|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the fiscal year ended |

|

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| for the transition period from _______ to __________ |

Commission file number:

(Exact name of registrant as specified in its charter) |

| ||

(State or Other Jurisdiction of Incorporation or Organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

|

| |

| ||

| (Zip Code) |

__________________________________________________________________

(Former name, former address and former fiscal year, if changed since last report)

Securities Registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

None |

| None |

| None |

Securities Registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

⌧ | Smaller reporting company | ||

|

| Emerging Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

As of June 30, 2023, because the Company’s common stock did not trade in the public markets, the aggregate market value of the voting and non-voting common equity held by non-affiliates, computed based on the average bid and asked price of the common stock, was $

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: As of April 3, 2024, the issuer had

DOCUMENTS INCORPORATED BY REFERENCE

None.

|

|

QMIS TBS CAPITAL GROUP CORP.

FISCAL YEAR ENDED DECEMBER 31, 2022

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

PART I |

| Page |

|

|

|

ITEM 1. | 3 | |

|

|

|

ITEM 1A. | 37 | |

|

|

|

ITEM 1B. | 37 | |

|

|

|

ITEM 2. | 38 | |

|

|

|

ITEM 3. | 38 | |

|

|

|

ITEM 4. | 38 | |

|

|

|

PART II |

|

|

|

|

|

ITEM 5. | 38 | |

|

|

|

ITEM 6. | 41 | |

|

|

|

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 41 |

|

|

|

ITEM 7A. | 58 | |

|

|

|

ITEM 8. | 58 | |

|

|

|

ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 59 |

|

|

|

ITEM 9A. | 59 | |

|

|

|

ITEM 9B. | 60 | |

|

|

|

ITEM 9C. | DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | 60 |

|

|

|

PART III |

|

|

|

|

|

ITEM 10. | 61 | |

|

|

|

ITEM 11. | 64 | |

|

|

|

ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 65 |

|

|

|

ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 65 |

|

|

|

ITEM 14. | 69 | |

|

|

|

PART IV |

|

|

|

|

|

ITEM 15. | 70 | |

|

|

|

74 | ||

PART I

Special Note Regarding Forward-Looking Statements

This Annual Report contains forward-looking statements, including, without limitation, in the sections captioned “Management’s Discussion and Analysis of Financial Condition and Plan of Operations,” and “Business.” Known and unknown risks, uncertainties and other factors may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include statements relating to:

●Our goals and strategies;

●Our future business development, financial conditions and results of operations;

●Our expectations regarding demand for and market acceptance of our products and services;

●Our ability to attract and retain management;

●Our ability to raise capital when needed and on acceptable terms and conditions;

●The intensity of competition;

●General economic conditions;

●Changes in regulations;

●Relevant government policies and regulations relating to our industry;

●Whether the market for healthcare services continues to grow, and, if it does, the pace at which it may grow;

●Our ability to compete against large competitors in a rapidly changing market; and

●Our ability to comply with the continued listing standards on the exchange or trading market on which our common stock is listed for trading; and

●The impact of COVID-19 on business environment and consumer preference.

These forward-looking statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may later be found to be incorrect. Our actual results could be materially different from our expectations. Important risks and factors that could cause our actual results to be materially different from our expectations are generally set forth in “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business,” and other sections in this Report. You should thoroughly read this Report and the documents that we refer to with the understanding that our actual future results may be materially different from and worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements.

This Report contains certain data and information that we obtained from private publications. Statistical data in these publications also include projections based on a number of assumptions. Our industry may not grow at the rate projected by market data, or at all. Failure of this market to grow at the projected rate may have a material and adverse effect on our business and the market price of our common stock. In addition, the rapidly changing nature of the health and wellness industry results in significant uncertainties for any projections or estimates relating to the growth prospects or future condition of our market. Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

The forward-looking statements made in this Report relate only to events or information as of the date on which the statements are made in this Report. Except as required by law, we expressly disclaim any obligation or intention to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this Report and the documents that we refer to in this Report and have filed as exhibits to this Report completely and with the understanding that our actual future results may be materially different from what we expect.

1

We file reports with the Securities and Exchange Commission ("SEC"). You can read and copy any materials we file with the SEC at the SEC's Public Reference Room, 100 F. Street, NE, Washington, D.C. 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

We disclaim any obligation or intention to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this Annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

2

ITEM 1. BUSINESS.

Organization and Business Overview

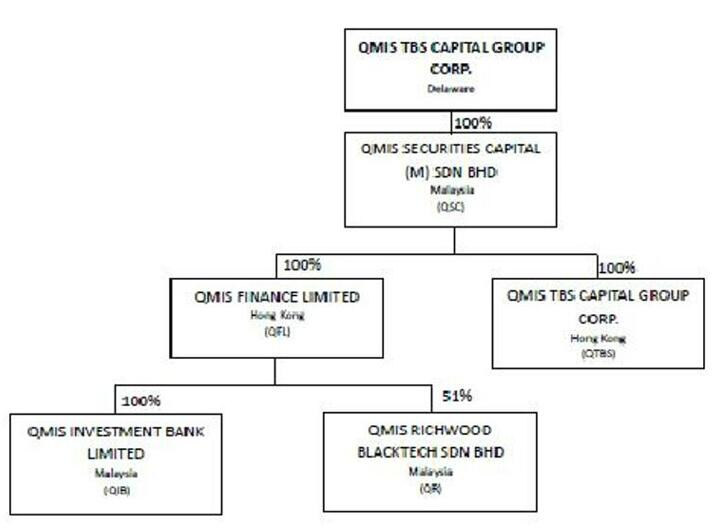

QMIS TBS Capital Group Corp., a Delaware corporation (“we,” “our,” “us,” “the Company,” or "QMIS USA"), was incorporated on November 21, 2019, under the name TBS Capital Management Group Corp. As a holding company with no material operations of its own, the Company conducts its operations primarily through its wholly owned subsidiaries in Hong Kong and Malaysia.

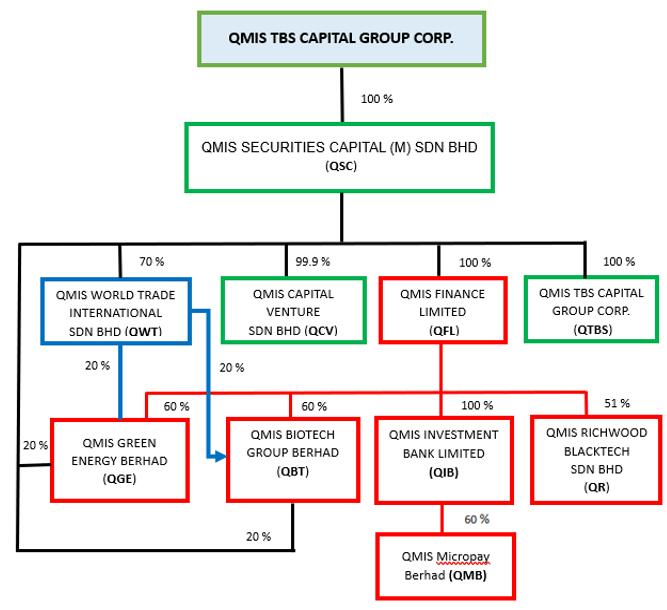

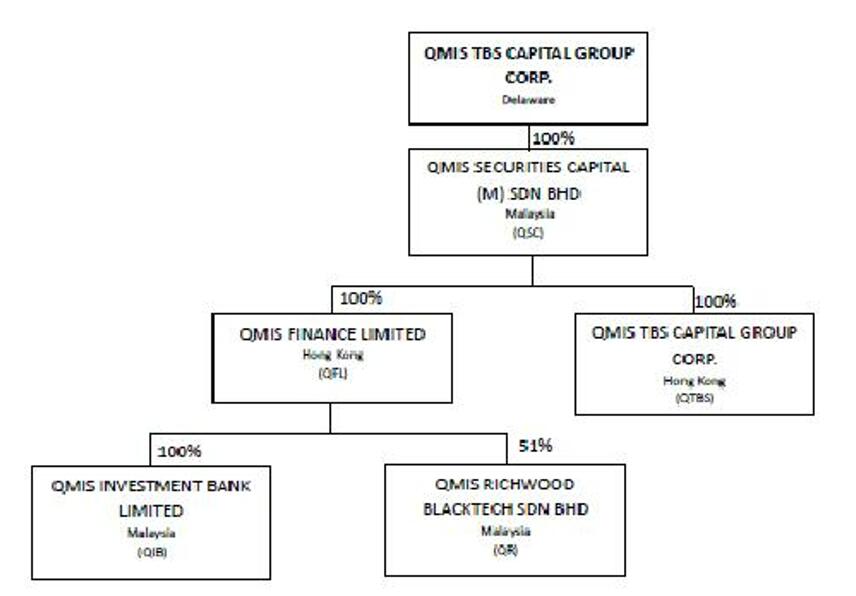

The Company is an investment holding company which is involved, through its operating subsidiaries, in independent advisory, software development, and e-wallet services. We have a diversified corporate structure through our direct and indirect subsidiaries including QMIS Securities Capital (M) Sdn. Bhd. (“QSC”), QMIS TBS Capital Group Corp. (HK) (“QTBS”), QMIS Finance Limited (“QFL”), QMIS Investment Bank Limited (“QIB”) and QMIS Richwood Blacktech Sdn. Bhd. (“QR”), QMIS Capital Venture Sdn Bhd (“QCV”), QMIS World Trade International Sdn. Bhd. (“QWT”), QMIS Biotech Group Berhad (“QBT”), and QMIS Green Energy Berhad (“QGE”). As of the date of this Annual Report, QFL, QTBS, and QSC were working together to provide consultant services, and QR was engaged in the business of software development and e-wallet services. The establishment of QIB investment banking infrastructure is currently underway, and this significant development is expected to lay the foundation for the realization of our ambitious plans, fortifying our position in the financial services landscape.

