Delaware |

001-39289 |

98-1524224 | ||

(State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Audrey S. Leigh Goodwin Procter LLP The New York Times Building 620 Eighth Avenue New York, NY 10018 (212) 813-8800 |

David Armstrong General Counsel Cano Health, Inc. 9725 NW 117th Avenue Miami, FL 33178 (855) 226-6633 |

| ☒ | Accelerated filer | ☐ | ||||

| Non-Accelerated filer | ☐ | Smaller reporting company | ||||

| Emerging growth company | ||||||

| Page | ||||

| ii | ||||

| iii | ||||

| 1 | ||||

| 11 | ||||

| 13 | ||||

| 69 | ||||

| 69 | ||||

| 69 | ||||

| 69 | ||||

| 69 | ||||

| 70 | ||||

| 79 | ||||

| 106 | ||||

| 134 | ||||

| 138 | ||||

| 146 | ||||

| 174 | ||||

| 186 | ||||

| 188 | ||||

| 191 | ||||

| 194 | ||||

| 198 | ||||

| 203 | ||||

| 203 | ||||

| 204 | ||||

F-1 |

||||

| • | “Jaws” are to Jaws Acquisition Corp., a Delaware corporation, prior to the Closing; |

| • | “Board” are to the board of directors of the Company; and |

| • | “Business Combination” or “Transactions” are to the Merger and other transactions contemplated by the Business Combination Agreement, collectively. |

| • | Under most of our agreements with health plans, we assume some or all of the risk that the cost of providing services will exceed our compensation. |

| • | Our revenues and operations are dependent upon a limited number of key existing payors and our continued relationship with those payors, and disruptions in those relationships (including renegotiation, non-renewal or termination of capitation agreements) or the inability of such payors to maintain their contracts with the Centers for Medicare and Medicaid Services could adversely affect our business. |

| • | COVID-19 or other pandemic, epidemic, or outbreak of an infectious disease may have an adverse effect on our business, results of operations, financial condition and cash flows, the nature and extent of which are highly uncertain and unpredictable. |

| • | Reductions in the quality ratings of the health plans we serve could have a material adverse effect on our business, results of operations, financial condition and cash flows. |

| • | Our medical centers are concentrated in certain geographic regions, which makes us sensitive to regulatory, economic, environmental and competitive conditions in those regions. |

| • | We primarily depend on reimbursements by third-party payors, which could lead to delays and uncertainties in the reimbursement process. |

| • | We have a history of net losses, we anticipate increasing expenses in the future, and we may not be able to achieve or maintain profitability. |

| • | We depend on our senior management team and other key employees, and the loss of one or more of these employees or an inability to attract and retain other highly skilled employees could harm our business. |

| • | If we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of service and member satisfaction or adequately address competitive challenges. |

| • | We may not be able to identify suitable de novo expansion opportunities, engage with payors in new markets to continue extension of financial risk-sharing model agreements that have proved successful in our existing markets or cost-effectively develop, staff and establish such new medical centers in new markets. |

| • | We conduct business in a heavily regulated industry, and if we fail to comply with applicable state and federal healthcare laws and government regulations or lose governmental licenses, we could incur financial penalties, become excluded from participating in government healthcare programs, be required to make significant operational changes or experience adverse publicity, which could harm our business. |

| • | We may not be able to identify suitable acquisition candidates, complete acquisitions or successfully integrate acquisitions, and acquisitions may not produce the intended results or may expose us to unknown or contingent liabilities. |

| • | Reductions in Medicare reimbursement rates or changes in the rules governing the Medicare program, including changes to Medicare Advantage, Accountable Care Organizations, Direct Contracting Entities (including the transition to ACO REACH program), and traditional Medicare programs, could have a material adverse effect on our financial condition and results of operations. |

| • | Our business could be harmed if the Affordable Care Act, or ACA, is overturned or by any legislative, regulatory or industry change that reduces healthcare spending or otherwise slows or limits the transition to more assumption of risk by healthcare providers. |

| • | Our use, disclosure, and other processing of personally identifiable information, including health information, is subject to the regulations implementing the federal Health Insurance Portability and Accountability Act of 1996, as amended by the Health Information Technology for Economic and Clinical Health Act, and their implementing regulations, or HIPPA, and other federal and state privacy and security regulations. If we suffer a data breach or unauthorized disclosure, we could incur significant liability including government and private investigations and claims of privacy and security non-compliance. We could also suffer significant reputational harm as a result and, in turn, a material adverse effect on our member base and revenue. |

| • | The Restatement (as defined below) may affect investor confidence and raise reputational issues and may subject us to additional risks and uncertainties, including increased professional costs and the increased possibility of legal proceedings. |

| • | We may be subject to legal proceedings and litigation, including intellectual property, privacy and medical malpractice disputes, which are costly to defend and could materially harm our business and results of operations. |

| • | Our existing indebtedness could adversely affect our business and growth prospects. The terms of the Credit Agreement (as defined herein) and our Senior Notes (as defined herein) restrict our current and future operations, particularly our ability to respond to changes or to take certain actions. |

| • | We are heavily dependent upon the current state and federal healthcare programs, primarily Medicare Advantage and Medicaid managed care, in heavily competitive and segmented markets that are constantly changing. |

| Shares of Class A common stock offered by us |

75,335,383 shares of our Class A common stock underlying an equal number of shares of Class B common stock. |

| Shares of Class A common stock offered by the Selling Securityholders | 75,335,383 shares of our Class A common stock. | |

Use of proceeds |

All of the shares of Class A common stock offered by the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their respective accounts. We will not receive any of the proceeds from these sales. | |

Market for our Class A Common Stock |

Our Class A common stock is listed on the NYSE under the symbol “CANO.” |

| • | the benefits of the Business Combination and the acquisitions described in this prospectus; |

| • | our financial and business performance; |

| • | changes in our strategy, future operations, financial position, estimated revenues, forecasts, projected costs, prospects and plans; |

| • | changes in applicable laws or regulations, including with respect to health plans and payors and our relationships with such plans and payors, and provisions that impact Medicare and Medicaid programs; |

| • | our ability to realize expected results with respect to patient membership, revenue and earnings; |

| • | our ability to grow market share in existing markets or enter into new markets and success of acquisitions; |

| • | the risk that we may not be able to procure sufficient space as we continue to grow and open additional medical centers; |

| • | our predictions about the need for our wellness centers after the coronavirus disease 2019, or COVID-19 pandemic, including the attractiveness of our offerings and member retention rates; |

| • | competition in our industry, the advantages of our products and technology over competing products and technology existing in the market, and competitive factors including with respect to technological capabilities, cost and scalability; |

| • | the impact of the COVID-19 pandemic or any other pandemic, epidemic or outbreak of an infectious disease in the United States or worldwide on our business, financial condition and results of operations and the actions we may take in response thereto; |

| • | our future capital requirements and sources and uses of cash; |

| • | our business, expansion plans and opportunities; |

| • | anticipated financial performance, including gross margin, and the expectation that our future results of operations will fluctuate on a quarterly basis for the foreseeable future; |

| • | our expected capital expenditures, cost of revenue and other future expenses, and the sources of funds to satisfy liquidity needs; |

| • | our ability to maintain proper and effective internal controls; |

| • | our ability to implement remediation plans to address our material weaknesses that are described herein; and |

| • | the outcome of any known and unknown litigation and regulatory proceedings. |

| • | the ability to maintain the listing of our Class A common stock and warrants on NYSE; |

| • | the price of our securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which we operate, variations in performance across competitors, changes in laws and regulations affecting our business and changes in our capital structure; |

| • | the risk of downturns and the possibility of rapid change in the highly competitive industry in which we operate; |

| • | the risk that we will need to raise additional capital to execute our business plan, which may not be available on acceptable terms or at all; |

| • | the risk that we experience difficulties in managing our growth and expanding operations; and |

| • | other risks and uncertainties described in this prospectus, including those under the section entitled “Risk Factors.” |

| • | the health status of our members; |

| • | higher levels of hospitalization among our members; |

| • | higher than expected utilization of new or existing healthcare services or technologies; |

| • | an increase in the cost of healthcare services and supplies, whether as a result of inflation or otherwise; |

| • | changes to mandated benefits or other changes in healthcare laws, regulations and practices; |

| • | increased costs attributable to specialist physicians, hospitals and ancillary providers; |

