UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23502

Siren ETF Trust

(Exact name of registrant as specified in charter)

2600 Philmont Avenue, Suite 215

Huntingdon Valley, Pennsylvania 19006

(Address of principal executive offices) (Zip code)

Javier Jimenez

U.S. Bancorp Fund Services, LLC

2020 East Financial Way, Suite 100

Glendora, California 91741

(Name and address of agent for service)

(855) 713-3837

Registrant's telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: March 31, 2021

Item 1. Reports to Stockholders.

| (a) |

Siren ETF Trust

Siren Large Cap Blend Index ETF (SPQQ)

Siren DIVCON Leaders Dividend ETF (LEAD)

Siren DIVCON Dividend Defender ETF (DFND)

Siren Nasdaq NexGen Economy ETF (BLCN)

ANNUAL REPORT

March 31, 2021

Beginning in March 2022, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you invest through a financial intermediary, you may elect to receive shareholder reports and other communications electronically from the Fund by contacting your financial intermediary (such as a broker-dealer or bank).

You may elect to receive all future shareholder reports in paper free of charge. You can request to continue receiving paper copies of your shareholder reports by contacting your financial intermediary.

Siren ETF Trust

Table of Contents

Shareholder Letter |

2 |

Performance Summary |

4 |

Fund Performance |

5 |

Siren Large Cap Blend Index ETF |

5 |

Siren DIVCON Leaders Dividend ETF |

6 |

Siren DIVCON Dividend Defender ETF |

7 |

Siren Nasdaq NexGen Economy ETF |

8 |

Schedules of Investments |

9 |

Statements of Assets and Liabilities |

19 |

Statements of Operations |

21 |

Statements of Changes in Net Assets |

23 |

Financial Highlights |

25 |

Notes to Financial Statements |

30 |

Report of Independent Registered Public Accounting Firm |

41 |

Expense Example |

43 |

Trustees and Officers of the Trust |

45 |

Board of Trustees’ Approval of Advisory Agreement |

47 |

Additional Information |

49 |

Qualified Dividend Income/Dividends Received Deduction |

49 |

Short Term Cap Gains |

49 |

1

Siren ETF Trust

Shareholder Letter

(Unaudited)

To my fellow shareholders,

Thank you for being a part of our inaugural year and trusting our ETFs with your investment decisions.

It was an exciting and interesting first year for the Siren ETF Trust (“Siren” or “Trust”), with the launch of our first product Siren Large Cap Blend Index ETF (“SPQQ”), and the acquisition of Siren Nasdaq NexGen Economy ETF (“BLCN”), Siren DIVCON Leaders Dividend ETF (“LEAD”) and Siren DIVCON Dividend Defender ETF (“DFND”) (each a “Fund” or “ETF”). In March of 2020 when we agreed to acquire BLCN, LEAD and DFND, they nearly had a combined $125 million in Assets Under Management (“AUM”). At the close of business on March 31, 2021, the total AUM of BLCN, LEAD, DFND and SPQQ was just over $380 million. The growth surpassed our expectations for the year, and you the shareholders were directly responsible for that. So again, Thank You for your trust and investment.

By far, the greatest performer in the Siren suite of products was BLCN, with November 23, 2020 to March 31, 2021 performance being up approximately 29.30%, as compared to the MSCI ACWI Total Return Index up 11.03% for the same time period. BLCN also experienced asset growth from approximately $156 million to $301 million. Two of the top positive contributors to performance were Canaan, Inc. (NYSE:CAN) up 305% and Galaxy Digital Holdings Ltd. (GLXY:CN) up 259% from November 23, 2020 to March 31, 2021. One of the top negative contributors to performance was Atos SE dropping 7.3% from November 23, 2020 to March 31, 2021.

I think it is important to point out that BLCN does not invest directly into cryptocurrency. Rather, it may invest a portion of its assets in companies involved in that space. Our goal is to flatten out the day-to- day roller-coaster ride of crypto by investing in companies based on their exposure to blockchain as a technology and not just focusing on the crypto aspects of blockchain.

DFND returned -1.56% during the period November 23, 2020 to March 31, 2021, as compared to the S&P 500 Total Return Index, which returned 12.29% during the same period. While the long component of DFND’s portfolio tracked the returns of the underlying index, the short positions, which consist of mostly energy, financials and COVID-19 “re-opening” stocks, suffered outsized losses as those sectors climbed within the last three months.

As with most things, the numbers alone don’t truly reflect the DFND story from the last year. There was a point where DFND had in excess of $51 million in AUM, and then the Wall Street Bets meme stock euphoria took over. The office fielded many calls and e-mail requests asking about DFND’s short positions, collateral and exposure. We continue to manage DNFD as 75% long and 25% short, and I would like to share the process of shorting in the basket with you. As of March 31, 2021, DFND is short 17 securities. We do not naked short, every security we short in the portfolio is fully collateralized and our current short positions have, in my opinion, ample liquidity to exit the positions. I understand the fear that the “short squeeze” and headlines from that time period may have caused. However, we feel the securities that DFND has sold short possess certain key differences from the securities at the center of the recent short squeeze. Specifically, the short securities in DFND’s portfolio currently do not have a high level of “short percentage”, and they trade in liquid markets that assist in our ability to exit positions.

LEAD has been fairly stagnant for the fiscal year, starting at $38.6 million in AUM and finishing at $39.7 million in AUM, despite positive performance of 7.73% during the period November 23, 2021 to March 31, 2021 as compared to the S&P 500 Total Return Index’s returns of 12.29% for the same period. The portfolio continues to reflect a combination of large cap securities we feel will increase their dividends throughout the year, and they have mostly tracked their underlying index with some technology names such as Apple, Inc. (NASDAQ:AAPL) and NVIDIA Corp. (NASDAQ:NVDA) being the outliers within the index during the short time period we managed the fund.

With the price movement of the underlying basket growing we have seen the yield on LEAD drop to approximately 0.77%, which we would like to see improve. In determining the portfolio allocation for LEAD, the Fund’s index ranks securities by those having the highest probability of increasing their dividends within the following year according to the index’s methodology (dividend growers). In that regard, the index has not included certain dividend growers that would have contributed more positively to LEAD’s yield. While we are pleased with the price performance of LEAD, we hope to see the Fund’s yield improve as part of the Fund’s December 2021 rebalance and will strive to continue to provide positive price growth.

2

Siren ETF Trust

Shareholder Letter

(Unaudited) (Continued)

SPQQ is the ETF I am most excited about, and most disappointed with at the same time. Designed to provide investors with a blend of the top 30 names in the large cap universe and the top 30 names in the technology sector, the Fund is designed to offer investors a one stop silo for broad based market exposure at a low price (20 basis points) so that investors wouldn’t have to buy two separate funds for large cap and technology exposure but could get them both in one fund. SPQQ has returned 24.49% from June 30, 2020 – March 31, 2021, as compared to the S&P 500 up 29.71% for the timeframe. We find it difficult to benchmark to a single index since the portfolio includes components of two indices. We recognize that as the technology sector outperforms or underperforms the large cap universe that our performance will be skewed, since the technology sector is currently more heavily weighted in SPQQ. Our goal was to create a product that would give investors the ability to capture exposure to both universes, and in essence, free up capital for other investments within their portfolio. We are pleased with SPQQ’s performance, but we haven’t seen any asset growth or creations in the fund since inception. I believe that lack of growth is a direct result of the lack of affordable marketing opportunities we have found during the pandemic. I am optimistic about SPQQ’s growth as we go through 2021 and into 2022.

Siren continues to have a philosophy of “lean and mean”, where we seek to avoid extraneous expenses and costs with a focus on product design and affordability for shareholders. Our main focus at this moment is organic growth and trying to get total firm assets over $500 million so that we can achieve platform eligibility and have our offering included in the larger wire house suites. Siren was founded as a firm where the shareholder benefit would be the number one concern and focus.

Thank you for a great inaugural year, and I look forward to sharing many more smiles and news with you in my next letter.

Regards,

Scott Freeze

President

Siren ETF Trust

3

Siren ETF Trust

Performance Summary

As of March 31, 2021 (Unaudited)

1M |

3M |

6M |

1Y |

3Y |

5Y |

Incept. |

Since |

|

Siren Large Cap Blend Index ETF — NAV |

2.70% |

1.98% |

13.73% |

N/A |

N/A |

N/A |

24.49% |

N/A |

Siren Large Cap Blend Index ETF — Market Price |

2.60% |

2.05% |

13.61% |

N/A |

N/A |

N/A |

24.57% |

N/A |

Siren Large Cap Blend Index |

2.38% |

1.81% |

14.41% |

N/A |

N/A |

N/A |

25.20% |

N/A |

S&P 500 Total Return Index |

4.38% |

6.17% |

19.07% |

N/A |

N/A |

N/A |

29.71% |

N/A |

Siren DIVCON Leaders Dividend ETF — NAV(2) |

5.46% |

4.90% |

13.35% |

52.46% |

17.26% |

15.92% |

119.99% |

16.25% |

Siren DIVCON Leaders Dividend ETF — Market Price(2) |

5.32% |

5.02% |

13.99% |

51.76% |

17.15% |

15.86% |

120.15% |

16.27% |

DIVCON Leaders Dividend Index |

5.45% |

4.65% |

13.88% |

53.63% |

17.89% |

16.58% |

126.62% |

16.91% |

S&P 500 Total Return Index |

4.38% |

6.17% |

19.07% |

56.35% |

16.78% |

16.29% |

118.44% |

16.09% |

Siren DIVCON Dividend Defender ETF — NAV(3) |

3.04% |

-1.89% |

-0.18% |

16.65% |

10.28% |

9.12% |

55.32% |

8.81% |

Siren DIVCON Dividend Defender ETF — Market Price(3) |

2.65% |

-1.95% |

-0.91% |

15.31% |

10.05% |

9.01% |

54.66% |

8.72% |

DIVCON Dividend Defender Index |

2.59% |

-2.24% |

0.50% |

18.20% |

10.67% |

9.65% |

59.44% |

9.36% |

S&P 500 Total Return Index |

4.38% |

6.17% |

19.07% |

56.35% |

16.78% |

16.29% |

132.93% |

17.61% |

Siren Nasdaq NexGen Economy ETF — NAV(4) |

3.85% |

17.97% |

41.12% |

124.00% |

30.05% |

N/A |

106.58% |

25.45% |

Siren Nasdaq NexGen Economy ETF — Market Price(4) |

3.92% |

18.13% |

41.18% |

126.64% |

30.11% |

N/A |

107.50% |

25.62% |

RS Nasdaq Blockchain Economy NTR Index |

4.52% |

19.25% |

43.80% |

127.42% |

30.90% |

N/A |

109.63% |

26.02% |

MSCI ACWI Total Return Index |

2.67% |

4.57% |

19.93% |

54.60% |

12.07% |

N/A |

33.12% |

9.35% |

|

(1) |

The Siren Large Cap Blend Index ETF commenced operations on June 30, 2020. The Siren DIVCON Leaders Dividend ETF commenced operations on January 6, 2016. The SIREN DIVCON Dividend Defender ETF commenced operations on January 14, 2016. The Siren Nasdaq NexGen Economy ETF commenced operations on January 17, 2018. |

