toi-2022123100017991912022FYFALSEhttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2022#OtherReceivablesNetCurrenthttp://fasb.org/us-gaap/2022#OtherReceivablesNetCurrent0.100017991912022-01-012022-12-310001799191us-gaap:CommonStockMember2022-01-012022-12-310001799191us-gaap:WarrantMember2022-01-012022-12-3100017991912022-06-30iso4217:USD00017991912023-03-06xbrli:shares00017991912022-12-3100017991912021-12-31iso4217:USDxbrli:shares0001799191us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001799191us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001799191us-gaap:HealthCarePatientServiceMember2022-01-012022-12-310001799191us-gaap:HealthCarePatientServiceMember2021-01-012021-12-310001799191toi:DispensaryRevenueMember2022-01-012022-12-310001799191toi:DispensaryRevenueMember2021-01-012021-12-310001799191toi:ClinicalResearchTrialsAndOtherRevenueMember2022-01-012022-12-310001799191toi:ClinicalResearchTrialsAndOtherRevenueMember2021-01-012021-12-3100017991912021-01-012021-12-310001799191us-gaap:CommonStockMember2020-12-310001799191us-gaap:ConvertiblePreferredStockMemberus-gaap:PreferredStockMember2020-12-310001799191us-gaap:AdditionalPaidInCapitalMember2020-12-310001799191us-gaap:RetainedEarningsMember2020-12-3100017991912020-12-310001799191us-gaap:RetainedEarningsMember2021-01-012021-12-310001799191us-gaap:CommonStockMember2021-01-012021-12-310001799191us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001799191us-gaap:ConvertiblePreferredStockMemberus-gaap:PreferredStockMember2021-01-012021-12-310001799191us-gaap:CommonStockMember2021-12-310001799191us-gaap:ConvertiblePreferredStockMemberus-gaap:PreferredStockMember2021-12-310001799191us-gaap:AdditionalPaidInCapitalMember2021-12-310001799191us-gaap:RetainedEarningsMember2021-12-310001799191us-gaap:RetainedEarningsMember2022-01-012022-12-310001799191us-gaap:CommonStockMember2022-01-012022-12-310001799191us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001799191us-gaap:ConvertiblePreferredStockMemberus-gaap:PreferredStockMember2022-01-012022-12-310001799191us-gaap:CommonStockMember2022-12-310001799191us-gaap:ConvertiblePreferredStockMemberus-gaap:PreferredStockMember2022-12-310001799191us-gaap:AdditionalPaidInCapitalMember2022-12-310001799191us-gaap:RetainedEarningsMember2022-12-31toi:subsidiarytoi:oncologisttoi:clinictoi:statetoi:segment0001799191toi:LegacyTOIEarnoutSharesMember2021-11-122021-11-12toi:tranche0001799191toi:LegacyTOIEarnoutSharesMembertoi:TrancheOneMember2021-11-122021-11-120001799191toi:LegacyTOIEarnoutSharesMembertoi:TrancheTwoMember2021-11-122021-11-120001799191toi:LegacyTOIEarnoutSharesMembertoi:TrancheOneMember2021-11-120001799191toi:LegacyTOIEarnoutSharesMember2021-11-12toi:trading_day0001799191toi:DFPHEarnoutSharesMember2021-11-122021-11-12xbrli:pure0001799191us-gaap:AccountingStandardsUpdate201602Member2022-01-010001799191toi:PayorAMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001799191toi:PayorAMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001799191us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMembertoi:PayorBMember2022-01-012022-12-310001799191us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMembertoi:PayorBMember2021-01-012021-12-310001799191us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertoi:PayorBMember2022-01-012022-12-310001799191us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertoi:PayorBMember2021-01-012021-12-310001799191us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertoi:PayorCMember2022-01-012022-12-310001799191us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembertoi:PayorCMember2021-01-012021-12-310001799191us-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMembertoi:VendorAMember2022-01-012022-12-310001799191us-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMembertoi:VendorAMember2021-01-012021-12-310001799191us-gaap:SupplierConcentrationRiskMembertoi:VendorBMemberus-gaap:CostOfGoodsTotalMember2022-01-012022-12-310001799191us-gaap:SupplierConcentrationRiskMembertoi:VendorBMemberus-gaap:CostOfGoodsTotalMember2021-01-012021-12-310001799191us-gaap:SupplierConcentrationRiskMemberus-gaap:AccountsPayableMembertoi:VendorAMember2022-01-012022-12-310001799191us-gaap:SupplierConcentrationRiskMemberus-gaap:AccountsPayableMembertoi:VendorAMember2021-01-012021-12-310001799191us-gaap:SupplierConcentrationRiskMembertoi:VendorBMemberus-gaap:AccountsPayableMember2021-01-012021-12-310001799191toi:CentersForMedicareAndMedicaidServicesMember2022-01-012022-12-310001799191toi:PaycheckProtectionProgramLoanDueMay2022Member2022-01-012022-12-310001799191toi:PaycheckProtectionProgramLoanDueMay2022Memberus-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2022-01-012022-12-310001799191toi:PaycheckProtectionProgramLoanDueMay2022Member2021-01-012021-12-310001799191toi:ProviderReliefFundingMember2021-01-012021-12-310001799191toi:OralDrugAccountsReceivableMember2022-12-310001799191toi:OralDrugAccountsReceivableMember2021-12-310001799191toi:CapitatedAccountsReceivableMember2022-12-310001799191toi:CapitatedAccountsReceivableMember2021-12-310001799191toi:FfsAccountsReceivableMember2022-12-310001799191toi:FfsAccountsReceivableMember2021-12-310001799191toi:ClinicalTrialsAccountsReceivableMember2022-12-310001799191toi:ClinicalTrialsAccountsReceivableMember2021-12-310001799191toi:OtherTradeReceivableMember2022-12-310001799191toi:OtherTradeReceivableMember2021-12-310001799191toi:CapitatedRevenueMember2022-01-012022-12-310001799191toi:CapitatedRevenueMember2021-01-012021-12-310001799191toi:FeeForServiceMember2022-01-012022-12-310001799191toi:FeeForServiceMember2021-01-012021-12-310001799191toi:OralDrugInventoryMember2022-12-310001799191toi:OralDrugInventoryMember2021-12-310001799191toi:IvDrugInventoryMember2022-12-310001799191toi:IvDrugInventoryMember2021-12-310001799191us-gaap:USTreasurySecuritiesMemberus-gaap:CashEquivalentsMember2022-12-310001799191toi:MarketableSecuritiesCurrentMemberus-gaap:USTreasurySecuritiesMember2022-12-310001799191toi:MarketableSecuritiesNoncurrentMemberus-gaap:USTreasurySecuritiesMember2022-12-31toi:security0001799191us-gaap:USTreasuryBillSecuritiesMember2022-12-310001799191us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryBillSecuritiesMember2022-12-310001799191us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryBillSecuritiesMember2022-12-310001799191us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryBillSecuritiesMember2022-12-310001799191us-gaap:ShortTermInvestmentsMember2022-12-310001799191us-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMember2022-12-310001799191us-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMember2022-12-310001799191us-gaap:FairValueInputsLevel3Memberus-gaap:ShortTermInvestmentsMember2022-12-310001799191toi:LongTermInvestmentsMember2022-12-310001799191us-gaap:FairValueInputsLevel1Membertoi:LongTermInvestmentsMember2022-12-310001799191us-gaap:FairValueInputsLevel2Membertoi:LongTermInvestmentsMember2022-12-310001799191toi:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel3Member2022-12-310001799191us-gaap:FairValueInputsLevel1Member2022-12-310001799191us-gaap:FairValueInputsLevel2Member2022-12-310001799191us-gaap:FairValueInputsLevel3Member2022-12-310001799191us-gaap:FairValueInputsLevel1Member2021-12-310001799191us-gaap:FairValueInputsLevel2Member2021-12-310001799191us-gaap:FairValueInputsLevel3Member2021-12-310001799191us-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueInputsLevel3Member2022-12-310001799191toi:PrivateWarrantLiabilityMember2020-12-310001799191toi:DerivativeEarnoutMember2020-12-310001799191us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2020-12-310001799191toi:PrivateWarrantLiabilityMember2021-01-012021-12-310001799191toi:DerivativeEarnoutMember2021-01-012021-12-310001799191us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2021-01-012021-12-310001799191toi:PrivateWarrantLiabilityMember2021-12-310001799191toi:DerivativeEarnoutMember2021-12-310001799191us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2021-12-310001799191toi:PrivateWarrantLiabilityMember2022-01-012022-12-310001799191toi:DerivativeEarnoutMember2022-01-012022-12-310001799191us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-01-012022-12-310001799191toi:PrivateWarrantLiabilityMember2022-12-310001799191toi:DerivativeEarnoutMember2022-12-310001799191us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-12-310001799191toi:MeasurementInputUnitPriceMembertoi:DerivativeWarrantLiabilityMember2022-12-310001799191toi:MeasurementInputUnitPriceMembertoi:EarnoutLiabilityFirstTrancheMember2022-12-310001799191toi:EarnoutLiabilitySecondTrancheMembertoi:MeasurementInputUnitPriceMember2022-12-310001799191toi:ConvertibleNoteWarrantDerivativeLiabilityMembertoi:MeasurementInputUnitPriceMember2022-12-310001799191toi:MeasurementInputUnitPriceMembertoi:DerivativeInstrumentMember2022-12-310001799191us-gaap:MeasurementInputExpectedTermMembertoi:DerivativeWarrantLiabilityMember2022-12-31utr:Y0001799191us-gaap:MeasurementInputExpectedTermMembertoi:EarnoutLiabilityFirstTrancheMember2022-12-310001799191toi:EarnoutLiabilitySecondTrancheMemberus-gaap:MeasurementInputExpectedTermMember2022-12-310001799191toi:ConvertibleNoteWarrantDerivativeLiabilityMemberus-gaap:MeasurementInputExpectedTermMember2022-12-310001799191us-gaap:MeasurementInputExpectedTermMembertoi:DerivativeInstrumentMember2022-12-310001799191us-gaap:MeasurementInputPriceVolatilityMembertoi:DerivativeWarrantLiabilityMember2022-12-310001799191us-gaap:MeasurementInputPriceVolatilityMembertoi:EarnoutLiabilityFirstTrancheMember2022-12-310001799191toi:EarnoutLiabilitySecondTrancheMemberus-gaap:MeasurementInputPriceVolatilityMember2022-12-310001799191us-gaap:MeasurementInputPriceVolatilityMembertoi:ConvertibleNoteWarrantDerivativeLiabilityMember2022-12-310001799191us-gaap:MeasurementInputPriceVolatilityMembertoi:DerivativeInstrumentMember2022-12-310001799191us-gaap:MeasurementInputRiskFreeInterestRateMembertoi:DerivativeWarrantLiabilityMember2022-12-310001799191us-gaap:MeasurementInputRiskFreeInterestRateMembertoi