| • | changes in the demographics of our members and medical trends; |

| • | contractual or claims disputes with providers, hospitals or other service providers within and outside a health plan’s network; |

| • | the occurrence of catastrophes, major epidemics or pandemics, including COVID-19 and any variants thereof, or acts of terrorism; and |

| • | the reduction of health plan premiums. |

| • | requiring us to change or increase our products and services provided to members; |

| • | increasing the regulatory, including compliance, burdens under which we operate, which, in turn, may negatively impact the manner in which we provide services and increase our costs of providing services; |

| • | adversely affecting our ability to market our products or services through the imposition of further regulatory restrictions regarding the manner in which plans and providers market to Medicare Advantage or traditional Medicare enrollees; or |

| • | adversely affecting our ability to attract and retain members. |

| • | we may not be able to successfully enter into contracts with local payors on terms favorable to us or at all, including as a result of competition for payor relationships with other potential players, some of whom may have greater resources than we do, which competition may intensify due to the ongoing consolidation in the healthcare industry; |

| • | we may not be able to enroll or retain a sufficient number of new members to execute our growth strategy, and we may incur substantial costs to enroll new members and we may be unable to enroll a sufficient number of new members to offset those costs; |

| • | we may not be able to hire sufficient numbers of physicians and other staff and may fail to integrate our employees, particularly our medical personnel, into our care model; |

| • | per-member revenue in new markets may be lower than in our existing markets, including as a result of geographic cost index-based adjustments by CMS; |

| • | we may not be able to hire sufficient numbers of physicians and other staff and may fail to integrate our employees, particularly our medical personnel, into our care model; |

| • | when expanding our business into new states, we may be required to comply with laws and regulations that may differ from states in which we currently operate; and |

| • | depending upon the nature of the local market, we may not be able to implement our business model in every local market that we enter; for example, we may be unable to offer all services that we offer in our current markets (e.g., transportation), which could negatively impact our revenues and financial condition. |

| • | managing a larger combined company and consolidating corporate and administrative infrastructures; |

| • | the inability to realize any expected synergies and cost-savings; |

| • | difficulties in managing geographically dispersed operations, including risks associated with entering markets in which we have no or limited prior experience; |

| • | underperformance of any acquired business relative to our expectations and the price we paid; |

| • | negative near-term impacts on financial results after an acquisition, including acquisition-related earnings charges; |

| • | the assumption or incurrence of additional debt obligations or expenses, or use of substantial portions of our cash; |

| • | the issuance of equity securities to finance or as consideration for any acquisitions that dilute the ownership of our stockholders; |

| • | claims by terminated employees and shareholders of acquired companies or other third parties related to the transaction; |

| • | problems maintaining uniform procedures, controls and policies with respect to our financial accounting systems; |

| • | unanticipated issues in integrating information technology, communications and other systems; and |

| • | risks associated with acquiring intellectual property, including potential disputes regarding acquired companies’ intellectual property. |

| • | develop and enhance our member services; |

| • | continue to expand our organization; |

| • | hire, train and retain employees; |

| • | respond to competitive pressures or unanticipated working capital requirements; or |

| • | pursue acquisition opportunities. |

| • | Medicare and Medicaid reimbursement rules and regulations; |

| • | federal Anti-Kickback Statute, which, subject to certain exceptions known as “safe harbors,” prohibits the knowing and willful offer, payment, solicitation or receipt of any bribe, kickback, rebate or other remuneration for referring an individual, in return for ordering, leasing, purchasing or recommending or arranging for or to induce the referral of an individual or the ordering, purchasing or leasing of items or services covered, in whole or in part, by any federal healthcare program, such as Medicare and Medicaid. A person or entity can be found guilty of violating the statute without actual knowledge of the statute or specific intent to violate it. In addition, a claim including items or services resulting from a violation of the federal Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the False Claims Act, or the FCA; |

| • | the federal physician self-referral law, commonly referred to as the Stark Law, and analogous state self-referral prohibition statutes, which, subject to limited exceptions, prohibit physicians from referring Medicare or Medicaid patients to an entity for the provision of certain “designated health services” if the physician or a member of such physician’s immediate family has a direct or indirect financial relationship (including an ownership interest or a compensation arrangement) with an entity, and prohibit the entity from billing Medicare or Medicaid for such “designated health services.” The Stark Law excludes certain ownership interests in an entity from the definition of a financial relationship, including ownership of investment securities that could be purchased on the open market when the designated health services referral was made and when the entity had stockholder equity exceeding $75 million at the end of the corporation’s most recent fiscal year or on average during the previous three fiscal years. “Stockholder equity” is the difference in value between a corporation’s total assets and total liabilities; |

| • | federal civil and criminal false claims laws, including the FCA, which prohibit, among other things, individuals or entities from knowingly presenting, or causing to be presented, false or fraudulent claims for payment to, or approval by Medicare, Medicaid, or other federal healthcare programs, knowingly making, using or causing to be made or used a false record or statement material to a false or fraudulent claim or an obligation to pay or transmit money to the federal government, or knowingly concealing or knowingly and improperly avoiding or decreasing an obligation to pay money to the federal government. The FCA also permits a private individual acting as a “whistleblower” to bring actions on behalf of the federal government alleging violations of the FCA and to share in any monetary recovery; |

| • | the Civil Monetary Penalty statute and associated regulations, which authorizes the government agent to impose civil money penalties, an assessment, and program exclusion for various forms of fraud and abuse involving the Medicare and Medicaid programs; |

| • | the criminal healthcare fraud provisions of HIPAA, and related rules that prohibit knowingly and willfully executing, or attempting to execute, a scheme or artifice to defraud any healthcare benefit program or obtain, by means of false or fraudulent pretenses, representations, or promises, any of the money or property owned by, or under the custody or control of, any healthcare benefit program, regardless of the payor (e.g., public or private), and knowingly and willfully falsifying, concealing or covering up by any trick or device a material fact or making any material false, fictitious or fraudulent statement in connection with the delivery of or payment for health care benefits, items or services. Similar to the federal Anti-Kickback Statute, a person or entity can be found guilty of violating HIPAA without actual knowledge of the statute or specific intent to violate it; |

| • | federal and state laws regarding telemedicine services, including necessary technological standards to deliver such services, coverage restrictions associated with such services, the amount of reimbursement for such services, the licensure of individuals providing such services; |

| • | federal and state laws and policies related to the prescribing and dispensing of pharmaceuticals and controlled substances; |

| • | federal and state laws related to the advertising and marketing of services by healthcare providers; |

| • | state laws regulating the operations and financial condition of risk bearing providers, which may include capital requirements, licensing or certification, governance controls and other similar matters; |

| • | state and federal statutes and regulations that govern workplace health and safety; |

| • | federal and state laws and policies that require healthcare providers to maintain licensure, certification or accreditation to enroll and participate in the Medicare and Medicaid programs, to report certain changes in their operations to the agencies that administer these programs and, in some cases, to re-enroll in these programs when changes in direct or indirect ownership occur; |

| • | state laws pertaining to kickbacks, fee splitting, self-referral and false claims, some of which are not consistent with comparable federal laws and regulations, including, for example, not being limited in scope to relationships involving government health care programs; |

| • | state insurance laws governing what healthcare entities may bear financial risk and the allowable types of financial risks, including direct primary care programs, provider-sponsored organizations, Accountable Care Organizations, Independent Physician Associations, and provider capitation; |

| • | federal and state laws pertaining to the provision of services by nurse practitioners and physician assistants in certain settings, physician supervision of those services, and reimbursement requirements that depend on the types of services provided and documented and relationships between physician supervisors and nurse practitioners and physician assistants; and |

| • | federal and state laws pertaining to the privacy and security of protected health information, or PHI, and other patient information. |

| • | suspension or termination of our participation in government payment programs; |

| • | refunds of amounts received in violation of law or applicable payment program requirements dating back to the applicable statute of limitation periods; |

| • | loss of our required government certifications or exclusion from government payment programs; |

| • | loss of our licenses required to operate healthcare medical centers or administer pharmaceuticals in the states in which we operate; |

| • | criminal or civil liability, fines, damages, exclusion from participation in federal and state health care programs and/or monetary penalties for violations of healthcare fraud and abuse laws, including the federal Anti-Kickback Statute, Civil Monetary Penalties Law, Stark Law and FCA, state laws and regulations, or other failures to meet regulatory requirements; |

