|

Delaware

|

| |

6770

|

| |

84-4117825

|

|

(State or other jurisdiction of

incorporation or organization)

|

| |

(Primary Standard Industrial

Classification Code Number)

|

| |

(I.R.S. Employer

Identification Number)

|

|

Steven D. Pidgeon

Andrew D. Ledbetter

DLA Piper LLP (US)

2525 East Camelback Road

Phoenix, Arizona 85016-4232

Telephone: (480) 606-5100

|

| |

Alexandra Plasencia

General Counsel

MSP Recovery, LLC

2701 Le Jeune Road, Floor 10

Coral Gables, Florida 33134

Telephone: (305) 614-2222

|

| |

Michael J. Aiello

Matthew Gilroy

Amanda Fenster

Weil, Gotshal & Manges LLP

767 Fifth Avenue

New York, NY 10153

Telephone: (212) 310-8000

|

|

Large accelerated filer

|

| |

☐

|

| |

|

| |

Accelerated filer

|

| |

☐

|

|

Non-accelerated filer

|

| |

☒

|

| |

|

| |

Smaller reporting company

|

| |

☒

|

|

|

| |

|

| |

|

| |

Emerging growth company

|

| |

☒

|

|

(1)

|

The Business Combination Proposal—To consider and vote upon a proposal to

approve the Membership Interest Purchase Agreement, dated as of July 11, 2021 (as it may be amended, supplemented or otherwise modified from time to time in accordance with its terms, the “MIPA”), a copy of which is attached to the

accompanying proxy statement/prospectus as Annex A, by and among the Company, Lionheart II Holdings, LLC, a newly formed wholly owned subsidiary of the Company (“Opco”), the MSP

Purchased Companies (as defined in the MIPA) (collectively, “MSP”), the members of MSP (the “Members”), and John H. Ruiz, in his capacity as the representative of the Members (the “Members’ Representative”), and the transactions

contemplated thereby. Pursuant to the MIPA, the Members will sell and assign all of their membership interests in MSP to Opco in exchange for non-economic voting shares of Class V common stock, par value $0.0001, of the Company

(“Class V Common Stock”) and non-voting economic Class B Units of Opco (“Class B Units,” and each pair consisting of one share of Class V Common Stock and one Class B Unit, an

“Up-C Unit”) (such transaction, the “Business Combination”). Following the closing of the Business Combination (the “Closing”), the Company will be organized in an “Up-C” structure in which all of the business of MSP and its

subsidiaries will be held directly or indirectly by Opco, and the Company will own all of the voting economic Class A Units of Opco and the Members and their designees will own all of the non-voting economic Class B Units in

accordance with the terms of the first amended and restated limited liability company agreement of Opco (the “LLC Agreement”). Each Up-C Unit may be exchanged for either, at the Company’s option, (a) cash or (b) one share of Class A

common stock, par value $0.0001, of the Company (“Class A Common Stock”), subject to the provisions set forth in the LLC Agreement. Subject to the terms and conditions set forth in the MIPA, the aggregate consideration to be paid to

the Members (or their designees) will consist of (i) 3,250,000,000 Up-C Units and (ii) rights to receive payments under the tax receivable agreement to be entered into at the Closing. Of the Up-C Units to be issued to certain Members

at Closing, 6,000,000 (the “Escrow Units”) will be deposited into an escrow account with Continental Stock Transfer and Trust Company to satisfy any indemnification claims that may be brought pursuant to the MIPA. Additionally, in

connection with the Business Combination, the Company intends, subject to compliance with applicable law, to declare a dividend comprising approximately 1,029,000,000 newly issued warrants, each to purchase one share of Class A Common

Stock for an exercise price of $11.50 per share (the “New Warrants”), conditioned upon the consummation of any redemptions by the holders of Class A Common Stock and the Closing, to the holders of record of the Class A Common Stock as

of the close of business on the date of Closing (the “Closing Date”), after giving effect to the waiver of the right, title and interest in, to or under, participation in any such dividend by the Members, on behalf of themselves and

any of their designees. Following the Closing, the Company will have two classes of authorized common stock. The shares of Class A Common Stock and Class V Common Stock each will be entitled to one vote per share on matters submitted

to a vote of stockholders. Holders of the Class V Common Stock will not have any of the economic rights (including rights to dividends and distributions upon liquidation) provided to holders of the Class A Common Stock. Following the

Closing, assuming no additional redemptions by Public Stockholders (after giving effect to the redemption of 10,946,369 shares of Class A Common Stock in connection with the Company stockholder vote to approve the Extension Amendment

(as defined below)) (the “no redemption scenario”) and excluding the impact on any outstanding warrants and New Warrants, John H. Ruiz, the CEO and founder of MSP, and Frank C. Quesada, the CLO of MSP, will together control

approximately 92.58% of the combined voting power of the capital stock of the Company (assuming no attributed ownership based on Messrs. Ruiz and Quesada’s investment in VRM) (the “Business Combination Proposal”). Such ownership

percentages will be affected by the level of redemptions by Public Stockholders and the exercise of outstanding warrants or New Warrants. See “Summary—Ownership of the Post- Combination Company”;

|

|

(2)

|

The Nasdaq Proposal—To consider and vote upon a proposal to approve, for purposes of

complying with applicable listing rules of The Nasdaq Capital Market (“Nasdaq”) the issuance of more than 20% of the issued and outstanding common stock, par value $0.0001 per share, of the Company and voting power in connection with

the Business Combination (the “Nasdaq Proposal”);

|

|

(3)

|

The Charter Approval Proposal—To consider and vote upon a proposal to adopt the

Second Amended and Restated Certificate of Incorporation (the “Proposed Charter”) in the form attached to the accompanying proxy statement/prospectus as Annex B (the “Charter Approval

Proposal”);

|

|

(4)

|

The Non-Binding Governance Proposals—To consider and vote upon, on a non-binding

advisory basis, the separate proposals with respect to certain governance provisions in the Proposed Charter in accordance with the requirements of the Securities and Exchange Commission (the “Non-Binding Governance Proposals”):

|

|

a.

|

Proposal No. 4A: Change in Authorized Shares—To (i) increase the Company’s

total number of authorized shares of capital stock from 111,000,000 shares to 8,760,000,000 shares of capital stock, (ii) increase the Company’s authorized Class A Common Stock from 100,000,000 shares to 5,500,000,000 shares of

Class A Common Stock, (iii) create the Class V Common Stock, consisting of 3,250,000,000 authorized shares of Class V Common Stock and (iv) increase the Company’s authorized shares of Preferred Stock from 1,000,000 to 10,000,000

shares of Preferred Stock.

|

|

b.

|

Proposal No. 4B: Dual-Class Stock—To provide for a capital structure

pursuant to which there are two classes of common stock and in which, subject to applicable law and the rights, if any, of the holders of any outstanding series of Preferred Stock, the holders of outstanding shares of common stock of

the Company will vote together as a single class on all matters with respect to which stockholders of the Company are entitled to vote under applicable law, the Proposed Charter or the Amended and Restated Bylaws, or upon which a vote

of the stockholders generally entitled to vote is otherwise duly called for by the Company; provided, however, that except as may otherwise be required by applicable law, each holder of outstanding shares of common stock of the

Company will not be entitled to vote on any amendment to the Proposed Charter that relates solely to the terms of one or more outstanding series of Preferred Stock (including, without limitation, the powers (including voting powers),

if any, preferences and relative, participating, optional, special or other rights, if any, and the qualifications, limitations and restrictions, if any, of such series of Preferred Stock), if the holders of such affected series are

entitled, either voting separately as a single class or together as a class with the holders of any other outstanding series of Preferred Stock, to vote thereon pursuant to the Proposed Charter or the Delaware General Corporation Law.

In each such vote, the holders of Class A Common Stock and holders of Class V Common Stock will be entitled to one vote per share of Class A Common Stock or Class V Common Stock, respectively, including the election of directors and

significant corporate transactions (such as a merger or other sale of the Company or its assets).

|

|

c.

|

Proposal No. 4C: Removal of Directors—To provide that any director or the entire

board of directors of the Post-Combination Company (the “Board”) may be removed (i) at any time prior to the Voting Rights Threshold Date by a simple majority voting together as a single class, with or without cause, notwithstanding the

classification of the Board, and (ii) at any time from and after the Voting Rights Threshold Date, solely for cause and only by the affirmative vote of the holders of at least 662∕3% of

the voting power of all of the then outstanding shares of the Company generally entitled to vote thereon, voting together as a single class.

|

|

d.

|

Proposal No. 4D: Required Stockholder Vote to Amend Certain Sections of the Proposed

Charter—To provide that, in addition to any affirmative vote required by applicable law or the Proposed Charter, from and after the Voting Rights Threshold Date, the approval by affirmative vote of the holders of at

least 662∕3% in voting power of the then outstanding shares of the Company generally entitled to vote is required to make any amendment to Article Seventh

(Board of Directors) or Article Eighth (Written Consent of Stockholders) of the Proposed Charter.

|

|

e.

|

Proposal No. 4E: Required Stockholder Vote to Amend the Amended and Restated Bylaws—To

provide that, in addition to any affirmative vote required by the Proposed Charter, any bylaw that is to be made, altered, amended or repealed by the stockholders of the Company shall receive, at any time (i) prior to the Voting

Rights Threshold Date, the affirmative vote of the holders of at least a majority in voting power of the then outstanding shares of the Company generally entitled to vote, voting together as a single class, and (ii) from and after the

Voting Rights Threshold Date, the affirmative vote of the holders of at least 662∕3% in voting power of the then outstanding shares of stock of the Company

generally entitled to vote, voting together as a single class.

|

|

(5)

|

The Director Election Proposal—To consider and vote upon a proposal to elect seven

directors to serve on the Board of Directors of the Post-Combination Company until the first annual meeting of stockholders following the Business Combination, in the case of Class I directors, the second annual meeting of stockholders

following the Business Combination, in the case of Class II directors, and the third annual meeting of stockholders following the Business Combination, in the case of Class III directors, and, in each case, until their respective

successors are duly elected and qualified (the “Director Election Proposal”);

|

|

(6)

|

The Incentive Plan Proposal—To consider and vote upon a proposal to approve and adopt

the MSP Recovery, Inc. 2022 Omnibus Incentive Plan (the “Incentive Plan”) and the material terms thereunder (the “Equity Incentive Plan Proposal”). A copy of the Incentive Plan is attached to the accompanying proxy statement/prospectus

as Annex J; and

|

|

(7)

|

The Adjournment Proposal—To consider and vote upon a proposal to approve the

adjournment of the Special Meeting to a later date or dates, if necessary, (A) to ensure that any supplement or amendment to the accompanying proxy statement/prospectus that the Board of Directors of the Company (the “LCAP Board”) has

determined in good faith is required by applicable law to be disclosed to Company stockholders and for such supplement or amendment to be promptly disseminated to Company stockholders prior to the Special Meeting, (B) if, as of the time

for which the Special Meeting is originally scheduled, there are insufficient shares of common stock represented (either in person or by proxy) to constitute a quorum necessary to conduct business at the Special Meeting or (C) to permit

further solicitation and vote of proxies if there are insufficient votes for, or otherwise in connection with, the approval of the Business Combination Proposal, the Nasdaq Proposal, the Charter Approval Proposal, the Director Election