:EarnoutLiabilityFirstTrancheMember2022-12-310001799191toi:EarnoutLiabilitySecondTrancheMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2022-12-310001799191us-gaap:MeasurementInputRiskFreeInterestRateMembertoi:ConvertibleNoteWarrantDerivativeLiabilityMember2022-12-310001799191us-gaap:MeasurementInputRiskFreeInterestRateMembertoi:DerivativeInstrumentMember2022-12-310001799191us-gaap:MeasurementInputExpectedDividendRateMembertoi:DerivativeWarrantLiabilityMember2022-12-310001799191us-gaap:MeasurementInputExpectedDividendRateMembertoi:EarnoutLiabilityFirstTrancheMember2022-12-310001799191toi:EarnoutLiabilitySecondTrancheMemberus-gaap:MeasurementInputExpectedDividendRateMember2022-12-310001799191us-gaap:MeasurementInputExpectedDividendRateMembertoi:ConvertibleNoteWarrantDerivativeLiabilityMember2022-12-310001799191us-gaap:MeasurementInputExpectedDividendRateMembertoi:DerivativeInstrumentMember2022-12-310001799191toi:MeasurementInputCostOfEquityMembertoi:DerivativeWarrantLiabilityMember2022-12-310001799191toi:MeasurementInputCostOfEquityMembertoi:EarnoutLiabilityFirstTrancheMember2022-12-310001799191toi:MeasurementInputCostOfEquityMembertoi:EarnoutLiabilitySecondTrancheMember2022-12-310001799191toi:MeasurementInputCostOfEquityMembertoi:ConvertibleNoteWarrantDerivativeLiabilityMember2022-12-310001799191toi:MeasurementInputCostOfEquityMembertoi:DerivativeInstrumentMember2022-12-310001799191toi:MeasurementInputUnitPriceMembertoi:DerivativeWarrantLiabilityMember2021-12-310001799191toi:MeasurementInputUnitPriceMembertoi:EarnoutLiabilityFirstTrancheMember2021-12-310001799191toi:EarnoutLiabilitySecondTrancheMembertoi:MeasurementInputUnitPriceMember2021-12-310001799191us-gaap:MeasurementInputExpectedTermMembertoi:DerivativeWarrantLiabilityMember2021-12-310001799191us-gaap:MeasurementInputExpectedTermMembertoi:EarnoutLiabilityFirstTrancheMember2021-12-310001799191toi:EarnoutLiabilitySecondTrancheMemberus-gaap:MeasurementInputExpectedTermMember2021-12-310001799191us-gaap:MeasurementInputPriceVolatilityMembertoi:DerivativeWarrantLiabilityMember2021-12-310001799191us-gaap:MeasurementInputPriceVolatilityMembertoi:EarnoutLiabilityFirstTrancheMember2021-12-310001799191toi:EarnoutLiabilitySecondTrancheMemberus-gaap:MeasurementInputPriceVolatilityMember2021-12-310001799191us-gaap:MeasurementInputRiskFreeInterestRateMembertoi:DerivativeWarrantLiabilityMember2021-12-310001799191us-gaap:MeasurementInputRiskFreeInterestRateMembertoi:EarnoutLiabilityFirstTrancheMember2021-12-310001799191toi:EarnoutLiabilitySecondTrancheMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2021-12-310001799191us-gaap:MeasurementInputExpectedDividendRateMembertoi:DerivativeWarrantLiabilityMember2021-12-310001799191us-gaap:MeasurementInputExpectedDividendRateMembertoi:EarnoutLiabilityFirstTrancheMember2021-12-310001799191toi:EarnoutLiabilitySecondTrancheMemberus-gaap:MeasurementInputExpectedDividendRateMember2021-12-310001799191toi:MeasurementInputCostOfEquityMembertoi:DerivativeWarrantLiabilityMember2021-12-310001799191toi:MeasurementInputCostOfEquityMembertoi:EarnoutLiabilityFirstTrancheMember2021-12-310001799191toi:MeasurementInputCostOfEquityMembertoi:EarnoutLiabilitySecondTrancheMember2021-12-310001799191toi:ConvertibleNoteWarrantDerivativeLiabilityMembertoi:MeasurementInputUnitPriceMember2022-08-090001799191toi:MeasurementInputUnitPriceMembertoi:DerivativeInstrumentMember2022-08-090001799191toi:ConvertibleNoteWarrantDerivativeLiabilityMemberus-gaap:MeasurementInputExpectedTermMember2022-08-090001799191us-gaap:MeasurementInputExpectedTermMembertoi:DerivativeInstrumentMember2022-08-090001799191us-gaap:MeasurementInputPriceVolatilityMembertoi:ConvertibleNoteWarrantDerivativeLiabilityMember2022-08-090001799191us-gaap:MeasurementInputPriceVolatilityMembertoi:DerivativeInstrumentMember2022-08-090001799191us-gaap:MeasurementInputRiskFreeInterestRateMembertoi:ConvertibleNoteWarrantDerivativeLiabilityMember2022-08-090001799191us-gaap:MeasurementInputRiskFreeInterestRateMembertoi:DerivativeInstrumentMember2022-08-090001799191us-gaap:MeasurementInputExpectedDividendRateMembertoi:ConvertibleNoteWarrantDerivativeLiabilityMember2022-08-090001799191us-gaap:MeasurementInputExpectedDividendRateMembertoi:DerivativeInstrumentMember2022-08-090001799191toi:MeasurementInputCostOfEquityMembertoi:ConvertibleNoteWarrantDerivativeLiabilityMember2022-08-090001799191toi:MeasurementInputCostOfEquityMembertoi:DerivativeInstrumentMember2022-08-090001799191toi:ComputerAndSoftwareMember2022-01-012022-12-310001799191toi:ComputerAndSoftwareMember2022-12-310001799191toi:ComputerAndSoftwareMember2021-12-310001799191us-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001799191us-gaap:FurnitureAndFixturesMember2022-12-310001799191us-gaap:FurnitureAndFixturesMember2021-12-310001799191us-gaap:LeaseholdImprovementsMember2022-12-310001799191us-gaap:LeaseholdImprovementsMember2021-12-310001799191us-gaap:EquipmentMember2022-01-012022-12-310001799191us-gaap:EquipmentMember2022-12-310001799191us-gaap:EquipmentMember2021-12-310001799191us-gaap:ConstructionInProgressMember2022-12-310001799191us-gaap:ConstructionInProgressMember2021-12-310001799191us-gaap:CapitalLeaseObligationsMember2021-12-310001799191srt:MinimumMember2022-12-310001799191srt:MaximumMember2022-12-310001799191srt:MinimumMember2022-01-012022-12-310001799191srt:MaximumMember2022-01-012022-12-3100017991912020-01-012020-12-31toi:corporate_office0001799191us-gaap:ConvertibleDebtMembertoi:FacilityAgreementMember2022-08-090001799191us-gaap:ConvertibleDebtMembertoi:DebtInstrumentCovenantPeriodOneMembertoi:FacilityAgreementMember2022-08-090001799191us-gaap:ConvertibleDebtMembertoi:FacilityAgreementMembertoi:DebtInstrumentCovenantPeriodTwoMember2022-08-090001799191us-gaap:ConvertibleDebtMembertoi:FacilityAgreementMembertoi:DebtInstrumentCovenantPeriodThreeMember2022-08-090001799191us-gaap:ConvertibleDebtMembertoi:FacilityAgreementMember2021-01-012021-12-310001799191us-gaap:ConvertibleDebtMembertoi:FacilityAgreementMember2022-01-012022-12-310001799191us-gaap:ConvertibleDebtMembertoi:FacilityAgreementMember2022-12-310001799191us-gaap:ConvertibleDebtMembertoi:FacilityAgreementMember2022-08-092022-08-090001799191toi:ConvertibleNoteWarrantMembertoi:FacilityAgreementMember2022-08-090001799191toi:OptionalRedemptionMembertoi:FacilityAgreementMember2022-08-090001799191toi:FacilityAgreementMembertoi:EmbeddedConversionOptionFeatureMember2022-08-090001799191toi:FacilityAgreementMember2022-08-090001799191toi:PaycheckProtectionProgramLoanDueOctober2026Memberus-gaap:NotesPayableToBanksMember2022-01-012022-12-310001799191toi:PaycheckProtectionProgramLoanDueOctober2026Memberus-gaap:NotesPayableToBanksMember2021-11-120001799191us-gaap:DomesticCountryMember2022-12-310001799191srt:ParentCompanyMemberstpr:CA2022-12-310001799191srt:ParentCompanyMemberstpr:FL2022-12-310001799191srt:ParentCompanyMemberstpr:TX2022-12-310001799191us-gaap:DomesticCountryMembersrt:AffiliatedEntityMember2022-12-310001799191srt:ParentCompanyMemberus-gaap:DomesticCountryMember2022-12-310001799191us-gaap:StateAndLocalJurisdictionMember2022-12-310001799191us-gaap:StateAndLocalJurisdictionMembersrt:AffiliatedEntityMember2022-12-310001799191srt:ParentCompanyMemberus-gaap:StateAndLocalJurisdictionMember2022-12-3100017991912021-11-12toi:vote0001799191toi:PublicAndPrivateWarrantsMember2021-12-122021-12-120001799191toi:PublicAndPrivateWarrantsMember2021-12-120001799191toi:PublicWarrantsMember2022-12-310001799191toi:PrivateWarrantsMember2022-12-310001799191toi:PublicWarrantsMember2021-12-120001799191toi:PublicWarrantsMember2021-12-122021-12-12utr:D00017991912021-12-122021-12-1200017991912022-05-100001799191us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001799191us-gaap:EmployeeStockOptionMember2019-01-020001799191us-gaap:EmployeeStockOptionMember2020-11-060001799191us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001799191us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001799191us-gaap:EmployeeStockOptionMember2021-11-120001799191us-gaap:EmployeeStockOptionMember2021-11-122021-11-120001799191toi:TwoThousandAndTwentyOnePlanMemberus-gaap:EmployeeStockOptionMember2022-12-310001799191us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001799191srt:MinimumMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001799191srt:MaximumMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001799191us-gaap:EmployeeStockOptionMember2021-12-310001799191us-gaap:EmployeeStockOptionMember2022-12-310001799191us-gaap:EmployeeStockOptionMember2020-12-310001799191us-gaap:EmployeeStockOptionMember2022-10-012022-12-3100017991912021-11-122021-11-120001799191us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2022-01-012022-12-310001799191us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2022-01-012022-12-310001799191us-gaap:RestrictedStockMember2021-11-120001799191us-gaap:RestrictedStockUnitsRSUMember2021-11-122021-11-120001799191us-gaap:RestrictedStockUnitsRSUMember2022-10-012022-12-310001799191us-gaap:RestrictedStockUnitsRSUMember2021-11-122021-12-310001799191toi:RestrictedStockUnitsAndRestrictedStockAwardsMember2021-12-310001799191toi:RestrictedStockUnitsAndRestrictedStockAwardsMember2020-12-310001799191toi:RestrictedStockUnitsAndRestrictedStockAwardsMember2022-01-012022-12-310001799191toi:RestrictedStockUnitsAndRestrictedStockAwardsMember2021-01-012021-12-310001799191toi:RestrictedStockUnitsAndRestrictedStockAwardsMember2022-12-310001799191us-gaap:RestrictedStockMember2022-01-012022-12-310001799191us-gaap:RestrictedStockMember2021-01-012021-12-310001799191us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001799191us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-03-31toi:participant0001799191us-gaap:RestrictedStockUnitsRSUMember2022-12-310001799191us-gaap:RestrictedStockUnitsRSUMember2021-12-310001799191toi:EmployeesEarnoutSharesMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-11-120001799191toi:EmployeesEarnoutSharesMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-11-120001799191toi:EmployeesEarnoutSharesMember2021-11-122021