|

(2) |

On November 23, 2020, the Reality Shares DIVCON Leaders Dividend ETF (the “Predecessor Leaders Fund”) was reorganized into the Fund. Accordingly, the performance shown for periods prior to the Reorganization represents the performance of the Predecessor Leaders Fund. |

|

(3) |

On November 23, 2020, the Reality Shares DIVCON Dividend Defender ETF (the “Predecessor Defender Fund”) was reorganized into the Fund. Accordingly, the performance shown for periods prior to the Reorganization represents the performance of the Predecessor Defender Fund. |

|

(4) |

On November 23, 2020, the Reality Shares Nasdaq NexGen Economy ETF (the “Predecessor NexGen Fund”) was reorganized into the Fund. Accordingly, the performance shown for periods prior to the Reorganization represents the performance of the Predecessor NexGen Fund. |

4

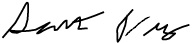

Siren Large Cap Blend Index ETF

Fund Performance

As of March 31, 2021 (Unaudited)

Fund Performance History (%) |

Total Return |

Fund |

Since Inception |

NAV Return |

24.49% |

Market Price Return |

24.57% |

Index |

|

Siren Large Cap Blend Index |

25.20% |

S&P 500 Total Return Index |

29.71% |

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund.

Past performance does not predict future performance. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the sale of fund shares.

|

(1) |

The Index invests equally in the top 30 of the largest 500 U.S. companies, and the top 30 of the largest 100 companies listed on Nasdaq Stock Exchange. The Index is rebalanced quarterly and reconstituted annually. |

|

(2) |

S&P 500 Index is a broad stock market index of 500 large companies based on market capitalization. S&P 500 Total Return Index is the S&P 500 Index with dividends reinvested. |

5

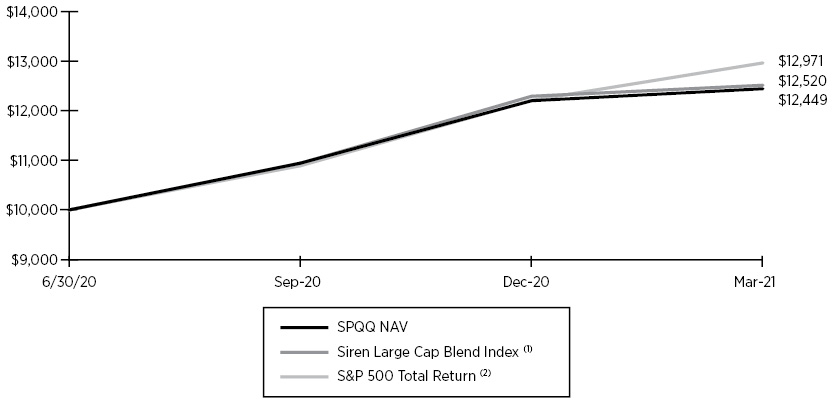

Siren DIVCON Leaders Dividend ETF

Fund Performance

As of March 31, 2021 (Unaudited)

Fund Performance History (%) |

Total Return |

|

Fund |

1 Year |

Since Inception |

NAV Return |

52.46% |

16.25% |

Market Price Return |

51.76% |

16.27% |

Index |

||

DIVCON Leaders Dividend Index |

53.63% |

16.91% |

S&P 500 Total Return Index |

56.35% |

16.09% |

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund.

On November 23, 2020, the Reality Shares DIVCON Leaders Dividend ETF (the “Predecessor Leaders Fund”) was reorganized into the Fund. Accordingly, the performance shown for periods prior to the Reorganization represents the performance of the Predecessor Leaders Fund.

Past performance does not predict future performance. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the sale of fund shares.

|

(1) |

The Index invests in the largest U.S. companies by market capitalization that, based on their DIVCONTM ratings, have the highest probability of increasing their dividends in the next 12 months. DIVCON is a dividend health rating system created by Reality Shares, Inc. which assesses the likelihood that companies will grow or cut their dividends. |

|

(2) |

S&P 500 Index is a broad stock market index of 500 large companies based on market capitalization. S&P 500 Total Return Index is the S&P 500 Index with dividends reinvested. |

6

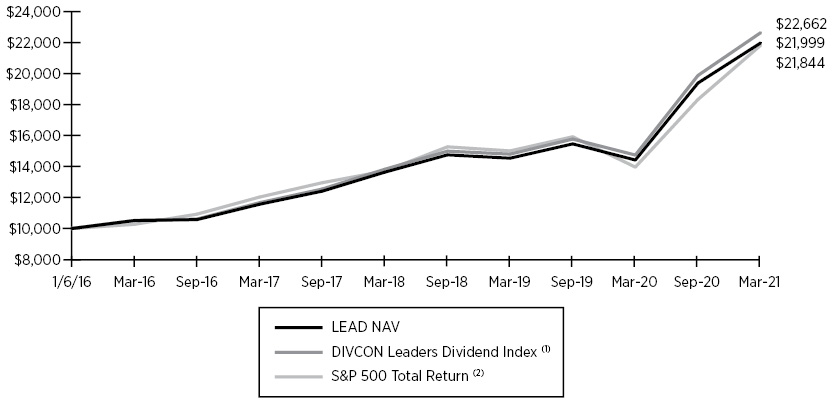

Siren DIVCON Dividend Defender ETF

Fund Performance

As of March 31, 2021 (Unaudited)

Fund Performance History (%) |

Total Return |

|

Fund |

1 Year |

Since Inception |

NAV Return |

16.65% |

8.81% |

Market Price Return |

15.31% |

8.72% |

Index |

||

DIVCON Dividend Defender Index |

18.20% |

9.36% |

S&P 500 Total Return Index |

56.35% |

17.61% |

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund.

On November 23, 2020, the Reality Shares DIVCON Dividend Defender ETF (the “Predecessor Defender Fund”) was reorganized into the Fund. Accordingly, the performance shown for periods prior to the Reorganization represents the performance of the Predecessor Defender Fund.

Past performance does not predict future performance. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the sale of fund shares.

|

(1) |

The Index invests 75% in the largest U.S. companies by market capitalization that, based on their DIVCONTM ratings, have the highest probability of increasing their dividends in the next 12 months. As a hedge, the remaining 25% of the Index takes a short position in companies with the highest probability of cutting their dividends in the next 12 months based on their DIVCON ratings. DIVCON is a dividend health rating system created by Reality Shares, Inc. which assesses the likelihood that companies will grow or cut their dividends. |

|

(2) |

S&P 500 Index is a broad stock market index of 500 large companies based on market capitalization. S&P 500 Total Return Index is the S&P 500 Index with dividends reinvested. |

7

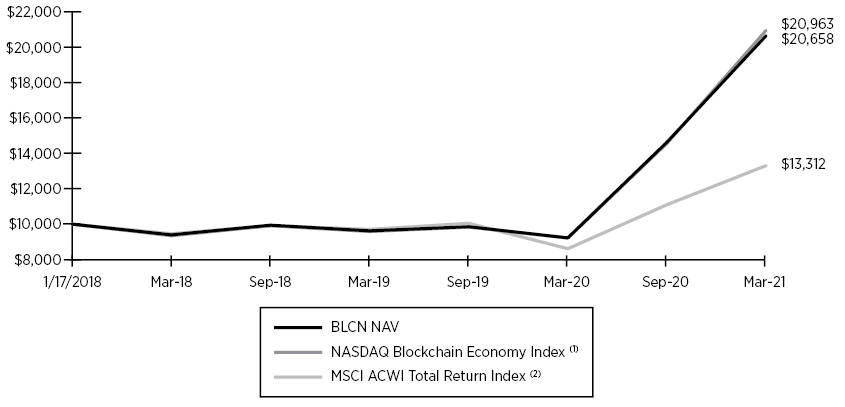

Siren Nasdaq NexGen Economy ETF

Fund Performance

As of March 31, 2021 (Unaudited)

Fund Performance History (%) |

Total Return |

|

Fund |

1 Year |

Since Inception |

NAV Return |

124.00% |

25.45% |

Market Price Return |

126.64% |

25.62% |

Index |

||

NASDAQ Blockchain Economy Index |

127.42% |

26.02% |

MSCI ACWI Total Return Index |

54.60% |

9.35% |

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund.

On November 23, 2020, the Reality Shares Nasdaq NexGen Economy ETF (the “Predecessor NexGen Fund”) was reorganized into the Fund. Accordingly, the performance shown for periods prior to the Reorganization represents the performance of the Predecessor NexGen Fund.