For the years ended December 31, 2023 and 2022, our total revenue amounted to approximately U.S. $2,487,531, and approximately U.S. $1,261,771, respectively. We derive our revenue mainly from our corporate consultancy services in Hong Kong. Our financial results are significantly dependent on a single customer, Hew & Associates. For the year ended December 31, 2023, this customer accounted for 96% of our total revenues, while for the same period in 2022, the customer contributed 92%.

In 2023, following the acquisition of QSC and its subsidiaries, we commenced our corporate advisory services which includes incubating fintech and high growth companies in Malaysia and Hong Kong. In January 2023, the Company entered into negotiations to acquire QSC. On February 13, 2023, the Company closed a share exchange (the “Share Exchange”) pursuant to which the shareholders of QSC sold all of their capital stock in QSC to the Company in exchange for an aggregate of 1,000,100 shares of the Company’s common stock, $0.001 par value per share. As a result, QSC and each of QSC’s subsidiaries became wholly owned subsidiaries of the Company.

The following diagram illustrates our current corporate structure and existing shareholders of each corporate entity listed herein as of the date of this Annual Report:

3

Corporate History and Structure

The Company was incorporated on November 21, 2019, under the name TBS Capital Management Group Corp. As a holding company with no material operations of its own, the Company primarily conducts its operations through wholly owned subsidiaries in Hong Kong and Malaysia.

On February 13, 2023, the Company entered into a Share Exchange Agreement (the “Exchange Agreement”) with the shareholders of QSC. Pursuant to this agreement, the shareholders of QSC sold all of their capital stock in QSC to the Company in exchange for an aggregate of 1,000,100 shares of the Company’s common stock, with a par value of $0.001 per share (the “Share Exchange”). Following the closing of the Share Exchange, Dr. Yung Kong Chin owned approximately 52.72% of the Company’s outstanding common stock.

Pursuant to the Share Exchange Agreements, the Company now owns 100% of QSC, which in turn owns 100% of QTBS, 100% of QFL, 99.9% of QCV, QWT, 20% of QBT, and 20% of QMIS Waste Management Group Berhad (“QWM”).

QMIS Securities Capital (M) Sdn. Bhd. (“QSC”). initially incorporated as Multi Securities Capital (M) Sdn. Bhd in Malaysia on January 13, 2015, and later renamed to QMIS Securities Capital (M) Sdn. Bhd. on March 19, 2015, is involved in providing corporate advisory services, including nurturing FinTech and high-growth companies. Due to a Share Exchange and QMIS's expansion plans into new markets, QSC decided to restructure its legal organization. This led to QSC acquiring full ownership of QMIS TBS (HK) and QMIS Finance Limited on December 31, 2021. Consequently, QFL and QTBS became wholly owned subsidiaries of QSC. As of the date of this Annual Report, QSC serves as the operational entity for the company's activities in Malaysia. QSC's ownership percentages in various entities are as follows:

a.QMIS TBS Capital Group Corp. (“QTBS”) -QTBS is a limited liability company incorporated and domiciled in Hong Kong. QTBS primarily engages in offering corporate advisory services, which encompasses the nurturing of high-tech and rapidly expanding enterprises. As of December 31, 2022, QTBS did not have any subsidiaries or associated companies under its umbrella.

b.QMIS Finance Limited (“QFL”) -QFL is an investment holding company incorporated in Hong Kong and has the following subsidiaries: (1) QMIS Investment Bank Limited (“QIB”) (wholly owned); and (2) QMIS-Richwood Blacktech Sdn Bhd (“QR”) (majority owned).

c.QMIS Capital Venture Sdn Bhd (“QCV”). QCV was incorporated in Malaysia on January 14, 2015, under the name of Diversified Multi Capital Venture (M) Sdn. Bhd, which was subsequently changed to its present name on March 19, 2015. On November 16, 2015, QSC acquired 99.9% equity ownership interest of QCV. As of the date of this Annual Report, QCV does not possess any subsidiary or affiliated companies. Additionally, QCV has not initiated its business operations since its incorporation.

d.QMIS World Trade International Sdn. Bhd. (“QWT”). QWT was incorporated in Malaysia on October 15, 2014, under the name of Santubong Business Trading Sdn. Bhd., which was subsequently changed to its present name on August 7, 2015. On October 15, 2015, QSC acquired 69.99% equity ownership interest of QWT, and subsequently on November 27, 2015, QSC acquired anther 0.01% equity ownership interest in QWT, for a total of 70.00% ownership by QSC. As of the date of this Annual Report, QWT does not possess any subsidiary or affiliated companies. Additionally, QWT has not initiated its business operations since its incorporation.

e.QMIS Biotech Group Berhad (“QBT”). QBT was incorporated in Malaysia on May 8, 2020 under name QMIS Biotechs Group Berhad, which was subsequently changed to its current name on May 29, 2020. On May 8, 2020, QFL, QSC, and QWT acquired 60%, 20%, and 20%, respectively, equity ownership interest in QBT. As of the date of this Annual Report, QBT does not possess any subsidiary or affiliated companies. Additionally, QBT has not initiated its business operations since its incorporation.

4

f.QMIS Green Energy Berhad (“QGE”). QGE was incorporated in Malaysia on May 27, 2020, under the name QMIS Waste Management Group Berhad, which was subsequently changed to QMIS Green Energy Berhad on September 13, 2022. On May 27, 2020, QFL, QSC, and QWT acquired 60%, 20%, and 20%, respectively, equity ownership interest in QGE. As of the date of this Annual Report, QGE does not possess any subsidiary or affiliated companies. Additionally, QQGE has not initiated its business operations since its incorporation.

QMIS TBS Capital Group Corporation Limited, Hong Kong (“QTBS”).

Business Overview

QTBS primarily focuses on small to middle-market companies in China, Malaysia, and Southeast Asia. QTBS boasts an extensive network of international, national, and local consultants, business advisors, and directors. In addition to offering support for Hong Kong-licensed stock brokerage and asset management services, QTBS can leverage its substantial pool of business contacts to assist clients with business incubation services. These services include raising capital, private equity, conducting due diligence, performing business valuation, facilitating mergers and acquisitions, offering accounting services, and providing market research services.

QTBS provides a wide range of corporate advisory services to its clients, including:

Management and Strategy Consulting

oStrategy & Research Strategic & Business Partnership

oBusiness & Strategic Planning

oMarket Entry & Feasibility Studies

oMarketing Strategy

oNew Product Development

oTransformation

-Operations

oOperation Consulting

oProject Management

oStrategic Sourcing & Supply Chain Management

Corporate Advisory

-Transactions

oCorporate and Capital Structuring

oMergers and Acquisitions

oDivestments and Fund Raising

-Evaluation & Corporate Advisory

oInvestment Due Diligence and Review

oPrivatization and Public-Private Partnership

oValuation Consulting

oEntrepreneur Coaching and Executive Training

QTBS operates a diverse range of businesses spanning various alternative asset classes and investment strategies on a global scale. This diversification offers QTBS significant benefits, including the ability to capitalize on synergies between these businesses and leverage the extensive intellectual resources within the company. Driven by the potential to utilize its financial and intellectual assets, resulting in strong investment returns, attractive net income margins, and substantial cash flow, QTBS has expanded its investments into complementary sectors including the establishment of a Family Business Office by QTBS in Hong Kong. This office targets a discerning clientele hailing from mainland China, Hong Kong, and Macao. It is a strategic move that capitalizes on the growing demand for specialized family office services in the region. The Family Business Office's focus on serving clients from mainland China, Hong Kong, and Macao. QTBS’s management believes that its ability to identify and effectively enter new growth areas is a crucial competitive edge, and QTBS will continue to seek new opportunities to expand its asset management franchise and advisory business.

5

The expansion of the QMIS TBS group is strengthened by the synergies among its diverse businesses, creating a comprehensive ecosystem that boosts overall performance. The Family Business Office benefits from this synergy by tapping into the expertise and resources of other group entities, such as financial insights and investment expertise, leading to significant growth potential. Positioned strategically in Hong Kong, the office is well-placed to meet the increasing demand for family office services in the region, catering to high-net-worth families and businesses with tailored services.

QTBS actively nurtures relationships with major investment banking firms and other financial intermediaries. QTBS’s management believes that its strong network of relationships with these firms provides QTBS with a significant advantage in identifying transactions, securing investment opportunities, and generating exceptional returns. This advantage includes access to a substantial number of exclusive investment opportunities that are available to only a limited number of other private equity firms.

Business Incubator Model

QTBS collaborates with clients across a wide spectrum of industries on projects that yield substantial value, encompassing fundraising, deal structuring, market research, and strategy development. QTBS distinguishes itself as a boutique firm not only in size but also in the caliber of service it delivers to its clients. This translates to profound, hands-on engagement by QTBS’s senior management in each project, complemented by closely-knit teams of proficient consultants and analysts. Consequently, QTBS ensures that its clients fully benefit from the collective expertise and skills within the organization.

Services Provided During the Incubation Program

In addition to providing financial capital, QTBS offers extensive guidance and advice to its clients through its investment and incubation program. This program encompasses all the key elements and tools necessary for successfully incubating a company.

Investee companies and clients participating in QTBS’s investment and incubation program receive advice and assistance in critical areas such as strategic guidance, strengthening the management team, staff recruitment, product commercialization, sales and marketing strategy, establishing business alliances and partnerships, as well as corporate strategy. These efforts accelerate the growth of the investee companies.

6

(a)Strategic Guidance

QTBS assesses the business model, competitive edge, and management team of the investee companies, as well as the current market opportunities for the products and services they offer. This assessment aids in formulating a business strategy, creating an implementation plan for the investee company, and establishing key milestones for its future development. Some of the key guidance that QTBS provides includes:

·Charting the vision and mission of the investee companies.

