|

Delaware

|

| |

7371

|

| |

88-2789488

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

| |

(Primary Standard Industrial Classification Code Number)

|

| |

(I.R.S. Employer

Identification Number)

|

|

Large accelerated filer

|

| |

☐

|

| |

|

| |

|

| |

Accelerated filer

|

| |

☐

|

|

Non-accelerated filer

|

| |

☐

|

| |

(Do not check if a smaller reporting company)

|

| |

|

| |

Smaller reporting company

|

| |

☒

|

|

|

| |

|

| |

|

| |

|

| |

Emerging growth company

|

| |

☒

|

|

•

|

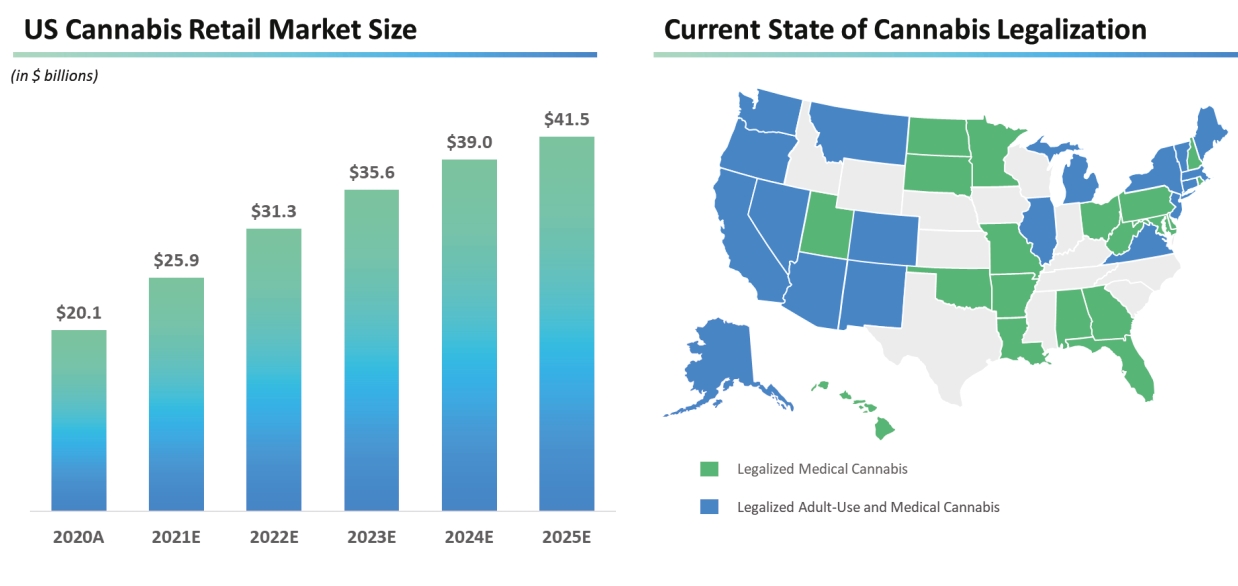

trends in the cannabis industry and SpringBig’s market size, including with respect to the potential total addressable market

in the industry;

|

|

•

|

SpringBig’s growth prospects;

|

|

•

|

new product and service offerings SpringBig may introduce in the future;

|

|

•

|

the price of SpringBig’s securities, including volatility resulting from changes in the competitive and highly regulated

industry in which SpringBig operates and plans to operate, variations in performance across competitors, changes in laws and regulations affecting SpringBig’s business and changes in the combined capital structure;

|

|

•

|

the ability to implement business plans, forecasts, and other expectations as well as identify and realize additional

opportunities; and

|

|

•

|

other risks and uncertainties indicated from time to time in filings made with the SEC.

|

|

•

|

SpringBig’s platform offers retailers text message marketing, which allows clients to send promotions to existing

customers. This text messaging platform offers a variety of features, including multiple customer segmentations, which automatically groups customers into segments based on their preferences and purchase behavior. Retailers also have

access to the “autoconnects” feature, which allows them to easily leverage customer data and send messages directly to consumers based on certain actions and also includes functionality to help clients identify opportunities to send

text messages. SpringBig also provides an e-signature app, designed to accommodate proper ‘double opt-in’ procedure, through both implied and expressed consent to facilitate compliance with the TCPA, FCC, and Canadian CRTC.

|

|

•

|

The consumer application (or wallet) offered by SpringBig allows customers to access and check their points, redeem

rewards, and view upcoming offers. The wallet fully integrates with cannabis e-commerce providers, allowing customers to place orders directly from their wallet. Retailers can customize this application with a distinct icon, name,

layout, and color scheme, thus allowing for brand consistency and a higher-quality and frictionless customer experience.

|

|

•

|

Retailers can use the SpringBig platform to compile marketing campaigns based on consumer profiles and preferences. Once a

campaign launches, retailers are able to analyze in-depth data in order to measure campaign success. Enterprise Resource Planning (or ERP)-level customer data management and analysis also allow retailers to organize their sales funnel

and provide a personalized, targeted approach to marketing campaigns.

|

|

•

|

SpringBig’s platform integrates with many point of sale (“POS”) systems used in the cannabis industry, allowing retailers

to automatically collect additional data on consumers.

|

|

•

|

SpringBig has a brand marketing platform that offers a direct-to-consumer marketing automation platform specifically for

cannabis brands. This direct-to-consumer marketing engine allows brands to target and measure the complete transaction cycle from initial engagement through point of sale.

|

|

•

|

SpringBig provides brands with the opportunity to provide content that, in turn, SpringBig’s retail clients can utilize in

their targeted consumer marketing campaigns. This provides the brand with access to the consumer and that can be leveraged through the brand and retailer cooperating in a promotional campaign on the SpringBig platform. The SpringBig

platform can be used by brands to increase their brand awareness, expand retail partnerships, and acquire and retain new customers. The SpringBig brands platform also provides brand clients with access to detailed reports regarding

campaign attribution metrics.

|

|

•

|

It is not possible to predict the actual number of Common Shares, if any, we will sell under the Purchase Agreement to

Cantor, or the actual gross proceeds resulting from those sales.

|

|

•

|

Investors who buy Common Shares from the Holder at different times will likely pay different prices.

|

|

•

|

We may use proceeds from sales of our Common Shares made pursuant to the Purchase Agreement in ways with which you may not

agree or in ways which may not yield a significant return.

|

|

•

|

Future resales and/or issuances of Common Shares, including pursuant to this prospectus may cause the market price of our

shares to drop significantly.

|

|

•

|

We have a relatively short operating history in a rapidly evolving industry, which makes it difficult to evaluate our

future prospects and may increase the risk that we will not be successful. As our costs increase, we may not be able to generate sufficient revenue to maintain profitability in the future. We also have a history of losses and may not

achieve profitability in the future.

|

|

•

|

If we do not successfully develop and deploy new software, platform features or services to address the needs of our

clients, our business, financial condition, and results of operations could suffer.

