UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

|

|

Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the quarterly period ended |

or

|

|

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to . |

Primary Standard Industrial Classification Code Number: 6221

Sponsored by Wilshire Phoenix Funds LLC

(Exact name of registrant as specified in its charter)

|

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

(

(Address, including Zip Code, and Telephone

Number, including Area Code, of Registrant’s

Principal Executive Offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

Title of each class: |

|

Trading Symbol(s) |

|

Name of each exchange on which registered: |

|

|

|

|

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer |

☐ |

|

Accelerated Filer |

☐ |

|

|

☐ |

|

Smaller Reporting Company |

|

|

Emerging Growth Company |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.). ☐ Yes ☒

The registrant had issued and outstanding Shares as of November 1, 2021.

wShares Enhanced Gold ETF

Table of Contents

Part I. FINANCIAL INFORMATION

Item 1. Financial Statements.

wShares Enhanced Gold ETF

Index to Financial Statements

1

wShares Enhanced Gold ETF

Statements of Financial Condition

|

|

|

September 30, |

|

|

December 31, |

|

||

|

|

|

(unaudited) |

|

|

|

|

||

|

Assets |

|

|

|

|

|

|

|

|

|

Investment in gold, at fair value (cost $ |

|

$ |

|

|

|

$ |

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

Gold receivable |

|

|

|

|

|

|

|

|

|

Offering costs |

|

|

|

|

|

|

|

|

|

Other asset |

|

|

|

|

|

|

|

|

|

Total assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

Sponsor’s fee payable |

||||||||

|

Total liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets |

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares issued and outstanding, authorized Shares with par value of $ per Share |

|

|

|

|

|

|

|

|

|

Net asset value per Share |

|

$ |

|

|

|

$ |

|

|

See notes to unaudited financial statements.

2

wShares Enhanced Gold ETF

Schedules of Investment

|

September 30, 2021 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

Fine Ounces of |

|

|

Cost |

|

|

Fair Value |

|

|

% of Net Assets |

|

||||

|

Investment in gold |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

% |

|

Total investments |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

% |

|

Other assets in excess of liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

Net assets |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

% |

|

December 31, 2020 |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

Fine Ounces of |

|

|

Cost |

|

|

Fair Value |

|

|

% of Net Assets |

|

||||

|

Investment in gold |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

% |

|

Total investments |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

% |

|

Other assets in excess of liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

Net assets |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

% |

See notes to unaudited financial statements.

3

wShares Enhanced Gold ETF

Statements of Operations

|

|

|

For the Three |

|

|

For the Nine |

|

||

|

(unaudited) |

|

|

(unaudited) |

|

||||

|

Expenses |

|

|

|

|

|

|

|

|

|

Offering costs |

|

$ |

|

|

|

$ |

|

|

|

Sponsor’s fee |

|

|

|

|

|

|

|

|

|

Miscellaneous fee |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

|

|

|

|

|

|

|

Total expenses |

|

|

|

|

|

|

|

|

|

Net investment loss |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

Net realized and change in unrealized gain (loss) on investment in gold |

|

|

|

|

|

|

|

|

|

Net realized gain (loss) from gold sold for rebalancing and to pay expenses |

|

|

|

|

|

|

|

|

|

Net change in unrealized appreciation (depreciation) on investment in gold |

|

|

( |

) |

|

|

( |

) |

|

Net realized and change in unrealized gain (loss) from investment in gold |

|

|

( |

) |

|

|

( |

) |

|

Net income (loss) |

|

$ |

( |

) |

|

$ |

( |

) |

See notes to unaudited financial statements.

4

wShares Enhanced Gold ETF

Statement of Cash Flows

|

|

|

For the Nine |

|

|

|

|

|

(unaudited) |

|

|

|

Cash Flows from Operating Activities: |

|

|

||

|

Net income (loss) |

|

$ |

( |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: |

|

|

|

|

|

Value of gold received |

|

|

( |

) |

|

Value of gold distributed |

|

|

|

|

|

Amortization of offering costs |

|

|

|

|

|

Proceeds from sales of gold to pay expenses |

|

|

|

|

|

Net realized (gain) loss from gold sold for rebalancing and to pay expenses |

|

|

( |

) |

|

Net change in unrealized (appreciation) depreciation on investment in gold |

|

|

|

|

|

(Increase) decrease in gold receivable |

|

|

( |

) |

|

(Increase) decrease in prepaid offering costs |

|

|

( |

) |

|

Increase (decrease) in Sponsor’s fee payable |

|

|

|

|

|

Net cash provided by (used in) operating activities |

|

|

( |

) |

|

Cash Flows from Investing Activities: |

|

|

|

|

|

Payments for other assets |

|

|

( |

) |

|

Net cash provided by (used in) investing activities |

|

|

( |

) |

|

Cash Flows from Financing Activities: |

|

|

|

|

|

Creation of Shares |

|

|

|

|

|

Redemption of Shares |

|

|

|

|

|

Net cash provided by (used in) financing activities |

|

|

|

|

|

Net Increase (Decrease) in Cash |

|

|

|

|

|

Cash beginning of period |

|

|

|

|

|

Cash end of period |

|

$ |

|

|

See notes to unaudited financial statements.

5

wShares Enhanced Gold ETF

Statements of Change in Net Assets

|

|

|

For the Three |

|

|

For the Nine |

|

||

|

|

|

(unaudited) |

|

|

(unaudited) |

|

||

|

Net assets, beginning of period |

|

$ |

|

|

|

$ |

|

|

|

Creation of and Shares, respectively |

|

|

|

|

|

|

|

|

|

Redemption of () and () Shares, respectively |

|

|

|

|

|

|

|

|

|

Net investment loss |

|

|

( |

) |

|

|

( |

) |

|

Net realized gain (loss) from gold sold |

|

|

|

|

|

|

|

|

|

Net change in unrealized appreciation (depreciation) on investment in gold |

|

|

( |

) |

|

|

( |

) |

|

Net assets, end of period |

|

$ |

|

|

|

$ |

|

|

See notes to unaudited financial statements.

6

wShares Enhanced Gold ETF

Financial Highlights

Per Share Performance (for a Share outstanding throughout each period presented)

|

|

|

For the Three |

|

|

For the Nine |

|

||

|

|

|

|

(unaudited) |

|

|

|

(unaudited) |

|

|

Net asset value per Share, beginning of period |

|

$ |

|

|

|

$ |

|

(a) |

|

Net investment loss(b) |

|

|

( |

) |

|

|

( |

) |

|

Net realized and unrealized gain (loss) on investment in gold |

|

|

( |

) |

|

|

( |

) |

|

Net change in net assets from operations |

|

|

( |

) |

|

|

( |

) |

|

Net asset value per Share, end of period |

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total return, at net asset value(c) |

|

|

( |

)% |

|

|

( |

)% |

|

|

|

|

|

|

|

|

|

|

|

Ratio to average net assets(d) |

|

|

|

|

|

|

|

|

|

Net investment loss |

|

|

( |

)% |

|

|

( |

)% |

|

Net expenses |

|

|

|

% |

|

|

|

% |

|

(a) |

|

|

(b) |

|

|

(c) |

|

|

(d) |

|

See notes to unaudited financial statements.

