Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

As submitted confidentially to the Securities and Exchange Commission on March 13, 2020.

This draft registration statement has not been publicly filed with the Securities and Exchange Commission, and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Hexion Holdings Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 2821 | 84-2191440 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

180 East Broad Street

Columbus, Ohio 43215

Attention: Corporate Secretary

(614) 225-4000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Douglas A. Johns

Executive Vice President and General Counsel

Hexion Holdings Corporation

180 East Broad Street

Columbus, Ohio 43215

(614) 225-4000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| David S. Huntington, Esq. (212) 373-3000 |

Michael Kaplan, Esq. Marcel Fausten, Esq. (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Share |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) | ||||

| Class A common stock, par value $0.01 per share |

||||||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes offering price of any additional shares that the underwriters have the option to purchase, if any. See “Underwriters.” |

| (3) | To be paid in connection with the initial filing of the registration statement. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

The information in this prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated March 13, 2020

PRELIMINARY PROSPECTUS

Shares

Hexion Holdings Corporation

Class A common stock

This is the initial public offering of Hexion Holdings Corporation, a Delaware corporation. We are offering shares of Class A common stock and the selling stockholders identified in this prospectus are offering shares of Class A common stock.

We expect the public offering price to be between $ and $ per share. Prior to this offering, no public market exists for the shares. We intend to apply to list our Class A common stock on the New York Stock Exchange (the “NYSE”) under the symbol “HXN.”

Investing in our Class A common stock involves risks that are described in the “Risk Factors” section beginning on page 21 of this prospectus.

| Per Share |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions (1) |

$ | $ | ||||||

| Proceeds to us, before expenses |

$ | $ | ||||||

| Proceeds to the selling stockholders, before expenses |

$ | $ | ||||||

| (1) | See “Underwriters” for additional information regarding the underwriters’ compensation and reimbursement of expenses. |

The underwriters may also exercise their option to purchase up to an additional shares of Class A common stock from us at the public offering price, less underwriting discounts and commissions, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares against payment on or about , 2020.

Morgan Stanley

The date of this prospectus is , 2020

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

We, the selling stockholders and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We, the selling stockholders and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide you. We and the selling stockholders are offering to sell, and seeking offers to buy, shares of our Class A common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our Class A common stock.

For investors outside the United States: none of us, the selling stockholders or the underwriters have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside of the United States.

Until , 2020, all dealers that buy, sell or trade our Class A common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

| i |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

PRESENTATION OF FINANCIAL INFORMATION

Prior to July 1, 2019, the date we emerged from bankruptcy (the “Emergence Date”), Hexion Holdings Corporation had not conducted any business operations. Accordingly, unless otherwise noted or suggested by context, all financial information and data and accompanying financial statements and corresponding notes, with respect to periods prior to the Emergence Date, as contained in this prospectus, reflect the actual historical consolidated results of operations and financial condition of Hexion Inc. for the periods presented and do not give effect to our plan of reorganization or any of the transactions contemplated thereby or the adoption of fresh start accounting. Such financial information may not be representative of our performance or financial condition after the Emergence Date.

This prospectus includes certain non-GAAP financial measures, including EBITDA, Segment EBITDA, Pro Forma EBITDA and Non-GAAP combined results. For a discussion of the limitations on these measures, the rationales for using these measures and a reconciliation of these measures to the most directly comparable measures used in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”), see “The Offering—Summary Historical and Pro Forma Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

This prospectus includes industry data that we obtained from periodic industry publications and internal company surveys. This prospectus includes market share and industry data that we prepared primarily based on management’s knowledge of the industry and industry data. Unless otherwise noted, statements as to our market share and market position relative to our competitors are approximated and based on management estimates using the above-mentioned latest available third-party data and our internal analysis and estimates. We determined our market share and market positions utilizing periodic industry publications. If we were unable to obtain relevant periodic industry publications, we based our estimates on our knowledge of the size of our markets, our sales in each of these markets and publicly available information regarding our competitors, as well as internal estimates of competitors’ sales based on discussion with our sales force and other industry participants.

Although we believe that the third-party sources are reliable, neither we, the selling stockholders nor the underwriters have independently verified market industry data provided by third parties or by industry or general publications, and neither we, the selling stockholders nor the underwriters take any further responsibility for this data. Similarly, while we believe our internal estimates with respect to our industry are reliable, our estimates have not been verified by any independent sources, and we cannot assure you that they are accurate. While we are not aware of any misstatements regarding any industry data presented in this prospectus or the documents incorporated herein by reference, our estimates, in particular as they relate to market share and our general expectations, involve risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors” and “Forward-Looking Statements.”

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

We use various trademarks, trade names and service marks in our business, including Bakelite®, Cardura™, EcoBind™, Epi-Rez™, EPIKOTE™, EPIKURE™, VeoVa™ and Versatic™. This prospectus contains references to our trademarks and service marks. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we

| ii |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Certain statements in this prospectus are forward-looking statements. All statements, other than statements of historical facts, are forward-looking statements. Forward-looking statements may be identified by the words “believe,” “expect,” “anticipate,” “project,” “might,” “plan,” “estimate,” “may,” “will,” “could,” “should,” “seek” or “intend” and similar expressions. Forward-looking statements reflect our current expectations and assumptions regarding our business, the economy and other future events and conditions and are based on currently available financial, economic and competitive data and our current business plans. Actual results could vary materially depending on risks and uncertainties that may affect our operations, markets, services, prices and other factors as discussed in the “Risk Factors” section of this prospectus. While we believe our assumptions are reasonable, we caution you against relying on any forward-looking statements as it is very difficult to predict the impact of known factors and it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to:

| • | a weakening of global economic and financial conditions, interruptions in the supply of or increased cost of raw materials; |

| • | the loss of, or difficulties with the further realization of, cost savings in connection with our strategic initiatives; |

| • | the impact of our substantial indebtedness; |

| • | our failure to comply with financial covenants under our credit facilities or other debt; |

| • | pricing actions by our competitors that could affect our operating margins; |

| • | changes in governmental regulations and related compliance and litigation costs; and |

| • | other factors, including the factors discussed in the “Risk Factors” section of this prospectus. |

All forward-looking statements are expressly qualified in their entirety by this cautionary notice. The forward-looking statements made by us speak only as of the date on which they are made. Factors or events that could cause our actual results to differ may emerge from time to time. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

| iii |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

This summary highlights the more detailed information contained elsewhere in this prospectus. This summary may not contain all the information that may be important to you. You should carefully read the entire prospectus before making an investment decision, especially the information presented under the heading “Risk Factors.”

In this prospectus, except as otherwise indicated, or as the context may otherwise require, all references to “Hexion,” the “Company,” “we,” “us,” and “our,” (i) with respect to periods prior to and including the Emergence Date (July 1, 2019) (the “Predecessor period”), refer to Hexion Inc. and its subsidiaries and (ii) with respect to periods after the Emergence Date (the “Successor period”), refer to Hexion Holdings Corporation and its subsidiaries.

Our Company

Overview

We are a leading global producer of adhesives, coatings and composites materials. Our products include a broad range of critical components and formulations used to impart valuable performance characteristics such as durability, gloss, heat resistance, adhesion and strength to our customers and their customers’ final products. As such, our products sold to our customers are highly value-added contributions to their final work product, even though they often represent only a small portion of the overall end-product cost. We serve highly diversified growing end-markets such as residential and non-residential construction, wind energy, industrial, automotive, consumer goods and electronics.

