As filed with the Securities and Exchange Commission on May 10, 2023

Registration No. 333-269438

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 3

TO

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

Nevada | 809913 | 82-2726719 |

(State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

7887 East Belleview Avenue, Suite 500

Denver, Colorado 80111

Telephone: 720-287-3093

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John Farlinger

Executive Chairman and Chief Executive Officer

7887 East Belleview Avenue, Suite 500

Denver, Colorado 80111

Telephone: 720-287-3093

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Jason K Brenkert, Esq. Sudeep Simkhada, Esq. Dorsey & Whitney LLP 1400 Wewatta Street, Suite 400 Denver, Colorado 80202 Telephone: (303) 352-1133 Fax Number: (303) 629-3450 | Ross D. Carmel, Esq. Philip Magri, Esq. Carmel, Milazzo & Feil LLP 55 West 39th Street, 4th Floor New York, New York 10018 Telephone: (212) 658-0458 Fax Number: (646) 838-1314 |

As soon as practicable after the effective date of this Registration Statement. |

(Approximate date of commencement of proposed sale to the public) |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer: ☐ | Accelerated filer: ☐ |

Smaller reporting company: | |

Emerging Growth Company: |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED MAY 10, 2023

PRELIMINARY PROSPECTUS

ASSURE HOLDINGS CORP.

Shares of Common Stock

Pre-Funded Warrants to Purchase Common Stock

(or some combination of Shares of Common Stock and Pre-Funded Warrants)

We are offering 2,013,423 shares of our common stock at an assumed offering price of $2.98 per share (the closing price of our common stock on the NASDAQ Capital Market (the “NASDAQ”) on April 26, 2023).

We are also offering to those purchasers, if any, whose purchase of our common stock in this offering would otherwise result in such purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation of this offering, the opportunity to purchase, if any such purchaser so chooses, pre-funded warrants in lieu of shares of our common stock that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock. The purchase price of each pre-funded warrant will be equal to the price per share being sold to the public in this offering, minus $0.001, and the exercise price of each pre-funded warrant will be $0.001 per share. Each pre-funded warrant will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full.

For each pre-funded warrant we sell, the number of shares we are offering will be decreased on a one-for-one basis. The shares of common stock issuable from time to time upon exercise of the pre-funded warrants are also being offered by this prospectus.

Our common stock is listed on the NASDAQ under the symbol “IONM”. On April 26, 2023 the closing price per share of our common stock as quoted on the NASDAQ was $2.98 per share. In this offering, the actual public offering price per share will be determined between us and the underwriters in the offering, and may be at a discount to the current market price of our common stock. Neither the recent market price of our common stock nor the $2.98 assumed offering price used throughout this prospectus are indicative of the final offering price per share of common stock or per pre-funded warrant. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering price.

We are a “smaller reporting company” and an “emerging growth company” as defined under the federal securities laws and, as such, we may continue to elect to comply with certain reduced public company reporting requirements in future reports.

Investing in our shares involves risks. You should carefully read the “Risk Factors” beginning on page 5 of this prospectus before investing.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Neither the Securities and Exchange Commission nor any other regulatory commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share(1) |

| Per Pre- Funded Warrant |

| Total(2) |

| ||||

Public offering price | $ | $ | $ | |||||||

Underwriting discount and commissions(3) | $ | $ | $ | |||||||

Proceeds, before expenses, to us | $ | $ | $ | |||||||

| (1) | Based on an assumed offering price of $2.98 per share (the closing price of our common stock on the NASDAQ on April 26, 2023). The final offering price per share or pre-funded warrant, as the case may be, will be determined by the Company and the underwriters in this offering and may be at a discount to the market price of the Company’s common stock. |

| (2) | Assumes 2,013,423 shares are issued and no pre-funded warrants are issued. |

| (3) | In addition to the underwriting discount above, we have also agreed to reimburse the underwriters for certain expenses and issue warrants to the underwriters in an amount equal to 5% of the aggregate number of shares of common stock and shares of common stock underlying pre-funded warrants issued in this offering. The underwriters’ warrants are included in this prospectus. For more information, see “Underwriting.” |

The offering is being underwritten on a firm commitment basis. We have granted the underwriters a 45-day option from the date of this prospectus to purchase up to 302,103 of (i) additional shares of our common stock and/or (ii) pre-funded warrants to purchase additional shares of our common stock, in any combination thereof, from us solely to cover over-allotments, if any.

The underwriters expect to deliver our shares to purchasers in the offering on or about , 2023.

JOSEPH GUNNAR & CO., LLC

The date of the prospectus is , 2023

3

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus or contained in any prospectus supplement or free writing prospectus filed with the Securities and Exchange Commission (the “SEC”). Neither we nor the selling stockholders have authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the SEC. The selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

As used in this prospectus, unless otherwise designated, the terms “we,” “us,” “our,” the “Company,” “Assure” and “our Company” refer to Assure Holdings Corp., a Nevada corporation, and its subsidiaries.

Unless otherwise specified, all dollar amounts are expressed in United States dollars. All references to “C$” or “Cdn$” refer to Canadian dollars and all references to “common shares” and “shares” refer to the common shares in our capital stock, unless otherwise indicated. All references to the number of common shares and price per common share have been adjusted to reflect the twenty-for-one reverse stock split effectuated during March 2023.

Assure Holdings Corp., the Assure logo and other trademarks or service marks of Assure appearing in this prospectus are the property of Assure or its subsidiaries. Trade names, trademarks and service marks of other companies appearing in this prospectus are the property of their respective holders.

i

Implications of Being an Emerging Growth Company

We are an "emerging growth company," as defined in the JOBS Act. We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act; (ii) the last day of the fiscal year in which we have total annual gross revenues of $1.235 billion or more; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under applicable SEC rules. We expect that we will remain an emerging growth company for the foreseeable future but cannot retain our emerging growth company status indefinitely and will no longer qualify as an emerging growth company on or before the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include:

| ● | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| ● | not being required to comply with the requirement of auditor attestation of our internal controls over financial reporting; |

| ● | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| ● | reduced disclosure obligations regarding executive compensation; and |

| ● | not being required to hold a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

An emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to avail ourselves of this extended transition period and, as a result, we will not be required to adopt new or revised accounting standards on the dates on which adoption of such standards is required for other public reporting companies.

We are also a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies. We will remain a smaller reporting company until the end of the fiscal year in which (i) we have a public common equity float of more than $250 million, or (ii) we have annual revenues for the most recently completed fiscal year of more than $100 million and a public common equity float or a public float of more than $700 million. We also would not be eligible for status as a smaller reporting company if we become an investment company, an asset-backed issuer or a majority-owned subsidiary of a parent company that is not a smaller reporting company.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different from what you might receive from other public reporting companies in which you hold equity interests.

ii

EXCHANGE RATE INFORMATION

Unless stated otherwise, all dollar amounts are in United States dollars. Certain dollar amounts are expressed in Canadian dollars (“Cdn$”).