| • | enforcement actions by governmental agencies and/or state law claims for monetary damages by patients who believe their PHI has been used, disclosed or not properly safeguarded in violation of federal or state patient privacy laws, including HIPAA and the Privacy Act of 1974; |

| • | mandated changes to our practices or procedures that significantly increase operating expenses; |

| • | imposition of and compliance with corporate integrity agreements that could subject us to ongoing audits and reporting requirements as well as increased scrutiny of our billing and business practices which could lead to potential fines, among other things; |

| • | termination of various relationships and/or contracts related to our business, including payor agreements, joint venture arrangements, medical director agreements, real estate leases and consulting agreements with physicians; |

| • | changes in and reinterpretation of rules and laws by a regulatory agency or court, such as state corporate practice of medicine laws, that could affect the structure and management of our business and its affiliated physician practice corporations; |

| • | negative adjustments to government payment models including, but not limited to, Medicare Parts A, B, C and D and Medicaid; and |

| • | harm to our reputation which could negatively impact our business relationships, affect our ability to attract and retain members and physicians, affect our ability to obtain financing and decrease access to new business opportunities, among other things. |

| • | administrative or legislative changes to base rates or the bases of payment; |

| • | limits on the services or types of providers for which Medicare will provide reimbursement; |

| • | changes in methodology for member assessment and/or determination of payment levels; |

| • | the reduction or elimination of annual rate increases; or |

| • | an increase in co-payments or deductibles payable by beneficiaries. |

| • | refunding amounts we have been paid pursuant to the Medicare or Medicaid programs or from payors; |

| • | state or federal agencies imposing fines, penalties and other sanctions on us; |

| • | temporary suspension of payment for new patients to the facility or agency; |

| • | decertification or exclusion from participation in the Medicare or Medicaid programs or one or more payor networks; |

| • | self-disclosure of violations to applicable regulatory authorities; |

| • | damage to our reputation; |

| • | the revocation of a facility’s or agency’s license; and |

| • | loss of certain rights under, or termination of, our contracts with payors. |

| • | limiting funds otherwise available for financing our working capital, capital expenditures, acquisitions, investments and other general corporate purposes by requiring us to dedicate a portion of our cash flows from operations to the repayment of indebtedness and the interest on this indebtedness; |

| • | making it more difficult for us to satisfy our obligations with respect to our indebtedness; |

| • | increasing our vulnerability to general adverse economic and industry conditions; |

| • | exposing us to the risk of increased interest rates as certain of our borrowings are at variable rates of interest; |

| • | limiting our flexibility in planning for and reacting to changes in the industry in which we compete; and |

| • | making us more vulnerable in the event of a downturn in our business. |

| • | incur or guarantee additional indebtedness; |

| • | incur liens; |

| • | pay dividends and distributions on, or redeem, repurchase or retire our capital stock; |

| • | make investments, acquisitions, loans, or advances; |

| • | engage in mergers, consolidations, liquidations or dissolutions; |

| • | sell, transfer or otherwise dispose of assets, including capital stock of subsidiaries; |

| • | engage in certain transactions with affiliates; |

| • | change of the nature of our business; |

| • | prepay, redeem or repurchase certain indebtedness; and |

| • | designate restricted subsidiaries as unrestricted subsidiaries. |

| • | limited in how we conduct our business; |

| • | unable to raise additional debt or equity financing to operate during general economic or business downturns; or |

| • | unable to compete effectively or to take advantage of new business opportunities. |

| • | pay certain dividends on, repurchase, or make distributions in respect of capital stock or make other restricted payments; |

| • | issue or sell capital stock of restricted subsidiaries; |

| • | incur or guarantee certain indebtedness; |

| • | make certain investments; |

| • | sell or exchange certain assets; |

| • | enter into transactions with affiliates; |

| • | create certain liens; and |

| • | consolidate, merge, or transfer all or substantially all of our assets and the assets of our subsidiaries on a consolidated basis. |

| • | limited in how we conduct our business; |

| • | unable to raise additional debt or equity financing to operate during general economic or business downturns; or |

| • | unable to compete effectively or to take advantage of new business opportunities. |

| • | We failed to establish controls to ensure the completeness and accuracy of information used to estimate and record certain accruals or make other closing adjustments in the financial statement close process. |

| • | We failed in the process of accounting for business combinations related to the design and operation of controls to record and measure the identifiable assets acquired, the liabilities assumed and any non-controlling interests recognized as part of a business combination. |

| • | Furthermore, we did not have a sufficient complement of personnel with an appropriate level of knowledge, experience, and oversight commensurate with its financial reporting requirements to ensure proper selection and application of U.S. generally accepted accounting principles, or GAAP. |

| • | market conditions in our industry or the broader stock market; |

| • | actual or anticipated fluctuations in our quarterly financial and operating results; |

| • | issuances of new or changed securities analysts’ reports or recommendations; |

| • | sales, or anticipated sales, of large blocks of our stock; |

| • | additions or departures of key personnel; |

| • | regulatory, legislative or political developments; |

| • | litigation and governmental investigations; |

| • | changing economic conditions; |

| • | investors’ perception of us; |

| • | events beyond our control such as weather and war; and |

| • | any default on our indebtedness. |

| • | a classified board of directors with three-year staggered terms, which could delay the ability of stockholders to change the membership of a majority of our Board; |

| • | the ability of our Board to issue shares of preferred stock, including “blank check” preferred stock and to determine the price and other terms of those shares, including preferences and voting rights, without stockholder approval, which could be used to significantly dilute the ownership of a hostile acquirer; |

| • | the limitation of the liability of, and the indemnification of, our directors and officers; |

| • | the right of our Board to elect a director to fill a vacancy created by the expansion of our Board or the resignation, death or removal of a director, which prevents stockholders from being able to fill vacancies on our Board; |

| • | the requirement that directors may only be removed from our Board for cause; |

| • | the requirement that a special meeting of stockholders may be called only by a majority of our directors, whether not there exists any vacancies or unfilled seats, which could delay the ability of stockholders to force consideration of a proposal or to take action, including the removal of directors; |

| • | controlling the procedures for the conduct and scheduling of our Board and stockholder meetings; |

| • | the requirement for the affirmative vote of holders of (i) (a) at least 66-2/3%, in case of certain provisions, or (b) a majority, in case of other provisions, of the voting power of all of the then-outstanding shares of the voting stock, voting together as a single class, to amend, alter, change or repeal certain provisions of our Certificate of Incorporation, and (ii) (a) at least 66-2/3%, in case of certain provisions, or (b) a majority, in case of other provisions, of the voting power of all of the then-outstanding shares of the voting stock, voting together as a single class, to amend, alter, change or repeal certain provisions of our Bylaws, which could preclude stockholders from bringing matters before annual or special meetings of stockholders and delay changes in our Board and also may inhibit the ability of an acquirer to effect such amendments to facilitate an unsolicited takeover attempt; |

| • | the ability of our Board to amend the Bylaws, which may allow our Board to take additional actions to prevent an unsolicited takeover and inhibit the ability of an acquirer to amend the Bylaws to facilitate an unsolicited takeover attempt; and |

| • | advance notice procedures with which stockholders must comply to nominate candidates to our Board or to propose matters to be acted upon at a stockholders’ meeting, which could preclude stockholders from bringing matters before annual or special meetings of stockholders and delay changes in our Board and also may discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of the Company. |

| • | allow us to authorize the issuance of undesignated preferred stock, the terms of which may be established and the shares of which may be issued without shareholder approval, and which may include super majority voting, special approval, dividend, or other rights or preferences superior to the rights of shareholders; |

| • | provide for a classified board of directors with staggered three-year terms; |

| • | provide that any amendment, alteration, rescission or repeal of our Bylaws or certain provisions of our Certificate of Incorporation by our shareholders will require the affirmative vote of the holders of a majority of at least two-thirds (2/3) of the outstanding shares of capital stock entitled to vote thereon as a class; and |

| • | establish advance notice requirements for nominations for elections to our Board or for proposing matters that can be acted upon by shareholders at shareholder meetings. |

| • | Business Combination: |

| • | Significant Acquisition: |

| • | Tax Receivable Agreement: |

| • | Debt Paydown: |

Jaws (Historical) Period from January 1, 2021 to June 3, 2021 |

Cano Health, Inc. (Historical) |

Pro Forma Transaction Accounting Adjustments |

Note 3 |

Jaws and Cano Health, Inc. Pro Forma Consolidated |

University (Historical) Period from January 1, 2021 to June 11, 2021 |

University Pro Forma Transaction Accounting Adjustments |

Note 3 |

Pro Forma Combined |

||||||||||||||||||||||||||||

Revenue |

||||||||||||||||||||||||||||||||||||

Capitated revenue |

$ | — | $ | 1,529,120 | $ | — | $ | 1,529,120 | $ | 149,711 | $ | — | $ | 1,678,831 | ||||||||||||||||||||||