Proposal or the Incentive Plan Proposal (the “Adjournment Proposal” and, together with the Business Combination Proposal, the Nasdaq Proposal, the Charter Approval Proposal, the Non-Binding Governance Proposals, the Director Election

Proposal and the Equity Incentive Plan Proposal, each, a “Proposal” and collectively, the “Proposals”).

|

|

|

| |

By Order of the Board of Directors

|

|

|

| |

|

|

|

| |

|

|

|

| |

Ophir Sternberg

|

|

|

| |

Chairman, President and Chief Executive Officer

|

|

Q:

|

WHAT IS THE BUSINESS COMBINATION?

|

|

A:

|

Pursuant to the MIPA, the Members will sell and assign all of their membership interests in MSP to Opco in exchange for

Up-C Units (or shares of Class A Common Stock). Following the Closing, the Company will be organized in an “Up-C” structure in which all of the business of MSP and its subsidiaries will be held directly or indirectly by Opco, and the

Company will own all of the voting economic Class A Units of Opco and the Members or their designees will own all of the non-voting economic Class B Units of Opco in accordance with the terms of the LLC Agreement. Each Up-C Unit may

be exchanged for either, at the Company’s option, (a) cash or (b) one share of Class A Common Stock, subject to the provisions set forth in the LLC Agreement. Subject to the terms and conditions set forth in the MIPA, the aggregate

consideration to be paid to the Members (or their designees) will consist of (i) 3,250,000,000 Up-C Units and (ii) rights to receive payments under the tax receivable agreement to be entered into at the Closing. Of the Up-C Units to

be issued to certain Members at Closing, 6,000,000 will be deposited into an escrow account with Continental Stock Transfer and Trust Company, to satisfy any indemnification claims that may be brought pursuant to the MIPA.

Additionally, in connection with the Business Combination and to provide additional consideration to holders of Class A Common Stock that do not redeem their shares of Class A Common Stock, the Company intends, subject to compliance

with applicable law, to declare a dividend comprising an aggregate of approximately 1,029,000,000 New Warrants, conditioned upon the consummation of any redemptions by the holders of Class A Common Stock and the Closing, to the

holders of record of the Class A Common Stock as of the Closing Date, after giving effect to the waiver of the right, title and interest in, to or under, participation in any such dividend by the Members, on behalf of themselves and

any of their designees. Following the Closing, the Company will have two classes of authorized common stock. The shares of Class A Common Stock and Class V Common Stock each will be entitled to one vote per share on matters submitted

to a vote of stockholders. The holders of the Class V Common Stock will not have any of the economic rights (including rights to dividends and distributions upon liquidation) provided to holders of the Class A Common Stock. Following

the Closing, assuming the no redemption scenario and excluding the impact on any outstanding warrants and New Warrants, John H. Ruiz, the CEO and founder of MSP, and Frank C. Quesada, the CLO of MSP, will together control

approximately 92.58% of the combined voting power of the capital stock of the Company (assuming no attributed ownership based on Messrs. Ruiz and Quesada’s investment in VRM) (See “Certain

Relationships and Related Party Transactions” beginning on page [243]). Such ownership percentage will be affected by the level of redemptions by Public Stockholders and the

exercise of outstanding warrants or New Warrants. See “Summary—Ownership of the Post-Combination Company.”

|

|

Q:

|

WHY AM I RECEIVING THIS DOCUMENT?

|

|

A:

|

The Company is sending this proxy statement/prospectus to its stockholders to help them decide how to vote their shares of

the Company’s common stock with respect to the matters to be considered at the Special Meeting. The Business Combination cannot be completed unless Company stockholders approve the Business Combination Proposal, the Nasdaq Proposal, the

Charter Approval Proposal, the Incentive Plan Proposal and the Director Election Proposal set forth in this proxy statement/prospectus for their approval. Information about the Special Meeting, the Business Combination and the other

business to be considered by stockholders at the Special Meeting is contained in this proxy statement/prospectus. This document constitutes a proxy statement of the Company and a prospectus of the Company. It is a proxy statement

because the LCAP Board is soliciting proxies from its stockholders using this proxy statement/prospectus. It is a prospectus because the Company is offering the New Warrants in connection with the Business Combination. See “Membership Interest Purchase Agreement.”

|

|

Q:

|

WHAT WILL MSP’S MEMBERS RECEIVE IN THE BUSINESS COMBINATION?

|

|

A:

|

Subject to the terms and conditions set forth in the MIPA, the aggregate consideration to be paid to the Members (or their

designees) will consist of (i) 3,250,000,000 Up-C Units or, pursuant to notice delivered to the Company, with respect to all or a portion of the Up-C Units to be received by each such Member, one share of Class A Common Stock in lieu of

each Up-C Unit and (ii) rights to receive payments under the tax receivable agreement to be entered into at the Closing. Of the Up-C Units to be issued to certain Members at Closing, 6,000,000 will be deposited into an escrow account

with Continental Stock Transfer and Trust Company to satisfy any indemnification claims that may be brought pursuant to the MIPA.

|

|

Q:

|

WHEN DO YOU EXPECT THE BUSINESS COMBINATION TO BE COMPLETED?

|

|

A:

|

It is currently anticipated that the Business Combination will be consummated promptly following the Special Meeting, which

is set for [ ], 2022; however, such meeting could be adjourned, as described herein. Neither the Company nor MSP can assure you of when or if the Business Combination will be completed and it is possible that factors outside of the

control of both companies could result in the Business Combination being completed at a different time or not at all. Prior to the Closing, the Company must obtain the approval of its stockholders for certain of the proposals set forth

in this proxy statement/prospectus for their approval and the Company and MSP must obtain certain necessary regulatory approvals and satisfy other closing conditions. See “The Membership Interest

Purchase Agreement — Conditions to the Business Combination” beginning on page [219].

|

|

Q:

|

WHAT HAPPENS IF THE BUSINESS COMBINATION IS NOT COMPLETED?

|

|

A:

|

If the Business Combination Proposal is not approved and we do not consummate a business combination by August 18, 2022, we

will be required to dissolve and liquidate our Trust Account, unless we amend our current certificate of incorporation (which requires the affirmative vote of the holders of 65% of all then outstanding shares of common stock) and amend

certain other agreements into which we have entered to extend the life of the Company.

|

|

Q:

|

HOW WILL THE COMPANY BE MANAGED AND GOVERNED FOLLOWING THE BUSINESS COMBINATION?

|

|

A:

|

The Company does not currently have any management-level employees other than Ophir Sternberg, our Chairman, President and

Chief Executive Officer, Paul Rapisarda, our Chief Financial Officer, and Faquiry Diaz Cala, our Chief Operating Officer. Following the Closing, the Company’s executive officers are expected to be the current management team of MSP. See

“Management of the Post-Combination Company Following the Business Combination” for more information.

|

|

Q:

|

WHAT EQUITY STAKE WILL CURRENT STOCKHOLDERS, THE INITIAL STOCKHOLDERS, AND THE MEMBERS HOLD IN THE

POST-COMBINATION COMPANY?

|

|

A:

|

It is anticipated that, upon completion of the Business Combination, and assuming (1) the no redemption scenario and (2)

that the holders of the Company’s existing Public Warrants and Private Warrants exercise those warrants, and no New Warrants are exercised: (i) the Public Stockholders will retain approximately 0.4% of the common stock of the

Post-Combination Company; (ii) the Initial Stockholders will retain approximately 0.2% of the common stock of the Post-Combination Company; and (iii) the Members (or their designees) will acquire

|

|

Q:

|

FOLLOWING THE BUSINESS COMBINATION, WILL THE COMPANY’S COMMON STOCK CONTINUE TO TRADE ON A STOCK EXCHANGE?

|

|

A:

|

Yes. We intend to apply to continue the listing of our publicly traded Class A Common Stock and Public Warrants on Nasdaq

under the symbols “MSPR” and “LCAPW,” respectively, and apply to list the New Warrants under the symbol “MSPRW,” upon the closing of the Business Combination. If issued, the New Warrants are expected to trade promptly following their

issuance. At the Closing, each Unit will separate into its components, comprising one share of Class A Common Stock and one-half of one Public Warrant. Following the Closing, we intend to change our name from “Lionheart Acquisition

Corporation II” to “MSP Recovery, Inc.”

|

|

Q:

|

WHAT ARE THE PRINCIPAL DIFFERENCES BETWEEN THE COMPANY’S CLASS A COMMON STOCK AND CLASS V COMMON STOCK?

|

|

A:

|

Each holder of record of Class A Common Stock and Class V Common Stock on the relevant record date will be entitled to cast

one vote for each share of Class A Common Stock or Class V Common Stock, respectively. Holders of the Class V Common Stock will not have any of the economic rights (including rights to dividends and distributions upon liquidation)

provided to holders of the Class A Common Stock. For more information, please see the section entitled “Description of Securities.”

|

|

Q:

|

WHAT CONDITIONS MUST BE SATISFIED TO COMPLETE THE BUSINESS COMBINATION?

|

|

A:

|

There are a number of closing conditions in the MIPA, including the approval by the stockholders of the Company of the

Business Combination Proposal, the Nasdaq Proposal, the Charter Approval Proposal, the Director Election Proposal and the Incentive Plan Proposal. For a summary of the conditions that must be satisfied or waived prior to completion of

the Business Combination, please see the section entitled “Membership Interest Purchase Agreement.”

|

|

Q:

|

WHEN AND WHERE IS THE SPECIAL MEETING?

|

|

A:

|

The Special Meeting will be held at a.m. Eastern Time, on , 2022 in virtual format. The Special Meeting can be accessed

by visiting [•], where Company stockholders will be able to listen to the meeting live and vote during the meeting. Additionally, Company stockholders have the option to listen to the Special Meeting by dialing [•] (toll-free within the

U.S. and Canada) or [•] (outside of the U.S. and Canada, standard rates apply). The passcode for telephone access is [•], but please note that Company stockholders who choose to participate telephonically cannot vote or ask questions.

Company stockholders who wish to join the Special Meeting telephonically may be counted as present, vote at and examine the list of Company stockholders entitled to vote at the Special Meeting by visiting and entering the control number

included in the proxy card, voting instruction form or notice included in their proxy materials.

|

|

Q:

|

WHAT AM I BEING ASKED TO VOTE ON AND WHY IS THIS APPROVAL NECESSARY?

|

|

A:

|

Company stockholders are being asked to vote on the following:

|

|

•

|

A proposal to adopt the MIPA and the transactions contemplated thereby. See the section entitled “Proposal No. 1 — The Business Combination Proposal.”

|

|

•

|

A proposal to approve, for purposes of complying with applicable listing rules of Nasdaq the issuance of more than 20% of the

issued and outstanding common stock of the Company and voting power in connection with the Business Combination. See the section entitled “Proposal No. 2 — The Nasdaq Proposal.”

|

|

•

|

A proposal to adopt the Proposed Charter in the form attached hereto as Annex B.

