Table of Contents

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| |

||

(Address of principal executive offices) |

(Zip Code) | |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | |||

| ☒ | Smaller reporting company | |||||

| Emerging growth company | ||||||

Table of Contents

TABLE OF CONTENTS

| 1 | ||||||

| 4 | ||||||

| 6 | ||||||

| ITEM 1. |

6 | |||||

| ITEM 1A. |

31 | |||||

| ITEM 1B. |

66 | |||||

| ITEM 1C. |

66 | |||||

| ITEM 2. |

68 | |||||

| ITEM 3. |

68 | |||||

| ITEM 4. |

68 | |||||

| 69 | ||||||

| ITEM 5. |

69 | |||||

| ITEM 6. |

69 | |||||

| ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

69 | ||||

| ITEM 7A. |

80 | |||||

| ITEM 8. |

81 | |||||

| ITEM 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

108 | ||||

| ITEM 9A. |

108 | |||||

| ITEM 9B. |

109 | |||||

| ITEM 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

109 | ||||

| 110 | ||||||

| ITEM 10. |

110 | |||||

| ITEM 11. |

110 | |||||

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

110 | ||||

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

111 | ||||

| ITEM 14. |

111 | |||||

| 112 | ||||||

| ITEM 15. |

112 | |||||

| ITEM 16. |

114 | |||||

| 115 | ||||||

i

Table of Contents

Forward-Looking Statements

This report contains forward-looking statements that involve risks and uncertainties. These statements relate to future periods, future events or our future operating or financial plans or performance. When used in this report, the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “forecast,” “goal,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “seeks,” “suggests,” “scheduled,” “target,” or “will,” and similar expressions are intended to identify forward-looking statements, and include but are not limited to:

| • | our future financial and business performance; |

| • | strategic plans for our business and product candidates; |

| • | the attributes of, and our ability to develop or commercialize, our product candidates; |

| • | the strength of our pipeline, product candidates, VersAptx platform and management team; |

| • | the expected results and timing of clinical trials and nonclinical studies; |

| • | our ability to comply with the terms of the Bayer License Agreement; |

| • | our future capital requirements and sufficiency of available cash, including our expected cash runway, timing of those requirements, and sources and uses of cash; |

| • | our ability to obtain funding for our operations and continue as a going concern; |

| • | developments and expectations relating to our competitors and industry; |

| • | our expectations regarding our ability to obtain, develop, and maintain intellectual property protection and not infringe on the rights of others; |

| • | our ability to retain key scientific or management personnel; |

| • | our expectations regarding the time during which we will be an emerging growth company under the JOBS Act; |

| • | the outcome of any known and unknown litigation and regulatory proceedings; |

| • | our business, expansion plans, and opportunities; and |

| • | changes in applicable laws or regulations. |

These statements are subject to known and unknown risks, uncertainties, and assumptions that could cause actual results to differ materially from those projected or otherwise implied by the forward-looking statements, including the following:

| • | risks associated with preclinical or clinical development and trials, including clinical trials conducted prior to our in-licensing; |

| • | risks related to the rollout of our business and the timing of expected business and product development milestones; |

| • | changes in the assumptions underlying our expectations regarding our future business or business model; |

| • | our ability to develop, manufacture, and commercialize product candidates; |

| • | our ability to raise capital and continue as a going concern; |

| • | general economic, financial, legal, political, and business conditions and changes in domestic and foreign markets; |

| • | changes in applicable laws or regulations, including the impact of the Inflation Reduction Act of 2022 and potential legislation restricting the use of foreign third-party service providers; |

1

Table of Contents

| • | the impact of natural disasters, including climate change, and the impact of health pandemics and epidemics on our business; |

| • | the size and growth potential of the markets for our products, and our ability to compete in those markets; |

| • | market acceptance of our planned products; |

| • | the effects of other economic, business, or competitive factors, including the impact of inflation and the wars in Ukraine and Israel; and |

| • | other risks and uncertainties set forth in this report in the section entitled “Risk Factors.” |

Given these and other risks and uncertainties described in this report, you should not place undue reliance on these forward-looking statements.

Forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those expected. These risks and uncertainties include, but are not limited to, those risks discussed in Item 1A of this report. These forward-looking statements made by us in this report speak only as of the date of this report. Except as required under the federal securities laws and rules and regulations of the Securities and Exchange Commission (the “SEC”), we expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions, or circumstances on which any such statement is based. You should, however, review additional disclosures we make in our definitive proxy statement for the 2024 Annual Meeting of Stockholders, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the SEC.

You should read this report completely and with the understanding that our actual future results, levels of activity, and performance as well as other events and circumstances may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

Frequently Used Terms

Unless the context indicates otherwise, references in this report to the “Company,” “Vincerx,” “we,” “us,” “our,” and similar terms refer to Vincerx Pharma, Inc. (f/k/a Vincera Pharma, Inc. f/k/a LifeSci Acquisition Corp.) and its consolidated subsidiaries. References to “LSAC” refer to our predecessor company prior to the consummation of the Business Combination (as defined below). Additional terms frequently used in this report include the following:

| • | “ADC” means antibody-drug conjugate. |

| • | “Affordable Care Act” means the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act. |

| • | “AML” means acute myeloid leukemia. |

| • | “ANDA” means an abbreviated new drug application. |

| • | “Bayer License Agreement” means that certain License Agreement, dated October 7, 2020, by and among Legacy Vincera Pharma, Bayer Aktiengesellschaft, and Bayer Intellectual Property GmbH. |

| • | “BLA” means a biologics license application. |

| • | “BPCIA” means the Biologics Price Competition and Innovation Act of 2009. |

| • | “Business Combination” means the Merger and the other transactions described in the Merger Agreement. |

2

Table of Contents

| • | “Bylaws” means our amended and restated bylaws. |

| • | “CDK” means cyclin-dependent kinase. |

| • | “CDX” means cell-derived xenograft. |

| • | “Certificate of Incorporation” means our second amended and restated certificate of incorporation, as amended. |

| • | “cGMP” means current Good Manufacturing Practice. |

| • | “CLL” means chronic lymphocytic leukemia. |

| • | “common stock” means our common stock, $0.0001 par value per share. |

| • | “CPT” means camptothecin. |

| • | “DLBCL” means diffuse large B-cell lymphoma. |

| • | “DH-DLBCL” means double-hit DLBCL (i.e., DLBCL characterized by translocations of MYC and BCL-2). |

| • | “Earnout Shares” means certain rights to common stock after the closing of the Business Combination that Legacy Holders may be entitled to receive pursuant to the Merger Agreement. |

| • | “Exchange Act” means the Securities Exchange Act of 1934, as amended. |

| • | “FDA” means the U.S. Food and Drug Administration. |

| • | “FDCA” means the Federal Food, Drug and Cosmetic Act. |

| • | “GAAP” means accounting principles generally accepted in the United States of America. |

| • | “HER2” means human epidermal growth factor receptor 2. |

| • | “IL3RA” means Interleukin 3 receptor subunit alpha. |

| • | “HIPAA” means the Health Insurance Portability and Accountability Act. |

| • | “IND” means an investigational new drug application. |

| • | “JOBS Act” means the Jumpstart Our Business Startups Act of 2012. |

| • | “KSPi” means kinesin spindle protein inhibitor. |

| • | “Legacy Holders” means the stockholders of Legacy Vincera Pharma immediately prior to the Business Combination. |

| • | “Legacy Vincera Pharma” means Vincera Pharma, Inc. prior to the consummation of the Business Combination, which changed its name to VNRX Corp. following the Business Combination. |

| • | “Legacy Vincera Pharma Common Stock” means Legacy Vincera Pharma common stock, par value $0.0001 per share. |