The annual average exchange rates for Canadian dollars in terms of the United States dollar for each of the two-year periods ended December 31, 2022 and 2021, as quoted by the Bank of Canada, were as follows:

Year ended December 31 | ||

2022 |

| 2021 |

Cdn$1.3011 |

| Cdn$1.2535 |

On April 26, 2023, the daily rate for United States dollars in terms of the Canadian dollar, as quoted by the Bank of Canada, was US $1.00 = Cdn$1.3625

iii

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This registration statement and the documents that are incorporated herein by reference contain certain forward-looking statements within the meaning of Canadian and United States securities laws, including the Private Securities Limitation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts and may be identified by the use of words including, but not limited to the following; “may,” “believe,” “will,” “expect,” “project,” “estimate,” “anticipate,” “plan,” “continue,” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. These forward-looking statements are based on the Company’s current plans and expectations and are subject to a number of risks, uncertainties and other factors which could significantly affect current plans and expectations and our future financial condition and results. These factors, which could cause actual results, performance and achievements to differ materially from those anticipated.

You should read this prospectus completely and with the understanding that actual future results may materially differ from expectations set forth in forward looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof, when evaluating the information presented in this registration statement or our other disclosures because current plans, anticipated actions, and future financial conditions and results may differ from those expressed in any forward-looking statements made by or on behalf of the Company.

We have not undertaken any obligation to publicly update or revise any forward-looking statements. All of our forward-looking statements speak only as of the date of the document in which they are made or, if a date is specified, as of such date. Subject to mandatory requirements of applicable law, we disclaim any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in expectations or any changes in events, conditions, circumstances or information on which the forward-looking statement is based. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the risk factors set forth in the section entitled “Risk Factors” in this prospectus.

iv

SUMMARY OF RISK FACTORS

We and our business are subject to material risks, which could cause actual results, performance and achievements to differ materially from those anticipated, and the risk factors set forth in the section entitled “Risk Factors” beginning on page 5 of this prospectus. These risks can be summarized as follows:

Risks Related to Our Business

| ● | We’ve had historical negative operating results, and substantial doubt exists as to our ability to continue as a going concern. |

| ● | There is meaningful decrease in underlying commercial insurance reimbursement for IONM services provided. |

| ● | Our plan is to grow our business through expansion, and we anticipate that we will be required to raise additional funds to finance our operations; however, we may not be able to do so when necessary and/or on terms advantageous or acceptable to us. |

| ● | Our business strategy is to grow through expansion and acquisitions; however, our business is currently not highly diversified. |

| ● | The business is expanding beyond our legacy provision of the Technical Component of IONM to offer the Professional Component via tele- neurology services. |

| ● | The termination of Managed Service Agreements may materially affect our financial results. |

| ● | We face significant competition from other health care providers. |

| ● | We rely on key personnel, industry partners and our ability to hire experienced employees and professionals. |

| ● | The intraoperative neuromonitoring industry is relatively new and is subject to risk associated with public scrutiny and gaps in technician oversight and formal board reviews. |

| ● | We are subject to fluctuations in revenues and payor mix. |

| ● | We depend on reimbursement from a small group of third-party payors which could lead to delays and uncertainties in the reimbursement rate and process. |

| ● | Our performance is greatly dependent on decisions that Third-Party Payors make regarding their out-of-network benefits and alternatively, our ability to negotiate profitable contracts with Third-Party Payors. |

| ● | The industry trend toward value-based purchasing may negatively impact our revenues. |

| ● | State and Federal surprise billing legislation could lead to lower reimbursement rates. |

| ● | Our revenues will depend on our customers’ continued receipt of adequate reimbursement from private insurers and government sponsored health care programs. |

| ● | Changes in accounting estimates due to changes in circumstances may require us to write off accounts receivables or write down intangible assets, such as goodwill, may have a material impact on our financial reporting and results of operations. |

| ● | We depend on referrals. |

| ● | We may be subject to professional liability claims. |

| ● | We may be subject to liability claims for damages and other expenses not covered by insurance that could reduce our earnings and cash flows. |

| ● | We are subject to rising costs, including malpractice insurance premiums or claims may adversely affect our business. |

| ● | We may incur unexpected, material liabilities as a result of acquisitions. |

| ● | Our reliance on software-as-a-service (“SaaS”) technologies from third parties may adversely affect our business and results of operations. |

| ● | Our business depends on network and mobile infrastructure developed and maintained by third-party providers. Any significant interruptions in service could result in limited capacity, processing delays and loss of customers. |

| ● | Cybersecurity incidents could disrupt business operations, result in the loss of critical and confidential information, and adversely impact our reputation and results of operations. |

| ● | If we fail to successfully maintain an effective internal control over financial reporting, the integrity of our financial reporting could be compromised, which could result in a material adverse effect on our reported financial results. |

| ● | Proposed legislation in the U.S. Congress, including changes in U.S. tax law and the Inflation Reduction Act of 2022, may adversely impact us and the value of our common stock and pre-funded warrants. |

Risks Related to the Regulation of the Healthcare Industry

| ● | Our business is subject to substantial government regulation. |

v

| ● | Our ongoing civil investigation by the U.S. Department of Justice could result in significant civil penalties. |

| ● | Our operations are subject to the nation's health care laws, as amended, repealed, or replaced from time to time. |

| ● | A cyber security incident could cause a violation of HIPAA, breach of customer and patient privacy, or other negative impacts. |

| ● | If we fail to comply with applicable laws and regulations, we could suffer penalties or be required to make significant changes to our operations. |

Risks Related to Our Debenture

| ● | Restrictive covenants in our loan agreements with Centurion Financial Trust may restrict our ability to pursue our business strategies. |

| ● | Our obligations to Centurion Financial Trust are secured by a security interest in substantially all of our assets, if we default on those obligations, the lender could foreclose on our assets. |

| ● | We are dependent on Centurion Financial Trust granting us certain add-backs and other one-time adjustments in the calculation of our financial covenant related to adjusted earnings before income, taxes, depreciation and amortization (EBITDA) and if we are not granted such allowances we may not meet our financial covenants which could result in a default on our obligations and the lender could foreclose on our assets. |