See the section entitled “Proposal No. 3 — The Charter Approval Proposal.”

|

|

•

|

Five separate proposals with respect to certain governance provisions in the Proposed Charter, which are being separately

presented in accordance with SEC requirements and which will be voted upon on a non-binding advisory basis.

|

|

○

|

Proposal No. 4A: Change in Authorized Shares—To (i) increase the Company’s total number of authorized shares of capital stock from 111,000,000 shares to 8,760,000,000 shares of capital stock, (ii) increase the Company’s

authorized Class A Common Stock from 100,000,000 shares to 5,500,000,000 shares of Class A Common Stock, (iii) create the Class V Common Stock, consisting of 3,250,000,000 authorized shares of Class V Common Stock

and (iv) increase the Company’s authorized shares of Preferred Stock from 1,000,000 to 10,000,000 shares of Preferred Stock.

|

|

○

|

Proposal No. 4B: Dual-Class Stock—To provide for a capital structure pursuant to which, subject to applicable law and the rights, if any, of the holders of any outstanding series of Preferred Stock, the holders of outstanding shares of

common stock of the Company will vote together as a single class on all matters with respect to which stockholders of the Company are entitled to vote under applicable law, the Proposed Charter or the

Amended and Restated Bylaws, or upon which a vote of the stockholders generally entitled to vote is otherwise duly called for by the Company; provided, however, that except as may otherwise be required by

applicable law, each holder of outstanding shares of common stock of the Company will not be entitled to vote on any amendment to the Proposed Charter that relates solely to the terms of one or more

outstanding series of Preferred Stock (including, without limitation, the powers (including voting powers), if any, preferences and relative, participating, optional, special or other rights, if any, and the

qualifications, limitations and restrictions, if any, of such series of Preferred Stock), if the holders of such affected series are entitled, either voting separately as a single class or together as a class with

the holders of any other outstanding series of Preferred Stock, to vote thereon pursuant to the Proposed Charter or the DGCL. In each such vote, the holders of Class A Common Stock and holders of Class V Common Stock

will be entitled to one vote per share of Class A Common Stock or Class V Common Stock, respectively, including the election of directors and significant corporate transactions (such as a merger or other sale of the

Company or its assets).

|

|

○

|

Proposal No. 4C: Removal of Directors—To

provide that any director or the entire Board may be removed (i) at any time prior to the Voting Rights Threshold Date by a simple majority voting together as a single class, with or without cause, notwithstanding the classification

of the Board, and (ii) at any time from and after the Voting Rights Threshold Date, solely for cause and only by the affirmative vote of the holders of at least 662∕3% of the voting power of all of the then outstanding shares of the Corporation generally entitled to vote thereon, voting together as a single class.

|

|

○

|

Proposal No. 4D: Required Stockholder Vote to Amend Certain Sections of

the Proposed Charter—To provide that, from and after the Voting Rights Threshold Date, in addition to any affirmative vote required by applicable law, the approval by

affirmative vote of the holders of at least 662∕3% in voting power of

the then outstanding shares of the Company generally entitled to vote is required to make any amendment to Article Seventh (Board of Directors) or Article Eighth (Written Consent of Stockholders) of the

Proposed Charter.

|

|

○

|

Proposal No 4E: Required Stockholder Vote to Amend the Amended and

Restated Bylaws—To provide that, in addition to any affirmative vote required by the Proposed Charter, any bylaw that is to be made, altered, amended or repealed by the

stockholders of the Company shall receive, at any time (i) prior to the Voting Rights Threshold Date, the affirmative vote of the holders of at least a majority in voting power of the then outstanding shares

of the Company generally entitled to vote, voting

|

|

•

|

A proposal to elect seven directors to serve on the Board until the first annual meeting of stockholders following the

Business Combination, in the case of Class I directors, the second annual meeting of stockholders following the Business Combination, in the case of Class II directors, and the third annual meeting of stockholders following the

Business Combination, in the case of Class III directors, and, in each case, until their respective successors are duly elected and qualified. See the section entitled “Proposal No. 5 —

The Director Election Proposal.”

|

|

•

|

A proposal to approve and adopt the MSP Recovery, Inc. 2022 Omnibus Incentive Plan, a copy of which is attached hereto as Annex J. See the section entitled “Proposal No. 6 — The Incentive Plan Proposal.”

|

|

•

|

A proposal to approve the adjournment of the Special Meeting to a later date or dates, if necessary, (A) to ensure that any

supplement or amendment to the accompanying proxy statement/prospectus that the LCAP Board has determined in good faith is required by applicable law to be disclosed to Company stockholders and for such supplement or amendment to be

promptly disseminated to Company stockholders prior to the Special Meeting, (B) if, as of the time for which the Special Meeting is originally scheduled, there are insufficient shares of common stock represented (either in person or by

proxy) to constitute a quorum necessary to conduct business at the Special Meeting or (C) to permit further solicitation and vote of proxies if there are insufficient votes for, or otherwise in connection with, the approval of the

Business Combination Proposal, the Nasdaq Proposal, the Charter Approval Proposal, the Director Election Proposal or the Incentive Plan Proposal. See the section entitled “Proposal No. 7 — The

Adjournment Proposal.”

|

|

Q:

|

ARE THE PROPOSALS CONDITIONED ON ONE ANOTHER?

|

|

A:

|

Yes. The Closing is conditioned on the approval of each of the Business Combination Proposal, the Nasdaq Proposal, the

Charter Approval Proposal, the Director Election Proposal and the Incentive Plan Proposal at the Special Meeting, subject to the terms of the MIPA. If any of these proposals are not approved, we will not consummate the Business

Combination. If the Business Combination Proposal is not approved, the other Proposals (except the Adjournment Proposal, as described below) will not be presented to the stockholders for a vote. The Adjournment Proposal is not

conditioned on the approval of any other proposal set forth in this proxy statement/prospectus. If we do not consummate the Business Combination and fail to complete an initial business combination by August 18, 2022, we will be

required to dissolve and liquidate our Trust Account by returning the then remaining funds in such account to the Public Stockholders.

|

|

Q:

|

WHAT IS MSP’S BUSINESS?

|

|

A:

|

MSP is a healthcare recovery and data analytics company. MSP has also developed software that solves many of the issues

currently being experienced by doctors, hospitals as well as other healthcare practitioners as well as payers within the healthcare system. The MSP systems provide a platform for providers to identify proper payers at the time of

patient encounter and to collect payment more quickly, at higher amounts. MSP’s agreements allow for MSP to monetize the claims that are processed and properly identified. MSP has also identified systemic issues relating to police

reporting at the time of auto accidents and is developing software to solve these issues. This software system, using blockchain technology, will involve proper capture of data to help first responders to identify health conditions at

the scene of accidents and transmit that data for improved patient care. MSP’s system will also enable individuals to access their health care data, which will be encrypted and stored and accessed through a cloud. Individuals can then

choose to grant immediate data access to their healthcare practitioners, for healthcare services based on up-to-date patient medical information. MSP’s business model includes two principal lines of business: (a) claims recovery and

(b) “chase to pay” services. First, through the claims recovery services, MSP acquires claims from its Assignors and utilizes its data analytics services to identify improper payments for healthcare services. After identifying

improper payments, MSP then seeks to recover the amounts owed to its Assignors from those parties who, under applicable law or contract,

|

|

Q:

|

WHY IS THE COMPANY PROPOSING THE BUSINESS COMBINATION?

|

|

A:

|

The Company was organized to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or

other similar business combination with one or more businesses or entities.

|

|

Q:

|

DID THE LCAP BOARD OBTAIN A FAIRNESS OPINION IN DETERMINING WHETHER OR NOT TO PROCEED WITH THE BUSINESS

COMBINATION?

|

|

A:

|

No. Neither the LCAP Board nor any committee thereof is required to obtain an opinion from an independent investment banking

or accounting firm that the Business Combination is fair to us from a financial point of view. Neither the LCAP Board nor any committee thereof obtained a third-party valuation in connection with the Business Combination. In analyzing

the Business Combination, the Company and its representatives and professional advisors conducted extensive due diligence on MSP and the financial terms set forth in the MIPA. Based on the foregoing, the LCAP Board unanimously

determined that the Business Combination was fair and advisable to, and in the best interest of, the Company and its stockholders.

|

|

Q:

|

WHY IS THE COMPANY PROVIDING STOCKHOLDERS WITH THE OPPORTUNITY TO VOTE ON THE BUSINESS COMBINATION?

|

|

A:

|

We are seeking approval of the Business Combination for purposes of complying with our Existing Charter and applicable Nasdaq

listing rules requiring stockholder approval of issuances of more than 20% of a listed company’s issued and outstanding common stock and voting power. In addition, pursuant to the Existing Charter, we must provide all Public

Stockholders with the opportunity to redeem all or a portion of their Public Shares upon the consummation of an initial business combination (as defined in our Existing Charter), either in conjunction with a tender offer or in

conjunction with a stockholder vote to approve such initial business combination. If we submit an initial business combination to the stockholders for their approval, our Existing Charter requires us to conduct a redemption offer in

conjunction with the proxy solicitation (and not in conjunction with a tender offer) pursuant to the applicable SEC proxy solicitation rules.

|

|

Q:

|

DO MSP’S MEMBERS NEED TO APPROVE THE BUSINESS COMBINATION?

|

|

A:

|

Although the Closing is subject to various actions by the Members, the Members are each party to the MIPA and, as such, have

already provided their approval for the Business Combination in their capacity as equityholders of the MSP Purchased Companies.

|

|

Q:

|

DO I HAVE REDEMPTION RIGHTS?

|

|

A:

|

If you are a holder of Public Shares, you have the right to demand that the Company redeem such shares for a pro rata portion

of the cash held in the Trust Account, which holds the proceeds of the IPO, as of two business days prior to the consummation of the transactions contemplated by the Business Combination Proposal (including interest earned on the funds

held in the Trust Account and not previously released to the Company to pay taxes) upon the Closing (“Redemption Rights”).

|

|

Q:

|

WILL MY VOTE AFFECT MY ABILITY TO EXERCISE REDEMPTION RIGHTS?

|

|

A:

|

No. You may exercise your redemption rights whether you vote your Public Shares for or against, or whether you abstain from

voting on, the Business Combination Proposal or any other Proposal described in this proxy statement/prospectus. As a result, the Business Combination Proposal can be approved by stockholders who will redeem their Public Shares and no

longer remain stockholders, and the Business Combination may be consummated even though the funds available from the Trust Account and the number of Public Stockholders are substantially reduced as a result of redemptions by Public

Stockholders.

|

|

Q:

|

HOW DO I EXERCISE MY REDEMPTION RIGHTS?

|

|

A:

|

In order to exercise your redemption rights, you must (i) if you hold Public Units, separate the underlying Public Shares and

Public Warrants, and (ii) prior to 5:00 p.m. Eastern Time on, [•], 2022 (two business days before the Special Meeting), tender your shares physically or electronically and submit a request in writing that we redeem your Public Shares

for cash to Continental Stock Transfer & Trust Company, our transfer agent (“Transfer Agent”), at the following address:

|

|

Q:

|

DO I HAVE APPRAISAL RIGHTS IF I OBJECT TO THE PROPOSED BUSINESS COMBINATION?