| • | “MCL” means mantle cell lymphoma. |

| • | “MCL1” means a protein coding gene. |

| • | “Merger” means the merger of Merger Sub with and into Legacy Vincera Pharma, with Legacy Vincera Pharma surviving as the surviving company and as a wholly-owned subsidiary of LSAC, which occurred on December 23, 2020. |

| • | “Merger Agreement” means that certain Merger Agreement, dated September 25, 2020, by and among LSAC, Merger Sub, Legacy Vincera Pharma and Raquel E. Izumi, as the representative of the Legacy Holders. |

| • | “Merger Sub” means LifeSci Acquisition Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of LSAC at the time of the Business Combination. |

3

Table of Contents

| • | “MYC” means a family of regulator genes and proto-oncogenes that code for transcription factors. |

| • | “NDA” means a new drug application. |

| • | “public warrants” means warrants originally issued in the initial public offering of LSAC, which were redeemed in April 2021. |

| • | “private warrants” means the warrants issued simultaneously with the closing of the initial public offering of LSAC in a private placement to LifeSci Holdings LLC and Rosedale Park, LLC and the warrants issued pursuant to Section 8.6 of the Merger Agreement. |

| • | “P-TEFb/CDK9” means positive transcription elongation factor beta/cyclin-dependent kinase 9. |

| • | “Securities Act” means the Securities Act of 1933, as amended. |

| • | “SMDC” means small molecule drug conjugate. |

| • | “USPTO” means the United States Patent and Trademark Office. |

| • | “Warrant Agreement” means that certain Warrant Agreement, dated March 5, 2020, between LSAC and the Continental Stock Transfer & Trust Company. |

Vincerx®, Vincerx Pharma®, the Vincerx Wings logo design, CellTrapper®, and VersAptx™ are our trademarks or registered trademarks. This report also contains trademarks and trade names that are the property of their respective owners.

Summary Risk Factors

Our business is subject to numerous risks and uncertainties that could affect our ability to successfully implement our business strategy and affect our financial results. You should carefully consider all of the information in this report and, in particular, the following principal risks and all of the other specific factors described in Item 1A of this report, “Risk Factors,” before deciding whether to invest in our company.

| • | We rely on the Bayer License Agreement to provide rights to the core intellectual property relating to all of our current product candidates, which agreement imposes significant payment and other obligations on us. Any failure by us to perform our obligations under the Bayer License Agreement could give Bayer AG (“Bayer”) the right to terminate or seek other remedies under the agreement, and any termination or loss of important rights under the Bayer License Agreement would significantly and adversely affect our ability to develop and commercialize VIP236, VIP943, VIP924, enitociclib, the VersAptx platform, and our other current product candidates and technologies that incorporate such intellectual property, raise capital, or continue our operations. |

| • | We are substantially dependent on the success of VIP236, VIP943, and enitociclib, our lead product candidates. If we are unable to complete development of, obtain approval for, and commercialize these lead product candidates in a timely manner, our business will be harmed. |

| • | We are at an early stage in development efforts for our product candidates, and we may not be able to successfully develop, manufacture, complete clinical trials and commercialize our product candidates on a timely basis or at all. |

| • | Our long-term prospects depend in part upon discovering, developing, manufacturing, and commercializing additional product candidates, which may fail in development or suffer delays that adversely affect their commercial viability. |

| • | Results from early-stage clinical trials may not be predictive of results from late-stage or other clinical trials. |

| • | Interim, “topline,” and preliminary data from our clinical trials that we announce or publish from time to time may change as more patient data become available and are subject to audit and verification procedures that could result in material changes in subsequent or final data. |

