solutions business.

Core Services

Our Core Services include CIT (Non-DV), CIT (DV), ATM Management, CPC and CCT. For the year ended December 31, 2020, Core Services represented approximately 94.2% of our total revenues.

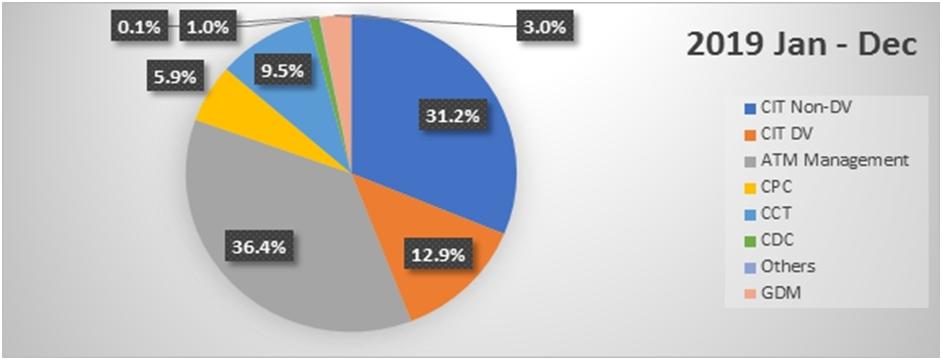

The charts below show the breakdown of our business services by sector for the fiscal years ended December 31, 2020 and 2019. These business sectors are discussed below.

15

Revenue by Services (For the year ended December 31, 2020)

Revenue by Services (For the year ended December 31, 2019)

(i) Cash-In-Transit – Non-Dedicated Vehicles (Non-DV)

CIT (Non-DV) includes the secure transportation of cash and other valuables between commercial banks and the Bank of Thailand, Thailand’s central bank. CIT (Non-DV) also includes the transportation of coins between the commercial banks, the Thai Royal Mints and the Bank of Thailand. As such, the main customers for this service are the local commercial banks. Charges to the customers are dependent on the value of the consignment; condition of the cash being collected (for example, seal bag collection, piece count collection, bulk count collection, or loose cash collection); and the volume of the transaction. Vehicles used for the delivery of this service are not dedicated to the specific customers.

For the years ended December 31, 2020 and 2019, CIT (Non-DV) revenues were approximately $12.0 million (32.0%) and 12.1 million (31.2%), respectively.

16

(ii) Cash-In-Transit - Dedicated Vehicle to Banks (DV)

CIT (DV) includes the secure transportation of cash and other valuables between commercial banks. As part of this service, dedicated vehicles are assigned specifically to the contracted customer for their dedicated use between the contracted designated bank branches. As this is a dedicated vehicle service, customers will submit direct schedules to our CIT teams for the daily operational arrangements and planning. Charges to the customers are on a per vehicle per month basis.

For the years ended December 31, 2020 and 2019, CIT (DV) revenues were approximately $4.8 million (12.8%) and $5.0 million (12.9%), respectively.

(iii) ATM Management

ATM management includes cash replenishment services and first and second line of maintenance services for the ATM machines. First line of maintenance services (FLM) includes rectification of issues related to jammed notes, dispenser failures and transaction record print-out issues. Second line of maintenance services (SLM) includes all other issues that cannot be rectified under the FLM. SLM includes complete machine failure, damage to hardware and software, among other things.

For the years ended December 31, 2020 and 2019, ATM Management revenues were approximately $12.5 million (33.3%) and $14.0 million (36.4%), respectively.

(iv) Cash Processing (CPC)

Cash processing (CPC) services include counting, sorting, counterfeit detection and vaulting services. We provide these services to commercial banks in Thailand.

For the years ended December 31, 2020 and 2019, CPC revenues were $2.8 million (7.5%) and $2.3 million (5.9%), respectively.

(v) Cash Center Operations (CCT)

Cash Center Operations (CCT) is an outsourced cash center management service. We operate the cash center on behalf of the customer, which includes note counting, sorting, storage, inventory management and secured transportation of the notes and coins to the various commercial banks in Thailand.

For the years ended December 31, 2020 and 2019, CCT revenues were approximately $3.3 million (8.6%) and $3.7 million (9.5%), respectively.

(vi) Cheque Center Service (CDC)

Cheque Center Service (CDC) includes secured cheque pickup and delivery service.

For the years ended December 31, 2020 and 2019, CDC revenues were approximately $0.1 million (0.2%) and $0.4 million (1%), respectively.

(vii) Express Cash

The express cash service is an expansion of our Guardforce Digital Machine, or GDM, solution. We work with commercial banks to have a mobile GDM installed in our CIT vehicles to collect cash from retail customers at the retailers’ sites. The cash is immediately processed inside the CIT vehicle and the cash counting results are immediately transmitted to GF Cash (CIT) headquarters and to the commercial bank. That bank will then credit the counted amount to its customers’ bank accounts. We launched the Express Cash service in 2019.

For the years ended December 31, 2020 and 2019, express cash service revenues were approximately $0.1 million (0.3%) and $nil (nil%), respectively.

17

(viii) Coin Processing Service

The Coin Processing Service includes the secure collection of coins from retail businesses and banks. The coins are stored and then delivered to the Royal Thai Mint, a sub-division of the Thai Treasury Department, Ministry of Finance. We deploy manpower to work at the Royal Thai Mint as cashier services. Additionally, we use our existing vehicle fleet to deliver coins from the Royal Thai Mint to bank branches, and vice versa.

For the years ended December 31, 2020 and 2019, coin processing service revenues were approximately $0.3 million (0.8%) and $0.04 million (0.1%), respectively.

(ix) Cash Deposit Management Solutions (GDM)

Cash Deposit Management Solutions are currently delivered by our Guardforce Digital Machine (GDM). The GDM product is deployed at customer sites to provide secured retail cash deposit services. Customers use our GDM product to deposit daily cash receipts. We then collect the daily receipts from our GDM in accordance to the agreed schedules. All cash receipts are then securely collected and delivered to our cash processing center for further handling and processing.

For the years ended December 31, 2020 and 2019, GDM revenues were $1.5 million (3.9%) and $1.2 million (3.0%), respectively.

(xi) Robotic Solutions

Our robotic solutions product offering is currently delivered via the deployment of T1-tempreature scanning concierge robots. Customers use our concierge robots to ensure compliance with COVD-19 health safety requirements. In addition, we are currently in the process of developing other value-added applications such as access control and environmental data analytics.

For the year ended Dec 31, 2020, robotics solutions revenues were $0.2 million (0.6%).

18

Service or performance obligations for each service type are as follows:

| Fixed Fees | ||||||||

| Service Type | Service/Performance Obligations | Per delivery / order | Per month | |||||

| Cash-In-Transit (CIT) – Non Dedicated Vehicles (Non-DV) | Delivery from point A to point B per customer request. Service obligation is generally completed within same day. | √ | ||||||