·Formulating product rollout plans and establishing key milestones to ensure the investee companies are on track for product development and future growth.

·Further enhance the business development plan of the investee companies based on the revised business strategy.

(b)Product Commercialization

QTBS assists investee companies in commercializing their products and services, either leveraging its own experience or consulting with business partners. This optimization aims to unlock the full potential of their products and services. QTBS provides advice on addressing business demands, exploring additional commercial application possibilities, and improving cost efficiency. Key areas where QTBS adds value for its investee companies include:

·Realigning and repositioning the products and services to address the demands of the target customers of the investee companies.

·Exploring other potential applications of the products and services of the investee companies.

·Enhancing manufacturing or production cost efficiency through strategies such as relocating to more cost-effective locations, outsourcing non-core processes, and hiring cost-effective foreign human resources.

·Reducing the expenses for the products and services commercialization through government incentives and grants (e.g., MSC Malaysia status and MGS grants to small and medium business enterprise).

(c)Sales and Marketing

Once the investee companies are prepared to launch their products and services, QTBS assists in formulating sales and marketing strategies to penetrate the target market, sustain newly acquired market share, and expand into other regional markets. In addition, QTBS generates business leads to facilitate the introduction of new products and services. QTBS's assistance in sales and marketing includes:

·Formulating sales and marketing strategies targeting potential customers identified by the investee companies.

·Advising on branding strategies to resonate with the target customer group.

·Enhancing the investee companies' visibility and positioning within their respective fields through media engagement, event participation, and pursuit of enterprise performance awards.

·Providing investee companies with business leads through QTBS’s extensive business networks and partnerships.

·Assisting in improving sales by enabling cross selling of products and services within the customer base of other QTBS investee companies.

7

(d)Management Team Strengthening and Staff Recruitment

Recognizing the pivotal role of the management team in the success of an investee company, QTBS collaborates closely to identify key positions lacking within the team. QTBS supports the sourcing, selection, and recruitment of management personnel to enhance team capabilities and functionality.

Furthermore, QTBS assists investee companies in staff recruitment, turnover management, and staff welfare administration, fostering a competent workforce that can effectively contribute to the investee companies' objectives.

(e)Business Alliances and Partnership Establishments

QTBS will introduce the investee company to prospective business partners and strategic alliances in order to further expand the marketing network of the investee company, enhancing its chances of securing projects for its products and services.

In addition, QTBS will also allow the investee company to cross sell its products and services to customers of other investee companies of QFL. QTBS will also introduce potential business leads directly to the investee companies as and when opportunities arise.

(f)Corporate Strategies

QTBS will work closely with the investee company on corporate strategies. This may include accelerating the growth of the investee companies through mergers and acquisitions. QTBS will advise the investee company on merger and acquisition issues such as the valuation and structure of the acquisition, should QTBS find that the acquisition would create synergy to the investee company’s existing business.

In addition, QTBS will also assist the investee companies in raising additional funds for the business expansion from potential investors. QTBS will assist the investee company to negotiate with the potential investors and to arrive at a fair valuation of the investee company as well as structure the terms and conditions of a proposed fund-raising transaction for potential investors.

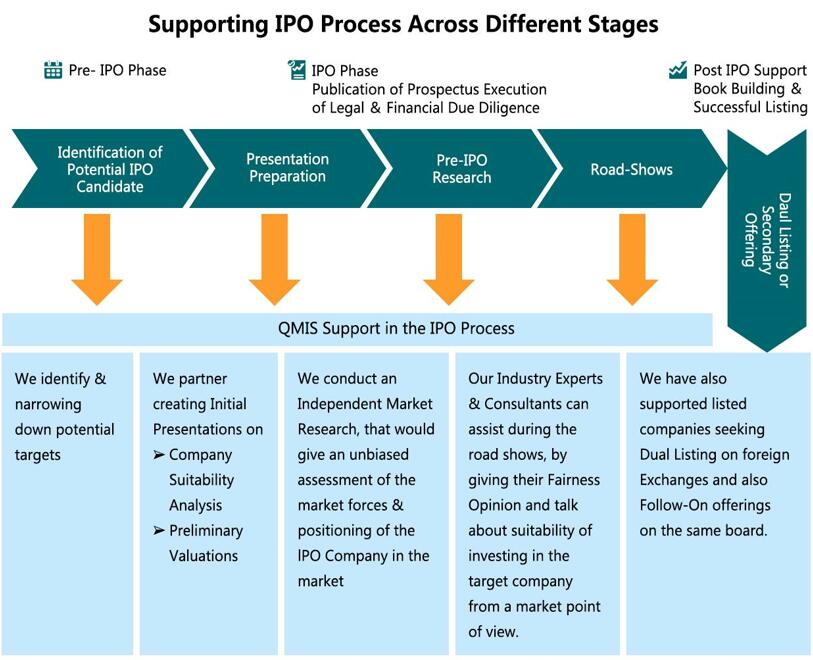

When the investee companies are ready to go for an initial public offering, QTBS will assist the investee companies in the process of selecting an Advisor for the initial public offering exercise of the investee company. QTBS will ensure that the valuation of the investee company is fairly reflected and the proceeds raised from initial public offering exercise are sufficient to meet the investee company’s future needs.

QMIS INVESTMENT BANK LIMITED (“QIB”)

On June 22, 2020, QMIS Investment Bank Limited (LL16863) ("QIB") was established under the Labuan Financial Services Authority Labuan Companies Act 1990 (Subsection 22(2)/Section 130R) and registered with the Labuan Financial Services Authority (Labuan FSA), formerly known as Labuan Offshore Financial Services Authority (LOFSA).

On March 5, 2021, QIB was granted an Investment Bank license by the Labuan Financial Services Authority (LFSA) to engage in Investment Banking Business in Labuan under Section 86 of The Labuan Financial Service and Securities Act 2010 (LFSSA), pursuant to Section 92(1) of the LFSSA. Subsequently, the name was changed to QMIS Labuan Investment Bank Limited on March 24, 2021, and later to QMIS Investment Bank Limited on July 28, 2022.

As of the date of this Registration Statement, QIB has not yet commenced business operations. The establishment of its investment banking infrastructure is currently in progress, and when completed, management anticipates that the infrastructure will a significant milestone that is expected to serve as the cornerstone for the realization of our ambitious plans, thereby strengthening our position in the financial services sector.

Looking forward, QIB is poised to embark on a strategic journey of diversification, intending to enter Equities Capital Markets, Corporate Finance and Advisory Services, Private Placement, transaction banking, private banking, and digital banking. QIB is actively exploring opportunities to leverage cutting-edge technology, adopt innovative business models in FinTech, and venture into the realm of a digital banking model. These aspirations are contingent upon securing adequate financial resources and will be implemented in a phased manner, reflecting a deliberate and strategic approach. The term 'digital banking' broadly encompasses financial services utilizing digital technologies to improve customer experiences, streamline operations, and offer innovative financial solutions. In the context of QIB,

8

digital banking primarily refers to online banking services, including electronic and internet-based financial activities like account management and fund transfers. QIB extends its digital banking services to Labuan, enabling customers in this jurisdiction to manage financial activities online in compliance with local regulations.

For clarification QIB currently does not offer, nor does it have any plans to offer, cryptocurrency or crypto asset investments or services. After careful consideration of the risks and challenges associated with the crypto asset market, including the potential for fraud, manipulation, and non-compliance with relevant laws and regulations, the company has decided to withdraw from this business segment. QIB's management believes that offering crypto asset investments or services poses risks that are not in the best interests of clients or the company. Due to the highly volatile nature of the crypto asset market and the potential for significant losses, QIB will not provide any investment advice, recommendations, or services related to cryptocurrencies or crypto assets.

Investment Bank Infrastructure

Investment bank infrastructure encompasses the foundational technology and systems supporting QIB's operations. This includes the hardware, software, and network infrastructure enabling the bank to deliver its financial services efficiently and securely. Key components of QIB's investment bank infrastructure shall include:

1. Investment Analysis Tools or Software:

Programs facilitating comprehensive analysis and evaluation of extensive financial data, empowering investors and financial analysts to make well-informed investment decisions. These tools offer features for data analysis and visualization, trend and pattern charting, various analytical functions, and predictive modeling for future market movements.

2. Fund Management Software:

Utilized to oversee the operations of investment funds, managing fund performance, portfolio operations, risk assessments through complex calculations, and delivering reports to investors.

3. SWIFT Code System:

The secure transmission of financial messages and instructions, essential for international transactions, facilitated through the use of SWIFT codes to identify banks and financial institutions.

4. Disaster Recovery Systems:

Comprehensive systems ensuring operational continuity in the face of disasters or system failures. This encompasses backup systems, redundant infrastructure, and business continuity plans, including secure off-site data storage in cloud storage or data centers.

5. Security Systems / Network Infrastructure:

Robust security systems protecting against cyber threats and safeguarding the confidentiality and integrity of client data. This includes firewalls, intrusion detection systems, and encryption technologies, all reliant on high-speed network infrastructure connecting offices and data centers through routers, switches, and fiber optic cables.

6. Product Launching Preparation:

Utilization of product launching roadshows for introducing new financial products, such as private equity funds. This involves preparing product information memorandums ('IM'), submitting product IM to regulatory authorities, and managing product distribution to clients.

QIB has implemented a comprehensive internal policy and manual to manage cyber risks. This internal framework provides additional guidelines and procedures specific to QIB's operations, ensuring a tailored approach to cybersecurity. The internal policy aligns with the overarching principles outlined in this document and reflects QIB's commitment to maintaining a robust cybersecurity posture.