7

wShares Enhanced Gold ETF

Notes to Unaudited Financial Statements

September 30, 2021

1. ORGANIZATION

The wShares Enhanced Gold ETF (the “Trust”), formerly known as Wilshire wShares Enhanced Gold Trust until October 7, 2021, is an exchange-traded fund formed on January 8, 2020, as a Delaware statutory trust and trades on the NYSE Arca, Inc. (the “Exchange”). The Trust operates pursuant to a trust agreement, dated as of January 8, 2020, as amended by the First Amendment to the Trust Agreement, dated as of August 24, 2020, and further amended and restated on December 17, 2020 (the “Trust Agreement”) between Wilshire Phoenix Funds LLC, a Delaware limited liability company (the “Sponsor”), and Delaware Trust Company (the “Trustee”). The Trust is not registered as an investment company under the Investment Company Act of 1940, as amended (the “Investment Company Act”), and is not a commodity pool for purposes of the Commodity Exchange Act (“CEA”). The Trust issues shares (the “Shares”), which represent units of fractional undivided beneficial interest in the Trust. The Trust will have no assets other than (a) physical gold held by the Trust (“Physical Gold”), and (b) cash. The Trust’s performance, whether positive or negative, will be driven primarily by its investments in Physical Gold. The Trust’s Physical Gold is carried, for financial statement purposes, at fair value, as required by accounting principles generally accepted in the United States (“U.S. GAAP”). The Trust’s Net Asset Value (the “NAV”) is determined by the Administrator, in conformity with U.S. GAAP, on each business day as of 4:00 p.m. (New York City time), or as soon thereafter as practicable. The Trust commenced operations on February 17, 2021 and its Shares commenced trading on February 18, 2021 and as such the statements of operations, changes in net assets, and cash flows for the period January 8, 2020 through September 30, 2020 are not included.

The investment objective of the Trust is for the Shares to closely reflect the wShares Gold Index (the “Index”), less the Trust’s liabilities and expenses. The objective of the Index is to reduce the risk-profile typically associated with the purchase of gold, as measured by the realized volatility of the London Bullion Market Association (“LBMA”) Gold Price PM, while maintaining the correlative benefits of gold versus the S&P 500® Index. Solactive AG calculates, maintains and publishes information about the Index (the “Index Calculation Agent”).

JPMorgan Chase Bank, N.A. is the gold custodian of the Trust (the “Gold Custodian”). Foreside Fund Services, LLC is the marketing agent for the Shares (the “Marketing Agent”). The Bank of New York Mellon is the custodian for cash (in such capacity, the “Cash Custodian”), the administrator (in such capacity, the “Administrator”), and the transfer agent (in such capacity, the “Transfer Agent”) of the Trust. Exchange Traded Concepts, LLC has been appointed as a representative (in such capacity, the “Representative”) for the purposes of performing certain operational functions, which include effecting the monthly rebalances of the Trust’s assets on the last business day of each month (each, a “Rebalance Date”), and effecting creations, redemptions, sales and other transactions on behalf of the Trust. All net proceeds from the sale of the Shares will be used to purchase Physical Gold to the extent required to track the Index’s allocation to Physical Gold and to pay the expenses of the Trust.

Shares of the Trust are listed on the Exchange under the ticker symbol “WGLD”. The market price of the Shares may be different from the NAV per Share. Shares may be purchased from the Trust only by certain eligible financial institutions called Authorized Participants and only in one or more blocks of Shares (“Creation Units”) in exchange for cash. The Trust issues Shares in Creation Units on a continuous basis at the applicable NAV per Share on the creation order date. Except when aggregated in Creation Units, the Shares are not redeemable securities.

The Trust is an “emerging growth company” as that term is used in the Securities Act of 1933, as amended (the “Securities Act”), and, as such, the Trust may elect to comply with certain reduced public company reporting requirements.

Virtu Financial BD LLC, the initial Authorized Participant, purchased Shares at a price of $ per Share on February 17, 2021.

The fiscal year-end of the Trust is December 31st.

On October 7, 2021, the Trust changed its name from “Wilshire wShares Enhanced Gold Trust” to “wShares Enhanced Gold ETF.”

8

2. SIGNIFICANT ACCOUNTING POLICIES

In preparing financial statements in conformity with U.S. GAAP, management of the Sponsor makes estimates and assumptions that affect the reported amounts of assets, liabilities and disclosures of contingent assets and liabilities at the date of the financial statements, as well as the reported amount of revenue and expenses during the period. Actual results could differ from these estimates.

The following is a summary of significant accounting policies followed by the Trust.

2.1. Basis of Presentation

The Sponsor has determined that the Trust falls within the scope of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 946, Financial Services - Investment Companies, and has concluded that only for financial reporting purposes, the Trust is classified as an Investment Company (as defined in ASC 946). The Trust is not registered as an investment company under the Investment Company Act and is not required to register under such act.

The statement of financial condition and schedule of investment at September 30, 2021 and the statements of operations, change in net assets, and cash flows for the three months and nine months ended September 30, 2021, have been prepared on behalf of the Trust and are unaudited. In the opinion of management of the Sponsor of the Trust, all adjustments (which include normal recurring adjustments) necessary to present fairly the financial position and results of operations for the three months and nine months ended September 30, 2021, have been made. In addition, interim period results are not necessarily indicative of results for a full-year period.

2.2. Valuation of Gold

The Trust follows the provisions of FASB ASC 820, Fair Value Measurements (“ASC 820”). ASC 820 provides guidance for determining fair value and requires increased disclosure regarding the inputs to valuation techniques used to measure fair value. ASC 820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The Administrator generally values the Physical Gold held by the Trust using that day’s LBMA Gold Price PM. If there is no LBMA Gold Price PM on any day, the Administrator is authorized to use that day’s LBMA Gold Price AM, or the most recently announced LBMA Gold Price PM or LBMA Gold Price AM. LBMA Gold Price is the price per troy ounce, in U.S. dollars, of unallocated gold delivered in London determined by ICE Benchmark Administration (“IBA”) following an electronic auction consisting of one or more 30-second rounds starting at 10:30 a.m. (London time) (in the case of LBMA Gold Price AM) or 3:00 p.m. (London time) (in the case of LBMA Gold Price PM) on each day that the London gold market is open for business, and published shortly thereafter. At the start of each round of auction, IBA publishes a price for that round. Participants then have 30 seconds to enter, change or cancel their orders (i.e., how much gold they want to buy or sell at that price). At the end of each round, order entry is frozen, and the system checks to see if the imbalance (i.e., the difference between buying and selling) is within the threshold (normally

Neither the Trustee nor the Sponsor are liable to any person for the determination that the most recently announced LBMA PM Gold Price (or other benchmark price) is not appropriate as a basis for evaluation of the gold held or receivable by the Trust or for any determination as to the alternative basis for evaluation, provided that such determination is made in good faith.

