As filed with the Securities and Exchange Commission on February 4, 2020

File No. ____________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-A

REGULATION A OFFERING CIRCULAR

UNDER THE SECURITIES ACT OF 1933

Worthy Peer Capital II, Inc.

(Exact name of issuer as specified in its charter)

Florida

(State of other jurisdiction of incorporation or organization)

One Boca Commerce Center

551 NW 77 Street, Suite 212

Boca Raton, FL 33487

Phone: (561) 288-8467

(Address, including zip code, and telephone number,

including area code of issuer’s principal executive office)

Sally Outlaw

Chief Executive Officer

One Boca Commerce Center

551 NW 77 Street, Suite 212

Boca Raton, FL 33487

Phone: (561) 288-8467

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Laura Anthony, Esq.

Craig D. Linder, Esq.

Anthony L.G., PLLC

625 N. Flagler Drive, Suite 600

West Palm Beach, FL 33401

Phone: (561) 514-0936

Fax: (561) 514-0832

| 7372 | 84-3587018 | |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Preliminary Offering Circular

February 4, 2020

Subject to Completion

An offering statement pursuant to Regulation A relating to these securities has been filed with the United States Securities and Exchange Commission. Information contained in this preliminary offering circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the United States Securities and Exchange Commission is qualified. This preliminary offering circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a final offering circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the final offering circular or the offering statement in which such final offering circular was filed may be obtained.

Worthy Peer Capital II, Inc.

WORTHY II BONDS

MAXIMUM OFFERING AMOUNT: $50,000,000

MINIMUM OFFERING AMOUNT: $0

Worthy Peer Capital II, Inc., (the “Company,” “we,” “us,” “our,” or “ours”) a newly formed entity, is offering up to $50 million of our “Worthy II Bonds” on a best efforts basis in increments of $10.00. For more information on the terms of Worthy II Bonds being offered, please see “Description of the Worthy II Bonds” beginning on page 26 of this offering circular.

We will offer and sell our Worthy II Bonds described in this offering circular on a continuous basis directly through the Worthy Website at www.worthybonds.com or though the Worthy App which may be downloaded for free from the Apple Store or from Google Play. The aggregate initial offering price of the Worthy II Bonds will not exceed $50,000,000 in any 12-month period, and there is no minimum number of Worthy II Bonds that need to be sold as a condition of closing this offering. This offering is being conducted on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be sold in this offering. Offers and sales of the Worthy II Bonds will be made by our management who will not receive any commissions or other remunerations for their efforts. We reserve the right to engage the services of a registered broker-dealer who will offer, sell and process the subscriptions for the Worthy II Bonds, although we do not presently expect to engage such selling agent. If any broker-dealer or other agent/person is engaged to sell our Worthy II Bonds, we will file a post-qualification amendment to the offering statement of which this offering circular forms a part disclosing the names and compensation arrangements prior to any sales by such persons. See “Plan of Distribution” in this offering circular.

The approximate date of the commencement of the proposed sales to the public of the Worthy II Bonds will be within two calendar days from the date on which the offering is qualified by the Securities and Exchange Commission (the “SEC”) and on a continuous basis thereafter until the maximum number of Worthy II Bonds offered hereby is sold. The minimum purchase is $10.00 and funds received will not be placed in escrow and will be immediately available to us. All offering expenses will be borne by us and will be paid out of the proceeds of this offering. The closing of the offering will occur on the earlier of (i) the date that subscriptions for the Worthy II Bonds offered hereby equal $50,000,000 or (ii) an earlier date determined by the Company in its sole discretion.

No public market has developed nor is expected to develop for Worthy II Bonds, and we do not intend to list Worthy II Bonds on a national securities exchange or interdealer quotational system.

Investing in our securities involves a high degree of risk, including the risk that you could lose all of your investment. Please read the section entitled “Risk Factors” beginning on page 8 of this offering circular about the risks you should consider before investing.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, or the “JOBS Act,” and, as such, have elected to comply with certain reduced public company reporting requirements. See “Offering Summary—Emerging Growth Company Status.”

| Price to Public | Selling Agent Commissions | Proceeds, Before Expenses, to Worthy Peer Capital II (1) | ||||||||||

| Per Worthy II Bond | $ | 10.00 | $ | 0.00 | $ | 10.00 | ||||||

| Total(2) | $ | 50,000,000 | $ | 0.00 | $ | 50,000,000 | ||||||

| (1) | Before the payment of our expenses in this offering which we estimate will be approximately $100,000. See “Use of Proceeds” appearing on page 15 of this offering circular. All expenses of the offering will be paid for by us using the proceeds of this offering. |

| (2) | Assumes that the maximum aggregate offering amount of $50,000,000 is received by us. |

THE SEC DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”); HOWEVER, THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

We believe that we fall within the exception of an investment company provided by Section 3(c)(5)(A) and/or Section 3(c)(5)(B) of the Investment Company Act of 1940. Section 3(c)(5)(A) provides an exemption for a company that is primarily engaged in purchasing or otherwise acquiring notes representing part or all of the sales price of merchandise and/or services. Section 3(c)(5)(B) provides an exemption for a company that is primarily engaged in making loans to manufacturers, wholesalers and retailers of and to prospective purchasers of specified merchandise and/or services. If for any reason we fail to meet the requirements of the exemptions provided by Section 3(c)(5)(A) or 3(c)(5)(B) we will be required to register as an investment company, which could materially and adversely affect our proposed plan of business.

Our principal office is located at One Boca Commerce Center, 551 NW 77 Street Suite 212, Boca Raton, Florida 33487 and our phone number is (561) 288-8467. Our corporate website address is located at www.worthybonds.com. Information contained on, or accessible through, the website is not a part of, and is not incorporated by reference into, this offering circular.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This offering circular is following the disclosure format of Part I of SEC Form S-1 pursuant to the general instructions of Part II(a)(1)(ii) of Form 1-A.

The date of this offering circular is ______, 2020

We are offering to sell, and seeking offers to buy, Worthy II Bonds only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this offering circular. We have not authorized anyone to provide you with any information other than the information contained in this offering circular. The information contained in this offering circular is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this offering circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this offering circular. This offering circular will be updated and made available for delivery to the extent required by the federal securities laws.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this offering circular in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourselves about and to observe any restrictions relating to the offering and the distribution of this offering circular.

TABLE OF CONTENTS

Unless the context otherwise indicates, when used in this offering circular, the terms “Worthy Peer Capital II,” “the Company,” “we,” “us,” “our” and similar terms refer to Worthy Peer Capital II, Inc., a Florida corporation, and our wholly-owned subsidiary Worthy Lending II, LLC, a Delaware limited liability company which we refer to as “Worthy Lending II.” We use a twelve-month fiscal year ending on March 31st. In a twelve-month fiscal year, each quarter includes three-months of operations; the first, second, third and fourth quarters end on June 30th, September 30th, December 31st , and March 31st, respectively.