Our products are well aligned with global mega-trends, which we believe are being driven by stringent safety requirements and regulations, growing urbanization and an increasing need for lighter, stronger, higher performance and engineered materials in many end-markets such as aerospace, automotive, energy and construction. We produce resins that are used in the formulation of adhesives, coatings and composites. Such resins are part of the broader thermoset resin industry. Thermosets are materials that permanently cure, harden or set in a final product application. Thermoset resins are generally considered specialty chemical products because they are principally produced based on customer product specifications and sold on the basis of performance, technical support, product innovation and customer service. We believe we have the broadest range of thermoset resin technologies in the world. We expect that favorable industry dynamics will continue to drive thermoset growth ahead of global GDP, driven by customers’ preferences that are shifting towards green energy, energy efficient production and lower volatile organic compounds (“VOCs”). We address our customers’ increasing sustainability requirements through our products such as the NextGen EpoxyTM waterborne system that delivers a low-VOC emitting system in construction, transportation and agricultural equipment markets, and the EPIKOTETM resin systems and EPICURETM curing agents that provide strength and fatigue performance for larger and heavier rotor blades in wind turbines.

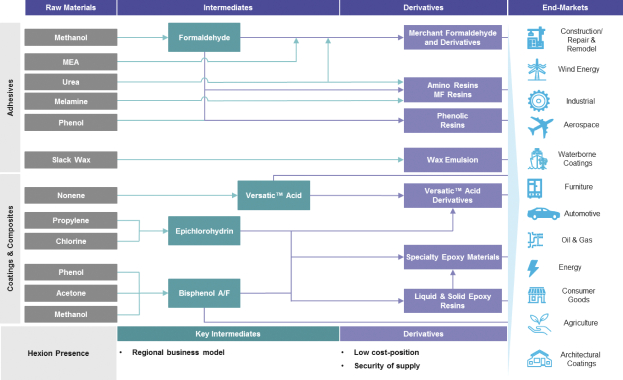

We have leading market share positions across our integrated and global manufacturing platform in well-structured markets with over 80% of our sales being products that have the number one or two global positions. We are the number one wood adhesive supplier in the United States, Canada, Brazil and Australia. In composites, we are one of only three global suppliers in the epoxy resin market and we have leadership positions in each of the key end-markets and regions in which we participate. In addition to market leadership, we are integrated from key intermediates to final products, which gives us significant competitive advantages through a cost-effective position, security of supply and stable integrated margins across our value chain. Our manufacturing is localized, providing additional stability and barriers to entry due to the proximity of our sites to our customers. For example, the majority of our wood adhesive and merchant formaldehyde products are delivered through our pipelines or through truck and rail within the region to our customers.

| 1 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

In January 2020, we changed our reporting segments to align around our two growth platforms, Adhesives and Coatings & Composites. Our Adhesives segment produces construction and industrial adhesives and additives for energy and agricultural applications. In our Coatings & Composites segment, we produce resins used in energy, aerospace and automotive, as well as other high performance coatings applications. Our integrated manufacturing platform allows us to supply our derivatives internally and sell excess material to the market. We sell this excess material as Intermediates & Derivatives in the Adhesives segment and Base Chemicals in the Coatings & Composites segment. Our Adhesives segment had net sales of $2.0 billion and Segment EBITDA of $311 million for the year ended December 31, 2019. Our Coatings & Composites segment had net sales of $1.3 billion and Segment EBITDA of $156 million for the year ended December 31, 2019. Note that our financial statements for the year ended December 31, 2019, which are included in this prospectus, are presented under our previous segment structure.

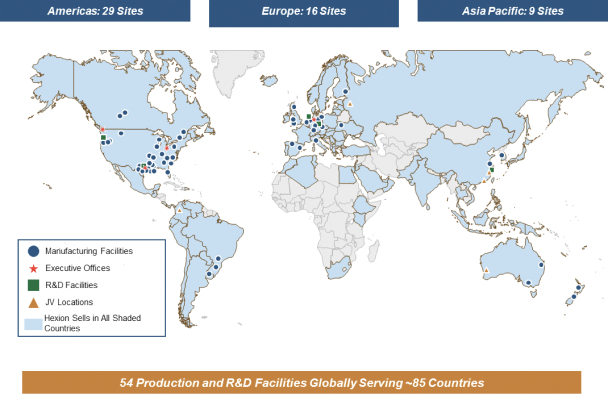

Our products are sold in approximately 85 countries to more than 3,100 customers. Our manufacturing network consists of 45 production facilities with regional and global supply to our customers in the United States, Europe, China, Latin America and Australia. We have approximately 4,000 employees with total net sales of $3.4 billion for the year ended December 31, 2019.

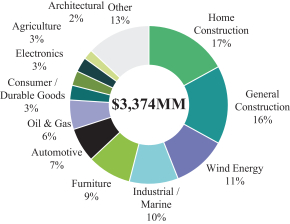

The breakdown of our diversified end-markets and global exposure are included below:

| 2019 Net Sales by End-Market |

2019 Net Sales by Origin | |

|

|

|

Our Business

Adhesives Segment

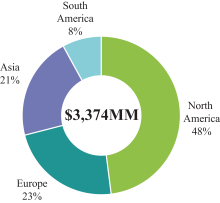

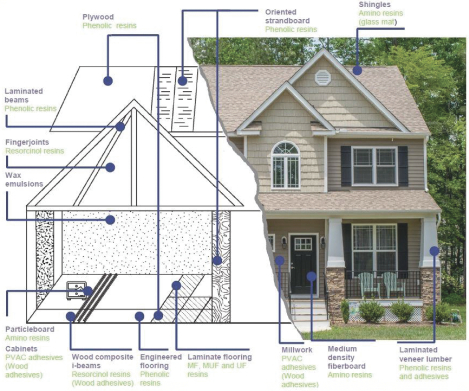

We are a leading producer of adhesive materials used in building products, furniture, industrial and automotive applications. Our adhesives are based on two vertically integrated production platforms: formaldehyde-based resins and phenolic-based resins. These adhesive materials are critical components that provide the structural integrity from their binding properties to structural and decorative wood products such as oriented strand board, plywood and medium density fiberboard. Our products also enable critical properties in industrial products such as abrasives, friction materials and acoustical insulation. We engineer our products with customized specifications based on collaboration with our customers who interface with our regional commercial, technical support and research and development organization. Through these collaborative relationships, we help our customers address the shifting requirements of their products due to new performance

| 2 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

requirements, new standards related to workplace safety, new environmental standards and increasing energy conservation requirements.

|

Sub-segment / Products |

Key Applications |

Key Product Attributes | ||

| Construction Adhesives (62% of 2019 Segment Sales) | ||||

| • Wood Adhesives: Phenol Formaldehyde, Amino Resins (Urea Formaldehyde, Melamine Formaldehyde), Laminates and Derivatives, Specialty |

• Plywood, particleboard, oriented strand board, medium density fiberboard, laminated veneer lumber particleboard, laminated beams, cross-laminated timber, truck-decking |

• Structural integrity, thermal stability, durability, moisture resistance | ||

| • Wax Emulsions |

• Panel board, specialty applications |

• Long-term stability, consistency, water absorption, lubrication | ||

| • Insulation: Mineral Wool Bonding, Phenolic Foams |

• Fiberglass insulation, fiberglass mat and coatings, floral foam, insulating foam |

• Imparts softness, shape recovery, moisture resistance and fire resistance

• Low thermal conductivity, minimal density

| ||

| Industrial Adhesives (18% of 2019 Segment Sales) | ||||

| • Phenolic Specialty Resins: Abrasives, Refractory, Molding Compounds, Foundry |

• Household goods, sandpaper, abrasive wheels |

• Binding qualities, high heat and strength properties | ||

| • Phenolic Specialty Resins: Friction, Acoustical Bonding, Filtration, Rubber & Tire, Resin Encapsulated Proppants

|

• Acoustical insulation, engine filters, brakes, friction materials |

• Binding qualities, lightweighting | ||

| Intermediates & Derivatives (20% of 2019 Segment Sales) | ||||

| • Formaldehyde: Solutions, Hexamine, Urea Formaldehyde Concentrates, Methaform |

