NETSTREIT REPORTS FIRST QUARTER 2024 FINANCIAL AND OPERATING RESULTS

– Net income of $0.01 and Adjusted Funds from Operations ("AFFO") of $0.31 Per Diluted Share for First Quarter –

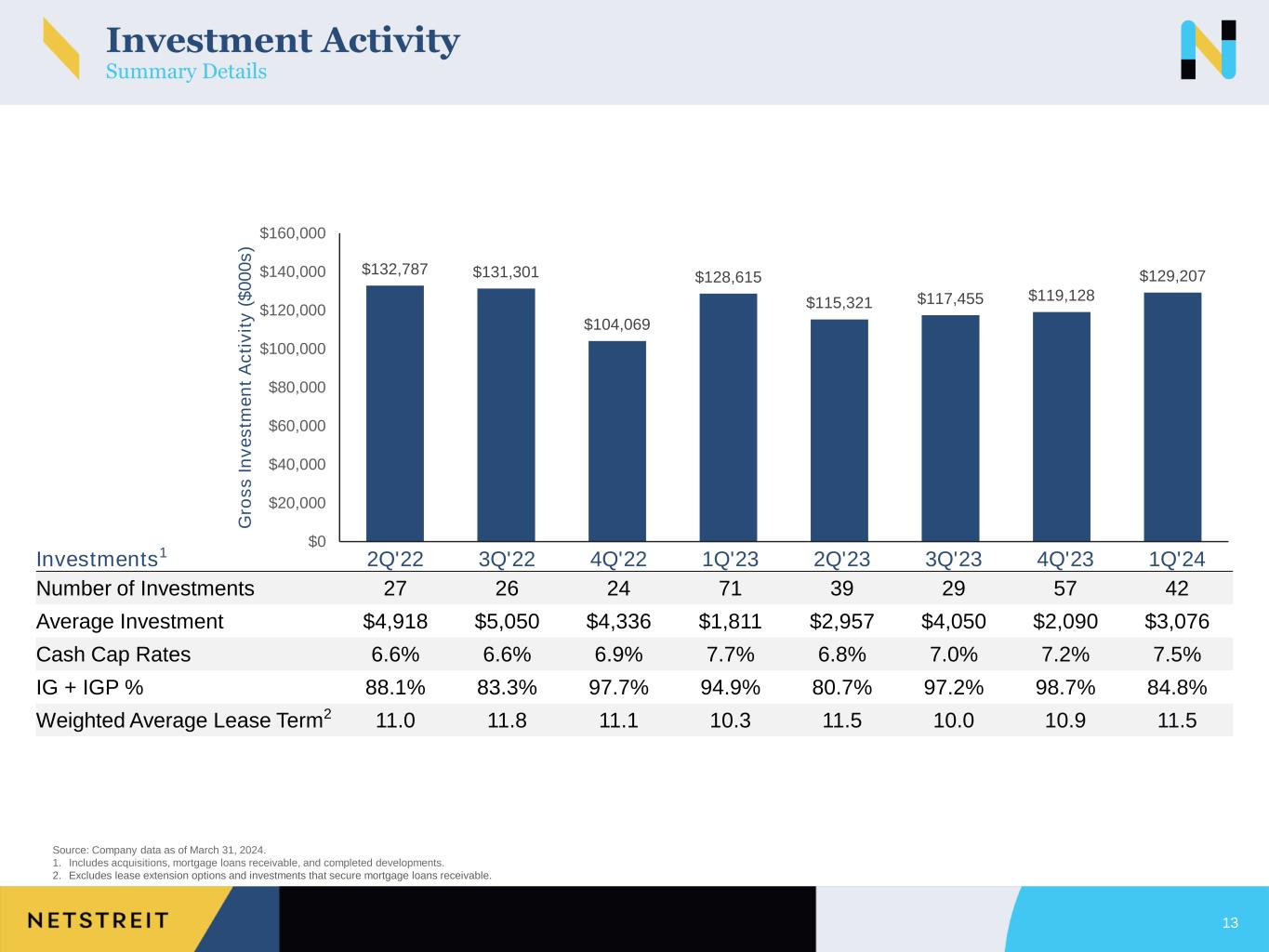

– Completed $129.2 Million of Gross Investment Activity at 7.5% Blended Cash Yield for First Quarter –

– Increasing Low End of 2024 AFFO Per Share Guidance to a New Range of $1.25 to $1.28 –

– Completed $198.7 Million Forward Equity Offering in January 2024 –

– $30.8 Million of Forward Equity Sales through ATM Year to Date –

Dallas, TX – April 29, 2024 – NETSTREIT Corp. (NYSE: NTST) (the “Company”) today announced financial and operating results for the first quarter ended March 31, 2024.

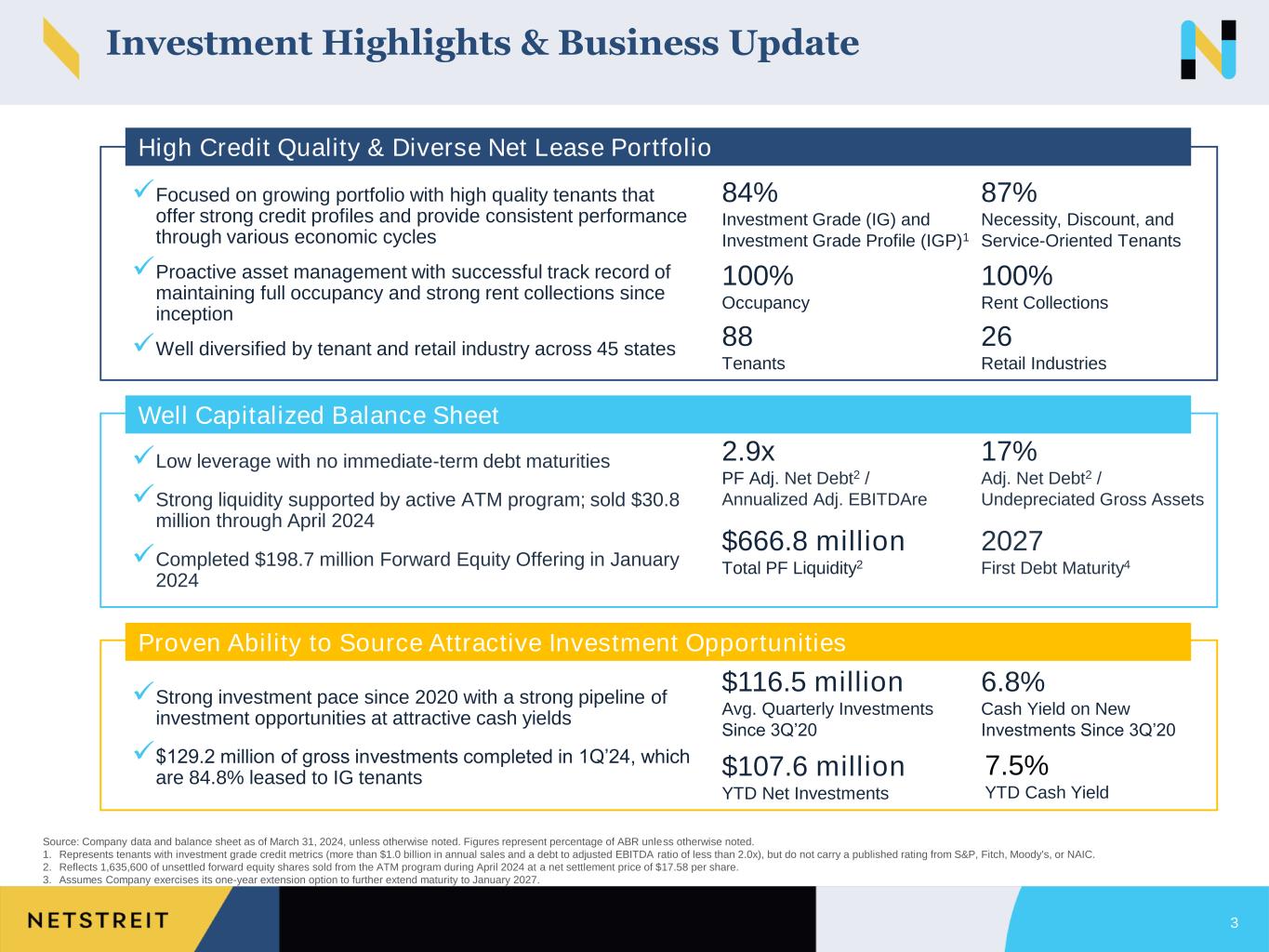

“I'm proud to report NETSTREIT's strong start to the year. We raised a combined $229.5 million from our January follow-on offering and our ATM program year to date, and have completed $129.2 million in gross investment activity at a blended cash yield of 7.5% during the quarter. With our 2024 capital needs already addressed, NETSTREIT is primed to continue to take advantage of an increasingly attractive acquisitions market,” said Mark Manheimer, Chief Executive Officer of NETSTREIT.

FIRST QUARTER 2024 HIGHLIGHTS

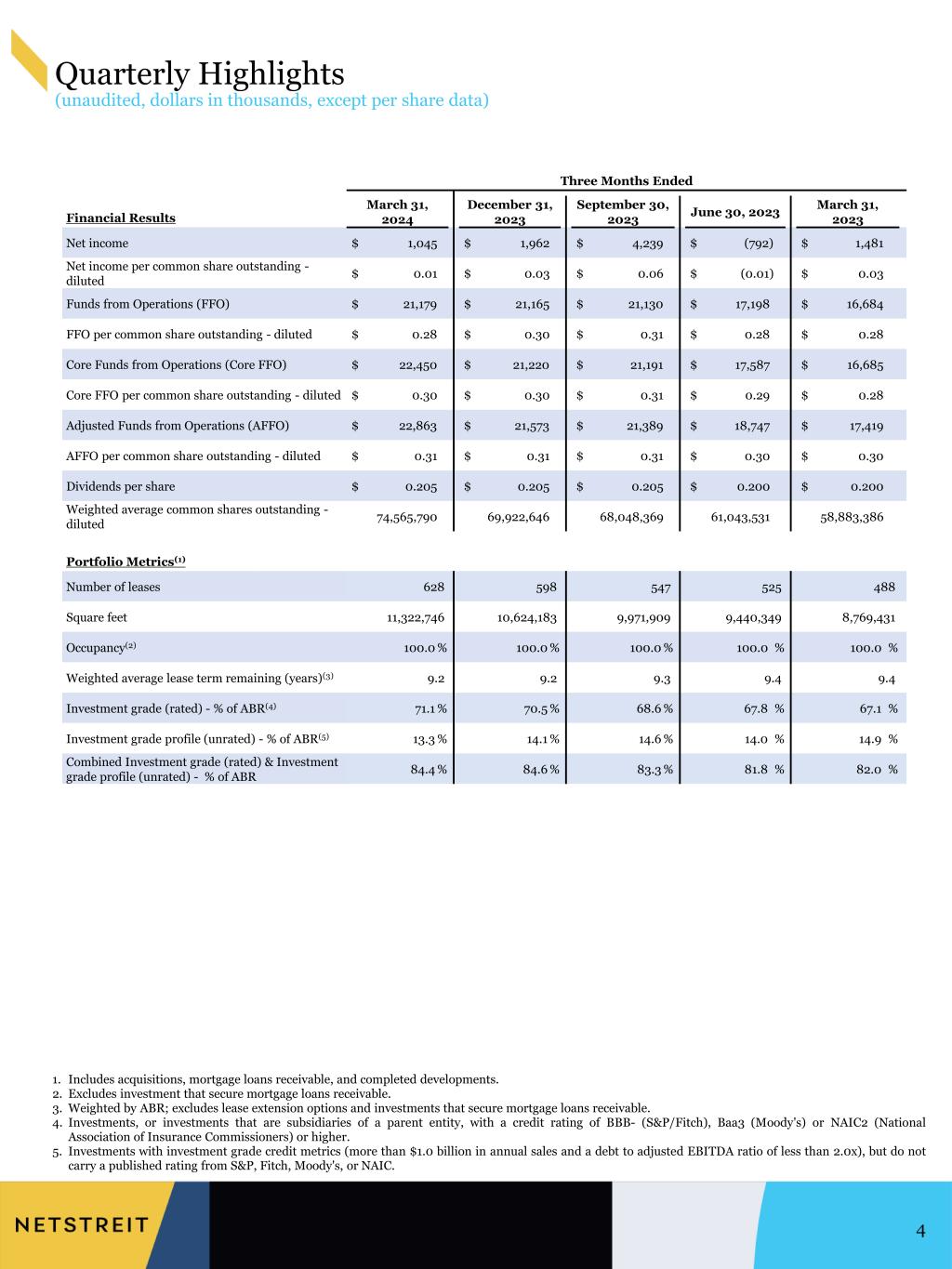

The following table summarizes the Company's select financial results1 for the three months ended March 31, 2024.

| Three Months Ended March 31, | |||||||||||||||||

| 2024 | 2023 | % Change | |||||||||||||||

(Unaudited) | |||||||||||||||||

Net Income per Diluted Share | $ | 0.01 | $ | 0.03 | (67) | % | |||||||||||

| Funds from Operations per Diluted Share | $ | 0.28 | $ | 0.28 | — | % | |||||||||||

| Core Funds from Operations per Diluted Share | $ | 0.30 | $ | 0.28 | 7 | % | |||||||||||

| Adjusted Funds from Operations per Diluted Share | $ | 0.31 | $ | 0.30 | 3 | % | |||||||||||

1.Funds from operations ("FFO"), core funds from operations ("Core FFO"), and adjusted funds from operations ("AFFO") are non-GAAP financial measures. See "Non-GAAP Financial Measures."