Risks Related to Our Stock

| ● | Our Former Founder, Preston Parsons, has a controlling interest in Assure. |

| ● | The price of our common stock is subject to volatility. |

| ● | Our bylaws designate the state and federal courts located in Denver, Colorado as the exclusive forum for certain types of actions and proceedings, which could limit a stockholder’s ability to choose the judicial forum for disputes arising with Assure Holdings Corp. |

| ● | There is a limited trading market for our common stock. |

| ● | Our common stock is listed in the U.S. on the Nasdaq and was historically traded in Canada on the TSX-V, but was voluntarily delisted on February 7, 2022. Historically, the trading volume for our common stock has been limited. Accordingly, investors may find it more difficult to buy and sell our shares. These factors may have an adverse impact on the trading and price of our common stock. |

| ● | Our issuance of common stock upon exercise of warrants or options or conversion of convertible notes may depress the price of our common stock. |

| ● | We qualify as an “emerging growth company” under the JOBS Act. As an “emerging growth company” we are subject to lessened disclosure requirements which could leave our stockholders without information or rights available to stockholders of more mature companies. |

Risks Related to This Offering

| ● | If our common stock is delisted from Nasdaq, the liquidity and price of our common stock could decrease and our ability to obtain financing could be impaired. |

| ● | Management will have broad discretion as to the use of the net proceeds from this offering, and we may not use the proceeds effectively. |

| ● | If you purchase shares of our common stock in this offering, you will experience immediate dilution as a result of this offering. |

| ● | If you purchase shares of our common stock in this offering, you may experience future dilution as a result of future equity offerings or other equity issuances. |

| ● | This offering may cause the trading price of our common stock to decrease. |

| ● | A significant portion of our total outstanding shares are eligible to be sold into the market, which could cause the market price of our common stock to drop significantly, even if our business is doing well. |

| ● | We do not intend to pay dividends in the foreseeable future. |

| ● | There is no public market for pre-funded warrants being offered in this offering. |

| ● | Holders of our pre-funded warrants will have no rights as a common stockholder until they acquire our common stock. |

| ● | The pre-funded warrants are speculative in nature. |

| ● | Provisions of the pre-funded warrants offered by this prospectus could discourage an acquisition of us by a third party. |

vi

The foregoing is a summary of significant risk factors that we think could cause our actual results to differ materially from expected results. However, there could be additional risk factors besides those listed herein that also could affect us in an adverse manner. You should read the risk factors set forth in the section entitled “Risk Factors” beginning on page 5 of this prospectus.

vii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. Before making an investment decision, you should read the entire prospectus carefully, including the sections entitled “Risk Factors,” “Caution Regarding Forward-Looking Statements,” “Management Discussion and Analysis of Financial Condition and Results of Operations” and in our consolidated financial statements and notes thereto.

In this prospectus, unless we indicate otherwise or the context requires, “Assure,” “company,” “our company,” “the company,” “we,” “our,” “ours” and “us” refer to Assure Holdings Corp. and its consolidated subsidiaries.

Our Business

Overview

Assure is a best-in-class provider of outsourced Intraoperative Neurophysiological Monitoring (“IONM”) and an emerging provider of remote neurology services. The Company delivers a turnkey suite of clinical and operational services to support surgeons and medical facilities during invasive surgical procedures. IONM has been well established as a standard of care and risk mitigation tool for various surgical verticals such as neurosurgery, spine, cardiovascular, orthopedic, ear, nose, and throat (“ENT”), and other surgical procures that place the nervous system at risk. Accredited by The Joint Commission, Assure’s mission is to provide exceptional surgical care and help make invasive surgeries safer. Our strategy focuses on utilizing best of class personnel and partners to deliver outcomes that are beneficial to all stakeholders including patients, surgeons, hospitals, insurers, and shareholders.

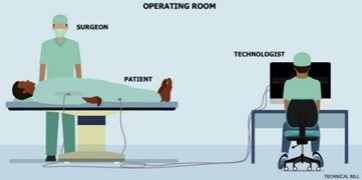

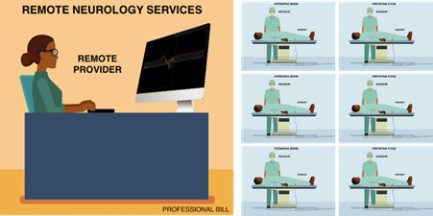

During each procedure, Assure provides two types of services, the Technical Component and Professional Component of IONM. Our in-house Interoperative Neurophysiologists (“INP”) provide Technical Component IONM services from the operating room throughout the procedure, while telehealth-oriented supervising practitioners provide a level of redundancy and risk mitigation in support of the onsite INPs and surgical team. In addition, Assure offers a comprehensive suite of IONM services, including scheduling the INP and supervising practitioner, real time monitoring, patient advocacy and subsequent billing and collecting for services provided.

Clinical leadership, surgeon support and patient care are Assure’s cornerstones. We make substantial ongoing investments in our training and development of clinical staff and have created a fellowship program to rigorously train new INPs to cost-effectively join the Assure team. In addition, we have partnered with the internationally renowned Texas Back Institute on clinical research relating to IONM safety and efficacy. Isador Lieberman, M.D., the director of the scoliosis and spine tumor program at the Texas Back Institute, is a member of Assure’s Medical Advisory Committee.

Our Strategy

Current Strategy

Our strategy is to build a telehealth tele-neurology services company with exceptional capabilities in IONM and numerous adjacent markets.

Assure has a history of providing industry-leading IONM services with an emphasis on clinical excellence and patient well-being, and are in the midst of a significant transformation to position for growth. With a focus on execution and providing a high level of patient care, the Company is transforming from being a provider of the Technical Component of IONM utilizing a one-to-one business model of INPs in the operating room to a business that also provides the Professional Component of IONM via off-site tele-neurology services in a far more scalable one-to-many business model. The next step in our development will relate to opportunities to expand into adjacent tele-neurology services while utilizing Assure’s platform and employees. This will extend our reach and redefine Assure’s position in the industry. We are thoughtfully deploying capital and focusing our investment in high potential growth initiatives including: organically expanding within existing states and into new states, growing our tele-neurology platform, signing new IONM outsourcing agreements with hospitals and medical facilities, as well as opportunistic M&A. In addition, we are investing to make our revenue cycle management function more automated, improving the velocity of our cash collections. The data and analytics-driven Company we are building will play a bigger role in the success of our key stakeholder groups: surgeons, hospitals, insurance companies and patients, as we seek to deliver attractive returns to our stockholders.

1

Assure has made substantial investments to make its revenue cycle management function more data-driven, analytical and automated. This modernization facilitated successful state-level arbitrations in 2022. Success in arbitration supported improving cash flow. There is currently a backlog of claims awaiting federal arbitration that we anticipate will begin in earnest in 2023. Many IONM competitors, particularly smaller peers that remain reliant on third-party billing companies lack the analytics and transparency to similarly leverage opportunities presented by the arbitration process.

