Table of Contents

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Title of each class |

Trading Symbol |

Name of each exchange on which registered | ||

| * | t for trading, but only in connection with the registration of the American Depositary Shares. |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ☐ | Emerging growth company |

| International Financial Reporting Standards as issued by the International Accounting Standards Board | ☐ | Other ☐ |

Table of Contents

TABLE OF CONTENTS

Table of Contents

About this annual report

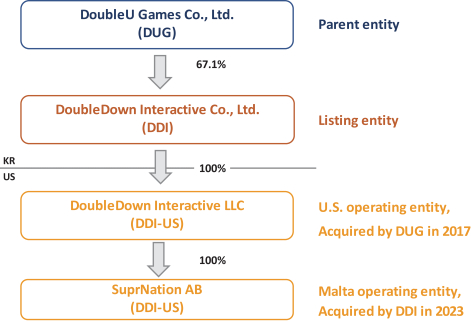

As used in this annual report, unless the context otherwise requires or otherwise states, (a) references to “we,” “us,” “our,” the “Company,” “our Company” and similar references refer to DoubleDown Interactive Co., Ltd., a corporation with limited liability organized under the laws of Korea, which is sometimes referred to in this annual report as “DDI,” its Korean subsidiary, Double8 Games Co., Ltd. (“Double8 Games”), its U.S. subsidiary, DoubleDown Interactive, LLC, a Washington limited liability company (“DDI-US”), and DDI-US’ wholly-owned subsidiary, SuprNation AB, a Swedish limited liability company with operations based in Malta (“SuprNation”), and (b) references to “DoubleU Games” or “DUG” refer to DoubleU Games Co., Ltd., a Korean company and our controlling shareholder.

References herein to “STIC” refer to STIC Special Situation Private Equity Fund and its wholly-owned affiliate, unless the context otherwise requires.

We have made rounding adjustments to some of the figures included in this annual report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them. The terms “dollar,” “USD,” “US$” or “$” refer to the legal currency of the United States. Currency amounts in this annual report are stated in dollars, unless otherwise indicated. Our reporting currency is the U.S. dollar, and our functional currencies are the Korean Won, or KRW or “(Won)”, and the Euro (“EUR” or “€”). Unless otherwise indicated, convenience translations included in this annual report of Korean Won into U.S. dollars and the Euro into U.S. dollars have been made at the rate of KRW1,290.97 = US$1.00 and €1.1062 = US$1.00, respectively, as reported by the Board of Governors of the Federal Reserve System on December 29, 2023. Historical and current exchange rate information of the Korean Won against the U.S. dollar may be found at https://www.federalreserve.gov/releases/h10/hist/dat00_ko.htm. Historical and current exchange rate information of the Euro against the U.S. dollar may be found at https://www.federalreserve.gov/releases/h10/hist/dat00_eu.htm.

Our financial statements are prepared in accordance with U.S. generally accepted accounting principles, or U.S. GAAP. Our fiscal year ends on December 31 of each year as does our reporting year. Therefore, any references to 2023, 2022 and 2021 are references to the fiscal and reporting years ended December 31, 2023, December 31, 2022 and December 31, 2021, respectively. See Note 2: Significant accounting policies to our audited consolidated financial statements for a discussion of the basis of presentation, functional currency and translation of financial statements.

Non-GAAP measures

In addition to U.S. GAAP measures, we also use Adjusted EBITDA, as described under “Item 5. Operating and Financial Review and Prospects—Other key performance indicators and non-GAAP metrics and trends—Adjusted EBITDA,” and Adjusted EBITDA margin in various places in this annual report. These financial measures are presented as supplemental disclosure and should not be considered in isolation of, as a substitute for, or superior to, the financial information prepared in accordance with U.S. GAAP, and should be read in conjunction with the financial statements included elsewhere in this annual report. Adjusted EBITDA and Adjusted EBITDA margin may differ from similarly titled measures presented by other companies.

Please see “Item 5B. Operating Results—Reconciliation of non-GAAP measures” for a reconciliation of non-GAAP financial measures to the most directly comparable financial measure calculated in accordance with U.S. GAAP.

i

Table of Contents

Market and industry data

This annual report contains references to industry market data and certain industry forecasts. Industry market data and industry forecasts are obtained from publicly available information and industry publications. Industry publications generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of that information is not guaranteed. Although we believe industry information to be accurate, it is not independently verified by us. In general, we believe there is less publicly available information concerning international social gaming industries than the same industries in the United States. Some data is also based on our good faith estimates, which are derived from our review of internal surveys or data, as well as the independent sources referenced above. Assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Item 3D. Risk Factors.” These and other factors could cause future performance to differ materially from our assumptions and estimates. See “Cautionary Note Regarding Forward-Looking Statements.”

ii

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Various statements contained in this annual report, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning our possible or assumed future results of operations, financial condition, business strategies and plans, market opportunity, competitive position, industry environment, and potential growth opportunities. In some cases, you can identify forward-looking statements by terms such as “may”, “will”, “should”, “believe”, “expect”, “could”, “intend”, “plan”, “anticipate”, “estimate”, “continue”, “predict”, “project”, “potential”, “target,” “goal” or other words that convey the uncertainty of future events or outcomes. You can also identify forward-looking statements by discussions of strategy, plans or intentions. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, because forward-looking statements relate to matters that have not yet occurred, they are inherently subject to significant business, competitive, economic, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including, among others, those discussed in this annual report under the headings “Risk Factors”, “Operating and Financial Review and Prospects” and “Our Business”, may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements in this annual report. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements in this annual report include:

| • | our ability to attract and retain players; |

| • | our expectations regarding the growth rates of our active users, payer conversion rate and revenue per daily active user; |

| • | our reliance on third-party platforms; |

| • | our ability to continue to launch and enhance games that attract and retain a significant number of paying players; |

| • | our reliance on a small percentage of our players for nearly all of our revenue; |

| • | our ability to adapt to, and offer games that keep pace with, changing technology and evolving industry standards; |

| • | competition; |

| • | our ability to use the intellectual property rights of our controlling shareholder, DoubleU Games, and other third parties, including the third-party intellectual property rights licensed to us by International Game Technology PLC (“IGT”); |

| • | the impact of the COVID-19 pandemic and any resulting social, political, economic and financial complications; |

| • | protection of our proprietary information and intellectual property, inability to license third-party intellectual property and the intellectual property rights of others; |

| • | security and integrity of our games and systems; |

| • | security breaches, cyber-attacks or other privacy or data security incidents, challenges or disruptions; |

| • | reliance on or failures in information technology and other systems; |

| • | the impact of legal and regulatory restrictions on our business, including significant opposition in some jurisdictions to interactive social gaming, including social casino gaming, and how such opposition could lead these jurisdictions to adopt legislation or impose a regulatory framework to govern interactive social gaming or social casino gaming specifically, and how this could result in a |

