Note 14-EQUITY CAPITAL

Authorized Capital

On the date of incorporation, the Company was authorized to issue 750,000,000 shares of common stock, par value $0.0001 per share. On October 7, 2020, the Company amended its Certificate of Incorporation to be authorized to issue 760,000,000 shares of stock, consisting of 750,000,000 shares of common stock having a par value of $0.0001 per share, and 10,000,000 shares of preferred stock having a par value of $0.0001 per share.

22

Issuance of Common Stock

On February 12, 2020, 300,000,000 shares of common stock were issued at par value $0.0001 per share to three directors as director fees, totaling $30,000.

On February 13, 2023, a total of 1,000,100 shares of common stock were issued to Mr. Chin Yung Kong and Mr. Chin Hua Fung for acquisition of QMIS Securities Capital SDN BHD.

In the third quarter 2023, the Company entered into stock subscription agreements with three individuals, pursuant to which the Company issued 15,500 shares of common stock, ranging from $8.5 to $10.00 per share, for a total consideration of $134,750.

In October 2023, 43,000 shares of common stock were issued at $10.00 per share to an induvial for a $430,000.

In December, 2023, the Company entered into two stock subscription agreements with two individual investors, pursuant to which the Company would issue 10,000 shares of common stock at $9.00 per share, for a total consideration of $90,000. The funds were received in December, 2023 and the stocks were issued in March 2024.

In February, 2024, the Company entered into a stock subscription agreement with another individual investor, pursuant to which the Company would issue 20,000 shares of common stock at $9.00 per share, for a total consideration of $180,000. The funds were received in February 2024, and the shares were issued in March 2024.

Broad Capital

On July 12, 2022, the Company entered into a Going Public Consultant Agreement (the “Consulting Agreement”) with Broad Capital Assets Management Ltd. (“Broad Capital”), an unrelated third party and a company incorporated in the State of New York, pursuant to which the Company agreed to issue a total of 12% of its issued and outstanding common stocks, as well as up to 8,160,000 additional shares (the “Future Allocation Shares”) of its common stock to Broad Capital or its assignees for services to be provided in connection with a transaction relating to QMIS Finance Securities Corp. (“QMIS Finance”), an entity of which Dr. Chin is also a director and majority shareholder.

Pursuant to the Consulting Agreement, the Company had agreed to issue a total of 36,360,012 shares of the Company’s common stock to Broad Capital’s assignees, which shares were eventually issued in November 2023, and which were allocated between two entities which are Broad Capital’s assignees as follows: 14,544,005 shares to Hong Kong Kazi International Group Co. Limited (“Kazi”), and 21,816,007 shares to Hong Kong Hanxin Holdings Limited (“Hanxin”).

Subsequently, following discussions and negotiations, the Company and Broad Capital have acknowledged and agreed that the services stipulated under the Consulting Agreement had not been provided to the satisfaction of the Company as of the date the shares were issued to Kazi and Hanxin. As such, after friendly and constructive discussions, the Company and Broad Capital, along with Kazi and Hanxin, mutually agreed to terminate the Consulting Agreement and the related issuance of shares due to the unsatisfactory provision of the agreed services.

On January 5, 2024, Hong Kong Kazi International Group Co. Limited agreed to cancel the 14,544,005 shares issued to it, and Hong Kong Hanxin Holdings limited agreed to cancel the 21,816,007 shares issued to it. On February 6, 2024, the Company cancelled the 36,360,012 shares issued to Kazi and Hanxin.

Since the Future Allocation Shares compensate for the services provided to QMIS Finance, which is not a subsidiary of the Company, the Company, Broad Capital, and Dr. Chin entered in a Replacement Agreement on March 14, 2024. Pursuant to the Replacement Agreement, the parties further acknowledged and agreed that Dr. Chin had previously transferred 1,000,000 shares of common stock of QMIS Finance (the “QFS Shares”) to Broad Capital and its assignees, and that on November 9, 2023, Dr. Chin transferred 2,000,000 shares of QMIS TBS common stock from his personal holdings to YiKim International Limited (the “YiKim Shares”), another assignee of Broad Capital. In the Replacement Agreement, Broad Capital has agreed to substitute 3,000,00 shares previously sent by Dr. Chin, consisting of 1,000,000 shares of QMIS Finance common stock, and 2,000,000 shares of the Company’s common stock, for 3,000,000 of the Future Allocation Shares. Broad Capital also agreed to accept 5,160,000 additional shares of QMIS TBS common stock from Dr. Chin, in addition to the 1,000,000 QFS Shares and the 2,000,000 YiKim Shares previously transferred from Dr. Chin as full settlement of the Future Allocation Shares obligations. On April 2, 2024, per Broad Capital’s instruction, Dr. Chin transferred 3,000,000 shares and 2,160,000 shares of QMIS TBS common stock to Hanxin and Kazi, respectively, from his personal holdings.

23

Dalian QMIS Software Technology Development Co., Ltd.

On December 12, 2021, QMIS Securities Limited ("QSL"), a stock brokerage firm based in Hong Kong with which Dr. Chin is a director (but which is not a subsidiary of the Company), entered into a Technical Consulting Agreement (the "Technical Consulting Agreement") with Dalian QMIS Software Technology Development Co., Ltd (“Dalian QMIS”), a company incorporated in Dalian City of the PRC. Ms. Ting Ting Gu, a former director of the Company is a major shareholder of Dalian QMIS. The Technical Consulting Agreement does not clearly outline the compensation for the services.

Despite the Technical Consulting Agreement being with QSL and not with the Company (i.e. the Company was not a party to the Technical Consulting Agreement), purportedly in connection with the Technical Consulting Agreement, the Company erroneously issued 2,000,000 shares of its common stock to Dalian QMIS for the services provided to QSL pursuant to the Technical Consulting Agreement.

As noted, QSL is not a subsidiary of the Company, and the Company had no duty or obligation under the Technical Consulting Agreement to issue shares. As such, the Company deemed it to be necessary and appropriate to cancel the erroneously issued 2,000,000 shares of common stock to rectify the mistake.

On December 27, 2023, Dalian QMIS agreed to cancel the 2,000,000 shares issued to it. On February 6, 2024, the Company cancelled the 2,000,000 shares issued to Dalian QMIS.

Private Investors

In the third quarter of 2022, four individual investors (collectively, the "Investors") intended to purchase shares directly from Dr. Chin, and not from the Company. Unfortunately, due to an initial misunderstanding and miscommunication, the Investors entered into agreements with the Company for the purchase and sale of an aggregate of 578,000 shares of common stock, $1.00 per share, for a total consideration of $578,000.

In November 2023, the Company's transfer agent, ClearTrust LLC (the "Transfer Agent"), erroneously issued 625,400 new shares, which included an extra 47,400 shares for delay in the issuance of the shares, from the Company to the Investors, per the original 2022 agreements, instead of transferring shares from Dr. Chin's holdings.

Subsequently, upon realization of the Investors’ original intent, the agreements with the Investors were amended accordingly to reflect the purchase of shares from Dr. Chin rather than from the Company. As such, the Company deemed it to be necessary and appropriate to terminate the agreements with the Investors and to cancel the erroneously issued shares and effectuate the transfer of shares from Dr. Chin to the Investors in accordance with the amended agreements.

On February 26, 2024, the Company cancelled the 625,400 shares of common stock issued in November 2023 to the Investors. On March 14, 2024, Dr. Chin transferred 625,400 shares of common stock from his account to the Investors. The full consideration of $578,000 paid by the Investors was retained by the Company and recorded as an advance from Dr. Chin. The Investors directly received an equivalent number of shares from Dr. Chin.