|

|

•

|

If we fail to retain our existing clients and consumers or to acquire new clients and consumers in a cost-effective manner,

our revenue may decrease and our business may be harmed.

|

|

•

|

If we fail to expand effectively into new markets, our revenue and business will be adversely affected.

|

|

•

|

Federal law enforcement may deem our clients to be in violation of U.S. federal law, and, in particular the CSA. A change

in U.S. federal policy on cannabis enforcement and strict enforcement of federal cannabis laws against our clients would undermine our business model and materially affect our business and operations.

|

|

•

|

Some of our clients currently and in the future may not be in compliance with licensing and related requirements under

applicable laws and regulations and we do not, and cannot, ensure that our client will conduct their business activities in a manner in compliance in all respects with regulations and requirements.

|

|

•

|

Our business is dependent on U.S. state laws and regulations and Canadian federal and provincial laws and regulations

pertaining to the cannabis industry, as well as continued market acceptance of cannabis by consumers.

|

|

•

|

Our business is highly dependent upon our brand recognition and reputation, and any erosion or degradation of our brand

recognition or reputation would likely adversely affect our business and operating results.

|

|

•

|

We currently face intense competition in marketing and advertising services available to our clients, and we expect

competition to further intensify as the cannabis industry continues to evolve.

|

|

•

|

If we fail to manage our growth effectively, our brand, business and operating results could be harmed. The growth of our

business depends on our ability to accurately predict consumer trends, successfully offer new services, improve existing services and expand into new markets.

|

|

•

|

If we are unable to recruit, train, retain and motivate key personnel, we may not achieve our business objectives.

|

|

•

|

If our current marketing model is not effective in attracting new clients, we may need to employ higher-cost sales and

marketing methods to attract and retain clients, which could adversely affect our profitability.

|

|

•

|

We may be unable to scale and adapt our existing technology and network infrastructure in a timely or effective manner to

ensure that our platform is accessible, which would harm our reputation, business and operating results.

|

|

•

|

Interruptions to, or perceived errors, failures, or bugs in our platform and other cyber-events affecting our platform or

our systems could adversely affect our operating results and growth prospects.

|

|

•

|

The impact of global, regional or local economic and market conditions or catastrophic events, including health crises, may

adversely affect our business, operating results and financial condition.

|

|

•

|

Fluctuations in our quarterly and annual operating results may adversely affect our business and prospects.

|

|

•

|

Investors are cautioned not to rely on outdated financial projections.

|

|

•

|

We may improve our products and solutions in ways that forego short-term gains.

|

|

•

|

We are subject to a variety of standards, governmental laws, regulations and other legal obligations and any actual or

perceived failure to comply with such obligations could harm our business. Changes to such standards, laws, regulations and other obligations may have material adverse effect on our business, cash flow, financial condition or

operating results.

|

|

•

|

Future investments in our growth strategy, including acquisitions, could disrupt our business and adversely affect our

operating results, financial condition and cash flows.

|

|

•

|

The terms of the agreements governing our funding may restrict our operations.

|

|

•

|

We may need to raise additional capital, which may not be available on favorable terms, if at all, causing dilution to our

stockholders, restricting our operations or adversely affecting our ability to operate our business. We may be unable to obtain additional financing to fund our operations or growth and we are limited in our ability to obtain

additional financing under the terms of our Notes and Investor Warrants.

|

|

•

|

We have obligations secured by a security interest in substantially all of our assets; in the event of a default, the

noteholders could foreclose on, liquidate and/or out take possession of our assets.

|

|

•

|

We may be subject to potential adverse tax consequences both domestically and in foreign jurisdictions and we may not be

able to utilize our net operating loss and tax credit carryforwards.

|

|

•

|

Changes in accounting standards or other factors could negatively impact our future effective tax rate.

|

|

•

|

Certain taxing authorities may successfully assert that SpringBig should have collected or that in the future SpringBig

should collect sales and use or similar taxes for certain services which could adversely affect our results of operations.

|

|

•

|

Our business and our clients are subject to a variety of U.S. and foreign laws regarding financial transactions related to

cannabis. Cannabis remains illegal under federal law, and therefore, strict enforcement of federal laws regarding cannabis would likely result in our inability to execute our business plan.

|

|

•

|

We are dependent on our banking relations, and we may have difficulty accessing or consistently maintaining banking or

other financial services due to our connection with the cannabis industry. We also may have a difficult time obtaining the various insurances that are desired to operate our business, which may expose us to additional risk and

financial liability.

|

|

•

|

We may have difficulty using bankruptcy courts or enforcing our commercial agreements due to our involvement in the

regulated cannabis industry.

|

|

•

|

The conduct of third parties may jeopardize our business.

|

|

•

|

A failure to comply with laws and regulations regarding our use of telemarketing, including the TCPA, could increase our

operating costs and materially and adversely impact our business, financial condition, results of operations, and prospects.

|

|

•

|

We may continue to be subject to constraints on marketing our products.

|

|

•

|

Cannabis businesses may be subject to civil asset forfeiture.

|

|

•

|

Due to our involvement in the cannabis industry, we may have a difficult time obtaining the various insurances that are

desired to operate our business, which may expose us to additional risk and financial liability.

|

|

•

|

We may in the future be, subject to disputes and assertions by third parties with respect to alleged violations of

intellectual property rights. These disputes could be costly to defend and could harm our business and operating results.

|

|

•

|

Some of our solutions contain open source software, which may pose particular risks to our proprietary software and

solutions.

|

|

•

|

The success of our business heavily depends on our ability to protect and enforce our intellectual property rights.

|

|

•

|

The price of our securities may be volatile.

|

|

•

|

We do not intend to pay cash dividends for the foreseeable future.

|

|

•

|

We may be subject to securities litigation, which is expensive and could divert management attention.

|

|

•

|

The issuance of our Common Shares in connection with the Notes and Warrants Purchase Agreement could cause substantial

dilution, which could materially affect the trading price of our Common Shares.

|

|

•

|

A significant portion of our total outstanding shares may be sold into the market in the near future, including the shares

being registered for resale pursuant to this prospectus. This could cause the market price of our Common Shares to drop significantly, even if our business is doing well.

|

|

•

|

If securities or industry analysts do not publish or cease publishing research or reports about us, our business, or our

market, or if they change their recommendations regarding our common stock adversely, the price and trading volume of our common stock could decline.

|

|

•

|

We may amend the terms of the warrants in a manner that may be adverse to holders with the approval by the holders of at

least 65% of then outstanding public warrants. As a result, the exercise price of your warrants could be increased, the exercise period could be shortened and the number of Common Stock purchasable upon exercise of a warrant could be

decreased, all without your approval.

|

|

•

|

We are an emerging growth company within the meaning of the Securities Act, and if we take advantage of certain exemptions

from disclosure requirements available to emerging growth companies, this could make our securities less attractive to investors and may make it more difficult to compare our performance with other public companies.

|

|

•

|

We have and will continue to incur increased costs as a result of operating as a public company and our management has and

will continue to devote a substantial amount of time to new compliance initiatives.