• Methylene diphenyl diisocyanate, butanediol, herbicides and fungicides, oil and gas production scavengers, fabric softeners, formaldehyde-based resins |

• Essential chemical precursor | ||

| • Formaldehyde: Triazines |

• Hydrogen sulfide scavenging for oil and gas applications |

• Heat, stress and corrosion resistance | ||

| 3 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

The schematic below showcases certain applications for our Construction Adhesives products:

Coatings & Composites Segment

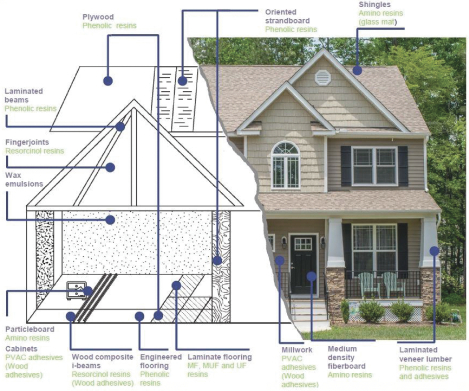

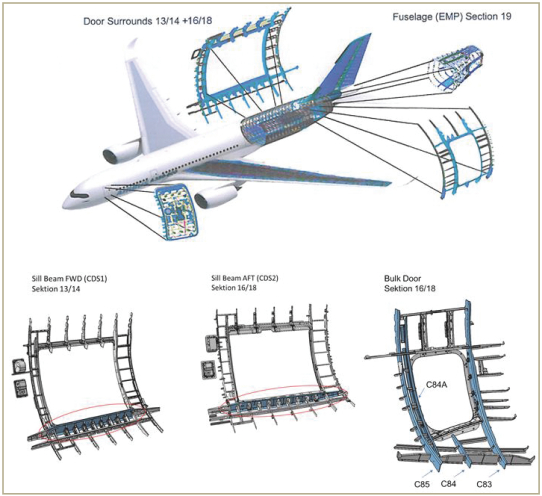

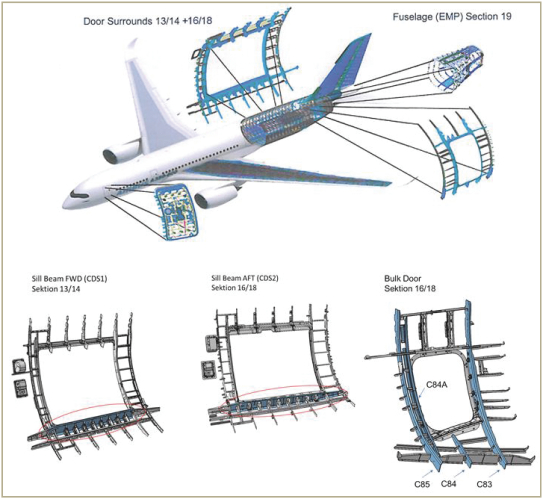

We are a leading producer of critical ingredients in highly engineered coatings and composites. In industrial coatings, our epoxy specialty resins are used to impart superior adhesion, corrosion resistance and other high-performance characteristics. In addition, we produce Versatic™ acid derivatives, VeoVa™ and Cardura™, which are branded ingredients sold to coatings companies to produce high-performance coatings applications. Our epoxy resins are also used as the key component in composite materials. Composite materials are high strength, yet lightweight materials that consist of our resins and a reinforcement material, such as glass and carbon fibers. We supply specialty epoxy resins to producers that make composites for wind blades, aerostructures and automotive parts among many other lightweight structural parts. Given our integrated platform, we supply liquid epoxy resins primarily to our epoxy specialty resins business and also to the external market. In addition, we supply Versatic™ acid to our derivatives business and to the external market. These products are in our Base Chemicals sub-segment. Products in our Coatings & Composites segment require collaboration with our customers and a technical and formulation expertise given that wind energy, automotive, aerospace and other industrial products are highly engineered for specific applications. These end-markets require demanding

| 4 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

performance requirements for these structural components and have long development cycles and long in-use time horizons.

|

Sub-segment / Products |

Key Applications |

Key Product Attributes | ||

| Composites (28% of 2019 Segment Sales) | ||||

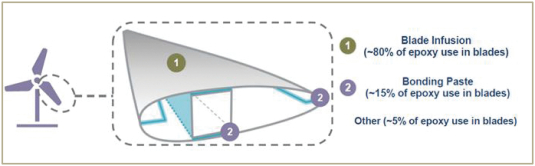

| • Epoxy Specialty Resins: Wind Infusion Resin, Bonding Paste, Electrical Castings, Composites |

• Wind turbine blades, pipes and tanks, automotive, aerospace, sports, boats, generators, bushings, transformers, switch gear components, post insulators, capacitors, automotive ignition coils, fiber sizing

|

• Superior adhesion, durability, high tensile strength, lightweighting | ||

| Performance Coatings (58% of 2019 Segment Sales) | ||||

| • Epoxy Specialty Resins: Coatings, Civil Engineering, Waterborne Coatings |

• Flooring, marine, shipping containers, steel structures, electronic laminates |

• Superior adhesion, corrosion resistance, durability, long service life, broad application functionality | ||

| • Epoxy Resins: Liquid Epoxy Resins |

• Automotive coatings, concrete coatings |

• Durability, corrosion resistance, superior adhesion, long service life | ||

|

• Versatic™ Acid & Derivatives: Re-dispersible Latex Powder, VeoVa™, Cardura™ |

• Automotive, industrial, architectural, construction |

• Hydrolytic stability, water resistance, appearance, ease of application, adhesion and durability, low VOC emissions

| ||

| Base Chemicals (14% of 2019 Segment Sales) | ||||

| • Epoxy Resins & Intermediates: Bisphenol A, Bisphenol F, Epichlorohydrin |

• Liquid and solid epoxy resins, polycarbonate resins, glycerol and derivatives |

• Essential chemical precursors | ||

| • Versatic™ Acid & Derivatives: Acids |

• Peroxides, pharmaceuticals, agrochemicals, adhesion promoters |

• hydrolytic stability, heat resistance, solubility in non-polar compounds | ||

| 5 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

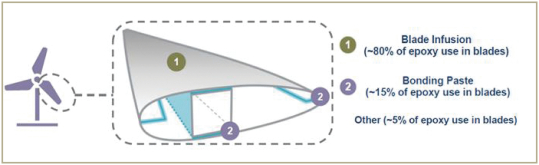

The schematics below showcase certain applications for our composites products:

Commercial / Aerospace

Wind Turbines

| 6 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

Competitive Strengths

Leading End-Market Positions. We have long-standing number one or two positions in key markets in adhesives, coatings and composites that represented approximately 80% of our sales in the year ended December 31, 2019. We generally operate in end-markets where we are one of two or three global suppliers who can bring solutions to regional and global customers. We believe we have the broadest range of thermoset resin technologies in the world, with leading technical service, application development and research capabilities that we believe are unmatched in the sector. In addition, our facilities are well positioned to serve local customers in regional geographies. The majority of our wood adhesives resins and formaldehyde business are served to customers via pipelines or truck and rail within the region.

| Segment / Sub-segment |

Products |

Leadership Position |

Key Attributes | |||

| Adhesives | ||||||

| Construction Adhesives | Wood Adhesives | #1 in United States, Canada, Brazil and Australia | • Regional market (300-mile economically viable shipping radius)

• Approximately two-and-a-half times bigger than next competitor | |||

| Industrial Adhesives | Phenolic Specialty Resins | #1 in Europe and North America | • Top two producers supply approximately half the market | |||

| Intermediates & Derivatives | Formaldehyde | #1 in North America | • Approximately three times bigger than next competitor

• 40% of North America capacity

| |||

| Coatings & Composites | ||||||

| Composites | Epoxy Resins | Waterborne coatings, aerospace and automotive, #1 in wind energy | • One of only three global players | |||

| Performance Coatings | Versatic™ Acid Derivatives | #1 Globally | • Only one other direct competitor in each of our product lines | |||

| Base Chemicals | Versatic™ Acid

|

#1 Globally | • Large scale producer provides backward integration | |||

| Bisphenol A | North America / Europe | |||||

Strategically Aligned with End-Market Growth Drivers.