The information contained on, or accessible through, the websites at www.worthybonds.com and www.joinworthy.com are not part of, and is not incorporated by reference in, this offering circular.

Certain data included in this offering circular is derived from information provided by third-parties that we believe to be reliable. The discussions contained in this offering circular relating to such information is taken from third-party sources that the Company believes to be reliable and reasonable, and that the factual information is fair and accurate. Certain data is also based on our good faith estimates which are derived from management’s knowledge of the industry and independent sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. We have not independently verified such third-party information, nor have we ascertained the underlying economic assumptions relied upon therein. While we are not aware of any material misstatements regarding any market, industry or similar data presented herein, such data was derived from third party sources and reliance on such data involves risks and uncertainties.

We own or have applied for rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that protect our business. This offering circular may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this offering circular is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this offering circular are listed without their ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This offering circular contains forward looking statements that are subject to various risk and uncertainties and that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results, in contrast with statements that reflect historical facts. Many of these statements are contained under the headings “Offering Circular Summary,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” Forward-looking statements are generally identifiable by use of forward-looking terminology such as “anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,” “project” or “expect,” “may,” “will,” “would,” “could” or “should,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, or state other forward-looking information. Our ability to predict future events, actions, plans or strategies is inherently uncertain. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, actual outcomes could differ materially from those set forth or anticipated in our forward-looking statements. Factors that could cause our forward-looking statements to differ from actual outcomes include, but are not limited to, those described under the heading “Risk Factors.” Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our views as of the date of this offering circular. Furthermore, except as required by law, we are under no duty to, and do not intend to, update any of our forward-looking statements after the date of this offering circular, whether as a result of new information, future events or otherwise.

You should read thoroughly this offering circular and the documents that we refer to herein with the understanding that our actual future results may be materially different from and/or worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements including those made in Risk Factors appearing elsewhere in this offering circular. Other sections of this offering circular include additional factors which could adversely impact our business and financial performance. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this offering circular, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

| 1 |

STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS

Our Worthy II Bonds are being offered and sold only to “qualified purchasers” (as defined in Regulation A under the Securities Act). As a Tier 2 offering pursuant to Regulation A under the Securities Act, this offering is exempt from state law “Blue Sky” review, subject to meeting certain state filing requirements and complying with certain anti-fraud provisions, to the extent that our Worthy II Bonds offered hereby are offered and sold only to “qualified purchasers” or at a time when our Worthy II Bonds are listed on a national securities exchange. “Qualified purchasers” include: (i) “accredited investors” under Rule 501(a) of Regulation D and (ii) all other investors so long as their investment in our Worthy II Bonds does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). Accordingly, we reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a “qualified purchaser” for purposes of Regulation A.

To determine whether a potential investor is an “accredited investor” for purposes of satisfying one of the tests in the “qualified purchaser” definition, the investor must be a natural person who has:

| 1. | an individual’s net worth, or joint net worth with the person’s spouse, that exceeds $1,000,000 at the time of the purchase, excluding the value of the primary residence of such person; or | |

| 2. | earned income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year. |

If the investor is not a natural person, different standards apply. See Rule 501 of Regulation D for more details.

For purposes of determining whether a potential investor is a “qualified purchaser,” annual income and net worth should be calculated as provided in the “accredited investor” definition under Rule 501 of Regulation D. In particular, net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings and automobiles.

This summary highlights certain information about us and this offering contained elsewhere in this offering circular. Because it is only a summary, it does not contain all the information that you should consider before investing in our securities and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this offering circular. Before you decide to invest in our securities, you should read the entire offering circular carefully, including “Risk Factors” beginning on page 8 and our financial statements and the accompanying notes included in this offering circular.

Overview

We are a newly formed company and to date our activities have involved the organization of our Company. We are a wholly owned subsidiary of Worthy Financial, Inc. (“WFI”) which owns a fintech platform and mobile app (the “Worthy App”) that allows its users to digitally purchase “Worthy Bonds.” Purchases can be made in several ways including by rounding up the users’ debit card and checking account linked credit card purchases and other checking account transactions and thereafter use the “round up” dollars in increments of $10.00 to purchase Worthy II Bonds from the Company. WFI also owns its proprietary website allowing direct purchases of Worthy II Bonds (collectively the “Worthy Fintech Platform”).

On October 28, 2019, the Company was formed as a Florida corporation and issued of 100 shares of its $0.001 per share par value common stock in exchange for $5,000 to WFI. WFI is the sole shareholder of the Company’s common stock.

We are an early stage company, which, through our wholly owned subsidiary Worthy Lending II, LLC (“Worthy Lending II”), a Delaware limited liability company, plan to implement our business model. Our business model is centered primarily around providing loans for small businesses including loans to manufacturers, wholesalers, and retailers secured by inventory, accounts receivable and/or equipment and purchase order financing. Inventory financing is a form of asset-based lending that allows retailers and wholesalers to use inventory as collateral to obtain a line of credit from us. Purchase order financing allows manufacturers and wholesalers to receive up to 100% of the funds needed to fill an order for specified merchandise when they are unable to do so on their own. To a lesser extent, we may also provide loans to other borrowers, acquire equity interests in real estate, make fixed income and/or equity investments, provide factoring financing and other types of loans and investments provided the amount and nature of such activities does not cause us to lose our exemption from regulations as an investment company pursuant to the Investment Company Act of 1940, or the “40 Act.” We will sell Worthy II Bonds in this offering to provide the capital for these activities.

| 2 |

The Worthy II Bonds:

| ● | are priced at $10.00 each; | |

| ● | represent a full and unconditional obligation of our company; | |

| ● | bear interest at 5% per annum; | |

| ● | have a three-year term, renewable at the option of the bond holder; | |

| ● | are redeemable at any time at the option of the holder; | |

| ● | are subject to a call by us at any time; | |

| ● | are not payment dependent on any underlying small business or other loan; and | |

| ● | are unsecured. |

For more information on the terms of Worthy II Bonds being offered, please see “Description of the Worthy II Bonds” beginning on page 26 of this offering circular.

The Company has not yet generated any revenue and has no operating history. These conditions raise substantial doubt about the Company’s ability to continue as a going concern and our auditor raised substantial doubt about our ability to continue as a going concern in their audit report with respect to our audited consolidated financial statements for the period from October 28, 2019 (inception) to December 31, 2019. We expect to generate income from the difference between the interest rates we charge borrowers or otherwise make from our permissible investments, including loan origination fees paid by borrowers, and the interest we will pay to the holders of Worthy II Bonds. We also expect to use up to 5% of the proceeds from sales of Worthy II Bonds to provide working capital for our company until such time as our revenues are sufficient to pay our operating expenses.

Until sufficient proceeds have been received by us from the sale of Worthy II Bonds in this offering, we will rely on advances from our parent as to which we have no assurances. WFI is not obligated to provide advances to us and there are no assurances that we will be successful in raising proceeds in this offering. If we do not raise sufficient funds in this offering or if our parent declines to make advances to us, we will not be able to implement our business plan, or may have to cease operations altogether.