Once the value of the Trust’s Physical Gold has been determined, the Administrator subtracts all accrued expenses and liabilities of the Trust from the total value of the Physical Gold and all other assets of the Trust. The resulting figure is the NAV of the Trust. The Administrator determines the NAV by dividing the NAV of the Trust by the number of Shares outstanding on the day the computation is made.

ASC 820 establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. The three levels of inputs are:

Level 1: Unadjusted quoted prices in active markets for identical assets or liabilities that the Trust has the ability to access.

Level 2: Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments and similar data.

Level 3: Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Trust’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available.

9

The Sponsor categorizes the Trust’s investment in gold as a Level 1 asset within the ASC 820 hierarchy.

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|||

|

Investment in gold |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Total |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

2.3. Expenses

The Trust pays the Sponsor a fee that will accrue daily at an annualized rate equal to

The following ordinary and recurring fees of the Trust will be paid by the Administrator out of the Sponsor’s Fee: the Administrator Fee, the Gold Custodian Fee, the Cash Custodian Fee, the Transfer Agent Fee, the Representative Fee, the Trustee Fee, the Partnership Representative Fee, the Trust’s audit fees (including any fees and expenses associated with tax preparation) and up to $

To pay the Sponsor’s Fee, the Cash Custodian will withdraw from the cash on deposit in the cash account an amount of U.S. dollars equal to the Sponsor’s Fee, determined as described above. Any Sponsor-Paid Expenses will be netted out of the Sponsor’s Fee, and the Cash Custodian will, pursuant to the instruction of the Administrator, directly pay the recipients of such amounts. After netting such Sponsor-Paid Expenses, the Administrator shall instruct the Cash Custodian to pay the remaining amount of the Sponsor’s Fee to the Sponsor. The Sponsor, from time to time, may waive all or a portion of the Sponsor’s Fee in its sole discretion.

The

Trust has capitalized certain offering costs and amortizes those costs over a 12-month period. The Trust capitalized $

The Trust is required to pay certain other fees and expenses that are not contractually assumed by the Sponsor, including, but not limited to, any fees and expenses associated with the Trust’s monthly rebalancing between Physical Gold and cash, any other fees (including commissions and/or exchange fees) associated with the buying and selling of Physical Gold for the Trust, fees and expense reimbursements due to the Marketing Agent, the Trust’s regulatory fees and expenses (including any filing, application or license fees), printing and mailing costs, costs of maintaining the Trust’s website, the Trust’s legal fees and expenses to the extent they exceed $

2.4. Gold Receivable or Payable and Revenue Recognition Policy

Gold receivable or payable represents the quantity of gold covered by contractually binding orders for the creation or redemption of Shares respectively, where the gold has not yet been transferred to or from the Trust’s account. Gold receivable or payable also represents the quantity of gold yet to be received from or distributed to the Gold Custodian in conjunction with a rebalance transaction. Generally, ownership of the gold is transferred within two business days of the trade date.

The Sponsor, on each Rebalance Date, shall instruct the Representative to purchase and/or sell Physical Gold. In addition, the Administrator, acting pursuant to instructions from the Sponsor, shall, on the Rebalance Date, instruct the Cash Custodian to pay amounts due and payable by the Trust as of the Determination Date. When selling gold to pay expenses, the Representative will endeavor to sell the smallest amount of gold needed to pay expenses to minimize the Trust’s holdings of assets other than gold. Unless otherwise directed by the Sponsor, the Representative will sell gold to the Custodian at the next LBMA Gold Price PM following the sale order. A gain or loss is recognized based on the difference between the selling price and the average cost of the gold sold, and such amounts are reported as net realized gain/(loss) from investment in gold sold to pay expenses in the statements of operations.

10

2.5. Creations and Redemptions of Shares

The Trust creates and redeems Shares from time to time, but only in one or more Creation Units. A Creation Unit is a block of Shares. Creation Units may be created or redeemed only by Authorized Participants. Except when aggregated in Creation Units, the Shares are not redeemable securities. Authorized Participants pay a transaction fee of $

Authorized Participants must be (i) registered broker-dealers or other securities market participants, such as banks and other financial institutions, which are not required to register as broker-dealers to engage in securities transactions, and (ii) participants in the Depository Trust Company (the “DTC”). To become an Authorized Participant, a person must enter into an Authorized Participant Agreement with the Trust and the Sponsor. The Authorized Participant Agreement sets forth the procedures for the creation and redemption of Creation Units and for the payment of cash required for such creations and redemptions. The Sponsor may delegate its duties and obligations under the Authorized Participant Agreement to the Marketing Agent, the Administrator, or the Transfer Agent, without consent from any Shareholder or Authorized Participant. The Authorized Participant Agreement may be amended by the Sponsor only with the consent of the Authorized Participant, while the procedures attached thereto may be amended with notice to the Authorized Participant by following the procedures specified in the Authorized Participant Agreement. Shareholder consent is not required in either case. To compensate the Transfer Agent for services in processing the creation and redemption of Creation Units, an Authorized Participant is required to pay a transaction fee of $

There were Shares outstanding at September 30, 2021.

Changes in the Shares for the nine months ended September 30, 2021 are:

|

|

|

Shares |

|

|

Amount |

|

||

|

Balance at January 1, 2021 |

|

|

|

|

$ |

|

|

|

|

Creation of Shares |

|

|

|

|

|

|

|

|

|

Redemption of Shares |

|

|

|

|

|

|

|

|

|

Balance at September 30, 2021 |

|

|

|

|

$ |

|

|

|

2.6. Organizational Costs

The costs of the Trust’s organization were borne directly by the Sponsor. The Trust is obligated to pay, or reimburse the Sponsor for, Additional Trust Expenses and any fees and expenses that are specified in the Trust Agreement as payable by the Trust.

2.7. Income Taxes

The Trust is classified as a “partnership” for United States federal income tax purposes. As a result, the Trust itself is not subject to United States federal income tax. Instead, the Trust’s income, gain, losses, and expenses will “flow through” to the Shareholders, and the Trustee reports these to the Internal Revenue Service on that basis.

The Sponsor evaluates tax positions taken or expected to be taken in the course of preparing the Trust’s tax returns to determine whether the tax positions are “more-likely-than-not” to be sustained by the applicable tax authority. Tax positions not deemed to meet that threshold would be recorded as an expense in the current year. The Trust is required to analyze all open tax years. Open tax years are those years that are open for examination by the relevant income taxing authority. As of September 30, 2021, no tax years are open for examination. There is no examination in progress at period end.