|

|

A:

|

No. The Company’s stockholders do not have appraisal rights in connection with the Business Combination under the DGCL. See

the section entitled “Appraisal Rights.”

|

|

Q:

|

WHAT HAPPENS TO THE FUNDS DEPOSITED IN THE TRUST ACCOUNT AFTER CONSUMMATION OF THE BUSINESS COMBINATION?

|

|

A:

|

A total of $230.0 million in net proceeds of the IPO was placed in the Trust Account following the IPO. After consummation of

the Business Combination, the funds in the Trust Account will be used to pay holders of the Public Shares who exercise redemption rights, to pay fees and expenses incurred in connection with the Business Combination (including aggregate

fees of up to $8,050,000 as deferred underwriting commissions) and for the Post-Combination Company’s working capital and general corporate purposes.

|

|

Q:

|

WHAT HAPPENS IF THE BUSINESS COMBINATION IS NOT CONSUMMATED?

|

|

A:

|

There are certain circumstances under which the MIPA may be terminated. Please see the section entitled “Proposal No. 1 — Business Combination Proposal — MIPA” for information regarding the parties’ specific termination rights.

|

|

Q:

|

HOW DO THE SPONSOR, AND OUR DIRECTORS AND OFFICERS INTEND TO VOTE ON THE PROPOSALS?

|

|

A:

|

The Sponsor and the Company’s directors and officers are entitled to vote an aggregate of 34.7% of the outstanding shares

of common stock (which includes the Founder Shares and the Private Shares). The Company has entered into a letter agreement with the Sponsor and our directors and officers pursuant to which each such person has agreed to vote all

shares of our common stock owned by them in favor of the Proposals. Nomura, the underwriter of our IPO, has agreed to vote any Founder Shares and Private Shares held by it in favor of the

|

|

Q:

|

WHAT CONSTITUTES A QUORUM AT THE SPECIAL MEETING?

|

|

A:

|

A majority of the voting power of the common stock entitled to vote at the Special Meeting must be present, in person or

represented by proxy at the Special Meeting to constitute a quorum and in order to conduct business at the Special Meeting. Abstentions and broker non-votes will be counted as present for the purpose of determining a quorum. Nomura,

the Sponsor and our directors and officers, who collectively currently own 43.0% of the issued and outstanding shares of common stock, will count towards this quorum. In the absence of a quorum, the chairman of the Special Meeting has

power to adjourn the Special Meeting. As of the Record Date for the Special Meeting, [•] shares of common stock would be required to be present in person or represented by proxy to achieve a quorum.

|

|

Q:

|

WHAT VOTE IS REQUIRED TO APPROVE EACH PROPOSAL AT THE SPECIAL MEETING?

|

|

A:

|

The Business Combination Proposal: The approval of the Business Combination Proposal

requires the affirmative vote (in person or by proxy) of the holders of a majority of the shares of Class A Common Stock and Class B Common Stock entitled to vote and actually cast thereon at the Special Meeting, voting as a single

class. Accordingly, a stockholder’s failure to submit a proxy or to vote in person at the Special Meeting, as well as an abstention from voting and a broker non-vote with regard to the Business Combination Proposal, will have no effect

on the Business Combination Proposal. Company stockholders must approve the Business Combination Proposal in order for the Business Combination to occur.

|

|

Q:

|

DO ANY OF THE COMPANY’S OFFICERS OR DIRECTORS HAVE INTERESTS IN THE BUSINESS COMBINATION THAT MAY DIFFER FROM

OR BE IN ADDITION TO THE INTERESTS OF STOCKHOLDERS?

|

|

A:

|

The Sponsor and our directors and officers have interests in the Business Combination that are different from or in addition

to (and which may conflict with) your interests. You should take these interests into account in deciding whether to approve the Proposals. These interests include:

|

|

•

|

the fact that our Initial Stockholders have agreed not to redeem any of the Founder Shares in connection with a stockholder

vote to approve the proposed Business Combination;

|

|

•

|

the fact that Ophir Sternberg, Thomas W. Hawkins and Roger Meltzer will serve as directors of the Post-Combination

Company;

|

|

•

|

the fact that the Sponsor paid an aggregate of $25,000 for 5,000,000 Founder Shares in January 2020 and, in February 2020,

the Company declared a stock dividend of 0.15 share for each Founder Share outstanding, resulting in the Sponsor holding an aggregate of 5,750,000 Founder Shares. After giving effect to the sales or transfer of Founder Shares to Nomura

and in connection with the IPO to certain insiders, the remaining 5,667,500 Founder Shares will have a significantly higher value at the time of the Business Combination, which if unrestricted and freely tradable would be valued at

approximately $56,675,000 but, given the restrictions on such shares, we believe such shares have less value;

|

|

•

|

the fact that our Initial Stockholders have agreed to waive their rights to liquidating distributions from the Trust Account

with respect to their Founder Shares if we fail to complete an initial business combination by August 18, 2022 (or such later date as may be approved by the Company’s stockholders);

|

|

•

|

the fact that our Initial Stockholders, being holders of Class A Common Stock, are eligible to receive the dividend comprised

of the New Warrants to be issued upon the automatic conversion of the Founder Shares at Closing, and the fact that, because our Initial Stockholders have agreed not to redeem their shares in connection with the Business Combination,

they may receive a significant number of such New Warrants, if other holders of Class A Common Stock elect to exercise their redemption rights;

|

|

•

|

the fact that the Sponsor paid an aggregate of $5,950,000 for Private Units comprised of 297,500 Private Warrants to purchase

shares of Class A Common Stock and that such Private Warrants will expire worthless if a business combination is not consummated by August 18, 2022;

|

|

•

|

the continued right of the Sponsor to hold Class A Common Stock and the shares of Class A Common Stock to be issued to the

Sponsor upon exercise of its Private Warrants following the Business Combination, subject to certain lock-up periods;

|

|

•

|

if the Trust Account is liquidated, including in the event we are unable to complete an initial business combination within

the required time period, the Sponsor has agreed to indemnify us to ensure that the proceeds in the Trust Account are not reduced below $10.00 per Public Share, or such lesser per Public Share amount as is in the Trust Account on the

liquidation date, by the claims of prospective target businesses with which we have entered into an acquisition agreement or claims of any third party (other than our independent public accountants) for services rendered or products

sold to us, but only if such a vendor or target business has not executed a waiver of any and all rights to seek access to the Trust Account;

|

|

•

|

the Sponsor (including its representatives and affiliates) and the Company directors and officers, are, or may in the future

become, affiliated with entities that are engaged in a similar business to the Company. For example, each of the Company’s officers may be considered an affiliate of the Sponsor, the Sponsor and our directors and officers of the Company

are also affiliated with Lionheart III and Lionheart IV, all of which are blank check companies incorporated for the purpose of effecting their respective initial business combinations. In addition, Mr. Meltzer serves on the board of

directors of Haymaker Acquisition Corp. III, a blank check company incorporated for the purpose of effecting a business combination. The Sponsor and the Company’s directors and officers are not prohibited from sponsoring, or otherwise

becoming involved with, any other blank check companies prior to the Company completing its initial business combination. Moreover, certain of the Company’s directors and officers have time and attention requirements for certain other

companies. The Company’s directors and officers also may become aware of business opportunities which may be appropriate for presentation to the Company, and the other entities to which they owe certain fiduciary or contractual duties,

including Lionheart III and Lionheart IV. Accordingly, they may have had conflicts of interest in determining to which entity a particular business opportunity should be presented. These conflicts may not be resolved in the Company’s

favor and such potential business opportunities may be presented to other entities prior to their presentation to the Company, subject to applicable fiduciary duties. The Existing Charter provides that the Company renounces its interest

in any corporate opportunity offered to any director or officer unless such opportunity is expressly offered to such person solely in his or her capacity as a director or officer of the Company and such opportunity is one the Company is

legally and contractually permitted to undertake and would otherwise be reasonable for the Company to pursue, and to the extent the director or officer is permitted to refer that opportunity to the Company without violating another

legal obligation. For more information, see “Management of the Company — Conflicts of Interests.”

|

|

•

|

the fact that Ophir Sternberg and John Ruiz have certain business dealings tied to shares of the Post-Combination Company.

For more information, see “Certain Relationships and Related Party Transactions”;

|

|

•

|

the continued indemnification of our existing directors and officers and the continuation of our directors’ and officers’

liability insurance after the Business Combination;

|

|

•

|

the fact that the Sponsor and our directors and officers will lose their entire investment in us and will not be reimbursed

for any out-of-pocket expenses if an initial business combination is not consummated by August 18, 2022; and

|

|

•

|

that, at the closing of the Business Combination we will enter into the amended and restated registration rights agreement

(“Registration Rights Agreement”), substantially in the form attached as Annex E to this proxy statement/prospectus, with the Sponsor and our directors and officers, which provides for

registration rights to such persons and their permitted transferees.

|

|

Q:

|

WHAT DO I NEED TO DO NOW?

|

|

A:

|

The Company urges you to read carefully and consider the information contained in this proxy statement/prospectus, including

the Annexes and the other documents referred to herein, and to consider how the Business Combination will affect you as a stockholder of the Company. Stockholders should then vote as soon as possible in accordance with the instructions

provided in this proxy statement/prospectus and on the enclosed proxy card.

|

|

Q:

|

WHAT HAPPENS IF I SELL MY SHARES OF CLASS A COMMON STOCK BEFORE THE SPECIAL MEETING?

|

|

A:

|

The Record Date for the Special Meeting is earlier than the date that the Business Combination is expected to be completed.

If you transfer your shares of Class A Common Stock after the Record Date, but before the Special Meeting, unless the transferee obtains from you a proxy to vote those shares, you will retain your right to vote at the Special Meeting.