As Worthy Lending II is a wholly owned subsidiary of the Company, we expect that the loans and other assets of Worthy Lending II, and the returns from the operations of such loans and assets, will generally remain available to support and fund the payment obligations of the Company with respect to the Worthy II Bonds. While there is no formal security agreement in place with respect to these loans and other assets within Worthy Lending II (and while any current and future creditors of Worthy Lending II may also have recourse to the assets of the entity), as the Company is the sole member of Worthy Lending II we expect that the Company will retain the right at any time to cause the distribution of available funds from Worthy Lending II up to the Company so that the Company may meet such payment obligations.

Competitive Strengths

We believe we benefit from the following competitive strengths:

We are part of the Worthy Community. The Worthy App and websites (the “Worthy FinTech Platform”) are targeted to the millennials who are part of the fastest growing segment of our population. We believe that they have a basic distrust of traditional banking institutions yet they have a need to accumulate assets for retirement or otherwise. The Worthy FinTech Platform provides for a savings and investing alternative for the millennials.

We are part of the fast-growing online lending industry. Alternative lenders often provide a more appealing financing option to small businesses as they are usually more flexible than larger financial institutions on loan repayment terms and often approve loans much faster than banks. For example, online “peer-to-peer” lending website uses technology to meet market demand where traditional bank and institutional financing has become more difficult to obtain. Lenders often have significant cost advantages over banks, including lower overhead and the absence of branch offices and extensive sales forces. These efficiencies often make it easier for nonbanks to originate loans to borrowers whose options online were traditionally limited to banks.

| 3 |

We focus on an underserved banking sector. Due to higher costs, we believe that banks cannot profitably serve the small business lending market for commercial loans below $500,000. Indeed, traditional banks have been exiting the small business loan market for over a decade. We believe our small business loan program enables us to profitably participate in loans at these levels.

Strategy

Our strategy is to expand our network of online information, social networking, and institutional, (colleges and universities, charities, trade organizations, and employer) sources of introductions and referrals to our targeted users.

Emerging Growth Company Status

We are an “emerging growth company” as defined in the JOBS Act, which permits us to elect not to be subject to certain disclosure and other requirements that otherwise would have been applicable to us had we not been an “emerging growth company.” These provisions include:

| ● | reduced disclosure about our executive compensation arrangements; | |

| ● | no non-binding advisory votes on executive compensation or golden parachute arrangements; and | |

| ● | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We may take advantage of these exemptions for up to five years or such earlier time as we are no longer an “emerging growth company.” We will qualify as an “emerging growth company” until the earliest of:

| ● | the last day of our fiscal year following the fifth anniversary of the date of completion of this offering; | |

| ● | the last day of our fiscal year in which we have annual gross revenue of $1.0 billion or more; | |

| ● | the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; or | |

| ● | the last day of the fiscal year in which we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the “Exchange Act.” |

Under this definition, we will be an “emerging growth company” upon completion of this offering and could remain an “emerging growth company” until as late as October, 2024.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Risks Affecting Us

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” beginning on page 8. These risks include, but are not limited to the following:

| ● | We are an early-stage startup with no operating history, and we may never become profitable; | |

| ● | Absent any additional financing or advances from our parent company, other than the sale of the Worthy II Bonds, we may be unable to meet our operating expenses; | |

| ● | In addition to the sale of the Worthy II Bonds, we are dependent on advances from our parent company in order to meet our operating expenses and our parent company is under no obligation to advance us any funds; | |

| ● | We have no operating history in an evolving industry, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful; | |

| ● | We operate in a highly regulated industry, and our business may be negatively impacted by changes in the regulatory environment; | |

| ● | Our business may be negatively impacted by worsening economic conditions and fluctuations in the credit market; | |

| ● | Competition in our industry is intense; | |

| ● | Holders of Worthy II Bonds are exposed to the credit risk of our company; | |

| ● | There has been no public market for Worthy II Bonds and none is expected to develop; | |

| ● | We may not qualify for an exemption from regulation as an investment company pursuant to the Investment Company Act of 1940; and | |

| ● | Our auditor raised substantial doubt about our ability to continue as a going concern in their audit report with respect to our audited consolidated financial statements for the period from October 28, 2019 (inception) to December 31, 2019. |

| 4 |

Corporate Information

We were incorporated under the laws of the State of Florida in October 2019. On October 28, 2019, the Company was founded with the issuance of 100 shares of our $0.001 per share par value common stock for $5,000 to WFI. WFI is the sole shareholder of the Company’s common stock. Our wholly owned subsidiary Worthy Lending II was organized under the laws of the State of Delaware in October 2019. Our principal executive offices are located at One Boca Commerce Center, 551 NW 77 Street, Suite 212, Boca Raton, Florida 33487, and our telephone number is (561) 288-8467. Our fiscal year end is March 31st. The information which appears on our websites, or is accessible through our websites, at www.worthybonds.com and www.joinworthy.com are not part of, and is not incorporated by reference into, this offering circular.

We have not generated any revenues since our formation. There is substantial doubt about our ability to continue as a going concern. We are a wholly-owned subsidiary of Worthy Financial, Inc., a Delaware corporation which we refer to as “WFI.”

We are presently dependent on advances from our parent, WFI, to provide capital for our operations. WFI, reported minimal revenues of $49,689 for the year ended December 31, 2018 and had a net loss of $805,840. At December 31, 2018 WFI had a working capital deficit of $1,101,764 and an accumulated deficit of $1,273,447. WFI reported its financial results in their Annual Report on Form C-AR dated April 22, 2019 filed with the Securities and Exchange Commission on April 23, 2019, on a consolidated basis with Worthy Peer Capital Inc., its wholly owned subsidiary which we refer to as “Worthy Peer I.”

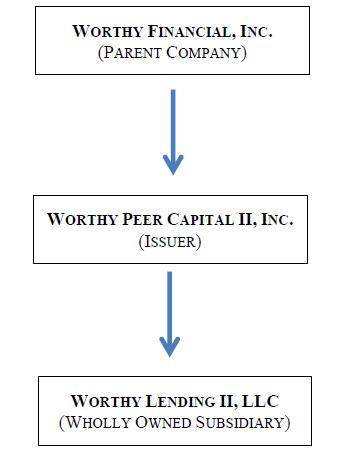

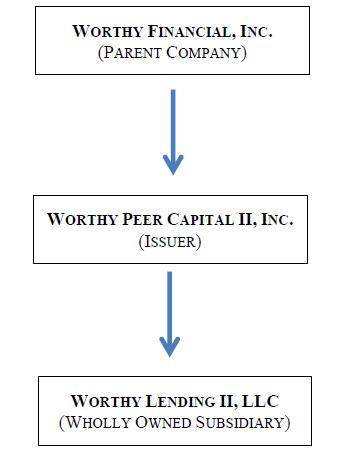

Organizational Structure

The following reflects the current organization structure of the Company:

| 5 |

| Securities offered by us: | Up to $50,000,000 of Worthy II Bonds on a “best efforts” basis. | |

| Offering Price per Worthy II Bonds: | $10.00 per each Worthy II Bonds. | |

| Description of the Worthy II Bonds: | The Worthy II Bonds are: | |

| ● | priced at $10.00 each; | |

| ● | represent our full and unconditional obligation; | |

| ● | bear interest at 5% per annum; | |

| ● | have a three-year term, extendable at the option of the bond holder; | |

| ● | are redeemable at any time at the option of the holder; | |

| ● | subject to a call by us at any time; | |

| ● | not payment dependent on any underlying small business or other loan; and | |

| ● | are unsecured. | |

| Principal amount of Worthy II Bonds: | We will not issue Worthy II Bonds offered hereby in excess of $50 million principal amount during any 12-month period. The Worthy II Bonds offered hereby will be offered on a continuous basis. As of the date of this offering circular we have not sold any Worthy II Bonds. | |

| Regulation A Tier: | Tier 2 | |

| Worthy II Bond purchasers: | Accredited investors pursuant to Rule 501 and non-accredited investors. Pursuant to Rule 251(d)(2)(C), non-accredited investors who are natural persons may only invest the greater of 10% of their annual income or net worth. Non-natural non-accredited persons may invest up to 10% of the greater of their net assets or revenues for the most recently completed fiscal year. | |

| Securities outstanding prior to this offering: | 100 shares of our common stock, all of which are owned by WFI. | |

| Securities Outstanding after the offering | 100 shares of our common stock, all of which are owned by WFI. | |

| Manner of offering: | We will offer and sell our Worthy II Bonds described in this offering circular on a continuous basis directly through the Worthy Website at www.worthybonds.com or though the Worthy App which may be downloaded for free from the Apple Store or from Google Play. This offering is being conducted on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be sold in this offering. Offers and sales of the Worthy II Bonds will be made by our management who will not receive any commissions or other remunerations for their efforts. We reserve the right to engage the services of a registered broker-dealer who will offer, sell and process the subscriptions for the Worthy II Bonds, although we do not presently expect to engage such selling agent. If any broker-dealer or other agent/person is engaged to sell our Worthy II Bonds, we will file a post-qualification amendment to the offering statement of which this offering circular forms a part disclosing the names and compensation arrangements prior to any sales by such persons. Please see “Plan of Distribution” beginning on page 29 of this offering circular. | |

| 6 |

| Minimum and Maximum Investment Amount | The minimum investment amount per subscriber is $10. There is no maximum investment amount per subscriber. | |

| Investment Amount Restrictions | Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, you are encouraged to review Rule 251(d)(2)(i)(c) of Regulation A. For general information on investing, you are encouraged to refer to www.investor.gov. | |

| Voting Rights | The Worthy II Bonds do not have any voting rights. | |

| Risk Factors | Purchasing the Worthy II Bonds and our business in general is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” beginning on page 8. | |

| How to invest: | Please visit the Worthy Website at www.worthybonds.com and click the “Get Started” link at the top of the home page. You may also download the Worthy App and use it to invest. Please see “Plan of Distribution” appearing later in this offering circular. | |

| Use of proceeds: | If we sell all $50 million of gross proceeds from the Worthy II Bonds offered under this offering circular, we estimate our net proceeds, after deducting estimated offering expenses of approximately $100,000, will be approximately $49,900,000. We intend to use the proceeds from this offering to implement the business model described above and for general corporate purposes including the costs of this offering. See “Use of Proceeds.” | |

Transfer Agent

|

The Company will act as its own transfer agent and maintain the Company’s share register. As of the date of this offering circular, we have not engaged a transfer agent, and do not intend to engage a transfer agent until such time as we determine it is necessary. | |

| Termination of the offering | We reserve the right to terminate this offering for any reason at any time. | |

| Closing | The closing of the offering will occur on the earlier of (i) the date that subscriptions for the Worthy II Bonds offered hereby equal $50,000,000 or (ii) an earlier date determined by the Company in its sole discretion. | |

| 7 |

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA

The following table presents our summary historical consolidated financial data for the period indicated. The summary historical consolidated financial data for the period ended December 31, 2019 and the balance sheet data as of December 31, 2019 and is derived from the audited financial statements.

Historical results are included for illustrative and informational purposes only and are not necessarily indicative of results we expect in future periods, and results of interim periods are not necessarily indicative of results for the entire year. You should read the following summary financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes appearing elsewhere in this Offering Circular.

| October 28, 2019 (inception) through December 31, 2019 | ||||

| Statement of Operations Data | ||||

| Total revenues | $ | 0 | ||

| Gross profits | $ | 0 | ||

| Total operating expenses | $ | 5,619 | ||

| Loss from operations | $ | (5,619 | ) | |

| Nonoperating income (expense) | $ | 0 | ||

| Net loss | $ | (5,619 | ) | |

| Net loss per share, basic and diluted | $ | (56.19 | ) | |

| Balance Sheet Data (at period end) | ||||

| Cash and cash equivalents | $ | 5,000 | ||

| Working capital (1) | $ | (619 | ) | |

| Total assets | $ | 5,000 | ||

| Total liabilities | $ | 5,619 | ||

| Stockholder’s equity (deficit) | $ | (619 | ) | |

| (1) | Working capital (deficit) represents total current assets less total current liabilities. |

Investing in our securities involves risks. In addition to the other information contained in this offering circular, you should carefully consider the following risks before deciding to purchase our securities in this offering. The occurrence of any of the following risks might cause you to lose all or a part of your investment. Some statements in this offering circular, including statements in the following risk factors, constitute forward-looking statements. Please refer to “Cautionary Statement Regarding Forward-Looking Statements” for more information regarding forward-looking statements.

Risks Related to our Industry

The lending industry is highly regulated. Changes in regulations or in the way regulations are applied to our business could adversely affect our business.

Changes in laws or regulations or the regulatory application or judicial interpretation of the laws and regulations applicable to us could adversely affect our ability to operate in the manner in which we intend to conduct business or make it more difficult or costly for us to participate in or otherwise make loans. A material failure to comply with any such laws or regulations could result in regulatory actions, lawsuits, and damage to our reputation, which could have a material adverse effect on our business and financial condition and our ability to participate in and perform our obligations to investors and other constituents.

The initiation of a proceeding relating to one or more allegations or findings of any violation of such laws could result in modifications in our methods of doing business that could impair our ability to collect payments on our loans or to acquire additional loans or could result in the requirement that we pay damages and/or cancel the balance or other amounts owing under loans associated with such violation. We cannot assure you that such claims will not be asserted against us in the future.

Worsening economic conditions may result in decreased demand for loans, cause borrowers’ default rates to increase, and harm our operating results.

