UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark one)

THE SECURITIES EXCHANGE ACT OF 1934

OR

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

OR

THE SECURITIES EXCHANGE ACT OF 1934

OR

THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report ________

For the transition period from ________ to ________

Commission file number

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

Long Jing High and New Technology Jingu Pioneer Park,

Nanshan District,

(Address of principal executive offices)

ir@viyialgo.com

Long Jing High and New Technology Jingu Pioneer Park,

Nanshan District,

Tel: (

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

|

|

The |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: As of December 31, 2023, there were ordinary shares issued and outstanding, par value US$0.001 per share. (5,160,671 ordinary shares, par value US$0.01 per share, if retroactively adjusted to reflect the 10-to-1 ordinary share consolidation effected on March 22, 2024).

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| ☒ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement Item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ Yes ☐ No

TABLE OF CONTENTS

i

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains forward-looking statements that involve risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “likely to” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategies and financial needs. These forward-looking statements include, but are not limited to, statements about:

| ● | our growth strategies; |

| ● | our future business development, financial condition and results of operations; |

| ● | our ability to retain, grow and engage our user base and expand our product offering; |

| ● | expected changes in our revenues, content-related costs and operating margins; |

| ● | our ability to retain key personnel and attract new talent; |

| ● | competition landscape in China’s central processing algorithms industry; |

| ● | general economic, political, demographic and business conditions in China and globally; and |

| ● | the regulatory environment in which we operate. |

We would like to caution you not to place undue reliance on these forward-looking statements and you should read these statements in conjunction with the risk factors disclosed in “Item 3. Key Information — 3.D. Risk Factors.” Other sections of this annual report include additional factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements. We do not undertake any obligation to update or revise the forward-looking statements except as required under applicable law. You should read this annual report and the documents that we reference in this annual report completely and with the understanding that our actual future results may be materially different from what we expect.

You should not rely upon forward-looking statements as predictions of future events. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

ii

INTRODUCTORY NOTE

Except where the context otherwise indicates and for the purpose of this annual report only:

| ● | “China” or “PRC” are to the People’s Republic of China; |

| ● | “CPM” are to cost per mille, a term used in traditional online advertising and marketing related to web traffic that measures the cost or expense incurred for every thousand potential customers who view the advertisement; |

| ● | “GAAP” are to the generally accepted accounting principles in the United States; |

| ● | “Hong Kong” or “HK” are to the Hong Kong Special Administrative Region of the PRC; |

| ● | “HK$”, “HKD” or “Hong Kong dollars” are to the legal currency of the Hong Kong SAR; |

| ● | “ordinary shares” are to our ordinary shares, par value US$0.001 per share (US$0.01 if retroactively adjusted to reflect the 10-to-1 share consolidation effected on March 22, 2024); |

| ● | “RMB ” or “Renminbi” are to the legal currency of the People’s Republic of China; |

| ● | “US$”, “dollars”, “USD” or “U.S. dollars” are to the legal currency of the United States; |

| ● | “SAFE” are to the State Administration for Foreign Exchange; |

| ● | “MOFCOM” are to the Ministry of Commerce of the People’s Republic of China; |

| ● | “View” are to the number of times an advertisement is fetched (each time an advertisement is fetched, it is counted as one impression or one view or one impression); and |

| ● | “MLGO”, “we”, “us”, “our company”, “the company”, “our”, or similar terms used in this annual report are to MicroAlgo Inc., a Cayman Islands exempted company, including its wholly-owned and majority-owned subsidiaries and, in the context of describing our operations and consolidated financial information.; |

Our reporting currency is the Renminbi. This annual report on Form 20-F also contains translations of Renminbi amounts into U.S. dollars for the convenience of the reader. Unless otherwise stated, all translations from Renminbi to U.S. dollars were made at the rate of RMB 7.0827 to USD 1.00, representing the mid-point reference rate set by People’s Bank of China on December 29, 2023, the last business day for the year ended December 31, 2023. We make no representation that the Renminbi or U.S. dollar amounts referred to in this annual report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. The PRC government imposes control over its foreign currency reserves in part through direct regulation of the conversion of Renminbi into foreign exchange and through restrictions on foreign trade.

iii

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

Our Holding Company Structure

MicroAlgo Inc. (“MicroAlgo” or the “Company”) (f/k/a Venus Acquisition Corporation (“Venus”)), a Cayman Islands exempted company, entered into the Merger Agreement dated June 10, 2021 (as amended on January 24, 2022, August 2, 2022, August 3, 2022 and August 10, 2022, the “Merger Agreement”), by and among WiMi Hologram Cloud Inc. (“WiMi” or the “Majority Shareholder”), Venus, Venus Merger Sub Corporation (“Venus Merger Sub”), a Cayman Islands exempted company incorporated for the purpose of effectuating the Business Combination (as defined herein), and VIYI Algorithm Inc. (“VIYI”), a Cayman Islands exempted company.

Pursuant to the terms of the Merger Agreement, the Company effected a business combination with VIYI through the merger of Merger Sub with and into VIYI, with VIYI surviving as the surviving company and as our wholly-owned subsidiary. On December 12, 2022, the closing of the Business Combination (the “Closing”) occurred. Upon the closing of the Business Combination, the Company changed its name to MicroAlgo Inc.

Our ordinary shares and Public Warrants are listed on the Nasdaq Stock Market LLC (“NASDAQ”) and Over-The-Counter Market (“OTC”) under the trading symbols “MLGO” and “VENAF” respectively.

MicroAlgo is not an operating company, but a holding company incorporated in the Cayman Islands. MicroAlgo operates its business through its subsidiaries in the PRC in which it owns equity interests.