Capital Stock Issued and Outstanding

As of March 31, 2024, and December 31, 2023, 301,088,600 and 301,058,600 shares of common stock were issued and outstanding, respectively, and 0 and 0 shares of preferred stock were issued and outstanding, respectively. The number of shares reflects the retrospective presentation of the share issuance on February 13, 2023, due to the recapitalization between entities under common control.

Note 15-CONTINGENCIES, RISKS AND UNCERTAINTIES

Foreign operation

The Company’s operations are carried out in Malaysia and Hong Kong. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environments therein. In addition, the Company’s business may be influenced by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, rates and methods of taxation among other factors.

Liquidity risk

The Company is exposed to liquidity risk which is risk that it is unable to provide sufficient capital resources and liquidity to meet its commitments and business needs. Liquidity risk is controlled by the application of financial position analysis and monitoring procedures. When necessary, the Company will turn to other financial institutions and the shareholders to obtain short-term funding to meet the liquidity shortage.

24

Other risk

The Company’s business, financial condition and results of operations may also be negatively impacted by risks related to natural disasters, extreme weather conditions, health epidemics and other catastrophic incidents, such as the COVID-19 outbreak and spread, which could significantly disrupt the Company’s operations.

Note 16-SUBSEQUENT EVENTS

Payment of Hong Kong Income Tax

As more fully disclosed in Note 12 - Income Taxe, QTBS made a payment of HKD 1,029,290 (approximately $131,120) with loans from Dr. Chin toward the outstanding payable balance of Hong Kong income tax.

Convertible Promissory Note

On October 30, 2020, the Company entered into an agreement to issue a convertible promissory note (the "Note") in the principal amount of one million five hundred thousand dollars ($1,500,000), to the Chairman of the Board and CEO, Dr. Yung Kong Chin. The Company will pay interest from the date of issuance of the Note on the unpaid principal balance at the annual rate of interest equal to eight percentage (8%) per Nine months, such principal and interest to be payable on demand. The Note is a general unsecured obligation of the Company. At any time, the unpaid principal amount of the Note and any unpaid interest accrued thereon can be converted into the Company's common stock at $1.50 per share. On April 12, 2024, since the Note has not been issued and no fund has been made to the Company, both the Company and Dr. Chin agreed that the funds will not be advanced and the Note will not be issued.

25

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

There are statements in this Quarterly Report that are not historical facts. These “forward-looking statements” can be identified by use of terminology such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control. For a discussion of these risks, you should read this entire Quarterly Report carefully, especially the risks discussed under “Risk Factors.” Although management believes that the assumptions underlying the forward-looking statements included in this Quarterly Report are reasonable, they do not guarantee our future performance, and actual results could differ from those contemplated by these forward-looking statements. The assumptions used for purposes of the forward-looking that the results and statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. In the light of these risks and uncertainties, there can be no assurance events contemplated by the forward-looking statements contained in this Quarterly Report will in fact transpire. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We expressly disclaim any obligation or intention to update or revise any forward-looking statements.

Basis of Presentation

The share exchanges were treated as a capitalization between entities under common control, with Dr. Chin holding the position of a controlling shareholder in both the Company and QSC before and after the transaction. The consolidation of the Company and its subsidiary was accounted for at historical cost, and the consolidated financial statements were prepared as if the transaction had become effective as of the beginning of the earliest period presented.

The audited financial statements for our fiscal years ended December 31, 2023 and 2022, include a summary of our significant accounting policies and should be read in conjunction with the discussion below. In the opinion of management, all material adjustments necessary to present fairly the results of operations for such periods have been included in these audited financial statements. All such adjustments are of a normal recurring nature.

Corporate History and Organization

QMIS TBS Capital Group Corp. (“we”, “our,” “us,” “the Company,” or “QMIS USA”) was incorporated in the state of Delaware on November 21, 2019, under the name TBS Capital Management Group Corp. The name was changed to QMIS TBS Capital Group Corp. on February 10, 2020.

On February 13, 2023, the Company entered into certain share exchange agreements (the “Share Exchange Agreements”) with the shareholders of all 1,000,100 outstanding shares of common stock of QMIS Securities Capital SDN BHD (“QSC”), which was incorporated by the Companies Commission of Malaysia on January 13, 2015 under the Companies Act 1965 as a private limited company with the name Multi Securities Capital (M) SDN BHD, which was subsequently changed to QMIS Securities Capital (M) SDN BHD on March 19, 2015. The two QSC shareholders were Dr. Chin Yung Kong, the Company’s Chief Executive Officer, and Chin Hua Fung, Dr. Chin’s son.

Pursuant to the Share Exchange Agreements, Dr. Chin exchanged 700,070 shares of QSC common stock for 700,070 shares of the Company’s common stock. Dr. Chin exchanged 300,030 shares of QSC common stock for 300,030 shares of the Company’s common stock. Accordingly, the Company became the sole shareholder of QSC after the share exchanges.

The share exchanges have been accounted for as a recapitalization between entities under common control since the same controlling shareholders controlled these two entities before and after the transaction. The consolidation of the Company and its subsidiary has been accounted for at historical cost and prepared on the basis as if the transaction had become effective as of the beginning of the earliest period presented in the accompanying consolidated financial statements.

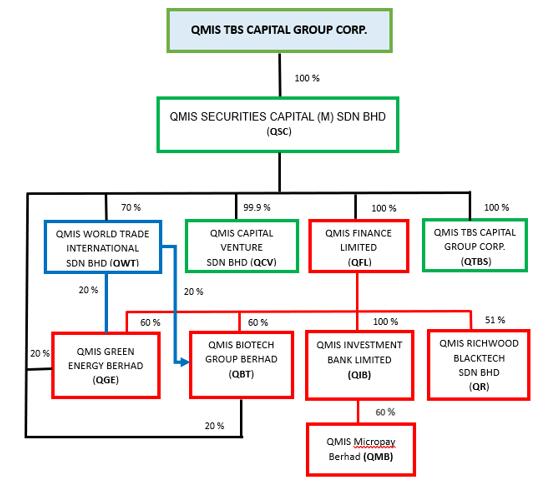

On November 16, 2015, QSC acquired 99.9% equity ownership interest of QMIS Capital Venture SDN BHD (“QCV”), which was incorporated by the Companies Commission of Malaysia on January 14, 2015, under the private limited company act with the name Diversified Multi Capital Venture (M) SDN BHD. Subsequently, the name was changed to QMIS Capital Venture SDN BHD on March 19, 2015.

On October 15, 2015, QSC acquired 69.99% equity ownership interest of QMIS World Trade International SDN BHD (“QWT”), and subsequently on November 27, 2015, QSC acquired anther 0.01% equity ownership interest in QWT, which was incorporated by the Companies Commission of Malaysia on 15 October 2014 under the private limited company act with the name of Santubong Business Trading SDN BHD. Subsequently, the name was changed to QMIS World Trade International SDN BHD on August 7, 2015.

26

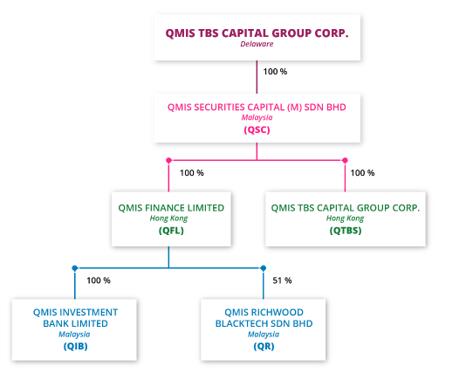

On December 31, 2021, QSC acquired 100% equity ownership interest of QMIS TBS Capital Group Corporation Limited (“QTBS”), which was incorporated in Hong Kong on September 9, 2013, under the Companies Ordinance as a limited liability company under the name QMIS Huayin Finance Credit Limited. Subsequently, the name was changed to QMIS Ample Luck Financial Group Limited on July 19, 2018, and finally QMIS TBS Capital Group Corporation Limited on June 16, 2020.