However, you will not be able to seek redemption of your shares of Class A Common Stock because you will no longer be able to tender them prior to the Special Meeting in accordance with the provisions described herein. If you

transferred your shares of Class A Common Stock prior to the Record Date, you have no right to vote those shares at the Special Meeting or redeem those shares for a pro rata portion of the proceeds held in the Trust Account.

|

|

Q:

|

HOW DO I VOTE?

|

|

A:

|

If you are a holder of record of common stock on the Record Date, you may vote in person at the Special Meeting by attending

the meeting virtually or by submitting a proxy for the Special Meeting. You may submit your proxy by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed postage paid envelope. You may also

vote by telephone or Internet by following the instructions printed on the proxy card.

|

|

Q:

|

IF MY SHARES ARE HELD IN “STREET NAME” BY A BROKER, BANK, OR OTHER NOMINEE, WILL MY BROKER, BANK, OR OTHER

NOMINEE VOTE MY SHARES FOR ME?

|

|

A:

|

If your shares are held in “street name” in a stock brokerage account or by a broker, bank, or other nominee, you must

provide the record holder of your shares with instructions on how to vote your shares. Please follow the voting instructions provided by your broker, bank, or other nominee. Please note that you may not vote shares held in “street name”

by returning a proxy card directly to the Company or by voting in person at the Special Meeting unless you provide a “legal proxy,” which you must obtain from your broker, bank, or other nominee.

|

|

Q:

|

WHAT IF I ATTEND THE SPECIAL MEETING AND ABSTAIN OR DO NOT VOTE?

|

|

A:

|

For purposes of the Special Meeting, an abstention occurs when a stockholder attends the meeting in person and does not vote

or returns a proxy with an “abstain” vote.

|

|

Q:

|

WHAT WILL HAPPEN IF I RETURN MY PROXY CARD WITHOUT INDICATING HOW TO VOTE?

|

|

A:

|

If you are a holder of record of common stock on the Record Date and you sign and return your proxy card without indicating

how to vote on any particular Proposal, the common stock represented by your proxy will be voted “FOR” each of the Proposals presented at the Special Meeting.

|

|

Q:

|

MAY I CHANGE MY VOTE AFTER I HAVE MAILED MY SIGNED PROXY CARD?

|

|

A:

|

Yes. If you are a holder of record of common stock on the Record Date, you may change your vote at any time before your proxy

is exercised by doing any one of the following:

|

|

•

|

send another proxy card with a later date;

|

|

•

|

notify the Company’s Secretary in writing before the Special Meeting that you have revoked your proxy; or

|

|

•

|

attend the Special Meeting and vote electronically by visiting and entering the control number found on your proxy card,

voting instruction form or notice you previously received.

|

|

Q:

|

WHAT HAPPENS IF I FAIL TO TAKE ANY ACTION WITH RESPECT TO THE SPECIAL MEETING?

|

|

A:

|

If you fail to take any action with respect to the Special Meeting and the Business Combination is approved by stockholders

and consummated, you will become a stockholder of the Post-Combination Company. Failure to take any action with respect to the Special Meeting will not affect your ability to exercise your redemption rights. If you fail to take any

action with respect to the Special Meeting and the Business Combination is not approved, you will continue to be a stockholder of the Company while the Company searches for another target business with which to complete a business

combination. If you fail to vote on the Charter Approval Proposal, your failure to vote will have the same effect as a vote “AGAINST” such proposal.

|

|

Q:

|

WHAT SHOULD I DO IF I RECEIVE MORE THAN ONE SET OF VOTING MATERIALS?

|

|

A:

|

Stockholders may receive more than one set of voting materials, including multiple copies of this proxy statement/prospectus

and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage

|

|

Q:

|

WHO CAN HELP ANSWER MY QUESTIONS?

|

|

A:

|

If you have questions about the Business Combination or if you need additional copies of the proxy statement/prospectus or

the enclosed proxy card you should contact our proxy solicitor, MacKenzie Partners, Inc.:

|

|

|

| |

Redemption Threshold(1)(2)

|

|||||||||||||||||||||

|

|

| |

No Redemption(3)

|

| |

Illustrative Redemption(4)

|

| |

Expense Adjusted

Maximum Redemption(5)

|

| |

Maximum Redemption(6)

|

||||||||||||

|

|

| |

Shares

|

| |

%

|

| |

Shares

|

| |

%

|

| |

Shares

|

| |

%

|

| |

Shares

|

| |

%

|

|

Class A - LCAP Public Stockholders and holders of Private

Shares(7)(8)

|

| |

12,703,631

|

| |

0.4%

|

| |

10,002,838

|

| |

0.3%

|

| |

7,302,044

|

| |

0.2%

|

| |

650,000

|

| |

0.0%

|

|

Class A - LCAP Initial Stockholders(7)(8)

|

| |

5,750,000

|

| |

0.2%

|

| |

5,750,000

|

| |

0.2%

|

| |

5,750,000

|

| |

0.2%

|

| |

5,750,000

|

| |

0.2%

|

|

Class A - LCAP Private and Public Warrantholders

|

| |

11,825,000

|

| |

0.4%

|

| |

11,825,000

|

| |

0.4%

|

| |

11,825,000

|

| |

0.4%

|

| |

11,825,000

|

| |

0.4%

|

|

Total LCAP(7)(8)

|

| |

30,278,631

|

| |

0.9%

|

| |

27,577,838

|

| |

0.8%

|

| |

24,877,044

|

| |

0.8%

|

| |

18,225,500

|

| |

0.6%

|

|

Class V - MSP Recovery Members (or their designees)(9)

|

| |

2,628,037,909

|

| |

80.1%

|

| |

2,628,037,909

|

| |

80.2%

|

| |

2,628,037,909

|

| |

80.2%

|

| |

2,628,037,909

|

| |

80.4%

|

|

Class V - Virage; VRM(10)

|

| |

140,000,000

|

| |

4.3%

|

| |

140,000,000

|

| |

4.3%

|

| |

140,000,000

|

| |

4.3%

|

| |

140,000,000

|

| |

4.3%

|

|

Class V – Other(9)

|

| |

65,662,091

|

| |

2.0%

|

| |

65,662,091

|

| |

2.0%

|

| |

65,662,091

|

| |

2.0%

|

| |

65,662,091

|

| |

2.0%

|

|

Class V - Series MRCS

|

| |

416,300,000

|

| |

12.8%

|

| |

416,300,000

|

| |

12.8%

|

| |

416,300,000

|

| |

12.7%

|

| |

416,300,000

|

| |

12.8%

|

|

Total MSP and Other Unrelated Parties(8)

|

| |

3,250,000,000

|

| |

99.1%

|

| |

3,250,000,000

|

| |

99.2%

|

| |

3,250,000,000

|

| |

99.2%

|

| |

3,250,000,000

|

| |

99.4%

|

|

Total Shares at Closing(8)

|

| |

3,280,278,631

|

| |

100.0%

|

| |

3,277,577,838

|

| |

100.0%

|

| |

3,274,877,044

|

| |

100.0%

|

| |

3,268,225,000

|

| |

100.0%

|

|

Additional Dilution

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

New Warrants(9)

|

| |

—

|

| |

—%

|

| |

—

|

| |

—%

|

| |

—

|

| |

—%

|

| |

—

|

| |

—%

|

|

Incentive Plan(11)

|

| |

98,736,750

|

| |

3.0%

|

| |

98,736,750

|

| |

3.0%

|

| |

98,736,750

|

| |

3.0%

|

| |

98,736,750

|

| |

3.0%

|

|

Total Additional Dilution Sources

|

| |

98,736,750

|

| |

3.0%

|

| |

98,736,750

|

| |

3.0%

|

| |

98,736,750

|

| |

3.0%

|

| |

98,736,750

|

| |

3.0%

|

|

(1)

|

Only 12,053,631 shares of Class A Common Stock are subject to redemption (after giving effect to the redemption of

10,946,369 shares of Class A Common Stock in connection with the Company stockholder vote to approve the Extension Amendment). The remaining 650,000 shares of Class A Common Stock are held by holders of Private Shares who have

waived their redemption rights pursuant to applicable subscription agreements.

|

|

(2)

|

Class A Common Stock are economic shares and entitled to one vote per share. Class V Common Stock are non-economic and

entitled to one vote per share.

|

|

(3)

|

Assumes that no additional shares of Class A Common Stock are redeemed (after giving effect to the redemption of

10,946,369 shares of Class A Common Stock in connection with the Company stockholder vote to approve the Extension Amendment). Refer to the section titled “Unaudited Pro Forma Condensed

Combined Financial Information” in this proxy statement/prospectus.

|

|

(4)

|

Assumes 2,700,793 additional shares of Class A Common Stock are redeemed at a redemption price of $10.00 (after giving

effect to the redemption of 10,946,369 shares of Class A Common Stock in connection with the Company stockholder vote to approve the Extension Amendment), and represents a midpoint redemption scenario between the no redemption and

expense adjusted maximum redemption scenarios.

|

|

(5)

|

As noted in (1) above, only 12,053,631 shares of Class A Common Stock are subject to redemption. This assumes that the

cash available for maximum redemptions is calculated as the cash in trust less remaining transaction costs to be paid in cash of $66.5 million. This amount is divided by the estimated per share redemption price of approximately

$10.00 per share to obtain the number of shares to be redeemed. Refer to section titled “Unaudited Pro Forma Condensed Combined Financial Information” in this proxy

statement/prospectus.

|

|

(6)

|

Assumes all of the 12,053,631 shares of Class A Common Stock subject to redemption (after giving effect to the redemption

of 10,946,369 shares of Class A Common Stock in connection with the Company stockholder vote to approve the Extension Amendment) are redeemed a redemption price of $10.00.

|

|

(7)

|

Shares exclude the approximately 1,029,000,000 shares of Class A Common Stock underlying the approximately 1,029,000,000

New Warrants to be issued, conditioned upon the consummation of any redemptions by the holders of Class A Common Stock and the Closing, to the holders of record of the Class A Common Stock on the Closing Date (which is expected to

include the 5,750,000 shares of Class A Common Stock into which Founder Shares will convert in connection with the Business Combination), after giving effect to the waiver of the right, title and interest in, to or under,

participation in any such dividend by the Members, on behalf of themselves and any of their designees. See (9) below.

|

|

(8)

|

Pursuant to the terms of the LLC Agreement, at least twice a month, to the extent any New Warrants have been exercised in

accordance with their terms, the Company following the Business Combination is required to purchase from the MSP Principals, proportionately, the number of Up-C Units or shares of Class A Common Stock owned by such MSP Principal

equal to the Aggregate Exercise Price divided by the Warrant Exercise Price (as defined in the LLC Agreement) in exchange for the Aggregate Exercise Price. As a result, no additional dilution is expected from the exercise of the New

Warrants. The number of New Warrants to be distributed in respect of each share of unredeemed Class A Common Stock is

|

|

(9)

|

Assuming the value of the VRM Full Return as of December 31, 2021, of $656.6 million and a per unit value of $10.00 per

Up-C unit, Messrs. Ruiz and Quesada are expected may exchange their Up-C Units for shares of Class A Common Stock to be sold in satisfaction of the VRM Full Return, pursuant to the VRM Full Return Guaranty, their Up-C Units received

as consideration pursuant to the MIPA. Such amount includes 65,000,000 Up-C Units to be delivered as Reserved Shares and an additional 662,091 Up-C Units to be delivered and exchanged for shares of Class A Common Stock to be sold

pursuant to the VRM Full Return Guaranty. See “The Business Combination — Other Agreements — VRM Full Return Guaranty.”

|

|

(10)

|

Assumes 120,000,000 Up-C Units are issued to VRM as Upfront Consideration and includes an additional 20,000,000 Up-C

Units to be paid in connection with the Virage Exclusivity Termination from the aggregate consideration being paid to the Members (or their designees) pursuant to the MIPA at Closing.

|

|

(11)

|

Assumes issuance of all shares of Class A Common Stock reserved for initial issuance under the Incentive Plan equal to

98,736,750. In addition, under the terms of the Incentive Plan, the aggregate number of shares that may be issued pursuant to awards will be subject to an annual increase on January 1 of each calendar year (commencing with

January 1, 2023 and ending on and including January 1, 2031) equal to the lesser of (i) a number of shares equal to 3% of the total number of shares actually issued and outstanding on the last day of the preceding fiscal year or