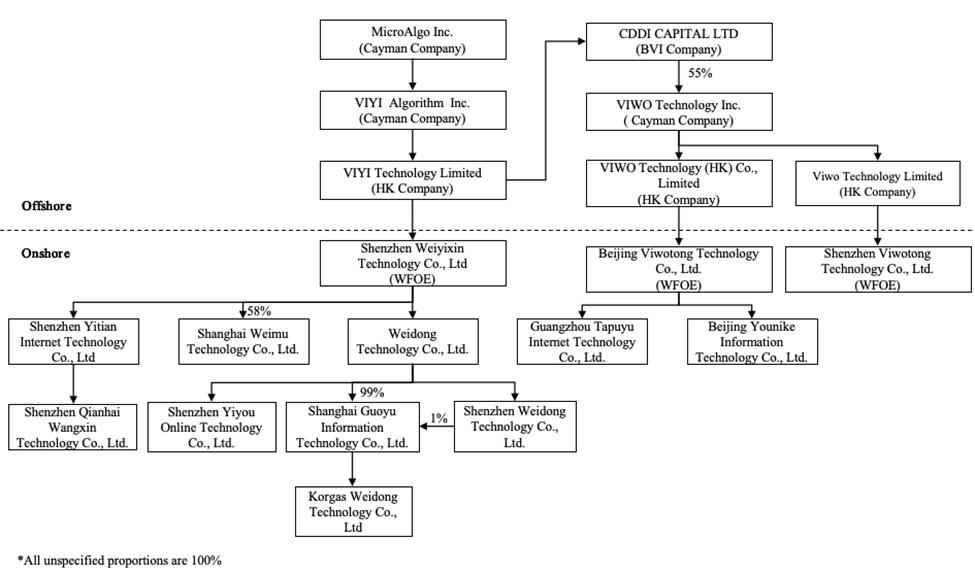

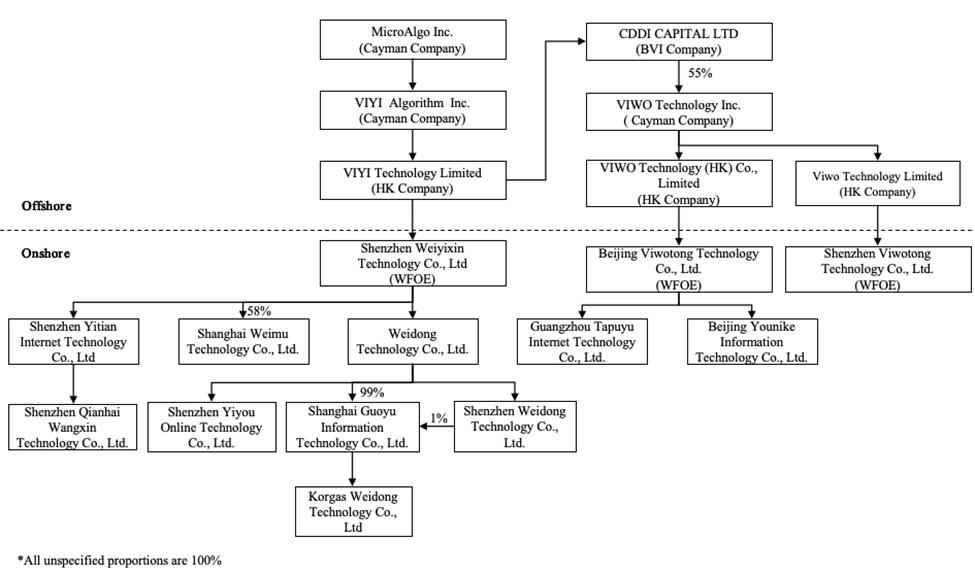

The following diagram illustrates our corporate structure, including our principal subsidiaries, as of the date of this annual report.

1

The Holding Foreign Companies Accountable Act

Our ordinary shares may be prohibited from trading on a national exchange or over-the-counter under the Holding Foreign Companies Accountable Act (“HFCA Act”) if the Public Company Accounting Oversight Board (United States) (the “PCAOB”) is unable to inspect our auditor for two consecutive years. Our current auditor, Onestop Assurance PAC (“Onestop”), and our prior auditor for 2021 annual reports, Marcum LLP, the independent registered public accounting firms that issue the financial reports included elsewhere in this report or our most recent annual report on Form 10-K, are registered with the PCAOB. The PCAOB conducts regular inspections to assess their compliance with the applicable professional standards. Onestop and Marcum LLP are headquartered in Singapore and New York, respectively.

On December 16, 2021, the PCAOB issued a report notifying the SEC of its determinations (the “PCAOB Determinations”) that they are unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong. The report sets forth lists identifying the registered public accounting firms headquartered in mainland China and Hong Kong, respectively, that the PCAOB is unable to inspect or investigate completely, and as of the date of this report, Onestop and Marcum LLP are not included in the list of PCAOB Identified Firms in the PCAOB Determinations issued on December 16, 2021. On August 26, 2022, the China Securities Regulatory Commission (the “CSRC”), the Ministry of Finance of the PRC (the “MOF”), and the PCAOB signed a Statement of Protocol (the “Protocol”), governing inspections and investigations of audit firms based in China and Hong Kong. Pursuant to the Protocol, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the U.S. Securities and Exchange Commission. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate completely registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations issued in December 2021. On December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act was enacted, which amended the Holding Foreign Companies Accountable Act, by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three.

As such, we do not expect to be identified as a “Commission-Identified Issuer” under the HFCA Act for the fiscal year ended December 31, 2023. Notwithstanding the foregoing, in the event it is later determined that the PCAOB is unable to inspect or investigate completely our auditor, then such lack of inspection could cause our securities to be delisted from Nasdaq Stock Market. In addition, whether the PCAOB will continue be able to conduct inspections and investigations completely to its satisfaction of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control, including positions taken by authorities of the PRC. The PCAOB is expected to continue to demand complete access to inspections and investigations against accounting firms headquartered in mainland China and Hong Kong in the future and states that it has already made plans to resume regular inspections in early 2023 and beyond. The PCAOB is required under the HFCA Act to make its determination on an annual basis with regards to its ability to inspect and investigate completely accounting firms based in the mainland China and Hong Kong. The possibility of being a “Commission-Identified Issuer” and risk of delisting could continue to adversely affect the trading price of our securities. See “Risk Factors—Risks Related to Doing Business in China—If the PCAOB is unable to inspect our auditors as required under the Holding Foreign Companies Accountable Act, the SEC will prohibit the trading of our shares. A trading prohibition for our shares, or the threat of a trading prohibition, may materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct inspections of our auditors, if any, would deprive our investors of the benefits of such inspections.”

Permission Required from the PRC Authorities for Our Operations

We conduct our business primarily through our subsidiaries in China. Our operations in China are governed by PRC laws and regulations. As of the date of this annual report, our consolidated affiliated Chinese entities have obtained the requisite licenses and permits from the PRC government authorities that are material for the business operations of our holding company, our subsidiaries in China. However, given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by government authorities, we cannot assure you that we have obtained all the permits or licenses required for conducting our business in China. We may be required to obtain additional licenses, permits, filings or approvals for our functions and services in the future. For more detailed information, see “Item 3. Key Information — D. Risk Factors — Risks Relating to Our Business and Industry — We may be materially and adversely affected by the complexity, uncertainties and changes in PRC regulation of the Internet industry and companies.”

2

In connection with our previous issuance of securities to foreign investors, under current PRC laws, regulations and regulatory rules, as of the date of this annual report, we, our PRC subsidiaries, (i) are not required to obtain permissions from the CSRC, (ii) are not required to go through cybersecurity review by the Cyberspace Administration of China, or the CAC, and (iii) have not received or were denied such requisite permissions by any PRC authority.

However, the PRC government has recently indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers. On February 17, 2023, the CSRC released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies and five supporting guidelines, or, collectively, the Trial Measures, which came into effect on March 31, 2023. According to the Trial Measures, domestic companies in the Chinese mainland that directly or indirectly offer or list their securities in an overseas market are required to file with the CSRC. In addition, an overseas-listed company must also submit the filing with respect to its follow-on offerings, issuance of convertible corporate bonds and exchangeable bonds, and other equivalent offering activities, within a specific time frame requested under the Trial Measures. Therefore, we will be required to file with the CSRC for our overseas offering of equity and equity linked securities in the future within the applicable scope of the Trial Measures. For more detailed information, see “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in China — We are subject to extensive and evolving legal system in the PRC, non-compliance with which, or changes in which, may materially and adversely affect our business and prospects, and may result in a material change in our operations and/or the value of our securities or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our securities to significantly decline or be worthless.”