On December 31, 2021, QSC acquired 100% equity ownership interest of QMIS Finance Limited (“QFL”), which was incorporated in Hong Kong on July 20, 2007, under the Companies Ordinance as a limited liability company with the name of Hua Xia Syndicate Financial Credit Limit. Subsequently, the name is changed to QMIS Syndicate Financial Credit Limited on February 21, 2014, and finally to QMIS Finance Limited on March 31, 2016.

On May 27, 2020, QFL, QSC, and QWT acquired 60%, 20% and 20%, respectively, equity ownership interest in QMIS Green Energy Berhad (“QGE”), which was incorporated by the Companies Commission of Malaysia on May 27, 2020, under the private limited company act with the name of QMIS Waste Management Group Berhad. Subsequently, the name was changed to QMIS Green Energy Berhad on September 13, 2022.

On May 8, 2020, QFL, QSC, and QWT acquired 60%, 20%, and 20%, respectively, equity ownership interest in QMIS Biotech Group Berhad (“QBT”), which was incorporated by the Companies Commission of Malaysia on 8 May 2020 under the private limited company act with the name of QMIS Biotech Group Berhad. Subsequently, the name was changed to QMIS Biotech Group Berhad on May 29, 2020.

On June 22, 2020, QFL incorporated QMIS Investment Bank Limited (“QIB”) by the Labuan Financial Services Authority (LFSA) in Malaysia under the Company limited by shares act with the name of QMIS Finance (L) Limited. Subsequently, the name was changed to QMIS Labuan Investment Bank Limited on March 24, 2021, and finally to QMIS Investment Bank Limited on 28 July 2022. QFL owns 100% equity ownership interest in QIB.

On June 21, 2021, QFL and four other shareholders incorporated QMIS Richwood Blacktech Sdn. Bhd. (“QR”) by the Companies Commission of Malaysia under the private limited company act. QFL owns 51% equity ownership interest in QR.

On August 3, 2023, QIB and Dr. Chin incorporated a company, QMIS Micropay Berhad, in Kuala Lumpur, Malaysia. QIB and Dr. Chin own 60% and 40% of the ownership equity interests of QMIS Micropay Berhad, respectively. QMIS Micropay Berhad plans to carry on the business of electronic payments and transactions but had not engaged in any business operation as of the date of this Quarterly Report.

A schematic of the Company’s current corporate structure, in operation, is set forth below.

27

Overview

The current structure and operations of the Company is comprised of QMIS TBS Capital Group Corp as the holding company, along with its subsidiaries QSC, QFL, QTBS, QR, QIB, QGE, QBT, QWT and QCV.

QSC, QFL and QTBS collaborate to provide consultant services, while QR is focused on software development. Starting from early 2023, QR generates revenue from its online payment software. At present, the other companies are not engaged in any business operations.

For the purposes of this Quarterly Report, QMIS TBS Capital Group Corp, QSC, QFL, QTBS, QR, QIB, QGE, QBT, QWT and QCV will be referred to as the “Company.”

QSC is an investment holding company and involved in providing investment banking and other financial services in Hong Kong and Malaysia through its direct and indirect subsidiaries shown below:

·QMIS Securities Capital (M) Sdn. Bhd. (“QSC”),

·QMIS TBS Capital Group Corp. (HK) (“QTBS”),

·QMIS Finance Limited (“QFL”),

·QMIS Investment Bank Limited (“QIB”), and

·QMIS Richwood Blacktech Sdn. Bhd. (“QR”).

QMIS Securities Capital (M) Sdn. Bhd. (“QSC”)

QSC is a professional firm geared to support and provide advisory services which includes the incubations of high tech and high growth companies.

The Company owns 100% of QSC, which owns:

·100% of QTBS;

·100% of QFL;

·99.9% of QCV;

·70% of QWT;

·20% of QBT; and

·20% of QMIS Green Energy Berhad (“QGE”) (formerly QMIS Waste Management Group Berhad).

QMIS TBS Capital Group Corp. (HK) (“QTBS”)

QTBS is a limited liability company incorporated and domiciled in Hong Kong. QMIS TBS Group perpetually generates ideas to grow and add value to its people, clients, shareholders and the communities it serves. It aims to excel in dimensions such as client service and support with effective risk management and decision making.

The principal activity of QTBS is the provision of corporate advisory services which includes incubating FinTech and high growth companies. QTBS focuses on the small to middle market companies in China, Malaysia and Southeast Asia. It has an extensive international, national and local network of consultants, business advisors and directors to assist clients with business incubators: raising capital, private equity, due diligence, business valuation, merger and acquisition, accounting and market research services.

QTBS provides a wide range of corporate advisory services to its clients as follows:

·Management and Strategy Consulting;

·Corporate Advisory;

·Market Research and Survey; and

·Business Incubation.

28

QMIS Finance Limited (“QFL”)

QFL is an Investment Holding Company and had two subsidiaries as of December 31, 2023:

·QIB, wholly owned; and

·QR, majority owned.

QMIS Investment Bank Limited (“QIB”)

QIB is set to offer a full range of financial products and services covering investment banking, digital banking, private banking and asset management services licensed by Labuan Financial Services Authority (LFSA), Malaysia.

Furthermore, QIB will also provide conventional investment banking services such as private placement, wealth management and corporate finance advisory and solutions in working capital management, fund raising, initial public offering, and merger and acquisition consulting services to its clients.

QMIS Richwood Blacktech Sdn. Bhd. (“QR”)

QR is a new company established in Malaysia involved in the Electronic Payment and Transaction Enabler services with a centralized platform for various payment transactions and value-added services. QR has entered into a partnership with ManagePay Services Sdn. Bhd. (“MPay”) for the issuance of e-wallet and prepaid card services. MPay will act as the underlying technology provider and licensing for QR’s payment solutions, while QR acts as a payment system enabler, providing payment infrastructure and card processing for card payment scheme owners with QR’s mobile e-wallet tied up with an international prepaid card as an addition payment option can be used by consumers at merchants for cashless transactions in various retail sectors. QR’s goal is to develop comprehensive payment products and services with international payment capability and security compliance to tap into the FinTech market. We are partnering with experienced players in the payment system industry and plan to develop a Super App to upgrade the payment system infrastructure and solutions.

As of the date of this Quarterly Report, QFL, QTBS and QSC were working together to provide consultant services, while QR was engaged in the business of electronic payment solution. The other companies, QCV, QWT, QBT, QGE, and QMB were not engaged in business as of the date of this Quarterly Report.

Recent Developments

Certificate of Amendment

On April 23, 2024, Company’s Board of Directors (the “Board”) approved and recommended to the Company’s shareholders for approval a certificate of amendment (the “Amendment”) to the Company’s Certificate of Incorporation, as amended to date (the “Certificate”).

Pursuant to the Amendment, the Company amended the Certificate to provide that as permitted under the Delaware General Corporation Law, the Chairman of the Company has two (2) votes on each matter voted on by the Board of Directors. The Amendment also confirms that as of the date of the Amendment, Dr. Yung Kong Chin is the Chairman of the Board.

On April 23 and 24, 2024, the holders of an aggregate of 292,914,670 shares of the Company’s common stock, or approximately 97.29% of the total shares outstanding, voted to approve the Amendment.

Subsequently, on April 29, 2024, the Amendment was filed with the Secretary of State of the State of Delaware, and the Amendment took effect upon filing.