-11-120001799191toi:EmployeesEarnoutSharesMember2021-12-310001799191toi:EmployeesEarnoutSharesMember2020-12-310001799191toi:EmployeesEarnoutSharesMember2022-01-012022-12-310001799191toi:EmployeesEarnoutSharesMember2021-01-012021-12-310001799191toi:EmployeesEarnoutSharesMember2022-12-310001799191toi:EmployeesEarnoutSharesMember2022-10-012022-12-310001799191toi:EmployeesEarnoutSharesMember2021-11-122021-12-310001799191us-gaap:ConvertiblePreferredStockMember2021-11-12toi:businessCombinationtoi:asset_acquisition0001799191us-gaap:CommonStockMember2021-06-282021-06-2800017991912021-06-280001799191us-gaap:PreferredStockMember2021-06-282021-06-2800017991912021-06-282021-06-280001799191toi:PublicWarrantsMember2021-11-120001799191toi:PrivatePlacementWarrantsMember2021-11-120001799191toi:RaikerAcquisitionMember2021-02-122021-02-12toi:installment0001799191toi:RaikerAcquisitionMember2022-02-122022-02-120001799191us-gaap:NoncompeteAgreementsMembertoi:GrantAcquisitionMember2021-11-120001799191toi:GrantAcquisitionMember2021-11-122021-11-120001799191us-gaap:NoncompeteAgreementsMembertoi:OrrAcquisitionMember2021-11-120001799191toi:OrrAcquisitionMember2021-11-122021-11-120001799191us-gaap:NoncompeteAgreementsMembertoi:DaveAcquisitionMember2021-11-190001799191toi:OncologyAssociationPAMember2021-11-192021-11-190001799191toi:DaveAcquisitionMember2021-11-192021-11-190001799191toi:DaveAcquisitionMember2022-12-310001799191us-gaap:NoncompeteAgreementsMembertoi:YangAcquisitionMember2021-12-090001799191toi:YangAcquisitionMember2021-12-092021-12-090001799191toi:PerkinsAcquisitionMemberus-gaap:TradeNamesMember2022-04-300001799191toi:ClinicalContractsAndNoncompetesMembertoi:PerkinsAcquisitionMember2022-04-300001799191toi:PerkinsAcquisitionMemberus-gaap:TradeNamesMember2022-04-302022-04-300001799191toi:ClinicalContractsAndNoncompetesMembertoi:PerkinsAcquisitionMember2022-04-302022-04-300001799191toi:PerkinsAcquisitionMember2022-04-302022-04-300001799191us-gaap:NoncompeteAgreementsMembertoi:ParikhAcquisitionMember2022-07-220001799191toi:ParikhAcquisitionMember2022-07-222022-07-220001799191us-gaap:NoncompeteAgreementsMembertoi:BarrerasAcquisitionMember2022-08-300001799191toi:BarrerasAcquisitionMember2022-08-302022-08-300001799191toi:DeLaRosaCostaAcquisitionMember2022-10-072022-10-070001799191us-gaap:NoncompeteAgreementsMembertoi:HashimiAcquisitionMember2022-11-210001799191toi:HashimiAcquisitionMember2022-11-212022-11-210001799191toi:HashimiAcquisitionMember2022-11-212022-11-210001799191toi:HashimiAcquisitionMember2022-08-302022-08-300001799191toi:A2021And2022AcquisitionsMember2022-01-012022-12-310001799191toi:RaikerAcquisitionMember2021-02-120001799191toi:GrantAcquisitionMember2021-11-120001799191toi:OrrAcquisitionMember2021-11-120001799191toi:DaveAcquisitionMember2021-11-190001799191toi:YangAcquisitionMember2021-12-090001799191toi:PerkinsAcquisitionMember2022-04-300001799191toi:ParikhAcquisitionMember2022-07-220001799191toi:BarrerasAcquisitionMember2022-08-300001799191toi:DeLaRosaCostaAcquisitionMember2022-10-070001799191toi:HashimiAcquisitionMember2022-11-210001799191toi:A2021And2022AcquisitionsMember2022-12-310001799191us-gaap:NoncompeteAgreementsMembertoi:RaikerAcquisitionMember2021-02-120001799191us-gaap:NoncompeteAgreementsMembertoi:PerkinsAcquisitionMember2022-04-300001799191us-gaap:NoncompeteAgreementsMembertoi:DeLaRosaCostaAcquisitionMember2022-10-070001799191us-gaap:NoncompeteAgreementsMembertoi:A2021And2022AcquisitionsMember2022-12-310001799191toi:RaikerAcquisitionMemberus-gaap:TradeNamesMember2021-02-120001799191toi:GrantAcquisitionMemberus-gaap:TradeNamesMember2021-11-120001799191toi:OrrAcquisitionMemberus-gaap:TradeNamesMember2021-11-120001799191toi:DaveAcquisitionMemberus-gaap:TradeNamesMember2021-11-190001799191toi:YangAcquisitionMemberus-gaap:TradeNamesMember2021-12-090001799191toi:PerkinsAcquisitionMemberus-gaap:TradeNamesMember2022-04-300001799191us-gaap:TradeNamesMembertoi:ParikhAcquisitionMember2022-07-220001799191toi:BarrerasAcquisitionMemberus-gaap:TradeNamesMember2022-08-300001799191us-gaap:TradeNamesMembertoi:DeLaRosaCostaAcquisitionMember2022-10-070001799191toi:HashimiAcquisitionMemberus-gaap:TradeNamesMember2022-11-210001799191toi:A2021And2022AcquisitionsMemberus-gaap:TradeNamesMember2022-12-310001799191toi:RaikerAcquisitionMember2022-01-012022-12-310001799191toi:OncologyAssociationPAMember2021-05-012021-05-010001799191toi:OncologyAssociationPAMember2022-05-012022-05-010001799191toi:SapraMember2022-07-012022-07-010001799191us-gaap:CustomerContractsMember2022-01-012022-12-310001799191us-gaap:CustomerContractsMember2022-12-310001799191us-gaap:TradeNamesMember2022-01-012022-12-310001799191us-gaap:TradeNamesMember2022-12-310001799191toi:ClinicalContractsAndNoncompetesMember2022-01-012022-12-310001799191toi:ClinicalContractsAndNoncompetesMember2022-12-310001799191us-gaap:CustomerContractsMember2021-01-012021-12-310001799191us-gaap:CustomerContractsMember2021-12-310001799191us-gaap:TradeNamesMember2021-01-012021-12-310001799191us-gaap:TradeNamesMember2021-12-310001799191toi:ClinicalContractsAndNoncompetesMember2021-01-012021-12-310001799191toi:ClinicalContractsAndNoncompetesMember2021-12-310001799191toi:PatientServicesSegmentMember2022-12-310001799191toi:PatientServicesSegmentMember2021-12-310001799191toi:DispensarySegmentMember2022-12-310001799191toi:DispensarySegmentMember2021-12-310001799191toi:ClinicalTrialsAndOtherSegmentMember2022-12-310001799191toi:ClinicalTrialsAndOtherSegmentMember2021-12-310001799191us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001799191toi:MedicalRestrictedStockUnitsRSUsMember2022-01-012022-12-310001799191toi:MedicalRestrictedStockUnitsRSUsMember2021-01-012021-12-310001799191us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001799191us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001799191us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001799191us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001799191toi:MedicalRestrictedStockUnitsRSUsMember2022-01-012022-12-310001799191toi:MedicalRestrictedStockUnitsRSUsMember2021-01-012021-12-310001799191toi:EarnoutSharesMember2022-01-012022-12-310001799191toi:EarnoutSharesMember2021-01-012021-12-310001799191toi:PublicWarrantsMember2022-01-012022-12-310001799191toi:PublicWarrantsMember2021-01-012021-12-310001799191toi:PrivateWarrantsMember2022-01-012022-12-310001799191toi:PrivateWarrantsMember2021-01-012021-12-310001799191toi:PatientServicesSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001799191toi:PatientServicesSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001799191toi:DispensarySegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001799191toi:DispensarySegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001799191toi:ClinicalTrialsAndOtherSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001799191toi:ClinicalTrialsAndOtherSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001799191us-gaap:OperatingSegmentsMember2022-01-012022-12-310001799191us-gaap:OperatingSegmentsMember2021-01-012021-12-310001799191us-gaap:MaterialReconcilingItemsMember2022-01-012022-12-310001799191us-gaap:MaterialReconcilingItemsMember2021-01-012021-12-310001799191toi:PatientServicesSegmentMemberus-gaap:OperatingSegmentsMember2022-12-310001799191toi:PatientServicesSegmentMemberus-gaap:OperatingSegmentsMember2021-12-310001799191toi:DispensarySegmentMemberus-gaap:OperatingSegmentsMember2022-12-310001799191toi:DispensarySegmentMemberus-gaap:OperatingSegmentsMember2021-12-310001799191toi:ClinicalTrialsAndOtherSegmentMemberus-gaap:OperatingSegmentsMember2022-12-310001799191toi:ClinicalTrialsAndOtherSegmentMemberus-gaap:OperatingSegmentsMember2021-12-310001799191us-gaap:MaterialReconcilingItemsMember2022-12-310001799191us-gaap:MaterialReconcilingItemsMember2021-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToAmericanInstituteOfResearchMember2022-01-012022-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToAmericanInstituteOfResearchMember2021-01-012021-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToKarenMJohnsonMember2022-01-012022-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToKarenMJohnsonMember2021-01-012021-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToRichardBaraschMember2022-01-012022-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToRichardBaraschMember2021-01-012021-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToAnneMMcGeorgeMember2022-01-012022-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToAnneMMcGeorgeMember2021-01-012021-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToMohitKaushalMember2022-01-012022-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToMohitKaushalMember2021-01-012021-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToRaviSarinMember2022-01-012022-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToRaviSarinMember2021-01-012021-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToMaeveOMearaDukeMember2022-01-012022-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToMaeveOMearaDukeMember2021-01-012021-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToHavencrestCapitalManagementLLCMember2022-01-012022-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToHavencrestCapitalManagementLLCMember2021-01-012021-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToM33GrowthLLCMember2022-01-012022-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToM33GrowthLLCMember2021-01-012021-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToRichyAgajanianMDMember2022-01-012022-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToRichyAgajanianMDMember2021-01-012021-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentToRichyAgajanianMDMember2022-01-012022-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentToRichyAgajanianMDMember2021-01-012021-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToVeeralDesaiMember2022-01-012022-12-310001799191toi:PaymentsToAffiliatedEntitiesMembertoi:PaymentsToVeeralDesaiMember2021-01-012021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to _____