4

Table of Contents

| • | We have incurred net losses since inception and expect to continue to incur significant net losses for the foreseeable future, and there can be no assurance we will be able to raise capital. |

| • | We require substantial capital to finance our operations. If we are unable to raise such capital when needed, or on acceptable terms, we may be forced to delay, reduce, or eliminate one or more of our research and drug development programs or future commercialization efforts and may not be able to continue as a going concern. |

| • | Even if approved, our product candidates may not achieve adequate market acceptance among physicians, patients, healthcare payors, and others in the medical community necessary for commercial success. |

| • | If the market opportunity for any product candidate that we develop is smaller than we believe, our revenue may be adversely affected and our business may suffer. |

| • | We face significant competition, and if our competitors develop and market technologies or products more rapidly than we do or that are more effective, safer, or less expensive than the product candidates we develop, our commercial opportunities will be negatively impacted. |

| • | We may expend our limited resources to pursue a particular product candidate, target, or indication and fail to capitalize on product candidates, targets, or indications that may be more profitable or for which there is a greater likelihood of success. |

| • | Clinical trials are expensive, time consuming, subject to enrollment and other delays, and may be required to continue beyond our available funding, and we cannot be certain that we will be able to raise sufficient funds to successfully complete the development, clinical trials, and commercialization of any of our product candidates currently in preclinical and clinical development, should they succeed. |

| • | Our business entails a significant risk of product liability, and if we are unable to obtain sufficient insurance coverage such inability could have an adverse effect on our business and prospects. |

| • | Any product candidates we develop may become subject to unfavorable third-party coverage and reimbursement practices, as well as pricing regulations, including those under the Inflation Reduction Act of 2022. |

| • | We are at an early stage of development as a company, and our limited operating history may make it difficult to evaluate our ability to succeed. |

| • | The Bayer License Agreement obligates us to make significant milestone and royalty payments, some of which will be triggered prior to the commercialization of any of our product candidates, and we may not be able to raise additional capital or enter into strategic alliances at levels sufficient to pay these amounts when due. |

| • | We may be unable to obtain U.S. or foreign regulatory approvals and, as a result, may be unable to commercialize our product candidates. |

| • | Our current or future product candidates may cause adverse events, toxicities, or other undesirable side effects when used alone or in combination with other approved products or investigational new drugs that may result in a safety profile that could inhibit regulatory approval, prevent market acceptance, limit their commercial potential, or result in significant negative consequences. |

5

Table of Contents

PART I

| ITEM 1. | Business. |

Corporate History and Background

We were initially formed on December 19, 2018 as a Delaware corporation for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization, or similar business combination with one or more businesses. From the time of our formation to the time of the consummation of the Business Combination, our name was “LifeSci Acquisition Corp.”

On September 25, 2020, we entered into the Merger Agreement. At the effective time of the Merger, each share of Legacy Vincera Pharma Common Stock, other than any Dissenting Shares (as defined in the Merger Agreement), was canceled and the Legacy Holders received (i) 0.570895 shares of our common stock, for each share of Legacy Vincera Pharma Common Stock held by them immediately prior to the effective time of the Merger and (ii) the right to receive Earnout Shares under certain conditions following the closing of the Business Combination.

The Legacy Holders are entitled to receive Earnout Shares after the closing of the Business Combination if the daily volume-weighted average price of our common stock equals or exceeds the following prices for any 20 trading days within any 30 trading-day period (the “Trading Period”), following the closing of the Business Combination: (1) during any Trading Period prior to the forty-two (42) month anniversary of the closing of the Business Combination, upon achievement of a daily volume-weighted average price of at least $20.00 per share, such number of shares of our common stock as equals the quotient of $20.0 million divided by the Closing Price Per Share (as defined in the Merger Agreement); (2) during any Trading Period prior to the six year anniversary of the closing, upon achievement of a daily volume-weighted average price of at least $35.00 per share, such number of shares of our common stock as equals the quotient of $20.0 million divided by the Closing Price Per Share; and (3) during any Trading Period prior to the eight year anniversary of the closing, upon achievement of a daily volume-weighted average price of at least $45.00 per share, such number of shares of our common stock as equals the quotient of $20.0 million divided by the Closing Price Per Share. A total of 90.6% (rounded to the nearest whole share) of the Earnout Shares then earned and issuable shall be issued to the Legacy Holders on a pro-rata basis based on the percentage of the number of shares of Legacy Vincera Pharma Common Stock owned by them immediately prior to the closing of the Business Combination, and the remaining Earnout Shares that would otherwise have been issuable shall not be issuable to the Legacy Holders but in lieu thereof the number of authorized shares available for issuance under the Vincerx Pharma, Inc. 2020 Stock Incentive Plan shall be automatically increased by an equivalent number of shares of our common stock.