Appointment of Additional Directors

On May 5, 2024, the Board appointed four additional members of the Board: Dr. Hj Mazlan Bin Ahmad; Lee Chang Yee; Wei Chen, Jerry; and Lim Bing Khim, effective as of that date.

Biographical information about the new members of the Board can be found in the Current Report filed by the Company with the U.S. Securities and Exchange Commission on May 8, 2024.

29

Key Factors Affecting Our Results of Operations

Our results of operations have been and will continue to be affected by a number of factors, including those set out below:

Corporate Consultant Services

Corporate consultant professional firms play a critical role in providing strategic, operational and organizational advice to businesses. Their success is influenced by a variety of internal and external factors that can positively or negatively impact their operations.

Market and Competitive Environment

The market and competitive environment are among the most significant drivers of success for a corporate consultant professional firm. Firms must be aware of the current trends in their respective industries and the competitive landscape to remain relevant and competitive. To address this challenge, QSC must continuously innovate their services and develop new, more effective solutions to meet their clients’ evolving needs. Additionally, they must maintain strong relationships with clients and establish a reputation as a trusted advisor in their industry.

Talent Management

The quality of talent and the ability to attract, retain and develop top-performing employees is critical to the success of a corporate consultant professional firm. To address this challenge, firms must have a robust human resource management strategy in place that prioritizes talent management, career development and diversity and inclusion. QSC must also provide competitive compensation and benefits packages and cultivate a positive, supportive work environment to retain top talent and attract new hires.

Industry Knowledge

Keeping up with the latest industry knowledge is important for staying competitive and meeting the evolving needs of customers and users. Firms must continuously invest in training and professional development programs that support the delivery of effective solutions and services to clients. To address this challenge, QSC must have a clear human resources development strategy in place that aligns with our business goals and supports its operations.

Additionally, firms must invest in training and development programs for their employees to ensure that they have the skills and knowledge necessary to effectively use technology in their work.

Research Methodology, Data Analysis, and Interpretation

The quality of the research methodology used by a market research firm affects its results. Firms that use rigorous and reliable research methods are more likely to deliver accurate and relevant insights to their clients.

The ability to analyze and interpret data effectively is a key factor in the success of a market research firm. A firm that can turn raw data into meaningful insights and recommendations is more likely to deliver value to its clients. Market research firms that have a deep understanding of specific industries are more likely to deliver relevant and accurate insights. This requires a combination of knowledge and experience in the industry and an understanding of the current market trends and dynamics.

Client Relationships

A strong client relationship is essential for the success of a consulting firm. Firms that build strong relationships with our clients are more likely to receive repeat business and positive word-of-mouth referrals.

Electronic Payment Solution

Regulation and Compliance

In Malaysia, the regulation and compliance for operating an e-wallet, a payment gateway business activity is governed by the Central Bank of Malaysia, Bank Negara Malaysia (“BNM”). BNM oversees and regulates the payment system in Malaysia to ensure its safety, efficiency and stability. To operate an e-wallet payment gateway business, the service provider needs to obtain an e-money issuer (“EMI”) license from BNM. In addition, the operator must comply with Anti-Money Laundering (“AML”) and Counter Financing of Terrorism (“CFT”) regulations set by BNM to prevent illegal activities such as money laundering and terrorism financing. The operator will also need to comply with Personal Data Protection Act to ensure the security and privacy of your customers’ personal and financial information.

30

As of the date of this Quarterly Report, QR did not hold an e-money issuer (EMI) license, but instead uses the license held by ManagePay Services Sdn. Bhd. (“MPay”). QR operates as a white-label partner of MPay, utilizing MPay’s EMI license, which is regulated by BNM. This partnership enables QR to provide e-wallet services to its customers under its own brand, while ensuring compliance with applicable regulations through MPay’s license.

Other General Market Conditions Affecting the Performance of the Company

Technical expertise

QR’s success in the e-wallet payment solution business is dependent on its technical expertise. QR must have a deep understanding of the technology used in the payment solutions industry, and continually invest in its people and technology to remain at the forefront of the industry.

Compliance with Regulations

The e-wallet payment solution business is subject to strict regulations, and QR must comply with these regulations to operate successfully. QR employed a strong compliance program in place to ensure that its solutions are secure, transparent and compliant with all relevant regulations.

User Adoption

QR’s success in the e-wallet payment solution business is dependent on the adoption of its solutions by users. We are committed to develop payment solutions that are user-friendly, secure and accessible to a wide range of users.

Market Competition

The e-wallet payment solution market is highly competitive, and QR must be able to compete effectively against other solutions providers. QR must differentiate itself from its competitors through its expertise, quality of service and pricing strategy.

Data Security

The security of user data is a critical factor in the success of QR’s e-wallet payment solution business. We are committed to invest in robust security measures to ensure that user data is protected against cyber threats.

Market Demand

The demand for the services is constantly evolving, and QR must be able to adapt to changing market conditions. QR must be able to respond to changes in technology and the needs of its clients to remain competitive.

Client Satisfaction

QR’s success is dependent on the satisfaction of its clients. QR must deliver high-quality software development solutions that meet the needs of its clients and provide ongoing support to ensure their continued success.

Financial Resources

QR’s financial stability is a key factor in its success. QR must have the resources to invest in its people and technology, and maintain a healthy balance sheet to support its growth.

Cost Management

QR’s ability to manage costs is also important to its success. QR must balance the cost of delivering high-quality software development services with the need to remain profitable.

Challenges of Geographic Concentration

QR may only be able to serve a smaller portion of the overall market. Additionally, geographic concentration can also lead to increased competition in a particular area, which can drive down prices and make it more difficult for us to differentiate our services from those of our competitors.

31

Marketing and Brand Awareness

Marketing and brand awareness can greatly impact the success of an e-wallet service provider. Firms that are able to effectively market their services and build a strong brand are more likely to attract and retain users.

QR is committed to continually evaluate these factors and implement strategies to overcome any risk factors that may affect its success. This may include:

User Experience

A user-friendly interface and seamless transaction process are crucial for attracting and retaining users.

Security

Ensuring the security of users’ funds and personal information is paramount.

Partnership and Integration

Establishing partnerships and integrating with merchants, banks and other financial institutions is crucial for providing a comprehensive service and increasing adoption.

Marketing and User Acquisition

Effective marketing and user acquisition strategies are important to reach and onboard a large user base.

Regulation Compliance

Ensuring compliance with regulatory requirements and obtaining necessary licenses is critical for operating legally and building trust with users.

Scalability

The ability to scale the platform and handle increasing transaction volumes is crucial for long-term success.

Regional Market Expanding

The Company needs to adopt a more diversified approach to its service offerings and consider expanding into new geographic areas. This could include investing in new infrastructure and resources, as well as developing new partnerships and strategic alliances with local businesses and organizations.

Continuous Innovation

Keeping up with the latest technologies and continuously improving the platform is important for staying competitive and meeting the evolving needs of users.

Investment Banking Services

Regulation and Compliance

Operating an LFSA-licensed investment bank in Malaysia requires strict adherence to the regulations and guidelines set by the LFSA and international regulatory bodies. A strong commitment to compliance and a robust risk management framework are essential for the success and sustainability of the business. The regulatory authority responsible for overseeing and regulating the financial services industry in the Labuan International Business and Financial Centre (the “Labuan IBFC”). The Labuan IBFC is a special economic zone in Malaysia established to promote and develop the offshore financial services industry.

As a licensed investment bank in Labuan, Malaysia, QIB must comply with the licensing requirements set by the LFSA. This includes submitting an application for a license, providing evidence of financial stability and operational readiness, and demonstrating a strong commitment to compliance with regulatory requirements and ethical standards. In terms of ongoing compliance, QIB must adhere to the regulations and guidelines set by the LFSA, including those related to financial reporting, risk management and consumer protection. QIB will also be required to conduct periodic internal audits to ensure compliance with regulations and to identify any potential risks or areas for improvement.

