impact public health conditions. The uncertainty and potential economic volatility impact our customer base, supply chains, our business practices and our employees.

The COVID-19 pandemic and its economic impact have caused financial strain on our customer base due to decreased funding and other revenue shortfalls. However, more recently we have observed some improvements and decreased effects on our customer base with regards to the financial strain caused by the pandemic, resulting in increased sales volume.

In addition, COVID-19 continues to have an on-going adverse impact on global supply chains, including ours. We have experienced constraints in availability, increasing lead times and costs required to obtain some inventory components. We have been able to partially manage the cost impact on our supply chain as we have a multi-year purchase commitment for a key inventory component in our manufacturing process. We are also actively implementing new operating efficiencies in our supply chain processes to help offset the cost increases in component parts for our device.

The pandemic caused us to make modifications to our business practices, including work from home policies, establishing strict health and safety protocols for our offices specific to COVID-19 and imposing restrictions on employee travel. Our employees have resumed traveling to perform sales-generating and corporate activities, and we have opened our offices and have allowed employees at their discretion to return to our offices. We are designing and implementing a plan to allow employees to safely resume work in the office on a more regular basis.

We continue to closely monitor the developments of COVID-19 for any material impact on our business. Given the uncertainty and potential economic volatility of the impact of the COVID-19 pandemic, the recent positive developments we have experienced may change based on new information that may emerge concerning COVID-19, the actions to contain it or treat its impact and the economic impact on local, regional, national and international markets.

Recent Developments

On February 12, 2021 we completed the business combination with Longview (the “Business Combination”) pursuant to the terms of the Business Combination Agreement, dated as of November 19, 2020 (the “Business Combination Agreement”), by and among Longview Acquisition Corp. (“Longview”), Clay Merger Sub, Inc., a Delaware corporation (“Merger Sub”), and Butterfly Network, Inc., a Delaware corporation (“Legacy Butterfly”). The Business Combination was approved by Longview's stockholders at its special meeting held on February 12, 2021. The transaction resulted in the Company being renamed to "Butterfly Network, Inc.," Legacy Butterfly being renamed “BFLY Operations, Inc.” and the Company’s Class A common stock and warrants to purchase Class A common stock commencing trading on the New York Stock Exchange ("NYSE") on February 16, 2021 under the symbol "BFLY" and “BFLY WS”, respectively. As a result of the Business Combination, we received gross proceeds of approximately $589 million.

On May 27, 2021, we entered into an office lease agreement (the “Lease”) with NEEP Investors Holdings LLC (the “Landlord”) for approximately 61,138 rentable square feet consisting of the entire building located at 1600 District Avenue, Burlington, Massachusetts (the “Premises”). The Premises covered by the Lease will serve as our new principal office. The initial term of the Lease is ten (10) years and eight (8) months beginning on the lease commencement date, which is expected to be January 14, 2022. We delivered a security deposit in the amount of $4.0 million in the form of a letter of credit to the Landlord as of June 30, 2021.

Key Performance Metrics

We review the key performance measures discussed below, to evaluate business and measure performance, identify trends, formulate plans and make strategic decisions.

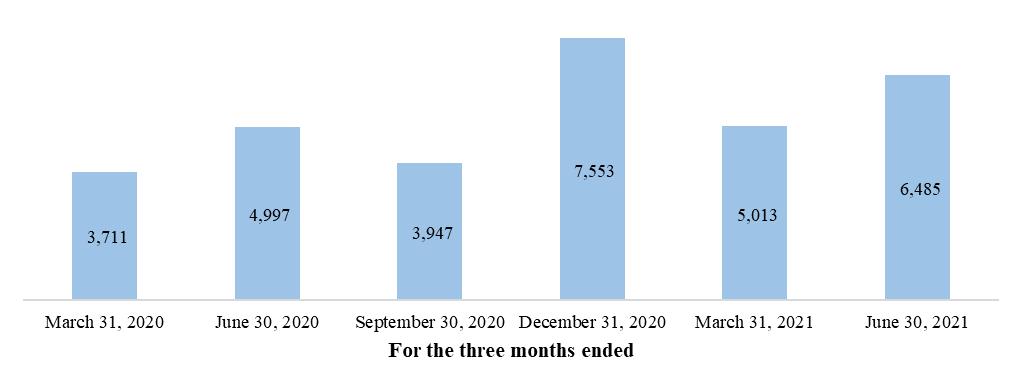

Units fulfilled

We define units fulfilled as the number of devices whereby control is transferred to a customer. We do not adjust this metric for returns as our volume of returns has historically been low. We view units fulfilled as a key indicator of the growth of our business. We believe that this metric is useful to investors because it presents our core growth and performance of our business period over period.