Fee-for-service |

— | 80,249 | — | 80,249 | 4,740 | — | 84,989 | |||||||||||||||||||||||||||||

Total revenue |

— | 1,609,369 | — | 1,609,369 | 154,451 | — | 1,763,820 | |||||||||||||||||||||||||||||

Operating expenses: |

||||||||||||||||||||||||||||||||||||

Third-party medical costs |

— | 1,231,047 | — | 1,231,047 | 126,594 | — | 1,357,641 | |||||||||||||||||||||||||||||

Direct patient expense |

— | 179,353 | — | 179,353 | 6,839 | — | 186,192 | |||||||||||||||||||||||||||||

Operating costs and formation costs |

2,808 | — | — | 2,808 | — | — | 2,808 | |||||||||||||||||||||||||||||

Selling, general and administrative expenses |

— | 252,133 | — | (d | ) | 252,133 | 7,941 | — | 260,074 | |||||||||||||||||||||||||||

Depreciation and amortization expense |

— | 49,441 | — | 49,441 | 223 | 14,125 | (a1 | ) | 63,789 | |||||||||||||||||||||||||||

Transaction costs and other |

— | 44,262 | — | (c | ) | 44,262 | — | — | (c | ) | 44,262 | |||||||||||||||||||||||||

Fair value adjustment - continent consideration |

— | (11,680 | ) | — | (11,680 | ) | — | — | (11,680 | ) | ||||||||||||||||||||||||||

Total operating expenses |

2,808 | 1,744,556 | — | 1,747,364 | 141,597 | 14,125 | 1,903,086 | |||||||||||||||||||||||||||||

Income / (loss) from operations |

(2,808 | ) | (135,187 | ) | — | (137,995 | ) | 12,854 | (14,125 | ) | (139,266 | ) | ||||||||||||||||||||||||

Interest expense |

— | (51,291 | ) | 18,099 | (a2 | ) | (33,192 | ) | — | (7,458 | ) | (a2 | ) | (40,650 | ) | |||||||||||||||||||||

Interest income |

112 | 4 | (112 | ) | (a3 | ) | 4 | — | — | 4 | ||||||||||||||||||||||||||

Loss on extinguishment of debt |

— | (13,115 | ) | — | (13,115 | ) | — | — | (13,115 | ) | ||||||||||||||||||||||||||

Other income |

— | (48 | ) | — | (48 | ) | 1,540 | — | 1,492 | |||||||||||||||||||||||||||

Fair value adjustment - warrant liability |

(72,518 | ) | 82,914 | — | 10,396 | — | — | 10,396 | ||||||||||||||||||||||||||||

Total other income / (expense) |

(72,406 | ) | 18,464 | 17,987 | (35,955 | ) | 1,540 | (7,458 | ) | (41,873 | ) | |||||||||||||||||||||||||

Net income / (loss) before income tax expense |

(75,214 | ) | (116,723 | ) | 17,987 | (173,950 | ) | 14,394 | (21,583 | ) | (181,139 | ) | ||||||||||||||||||||||||

Income tax expense |

— | 14 | — | 14 | — | — | 14 | |||||||||||||||||||||||||||||

Net income / (loss) |

(75,214 | ) | (116,737 | ) | 17,987 | (173,964 | ) | 14,394 | (21,583 | ) | (181,153 | ) | ||||||||||||||||||||||||

Net loss attributable to non-controlling interests |

— | (98,717 | ) | (9,654 | ) | (a4 | ) | (108,371 | ) | — | (4,479 | ) | (a4 | ) | (112,580 | ) | ||||||||||||||||||||

Net income / (loss) attributable to Cano Health, Inc. |

— | (18,020 | ) | $ | (27,641 | ) | $ | (65,593 | ) | $ | 14,394 | $ | (17,104 | ) | $ | (68,303 | ) | |||||||||||||||||||

Weighted average Class A shares outstanding, basic |

69,000,000 | 170,507,194 | (69,000,000 | ) | (b | ) | — | — | 1,788,952 | (b | ) | 172,296,146 | ||||||||||||||||||||||||

Basic net loss per share, Class A |

— | $ | (0.11 | ) | — | — | — | — | $ | (0.40 | ) | |||||||||||||||||||||||||

Weighted average Class A shares outstanding, diluted |

69,000,000 | 475,697,225 | (69,000,000 | ) | (b | ) | $ | — | — | 1,788,952 | (b | ) | 477,486,177 | |||||||||||||||||||||||

Diluted net loss per share, Class A |

— | $ | (0.28 | ) | — | — | — | — | $ | (0.38 | ) | |||||||||||||||||||||||||

Weighted average shares outstanding of Class B non-redeemable ordinary shares |

17,250,000 | — | (17,250,000 | ) | (b | ) | — | — | — | (b | ) | — | ||||||||||||||||||||||||

Basic and diluted net loss per share, Class B |

(4.36 | ) | — | — | — | — | — | — |

Shares Outstanding |

% |

|||||||

Seller |

297,385,981 | 62.3 | % | |||||

PIPE Investors |

80,000,000 | 16.8 | % | |||||

Jaws Shareholders |

68,993,491 | 14.4 | % | |||||

Sponsor and its affiliates |

17,250,000 | 3.6 | % | |||||

University Sellers |

4,055,698 | 0.8 | % | |||||

Other acquisitions/exchanges |

9,814,362 | 2.1 | % | |||||

Closing shares |

477,499,532 | 100 | % | |||||

| a. | The pro forma adjustments included in the unaudited pro forma condensed combined statement of operations for the year ended December 31, 2021 are as follows: |

| (1) | Adjustment to include amortization expense related to the intangible assets of University acquired by Cano Health, Inc.: |

Year ended December 31, 2021 |

||||

Elimination of University historical amortization expense |

$ | (35 | ) | |

Amortization expense for University intangible assets acquired by Cano Health, Inc. |

14,160 | |||

Total pro forma amortization expense |

$ | 14,125 | ||

| (2) | Adjustments to interest expense for the PCIH’s debt refinancing related to the Business Combination and the issuance of additional debt to finance the University acquisition: |

Year Ended December 31, 2021 |

||||

Elimination of PCIH historical interest expense |

$ | (20,340 | ) | |

Interest expense associated with the remaining balance of the Term Loan |

1,765 | |||

Amortization expense on the Term Loan |

476 | |||

Net Pro Forma adjustment to interest expense Post-Business Combination |

$ |

(18,099 |

) | |

Interest expense associated with Term Loan issued for University acquisition |

7,458 | |||

Total net Pro Forma adjustment to interest expense |

$ |

(10,641 |

) | |

Year Ended December 31, 2021 |

||||

Variable interest rate +1/8% |

$ | 40,855 | ||

Variable interest rate -1/8% |

$ | 40,449 | ||

| (3) | Adjustments for the elimination of interest income held in the Trust Account |

Year Ended December 31, 2021 |

||||

Elimination of interest income |

$ | 112 | ||

Net Pro Forma adjustment to interest income |

$ | 112 | ||

| (4) | Adjustments for the non-controlling interest in the Business Combination and the University acquisition: |

December 31, 2021 |

||||

NCI (62.3%) |

||||

Jaws + PCIH net pro forma loss before income taxes |

$ | (173,950 | ) | |

Non-controlling interest pro forma adjustment |

(9,654 | ) | ||

Jaws + PCIH pro forma loss attributable to non-controlling interest |

$ |

(108,371 |

) | |

University net pro forma loss before income taxes |

$ | (7,189 | ) | |

Non-controlling interest pro forma adjustment |

(4,479 | ) | ||

University pro forma loss attributable to non-controlling interest |

$ |

(4,479 |

) | |

Total net pro forma loss before income taxes |

$ | (181,139 | ) | |

Total non-controlling interest pro forma adjustment |

(14,133 | ) | ||

Total pro forma loss attributable to non-controlling interest |

$ |

(112,850 |

) | |

| b. | Adjustments for earnings per share included in the unaudited pro forma condensed combined statement of operations for the year ended December 31, 2021: |