32

Additionally, QIB must comply with international regulations and standards, such as the Basel Accords and the Financial Action Task Force recommendations, to prevent money laundering, terrorism financing and other illegal activities. This includes implementing and maintaining robust Anti-money Laundering (“AML”) and Counter Financing of Terrorism (“CFT”) policies and procedures, as well as performing customer due diligence and monitoring transactions for suspicious activities.

Other General Market Conditions Affecting the Performance of the Company

LFSA-licensed investment banks operate in a highly competitive and regulated financial services market. The results of these banks are impacted by a variety of factors, including economic conditions, competition, regulatory environment and technology advancements.

Economic Conditions

The performance of investment banks is closely tied to the state of the economy. A strong economy generally leads to increased demand for investment banking services, while a weak economy can result in decreased demand. The impact of economic conditions is particularly pronounced in the investment banking industry due to its reliance on capital markets, which are subject to fluctuations based on economic performance.

Competition

The investment banking industry is highly competitive, with many players vying for a share of the market. Competition can impact the results of investment banks in several ways, including pricing pressure, increased marketing and advertising expenses, and the need to invest in technology and other resources to remain competitive. In addition, new entrants into the market can disrupt existing players by offering new products and services.

Regulatory Environment

The investment banking industry is heavily regulated, with regulations affecting virtually every aspect of the business. Changes in regulations, particularly in response to economic or market conditions, can have a significant impact on the results of investment banks. For example, increased regulatory requirements may result in increased compliance costs, while changes to existing regulations may impact QIB’s ability to generate revenue from certain products and services.

Technology Advancements

Investment banks that fail to keep up with technology advancements may find themselves at a disadvantage compared to their competitors, while those that embrace new technologies may reap significant benefits in terms of efficiency and profitability.

The success of our business operation is impacted by a variety of factors, including economic conditions, competition, regulatory environment and technology advancements. The management strategies that are able to effectively navigate these factors and adapt to changing conditions are likely to be more successful than those that do not. To remain competitive, business model and decision must be proactive in their approach, continuously monitoring changes in the market and adapting their strategies as needed to stay ahead of the competition.

Industry

The Market Size of E-payment Industry in Southeast Asia

The e-payment industry in Southeast Asia is growing rapidly, driven by the region’s large and growing population, increasing smartphone adoption and favorable demographic and economic trends. According to a recent report by Google, Temasek and Bain & Company, the e-payment market in Southeast Asia is expected to reach $300 billion by 2025, representing a significant opportunity for companies operating in this space. Southeast Asia has a young and tech-savvy population, with a large proportion of the population having access to smartphones and internet services. This has led to the growth of online commerce and digital financial services, including e-payments, in the region. According to the same report, e-commerce sales in Southeast Asia are projected to reach $300 billion by 2025, representing a significant portion of the overall e-payment market.

The e-payment industry in Southeast Asia is highly competitive, with several major players vying for market share. Some of the key players in the region include Grab, Gojek, Razer, Sea Limited and Singtel. These companies offer a range of services, including ride-hailing, food delivery, mobile payments and digital wallets. In terms of growth, the e-payment market in Southeast Asia is expected to grow at a rapid pace over the next few years, driven by increasing adoption of digital financial services, the expansion of e-commerce and the growth of the region’s young and tech-savvy population.

Overall, the e-payment industry in Southeast Asia presents a significant opportunity for companies looking to enter this market. With a large and growing population, increasing smartphone adoption and favorable demographic and economic trends, the region is poised for continued growth in the e-payment space.

33

Impact of the COVID-19 Pandemic on Our Business and Operations

The COVID-19 pandemic has resulted in widespread economic disruption and uncertainty, which has caused many organizations to reduce their budgets and spending on consulting services. Additionally, the shift to remote work and the need to rapidly adapt to changing circumstances has created new challenges and opportunities for consulting and investment banking firms.

The COVID-19 pandemic has had a negative impact on our consulting business segment, primarily due to our main client base and revenue being generated from Malaysia and Hong Kong. The uncertain economic conditions, travel restrictions and quarantines have impeded our ability to contact clients and build trust, leading to a decrease in demand for our services. The operations of our clients have also been negatively impacted, further exacerbating the situation. Although the full impact of the pandemic is difficult to predict, the prolonged nature of the pandemic and potential mutations of the virus poses significant uncertainties that may materially and adversely affect our business, results of operations and financial condition.

To mitigate these impacts, we have adapted our operations to a virtual or remote-based model, while also finding ways to help clients address the unique challenges posed by the pandemic. Despite these challenges, the investment banking and consulting industry is likely to remain an important source of support and expertise for organizations as they navigate this crisis and beyond.

The lockdowns, quarantines and travel restrictions have led to a shift towards digital and online transactions, resulting in increased adoption of e-wallet services as people opt for contactless and cashless payment options. This has created new opportunities for e-wallet providers to grow their market share and attract new users. On the retail side, the pandemic has led to store closures and reduced foot traffic, causing many brick-and-mortar retailers to shift their focus towards online sales and e-commerce. This has put pressure on retailers to enhance their digital capabilities and develop new strategies to reach customers through online channels. However, any resurgence of the pandemic could have a negative impact on consumer spending and lead to further reductions in retail sales and e-wallet transaction volume as well.

Geopolitical Conditions

In February 2022, Russia initiated significant military action against Ukraine. In response, the U.S. and certain other countries imposed significant sanctions and export controls against Russia, Belarus and certain individuals and entities connected to Russian or Belarusian political, business, and financial organizations, and the U.S. and certain other countries could impose further sanctions, trade restrictions and other retaliatory actions should the conflict continue or worsen. It is not possible to predict the broader consequences of these conflicts, including related geopolitical tensions, and the measures and retaliatory actions taken by the U.S. and other countries in respect thereof as well as whether any counter measures or retaliatory actions in response, including, for example, potential cyberattacks or the disruption of energy exports, are likely to cause regional instability and geopolitical shifts, which could materially adversely affect global trade, currency exchange rates, regional economies and the global economy. These situations remain uncertain, and while it is difficult to predict the impact of any of the foregoing, the conflicts and actions taken in response to these conflicts could increase our costs, reduce our sales and earnings, impair our ability to raise additional capital when needed on acceptable terms, if at all, or otherwise adversely affect our business, financial condition, and results of operations.

In addition, while we do not have any operations in the Middle East nor Africa, geopolitical tensions and ongoing conflicts in these regions, particularly between Israel and Palestine as well as within Sudan, may lead to further global economic instability and fluctuating energy prices that could materially affect our business. It is not possible to predict the broader consequences of these conflicts, including related geopolitical tensions, and the measures and actions taken by other countries in respect thereof, which could materially adversely affect global trade, currency exchange rates, regional economies and the global economy. While it is difficult to predict the impact of any of the foregoing, these conflicts may increase our costs, disrupt our supply chain, reduce our sales and earnings, impair our ability to raise additional capital when needed on acceptable terms, if at all, or otherwise adversely affect our business, financial condition and results of operations.

Revenue Recognition

QSC adopted Accounting Standards Codification (“ASC”) 606 upon inception. Under ASC 606, revenue is recognized when a customer obtains control of promised goods or services, in an amount that reflects the consideration which the entity expects to receive in exchange for those goods or services. To determine revenue recognition for arrangements that an entity determines are within the scope of ASC 606, QSC performs the following five steps: (i) identify the contract(s) with a customer; (ii) identify the performance obligations in the contract; (iii) determine the transaction price; (iv) allocate the transaction price to the performance obligations in the contract; and (v) recognize revenue when (or as) the entity satisfies a performance obligation.