11

3. INVESTMENT IN GOLD

The following represents the changes in fine ounces of gold held and the respective fair value during the nine months ended September 30, 2021:

|

|

|

Amount in fine ounces |

|

|

Amount in US$ |

|

||

|

Balance at January 1, 2021 |

|

|

|

|

|

$ |

|

|

|

Gold received for the creation of Shares |

|

|

|

|

|

|

|

|

|

Gold distributed for the redemption of Shares |

|

|

|

|

|

|

|

|

|

Gold sold for rebalancing and to pay expenses |

|

|

( |

) |

|

|

( |

) |

Net realized gain (loss) from gold sold for rebalancing and to pay expenses |

||||||||

|

Change in unrealized appreciation (depreciation) on investment in gold |

|

|

|

|

|

|

( |

) |

|

Balance at September 30, 2021 |

|

|

|

|

|

$ |

|

|

There were no investments held during 2020.

4. RELATED PARTIES – SPONSOR, TRUSTEE, GOLD CUSTODIAN, CASH CUSTODIAN, ADMINISTRATOR AND TRANSFER AGENT

The Sponsor was formed on May 14, 2018, and established, coordinated, and paid the organizational expenses of the Trust. The Sponsor, together with the Administrator, the Gold Custodian, the Cash Custodian, the Transfer Agent, the Representative, and their respective agents are generally responsible for the administration of the Trust under the provisions of their respective governing agreements. Some of the responsibilities of the Sponsor include (i) selecting the Trust’s service providers and, from time to time, engaging additional, successor or replacement service providers, which shall also include negotiating each service provider agreement and related fees on behalf of the Trust, (ii) facilitating registration of the Shares in book-entry form to be held in the name of Cede & Co. at the facilities of DTC in consultation with the Transfer Agent, and (iii) performing such other services as the Sponsor believes the Trust may require. The Sponsor is generally not involved in the day-to-day activities of the Trust.

The Trustee is appointed to serve as the trustee of the Trust in the State of Delaware for the sole purpose of satisfying the requirement of Section 3807(a) of the Delaware Statutory Trust Act (“DSTA”) that the Trust have at least one trustee with a principal place of business in the State of Delaware. The Trustee’s duties and liabilities with respect to the offering of Shares and management of the Trust are limited to its express obligations under the Trust Agreement. The Trustee shall not be liable under any circumstances, except for its own willful misconduct, bad faith, or gross negligence with respect to its express duties under the Trust Agreement. The Trustee will have no obligation to monitor or supervise the obligations of the Sponsor, Transfer Agent, Administrator, Gold Custodian, Cash Custodian, or any other person. The Trustee will be compensated by the Trust, out of the Sponsor’s Fee, for the Trustee’s fees. The Trustee will be reimbursed by the Trust for reasonable legal expenses it incurs in connection with consultation with its counsel (who may be counsel for the Sponsor or the Trustee) in relation to indemnification under the Trust Agreement.

The Gold Custodian serves as a custodian on the Trust’s behalf, and the Physical Gold in the Trust’s account maintained by the Gold Custodian is considered an asset that remains the Trust’s property at all times. The Gold Custodian is responsible for receiving and safekeeping the Trust’s Physical Gold. The Gold Custodian will store Physical Gold in its own vaulting facilities, generally in London, New York, or such other locations where the Gold Custodian may maintain vaulting facilities from time to time. The Gold Custodian may appoint sub-custodians from time to time for the custody and safekeeping of Physical Gold, but the Gold Custodian remains liable for the custody and safekeeping of Physical Gold and for any loss suffered by the Trust as a result of any act or omission or insolvency of any sub-custodian. The Gold Custodian has agreed to maintain insurance in support of its custodial obligations under the Gold Custodian Agreement, including covering any loss of Physical Gold held in allocated form.

Under the Cash Custody Agreement, the Cash Custodian will be responsible for maintaining the cash account in which the Cash Custodian will hold U.S. dollars in the name of the Trust. The Cash Custodian will be compensated out of the Sponsor’s Fee for the Cash Custodian’s services under the Cash Custody Agreement.

The Administration Agreement establishes the rights and responsibilities of the Administrator and the Trust with respect to the administration, accounting, and recordkeeping of the Trust. The responsibilities of the Administrator will include duties and obligations set forth in the Administration Agreement in connection with (i) the Trust’s payment of fees and expenses on each Rebalance Date, (ii) providing information to the Sponsor in order for the Sponsor to determine the monthly rebalancing of the Trust’s holdings in Physical Gold and cash on each Rebalance Date, (iii) evaluating the Physical Gold holdings and the Cash, determining the Trust’s NAV and the NAV per Share and preparing daily reports, and (iv) maintaining books and records on behalf of the Trust. The Administrator will prepare the Trust’s required filings under the Exchange Act. The Administrator will be compensated by the Trust, out of the Sponsor’s Fee, for the Administrator’s fees.

The Transfer Agent records the ownership of the Shares on the books and records of the Trust and coordinates with the Marketing Agent and DTC as necessary. The Transfer Agent will credit or debit the number of Shares owned by holders of record. The Transfer Agent will (i) facilitate purchases and redemptions of Creation Units to be held in the name of DTC or its nominee, Cede & Co., at the facilities of DTC; (ii) prepare and transmit by means of DTC’s book-entry system payments on or with respect to the Shares declared by the Trust; (iii) maintain the record of the name and address of the Shareholder and the number of Shares issued by the Trust and held by the Shareholder; (iv) record the issuance of Shares of the Trust and maintain a record of the total number of Shares of the Trust which are outstanding, and, based upon data provided to it by the Trust, the total number of authorized Shares; (v) prepare and transmit to the Trust and the Administrator and to any applicable securities exchange information with respect to purchases and redemptions of Shares; (vi) extend the voting rights to the Shareholder for extension by DTC to DTC participants and the beneficial owners of Shares in accordance with policies and procedures of DTC for book-entry only securities; and (vii) maintain books and records related to its activities on behalf of the Trust. The Transfer Agent will also perform the customary services of a transfer agent including, but not limited to, maintaining the accounts of the Shareholders. The Transfer Agent will be compensated by the Trust, out of the Sponsor’s Fee, for the Transfer Agent’s fees.

12

5. CONCENTRATION OF RISK

The Trust’s sole business activity is the investment in gold bullion and cash to track the Index, less the Trust’s liabilities and expenses. Several factors could affect the price of gold: (i) global gold supply and demand, which is influenced by such factors as forward selling by gold producers, purchases made by gold producers to unwind gold hedge positions, central bank purchases and sales, and production and cost levels in major gold-producing countries, and new production projects; (ii) investors’ expectations regarding future inflation rates; (iii) currency exchange rate volatility; (iv) interest rate volatility; and (v) political, economic, global or regional incidents. In addition, there is no assurance that gold will maintain its long-term value in terms of purchasing power in the future. In the event that the price of gold declines, the Sponsor expects the value of an investment in the Shares to decline proportionately. Each of these events could have a material effect on the Trust’s financial position and results of operations.