9

This cybersecurity risk management policy outlines the mandatory requirements for QIB, including Marketing Offices, to manage cyber risks effectively. It covers the purpose, scope, and reporting obligations, emphasizing the protection of QIB's valuable information and systems. The policy sets risk limits, outlines prevention, detection, and recovery strategies, and details emergency procedures for cyber threats. It includes requirements for outsourcing, communication procedures, compliance reporting, and an annual attestation.

Responsibilities are defined for the Board, Board Audit Committee, Responsible Person, IT, Business Units, Individual Users, Risk Management/Compliance, Business Continuity Management, and Internal Audit. This multi-layered approach ensures that every stakeholder within QIB is actively involved in and accountable for maintaining the integrity and security of the institution's information and systems.

10

Investment Banking - Products and Services

Capital Markets

QIB’s Capital Markets segment will focus on Equities, Fixed Income (including futures, foreign exchange and commodities activities) and Investment Banking. QIB primarily will serve institutional investors, corporations and government entities.

Equities

Equities Research, Sales and Trading

QIB plans to offer its clients full-service equities research, sales, and trading capabilities across global securities markets. QIB plans to earn commissions or spread revenue by executing, settling, and clearing transactions for clients in various equity and equity-related products, including common stock, American depository receipts, global depository receipts, exchange-traded funds, exchange-traded and over-the-counter ("OTC") equity, convertible and other equity-linked products, and closed-end funds. QIB will be able to act as an agent or principal (including as a market-maker) when executing client transactions through both traditional "high-touch" and electronic "low-touch" channels. To facilitate client transactions, QIB may act as a principal to provide liquidity, which involves committing its capital and maintaining dealer inventory.

QIB's equity research, sales, and trading efforts will be organized across three geographical regions: the Americas; Asia Pacific; and Southeast Asia. The main product lines within these regions include cash equities, electronic trading, derivatives, and convertibles. QIB primarily plans to serve institutional market participants such as mutual funds, hedge funds, investment advisors, pension and profit-sharing plans, and insurance companies. Through its global research team and sales force, QIB plans to maintain relationships with clients; distribute investment research and strategy trading ideas, and market information; and analyze across a wide range of industries. QIB's equity research is anticipated to cover over 1,800 companies worldwide, and it plans to collaborate with leading local firms in the Asia Pacific, covering up to approximately 600 additional companies through alliances.

11

Equity Finance

QIB's Equity Finance business will offer a range of services, including financing, securities lending, and other prime brokerage services. In the U.S., QIB shall provide prime brokerage services to hedge funds, money managers, and registered investment advisors. These services will encompass execution, financing, clearing, reporting, and administrative support. QIB plans to generate revenue through an interest spread, which will be the difference between the cost of funds it pays and the income it receives from its clients.

Additionally, QIB will operate a matched book in equity and corporate bond securities. In this operation, QIB plans to borrow and lend securities against cash or liquid collateral, earning a net interest spread. Customer assets, both securities and funds, held by QIB will adhere to regulatory customer protection rules and will be segregated accordingly.

QIB also plans to offer select prime brokerage clients the option to custody their assets at an unaffiliated U.S. broker-dealer, which likely will be a subsidiary of a bank holding company. Under this arrangement, QIB shall provide its clients with all customary prime brokerage services directly.

Wealth Management

QIB plans to offer customized wealth management services specifically designed to meet the unique needs of high-net-worth individuals, their families, businesses, private equity and venture funds, as well as small institutions. QIB's dedicated advisors will provide clients with access to all of the institution's institutional execution capabilities and a wide range of additional financial services.

Management anticipates that QIB's open architecture platform will allow clients to access products and services not only from QIB's own offerings but also from a diverse array of other major financial services institutions. This approach will offer clients a broad spectrum of choices to effectively manage and grow their wealth.

Fixed Income Sales and Trading

QIB plans to offer its clients sales and trading services for a wide range of fixed income products, including investment-grade and high-yield corporate bonds, U.S. and European government and agency securities, municipal bonds, mortgage- and asset-backed securities, whole loans, leveraged loans, distressed securities, emerging markets debt, and derivative products.

Additionally, through the use of repurchase agreements, QIB plans to act as an intermediary between borrowers and lenders of short-term funds, facilitating funding for various inventory positions. QIB will actively trade and make markets globally in both cleared and un-cleared swaps and forwards, referencing various factors such as interest rates, investment-grade and non-investment-grade corporate credits, credit indexes, and asset-backed security indexes.

Furthermore, management anticipates that QIB's strategists and economists will provide ongoing commentary and analysis of the global fixed income markets. QIB's fixed income research professionals, including research and desk analysts, will offer investment ideas and analysis across a diverse range of fixed income products, enhancing the value it provides to its clients.

Futures, Foreign Exchange and Commodities

QIB shall provide its clients 24-hour global coverage, with direct access to major commodity and financial futures exchanges including the CME, CBOT, NYMEX, ICE, NYSE Euronext, LME and Eurex, and provides 24-hour global coverage, execution, clearing and market making in futures, options and derivatives on industrial metals including aluminum, copper, nickel, zinc, tin and lead. Products provided to clients include LME and CME futures and over-the-counter metals swaps and options.

QIB plans to operate a full-service trading desk in all precious metals, cash, futures and exchange-for-physicals markets, and to be a market maker providing execution and clearing services as well as market analysis. QIB also plans to provide prime brokerage services and to be a market-maker in foreign exchange spot, forward, swap and option contracts across major currencies and emerging markets globally and conduct these activities through QIB’s futures commission merchant and its swap dealer each registered with the CFTC.

12

Investment Banking

QIB shall provide its clients around the world with a full range of equity capital markets, debt capital markets and financial advisory services. QIB’s services will be enhanced by its industry sector expertise, its global distribution capabilities, and its senior level commitment to its clients.

Management anticipates that QIB’s sector coverage groups will include Consumer & Retailing; Financial Institutions; Skin Care and Cosmetic Industrials; Healthcare; Bio-Technology; Solar Energy; Internet of Think; Applied Data Science; Waste Management; Green-Tech Properties; Media & Telecommunications; Financial Sponsors and State & Local Governments.

QIB’s product coverage groups will include equity capital markets; debt capital markets; financial advisory, which includes both mergers and acquisitions and restructuring and recapitalization and U.S. corporate brokering. QIB’s geographic coverage groups will include coverage teams based in major cities in the United States, the United Kingdom, Sweden, China, Malaysia, Singapore and Cambodia.

Equity Capital Markets

QIB shall provide a broad range of equity financing capabilities to companies and financial sponsors. These capabilities include private equity placements, initial public offerings, follow-on offerings, block trades and equity-linked convertible securities.

Debt Capital Markets

QIB shall provide a wide range of debt financing capabilities for companies, financial sponsors and government entities. QIB plans to focus on structuring, underwriting and distributing public and private debt, including investment grade and non-investment grade corporate debt, leveraged loans, mortgage and other asset-backed securities, and liability management solutions.

Advisory Services

QIB shall provide mergers and acquisition and restructuring and recapitalization services to companies, financial sponsors and government entities. In the mergers and acquisition area, QIB plans to advise sellers and buyers on corporate sales and divestitures, acquisitions, mergers, tender offers, spinoffs, joint ventures, strategic alliances and takeover and proxy fight defense. QIB also plans to provide a broad range of acquisition financing capabilities to assist our clients. In the restructuring and recapitalization area, QIB shall provide to companies, bondholders and lenders a full range of restructuring advisory capabilities as well as expertise in the structuring, valuation and placement of securities issued in recapitalizations.

Asset Management

QIB shall provide investment management services to pension funds, insurance companies and other institutional investors. QIB’s primary asset management programs will be strategic investment and focus on high growth sectors. The anticipated expertise of Asset Management team is widely recognized, with proven track records, with a focus on identifying market trends and fulfilling unique investor needs.

QIB’s strategic investment programs, including our Artificial Intelligence Trading Software, will be provided through the FinTech Investments Division of Investment Advisers, which is registered as an investment adviser with the U.S. Securities and Exchange Commission (“SEC”). These programs are systematic, multi-strategy, cross-border and multi-asset class programs with the objective of generating a steady stream of absolute returns irrespective of the direction of major market indices or phase of the economic cycle. These strategies are provided through both long-short equity private funds and separately managed accounts.

QMIS-RICHWOOD BLACKTECH SDN. BHD. (“QR”)

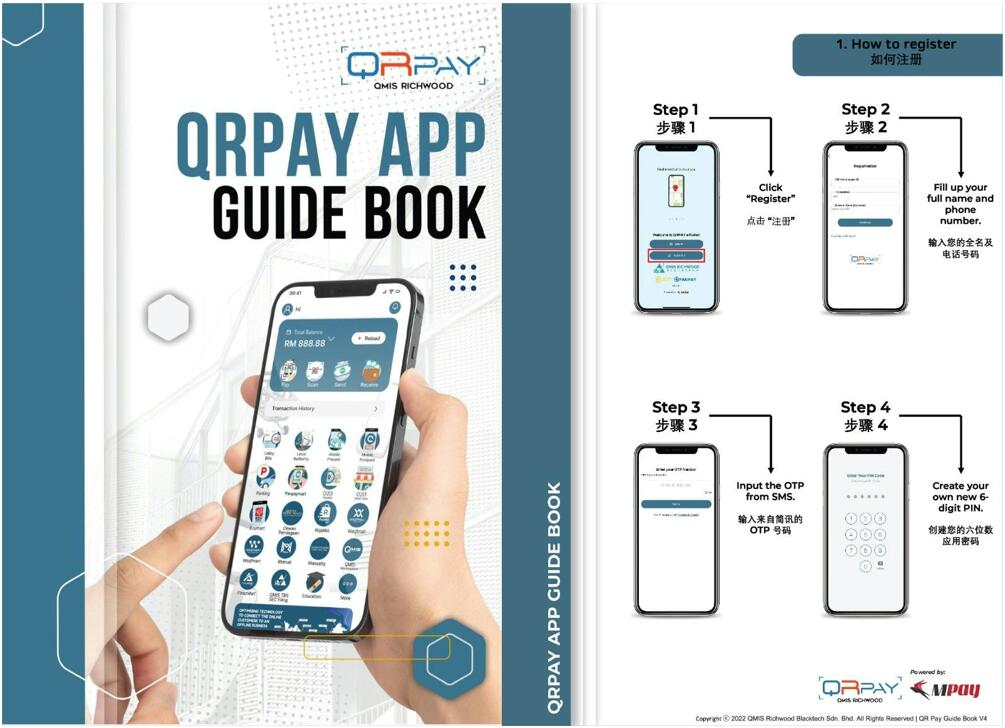

QMIS-Richwood Blacktech Sdn. Bhd. ("QR") is a recently established enterprise specializing in the Electronic Payment and Transaction Enabling business. The company's core offerings include a centralized platform facilitating various payment transactions for service providers, along with software development and maintenance services.