During the current reporting period, we did not make any significant changes to our revenue recognition policies and practices. However, we continue to monitor changes in accounting principles and regulations to ensure that our policies and practices are up-to-date and in compliance with current accounting standards.

34

QSC currently generates its revenue from the following main sources:

Revenue from Consultant Services

QSC, QFL and QTBS work together to provide business consultant services to customers. The revenue is recognized at the point in time when the consultant services promised are performed and accepted by the customers, which is generally when the consultant project is delivered and accepted by the customer. Our services include management and strategic planning, organizational development and implementation support, merger and acquisition, valuation report, industry and market survey and business incubation.

The consulting services are generally provided over a period of several months, and QSC, QFL, and QTBS perform the services specified in the contracts with clients. QSC, QFL, and QTBS monitor the progress of the consulting projects on an ongoing basis to ensure that they are on track to meet the obligations under the contracts. If QSC, QFL, and QTBS determine that they will not be able to meet the requirements of a contract, QSC, QFL, and QTBS will take the necessary steps to renegotiate the terms of the contract with the client or make other arrangements to ensure that they can meet the obligations.

Revenue from Software Development

QR provides customers with software development and support service pursuant to their specific requirements, which primarily compose of custom application development, supporting and training. QSC generally recognized revenue at a point in time when control is transferred to the customers and QSC is entitled to the payment, or when the promised services are delivered and accepted by the customers.

Payments for services received in advance in accordance to the contract is recognized as deferred revenues when received.

Cost of Revenues

Cost of revenues primarily consists of salaries and related expenses (e.g. bonuses, employee benefits, statutory pension contribution and payroll taxes) for personnel directly involved in the delivery of services and products to customers. In addition, other costs directly involved in the delivery of services and products to customers, such as outside consulting, legal services, and supporting overhead costs, are included in the costs of revenue.

Comprehensive Income (Loss)

ASC 220 “Comprehensive Income” established standards for reporting and display of comprehensive income/loss, its components and accumulated balances. Components of comprehensive income/loss include net income/loss and foreign currency translation adjustments. The component of accumulated other comprehensive income (loss) consisted of foreign currency translation adjustments.

Credit Risk

Customer accounts typically are collected within a short to medium period of time, and based on its assessment of current conditions and its experience collecting such receivables, management believes it has no significant risk related to accounts receivable.

Research and Development Expenses

Research and development expenses consist primarily of fees we are being charged for developing the source code of the software platform enabling us to build new products as well as improve existing products. We expense substantially all of our research and development costs as they are incurred.

Financial Overview

For the three months ended March 31, 2024 and 2023, we generated revenues of $480,283 and $794,667, respectively, and reported net loss of $308,226 and net profit of $234,276 respectively, with cash used in operating activities of $1,180,986 compared to cash inflow from operating activities of $249,877, respectively. As noted in our unaudited consolidated financial statements, as of March 31, 2024, we had an accumulated deficit of $4,358,938.

35

Results of Operations

Comparison of Results of Operations for the Three Months ended March 31, 2024 and 2023

The following table summarizes our operating results as reflected in our statements of income during the three months ended March 31, 2024 and 2023, respectively, and provides information regarding the dollar and percentage increase (or decrease) during such periods.

|

| For the Three Months Ended March 31,

|

|

| 2024

|

| 2023

|

| Variance

|

|

|

|

| % of

|

|

|

| % of

|

|

|

|

|

|

| Amount

|

| revenue

|

| Amount

|

| revenue

|

| Amount

|

| % of

|

REVENUE

|

| $480,283

|

| 100.0%

|

| $794,667

|

| 100.0%

|

| $(314,384)

|

| -39.6%

|

COST OF REVENUE

|

| 275,347

|

| 57.3%

|

| 127,336

|

| 16.0%

|

| 148,011

|

| 116.2%

|

GROSS PROFIT

|

| 204,936

|

| 42.7%

|

| 667,331

|

| 84.0%

|

| (462,395)

|

| -69.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses

|

| 669,115

|

| 139.3%

|

| 415,976

|

| 52.3%

|

| 253,139

|

| 60.9%

|

Research and development expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

| 669,115

|

| 139.3%

|

| 415,976

|

| 52.3%

|

| 253,139

|

| 60.9%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations

|

| (464,179)

|

| -96.6%

|

| 251,355

|

| 31.6%

|

| (715,534)

|

| -284.7%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expenses)

|

| 155,953

|

| 32.5%

|

| 2,046

|

| 0.3%

|

| 153,907

|

| 7522.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income tax provision

|

| (308,226)

|

| -64.2%

|

| 253,401

|

| 31.9%

|

| (561,627)

|

| -221.6%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

| -

|

|

|

| 19,125

|

| 2.4%

|

| (19,125)

|

| -100.0%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income / (loss)

|

| (308,226)

|

| -64.2%

|

| 234,276

|

| 29.5%

|

| (542,502)

|

| -231.6%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: net income attributable to non-controlling interest

|

| 7,700

|

| 1.6%

|

| 461

|

| 0.1%

|

| 7,239

|

| 1570.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME ATTRIBUTABLE TO QMIS TBS CAPITAL GROUP CORP

|

| $(315,926)

|

| -65.8%

|

| $233,815

|

| 29.4%

|

| $(549,741)

|

| -235.1%

|

This reduction in net income by $542,502, or 231.6%, is attributed to a combination of decreased revenue and increased cost of revenue. Specifically, our revenue experienced a substantial decrease of $314,384, or 39.6%, from $794,667 in the three months ended March 31, 2023, to $480,283 in the same period in 2024.

Revenues

Our different revenue sources for the three months ended March 31, 2024 and 2023, were as follows:

|

| For the Three Months Ended March 31,

|

|

| 2024

|

| 2023

|

| Variance

|

|

|

|

| % of

|

|

|

| % of

|

|

|

|

|

|

| Amount

|

| revenue

|

| Amount

|

| revenue

|

| Amount

|

| %

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consultant services

|

| $450,000

|

| 93.7%

|

| $776,347

|

| 97.7%

|

| $(326,347)

|

| -42.0%

|

Software development and maintenance services-Related parties

|

| 28,594

|

| 6.0%

|

| 15,727

|

| 2.0%

|

| 12,867

|

| 81.8%

|

Software development and maintenance services

|

| 1,689

|

| 0.4%

|

| 2,593

|

| 0.3%

|

| (904)

|

| -34.9%

|

Total revenue

|

| 480,283

|

| 100.0%

|

| 794,667

|

| 100.0%

|

| (314,384)

|

| -39.6%

|

36

For the three months ended March 31, 2024, the Company reported total revenues of $480,283, a decrease of 39.6% from $794,667 reported in the same period in 2023. The decrease in revenues can be attributed to the following reasons:

(i)Consultant Services: Consultant services continue to represent the majority of our revenue, constituting 93.7% of the total revenue in the three months ended March 31, 2024, compared to 97.7% in the same period of 2023. Revenue from consultant services saw a significant decline of 42.0%, dropping from $776,347 in 2023 to $450,000 in 2024. The reduction in consultant service revenue is primarily due to a decrease in client engagements within the first quarter, which have experienced budget cuts and project delays due to economic uncertainties. Despite the decline, consultant services remain a core focus for the Company, and efforts are underway to diversify the client base and enhance service offerings to adapt to changing market demands.

(ii)Software Development and Maintenance Services - Related Parties: Revenue from software development and maintenance services provided to related parties increased by 81.8% to $28,594, from $15,727 in the same period in 2023, primarily due to the expansion of services provided to existing related entities. This segment had contributed 6% of the total revenue.