Cash and Asset Flows through Our Organization

The Company is a holding company with no material operations of its own. We conduct our operations primarily through our subsidiaries in China. As a result, the Company’s ability to pay dividends depends upon dividends paid by our subsidiaries in China. If our existing PRC subsidiaries or any newly formed ones incur debt on their own behalf in the future, the instruments governing their debt may restrict their ability to pay dividends to us.

We are permitted under PRC laws and regulations as an offshore holding company to provide fundings to our wholly foreign-owned subsidiary in China only through loans or capital contributions, subject to the record-filing and registration with government authorities and limit on the amount of loans. Subject to satisfaction of the applicable government registration requirements, we may extend inter-company loans to our wholly foreign-owned subsidiaries in China or make additional capital contributions to the wholly foreign-owned subsidiaries to fund their capital expenditures or working capital. If we provide fundings to our wholly foreign-owned subsidiaries through loans, the total amount of such loans may not exceed the difference between the entity’s total investment as registered with the foreign investment authorities and our registered capital. Such loans must also be registered with SAFE (as defined herein) or their local branches. For more detailed information and risks associated with a transfer of funds by the Company to our PRC subsidiaries in the form of a loan or capital injection, please see “Item 3.D.Risk Factors — Risk Factors Relating to Doing Business in China — PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using the proceeds we receive from offshore financing activities to make loans to or make additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand business.”

| A. | [Reserved] |

| B. | CAPITALIZATION AND INDEBTEDNESS |

Not applicable.

| C. | REASONS FOR THE OFFER AND USE OF PROCEEDS |

Not applicable.

3

| D. | RISK FACTORS |

Summary of Risk Factors

Investment in our ordinary shares involves significant risks. Below is a summary of material risks we face, organized under relevant headings. These risks are discussed more fully in “Item 3. Key Information—D. Risk Factors.”

Risk Factors Relating to our Business and Industry

| ● | We operate in a relatively new and rapidly evolving market. | |

| ● | Our competitive position and results of operations could be harmed if we do not compete effectively. | |

| ● | We have a limited operating history, and it may not be able to sustain rapid growth, effectively manage growth or implement business strategies. | |

| ● | Recent acquisitions could prove difficult to integrate, disrupt the business, dilute shareholder value and strain the resources. | |

| ● | Failure to maintain adequate financial, information technology and management processes and controls could result in material weaknesses which could lead to errors in our financial reporting, which could adversely affect our business. | |

| ● | If we fail to keep up with industry trends or technological developments, or develop, acquire, market and offer new products and services, our business, results of operations and financial condition may be materially and adversely affected. | |

| ● | Our results of operations could materially suffer in the event of insufficient pricing to enable us to meet profitability expectations. | |

| ● | We make significant investments in research and development of new products and services that may not achieve expected returns. | |

| ● | We require a significant amount of capital to fund our research and development investments. If we cannot obtain sufficient capital on favorable terms or at all, our business, financial condition and prospects may be materially and adversely affected. | |

| ● | Our success depends on our ability to attract, hire, retain and motivate key management personnel and highly skilled employees. | |

| ● | Our business depends substantially on the market recognition of our brand and negative media coverage could adversely affect our business. | |

| ● | Our failure to protect intellectual property rights may undermine our competitive position. | |

| ● | Our services or solutions could infringe upon the intellectual property rights of others, or we might lose our ability to utilize the intellectual property of others. | |

| ● | We may not be able to protect our source code from copying if there is an unauthorized disclosure. | |

| ● | Third parties may register trademarks or domain names or purchase internet search engine keywords that are similar to our trademarks, brand or websites, or misappropriate our data and copy our platform, all of which could cause confusion to our users, divert online customers away from our products and services or harm our reputation. |

4

| ● | Our business is highly dependent on the proper functioning and improvement of our information technology systems and infrastructure. Our business and operating results may be harmed by service disruptions, or by our failure to timely and effectively scale up and adjust our existing technology and infrastructure. | |

| ● | Our operations depend on the performance of the Internet infrastructure and fixed telecommunications networks in China, which may experience unexpected system failure, interruption, inadequacy or security breaches. | |

| ● | We use third-party services and technologies in connection with our business, and any disruption to the provision of these services and technologies to us could result in adverse publicity and a slowdown in the growth of our users, which could materially and adversely affect our business, financial condition and results of operations. | |

| ● | Our insurance policies may not provide adequate coverage for all claims associate with our business operations. | |

| ● | We may be subject to claims, disputes or legal proceedings in the ordinary course of our business. If the outcome of these proceedings is unfavorable to us, then our business, results of operations and financial condition could be adversely affected. | |

| ● | We may need additional capital to support or expand our business, and we may be unable to obtain such capital in a timely manner or on acceptable terms, if at all. | |

| ● | We are a “controlled company” within the meaning of the applicable Nasdaq listing rules and, as a result, will qualify for exemptions from certain corporate governance requirements. If we rely on these exemptions, you will not have the same protections afforded to shareholders of companies that are subjected to such requirements. | |

| ● | Our business may be materially and adversely affected by the effects of natural disasters, health epidemics or similar situation. | |

| ● | We may be materially and adversely affected by the complexity, uncertainties and changes in PRC regulation of the Internet industry and companies. | |

| ● | Our business generates and processes a large amount of data, and we are required to comply with PRC laws and regulations relating to cyber security. These laws and regulations could create unexpected costs, subject us to enforcement actions for compliance failures, or restrict portions of our business or cause us to change our data practices or business model. | |

| ● | We may be liable for improper use or appropriation of personal information provided directly or indirectly by our customers or end users. | |

| ● | We and our subsidiaries have a limited customer base and depend on a small number of customers for a significant portion of revenues which may result in heightened concentration risk. | |

| ● | We and our subsidiaries depend on a limited number of vendors for a significant portion of our purchase which may result in heightened concentration risk. |

5

Risk Factors Relating to Doing Business in China

| ● | Substantial uncertainties exist with respect to the enactment timetable, interpretation and implementation of PRC Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and business operations. | |

| ● | If the chops of our PRC subsidiaries and their respective subsidiaries, are not kept safely, are stolen or are used by unauthorized persons or for unauthorized purposes, the corporate governance of these entities could be severely and adversely compromised. | |

| ● | The PRC government exerts substantial influence over the manner in which we, our subsidiaries must conduct our business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S. exchanges, however, if we are required to obtain approval in the future and was denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange, which would materially affect the interest of the investors. | |

| ● | We are or may be required to obtain certain permissions from Chinese authorities to issue securities to foreign investors. |

| ● | Adverse changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business, financial condition and results of operations. | |

| ● | A severe or prolonged downturn in the PRC or global economy and political tensions between the United States and China could materially and adversely affect our business and our financial condition. | |

| ● | The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies, including companies based in China, upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. | |

| ● | Uncertainties in the promulgation, interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us. | |

| ● | We are subject to extensive and evolving legal system in the PRC, non-compliance with which, or changes in which, may materially and adversely affect our business and prospects, and may result in a material change in our operations and/or the value of our ordinary shares or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our securities to significantly decline or be worthless. | |

| ● | Under the PRC enterprise income tax law, we may be classified as a “PRC resident enterprise”, which could result in unfavorable tax consequences to us and our shareholders and have a material adverse effect on our results of operations and the value of your investment. | |

| ● | We may not be able to obtain certain benefits under relevant tax treaties on dividends paid by our PRC subsidiaries to us through our Hong Kong subsidiaries. | |

| ● | We face uncertainty with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies. |