As we look forward, Assure is focused on aligning our costs with updated managed case revenue expectations. The Company expects to continue adding scale in favorable markets while fixing the cost of delivering for its services. Further, Assure wants to take advantage of an opportunistic M&A environment in IONM as the industry moves toward a near-term consolidation. Another catalyst for improving financials is moving away from Assure’s legacy Managed Service Agreement (“MSA”) model in order to keep all collections generated from services provided by the Professional Component of IONM. In addition, supported by a data-driven revenue cycle management function, the Company anticipates leveraging state and federal arbitration programs to maximize reimbursement per case. It is our expectation that consistent success in arbitrations will ultimately lead to new in-network contractual agreements with commercial insurance payors, which in turn will speed up cash flow and improve participation rates. Lastly, Assure remains entirely committed to maintaining its clinical leadership, providing surgeon partners and hospitals with clinical excellence and our patients with enhanced safety. Delivering industry-leading quality of service has long anchored the Company’s very strong surgeon retention rates and driven our referral network for winning new business.

IONM Market in the United States

Overview

A key factor driving growth in the market is the increasing number of surgeries for which IONM is required. Advances in technology, the growth of the geriatric population in the US and a rising incidence of chronic diseases are other factors increasing the number of spinal, musculoskeletal, and cardiovascular surgeries, which in turn is expected to drive market growth in IONM. Renowned medical institutions such as the Mayo Clinic are advocating greater adoption of IONM including requiring medical professionals to complete comprehensive neurophysiology training courses and hosting international IONM conferences.

Market Landscape

The IONM market is bifurcated into in-house and outsourced providers. The end user segment is categorized into hospital and ambulatory surgical centers. IONM finds its application in spinal, neurosurgery, cardiovascular, ENT, orthopedic and other surgeries related to the central or peripheral nervous system. IONM modalities include motor evoked potential, somatosensory evoked potential, electroencephalography, electromyography, brainstem auditory evoked potential, and visual evoked potential.

There has been a substantial increase in the use of IONM services by hospitals and ambulatory surgical centers during complex surgeries. Moreover, the market is moving toward outsourced monitoring to provide advanced treatment options for patients suffering from chronic diseases.

With no dominant players in the industry, the intraoperative neuromonitoring market in the U.S. is highly fragmented. Providers can generally be categorized into three groups: 1) IONM-specific companies, including a limited number of relatively larger players such as Assure and a much larger group of small local and regional providers, 2) In-house providers such as hospitals, and 3) Bundled product companies offering neuromonitoring as part of a broader suite of services including SpecialtyCare, Inc. and NuVasive, Inc. These bundled product companies are believed to be the largest IONM providers in the US, although each is estimated to individually comprise approximately 10% of the overall U.S. IONM market.

Competition

The IONM industry is highly competitive. We face significant competition from other IONM and tele-neurology providers for patients, physicians, INPs and supervising practitioners. Some of our competitors are larger and have longstanding and well-established relationships with physicians and third-party payors. We also compete with other health care providers in our efforts to hire and retain experienced professionals. As a result, we may have difficulty attracting or retaining key personnel or securing clinical resources.

2

Some of our competitors are hospitals that provide IONM services for surgeries occurring within their hospital facilities. Assure also has significantly larger competitors, some of which have access to greater marketing, financial and other resources and may be better known in the general community. As a result of these factors, the Company may not be able to compete effectively against current and future competitors. See “Risk Factors” beginning on page 5 of this prospectus.

Corporate Structure

Assure Holdings Corp.

Assure Holdings Corp., formerly Montreux Capital Corp, a Canadian Capital Pool Company (“Montreux”), was formed under the British Columbia Business Corporations Act in British Columbia, Canada on September 24, 2007, is a Nevada corporation, existing under the laws of the State of Nevada pursuant to its Articles of Domestication filed with the Nevada Secretary of State on May 15, 2017. A Canadian Capital Pool Company is a special purpose acquisition company organized for the purposes of completing acquisition transactions, known as “qualifying transactions,” with operating companies for the purposes of taking the operating companies public in Canada. Qualifying transactions are subject to Canadian securities laws and exchange listing requirements.

Our Common Stock

Our common stock is listed on the NASDAQ under the symbol “IONM”.

Available Information

Our executive office address is 7887 E. Belleview Ave., Suite 500, Denver, Colorado 80111. The telephone number for our executive office is (720) 287-3093.

We make available, free of charge, on or through our Internet website, at www.assureneuromonitoring.com, our annual reports on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. Our Internet website and the information contained therein or connected thereto are not intended to be, and are not, incorporated into this prospectus.

Recent Developments

Our cash position as of December 31, 2022 was $905 thousand compared to the December 31, 2021 cash balance of $4.0 million. Working capital was $16.4 million as of December 31, 2022 compared to $34.3 million at December 31, 2021. Our working capital balance and our estimated cash flows from operations during 2022 will not support our operating activities and our obligations for the next 12 months. Our independent registered public accountants have expressed that substantial doubt exists as to the Company’s ability to continue as a going concern. See Item 8. Report of Independent Registered Public Accountant for further discussion.

Our Board of Directors approved the consolidation of our authorized and issued and outstanding common stock, par $0.001, on a twenty (old) for one (new) share basis (the “Reverse Split”), pursuant to Nevada Revised Statute (“NRS”) Section 78.207. On March 2, 2023, we filed a Certificate of Change with the Nevada Secretary of State pursuant to NRS 78.209, to effect the Reverse Split, effective at 12:01 a.m. (Pacific Standard Time) on March 4, 2023.

On March 24, 2023, received confirmation from NASDAQ that it has regained compliance with the minimum bid price requirement of $1.00 per share under Nasdaq Listing Rule 5550(a)(2) and currently meets all other applicable criteria for continued listing.

Effective April 11, 2023, Martin Burian voluntarily resigned from his position as a member of the Company’s Board of Directors. Mr. Burian did not resign as a result of any disagreement with the Company on any matter relating to the Company’s operations, policies, or practices.

On April 11, 2023, Baker Tilly US, LLP (“Baker Tilly”) informed Assure Holdings Corp. (the “Company”) and the Audit Committee of the Company that Baker Tilly would not stand for re-election as the Company’s certifying accountant for the fiscal year ended December 31, 2023.