Our products are well aligned with global mega-trends in urbanization and sustainability, as well as increasingly stringent safety and performance standards. Global urbanization is expected to result in ever increasing demands for more sustainable

solutions, such as in energy, wind turbines, aerospace, automotive, agriculture and construction. Demand for carbon efficient buildings drives growth in our low-emitting coatings and our resins that

enable engineered structural wood. We believe growth in many of our key applications is being driven by an increasing need for lighter, stronger, higher performance engineered materials, as well as improved fire, smoke and

toxicity properties.

| 7 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

Our wood adhesives business serves the growing U.S. housing market, both through remodeling activity and new construction. Wood adhesives support a more sustainable structural market where wood products use renewable materials, such as tree plantations, that use much less energy per ton and have a lower carbon footprint than traditional materials such as steel, glass and concrete. Our epoxy coatings and phenolic resins businesses serve the global industrial construction market, providing solutions for a wide range of applications, including protective coatings for infrastructure, such as bridges, tunnels, large buildings, piping, insulation and industrial machinery. The lightweighting trend in aerospace and automotive applications is driving growth of our composite business through our supply of epoxy resins into carbon fiber and glass fiber composites. Demand for our coatings products is growing as a result of the global trend to use lower VOCs in specialty coatings applications due to environmental concerns. We are only one of two global epoxy resin players in China with local waterborne coatings assets and have over 20 years of technology heritage. The demand for sustainable energy alternatives is driving growth in the wind energy market that has seen a global installed electrical capacity increase of 199% from 2010 to 2018. Additionally, the increase of wind blade length will multiply our growth in bonding paste and infusion resin systems.

Diverse End-Markets and Customer Base Stabilizes Earnings and Reduces Volatility. Our products sold to our customers are used in thousands of applications and sold into diverse end-markets such as residential and non-residential construction, furniture, energy, wind energy, industrial, automotive, consumer products and electronics. Residential construction, our leading end-market, represents only 17% of our total sales. Our broad product portfolio also addresses diverse applications and geographies within a single end-market. For example, our products are used in a broad set of automotive applications such as friction-control, acoustical bonding, lightweighting, filtration, engineered thermosets and tire applications, which are growing due to trends in automotive materials that require the reduction of noise in electric vehicles and lightweighting to improve fuel efficiency. Our wood adhesives products are critical to engineered panel board production across diverse geographies including the United States, Canada, Brazil and Australia. Across our entire portfolio, we sell our products in approximately 85 countries. Our products are sold to a diverse global and regional set of customers that consist of more than 3,100 companies, with our top ten customers accounting for approximately 20% of our net sales. Our largest customer accounts for approximately 3% of our sales. Our global customers include leading multinational companies that collaborate with us to develop global product solutions. Many of these blue-chip companies are leaders in their respective industries such as 3M, Akzo Nobel, BMW, Airbus, BASF, Huntsman, Bayer, Norbord, PPG, DuPont, Ford, Saint-Gobain and Weyerhaeuser.

Leading Technology Platform Across Products and Applications. We have a leading technology platform of products that address critical performance attributes for our customers and their customers’ products through our global and regional network. Our product technologies are centered around our broad thermoset platform with leading research, applications development and technical service capabilities. We have 22 research and development sites and three innovation centers where we collaborate with local and global customers to develop customized products and solutions. These sites and innovation centers are located globally in North America, South America, Europe and Asia. We have the broadest wood adhesives platform with over 700 unique SKUs of products that make up the industry’s leading technology. Our phenolic resins are part of an almost 100 year heritage of industry innovation, with products under our Bakelite®, Duralite™ and Resonance™ brands that have consistently created the leading edge products. Our epoxy resins provide unique solutions and capabilities in the wind energy (over 20-year history), waterborne coatings (over 30 years of research and development heritage), aerospace composites and automotive markets. Our VeoVa™ and Cardura™ products provide a unique technology to the market to allow coatings players to both lower VOCs and provide high performance. Our new product sales across the portfolio represented approximately 20% of our total sales in each of the last five years. In addition, we are strategically located near our customers with large-scale facilities such as Edmonton, Canada and Springfield, Oregon, which enables a low-cost position. In Coatings & Composites, we have the only continuous epoxy production lines in Deer Park, Texas and Pernis, Netherlands, which allow us to have cost efficient manufacturing capability.

| 8 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

Tailored Solutions and Regional Customer Engagement. We engage our customer base by providing solutions for their product development and formulation needs. We provide these solutions on both a global and regional basis. We utilize a network of technical sales, commercial development centers and research and development facilities to provide collaborative solutions. In wood adhesives we have experts who develop customer products and are embedded at our customers’ panelboard facilities. We offer panelboard pilot facilities in North America, Latin America, Europe and Asia Pacific for customers to test new products or create existing product modifications. Our epoxy coatings and composites platform engages in joint research and co-development with customers given their specifications unique to wind energy, aerospace, specialty coatings and automotive applications with long product life cycles. In 2017, we completed an expansion of the technology center at our Edmonton, Alberta site to focus on developing next generation resin chemistry for panel production. We also recently constructed an Application Development Center in Shanghai, China that will support new product development and customer collaboration to accelerate growth in growing waterborne coatings and composite applications. Our Versatic™ acids and derivatives business works with customers in regional labs based in Belgium, France, United States, Canada and China where customers utilize our unique polymerization, formulation and synthesis capabilities unmatched in the industry. In our Coatings & Composites segment we have multiple regional research and development tech centers and product support labs where we partner with our customers to develop leading formulations for highly specified coatings, electronics and industrial applications. We believe our tailored solutions and intimate customer engagement have allowed us to maintain industry leadership, profitability and growth potential.

Integrated Value Chain Provides Stability and Competitive Advantage. We produce a majority of the critical intermediates for our key products across our portfolio. This integration gives us significant competitive advantages through cost effective production, security of supply to us and our customers and less volatility in our overall input costs. For example, we supply essentially all of the formaldehyde needed for our construction and adhesives business. Our North American and European specialty coatings and composites are 100% supplied through our backward integration via our world-scale liquid epoxy resin facilities. Our Cardura™ and VeoVa™ products source 100% of their Versatic™ acids needs from our facilities. This integrated platform allows us to lower costs through sourcing locally, often through pipelines, to reduce delivered costs of raw materials. In addition, we have the ability to run our intermediates facilities at high utilization rates to lower our operating cost per ton due to our internal needs for base-load operations.

Strong and Stable Free Cash Flow. We expect to generate strong and stable free cash flow given our limited working capital requirements, a right-sized capital structure, low capital-intensive operations and pass-through customer contract structures. In the second half of 2019, we generated cash flow from operations of $224 million. Year-end net working capital averaged approximately 10% of sales from 2015 through 2019, which is top decile in the chemical industry. Our annual investment in maintenance and environmental capital expenditures has typically ranged between $70 million and $90 million, which was approximately 2% of sales in 2019.