Uncertainty and negative trends in general economic conditions in the United States and abroad, including significant tightening of credit markets, historically have created a difficult environment for companies in the lending industry. Many factors, including factors that are beyond our control, may have a detrimental impact on our operating performance. These factors include general economic conditions, unemployment levels, energy costs and interest rates, as well as events such as natural disasters, acts of war, terrorism, and catastrophes.

Our borrowers are small businesses. Accordingly, our borrowers have historically been, and may in the future remain, more likely to be affected or more severely affected than large enterprises by adverse economic conditions. These conditions may result in a decline in the demand for loans by potential borrowers or higher default rates by borrowers.

| 8 |

There can be no assurance that economic conditions will remain favorable for our business or that demand for loans in which we participate or default rates by borrowers will remain at current levels. Reduced demand for loans would negatively impact our growth and revenue, while increased default rates by borrowers may inhibit our access to capital and negatively impact our profitability. Further, if an insufficient number of qualified individuals and small businesses apply for loans, our growth and revenue would be negatively impacted.

Competition for employees is intense, and we may not be able to attract and retain the highly skilled employees whom we need to support our business.

Competition for highly skilled personnel, especially data analytics personnel, is extremely intense, and we could face difficulty identifying and hiring qualified individuals in many areas of our business. We may not be able to hire and retain such personnel. Many of the companies with which we compete for experienced employees have greater resources than we have and may be able to offer more attractive terms of employment. In addition, we intend to invest significant time and expense in training our employees, which increases their value to competitors who may seek to recruit them. If we fail to retain our employees, we could incur significant expenses in hiring and training their replacements and the quality of our services and our ability to serve borrowers could diminish, resulting in a material adverse effect on our business. We currently have no full time employees. However, management and staffing are presently provided by Worthy Management, Inc., a wholly owned subsidiary of our parent company.

We operate in a competitive market which may intensify, and competition may limit our ability to implement our business model and have a material adverse effect on our business, financial condition, and results of operations.

We operate in a competitive market which may intensify, and competition may limit our ability to implement our business model and have a material adverse effect on our business, financial condition, and results of operations. Our competitors may be able to have a lower cost for their services which would lead to borrowers choosing such other competitors over the Company. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of loans and investments, offer more attractive pricing or other terms and establish more relationships than us.

Risks Related to Our Company

We are an early-stage startup with no operating history, and we may never become profitable.

We do not expect to be profitable for the foreseeable future. If we are unable to obtain or maintain profitability, we will not be able to attract investment, compete, or maintain operations.

Our auditors have raised substantial doubt about our ability to continue as a going concern.

We are an early-stage startup with no operating history, and we may never become profitable. Our independent registered public accounting firm has raised substantial doubt about our ability to continue as a going concern and included an explanatory paragraph in their opinion on our audited consolidated financial statements for the period from October 28, 2019 (inception) to December 31, 2019, that states that there is a substantial doubt about our ability to continue as a going concern. The accompanying consolidated financial statements have been prepared assuming that we will continue as a going concern. We generated net losses and had cash used in operations of $5,619 and $0, respectively, for the period from October 28, 2019 (inception) to December 31, 2019. At December 31, 2019, we had a working capital deficit, shareholder’s deficit and accumulated deficit of $619, $619 and $5,619, respectively. These conditions raise substantial doubt about our ability to continue as a going concern. No assurances can be given that we will generate sufficient revenue or obtain necessary financing to continue as a going concern. No assurances can be given that we will achieve success in selling the Worthy II Bonds.

We are dependent on advances from our parent company and the funds to be raised in this offering in order to be able to implement our business plan.

Until sufficient proceeds have been received by us from the sale of Worthy II Bonds in this offering we will rely on advances from our parent as to which we have no assurances. WFI is not obligated to provide advances to us and there are no assurances that we will be successful in raising proceeds in this offering. If we do not raise sufficient funds in this offering or if our parent declines to make advances to us, we will not be able to implement our business plan, or may have to cease operations altogether.

| 9 |

If we do not raise sufficient funds in this offering or if our parent company declines to make advances to us we won’t be able to implement our business plan.

We have not generated any revenues and we are dependent on the proceeds from this offering to provide funds to implement our business model. Given the uncertainty of the amount of Worthy II Bonds that we will sell makes it difficult to predict our planned operations. Until sufficient proceeds have been received by us from the sale of Worthy II Bonds we will rely on advances from our parent as to which we have no assurances. WFI is not obligated to provide advances to us and there are no assurances that we will be successful in raising proceeds in this offering. If we do not raise sufficient funds in this offering or if our parent company declines to make advances to us we won’t be able to implement our business plan.

We have no operating history in a rapidly evolving industry, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful.

We have no operating history in an evolving industry that may not develop as expected. Assessing our business and future prospects is challenging in light of the risks and difficulties we may encounter. These risks and difficulties include our ability to:

| ● | increase the number and total volume of loans and other credit products extended to borrowers; | |

| ● | improve the terms on which loans are made to borrowers as our business becomes more efficient; | |

| ● | increase the effectiveness of our direct marketing and lead generation through referral sources; | |

| ● | favorably compete with other companies that are currently in, or may in the future enter, the business of lending to small businesses; | |

| ● | successfully navigate economic conditions and fluctuations in the credit market; and | |

| ● | effectively manage the growth of our business. |

We may not be able to successfully address these risks and difficulties, which could harm our business and cause our operating results to suffer.

If the information provided by borrowers is incorrect or fraudulent, we may misjudge a customer’s qualification to receive a loan, and our operating results may be harmed.

Our loan participation or loan decisions are based partly on information provided to us by loan applicants. To the extent that these applicants provide information to us in a manner that we are unable to verify, we may not be able to accurately assess the associated risk. In addition, data provided by third-party sources is a significant component of our underwriting process, and this data may contain inaccuracies. Inaccurate analysis of credit data that could result from false loan application information could harm our reputation, business, and operating results.

Our risk management efforts may not be effective.

We could incur substantial losses, and our business operations could be disrupted if we are unable to effectively identify, manage, monitor, and mitigate financial risks, such as credit risk, interest rate risk, liquidity risk, and other market-related risk, as well as operational risks related to our business, assets, and liabilities. To the extent our models used to assess the creditworthiness of potential borrowers do not adequately identify potential risks, the risk profile of such borrowers could be higher than anticipated. Our risk management policies, procedures, and techniques may not be sufficient to identify all of the risks we are exposed to, mitigate the risks that we have identified, or identify concentrations of risk or additional risks to which we may become subject in the future.

We will rely on various referral sources and other borrower lead generation sources, including lending platforms.

Unlike banks and other larger competitors with significant resources, we intend to rely on our smaller-scale marketing efforts, affinity groups, partners, and loan referral services to acquire borrowers. We do not have exclusive rights to referral services, and we cannot control which loans or the volume of loans we are sent. In addition, our competitors may enter into exclusive or reciprocal arrangements with their own referral services, which might significantly reduce the number of borrowers we are referred. Any significant reduction in borrower referrals could have an adverse impact on our loan volume, which will have a correspondingly adverse impact on our operations and our company.