|

|

•

|

Our failure to timely and effectively implement controls and procedures required by Section 404(a) of the Sarbanes-Oxley

Act could have a material adverse effect on our business.

|

|

•

|

Anti-takeover provisions in our certificate of incorporation and bylaws and under Delaware law could delay or prevent a

change in control, limit the price investors may be willing to pay in the future for our Common Shares and could entrench management.

|

|

•

|

Our largest shareholders and certain members of our management own a significant percentage of our Common Shares and are

able to exert significant control over matters subject to shareholder approval.

|

|

•

|

Future sales and issuances of our Common Shares, including pursuant to our equity incentive and other compensatory plans,

will result in additional dilution of the percentage ownership of our shareholders and could cause our share price to fall. The issuance of additional shares in connection with the Company’s outstanding Notes and Investor Warrants

could cause substantial dilution, which could materially affect the trading price of our shares.

|

|

•

|

the Commitment Fee Shares, which are the 877,193 Common Shares that we have agreed to issue to Cantor in consideration of

its irrevocable commitment to purchase Common Shares at our election under the Purchase Agreement; and

|

|

•

|

up to 4,178,331 Common Shares consisting of Common Shares that we may elect, in our sole discretion, to issue and sell to

Cantor, from time to time from and after the Commencement Date (as defined below) under the Purchase Agreement.

|

|

•

|

sales and marketing, including continued investment in our current marketing efforts and future marketing initiatives;

|

|

•

|

successfully compete with existing and future providers of other forms of marketing and customer engagement;

|

|

•

|

managing complex, disparate and rapidly evolving regulatory regimes imposed by U.S. and Canadian federal, state and

provincial, local and other non-U.S. governments around the world applicable to cannabis and cannabis-related businesses;

|

|

•

|

executing our growth strategy;

|

|

•

|

hire, integrate and retain talented sales and other personnel;

|

|

•

|

expansion domestically and internationally in an effort to increase our client usage, client base, retail locations we serve,

and our sales to our clients;

|

|

•

|

development of new products and services, and increased investment in the ongoing development of our existing products and

services;

|

|

•

|

continuing to invest in scaling our business, particularly around client success and engineering;

|

|

•

|

avoiding interruptions or disruptions in our platform or services; and

|

|

•

|

general administration, including a significant increase in legal and accounting expenses related to public company

compliance, continued compliance with various regulations applicable to cannabis industry businesses and other work arising from the growth and maturity of our company.

|

|

•

|

managing complex, disparate and rapidly evolving regulatory regimes imposed by U.S. and Canadian federal, state and

provincial, local and other non-U.S. governments around the world applicable to cannabis and cannabis-related businesses;

|

|

•

|

adapting to rapidly evolving trends in the cannabis industry and the way consumers and cannabis industry businesses interact

with technology;

|

|

•

|

maintaining and increasing our base of clients;

|

|

•

|

continuing to preserve and build our brand while upgrading our existing offerings;

|

|

•

|

successfully competing with existing and future participants in the cannabis marketing and advertisement market and related

services;

|

|

•

|

successfully attracting, hiring, and retaining qualified personnel to manage operations;

|

|

•

|

adapting to changes in the cannabis industry if the sale of cannabis expands significantly beyond a regulated model, and

commodification of the cannabis industry;

|

|

•

|

successfully implementing and executing our business and marketing strategies;

|

|

•

|

successfully expanding our business into new and existing cannabis markets; and

|

|

•

|

successfully executing on our growth strategies.

|

|

•

|

the efficacy of our marketing efforts;

|

|

•

|

our ability to maintain a high-quality, innovative, and error- and bug-free platform and similarly high quality client

service;

|

|

•

|

our ability to maintain high satisfaction among clients (and our clients’ consumers);

|

|

•

|

the quality and perceived value of our platforms and services;

|

|

•

|

successfully implementing and developing new features and revenue streams;

|

|

•

|

our ability to obtain, maintain and enforce trademarks and other indicia of origin that are valuable to our brand;

|

|

•

|

our ability to successfully differentiate our platforms and services from competitors’ offerings;

|

|

•

|

our ability to integrate with POS systems;

|

|

•

|

our ability to provide our clients with accurate and actionable insights from the consumer data and feedback collected

through our platform;

|

|

•

|

our compliance with laws and regulations;

|

|

•

|

our ability to address any environmental, social, and governance expectations of our various stakeholders;

|

|

•

|

our ability to provide client support; and

|

|

•

|

any actual or perceived data breach or data loss, or misuse or perceived misuse of our platforms.

|

|

•

|

actions of competitors or other third parties;

|

|

•

|

consumers’ experiences with retailers or brands using our platform;

|

|

•

|

public perception of cannabis and cannabis-related businesses;

|

|

•

|

positive or negative publicity, including with respect to events or activities attributed to us, our employees, partners or

others associated with any of these parties;

|

|

•

|

interruptions, delays or attacks on our platforms; and

|

|

•

|

litigation or regulatory developments.

|

|

•

|

our ability to attract new clients and retain existing clients;

|

|

•

|

our ability to accurately forecast revenue and appropriately plan our expenses;

|

|

•

|

the effects of increased competition on our business;

|

|

•

|

our ability to successfully expand in existing markets and successfully enter new markets;

|

|

•

|

the impact of global, regional or economic conditions;

|

|

•

|

the ability of licensed cannabis markets to successfully grow and outcompete illegal cannabis markets;

|

|

•

|

our ability to protect our intellectual property;

|

|

•

|

our ability to maintain and effectively manage an adequate rate of growth;

|

|

•

|

our ability to maintain and increase traffic to our platform;

|

|

•

|

costs associated with defending claims, including intellectual property infringement claims and related judgments or

settlements;

|

|

•

|

changes in governmental or other regulation affecting our business;

|

|

•

|

interruptions in platform availability and any related impact on our business, reputation or brand;

|

|

•

|

the attraction and retention of qualified personnel;

|

|

•

|

the effects of natural or man-made catastrophic events and/or health crises (including COVID-19); and

|

|

•

|

the effectiveness of our internal controls.

|

|

•

|

political, social, and economic instability;

|

|

•

|

risks related to the legal and regulatory environment in foreign jurisdictions, including with respect to privacy and data

protection, and unexpected changes in laws, regulatory requirements, and enforcement;

|

|

•

|

fluctuations in currency exchange rates;

|

|

•

|

higher levels of credit risk and payment fraud;

|

|

•

|

complying with tax requirements of multiple jurisdictions;

|

|

•

|

enhanced difficulties of integrating any foreign acquisitions;

|

|

•

|

the ability to present our content effectively in foreign languages;

|

|

•

|

complying with a variety of foreign laws, including certain employment laws requiring national collective bargaining

agreements that set minimum salaries, benefits, working conditions, and termination requirements;

|

|

•

|

reduced protection for intellectual property rights in some countries;

|

|

•

|

difficulties in staffing and managing global operations and the increased travel, infrastructure, and compliance costs

associated with multiple foreign locations;

|

|

•

|

regulations that might add difficulties in repatriating cash earned outside the United States and otherwise preventing us

from freely moving cash;

|

|

•

|

import and export restrictions and changes in trade regulation;

|

|

•

|

complying with statutory equity requirements; and

|

|

•

|

complying with the U.S. Foreign Corrupt Practices Act of 1977, as amended and the Corruption of Public Officials Act