Commission file number 001-39248

The Oncology Institute, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | | 84-3562323 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

18000 Studebaker Rd, Suite 800 |

Cerritos, California 90703 |

(Address of Principal Executive Offices) |

(562) 735-3226

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | TOI | The Nasdaq Stock Market LLC |

| Warrants to purchase common stock | TOIIW | The Nasdaq Stock Market LLC |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates of the Registrant, based on the closing price of $5.06 per shares of the Registrant’s common stock as reported by the Nasdaq Capital Market as of June 30, 2022, was approximately $125.7 million.

The registrant had outstanding 74,551,556 shares of common stock as of March 6, 2023.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Form 10-K incorporates by reference information from the registrant’s proxy statement for the annual meeting of stockholders expected to be held on June 15, 2023.

Table of Contents

FORWARD-LOOKING STATEMENTS

In this Annual Report on Form 10-K, including "Business” in Item 1, “Risk Factors” in Item 1A, and "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in Item 7, and the documents incorporated by reference herein, The Oncology Institute, Inc. ("TOI", "we", or "our") make forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for our business. These statements may be preceded by, followed by or include the words "may," "might," "will," "will likely result," "should," "estimate," "plan," "project," "forecast," "intend," "expect," "anticipate," "believe," "seek," "continue," "target" or similar expressions.

These forward-looking statements are based on information available to us as of the date they were made, and involve a number of risks and uncertainties which may cause them to turn out to be wrong. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward- looking statements. Some factors that could cause actual results to differ include:

•expectations and assumptions about growth rate and market opportunity of TOI;

•our public securities’ potential liquidity and trading;

•our ability to raise financing in the future;

•our success in retaining or recruiting, or changes required in, our officers, key employees or directors;

•the impact of the regulatory environment and complexities with compliance related to such environment;

•factors relating to the business, operations and financial performance of TOI, including:

◦the impact of the COVID-19 pandemic;

◦the ability of TOI to maintain an effective system of internal controls over financial reporting;

◦the ability of TOI to grow market share in its existing markets or any new markets it may enter;

◦the ability of TOI to respond to general economic conditions;

◦the ability of TOI to manage its growth effectively;

◦the ability of TOI to achieve and maintain profitability in the future;

◦the ability of TOI to attract new patients;

◦continued reimbursement from third-party payors; and

◦other factors detailed under the section titled “Risk Factors” within this 10-K.

PART I

Item 1. Business

Overview

The Oncology Institute, Inc. ("TOI", the "Company", "we", or "our) is a leading value-based oncology company that manages community-based oncology practices that serve patients at 76 clinic locations across 15 markets and five states throughout the United States. Our community-based oncology practices are staffed with 112 oncologists and advanced practice providers. 62 of these clinics are staffed with 101 providers employed by our affiliated physician-owned professional corporations, referred to as the "TOI PCs", which provided care for more than 64,000 patients in 2022 and managed a population of approximately 1.7 million patients under value-based agreements as of December 31, 2022. We also provide management services to 14 clinic locations owned by independent oncology practices. Our mission is to heal and empower cancer patients through compassion, innovation, and state-of-the-art medical care.