(iii)Software Development and Maintenance Services: This segment experienced a decline of 34.9%, with revenues decreasing from $2,593 in 2023 to $1,689 in 2024. It contributes the least as of this reporting period.

Cost of Sales

The following table sets forth the breakdown of our total cost of sales for the three months ended March 31, 2024 and 2023:

|

| For the Three Months Ended March 31,

|

|

| 2024

|

| 2023

|

| Variance

|

|

|

|

| % of

|

|

|

| % of

|

|

|

|

|

|

| Amount

|

| revenue

|

| Amount

|

| revenue

|

| Amount

|

| %

|

Cost of Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

Consultant services

|

| $270,708

|

| 98.3%

|

| $120,817

|

| 94.9%

|

| $149,891

|

| 124.1%

|

Software development and maintenance services

|

| 4,639

|

| 1.7%

|

| 6,519

|

| 5.1%

|

| (1,880)

|

| -28.8%

|

Total cost of revenue

|

| 275,347

|

| 100.0%

|

| 127,336

|

| 100.0%

|

| 148,011

|

| 116.2%

|

During the three months ended March 31, 2024, our total cost of revenue increased by $148,011, representing a 116.2% rise, and reached $275,347 compared to $127,336 for the same period in 2023.

The cost associated with consultant services amounted to $270,708, accounting for 98.3% of the total cost of revenue in 2024. In comparison, for the corresponding period in 2023, the cost of consultant services was $120,817, representing 94.9% of the total cost of revenue. The increase of $149,891, or a 124.1% surge, indicates escalated expenses related to consultant services in the first quarter of 2024.

The cost of software development amounted to $4,639, comprising 1.7% of the total costs for the three months ended March 31, 2024, compared to $6,519 for the same period in 2023.

Gross Profit

The following table sets forth the breakdown of our total gross profit for the three months ended March 31, 2024 and 2023:

|

| For the Three Months Ended March 31,

|

|

| 2024

|

| 2023

|

| Variance

|

|

|

|

| % of

|

|

|

| % of

|

|

|

|

|

|

| Amount

|

| revenue

|

| Amount

|

| revenue

|

| Amount

|

| %

|

Consultant services

|

| $179,0292

|

| 87.5%

|

| $655,530

|

| 98.2%

|

| $(476,238)

|

| -72.6%

|

Software development and maintenance

|

| 25,644

|

| 12.5%

|

| 11,801

|

| 1.8%

|

| 13,843

|

| 117.3%

|

Total Gross Profit

|

| 204,936

|

| 100.0%

|

| 667,331

|

| 100.0%

|

| (462,395)

|

| -69.3%

|

Our gross profit decreased by $462,395 or 69.3% to $204,936 in the three months ended March 31, 2024, from a gross profit of $667,331 in the same period of 2023, primarily due to the decreases of $476,238 in gross profit from consultant services, as a result of a significant reduction in billable hours and rates of our consultancy activities following a strong rebound in the last quarter of 2023.

37

Operating Expenses

The following table sets forth the breakdown of our total operating expenses for the three months ended March 31, 2024 and 2023:

|

| For the Three Months Ended March 31,

|

|

| 2024

|

| 2023

|

| Variance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amount

|

| %

|

| Amount

|

| % of

|

| Amount

|

| %

|

General and Administrative Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

Payroll and employee benefit

|

| $15,496

|

| 2.3%

|

| $15,358

|

| 3.7%

|

| $138

|

| 0.9%

|

Depreciation expenses

|

| 120

|

| 0.0%

|

| 1,136

|

| 0.3%

|

| (1,016)

|

| -89.4%

|

Office expenses

|

| 36,543

|

| 5.5%

|

| 11,690

|

| 2.8%

|

| 24,853

|

| 212.6%

|

Rental expenses

|

| 12,737

|

| 1.9%

|

| 10,241

|

| 2.5%

|

| 2,496

|

| 24.4%

|

Due and subscription

|

| 32,500

|

| 4.9%

|

| 34,250

|

| 8.2%

|

| (1,750)

|

| -5.1%

|

Taxes expenses

|

| 6,120

|

| 0.9%

|

| 114

|

| 0.0%

|

| 6,006

|

| 5268.4%

|

Professional fees

|

| 183,685

|

| 27.5%

|

| 54,065

|

| 13.0%

|

| 129,620

|

| 239.7%

|

Consultant fees

|

| 143,151

|

| 21.4%

|

| -

|

| -

|

| 143,151

|

| 100.0%

|

Travel and lodging

|

| 35,763

|

| 5.3%

|

| 328

|

| 0.1%

|

| 35,435

|

| 10803.4%

|

Management fees-related party (Note 9 (2))

|

| 203,000

|

| 30.3%

|

| 285,189

|

| 68.6%

|

| (82,189)

|

| -28.8%

|

Advisory fee-related party (Note 9 (3))

|

| -

|

| -

|

| 3,605

|

| 0.9%

|

| (3,605)

|

| -100.0%

|

Total operating expenses

|

| $669,115

|

| 100.0%

|

| $415,976

|

| 100.0%

|

| $253,139

|

| 60.9%

|

General and Administrative Expenses

Our general and administrative expenses primarily consist of professional fees, consultant fees, office expenses, payroll and employee benefits, rental expenses, travel and lodging, and management fees. The total general and administrative expenses for the three months ended March 31, 2024, amounted to $669,115, which represents a substantial increase of $253,139 or 60.9% compared to the $415,976 incurred in the same period in 2023.

The increase in general and administrative expenses can be attributed to several significant factors:

(i)Professional Fees: This category showed a substantial increase, as professional fees amounted to $183,685, which increased by $129,620 or 239.7% compared to the previous period. This rise indicates a greater utilization of professional services. The increase in professional fees is mainly attributed to counsel fees from the US, Hong Kong, and Malaysia. The significant increase in professional fees is chiefly related to our efforts to become publicly traded on a national exchange, involving extensive legal and financial advisory services.

(ii)Consultant Fees: The largest increase in costs came from consultant fees, as consultant fees amounted to $143,151, where there were none reported in the previous year. This rise indicates new engagement and increased utilization of external consulting services for going public.

(iii)Travel and Lodging: Travel and lodging expenses increased dramatically by $35,435 or 10,803.4%, due to intensified travel activities during the accounting period, as the Management traveled to the US to seek assistant for going public.

(iv)Office Expenses: There was a significant rise in office expenses, increasing by $24,853 or 212.6%, due to expanded operations, including the effort of going public.

(v)Offset by decrease in management fees-related party: There was a decrease in management fees-related party by $82,189 or 28.8%, as there was less need for business advice and administrative services from the related party for the three months ended March 31, 2024.

As a percentage of revenues, general and administrative expenses were 139.3% and 52.3% of our revenues for the three months ended March 31, 2024 and 2023, respectively

Other Income (Expenses), Net

Our other income (expenses) primarily consists of revision of overprovision of service tax of $156,082 from QSC, as more fully disclosed in Note 9 to the consolidated financial statements, interest income generated from bank deposits and gains and losses on foreign currency transactions. Net interest income increased by $25 during the three months ended March 31, 2024. Additionally, there were net losses of $165 and net gains of $2,035 the three months ended March 31, 2024 and 2023, respectively, in foreign currency transactions due to the fluctuations in foreign currency exchange rates.

38

Income Tax Expense

In the three months ended March 31, 2024, no income tax was accrued due to the net losses, compared to income tax expenses of $19,125 recorded in the corresponding period of 2023, following a notice from the local tax authority.