(Canada), and similar laws in other jurisdictions.

|

|

•

|

an acquisition may negatively affect our operating results, financial condition or cash flows because it may require us to

incur charges or assume substantial debt or other liabilities, may cause adverse tax consequences or unfavorable accounting treatment, may expose us to claims and disputes by third parties, including intellectual property claims and

disputes, or may not generate sufficient financial return to offset additional costs and expenses related to the acquisition;

|

|

•

|

we may encounter difficulties or unforeseen expenditures in integrating the business, technologies, products, personnel or

operations of any company that we acquire, particularly if key personnel of the acquired company decide not to work for us, and potentially across different cultures and languages in the event of a foreign acquisition;

|

|

•

|

the acquired business may not perform at levels and on the timelines anticipated by our management and/or we may not be able

to achieve expected synergies;

|

|

•

|

an acquisition may disrupt our ongoing business, divert resources, increase our expenses and distract our management;

|

|

•

|

an acquisition may result in a delay or reduction of sales for both us and the company we acquire due to uncertainty about

continuity and effectiveness of products or support from either company;

|

|

•

|

we may encounter difficulties in, or may be unable to, successfully sell any acquired products or services;

|

|

•

|

an acquisition may involve the entry into geographic or business markets in which we have little or no prior experience or

where competitors have stronger market positions;

|

|

•

|

potential strain on our financial and managerial controls and reporting systems and procedures;

|

|

•

|

potential known and unknown liabilities associated with an acquired company;

|

|

•

|

if we incur debt to fund such acquisitions, such debt may subject us to material restrictions on our ability to conduct our

business as well as financial maintenance covenants;

|

|

•

|

the risk of impairment charges related to potential write-downs of acquired assets or goodwill in future acquisitions;

|

|

•

|

to the extent that we issue a significant amount of equity or convertible debt securities in connection with future

acquisitions, existing equity holders may be diluted and earnings per share may decrease; and

|

|

•

|

managing the varying intellectual property protection strategies and other activities of an acquired company.

|

|

•

|

actual or anticipated fluctuations in our quarterly and annual financial results or the quarterly and annual financial

results of companies perceived to be similar to us;

|

|

•

|

changes in the market’s expectations about operating results;

|

|

•

|

operating results failing to meet market expectations in a particular period, which could impact the market price our Common

Shares;

|

|

•

|

operating and stock price performance of other companies that investors deem comparable to us;

|

|

•

|

changes in laws and regulations affecting our businesses;

|

|

•

|

commencement of, or involvement in, litigation involving the Company;

|

|

•

|

changes in our capital structure, such as future issuances of securities or the incurrence of debt;

|

|

•

|

any significant change in our Board of Directors or management;

|

|

•

|

sales of substantial amounts of our Common Shares by the Company, Cantor, the Investor, or our directors, executive officers

or significant shareholders or the perception that such sales could occur; and

|

|

•

|

general economic and political conditions such as recessions, interest rates, fuel prices, international currency

fluctuations and acts of war or terrorism.

|

|

•

|

a classified Board of Directors with staggered three-year terms;

|

|

•

|

the ability of our Board of Directors to determine the powers, preferences and rights of preference shares and to cause us to

issue the preference shares without shareholder approval; and

|

|

•

|

requiring advance notice for shareholder proposals and nominations and placing limitations on convening shareholder meetings.

|

|

•

|

a number of Common Shares which, when aggregated with all other Common Shares then beneficially owned by Cantor and its

affiliates (as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 promulgated thereunder), would result in Cantor beneficially owning Common Shares equal to (but not exceeding) the Beneficial Ownership Cap;

|

|

•

|

(i) the total volume of Common Shares as reported by Bloomberg through its “VWAP” function during the applicable period

(subject to adjustment in the case that the price of our Common Shares falls below a

|

|

•

|

the number of Common Shares set forth in any VWAP Purchase Notice, representing the Company’s good faith estimate of the

number of Common Shares equivalent to the VWAP Purchase Share Request during the applicable period on the date on which such Common Shares are delivered to Cantor under the Purchase Agreement (the “VWAP Purchase Date”).

|

|

•

|

the accuracy in all material respects of the representations and warranties of the Company included in the Purchase

Agreement;

|

|

•

|

the Company having performed, satisfied and complied in all material respects with all covenants, agreements and conditions

required by the Purchase Agreement to be performed, satisfied or complied with by the Company;

|

|

•

|

the aggregate market value of the Company’s outstanding Common Stock is equal to or greater than $25 million (determined

based on the closing price of the Company’s Common Stock on Nasdaq on the day prior to the delivery of a VWAP Purchase Notice and the number of outstanding shares on such date);

|

|

•

|

the registration statement that includes this prospectus (and any one or more additional registration statements filed with

the SEC that include Common Shares that may be issued and sold by the Company to Cantor under the Purchase Agreement) having been declared effective under the Securities Act by the SEC and not being subject to any stop order or

suspension by the SEC, FINRA or Nasdaq, and Cantor being

|

|

•

|

the absence of any material misstatement or omission in the registration statement that includes this prospectus (or in any

one or more additional registration statements filed with the SEC that include Common Shares that may be issued and sold by the Company to Cantor under the Purchase Agreement);

|

|

•

|

this prospectus and all reports, schedules, registrations, forms, statements, information and other documents required to

have been filed by the Company with the SEC pursuant to the reporting requirements of the Exchange Act having been filed with the SEC;

|

|

•

|

all of the Common Shares that have been registered with the SEC for resale having been approved for listing or quotation on

Nasdaq (or if the Common Shares are not then listed on Nasdaq, on any Principal Market), subject only to notice of issuance;

|

|

•

|

no condition, occurrence, state of facts or event constituting a Material Adverse Effect (as such term is defined in the

Purchase Agreement) shall have occurred and be continuing;

|

|

•

|

customary bankruptcy-related conditions; and

|

|

•

|

the receipt by Cantor of customary legal opinions, auditor comfort letters and bring-down legal opinions, and auditor comfort

letters as required under the Purchase Agreement.

|

|

•

|

the first day of the month next following the 36-month anniversary of the date of this prospectus;

|

|

•

|

the date on which Cantor shall have purchased Common Shares under the Purchase Agreement for an aggregate gross purchase

price equal to $50.0 million;

|

|

•

|

the date on which the Common Shares shall have failed to be listed or quoted on Nasdaq or any other Principal Market;

|

|

•

|

the date on which the Company commences a voluntary bankruptcy case or any third party commences a bankruptcy proceeding

against the Company; and

|

|

•

|

the date on which a custodian is appointed for the Company in a bankruptcy proceeding for all or substantially all of its

property, or the Company makes a general assignment for the benefit of its creditors.