In a majority of our business, we benefit from strong contract structures that allow for raw material pass-through. In our formaldehyde and wood adhesives businesses, we leverage third-party raw material indexes to periodically adjust contractual and non-contractual pricing for approximately 90% of revenue, which has produced consistent material margins. In our phenolic resins business, over 70% of our material is under contract with formula pricing to pass through raw materials. We expect these attributes to help produce more stable profit and free cash flow through fluctuating raw material price environments.

Experienced Management Team with Impressive Track Record. Our management is highly experienced with a history and track record of creating value at other public companies. Craig Rogerson, our Chief Executive Officer, was chief executive officer of Chemtura Corporation for over seven years. Our key segments leaders each have over 20 years of relevant industry experience. In addition, our management team has reduced fixed costs by $78 million between 2017 and 2019. In addition, as a result of this team, the portfolio has been better

| 9 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

positioned with a new product focus, where our new products across the portfolio have consisted of approximately 20% of our sales from 2014 to 2019.

Strategy

Our strategy is focused on increasing shareholder value by increasing our profit and free cash flow generation dollars through initiatives to grow our businesses from our foundation of attractive products and end-market demand. We continually seek to introduce new products to address our growing end-market needs. In addition, we plan to increase volumes and manage costs to create significant operating leverage from our well-invested base of technologies and global production. We also plan to optimize our portfolio to broaden and deepen our specialty product solutions.

Introduce New Products to Address Our Growing End-Markets. We have a platform of technologies in thermoset markets that we will leverage to continue to introduce new products to address market growth which is being driven by increasing urbanization, increasing stringent safety requirements and increasing sustainability trends. Our new products across the portfolio have consisted of 20% of our sales from 2014 to 2019. We intend to continue this new product focus with our global commercial, technical support and research and development base of people and capabilities, such as in our commercial development centers and regional labs. For example, our new proprietary bonding paste for wind turbine blades enables the production of increasingly long blades, which create turbines with greater efficiency. Our waterborne coatings will address the increasing requirements by global customers to drive lower VOCs in industrial coatings. Our BPA-Free can coating materials address changing consumer preferences. Our composite materials will address sustainability through enabling automotive lightweighting for manufacturers by replacing heavier metal components to enable improved fuel efficiency. Our wood adhesive systems are ideal for new building applications, such as cross-laminated timbers for multi-story commercial buildings, for example. Our constantly developing pipeline should drive growth of our business to increase profit and margin to increase shareholder value.

Focus on Driving Growth Through Productivity and Operating Leverage. We have continued to invest over the last decade in growing our global and regional commercial base, developing our research and development capabilities and expanding our production network. As we address our attractive growing markets through increased volumes of existing and new product sales, we intend to improve our profit through operating leverage across our global and regional base of operations. We also have a track record of effectively managing our cost base. For example, we reduced fixed costs by $78 million from 2017 to 2019. We believe this stable fixed cost base will support future operating leverage driven by increasing volumes. We believe we have sufficient capacity available in our formaldehyde and epoxy resin business to benefit from increased growth without need for increased capital investment or fixed costs. We will invest to support our businesses that have limited excess capacity, such as our intention to add phenolic resin capacity to expand our adhesives and binders business at our Brimbank, Australia site.

Optimize Portfolio Through Targeted Strategic Mergers and Acquisitions. We plan to productively optimize our portfolio of businesses and solutions by focusing on the most attractive businesses we have today and through strategic bolt-on acquisitions. We believe our optimization, through divestitures, acquisitions and joint ventures, will drive our businesses to areas where our solutions and products achieve attractive margins based on their performance enabling characteristics for customers and where we can achieve high and increasing returns over the long term. We intend to explore new product technologies that complement our existing thermoset solution base and customer application set and/or our downstream formulation expertise. In addition, we intend to evaluate regional additions in our current product set that can broaden our global reach. Our acquisitions will be evaluated under a disciplined return on capital requirement considering achievable synergies. We believe this portfolio optimization will position us to expand globally as a stronger and higher valued specialty chemical company with capabilities to continue to deliver best-in-class solutions to our customers.

| 10 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

Emergence Transactions

On July 1, 2019 (the “Emergence Date”), we emerged from bankruptcy proceedings pursuant to the terms of a Plan of Reorganization (the “Plan”). On the Emergence Date, we consummated the following exit financings (collectively, the “Exit Financings”) in accordance with the Plan:

| • | We issued $450 million aggregate principal amount of 7.875% Senior Notes due 2027 (the “Senior Notes”); |

| • | We entered into a new $350 million asset-based revolving credit facility (the “ABL Facility”) and a new $1,200 million senior secured term loan facility (the “Term Loan Facility” and, together with the ABL Facility, the “Credit Facilities”); and |

| • | We raised $300 million of gross cash proceeds from a rights offering (the “Rights Offering”) of our Class B common stock to certain eligible holders of Hexion Inc.’s pre-petition notes under the Plan. |

In this prospectus, the “Emergence Transactions” refers, collectively, to the consummation of the Plan and related transactions, including the application of fresh start accounting principles, the consummation of the Rights Offering, the entry into the ABL Facility, the entry into the Term Loan Facility and the borrowing of $1,200 million thereunder, the issuance of the Senior Notes and the application of the proceeds from the Exit Financings pursuant to the terms of the Plan.

Risk Factors

Participating in this offering involves substantial risk. Our ability to execute our strategy also is subject to certain risks. The risks described under the heading “Risk Factors” immediately following this summary may cause us not to realize the full benefits of our competitive strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the more significant challenges and risks we face include the following:

| • | If global economic conditions weaken or deteriorate, it will negatively impact our business, results of operations and financial condition; |

| • | Natural or other disasters or pandemics could disrupt our business and result in loss of revenue or higher expenses; |

| • | Our substantial debt could adversely affect our operations and prevent us from satisfying our obligations under our debt obligations and may have an adverse effect on our stock price. As of December 31, 2019, we had approximately $1.8 billion aggregate principal amount of consolidated outstanding indebtedness; |

| • | We may be unable to achieve the cost savings or synergies that we expect to achieve from our strategic initiatives, which would adversely affect our profitability and financial condition; and |

| • | Fluctuations in direct or indirect raw material costs could have an adverse impact on our business. |

Corporate Information

We were incorporated under the laws of the State of Delaware on June 24, 2019. Our principal executive offices are located at 180 East Broad Street, Columbus, Ohio 43215. Our telephone number is (614) 225-4000. Our website is located at www.hexion.com. Our website and the information contained on, or that can be accessed through, our website will not be deemed to be incorporated by reference in, and are not considered part of, this prospectus. You should not rely on our website or any such information in making your decision whether to purchase shares of our Class A common stock.

| 11 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

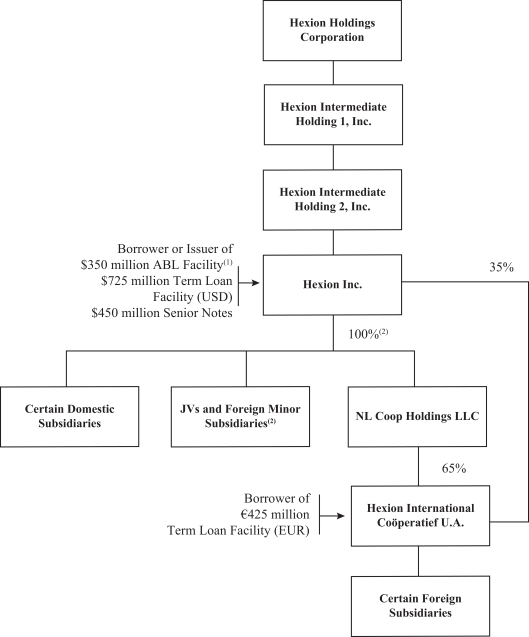

Organizational Structure

The following chart summarizes our organizational structure and illustrates the long-term debt outstanding as of December 31, 2019:

| (1) | Total availability of $350 million (subject to borrowing base availability), of which approximately $301 million was available as of December 31, 2019, after giving effect to $49 million of outstanding letters of credit. |

| (2) | Direct and indirect ownership. |

| 12 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

The Offering

| Issuer |

Hexion Holdings Corporation | |

| Class A common stock offered by us |

shares of Class A common stock (or shares, if the underwriters exercise in full their option to purchase additional shares as described below). | |

| Class A common stock offered by the selling stockholders |

shares of Class A common stock. | |

| Option to purchase additional shares |

We have granted the underwriters an option to purchase from us up to an additional shares of Class A common stock. The underwriters may exercise this option at any time within 30 days from the date of this prospectus. See “Underwriters.” | |

| Class A common stock outstanding after this offering |

shares of Class A common stock (or if the underwriters exercise in full their option to purchase additional shares), giving effect to the conversion of all outstanding shares of Class B common stock into Class A common stock as described below and assuming exercise of all of the outstanding warrants to purchase 10,225,445 shares of Class A common stock at an exercise price of $0.01 per share. | |

| Use of proceeds |

We estimate that our net proceeds from this offering will be approximately $ million (or approximately $ million if the underwriters exercise in full their option to purchase additional shares), after deducting underwriting discounts and commissions and estimated offering expenses payable by us, based on an assumed initial offering price of $ per share (the midpoint of the range set forth on the cover of this prospectus). We intend to use the net proceeds received by us in this offering for general corporate purposes and to redeem shares of Class B common stock. We will not receive any of the proceeds from the sale of shares offered by the selling stockholders. See “Use of Proceeds.” | |

| Conversion of Class B common stock |

In accordance with the terms of our amended and restated certificate of incorporation and the underwriting agreement, each outstanding share of Class B common stock immediately following this offering will be subject to the lock-up provisions contained in our amended and restated certificate of incorporation and will automatically convert into one share of Class A common stock on the date that is 180 days following the closing of this offering or such earlier date as may be specified by the board of directors with the prior consent of Morgan Stanley. Following such conversion, we will no longer have any shares of Class B common stock outstanding. See “Principal and Selling Stockholders” and “Description of Capital Stock.” | |

| 13 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

| Dividend policy |

We have not paid any dividends on our common stock. We do not intend to declare or pay any cash dividends on our Class A common stock in the foreseeable future. We plan to review our dividend policy periodically. See “Dividend Policy.” | |

| Listing |

We intend to apply to list our Class A common stock on the NYSE under the symbol “HXN.” | |

| Risk Factors |

You should read the section titled “Risk Factors” and the other information included in this prospectus for a discussion of some of the risks and uncertainties you should carefully consider before deciding to invest in our Class A common stock. | |

Except as otherwise indicated, all of the information in this prospectus assumes:

| • | an initial public offering price of $ per share of Class A common stock, the midpoint of the range set forth on the cover of this prospectus; |

| • | no exercise of the underwriters’ option to purchase up to additional shares of Class A common stock in this offering; |

| • | the conversion of all outstanding shares of Class B common stock into shares of Class A common stock; |

| • | the exercise of all outstanding warrants to purchase an aggregate of shares of Class A common stock at an exercise price of $0.01 per share; |

| • | that the shares of common stock reserved for future grant under our Management Incentive Plan have not been issued; and |

| • | that the shares of common stock reserved for issuance under our 2019 Omnibus Incentive Plan (the “2019 Incentive Plan”) have not been issued. |

| 14 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

Summary Historical and Pro Forma Financial Information

The following table presents Hexion Holdings Corporation’s summary historical financial information as of and for the periods presented. Prior to our emergence from bankruptcy on July 1, 2019 (the “Emergence Date”), Hexion Holdings Corporation had not conducted any business operations. Accordingly, unless otherwise noted or suggested by context, all financial information and data and accompanying financial statements and corresponding notes, as of and prior to the Emergence Date, as contained in this prospectus, reflect the actual historical consolidated results of operations and financial condition of Hexion Inc. for the periods presented and do not give effect to the Plan or any of the transactions contemplated thereby or the adoption of fresh start accounting.

Upon emergence from bankruptcy on the Emergence Date, we adopted fresh start accounting, which resulted in the creation of a new entity for financial reporting purposes. As a result of the application of fresh start accounting, as well as the effects of the implementation of the Plan, the consolidated financial statements after July 1, 2019 are not comparable with the consolidated financial statements on or prior to that date. Refer to Notes 1 and 3 to our audited consolidated financial statements included elsewhere in this prospectus for more information.

The summary historical financial information as of December 31, 2019 (Successor) and December 31, 2018 (Predecessor) and for the Successor period from July 2, 2019 through December 31, 2019 and the Predecessor period from January 1, 2019 through July 1, 2019 and for the Predecessor years ended December 31, 2018 and 2017 have been derived from, and should be read in conjunction with, our audited consolidated financial statements included elsewhere in this prospectus.

The summary unaudited pro forma condensed consolidated financial data for the year ended December 31, 2019 has been derived from the unaudited pro forma condensed consolidated financial information contained in “Unaudited Pro Forma Condensed Consolidated Financial Information” included elsewhere in this prospectus and is subject to the assumptions and adjustments as described in the accompanying notes thereto. We prepared the summary unaudited pro forma condensed consolidated financial data by applying adjustments to our historical consolidated financial statements included herein to give effect to the Emergence Transactions contemplated by the Plan and our emergence from Chapter 11, including the settlement of various liabilities, securities issuances, incurrence of new indebtedness and cash payments and asset and liability revaluations consistent with our reorganization value, in each case, as described under “—Emergence Transactions” and “Unaudited Pro Forma Condensed Consolidated Financial Information.” The summary unaudited pro forma consolidated statement of operations data has been prepared to give effect to the pro forma adjustments in each case as if they had occurred on the first day of the period presented. Our management believes these assumptions and adjustments are reasonable.

The summary unaudited pro forma condensed consolidated financial data set forth below is presented for illustrative purposes only and is not necessarily indicative of the results of operations or financial position that would have actually been reported had the Emergence Transactions and other matters reflected in the pro forma adjustments had occurred at the beginning of the period presented, nor is it indicative of our future results of operations or financial position. In addition, the historical financial statements of Hexion Inc. are not comparable to the financial statements of Hexion Holdings Corporation following emergence from bankruptcy due to the effects of the consummation of the Plan and the Emergence Transactions as well as adjustments for fresh start accounting.

You should read the following summary information in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the historical financial statements included elsewhere in this prospectus.

| 15 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

| Successor | Predecessor | |||||||||||||||||||||||

| Pro Forma Year Ended December 31, 2019 |

Period from July 2, 2019 through December 31, 2019 |

Period from January 1, 2019 through July 1, 2019 |

Year Ended December 31, |

|||||||||||||||||||||

| 2018 | 2017 | |||||||||||||||||||||||

| (in millions, except per share data) | ||||||||||||||||||||||||

| Statements of Operations: |

||||||||||||||||||||||||

| Net sales(1) |

$ | 3,374 | $ | 1,596 | $ | 1,778 | $ | 3,797 | $ | 3,591 | ||||||||||||||

| Cost of sales(1)(2)(3) |

2,782 | 1,349 | 1,462 | 3,127 | 2,979 | |||||||||||||||||||

| Selling, general and administrative expense(1)(2)(3) |

255 | 139 | 145 | 277 | 301 | |||||||||||||||||||

| Depreciation and amortization(3)(4) |

219 | 110 | 52 | 117 | 129 | |||||||||||||||||||

| Gain on dispositions |

— | — | (44 | ) | — | |||||||||||||||||||

| Asset impairments |

— | — | 28 | 13 | ||||||||||||||||||||

| Business realignment costs |

39 | 24 | 15 | 29 | 52 | |||||||||||||||||||

| Other operating expense, net |

33 | 17 | 16 | 36 | 17 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Operating (loss) income |