Our loans may be unsecured obligations of our borrowers.

We believe that some of our loans may be unsecured obligations of the borrowers. This means that, for those loans, we will not be able to foreclose on any assets of our borrowers in the event that they default. This limits our recourse in the event of a default. We may also attract borrowers who have fewer assets and may be engaged in less developed businesses than our peers. If we are unable to access collateral on our loans that default, our results of operations may be adversely impacted.

| 10 |

A significant disruption in our computer systems or a cybersecurity breach could adversely affect our operations.

We rely extensively on our computer systems to manage our loan origination and other processes. Our systems are subject to damage or interruption from power outages, computer and telecommunications failures, computer viruses, cyber security breaches, vandalism, severe weather conditions, catastrophic events and human error, and our disaster recovery planning cannot account for all eventualities. If our systems are damaged, fail to function properly or otherwise become unavailable, we may incur substantial costs to repair or replace them, and may experience loss of critical data and interruptions or delays in our ability to perform critical functions, which could adversely affect our business and results of operations. Any compromise of our security could also result in a violation of applicable privacy and other laws, significant legal and financial exposure, damage to our reputation, loss or misuse of the information and a loss of confidence in our security measures, which could harm our business.

Our ability to protect the confidential information of our borrowers and investors may be adversely affected by cyber-attacks, computer viruses, physical or electronic break-ins or similar disruptions.

We process certain sensitive data from our borrowers and investors. While we have taken steps to protect confidential information that we receive or have access to, our security measures could be breached. Any accidental or willful security breaches or other unauthorized access to our systems could cause confidential borrower and investor information to be stolen and used for criminal purposes. Security breaches or unauthorized access to confidential information could also expose us to liability related to the loss of the information, time-consuming and expensive litigation and negative publicity. If security measures are breached because of third-party action, employee error, malfeasance or otherwise, or if design flaws in our software are exposed and exploited, our relationships with borrowers and investors could be severely damaged, and we could incur significant liability.

Because techniques used to sabotage or obtain unauthorized access to systems change frequently and generally are not recognized until they are launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. In addition, federal regulators and many federal and state laws and regulations require companies to notify individuals of data security breaches involving their personal data. These mandatory disclosures regarding a security breach are costly to implement and often lead to widespread negative publicity, which may cause borrowers and investors to lose confidence in the effectiveness of our data security measures. Any security breach, whether actual or perceived, would harm our reputation, we could lose borrowers and investors and our business and operations could be adversely affected.

Any significant disruption in service on our platform or in our computer systems, including events beyond our control, could prevent us from processing or posting payments on loans, reduce the attractiveness of our marketplace and result in a loss of borrowers or investors.

In the event of a system outage and physical data loss, our ability to perform our servicing obligations, process applications or make loans available would be materially and adversely affected. The satisfactory performance, reliability and availability of our technology are critical to our operations, customer service, reputation and our ability to attract new and retain existing borrowers and investors.

Any interruptions or delays in our service, whether as a result of third-party error, our error, natural disasters or security breaches, whether accidental or willful, could harm our relationships with our borrowers and investors and our reputation. Additionally, in the event of damage or interruption, our insurance policies may not adequately compensate us for any losses that we may incur. Our disaster recovery plan has not been tested under actual disaster conditions, and we may not have sufficient capacity to recover all data and services in the event of an outage. These factors could prevent us from processing or posting payments on the loans, damage our brand and reputation, divert our employees’ attention, reduce our revenue, subject us to liability and cause borrowers and investors to abandon our marketplace, any of which could adversely affect our business, financial condition and results of operations.

We contract with third parties to provide services related to our online web lending and marketing, as well as systems that automate the servicing of our loan portfolios. While there are material cybersecurity risks associated with these services, we require that our vendors provide industry-leading encryption, strong access control policies, Statement on Standards for Attestation Engagements (SSAE) 16 audited data centers, systematic methods for testing risks and uncovering vulnerabilities, and industry compliance audits to ensure data and assets are protected. To date, we have not experienced any cyber incidents that were material, either individually or in the aggregate.

| 11 |

If our estimates of loan receivable losses are not adequate to absorb actual losses, our provision for loan receivable losses would increase, which would adversely affect our results of operations.

We maintain an allowance for loans receivable losses. To estimate the appropriate level of allowance for loan receivable losses, we consider known and relevant internal and external factors that affect loan receivable collectability, including the total amount of loan receivables outstanding, historical loan receivable charge-offs, our current collection patterns, and economic trends. If customer behavior changes as a result of economic conditions and if we are unable to predict how the unemployment rate, housing foreclosures, and general economic uncertainty may affect our allowance for loan receivable losses, our provision may be inadequate. Our allowance for loan receivable losses is an estimate, and if actual loan receivable losses are materially greater than our allowance for loan receivable losses, our financial position, liquidity, and results of operations could be adversely affected.

We will face increasing competition and, if we do not compete effectively, our operating results could be harmed.

We compete with other companies that lend to small businesses. These companies include traditional banks, merchant cash advance providers, and newer, technology-enabled lenders. In addition, other technology companies that lend primarily to individual consumers, such as Lending Club and Prosper Marketplace, have already begun to focus, or may in the future focus, their efforts on lending to small businesses. If we are not able to compete effectively with our competitors, our operating results could be harmed.

Many of our competitors have significantly more resources and greater brand recognition than we do and may be able to attract borrowers more effectively than we do.

When new competitors seek to enter one of our markets, or when existing market participants seek to increase their market share, they sometimes undercut the pricing and/or credit terms prevalent in that market, which could adversely affect our market share or ability to explore new market opportunities. Our pricing and credit terms could deteriorate if we act to meet these competitive challenges. Further, to the extent that the fees we pay to our strategic partners and borrower referral sources are not competitive with those paid by our competitors, whether on new loans or renewals or both, these partners and sources may choose to direct their business elsewhere. All of the foregoing could adversely affect our business, results of operations, financial condition, and future growth.

The collection, processing, storage, use, and disclosure of personal data could give rise to liabilities as a result of governmental regulation, conflicting legal requirements, or differing views of personal privacy rights.

We receive, collect, process, transmit, store, and use a large volume of personally identifiable information and other sensitive data from borrowers and purchasers of the Worthy II Bonds and services. There are federal, state, and foreign laws regarding privacy, recording telephone calls, and the storing, sharing, use, disclosure, and protection of personally identifiable information and sensitive data. Specifically, personally identifiable information is increasingly subject to legislation and regulations to protect the privacy of personal information that is collected, processed, and transmitted. Any violations of these laws and regulations may require us to change our business practices or operational structure, address legal claims, and sustain monetary penalties, or other harms to our business.

The regulatory framework for privacy issues in the United States and internationally is constantly evolving and is likely to remain uncertain for the foreseeable future. The interpretation and application of such laws is often uncertain, and such laws may be interpreted and applied in a manner inconsistent with other binding laws or with our current policies and practices. If either we or our third-party service providers are unable to address any privacy concerns, even if unfounded, or to comply with applicable laws and regulations, it could result in additional costs and liability, damage our reputation, and harm our business.