(ii) a number of shares as determined by the Board. Such increase in reserve may present an additional source of dilution. See “Proposal No. 6—Incentive Plan Proposal.”

|

|

|

| |

Redemption Threshold

|

|||||||||||||||||||||

|

|

| |

No Redemption

|

| |

Illustrative Redemption

|

| |

Expense Adjusted

Maximum Redemption

|

| |

Maximum Redemption

|

||||||||||||

|

|

| |

$/share

|

| |

%

|

| |

Amount

|

| |

%

|

| |

Amount

|

| |

%

|

| |

Amount

|

| |

%

|

|

Underwriting fee (inclusive of financial advisor

fees)(1)

|

| |

$1.74

|

| |

17.39%

|

| |

$1.91

|

| |

19.09%

|

| |

$2.12

|

| |

21.16%

|

| |

$2.89

|

| |

28.89%

|

|

(1)

|

LCAP incurred $4.6 million of underwriting fees and $8.05 million in deferred underwriting fees in connection with its IPO,

which are payable to the underwriters in connection with the Business Combination and will not be adjusted for any shares that are redeemed. LCAP will also pay Nomura, in its role as financial advisor in connection with the Business

Combination, total fees of $20 million. In addition, MSP will pay KBW in its role as financial advisor in connection with the Business Combination total fees of $20 million. In total the underwriting fees (inclusive of fees to be paid

to financial advisors in connection with the Business Combination) will be $52.65 million.

|

|

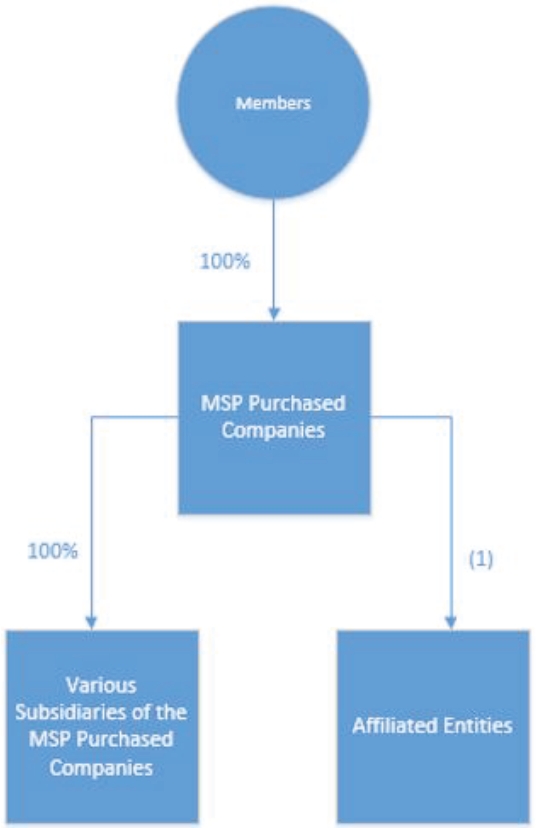

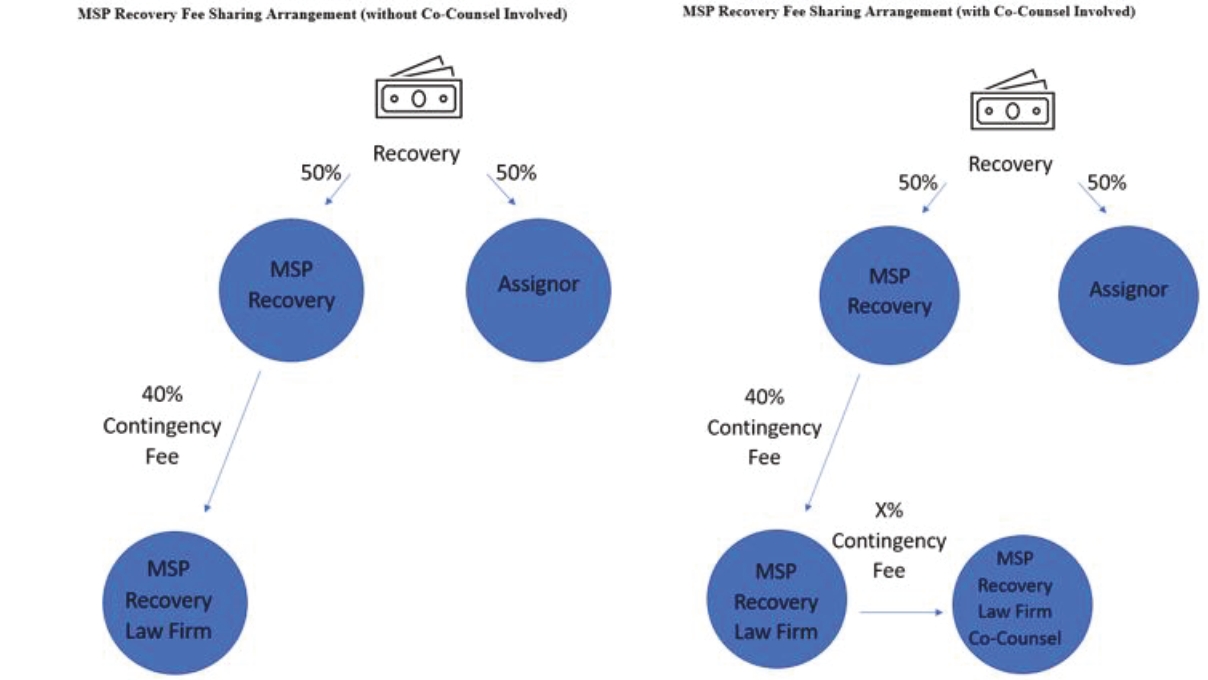

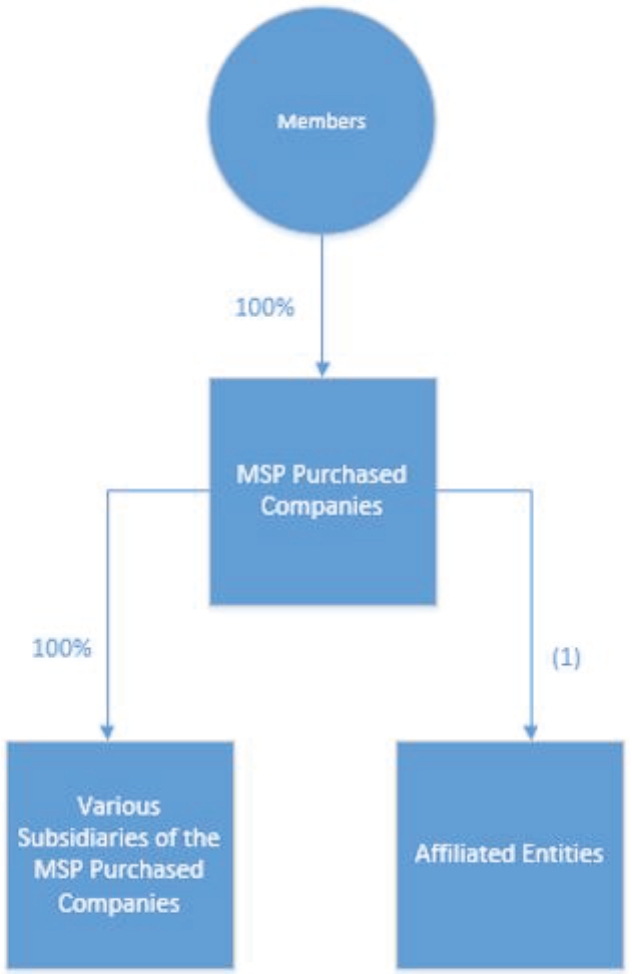

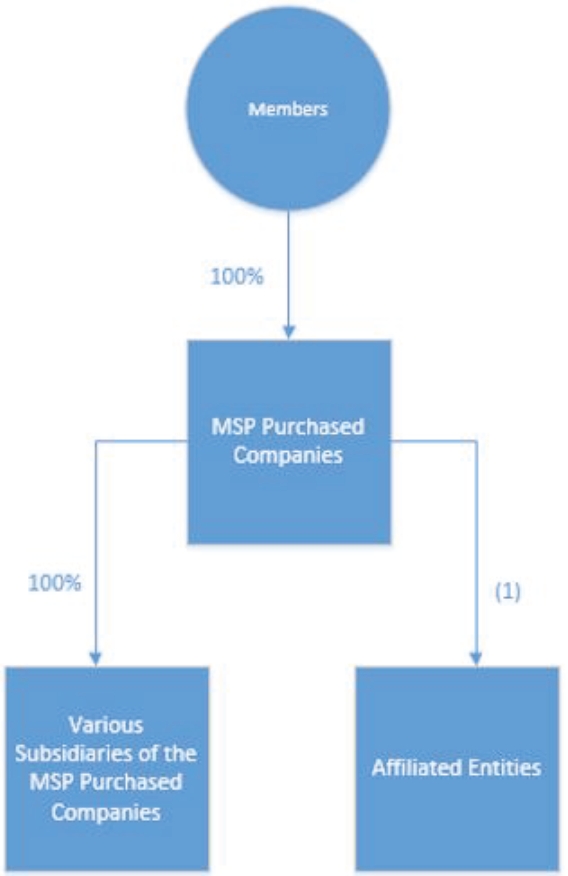

(1)

|

The Members have a 50% ownership interest in each of MAO-MSO Recovery, LLC, MAO-MSO Recovery II, LLC, MAO-MSO Recovery LLC,

Series FHCP and MAO-MSO Recovery II LLC, Series PMPI.