13

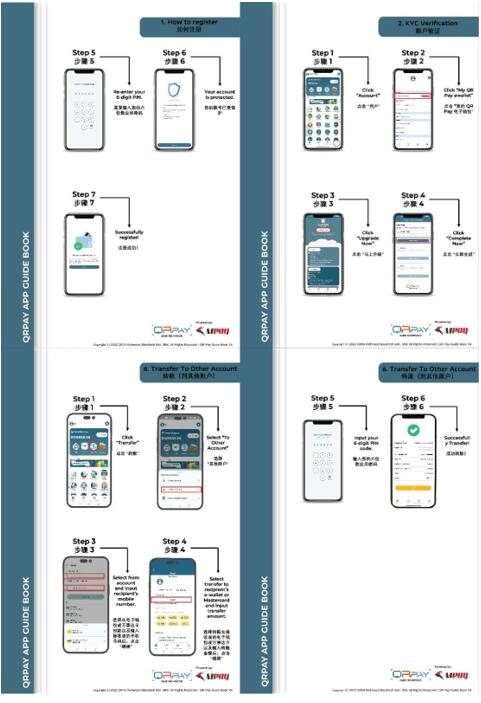

QR has successfully developed and currently owns the e-wallet app known commercially as QMIS Richwood Pay (QRPay). This application is accessible on:

-Google Play Store for Android phones running Android 7.0 and above.

-Apple App Store for iPhones running iOS 10.0 and above.

-Huawei AppGallery for Huawei phones running Android 7.0 and above.

Functioning as a Payment System Enabler, QR is committed to furnishing the requisite payment infrastructure and processor for Card Payment Scheme owners and QRPay e-wallet users. This involves the implementation of Q-R Electronic Payment Solutions, encompassing International Card Payment Scheme options like ATM/Debit cards, Credit cards, and Prepaid cards, thereby making them viable at merchant establishments. This initiative aims to facilitate a comprehensive shift towards cashless transactions, spanning various consumer retail sectors. QR's current revenue streams predominantly arise from software development, system maintenance services, and e-wallet services.

QR harbors ambitious plans to develop banking, acquiring, issuing, voucher, remittance, and e-wallet management systems tailored for iPhone and Android integration into the existing QRPay app. QR envisions an all-modern, flat design optimized for smartphones and smart QR codes. The primary goal is to create comprehensive payment products and services, complemented by a broad spectrum of international payment capabilities and operation certifications to tap into emerging opportunities in the FinTech space. Building upon QR's technology partner's extensive experience in the Payment System industry, QR plans to enhance its Payment System Infrastructure, introduce online delivery services, facilitate online movie purchases, and explore insurance offerings.

QR intends to develop a proprietary Super App, integrating services such as credit offerings and insurance collaborations. It is essential to highlight that the QRPay e-wallet Super App project is currently in its early developmental stage, and QR has not yet engaged an app developer or external marketing agency for its promotion. The broader vision encompasses embracing cutting-edge technology, adopting new business models in FinTech, and exploring a Virtual Banker Advisor model. QR is also in the process of finalizing a technology collaboration partnership with Tencent Cloud International Pte Ltd. to establish an innovative Financial Cloud System. For more detailed information, please refer to the specific subsections within this section.

Technology Platform

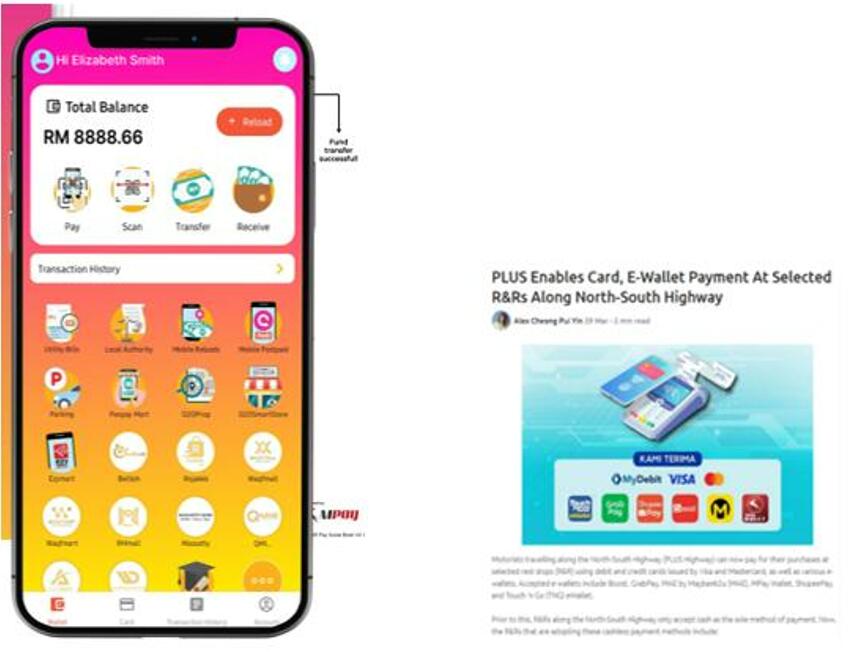

On August 13, 2021, QR entered into a partnership with ManagePay Services Sdn. Bhd. (“MPay”) for the issuance of MPay, QR Pay e-wallet, Mastercard Prepaid Card, Smartlink Pay eWallet whereby MPay acted as the technology provider for QR’s payment solutions.

ManagePay Systems Bhd (MPay) is an investment holding company. The group’s operating segment is classified into two: FinTech Services and Non-FinTech services. The FinTech services segment is involved in POS terminal services, third party acquiring, payment services, e-money and Mastercard card issuing, alternative financing business outsourcing services, and loyalty management services. The Non-FinTech services segment is involved in the software and digital security, information communications, e-commerce, and technology services. Management anticipates that payment services will be the major contributor to the Company’s total turnover and revenue.

MPay is currently listed on the ACE Market of Bursa Malaysia with market capitalization in excess of RM120 million. Many people are familiar with MPay as the leading payment service provider in some of the large retail chains in Malaysia like KFC, Pizza Hut, Giant, Guardian, Mercato, Cold Storage, Sunway Group, and Hero Market.

QRPay e-wallet Super App

QRPay e-wallet is powered by MPay and is licensed by Malaysia Central Bank (BNM). QRPay e-wallet is an online e-wallet account that a potential user can open online via QRPay e-wallet Super App, anytime and anywhere without going into a physical office, giving you immediate usage of the account. Once a user has loaded funds into the account, QRPay e-wallet immediately allows the user to perform in-store purchases and, make P2P fund transfer, and make investments, among other financial transactions. QR Pay provides services such as e-wallet reloads, bill payments, funds transfer, perform payment, shopping e-commerce, viewing property, receive reward benefit within a single app.

The Pay Bills feature is ready for Domestic Utility Bill Payments, Telco Prepaid/ Postpaid, Insurance & Road Tax Renewal, Council Bill, International Utility Bill Payments, International Reloads, Content Subscriptions, Gaming Points such as Gerena, TNB, Unifi, Astro, Maxis, Digi (Prepaid & Postpaid), PTPTN, etc.

14

O2O Property is a platform that will let you find your dream home with ease. We have a one stop solution for potential home buyers: from finding the house of your dreams, to buying the house, owning it, furnishing it, and moving in without any hassle or worry.

QR Pay has its own E-commerce platform known as QR Mart - QMIS Richwood Mart. We also have collaboration with a few other E-commerce platform such as Panpaymart and Ezymart. The uniqueness of these E-commerce platforms is our referral programs where users can get bonus by referring their friends to purchase on the platform.

QR Pay also recently launched the referral program which provides an introducer-affiliate bonus, available for inviting new users to register and spend with QR Pay e-wallet and Mastercard. This program is different from other competitor e-wallet companies, because other e-wallet companies typically give away one-time introducer bonuses for every new user when inviting. However, for the QR Pay referral program, the affiliate bonuses are given for every introduced user spending transaction. In other words, a QR e-wallet customer who introduces affiliates who spend using the QR e-wallet or Mastercard will be eligible to receive ongoing affiliate bonuses, rather than just for the initial introduction.

QMIS Richwood Blacktech Mastercard Prepaid Card

In addition to opening a QRPay Account, cardholders can apply to receive a physical QMIS Richwood Blacktech Mastercard Prepaid Card. This Mastercard can be linked to the QR Pay e-wallet, allowing the user to instantly transfer money from the QR Pay e-wallet to Mastercard. Afterwards, users can make payment for goods and services at Mastercard merchants store domestically, worldwide and online purchase. Cardholders can withdraw cash at worldwide Bank ATMs with their Mastercard and a secure PIN. Users are also able to check the card’s balance via QRPay at any time and from any location.