46 | (43 | ) | 88 | 227 | 100 | ||||||||||||||||||

| Interest expense, net |

105 | 55 | 89 | 365 | 329 | |||||||||||||||||||

| Loss (gain) on extinguishment of debt |

— | — | — | 3 | ||||||||||||||||||||

| Reorganization items, net |

— | — | (3,105 | ) | — | — | ||||||||||||||||||

| Other non-operating expense (income), net(2) |

(10 | ) | 1 | (11 | ) | (12 | ) | (12 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (Loss) income before income tax and earnings from unconsolidated entities |

(49 | ) | (99 | ) | 3,115 | (126 | ) | (220 | ) | |||||||||||||||

| Income tax (benefit) expense |

17 | (9 | ) | 222 | 40 | 18 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (Loss) income before earnings from unconsolidated entities |

(66 | ) | (90 | ) | 2,893 | (166 | ) | (238 | ) | |||||||||||||||

| Earnings from unconsolidated entities, net of taxes |

4 | 2 | 2 | 3 | 4 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net (loss) income |

(62 | ) | (88 | ) | 2,895 | (163 | ) | (234 | ) | |||||||||||||||

| Net (income) loss attributable to noncontrolling interest |

(2 | ) | (1 | ) | (1 | ) | 1 | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net (loss) income attributable to Hexion Holdings Corporation common stockholders and warrant holders |

$ | (64 | ) | $ | (89 | ) | $ | 2,894 | $ | (162 | ) | $ | (234 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net (loss) income attributable to Hexion Holdings Corporation common stockholders and warrant holders per share: |

||||||||||||||||||||||||

| Basic |

$ | (0.93 | ) | $ | (1.30 | ) | $ | 35.04 | $ | (1.96 | ) | $ | (2.83 | ) | ||||||||||

| Diluted |

(0.93 | ) | (1.30 | ) | 35.04 | (1.96 | ) | (2.83 | ) | |||||||||||||||

| Weighted Average common shares and warrants outstanding: |

||||||||||||||||||||||||

| Basic |

68.7 | 68.7 | 82.6 | 82.6 | 82.6 | |||||||||||||||||||

| Diluted |

68.7 | 68.7 | 82.6 | 82.6 | 82.6 | |||||||||||||||||||

| Cash Flows provided by (used in): |

||||||||||||||||||||||||

| Operating activities |

$ | 224 | $ | (173 | ) | $ | (23 | ) | $ | (153 | ) | |||||||||||||

| Investing activities(5) |

(58 | ) | (42 | ) | (40 | ) | (110 | ) | ||||||||||||||||

| Financing activities |

(38 | ) | 212 | 81 | 174 | |||||||||||||||||||

| Balance Sheet Data (at end of period): |

||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 254 | $ | 96 | $ | 128 | $ | 115 | ||||||||||||||||

| Total assets(1) |

4,146 | 2,131 | 1,961 | 2,097 | ||||||||||||||||||||

| Total debt(6)(7) |

1,785 | 528 | 3,815 | 3,709 | ||||||||||||||||||||

| Total liabilities(1) |

3,071 | 5,212 | 4,875 | 4,839 | ||||||||||||||||||||

| Total redeemable common stock |

147 | — | — | — | ||||||||||||||||||||

| Total equity (deficit) |

928 | (3,081 | ) | (2,914 | ) | (2,742 | ) | |||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||

| Capital Expenditures |

$ | (58 | ) | $ | (43 | ) | $ | (90 | ) | $ | (117 | ) | ||||||||||||

| EBITDA(8) |

$ | 3,326 | 68 | 3,258 | 359 | 242 | ||||||||||||||||||

| Segment EBITDA(8) |

400 | 167 | 233 | 440 | 365 | |||||||||||||||||||

| Hexion Inc. Pro Forma EBITDA(9) |

419 | |||||||||||||||||||||||

| 16 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

| (1) | ASC 606 Revenue from Contracts with Customers and ASC 842 Leases, were effective as of January 1, 2018 and January 1, 2019, respectively, and prior periods have not been adjusted for the adoption of these standards. |

| (2) | “Cost of sales,” “Selling, general and administrative expense” and “Other non-operating (income) expense, net” have been adjusted for all periods presented to reflect the adoption of Accounting Standards Board Update No. 2017-07 (“ASU 2017-07”), which reclassified certain components of net periodic pension and postretirement benefit costs from “Cost of sales” and “Selling, general and administrative expense” to “Other non-operating (income) expense, net” within our consolidated statements of operations. See Note 2 to our audited consolidated financial statements for more information. |

| (3) | As a result of the application of fresh start accounting upon our emergence from Chapter 11, we elected to change our income statement presentation for depreciation and amortization expense. All depreciation and amortization expense has been reclassified from “Cost of sales” and “Selling, general and administrative expense” to “Depreciation and amortization” for all periods presented. In addition, we will no longer present “Gross profit” as a subtotal caption. |

| (4) | Depreciation and amortization for the year ended December 31, 2018 and 2017 includes accelerated depreciation of $4 million and $14 million, respectively, related to facility rationalizations. |

| (5) | “Investing activities” within our consolidated statement of cash flows has been adjusted for all periods presented to reflect the adoption of Accounting Standards Board Update No. 2016-18 (“ASU 2016-18”), which removed the change in restricted cash from “Investing activities” in the consolidated statement of cash flows. See Note 2 to our consolidated financial statements for more information. |

| (6) | Total debt represents the sum of “Debt payable within one year” and “Long-term debt” on our consolidated balance sheets. See Note 8 to our consolidated financial statements for more information. |

| (7) | As of July 1, 2019, $3,420 million of total debt was included in “Liabilities subject to compromise” due to our Chapter 11 proceedings. |

| (8) | EBITDA is defined as Net income (loss) (excluding loss (gain) on extinguishment of debt) before interest, income taxes and depreciation and amortization. Segment EBITDA is defined as EBITDA adjusted for certain non-cash items and other income and expenses. We have presented EBITDA and Segment EBITDA because we believe that these measures are useful to investors since they are frequently used by securities analysts, investors and other interested parties to evaluate companies in our industry. Segment EBITDA is the primary performance measure used by the Company’s senior management, the chief operating decision-maker and the board of directors to evaluate operating results and allocate capital resources among segments. Segment EBITDA is also the profitability measure used to set management and executive incentive compensation goals. EBITDA and Segment EBITDA are not recognized terms under GAAP, should not be viewed in isolation and do not purport to be alternatives to Net income (loss) as indicators of operating performance or cash flows from operating activities as measures of liquidity. There are material limitations associated with making the adjustments to our earnings to calculate EBITDA and Segment EBITDA and using these non-GAAP financial measures as compared to the most directly comparable GAAP financial measures. For instance, EBITDA and Segment EBITDA do not include: |

| • | interest expense, and because we have borrowed money in order to finance our operations, interest expense is a necessary element of our costs and ability to generate revenue; |

| • | depreciation and amortization expense, and because we use capital assets, depreciation and amortization expense is a necessary element of our costs and ability to generate revenue; and |

| • | tax expense, and because the payment of taxes is part of our operations, tax expense is a necessary element of our costs and ability to operate. |

Additionally, EBITDA and Segment EBITDA are not intended to be measures of free cash flow for management’s discretionary use, as they do not consider certain cash requirements such as capital expenditures, contractual commitments, interest payments, tax payments and debt service requirements. Because not all companies use identical calculations, this presentation of EBITDA and Segment EBITDA may not be comparable to other similarly titled measures for other companies.