Past performance does not predict future performance. The graph and table above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the sale of fund shares.

|

(1) |

The Index was created through a partnership between Reality Shares, Inc. and Nasdaq, and constitutes the joint research, analysis and investigation of both groups on the emerging development of blockchain technology. The Index is designed to measure the returns of companies that are committing material resources to developing, researching, supporting, innovating or utilizing blockchain technology for their use or for use by others. |

|

(2) |

MSCI ACWI Total Return Index captures large and mid-cap representation across 23 developed markets and 24 emerging markets countries. One cannot invest directly in an index. |

8

Siren Large Cap Blend Index ETF

Schedule of Investments

March 31, 2021

Number |

|

Value |

||||||

|

COMMON STOCKS 96.6% |

|||||||

Communications 21.4% |

||||||||

28 |

Alphabet, Inc. (a) |

$ | 57,750 | |||||

867 |

AT&T, Inc. |

26,244 | ||||||

42 |

Charter Communications, Inc. (a) |

25,915 | ||||||

934 |

Comcast Corp. |

50,539 | ||||||

205 |

Facebook, Inc. (a) |

60,379 | ||||||

50 |

Netflix, Inc. (a) |

26,083 | ||||||

170 |

T-Mobile US, Inc. (a) |

21,299 | ||||||

128 |

The Walt Disney Co. (a) |

23,619 | ||||||

428 |

Verizon Communications, Inc. |

24,888 | ||||||

| 316,716 | ||||||||

Consumer Discretionary 14.3% |

||||||||

17 |

Amazon.com, Inc. (a) |

52,599 | ||||||

258 |

JD.com, Inc. (a) |

21,757 | ||||||

173 |

NIKE, Inc. - Class B |

22,990 | ||||||

140 |

Pinduoduo, Inc. (a) |

18,743 | ||||||

235 |

Starbucks Corp. |

25,679 | ||||||

61 |

Tesla, Inc. (a) |

40,744 | ||||||

96 |

The Home Depot, Inc. |

29,304 | ||||||

| 211,816 | ||||||||

Consumer Staples 8.3% |

||||||||

70 |

Costco Wholesale Corp. |

24,674 | ||||||

178 |

PepsiCo, Inc. |

25,178 | ||||||

500 |

The Coca-Cola Co. |

26,355 | ||||||

178 |

The Procter & Gamble Co. |

24,106 | ||||||

171 |

Walmart, Inc. |

23,227 | ||||||

| 123,540 | ||||||||

Energy 1.9% |

||||||||

519 |

Exxon Mobil Corp. |

28,976 | ||||||

Financials 5.8% |

||||||||

761 |

Bank of America Corp. |

29,443 | ||||||

111 |

Berkshire Hathaway, Inc. (a) |

28,357 | ||||||

181 |

JPMorgan Chase & Co. |

27,554 | ||||||

| 85,354 | ||||||||

Health Care 6.4% |

||||||||

97 |

Amgen, Inc. |

24,134 | ||||||

140 |

Johnson & Johnson |

23,009 | ||||||

264 |

Merck & Co., Inc. |

20,352 | ||||||

72 |

UnitedHealth Group, Inc. |

26,789 | ||||||

| 94,284 | ||||||||

COMMON STOCKS 96.6% (continued) |

||||||||

Technology 38.5% |

||||||||

103 |

Adobe, Inc. (a) |

$ | 48,963 | |||||

269 |

Advanced Micro Devices, Inc. (a) |

21,117 | ||||||

359 |

Apple, Inc. |

43,852 | ||||||

225 |

Applied Materials, Inc. |

30,060 | ||||||

42 |

ASML Holding NV |

25,929 | ||||||

78 |

Broadcom, Inc. |

36,165 | ||||||

554 |

Cisco Systems, Inc . |

28,647 | ||||||

828 |

Intel Corp . |

52,992 | ||||||

64 |

Intuit, Inc. |

24,516 | ||||||

76 |

Mastercard, Inc. |

27,060 | ||||||

199 |

Microsoft Corp. |

46,918 | ||||||

44 |

NVIDIA Corp. |

23,493 | ||||||

189 |

PayPal Holdings, Inc. (a) |

45,897 | ||||||

149 |

QUALCOMM, Inc. |

19,756 | ||||||

108 |

Salesforce.com, Inc. (a) |

22,882 | ||||||

138 |

Texas Instruments, Inc. |

26,081 | ||||||

117 |

Visa, Inc. |

24,772 | ||||||

64 |

Zoom Video Communications, Inc. (a) |

20,562 | ||||||

| 569,662 | ||||||||

Total Common Stocks |

||||||||

(Cost $1,224,770) |

1,430,348 | |||||||

MONEY MARKET FUNDS 3.4% |

||||||||

49,687 |

First American Government Obligations Fund, 0.036% (b) |

49,687 | ||||||

Total Money Market Funds |

||||||||

(Cost $49,687) |

49,687 | |||||||

Total Investments 100.0% |

||||||||

(Cost $1,274,457) |

1,480,035 | |||||||

Other Assets in Excess Liabilities 0.0% |

278 | |||||||

TOTAL NET ASSETS 100.0% |

$ | 1,480,313 | ||||||

|

(a) |

Non-Income Producing. |

|

(b) |

7-day net yield at March 31, 2021. |

The accompanying notes are an integral part of the financial statements.

9

Siren Large Cap Blend Index ETF

Schedule of Investments

Summary of Schedule of Investments (Unaudited)

March 31, 2021

ALLOCATION BY SECTOR |

|

Sector |

Percentage of |

Technology |

38.5% |

Communications |

21.4 |

Consumer Discretionary |

14.3 |

Consumer Staples |

8.3 |

Health Care |

6.4 |

Financials |

5.8 |

Energy |

1.9 |

Total Common Stocks |

96.6 |

Total Short-Term Investments |

3.4 |

Total Investments |

100.0 |

Other Assets in Excess of Liabilities |

0.0(a) |

Total Net Assets |

100.0% |

|

(a) |

Rounds to less than 0.1%. |

The accompanying notes are an integral part of the financial statements.

10

Siren DIVCON Leaders Dividend ETF

Schedule of Investments

March 31, 2021

Number |

|

Value |

||||||

COMMON STOCKS 95.8% |

||||||||

Communications 2.0% |

||||||||

8,721 |

Activision Blizzard, Inc. |

$ | 811,053 | |||||

Consumer Discretionary 12.2% |

||||||||

7,097 |

Best Buy Co., Inc. |

814,807 | ||||||

2,502 |

Domino’s Pizza, Inc. |

920,211 | ||||||

13,567 |

DR Horton, Inc. |

1,209,091 | ||||||

2,849 |

The Home Depot, Inc. |

869,657 | ||||||

5,736 |

Tractor Supply, Co. |

1,015,731 | ||||||

| 4,829,497 | ||||||||

Consumer Staples 13.5% |

||||||||

8,503 |

Church & Dwight Co, Inc. |

742,737 | ||||||

2,480 |

Costco Wholesale Corp. |

874,150 | ||||||

3,601 |

Dollar General Corp. |

729,635 | ||||||

8,088 |

McCormick & Co. Inc. |

721,126 | ||||||

3,699 |

The Clorox Co. |

713,463 | ||||||

23,273 |

The Kroger Co. |

837,595 | ||||||

5,550 |

The Procter & Gamble Co. |

751,637 | ||||||

| 5,370,343 | ||||||||

Financials 8.2% |

||||||||

15,516 |

Aflac, Inc. |

794,109 | ||||||

16,485 |

Brown & Brown, Inc. |

753,529 | ||||||

5,151 |

T. Rowe Price Group, Inc. |

883,912 | ||||||

7,139 |

The Allstate Corp. |

820,271 | ||||||

| 3,251,821 | ||||||||

Health Care 8.4% |

||||||||

5,730 |

Merck & Co., Inc. |

441,726 | ||||||

4,044 |

STERIS plc |

770,301 | ||||||

2,750 |

UnitedHealth Group, Inc. |

1,023,192 | ||||||

2,901 |

West Pharmaceutical Services, Inc. |

817,444 | ||||||

1,712 |

Zoetis, Inc. |

269,606 | ||||||

| 3,322,269 | ||||||||

Industrials 16.8% |

||||||||

10,388 |

Amphenol Corp . |

685,296 | ||||||

2,127 |

Cintas Corp. |

725,966 | ||||||

9,314 |

Cognex Corp. |

772,969 | ||||||

14,459 |

Fastenal Co. |

726,999 | ||||||

6,454 |

HEICO Corp. |

733,174 | ||||||

5,410 |

JB Hunt Transport Services, Inc. |

909,259 | ||||||

4,562 |

L3Harris Technologies, Inc. |

924,626 | ||||||

6,042 |

Nordson Corp. |

1,200,425 | ||||||

| 6,678,714 | ||||||||

COMMON STOCKS 95.8% (continued) |

||||||||

Materials 2.0% |

||||||||

1,091 |

The Sherwin-Williams Co. |

$ | 805,169 | |||||

Technology 32.7% |

||||||||

6,216 |

Apple, Inc. |

759,284 | ||||||

7,716 |

Booz Allen Hamilton Holding Corp. |

621,370 | ||||||

2,181 |

FactSet Research Systems, Inc. |

673,035 | ||||||

14,158 |

Intel Corp. |

906,112 | ||||||

2,199 |

Intuit, Inc. |

842,349 | ||||||

4,600 |

Jack Henry & Associates, Inc. |

697,912 | ||||||

2,955 |

KLA Corp. |

976,332 | ||||||

1,558 |

Lam Research Corp. |

927,384 | ||||||

1,308 |

MarketAxess Holdings, Inc. |

651,279 | ||||||

3,597 |

Microsoft Corp. |

848,065 | ||||||

2,799 |

Moody’s Corp. |

835,809 | ||||||

1,385 |

NVIDIA Corp. |

739,493 | ||||||

2,514 |

S&P Global, Inc. |

887,115 | ||||||

5,311 |

Skyworks Solutions, Inc. |

974,462 | ||||||

6,331 |

Teradyne, Inc. |

770,356 | ||||||

4,745 |

Texas Instruments, Inc. |

896,758 | ||||||

| 13,007,115 | ||||||||

Total Common Stocks |

||||||||

(Cost $30,413,578) |

38,075,981 | |||||||

MONEY MARKET FUNDS 3.7% |

||||||||

1,463,223 |

First American Government Obligations Fund 0.036% (a) |

1,463,223 | ||||||

Total Money Market Funds |

||||||||

(Cost $1,463,223) |

1,463,223 | |||||||

Total Investments 99.5% |

||||||||

(Cost $31,876,801) |

39,539,204 | |||||||

Other Assets in Excess of Liabilities 0.5% |

197,399 | |||||||

TOTAL NET ASSETS 100.0% |

$ | 39,736,603 | ||||||

|

(a) |

7-day net yield at March 31, 2021. |

The accompanying notes are an integral part of the financial statements.