6

| ● | Certain judgments obtained against us by our shareholders may not be enforceable. | |

| ● | The enforcement of the PRC Labor Contract Law and other labor-related regulations in the PRC may adversely affect our business and results of operations. | |

| ● | The M&A Rules and certain other PRC regulations may make it more difficult for us to pursue growth through acquisitions. |

| ● | PRC regulations relating to offshore investment activities by PRC residents may limit our PRC subsidiaries’ ability to increase their registered capital or distribute profits to us or otherwise expose us to liability and penalties under PRC law. | |

| ● | PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using the proceeds we receive from offshore financing activities to make loans to or make additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand business. | |

| ● | Our PRC subsidiaries are subject to restrictions on paying dividends or making other payments to us, which may restrict our ability to satisfy liquidity requirements, conduct business and pay dividends to holders of our ordinary shares. | |

| ● | Fluctuations in exchange rates could have a material adverse effect on our results of operations and the value of your investment. | |

| ● | Governmental control of currency conversion may limit our ability to utilize our revenues effectively and affect the value of your investment. | |

| ● | Failure to comply with PRC regulations regarding the registration requirements for employee stock ownership plans or share option plans may subject the PRC plan participants or we to fines and other legal or administrative sanctions. | |

| ● | Our leased property interests may be defective and our right to lease the properties affected by such defects may be challenged, which could adversely affect our business. | |

| ● | If we are classified as a PRC resident enterprise for PRC enterprise income tax purposes, such classification could result in unfavorable tax consequences to us and our non-PRC shareholders |

7

Risk Factors Relating to an Investment in our Ordinary Shares

| ● | Certain judgments obtained against us by our shareholders may not be enforceable. | |

| ● | The market price for our ordinary shares have fluctuated and may be volatile. | |

| ● | Our Key Projected Financial Metrics are subject to significant risks, assumptions, estimates and uncertainties, including assumptions regarding future market and changes in regulations. As a result, our projected revenues, market share, expenses and profitability may differ materially from our expectations. | |

| ● | We may be unable to obtain additional financing to fund our operations or growth. | |

| ● | Our share price may be volatile and could decline substantially. | |

| ● | We do not intend to pay cash dividends for the foreseeable future. | |

| ● | We may be subject to securities litigation, which is expensive and could divert management attention. | |

| ● | The sale or availability for sale of substantial amounts of our ordinary shares could adversely affect their market price. | |

| ● | If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about us or our business, our ordinary shares price and trading volume could decline. | |

| ● | We may redeem your unexpired warrants prior to their exercise at a time that is disadvantageous to you, thereby making your warrants worthless. | |

| ● | If we cannot satisfy, or continue to satisfy, the initial listing requirements and other rules of Nasdaq, our securities may not be listed or may be delisted, which could negatively impact the price of our securities and your ability to sell them. | |

| ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law. | |

| ● | You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in China against us or our management named in the report based on foreign laws. | |

| ● | Changes in laws or regulations, or a failure to comply with any laws and regulations, may adversely affect our business, investments and results of operations. | |

| ● | Future changes to tax laws could adversely affect us. | |

| ● | We are an emerging growth company within the meaning of the Securities Act, and if we take advantage of certain exemptions from disclosure requirements available to emerging growth companies, this could make our securities less attractive to investors and may make it more difficult to compare our performance with other public companies. | |

| ● | We became a PFIC, which could result in adverse U.S. federal income tax consequences to U.S. Holders. |

8

Risk Factors Relating to our Business and Industry

We operate in a relatively new and rapidly evolving market.