For the year ended December 31, 2021 |

||||||||||||||||

Jaws (Historical) |

Cano Health, Inc. (Historical) |

Pro Forma Adjustments |

Pro Forma Combined |

|||||||||||||

(in thousands, except share and per share data) |

||||||||||||||||

Net loss attributable to Cano Health |

$ | (75,214 | ) | $ | (18,020 | ) | $ | 24,931 | $ | (68,303 | ) | |||||

Diluted net loss attributable to Cano Health |

$ | — | $ | — | $ | — | $ | (181,153 | ) | |||||||

Weighted average shares outstanding of Class A redeemable ordinary shares, basic |

69,000,000 | 170,507,194 | (67,211,048 | ) | 172,296,146 | |||||||||||

Basic net loss per share, Class A 1 |

— | $ | (0.11 | ) | — | $ | (0.40 | ) | ||||||||

Weighted average shares outstanding of Class A redeemable ordinary shares, diluted |

69,000,000 | 475,697,225 | (67,211,048 | ) | 477,486,177 | |||||||||||

Diluted net loss per share, Class A 1 |

— | $ | (0.28 | ) | — | $ | (0.38 | ) | ||||||||

Weighted average shares outstanding of Class B non-redeemable ordinary shares2 |

17,250,000 | — | (17,250,000 | ) | — | |||||||||||

Basic and diluted net loss per share, Class B |

(4.36 | ) | — | — | — | |||||||||||

| c. | Given transaction costs incurred in connection with the Business Combination and the University acquisition of $19.7 million are included in the historical statements of operations of the Company for the year ended December 31, 2021, no further adjustment to the transaction costs and other expenses caption is required. |

| d. | Given the acceleration of profit unit interests incurred in connection with the Business Combination for $1.0 million are included in the historical statement of operations of the Company for the year ended December 31, 2021, no further adjustment to the selling, general and administrative expenses caption is required. |

| e. | Given the write-off of the unamortized debt issuance costs and debt extinguishment of $13.2 million is included in the historical statement of operations of the Company for the year ended December 31, 2021, no further adjustment is required. |

| • | suspension or termination of our participation in government and/or private payment programs; |

| • | refunds of amounts received in violation of law or applicable payment program requirements dating back to the applicable statute of limitation periods; |

| • | loss of our licenses required to operate healthcare medical centers, dispense pharmaceuticals, or provide ancillary services in the states in which we operate; |

| • | criminal or civil liability, fines, damages, exclusion from participating in federal and state healthcare programs and/or monetary penalties for violations of healthcare fraud and abuse laws, including, but not limited to, the federal Anti-Kickback Statute, Civil Monetary Penalties Law of the Social Security Act, or the CMPL, the federal physician self-referral law, commonly referred to as the Stark Law, the False Claims Act, or the FCA, and/or state analogs to these federal enforcement authorities, or other regulatory requirements; |

| • | enforcement actions by governmental agencies and/or state law claims for monetary damages by patients who believe their health information has been used, disclosed or not properly safeguarded in violation of federal or state patient privacy laws, including the regulations implementing the federal Health Insurance Portability and Accountability Act of 1996, as amended by the Health Information Technology for Economic and Clinical Health Act, and their implementing regulations, or HIPAA; |

| • | mandated changes to our practices or procedures that significantly increase operating expenses or decrease our revenue; |

| • | imposition of and compliance with corporate integrity agreements that could subject us to ongoing audits and reporting requirements as well as increased scrutiny of our billing and business practices which could lead to potential fines, among other things; |

| • | termination of various relationships and/or contracts related to our business, including joint venture arrangements, contracts with payors, real estate leases and provider employment arrangements; |

| • | changes in and reinterpretation of rules and laws by a regulatory agency or court, such as state corporate practice of medicine laws, that could affect the structure and management of our business and its affiliated physician practice corporations; |

| • | negative adjustments or insufficient inflationary adjustments to government payment models including, but not limited to, Medicare Parts A, B, C and D and Medicaid; and |

| • | harm to our reputation, which could negatively impact our business relationships, the terms of payor contracts, our ability to attract and retain patients and physicians, our ability to obtain financing and our access to new business opportunities, among other things. |

| • | Affiliated Physician Agreements |

| • | Management Services Agreements |

| • | Marketing Arrangements. |

| • | Joint Venture Arrangements. |

| • | Administrative Services Agreements. |

| • | Acquisitions. |

| • | knowingly presents or causes to be presented to the federal government a false or fraudulent claim for payment or approval; |

| • | knowingly makes, uses or causes to be made or used a false record or statement material to a false or fraudulent claim; |

| • | knowingly makes, uses or causes to be made or used a false record or statement material to an obligation to pay the government, or knowingly conceals or knowingly and improperly avoids or decreases an obligation to pay or transmit money or property to the federal government; or |

| • | conspires to commit the above acts. |

| • | presenting, or causing to be presented, claims for payment to Medicare, Medicaid or other third-party payors that the individual or entity knows or should know are for an item or service that was not provided as claimed or is false or fraudulent; |

| • | offering remuneration to a federal healthcare program beneficiary that the individual or entity knows or should know is likely to influence the beneficiary to order or receive health care items or services from a particular provider; |

| • | arranging contracts with an entity or individual excluded from participation in the federal healthcare programs; |

| • | violating the federal Anti-Kickback Statute; |

| • | making, using or causing to be made or used a false record or statement material to a false or fraudulent claim for payment for items and services furnished under a federal healthcare program; |

| • | making, using or causing to be made any false statement, omission or misrepresentation of a material fact in any application, bid or contract to participate or enroll as a provider of services or a supplier under a federal healthcare program; |

| • | failing to report and return an overpayment owed to the federal government; |

| • | being convicted of fraud, theft, embezzlement, breach of fiduciary responsibility or any other financial misconduct relating to health care; |

| • | being convicted of illegally manufacturing, distributing, prescribing or dispensing a controlled substance; |

| • | being convicted of any crime related to the Medicare program; |

| • | being convicted of fraud in connection with non-health care programs; |

| • | being convicted of obstructing an audit or investigation; |

| • | having an entity controlled by a sanctioned individual or by a family or household member of an excluded individual where there has been a transfer of ownership/control; |

| • | filing claims for excessive charges, unnecessary services or services which fail to meet professionally recognized standards of health care; and |

| • | making false statement or misrepresentations of material fact. |

| • | Patients low-income communities, including large minority and immigrant populations, with complex care needs, many of whom previously had very limited or no access to quality healthcare. We are proud of the impact we have made in these underserved communities. |

| • | Providers pre-authorizations, referrals, billing and coding. Our physicians receive ongoing training through regular clinical meetings to review the latest findings in primary care medicine. In addition, our physicians are eligible to receive a bonus based upon patient results, including reductions in patient emergency room visits and hospital admissions, among other metrics. |

| • | Payors |

| • | Primary Care Physicians and related entities Class A-4 Units of PCIH and $2.6 million in other closing payments. Primary Care Physicians is comprised of eleven primary care centers and a managed services organization serving populations in the Broward County region of South Florida. |

| • | HP Enterprises II, LLC and related entities Class A-4 Units of PCIH and $16.1 million in deferred payments. Healthy Partners is comprised of sixteen primary care centers and a management services organization serving populations across Florida, including the Miami-Dade, Broward, Palm Beach, Treasure Coast and Central Florida areas. |

| • | University Health Care and its affiliates add-ons based on additional acquired entities. University is comprised of thirteen primary care centers, a managed services organization and a pharmacy serving populations throughout various locations in South Florida. |