|

|

Assumed Trading

Price of Common Shares

|

| |

Number of

Shares Sold

Under the

Facility(1)

|

| |

Commitment

Fee Shares(2)

|

| |

Total Common

Shares Issued

to Holder

|

| |

Percentage of

Outstanding

Common Shares

After Giving Effect

to Issuances to

Holder(3)

|

| |

Proceeds

for Common

Shares Sold

Under the

Facility(4)

|

|

$1.62(5)

|

| |

4,178,331

|

| |

877,193

|

| |

5,055,524

|

| |

16.7%

|

| |

$6.8 million

|

|

$3.00

|

| |

4,178,331

|

| |

877,193

|

| |

5,055,524

|

| |

16.7%

|

| |

$12.2 million

|

|

$6.00

|

| |

4,178,331

|

| |

877,193

|

| |

5,055,524

|

| |

16.7%

|

| |

$24.4 million

|

|

$13.00

|

| |

3,965,107

|

| |

877,193

|

| |

4,842,300

|

| |

16.1%

|

| |

$50.0 million

|

|

(1)

|

The assumed average purchase prices are solely for illustrative purposes and are not intended to be estimates or predictions

of the future performance of our Common Shares.

|

|

(2)

|

Represents the Commitment Fee Shares, which are the 877,193 Common Shares we agreed to issue to the Holder as consideration

for its irrevocable commitment to purchase the Common Shares at our election in our sole discretion, from time to time after the date of this prospectus, upon the terms and subject to the satisfaction of the conditions set forth in the

Purchase Agreement.

|

|

(3)

|

The denominator used to calculate the percentages in this column is based on 25,290,270 Common Shares outstanding as of

June 14, 2022, adjusted to include the Common Shares (a) issued and sold to the Holder under the Facility and (b) issued to the Holder as Commitment Fee Shares.

|

|

(4)

|

Proceeds represent the illustrative aggregate purchase price to be received from the sale of all of the Common Shares issued

and sold to the Holder under the Facility, which is determined by multiplying the VWAP Purchase Price, which would be calculated as 97% of the assumed trading prices of the Common Shares shown at the various illustrative prices set

forth in the first column, by the number of shares set forth in the second column.

|

|

(5)

|

Represents the closing price of our Common Shares on Nasdaq on July 21, 2022.

|

|

•

|

the historical unaudited consolidated financial statements of Tuatara as of and for the three months ended March 31, 2022 and

2021;

|

|

•

|

the historical audited financial statements of Tuatara as of and for the year ended December 31, 2021 and as of December 31,

2020 and for the period from January 24, 2020 through December 31, 2020;

|

|

•

|

the historical unaudited consolidated financial statements of SpringBig as of and for the three months ended March 31, 2022

and 2021;

|

|

•

|

the historical audited consolidated financial statements of SpringBig as of and for the years ended December 31, 2021 and

December 31, 2020;

|

|

•

|

the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other

financial information included elsewhere in this prospectus; and

|

|

•

|

other information relating to Tuatara and SpringBig included in this prospectus, including the merger agreement and the

description of certain terms thereof set forth under the section entitled “The Description of the Business Combination.”

|

|

•

|

SpringBig’s shareholders will have the largest voting interest in New SpringBig under the maximum redemption scenario;

|

|

•

|

The board of directors of the post-combination company has seven members, and SpringBig shareholders have the ability to

nominate at least the majority of the members of the board of directors;

|

|

•

|

SpringBig’s senior management is the senior management of the post-combination company;

|

|

•

|

The business of SpringBig will comprise the ongoing operations of New SpringBig; and

|

|

•

|

SpringBig is the larger entity, in terms of substantive operations and employee base.

|

|

Weighted average shares calculation, basic and diluted

|

| |

|

|

Tuatara public shares

|

| |

1,752,388

|

|

Tuatara founder shares

|

| |

3,000,000

|

|

Subscription investors

|

| |

1,341,356

|

|

Combined company shares issued in business combination

|

| |

18,196,526

|

|

Weighted average shares outstanding

|

| |

24,290,270

|

|

Percent of shares owned by SpringBig shareholders

|

| |

74.9%

|

|

Percent of shares owned by Tuatara holders

|

| |

19.6%

|

|

Percent of shares owned by subscription investors(1)

|

| |

5.5%

|

|

(1)

|

Of the shares owned by the subscription investors, 600,000 shares are attributable to affiliates of Tuatara and 10,000 shares

are attributable to affiliates of SpringBig.

|

|

|

| |

SpringBig

(Historical)

|

| |

Tuatara

(Historical)

|

| |

Transaction

Accounting

Adjustments

|

| |

|

| |

Pro Forma

Combined

|

|

Assets

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Current assets:

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Cash and cash equivalents

|

| |

$6,761

|

| |

$417

|

| |

$200,039

|

| |

(1)

|

| |

$18,518

|

|

|

| |

|

| |

|

| |

(191,438)

|

| |

(2)

|

| |

|

|

|

| |

|

| |

|

| |

(13,361)

|

| |

(3)

|

| |

|

|

|

| |

|

| |

|

| |

6,100

|

| |

(4)

|

| |

|

|

|

| |

|

| |

|

| |

10,000

|

| |

(8)

|

| |

|

|

Accounts receivable, net

|

| |

2,645

|

| |

—

|

| |

—

|

| |

|

| |

2,645

|

|

Contract assets

|

| |

303

|

| |

—

|

| |

—

|

| |

|

| |

303

|

|

Prepaid expenses and other current assets

|

| |

1,297

|

| |

249

|

| |

1,350

|

| |

(3)

|

| |

2,896

|

|

Total Current Assets

|

| |

11,006

|

| |

666

|

| |

12,690

|

| |

|

| |

24,362

|

|

Property, plant and equipment

|

| |

495

|

| |

—

|

| |

—

|

| |

|

| |

495

|

|

Deposits and other assets

|

| |

84

|

| |

—

|

| |

—

|

| |

|

| |

84

|

|

Investments held in Trust Account

|

| |

—

|

| |

200,039

|

| |

(200,039)

|

| |

(1)

|

| |

—

|

|

Total Assets

|

| |

$11,585

|

| |

$200,705

|

| |

$(187,349)

|

| |

|

| |

$24,941

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Liabilities and Stockholders’ Equity