We are reliant on the efforts of Sally Outlaw and Alan Jacobs.

We rely on our management team and need additional key personnel to grow our business, and the loss of key employees or inability to hire key personnel could harm our business. We believe our success has depended, and continues to depend, on the efforts and talents of our executive officers, Sally Outlaw and Alan Jacobs. Ms. Outlaw and/or Mr. Jacobs have expertise that could not be easily replaced if we were to lose any or all of their services.

| 12 |

The nature of our business may subject us to regulation as an investment company pursuant to the Investment Company Act of 1940.

We believe that we fall within the exception of an investment company provided by Section 3(c)(5)(A) and/or Section 3(c)(5)(B) of the Investment Company Act of 1940. Section 3(c)(5)(A) provides an exemption for a company that is primarily engaged in purchasing or otherwise acquiring notes representing part or all of the sales price of merchandise and/or services. Section 3(c)(5)(B) provides an exemption for a company that is primarily engaged in making loans to manufacturers, wholesalers and retailers of and to prospective purchasers of specified merchandise and/or services. If for any reason we fail to meet the requirements of the exemptions provided by Section 3(c)(5)(A) or 3(c)(5)(B) we will be required to register as an investment company, which could materially and adversely affect our proposed plan of business.

Compliance with Regulation A and reporting to the SEC could be costly.

Compliance with Regulation A could be costly and requires legal and accounting expertise. After qualifying this Form 1-A, we will be required to file an annual report on Form 1-K, a semiannual report on Form 1-SA, and current reports on Form 1-U.

Our legal and financial staff may need to be increased in order to comply with Regulation A. Compliance with Regulation A will also require greater expenditures on outside counsel, outside auditors, and financial printers in order to remain in compliance. Failure to remain in compliance with Regulation A may subject us to sanctions, penalties, and reputational damage and would adversely affect our results of operations.

We will be required to publicly report on an ongoing basis under the reporting rules set forth in Regulation A for Tier 2 issuers. Therefore, we will be subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies that are not “emerging growth companies,” and our investors could receive less information than they might expect to receive from exchange traded public companies.

We will be required to publicly report on an ongoing basis under the reporting rules set forth in Regulation A for Tier 2 issuers. The ongoing reporting requirements under Regulation A are more relaxed than for “emerging growth companies” under the Exchange Act. The differences include, but are not limited to, being required to file only annual and semiannual reports, rather than annual and quarterly reports. Annual reports are due within 120 calendar days after the end of the issuer’s fiscal year, and semiannual reports are due within 90 calendar days after the end of the first six months of the issuer’s fiscal year. Therefore, our investors could receive less information than they might expect to receive from exchange traded public companies.

Our lack of operating history makes it difficult for you to evaluate this investment.

We are a recently formed entity with no operating history and may not be able to successfully operate our business or achieve our investment objectives. We may not be able to conduct our business as described in our plan of operation.

We are subject to the risk of fluctuating interests rates, which could harm our planned business operations.

We expect to generate net income from the difference between the interest rates we charge borrowers or otherwise make from our permissible investments, including loan origination fees paid by borrowers, and the interest we will pay to the holders of Worthy II Bonds. Due to fluctuations in interest rates, we may not be able to charge borrower’s an interest rate sufficient for us to generate income, which could harm our planned business operations

Risks Related to Worthy II Bonds and this Offering

The characteristics of the Worthy II Bonds, including maturity, interest rate, lack of collateral security or guarantee, and lack of liquidity, may not satisfy your investment objectives.

The Worthy II Bonds may not be a suitable investment for you, and we advise you to consult your investment, tax and other professional financial advisors prior to purchasing Worthy II Bonds. The characteristics of the notes, including maturity, interest rate, lack of collateral security or guarantee, and lack of liquidity, may not satisfy your investment objectives. The Worthy II Bonds may not be a suitable investment for you based on your ability to withstand a loss of interest or principal or other aspects of your financial situation, including your income, net worth, financial needs, investment risk profile, return objectives, investment experience and other factors. Prior to purchasing any Worthy II Bonds, you should consider your investment allocation with respect to the amount of your contemplated investment in the Worthy II Bonds in relation to your other investment holdings and the diversity of those holdings.

| 13 |

Holders of Worthy II Bonds are exposed to the credit risk of our company.

Worthy II Bonds are our full and unconditional obligations. If we are unable to make payments required by the terms of the notes, you will have an unsecured claim against us. Worthy II Bonds are therefore subject to non-payment by us in the event of our bankruptcy or insolvency. In an insolvency proceeding, there can be no assurances that you will recover any remaining funds. Moreover, your claim may be subordinate to that of any senior creditors and any secured creditors to the extent of the value of their security.

The Worthy II Bonds are unsecured obligations.

The Worthy II Bonds do not represent an ownership interest in any specific Worthy loans, their proceeds, or their assets. The Worthy II Bonds are unsecured general obligations of Worthy only and not any Worthy borrower. The Worthy II Bonds will be general unsecured obligations, and will rank equally with all of our other unsecured debt unless such debt is senior to or subordinate to the Worthy II Bonds by their terms. We may issue secured debt in our sole discretion without notice to or consent from the holders of Worthy II Bonds. Therefore as unsecured obligations, there is no security to be provided to the holders of the Worthy II Bonds.

There is no public market for Worthy II Bonds, and none is expected to develop.

Worthy II Bonds are newly issued securities. Although under Regulation A the securities are not restricted, Worthy II Bonds are still highly illiquid securities. No public market has developed nor is expected to develop for Worthy II Bonds, and we do not intend to list Worthy II Bonds on a national securities exchange or interdealer quotational system. You should be prepared to hold your Worthy II Bonds through their maturity dates as Worthy II Bonds are expected to be highly illiquid investments.

Holders of the Worthy II Bonds will have no voting rights.

Holders of the Worthy II Bonds will have no voting rights and therefore will have no ability to control the Company. The Worthy II Bonds do not carry any voting rights and therefore the holders of the Worthy II Bonds will not be able to vote on any matters regarding the operation of the Company. As a bondholder purchasers in this offering will have no right to vote upon or receive notice of any corporate actions we may undertake which you might otherwise have if you owned equity in our Company.

There is a risk that the Worthy Website will not be able to handle a large amount of investors subscribing to this offering.

Although the Worthy Website has been designed to handle numerous purchase orders and prospective investors, we cannot predict the response of the Worthy Website to any particular issuance of Worthy II Bonds pursuant to this offering circular. You should be aware that if a large number of investors try to access the Worthy Website at the same time and submit their purchase orders simultaneously, there may be a delay in receiving and/or processing your purchase order. You should also be aware that general communications and internet delays or failures unrelated to the Worthy Website, as well as website capacity limits or failures may prevent purchase orders from being received on a timely basis by the Worthy Website. We cannot guarantee you that any of your submitted purchase orders will be received, processed and accepted during the offering process.