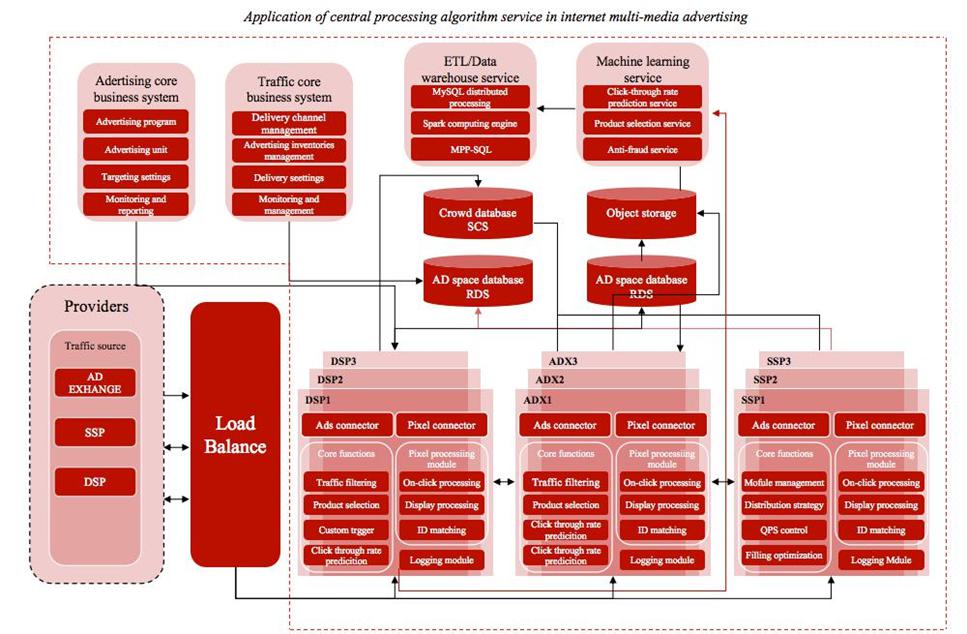

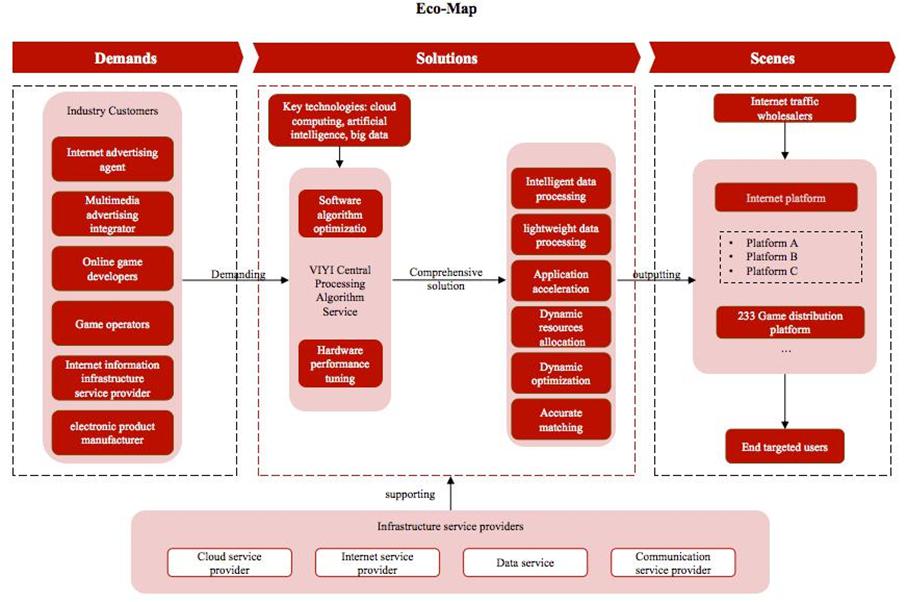

We provide customers with comprehensive solutions integrating central processing algorithms with software or hardware to streamline their digital services to end users, thereby helping our customers to improve end user satisfaction, achieve direct cost savings, and reduce power consumption. Our services include algorithm optimization, accelerating computing power without the need for hardware upgrades, lightweight data processing and data intelligence services. Our business and prospects mainly depend on the continuous development and growth of the central processing algorithm service industry in the PRC. The development of this industry is affected by numerous factors, including but not limited to technological innovation, user experience, the development of the Internet and Internet-based services, regulatory environment, and macro-economic environment. The markets for our products and services are relatively new and rapidly developing and are subject to significant challenges. In addition, our continued growth depends, in part, on our ability to respond to changes in the central processing algorithm service industry, including rapid technological evolution, continued shifts in customer demands, introductions of new products and services and emergence of new industry standards and practices. Developing and integrating new solutions, products, services or infrastructure could be expensive and time-consuming, and these efforts may not yield the benefits we expect to achieve.

In addition, as the central processing algorithm service industry in China is relatively young, there are few proven methods of projecting customer demand or available industry standards on which we can rely. Some of our current monetization methods are also in a relatively preliminary stage. We cannot assure you that our attempts to monetize current applications will continue to be successful, profitable or accepted, and therefore the profit potential of our business is difficult to gauge. Our growth prospects should be considered in light of the risks and uncertainties that fast-growing early-stage companies with limited operating history in an evolving industry may encounter, including, among others, risks and uncertainties regarding our ability to:

| ● | continue to develop new software and related solutions that are appealing to customers; |

| ● | maintain stable relationships with other key participants in the value chain; |

| ● | expand products and services into more scenarios and customer bases; and |

| ● | expand into new geographic markets with high growth potential. |

Addressing these risks and uncertainties will require significant capital expenditures and allocation of valuable management and employee resources. We cannot assure you that it will succeed in any of these aspects or that the central processing algorithm service industry in the PRC will continue to grow at a rapid pace. If we fail to successfully address any of the above risks and uncertainties, then the size of our customer base, our revenue and profits may decline.

Our competitive position and results of operations could be harmed if we do not compete effectively.

The markets for our products and services are characterized by intense competition, new industry standards, limited barriers to entry, disruptive technology developments, short product life cycles, customer price sensitivity and frequent product introductions (including alternatives with limited functionality available at lower costs or free of charge). Any of these factors could create downward pressure on pricing and profitability and could adversely affect our ability to retain current customers or attract new customers. Our future success will depend on a continued ability to enhance and integrate our existing products and services, introduce new products and services in a timely and cost-effective manner, meet changing customer expectations and needs, extend our core technology into new applications, and anticipate emerging standards, business models, software delivery methods and other technological developments. Furthermore, some of our current and potential competitors enjoy competitive advantages such as greater financial, technical, sales, marketing and other resources, broader brand awareness, and access to larger customer bases. As a result of these advantages, potential and current customers might select the products and services of our competitors, causing a loss of market share to us.

9

We have a limited operating history, and it may not be able to sustain rapid growth, effectively manage growth or implement business strategies.

We have a limited operating history. Although we have experienced significant growth since launching our business, our historical performance results and growth rate may not be indicative of our future performance. We may not be able to achieve similar results or grow at the same rate as it has in the past. To keep pace with the development of the central processing algorithm service industry in the PRC, we may need to adjust and upgrade our product and service offerings or modify our business model. These adjustments may not achieve expected results and may have a material and adverse impact on our financial conditions and results of operations.

In addition, our rapid growth and expansion have placed, and is expected to continue to place, a significant strain on our management and resources. There is no assurance that the future growth of us will be sustained at a similar rate or at all. We believe that our revenue, expenses and operating results may vary from period to period in response to a variety of factors beyond our control, which primarily include general economic conditions, emergencies and changes in policies, laws and regulations that may affect our business operations and our ability to monitor costs. In addition, our ability to develop new sources of revenues, diversify monetization methods, attract and retain customers, continue developing innovative technologies, increase brand awareness, expand into new market segments, and adjust to the rapidly changing regulatory environment in the PRC, will also affect our future growth to a great extent. Therefore, you should not rely on our historical results in predict our future financial performance.

Recent acquisitions could prove difficult to integrate, disrupt the business, dilute shareholder value and strain the resources.

Integrating the operations of acquired businesses successfully or otherwise realizing any of the anticipated benefits of acquisitions, including anticipated cost savings and additional revenue opportunities, involves a number of potential challenges. The failure to meet these integration challenges could seriously harm the financial condition and results of operations of us. Realizing the benefits of acquisitions depends in part on the integration of operations and personnel. These integration activities are complex and time-consuming, and we may encounter unexpected difficulties or incur unexpected costs, including:

| ● | the inability to achieve the operating synergies anticipated in the acquisitions; |

| ● | diversion of management attention from ongoing business concerns to integration matters; |

| ● | consolidating and rationalizing information technology platforms and administrative infrastructures; |

| ● | complexities associated with managing the geographic separation of the combined businesses and consolidating multiple physical locations; |

| ● | retaining professionals and other key employees and achieving minimal unplanned attrition; |

| ● | integrating personnel from different corporate cultures while maintaining focus on providing consistent and high quality service; |

| ● | demonstrating to the clients and to clients of acquired businesses that the acquisition will not result in adverse changes in client service standards or business focus; |

| ● | possible cash flow interruption or loss of revenue as a result of transitional matters; and |

| ● | inability to generate sufficient revenue to offset acquisition costs. |

10

Acquired businesses may have liabilities or adverse operating issues that we failed to discover through due diligence prior to the acquisition. In particular, to the extent that prior owners of any acquired businesses or properties failed to comply with or otherwise violated applicable laws or regulations, or failed to fulfill their contractual obligations to clients, us, as the successor owner, may be financially responsible for these violations and failures and may suffer financial or reputational harm or otherwise be adversely affected. Similarly, the acquisition targets may not have as robust internal controls over financial reporting as would be expected of a public company. Acquisitions also frequently result in the recording of goodwill and other intangible assets which are subject to potential impairment in the future that could harm our financial results. We may also become subject to new regulations as a result of an acquisition, including if we acquire a business serving clients in a regulated industry or acquires a business with clients or operations in a country in which we do not already operate. In addition, if we finance acquisitions by issuing equity securities, the interests of existing shareholders may be diluted, which could affect the market price of the shares of us. As a result, if we fail to evaluate properly acquisitions or investments, we may not achieve the anticipated benefits of any such acquisitions, and we may incur costs in excess of what we anticipate. Acquisitions frequently involve benefits related to the integration of operations of the acquired business. The failure to successfully integrate the operations or otherwise to realize any of the anticipated benefits of the acquisition could seriously harm the results of operations of us.