6. INDEMNIFICATION

The Sponsor and its affiliates, and their respective members, managers, directors, officers, employees, agents and controlling persons (each a “Sponsor Indemnified Party”), will be indemnified by the Trust and held harmless against any loss, judgment, liability, claim, suit, penalty, tax, cost, amount paid in settlement of any claims sustained by it or expense incurred by it arising out of or in connection with the performance of its obligations under the Trust Agreement and under each other agreement entered into by the Sponsor in furtherance of the administration of the Trust, including any costs and expenses incurred by the Sponsor in defending itself against any claim or liability in its capacity as Sponsor; provided that (i) such loss was not the direct result of gross negligence, bad faith or willful misconduct on the part of the Sponsor or a Sponsor Indemnified Party, and (ii) any such indemnification will be recoverable only from the assets of the Trust. Any indemnifiable amounts payable to such indemnified persons may be payable in advance or shall be secured by a lien on the Trust.

The Trustee and any of the officers, directors, affiliates, employees and agents of the Trustee (each, a “Trustee Indemnified Party”) shall be indemnified by the Trust and held harmless against any loss, damage, liability (including liability under state or federal securities laws), claim, action, suit, cost, expense, disbursement (including the reasonable fees and expenses of counsel generally and in connection with its enforcement of its indemnification rights), tax or penalty of any kind and nature whatsoever, to the extent arising out of, imposed upon or asserted at any time against such indemnified person in connection with the execution or delivery of the Trust Agreement, the performance of its obligations under the Trust Agreement, the creation, operation or termination of the Trust or the transactions contemplated therein; provided, however, that (i) the Trust shall not be required to indemnify any such indemnified person for any such expenses which are a result of the willful misconduct, bad faith or gross negligence related to the express duties of the Trustee or Trustee Indemnified Party, and (ii) any such indemnification will be recoverable only from the assets of the Trust. The obligations of the Trust to indemnify such indemnified persons under the Trust Agreement shall survive the resignation or removal of the Trustee and the termination of the Trust Agreement. Any indemnifiable amounts payable to such indemnified persons may be payable in advance or shall be secured by a lien on the Trust.

13

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This information should be read in conjunction with the financial statements and notes included in Item 1 of Part I of this Form 10-Q. This Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such forward-looking statements involve risks and uncertainties. All statements (other than statements of historical fact) included in this Form 10-Q that address activities, events or developments that may occur in the future, including such matters as future gold prices, gold sales, costs, objectives, changes in commodity prices and market conditions (for gold and the shares), the Trust’s operations (including the effects thereon related to the coronavirus (“COVID-19”) pandemic), the Sponsor’s plans and references to the Trust’s future success and other similar matters are forward-looking statements. Words such as “could,” “would,” “may,” “expect,” “intend,” “estimate,” “predict,” and variations on such words or negatives thereof, and similar expressions that reflect our current views with respect to future events and Trust performance, are intended to identify such forward-looking statements. These forward-looking statements are only predictions, subject to risks and uncertainties that are difficult to predict and many of which are outside of our control, and actual results could differ materially from those discussed. Forward-looking statements involve risks and uncertainties that could cause actual results or outcomes to differ materially from those expressed therein. We express our estimates, expectations, beliefs, and projections in good faith and believe them to have a reasonable basis. However, we make no assurances that management’s estimates, expectations, beliefs, or projections will be achieved or accomplished. These forward-looking statements are based on assumptions about many important factors that could cause actual results to differ materially from those in the forward-looking statements. Such factors are discussed in: Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Form 10-Q; Part II, Item 1A. Risk Factors of this Form 10-Q, and other parts of this Form 10-Q. We do not intend to update any forward-looking statements even if new information becomes available or other events occur in the future, except as required by the federal securities laws.

Organization and Trust Overview

The wShares Enhanced Gold ETF (the “Trust”) is an exchange-traded fund formed on January 8, 2020, as a Delaware statutory trust and trades on the NYSE Arca, Inc. (the “Exchange”). The Trust operates pursuant to a trust agreement, dated as of January 8, 2020, as amended by the First Amendment to the Trust Agreement, dated as of August 24, 2020, and further amended and restated on December 17, 2020 (the “Trust Agreement”) between Wilshire Phoenix Funds LLC, a Delaware limited liability company (the “Sponsor”), and Delaware Trust Company (the “Trustee”). On October 7, 2021, the Trust changed its name from “Wilshire wShares Enhanced Gold Trust” to “wShares Enhanced Gold ETF.” The Trust is not registered as an investment company under the Investment Company Act of 1940, as amended (the “Investment Company Act”), and is not a commodity pool for purposes of the Commodity Exchange Act (“CEA”). The Trust issues shares (the “Shares”), which represent units of fractional undivided beneficial interest in the Trust. The Trust will have no assets other than (a) physical gold held by the Trust (“Physical Gold”), and (b) cash. The Trust’s performance, whether positive or negative, will be driven primarily by its investments in Physical Gold. The Trust’s Physical Gold is carried, for financial statement purposes, at fair value, as required by U.S. GAAP. The Trust’s NAV is determined by the Administrator, on a U.S. GAAP basis, on each business day as of 4:00 p.m., (New York City time) or as soon thereafter as practicable.

The investment objective of the Trust is for the Shares to closely reflect the wShares Gold Index (the “Index”), less the Trust’s liabilities and expenses, and the Trust aims to achieve its investment objective by investing in Physical Gold and holding cash in proportions that seek to replicate the proportions in which Physical Gold and cash are represented in the Index. The objective of the Index is to reduce the risk-profile typically associated with the purchase of gold, as measured by the realized volatility of the LBMA Gold Price PM, while maintaining the correlative benefits of gold versus the S&P 500® Index. The purpose of the Index is to seek to outperform a stand-alone investment in gold. Solactive AG calculates the Index (the “Index Calculation Agent”).

The Index systematically rebalances between gold and cash on a monthly basis. Realized volatility, sometimes referred to herein as historical volatility, measures the magnitude of price movements of a given asset over a defined historical time period. The Index generally seeks to reduce its realized volatility relative to the realized volatility of the LBMA Gold Price PM by lowering its exposure to gold during periods of increased realized volatility in the LBMA Gold Price PM. Gold may serve or act as a diversifier and a hedge within a portfolio of assets, especially during times of heightened realized volatility observed in the S&P 500® Index, and therefore the Index will generally calculate an increased gold exposure during periods of heightened realized volatility observed in the S&P 500® Index. The Index has a notional component representing Physical Gold (the “Physical Gold Component”) and cash (the “Cash Component”) based on a cash weighting to the extent that less than 100% of the Index is comprised of the Physical Gold Component (the “Cash Weighting”). In seeking to track the Cash Weighting portion of the Index, the Trust will hold cash.