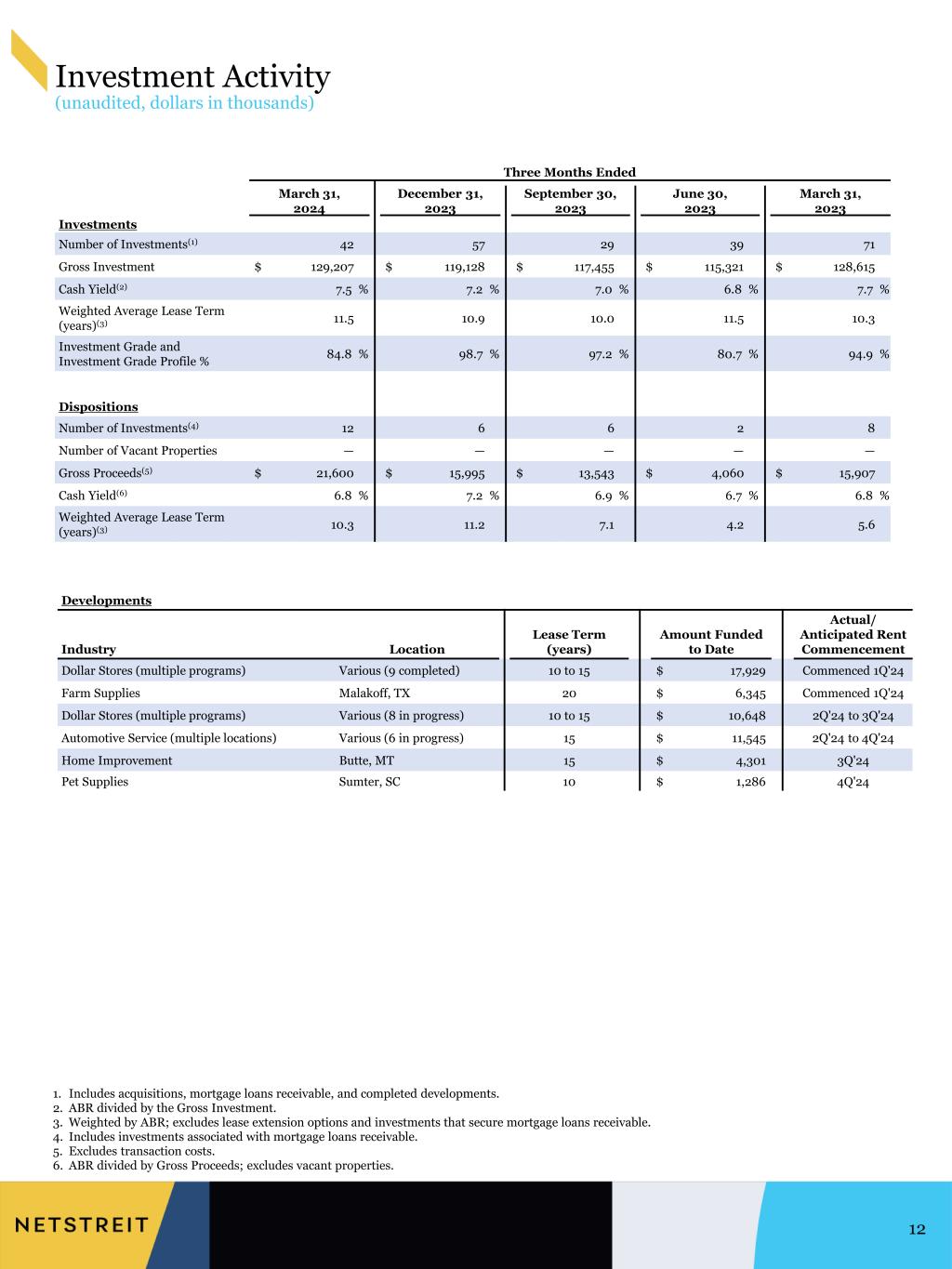

INVESTMENT ACTIVITY

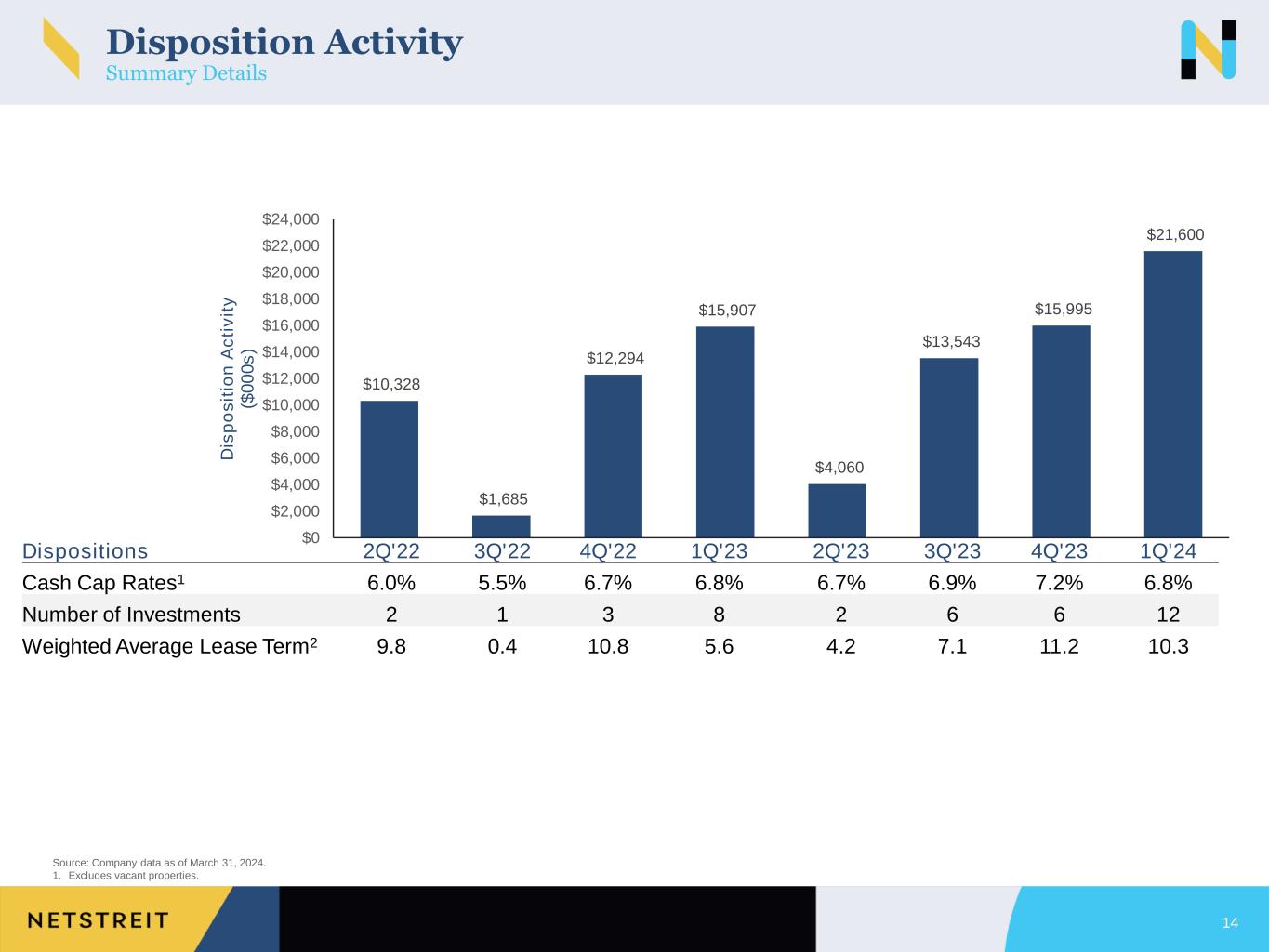

The following tables summarize the Company's investment and disposition activities (dollars in thousands) for the three months ended March 31, 2024.

Three Months Ended March 31, 2024 | |||||||||||

| Number of Investments | Amount | ||||||||||

| Investments | 42 | $ | 129,207 | ||||||||

Dispositions | 12 | 21,600 | |||||||||

| Net Investment Activity | $ | 107,607 | |||||||||

| Investment Activity | |||||||||||

| Cash Yield | 7.5 | % | |||||||||

| % of ABR derived from Investment Grade Tenants | 84.8 | % | |||||||||

| % of ABR derived from Investment Grade Profile Tenants | — | % | |||||||||

| Weighted Average Lease Term (years) | 11.5 | ||||||||||

| Disposition Activity | |||||||||||

Cash Yield | 6.8 | % | |||||||||

| Weighted Average Lease Term (years) | 10.3 | ||||||||||

The following table summarizes the Company's on-going development projects and estimated development costs (dollars in thousands) as of March 31, 2024.

| Developments | Three Months Ended March 31, 2024 | ||||

| Amount Funded During the Quarter | $ | 10,936 | |||

As of March 31, 2024 | |||||

| Number of Developments | 16 | ||||

| Amount Funded to Date | $ | 27,780 | |||

| Estimated Funding Remaining on Developments | 19,357 | ||||

| Total Estimated Development Cost | $ | 47,137 | |||

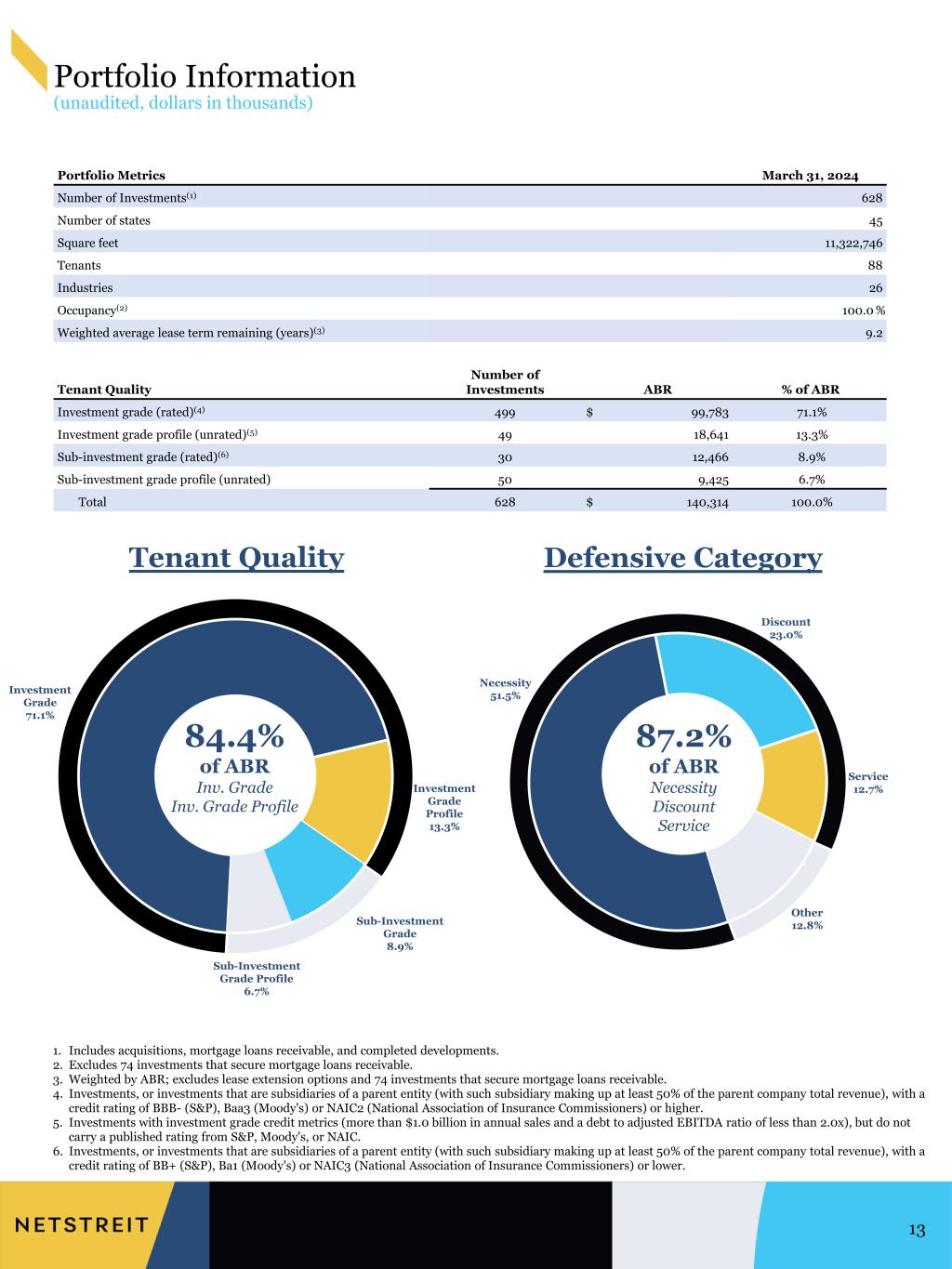

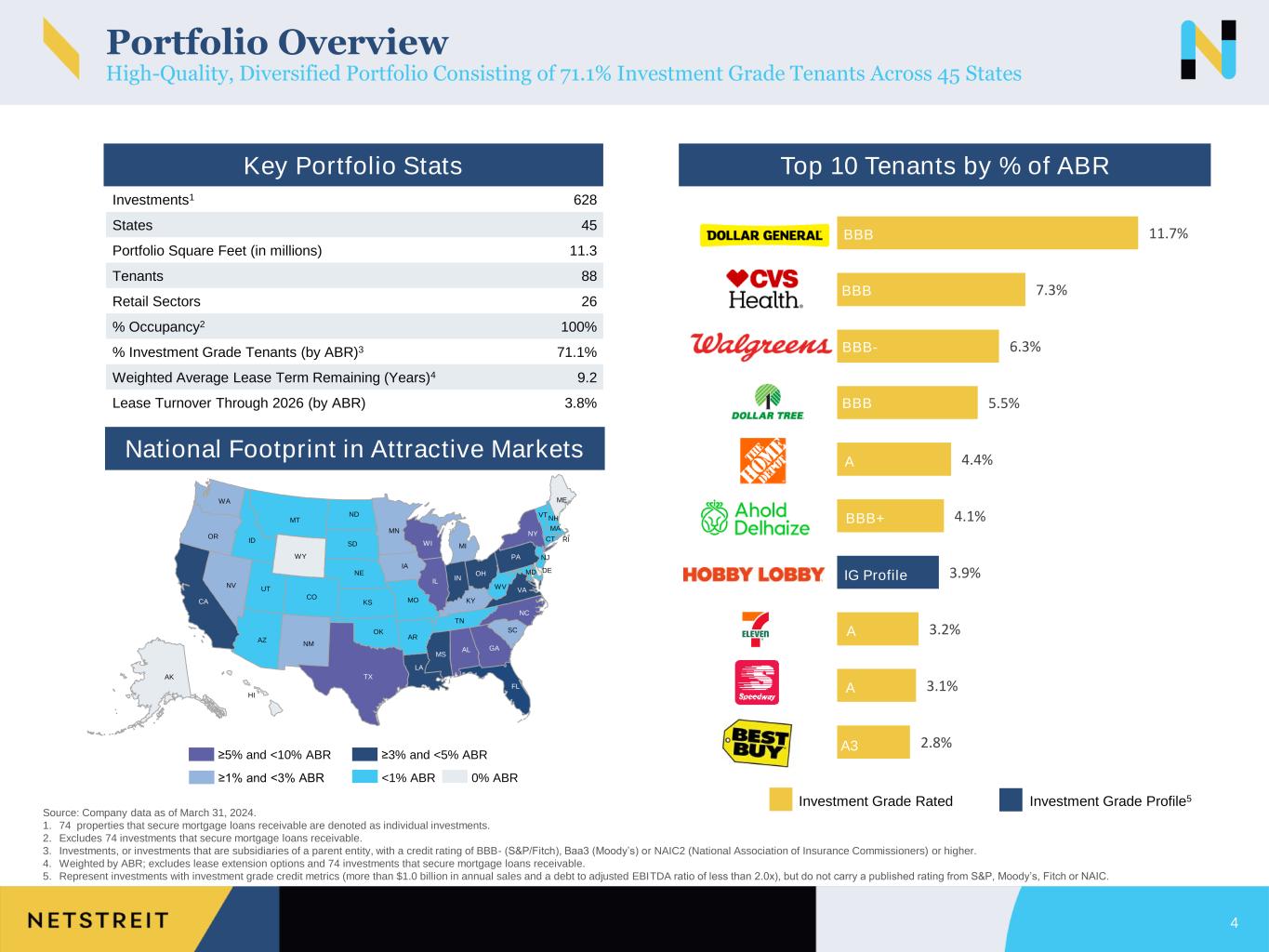

PORTFOLIO UPDATE

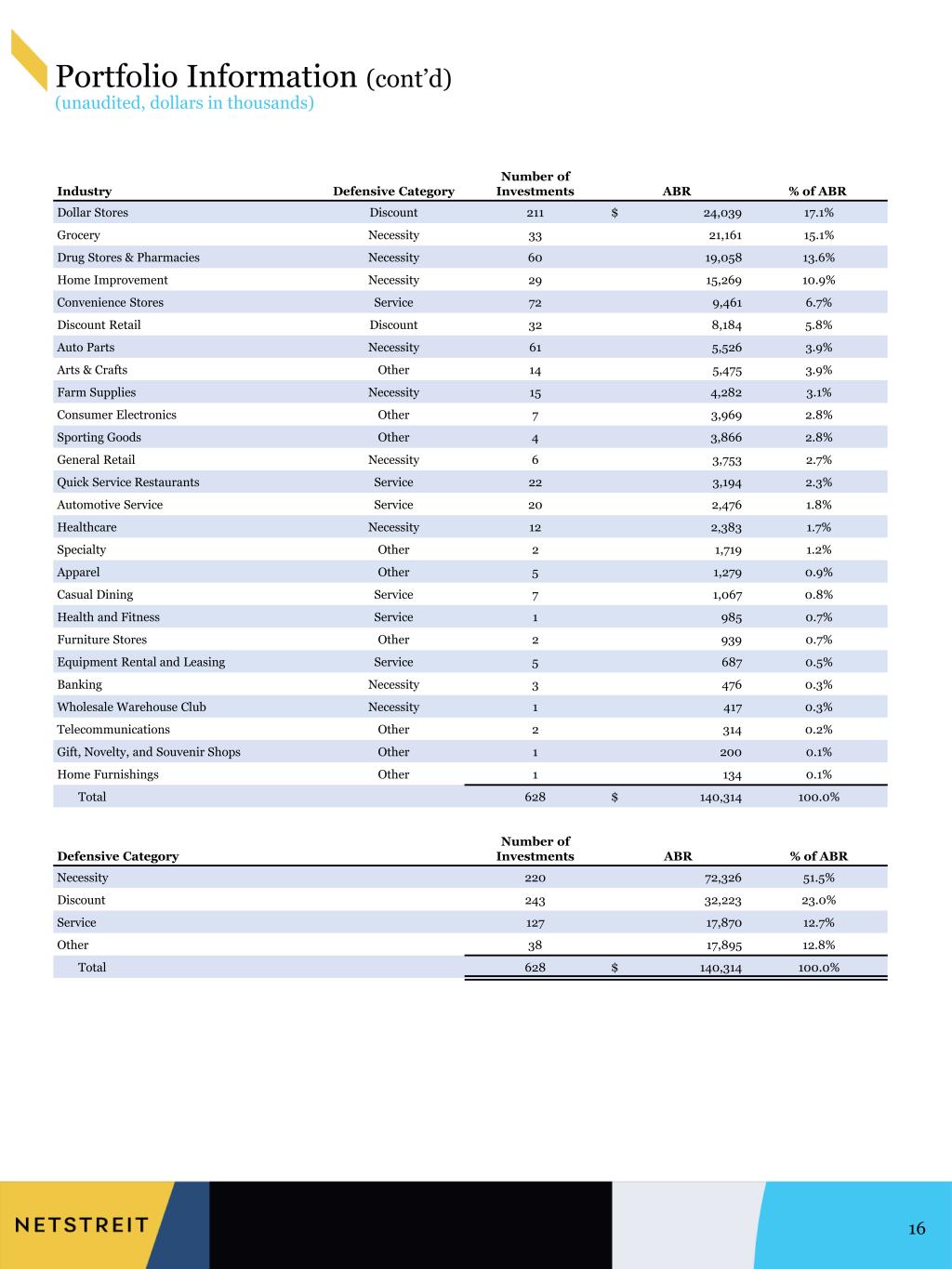

The following table summarizes the Company's real estate portfolio (weighted by ABR, dollars in thousands) as of March 31, 2024.