We may be required to record a significant charge to earnings when we reassess our goodwill or amortizable intangible assets.

We are required under U.S. GAAP to test for goodwill impairment annually or when an event occurs or circumstances change in a manner that could indicate that the goodwill might be impaired. We are also required to review our amortizable intangible assets for impairment when events or changes in circumstances indicate the carrying value may not be recoverable. Factors that may be considered a change in circumstances indicating that the carrying value of our amortizable intangible assets may not be recoverable include a decline in stock price and market capitalization and slower or declining growth rates in our industry, or a divestment from prior acquisitions of asset. We may be required to record a significant charge to earnings in our financial statements during the period in which any impairment of our goodwill or amortizable intangible assets is determined. See “Note 11 - Goodwill” of the Notes to Consolidated Financial Statements included in this annual report.

Failure to maintain adequate financial, information technology and management processes and controls could result in material weaknesses which could lead to errors in our financial reporting, which could adversely affect our business.

As a subsidiary of WiMi, a public company, we are subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act and of the rules and regulations of the Nasdaq Global Market. However, failure to maintain adequate financial, information technology and management processes and controls of us could result in material weaknesses which could lead to errors in our financial reporting, which could adversely affect our business. Similarly, as an “emerging growth company,” we would be exempted from the SEC’s internal control reporting requirements. We may lose our emerging growth company status and become subject to the SEC’s internal control over financial reporting management and auditor attestation requirements in the year in which it is deemed to be a large accelerated filer, which would occur once the market value of our ordinary share held by non-affiliates exceeds $700 million as of the end of the prior fiscal year’s second fiscal quarter. In addition, our current controls and any new controls that it develops may become inadequate because of poor design and changes in our business. Any failure to implement and maintain effective internal controls over financial reporting could adversely affect the results of assessments by our independent registered public accounting firm and their attestation reports.

If we are unable to certify the effectiveness of our internal controls, or if our internal controls have material weaknesses, we may not detect errors timely, our consolidated financial statements could be misstated, it could be subject to regulatory scrutiny and a loss of confidence by our shareholders, which could harm our reputation and business and adversely affect the market price of our securities.

As a public company, we will be subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act, the Dodd-Frank Wall Street Reform and Consumer Protection Act, as well as rules adopted, and to be adopted, by the SEC and the applicable stock exchange. Our management and other personnel will need to devote a substantial amount of time to these compliance initiatives and may not effectively or efficiently manage our transition into a public company. Moreover, we expect these rules and regulations to substantially increase our legal and financial compliance costs and to make some activities more time-consuming and costly. For example, we expect these rules and regulations to make it more difficult and more expensive for it to obtain directors and officers liability insurance, and we may be forced to accept reduced policy limits or incur substantially higher costs to maintain the same or similar coverage. We cannot predict or estimate the amount or timing of additional costs it may incur to respond to these requirements. The impact of these requirements could also make it more difficult for us to attract and retain qualified people to serve on our board of directors, our board committees or as executive officers.

11

If we fail to keep up with industry trends or technological developments, or develop, acquire, market and offer new products and services, our business, results of operations and financial condition may be materially and adversely affected.

The central processing algorithm service industry is rapidly evolving and is subject to continuous technological changes. Our success depends on our ability to continue to develop and implement services and solutions that anticipate and respond to rapid and continuing changes in technology and industry developments and offerings to serve the evolving needs of our customers. Our growth strategy is focused on responding to these types of developments by driving innovation that will enable us to expand business into new growth domains. Our competitive advantage could be adversely affected if we do not invest enough in new technologies and industrial developments, or if we make the incorrect strategical investment to respond to these developments and to drive innovation. If we do not sufficiently invest in new technology and industry developments, or evolve and expand our business at sufficient speed and scale, or if we do not make the right strategic investments to respond to these developments and successfully drive innovation, then our services and solutions, results of operations, and ability to develop and maintain a competitive advantage and continue to grow could be negatively affected.

In addition, we operate in a quickly evolving environment, in which there currently are, and we expect will continue to be, new technology developments. New services or technologies offered by competitors or new entrants may make our offerings less differentiated or less competitive when compared to other alternatives, which may adversely affect our results of operations. Technological innovations may also require substantial capital expenditures in product development as well as in modification of products, services or infrastructure. In order to maintain and improve competitiveness and continue to expand our business, we need to introduce constantly new solutions and products and services to satisfy customers’ needs, in order for us to attract new customers and retain existing customers. Researching and developing new technologies and solutions require significant investment of human resources and capital. We cannot assure you that any research and development efforts will be successful, or that we will be able to obtain financing to cover such expenditure. Failure to adapt our products and services to such changes in an effective and timely manner could materially and adversely affect our business, financial condition and results of operations.

Our results of operations could materially suffer in the event of insufficient pricing to enable us to meet profitability expectations.

If we are not able to obtain sufficient pricing for our services and solutions, our revenues and profitability could materially suffer. The rates we are able to charge for services and solutions are affected by a number of factors, including:

| ● | general economic and political conditions; |

| ● | the competitive environment in our industry; |

| ● | market price of our service and products provided; |

| ● | our bargaining power when entering into contract with customers; |

| ● | our customers’ preferences and desire to reduce their costs; and |

| ● | our ability to accurately estimate, monitor and manage our contract revenues, costs of sales, profit margins and cash flows over the full contract period. |

In addition, our profitability with respect to services and solutions for new technologies may be different when compared to the profitability of our current business, due to factors such as the use of alternative pricing, the mix of work and the number of service providers, among others.

12

The competitive environment the central processing algorithm services industry in the PRC affects our ability to obtain favorable pricing in a number of ways, any of which could have a material negative impact on our results of operations. The less we are able to differentiate and/or clearly convey the value of our services and solutions, the more risk we face in terms of our services and solutions will be seen as commodities, and price will become the driving factor in selecting a service provider. In addition, the introduction of new services or products by competitors could reduce our ability to obtain favorable pricing for the services or products that we offer. Competitors may be willing, at times, to price contracts lower than us in an effort to enter new markets or increase market share. Further, if competitors develop and implement methodologies that yield greater efficiency and productivity, they may be better positioned to offer similar services at lower prices. As such, failure to adopt a sufficient pricing policy or adjust our pricing policy in a timely and effective manner could adversely and materially affect our competitive position in the industry, which could adversely and materially affect our operations and financial conditions.

We make significant investments in research and development of new products and services that may not achieve expected returns.