On each “Determination Date” (the second business day prior to a Rebalance Date), the Index Calculation Agent calculates the new weighting of the Physical Gold Component utilizing a mathematically derived, non-discretionary, objective and passive rules-based methodology that will apply on the Rebalance Date. This methodology adjusts the Index’s exposure to Physical Gold depending on the historical realized volatility and returns of the LBMA Gold Price PM and historical realized volatility of the S&P 500® Index utilizing a look-back period of 45 days, among other parameters. The Index Calculation Agent’s determination of the new weight for the Physical Gold Component will be based on the observed historical realized volatility and returns of the LBMA Gold Price PM and historical realized volatility of the S&P 500® Index.

14

The new percentage weighting for the Physical Gold Component will generally be lower than the prior month if the historical realized volatility of Physical Gold is higher than during the previous period, and vice versa. In addition, during a period of increased historical realized volatility within the S&P 500® Index, the Index may calculate a higher weighting for the overall exposure to gold. The weightings of the Physical Gold Component and the Cash Weighting will never be negative. The weighting for the Physical Gold Component will not exceed 100%. The combined weightings of the Physical Gold Component and the Cash Weighting will always sum to 100%, and if the weighting of the Physical Gold Component is 100%, then the Cash Weighting will be zero. The calculated weighting for the Physical Gold Component on each Rebalance Date will not be less than 50%.

On each Rebalance Date, the changes to the weightings of the Physical Gold Component and the Cash Weighting as calculated on the Determination Date will be effective for the Index through the next Rebalance Period, and the Trust will rebalance its assets in order to closely replicate the new weightings in the Index. The Index’s weight for the Physical Gold Component is always positive and therefore represents a long position in Physical Gold to the extent of the percentage of Physical Gold represented in the Index. Historically, price returns of the Index exhibit high correlation to the returns of gold as represented by the LBMA Gold Price PM. In periods where the weight of the Physical Gold Component is less than 100%, it is expected that the daily Index price movement will be in the same direction as the daily LBMA Gold Price PM movement, albeit to a lesser extent. The Trust’s daily performance is expected to exhibit the same relationship to the price of the LBMA Gold Price PM to the extent that the Trust’s daily performance tracks that of the Index.

This description of the Index methodology is only a summary, and this and other information about the Index is provided here for informational purposes but is not intended to provide sufficient detail to permit full replication of the Index.

The Trust lists the Shares on the Exchange under the ticker symbol “WGLD”. The market price of the Shares may be different from the NAV per Share. Shares may be purchased from the Trust only by certain eligible financial institutions called Authorized Participants (as defined below) and only in one or more blocks of 10,000 Shares (“Creation Units”). The Trust issues Shares in Creation Units on a continuous basis at the applicable NAV per Share on the creation order date. Except when aggregated in Creation Units, the Shares are not redeemable securities.

The Trust pays the Sponsor a fee that will accrue daily at an annualized rate equal to 0.65% of the daily NAV of the Trust, paid monthly in arrears (the “Sponsor Fee”). The Sponsor Fee is accrued in and payable in U.S. dollars.

Valuation of Gold and Computation of Net Asset Value

The Administrator determines the NAV of the Trust on each day that the Exchange is open for regular trading, as promptly as practical after 4:00 p.m. New York time. The NAV of the Trust is the aggregate value of gold and cash, if any, less liabilities of the Trust, which include estimated accrued but unpaid fees, expenses, and other liabilities. In determining the Trust’s NAV, the Administrator values the gold held by the Trust based on the afternoon London gold price per troy ounce of gold for delivery in London through a member of the London Bullion Market Association (“LBMA”) authorized to effect such delivery, as calculated and administered by independent service provider(s) and published by the LBMA on its website or by its successor that publicly displays prices (the “LBMA PM Gold Price”), or, if such day’s afternoon price is not available, the morning LBMA Gold Price (the “LBMA AM Gold Price”). If no LBMA Gold Price is available for the day, the Administrator will value the Trust’s gold based on the most recently announced LBMA PM Gold Price or LBMA AM Gold Price. If the Sponsor determines that such price is inappropriate to use, it shall identify an alternate basis for evaluation to be employed by the Administrator. The Sponsor may instruct the Administrator to use a different publicly available price, which the Sponsor determines to fairly represent the value of the Trust’s gold.

Results of Operations

Three Months Ended September 30, 2021

For the three months ended September 30, 2021, 14.3 fine ounces of gold were sold to pay expenses. The Trust’s NAV per Share ended the period at $17.38 compared to $17.78 at June 30, 2021. The decrease in NAV per Share was due to a lower price of gold of $1,742.80 at period end, which represented a decrease of 1.15% from $1,763.15 at June 30, 2021. The change in the price of gold and the percentage weighting of gold in the Index contributed to a decrease of 1.27% in the level of the Index during that period. The difference in return of the Trust’s NAV compared to that of the Index was –0.98%.

Nine Months Ended September 30, 2021

For the nine months ended September 30, 2021, 100,001 Shares (inclusive of 10 Baskets that were created upon the launch of the Trust and one Share that was purchased by the Sponsor in a private placement prior to the Trust’s launch) were issued in exchange for cash that was used to purchase 1,136.376 fine ounces of gold, and 176.900 fine ounces of gold were sold to pay expenses. The Trust’s NAV per Share ended the period at $17.38 compared to $18.00 at February 17, 2021. The decrease in NAV per Share was due to a lower price of gold of $1,742.80 at period end, which represented a decrease of 2.13% from $1,780.70 at February 17, 2021. The change in the price of gold and the percentage weighting of gold in the Index contributed to a decrease of 0.51% in the level of the Index during that period. The difference in return of the Trust’s NAV compared to that of the Index was –2.94%.

15

Comparison of Share Price, NAV and wShares Gold Index

At September 30, 2021, the Gold Custodian held 959.476 fine ounces of gold on behalf of the Trust in its vault, with a market value of $1,672,175 (cost: $1,706,106) based on the LBMA PM Gold Price at period end.

The change in net assets from operations for the nine months ended September 30, 2021, was $(62,049), which was due to (i) the Sponsor Fee of $(7,201), (ii) offering costs of $(39,661), (iii) interest expense of $(30), (iv) miscellaneous fee of $(2,265), and (v) a net realized and change in unrealized gain (loss) from investment in gold of $(12,892), which in turn resulted from a net realized gain on gold sold for rebalancing and to pay expenses of $21,039 and a net change in unrealized (depreciation) on investments in gold of $(33,931).

For the three months ended September 30, 2021, the price of the Shares traded on the Exchange decreased from $17.85 per Share to $17.52 per Share. The percentage change of the Share price over the course of the period was a decrease of 1.85%. The difference in return of the price of the Shares compared to the performance of the Index was –0.61%.