11

Siren DIVCON Leaders Dividend ETF

Schedule of Investments

Summary of Schedule of Investments (Unaudited)

March 31, 2021

ALLOCATION BY SECTOR |

|

Sector |

Percentage of |

Technology |

32.7% |

Industrials |

16.8 |

Consumer Staples |

13.5 |

Consumer Discretionary |

12.2 |

Health Care |

8.4 |

Financials |

8.2 |

Communications |

2.0 |

Materials |

2.0 |

Total Common Stocks |

95.8 |

Total Short-Term Investments |

3.7 |

Total Investments |

99.5 |

Other Assets in Excess of Liabilities |

0.5 |

Total Net Assets |

100.0% |

The accompanying notes are an integral part of the financial statements.

12

Siren DIVCON Dividend Defender ETF

Schedule of Investments

March 31, 2021

Number |

|

Value |

||||||

COMMON STOCKS 87.9% |

||||||||

Communications 1.8% |

||||||||

7,095 |

Activision Blizzard, Inc. (a) |

$ | 659,835 | |||||

Consumer Discretionary 10.4% |

||||||||

6,276 |

Best Buy Co., Inc. |

720,548 | ||||||

1,693 |

Domino’s Pizza, Inc. |

622,668 | ||||||

9,840 |

DR Horton, Inc. (a) |

876,941 | ||||||

2,337 |

The Home Depot, Inc. |

713,369 | ||||||

5,289 |

Tractor Supply Co. (a) |

936,576 | ||||||

| 3,870,102 | ||||||||

Consumer Staples 11.3% |

||||||||

6,372 |

Church & Dwight Co., Inc. (a) |

556,594 | ||||||

1,823 |

Costco Wholesale Corp. (a) |

642,571 | ||||||

2,780 |

Dollar General Corp. (a) |

563,283 | ||||||

6,192 |

McCormick & Co., Inc. (a) |

552,079 | ||||||

2,727 |

The Clorox Co. (a) |

525,984 | ||||||

22,300 |

The Kroger Co. (a) |

802,577 | ||||||

4,130 |

The Procter & Gamble Co. (a) |

559,326 | ||||||

| 4,202,414 | ||||||||

Financials 7.0% |

||||||||

12,054 |

Aflac, Inc. (a) |

616,924 | ||||||

12,138 |

Brown & Brown, Inc. (a) |

554,828 | ||||||

3 |

Brown-Forman Corp. - Class B |

207 | ||||||

3,874 |

T. Rowe Price Group, Inc. (a) |

664,778 | ||||||

6,670 |

The Allstate Corp. (a) |

766,383 | ||||||

| 2,603,120 | ||||||||

Health Care 10.8% |

||||||||

13,555 |

Merck & Co., Inc. (a) |

1,044,955 | ||||||

2,937 |

STERIS plc (a) |

559,440 | ||||||

2,044 |

UnitedHealth Group, Inc. (a) |

760,511 | ||||||

2,872 |

West Pharmaceutical Services, Inc. (a) |

809,272 | ||||||

5,248 |

Zoetis, Inc. (a) |

826,455 | ||||||

| 4,000,633 | ||||||||

COMMON STOCKS 87.9% (continued) |

||||||||

Industrials 14.5% |

||||||||

9,440 |

Amphenol Corp. (a) |

$ | 622,757 | |||||

1,526 |

Cintas Corp. (a) |

520,839 | ||||||

7,093 |

Cognex Corp. (a) |

588,648 | ||||||

12,038 |

Fastenal Co. (a) |

605,271 | ||||||

4,844 |

HEICO Corp. |

550,278 | ||||||

5,125 |

JB Hunt Transport Services, Inc. (a) |

861,359 | ||||||

3,160 |

L3Harris Technologies, Inc. (a) |

640,469 | ||||||

5,125 |

Nordson Corp. (a) |

1,018,235 | ||||||

| 5,407,856 | ||||||||

Materials 0.1% |

||||||||

31 |

The Sherwin-Williams Co. (a) |

22,878 | ||||||

Technology 32.0% |

||||||||

4,554 |

Apple, Inc. (a) |

556,271 | ||||||

7,675 |

Booz Allen Hamilton Holding Corp. (a) |

618,068 | ||||||

1,723 |

FactSet Research Systems, Inc. (a) |

531,701 | ||||||

13,560 |

Intel Corp. (a) |

867,840 | ||||||

1,656 |

Intuit, Inc. (a) |

634,347 | ||||||

4,469 |

Jack Henry & Associates, Inc. (a) |

678,037 | ||||||

2,378 |

KLA Corp. (a) |

785,691 | ||||||

1,521 |

Lam Research Corp. (a) |

905,360 | ||||||

1,355 |

MarketAxess Holdings, Inc. (a) |

674,682 | ||||||

3,172 |

Microsoft Corp. (a) |

747,862 | ||||||

2,443 |

Moody’s Corp. (a) |

729,504 | ||||||

1,260 |

MSCI, Inc. (a) |

528,293 | ||||||

1,253 |

NVIDIA Corp. (a) |

669,014 | ||||||

2,337 |

S&P Global, Inc. (a) |

824,657 | ||||||

4,091 |

Skyworks Solutions, Inc. (a) |

750,617 | ||||||

4,715 |

Teradyne, Inc. (a) |

573,721 | ||||||

4,225 |

Texas Instruments, Inc. (a) |

798,483 | ||||||

| 11,874,148 | ||||||||

Total Common Stocks |

||||||||

(Cost $29,021,272) |

32,640,986 | |||||||

The accompanying notes are an integral part of the financial statements.

13

Siren DIVCON Dividend Defender ETF

Schedule of Investments

March 31, 2021 (Continued)

Number |

|

Value |

||||||

MONEY MARKET FUNDS 23.4% |

||||||||

8,675,553 |

First American Government Obligations Fund, 0.04% (b) |

$ | 8,675,553 | |||||

Total Money Market Funds |

||||||||

(Cost $8,675,553) |

8,675,553 | |||||||

Total Investments Before Securities Sold Short |

||||||||

(Cost $37,696,825) |

41,316,539 | |||||||

SECURITIES SOLD SHORT |

||||||||

COMMON STOCKS (30.1)% |

||||||||

Consumer Discretionary (1.9)% |

||||||||

(5,045) |

Darden Restaurants, Inc. |

(716,390 | ) | |||||

Consumer Staples (1.8)% |

||||||||

(16,789) |

The Kraft Heinz Co. |

(671,560 | ) | |||||

Energy (13.7)% |

||||||||

(21,045) |

Baker Hughes Co. |

(454,782 | ) | |||||

(10,080) |

ConocoPhillips |

(533,938 | ) | |||||

(30,526) |

Halliburton Co. |

(655,088 | ) | |||||

(10,667) |

Hess Corp. |

(754,797 | ) | |||||

(30,687) |

Kinder Morgan, Inc. |

(510,939 | ) | |||||

(38,749) |

Occidental Petroleum Corp. |

(1,031,498 | ) | |||||

(24,759) |

Schlumberger NV |

(673,197 | ) | |||||

(19,921) |

The Williams Companies, Inc. |

(471,929 | ) | |||||

| (5,086,168 | ) | |||||||

Financials (3.9)% |

||||||||

(5,291) |

Capital One Financial Corp. |

(673,174 | ) | |||||

(19,413) |

Wells Fargo & Co. |

(758,466 | ) | |||||

| (1,431,640 | ) | |||||||

COMMON STOCKS (30.1)% (continued) |

||||||||

Industrials (2.4)% |

||||||||

(68,450) |

General Electric Co. |

$ | (898,748 | ) | ||||

Information (1.9)% |

||||||||

(52,735) |

Lumen Technologies, Inc. |

(704,012 | ) | |||||

Materials (1.9)% |

||||||||

(13,448) |

Westrock Co. |

(699,968 | ) | |||||

Utilities (2.6)% |

||||||||

(22,469) |

CenterPoint Energy, Inc. |

(508,923 | ) | |||||

(5,949) |

Dominion Energy, Inc. |

(451,886 | ) | |||||

| (960,809 | ) | |||||||

Total Securities Sold Short |

||||||||

[Proceeds $(9,408,948)] |

(11,169,295 | ) | ||||||

Total Investments 81.2% |

||||||||

(Cost $28,287,877) |

30,147,244 | |||||||

Other Assets in Excess of Liabilities 18.8% |

7,015,696 | |||||||

TOTAL NET ASSETS 100.0% |

$ | 37,162,940 | ||||||

|

(a) |

Substantially all the securities, or a portion thereof, have been pledged as collateral for open short positions by the Fund. The aggregate market value of the collateral at March 31, 2021 was $37,045,340, which includes cash in the amount of $7,011,424. |

|

(b) |

7-day net yield at March 31, 2021. |

The accompanying notes are an integral part of the financial statements.