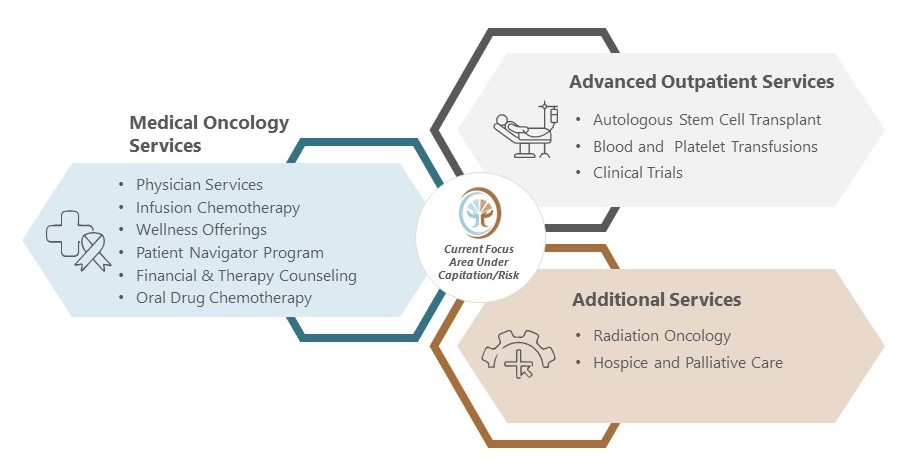

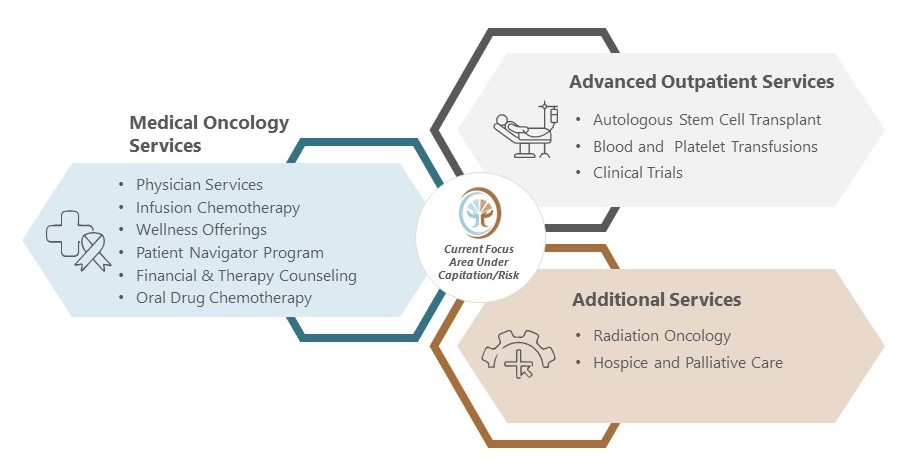

Our managed clinics provide a range of medical oncology services, including physician services, in-house infusion and dispensary, clinical trial services, radiation, innovative programs like outpatient blood product transfusions, along with 24/7 patient support. Through TOI Clinical Research, LLC ("TCR"), the clinical research arm of the TOI PCs, we also provide and manage clinical trial services and research for the benefit of cancer patients. Many of our services, such as managing clinical trials and palliative care programs, are traditionally accessed through academic and tertiary care settings, while the TOI PCs bring these services to patients in a community setting. As scientific research progresses and more treatment options become available, cancer care is shifting from acute care episodes to chronic disease management. With this shift, it is increasingly important for high-quality, high-value cancer care to be available in a local community setting to all patients in need.

As a value-based oncology company, we seek to deliver better quality care while managing costs for patients and payors that we serve. We define value-based care as care that focuses on providing optimal health outcomes and healthcare affordability and a value-based contract as any contract that removes the incentive to drive up cost of care or overutilization, while rewarding better clinical outcomes, cost and quality. We work to accomplish this goal by reducing wasteful, inefficient or futile care that drives up costs but does not improve outcomes. We believe payors and employers are aligned with the value-based model due to its enhanced access, improved outcomes, and lower costs. Patients under our affiliated providers’ care can benefit from evidence-based and personalized care plans, gain access to sub-specialized care in convenient community locations, and lower out-of-pocket costs. We believe our affiliated providers enjoy the stability and predictability of a large multi-state practice, are not incentivized or pressured to over-treat when it may be inconsistent with a patient’s goals of care and can focus on practicing outstanding evidence-based oncology care.

In contrast to value-based care, we believe much of traditional fee-for-service, or FFS, oncology care is plagued by misaligned incentives that drive up costs and often lower the quality of care. In FFS care, oncologists are reimbursed on a “cost-plus” basis for drugs which in turn are often responsible for the majority of a practice’s revenue. This "cost-plus" model may incentivize oncologists to prescribe the most expensive treatments even if lower cost alternatives that are still medically appropriate are available, as well as to continue to utilize chemotherapy in advanced cancer patients who may no longer benefit from such treatment. In these cases, patients and payors not only bear the burden of higher cost of care, but patients may also suffer negative health outcomes including higher rates of emergency room visits and hospitalizations for supportive care needs due to the side effects associated with chemotherapy.

In 2022, we generated more than 50% of our revenue from patients who are covered by value-based contracts. Historically, our value-based contracts have predominately taken the form of capitated contracts. Our capitated contracts remove incentives to drive up costs, and they also have incentives for meeting or exceeding certain quality metrics. In some capitated contracts we are penalized if we fail to meet certain quality metrics. In other capitated contracts, we receive bonuses/rewards if we meet or exceed certain quality metrics. Our value-based contracts could also take on other forms, such as sharing with payors in the cost savings generated for specific medical oncology costs (which we refer to as 'gain-sharing' contract), along with incentives to meet certain quality metrics. These contracts, despite their modifications on how reimbursement is structured, still meet the definition of value-based care. We and our affiliated providers have contractual relationships with payors serving a variety of patients, including Medicare Advantage ("MA"), Medicaid, and commercial patients. These payors include affiliates of Anthem, CareMore Health, Heritage Provider Network and Optum Care.

In 2023, we are continuing to evolve the way we structure our value-based arrangements, particularly in areas of the country where there are limits on medical group delegation, or an increased desire from groups to incentivize TOI for cost of care that extends beyond medical oncology and includes elements such as management of acute care utilization and/or management of non-employed oncologists. We believe that these new contracting methodologies are furthering our mission to provide access to world-class oncology care in an affordable manner to underserved populations.

We believe that our position in the market and focus on elevating the state of oncology care with a value-based care model positions our affiliated providers well for future growth. Our technology platform supports this growth and enables the TOI PCs to standardize and deliver consistent value-based care at scale. We believe that our model will support growth into new markets, allow us to continue service more patients across the United States.

Our website is www.theoncologyinstitute.com. The information contained on our website is not a part of this annual report.

Affiliated Physician Practices

Some states have laws that prohibit business entities with non-physician owners from practicing medicine, which are generally referred to as the corporate practice of medicine. States that have corporate practice of medicine laws require only physicians to practice medicine, exercise control over medical decisions or engage in certain arrangements with other physicians, such as fee-splitting. For example, under California's corporate practice of medicine doctrine, physicians and certain licensed professionals cannot be employed by non-professional corporations, except under limited exceptions which do not apply to us. Additionally, all clinical decisions and certain business or management decisions that result in control over a physician's practice of medicine must be made by a licensed physician and not by an unlicensed person or entity. California also prohibits professional fee-splitting arrangements, but management fees based on a percentage of gross revenue or similar arrangement that is commensurate with fair market value of services provided by the management company are generally permissible.

We have entered into a management services agreement with each of the TOI PCs, which are entirely physician owned. Under our management services agreements, we have agreed to serve, on an exclusive basis, as manager and administrator of each TOI PC’s non-medical functions and services related to healthcare services and items provided to patients by physicians and other licensed healthcare providers employed by or under contract with a TOI PC. The non-medical functions and services

we provide under the management services agreements include practice management services and non-clinical operational assistance for all TOI PC clinic locations, assistance with provider and payor contract negotiations and administration, billing and collection services, financial and accounting services, electronic medical records and practice management technology solutions, assistance in maintaining licensure, permits and other credentialing requirements for the TOI PCs, risk management services, non-clinical personnel services, provider recruitment services and other administrative services required for the day-to-day operations of the clinics and TOI PCs. Our management services agreements with the TOI PCs have 20-year terms, unless terminated upon mutual agreement of the parties or unilaterally by a party following a material breach or commencement of bankruptcy or liquidation events by the other party, or a governmental or judicial termination order against a party. Under the management services agreement, we receive a monthly management fee that is structured as direct reimbursement of all costs incurred plus a percentage of the TOI PC’s gross revenue, which is defined as the TOI PC’s total revenues payable for all healthcare services and items rendered by the TOI PC, adjusted for bad debt, discounts and payor contract adjustments. In accordance with relevant accounting guidance, each of the TOI PCs is determined to be a variable interest entity, or VIE, of the Company as the Company has the ability, through the management services agreement, to direct the activities (excluding clinical decisions) that most significantly affect the TOI PC’s economic performance.