For the period ended September 30, 2021 (the Shares commenced trading on February 18, 2021), the price of the Shares traded on the Exchange decreased from $17.96 per Share to $17.52 per Share. The percentage change of the Share price over the course of the period was a decrease of 2.45%. The difference in return of the price of the Shares compared to the performance of the Index was -2.16%.

Historical Information Regarding Movements in the Price of Gold (as Represented by the LBMA Gold Price PM), the Return of the Index and Realized Volatility of the LBMA Gold Price PM and the S&P 500® Index

|

|

Three Months Ended September 30, 2021 |

|

Period Ended September 30, 2021* |

|

Aggregate Return of the LBMA Gold Price PM |

–1.15% |

|

–2.13% |

|

Aggregate Return of the Index |

–1.27% |

|

–0.51% |

|

Realized Volatility of LBMA Gold Price PM |

14.57% |

|

14.13% |

|

Realized Volatility of the S&P 500(R) Index |

10.66% |

|

12.40% |

* The period began at the commencement of the Trust’s operations on February 17, 2021.

Past performance should not be considered indicative of future performance, and current performance may be lower or higher than the performance quoted. The Index has limited historical data and no operating history. The Index’s historical data may not be representative of the Index’s potential performance under other market conditions. Back-tested performance prior to the launch of the Index refers to simulated performance data over the time periods indicated created by applying the Index’s calculation methodology to historical gold prices and, with respect to rebalancings, the levels of the S&P 500® Index. The back-tested performance data does not represent the investment performance of the Trust or the actual accounts of any investors or investment funds. This back-tested performance is designed to allow investors to understand and evaluate the Index methodology by seeing how it would have performed hypothetically during certain time periods. Such simulated performance data may not account for all factors that affect gold prices and the equities markets and are neither an indicator or guarantor of future performance. The back-tested performance data may not reflect the impact that any material market or economic factors might have had on the use of the Index’s methodology if the methodology had been used during the period for the Index. The back-tested Index data only reflects the application of that methodology in hindsight, since the Index was not actually calculated and published prior to November 3, 2020. The back-tested Index data cannot completely account for the impact of financial risk in actual trading. Consequently, you should not rely on that data as a reflection of what the actual Index performance would have been had the Index been in existence or in forecasting future Index performance. Any hypothetical or actual historical upward or downward trend in the level of the Index during any period shown is not an indication that the level of the Index is more or less likely to increase or decrease at any time.

16

The price of gold is volatile and gold prices and realized volatility of gold prices are impacted by a variety of factors. These factors include, but are not limited to: announcements from central banks regarding a country’s reserve gold holdings, fluctuations in the value of the U.S. dollar, gold supply and demand, global or regional political, economic or financial events and situations, especially those unexpected in nature, interest rates in fiat currencies, currency exchange rates, investment and trading activities of large investors, including private and registered trusts, hedge funds and commodity funds, commodity pools, that may directly or indirectly invest in gold, changes in economic variables such as economic output and growth and monetary policies, changes in global gold supply and demand and investor and speculator attitude and confidence toward gold. Further, movements in the price of gold in the past, and any past or present trends, are not a reliable indicator of future movements. Such factors will impact the performance of the Trust and the results of operations on an ongoing basis. The Sponsor cannot predict the impact of such factors.

The returns of the S&P 500® Index are volatile and realized volatility of S&P 500® Index values is impacted by a variety of factors. These factors include, but are not limited to: market fluctuations caused by such factors as economic and political developments, changes in interest rates, perceived trends in securities prices, war, acts of terrorism, the spread of infectious disease or other public health issues, local, regional or global events such as war, acts of terrorism, recessions, changes in the financial condition of the issuers of securities underlying the S&P 500® Index, the value of equity securities generally, market confidence in and perceptions of securities underlying the S&P 500® Index, expectations regarding government, economic, monetary and fiscal policies, inflation and interest rates, economic expansion or contraction, global or regional political, economic and banking crises. Further, movements in the realized volatility of the S&P 500® Index values in the past, and any past or present trends, are not a reliable indicator of future movements. Such factors will impact the performance of the Trust and the results of operations on an ongoing basis. The Sponsor cannot predict the impact of such factors.

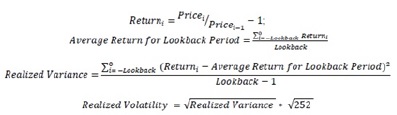

The realized volatility of the LBMA Gold Price PM for the table above is calculated using prices from the LBMA, which are made publicly available at the LBMA’s website (www.lbma.org.uk). Realized volatility of the S&P 500® Index for the table above is calculated using prices from S&P Dow Jones Indices LLC (“S&P”), which are publicly available on S&P’s website (www.spglobal.com/spdji/en/). The Trust and the Sponsor are not affiliated with the LBMA or S&P and do not accept responsibility for, or guarantee the accuracy and/or completeness of, the data included on their websites. Realized volatility is calculated using standard calculation of realized volatility on a price time series of an asset, which is shown below.

“Price” = price time series

“Lookback” = number of days in the lookback period

252 is used as the normalizing constant to convert the realized volatility to an annualized equivalent (i.e., it represents the number of trading days in any given year)

√= Square root operator

∑= Summation operator, addition of all of the inputs calculated by iterating over the business days in the lookback period

2 = Squared operator, the value multiplied by itself

Liquidity and Capital Resources

The Trust is not aware of any trends, demands, commitments, events, or uncertainties that are reasonably likely to result in material changes to its liquidity needs. The Sponsor Fee accrues daily at an annualized rate equal to 0.65% of the daily NAV of the Trust and is payable in U.S. dollars monthly in arrears.

The Administrator, acting pursuant to instructions from the Sponsor, will direct the Cash Custodian to withdraw from the cash account on each Rebalance Date, an amount of U.S. dollars sufficient to pay the Trust’s fees and expenses provided for in the Trust Agreement, and pay such amount to the recipients thereof; provided, however that the Sponsor shall separately instruct the Administrator with respect to the timing for distribution of amounts in respect of redemptions. At September 30, 2021, the Trust had a cash balance of $197.

17

Rebalancing of the Trust’s Assets

On each Rebalance Date, following the calculation of the weighting of the components of the Index, the Trust shall rebalance the Trust’s holdings in Physical Gold and cash in order to closely replicate the Index. In order to affect the monthly rebalancing, the Index Calculation Agent shall provide the percentage weight of the Physical Gold Component and the Cash Component as of the Determination Date to the Administrator and the Sponsor. The Sponsor, based on information provided by the Administrator and the Index Calculation Agent, shall make such determinations and calculations as of each Determination Date (taking into account amounts on deposit in the cash account as of such Rebalance Date and the amount of U.S. dollars necessary to, on such Rebalance Date, pay amounts due and payable by the Trust) as are necessary in order to determine the amount of Physical Gold to purchase or sell.