iii

Table of Contents

| prohibition on interactive social gaming or social casino gaming altogether, restrict our ability to advertise our games, or substantially increase our costs to comply with these regulations; |

| • | laws and government regulations, both foreign and domestic, and to data privacy and security, including with respect to the collection, storage, use, transmission, sharing and protection of personal information and other consumer data, and those laws and regulations that affect companies conducting business on the internet, including ours; |

| • | the continuing evolution of the scope of data privacy and security regulations, and our belief that the adoption of increasingly restrictive regulations in this area is likely within the U.S. and other jurisdictions; |

| • | our ability to complete acquisitions and integrate businesses successfully; |

| • | our ability to pursue and execute new business initiatives; and |

| • | U.S. and international economic and industry conditions. |

Given the foregoing risks and uncertainties, you are cautioned not to place undue reliance on the forward-looking statements in this annual report. The forward-looking statements contained in this annual report are not guarantees of future performance and our actual results of operations and financial condition may differ materially from such forward-looking statements. In addition, even if our results of operations and financial condition are consistent with the forward-looking statements in this annual report, they may not be predictive of results or developments in future periods.

Any forward-looking statement that we make in this annual report speaks only as of the date of this annual report. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements in this annual report, whether as a result of new information, future events or otherwise, after the date of this annual report.

iv

Table of Contents

PART I.

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

| A. | [RESERVED] |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

We operate in a dynamic and rapidly changing industry that involves numerous risks and uncertainties. You should carefully consider the factors described below, together with all of the other information contained in this annual report, including our audited consolidated financial statements and the related notes included in this annual report. These risk factors are not presented in the order of importance or probability of occurrence. If any of the following risks actually occurs, our business, financial condition and results of operations could be materially and adversely affected. Some statements in this annual report, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

As used in this annual report, the terms “the Company”, “our Company”, “DDI”, “we”, “our” or “us” may, depending upon the context, refer solely to the Company, to one or more of the Company’s consolidated subsidiaries or to all of them taken as a whole.

Summary Risk Factors

The following is a summary of some of the risks and uncertainties that could materially adversely affect our business, financial condition and results of operations. You should read this summary together with the more detailed description of each risk factor contained below.

| • | Our profitability may be affected by the rate and manner at which we successfully manage our current and future growth. |

| • | We rely on a small percentage of our players for all of our revenue. |

| • | To date, we have been reliant upon our DoubleDown Casino game for substantially all of our revenue. |

| • | We rely substantially on third-party platforms to make our games available to players and to collect revenue. |

| • | Certain social opposition to interactive gaming or potential issues relating to social casino games could adversely impact our business and limit the growth of our operations. |

| • | We rely on the ability to use the intellectual property of third parties, particularly IGT and DUG, for a substantial portion or our content and other features incorporated into our games. |

| • | Our business depends on our ability to protect proprietary information and our owned and licensed intellectual property. |

1

Table of Contents

| • | The intellectual property rights of others may prevent us from developing new games and/or entering new markets, or may expose us to costly litigation. |

| • | Our success depends upon our ability to adapt to and offer games that keep pace with changing technology and evolving industry standards. |

| • | Legal proceedings can materially adversely affect our business and our results of operations, cash flows, and financial condition. |

| • | Data privacy and security laws and regulations could increase the cost of our operations and subject us to possible sanctions or penalties. |

| • | We operate in a highly competitive industry, and our success depends on our ability to effectively compete. |

| • | Our success depends on the security and integrity of the games we offer, and cyber-attacks, security breaches, or other disruptions could compromise our information or the information of our players and expose us to liability, which would cause our business and reputation to suffer. |

Risks Related to Our Business and Industry

Our profitability may be affected by the rate at which we grow our business. The inability to successfully manage our current and future growth may materially and adversely affect our results of operations and financial condition.

We have grown the business since the acquisition of DDI-US from IGT in 2017 and we intend to continue to expand the scope and geographic relevance of the games we provide. Achieving our growth strategy will depend, in large part, upon the rate at which we are able to attract and retain paying players to our games, create engaging content, and expand geographically.

Our ability to increase the number of players of our games will depend on continued player adoption of online social casino and other forms of casual online gaming. Growth in the online gaming industry and the level of demand for and market acceptance of our games are subject to a high degree of uncertainty. We expect that the overall number of our customers and the amount that they are willing to invest in our games will fluctuate from time to time. The rate at which we acquire paying players may be affected by increased competition, general economic conditions, and other factors. In addition, we may not be successful in providing sufficient incentives and creating engaging content to retain our existing customers and attract new customers. If we are unable to successfully acquire, retain, and monetize players who make purchases in our games, our operations and financial condition will be adversely affected and our profitability may decline.

In addition, we hope to grow our player base through geographic expansion of our markets, particularly in Asia-Pacific and Western Europe. However, significant growth in such markets may not be successful if we do not plan the timing of the expansion appropriately, understand the social and other factors driving player participation in such markets so that we can adapt our content accordingly, and effectively navigate the regulatory environment in which we may be required to operate. If we are unable to properly and prudently manage our operations as we continue to grow, if the quality of our games deteriorates, or if we are unable to provide suitable incentives and content, our name and reputation could be severely harmed, and our business, prospects, financial condition, and results of operations could be adversely affected.

We rely on a small percentage of our players for all of our revenue.

Our games are available to players for free, and we generate revenue from players only if they voluntarily purchase virtual chips above and beyond the level of free virtual chips provided periodically as part of the games. In particular, we monitor the number of players who make a purchase to assess any periodic changes in behavior and associated trends. Average MPUs, or the average number of players who made a purchase at least once in a

2

Table of Contents

month, decreased from 2022 to 2023, while our overall payer conversion rate has increased from 5.4% in 2022 to 6.4% in 2023. Our paying players may stop making purchases in our games or playing our games altogether at any time. In order to sustain or increase our revenue levels, we must increase the amount our players spend in our games and/or increase the number of players who purchase virtual chips. To retain paying players, we must devote significant resources so that the games they play retain their interest and motivate them to purchase virtual chips through incentives and engaging content. If the average amount spent by our paying players declines, if we fail to offer games that sufficiently incentivize players to purchase our virtual chips, or if we fail to properly manage the economics of free versus paid chips, our business, financial condition, and results of operations could be materially and adversely affected.

Our DoubleDown Casino game has generated substantially all of our revenue, and we intend to continue to refresh content and launch new games in order to attract and retain a significant number of paying players to grow our revenue and sustain our competitive position.