|

|

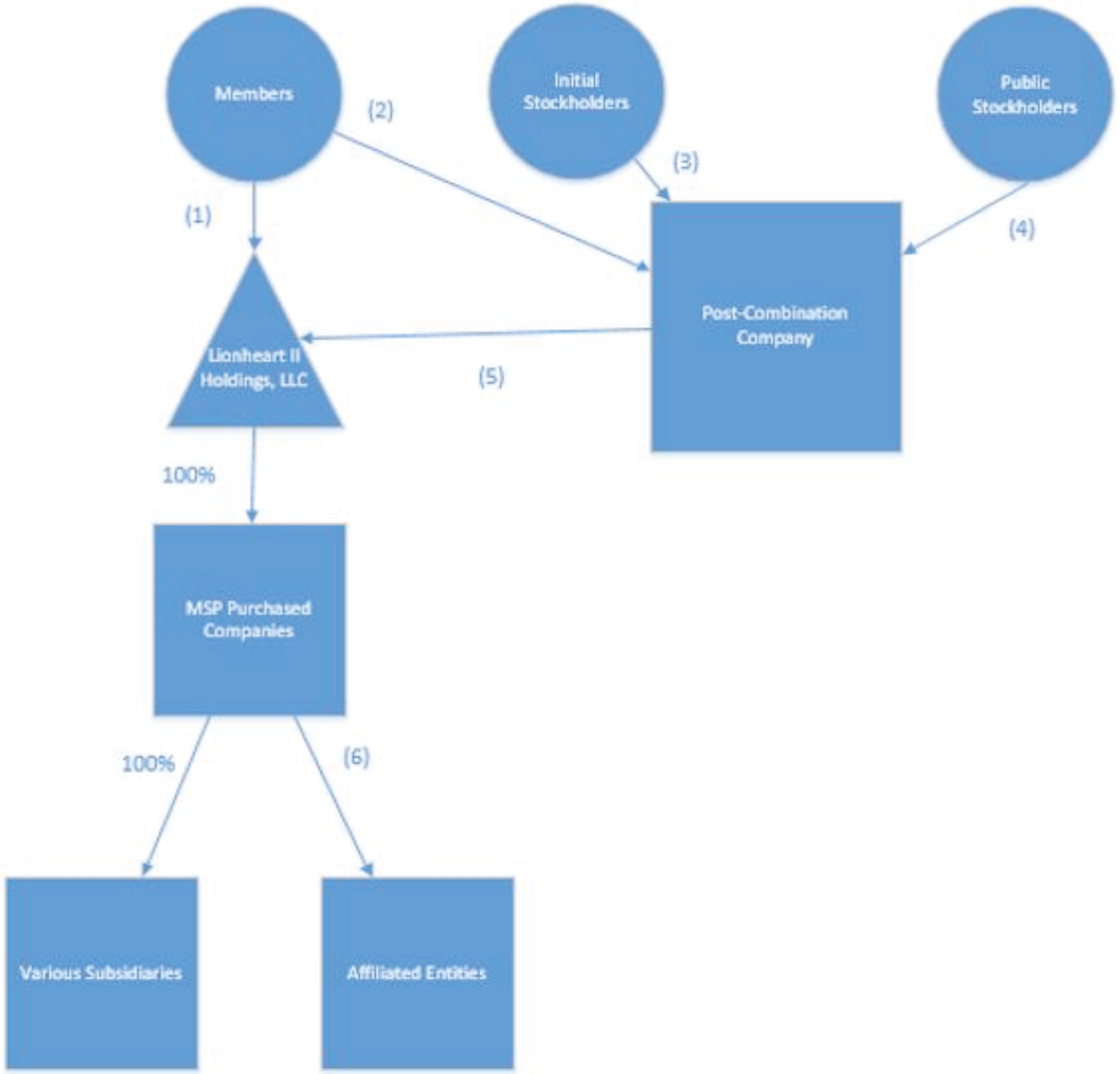

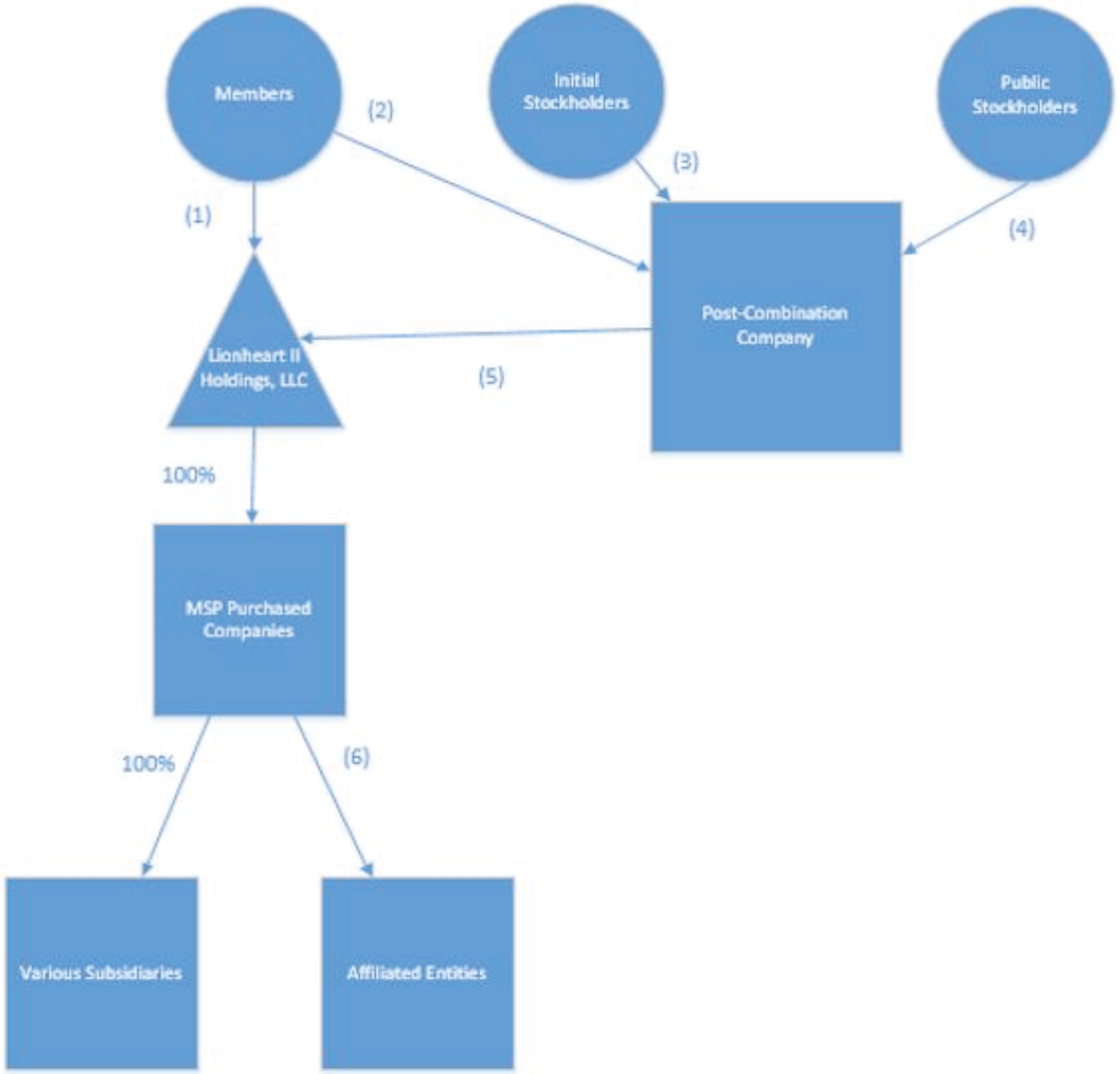

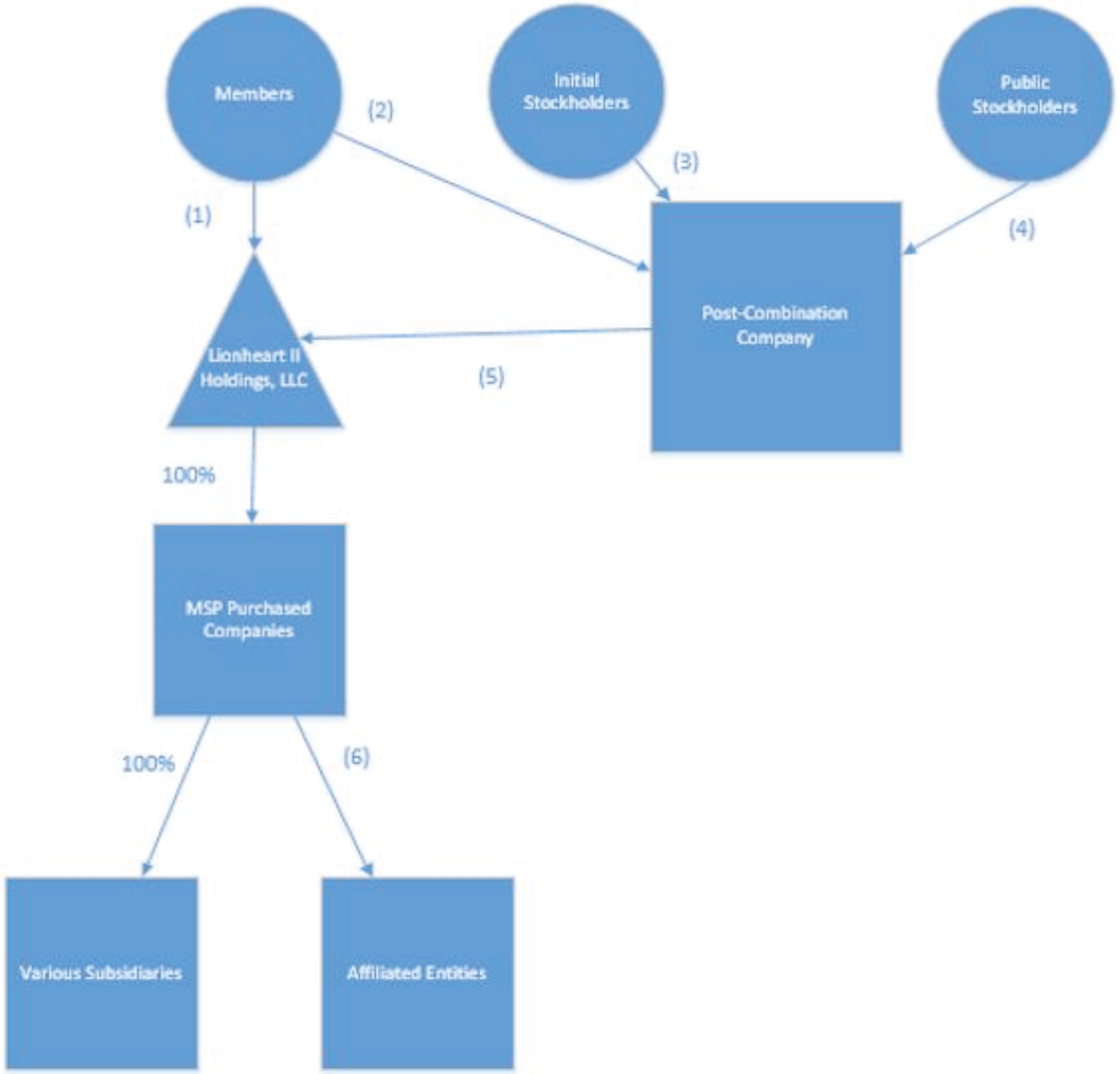

(1)

|

The Members (or their designees) will hold all of the Class B Units of Opco.

|

|

(2)

|

The Members (or their designees) will hold all of the shares of the Class V Common Stock of the Post-Combination Company,

which are voting, non-economic shares. The shares of Class V Common Stock, together with their accompanying Class B Units of Opco, are convertible on a one-for-one basis into shares of the Company’s Class A Common Stock (or cash, at

the Post-Combination Company’s option), in accordance with the terms of the LLC Agreement.

|

|

(3)

|

The Initial Stockholders will hold 5,750,000 of the shares of Class A Common Stock of the Post-Combination Company. This

amount will be affected by the exercise of outstanding warrants or New Warrants. See “Summary—Ownership of the Post-Combination Company.”

|

|

(4)

|

The Public Stockholders and holders of Private Shares will hold 12,703,631 of the shares of Class A Common Stock of the

Post-Combination Company. This amount will be affected by the level of redemptions by Public Stockholders and the exercise of outstanding warrants or New Warrants. See “Summary—Ownership of

the Post-Combination Company.