There is a risk that the Worthy Website and the Worthy APP may be hacked.

We receive, collect, process, transmit, store, and use a large volume of personally identifiable information and other sensitive data from borrowers and purchasers of the Worthy II Bonds and services on the Worthy Website and the Worthy App. There is a risk that the Worthy Website and the Worthy APP may be hacked. Worthy II Bonds will be issued by computer-generated program on our website and electronically signed by us in favor of the investor. The Worthy II Bonds will be stored by us and will remain in our custody for ease of administration. In today’s environment, cyberattacks are perpetrated by identity thieves, unscrupulous contractors and vendors, malicious employees, business competitors, prospective insider traders and market manipulators, so-called “hacktivists,” terrorists, state-sponsored actors and others. Many companies that utilize technology in the business operations, such as ours are subject to the risk that they may be hacked. Even the most diligent cybersecurity efforts will not address all cyber risks that the Company faces. We cannot assure you that we’ll be able to prevent any such hacks by third parties, and if we experience these hacks, the effects would case an adverse effect on our business operations and will jeopardize the privacy of our users date, and can lead to us having to cease operations altogether.

The Worthy II Bond Holders may be subject to third party fees.

Worthy II Bond investors are not charged a servicing fee for their investment, but you may be charged a transaction fee if your method of payment requires us to incur an expense. Other financial intermediaries, however, if engaged by you, may charge you commissions or fees.

| 14 |

The Worthy II Bond Holders may be subject to a servicing fee upon transfer.

The Worthy II Bonds are transferable except a servicing fee of up to 1% may be charged for the transfer of Worthy II Bonds to third parties, which charge would only be made against accrued interest.

Because the Worthy II Bonds will have no sinking fund, insurance, or guarantee, you could lose all or a part of your investment if we do not have enough cash to pay.

There is no sinking fund, insurance or guarantee of our obligation to make payments on the Worthy II Bonds. We will not contribute funds to a separate account, commonly known as a sinking fund, to make interest or principal payments on the Worthy II Bonds. The Worthy II Bonds are not certificates of deposit or similar obligations of, and are not guaranteed or insured by, any depository institution, the Federal Deposit Insurance Corporation, the Securities Investor Protection Corporation, or any other governmental or private fund or entity. Therefore, if you invest in the Worthy II Bonds, you will have to rely only on our cash flow from operations and other sources of funds for repayment of principal at maturity or redemption and for payment of interest when due. If our cash flow from operations and other sources of funds are not sufficient to pay any amounts owed under the Worthy II Bonds, then you may lose all or part of your investment.

By purchasing Worthy II Bonds in this Offering, you are bound by the arbitration provisions contained in our Investor Purchase Agreement to be used for subscriptions in this offering which limits your ability to bring class action lawsuits or seek remedies on a class basis.

By purchasing shares in this Offering, investors agree to be bound by the arbitration provisions contained in Section 13 of our Investor Purchase Agreement to be used for subscriptions on this offering which provides that arbitration or small claims court are the exclusive means for resolving disputes against the Company. Section 13 also waives a right to a trial by jury for each the Company and the subscribing investor. All Arbitration shall take place in Palm Beach County, Florida, within the U.S. Southern District of Florida, or in such location as agreed upon by the parties. In the event that the Company were to invoke the arbitration clause, the rights of the adverse bond holder to seek redress in court would be severely limited. These restrictions on the ability to bring a class action lawsuit may result in increased costs and/or reduced remedies, to individual investors who wish to pursue claims against the Company. Any investor can choose to opt out of the terms of the arbitration provision in accordance with the terms of the Investor Purchase Agreement.

If we sell all $50 million of Worthy II Bonds offered hereby, we estimate we will receive net proceeds from this offering of approximately $49,900,000, after deducting the estimated offering expenses payable by us including our legal fees, accounting fees, financial printing costs, SEC filing fees, EDGAR fees, and other expenses of this offering which we estimate to be $100,000. We intend to use (i) approximately 75% of the net proceeds from this offering providing loans for small businesses including loans to manufacturers, wholesalers, and retailers secured by inventory, accounts receivable and/or equipment and purchase order financing, to a lesser extent, we may also provide loans to other borrowers, acquire equity interests in real estate, make fixed income and/or equity investments, provide factoring financing and make other types of loans and investments provided the amount and nature of such activities does not cause us to lose our exemption from regulations as an investment company pursuant to the 40 Act, and (ii) approximately 5% of the proceeds for general corporate purposes, including the costs of this offering and amounts due under the Management Services Agreement with Worthy Management, Inc., or “Worthy Management.” We reserve the right however to change the estimated use of proceeds from this offering at any time so long as doing so does not result in the loss of our exemption from the 40 Act.

If all of the Worthy II Bonds are sold in this Offering on a “self-underwritten” basis through our officers and directors without utilizing broker-dealers to sell the Worthy II Bonds, we expect to receive net proceeds from this Offering of approximately $49,900,000. If all of the Worthy II Bonds are sold in this Offering through broker-dealers, we expect to receive net proceeds from this Offering in an amount equal to the gross proceeds in this Offering of approximately $49,900,000 minus estimated underwriting discounts and commissions to the broker-dealers.

However, we cannot guarantee that we will sell all of the Worthy II Bonds being offered by us. The following table summarizes how we anticipate using the gross proceeds of this Offering assuming the Worthy II Bonds are not sold in this Offering through broker-dealers, depending upon whether we sell 25%, 50%, 75%, or 100% (Maximum Offering Amount) of the Worthy II Bonds being offered in the Offering:

| 15 |

| If 25% of Bonds Sold | If 50% of Bonds Sold | If 75% of Bonds Sold | If 100% of Bonds Sold | |||||||||||||

| Gross Proceeds | $ | 12,500,000 | $ | 25,000,000 | $ | 37,500,000 | $ | 50,000,000 | ||||||||

| Offering Expenses (Underwriting Discounts and Commissions to Placement Agent and other broker dealers) | $ | (0 | ) | $ | (0 | ) | $ | (0 | ) | $ | (0 | ) | ||||

| Net Proceeds | $ | 12,500,000 | $ | 25,000,000 | $ | 37,500,000 | $ | 50,000,000 | ||||||||

| Our intended use of the net proceeds is as follows: | ||||||||||||||||

| Fees for Qualification of Offering under Regulation A (includes legal, auditing, accounting, transfer agent, financial printer and other professional fees) | $ | (100,000 | ) | $ | (100,000 | ) | $ | (100,000 | ) | $ | (100,000 | ) | ||||

| Providing Loans to Small Businesses | (7,400,000 | ) | (14,900,000 | ) | (22,400,000 | ) | (29,900,000 | ) | ||||||||

| Providing Loans to Other Borrowers | (1,250,000 | ) | (2,500,000 | ) | (3,750,000 | ) | (5,000,000 | ) | ||||||||