15

Revenue Model

QR Management anticipates that revenue streams will be derived from core business areas. QR Pay e-wallet will provide a variety of services in a single mobile interface. The ultimate aims will be to provide users with access to multiple services in a single location. The services include payment and financial transactions processing (e-wallet), e-Commerce and communication online platform. There are two main sources of revenue of the e-wallet, which are as follows:

1. E-Commerce; and

16

2. E-wallet

REVENUE | COST OF SERVICES |

·Fixed Rate Commission (From Seller) ·Customer Loyalty Program (Coins) ·Cost-Per-Click Advertising Services (Bid for Keywords) ·Commission for Trans-shipments ·Logistics ·Gross Merchandize Value (GMV) ·Monthly Active Users (MAUs) ·No. of Transactions per Active Buyer | ·Server Costs ·Hosting Costs ·Sales & Marketing Expenses (Customer Acquisition & Retention Expenses) ·Staff Compensation & Welfare Costs ·Other Fixed Costs |

17

18

Future Business Prospects

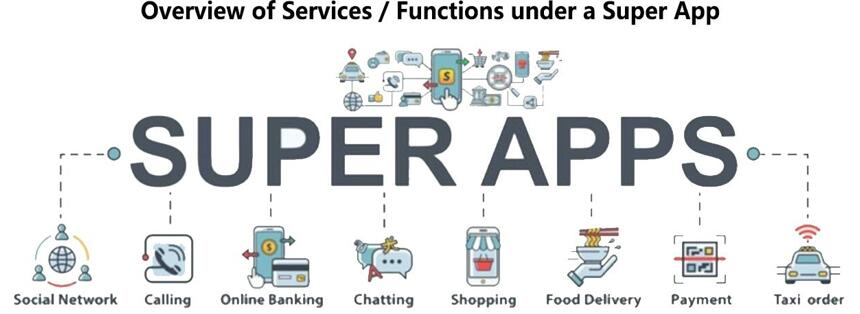

Super Apps

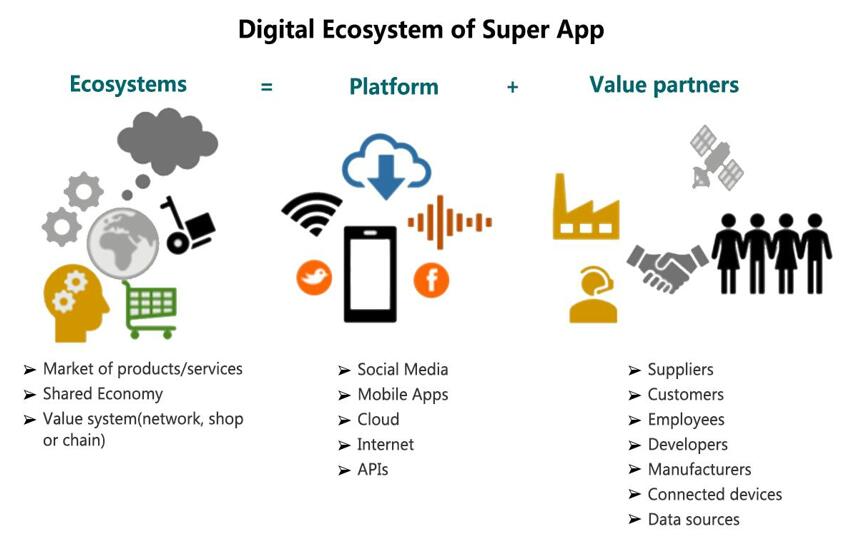

Super Apps are basically apps with aggregated services or functions. As opposed to single-purpose apps like Skype, Super Apps will offer a unified and centralized experience. Super Apps are the current trend, as consumers are looking for convenience and efficiency in managing their day-to-day activities and entertainment. Companies which develop Super Apps are also on the rise, especially with Grab being listed via SPAC (Special Purpose Acquisition Company) on Nasdaq recently.

Super Apps in general are a digital ecosystem that can serve to connect all merchants (Ecosystems) registered on the Super App (Mobile Platform) to their Users (Value Partners). Super Apps integrate multiple services and functions (including in-house services and services provided by third party merchants) within a mobile app. The following value chain illustrates the main stakeholders (i.e. super app owner, merchants and users) involved in the digital ecosystem of super app and the relationships between all parties.

19

Digital Ecosystem of Super App

The growing preference of consumers for Super Apps is mainly driven by convenience and simplicity. With a one-time login to a Super App, users are able to fulfil many of their daily life needs through the functions integrated in a Super App. Such integration of functions delivers the users convenience, ease of use and a seamless experience without the hassle of resorting to different apps for multiple activities. Examples of some functions that can be integrated within a Super App area as follows:

Overview of Services / Functions under a Super App

In addition to the above functions that can be integrated within a Super App, QR Management anticipates that QR Pay Super Apps may also offer services related to financial services and other related services. Further, QR Pay Super Apps will be able to enable integrations with third party mobile apps to expand the range of services available to users. Examples of third-party mobile apps that can be integrated into a Super App include third-party e-commerce platforms, third party social media sites and third-party reward platforms. The diagram below provides an overview of services/functions that QR is working to or plans to integrate with Super Apps.

20

The figure above illustrates a range of services and functions that QR management is working or plans to work to integrate in QRPay.

Financial and other Related Services

E-wallet

An e-wallet includes online payment and transfer, credit services (i.e., micro loan) and insurance products. The usage of an e-wallet saves users the hassle and avoids security issues arising from cash withdrawal and cash handling. Payment through an e-wallet is a key ‘enabler’ to the success of a Super App as it facilitates payments for products and services sold through the Super App. Therefore, e-wallets have become an indispensable element in many Super Apps. It is also a convenient method of performing transactions and was especially widely used during the COVID-19 pandemic due to its contactless nature which avoided the risk of virus infection from handling cash.

Credit Services

QR Management believes that Super Apps may also offer credit services by partnering with financial institutions to provide credit facilities, especially support ‘BUY NOW PAY LATER’ payment schemes offered by e-commerce merchants for high-priced items such as furniture and electronic devices. ‘BUY NOW PAY LATER’ is a payment scheme offered to customers which can spread out their online shopping bill into several monthly instalments.

Insurance

Further, QR Management believes that Super App owners also may collaborate with insurance companies to offer a range of insurance plans such as travel and car insurance to users. The users will have easier access to the insurance plans as they will be able to browse and complete payment for the insurance plans directly through the App without the need of going through an agent.

Along with the proliferation of mobile phone usage and increasing convenience of performing tasks using mobile phones (particularly using mobile apps), there have been increasing mobile apps introduced in the market with interesting and sophisticated functions to cater to the needs of consumers from all aspects of daily life, including transportation, food services, entertainment and financial services.

Over the last decade, several Super Apps have been introduced into the Asia-Pacific market, including WeChat, Grab, Gojek, Alipay, Kakao and Paytm, which are among the popular Super Apps used by consumers in the Asia Pacific region.

21

Examples of Super Apps in Asia

The QR Super App project is currently in its early development stage. QR is in the midst of engaging an app developer and marketing agency to develop a marketing plan for a proprietary Super App.

Roadmap

QR Management anticipates the development and deployment of the proprietary Super App will include several key steps and goals, including the following:

1. To be the integrated e-payment enabler of choice for consumer sector in the South East Asia Region.

2. Position as an integrated e-payment enabler for Malaysian Retail Outlet, Transit and Parking.

·Pilot launch at the key targeted sites

· Deliver compelling value to Service providers and relevant authorities

3. Expansion of the services to all Service Providers for Southeast Asian and beyond.

4. Strengthening the position as integrated e-payment enabler of ‘CHOICE’ for local and regional market.

·Open the services to other local and international payment scheme i.e., TouchnGo, UnionPay, Paypal, Grabpay, etc.

·Replicate and enable the services at other countries.

5. Promote cross-sector usage through bundling and targeted promotions with International Card Brands and Banks.

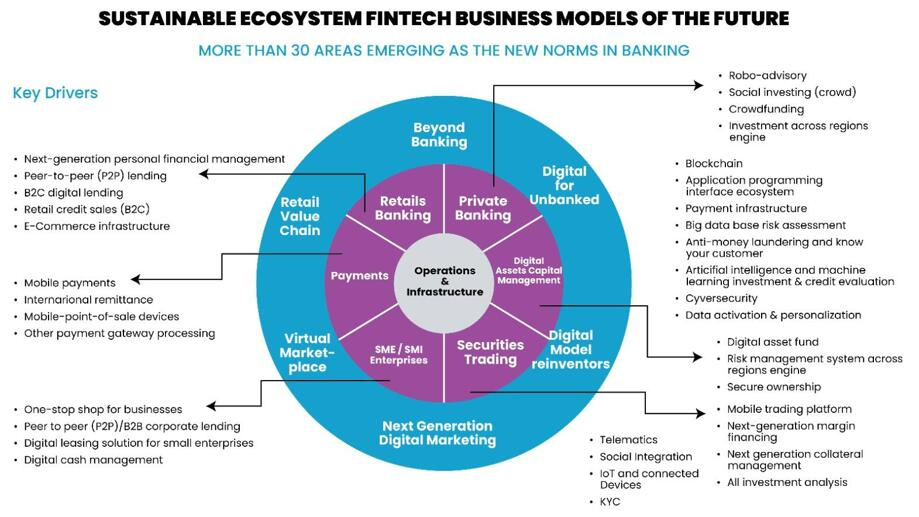

The Company’s Management believes that disruption is hitting businesses of all kinds, and the investment banking and financial services industry is no exception. With the Covid-19 crisis having resulted in the deepest recession since the Second World War, financial services providers will need to adapt to the data, digital and strategy needs of clients if they are to survive amid the chaos.

22

Financial services in 2020 was defined by a sudden acceleration in digitization and digital engagement-pushed by the impacts of the COVID-19 pandemic. Mobile banking transactions spiked, personal trading apps saw record transaction volumes, and call center personnel kept customer support going by working from their living rooms.