| • | Doctor’s Medical Center, LLC and its affiliates |

December 31, 2021 |

December 31, 2020 |

December 31, 2019 |

||||||||||

| Membership |

227,005 | 105,707 | 41,518 | |||||||||

| Medical centers |

130 | 71 | 35 | |||||||||

Years Ended December 31, |

||||||||||||

($ in thousands) |

2021 |

2020 (as Revised) |

2019 (as Revised) |

|||||||||

| Revenue: |

||||||||||||

| Capitated revenue |

$ | 1,529,120 | $ | 796,373 | $ | 340,901 | ||||||

| Fee-for-service |

80,249 | 35,203 | 20,483 | |||||||||

| |

|

|

|

|

|

|||||||

| Total revenue |

1,609,369 | 831,576 | 361,384 | |||||||||

| Operating expenses: |

||||||||||||

| Third-party medical costs |

1,231,047 | 564,987 | 242,572 | |||||||||

| Direct patient expense |

179,353 | 101,358 | 42,100 | |||||||||

| Selling, general, and administrative expenses |

252,133 | 103,962 | 59,148 | |||||||||

| Depreciation and amortization expense |

49,441 | 18,499 | 6,822 | |||||||||

| Transaction costs and other |

44,262 | 42,945 | 17,583 | |||||||||

| Change in fair value of contingent consideration |

(11,680 | ) | 65 | 2,845 | ||||||||

| |

|

|

|

|

|

|||||||

| Total operating expenses |

1,744,556 | 831,816 | 371,070 | |||||||||

| |

|

|

|

|

|

|||||||

| Loss from operations |

(135,187 | ) | (240 | ) | (9,686 | ) | ||||||

| Other income and expense: |

||||||||||||

| Interest expense |

(51,291 | ) | (34,002 | ) | (10,163 | ) | ||||||

| Interest income |

4 | 320 | 319 | |||||||||

| Loss on extinguishment of debt |

(13,115 | ) | (23,277 | ) | — | |||||||

| Change in fair value of embedded derivative |

— | (12,764 | ) | — | ||||||||

| Change in fair value of warrant liabilities |

82,914 | — | — | |||||||||

| Other expenses |

(48 | ) | (450 | ) | (250 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Total other income (expense) |

18,464 | (70,173 | ) | (10,094 | ) | |||||||

| |

|

|

|

|

|

|||||||

| Net loss before income tax expenses |

(116,723 | ) | (70,413 | ) | (19,780 | ) | ||||||

| Income tax expense |

14 | 651 | — | |||||||||

| |

|

|

|

|

|

|||||||

| Net loss |

(116,737 | ) | (71,064 | ) | $ | (19,780 | ) | |||||

| Net loss attributable to non-controlling interests |

(98,717 | ) | — | — | ||||||||

| |

|

|

|

|

|

|||||||

| Net loss attributable to Class A common stockholders |

$ | (18,020 | ) | $ | — | $ | — | |||||

| |

|

|

|

|

|

|||||||

Years Ended December 31, |

||||||||||||

(% of revenue) |

2021 |

2020 (as Revised) |

2019 (as Revised) |

|||||||||

| Revenue: |

||||||||||||

| Capitated revenue |

95.0 | % | 95.8 | % | 94.3 | % | ||||||

| Fee-for-service |

5.0 | % | 4.2 | % | 5.7 | % | ||||||

| |

|

|

|

|

|

|||||||

| Total revenue |

100.0 | % | 100.0 | % | 100.0 | % | ||||||

| |

|

|

|

|

|

|||||||

| Operating expenses: |

||||||||||||

| Third-party medical costs |

76.5 | % | 67.9 | % | 67.1 | % | ||||||

| Direct patient expense |

11.1 | % | 12.2 | % | 11.6 | % | ||||||

| Selling, general, and administrative expenses |

15.7 | % | 12.5 | % | 16.4 | % | ||||||

| Depreciation and amortization expense |

3.1 | % | 2.2 | % | 1.9 | % | ||||||

| Transaction costs and other |

2.8 | % | 5.2 | % | 4.9 | % | ||||||

| Change in fair value of contingent consideration |

(0.7 | )% | 0.0 | % | 0.8 | % | ||||||

| |

|

|

|

|

|

|||||||

| Total operating expenses |

108.5 | % | 100.0 | % | 102.7 | % | ||||||

| |

|

|

|

|

|

|||||||

| Loss from operations |

(8.5 | )% | 0.0 | % | (2.7 | )% | ||||||

| Other income and expense: |

||||||||||||

| Interest expense |

(3.2 | )% | (4.1 | )% | (2.8 | )% | ||||||

| Interest income |

0.0 | % | 0.0 | % | 0.1 | % | ||||||

| Loss on extinguishment of debt |

(0.8 | )% | (2.8 | )% | 0.0 | % | ||||||

| Change in fair value of embedded derivative |

0.0 | % | (1.5 | )% | 0.0 | % | ||||||

| Change in fair value of warrant liabilities |

5.2 | % | 0.0 | % | 0.0 | % | ||||||

| Other expenses |

0.0 | % | (0.1 | )% | (0.1 | )% | ||||||

| |

|

|

|

|

|

|||||||

| Total other income (expense) |

1.2 | % | (8.5 | )% | (2.8 | )% | ||||||

| |

|

|

|

|

|

|||||||

| Net loss before income tax expenses |

(7.3 | )% | (8.5 | )% | (5.5 | )% | ||||||

| Income tax expense (benefit) |

0.0 | % | 0.1 | % | 0.0 | % | ||||||

| |

|

|

|

|

|

|||||||

| Net loss |

(7.3 | )% | (8.4 | )% | (5.5 | )% | ||||||

| Net loss attributable to non-controlling interests |

(6.1 | )% | — | % | — | % | ||||||

| |

|

|

|

|

|

|||||||

| Net loss attributable to Class A common stockholders |

(1.2 | )% | — | % | — | % | ||||||

| |

|

|

|

|

|

|||||||

Years Ended December 31, |

||||||||||||||||||||||||

2021 |

2020 (as Revised) |

2019 (as Revised) |

||||||||||||||||||||||

($ in thousands) |

Revenue $ |

Revenue % |

Revenue $ |

Revenue % |

Revenue $ |

Revenue % |

||||||||||||||||||

| Capitated revenue |

||||||||||||||||||||||||

| Medicare |

$ | 1,334,308 | 82.9 | % | $ | 672,588 | 80.9 | % | $ | 279,788 | 77.4 | % | ||||||||||||

| Other capitated revenue |

194,812 | 12.1 | % | 123,785 | 14.9 | % | 61,113 | 16.9 | % | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total capitated revenue |

1,529,120 | 95.0 | % | 796,373 | 95.8 | % | 340,901 | 94.3 | % | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Fee-for-service |

||||||||||||||||||||||||

| Fee-for-service |

25,383 | 1.6 | % | 9,504 | 1.1 | % | 5,769 | 1.6 | % | |||||||||||||||

| Pharmacy |

36,306 | 2.3 | % | 23,079 | 2.8 | % | 12,897 | 3.6 | % | |||||||||||||||

| Other |

18,560 | 1.1 | % | 2,620 | 0.3 | % | 1,817 | 0.5 | % | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total fee-for-service |

80,249 | 5.0 | % | 35,203 | 4.2 | % | 20,483 | 5.7 | % | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total revenue |

$ | 1,609,369 | 100.0 | % | $ | 831,576 | 100.0 | % | $ | 361,384 | 100.0 | % | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Years Ended December 31, |