As of March 31, 2024 | |||||

| Number of Investments | 628 | ||||

| ABR | $ | 140,314 | |||

| States | 45 | ||||

| Square Feet | 11,322,746 | ||||

| Tenants | 88 | ||||

| Industries | 26 | ||||

| Occupancy | 100.0 | % | |||

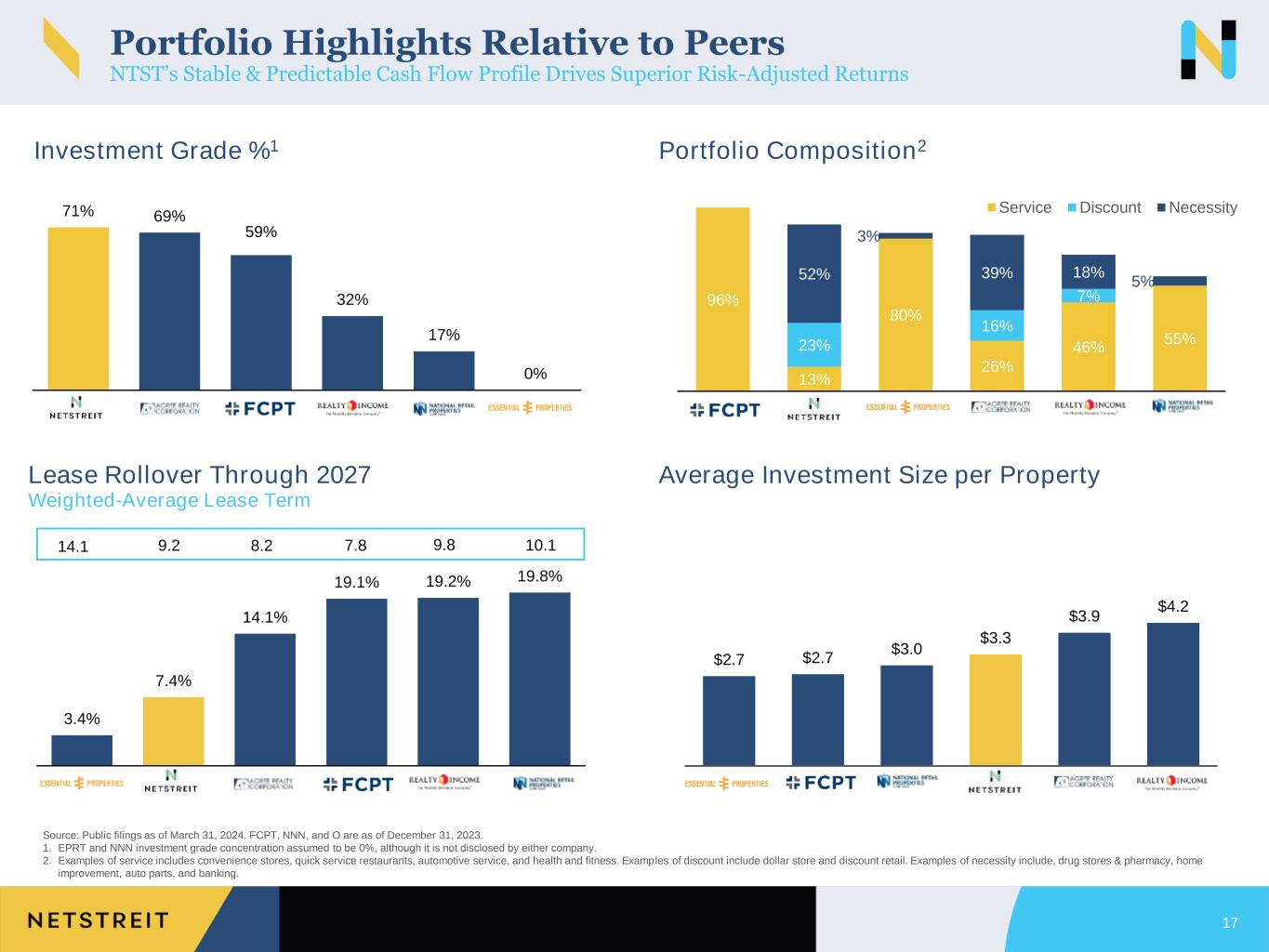

| Weighted Average Lease Term (years) | 9.2 | ||||

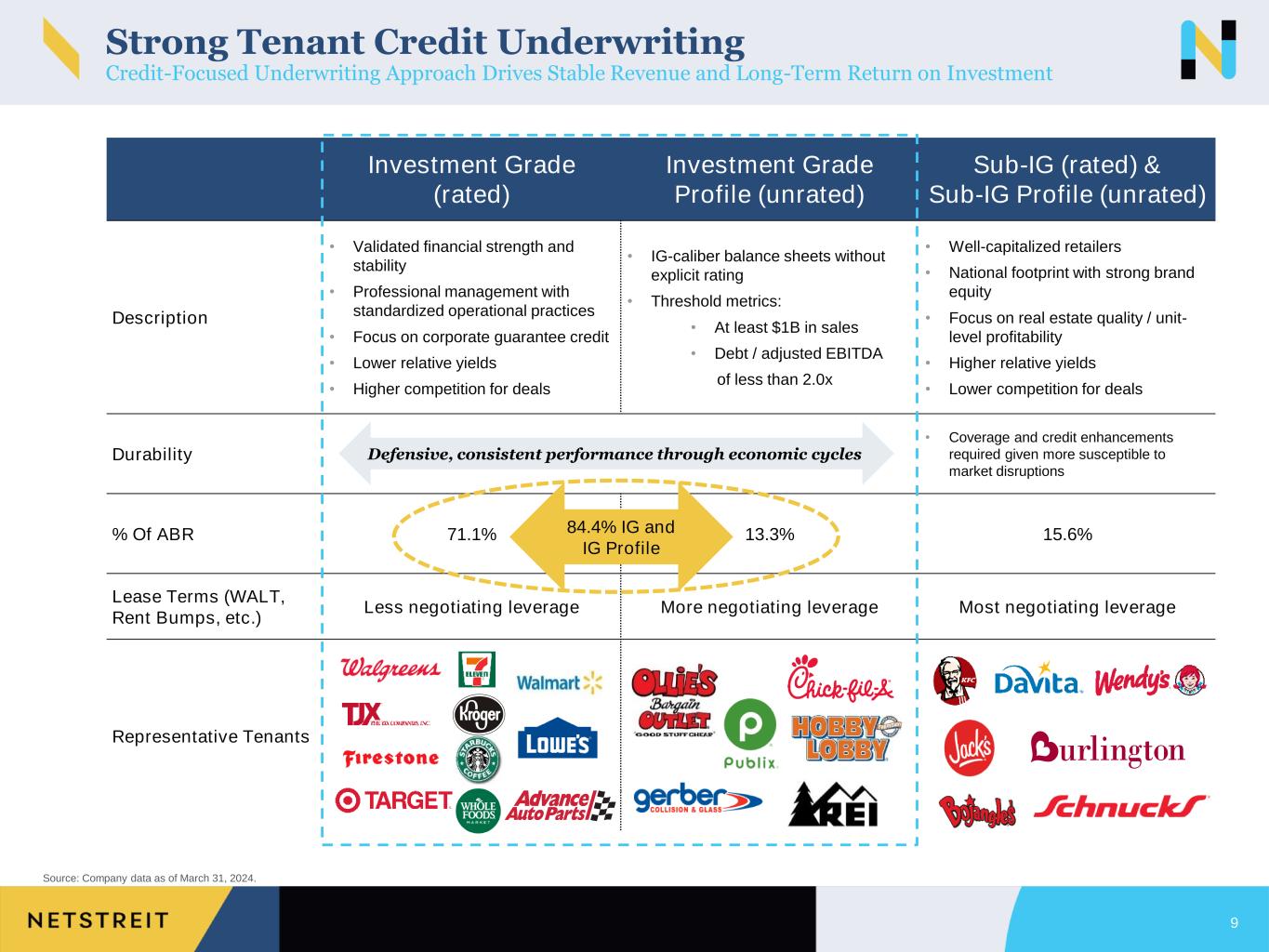

| Investment Grade % | 71.1 | % | |||

| Investment Grade Profile % | 13.3 | % | |||

2

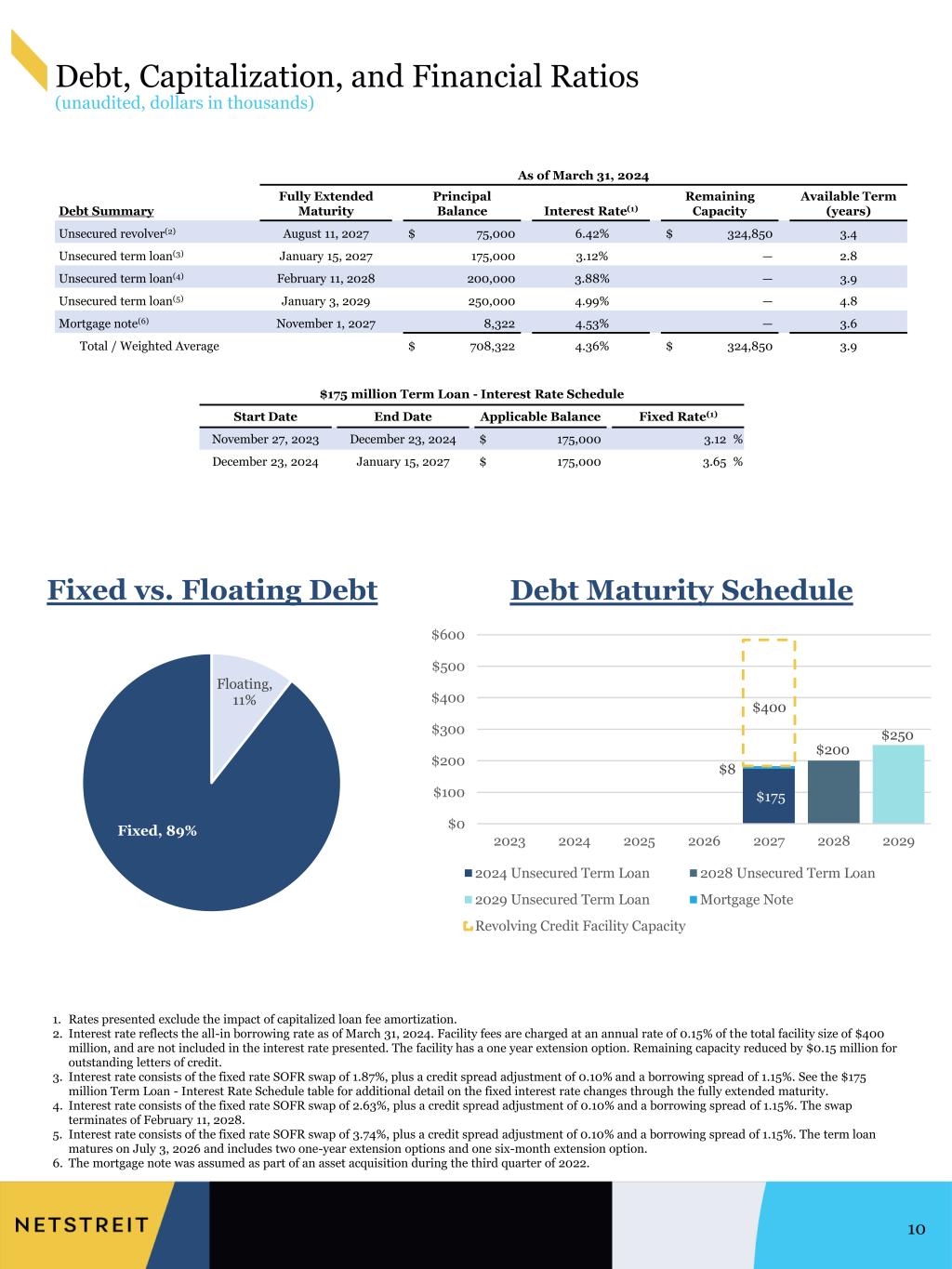

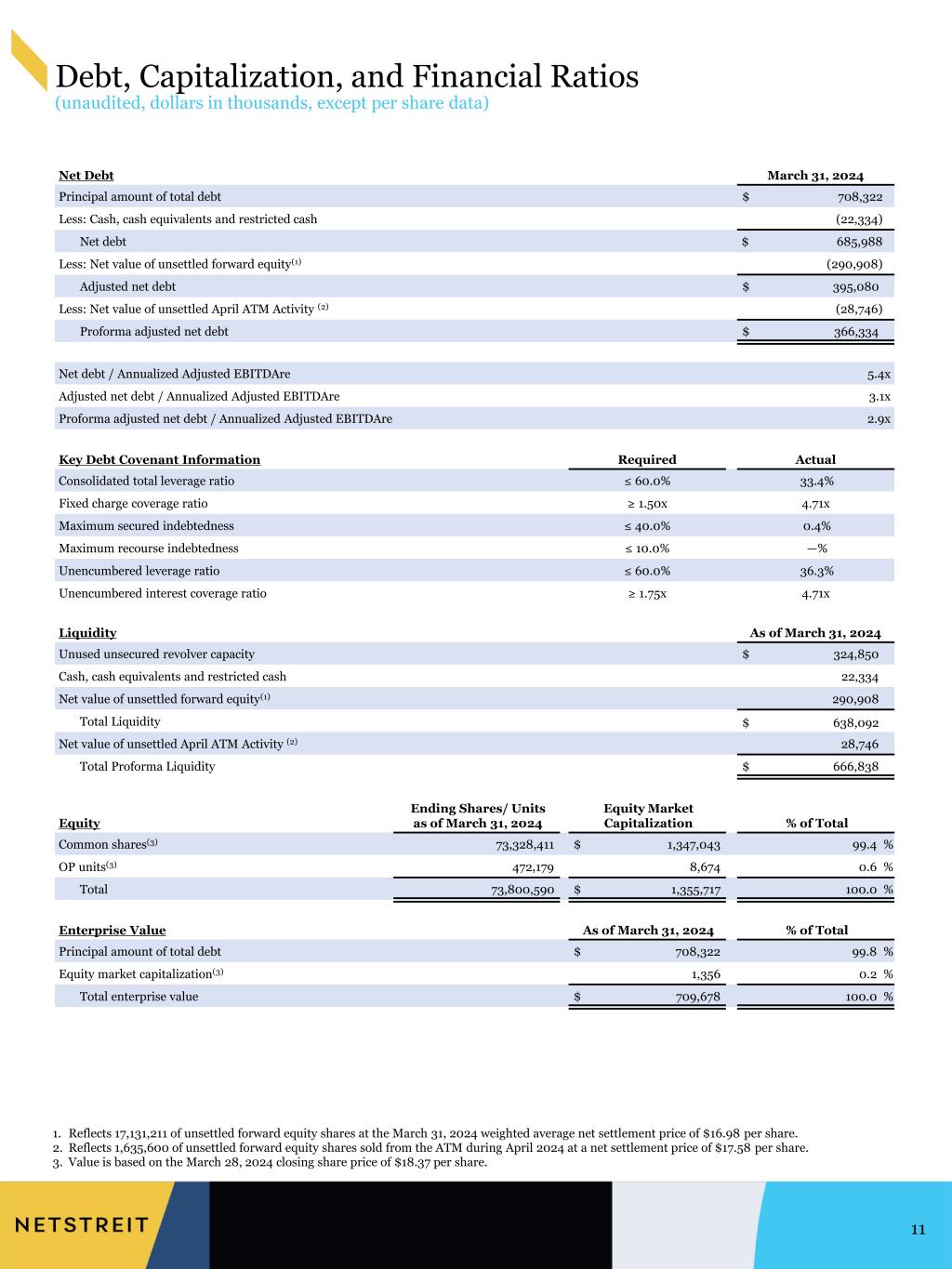

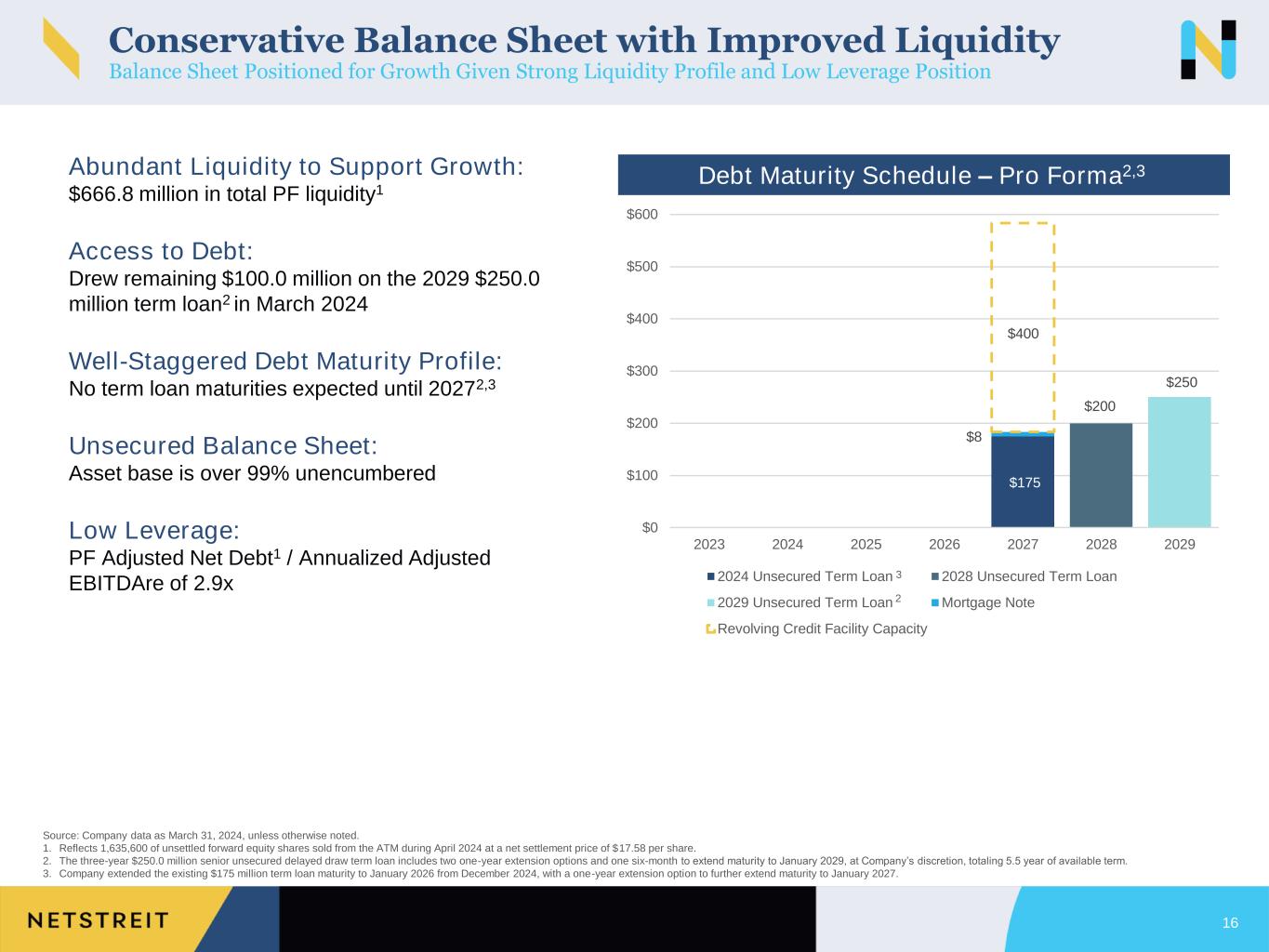

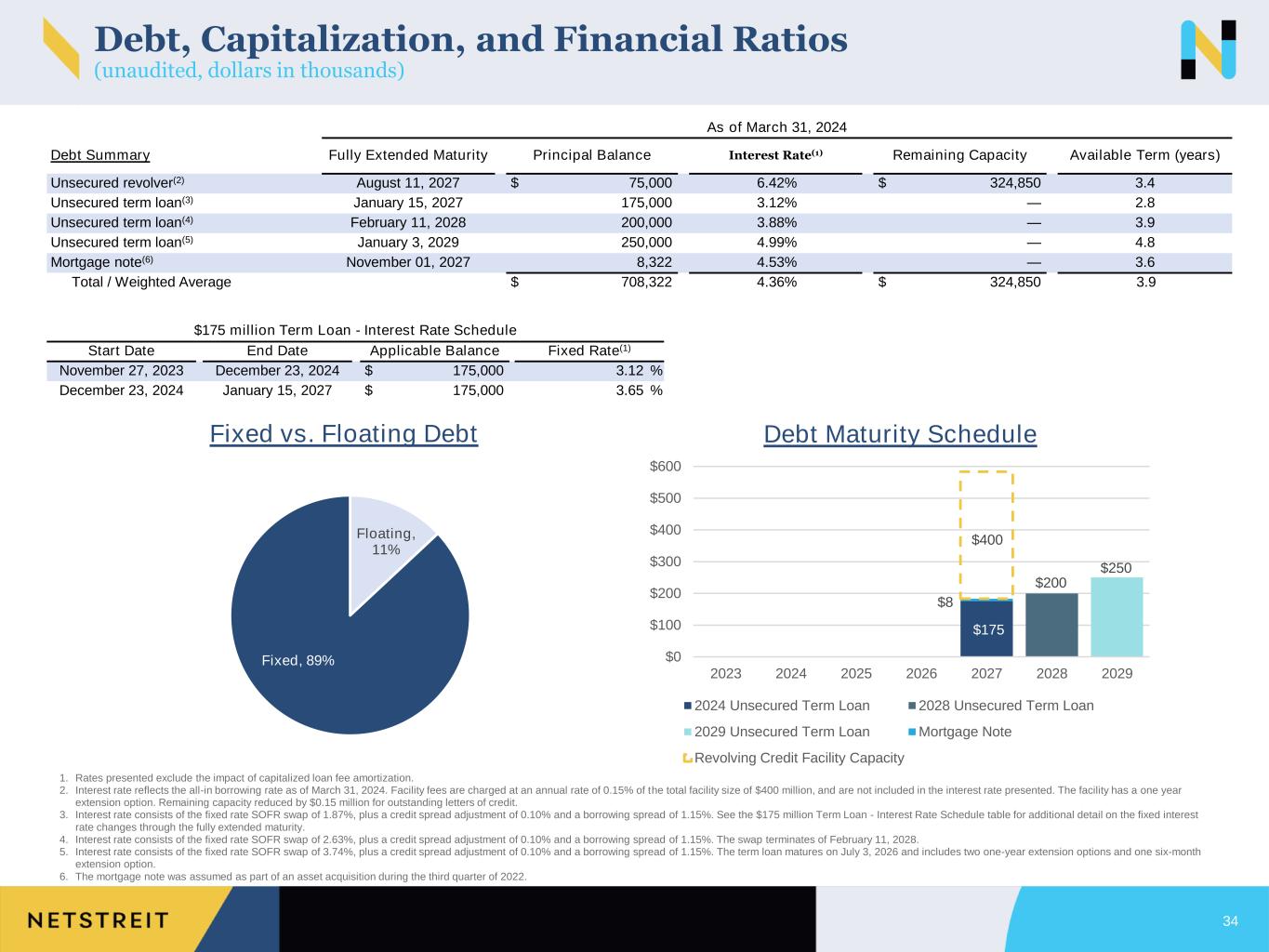

CAPITAL MARKETS AND BALANCE SHEET

The following tables summarize the Company's leverage, balance sheet, liquidity and ATM sales (dollars in thousands, except per share data) as of and for the three months ended March 31, 2024.

| Leverage | As of March 31, 2024 | ||||

Net Debt / Annualized Adjusted EBITDAre | 5.4x | ||||

Adjusted Net Debt / Annualized Adjusted EBITDAre | 3.1x | ||||

Proforma Adjusted Net Debt / Annualized Adjusted EBITAre1 | 2.9x | ||||

| Liquidity | |||||

| Unused Unsecured Revolver Capacity | $ | 324,850 | |||

| Cash, Cash Equivalents and Restricted Cash | 22,334 | ||||

Net Value of Unsettled Forward Equity | 290,908 | ||||

| Total Liquidity | $ | 638,092 | |||

Net Value of Unsettled Forward Equity from April ATM Activity | 28,746 | ||||

Total Proforma Liquidity1 | $ | 666,838 | |||

January 2024 Forward Equity Offering | As of March 31, 2024 | ||||

Shares Unsettled | 11,040,000 | ||||

Price Per Share (Gross) | $ | 18.00 | |||

Net Value of Unsettled Forward Equity | $ | 190,467 | |||

| ATM Program | |||||

Shares Unsettled | 107,500 | ||||

Weighted Average Price Per Share (Gross) | $ | 18.29 | |||

Net Value of Unsettled Forward Equity | $ | 1,948 | |||

2023 ATM Program Initial Capacity | $ | 300,000 | |||

ATM Capacity Remaining as of March 31, 2024 | $ | 220,710 | |||

Unsettled Forward Equity | |||||

Shares Unsettled as of March 31, 2024 | 17,131,211 | ||||

Weighted Average Price Per Share (Net) | $ | 16.98 | |||

Net Value of Unsettled Forward Equity | $ | 290,908 | |||

1.See Subsequent Activity. These proforma calculations include the net value of unsettled shares from the April 2024 ATM activity.

SUBSEQUENT ACTIVITY

In April 2024, the Company sold 1,635,600 shares of its common stock through its at-the-market ("ATM") sales program (the "ATM Program"). The shares were sold on a forward basis at a weighted average price of $17.63 per share. The following table summarizes the Company's April ATM activity (dollars in thousands, except per share data).

April 2024 ATM Activity | As of April 29, 2024 | ||||

Shares Unsettled | 1,635,600 | ||||

Price Per Share (Gross) | $ | 17.63 | |||

Net Value of Unsettled Forward Equity | $ | 28,746 | |||

DIVIDEND