Overview

We are a clinical-stage biopharmaceutical company committed to developing differentiated and novel therapies to address the unmet medical needs of patients with cancer.

We have a versatile and adaptable, next generation bioconjugation platform, called VersAptx. The modular nature of this innovative platform allows us to combine targeting, linker, and payload technologies to develop bespoke bioconjugates to address different cancer biologies. The VersAptx platform has the following features:

| • | Antibodies and small molecules that target different tumor antigens, including non-internalizing targets |

| • | Linkers designed to: |

| • | reduce non-specific release of the payload |

| • | cleave intracellularly or extracellularly |

| • | conjugate to single or multiple payloads |

6

Table of Contents

| • | Payloads designed to: |

| • | reduce permeability using our CellTrapper™ technology to ensure accumulation in cancer cells |

| • | increase permeability with low efflux for release in the TME. |

The VersAptx platform allows us to optimize these technologies to a specific target and develop bioconjugates designed to address the safety and efficacy challenges of first-generation bioconjugates.

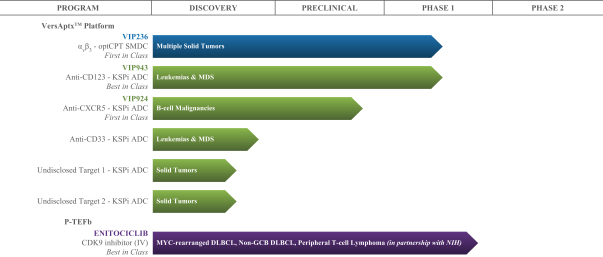

The following graphic summarizes our diverse pipeline:

Our accomplished management team, with collective experience of over 120 years in oncology, brings a proven track record in successful drug development, approvals, and value creation. Drawing talent from leading companies such as Pharmacyclics LLC, Acerta Pharma LLC, AstraZeneca plc, Bayer AG, Amgen Inc., Genentech Inc., Eli Lilly and Company, and Johnson & Johnson Inc, they have significantly contributed to multiple drug approvals and blockbuster exits, including the $7B acquisition of Acerta Pharma’s Calquence® by AstraZeneca and the $975M Imbruvica® partnership between Janssen Pharmaceuticals (now J&J Innovative Medicine) and Pharmacyclics.

We believe our diverse pipeline including our next-generation VersAptx platform and our management team position us to successfully develop paradigm-shifting therapies for patients.

Strategy

Our goal is to become a leading biopharmaceutical company by developing differentiated and novel therapies that are safe, effective, and well-tolerated. We seek to accomplish this goal through the implementation of the following strategy:

| • | Progress VIP943, VIP236, and enitociclib through clinical development and proof-of concept |

| • | Progress VIP924 to an IND application in late 2025 or early 2026 |

| • | Leverage our next-generation VersAptx platform to expand our pipeline and collaborate with other companies to develop unique, safe, and effective ADCs and SMDCs |

| • | Form strategic partnerships/collaborations to maximize the potential of our pipeline and VersAptx platform |

7

Table of Contents

Our ability to achieve these goals and strategies will be dependent on a number of factors as described in the section titled “Risk Factors.”

Our Value Proposition

The VersAptx Platform

The VersAptx platform is a versatile and adaptable, next generation bioconjugation platform. The modular nature of this platform allows us to combine different targeting, linker, and payload technologies to develop unique ADCs and SMDCs that address the safety and efficacy challenges of first-generation bioconjugates.