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Current Liabilities

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Accounts payable

|

| |

$580

|

| |

$2,252

|

| |

$(902)

|

| |

(3)

|

| |

$1,930

|

|

Related party payable

|

| |

33

|

| |

—

|

| |

—

|

| |

|

| |

33

|

|

Accrued wages and commissions

|

| |

691

|

| |

—

|

| |

—

|

| |

|

| |

691

|

|

Accrued expenses

|

| |

888

|

| |

108

|

| |

—

|

| |

|

| |

996

|

|

Contract liability

|

| |

485

|

| |

—

|

| |

—

|

| |

|

| |

485

|

|

Interest payable

|

| |

89

|

| |

—

|

| |

(89)

|

| |

(4)

|

| |

—

|

|

Notes payable

|

| |

7,000

|

| |

—

|

| |

(7,000)

|

| |

(4)

|

| |

—

|

|

Other liabilities

|

| |

39

|

| |

—

|

| |

—

|

| |

|

| |

39

|

|

Total current liabilities

|

| |

9,805

|

| |

2,360

|

| |

(7,991)

|

| |

|

| |

4,174

|

|

Warrant liability

|

| |

—

|

| |

5,278

|

| |

—

|

| |

|

| |

5,278

|

|

Convertible notes

|

| |

—

|

| |

—

|

| |

8,565

|

| |

(8)

|

| |

8,565

|

|

Deferred underwriting fee payable

|

| |

—

|

| |

7,000

|

| |

(7,000)

|

| |

(3)

|

| |

—

|

|

Total Liabilities

|

| |

9,805

|

| |

14,638

|

| |

(6,426)

|

| |

|

| |

18,017

|

|

Ordinary shares subject to possible redemption

|

| |

—

|

| |

200,000

|

| |

(200,000)

|

| |

(2)

|

| |

—

|

|

Shareholders’ Equity

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Series B Preferred

|

| |

5

|

| |

—

|

| |

(5)

|

| |

(5)

|

| |

—

|

|

Series A Preferred

|

| |

5

|

| |

—

|

| |

(5)

|

| |

(5)

|

| |

—

|

|

Series Seed Preferred

|

| |

7

|

| |

—

|

| |

(7)

|

| |

(5)

|

| |

—

|

|

Common stock

|

| |

14

|

| |

—

|

| |

—

|

| |

(2)

|

| |

3

|

|

|

| |

|

| |

|

| |

(14)

|

| |

(5)

|

| |

|

|

|

| |

|

| |

|

| |

2

|

| |

(5)

|

| |

|

|

|

| |

|

| |

|

| |

1

|

| |

(5)

|

| |

|

|

Additional paid in capital

|

| |

17,840

|

| |

—

|

| |

8,562

|

| |

(2)

|

| |

27,121

|

|

|

| |

|

| |

|

| |

13,189

|

| |

(4)

|

| |

|

|

|

| |

|

| |

|

| |

(13,905)

|

| |

(5)

|

| |

|

|

|

| |

|

| |

|

| |

1,435

|

| |

(8)

|

| |

|

|

Class B ordinary shares

|

| |

—

|

| |

1

|

| |

(1)

|

| |

(5)

|

| |

—

|

|

Accumulated deficit

|

| |

(16,091)

|

| |

(13,934)

|

| |

(4,109)

|

| |

(3)

|

| |

(20,200)

|

|

|

| |

|

| |

|

| |

13,934

|

| |

(5)

|

| |

|

|

Total Shareholders’ Equity

|

| |

1,780

|

| |

(13,933)

|

| |

19,077

|

| |

|

| |

6,924

|

|

Total Liabilities and Shareholders’ Equity

|

| |

$11,585

|

| |

$200,705

|

| |

$(187,349)

|

| |

|

| |

$24,941

|

|

|

| |

SpringBig

(Historical)

|

| |

Tuatara

(Historical)

|

| |

Transaction

Accounting

Adjustments

|

| |

|

| |

Pro Forma

Combined

|

|

Revenue

|

| |

$6,364

|

| |

$—

|

| |

$—

|

| |

|

| |

$6,364

|

|

Cost of revenue

|

| |

1,843

|

| |

—

|

| |

—

|

| |

|

| |

1,843

|

|

Gross profit

|

| |

4,521

|

| |

—

|

| |

—

|

| |

|

| |

4,521

|

|

Selling, servicing and marketing

|

| |

2,943

|

| |

—

|

| |

—

|

| |

|

| |

2,943

|

|

Technology and software development

|

| |

2,637

|

| |

—

|

| |

—

|

| |

|

| |

2,637

|

|

General and administrative

|

| |

1,537

|

| |

—

|

| |

—

|

| |

|

| |

1,537

|

|

Operating expenses

|

| |

—

|

| |

912

|

| |

—

|

| |

(2)

|

| |

912

|

|

Total operating expenses

|

| |

7,117

|

| |

912

|

| |

—

|

| |

|

| |

8,029

|

|

Loss from operations

|

| |

(2,596)

|

| |

(912)

|

| |

—

|

| |

|

| |

(3,508)

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Interest income

|

| |

—

|

| |

—

|

| |

—

|

| |

|

| |

—

|

|

Interest expense

|

| |

(89)

|

| |

—

|

| |

(469)

|

| |

(3)

|

| |

(558)

|

|

Forgiveness of PPP Loan

|

| |

—

|

| |

—

|

| |

—

|

| |

|

| |

—

|

|

Change in fair value of warrants

|

| |

—

|

| |

4,162

|

| |

—

|

| |

|

| |

4,162

|

|

Compensation expense

|

| |

(181)

|

| |

—

|

| |

—

|

| |

|

| |

(181)

|

|

Transaction costs allocated to warrants

|

| |

—

|

| |

—

|

| |

—

|

| |

|

| |

—

|

|

Interest earned on investments held in Trust Account

|

| |

—

|

| |

3

|

| |

(3)

|

| |

(1)

|

| |

—

|

|

(Loss) income before taxes

|

| |

(2,866)

|

| |

3,253

|

| |

(472)

|

| |

|

| |

(85)

|

|

Provision for taxes

|

| |

—

|

| |

—

|

| |

—

|

| |

(4)

|

| |

—

|

|

Net (loss) income

|

| |

$(2,866)

|

| |

$3,253

|

| |

$(472)

|

| |

|

| |

$(85)

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Weighted average shares outstanding, basic

|

| |

13,571,872

|

| |

25,000,000

|

| |

(709,730)

|

| |

(5)

|

| |

24,290,270

|

|

Basic net (loss) income per share

|

| |

$(0.21)

|

| |

$0.13

|

| |

|

| |

|

| |

$—

|

|

Weighted average shares outstanding, diluted

|

| |

13,571,872

|

| |

25,000,000

|

| |

(709,730)

|

| |

(5)

|

| |

24,290,270

|

|

Diluted net (loss) income per share

|

| |

$(0.21)

|

| |

$0.13

|

| |

|

| |

|

| |

$—

|

|

|

| |

SpringBig

(Historical)

|

| |

Tuatara

(Historical)

|

| |

Transaction

Accounting

Adjustments

|

| |

|

| |

Pro Forma

Combined

|

|

Revenue

|

| |

$24,024

|

| |

$—

|

| |

$—

|

| |

|

| |

$24,024

|

|

Cost of revenue

|

| |

6,929

|

| |

—

|

| |

—

|

| | | |

6,929

|

|

|

Gross profit

|

| |

17,095

|

| |

—

|

| |

—

|

| |

|

| |

17,095

|

|

Selling, servicing and marketing

|

| |

10,185

|

| |

—

|

| |

—

|

| |

|

| |

10,185

|

|

Technology and software development

|

| |

8,410

|

| |

—

|

| |

—

|

| |

|

| |

8,410

|

|

General and administrative

|

| |

5,032

|

| |

—

|

| |

—

|

| |

|

| |

5,032

|

|

Operating expenses

|

| |

—

|

| |

2,035

|

| |

3,559

|

| |

(2)

|

| |

5,594

|

|

Total operating expenses

|

| |

23,627

|

| |

2,035

|

| |

3,559

|

| |

|

| |

29,221

|

|

Loss from operations

|

| |

(6,532)

|

| |

(2,035)

|

| |

(3,559)

|

| |

|

| |

(12,126)