We have made and will continue to make significant investments in research, development, and marketing for existing products, services, and technologies, as well as new technology or new applications of existing technology. Investments in new technology are speculative. Commercial success depends on many factors, including but not limited to, innovativeness, developer support, and effective distribution and marketing. There is no assurance that we will be rewarded from our investments in developing new services and products. If our customers do not perceive our latest offerings as providing significant new functionality or other value, they may reduce their purchases of services or products, thus unfavorably affecting revenue and profits. We may not achieve significant revenue from new products and services, or new applications of existing products and services, for several years, if at all. New products and services may not be profitable, and even if they are profitable, operating margins for some new products, services and businesses may not be as high as the margins we have experienced historically. Furthermore, developing new technologies is complex and unpredictable, which can require long development and testing periods. Significant delays in new releases or significant problems in creating new products or offering new services could adversely affect our revenue and profits.

We require a significant amount of capital to fund our research and development investments. If we cannot obtain sufficient capital on favorable terms or at all, our business, financial condition and prospects may be materially and adversely affected.

Operating our business requires significant, continuous investment in acquiring, maintaining and upgrading contents, services, and technologies. Historically, we have financed our operations primarily with net cash generated from operating activities, financial support from shareholders and equity financing and loans from third-parties. As part of our growth strategy, we plan to continue investing substantial capital in research and development activities in the future, which may require us to obtain additional equity or debt financing. Our ability to obtain additional financing in the future is subject to a number of uncertainties, including but not limited to those relating to:

| ● | our future business development, financial condition and results of operations; |

| ● | general market conditions for financing activities; and |

| ● | macro-economic and other conditions in China and elsewhere. |

Although we expect to rely on net cash provided by operating activities and financing through capital markets for liquidity needs as our business continues to grow, and after it becomes a public company, there can be no assurances that we will be successful in our efforts to diversify sources of liquidity. If we raise additional funds through future issuance of equity or convertible debt securities, our existing shareholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of holders of our ordinary shares. Any debt financing that we secure in the future could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, including the ability to pay dividends. This may make it more difficult for us to obtain additional capital to fund our research and development, and pursue business opportunities, including potential acquisitions. If we are unable to obtain sufficient capital to meet capital needs, then it may not be able to implement growth strategies, which may cause our business, financial condition and general prospects to be materially and adversely affected.

13

Our success depends on our ability to attract, hire, retain and motivate key management personnel and highly skilled employees.

Our success is largely attributable to the continued commitment and contribution of our directors and key senior management personnel. Their extensive knowledge and experience in the central processing algorithm service industry as well as their established relationships with our customers, are vital to our business. There are no assurances that we will be able to retain these key personnel, and the loss any of them without suitable and timely replacements, or the inability to attract and retain qualified personnel may adversely affect our business, results of operations, financial position and general prospects.

As of December 31, 2023, we have a total number of 86 employees. We believe that our future success depends on our continued ability to attract, hire, retain and motivate qualified and skilled employees, as they are critical in improving our infrastructure and technologies and optimizing our operations. Competition for recruitment of highly skilled professionals is intense, which could also increase costs to attract and retain talented employees. We may not be able to hire and retain skilled employees at compensation levels consistent with our existing compensation level and structure. Some of the companies with which we compete for experienced employees may have greater resources than us do and may be able to offer more attractive terms of employment. In addition, we invest significant time and resources in training employees to ensure their competitiveness, which increases these employees’ value to competitors who may seek to recruit them. If we fail to retain these employees, we could incur significant expenses in hiring and training new employees, and our ability to provide services consistently could diminish, resulting in a material adverse effect on our business and ability to sustain profitability. Moreover, if any member of our management team or any of our other key personnel joins a competitor or forms a competing business, our trade secrets and know-hows may leak which could have a material adverse effect on our business.

Our business depends substantially on the market recognition of our brand and negative media coverage could adversely affect our business.

We believe that enhancing our brand and extending our customer base are cornerstones to sustaining our competitive advantages. Negative publicity about us and our business, shareholders, affiliates, directors, officers, and other employees, as well as the industry in which we operate, could be devastating and could materially and adversely affect the public perception of our brand, and in turn, reduce the sales of our products and services. Negative publicity concerning could be related to a wide variety of matters, including:

| ● | alleged misconduct or other improper activities committed by our shareholders, affiliates, directors, officers and other employees; |

| ● | false or malicious allegations or rumors about us or our shareholders, affiliates, directors, officers, and other employees; |

| ● | user complaints about the quality of our products and services; |

| ● | copyright or patent infringements involving us and contents offered on our platforms; and |

| ● | governmental and regulatory investigations or penalties resulting from our failure to comply with applicable laws and regulations. |

In addition to traditional media, there has been an increasing use of social media platforms and similar devices in China, including instant messaging applications, social media websites and other forms of internet-based communications that provide individuals with access to a broad audience of users and other interested people. The availability of information on instant messaging applications and social media platforms is virtually immediate as our impact without affording us an opportunity for redress or correction. The opportunity for dissemination of information, including inaccurate information, is seemingly limitless and readily available. Information concerning us, shareholders, directors, officers and employees may be posted on such platforms at any time. The risks associated with any such negative publicity or incorrect information cannot be eliminated entirely or mitigated and may materially harm our reputation, business, financial condition and results of operations.

14

Our failure to protect intellectual property rights may undermine our competitive position.

We believe that our patents, copyrights, trademarks and other intellectual property are essential to the success of us. We depend to a large extent on the ability to develop and maintain the intellectual property rights relating to our central processing algorithm solutions and products. We have devoted considerable time and energy to the development and improvement of software, middleware, websites, and intellectual property.

We rely primarily on a combination of patents, copyrights, trademarks and trade secrets laws, and contractual restrictions for the protection of the intellectual property used in our business. Nevertheless, these provide only limited protection and the actions we take to protect intellectual property rights may not be adequate. Our trade secrets may become known or be independently discovered by competitors. We may have no rights or limited rights to stop others’ use of our information, including intellectual property. Moreover, to the extent that our employees or third parties with whom we do business use intellectual property owned by others in their work for us, disputes may arise as to the rights to such intellectual property. Furthermore, it is often difficult to maintain and enforce intellectual property rights in China. Statutory laws and regulations are subject to judicial interpretation and enforcement, and may not be applied consistently due to the lack of clear guidance on statutory interpretation. Contractual restrictions may be breached by counterparties, and there may not be adequate remedies available to us for any such breach. Accordingly, we may not be able to effectively protect intellectual property rights or to enforce our contractual rights in China. Preventing any unauthorized use of our intellectual property is difficult and costly and the steps we take may be inadequate to prevent the misappropriation of company intellectual property. In the event that we resort to litigation to enforce intellectual property rights, such litigation could result in substantial costs and a diversion of our managerial and financial resources. We cannot provide assurance that we will prevail in such litigation. Any failure in protecting or enforcing our intellectual property rights could have a material adverse effect on our business, financial condition and results of operations.

Our services or solutions could infringe upon the intellectual property rights of others, or we might lose our ability to utilize the intellectual property of others.