While the financial services industry was able to weather the digital tsunami and continue its operations, it has become clear that the winds of change are not transient. Financial institutions are now thinking strategically about their technical setup and questioning whether the tools that they have previously relied on are the right ones to use going forward.

Here are a few major themes that the Company’s Management has identified as being likely to dominate financial industry conversations and technology roadmaps in 2022 and beyond:

·Modernizing dated core systems will be imperative;

·Banking goes beyond cash with digital engagement;

·Institutional and wholesale trading moves off trading floors;

·Work-from-home must work across financial services;

·Embedded innovation is the new status quo;

·Financial products and services are tailored to the specific needs of the customers; and

·Online financial products have become increasingly popular among global consumers.

23

To emerge from the COVID-19 crisis, the Company’s Management believes that the business should focus on the fundamentals of agility, technology, innovation, resilient and visionary leadership. On the flip side, we will see the emergence of new business opportunities. The world of connected devices - internet of things - cloud computing - AI, including machine learning, will provide the stepping stones for business and their own survival.

In line with the business objectives of QMIS TBS Group, the Company will continue to conduct strategic reviews for its existing core business and search for potential new investments. The proposed activities are detailed in the following sections:

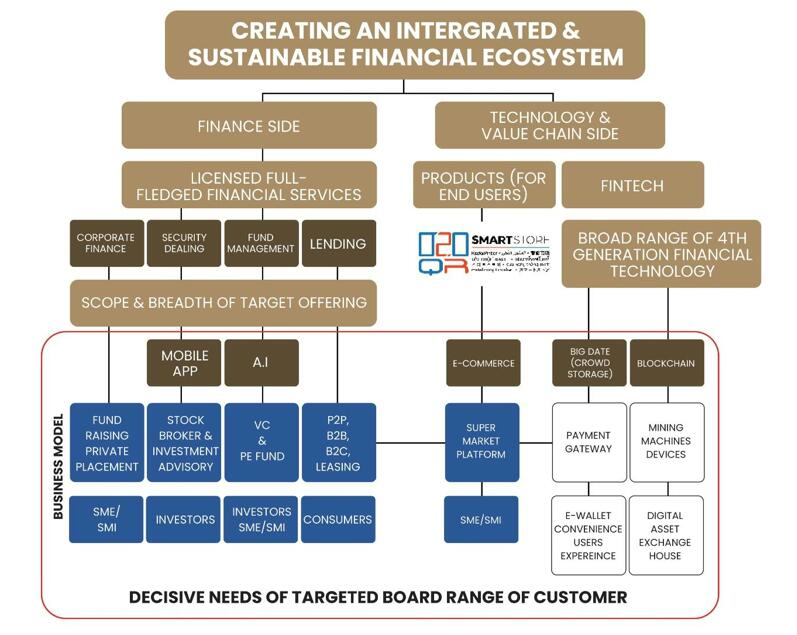

(a)Creating an Integrated and Sustainable Financial Ecosystem

Technology’s Innovation

Technology innovation will make the greatest impact on business and the initial survival of business will depend on how rapidly business embrace technology to drive their own operations and also link up with others to build upon possible synergies. Cohesive Collaboration will be a key.

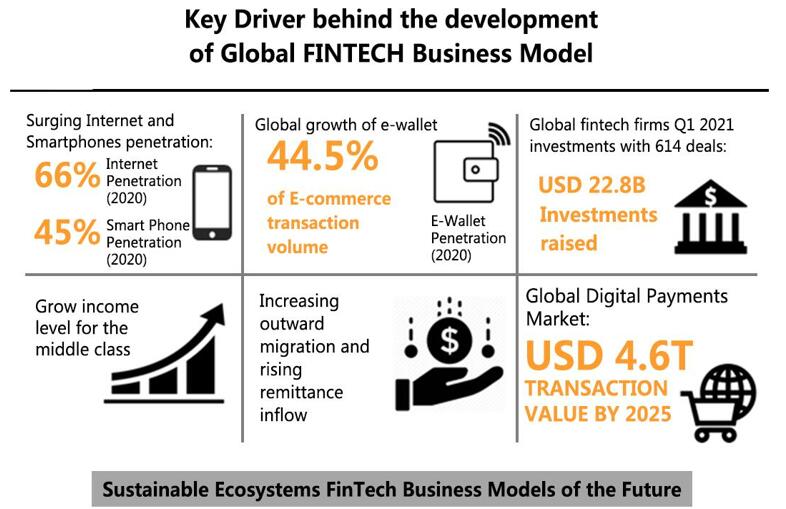

Emerging Business Model – FinTech Aggregating Financial Services

The Company would turn itself into a FinTech company distributor of financial services products. That is, the Company would not dependent on internal resources to create financial products and services but instead source them from an ecosystem of partners. In this way, the Company does not have to incur heavy expenditure and long period of time in products development or compliance and can also provide customers with access to a broader range of products than if the bank tried to produce everything itself.

Sustainable FinTech Business Models for the Digital Age

(i) Virtual Banker Advisor

In order to make this model successful, the bank would need to become a virtual advisor, using customers’ data to help them make better financial and operational decisions - effectively providing a customer with the right advice and/or other service at the right time and across the right channel to enable the customer to make more informed decisions.

24

The Company plans to monetize this service, inter alia, by taking a small fee on all of the products and services the customer uses.

(ii) Economies of Scale Intelligence Solution

Operating such a model, management believes that the Company can generate massive economies of scale by potentially servicing millions of customers from the same software platform. Also, as a platform, there would be the potential for the Company to generate network effects that could lead to increasing returns to scale.

First, there are the two-sided network effects whereby larger customer numbers lead to a larger number of ecosystem partners which then, by offering the widest choice, attracts more customers and so. However, there are also the data network effects, whereby the Company learns more about how best to serve customers the more data it captures meaning it gives better and better services, attracting more data and so on.

If the group also opens up its platform for customer interactions with each other - with peers giving advice to each other, for example - then there are also interaction network effects enjoyed by the social network platforms.

(b)Expansion of QMIS TBS’s Core Investment and Business Activities

In light of the competitive and dynamic environment, the Company intends to intensify its involvement in the ICT, App developer and Biotechnology and Life sciences areas by exploiting new technologies and to optimize risk-reward profiles of its investments.

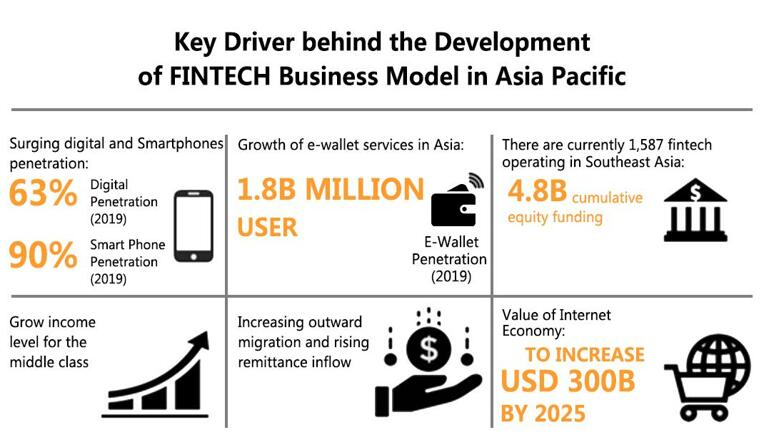

(c)Geographical Expansion

The Company intends to expand its geographical coverage and increase its investment and incubation activities across the Asia Pacific region. In the medium term, the Company plans to pursue the markets in China, Singapore and Taiwan. The Company plans to form strategic alliances with foreign technology incubators and venture capitalists to establish its market presence in these countries. Management anticipates that the modes of investments will include, inter-alia, direct investments in technology companies, acquisition of established technology incubators and formation of co-managed fund management companies. In the long term, the Company intends to pursue its business beyond the Asia Pacific region.

25

(d)Continuous Development of Expertise

The Company has identified the following strategies to develop the expertise of its investment personnel:

i. Increase the scope of financial expertise via direct employment and/or outsourced technical services in line with the expansion of the investment and consultancy business;

ii. Expand the staff training and development programs to enhance its professional personnel’s technical skills, knowledge and capabilities; and

iii. Increase the exposure and create “shared experience” education programs via strategic alliance with other local higher learning institutions and other technology incubators either through direct investment in investee companies or through co-managed fund basis.

(e)Business Alliances and Partnership Establishments

The Company plans to introduce the investee company to prospective business partners and strategic alliances in order to further expand the marketing network of the investee company and therefore enhance the investee company’s chances of securing projects for its product and services.

While 2020 was bleak from many perspectives, one of the rare positives is that it helped prove that agility and innovation, done right, is a game changer. The speed at which the financial services industry transformed to help their customers through the pandemic is the speed at which they want to continue operating. And that requires a culture of innovation that is embedded into the corporate culture of an institution.

From financial services institutions to vendors, regulators, and supervisors, the Company’s management believes that 2024 and beyond are likely to be years of deliberate cultural transformation to find new ways of working together to create safer, cheaper, more inclusive, and more equitable financial markets.