On April 23, 2024, the Company’s Board of Directors declared a quarterly cash dividend of $0.205 per share for the second quarter of 2024. On an annualized basis, the dividend of $0.82 per share of common stock represents an increase of $0.02 per share over the prior year annualized dividend. The dividend will be paid on June 14, 2024 to shareholders of record on June 3, 2024.

3

2024 GUIDANCE

The Company is increasing the low end of its 2024 AFFO per share guidance to a new range of $1.25 to $1.28 from its previously announced range of $1.24 to $1.28. The Company also expects cash G&A to be in the range of $13.5 million to $14.5 million (exclusive of transaction costs and severance payments).

The Company's 2024 guidance is based on a number of assumptions that are subject to change and many of which are outside the Company's control. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results.

AFFO is a non-GAAP financial measure. The Company does not provide a reconciliation of such forward-looking non-GAAP measure to the most directly comparable financial measures calculated and presented in accordance with GAAP because to do so would be potentially misleading and not practical given the difficulty of projecting event driven transactional and other non-core operating items in any future period. The magnitude of these items, however, may be significant.

EARNINGS CONFERENCE CALL

A conference call will be held on Tuesday, April 30, 2024 at 11:00 AM ET. During the conference call the Company’s officers will review first quarter performance, discuss recent events, and conduct a question and answer period.

The webcast will be accessible on the “Investor Relations” section of the Company’s website at www.NETSTREIT.com. To listen to the live webcast, please go to the site at least 15 minutes prior to the scheduled start time to register, as well as download and install any necessary audio software.

The conference call can also be accessed by dialing 1-877-451-6152 for domestic callers or 1-201-389-0879 for international callers. A dial-in replay will be available starting shortly after the call until May 7, 2024, which can be accessed by dialing 1-844-512-2921 for domestic callers or 1-412-317-6671 for international callers. The passcode for this dial-in replay is 13745165.

SUPPLEMENTAL PACKAGE

The Company’s supplemental package will be available prior to the conference call in the Investor Relations section of the Company’s website at www.investors.netstreit.com.

About NETSTREIT Corp.

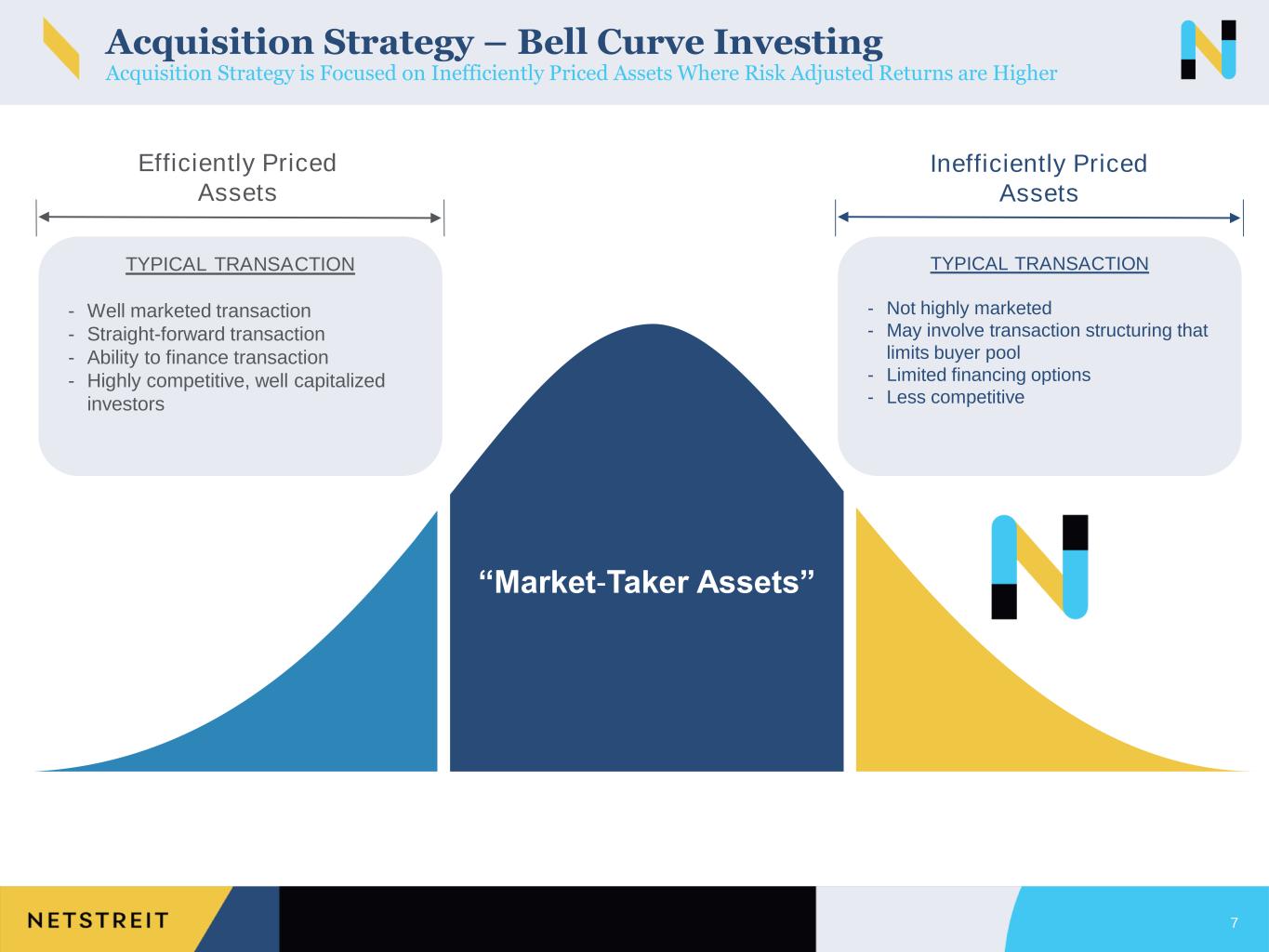

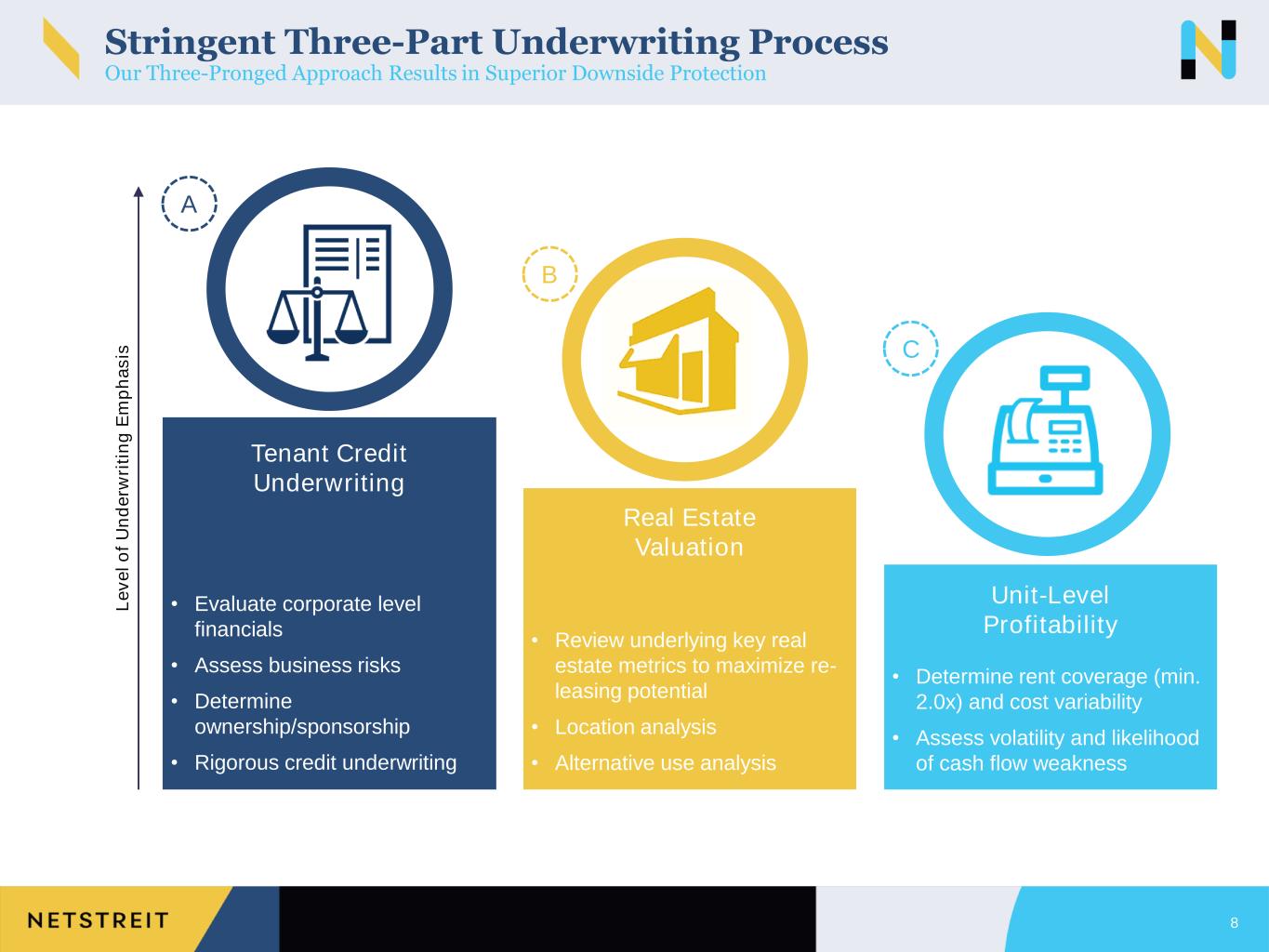

NETSTREIT Corp. is an internally managed real estate investment trust (REIT) based in Dallas, Texas that specializes in acquiring single-tenant net lease retail properties nationwide. The growing portfolio consists of high-quality properties leased to e-commerce resistant tenants with healthy balance sheets. Led by a management team of seasoned commercial real estate executives, NETSTREIT’s strategy is to create the highest quality net lease retail portfolio in the country with the goal of generating consistent cash flows and dividends for its investors.