||||||||||||

2021 |

2020 |

% Change |

||||||||||

| Members: |

||||||||||||

| Medicare Advantage |

118,348 | 74,644 | 58.5 | % | ||||||||

| Medicare DCE |

7,651 | — | 100.0 | % | ||||||||

| Medicaid |

66,500 | 19,314 | 244.3 | % | ||||||||

| ACA |

34,506 | 11,749 | 193.7 | % | ||||||||

| |

|

|

|

|||||||||

| Total members |

227,005 | 105,707 | 114.7 | % | ||||||||

| |

|

|

|

|||||||||

| Member months: |

||||||||||||

| Medicare Advantage |

1,167,848 | 708,505 | 64.8 | % | ||||||||

| Medicare DCE |

69,707 | — | 100.0 | % | ||||||||

| Medicaid |

518,335 | 193,849 | 167.4 | % | ||||||||

| ACA |

286,005 | 125,319 | 128.2 | % | ||||||||

| |

|

|

|

|||||||||

| Total member months |

2,041,895 | 1,027,673 | 98.7 | % | ||||||||

| |

|

|

|

|||||||||

| Per Member Per Month, or PMPM: |

(as Revised |

) |

||||||||||

| Medicare Advantage |

$ | 1,066 | $ | 949 | 12.3 | % | ||||||

| Medicare DCE |

$ | 1,276 | $ | — | 100.0 | % | ||||||

| Medicaid |

$ | 355 | $ | 623 | (43.0 | )% | ||||||

| ACA |

$ | 39 | $ | 24 | 62.5 | % | ||||||

| Total PMPM |

$ | 749 | $ | 775 | (3.4 | )% | ||||||

| Owned medical centers |

130 | 71 | ||||||||||

Years Ended December 31, |

||||||||||||||||

($ in thousands) |

2021 |

2020 (as Revised) |

$ Change |

% Change |

||||||||||||

| Revenue: |

||||||||||||||||

| Capitated revenue |

$ | 1,529,120 | $ | 796,373 | $ | 732,746 | 92.0 | % | ||||||||

| Fee-for-service |

80,249 | 35,203 | 45,046 | 128.0 | % | |||||||||||

| |

|

|

|

|

|

|||||||||||

| Total revenue |

$ | 1,609,369 | $ | 831,576 | $ | 777,792 | ||||||||||

| |

|

|

|

|

|

|||||||||||

Years Ended December 31, |

||||||||||||||||

($ in thousands) |

2021 |

2020 (as Revised) |

$ Change |

% Change |

||||||||||||

Operating expenses: |

||||||||||||||||

Third-party medical costs |

$ | 1,231,047 | $ | 564,987 | $ | 666,060 | 117.9 | % | ||||||||

Direct patient expense |

179,353 | 101,358 | 77,995 | 77.0 | % | |||||||||||

Selling, general, and administrative expenses |

252,133 | 103,962 | 148,171 | 142.5 | % | |||||||||||

Depreciation and amortization expense |

49,441 | 18,499 | 30,942 | 167.3 | % | |||||||||||

Transaction costs and other |

44,262 | 42,945 | 1,317 | 3.1 | % | |||||||||||

Change in fair value of contingent consideration |

(11,680 | ) | 65 | (11,745 | ) | N/A | ||||||||||

Total operating expenses |

$ | 1,744,556 | $ | 831,816 | $ | 912,740 | ||||||||||

Years Ended December 31, |

||||||||||||||||

($ in thousands) |

2021 |

2020 (as Revised) |

$ Change |

% Change |

||||||||||||

Other income and expense: |

||||||||||||||||

Interest expense |

$ | (51,291 | ) | $ | (34,002 | ) | $ | (17,289 | ) | 50.8 | % | |||||

Interest income |

4 | 320 | (316 | ) | (98.8 | )% | ||||||||||

Loss on extinguishment of debt |

(13,115 | ) | (23,277 | ) | 10,162 | (43.7 | )% | |||||||||

Change in fair value of embedded derivative |

— | (12,764 | ) | 12,764 | (100.0 | )% | ||||||||||

Change in fair value of warrant liabilities |

82,914 | — | 82,914 | 100.0 | % | |||||||||||

Other expenses |

(48 | ) | (450 | ) | 402 | (89.3 | )% | |||||||||

Total other income (expense) |

$ | 18,464 | $ | (70,173 | ) | $ | 88,637 | |||||||||

| • | On June 3, 2021, the Business Combination with Jaws closed. In aggregate, the Company generated approximately $935.4 million in net cash proceeds after transaction costs and advisory fees paid and distributions to PCIH shareholders. |

| • | On June 4, 2021, the Company utilized $400.0 million of the net proceeds from the Business Combination to pay down the Company’s debt under Term Loan 3 and the remainder of the net proceeds was held on the balance sheet for general corporate purposes. |

| • | See further discussion related to the Business Combination in Note 1, “Nature of Business and Operations” in our audited consolidated financial statements. |

| • | In June 2021, we borrowed the remaining availability under our Delayed Draw Term Loan Facility of $175.0 million and entered into the Third Amendment and Incremental Facility Amendment to the Credit Agreement pursuant to which we borrowed $295.0 million and made certain other amendments to our Credit Agreement. |

| • | See further discussion of the Credit Agreement with Credit Suisse AG, Cayman Islands Branch, in Note 9, “Long-term debt”, under Term Loan 3, in our audited consolidated financial statements. |

| • | On July 2, 2021, we entered into the Bridge Loan Agreement with certain lenders and Credit Suisse AG, Cayman Islands Branch, as administrative agent, pursuant to which the lenders provided a $250.0 million unsecured bridge term loan. We used the bridge term loan to acquire DMC. |

| • | On September 30, 2021, we issued senior unsecured notes for a principal amount of $300.0 million, or the Senior Notes, in a private offering. Proceeds from the Senior Notes were used to repay in full the $250.0 million bridge term loan under the Bridge Loan Agreement. The Senior Notes bear interest at 6.25% per annum, payable semi-annually on April 1st and October 1st of each year, commencing April 1, 2022. |

| • | Further, on September 30, 2021, the Credit Agreement was amended to increase the Term Loan 3 by an additional $100.0 million and to increase the Revolving Credit Facility by an additional $30.0 million, bringing the aggregate amount of commitments under the Revolving Credit Facility to $60.0 million. |

| • | On December 10, 2021, Credit Agreement was further amended to increase the Revolving Credit Facility by an additional $60.0 million for an aggregate amount of commitments of $120.0 million. |

Years Ended December 31, |

||||||||

($ in thousands) |

2021 |

2020 (as Revised) |

||||||

Net cash used in operating activities |

$ | (128,527 | ) | $ | (9,235 | ) | ||

Net cash used in investing activities |

(1,131,248 | ) | (268,366 | ) | ||||

Net cash provided by financing activities |

1,389,138 | 282,216 | ||||||

Net increase in cash, cash equivalents and restricted cash |

129,363 | 4,615 | ||||||

Cash, cash equivalents and restricted cash at beginning of year |

33,807 | 29,192 | ||||||

Cash, cash equivalents and restricted cash at end of period |

$ | 163,170 | $ | 33,807 | ||||

| • | Increase in net loss after adjusting for the $82.91 million gain from the change in the fair value of the warrant liabilities for the year ended December 31, 2021 was $199.7 million compared to a net loss for the year ended December 31, 2020 of $71.1 million; |

| • | Increases in accounts receivable, net was $15.1 million for the year ended December 31, 2021 compared to $30.3 million for the year ended December 31, 2020 due to timing of collections; |

| • | Increases in prepaid expenses and other current assets and other non-current assets of $28.2 million for the year ended December 31, 2021 compared to $7.9 million for the year ended December 31, 2020 due to higher prepaid insurance payments and prepaid bonus incentives; |

| • | Increases in accounts payable was $33.7 million for the year ended December 31, 2021 compared to an increase of $27.3 million for the year ended December 31, 2020 due to the addition of MSO provider payments related to the Company’s acquisitions and an increase in accrued salaries, bonuses, and interest, and accruals relates to various professional services. |

| • | allow investors to evaluate our performance from management’s perspective, resulting in greater transparency with respect to supplemental information used by us in our financial and operational decision making; |

| • | provide better transparency as to the measures used by management and others who follow our industry to estimate the value of our company; and |

| • | allow investors to view our financial performance and condition in the same manner that our significant lenders and landlords require us to report financial information to them in connection with determining our compliance with financial covenants. |

| • | although depreciation and amortization expense are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; |

| • | Adjusted EBITDA does not reflect: (1) changes in, or cash requirements for, our working capital needs; (2) the potentially dilutive impact of non-cash stock-based compensation; (3) the change in the fair value of our warrant liabilities, ; or (4) net interest expense/income; and |

| • | other companies, including companies in our industry, may calculate EBITDA and/or Adjusted EBITDA or similarly titled measures differently, which reduces its usefulness as a comparative measure. |