14

Siren DIVCON Dividend Defender ETF

Schedule of Investments

Summary of Schedule of Investments (Unaudited)

March 31, 2021

ALLOCATION BY SECTOR |

|

Sector |

Percentage of |

Securities Held Long |

|

Technology |

32.0% |

Industrials |

14.5 |

Consumer Staples |

11.3 |

Health Care |

10.8 |

Consumer Discretionary |

10.4 |

Financials |

7.0 |

Communications |

1.8 |

Materials |

0.1 |

87.9 |

|

Securities Sold Short |

|

Consumer Staples |

(1.8) |

Consumer Discretionary |

(1.9) |

Materials |

(1.9) |

Information |

(1.9) |

Industrials |

(2.4) |

Utilities |

(2.6) |

Financials |

(3.9) |

Energy |

(13.7) |

(30.1) |

|

Total Common Stocks |

57.8 |

Total Short-Term Investments |

23.4 |

Total Investments |

81.2 |

Other Assets in Excess of Liabilities |

18.8 |

Total Net Assets |

100.0% |

The accompanying notes are an integral part of the financial statements.

15

Siren Nasdaq NexGen Economy ETF

Schedule of Investments

March 31, 2021

Number |

|

Value |

||||||

COMMON STOCKS 98.8% |

||||||||

Communications 10.9% |

||||||||

2,051 |

Alphabet, Inc. (b) |

$ | 4,230,228 | |||||

21,479 |

Baidu, Inc. (b) |

4,672,756 | ||||||

112,709 |

Digital Garage, Inc. (a) |

4,585,722 | ||||||

11,077 |

Facebook, Inc. (b) |

3,262,509 | ||||||

151,363 |

GMO internet, Inc. (a) |

4,333,445 | ||||||

6,428 |

Swisscom AG (a) |

3,448,126 | ||||||

62,413 |

Tencent Holdings Ltd. (a) |

4,897,278 | ||||||

707,960 |

Z Holding Corp. (a) |

3,520,459 | ||||||

| 32,950,523 | ||||||||

Consumer Discretionary 6.9% |

||||||||

20,372 |

Alibaba Group Holding Ltd. (b) |

4,618,943 | ||||||

1,111 |

Amazon.com, Inc. (b) |

3,437,523 | ||||||

55,969 |

JD.com, Inc. (b) |

4,719,866 | ||||||

68,991 |

Overstock.com, Inc. (b) |

4,571,344 | ||||||

299,795 |

Rakuten Group, Inc. (a) |

3,571,276 | ||||||

| 20,918,952 | ||||||||

Consumer Staples 1.2% |

||||||||

26,260 |

Walmart, Inc. |

3,566,896 | ||||||

Financials 35.8% |

||||||||

1,043,630 |

Argo Blockchain PLC (a)(b) |

3,467,400 | ||||||

24,320 |

American Express Co. |

3,439,821 | ||||||

16,709 |

Aon PLC |

3,844,908 | ||||||

62,383 |

ASX Ltd. (a) |

3,366,560 | ||||||

718,626 |

Banco Santander Central Hispano SA - ADR |

2,464,887 | ||||||

85,426 |

Bank of America Corp. |

3,305,132 | ||||||

402,483 |

Barclays PLC - ADR |

4,117,401 | ||||||

932,889 |

BOC Hong Kong Holdings Ltd. (a) |

3,257,990 | ||||||

49,959 |

Citigroup, Inc. |

3,634,517 | ||||||

15,450 |

CME Group, Inc. |

3,155,353 | ||||||

22,731 |

Deutsche Boerse AG (a) |

3,777,260 | ||||||

207,227 |

Galaxy Digital Holdings Ltd. (a)(b) |

4,216,435 | ||||||

271,094 |

ING Groep NV - ADR |

3,315,480 | ||||||

33,236 |

Intercontinental Exchange, Inc. |

3,711,796 | ||||||

29,397 |

JPMorgan Chase & Co. |

4,475,105 | ||||||

115,236 |

Marathon Digital Holdings, Inc. (b) |

5,533,633 | ||||||

223,161 |

Mizuho Financial Group, Inc. (a) |

3,222,709 | ||||||

29,784 |

Nasdaq, Inc. |

4,391,949 | ||||||

373,195 |

Ping An Insurance Group Co. of China Ltd. (a) |

4,442,855 | ||||||

181,398 |

Plus500 Ltd. (a) |

3,501,071 | ||||||

COMMON STOCKS 98.8% (continued) |

||||||||

Financials 35.8% (continued) |

||||||||

177,556 |

SBI Holdings, Inc. (a) |

$ | 4,810,729 | |||||

15,947 |

Signature Bank/New York NY |

3,605,617 | ||||||

34,776 |

Silvergate Capital Corp. - Class A (b) |

4,944,104 | ||||||

87,428 |

The Bank of New York Mellon Corp. |

4,134,470 | ||||||

11,508 |

The Goldman Sachs Group, Inc. |

3,763,116 | ||||||

34,234 |

TMX Group Ltd. (a) |

3,557,427 | ||||||

294,005 |

VPC Impact Acquisition Holdings (b) |

3,819,125 | ||||||

783,428 |

ZhongAn Online P&C Insurance Co. Ltd. (a)(b) |

4,726,306 | ||||||

| 108,003,156 | ||||||||

Industrials 2.6% |

||||||||

89,486 |

Hitachi Ltd. (a) |

4,044,145 | ||||||

23,576 |

Siemens AG (a) |

3,870,674 | ||||||

| 7,914,819 | ||||||||

Technology 41.4% |

||||||||

17,857 |

Accenture PLC - Class A |

4,932,996 | ||||||

52,358 |

Advanced Micro Devices, Inc. (b) |

4,110,103 | ||||||

42,065 |

Atos SE (a)(b) |

3,281,418 | ||||||

26,674 |

Broadridge Financial Solutions, Inc. |

4,083,789 | ||||||

194,600 |

Canaan, Inc. (b) |

4,022,382 | ||||||

78,507 |

Cisco Systems, Inc. |

4,059,597 | ||||||

19,963 |

DocuSign, Inc. (b) |

4,041,509 | ||||||

472,960 |

Ebang International Holdings, Inc. - Class A (b) |

3,760,032 | ||||||

32,291 |

Fujitsu Ltd. (a) |

4,666,119 | ||||||

264,106 |

Hewlett Packard Enterprise Co. |

4,157,029 | ||||||

194,200 |

Infosys Ltd. |

3,635,424 | ||||||

61,660 |

Intel Corp. |

3,946,240 | ||||||

38,293 |

International Business Machines Corp. |

5,102,925 | ||||||

13,123 |

Mastercard, Inc. - Class A |

4,672,444 | ||||||

38,637 |

Micron Technology, Inc. (b) |

3,408,170 | ||||||

20,051 |

Microsoft Corp. |

4,727,424 | ||||||

7,676 |

MicroStrategy, Inc. (b) |

5,210,469 | ||||||

258,553 |

NTT Data Corp. (a) |

4,000,012 | ||||||

7,800 |

NVIDIA Corp. |

4,164,654 | ||||||

273,782 |

OneConnect Financial Technology Co. Ltd. (b) |

4,046,498 | ||||||

57,582 |

Oracle Corp. |

4,040,529 | ||||||

18,528 |

PayPal Holdings, Inc. (b) |

4,499,340 | ||||||

2,091 |

Samsung Electronics Company, Ltd. - GDR 144A (c) |

3,813,984 | ||||||

39,249 |

SAP SE |

4,819,385 | ||||||

22,841 |

Square, Inc. (b) |

5,186,049 | ||||||

34,389 |

Taiwan Semiconductor Manufacturing Co. Ltd. - ADR |

4,067,531 | ||||||

The accompanying notes are an integral part of the financial statements.

16

Siren Nasdaq NexGen Economy ETF

Schedule of Investments

March 31, 2021 (Continued)

Number |

|

Value |

||||||

COMMON STOCKS 98.8% (continued) |

||||||||

Technology 41.4% (continued) |

||||||||

18,906 |

Texas Instruments, Inc. |

$ | 3,573,045 | |||||

37,457 |

Thomson Reuters Corp. |

3,280,110 | ||||||

16,525 |

Visa, Inc. |

3,498,838 | ||||||

31,397 |

Xilinx, Inc. |

3,890,088 | ||||||

| 124,698,133 | ||||||||

Total Common Stocks |

||||||||

(Cost $249,959,043) |

298,052,479 | |||||||

Total Investments 98.8% |

||||||||

(Cost $249,959,043) |

298,052,479 | |||||||

Other Assets in Excess of Liabilities 1.2% |

3,635,303 | |||||||

TOTAL NET ASSETS 100.0% |

$ | 301,687,782 | ||||||

|

(a) |

U.S.-dollar denominated security of a foreign issuer. |

|

(b) |

Non-Income Producing. |

|

(c) |

Security was purchased pursuant to Rule 144 under the securities Act of 1933 and may not be resold subject to the rule except to qualified institutional buyers. Unless otherwise noted, 144 securities are deemed to be liquid. At March 31, 2021, the net value of these securities amounted to $3,813,984, which represents 1.3% of net assets. |

The accompanying notes are an integral part of the financial statements.

17

Siren Nasdaq NexGen Economy ETF

Schedule of Investments

Summary of Schedule of Investments (Unaudited)

March 31, 2021

ALLOCATION BY SECTOR |

|

Sector |

Percentage of |

Technology |

41.4% |

Financials |

35.8 |

Communications |

10.9 |

Consumer Discretionary |

6.9 |

Industrials |

2.6 |

Consumer Staples |

1.2 |

Total Common Stocks |

98.8 |

Total Investments |

98.8 |

Other Assets in Excess of Liabilities |

1.2 |

Total Net Assets |

100.0% |

The accompanying notes are an integral part of the financial statements.