We cannot be sure that our services and solutions do not infringe on the intellectual property rights of third parties, and these third parties could claim that we or our clients are infringing upon their intellectual property rights. These claims could harm our reputation, cause us to incur substantial costs or prevent it from offering some services or solutions in the future. Any related proceedings could require us to expend significant resources over an extended period. Any claims or litigation in this area could be time-consuming and costly, damage our reputation and/or require it to incur additional costs to obtain the right to continue to offer a service or solution to our customers. If we cannot secure this right at all or on reasonable terms, or if it cannot substitute alternative technology, then our results of operations could be materially adversely affected. The risk of infringement claims against us may increase as we expand upon our industry software solutions.

Additionally, in recent years, individuals and firms have purchased intellectual property assets in order to assert claims of infringement against technology providers and customers that use such technology. Any such action naming we or our clients could be costly to defend or lead to an expensive settlement or judgment against us. Moreover, such an action could result in an injunction being ordered against our client or our services or operations, causing further damages.

In addition, we rely on third-party software in providing some of our services and solutions. If we lose our ability to continue using such software for any reason, including in the event that the software is found to infringe the rights of others, we will need to obtain substitute software or seek alternative means of obtaining the technology necessary to continue to provide such services and solutions. Our inability to replace such software, or to replace such software in a timely or cost-effective manner, could materially adversely affect our results of operations. In addition, the application and interpretation of intellectual property right laws as well as the procedures and standards for granting trademarks, patents, copyrights, know-how and other intellectual property rights are constantly evolving and may be uncertain, so we cannot assure you that the courts or regulatory authorities will agree with our legal analysis. If we are ruled to have violated the intellectual property rights of a third party, we may be liable for infringement activities, or may be prohibited from using the intellectual property rights, and we may incur licensing fees or be forced to develop alternatives. In this case, our business and financial condition may be materially and adversely affected.

15

We may not be able to protect our source code from copying if there is an unauthorized disclosure.

Source code, the detailed program commands for our middleware and software programs and solutions, is critical to our business. Although we license portions of our application and operating system source code to several licensees, we take significant measures to protect the secrecy of large portions of our source code. If our source code leaks, we might lose future trade secret protection for that code. It may then become easier for third parties to compete with our products by copying functionality, which could adversely affect our revenue and operating margins.

Third parties may register trademarks or domain names or purchase internet search engine keywords that are similar to our trademarks, brand or websites, or misappropriate our data and copy our platform, all of which could cause confusion to our users, divert online customers away from our products and services or harm our reputation.

To divert potential customers from us to such competitors’ or third parties’ websites or platforms, competitors and other third parties may purchase (i) trademarks that are similar to our trademarks and (ii) keywords that are confusingly similar to our brand or websites in the internet search engine advertising programs and in the header and text of the resulting sponsored links or advertisements in order to divert potential customers from us to such competitors’ or third parties’ websites or platforms. Preventing such unauthorized use is inherently difficult. If we are unable to prevent such unauthorized use, competitors and other third parties may continue to drive potential customers away from our platform to competing, irrelevant or potentially offensive platform, which could harm our reputation and cause us to lose revenue.

Our business is highly dependent on the proper functioning and improvement of our information technology systems and infrastructure. Our business and operating results may be harmed by service disruptions, or by our failure to timely and effectively scale up and adjust our existing technology and infrastructure.

Our business depends on the continuous and reliable operation of our information technology (“IT”) systems. Our IT systems are vulnerable to damage or interruption as a result of fires, floods, earthquakes, power losses, telecommunications failures, undetected errors in software, computer viruses, hacking and other attempts to harm our IT systems. Disruptions, failures, unscheduled service interruptions or a decrease in connection speeds could damage our reputation and cause our customers and end-users to migrate to our competitors’ platforms. If we experience frequent or constant service disruptions, whether caused by failures of our own IT systems or those of third-party service providers, then our user experience may be negatively affected, which in turn may have a material and adverse effect on our reputation and business. We may not be successful in minimizing the frequency or duration of service interruptions. As the number of our end-users increases and more user data are generated on our platform, it may be required to expand and adjust technology and infrastructure to continue to reliably store and process content.

Our operations depend on the performance of the Internet infrastructure and fixed telecommunications networks in China, which may experience unexpected system failure, interruption, inadequacy or security breaches.

Almost all access to the Internet in China is maintained through state-owned telecommunication operators under the administrative control and regulatory supervision of the Ministry of Industry and Information Technology, or the MIIT. Moreover, we primarily rely on a limited number of telecommunication service providers to provide us with data communications capacity through local telecommunication’s lines and Internet data centers to host our servers. We have limited access to alternative networks or services in the event of disruptions, failures or other problems with China’s Internet infrastructure or the fixed telecommunication networks provided by telecommunication service providers. Network flow in China has experienced significant growth during the past few years. Effective bandwidth and server storage at Internet data centers in large cities such as Beijing and Shenzhen are scarce. With the expansion of our business, it may be required to upgrade technology and infrastructure to keep up with the increasing traffic on our platform. We cannot assure you that the Internet infrastructure and the fixed telecommunication networks in China will be able to support the demands associated with the continued growth in the Internet usage. If we cannot increase our capacity to deliver online services, then it may not be able to expand our customer base, and the adoption of our services may be hindered, which could adversely impact our business and profitability.

16

In addition, we have no control over the costs of the services provided by telecommunication service providers. If the prices we pay for telecommunications and Internet services rise significantly, our results of operations may be materially and adversely affected. Furthermore, if the Internet access fees or other charges to Internet users increase, some users may be prevented from accessing the mobile Internet and thus cause the growth of mobile Internet users to decelerate. Such deceleration may adversely affect our ability to continue to expand our user base.

We use third-party services and technologies in connection with our business, and any disruption to the provision of these services and technologies to us could result in adverse publicity and a slowdown in the growth of our users, which could materially and adversely affect our business, financial condition and results of operations.

Our business partially depends on services provided by, and relationships with, various third parties. Some third-party software we use in our operations is currently publicly available and free of charge. If the owner of any such software decides to charge users or no longer makes the software publicly available, then we may need to incur significant costs to obtain licensing, find replacement software or develop it on our own. If we are unable to obtain licensing, find or develop replacement software at a reasonable cost, or at all, our business and operations may be adversely affected.

We exercise no control over the third parties with whom we have business arrangements. If such third parties increase their prices, fail to provide their services effectively, terminate their service or agreements or discontinue their relationships with us, then we could suffer service interruptions, reduced revenues or increased costs, any of which may have a material adverse effect on our business, financial condition and results of operations.

Our insurance policies may not provide adequate coverage for all claims associate with our business operations.

We maintain various insurance policies, such as group personal accident insurance and corporate employee benefits insurance. However, our insurance coverage is still limited in terms of amount, scope and benefit. Insurance companies in China offer limited business insurance products. We do not have any business liability or disruption insurance coverage for our operations in China. Any business disruption may result in our incurring substantial costs and the diversion of our resources. Any uninsured business disruption, litigation or legal proceedings or natural disasters, such as epidemics, pandemics or earthquakes, or other events beyond our control could result in substantial costs and the diversion of our management’s attention. If we are to be held liable for uninsured losses or amounts and claims for insured losses exceeding the limits of our insurance coverage, then our business, financial condition, and results of operations may be materially and adversely affected as a result.