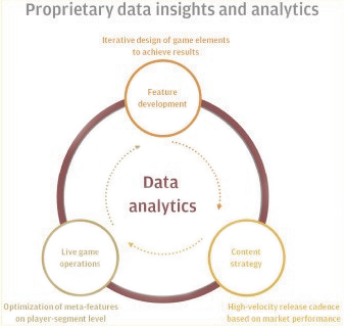

Historically, DoubleDown Casino has accounted for substantially all our revenue (2023: 96.3%; 2022: 96.7%), and we expect that this dependency will continue for the foreseeable future while we endeavor to further diversify our portfolio through the addition of new games. See “Item 4B. Business Overview—Our games.” Our growth will depend, in part, on our ability to consistently refresh content for our existing games to promote engagement with our players, as well as launch new games that achieve significant popularity. However, as we add new games to our portfolio, certain of our players may leave existing games, such as DoubleDown Casino, and move to a new offering. As we refresh content and develop new games, we expend significant resources in research and development, analytics, marketing, and others to design, test, and launch refreshed content and our new games.

Our ability to successfully and timely design, test, and launch our games and provide refreshed content, as well as attract and retain paying players, largely depends on our ability to, among other things:

| • | analyze player demographics and effectively respond to changing player interests and preferences and the competitive landscape; |

| • | enhance existing games with refreshed content and develop new games that, in each case, are interesting and compelling and that incentivize players to purchase virtual chips on a regular basis; |

| • | effectively develop new social and geographic markets for our games; |

| • | minimize delays and cost overruns on development and launch of refreshed content for existing games and of new games; and |

| • | expand our proprietary portfolio of games through organic growth and licensed third-party content. |

If we do not successfully extend the life of our existing games and launch games that attract and retain a significant number of paying players, our market share, reputation, and financial results could be harmed. In addition, if the popularity of any of our most successful games decreases significantly, it would have a material adverse effect on our results of operations, cash flows, and financial condition. We cannot assure that our initiatives to improve our player experience will always be successful.

We rely substantially on third-party platforms to make our games available to players and to collect revenue.

Our games are distributed through several main platform providers, including Apple, Facebook, Google, and Amazon, which also provide us valuable information and data, such as the rankings of our games. Substantially all of our revenue is generated by players using those platforms. Consequently, our expansion and prospects depend on our continued relationships with these providers, and any emerging platform providers that are widely adopted by our target player base in the geographic markets in which we operate.

3

Table of Contents

We are subject to the standard terms and conditions that these platform providers have for application developers, which govern the promotion, distribution and operation of games and other applications on their platforms, and which the platform providers can change unilaterally on short or no notice. Our business would be harmed if:

| • | the platform providers discontinue or limit our access to their platforms; |

| • | governments or private parties, such as internet providers, impose bandwidth restrictions, increase charges, or restrict or prohibit access to those platforms; |

| • | the platforms modify their current discovery mechanisms, communication channels available to developers, respective terms of service, or other policies, including fees; |

| • | the platforms adopt changes or updates to their technology that impede integration with other software systems, such as Adobe Flash or others, or otherwise require us to modify our technology or update our games in order to ensure players can continue to access our games and content with ease; |

| • | the platforms impose restrictions or make it more difficult for players to buy our virtual chips; or |

| • | the platforms develop their own competitive offerings. |

If alternative platforms increase in popularity, we could be adversely impacted if we fail to create compatible versions of our games in a timely manner, or if we fail to establish a relationship with such alternative platforms. Likewise, if our existing platform providers alter their operating platforms or browsers, we could be adversely impacted as our offerings may not be compatible with the altered platforms or browsers or may require significant and costly modifications in order to become compatible. If our platform providers were to develop competitive offerings, either on their own or in cooperation with one or more competitors, our growth prospects could be negatively impacted. If our platform providers do not perform their obligations in accordance with our platform agreements, we could be adversely impacted.

In the past, some of these providers’ platforms have been unavailable for short periods of time or experienced issues with certain features. If such events occur on a prolonged basis or other similar issues arise that impact players’ ability to download our games, access social features, or purchase virtual chips, it could have a material adverse effect on our revenue, operating results, and reputation.

Certain social opposition to interactive gaming or potential issues relating to social casino games could adversely impact our business and limit the growth of our operations.

There is certain opposition in some jurisdictions to interactive online gaming, including social casino games. In September 2018, the World Health Organization added “gaming disorder” to the International Classification of Diseases, defining the disorder as a pattern of behavior characterized by impaired control over gaming and an increase in the priority of gaming over other interests and daily activities. Some states or countries have anti-gaming groups that specifically target social casino games. Such opposition could lead these jurisdictions to adopt legislation or impose a regulatory framework to govern interactive social gaming or social casino games specifically and which could require us to comply with stringent regulations and/or require us to modify our operations in order to comply. These could result in a prohibition on interactive online gaming or social casino games altogether, restrict our ability to advertise our games, encourage our existing platform partners to restrict our ability to deploy our games through their media, or substantially increase our costs to comply with these regulations, all of which could have an adverse effect on our results of operations, cash flows, and financial condition. We cannot predict the likelihood, timing, scope, or terms of any such legislation or regulation or the extent to which they may affect our business. In addition, certain third-party distribution platforms on which we rely have had lawsuits brought against them for servicing social casino games, which may limit our access to such platforms.

On September 17, 2018, 15 international gambling regulators, plus the Washington State Gambling Commission, signed a declaration expressing concern “with the risks posed by the blurring of lines between

4

Table of Contents

gambling and other forms of digital entertainments such as video gaming,” including, among others, social casino gaming. The regulators committed to work together to analyze the characteristics of video games and social gaming, and to engage in an informed dialogue with the video game and social gaming industries to ensure the appropriate and efficient implementation of applicable laws and regulations. The regulators also indicated they would work closely with their consumer protection enforcement agencies. Several other gambling regulators have joined as new signatories to the declaration since its publication. We cannot predict the likelihood, timing, scope, or terms of any actions taken as a result of the declaration.

Consumer protection concerns regarding games such as ours have been raised in the past and may again be raised in the future. These concerns include (i) whether social casino games may be shown to serve as a gateway for adolescents to monetary gambling, and (ii) a concern that social casino gaming companies are using big data and advanced technology to predict and target “vulnerable” users who may spend significant time and money on social casino games in lieu of other activities. Such concerns could lead to increased scrutiny, including the potential imposition of a regulatory framework, over the manner in which our games are designed, developed, distributed, and presented. It is difficult for us to monitor and enforce age or other jurisdictional restrictions with respect to players who download or play our games, as we rely on third-party distribution platforms such as Apple App Store, Facebook, Google Play Store, and Amazon Appstore. We cannot predict the likelihood, timing, or scope of any concern reaching a level that will impact our business, or whether, as a result, we would suffer any adverse impacts to our results of operations, cash flows, financial condition, and reputation.

We rely on the ability to use the intellectual property rights of third parties, and we may lose the benefit of some of the intellectual property licensed to us if the license agreements are terminated.