18

Siren ETF Trust

Statements of Assets and Liabilities

March 31, 2021

Siren |

Siren |

|||||||

ASSETS: |

||||||||

Investments at cost |

$ | 1,274,457 | $ | 31,876,801 | ||||

Investments at value |

$ | 1,480,035 | $ | 39,539,204 | ||||

Receivable for investments sold |

— | 193,395 | ||||||

Interest and dividends receivable |

525 | 18,056 | ||||||

Total assets |

1,480,560 | 39,750,655 | ||||||

LIABILITIES: |

||||||||

Payable to Adviser |

247 | 14,052 | ||||||

Total liabilities |

247 | 14,052 | ||||||

Net Assets |

$ | 1,480,313 | $ | 39,736,603 | ||||

NET ASSETS CONSIST OF: |

||||||||

Paid in capital |

$ | 1,231,338 | $ | 31,418,364 | ||||

Total distributable earnings |

248,975 | 8,318,239 | ||||||

Net Assets |

$ | 1,480,313 | $ | 39,736,603 | ||||

Shares issued and outstanding, $0 par value, unlimited shares authorized |

50,000 | 800,000 | ||||||

Net Asset Value, Redemption Price and Offering Price Per Share |

$ | 29.61 | $ | 49.67 | ||||

The accompanying notes are an integral part of the financial statements.

19

Siren ETF Trust

Statements of Assets and Liabilities

March 31, 2021 (Continued)

Siren DIVCON |

Siren |

|||||||

ASSETS: |

||||||||

Investments at cost |

$ | 37,696,825 | $ | 249,959,043 | ||||

Foreign currency at cost |

$ | — | $ | 5,698,832 | ||||

Investments at value |

$ | 41,316,539 | $ | 298,052,479 | ||||

Foreign currency at value |

— | 5,686,347 | ||||||

Cash pledged as collateral for securities sold short |

97,206 | — | ||||||

Cash held at broker for securities sold short |

6,914,218 | — | ||||||

Receivable for investments sold |

— | 22,818,774 | ||||||

Receivable for Fund shares sold |

— | 4,615,522 | ||||||

Interest and dividends receivable |

26,806 | 689,470 | ||||||

Total assets |

48,354,769 | 331,862,592 | ||||||

LIABILITIES: |

||||||||

Securities sold short, proceeds |

$ | 9,408,948 | ||||||

Securities sold short, at value |

$ | 11,169,295 | — | |||||

Payable to Custodian |

— | 11,389,237 | ||||||

Payable to Adviser |

5,301 | 176,591 | ||||||

Payable for investments purchased |

— | 4,599,373 | ||||||

Payable for Fund shares redeemed |

— | 14,009,609 | ||||||

Dividends and interest payable on securities sold short |

17,233 | — | ||||||

Total liabilities |

11,191,829 | 30,174,810 | ||||||

Net Assets |

$ | 37,162,940 | $ | 301,687,782 | ||||

NET ASSETS CONSIST OF: |

||||||||

Paid in capital |

$ | 39,458,029 | $ | 259,306,269 | ||||

Total accumulated earnings (loss) |

(2,295,089 | ) | 42,381,513 | |||||

Net Assets |

$ | 37,162,940 | $ | 301,687,782 | ||||

Shares issued and outstanding, $0 par value, unlimited shares authorized |

1,030,060 | 6,300,000 | ||||||

Net Asset Value, Redemption Price and Offering Price Per Share |

$ | 36.08 | $ | 47.89 | ||||

The accompanying notes are an integral part of the financial statements.

20

Siren ETF Trust

Statements of Operations

Siren |

Siren DIVCON Leaders Dividend ETF |

|||||||||||

For the Period |

For the Period |

For the |

||||||||||

INVESTMENT INCOME: |

||||||||||||

Dividend income |

$ | 27,386 | $ | 241,625 | $ | 439,016 | ||||||

Interest income |

36 | 166 | 271 | |||||||||

Total investment income |

27,422 | 241,791 | 439,287 | |||||||||

EXPENSES: |

||||||||||||

Investment advisory fees |

3,276 | 68,462 | 139,667 | |||||||||

Total expenses |

3,276 | 68,462 | 139,667 | |||||||||

Net Investment Income |

24,146 | 173,329 | 299,620 | |||||||||

REALIZED AND UNREALIZED GAIN ON INVESTMENTS: |

||||||||||||

Net realized gain on: |

||||||||||||

Investments |

84,666 | 2,723,054 | 123,706 | |||||||||

In-Kind Redemptions |

197,820 | 2,419,480 | 2,776,263 | |||||||||

Change in net unrealized appreciation/depreciation on: |

||||||||||||

Investments |

205,578 | 563,900 | 2,240,746 | |||||||||

Net Realized and Unrealized Gain on Investments |

488,064 | 5,706,434 | 5,140,715 | |||||||||

Net Increase in Net Assets Resulting from Operations |

$ | 512,210 | $ | 5,879,763 | $ | 5,440,335 | ||||||

|

(1) |

Commenced operations on June 30, 2020. |

|

(2) |

The Board of Trustees elected to change the Fund’s fiscal year end to March 31 from October 31. |

The accompanying notes are an integral part of the financial statements.

21

Siren ETF Trust

Statements of Operations

(Continued)

Siren DIVCON Dividend |

Siren Nasdaq NexGen Economy ETF |

|||||||||||||||

For the Period |

For the |

For the Period |

For the |

|||||||||||||

INVESTMENT INCOME: |

||||||||||||||||

Dividend income |

$ | 257,088 | $ | 195,397 | $ | 1,307,392 | $ | 1,223,741 | ||||||||

Non-cash dividend income |

— | — | — | 158,000 | ||||||||||||

Interest income |

1,528 | 13,252 | 252 | 4,417 | ||||||||||||

Foreign withholding tax |

— | — | (91,136 | ) | (91,588 | ) | ||||||||||

Total investment income |

258,616 | 208,649 | 1,216,508 | 1,294,570 | ||||||||||||

EXPENSES: |

||||||||||||||||

Investment advisory fees |

165,950 | 178,978 | 610,546 | 519,453 | ||||||||||||

Dividends on securities sold short |

104,275 | 156,600 | — | — | ||||||||||||

Borrowing fees on securities sold short |

41,529 | 10,433 | — | — | ||||||||||||

Total expenses before waiver |

311,754 | 346,011 | 610,546 | 519,453 | ||||||||||||

Waiver of advisory fees for borrowing fees |

(21,716 | ) | — | — | — | |||||||||||

Net expenses |

290,038 | 346,011 | 610,546 | 519,453 | ||||||||||||

Net Investment Income (Loss) |

(31,422 | ) | (137,362 | ) | 605,962 | 775,117 | ||||||||||

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: |

||||||||||||||||

Net realized gain (loss) on: |

||||||||||||||||

Investments |

1,333,096 | (576,939 | ) | 410,307 | (2,607,486 | ) | ||||||||||

In-Kind Redemptions |

2,946,886 | 1,099,133 | 24,227,064 | 10,116,497 | ||||||||||||

Securities sold short |

(3,046,418 | ) | (178,324 | ) | — | — | ||||||||||

Foreign currency translations |

— | — | (705 | ) | (13,735 | ) | ||||||||||

Change in net unrealized appreciation/depreciation on: |

||||||||||||||||

Investments |

1,096,662 | 2,741,810 | 42,960,631 | 10,961,608 | ||||||||||||

Securities sold short |

(1,620,039 | ) | (210,125 | ) | — | — | ||||||||||

Foreign currency translations |

— | — | (19,867 | ) | 5,805 | |||||||||||

Net Realized and Unrealized Gain on Investments |

710,187 | 2,875,555 | 67,577,430 | 18,462,689 | ||||||||||||

Net Increase in Net Assets Resulting from Operations |

$ | 678,765 | $ | 2,738,193 | $ | 68,183,392 | $ | 19,237,806 | ||||||||

|

(1) |

The Board of Trustees elected to change the Fund’s fiscal year end to March 31 from October 31. |

The accompanying notes are an integral part of the financial statements.

22

Siren ETF Trust

Statements of Changes in Net Assets

Siren Large |

Siren DIVCON Leaders Dividend ETF |

|||||||||||||||

For the Period |

For the Period |

For the |

For the |

|||||||||||||

OPERATIONS: |

||||||||||||||||

Net investment income |

$ | 24,146 | $ | 173,329 | $ | 299,620 | $ | 567,755 | ||||||||

Net realized gain (loss) on: |

||||||||||||||||

Investments |

84,666 | 2,723,054 | 123,706 | (2,195,172 | ) | |||||||||||

In-Kind Redemptions |

197,820 | 2,419,480 | 2,776,263 | 1,833,045 | ||||||||||||

Change in net unrealized appreciation/depreciation on: |

||||||||||||||||

Investments |

205,578 | 563,900 | 2,240,746 | 5,307,926 | ||||||||||||

Net increase in net assets resulting from operations |

512,210 | 5,879,763 | 5,440,335 | 5,513,554 | ||||||||||||

DISTRIBUTIONS TO SHAREHOLDERS: |

||||||||||||||||

Net distributions to shareholders |

(109,654 | ) | (205,845 | ) | (321,796 | ) | (568,034 | ) | ||||||||

Net decrease in net assets resulting from distributions paid |

(109,654 | ) | (205,845 | ) | (321,796 | ) | (568,034 | ) | ||||||||

CAPITAL SHARE TRANSACTIONS: |

||||||||||||||||

Shares sold |

2,500,000 | 12,937,595 | 20,224,757 | — | ||||||||||||

Shares redeemed |

(1,422,243 | ) | (14,113,233 | ) | (21,839,904 | ) | (18,467,609 | ) | ||||||||

Transaction fees |

— | 11 | — | — | ||||||||||||

Net increase (decrease) in net assets resulting from capital share transactions |

1,077,757 | (1,175,627 | ) | (1,615,147 | ) | (18,467,609 | ) | |||||||||

Total Increase (Decrease) in Net Assets |

1,480,313 | 4,498,291 | 3,503,392 | (13,522,089 | ) | |||||||||||

NET ASSETS: |

||||||||||||||||

Beginning of Period |

— | 35,238,312 | 31,734,920 | 45,257,009 | ||||||||||||

End of Period |

$ | 1,480,313 | $ | 39,736,603 | $ | 35,238,312 | $ | 31,734,920 | ||||||||

TRANSACTIONS IN SHARES: |

||||||||||||||||

Shares sold |

100,000 | 275,000 | 525,000 | — | ||||||||||||

Shares redeemed |

(50,000 | ) | (300,000 | ) | (575,000 | ) | (550,000 | ) | ||||||||

Net increase (decrease) in shares outstanding |

50,000 | (25,000 | ) | (50,000 | ) | (550,000 | ) | |||||||||

|

(1) |

Commencement of operations. |

|

(2) |

The Board of Trustees elected to change the Fund’s fiscal year end to March 31 from October 31. |

The accompanying notes are an integral part of the financial statements.