3

THE OFFERING

Issuer |

| Assure Holdings Corp. |

|

| |

Securities Offered by Us: | 2,013,423 shares on a “firm commitment” basis at an assumed price of $2.98 per share (the closing price of our common stock on NASDAQ on April 26, 2023). | |

|

| |

Pre-Funded Warrants Offered by Us: | We are also offering to certain purchasers whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, pre-funded warrants to purchase shares of common stock (in lieu of shares of common stock being offered as described above under “Securities Offered by Us”). Each pre-funded warrant will be exercisable for one share of our common stock. The purchase price of each pre-funded warrant will be equal to the price at which a share of common stock is being sold to the public in this offering, minus $0.001, and the exercise price of each pre-funded warrant will be $0.001 per share. The pre-funded warrants will be exercisable immediately and may be exercised at any time until all of the pre-funded warrants are exercised in full. This offering also relates to the shares of Common Stock issuable upon exercise of any pre-funded warrants sold in this offering. For each pre-funded warrant we sell, the number of shares of Common Stock we are offering will be decreased on a one-for-one basis. | |

Common Stock Outstanding Before this offering: | 1,101,098 shares of common stock. | |

|

| |

Common Stock Outstanding After this offering (1): | 3,114,521 shares of common stock (or, 3,416,534 shares if the underwriters exercise their over-allotment option in full). | |

|

| |

Over-Allotment Option | We have granted the underwriters a 45-day option from the date of this prospectus to purchase up to 302,013 (i) shares of our common stock and/or (ii) pre-funded warrants to purchase shares of common stock, or any combination thereof, from us solely to cover over-allotments, if any. | |

Use of Proceeds: | We intend to use the net proceeds from this offering for general corporate purposes, including working capital, marketing, product development and capital expenditures. See “Use of Proceeds” in this prospectus. | |

Dividend Policy: | We have never declared or paid any cash dividends on our shares of common stock. We do not anticipate paying any cash dividends in the foreseeable future. | |

Nasdaq Capital Market Trading Symbol: | Our shares of common stock are listed on the Nasdaq Capital Market under the symbol “IONM.” | |

Risk Factors: | Please read “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in the securities offered in this prospectus. |

4

| (1) | The number of shares of common stock shown above to be outstanding after this offering is based on 1,101,098 shares outstanding as of April 26, 2023, and excludes the following: |

| ● | 194,974 shares of common stock issuable upon the exercise of outstanding warrants with an average weighted exercise price of $81.82; |

| ● | 55,540 shares of common stock issuable upon the exercise of outstanding stock options with an average weighted exercise price of $15.36; |

| ● | 30,584 shares of common stock issuable upon conversion of convertible notes. |

Except as otherwise indicated herein, all information in this prospectus assumes no issuance of pre-funded warrants and no exercise by the underwriters of their over-allotment option and/or the underwriter’s warrants.

5

SUMMARY HISTORICAL FINANCIAL DATA

The following tables set forth a summary of the historical consolidated financial data of Assure Holdings Corp. as at and for the years ended December 31, 2022 and 2021. The historical summary consolidated financial data set forth in the following tables has been derived from the Company’s consolidated financial statements included elsewhere in this prospectus. You should read this data together with the Company’s financial statements and the related notes appearing elsewhere in this prospectus and the information included under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The Company’s historical results are not necessarily indicative of our future results.

Consolidated Statements of Operations:

(expressed in United States dollars, in thousands, except per share amounts)

| Year Ended |

| Year Ended |

| |||

Total revenue | $ | 10,976 | $ | 29,192 | |||

Total operating Expenses | $ | 23,610 | $ | 17,001 | |||

Loss from operations | $ | (27,824) | $ | (2,127) | |||

Net loss | $ | (30,112) | $ | (2,756) | |||

Loss per share | $ | (40.06) | $ | (4.70) | |||

Diluted Weighted average number of shares used in per share calculation - basic | $ | 751,659 | $ | 586,271 | |||

Consolidated Balance Sheets:

(expressed in United States dollars, in thousands, except per share amounts)

| As at |

| As at |

| |||

Total current assets | $ | 21,394 | $ | 38,003 | |||

Total assets | $ | 24,249 | $ | 48,409 | |||

Current liabilities | $ | 4,971 | $ | 3,717 | |||

Total liabilities | $ | 18,784 | $ | 19,453 | |||

Additional paid-in capital | $ | 50,000 | $ | 43,387 | |||

Accumulated deficit | $ | (44,556) | $ | (14,444) | |||

Total shareholders’ equity | $ | 5,465 | $ | 28,956 | |||

Total liabilities and shareholders’ equity | $ | 24,249 | $ | 48,409 | |||

RISK FACTORS

An investment in our securities involves a high degree of risk. You should consider carefully the following information about these risks, together with the other information contained in this prospectus, including the matters addressed in the section entitled “Caution Regarding Forward-Looking Statements,” beginning on page iv of this prospectus, before making an investment decision. Our business, prospects, financial condition, and results of operations may be materially and adversely affected as a result of any of the following risks. The value of our securities could decline as a result of any of these risks. You could lose all or part of your investment in our securities. Some of the statements in “Risk Factors” are forward-looking statements. The following risk factors are not the only risk factors facing our Company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business, prospects, financial condition, and results of operations and it is not possible to predict all risk factors, nor can we assess the impact of all factors on us or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in or implied by any forward-looking statements.

5

Risks Related to Our Business

We’ve had historical negative operating results, and substantial doubt exists as to our ability to continue as a going concern.

In 2015, we launched our business as a neuromonitoring service company. Since its initial launch, the Company has experienced operating losses. Our net loss was $30.1 million and $2.8 million for the years ended December 31, 2022 and 2021, respectively. Although we plan to be profitable in the future, there is no guarantee when profitability will occur. Furthermore, our independent registered public accountants have expressed that substantial doubt exists as to the Company’s ability to continue as a going concern. See Note 2 to the Consolidated Financial Statements included in this Form S-1 Registration statement for further discussion.

Meaningful decrease in underlying commercial insurance reimbursement for IONM services provided.

In recent years, the IONM industry including Assure has seen a meaningful compression in reimbursement for IONM services provided. This trend has been more pronounced for the Technical Component relative to the Professional Component, driven in part by a shift in perceived benefit.

In addition, in October 2022, Assure and other IONM providers experienced a meaningful decrease in the Texas reimbursement benchmark, which had been utilized in state arbitration claims to great success from January 2022 through September 2022. In October 2022, Texas state arbitration reimbursement was realigned to a level much closer to the state average across the Company’s operational footprint. As a reminder, Texas is Assure’s largest market and represents approximately 60% of our patient volume. The company is focused on improving margin and increasing participation rates for state arbitrations in Texas. This change does not affect the larger pool of federal arbitrations associated with the No Surprises Act, both in Texas and other states within Assure’s operational footprint still to come. This pool is anticipated to be much larger than the pool of state arbitration claims.