Substantially all of the content and related intellectual property incorporated into our games are licensed from third parties, in particular IGT and DUG. Since June 2017, we have been party to a Game Development, Distribution and Services Agreement with IGT (which we refer to as the “IP License Agreement”), pursuant to which we are granted the right to develop and distribute certain IGT game titles and related intellectual property. Under the IP License Agreement, we expect, but cannot guarantee, that we will be able to continue to receive those rights on favorable or reasonable terms. In addition, although IGT has the right to terminate the IP License Agreement for cause, we will retain exclusive, perpetual, and irrevocable use of any IGT intellectual property already used by us for games launched before June 1, 2020 (excluding third party rights that IGT no longer has rights to itself), except in limited circumstances. For each slot game first launched in the social online game field starting on June 1, 2020, the license from IGT is non-exclusive, perpetual and irrevocable. See “Item 4B. Business Overview—Intellectual property.” In addition, we have licensing arrangements with our controlling shareholder, DUG, since March 2018, pursuant to which we are granted an exclusive license to develop and distribute certain of their social casino game titles and sequels, subject to our payment of customary terms and license fees. As of December 31, 2023, we license approximately 49 game titles that are actively offered to players. We expect, but cannot guarantee, that we will be able to continue to receive those rights on favorable or reasonable terms. See “Item 4B. Business Overview—Intellectual property.”

The future success of our business will depend, in part, on our ability to retain or expand intellectual property licenses. We cannot assure that these third-party licenses will continue to be available to us on commercially reasonable terms, if at all. Further, existing and future license arrangements containing royalty provisions could cause us to incur impairment charges in connection with minimum guarantees. To address these risks, we have increased our research and development capabilities in order to create proprietary intellectual property, including content, although there is no guarantee we will be able to create content that receives sufficient acceptance from the market or that is developed in a timely manner. In the event that we are unable to create such content and, in addition, if we lose the benefit of, or cannot renew and/or expand existing licenses with IGT and DUG, we may be required to discontinue or limit our use of certain game titles and related technologies that include or incorporate the licensed intellectual property.

5

Table of Contents

Our business depends on the protection of our proprietary information and our owned and licensed intellectual property.

We believe that our success depends in part on protecting our owned and licensed intellectual property in the United States and other countries. Our intellectual property includes certain patents, trademarks and copyrights relating to our games, and proprietary or confidential information that is not subject to formal intellectual property protection. Much of our intellectual property that is significant to our business is owned by DoubleU Games or IGT and licensed to us, and we do not control the protection and maintenance of such intellectual property from third parties and must rely on DoubleU Games or IGT to protect and maintain such intellectual property. Our success may depend, in part, on our and our licensors’ ability to protect the trademarks, trade dress, names, logos, or symbols under which we market our games and to obtain and maintain patent, copyright, and other intellectual property protection for the technologies, designs, software, and innovations used in our games and our business. We cannot assure that we will be able to build and maintain consumer value in our proprietary trademarks and copyrights or otherwise protect our technologies, designs, software, and innovations or that any patent, trademark, copyright, or other intellectual property right will provide us with competitive advantages.

We also rely on trade secrets and proprietary knowledge. We enter into confidentiality agreements with our employees and independent contractors regarding our trade secrets and proprietary information, but we cannot assure that the obligation to maintain the confidentiality of our trade secrets and proprietary information will be honored by such individuals.

In the future we may make claims of infringement against third parties or make claims that third-party intellectual property rights are invalid or unenforceable. These claims could cause us to incur greater costs and expenses in the protection of our intellectual property and could potentially negatively impact our intellectual property rights, for example, by causing one or more of our intellectual property rights to be ruled or rendered unenforceable or invalid.

Despite our efforts to protect our intellectual property rights, the steps we take in this regard might not be adequate to prevent or deter infringement or other misappropriation of our intellectual property by competitors or other third parties.

The intellectual property rights of others may prevent us from developing new games and/or entering new markets, or may expose us to liability or costly litigation.

Our success depends in part on our ability to continually adapt our games to incorporate new technologies as well as intellectual property related to game mechanics and procedures, and to expand into markets that may be created by these new developments. If technologies are protected by the intellectual property rights of our competitors or other third parties, we may be prevented from introducing games based on these technologies or expanding into markets created by these technologies.

We cannot assure that our business activities and games will not infringe upon the proprietary rights of others, or that other parties will not assert infringement claims against us. A successful claim of infringement by a third party against us, our games or one of our licensees in connection with the use of our technologies, game mechanics or procedures, or an unsuccessful claim of infringement made by us against a third party or its products or games, could adversely affect our business or cause us financial harm. Any such claim and any resulting litigation, should it occur, could:

| • | be expensive and time-consuming to defend or require us to pay significant amounts in damages; |

| • | result in invalidation of our proprietary rights or render our proprietary rights unenforceable; |

| • | cause us to cease making, licensing, or using games that incorporate the intellectual property; |

| • | require us to redesign, reengineer, or rebrand our games or limit our ability to bring new games to the market in the future; |

6

Table of Contents

| • | require us to enter into costly or burdensome royalty, licensing, or settlement agreements in order to obtain the right to use a product or process; |

| • | impact the commercial viability of the games that are the subject of the claim during the pendency of such claim; or |

| • | require us to stop offering the infringing games. |

Our success depends upon our ability to acquire and retain players, as well as adapt to and offer games that keep pace with changing technology and evolving industry standards.

Our ability to acquire and retain players is largely driven by our success in maintaining and increasing the quantity and quality of games in our portfolio. To satisfy players, we need to continue to improve their online gaming experience and innovate and introduce games that our players find more rewarding to play than those of our competitors. This will require us to, among other things, continue to improve our technology, game mechanics, and procedures to optimize search results for our games, tailor our game offerings to additional geographic and demographic market segments, and improve the user-friendliness of our games, while working to minimize the risk that players will be diverted from our existing games to one of our new games resulting in reduced purchases by those players. Our ability to anticipate or respond to changing technology and evolving industry standards and to develop and introduce new and enhanced games on a timely basis, or at all, is a significant factor affecting our ability to remain competitive and expand and attract new players. We cannot assure that we will have the financial and technical resources needed to introduce new games on a timely basis, or at all.

Further, as technological or regulatory standards change and we modify our games to comply with those standards, we may need players to take certain actions to continue playing, such as downloading a new game, performing age-gating checks or accepting new terms and conditions. Players may stop using our games at any time, including if the quality of the player experience on our games and our support capabilities in the event of a problem do not meet their expectations or keep pace with the quality of the player experience generally offered by competitive games and services.

Our players depend on our support organization to resolve any issues relating to our games. Our ability to provide effective support is largely dependent on our ability to attract, resource, and retain employees who are not only qualified to support players of our games, but are also well versed in our games. Any failure to maintain high-quality support, or a market perception that we do not maintain high-quality support, could harm our reputation, adversely affect our ability to sell virtual chips within our games to existing and prospective players, and adversely impact our results of operations, cash flows, and financial condition.