Investor Relations

ir@netstreit.com

972-597-4825

4

NON-GAAP FINANCIAL MEASURES

This press release contains non-GAAP financial measures, including FFO, Core FFO, AFFO, EBITDA, EBITDAre, Adjusted EBITDAre, Annualized Adjusted EBITDAre, Property-Level NOI, Property-Level Cash NOI, Property-Level Cash NOI Estimated Run Rate, Total Property-Level Cash NOI Estimated Run Rate, Net Debt and Adjusted Net Debt. A reconciliation of each non-GAAP financial measure to the most comparable GAAP measure, and definitions of each non-GAAP measure, are included below.

FORWARD LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements concerning our business and growth strategies, investment, financing and leasing activities, including estimated development costs, trends in our business, including trends in the market for single-tenant, retail commercial real estate and our 2024 guidance. Words such as “expects,” “anticipates,” “intends,” “plans,” “likely,” “will,” “believes,” “seeks,” “estimates,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the results of operations or plans expressed or implied by such forward-looking statements. Although we believe that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore such statements included in this press release may not prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved. For a further discussion of these and other factors that could impact future results, performance or transactions, see the information under the heading “Risk Factors” in our Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission (the “SEC”) on February 14, 2024 and other reports filed with the SEC from time to time. Forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this press release. New risks and uncertainties may arise over time and it is not possible for us to predict those events or how they may affect us. Many of the risks identified herein and in our periodic reports have been and will continue to be heightened as a result of the ongoing and numerous adverse effects arising from macroeconomic conditions, including inflation, interest rates and instability in the banking system. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein, to reflect any change in our expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required by law.

5

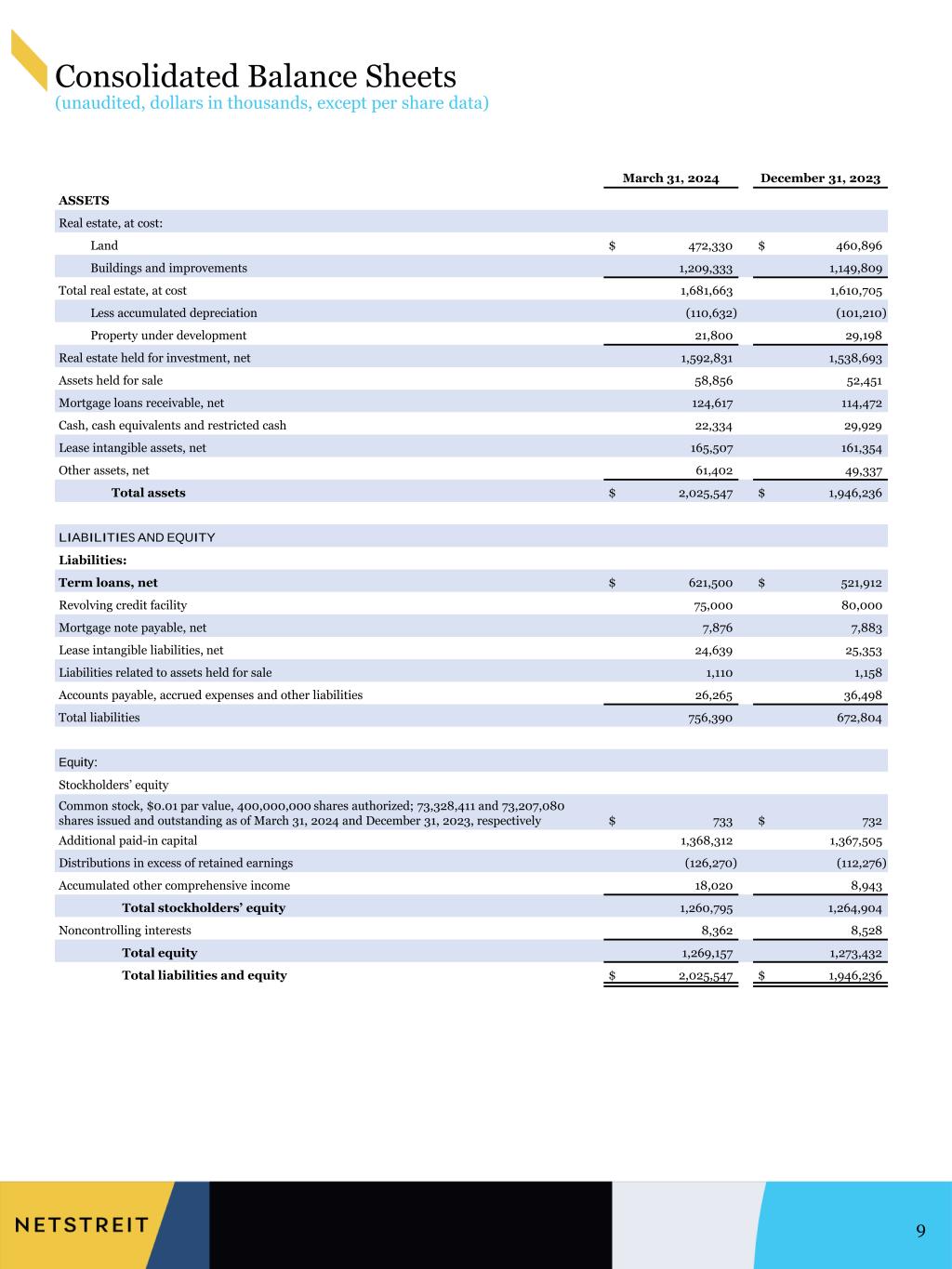

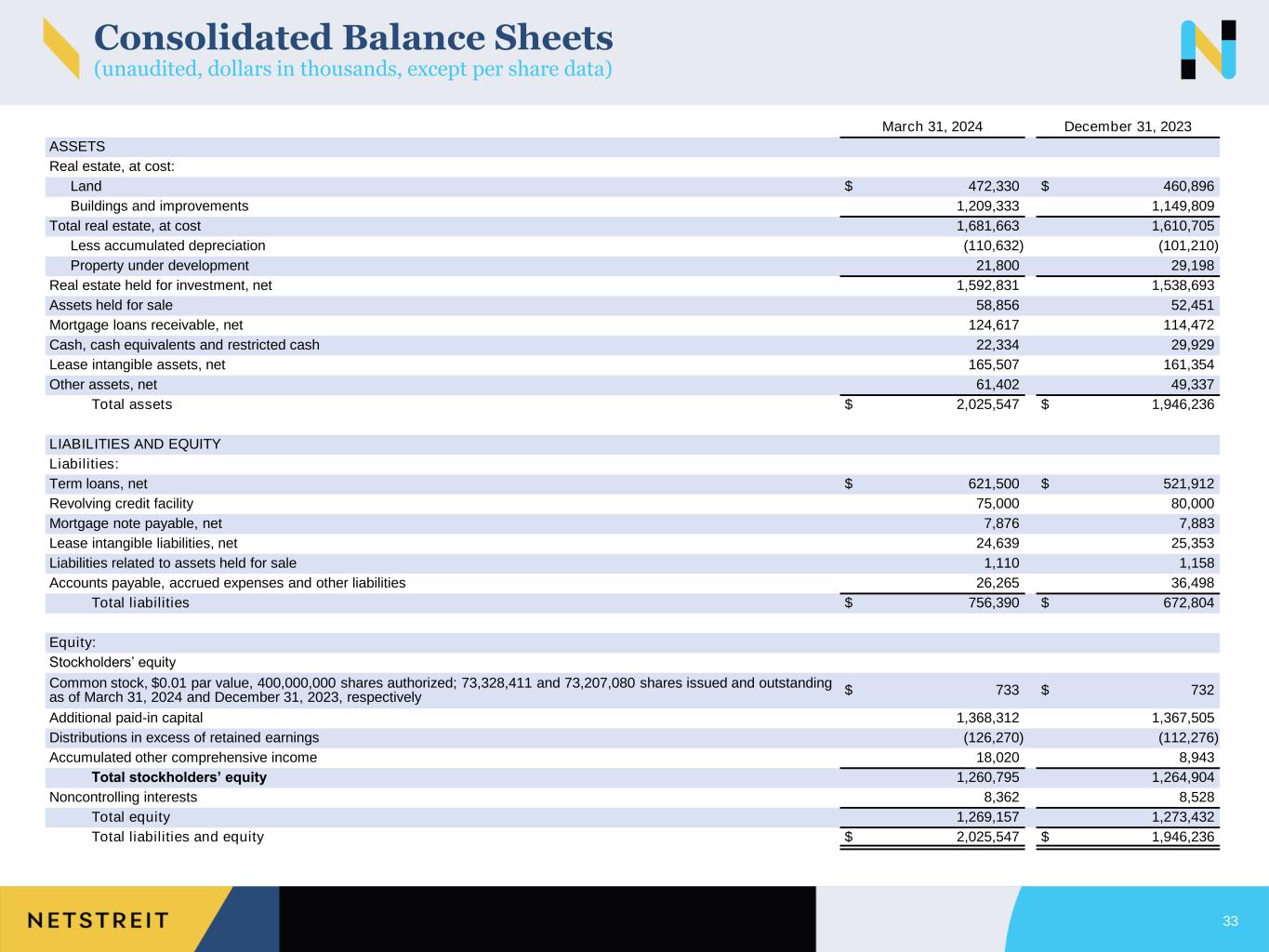

NETSTREIT CORP. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

(Unaudited)

| March 31, 2024 | December 31, 2023 | ||||||||||

| Assets | |||||||||||

| Real estate, at cost: | |||||||||||

| Land | $ | 472,330 | $ | 460,896 | |||||||

| Buildings and improvements | 1,209,333 | 1,149,809 | |||||||||

| Total real estate, at cost | 1,681,663 | 1,610,705 | |||||||||

| Less accumulated depreciation | (110,632) | (101,210) | |||||||||

| Property under development | 21,800 | 29,198 | |||||||||

| Real estate held for investment, net | 1,592,831 | 1,538,693 | |||||||||

| Assets held for sale | 58,856 | 52,451 | |||||||||

| Mortgage loans receivable, net | 124,617 | 114,472 | |||||||||

| Cash, cash equivalents and restricted cash | 22,334 | 29,929 | |||||||||

| Lease intangible assets, net | 165,507 | 161,354 | |||||||||

| Other assets, net | 61,402 | 49,337 | |||||||||

| Total assets | $ | 2,025,547 | $ | 1,946,236 | |||||||

| Liabilities and equity | |||||||||||

| Liabilities: | |||||||||||

| Term loans, net | $ | 621,500 | $ | 521,912 | |||||||

| Revolving credit facility | 75,000 | 80,000 | |||||||||

| Mortgage note payable, net | 7,876 | 7,883 | |||||||||

| Lease intangible liabilities, net | 24,639 | 25,353 | |||||||||

| Liabilities related to assets held for sale | 1,110 | 1,158 | |||||||||

| Accounts payable, accrued expenses and other liabilities | 26,265 | 36,498 | |||||||||

| Total liabilities | 756,390 | 672,804 | |||||||||

| Commitments and contingencies (Note 12) | |||||||||||

| Equity: | |||||||||||

| Stockholders’ equity | |||||||||||

| Common stock, $0.01 par value, 400,000,000 shares authorized; 73,328,411 and 73,207,080 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | 733 | 732 | |||||||||

| Additional paid-in capital | 1,368,312 | 1,367,505 | |||||||||

| Distributions in excess of retained earnings | (126,270) | (112,276) | |||||||||