Net Income (Loss)

As a result of the foregoing, we reported a net loss of $308,226 for the three months ended March 31, 2024, representing a substantial decrease of $542,502, or 231.6%, compared to the net income of $234,276 reported for the same period in 2023.

Net Loss Attributable to Non-controlling Interest

As referenced in the discussion of our company structure, we have non-controlling interest in our equity, meaning the portion of the equity in the subsidiaries of the Company not attributable, directly or indirectly to the Company. Accordingly, we recorded non-controlling interest income attributable to the non-controlling interest. In the three months ended March 31, 2024, we recorded a net income attributable to the non-controlling interest of $7,700 and $461 in the three months ended March 31, 2023.

Net income (loss) attributable to QMIS TBS Capital Group Corp.

As a result of the foregoing, we reported a net loss attributable to QMIS TBS Capital Group Corp. of $315,926 for the three months ended March 31, 2024, representing a $549,741 or 235.1% decrease from a net profit of $233,815 for the three months ended March 31, 2023.

Liquidity and Capital Resources

As of March 31, 2024, we had $120,722 in cash as compared to $1,121,580 as of December 31, 2023. We also had $323,365 in project advance primarily for a digital platform and $95,724 in prepaid expenses as of March 31, 2024.

The Company incurred a loss of $308,226 and a profit of $234,276 for the three months ended March 31, 2024 and 2023, respectively. The Company also had working capital deficit of $2,208,812 and $2,095,110 as of March 31, 2024, and 2023, respectively. In addition, the Company had accumulated deficit of $4,358,938 and $4,043,012 as of March 31, 2024, and March 31, 2023, respectively. These factors among others raise substantial doubt about the ability to continue as a going concern for a reasonable period of time.

In order to continue as a going concern, the Company will need to secure additional capital resources. Management’s plan is to obtain such resources by obtaining capital from directors/shareholders sufficient to meet its minimal operating expenses and seeking third-party equity and/or debt financing. However, it should be noted that management cannot provide any assurance that the Company will be successful in accomplishing any of its plans. These financial statements do not include any adjustments related to the recoverability and classification of assets or the amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

The following table sets forth summary of our cash flows for the periods indicated:

|

| For the Three Months Ended

|

|

| March 31,

|

| March 31,

|

|

| 2024

|

| 2023

|

|

|

|

|

|

Net cash used by operating activities

|

| $(1,180,986)

|

| $249,877

|

Net cash provided (used) by investing activities

|

| -

|

| (1,245)

|

Net cash provided (used) by financing activities

|

| 190,017

|

| (3,144)

|

Effect on changes in foreign exchange rate

|

| (9,889)

|

| (3,440)

|

NET CHANGE IN CASH

|

| (1,000,858)

|

| 242,048

|

CASH BEGINNING OF YEAR

|

| 1,121,580

|

| 187,437

|

CASH END OF YEAR

|

| $120,722

|

| $429,485

|

39

Operating Activities

For the three months ended March 31, 2024, net cash used by operating activities was significant, totaling $1,180,986, primarily consisting of the following:

·Net loss of $308,226 for the three months ended March 31, 2024.

·A decrease of $450,001 in deferred revenue, as we received an upfront payment of $450,001 in December 2023, for services to-be provided in the first quarter 2024;

·An increase of $156,021 in project advance for the development of a software;

·A decrease of $175,344 in taxes payable, primarily due to the revision of overprovision of service tax payable from QSC.

Net cash provided by operating activities was $249,877 in the three months ended March 31, 2023, primarily consisting of the following:

·Net income of $234,276.

·Increase of $4,850 in accrued expenses, due to increase in professional expenses related to SEC filings.

·Increase of $4,786 in deferred revenue from a related party.

Investing Activities

There were no investing activities in the three months ended March 31, 2024. For the three months ended March 31, 2023, net cash used in investment activities was $1,245 for purchase of fixed assets.

Financing Activities

For the three months ended March 31, 2024, the financing activities of the company resulted in a net cash inflow of $190,017, primarily consisting of the following:

·Proceeds of $180,000 from sale of common stocks.

·Proceeds of $210,017 from loans from Related Parties.

Offset by a repayment of $200,000 to loans from related parties;

Contractual Obligations

Lease commitment

The Company has operating leases for corporate offices, employees’ accommodation, and office equipment. These leases have initial lease terms of 12 months to 5 years. The Company has elected not to recognize lease assets and liabilities for leases with an initial term of 12 months or less.

As of March 31, 2023, future minimum lease payments under the non-cancelable lease agreements are as follows:

|

| March 31,

|

|

| 2024

|

|

| (unaudited)

|

Lease payment in Year 2024

|

| 305

|

Less: imputed interest

|

| (5)

|

Total lease liabilities-current

|

| 300

|

40

PART II - OTHER INFORMATION

Item 1. Legal Proceedings.

From time to time, the Company may become involved in lawsuits and other legal proceedings that arise in the course of business. Litigation is subject to inherent uncertainties, and it is not possible to predict the outcome of litigation with total confidence. The Company is currently not aware of any legal proceedings or potential claims against it whose outcome would be likely, individually or in the aggregate, to have a material adverse effect on the Company’s business, financial condition, operating results, or cash flows.

Item 1A. Risk Factors.

As a “smaller reporting company,” we are not required to provide the information required by this Item.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

Sale of shares

On February 27, 2024, the Company entered into a stock subscription agreement with an individual investor pursuant to which the Company issued a total of 20,000 shares of common stock, $9.00 per share, for total consideration of $180,000.

The issuance and sale of the shares to the shareholder in the transaction listed above were made in reliance on the private offering exemption of Section 4(a)(2) of the Securities Act and the rules and regulations promulgated thereunder, based on the following factors: (i) the number of offerees or purchasers, as applicable; (ii) the absence of general solicitation; (iii) investment representations obtained from the investors; (iv) the provision of appropriate disclosure; and (v) the placement of restrictive legends on the certificates reflecting the securities.

Broad Capital

On July 12, 2022, the Company entered into a Going Public Consultant Agreement (the “Consulting Agreement”) with Broad Capital Assets Management Ltd. (“Broad Capital”), an unrelated third party and a company incorporated in the State of New York, pursuant to which the Company agreed to issue a total of 12% of its issued and outstanding common stocks, as well as up to 8,160,000 additional shares (the “Future Allocation Shares”) of its common stock to Broad Capital or its assignees for services to be provided in connection with a transaction relating to QMIS Finance Securities Corp. (“QMIS Finance”), an entity of which Dr. Chin is also a director and majority shareholder.

Pursuant to the Consulting Agreement, the Company had agreed to issue a total of 36,360,012 shares of the Company’s common stock to Broad Capital’s assignees, which shares were eventually issued in November 2023, and which were allocated between two entities which are Broad Capital’s assignees as follows: 14,544,005 shares to Hong Kong Kazi International Group Co. Limited (“Kazi”), and 21,816,007 shares to Hong Kong Hanxin Holdings Limited (“Hanxin”).

Subsequently, following discussions and negotiations, the Company and Broad Capital have acknowledged and agreed that the services stipulated under the Consulting Agreement had not been provided to the satisfaction of the Company as of the date the shares were issued to Kazi and Hanxin. As such, after friendly and constructive discussions, the Company and Broad Capital, along with Kazi and Hanxin, mutually agreed to terminate the Consulting Agreement and the related issuance of shares due to the unsatisfactory provision of the agreed services.

On January 5, 2024, Hong Kong Kazi International Group Co. Limited agreed to cancel the 14,544,005 shares issued to it, and Hong Kong Hanxin Holdings limited agreed to cancel the 21,816,007 shares issued to it. On February 6, 2024, the Company cancelled the 36,360,012 shares issued to Kazi and Hanxin.