Legal proceedings can materially adversely affect our business and our results of operations, cash flows, and financial condition.

We have been party to, and in the future may become subject to additional, legal proceedings in the operation of our business, including, but not limited to, with respect to consumer protection, gaming-related matters, employee matters, alleged service and system malfunctions, alleged intellectual property infringement, and claims relating to our contracts, licenses, and strategic investments.

For example, in April 2018, a class-action lawsuit was filed against DDI-US demanding a return of unfair benefit under the pretext that our social casino games are not legal in the State of Washington, United States (the “Benson case”). On August 29, 2022, DDI-US entered into an agreement in principle to settle the Benson case and associated proceedings, pursuant to which, among other things, DDI-US would contribute $145.25 million to the settlement fund. As a result of the settlement, we accrued $141.8 million and $3.5 million in expenses in 2022 and 2021, respectively, related to the incremental loss associated with the Benson case and related claims. See Note 12: Commitments and contingencies to our audited consolidated financial statements included

7

Table of Contents

elsewhere in the annual report. This agreement in principle received final court approval with the final contribution to the settlement fund made in June 2023. We had an accrual of $95.25 million for the year ended December 31, 2022, which was cleared by a $95.25 million payment in the second quarter of 2023.

In the future, additional legal proceedings or regulatory investigations targeting our social casino games and claiming violations of state or federal laws could also occur in other states, based on the unique and particular laws of each jurisdiction. We could, in connection with any such proceedings or regulatory actions, including as a result of the Benson case, be restricted from operating social casino games in certain states, or be required to make modifications to the operation of one or more of our games, or have to pay significant damage awards or settlement amounts. We cannot predict the likelihood, timing, or scope of the consequences of such an outcome, or the outcome of any other legal proceedings to which we may be a party, any of which could have a material adverse effect on our results of operations, cash flows, or financial condition.

Our global operations expose us to business and legal risks, which could restrict or limit our ability to execute our strategy.

Substantially all of our revenues are currently generated through DDI-US in the United States. Our headquarters and significant game development operations are based in Seoul, Korea. We are subject to risks customarily associated with such global operations, including: the complexity of laws, regulations, and markets in the countries in which we operate; the uncertainty of enforcement of remedies in certain jurisdictions; the effect of currency exchange rate fluctuations; export control laws; the impact of foreign labor laws and disputes; the ability to attract and retain key personnel; the economic, tax, and regulatory policies of local governments; compliance with applicable anti-money laundering, anti-bribery, and anti-corruption laws, including the Foreign Corrupt Practices Act, The Improper Solicitation and Graft Act of Korea, and other anti-corruption laws that generally prohibit persons and companies and their agents from offering, promising, authorizing, or making improper payments to foreign government officials for the purpose of obtaining or retaining business; and compliance with applicable sanctions regimes regarding dealings with certain persons or countries. Certain of these laws also contain provisions that require accurate recordkeeping and further require companies to devise and maintain an adequate system of internal accounting controls.

If we adopt policies and controls that are ineffective or an employee or intermediary fails to comply with the applicable regulations, we may be subject to criminal and civil sanctions and other penalties. Any such violation could disrupt our business and adversely affect our reputation, results of operations, cash flows, and financial condition. In addition, our business operations could be interrupted and negatively affected by terrorist activity, political unrest, or other economic or political uncertainties. Moreover, countries, including in particular Korea, the United States, and Malta could impose tariffs, quotas, trade barriers, and other similar restrictions that adversely impact the international nature of our business.

Further, our ability to expand successfully in other countries involves other risks, including difficulties in integrating local operations, risks associated with entering jurisdictions in which we may have little experience in the day-to-day management of a growing and increasingly geographically diverse company. We may not realize the operating efficiencies, competitive advantages or financial results that we anticipate from our investments in countries other than Korea and the United States.

In addition, from time to time, we pursue strategic acquisitions. Our ability to succeed in implementing our strategy will depend, to a certain degree, upon our ability to identify and complete commercially viable acquisitions. We cannot assure that acquisition opportunities will be available on acceptable terms or at all, or that we will be able to obtain necessary financing or regulatory approvals to complete potential acquisitions. Furthermore, we may not be able to successfully integrate any businesses that we acquire or do so within the intended timeframes. We could face significant challenges in managing and integrating our acquisitions and our combined operations, and the expected cost synergies or any other anticipated benefits associated with such acquisitions may not be fully realized in the anticipated amounts or within the contemplated timeframes or cost

8

Table of Contents

expectations, which could result in increased costs and have an adverse effect on our prospects, results of operations, cash flows and financial condition.

In October 2023, we completed the acquisition of SuprNation, an iGaming operator with its main operations in Western Europe. See Note 14: Acquisition to our audited consolidated financial statements included elsewhere in this annual report. SuprNation’s growth prospects depend on the legal status of real-money gaming in various jurisdictions, and legalization may not occur in as many jurisdictions as we expect, or may occur at a slower pace than we anticipate. Additionally, even if jurisdictions legalize real money gaming, this may be accompanied by legislative or regulatory restrictions and/or taxes that make it impracticable or less attractive to operate in those jurisdictions, or the process of implementing regulations or securing the necessary licenses to operate in a particular jurisdiction may take longer than we anticipate, or existing laws or regulations may be changed or interpreted adversely, any of which could adversely affect SuprNation’s future results of operations and make it more difficult to meet our expectations for its financial performance.

Failure to comply with regulatory requirements in a particular jurisdiction, or the failure to successfully obtain a license or permit applied for in a particular jurisdiction, could impact SuprNation’s ability to comply with licensing and regulatory requirements in other jurisdictions, or could cause the rejection of license applications or cancellation of existing licenses in other jurisdictions, or could cause financial institutions, online and mobile platforms, advertisers and distributors to stop providing services to Supernation which it relies upon to receive payments from, or distribute amounts to, its users, or otherwise to deliver and promote our product offerings and services.

Compliance with the various regulations applicable to iGaming is costly and time-consuming. Although our wholly-owned subsidiary, SuprNation, currently has its main operations in Europe, non-U.S. regulatory authorities have broad powers with respect to the regulation and licensing of real money gaming operations and may revoke, suspend, condition or limit SuprNation’s real money gaming licenses, impose substantial fines on SuprNation and take other actions, any one of which could have a material adverse effect on our business, financial condition, results of operations and prospects. These laws and regulations are dynamic and subject to potentially differing interpretations, and various legislative and regulatory bodies may expand current laws or regulations or enact new laws and regulations regarding these matters. We endeavor to ensure that SuprNation will comply with all applicable laws and regulations relating to its business. It is possible, however, that these requirements may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules. Non-compliance with any such law or regulations could expose us, through SuprNation, to claims, proceedings, litigation and investigations by private parties and regulatory authorities, as well as substantial fines and negative publicity, each of which may materially and adversely affect our business.