| Accumulated other comprehensive income | 18,020 | 8,943 | |||||||||

| Total stockholders’ equity | 1,260,795 | 1,264,904 | |||||||||

| Noncontrolling interests | 8,362 | 8,528 | |||||||||

| Total equity | 1,269,157 | 1,273,432 | |||||||||

| Total liabilities and equity | $ | 2,025,547 | $ | 1,946,236 | |||||||

6

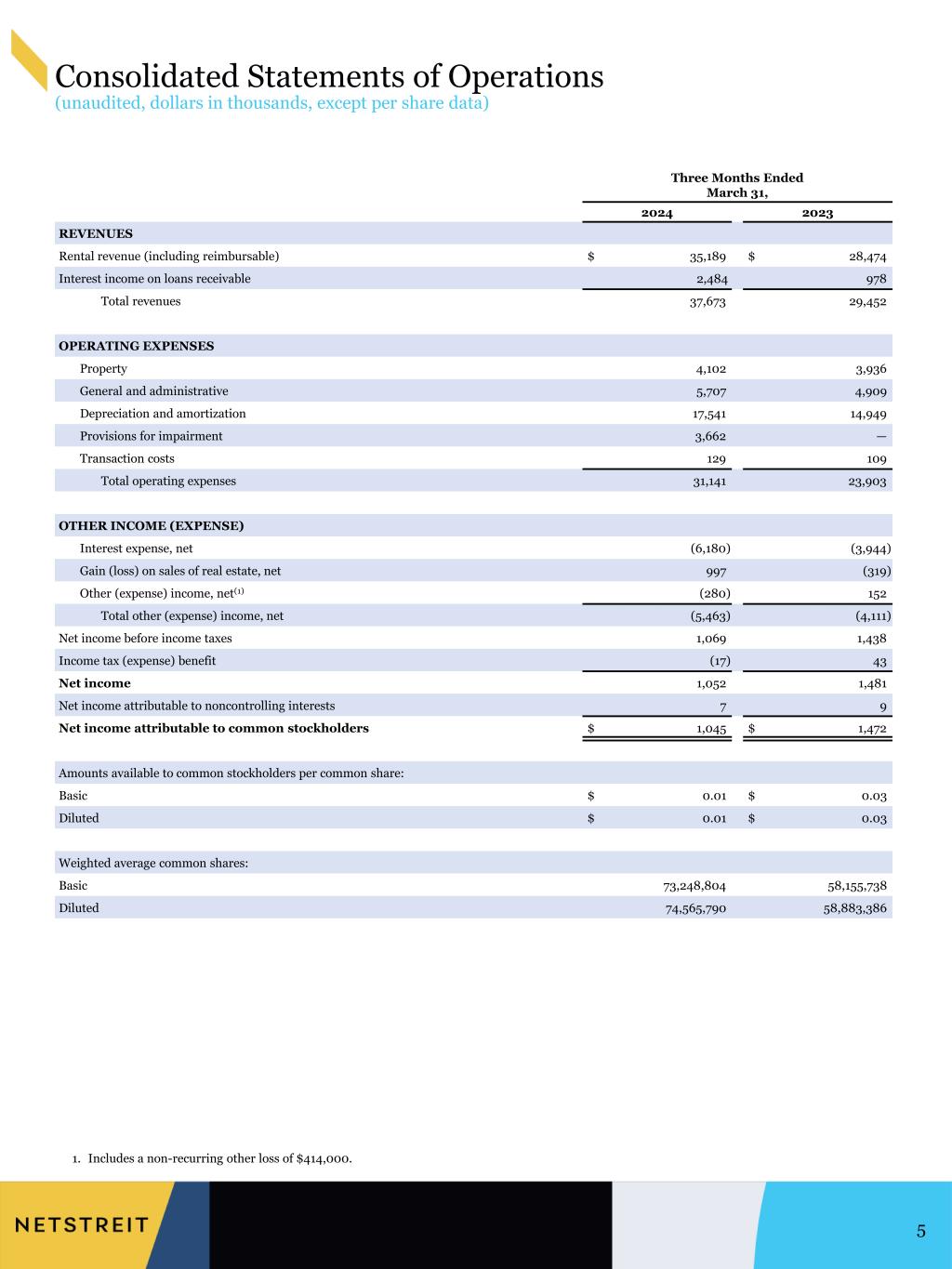

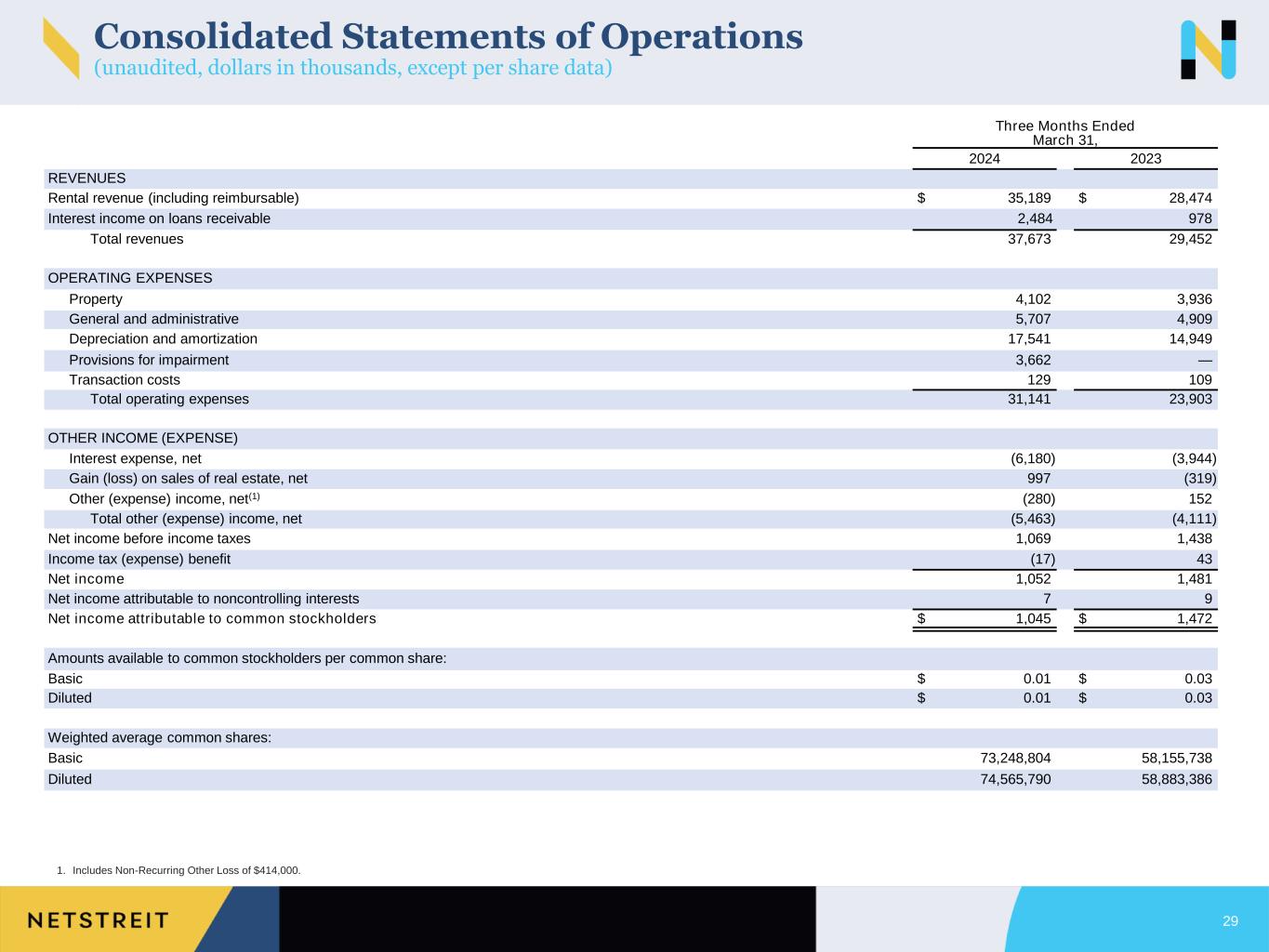

NETSTREIT CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

(Unaudited)

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Revenues | |||||||||||

| Rental revenue (including reimbursable) | $ | 35,189 | $ | 28,474 | |||||||

| Interest income on loans receivable | 2,484 | 978 | |||||||||

| Total revenues | 37,673 | 29,452 | |||||||||

| Operating expenses | |||||||||||

| Property | 4,102 | 3,936 | |||||||||

| General and administrative | 5,707 | 4,909 | |||||||||

| Depreciation and amortization | 17,541 | 14,949 | |||||||||

| Provisions for impairment | 3,662 | — | |||||||||

| Transaction costs | 129 | 109 | |||||||||

| Total operating expenses | 31,141 | 23,903 | |||||||||

| Other (expense) income | |||||||||||

| Interest expense, net | (6,180) | (3,944) | |||||||||

| Gain (loss) on sales of real estate, net | 997 | (319) | |||||||||

Other (expense) income, net (1) | (280) | 152 | |||||||||

| Total other (expense) income, net | (5,463) | (4,111) | |||||||||

| Net income before income taxes | 1,069 | 1,438 | |||||||||

| Income tax (expense) benefit | (17) | 43 | |||||||||

| Net income | 1,052 | 1,481 | |||||||||

| Net income attributable to noncontrolling interests | 7 | 9 | |||||||||

| Net income attributable to common stockholders | $ | 1,045 | $ | 1,472 | |||||||

| Amounts available to common stockholders per common share: | |||||||||||

| Basic | $ | 0.01 | $ | 0.03 | |||||||

| Diluted | $ | 0.01 | $ | 0.03 | |||||||

| Weighted average common shares: | |||||||||||

| Basic | 73,248,804 | 58,155,738 | |||||||||

| Diluted | 74,565,790 | 58,883,386 | |||||||||

(1) Includes a non-recurring other loss of $414,000.

7

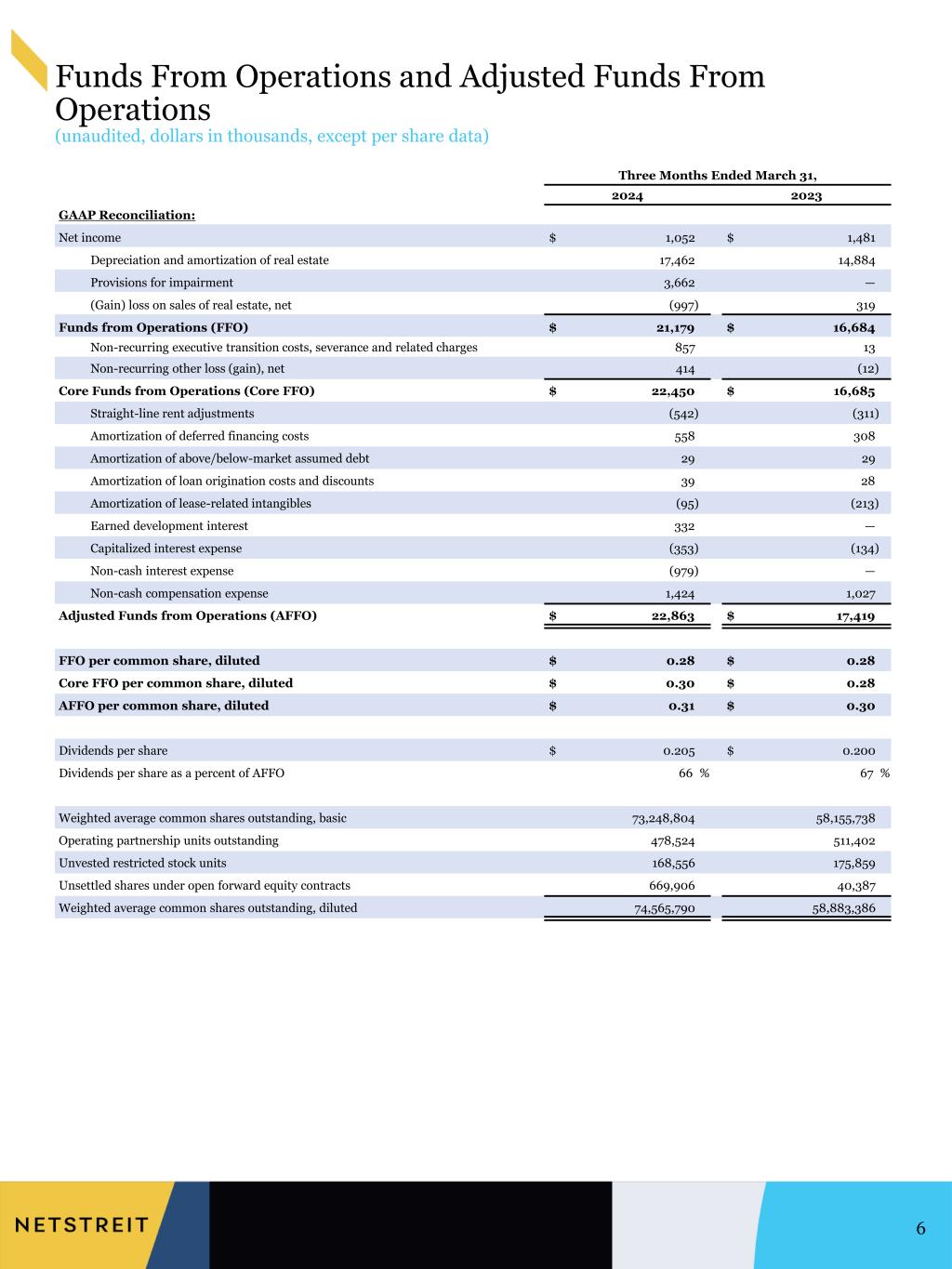

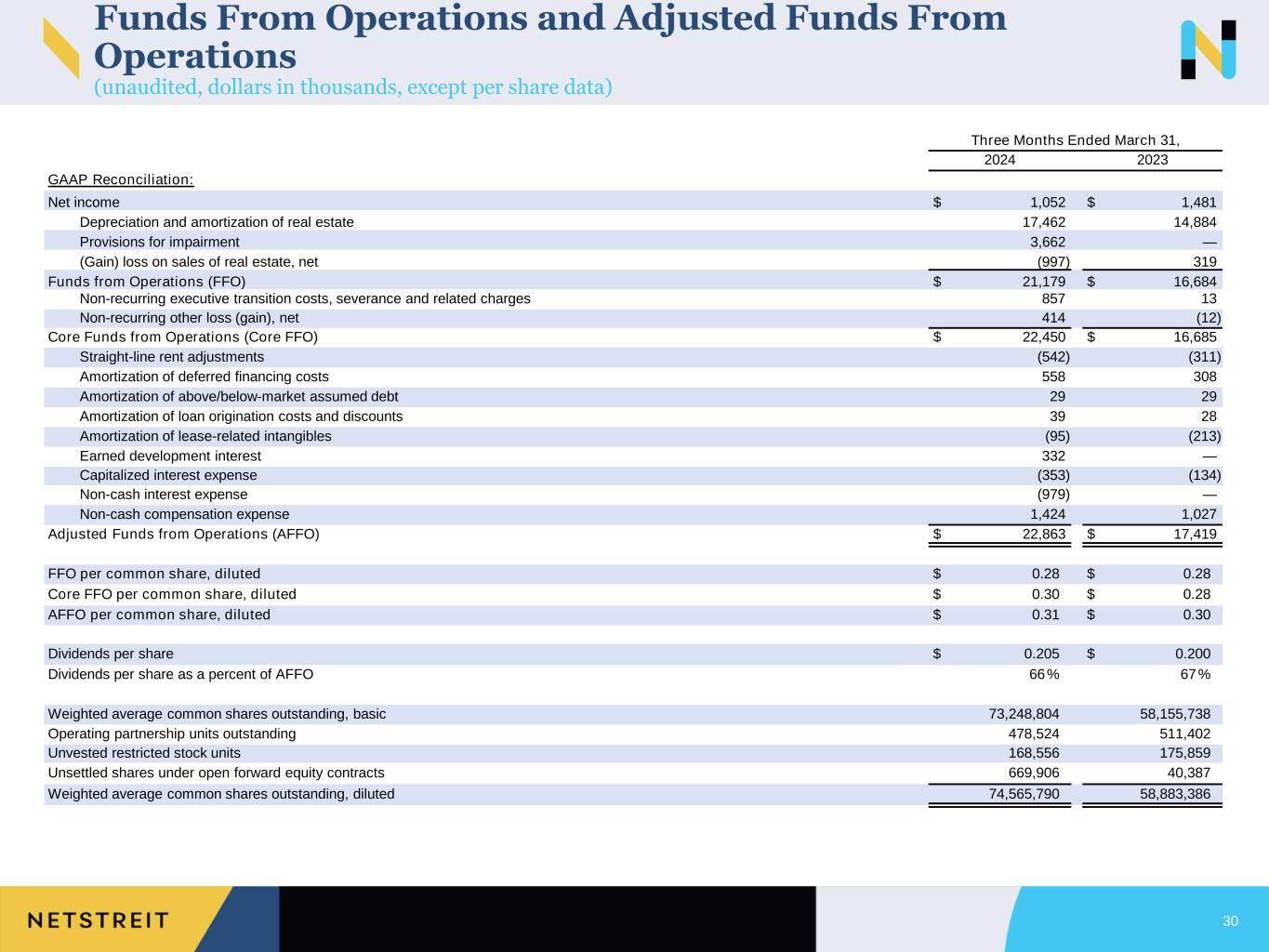

NETSTREIT CORP. AND SUBSIDIARIES

RECONCILIATION OF NET INCOME TO FFO, CORE FFO AND ADJUSTED FFO

(in thousands, except share and per share data)

(Unaudited)

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Net income | $ | 1,052 | $ | 1,481 | |||||||

| Depreciation and amortization of real estate | 17,462 | 14,884 | |||||||||

| Provisions for impairment | 3,662 | — | |||||||||

| (Gain) loss on sales of real estate, net | (997) | 319 | |||||||||

| FFO | 21,179 | 16,684 | |||||||||

| Adjustments: | |||||||||||

| Non-recurring executive transition costs, severance and related charges | 857 | 13 | |||||||||

| Non-recurring other loss (gain), net | 414 | (12) | |||||||||

| Core FFO | 22,450 | 16,685 | |||||||||

| Adjustments: | |||||||||||

| Straight-line rent adjustments | (542) | (311) | |||||||||

| Amortization of deferred financing costs | 558 | 308 | |||||||||

| Amortization of above/below-market assumed debt | 29 | 29 | |||||||||

| Amortization of loan origination costs and discounts | 39 | 28 | |||||||||

| Amortization of lease-related intangibles | (95) | (213) | |||||||||

| Earned development interest | 332 | — | |||||||||

| Capitalized interest expense | (353) | (134) | |||||||||

| Non-cash interest expense | (979) | — | |||||||||

| Non-cash compensation expense | 1,424 | 1,027 | |||||||||

| AFFO | $ | 22,863 | $ | 17,419 | |||||||

| Weighted average common shares outstanding, basic | 73,248,804 | 58,155,738 | |||||||||

| Operating partnership units outstanding | 478,524 | 511,402 | |||||||||

| Unvested restricted stock units | 168,556 | 175,859 | |||||||||

| Unsettled shares under open forward equity contracts | 669,906 | 40,387 | |||||||||

| Weighted average common shares outstanding, diluted | 74,565,790 | 58,883,386 | |||||||||