Years Ended December 31, |

||||||||||||

($ in thousands) |

2021 |

2020 (as Revised) |

2019 (as Revised) |

|||||||||

Net loss |

$ |

(116,737 |

) |

$ |

(71,064 |

) |

$ |

(19,780 |

) | |||

Interest income |

(4 | ) | (320 | ) | (319 | ) | ||||||

Interest expense |

51,291 | 34,002 | 10,163 | |||||||||

Income tax expense |

14 | 651 | — | |||||||||

Depreciation and amortization expense |

49,441 | 18,499 | 6,822 | |||||||||

EBITDA |

$ |

(15,995 |

) |

$ |

(18,232 |

) |

$ |

(3,114 |

) | |||

Stock-based compensation |

27,983 | 528 | 182 | |||||||||

De novo losses (1) |

40,562 | 8,662 | 5,523 | |||||||||

Acquisition transaction costs (2) |

48,303 | 43,333 | 17,909 | |||||||||

Restructuring and other |

7,883 | 2,435 | 299 | |||||||||

Change in fair value of contingent consideration |

(11,680 | ) | 65 | 2,845 | ||||||||

Loss on extinguishment of debt |

13,115 | 23,277 | — | |||||||||

Change in fair value of embedded derivative |

— | 12,764 | — | |||||||||

Change in fair value of warrant liabilities |

(82,914 | ) | — | — | ||||||||

Adjusted EBITDA |

$ |

27,257 |

$ |

72,832 |

$ |

23,644 |

||||||

| (1) | De novo losses include those costs associated with the ramp up of new medical centers and that are not expected to be incurred past the first 12 months after opening. These costs collectively are higher than comparable expenses incurred once such a facility has been opened and generating revenue, and would not have been incurred unless a new facility was being opened. |

| (2) | Acquisition transaction costs included $4.0 million, $0.4 million and $0.3 million of corporate development payroll costs for the years ended December 31, 2021, 2020 and 2019, respectively. Corporate development payroll costs include those expenses directly related to the additional staff needed to support our increased acquisition activity. |

| • | the amounts involved exceeded or will exceed $120,000; and |

| • | any of our directors, executive officers, or holders of more than 5% of our capital stock, or any member of the immediate family of, or person sharing the household with, the foregoing persons, had or will have a direct or indirect material interest. |

Name |

Age |

Position | ||

Executive Officers: |

||||

| Dr. Marlow Hernandez | 37 | Chief Executive Officer and President | ||

| Brian D. Koppy | 52 | Chief Financial Officer | ||

| Dr. Richard B. Aguilar | 65 | Chief Clinical Officer | ||

| David Armstrong | 56 | General Counsel, Chief Compliance Officer and Secretary | ||

| Mark Novell | 58 | Chief Accounting Officer |

Name |

Age |

Position | ||

| Directors: | ||||

| Dr. Marlow Hernandez | 37 | Chairman | ||

| Elliot Cooperstone | 60 | Director | ||

| Dr. Lewis Gold | 65 | Director | ||

| Jacqueline Guichelaar | 49 | Director | ||

| Angel Morales | 48 | Director | ||

| Dr. Alan Muney | 68 | Director | ||

| Kim. M Rivera | 53 | Director | ||

| Barry S. Sternlicht | 61 | Director | ||

| Solomon Trujillo | 70 | Director |

| • | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| • | full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications; |

| • | compliance with laws, rules and regulations; |

| • | prompt internal reporting of violations of the code to appropriate persons identified in the code; and |

| • | accountability for adherence to the Code of Business Conduct and Ethics. |

| • | selecting a qualified firm to serve as the independent registered public accounting firm to audit the Company’s financial statements; |

| • | helping to ensure the independence and performance of the independent registered public accounting firm; |

| • | discussing the scope and results of the audit with the independent registered public accounting firm and reviewing, with management and the independent registered public accounting firm, the Company’s interim and year-end financial statements; |

| • | developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters; |

| • | reviewing and overseeing the Company’s policies on risk assessment and risk management, including enterprise risk management; |

| • | assisting the Board in fulfilling its oversight responsibilities relating to the Company’s internal controls over financial reporting and its other processes to manage and control risk; and |

| • | approving or, as required, pre-approving, all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm. |

| • | reviewing, approving and determining the compensation of the Company’s officers and key employees; |

| • | reviewing and recommending compensation and benefits, including equity awards, to directors for service on the Board or any committee thereof; |

| • | administering the Company’s equity compensation plans; |

| • | reviewing, approving and making recommendations to the Board regarding incentive compensation and equity compensation plans; and |

| • | reviewing and making recommendations to the Board regarding policies and procedures for the grant of equity-based awards. |

| • | identifying, evaluating and selecting, or making recommendations to the Board regarding, nominees for election to the Board and its committees; |

| • | evaluating the performance of the Board and of individual directors; |

| • | considering, and making recommendations to the Board regarding the composition of the Board and its committees; and |

| • | review, evaluate and recommend to the Board corporate governance guidelines; and |

| • | periodically review those guidelines and recommend any changes. |

Name |

Position | |

| Dr. Marlow Hernandez | Chief Executive Officer | |

| Brian Koppy | Chief Financial Officer | |

| Dr. Richard Aguilar | Chief Clinical Officer | |

| David Armstrong | Chief Compliance Officer and General Counsel | |

| Mark Novell | Chief Accounting Officer |

| • | Attracting, Motivating and Retaining the Right Talent |

| • | Pay for Performance at-risk and directly aligned with Company performance. |

| • | Alignment with Stockholder Interests |

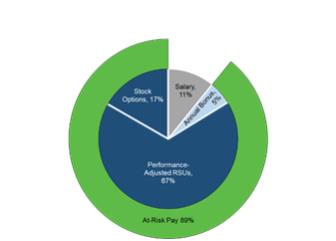

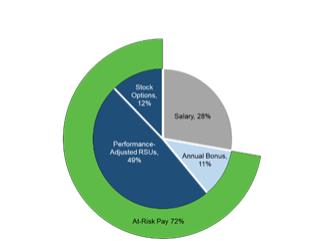

CEO 2021 Target Pay Mix |

Other NEOs Average 2021 Target Pay Mix | |

|

|

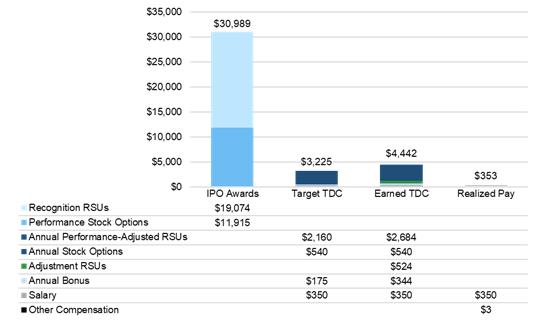

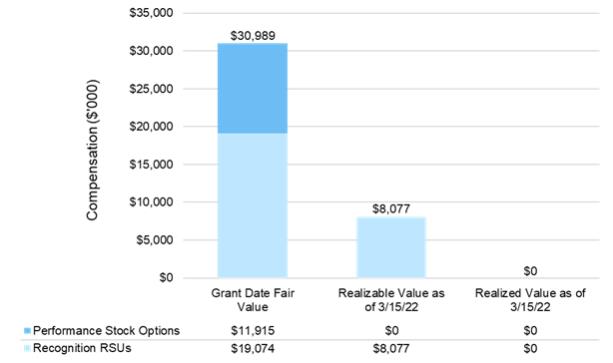

| 2021 CEO Pay IPO-related Awards, Target Total Direct Compensation (TDC),Earned TDC and Realized Pay ($ ’000) |

|

| What We Do |

What We Don’t Do | |||||

| ✓ | Pay for performance by providing a significant percentage of target annual compensation in the form of variable, at-risk compensation |

X | No automatic or guaranteed annual salary increases or annual cash incentive payments | |||

| ✓ | Pre-established performance goals that are aligned with creation of stockholder value |

X | No “single-trigger” automatic acceleration of equity awards upon a change of control | |||

| ✓ | Market comparison of executive compensation against a relevant peer group of companies | X | No option repricing, backdating, or spring-loading | |||

| ✓ | Use of an independent compensation consultant reporting to the Compensation Committee and providing no other services to the Company | X | No excessive perquisites to our named executive officers | |||

| ✓ | Annual say-on-pay |

X | No supplemental executive retirement plans | |||

| X | No excise tax gross-ups |

Compensation Committee |

• Determines base salaries, annual cash incentive compensation and equity incentive compensation, considers compensation for comparable positions in the market, the historical compensation levels of our named executive officers, and individual performance as compared to our expectations and objectives • Approves incentive compensation programs and performance goals for the Annual Incentive Plan, or AIP • Approves all compensation actions for the named executive officers | |

Board of Directors |

• Reviews and ratifies compensation for the named executive officers | |

| Independent Committee Consultant — FW Cook (December 2021 - present) |

• Provides independent advice, research, and analytical services with respect to executive compensation matters to the Compensation Committee | |

| • Participates in Compensation Committee meetings as requested and communicates with the Chair of the Compensation Committee between meetings | ||

| • Reports to the Compensation Committee, does not perform any other services for the Company, and has no economic or other ties to the Company or the management team that could compromise its independence or objectivity • Our Compensation Committee has assessed the independence of FW Cook consistent with NYSE listing standards and has concluded that the engagement of FW Cook does not raise any conflict of interest | ||

CEO and Management |