The VersAptx platform has the following features:

Targets. We use antibodies or small molecules to target different tumor antigens. Currently, we have disclosed the following hematologic and solid tumor targets:

| • | CD123: A protein mainly produced by activated T-cells and expressed at high levels in AML, classical Hodgkin lymphoma, B-cell acute lymphoblastic leukemia (B-ALL), and MDS. Targeting CD123 allows for selective destruction of cancer cells while sparing normal cells, potentially minimizing side effects. |

| • | CXCR5: A receptor that regulates chemotaxis, germinal center formation, and plasma and memory B-cell differentiation and is highly expressed on the tumor cells of DLBCL, FL, MCL, and CLL. The specific expression pattern of CXCR5 prevents general effects on the B-cell population commonly observed with other compounds in this disease area. Targeting CXCR5 can also address the issue of cancer cell masking, by preventing homing into lymphatic systems (e.g., lymph nodes), keeping the cells exposed to the treatment. |

| • | αvß3: A small molecule integrin binder and well-established target in solid tumors. αvß3 is found on tumor cells and in the TME and is overexpressed in advanced and metastatic solid tumors. High expression of αvß3 is commonly associated with poor survival prognosis. |

| • | CD33: CD33 is a cell surface protein primarily found in myeloid cells and plays a crucial role in regulating immune cell activity. This protein is particularly intriguing as a target for ADCs due to its prevalence in malignant AML cells. CD33 is a validated target in AML as a monotherapy and could also prove to be safe and efficacious when combined with VIP943 by effectively targeting nearly all malignant AML cells in patients. |

Linkers. Linkers designed to reduce non-specific release of the payload, cleave intracellularly or extracellularly, and conjugate to single or multiple payloads. Currently, we have disclosed the following linker technologies:

| • | Legumain Linker: A novel linker that cleaves specifically by legumain, a protein that is present and overactive inside cancer cells. The stability and mechanism of action of this linker allows for targeted payload release within tumor cells after internalization. |

| • | Neutrophil Elastase Linker: A novel linker that selectively cleaves in the TME by neutrophil elastase, a protein highly expressed in the TME of advanced and metastatic solid tumors and associated with poor survival. Neutrophil elastase retains its structural integrity while circulating in the body and avoids cleavage in non-target tissues, allowing for a targeted payload release inside the TME. |

Payloads. Highly potent and optimized payloads, designed to address common challenges in their class. Currently, we have disclosed the following payloads:

| • | Optimized Camptothecin (CPT): Designed to have (i) high permeability, so it can efficiently enter cancer cells, and (ii) low efflux, so it stays in the cancer cell to inhibit topoisomerase 1—causing |

8

Table of Contents

| DNA damage and cell death. Camptothecins are an established payload class. The structural optimization of our camptothecin is designed to address the issue of transporter effect, a common resistance mechanism seen in this payload class. |

| • | Kinesin Spindle Protein Inhibitor (KSPi): This highly potent and selective KSPi payload specifically targets the kinesin spindle protein, a protein that is essential for mitotic spindle formation and only expressed during cell division. This novel payload is designed to allow us to only target dividing cells while sparing healthy cells, effectively circumventing common side effects associated with other payload classes. |

CellTrapper. Our proprietary CellTrapper technology is designed to reduce payload cellular permeability, so the released payload accumulates within the target cell. This accumulation enables precise targeting of transiently expressed KSP, thereby inducing cell death. Moreover, the inability of the released payload to diffuse through membranes ensures non-target cells remain unaffected.

Beyond the technologies described above, our research and development team continues to work on new undisclosed bioconjugation technologies for solid tumor and hematologic indications.