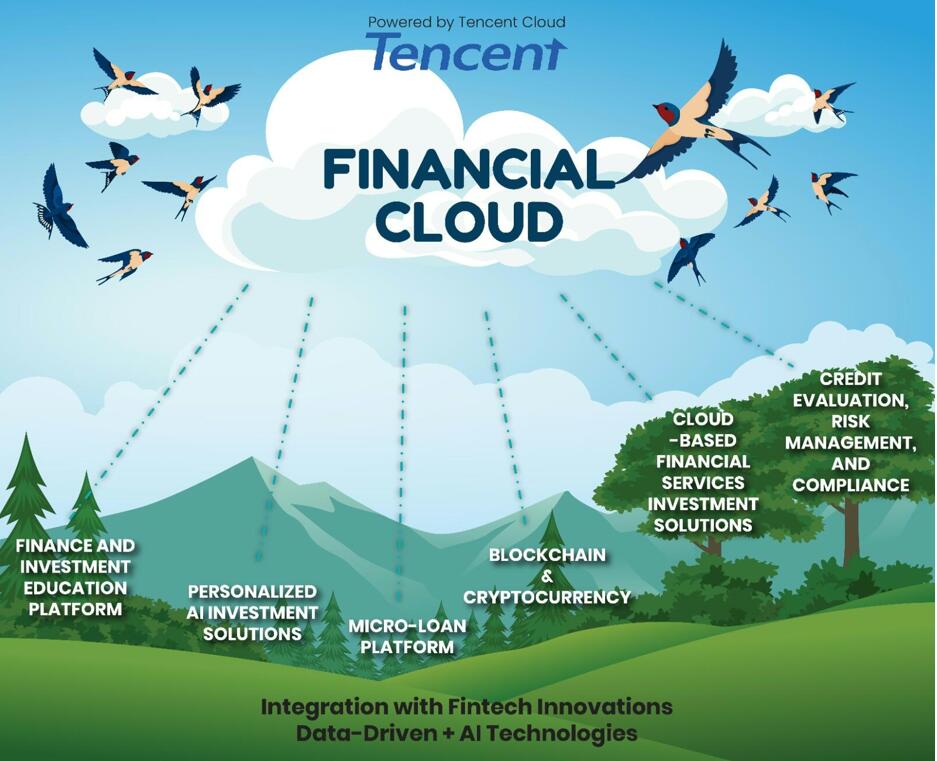

Financial Cloud

As of the date of this Annual Report, QR was in the process of finalizing the partnership with Tencent Holdings Ltd. (“Tencent”), a top-ranking Chinese conglomerate. Tencent, with a historic market cap surpassing HKD3 trillion, and QR will work in establishing an innovative Financial Cloud System, through which QR plans to further expand its micro lending operations. Management anticipates that QR’s collaboration with Tencent Cloud will extend beyond a conventional partnership, and that it will be a strategic alignment that underscores QR’s commitment to empowering users. This partnership will form the bedrock of a finance and investment platform that will not only enhance our

26

clients’ financial literacy but also will provide the necessary resources and tools for individuals and businesses to make informed decisions. Management anticipates that QR and Tencent will enter into a white-labelling agreement, pursuant to which Tencent will assume the pivotal role of a technology provider, while QR will spearhead the operational facets of the system as the business operator, thus leveraging Tencent's Infrastructure as a Service (IAAS) Platform: Tencent Cloud. For clarification, the Company has decided not to engage, either directly or through its subsidiaries, in cryptocurrency or any related activities.

Management believes that the financial sector is a linchpin of economic activity, and in the face of technological advancements, it is imperative to be prepared for the future. Tencent Cloud, with its sterling track record, has emerged as the preeminent partner for our foray into the Malaysian financial industry. QR Management believes that the robustness and versatility of Tencent Cloud's offerings position us uniquely to address the evolving needs of the financial landscape. Management believes that the Financial Cloud Ecosystem, operating on a SaaS model, shall ensure secure, efficient, and interconnected financial solutions.

QR faces several risks and challenges in its collaboration with Tencent, primarily centered around network congestion, protocol changes, operational impact, security concerns, regulatory changes, and scalability issues. The high transaction volumes on Tencent's platform pose a risk of network congestion, potentially causing delays and increased transaction fees, necessitating proactive measures to optimize network capacity. Protocol changes implemented by Tencent for security or functionality improvements may create compatibility issues for QR's existing applications and algorithms, requiring a robust communication channel and timely adaptation. Unforeseen issues within Tencent's platform, like outages or glitches, could disrupt QR's operations, emphasizing the need for contingency plans and redundancies. Security concerns arise from shared responsibility, where vulnerabilities in Tencent's platform may impact the integrity of QR's financial transactions, demanding collaborative security measures.

27

A Comprehensive Financial Cloud Ecosystem:

Management anticipates that QR and Tencent will jointly envisage an encompassing Financial Cloud System, integrating an array of sophisticated financial services and state-of-the-art technology:

1. Big Data Analytics: Through the consolidation of financial data, the collaboration between QR and Tencent Cloud will seek to empower Big Data Analysts. This initiative will be structured to catalyze progress in the financial industry, offering crucial insights that can enhance economies and empower citizens to make well-informed decisions when navigating intricate financial challenges.

2. Micro-loan Platform: A crucial facet of economic empowerment, the Financial Cloud will introduce a micro-loan platform, providing individuals and small businesses with access to credit to seize opportunities and navigate financial challenges.

3. Cloud-Based Financial Services: Expanding beyond core components, QR management anticipates that the Financial Cloud ecosystem will encompasses an array of cloud-based financial services, including insurance, unit trust funds, and trustee services, simplifying and enhancing clients' financial experiences with added convenience and security..

4. Finance and Investment Education Platform: Aligned with QR's mission to empower users, QR management anticipates that the partnership with Tencent Cloud will establishes a finance and investment platform, providing education, resources, and tools to enhance financial literacy, enabling users to make informed decisions. This commitment underscores the transformative initiative's cornerstone, positioning financial literacy as pivotal. QR and Tencent plan to collectively shape a future where knowledge and access to innovative financial solutions empower individuals and businesses, fostering global economic growth and personal prosperity..

To ensure a seamless transition and optimal resource allocation, QR management anticipates that the implementation of services within the Financial Cloud Ecosystem will occur in stages. This strategic approach reflects QR's commitment to delivering world-class financial solutions while upholding operational excellence.

The Significance of Big Data:

It is anticipated that the power of Big Data will be central to the Financial Cloud Ecosystem. With vast amounts of financial data flowing through the system, QR management believes that it is possible to harness this data to gain insights, improve financial decision-making, and enhance the user experience. Big Data analytics drive personalized recommendations, risk assessments, and predictive modeling, enabling QR to better serve the client’s financial needs.

A Global Impact:

QR management believes that the Financial Cloud Ecosystem is not limited by borders, but rather that it is a global solution. The Financial Cloud Ecosystem has the potential to transcend geographical boundaries, contributing to financial inclusion and empowerment worldwide. From enabling entrepreneurs in emerging markets to providing secure financial services to remote areas, QR management anticipates that the impact will reaches far and wide.

Security and Compliance at the Core:

The backbone of Financial Cloud Ecosystem will be the robust security and adherence to regulatory standards. User data and transactions are safeguarded with the utmost care, ensuring trust and reliability.

Reaching the Software as a Service (SaaS) Platform:

QR management anticipates that Tencent, as QR’s technology provider, will operate on a robust SaaS (Software as a Service) model. In this collaborative partnership, QR management anticipates that Tencent will develop and maintain cloud application software within the SaaS framework, ensuring seamless access to innovative financial solutions for QR’s our users. Additionally, under this model, QR management anticipates that Tencent will offer automatic software updates, making the latest financial tools readily available to our customers via the internet. QR management believes that the partnership between QR and Tencent Group will be nothing short of revolutionary in the financial industry. It reflects a shared belief that the fusion of technology, innovation, and a user-centric approach can redefine the way financial services are delivered.

28

QR management anticipates that the Financial Cloud Ecosystem will go beyond the present, and that its essence lies in influencing the future of the financial industry. QR management believes that the Financial Cloud Ecosystem will revolve around empowering individuals and businesses with knowledge and access to cutting-edge financial solutions, ultimately fostering global economic growth and personal prosperity.

Competition

The Major Industry Competitors in Southeast Asia

In Southeast Asia, the e-payment industry is dominated by a few major players. These include:

Grab: A ride-hailing and e-payment platform that offers a range of services including food delivery, mobile payments and more.

Gojek: A multi-service platform that offers ride-hailing, food delivery, and mobile payments.

Razer: A Singapore-based gaming and financial technology company that offers e-payment solutions and a digital wallet.

Sea Limited: A Singapore-based company that operates the e-commerce platform Shopee and digital wallet AirPay.

Singtel: A Singapore-based telecommunications company that offers mobile payments and digital financial services through its subsidiary, Dash.

These companies have established themselves as key players in the Southeast Asian e-payment market, offering a range of services that cater to the region's growing demand for mobile and online payment solutions. Other notable players include Liquid Pay, Akulaku, and Touch 'n Go.

Employees

As of the date of this Annual Report, we employed a total of 16 full-time and no part-time employees. In general, we maintain a good working relationship with our employees and we have not experienced any material labor disputes. We value our employees and insurance agents the most and are constantly encouraging innovation, efficiency, and teamwork at the Company.

Description Of Properties

The Company’s principal executive offices are located at 55-6, The Boulevard Office, Lingkaran Syed Putra, Mid Valley City, 59200, Kuala Lumpur, Malaysia. We signed a total of four written leases, which included one lease for the Company’s headquarters and three leases for its subsidiaries. On April 22, 2021, the Company and the JKC Resources Sdn. Bhd. signed the lease contract for its headquarter office spaces of consist of 2,000 square feet of office space. The initial term of the lease for our headquarters was from July 1, 2018 to June 30, 2023, with an extension to

29

June 30, 2024. The address of each of the subsidiaries, except for the Hong Kong subsidiaries, is C/O the Company at the address listed above.

Legal Proceedings

From time to time, we are involved in litigation or other legal proceedings incidental to our business. We are not currently a party to any litigation the outcome of which, if determined adversely to us, would individually or in the aggregate be reasonably expected to have a material adverse effect on our business, operating results, cash flows or financial condition.

Regulations Related to our Business Operations Hong Kong

Regulation of limited liability companies in Hong Kong