Effective January 1, 2022, the No Surprises Act (enacted as part of the Consolidated Appropriations Act, 2021), was intended to protect patients from receiving balance bills or “surprise bills”, the difference between what the provider charged and what insurance paid. This new law also provides for negotiation and independent dispute resolution (“IDR”) processes to resolve disputed claim payment amounts for federally regulated insurance plans. Assure has filed several hundred negotiation requests and IDR cases, although decisions for those cases are still pending. Health and Human Services has acknowledged that there is a substantial backlog of IDR case decisions due to a larger than expected demand for dispute resolutions. If we are unsuccessful in arbitrating, or if the arbitration process is delayed, we may not collect for our services or experience delays in collecting for our services and our business and financial results could be materially adversely affected.

The Consolidated Appropriations Act of 2023 enacted a 2.08% payment cut in Medicare physician fee schedule rates for 2023. The updating of Medicare physician fee schedule rates will be threatened by budget neutrality requirements for the foreseeable future. Any future cuts to rates for professional physician services under the Medicare program, other public health care programs in which we may choose to participate, or commercial payor reimbursement could materially and adversely impact our financial results.

Assure management has made strategic and tactical decisions to stay ahead of these reimbursement trends. This includes the Company launching its own remote neurology business in 2021 to realign Assure toward the Professional Component. More recently, Assure has focused on fixing the cost of delivery for IONM services it provides while maintaining a high standard of clinical care. Additional mitigating strategic initiatives include increasing scale through organic growth and M&A in a consolidating IONM market and moving away from the MSA model of revenue sharing.

If we are unable to be reimbursed for our services at expected levels, our business and financial results could be materially adversely affected.

Our plan is to grow our business through expansion, and we anticipate that we will be required to raise additional funds to finance our operations; however, we may not be able to do so when necessary and/or on terms advantageous or acceptable to us.

We have financed our capital and cash requirements primarily from revenues generated from services, using a bank facility and line of credit, issuing convertible debentures, common stock and warrants in private placement offerings, and more recently using our debt arrangement with Centurion Financial Trust. Our ability to maintain the carrying value of our assets and become profitable is dependent on successfully marketing our services, maintaining future profitable operations, improving our billing and collections processes,

6

successfully negotiating pricing and payment arrangements with payors and maintaining our network of providers, the outcome of which cannot be predicted at this time. We intend to grow our operations by developing additional relationships with Provider Network Entities (“PEs”), which are professional IONM entities, and directly contracting with hospitals and surgery centers for services. In the future, we anticipate that it may be necessary for us to raise additional funds for the continuing development of our business strategy.

Our operations to date have consumed substantial amounts of cash and we have sustained negative cash flows from our operations for the last several years. We anticipate that we will require future additional capital, including public or private financing, strategic partnerships or other arrangements with organizations that have capabilities and/or products that are complementary to our own capabilities and/or products, in order to continue the development of our product candidates. However, there can be no assurances that we will complete any financings, strategic alliances or collaborative development agreements, and the terms of such arrangements may not be advantageous to us. Any additional equity financing will be dilutive to our current stockholders and debt financing, if available, may involve restrictive covenants. If we raise funds through collaborative or licensing arrangements, we may be required to relinquish, on terms that are not favorable to us, rights to some of our technologies or product candidates that we would otherwise seek to develop or commercialize. Our failure to raise capital when needed could materially harm our business, financial condition, and results of operations.

Our business strategy is to grow through expansion and acquisitions; however, our business is currently not highly diversified.

Our business strategy has been to grow through expansion. Although we operate in numerous states, approximately 75% of our case volume is currently concentrated in Colorado and Texas, where we are susceptible to local and regional fluctuations in demand for our service, downturns in the economy, adverse weather conditions, changes in local or state regulations, and other localized market changes.

Efforts to expand and execute our acquisition strategy may be affected by our ability to identify suitable candidates and negotiate and close acquisition transactions.

Our loan agreement subjects us to covenants that affect the conduct of business. In the event that our shares of common stock do not maintain a sufficient valuation, or potential acquisition candidates are unwilling to accept our common stock as all or part of the purchase consideration, we may be required to use more of our cash resources, if available, or to rely solely on additional financing arrangements to pursue our acquisition and development strategy. We may not have sufficient capital resources or be able to obtain financing on terms acceptable to us for our acquisition and development strategy, which would limit our growth. Without sufficient capital resources to implement this strategy, our future growth could be limited and operations impaired. There can be no assurance that additional financing will be available to fund this growth strategy or that, if available, the financing will be on terms that are acceptable to us.

The business is expanding beyond our legacy provision of the Technical Component of IONM to offer the Professional Component via tele-neurology services.

Historically, our business has provided the Technical Component of IONM. While it remains a core part of our business and we expect it to remain so in the future, Assure has begun providing the Professional Component via off-site tele-neurology services for IONM. In some cases, this is done directly via our own supervising practitioners. In other instances, these services are provided by and through subsidiaries, which own interest in entities that either (i) directly perform the Professional Component through third-party contracted neurologists or oversight reading physicians, or (ii) provide management services for entities owned by licensed physicians. Assure employs supervising practitioners and has created a structure deploying them as reading physicians.

Providing the Professional Component of IONM subjects the Company to additional legal and government regulations as well as risk of billing and collecting for these services.

The termination of Managed Service Agreements may materially affect our financial results.

In instances in which the Professional Component is provided via MSA’s with surgeons or through agreements with PEs, Assure engages in a revenue share based on our percentage ownership of the PE. Assure disclosed during its third quarter 2022 earnings call in November 2022 that the Company was moving away from the MSA model so that it can keep all collections from the Professional Component. Assure’s goal is to entirely terminate its MSA relationships by the middle of 2023. This process may lead to the loss of some surgeon relationships and as a result our business, reputation, and financial results could be materially adversely affected.

7

We face significant competition from other health care providers.

We compete with other IONM service providers for patients, surgeons, neurologists and INPs. Some of our competitors have longstanding and well-established relationships with physicians and third-party payors in the community. Some of our competitors are hospitals that provide IONM services for surgeries occurring within their hospital facilities. Some of our competitors are also significantly larger than us, may have access to greater marketing, financial and other resources and may be better known in the general community.

The competition among service providers, facilities and hospitals for surgeons, neurologists, professional staff, and patients has intensified in recent years. We face competition from other providers that perform similar services, both inside and outside of our primary service areas. Some of our competitors are owned by non-profit or governmental entities, which may be supported by endowments and charitable contributions or by public or governmental support. These competitors can make capital expenditures without paying sales tax, may hold the property without paying property taxes and may pay for the equipment out of earnings not burdened by income taxes. This competitive advantage may affect our ability to compete effectively with these non-profit or governmental entities.