23

Siren ETF Trust

Statements of Changes in Net Assets

(Continued)

Siren DIVCON Dividend Defender ETF |

Siren Nasdaq NexGen Economy ETF |

|||||||||||||||||||||||

For the Period |

For the |

For the |

For the Period |

For the |

For the |

|||||||||||||||||||

OPERATIONS: |

||||||||||||||||||||||||

Net investment income (loss) |

$ | (31,422 | ) | $ | (137,362 | ) | $ | 46,841 | $ | 605,962 | $ | 775,117 | $ | 1,107,947 | ||||||||||

Net realized gain (loss) on: |

||||||||||||||||||||||||

Investments |

1,333,096 | (576,939 | ) | (182,102 | ) | 410,307 | (2,607,486 | ) | (841,927 | ) | ||||||||||||||

In-Kind Redemptions |

2,946,886 | 1,099,133 | 19,086 | 24,227,064 | 10,116,497 | (870,476 | ) | |||||||||||||||||

Securities sold short |

(3,046,418 | ) | (178,324 | ) | 65,656 | — | — | — | ||||||||||||||||

Foreign currency transactions |

— | — | — | (705 | ) | (13,735 | ) | (3,709 | ) | |||||||||||||||

Change in net unrealized appreciation/depreciation on: |

||||||||||||||||||||||||

Investments |

1,096,662 | 2,741,810 | 708,137 | 42,960,631 | 10,961,608 | 10,330,350 | ||||||||||||||||||

Securities sold short |

(1,620,039 | ) | (210,125 | ) | (44,710 | ) | — | — | — | |||||||||||||||

Foreign currency transactions |

— | — | — | (19,867 | ) | 5,805 | (4 | ) | ||||||||||||||||

Net increase in net assets resulting from operations |

678,765 | 2,738,193 | 612,908 | 68,183,392 | 19,237,806 | 9,722,181 | ||||||||||||||||||

DISTRIBUTIONS TO SHAREHOLDERS: |

||||||||||||||||||||||||

Net distributions to shareholders |

— | (14,654 | ) | (46,093 | ) | (689,159 | ) | (513,431 | ) | (1,149,910 | ) | |||||||||||||

Net decrease in net assets resulting from distributions paid |

— | (14,654 | ) | (46,093 | ) | (689,159 | ) | (513,431 | ) | (1,149,910 | ) | |||||||||||||

CAPITAL SHARE TRANSACTIONS: |

||||||||||||||||||||||||

Shares sold |

15,467,454 | 37,679,131 | 741,249 | 143,956,504 | 73,449,195 | — | ||||||||||||||||||

Shares issued in connection with merger |

— | 10,108,401 | (2) | — | — | — | — | |||||||||||||||||

Shares redeemed |

(26,705,018 | ) | (8,951,047 | ) | (690,616 | ) | (38,013,330 | ) | (31,255,977 | ) | (27,642,715 | ) | ||||||||||||

Transaction fees |

35,360 | — | — | 55,725 | — | — | ||||||||||||||||||

Net increase (decrease) in net assets resulting from capital share transactions |

(11,202,204 | ) | 38,836,485 | 50,633 | 105,998,899 | 42,193,218 | (27,642,715 | ) | ||||||||||||||||

Total Increase (Decrease) in Net Assets |

(10,523,439 | ) | 41,560,024 | 617,448 | 173,493,132 | 60,917,593 | (19,070,444 | ) | ||||||||||||||||

NET ASSETS: |

||||||||||||||||||||||||

Beginning of Period |

47,686,379 | 6,126,355 | 5,508,907 | 128,194,650 | 67,277,057 | 86,347,501 | ||||||||||||||||||

End of Period |

$ | 37,162,940 | $ | 47,686,379 | $ | 6,126,355 | $ | 301,687,782 | $ | 128,194,650 | $ | 67,277,057 | ||||||||||||

TRANSACTIONS IN SHARES: |

||||||||||||||||||||||||

Shares sold |

425,000 | 1,100,000 | 25,000 | 3,225,000 | 2,175,000 | 4,075,001 | ||||||||||||||||||

Shares issued in connection with merger |

— | 330,060 | (2) | — | — | — | — | |||||||||||||||||

Shares redeemed |

(750,000 | ) | (275,000 | ) | (25,000 | ) | (800,001 | ) | (1,100,000 | ) | (1,275,000 | ) | ||||||||||||

Net increase (decrease) in shares outstanding |

(325,000 | ) | 1,155,060 | — | 2,424,999 | 1,075,000 | 2,800,001 | |||||||||||||||||

|

(1) |

The Board of Trustees elected to change the Fund’s fiscal year end to March 31 from October 31. |

|

(2) |

See Note 12 in the Notes to Financial Statements. |

The accompanying notes are an integral part of the financial statements.

24

Siren Large Cap Blend Index ETF

Financial Highlights

For a share outstanding throughout the period presented.

For the Period |

||||

Net Asset Value, Beginning of Period |

$ | 25.00 | ||

INCOME FROM INVESTMENT OPERATIONS: |

||||

Net investment income |

0.31 | (2) | ||

Net realized and unrealized gain on investments |

5.76 | |||

Total Income from Investment Operations |

6.07 | |||

LESS DISTRIBUTIONS: |

||||

From net investment income |

(0.27 | ) | ||

From net realized gain on investments |

(1.19 | ) | ||

Total Distributions |

(1.46 | ) | ||

Net Asset Value, End of Period |

$ | 29.61 | ||

Total Returns: |

||||

Net Asset Value(3) |

24.49 | %(5) | ||

Market Value(4) |

24.57 | %(5) | ||

SUPPLEMENTAL DATA AND RATIOS: |

||||

Net assets, end of period (in thousands) |

$ | 1,480 | ||

Ratio of expenses to average net assets |

0.20 | %(6) | ||

Ratio of net investment income to average net assets |

1.47 | %(6) | ||

Portfolio turnover rate(7) |

61 | %(5) | ||

|

(1) |

Commenced operations on June 30, 2020. |

|

(2) |

Per share net investment income has been calculated using the daily average share method. |

|

(3) |

Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period and redemption on the last day of the period at net asset value. |

|

(4) |

Market value total return is calculated assuming an initial investment made at market value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period and redemption on the last day of the period at market value. The market value is determined by the mid point of the bid/ask spread at 4:00 p.m. EST from the NASDAQ Stock Market, LLC. Market value returns may vary from net asset value returns. |

|

(5) |

Not annualized. |

|

(6) |

Annualized. |

|

(7) |

Portfolio turnover rate excludes securities received or delivered in-kind. |

The accompanying notes are an integral part of the financial statements.

25

Siren DIVCON Leaders Dividend ETF

Financial Highlights

For a share outstanding throughout each year/period presented.

For the Period |

Year Ended |

Year Ended |

Year Ended |

Year Ended |

For the Period |

|||||||||||||||||||

Net Asset Value, Beginning of Year/Period |

$ | 42.71 | $ | 36.27 | $ | 31.76 | $ | 29.98 | $ | 24.36 | $ | 24.06 | ||||||||||||

INCOME FROM INVESTMENT OPERATIONS: |

||||||||||||||||||||||||

Net investment income(3) |

0.21 | 0.37 | 0.50 | 0.39 | 0.33 | 0.24 | ||||||||||||||||||

Net realized and unrealized gain on investments |

7.00 | 6.46 | 4.51 | 1.77 | 5.57 | 0.33 | ||||||||||||||||||

Total Income from Investment Operations |

7.21 | 6.83 | 5.01 | 2.16 | 5.90 | 0.57 | ||||||||||||||||||

LESS DISTRIBUTIONS: |

||||||||||||||||||||||||

From net investment income |

(0.25 | ) | (0.39 | ) | (0.50 | ) | (0.36 | ) | (0.28 | ) | (0.27 | ) | ||||||||||||

From net realized gain on investments |

— | — | — | (4) | (0.02 | ) | — | — | ||||||||||||||||

Total Distributions |

(0.25 | ) | (0.39 | ) | (0.50 | ) | (0.38 | ) | (0.28 | ) | (0.27 | ) | ||||||||||||

Net Asset Value, End of Year/Period |

$ | 49.67 | $ | 42.71 | $ | 36.27 | $ | 31.76 | $ | 29.98 | $ | 24.36 | ||||||||||||

Total Return |

||||||||||||||||||||||||

Net Asset Value(5) |

16.91 | %(7) | 18.98 | % | 15.95 | % | 7.19 | % | 24.29 | % | 2.38 | %(7) | ||||||||||||

Market Value(6) |

17.39 | %(7) | ||||||||||||||||||||||

SUPPLEMENTAL DATA AND RATIOS: |

||||||||||||||||||||||||

Net assets, end of year/period (in thousands) |

$ | 39,737 | $ | 35,238 | $ | 31,735 | $ | 45,257 | $ | 29,229 | $ | 4,264 | ||||||||||||

Ratio of expenses to average net assets |

0.43 | %(8) | 0.43 | % | 0.43 | % | 0.43 | % | 0.43 | % | 0.43 | %(8) | ||||||||||||

Ratio of net investment income to average net assets |

1.09 | %(8) | 0.92 | % | 1.50 | % | 1.18 | % | 1.18 | % | 1.19 | %(8) | ||||||||||||

Portfolio turnover rate(10) |

47.34 | %(7),(9) | 1.81 | % | 65.52 | %(9) | 0.26 | % | 3.35 | % | 3.38 | %(7) | ||||||||||||

|

(1) |

The Board of Trustees elected to change the Fund’s fiscal year end to March 31 from October 31. |

|

(2) |

Commencement of operations. |

|

(3) |

Per share net investment income has been calculated using the daily average share method. |

|

(4) |

Less than 0.001. |

|

(5) |

Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period and redemption on the last day of the period at net asset value. |

|

(6) |

Market value total return is calculated assuming an initial investment made at market value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period and redemption on the last day of the period at market value. The market value is determined by the mid point of the bid/ask spread at 4:00 p.m. EST from the Cboe BZX Exchange, Inc. Market value returns may vary from net asset value returns. |

|

(7) |

Not annualized. |

|

(8) |

Annualized. |

|

(9) |

During the period ended March 31, 2021 and fiscal year ended October 31, 2019, the Fund underwent a portfolio re-balancing. As a result, investment transactions were increased during the period, which caused a higher than normal turnover. |

|

(10) |

Portfolio turnover rate excludes securities received or delivered in-kind. |

The accompanying notes are an integral part of the financial statements.