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Interest income

|

| |

3

|

| |

—

|

| |

—

|

| |

|

| |

3

|

|

Interest expense

|

| |

—

|

| |

—

|

| |

(1,877)

|

| |

(3)

|

| |

(1,877)

|

|

Forgiveness of PPP Loan

|

| |

781

|

| |

—

|

| |

—

|

| |

|

| |

781

|

|

Change in fair value of warrants

|

| |

—

|

| |

12,960

|

| |

—

|

| |

|

| |

12,960

|

|

Compensation expense

|

| |

—

|

| |

(2,400)

|

| |

—

|

| |

|

| |

(2,400)

|

|

Transaction costs allocated to warrants

|

| |

—

|

| |

(853)

|

| |

—

|

| |

|

| |

(853)

|

|

Interest earned on investments held in Trust Account

|

| |

—

|

| |

35

|

| |

(35)

|

| |

(1)

|

| |

—

|

|

(Loss) income before taxes

|

| |

(5,748)

|

| |

7,707

|

| |

(5,471)

|

| |

|

| |

(3,512)

|

|

Provision for taxes

|

| |

(2)

|

| |

—

|

| |

—

|

| |

(4)

|

| |

(2)

|

|

Net (loss) income

|

| |

$(5,750)

|

| |

$7,707

|

| |

$(5,471)

|

| |

|

| |

$(3,514)

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Weighted average shares outstanding, basic

|

| |

13,385,267

|

| |

22,287,671

|

| |

2,002,599

|

| |

(5)

|

| |

24,290,270

|

|

Basic net (loss) income per share

|

| |

$(0.43)

|

| |

$0.35

|

| |

|

| |

|

| |

$(0.14)

|

|

Weighted average shares outstanding, diluted

|

| |

13,385,267

|

| |

22,369,863

|

| |

1,920,407

|

| |

(5)

|

| |

24,290,270

|

|

Diluted net (loss) income per share

|

| |

$(0.43)

|

| |

$0.34

|

| |

|

| |

|

| |

$(0.14)

|

|

1.

|

Basis of Presentation

|

|

•

|

SpringBig historical unaudited consolidated balance sheet as of March 31, 2022.

|

|

•

|

Tuatara’s historical unaudited consolidated balance sheet as of March 31, 2022, included Tuatara’s Quarterly report on Form

10-Q, filed on May 16, 2022.

|

|

•

|

SpringBig historical unaudited consolidated statement of operations for the three months ended March 31, 2022.

|

|

•

|

Tuatara’s historical unaudited consolidated statement of operations for the three months ended March 31, 2022, included

Tuatara’s Quarterly report on Form 10-Q, filed on May 16, 2022.

|

|

•

|

SpringBig historical consolidated statement of operations for the year ended December 31, 2021, included in Tuatara’s

prospectus.

|

|

•

|

Tuatara’s statement of operations for the year ended December 31, 2021, included in Tuatara’s prospectus.

|

|

2.

|

Adjustments to Unaudited Pro Forma Condensed Combined Balance Sheets as of March 31, 2022

|

|

3.

|

Adjustments to Unaudited Pro Forma Condensed Combined Statement of Operations for the Three Months Ended

March 31, 2022

|

|

4.

|

Net Income (Loss) per Share

|

|

|

| |

Pro Forma

Combined

|

|

Three Months Ended March 31, 2022

|

| |

|

|

Net loss

|

| |

$(85)

|

|

Weighted average shares outstanding - basic and diluted

|

| |

24,290,270

|

|

Basic and diluted net loss per share

|

| |

$(0.00)

|

|

Year Ended December 31, 2021

|

| |

|

|

Net loss

|

| |

$(3,514)

|

|

Weighted average shares outstanding - basic and diluted

|

| |

24,290,270

|

|

Basic and diluted net loss per share

|

| |

$(0.14)

|

|

|

| |

|

|

Weighted average shares calculations, basic and diluted

|

| |

Pro Forma

Combined

|

|

Tuatara’s public shares

|

| |

1,752,388

|

|

Tuatara initial stockholders

|

| |

3,000,000

|

|

Subscription investors

|

| |

1,341,356

|

|

SpringBig stockholders

|

| |

18,196,526

|

|

Weighted average shares outstanding - basic and diluted

|

| |

24,290,270

|

|

|

| |

Three Months ended March 31,

|

| |

Year ended December 31,

|

||||||

|

|

| |

2021

|

| |

2022

|

| |

2020

|

| |

2021

|

|

|

| |

(dollars in thousands)

|

|||||||||

|

Revenue

|

| |

$5,209

|

| |

$6,364

|

| |

$15,183

|

| |

$24,024

|

|

Net Loss

|

| |

(1,118)

|

| |

(2,866)

|

| |

(1,598)

|

| |

(5,750)

|

|

Adjusted EBITDA

|

| |

(1,113)

|

| |

(2,718)

|

| |

(1,582)

|

| |

(6,361)

|

|

|

| |

|

| |

|

| |

|

| |

|

|

Number of retail clients

|

| |

890

|

| |

1,475

|

| |

759

|

| |

1,240

|

|

Net revenue retention

|

| |

112%

|

| |

107%

|

| |

128%

|

| |

110%

|

|

Number of messages (million)

|

| |

394

|

| |

436

|

| |

1,191

|

| |

1,861

|

|

•

|

First, we specify a measurement period consisting of the trailing twelve months from the current period end. We measure our

net revenue retention rate on an ongoing, rolling basis over the prior twelve months rather than as a “point in time” metric.

|

|

•

|

Next, we calculate the numerator as the average monthly recurring revenue (“Base Revenue”), plus any changes in monthly

recurring revenue attributable to upgrades (“Upgrades”), less any lost monthly recurring revenue (“Losses”) and less any changes in monthly recurring revenue attributable downgrades(“Downgrades”).

|

|

•

|

We calculate the denominator as the average monthly recurring revenue for such trailing twelve month period (the “Base

Revenue” defined above).

|

|

•

|

Our net revenue retention rate is calculated as the quotient obtained by dividing the adjusted monthly recurring revenue

amount by the average monthly recurring revenue for such trailing twelve month period. The calculation can be summarized as follows:

|

|

•

|

although depreciation is a non-cash charge, the assets being depreciated may have to be replaced in the future, and neither

EBITDA nor Adjusted EBITDA reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

|

|

•

|

EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, our working capital needs; and

|

|

•

|

EBITDA and Adjusted EBITDA do not reflect tax payments that may represent a reduction in cash available.