Any real money gaming license could be revoked, suspended or conditioned at any time. The loss of a license in one jurisdiction could trigger the loss of a license or affect our eligibility for such a license in another jurisdiction, and any of such losses, or potential for such loss, could cause us to cease offering some or all of SuprNation’s product offerings in the impacted jurisdictions. We may be unable to obtain or maintain all necessary registrations, licenses, permits or approvals, and could incur fines or experience delays related to the licensing process, which could adversely affect SuprNation’s operations. Our delay or failure to obtain or maintain licenses in any jurisdiction may prevent us from distributing SuprNation’s product offerings, increasing its customer base and/or generating revenues. We cannot assure you that we will be able to obtain and maintain the licenses and related approvals necessary to conduct our iGaming operations. Any failure to maintain or renew our existing licenses, registrations, permits or approvals could have a material adverse effect on our business, financial condition, results of operations and prospects.

Data privacy and security laws and regulations in the jurisdictions in which we do business could increase the cost of our operations and subject us to possible sanctions and other penalties.

We collect, process, store, use, and share data, some of which contains limited personal information. Consequently, our business is subject to a number of U.S. and international laws and regulations governing data

9

Table of Contents

privacy and security, including with respect to the collection, storage, use, transmission, sharing, and protection of personal information. Data privacy protection laws are rapidly changing and likely will continue to do so for the foreseeable future and may be inconsistent from jurisdiction to jurisdiction.

We are subject to U.S. federal and state and foreign laws related to the privacy and protection of player data. Such regulations such as the General Data Protections Regulation (“GDPR”) from the European Union (“EU”), the United Kingdom’s Data Protection Act of 2018, the UK GDPR, and the California Consumer Privacy Act, as amended by the California Privacy Rights Act, and newly enacted privacy laws in Virginia, Colorado, Connecticut and Utah, which went into effect in 2023, are new, untested laws and regulations that could affect our business, and the potential impact is unknown. See “Item 4B. Business Overview—Regulation of the industry.” The U.S. government, including the Federal Trade Commission and the Department of Commerce, also continue to review the need for greater regulation over the collection of personal information and information about consumer behavior, and the U.S. Congress is considering a number of legislative proposals to regulate this area. Currently, there are various legislation related to data privacy and security pending before several legislative and regulatory bodies in the United States and worldwide that if passed could impact our operations.

We are also subject to evolving laws and regulations that dictate under what circumstances we can transfer, process and/or receive personal information that is critical to our operations, including data shared between countries or regions in which we operate. For example, in July 2020, the European Union-U.S. Privacy Shield was invalidated by the Court of Justice of the European Union (“CJEU”). While the EU and the UK issued new Standard Contractual Clauses, such transfers of European personal information continue to be subjected to regulatory and judicial scrutiny. If we are unable to transfer data between and among countries and regions in which we operate, or if we are restricted from sharing data among our products and services, it could affect the manner in which we operate and require us to change our data processing policies and measures, which may be burdensome and difficult to undertake successfully, and could adversely affect our financial results.

Due to the rapidly changing nature of these data protection laws, there is not always clear guidance from the respective governments and regulators regarding the interpretation of the law, which may create the risk of an inadvertent violation. Efforts to comply with these and other data privacy and security restrictions that may be enacted could require us to modify our data processing practices and policies and could significantly increase the cost of our operations. Failure to comply with such restrictions could subject us to criminal and civil sanctions and other penalties. In part due to the uncertainty of the legal climate, complying with regulations, and any applicable rules or guidance from self- regulatory organizations relating to privacy, data protection, information security, and consumer protection, may result in substantial costs and may necessitate changes to our business practices, which may compromise our growth strategy, adversely affect our ability to attract or retain players, and otherwise adversely affect our business, financial condition, and operating results.

Any failure or perceived failure by us to comply with our posted privacy policies or terms of use, our privacy-related obligations to players or other third parties, or any other legal obligations or regulatory requirements relating to privacy, data protection, or information security may result in governmental investigations or enforcement actions, litigation, claims, or public statements against us by consumer advocacy groups or others, and could result in significant liability, cause our players to lose trust in us, and otherwise materially and adversely affect our reputation and business. Furthermore, the costs of compliance with, and other burdens imposed by, the laws, regulations, and policies that are applicable to us may limit the adoption and use of, and reduce the overall demand for, our games.

Additionally, if third parties we work with violate applicable laws, regulations, or agreements, such violations may put our players’ data at risk, or result in governmental investigations or enforcement actions, fines, litigation, claims, or public statements against us by consumer advocacy groups or others, and could result in significant liability, cause our players to lose trust in us, and otherwise materially and adversely affect our reputation and business. Further, public scrutiny of, or complaints about, technology companies or their data

10

Table of Contents

handling or data protection practices, even if unrelated to our business, industry, or operations, may lead to increased scrutiny of technology companies, including us, and may cause government agencies to enact additional regulatory requirements or to modify their enforcement or investigation activities, which may increase our costs and risks.

Security breaches or other disruptions could compromise our information or the information of our players. If we sustain cyber-attacks or other security incidents that result in data breaches, we could suffer a loss of players and associated revenue, increased costs, exposure to significant liability, reputational harm, and other negative consequences.

Our business involves the storage, processing, and transmission of certain proprietary, confidential, and personal information of our players. We also maintain certain other proprietary and confidential information relating to our business and personal information of our personnel. Despite our security measures, our information technology may be subject to cyber-attacks, viruses, malicious software, break-ins, theft, computer hacking, employee error or malfeasance, or other security breaches. Hackers and data thieves are increasingly sophisticated and operate large-scale and complex automated attacks. Experienced computer programmers and hackers may be able to penetrate our security controls and misappropriate or compromise sensitive personal, proprietary, or confidential information, create system disruptions, or cause shutdowns. They also may be able to develop and deploy malicious software programs that attack our systems or otherwise exploit any security vulnerabilities.

Our systems and the data stored on those systems may also be vulnerable to security incidents or security attacks, acts of vandalism or theft, coordinated attacks by activist entities, misplaced or lost data, human errors, or other similar events that could negatively affect our systems, the data stored on those systems, and the data of our business partners. Data security breaches and other data security incidents may also result from non-technical means, for example, actions by employees or contractors. Further, third parties, such as hosted solution providers, that provide services to us, could also be a source of security risks in the event of a failure of their own security systems and infrastructure. An increasing number of online services have disclosed security breaches, some of which have involved sophisticated and highly targeted attacks on portions of their services. Because the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and often are not foreseeable or recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. Any security breach or incident that we experience could result in unauthorized access to, misuse of, or unauthorized acquisition of our or our players’ data, the loss, corruption or alteration of this data, interruptions in our operations, or damage to our computers or systems or those of our players or third-party platforms. Any of these could expose us to claims, litigation, fines, and potential liability.