Market Overview

Our business is focused on caring for adult and senior populations with medical oncology and related care needs, including members of MA plans run by private insurance companies on behalf of the Centers for Medicare and Medicaid Services, or CMS, as well as traditional FFS Medicare, Medicaid, other government healthcare programs and commercial insurance populations. One of our primary focuses is on value-based contracts in which we manage the medical oncology care for a population of patients for a pre-determined, population-based capitated payment. Many of the patients that we manage under value-based arrangements are referred to as “capitated” populations, however our affiliated providers also provide care to patients outside of these arrangements under traditional FFS arrangements as well as other types of value-based contract.

As of December 31, 2022, we were active in 15 markets in five states. Across these states, there were approximately 81 million commercial, Medicaid, and MA lives. This population provides us with a substantial opportunity to capture a portion of those lives in both our legacy, existing markets, as well as in our new expansion geographies.

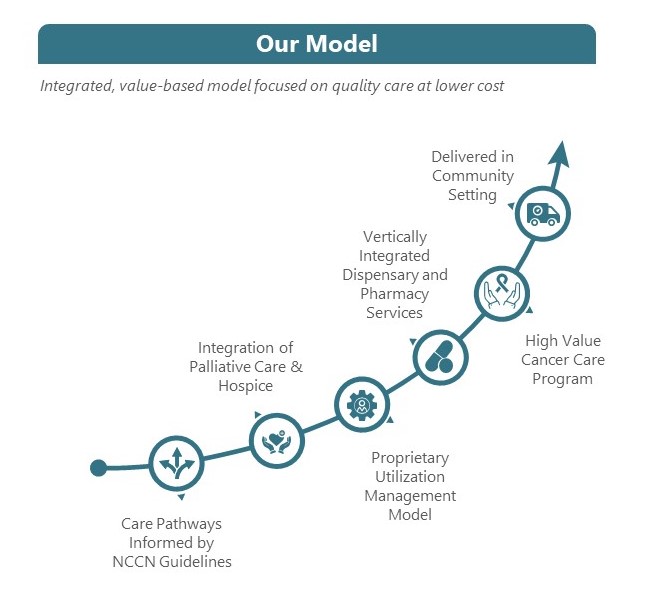

Our Care Model

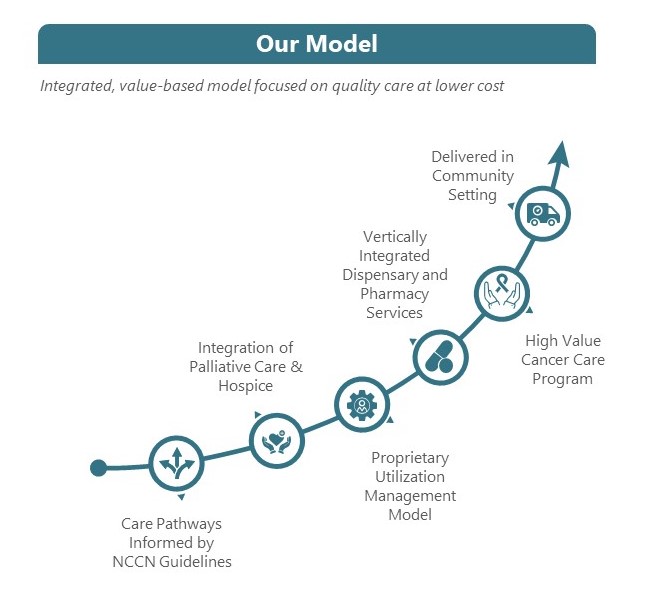

Since our founding over 15 years ago, we have built a solid track record around our care model for value-based oncology care. Our care model is focused on delivering personalized, evidenced-based care, consistently, and at scale. We seek to deliver better patient outcomes for lower costs, and to care for more of our payors’ patient populations.

Our care model is designed to remove physicians’ incentives to over-prescribe or prescribe high-cost chemotherapy that is of limited clinical utility to patients. We invest in nurse practitioners to help with advanced care planning and palliative care discussions with patients. We give patients the education and tools to make their own decisions about when the right time is to choose palliative care or hospice.

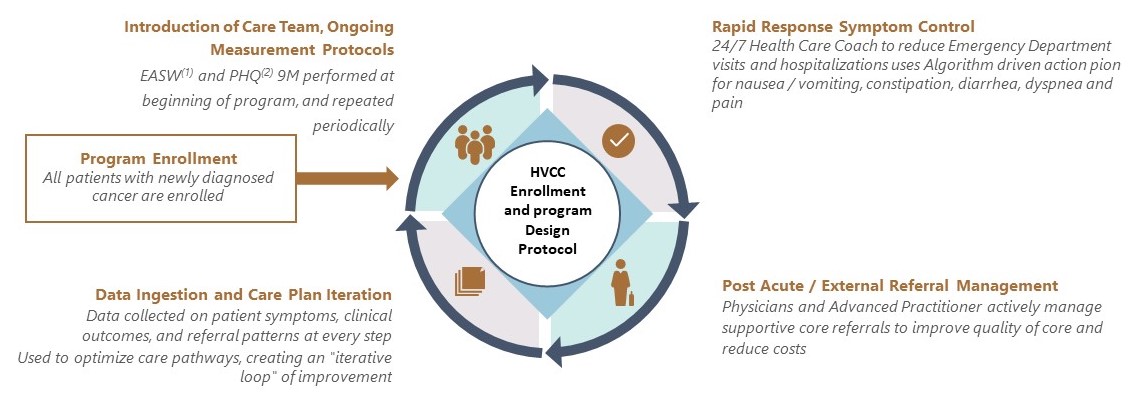

While the TOI PCs treat patients under both value-based and FFS contracts, our affiliated providers’ approach to care focuses on achieving the best outcomes at the lowest cost, regardless of the reimbursement methodology. We have developed a High Value Cancer Care, or HVCC, program, in which patients are able to access targeted care resources that augment and support their treatment. Our treatment regimens are based on algorithms established by the National Comprehensive Cancer Network (“NCCN”) and are evidence-based. NCCN is a not-for-profit alliance of 32 leading cancer centers devoted to patient care, research and education (not including TOI). NCCN focuses on improving cancer care through the input of clinical thought leaders at its member organizations. NCCN publishes guidelines developed from evidence- based medicine to ensure that all cancer patients receive preventative, diagnostic, treatment, and supportive services that are most likely to lead to optimal outcomes. The NCCN guidelines are widely recognized as the standard for clinical care in medical oncology, and the intent of the guidelines is to assist in clinical decision making. Our affiliated providers strive to ensure that clinical pathways in our electronic health records system, as well as recommendations on use of chemotherapy and supportive care medications are consistent with NCCN guidelines to ensure patients receive the best clinical care based on their individual disease and comorbidities. Moreover, the TOI PCs operate physician dispensaries that allow our affiliated providers to prescribe and dispense oral oncolytics and related medications to patients, alongside chemotherapy infusion and injections. This provides patients with holistic and convenient access to the most appropriate treatment pathways, all in a community setting. According to a study conducted by researchers at Stanford University on the TOI PCs’ patients in 2019 who were enrolled in our HVCC program, we saw improvements in several key metrics, including:

Overall, the study demonstrated greater than 25% lower median total healthcare costs from diagnosis to death. We are continuously improving and innovating our care model, using the clinical data from the HVCC program to develop evidence-based care and treatment protocols for all patients.

Our Value Proposition and Differentiated Care Model

Our managed clinics primarily serve adult and senior cancer patients in markets that have MA plans and primary care medical groups reimbursed on a capitated basis. Our affiliated providers provide these services primarily through employed providers who are responsible for patient care. We intend to leverage our long-established, strong relationships with payors to continue to build out our network and increase access to cancer patients in adjacent markets, while at the same time, decreasing oncology care costs for both patients and payors. Through the TOI PCs, we seek to provide high quality and lower cost care delivery through the following capabilities:

•recruiting process focused on selecting physicians that want to practice evidence-based medicine;

•technology-enabled care pathways ensuring adherence to evidence-based clinical protocols;

•strong clinical culture and physician oversight;

•care management to prevent unnecessary hospitalizations;

•care delivered in community clinics vs. hospital setting;

•clinically appropriate integration of palliative care and hospice aligned with patients’ goals of care;

•access to clinical trials providing cutting-edge treatment options at low or no cost to patients or payors; and

•appropriate provider training on clinical documentation to ensure proper risk adjustment and reimbursement for complex patients.

We strive to add value by consistently performing these activities effectively. The goal is a lower cost of care for the same or better clinical outcomes while providing a superior patient experience.

Patient Experience

We believe our patient-centric focus facilitates high levels of patient satisfaction and supports our care delivery model while strengthening payor relationships. We employ a continuous feedback mechanism to ensure superior patient experience and satisfaction among our affiliated physicians and advanced practice providers.