Improving the Safety and Efficacy of Bioconjugates

The full potential of bioconjugates has been hindered by many challenges, such as payload damage of non-dividing/non-target cells, premature payload release, and unspecific cellular uptake, each of which can result in severe adverse effects including myelosuppression, infections, and hepatotoxicity. The adaptable and modular nature of our VersAptx platform allows us to combine different targeting, linker, and payload technologies to develop unique bioconjugates, such as those in our current product pipeline, that are designed to address the safety and efficacy challenges of existing bioconjugates. Our technological advancements have been demonstrated in preclinical studies, including the following comparisons to FDA-approved bioconjugates:

| • | At the American Society of Hematology (ASH) 2022 Annual Meeting, we presented preclinical data demonstrating how our legumain linker + KSPi payload with CellTrapper effector chemistry improved the safety and efficacy of Mylotarg®1 (gemtuzumab-ozogamycin), the only marketed ADC for AML. |

| • | At the American Association for Cancer Research (AACR) 2023 Annual Meeting, we presented preclinical data for VIP236, our SMDC, demonstrating improved efficacy in patient- and cell line-derived gastric cancer models compared with ENHERTU®2, a marketed ADC for HER2+ solid tumors. |

| • | At the ASH 2023 Annual Meeting, we presented preclinical data for VIP924 demonstrating superior efficacy and safety compared with Polivy®3 and Zynlonta®4, two marketed ADCs for B-cell lymphoma. |

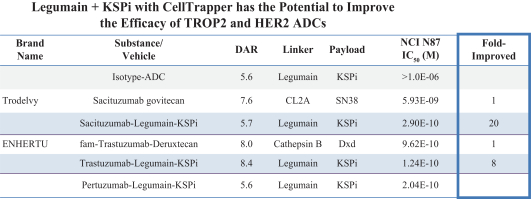

| • | Recently, we demonstrated in a preclinical study the ability of our legumain linker + KSPi payload with CellTrapper effector chemistry to enhance the potency of TRODELVY®5 and ENHERTU, two marketed ADCs, by conjugating TRODELVY’s TROP2 and ENHERTU’s HER2 antibodies with our effector chemistry. The results of this study, shown in the table below, demonstrated a significant improvement in the potency of both drugs, with TRODELVY potency amplified by a factor of 20 and ENHERTU potency by a factor of 8. |

| 1 | Mylotarg™ is a trademark owned by Pfizer Inc. |

| 2 | ENHERTU® is a trademark owned by Daiichi Sankyo, Inc. and AstraZeneca LP |

| 3 | Polivy® is a trademark owned by Genentech USA, Inc. |

| 4 | Zynlonta® is a trademark owned by ADC Therapeutics SA |

| 5 | TRODELVY® is a trademark owned by Gilead Sciences, Inc. |

9

Table of Contents

These preclinical studies underscore the potential of the VersAptx platform in developing safer and more efficacious treatment options in hematological malignancies and solid tumors.

Our Product Candidates

Antibody Drug Conjugate: VIP943 (CD123-KSPi)

VIP943 is a potential best-in-class anti-CD123 ADC created with our VersAptx Platform. It consists of an anti-CD123 antibody, a novel legumain-cleavable linker, and a KSPi payload enhanced with our CellTrapper technology. CD123 is a protein predominantly produced by activated T-cells. In diseases like AML, B-cell acute lymphoblastic leukemia (B-ALL), classical Hodgkin lymphoma, and MDS, CD123 is expressed at elevated levels, particularly in peripheral blasts and leukemic stem cells. By employing an anti-CD123 antibody, VIP943 can selectively target cells expressing CD123 while minimizing impact on healthy cells. Our VIP943 effector chemistry (legumain linker + KSPi payload with CellTrapper) is designed to deliver improved efficacy and safety, allowing us to prolong patients’ treatment duration and thereby effectively target the leukemic stem cells accountable for disease relapse.