The costs to eliminate or address the foregoing security threats and vulnerabilities before or after a cyber incident could be significant. Our remediation efforts may not be successful and could result in interruptions, delays or cessation of service, and loss of existing or potential suppliers or players. As threats related to cyber-attacks develop and grow, we may also find it necessary to make further investments to protect our data and infrastructure, which may impact our operations. Although we have insurance coverage for protecting against cyber-attacks, it may not be sufficient to cover all possible claims, and we may suffer losses that could have a material adverse effect on our business. We could also be negatively impacted by existing and proposed laws and regulations, and government policies and practices related to cybersecurity, data privacy, data localization, and data protection in the United States, Korea, the European Union, and other countries.

If an actual or perceived breach of our security occurs, public perception of the effectiveness of our security measures for our games and content could be harmed, and we could lose players. Any compromise of our security could result in a violation of applicable privacy and other laws, regulatory or other governmental investigations, enforcement actions, and legal and financial exposure, including potential contractual liability that is not always limited to the amounts covered by our insurance. Any such compromise could also result in damage

11

Table of Contents

to our reputation and a loss of confidence in our security measures. If we are subject to a data security breach, we may have a loss in sales or increased costs arising from the restoration or implementation of additional security measures which could materially and adversely affect our business, financial condition and operating results.

Our business depends on our ability to collect and use data to deliver relevant content and advertisements, and any limitation on the collection and use of this data could cause us to lose revenues.

When our players use our games, we may process, store, use, and share data about our players, some of which contains personal information. We use some of this data to provide a better experience for the player by delivering relevant content and advertisements. As a result of new data protection laws, which expand the definition of “personal information” to include identifiers used for advertising purposes, our players in certain jurisdictions may decide not to allow us to collect some or all of this data or may limit our use of this data. Any limitation on our ability to collect data about players and game interactions would likely make it more difficult for us to deliver targeted content and advertisements to our players. Interruptions, failures or defects in our data collection, mining, analysis and storage systems, as well as privacy concerns and regulatory restrictions regarding the collection of data, could also limit our ability to aggregate and analyze player data. If that happens, we may not be able to successfully adapt to player preferences to improve and enhance our games, retain existing players and maintain the popularity of our games, which could cause our business, financial condition, or results of operations to suffer.

Additionally, Internet-connected devices and operating systems controlled by third parties increasingly contain features that allow device users to disable functionality that allows for the delivery of advertising on their devices, including through Apple’s Identifier for Advertising, or IDFA, or Google’s Advertising ID, or AAID, for Android devices. More device and browser manufacturers are including these features as part of their standard device specifications. For example, Apple requires app developers to ask for permission before they can track an individual’s activity across apps or websites they do not own in order to target advertising to the individual, measure an individual’s actions due to advertising, or to share the individual’s information with data brokers. Similarly, Android devices allow an individual to delete their advertising ID, which prevents such tracking. If players elect to utilize the opt-out mechanisms in greater numbers, our ability to deliver effective advertisements would suffer, which could adversely affect our revenues from in-game advertising.

We are subject to certain risks as an environmental, social and governance (“ESG”) driven company, and increasing scrutiny of, and evolving expectations for, sustainability and ESG initiatives could increase our costs or otherwise adversely impact our business.

We believe that a contributor to our success has been our commitment to environmental, social and governance based values, and we strive to operate our gaming business in a socially responsible manner. Internally, attracting, developing, and retaining top talent in an environment that promotes employee well-being, safety, development, diversity and inclusion is a part of our long-term strategy. However, we may be affected by negative reports or publicity if we fail, or are perceived to have failed, to live up to these values. For example, providing a safe and responsible online gaming environment for users is central to our operations. As a result, our brands and reputation may be negatively affected by the actions of users that are deemed to be irresponsible while using our apps. Similarly, any negative publicity about activity in the business that is perceived to be contrary to our human capital management policies would negatively affect our brands and reputation.

In addition, we may make decisions regarding our business and games in accordance with our values that may negatively impact our short-or medium-term operating results if we believe those decisions are consistent with such values and will improve the aggregate user experience or promotes employee well-being, safety, development, diversity and inclusion. Although we expect that our commitment to environmental, social and governance based values will, accordingly, improve our financial performance over the long term, these decisions may not be consistent with the expectations of investors and any longer-term benefits may not materialize within the time frame we expect or at all, which could harm our business, revenue and financial results.

12

Table of Contents

Furthermore, public companies are facing increasing scrutiny related to ESG practices and disclosures from certain investors, capital providers, shareholder advocacy groups, other market participants and other stakeholder groups. With this increased focus, public reporting regarding ESG practices is becoming more broadly expected. Such increased scrutiny may result in increased costs, enhanced compliance or disclosure obligations, or other adverse impacts on our business, financial condition or results of operations. If our ESG practices and reporting do not meet investor or other stakeholder expectations, which continue to evolve, we may be subject to investor or regulator engagement regarding such matters. In addition, new sustainability rules and regulations have been adopted and may continue to be introduced in various states and other jurisdictions. Our failure to comply with any applicable rules or regulations could lead to penalties and adversely impact our reputation, access to capital and employee retention. Such ESG matters may also impact our platform partners and other third parties on which we rely, which may augment or cause additional impacts on our business, financial condition, or results of operations.

If the use of mobile devices as gaming platforms and the proliferation of mobile devices generally do not increase, our business could be adversely affected.

The number of people using mobile devices has increased significantly over time and we expect that this trend will continue. However, the mobile market, particularly the market for mobile games, may not grow in the way that we anticipate. Approximately 75% of our revenue for each of the years ended December 31, 2023 and December 31, 2022 was attributable to mobile device use. If the mobile devices on which our games are available decline in popularity or become obsolete faster than anticipated, we could experience a decline in revenue and may not achieve the anticipated return on our development efforts. Any such decline in the growth of the mobile market or in the use of mobile devices for games could harm our business, financial condition, or results of operations.

We operate in a highly competitive industry, and our success depends on our ability to effectively compete.

Online gaming is a rapidly evolving industry with low barriers to entry. Businesses can easily launch online or mobile platforms and applications at nominal cost by using commercially available software or partnering with various established companies in these markets, but may not offer the same level of sophistication or capabilities as our games. The market for our games is also characterized by rapid technological developments, frequent launches of new games and content, changes in player needs and behavior, disruption by innovative entrants, and evolving business models and industry standards. As a result, our industry is constantly changing games and business models in order to adopt and optimize new technologies, increase cost efficiency, and adapt to player preferences.

We face competition for leisure time and discretionary spending of our players. Other forms of leisure activities, such as offline, traditional online, personal computer and console games, television, movies, sports, and the internet, offer much larger and more well-established options for consumers. Consumer tastes and preferences for leisure activities are also subject to sudden or unpredictable change due to new innovations. If consumers do not find our games to be compelling or if other existing or new leisure activities are perceived by our players to offer greater variety, affordability, interactivity, and overall enjoyment, our business could be materially and adversely affected.