As of a recent patient survey in 2022, 88% of our oncologists and 90% of our locations were rated 4.0 or above as measured by our survey, which we distribute to patients via text or e-mail following their clinic visit.

Growth Strategy and Opportunities

To date, revenue has grown at a roughly 30% CAGR from 2016 to 2022, driven by robust growth in capitated lives under value-based contracts.

Our footprint as of December 31, 2022 spanned five states and is growing rapidly.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| California | | Arizona | | Nevada | | Florida | | Texas |

Markets | 7 | | 1 | | 1 | | 5 | | 1 |

Managed and Affiliated Clinics(1) | 57 | | 4 | | 5 | | 8 | | 2 |

Providers | 84 | | 5 | | 4 | | 15 | | 4 |

(1) 62 clinics operated under the TOI PCs, whereby we receive a percentage of revenues under our MSAs and are consolidated; and 14 independent oncology practice locations that are under MSAs for limited management and administrative services but do not bear any direct operating costs.

We anticipate adding more TOI PC clinics and other managed practices in the future across our markets through acquisitions and through de novo clinic builds, and we are in constant discussion with payors and providers to enter new markets. We continually seek to evaluate our growth strategy and may continue to modify it in the future, and there can be no assurance that we will be able to successfully capitalize on growth strategies.

Our go-to-market strategy focuses on both payors and providers. This blend is important given the increasing penetration of non-traditional payors, such as Oscar and Bright HealthCare, and primary care risk models such as Agilon health and ChenMed LLC.

We believe that our existing payor relationships provide us leads on opportunities to enter new markets, and we often receive outreach from new management services organizations, health plans and risk bearing organizations. When evaluating a new market, we consider three primary factors:

1.the penetration and growth of Medicare Advantage and other value-based reimbursement models;

2.the presence of value-based primary care groups with whom we can partner to generate referrals and manage outcomes; and

3.how well oncology spend is currently managed in that market.

We believe that new markets we are focused on meet all of the above criteria and could provide us with significant opportunity to create value for patients, providers and payors.

We have multiple strategies we believe can achieve long term growth.

•Existing Market Contract Growth: Continue driving covered lives growth. Significant growth potential in existing markets can be achieved through expanding the scope of our services with existing partners and securing new contracts with new payors and independent practices. The addition of new de novo clinics and affiliated providers can drive additional growth. By continuing to build regional density in existing markets, we also have an opportunity to achieve efficiencies with increased scale.

•New Market Contract Growth: Our replicable operating model enables quick scaling in new markets. Oncology continues to be a key focus area for payors and providers, who are highly supportive of our entry into new markets. Our high priority markets have attractive market dynamics due to the high cost of oncology care in these geographies, the prevalence of risk-bearing organizations, and the presence of national payor partners who we collaborate with in existing markets. Our initial approach to value-based contracting in new markets is likely to be in the form of gain share contracts These new contracts, which will enable us to work with payors and risk-taking providers as they continue their shift to value-based care, are likely to produce lower revenue and profitability in the initial period as compared to full capitation. Once payors and risk-bearing providers in these new markets become comfortable with our ability to generate savings and better outcomes, we believe these contracts will shift to capitation.

•M&A Opportunities: Leveraging our existing pipeline and mergers and acquisition expertise can help us facilitate growth in both existing and new markets, allowing us to rapidly establish market presence. Once on-boarded, we can transition the affiliated practice to our value-based model, as well as expand and enhance the scope of services provided to patients by the affiliated practice, such as adding dispensary operations, managing clinical trials and access to our broad purchasing contracts. Independent oncologists continue to face multitude of challenges and our acquisition model offers a path for these oncologists to continue to practice in their community without the burdens of business building or administration, while at the same time working alongside a dynamic and growing organization at the forefront of value-based care. We look for acquisition targets where the practice is philosophically aligned with us in driving the shift to value-based care.

•Service Expansion: We can broaden scope and diversify service offerings, including ancillary and adjacent services focused on patient care and innovation and providing access to new oncology treatments being investigated in clinical trials that our affiliated practices manage. We have the potential to scale significantly faster with additional capital via

new oncologist on-boarding and training, further technology investments, investments in ancillaries, and strategic acquisitions. In Q4 2021, we acquired our first radiation oncology practice, adding a new service line to our business.

Contracting Overview

At a time when many FFS healthcare organizations have been struggling due to the decrease in service volumes, our value-based capitation payments have allowed us to maintain our level of member care and prioritize member safety by incentivizing the provision of care in the most appropriate setting.

We have focused our business on capitation arrangements and other types of value-based contracts, which we believe align provider incentives with both quality and efficiency of care. Under capitation arrangements, payors pay a fixed per member per month, or PMPM, amount for every plan member within a population assigned to us for oncology care.

Our affiliated providers are responsible for managing oncology care for this population based on a scope of medical services and drugs agreed upon by both parties. The PMPM rates for our capitation arrangements are determined based on our analysis of historical patient data and agreements with contractual partners. In new markets, this may require the TOI PCs to contract with both the health insurance company and their risk-bearing provider organization in order to service these members.

In addition to capitation-based arrangements, we continue to explore several other forms of value-based arrangements. Although many of these arrangements continue to be based on a FFS-based methodology, our affiliated providers are eligible to earn additional bonuses based on their ability to achieve oncology specific clinical and other quality of care based benchmarks. While these alternative value-based arrangements may not produce as much initial revenue on a PMPM basis as capitation, we believe this flexibility in contracting models will allow us to speed our expansion into new markets while preserving the value-based economics that are critical for our business’ growth and success.

Payor Relationships

Our ability to consistently attract patients across multiple geographic markets depends on our ability to contract with payors in each market. Depending on the market, payors can be delegated medical groups who are taking risk or insurance companies themselves. By opening clinics in locations where the TOI PCs currently manage the oncology care for a large number of insured Medicare, Commercial and Medicaid members, we believe we are creating net benefits for payors, as our affiliated providers are able to reduce unnecessary costs and improve patient care and experience. This also allows us to benefit from the value-based offerings already established by payors in the market, therefore not requiring us to single-handedly drive patient growth. Some of the biggest and most respected names in healthcare contract with the TOI PCs to provide oncology care to their members, including Anthem, CareMore Health, Heritage Provider Network and Optum Care. More than half of our revenue in 2022 was generated from value-based contracts where payors have made our affiliated providers their preferred or exclusive oncology group.

While our relationships with payors are very strong, we believe we have limited concentration risk as our largest customer by revenue in 2022 represented less than 20% of our revenue.

Provider and Clinic Capacity Growth

Our primary driver for growth in provider and clinic capacity is to create network adequacy to service members from payors with whom we have capitated or other value-based arrangements. For each market we currently operate in or are considering entering, we do a detailed assessment of the existing market landscape and determine the optimal approach to create the capacity we need given our payor relationships and pipeline of contracts. We can achieve capacity growth through multiple avenues, including practice acquisitions and de novo clinics. Practice acquisitions offer an opportunity to gain scale and market presence rapidly, while de novo clinics allow us to build out our network in a highly capital efficient manner. We believe both approaches can work in tandem to achieve optimal scale, network presence and speed to market. In addition, we have an active recruitment pipeline for providers to join our network and help us both manage patient load and grow the patient base.

We believe we have built a robust and data-driven approach to acquisitions, with a dedicated team to identify, assess and integrate physician practices into our network, and a strong pipeline of targets in both existing and new markets. We have invested in resources to continually add to our pipeline.

Clinic Structure, Staffing and Network Design

We have a standard clinic design and approach to staffing that has been refined over many years. Managed clinics typically range from 2,000 to 3,000 square feet with 3-4 providers (physicians and advanced practice providers) per clinic. We have flexibility around clinic size to allow us to establish smaller clinics and part time staffing in areas where needed to ensure the

TOI PCs can meet network adequacy under existing payor contracts. We group our managed clinics in a similar geographic area into pods, with multiple pods in each market. We have operations teams managing our markets and pods allowing us to drive performance and scale efficiently.

Competition

The U.S. healthcare industry is generally highly competitive. We compete with large and medium-sized local and national providers of cancer care services, such as health system affiliated practices, for, among other things, contracts with payors, recruitment of physicians and other medical and non-medical personnel and patients. The closest competitors are traditional oncology physician practices, such as American Oncology Network, LLC, Florida Cancer Specialists & Research Institute, LLC, U.S. Oncology Network, Inc., and OneOncology, Inc. These organizations are predominantly reimbursed via FFS contracts, which we believe can often lead to over utilization of treatments that may be medically appropriate but often results in higher costs. Secondary competitors may include specialty benefit managers. These include companies such as AIM Specialty Health, eviCore Healthcare, Magellan Health, New Century Health, and OncoHealth. These benefit managers seek to change provider behavior by reviewing and authorizing treatment requests. The benefit manager model can produce incremental improvement in utilization, but the benefit managers are often unable to achieve results comparable to managed healthcare practices like ours. Furthermore, the benefit manager model frequently results in an antagonistic relationship with physicians who are operating in a traditional FFS-based practice. We distinguish ourselves from other managed oncology practices and specialty benefit managers in our ability to align incentives across the care continuum, including physicians and payors in delivering high quality care at lower costs, and we believe there are currently no other value-based oncology management companies of meaningful scale in the U.S.