| 17 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

See below for a reconciliation of Net loss to EBITDA and Segment EBITDA.

| Successor | Predecessor | Predecessor | ||||||||||||||||||

| Pro Forma Year Ended December 31, 2019 |

July 2, 2019 through December 31, 2019 |

January 1, 2019 through July 1, 2019 |

Year Ended | |||||||||||||||||

| 2018 | 2017 | |||||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Reconciliation: |

||||||||||||||||||||

| Net (loss) income attributable to Hexion Holdings Corporation |

$ | (64 | ) | $ | (89 | ) | $ | 2,894 | $ | (162 | ) | $ | (234 | ) | ||||||

| Net (income) loss attributable to noncontrolling interest |

(2 | ) | (1 | ) | (1 | ) | 1 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income |

62 | (88 | ) | 2,895 | (163 | ) | (234 | ) | ||||||||||||

| Income tax expense (benefit) |

17 | (9 | ) | 222 | 40 | 18 | ||||||||||||||

| Interest expense, net |

105 | 55 | 89 | 365 | 329 | |||||||||||||||

| Depreciation and amortization(a) |

219 | 110 | 52 | 117 | 129 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

$ | 279 | $ | 68 | $ | 3,258 | $ | 359 | $ | 242 | ||||||||||

| Adjustments to arrive at Segment EBITDA: |

||||||||||||||||||||

| Asset impairments and write-downs |

$ | — | $ | — | $ | — | $ | 32 | $ | 13 | ||||||||||

| Business realignment costs |

39 | 24 | 15 | 29 | 52 | |||||||||||||||

| Realized and unrealized foreign currency (gains) losses |

(1 | ) | 5 | (6 | ) | 27 | 3 | |||||||||||||

| Gain on dispositions |

— | — | — | (44 | ) | — | ||||||||||||||

| Loss on extinguishment of debt |

— | — | — | — | 3 | |||||||||||||||

| Unrealized losses (gains) on pension and OPEB plan liabilities |

5 | 5 | — | (13 | ) | (4 | ) | |||||||||||||

| Transaction costs |

8 | 11 | 26 | 13 | 8 | |||||||||||||||

| Reorganization items, net(b) |

— | — | (3,076 | ) | — | — | ||||||||||||||

| Non-cash impact of inventory step-up(c) |

— | 29 | (29 | ) | — | — | ||||||||||||||

| Other non-cash items(d) |

19 | 10 | 9 | 14 | 16 | |||||||||||||||

| Other(e) |

51 | 15 | 36 | 23 | 32 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total adjustments |

121 | 99 | (3,025 | ) | 81 | 123 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Segment EBITDA |

$ | 400 | $ | 167 | $ | 233 | $ | 440 | $ | 365 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Segment EBITDA(f): |

||||||||||||||||||||

| Adhesives |

$ | 311 | $ | 144 | $ | 167 | $ | 311 | $ | 272 | ||||||||||

| Coatings & Composites |

156 | 60 | 96 | 200 | 159 | |||||||||||||||

| Corporate & Other |

(67 | ) | (37 | ) | (30 | ) | (71 | ) | (66 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 400 | $ | 167 | $ | 233 | $ | 440 | $ | 365 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | For the years ended December 31, 2018 and 2017, accelerated depreciation of $4 million and $14 million, respectively, has been included in “Depreciation and amortization.” |

| (b) | Excludes the “Non-cash impact of inventory step-up” discussed below. |

| (c) | Represents $29 million of non-cash expense related to the step up of finished goods inventory on July 1, 2019 as part of fresh start accounting that was expensed in the Successor period upon the sale of the inventory (see Note 4 to our consolidated financial statements for more information). |

| 18 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

| (d) | Primarily include expenses for retention programs, fixed asset disposals and share-based compensation costs. |

| (e) | Includes $18 million of Segment EBITDA impact related to deferred revenue that was accelerated on July 1, 2019 as part of fresh start accounting. |

| (f) | Reflects our new reporting segments as of January 2020. See “Management’s Discussion and Analysis—Overview and Outlook—Realignment of Reportable Segments in 2020.” |

| (9) | Hexion Inc. Pro Forma EBITDA reflects certain other adjustments permitted in calculating compliance under the indenture governing our Senior Notes and under our Credit Facilities, including reflecting the expected future impact of announced acquisitions and in-process cost savings initiatives. The estimated cost savings are based on certain assumptions and our current estimates, but they involve risks, uncertainties, projections and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied. Any of the assumptions could be inaccurate and, therefore, there can be no assurance that the estimated cost savings will prove to be accurate. |

The following table reconciles Hexion Inc.’s net income to EBITDA, Segment EBITDA and Pro Forma EBITDA for the twelve month period that includes combined information from the Predecessor Company from January 1, 2019 through July 1, 2019 and the Successor Company from July 2, 2019 through December 31, 2019.

| December 31, 2019 LTM Period (Hexion Inc.) |

||||

| (in millions) | ||||

| Net income |

$ | 2,807 | ||

| Income tax expense |

213 | |||

| Interest expense, net |

144 | |||

| Depreciation and amortization |

162 | |||

|

|

|

|||

| EBITDA |

$ | 3,326 | ||

| Adjustments to arrive at Segment EBITDA: |

||||

| Business realignment costs(a) |

39 | |||

| Realized and unrealized foreign currency gains |

(1 | ) | ||

| Unrealized loss on pension and OPEB plan liabilities(b) |

5 | |||

| Transaction costs(c) |

37 | |||

| Reorganization items, net(d) |

(3,105 | ) | ||

| Non-cash impact of inventory step-up(e) |

29 | |||

| Non-cash other(f) |

19 | |||

| Acceleration of deferred revenue(g) |

18 | |||

| Other(h) |

33 | |||

| Segment EBITDA |

$ | 400 | ||

| Cost reduction programs savings(i) |

14 | |||

| Business operations expenses(j) |

5 | |||

|

|

|

|||

| Hexion Inc. Pro Forma EBITDA |

$ | 419 | ||

|

|

|

|||

| (a) | Primarily represents costs related to headcount reduction expenses and plant rationalization costs related to in-process and recently completed cost reduction programs, termination costs and other costs associated with business realignments. |

| (b) | Represents non-cash losses resulting from pension and postretirement benefit plan liability remeasurements. |

| (c) | Represents certain professional fees related to strategic projects, including $29 million of certain professional fees and other expenses related to our Chapter 11 proceedings incurred prior to filing and post-emergence. |

| 19 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation

| (d) | Represents incremental costs incurred directly as a result of our Chapter 11 proceedings after the date of filing, gains on the settlement of liabilities under the Plan and the net impact of fresh start accounting adjustments. |

| (e) | Represents $29 million of non-cash expense related to the step up of finished goods inventory on July 1, 2019 as part of fresh start accounting that was expensed in the Successor period upon the sale of the inventory. |

| (f) | Primarily includes expenses for retention programs, fixed asset disposals and share-based compensation costs. |

| (g) | Represents the impact of deferred revenue that was accelerated on July 1, 2019 as part of fresh start accounting. |

| (h) | Primarily includes IT outage costs and expenses related to legacy liabilities. |

| (i) | Represents pro forma impact of in-process cost reduction programs savings. Cost reduction program savings represent the unrealized headcount reduction savings and plant rationalization savings related to cost reduction programs and other unrealized savings associated with our business realignments activities, and represent our estimate of the unrealized savings from such initiatives that would have been realized had the related actions been completed at the beginning of the period presented. The savings are calculated based on actual costs of exiting headcount and elimination or reduction of site costs. We expect the savings to be realized within the next 12 months. |

| (j) | Represents costs incurred related to the systematic reduction of operating costs. |

| 20 |

Table of Contents

Confidential Treatment Requested by Hexion Holdings Corporation