| FFO per common share, diluted | $ | 0.28 | $ | 0.28 | |||||||

| Core FFO per common share, diluted | $ | 0.30 | $ | 0.28 | |||||||

| AFFO per common share, diluted | $ | 0.31 | $ | 0.30 | |||||||

8

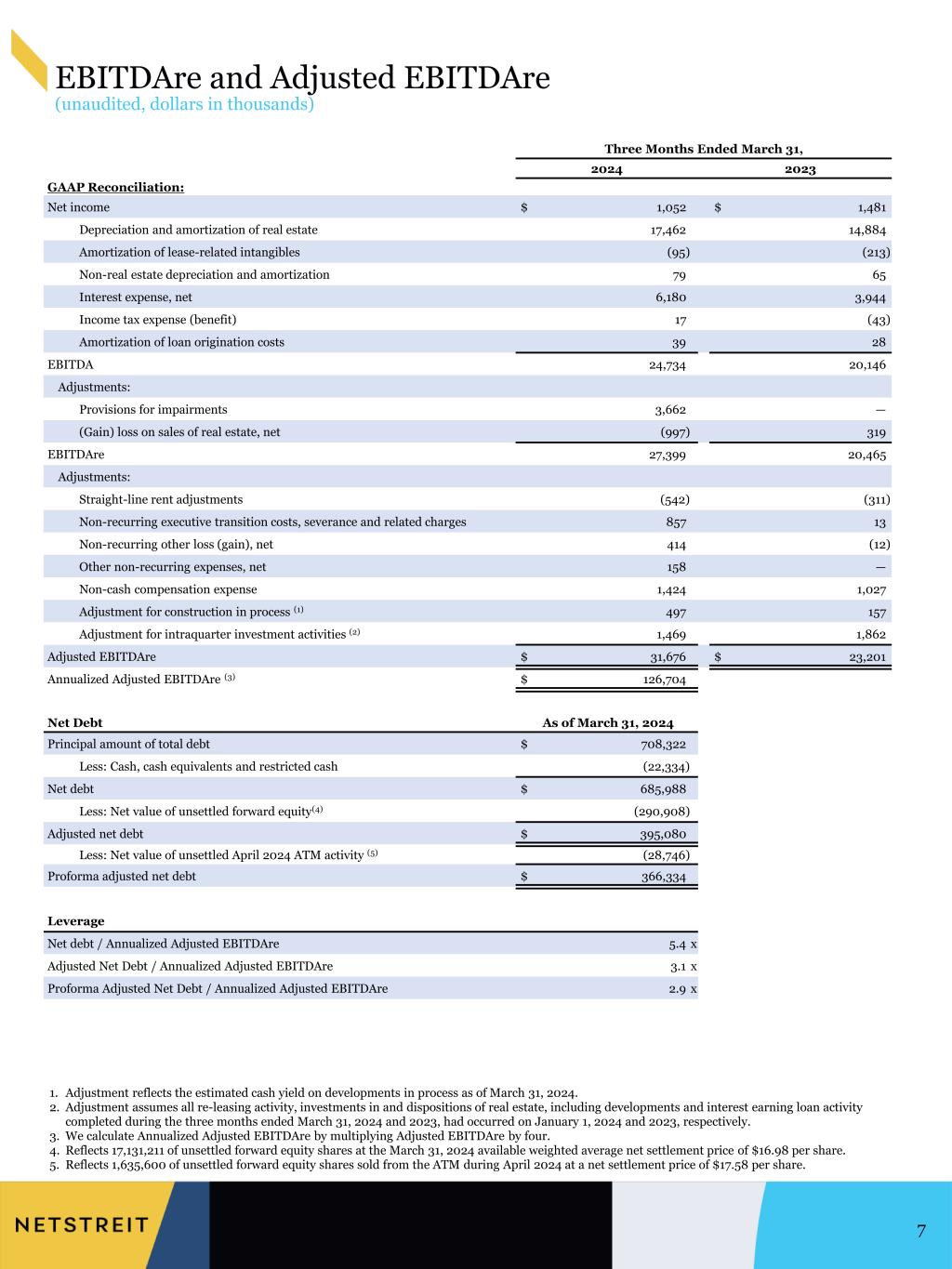

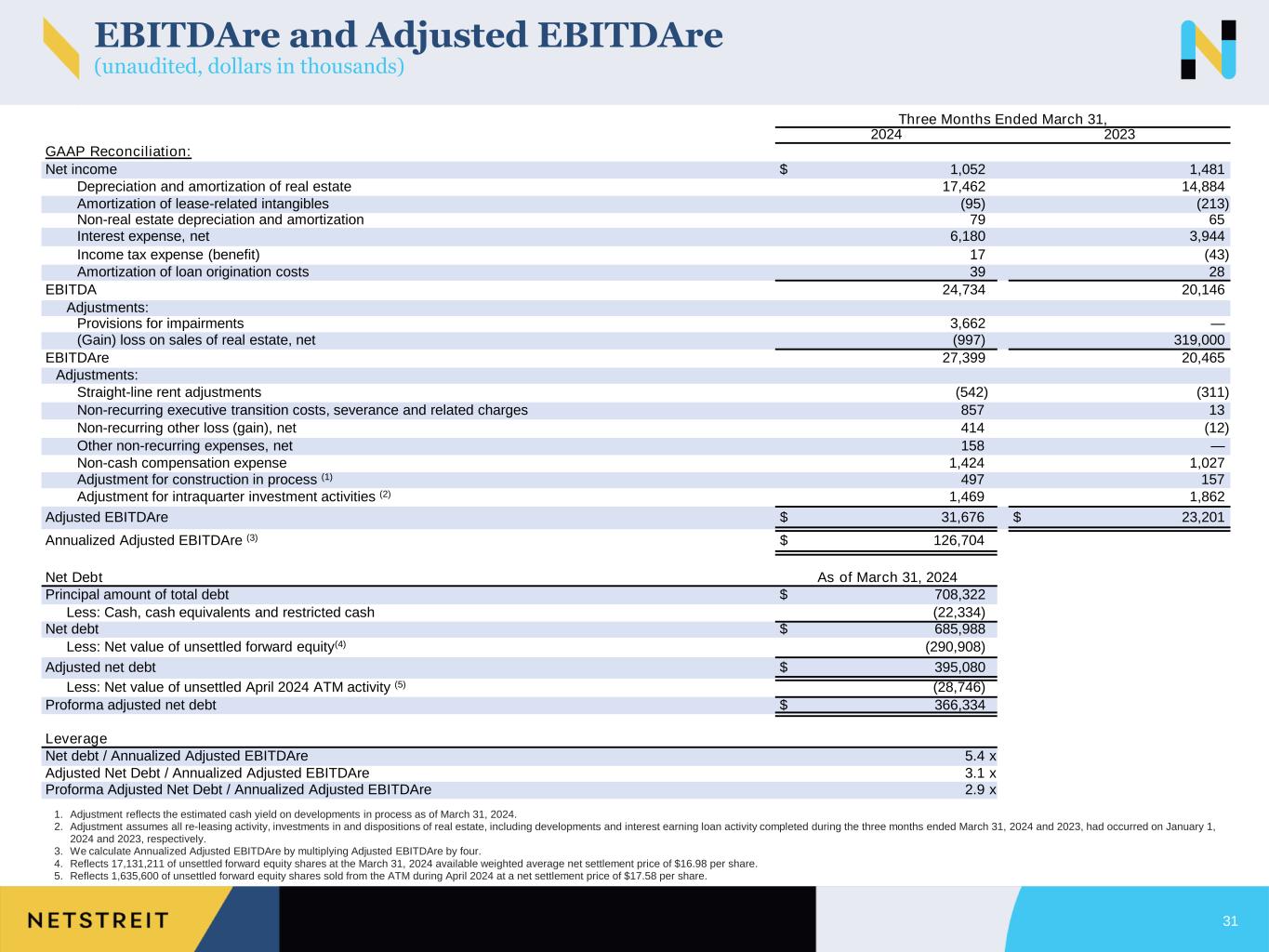

NETSTREIT CORP. AND SUBSIDIARIES

RECONCILIATION OF NET INCOME TO EBITDA, EBITDAre AND ADJUSTED EBITDAre

(in thousands, except share and per share data)

(Unaudited)

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Net income | $ | 1,052 | $ | 1,481 | |||||||

| Depreciation and amortization of real estate | 17,462 | 14,884 | |||||||||

| Amortization of lease-related intangibles | (95) | (213) | |||||||||

| Non-real estate depreciation and amortization | 79 | 65 | |||||||||

| Interest expense, net | 6,180 | 3,944 | |||||||||

| Income tax expense (benefit) | 17 | (43) | |||||||||

| Amortization of loan origination costs | 39 | 28 | |||||||||

| EBITDA | 24,734 | 20,146 | |||||||||

| Adjustments: | |||||||||||

| Provisions for impairments | 3,662 | — | |||||||||

| (Gain) loss on sales of real estate, net | (997) | 319 | |||||||||

| EBITDAre | 27,399 | 20,465 | |||||||||

| Adjustments: | |||||||||||

| Straight-line rent adjustments | (542) | (311) | |||||||||

| Non-recurring executive transition costs, severance and related charges | 857 | 13 | |||||||||

| Non-recurring other loss (gain), net | 414 | (12) | |||||||||

| Other non-recurring expenses, net | 158 | — | |||||||||

| Non-cash compensation expense | 1,424 | 1,027 | |||||||||

| Adjustment for construction in process (1) | 497 | 157 | |||||||||

| Adjustment for intraquarter investment activities (2) | 1,469 | 1,862 | |||||||||

| Adjusted EBITDAre | $ | 31,676 | $ | 23,201 | |||||||

| Annualized Adjusted EBITDAre (3) | $ | 126,704 | |||||||||

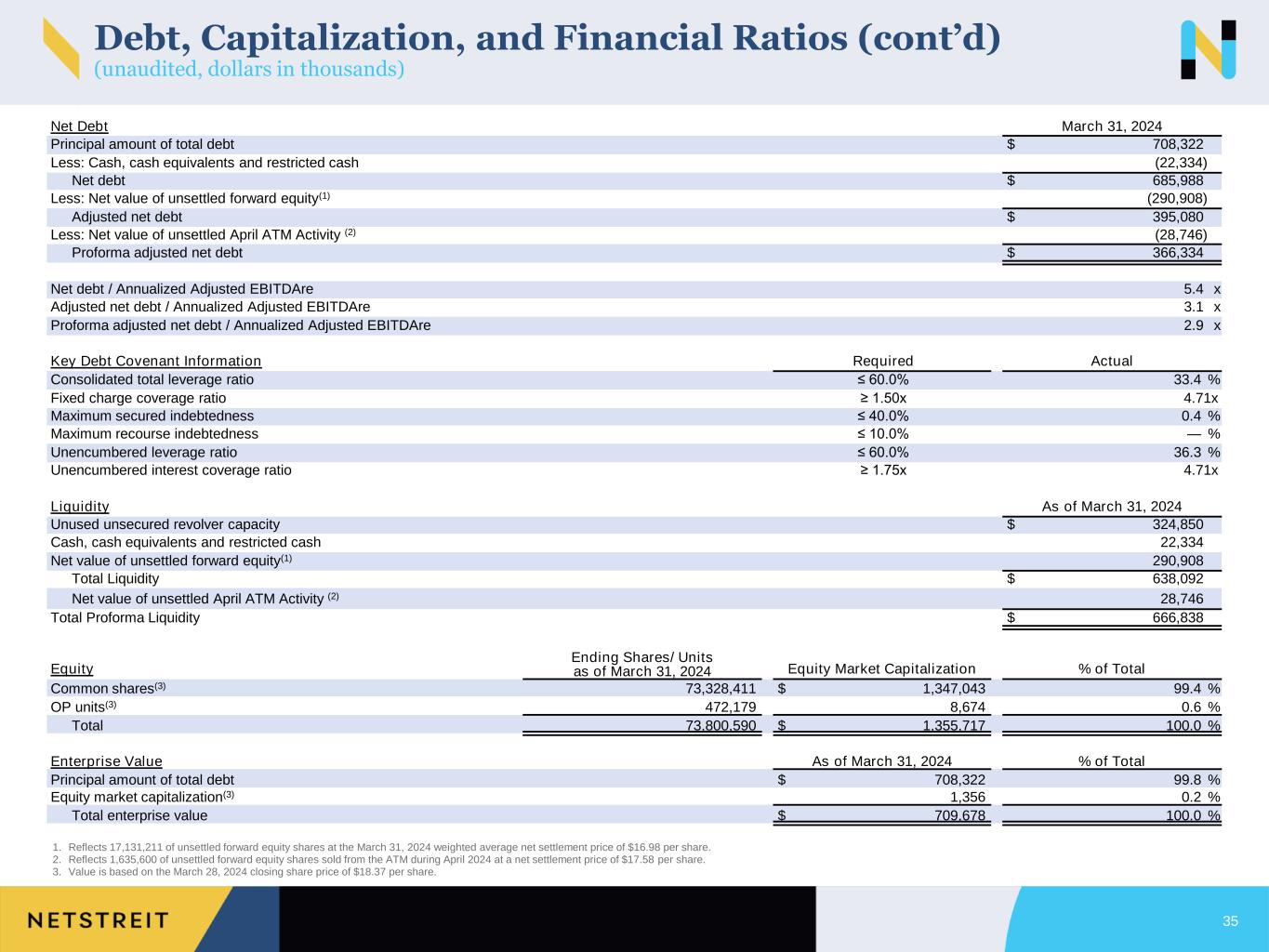

| Net Debt | As of March 31, 2024 | ||||||||||

| Principal amount of total debt | $ | 708,322 | |||||||||

| Less: Cash, cash equivalents and restricted cash | (22,334) | ||||||||||

| Net Debt | 685,988 | ||||||||||

Less: Value of unsettled forward equity (4) | (290,908) | ||||||||||

| Adjusted Net Debt | $ | 395,080 | |||||||||

Less: Net value of unsettled April 2024 ATM activity (5) | (28,746) | ||||||||||

Proforma adjusted net debt(5) | $ | 366,334 | |||||||||

| Leverage | |||||||||||

| Net debt / Annualized Adjusted EBITDAre | 5.4 | x | |||||||||

| Adjusted Net Debt / Annualized Adjusted EBITDAre | 3.1 | x | |||||||||

| Proforma Adjusted Net Debt / Annualized Adjusted EBITDAre | 2.9 | x | |||||||||

(1) Adjustment reflects the estimated cash yield on developments in process as of March 31, 2024.

(2) Adjustment assumes all re-leasing activity, investments in and dispositions of real estate, including developments and interest earning loan activity

completed during the three months ended March 31, 2024 and 2023 had occurred on January 1, 2024 and 2023, respectively.

(3) We calculate Annualized Adjusted EBITDAre by multiplying Adjusted EBITDAre by four.

(4) Reflects 17,131,211 of unsettled forward equity shares, at the March 31, 2024 available weighted average net settlement price of $16.98 per share.

(5) Reflects 1,635,600 of unsettled forward equity shares sold through the ATM Program during April 2024 at a net settlement price of $17.58 per share.