We believe the principal competitive factors for serving the healthcare market for Medicare beneficiaries include: patient experience, quality of care, health outcomes, total cost of care, brand identity and trust in that brand. We believe we compete favorably on all these factors.

Government Regulation

Regulatory Licensing, Accreditation and Certification

Many states, including California, require regulatory approval, including licensure, accreditation and certification before establishing certain types of clinics offering certain professional and ancillary services, including the services we offer. The operations of our managed clinics are subject to extensive federal, state and local regulation relating to, among other things, the adequacy of medical care, equipment, personnel, operating policies and procedures, dispensing of prescription drugs, fire prevention, rate-setting and compliance with building codes and environmental protection. Our ability to operate profitably will depend in part on the ability of our managed clinics and doctors to obtain and maintain all necessary licenses, accreditation and other approvals, and maintain updates to their enrollment in the Medicare and Medicaid programs, including the addition of new clinic locations, providers and other enrollment information. In addition, certain ancillary services such as the provision of diagnostic laboratory testing require additional state and federal licensure and regulatory oversight, including oversight by CMS, under Clinical Laboratory Improvement Amendments of 1988, which requires all clinical laboratories to meet certain quality assurance, quality control and personnel standards, and comparable state laboratory licensing authorities, including for example, the California Department of Public Health. Our dispensary operations must also comply with applicable laws. Sanctions for failure to comply with applicable state and federal licensing, accreditation, certification and other regulatory requirements include suspension, revocation or limitation of the applicable authorization, significant fines and penalties and/or an inability to receive reimbursement from government healthcare programs and other third-party payors.

State Corporate Practice of Medicine and Fee-Splitting Laws

Our arrangements with the TOI PCs are subject to various state laws, including California, commonly referred to as corporate practice of medicine and fee-splitting laws, which are intended to prevent unlicensed persons from interfering with or influencing the physician’s professional judgment, and prohibiting the sharing of professional service fees with non-professional or business interests. These laws vary from state to state and are subject to broad interpretation and enforcement by state regulators. A determination of non-compliance against us and/or the TOI PCs could lead to adverse judicial or administrative action, civil or criminal penalties, receipt of cease and desist orders from state regulators, loss of provider licenses, and/or restructuring of these arrangements.

Healthcare Fraud and Abuse Laws

We are subject to a number of federal and state healthcare regulatory laws that restrict certain business practices in the healthcare industry. These laws include, but are not limited to, federal and state anti- kickback, false claims, self-referral and other healthcare fraud and abuse laws.

The federal Anti-Kickback Statute, or AKS, prohibits, among other things, knowingly and willfully offering, paying, soliciting or receiving remuneration, directly or indirectly, in cash or kind, to induce or reward either the referral of an individual for, or the purchase, order or recommendation of, any good or service, for which payment may be made under federal and state healthcare programs such as Medicare and Medicaid. A person or entity does not need to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation. The AKS includes statutory exceptions and regulatory safe harbors that protect certain arrangements. The AKS safe harbors for value-based arrangements require, among other things, that the arrangement does not induce a person or entity to reduce or limit medically necessary items or services furnished to any patient. Failure to meet the requirements of the safe harbor, however, does not render an arrangement illegal. Rather, the government may evaluate such arrangements on a case-by-case basis, taking into account all facts and circumstances, including the parties’ intent and the arrangement’s potential for abuse, and may be subject to greater scrutiny by enforcement agencies.

The Stark Law prohibits a physician who has a financial relationship, or who has an immediate family member who has a financial relationship, with entities providing designated health services, or DHS, from referring Medicare and Medicaid patients to such entities for the furnishing of DHS, unless an exception applies. The Stark Law also prohibits the entity from billing for any such prohibited referral. Unlike the AKS, the Stark Law is violated if the financial arrangement does not meet an applicable exception, regardless of any intent by the parties to induce or reward referrals or the reasons for the financial relationship and the referral.

The Federal False Claims Act, or FCA, prohibits a person from knowingly presenting, or caused to be presented, a false or fraudulent request for payment from the federal government, or from making a false statement or using a false record to have a claim approved. The FCA further provides that a lawsuit thereunder may be initiated in the name of the United States by an individual, a “whistleblower,” who is an original source of the allegations. Moreover, the government may assert that a claim including items and services resulting from a violation of the AKS or the Stark Law constitutes a false or fraudulent claim for purposes of the civil False Claims Act. Penalties for a violation of the FCA include fines for each false claim, plus up to three times the amount of damages caused by each false claim.

Further, the Civil Monetary Penalties Statute authorizes the imposition of civil monetary penalties, assessments and exclusion against an individual or entity based on a variety of prohibited conduct, including, but not limited to offering remuneration to a federal health care program beneficiary that the individual or entity knows or should know is likely to influence the beneficiary to order or receive health care items or services from a particular provider.

Health Insurance Portability and Accountability Act of 1996 ("HIPAA") also established federal criminal statutes that prohibit, among other things, knowingly and willfully executing, or attempting to execute, a scheme to defraud any healthcare benefit program, including private third-party payors, and knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services. Similar to the AKS, a person or entity does not need to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation.

Several states in which we operate have also adopted similar fraud and abuse laws as described above. The scope of these laws and the interpretations of them vary from state to state and are enforced by state courts and regulatory authorities, each with broad discretion. Some state fraud and abuse laws apply to items or services reimbursed by any payor, including patients and commercial insurers, not just those reimbursed by a federally funded healthcare program, including California's anti-kickback statutes and the Physician Ownership and Referral Act of 1993.

Violation of any of these laws or any other governmental regulations that apply may result in significant penalties, including, without limitation, administrative civil and criminal penalties, damages, disgorgement, fines, additional reporting requirements and compliance oversight obligations, contractual damages, the curtailment or restructuring of operations, exclusion from participation in governmental healthcare programs and/ or imprisonment.

Healthcare Reform

In the United States, there have been, and we expect there will continue to be, a number of legislative and regulatory changes to the healthcare system, many of which are intended to contain or reduce healthcare costs. By way of example, in the United States, the Affordable Care Act (“ACA”), substantially changed the way healthcare is financed by both governmental and private insurers. Since its enactment, there have been judicial, executive and Congressional challenges to certain aspects of the ACA. On June 17, 2021, the U.S. Supreme Court dismissed the most recent judicial challenge to the ACA without specifically ruling on the constitutionality of the ACA. Prior to the Supreme Court’s decision, President Biden issued an executive order initiating a special enrollment period from February 15, 2021 through August 15, 2021 for purposes of obtaining health insurance coverage through the ACA marketplace. The executive order also instructed certain governmental agencies to review and reconsider their existing policies and rules that limit access to healthcare. It is unclear how other

healthcare reform measures of the Biden administration or other efforts, if any, to challenge, repeal or replace the ACA will impact the ACA or our business.

In addition, other legislative changes have been proposed and adopted since the ACA was enacted. These changes included aggregate reductions to Medicare payments to providers of 2% per fiscal year, which went into effect on April 1, 2013 and, due to subsequent legislative amendments to the statute, will remain in effect through 2030, with the exception of a temporary suspension from May 1, 2020 through March 31, 2022 and a 1% payment reduction from April 1, 2022 to June 30, 2022, unless additional Congressional action is taken. In addition, on January 2, 2013, the American Taxpayer Relief Act of 2012 was signed into law, which, among other things, reduced Medicare payments to several providers, including hospitals, and increased the statute of limitations period for the government to recover overpayments to providers from three to five years.

CMS, through the Centers for Medicare and Medicaid Innovation, or CMMI, has implemented or has announced plans to implement numerous demonstration models designed to test value-based reimbursement models, some of which are specifically focused on oncology services. For example, in 2016, CMS initiated the Oncology Care Model demonstration, which continues into 2022 and provides participating physician practices, including the TOI PCs that participate in this program, with performance-based financial incentives that aim to manage or reduce Medicare costs without negatively affecting the efficacy of care. In late 2019, CMS issued a request for information on the Oncology Care First model, a new voluntary model that, if implemented, would build on the Oncology Care Model. More recently, CMMI has announced plans to implement the Radiation Oncology Model, which would require radiotherapy providers in certain regions to participate in a prospective, episode-based payments model where payment is based on a patient’s diagnosis as opposed to the traditional volume-based FFS payment model. Although the Radiation Oncology Model was originally intended to begin on January 1, 2022, recent legislation delayed its implementation until January 1, 2023. There likely will continue to be regulatory proposals directed at containing or lowering the cost of healthcare. The implementation of cost containment measures or other healthcare reforms may prevent us from being able to generate revenue or attain growth, any of which could have a material impact on our business.

Further, healthcare providers and industry participants are also subject to a growing number of requirements intended to promote the interoperability and exchange of patient health information. For example, on April 5, 2021, healthcare providers and certain other entities became subject to information blocking restrictions pursuant to the Cures Act that prohibit practices that are likely to interfere with the access, exchange or use of electronic health information ("EHI"), except as required by law or specified by HHS as a reasonable and necessary activity.