26

Siren DIVCON Dividend Defender ETF

Financial Highlights

For a share outstanding throughout each year/period presented.

For the Period |

Year Ended |

Year Ended |

Year Ended |

Year Ended |

For the Period |

|||||||||||||||||||

Net Asset Value, Beginning of Year/Period |

$ | 35.19 | $ | 30.63 | $ | 27.54 | $ | 26.08 | $ | 22.44 | $ | 23.55 | ||||||||||||

INCOME (LOSS) FROM INVESTMENT OPERATIONS: |

||||||||||||||||||||||||

Net investment income (loss)(3) |

(0.02 | ) | (0.22 | ) | 0.26 | 0.12 | 0.03 | (0.04 | ) | |||||||||||||||

Net realized and unrealized gain (loss) on investments |

0.91 | 4.85 | 3.09 | 1.41 | 3.61 | (1.07 | ) | |||||||||||||||||

Total Income (Loss) from Investment Operations |

0.89 | 4.63 | 3.35 | 1.53 | 3.64 | (1.11 | ) | |||||||||||||||||

LESS DISTRIBUTIONS: |

||||||||||||||||||||||||

From net investment income |

— | (0.07 | ) | (0.26 | ) | (0.07 | ) | — | — | |||||||||||||||

Total Distributions |

— | (0.07 | ) | (0.26 | ) | (0.07 | ) | 0.00 | — | |||||||||||||||

Net Asset Value, End of Year/Period |

$ | 36.08 | $ | 35.19 | $ | 30.63 | $ | 27.54 | $ | 26.08 | $ | 22.44 | ||||||||||||

Total Return |

||||||||||||||||||||||||

Net Asset Value(4) |

2.53 | %(6) | 15.12 | % | 12.22 | % | 5.89 | % | 16.23 | % | (4.72 | %)(6) | ||||||||||||

Market Value(5) |

2.36 | %(6) | ||||||||||||||||||||||

SUPPLEMENTAL DATA AND RATIOS: |

||||||||||||||||||||||||

Net assets, end of year/period (in thousands) |

$ | 37,163 | $ | 47,686 | $ | 6,126 | $ | 5,509 | $ | 3,912 | $ | 2,805 | ||||||||||||

Ratio of expenses to average net assets: |

||||||||||||||||||||||||

Before waivers |

1.60 | %(7),(8) | 1.64 | %(10) | 1.44 | %(11) | 1.21 | %(12) | 1.38 | %(13) | 1.54 | %(7),(14) | ||||||||||||

Net of waivers |

1.49 | %(7),(9) | 1.64 | %(10) | 1.44 | %(11) | 1.21 | %(12) | 1.38 | %(13) | 1.54 | %(7),(14) | ||||||||||||

Ratio of net investment income to average net assets: |

||||||||||||||||||||||||

Before waivers |

(0.27 | %)(7),(8) | (0.65 | %) | 0.89 | % | 0.42 | % | 0.11 | % | (0.19 | %)(7) | ||||||||||||

Net of waivers |

(0.16 | %)(7),(9) | (0.65 | %) | 0.89 | % | 0.42 | % | 0.11 | % | (0.19 | %)(7) | ||||||||||||

Portfolio turnover rate(15) |

75.16 | %(6),(17) | 23.34 | %(16) | 57.30 | %(17) | 36.94 | % | 69.11 | % | 4.18 | %(6) | ||||||||||||

|

(1) |

Effective March 31, 2021, the Fund changed its fiscal year end to March 31 from October 31. |

|

(2) |

Commencement of operations. |

|

(3) |

Per share net investment income has been calculated using the daily average share method. |

|

(4) |

Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period and redemption on the last day of the period at net asset value. |

The accompanying notes are an integral part of the financial statements.

27

Siren DIVCON Dividend Defender ETF

Financial Highlights

For a share outstanding throughout each year/period presented. (Continued)

|

(5) |

Market value total return is calculated assuming an initial investment made at market value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period and redemption on the last day of the period at market value. The market value is determined by the mid point of the bid/ask spread at 4:00 p.m. EST from the Cboe BZX Exchange, Inc. Market value returns may vary from net asset value returns. |

|

(6) |

Not annualized. |

|

(7) |

Annualized. |

|

(8) |

Includes interest expense (borrowing fees) associated with short sale transactions of 0.21% and dividend expense of 0.53%. |

|

(9) |

Includes interest expense (borrowing fees) associated with short sale transactions of 0.10% and dividend expense of 0.53%. The Adviser has agreed to limit interest expense (borrowing fees) to 0.10% of the average daily net assets. See Note 6. |

|

(10) |

Includes expense interest expense (borrowing fees) associated with short sale transactions of 0.05% and dividend expense of 0.74%. |

|

(11) |

Includes expenses and rebates associated with short sale transactions of (0.39)% and dividend expense of 0.59%. |

|

(12) |

Includes expenses and rebates associated with short sale transactions of (0.30)% and dividend expense of 0.66%. |

|

(13) |

Includes dividend expense on short sales of 0.53%. |

|

(14) |

Includes expenses associated with short sale transactions of 0.06% and dividend expense of 0.63%. |

|

(15) |

Portfolio turnover rate excludes securities received or delivered in-kind. |

|

(16) |

Portfolio turnover rate excludes securities the purchase and sale of the Reality Shares DIVCON Dividend Guard ETF acquired on March 27, 2020 (see Note 12 in the Notes to the Financial Statements). If these transactions were included, portfolio turnover would have been higher. |

|

(17) |

During the period ended March 31, 2021 and fiscal year ended October 31, 2019, the Fund underwent a portfolio re-balancing. As a result, investment transactions were increased during the period, which caused a higher than normal turnover. |

The accompanying notes are an integral part of the financial statements.

28

Siren Nasdaq NexGen Economy ETF

Financial Highlights

For a share outstanding throughout each year/period presented.

For the Period |

Year Ended |

Year Ended |

For the Period |

|||||||||||||

Net Asset Value, Beginning of Year/Period |

$ | 33.08 | $ | 24.03 | $ | 21.19 | $ | 24.00 | ||||||||

INCOME (LOSS) FROM INVESTMENT OPERATIONS: |

||||||||||||||||

Net investment income(3) |

0.12 | 0.29 | 0.34 | 0.21 | ||||||||||||

Net realized and unrealized gain (loss) on investments |

14.83 | 8.97 | 2.86 | (2.86 | ) | |||||||||||

Total Income (Loss) from Investment Operations |

14.95 | 9.26 | 3.20 | (2.65 | ) | |||||||||||

LESS DISTRIBUTIONS: |

||||||||||||||||

From net investment income |

(0.14 | ) | (0.21 | ) | (0.36 | ) | (0.16 | ) | ||||||||

Total Distributions |

(0.14 | ) | (0.21 | ) | (0.36 | ) | (0.16 | ) | ||||||||

Net Asset Value, End of Year/Period |

$ | 47.89 | $ | 33.08 | $ | 24.03 | $ | 21.19 | ||||||||

Total Return |

||||||||||||||||

Net Asset Value(4) |

45.25 | %(6) | 38.81 | % | 15.24 | % | (11.09 | %)(6) | ||||||||

Market Value(5) |

45.76 | %(6) | ||||||||||||||

SUPPLEMENTAL DATA AND RATIOS: |

||||||||||||||||

Net assets, end of year/period (in thousands) |

$ | 301,688 | $ | 128,195 | $ | 67,277 | $ | 86,348 | ||||||||

Ratio of expenses to average net assets |

0.68 | %(7) | 0.68 | % | 0.68 | % | 0.68 | %(7) | ||||||||

Ratio of net investment income to average net assets |

0.68 | %(7) | 1.01 | % | 1.51 | % | 1.14 | %(7) | ||||||||

Portfolio turnover rate(8) |

37.54 | %(6) | 18.39 | % | 20.72 | % | 31.18 | %(6) | ||||||||

|

(1) |

The Board of Trustees elected to change the Fund’s fiscal year end to March 31 from October 31. |

|

(2) |

Commencement of operations. |

|

(3) |

Per share net investment income has been calculated using the daily average share method. |

|

(4) |

Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period and redemption on the last day of the period at net asset value. |

|

(5) |

Market value total return is calculated assuming an initial investment made at market value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period and redemption on the last day of the period at market value. The market value is determined by the mid point of the bid/ask spread at 4:00 p.m. EST from the NASDAQ Stock Market, LLC. Market value returns may vary from net asset value returns. |

|

(6) |

Not annualized. |

|

(7) |

Annualized. |

|

(8) |

Portfolio turnover rate excludes securities received or delivered in-kind. |

The accompanying notes are an integral part of the financial statements.

29

Siren ETF Trust

Notes to Financial Statements

March 31, 2021

|

1. |

ORGANIZATION |