9

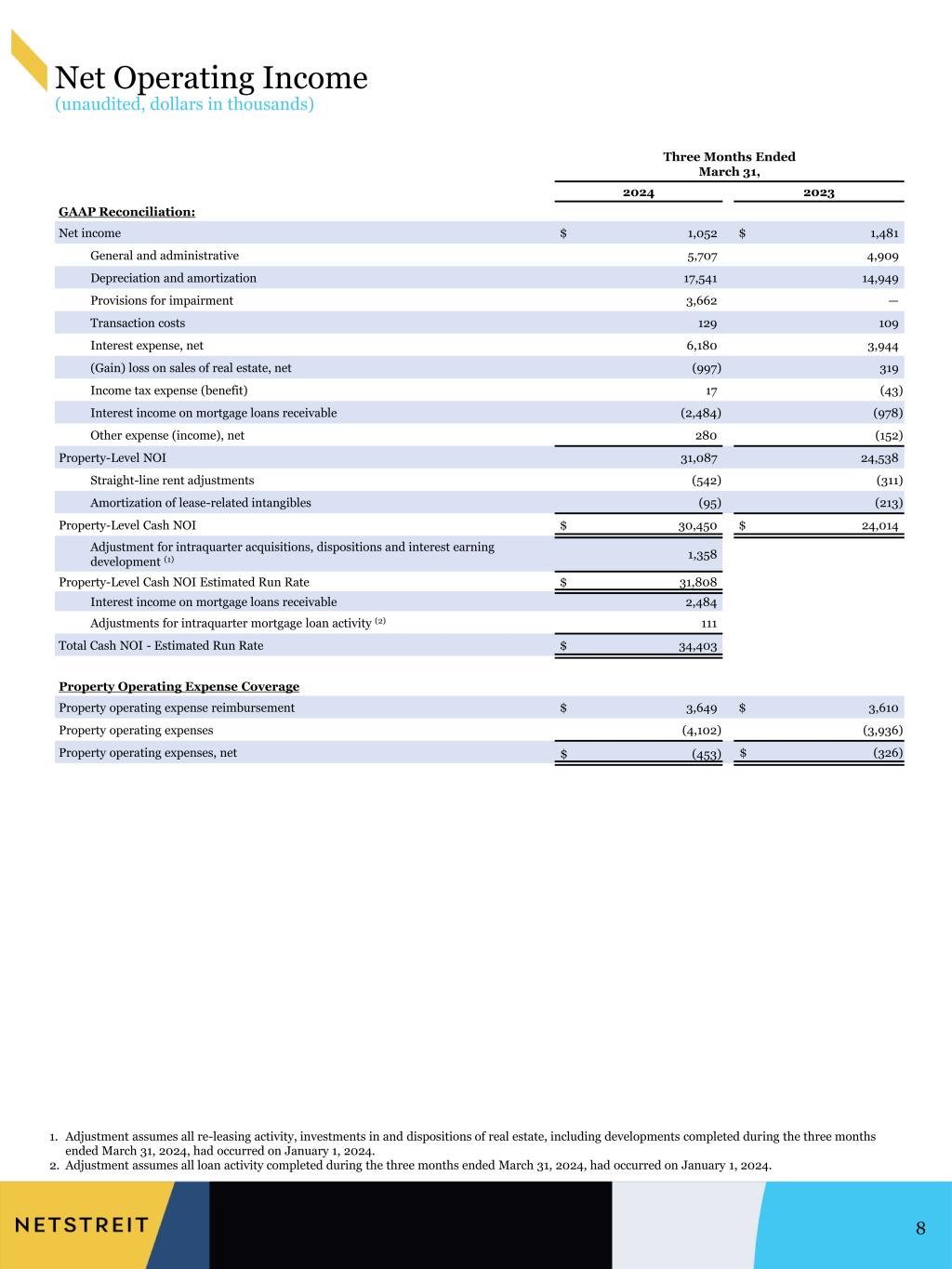

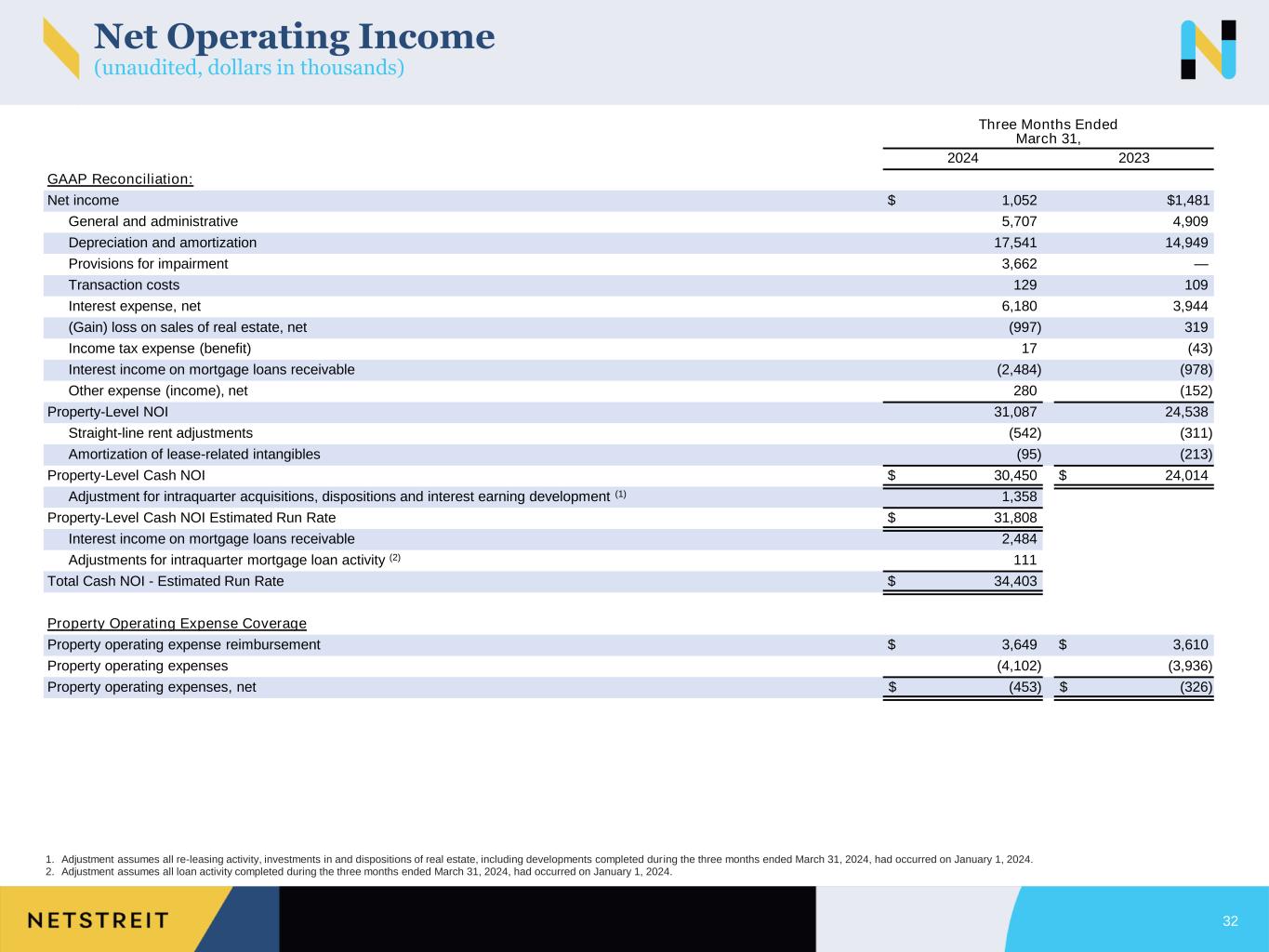

NETSTREIT CORP. AND SUBSIDIARIES

RECONCILIATION OF NET INCOME TO NOI AND CASH NOI

(in thousands, except share and per share data)

(Unaudited)

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Net income | $ | 1,052 | $ | 1,481 | |||||||

| General and administrative | 5,707 | 4,909 | |||||||||

| Depreciation and amortization | 17,541 | 14,949 | |||||||||

| Provisions for impairment | 3,662 | — | |||||||||

| Transaction costs | 129 | 109 | |||||||||

| Interest expense, net | 6,180 | 3,944 | |||||||||

| (Gain) loss on sales of real estate, net | (997) | 319 | |||||||||

| Income tax expense (benefit) | 17 | (43) | |||||||||

| Interest income on mortgage loans receivable | (2,484) | (978) | |||||||||

| Other expense (income), net | 280 | (152) | |||||||||

| Property-Level NOI | 31,087 | 24,538 | |||||||||

| Straight-line rent adjustments | (542) | (311) | |||||||||

| Amortization of lease-related intangibles | (95) | (213) | |||||||||

| Property-Level Cash NOI | $ | 30,450 | $ | 24,014 | |||||||

| Adjustment for intraquarter acquisitions, dispositions and interest earning development (1) | 1,358 | ||||||||||

| Property-Level Cash NOI Estimated Run Rate | 31,808 | ||||||||||

| Interest income on mortgage loans receivable | 2,484 | ||||||||||

| Adjustments for intraquarter mortgage loan activity (2) | 111 | ||||||||||

| Total Cash NOI - Estimated Run Rate | $ | 34,403 | |||||||||

(1) Adjustment assumes all re-leasing activity, investments in and dispositions of real estate, including developments completed during the three months ended March 31, 2024, had occurred on January 1, 2024.

(2) Adjustment assumes all loan activity completed during the three months ended March 31, 2024, had occurred on January 1, 2024.

10

NON-GAAP FINANCIAL MEASURES

FFO, Core FFO and AFFO

The National Association of Real Estate Investment Trusts ("NAREIT"), an industry trade group, has promulgated a widely accepted non-GAAP financial measure of operating performance known as FFO. Our FFO is net income in accordance with GAAP, excluding gains (or losses) resulting from dispositions of properties, plus depreciation and amortization and impairment charges on depreciable real property.

Core FFO is a non-GAAP financial measure defined as FFO adjusted to remove the effect of unusual and non-recurring items that are not expected to impact our operating performance or operations on an ongoing basis. These include non-recurring executive transition costs, severance and related charges, other loss (gain), net, and loss on debt extinguishments and other related costs.

AFFO is a non-GAAP financial measure defined as Core FFO adjusted for GAAP net income related to non-cash revenues and expenses, such as straight-line rent, amortization of above- and below-market lease-related intangibles, amortization of lease incentives, capitalized interest expense, earned development interest, non-cash interest expense, non-cash compensation expense, amortization of deferred financing costs, amortization of above/below-market assumed debt, and amortization of loan origination costs.

Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. In fact, real estate values historically have risen or fallen with market conditions. FFO is intended to be a standard supplemental measure of operating performance that excludes historical cost depreciation and valuation adjustments from net income. We consider FFO to be useful in evaluating potential property acquisitions and measuring operating performance.

We further consider FFO, Core FFO and AFFO to be useful in determining funds available for payment of distributions. FFO, Core FFO and AFFO do not represent net income or cash flows from operations as defined by GAAP. You should not consider FFO, Core FFO and AFFO to be alternatives to net income as a reliable measure of our operating performance nor should you consider FFO, Core FFO and AFFO to be alternatives to cash flows from operating, investing or financing activities (as defined by GAAP) as measures of liquidity.

FFO, Core FFO and AFFO do not measure whether cash flow is sufficient to fund our cash needs, including principal amortization, capital improvements and distributions to stockholders. FFO, Core FFO and AFFO do not represent cash flows from operating, investing or financing activities as defined by GAAP. Further, FFO, Core FFO and AFFO as disclosed by other REITs might not be comparable to our calculations of FFO, Core FFO and AFFO.

EBITDA, EBITDAre, Adjusted EBITDAre, and Annualized Adjusted EBITDAre

We compute EBITDA as earnings before interest expense, income tax expense, and depreciation and amortization. In 2017, NAREIT issued a white paper recommending that companies that report EBITDA also report EBITDAre. We compute EBITDAre in accordance with the definition adopted by NAREIT. NAREIT defines EBITDAre as EBITDA (as defined above) excluding gains (or losses) from the sales of depreciable property and impairment charges on depreciable real property.

Adjusted EBITDAre is a non-GAAP financial measure defined as EBITDAre further adjusted to exclude straight-line rent, non-cash compensation expense, non-recurring executive transition costs, severance and related charges, loss on debt extinguishment and other related costs, other loss (gain), net, other non-recurring expenses (income), lease termination fees, adjustment for construction in process, and adjustment for intraquarter activities. Beginning in the quarter ended June 30, 2023, we modified our definition of Adjusted EBITDAre to include adjustments for construction in process and intraquarter investment activities. Prior periods have been recast to reflect this new definition.

Annualized Adjusted EBITDAre is Adjusted EBITDAre multiplied by four.

We present EBITDA, EBITDAre, Adjusted EBITDAre, and Annualized Adjusted EBITDAre as they are measures commonly used in our industry. We believe that these measures are useful to investors and analysts because they provide supplemental information concerning our operating performance, exclusive of certain non-cash items and other costs. We use EBITDA, EBITDAre, Adjusted EBITDAre, and Annualized Adjusted EBITDAre as measures of our operating performance and not as measures of liquidity.

11

EBITDA, EBITDAre, Adjusted EBITDAre and Annualized Adjusted EBITDAre do not include all items of revenue and expense included in net income, they do not represent cash generated from operating activities and they are not necessarily indicative of cash available to fund cash requirements; accordingly, they should not be considered alternatives to net income as a performance measure or cash flows from operations as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures. Additionally, our computation of EBITDA, EBITDAre, Adjusted EBITDAre and Annualized Adjusted EBITDAre may differ from the methodology for calculating these metrics used by other equity REITs and, therefore, may not be comparable to similarly titled measures reported by other equity REITs.

Net Debt, Adjusted Net Debt, and Proforma Adjusted Net Debt

We calculate our Net Debt as our principal amount of total debt outstanding excluding deferred financing costs, net discounts and debt issuance costs less cash, cash equivalents and restricted cash available for future investment. We believe excluding cash, cash equivalents and restricted cash available for future investment from our principal amount, all of which could be used to repay debt, provides an estimate on the net contractual amount of borrowed capital to be repaid. We believe these adjustments are additional beneficial disclosures to investors and analysis.

We further adjust Net Debt by the net value of unsettled forward equity as of period end to derive Adjusted Net Debt.

Proforma Adjusted Net Debt is Adjusted Net Debt shown on a proforma basis to include the net value of proforma equity issued after the period end as if it was outstanding as of period end.

Property-Level NOI, Property-Level Cash NOI, Property-Level Cash NOI - Estimated Run Rate, and Total Cash NOI - Estimated Run Rate

Property-Level NOI, Property-Level Cash NOI, Property-Level Cash NOI - Estimated Run Rate, and Total Cash NOI - Estimated Run Rate are non-GAAP financial measures which we use to assess our operating results. We compute Property-Level NOI as net income (computed in accordance with GAAP), excluding general and administrative expenses, interest expense (or income), income tax expense, transaction costs, depreciation and amortization, gains (or losses) on sales of depreciable property, real estate impairment losses, interest income on mortgage loans receivable, loss on debt extinguishment, lease termination fees, and other expense (income), net. We further adjust Property-Level NOI for non-cash revenue components of straight-line rent and amortization of lease-intangibles to derive Property-Level Cash NOI. We further adjust Property-Level Cash NOI for intraquarter acquisitions, dispositions and completed developments to derive Property-Level Cash NOI - Estimated Run Rate. We further adjust Property-Level Cash NOI - Estimated Run Rate for interest income on mortgage loans receivable and intraquarter mortgage loan activity to derive Total Cash NOI - Estimated Run Rate. We believe Property-Level NOI, Property-Level Cash NOI, Property-Level Cash NOI - Estimated Run Rate, and Total Cash NOI - Estimated Run Rate provide useful and relevant information because they reflect only those income and expense items that are incurred at the property level and present such items on an unlevered basis.

Property-Level NOI, Property-Level Cash NOI, Property-Level Cash NOI - Estimated Run Rate, and Total Cash NOI - Estimated Run Rate are not measurements of financial performance under GAAP, and may not be comparable to similarly titled measures of other companies. You should not consider our NOI and Cash NOI as alternatives to net income or cash flows from operating activities determined in accordance with GAAP.

OTHER DEFINITIONS

ABR is annualized base rent as of March 31, 2024, for all leases that commenced and annualized cash interest on mortgage loans receivable in place as of that date.

Cash Yield is the annualized base rent contractually due from acquired properties, interest income from mortgage loans receivable, and completed developments, divided by the gross investment amount, or gross proceeds in the case of dispositions.

Investments are lease agreements in place at owned properties, properties that have leases associated with mortgage loans receivable, developments where rent commenced, or in the case of master lease arrangements each property under the master lease is counted as a separate lease.

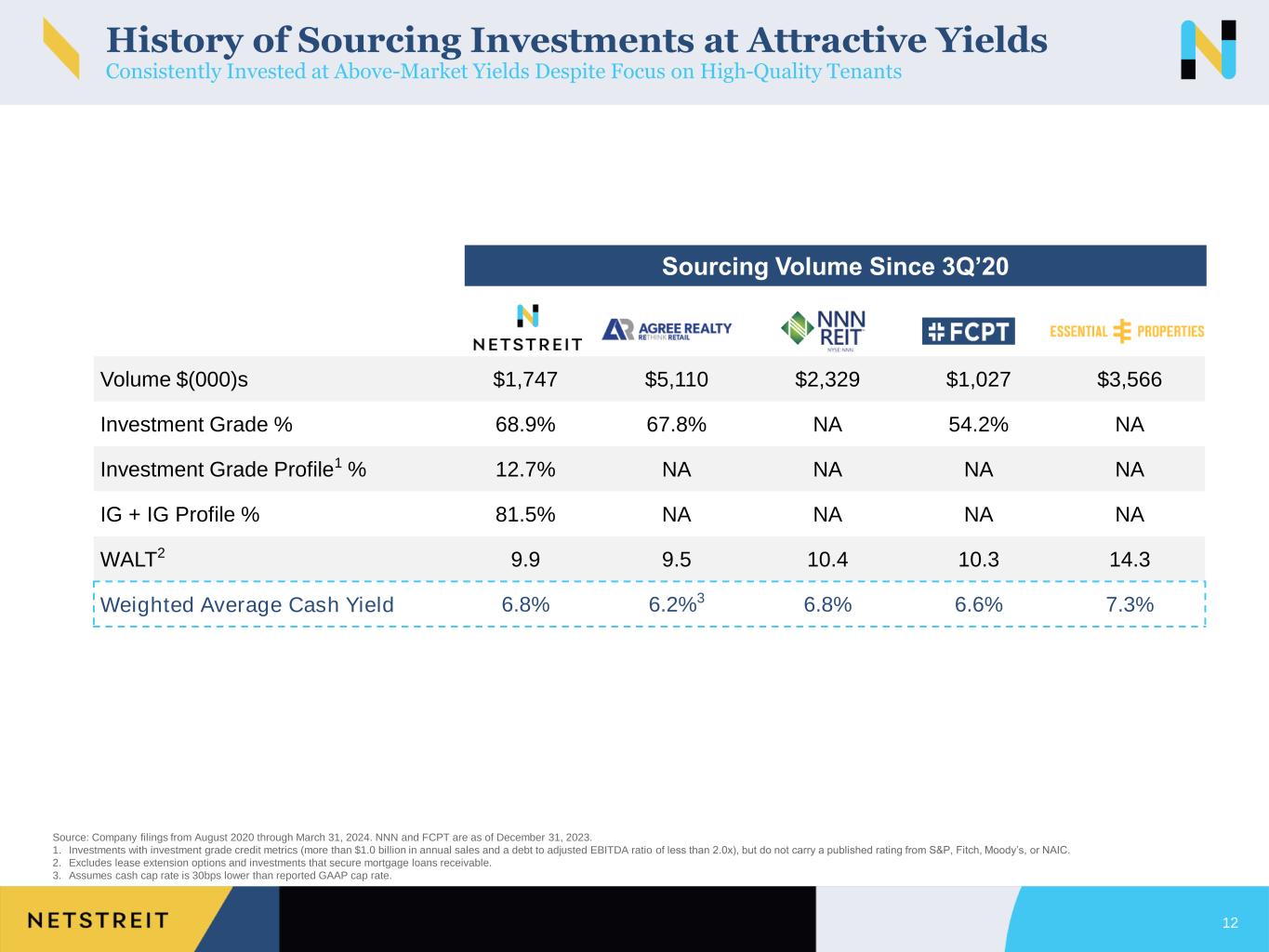

Investment Grade are investments, or investments that are subsidiaries of a parent entity, with a credit rating of BBB- (S&P/Fitch), Baa3 (Moody's) or NAIC2 (National Association or Insurance Commissioners) or higher.

Investment Grade Profile are investments with investment grade credit metrics (more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x), but do not carry a published rating from S&P, Fitch, Moody's, or NAIC.

12

Occupancy is expressed as a percentage, and is the number of economically occupied properties divided by the total number of properties owned, excluding mortgage loans receivable and properties under development.

Weighted Average Lease Term is weighted by the annualized base rent, excluding lease extension options and investments associated with mortgage loans receivable.

13