The Sponsor, on each Rebalance Date, shall instruct the Gold Custodian and the Cash Custodian, respectively, to purchase and/or sell Physical Gold, as applicable. The Administrator shall, on the Rebalance Date, instruct the Cash Custodian to pay amounts due and payable by the Trust as of the Determination Date; provided however that the Sponsor shall separately instruct the Administrator with respect to the timing for distribution of amounts in respect of redemptions.

In addition, the Representative interacts with the Cash Custodian, the Gold Custodian, the Administrator, the Trustee, the Index Calculation Agent and any other third-party service providers to the Trust for the purpose of effecting monthly rebalances of the Trust’s assets on a Rebalance Date, and effecting creations and redemptions.

The Sponsor may exercise discretion in connection with the amount of cash and Physical Gold to hold, purchase and/or sell on each Rebalance Date compared to their weightings in the Index, based on market value fluctuations or other factors occurring between the Determination Date and the Rebalance Date, in order to have the assets of the Trust more closely replicate the Index on such Rebalance Date and shall have no liability in connection therewith so long as it has exercised such discretion in good faith. The Sponsor and the applicable service providers shall use commercially reasonable efforts to effect the purchases, sales and/or payments contemplated on the Rebalance Date, provided that if any such purchases, sales and/or payments are unable to be made on the Rebalance Date, such purchases, sales and/or payments shall be made as soon as practicable thereafter.

Off-Balance Sheet Arrangement

The Trust does not have any off-balance sheet arrangements.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

The Trust is a passive investment vehicle. It is not actively managed. The Trust’s investment objective is to closely reflect the Index, which varies allocations between gold and cash, less the Trust liabilities and expenses. Accordingly, fluctuations in the price of gold will affect the value of the Shares. Fluctuations in realized volatility of the LBMA Gold Price and the S&P 500® Index will affect the Index’s allocations to gold and cash accounting to the Index methodology and will affect the Trust’s exposure to gold. The Trust does not use derivatives or leverage to increase its exposure to gold. The maximum weight of the physical gold in the Trust is 100%.

Item 4. Controls and Procedures.

Disclosure Controls and Procedures

The duly authorized officers of the Sponsor, performing functions equivalent to those a principal executive officer and principal financial officer of the Trust would perform if the Trust had any officers, have evaluated the effectiveness of the Trust’s disclosure controls and procedures, and have concluded that the disclosure controls and procedures of the Trust were effective as of the end of the period covered by this report. Such disclosure controls and procedures are designed to provide reasonable assurance that information required to be disclosed in the reports that the Trust files or submits under the Securities Exchange Act of 1934, as amended, are recorded, processed, summarized and reported, within the time period specified in the applicable rules and forms, and that such information is accumulated and communicated to the duly authorized officers of the Sponsor performing functions equivalent to those a principal executive officer and principal financial officer of the Trust would perform if the Trust had any officers, and to the Sponsor, as appropriate, to allow timely decisions regarding required disclosure.

Internal Control over Financial Reporting

There has been no change in the internal control over financial reporting that occurred during the fiscal period that has materially affected, or is reasonably likely to materially affect, the Trust’s internal control over financial reporting.

18

Part II. OTHER INFORMATION.

Item 1. Legal Proceedings.

The Trust is not aware of any existing or pending legal proceedings against it, nor is it involved as a plaintiff in any proceeding or pending litigation.

Item 1A. Risk Factors.

You should carefully consider the risks and uncertainties described in the Trust’s amended and restated prospectus filed on April 16, 2021 (file no. 333-235913) pursuant to Rule 424(b)(3) under the Securities Act, as amended to date (the “Prospectus”) and the other information contained in the Prospectus before making an investment decision. The risks set forth in the Prospectus are not the only ones facing the Trust. Additional risks and uncertainties may exist that could also adversely affect the Trust.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

a) None.

b) Not applicable.

c) The Trust does not purchase Shares directly from its Shareholders. In connection with its redemption of baskets held by Authorized Participants, the Trust redeemed 0 baskets (comprising 0 Shares) during the three months ended September 30, 2021. The following table summarizes the redemptions by Authorized Participants during the period:

|

Period |

|

Total |

|

Average Price Per |

|

|

7/1/21 to 7/31/21 |

|

— |

|

$ |

— |

|

8/1/21 to 8/31/21 |

|

— |

|

$ |

— |

|

9/1/21 to 9/30/21 |

|

— |

|

$ |

— |

|

Total |

|

— |

|

|

|

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Mine Safety Disclosures.

None.

Item 5. Other Information.

None.

Item 6. Exhibits.

See the Exhibit Index below, which is incorporated by reference herein.

19

EXHIBIT INDEX

|

Exhibit No. |

Description of Exhibit |

|

1.1 |

Form of Authorized Participant Agreement |

|

4.1 |

Amended and Restated Trust Agreement |

|

4.1.1 |

Second Amended and Restated Trust Agreement |

|

4.2 |

Certificate of Trust (attached as Exhibit A to the Second Amended and Restated Trust Agreement) |

|

5.1 |

Form of Opinion of Seward & Kissel LLP as to legality of Shares |

|

8.1 |

Form of Opinion of Seward & Kissel LLP as to tax matters |

|

10.1* |

Gold Custodian Agreement (Allocated Gold) |

|

10.2* |

Gold Custodian Agreement (Unallocated Gold) |

|

10.3 |

Cash Custodian Agreement |

|

10.4* |

Index Calculation Agreement |

|

10.5 |

Fund Administration and Accounting Agreement |

|

10.6* |

Marketing Agent Agreement |

|

10.7 |

First Amendment to Marketing Agent Agreement |

|

10.8 |

Transfer Agency and Service Agreement |

|

10.9* |

Sponsor Representative Services Agreement |

|

10.10 |

Sublicense Agreement |

|

23.2 |

Consent of Seward & Kissel LLP (included in Exhibit 5.1) |

|

23.3 |

Consent of Seward & Kissel LLP (included in Exhibit 8.1) |

|

104 |

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

|

101.SCH |

XBRL Taxonomy Extension Schema Document |

|

101.CAL |

XBRL Taxonomy Extension Calculation Linkbase Document |

|

101.LAB |

XBRL Taxonomy Extension Label Linkbase Document |

|

101.PRE |

XBRL Taxonomy Extension Presentation Linkbase Document |

|

101.DEF |

XBRL Taxonomy Extension Definition Linkbase Document |

* Portions of these exhibits have been omitted as permitted by the rules and regulations of the SEC.

20

Signatures

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned in the capacities* indicated thereunto duly authorized.

Wilshire Phoenix Funds, LLC

Sponsor of the Trust

|

By: |

/s/ William Herrmann* |

|

|

|

William Herrmann |

|

|

|

Managing Partner |

|

|

|

(serving in the capacity of principal executive officer) |

|

Date: November 15, 2021

* The registrant is a trust and the person is signing in his capacity as an officer of Wilshire Phoenix Funds, LLC, the Sponsor of the Registrant.

21