There are several large, publicly traded companies, divisions or subsidiaries of large publicly held companies, and several private companies that develop and acquire specialty services, which may include neuromonitoring, and these companies compete with us in the acquisition of additional businesses. Further, many surgeon groups develop groups that provide ancillary services, using consultants who typically perform these services for a fee and who may take a small equity interest in the ongoing operations of a business. We can give no assurance that we can compete effectively in these areas. If we are unable to compete effectively to recruit new surgeons, neurologists, attract patients, enter into arrangements with managed care payors or acquire new facilities, our ability to implement our growth strategies successfully could be impaired. This may have an adverse effect on our business, results of operations and financial condition.

We rely on key personnel, industry partners and our ability to hire experienced employees and professionals.

Our development will depend on the efforts of key management, key personnel and our relationships with medical partners in the surgical industry and our ability to hire experienced employees and professionals. Loss of any of these people and partnerships, particularly to competitors, could have a material adverse effect on our business. Further, with respect to the future development of our business, it is necessary to attract additional partners and personnel for such development.

The marketplace for key skilled personnel is becoming more competitive, which means the cost of hiring, training and retaining such personnel may increase. Our business is dependent on our ability to hire and retain employees who have advanced clinical and other technical skills. Employees who meet these high standards are in great demand and are likely to remain a limited resource in the foreseeable future. If we are unable to recruit and retain a sufficient number of these employees, the ability to maintain and grow the business could be negatively impacted. A limited supply of qualified applicants may also contribute to wage increases which outpace the rate of inflation.

Factors outside our control, including competition for human capital and the high level of technical expertise and experience required to execute this development, will affect our ability to employ the specific personnel required. Due to our relatively small size, the failure to retain or attract a sufficient number of key skilled personnel and partnerships could have a material adverse effect on our business, results of future operations and financial condition.

The intraoperative neuromonitoring industry is relatively new and is subject to risk associated with public scrutiny and gaps in technician oversight and formal board reviews.

The intraoperative neuromonitoring industry is relatively new and many of service providers are small privately held providers of intraoperative neuromonitoring that lack quality assurance programs. Our competitors may be more susceptible to adverse patient outcomes, thus raising public scrutiny of the industry as a whole. Such public scrutiny could impact our ability to maintain and grow the business.

INPs within the intraoperative neuromonitoring industry are not subject to oversight or formal board reviews. Lack of oversight and reviews could lead to declining quality among providers who lack self-governed internal programs designed to ensure high-quality

8

standards. Given the fragmented competitive landscape of the neuromonitoring industry, such gaps in appropriate clinical oversight could impact our ability to maintain or grow the business.

We are subject to fluctuations in revenues and payor mix.

We depend on payments from third-party payors, including private insurers, managed care organizations and government health care programs. We are dependent on private and, to a lesser extent, governmental third- party sources of payment for the managed cases performed in Procedure Facilities. Our competitive position has been, and will continue to be, affected by reimbursement and co-payment initiatives undertaken by third- party payors, including insurance companies, and, to a lesser extent, employers, and Medicare and Medicaid.

As an increasing percentage of patients become subject to health care coverage arrangements with managed care payors, our success may depend in part on our ability to negotiate favorable contracts on behalf of Procedure Facilities with managed care organizations, employer groups and other private third-party payors. There can be no assurances that we will be able to enter into these arrangements on satisfactory terms in the future. Also, to the extent that Procedure Facilities have managed care contracts currently in place, there can be no assurance that such contracts will be renewed, or the rates of reimbursement held at current levels.

Managed care plans often set their reimbursement rates based on Medicare and Medicaid rates and consequently, although only a small portion of our revenues are from Medicare and Medicaid, the rates established by these payors may influence our revenues from private payors. As with most government reimbursement programs, the Medicare and Medicaid programs are subject to statutory and regulatory changes, possible retroactive and prospective rate adjustments, administrative rulings, freezes and funding reductions, all of which may adversely affect our revenues and results of operations.

The Centers for Medicare and Medicaid Services introduced substantial changes to reimbursement and coverage related to ambulatory surgical centers (“ASC”). Under these ASC rules, reimbursement levels decreased and remain subject to change. Consequently, our operating margins may continue to be under pressure as a result of changes in payor mix and growth in operating expenses in excess of increases in payments by third-party payors. In addition, as a result of competitive burdens, our ability to maintain operating margins through price increases to privately insured patients is limited. This could have a material adverse effect on our business, operating results and financial condition. Net patient service revenue is reported at the estimated net realizable amounts from patients, third-party payors, and others for services rendered and is recognized upon performance of the patient service. In determining net patient service revenue, management periodically reviews and evaluates historical payment data, payor mix and current economic conditions and adjusts, as required, the estimated collections as a percentage of gross billings in subsequent periods based on final settlements and collections. Management continues to monitor historical collections and market conditions to manage and report the effects of a change in estimates. While we believe that the current reporting and trending software provides us with an accurate estimate of net patient service revenues, any changes in collections or market conditions that we fail to accurately estimate or predict could have a material adverse effect on our operating results and financial condition.

We depend on reimbursement from a small group of third-party payors which could lead to delays and uncertainties in the reimbursement rate and process.

Approximately 57% of our accrued revenue for the year ended December 31, 2022 relates to 30 third-party payors. The loss or disruption of any one of these payors could have an adverse effect on our business, results of operations and financial condition. Additionally, about 53% of our cash collections during the year ended December 31, 2022 was concentrated among these same third-party payors. Greater diversification of payors is dependent on expansion into new markets.

Our performance is greatly dependent on decisions that Third-Party Payors make regarding their out-of-network benefits and alternatively, our ability to negotiate profitable contracts with Third-Party Payors.

One of the complexities of our business is navigating the increasingly hostile environment for entities that are not participants in the health insurance companies’ (“Third-Party Payors”) provider networks (also referred to as an out-of-network provider or facility). Third-Party Payors negotiate discounted fees with providers and facilities in return for access to the patient populations which those Third-Party Payors cover. The providers and facilities that contractually agree to these rates become part of the Third-Party Payor’s “network”. We are currently out-of-network as to most Third-Party Payors.

9

There are several risks associated with not participating in Third-Party Payor networks. First, not all Third- Party Payors offer coverage to their patients for services rendered by non-participants in that Third-Party Payor’s network. Further, it is typically the case that patients with so-called “out-of-network benefits” will be obliged to pay higher co-pays, higher deductibles, and a larger percentage of co-insurance payments. In addition, because the out-of-network coverage often mandates payment at a “usual and customary rate”, the determination of the amounts payable by the Third-Party Payor can fluctuate.

Health care providers and facilities that choose not to participate in a Third-Party Payor’s network often face longer times for their claims to be processed and paid. Further, many Third-Party Payors aggressively audit claims from out-of-network providers and facilities and continuously change their benefit policies in various ways that restrict the ability of beneficiaries to access out of network benefits, and to restrict out-of-network providers from treating their beneficiaries. Consequently, it may become necessary for us to change our out- of-network strategy and join Third-Party Payor networks. This may require us to negotiate and maintain numerous contracts with various Third-Party Payors. In either case, our performance is greatly dependent upon decisions that Third-Party Payors make regarding their out-of-network benefits and alternatively, our ability to negotiate profitable contracts with Third-Party Payors.