|

|

(5)

|

The Post-Combination Company will hold all of the Class A Units of Opco.

|

|

(6)

|

The MSP Purchased Companies will own 50% of the membership interest in each of MAO-MSO Recovery, LLC, MAO MSO Recovery II,

LLC, MAO-MSO Recovery LLC, Series FHCP and MAO-MSO Recovery II LLC, Series PMPI.

|

|

•

|

Following a review of the financial data provided to the Company, including certain unaudited prospective financial

information of MSP (including, where applicable, the assumptions underlying such unaudited prospective financial information) and the Company’s due diligence review of MSP’s business, the LCAP Board determined that the consideration

to be paid to the Members was reasonable in light of such data and financial information.

|

|

•

|

The Company’s management and advisors conducted due diligence examinations of MSP, including: commercial, financial, legal

and regulatory due diligence, and extensive discussions with MSP’s management and the Company’s management and legal advisors concerning such due diligence examinations of MSP.

|

|

•

|

MSP’s business is based in a serviceable market that has a long-standing history of improper claim reimbursement concerns,

and that the LCAP Board considers attractive, and which, following a review of industry trends and other industry factors (including, among other things, historic and projected market growth), the LCAP Board believes has continued

growth potential in future periods.

|

|

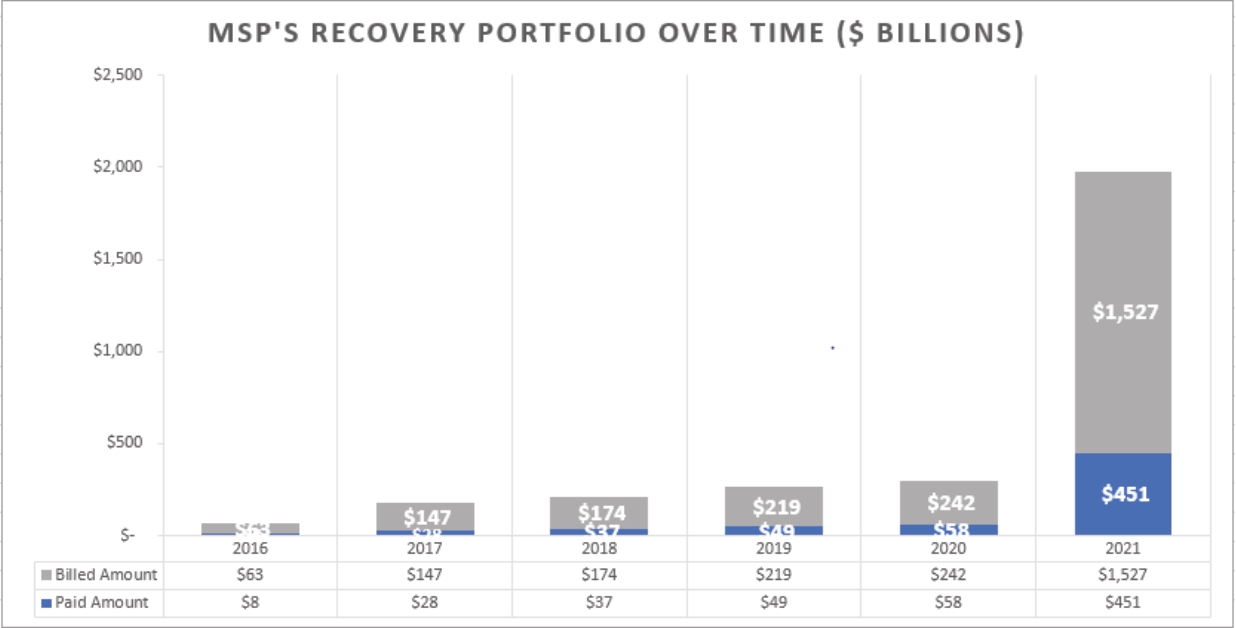

•

|

Defensive, niche business model, coupled with a first mover advantage has led to MSP identifying more than $15 billion of

Paid Value of Potentially Recoverable Claims, as of the date of the MIPA, that could be recoverable in the near future.

|

|

•

|

The Members (or their designees) will control approximately 99.1% of the Post-Combination Company, assuming (1) the no

redemption scenario, (2) that the holders of the Company’s existing Public Warrants and Private Warrants exercise those warrants, and no New Warrants are exercised and (3) no attributed ownership based on Messrs. Ruiz and Quesada’s

investment in VRM (See “Certain Relationships and Related Party Transactions” beginning on page [243]). Such ownership percentage will

be affected by the level of redemptions by Public Stockholders and the exercise of outstanding warrants or New Warrants. See “Summary—Ownership of the Post-Combination Company.”

The LCAP Board believes that the Members continuing to own a substantial percentage of the Post-Combination Company on a pro forma basis reflects such equityholders’ belief in and commitment to the continued growth prospects of MSP

going forward.

|

|

•

|

The agreement by Messrs. Ruiz and Quesada to be subject to a post-Closing lockup in respect of their Up-C Units and shares

of Class A Common Stock, subject to certain exceptions, and to enter into employment agreements with the Post-Combination Company, which is expected to provide important stability to the leadership and governance of MSP.

|

|

•

|

Opportunity to introduce an attractive asset class to public investors that has historically been transacted in private

market settings.

|

|

•

|

Driven MSP management with diverse experience and an entrepreneurial mindset to bring this asset class to the public

markets.

|

|

•

|

The terms and conditions of the MIPA and the related agreements and the transactions contemplated thereby, each party’s

representations, warranties and covenants, the conditions to each party’s obligation to consummate the Business Combination and the termination provisions, as well as the strong commitment by both the Company and MSP to complete the

Business Combination.

|

|

•

|

After a review of other business combination opportunities reasonably available to the Company, the LCAP Board believes

that the proposed Business Combination represents the best potential business combination reasonably available to the Company taking into consideration, among other things, the timing and likelihood of accomplishing the goals of any

alternatives.

|

|

•

|

MSP’s unique social focus on supporting the long-term sustainability of Medicare and Medicaid programs relied upon by over

100 million Americans.

|

|

•

|

Proprietary data system that has proven experience aggregating, normalizing and analyzing large volumes of data to identify

recoverable healthcare claims.

|

|

•

|

John H. Ruiz and Frank C. Quesada are key business drivers of MSP and the success of MSP remains highly dependent on their

continued involvement.

|

|

•

|

The potential benefits of the Business Combination may not be fully achieved or may not be achieved within the expected

timeframe.

|

|

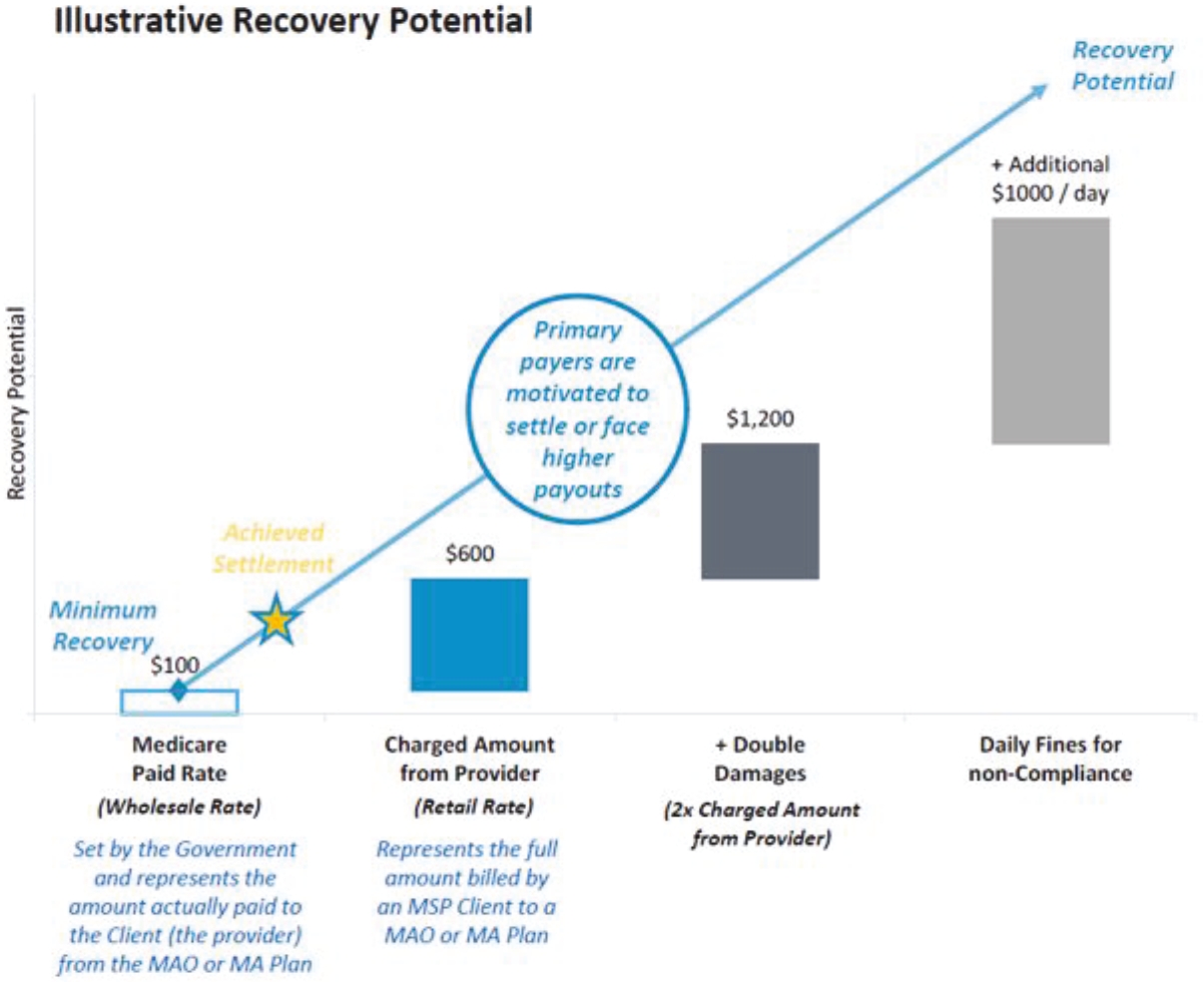

•

|

Validity of the claim assignments, legal standing of the MSP claims, penalties and double damages provisions, and several

other key legal issues remain subject to continued affirmation in the U.S. court system.

|

|

•

|

Medicare Secondary Payer Act of 1980 still remains subject to legal interpretation and potential revision.

|

|

•

|

While the MSP management has modeled the expected operating expenses, they have not previously operated at a scale

indicated in the MSP management projections nor executed on the scale of growth contemplated.

|

|

•

|

The Company’s stockholders may fail to approve the proposals necessary to effect the Business Combination.

|

|

•

|

The completion of the Business Combination is conditioned on the satisfaction of certain closing conditions that are not

within the Company’s control, including the receipt of certain required regulatory approvals.

|

|

•

|

The Public Stockholders will hold a minority position in the Post-Combination Company (approximately 0.4%, assuming (1)