We also compete with online gaming companies, including those that offer social casino games such as Playtika, Aristocrat, SciPlay, Netmarble, Take-Two Interactive, and others, and some of these companies have a base of existing players that is larger than ours. In addition, our controlling shareholder, DoubleU Games, also creates and markets online games and represents a potential source of competition for talent, content development, and players. The interests of DoubleU Games may, from time to time, conflict or compete with our interests. Some of our current and potential competitors, including DoubleU Games, enjoy substantial competitive advantages, such as greater financial, technical, and other resources and, in some cases, the ability to rapidly combine online platforms with traditional staffing solutions. These companies may use these advantages

13

Table of Contents

to develop different platforms and services to compete with our games, spend more on advertising and marketing, invest more in research and development or respond more quickly and effectively than we do to new or changing opportunities, technologies, standards, regulatory conditions, or player preferences or requirements. If we are not able to respond to and manage competitive pressure on our business effectively, it could adversely impact our results of operations, cash flows, and financial condition.

If we do not successfully invest in, establish and maintain awareness of our games, if we incur excessive expenses promoting and maintaining our games, or if our games contain defects or objectionable content, our business, financial condition, results of operations, or reputation could be harmed.

We believe that establishing and maintaining our awareness of our games is critical to developing and maintaining favorable relationships with players, platform providers, advertisers, and content licensors, as well as competing for key management and technical talent. Increasing awareness and recognition of our games is particularly important in connection with our strategic focus on developing games based on our own intellectual property and successfully cross-promoting our games. In addition, globalizing and extending awareness and recognition of our games require significant investment and extensive management time to execute successfully. Although we make significant sales and marketing expenditures in connection with the launch of our games, these efforts may not succeed in increasing awareness of our existing or new games. In addition, if a game contains objectionable content or the messaging functionality of our games is abused, our reputation could be damaged. Despite reasonable precautions, some consumers may be offended by certain of our game content or by treatment of other players. If consumers believe that a game we published contains objectionable content, consumers could refuse to play it and could pressure the platform providers to remove the game from their platforms. Further, if we fail to increase and maintain awareness and consumer recognition of our games, our potential revenues could be limited, our costs could increase, and our business, financial condition, results of operations, or reputation could suffer.

Our applications enable us to track certain performance metrics with internal and third-party tools and we do not independently verify such metrics. Certain of our performance metrics are subject to inherent challenges in measurement, and real or perceived inaccuracies in such metrics may harm our reputation and adversely affect our business.

We track certain performance metrics, including the number of active and paying players of our games. Our all-in-one app strategy, in particular, provides us with large amounts of data on users and participation rates, among other things. Our performance metrics tools have a number of limitations and our methodologies for tracking these metrics may change over time, which could result in unexpected changes to our metrics, including the metrics we report. If the internal or third-party tools we use to track these metrics undercount or overcount performance or contain algorithm or other technical errors, the data we report may not be accurate. In addition, limitations or errors with respect to how we measure data (or the data that we measure) may affect our understanding of certain details of our business, which could affect our longer-term strategies.

Furthermore, our performance metrics may be perceived as unreliable or inaccurate by players, analysts, or business partners. If our performance metrics are not accurate representations of our business, player base, or traffic levels, if we discover material inaccuracies in our metrics, or if the metrics do not provide an accurate measurement of our business, our reputation may be harmed and our business, prospects, financial condition, and results of operations could be materially and adversely affected.

We rely on information technology and other systems, and any failures in our systems or errors, defects, or disruptions in our games could diminish our reputation, subject us to liability, disrupt our business, and adversely impact our results.

We rely on information technology systems that are important to the operation of our business, some of which are managed by third parties. These third parties are typically under no obligation to renew agreements and there is no guarantee that we will be able to renew these agreements on commercially reasonable terms, or at

14

Table of Contents

all. These systems are used to process, transmit, and store electronic information, to manage and support our business operations, and to maintain internal control over our financial reporting. In addition, we collect and store certain data, including proprietary business information, and may have access to confidential or personal information in certain of our businesses that is subject to privacy and security laws, and regulations. We could encounter difficulties in developing new systems, maintaining and upgrading current systems, and preventing security breaches. Among other things, our systems are susceptible to damage, outages, disruptions, or shutdowns due to fire, floods, power loss, break-ins, cyber-attacks, network penetration, denial of service attacks, and similar events. Any failures in our computer systems or telecommunications services could affect our ability to operate our games or otherwise conduct business.

Portions of our information technology infrastructure, including those operated by third parties, may experience interruptions, delays or cessations of service or produce errors in connection with systems integration or migration work that takes place from time to time. We may not be successful in implementing new systems and transitioning data, which could cause business disruptions and be more expensive, time-consuming, disruptive, and resource-intensive. We have no control over third parties that provide services to us and those parties could suffer problems or make decisions adverse to our business. We have contingency plans in place to prevent or mitigate the impact of these events. However, such disruptions could materially and adversely impact our ability to deliver games to players and interrupt other processes. If our information systems do not allow us to transmit accurate information, even for a short period of time, to key decision-makers, the ability to manage our business could be disrupted and our results of operations, cash flows, and financial condition could be materially and adversely affected. Failure to properly or adequately address these issues could impact our ability to perform necessary business operations, which could materially and adversely affect our reputation, competitive position, results of operations, cash flows, and financial condition.

Substantially all of our games rely on data transferred over the internet, including wireless internet. Access to the internet in a timely fashion is necessary to provide a satisfactory player experience to the players of our games. Third parties, such as telecommunications companies, could prevent access to the internet or limit the speed of our data transmissions, with or without reason, causing an adverse impact on our player experience that may materially and adversely affect our reputation, competitive position, results of operations, cash flows, and financial condition. In addition, telecommunications companies may implement certain measures, such as increased cost or restrictions based on the type or amount of data transmitted, that would impact consumers’ ability to access our games, which could materially and adversely affect our reputation, competitive position, results of operations, cash flows, and financial condition. Furthermore, internet penetration may be adversely affected by difficult global economic conditions or the cancellation of government programs to expand broadband access.

Our games and other software applications and systems, and the third-party platforms upon which they are made available, could contain undetected errors.

Our games and other software applications and systems, as well as the third-party platforms upon which they are made available, could contain undetected errors, bugs, flaws, corrupted data, defects, and other vulnerabilities that could adversely affect the performance of our games. For example, these errors could prevent the player from making in-app purchases of virtual chips, which could harm our operating results. They could also harm the overall game-playing experience for our players, which could cause players to reduce their playing time or in game purchases, discontinue playing our games altogether, or not recommend our games to other players. Such errors could also result in our games being non-compliant with applicable laws or create legal liability for us.