|

|

|

| |

Quarter ended March 31,

|

|||

|

|

| |

2021

|

| |

2022

|

|

|

| |

(dollars in thousands)

|

|||

|

Revenue

|

| |

$5,209

|

| |

$6,364

|

|

Net Loss

|

| |

(1,118)

|

| |

(2,866)

|

|

EBITDA

|

| |

(1,113)

|

| |

(2,718)

|

|

|

| |

Year ended

December 31,

|

|||

|

|

| |

2020

|

| |

2021

|

|

|

| |

(dollars in thousands)

|

|||

|

Net Loss

|

| |

$(1,598)

|

| |

$(5,750)

|

|

Interest income

|

| |

(3)

|

| |

(3)

|

|

Depreciation expense

|

| |

19

|

| |

173

|

|

EBITDA

|

| |

(1,582)

|

| |

(5,580)

|

|

Forgiveness of PPP loan

|

| |

—

|

| |

(781)

|

|

Adjusted EBITDA

|

| |

(1,582)

|

| |

(6,361)

|

|

|

| |

Quarter Ended March 31,

|

| |

Change

|

||||||

|

|

| |

2021

|

| |

2022

|

| |

($)

|

| |

(%)

|

|

|

| |

(dollars in thousands)

|

|||||||||

|

Revenue

|

| |

$5,209

|

| |

$6,364

|

| |

$1,115

|

| |

22%

|

|

Cost of revenue

|

| |

1,594

|

| |

1,843

|

| |

249

|

| |

16%

|

|

Gross profit

|

| |

3,615

|

| |

4,521

|

| |

906

|

| |

25%

|

|

Operating expenses:

|

| |

|

| |

|

| |

|

| |

|

|

Selling, servicing and marketing

|

| |

2,071

|

| |

2,943

|

| |

872

|

| |

42%

|

|

Technology and software development

|

| |

1,551

|

| |

2,637

|

| |

1,086

|

| |

70%

|

|

General and administrative

|

| |

1,106

|

| |

1,659

|

| |

553

|

| |

50%

|

|

Depreciation expense

|

| |

6

|

| |

59

|

| |

53

|

| |

883%

|

|

Total operating expenses

|

| |

4,734

|

| |

7,298

|

| |

2,564

|

| |

54%

|

|

Loss from operations

|

| |

(1,119)

|

| |

(2,777)

|

| |

(1,658)

|

| |

148%

|

|

Interest income

|

| |

1

|

| |

—

|

| |

|

| |

|

|

Interest expense

|

| |

—

|

| |

(89)

|

| |

|

| |

|

|

Net Income before taxes

|

| |

(1,118)

|

| |

(2,866)

|

| |

(1,748)

|

| |

156%

|

|

Provision for income taxes

|

| |

—

|

| |

—

|

| |

|

| |

|

|

Net Loss

|

| |

(1,118)

|

| |

(2,866)

|

| |

(1,748)

|

| |

156%

|

|

|

| |

Quarter ended March 31,

|

|||

|

|

| |

2021

|

| |

2022

|

|

|

| |

(dollars in thousands)

|

|||

|

Net cash used in operating activities

|

| |

(1,151)

|

| |

(2,399)

|

|

Net cash used in investing activities

|

| |

(164)

|

| |

(73)

|

|

Net cash provided by financing activities

|

| |

—

|

| |

7,006

|

|

Net increase (decrease) in cash

|

| |

(1,315)

|

| |

4,543

|

|

|

| |

Year Ended December 31,

|

| |

Change

|

||||||

|

|

| |

2020

|

| |

2021

|

| |

($)

|

| |

(%)

|

|

|

| |

(dollars in thousands)

|

|||||||||

|

Revenue

|

| |

$15,183

|

| |

$24,024

|

| |

$8,841

|

| |

58%

|

|

Cost of revenue

|

| |

4,978

|

| |

6,929

|

| |

1,951

|

| |

39%

|

|

Gross profit

|

| |

10,205

|

| |

17,095

|

| |

6,890

|

| |

68%

|

|

|

| |

Year Ended December 31,

|

| |

Change

|

||||||

|

|

| |

2020

|

| |

2021

|

| |

($)

|

| |

(%)

|

|

|

| |

(dollars in thousands)

|

|||||||||

|

Operating expenses:

|

| |

|

| |

|

| |

|

| |

|

|

Selling, servicing and marketing

|

| |

$4,843

|

| |

$10,185

|

| |

$342

|

| |

110%

|

|

Technology and software development

|

| |

4,391

|

| |

8,410

|

| |

4,019

|

| |

92%

|

|

General and administrative

|

| |

2,553

|

| |

4,859

|

| |

2,306

|

| |

90%

|

|

Depreciation expense

|

| |

19

|

| |

173

|

| |

154

|

| |

810%

|

|

Total operating expenses

|

| |

11,806

|

| |

23,627

|

| |

11,821

|

| |

110%

|

|

Loss from operations

|

| |

(1,601)

|

| |

(6,532)

|

| |

(4,931)

|

| |

308%

|

|

Interest and other income

|

| |

3

|

| |

784

|

| |

781

|

| |

26033%

|

|

Net Income before tax

|

| |

(1,598)

|

| |

(5,748)

|

| |

(4,150)

|

| |

260%

|

|

Provision for income taxes

|

| |

—

|

| |

2

|

| |

—

|

| |

—

|

|

Net Loss

|

| |

(1,598)

|

| |

(5,750)

|

| |

(4,152)

|

| |

260%

|

|

|

| |

Years ended December 31,

|

|||

|

|

| |

2020

|

| |

2021

|

|

|

| |

(dollars in thousands)

|

|||

|

Cash

|

| |

$10,447

|

| |

$2,227

|

|

Accounts receivable, net

|

| |

1,141

|

| |

3,045

|

|

Working capital

|

| |

(930)

|

| |

3,895

|

|

|

| |

Year ended

December 31,

|

|||

|

|

| |

2020

|

| |

2021

|

|

|

| |

(dollars in thousands)

|

|||

|

Net cash used in operating activities

|

| |

$(1,006)

|

| |

$(7,884)

|

|

Net cash used in investing activities

|

| |

(195)

|

| |

(374)

|

|

Net cash provided by financing activities

|

| |

9,025

|

| |

38

|

|

Net increase (decrease) in cash

|

| |

7,824

|

| |

(8,220)

|

|

|

| |

Payments Due by Period

|

||||||||||||

|

|

| |

Total

|

| |

Less

than

1 year

|

| |

1 - 3

years

|

| |

3 - 5

years

|

| |

More

than

5 years

|

|

|

| |

(dollars in thousands)

|

||||||||||||

|

Operating lease obligations

|

| |

1,098

|

| |

471

|

| |

627

|

| |

—

|

| |

—

|

|

(1)

|

Estimate based on average marketing spend in similar industries.

|

|

1

|

New Frontier Data, December 2020

|

|

•

|