If it becomes necessary for us to convert entirely to in-network, there is no guarantee that we will be able to successfully negotiate these contracts. Further, we may experience difficulty in establishing and maintaining relationships with health maintenance organizations, preferred provider organizations, and other Third-Party Payors. Out-of-network reimbursement rates are typically higher than in network reimbursement rates, so our revenue would likely decline if we move to an in-network provider strategy and fail to increase our volume of business sufficiently to offset reduced in-network reimbursement rates. These factors could adversely affect our revenues and our business.

Historically, all privately insured cases were billed on an out-of-network basis. Over the past three years, the Company has shifted some of the business to direct and indirect contracts with the payors and related parties. However, as of December 31, 2022, approximately 85% of our privately insured cases remain out of network basis, without any reimbursement rate protection or consistent in-network patient enrollments typically seen from an in-network agreement. Accordingly, we are susceptible to changes in reimbursement policies and procedures by Third-Party Payors and patients’ preference of using their out-of-network benefits which could have an adverse effect on our business, results of operations and financial condition.

The industry trend toward value-based purchasing may negatively impact our revenues.

We believe that value-based purchasing initiatives of both governmental and private payors tying financial incentives to quality and efficiency of care will increasingly affect the results of operations of Procedure Facilities and may negatively impact our revenues if we are unable to meet expected quality standards.

We may be affected by the Patient Protection and Affordable Care Act (“ACA”), which contains several provisions intended to promote value-based purchasing in federal health care programs. Medicare now requires providers to report certain quality measures in order to receive full reimbursement increases for inpatient and outpatient procedures that were previously awarded automatically. In addition, hospitals that meet or exceed certain quality performance standards will receive increased reimbursement payments, while hospitals that have “excess readmissions” for specified conditions will receive reduced reimbursement. There is a trend among private payors toward value-based purchasing of health care services, as well. Many large commercial health insurance payors require hospitals to report quality data, and several of these payors will not reimburse hospitals for certain preventable adverse events.

We expect value based purchasing programs, including programs that condition reimbursement on patient outcome measures, to become more common, to involve a higher percentage of reimbursement amounts and to spread to reimbursement for ancillary services. Although we are unable to predict how this trend will affect our future results of operations, it could negatively impact our revenues if we are unable to meet quality standards established by both governmental and private payors.

State and Federal surprise billing legislation could lead to lower reimbursement rates.

In December 2020, federal legislation called the No Surprises Act was passed by Congress and signed by the President. Beginning in 2022, the law was implemented with the intended effect to prohibit surprise billing. Another feature of the No Surprise Act relevant to Assure is that it will for the first time allow companies like Assure to arbitrate disputed claims where we are not being paid in every state. While each arbitration case is treated like an individual lawsuit with unpredictable outcomes, we believe this dispute resolution process has the potential to help us get paid on a greater proportion of our claims.

10

The majority of U.S. states have laws protecting consumers against out-of-network balance billing or “surprise billing”. While consumer collections represent a negligible amount of our total revenue, most state surprise billing laws have established payment standards based on the median in-network rate or a multiplier of what Medicare would pay. These payment standards are often less than the average out-of-network payment and could therefore have an adverse effect on reimbursement rates. Although we have already experienced lower reimbursement rates from such laws, additional impact may be experienced as more states and/or federal legislation is adopted. Today, approximately 15% of our third-party payor revenue is contracted with in- network rate agreements and we are actively pursuing more in-network agreements to further mitigate this risk.

Our revenues will depend on our customers’ continued receipt of adequate reimbursement from private insurers and government sponsored health care programs.

Political, economic, and regulatory influences continue to change the health care industry in the United States. The ability of hospitals to pay fees for our products partially depends on the extent to which reimbursement for the costs of such materials and related treatments will continue to be available from private health coverage insurers and other similar organizations. We may have difficulty gaining market acceptance for the products we sell if third-party payors do not provide adequate coverage and reimbursement to hospitals. Major third- party payors of hospitals, such as private health care insurers, periodically revise their payment methodologies based, in part, upon changes in government sponsored health care programs. We cannot predict these periodic revisions with certainty, and such revisions may result in stricter standards for reimbursement of hospital charges for certain specified products, potentially adversely impacting our business, results of operations, and financial conditions.

Changes in accounting estimates due to changes in circumstances may require us to write off accounts receivables or write down intangible assets, such as goodwill, may have a material impact on our financial reporting and results of operations.

We have made updates to estimates resulting from changes in circumstances. For example, during the year ended December 31, 2022, we decreased the useful of intangible assets related to doctor agreements from 10 years to one year as one year more accurately represents our current useful life of such agreements. As a result of this change in estimate, the amortization of historical doctor agreements was accelerated brining the balance as of December 31, 2022 to nil. There will be no amortization in future periods related to historical capitalized doctor agreements. Any agreements entered into after December 2022, will be amortized over one year. Future changes in estimates may cause us to write off accounts receivable, intangible assets, such as goodwill, based on changes in circumstances which may have a negative impact on our consolidated financial statements.

Accounts Receivable

In order to more precisely estimate and our accounts receivable reserves, in January 2021 the Company modified its accounting estimate procedures to update its technical and professional collection experience monthly. This change in estimate procedures will not eliminate additional reserves being recorded for fluctuation in the technical and professional collection experience in future periods. However, our change in policy is expected to reduce the magnitude of future reserves that are recorded as a result of fluctuations in the Company’s collection experience.

Goodwill and Intangible Assets

As a result of purchase accounting for our acquisition transactions, our consolidated balance sheet at December 31, 2021 contains intangible assets designated as either goodwill or intangibles totaling approximately $4.4 million in goodwill and approximately $3.6 million in intangibles. Additional acquisitions that result in the recognition of additional intangible assets would cause an increase in these intangible assets. On an ongoing basis, we evaluate whether facts and circumstances indicate any impairment of the value of intangible assets. As of December 31, 2022, we determine that a significant impairment had occurred, which required us to write-off $3.4 million of goodwill and $117 thousand of other intangible assets for a total impairment charge of $3.5 million. Future impairment charges could have a material adverse effect on our results of operations in the period in which the write-off occurs.

We depend on referrals.

Our success, in large part, is dependent upon referrals to our physicians from other physicians, systems, health plans and others in the communities in which we operate, and upon our medical staff’s ability to maintain good relations with these referral sources. Physicians who use Procedure Facilities and those who refer patients are not our employees and, in many cases, most physicians have admitting

11