Preclinical Results

On-target selectivity and activity assays show our KSPi payload is highly selective for the kinesin spindle protein target, Eg5, versus other members of the related KIF super family. This on-target activity translates to cell cycle arrest at the G2/M phase of mitosis, resulting in cell death in AML cell lines. In vitro cytotoxicity assays show that most hematologic cell lines (n=56) are sensitive to KSPi and that DNA alterations (including common AML mutations such as TP53) did not reduce its cytotoxicity. Nonhuman primate safety and toxicokinetic studies show that repeat dosing of VIP943 in cynomolgus monkeys has good overall tolerability without the myelosuppression and hepatotoxicity seen with other ADCs. This is consistent with the favorable safety profile seen to date in the VIP943 Phase 1 dose-escalation study.

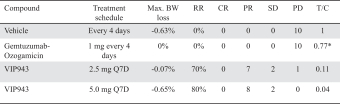

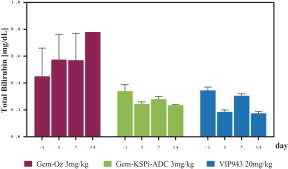

At the American Society of Hematology (ASH) 2022 Annual Meeting, we presented data for VIP943 demonstrating in monkeys the benefit of our VIP943 effector chemistry. In this safety study, we compared VIP943 to Mylotarg (gemtuzumab-ozogamycin; FDA approved ADC for AML), and to Mylotarg’s anti-CD33 monoclonal antibody combined with our VIP943 effector chemistry (legumain linker + KSPi payload with CellTrapper). Following a single dose of each test agent (n=2 per group), the Mylotarg group showed a significant drop in platelet and red blood cell counts with insufficient recovery, along with a continuous decrease in white blood cells and lymphocyte. Mylotarg-treated animals also exhibited critical decreases in hemoglobin and hematocrit, indicating adverse effects. In contrast, the ADCs with our VIP943 effector chemistry showed no impact on the number of platelets or red blood cell populations. Mylotarg also led to increased liver enzymes, severely elevated total bilirubin (signifying liver toxicity), and an extreme rise in urea nitrogen (indicating kidney toxicity). These adverse events prompted euthanasia for one Mylotarg-treated monkey, while another died on

10

Table of Contents

day 13. In contrast, no animals treated with ADCs using our VIP943 effector chemistry died, and all were healthy after the study’s conclusion.

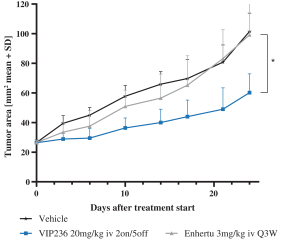

The data presented at ASH also included results of an efficacy study in a MOLM-13 mouse model, which showed that VIP943 had superior efficacy as compared with Mylotarg. In that study, VIP943 achieved tumor regression after 2 cycles, while Mylotarg resulted in disease progression in all treated mice.

|

** P<0.01, *** P<0.001 vs vehicle |

* Measured at day 10 |

Clinical Studies

VIP943 is in a Phase 1 dose-escalation study treating patients with relapsed/refractory AML, myelodysplastic syndrome, and B-cell acute lymphoblastic leukemia who have exhausted standard therapeutic options (NCT06034275).

In September 2023, we dosed the first patient in this study. To date, we have completed dosing two cohorts and enrollment in the third cohort has started, with a total of 9 patients dosed in the study. The preliminary pharmacokinetic data from the first two cohorts show low levels of unconjugated payload in circulation, aligning with preclinical findings in nonhuman primates. Early safety data is also promising, with no patients showing dose-limiting toxicities in cohorts 1 and 2. We expect to release more details regarding the preliminary dose escalation study data on or around the 2024 European Hematology Association (EHA) Annual Meeting in June 2024.

Potential Clinical Path

We expect to expand into additional CD123-positive indications, including TP53 mutated AML, as safety and efficacy data are generated.

11

Table of Contents

Antibody Drug Conjugate: VIP924 (CXCR5-KSPi)

VIP924 is a first-in-class anti-CXCR5 ADC created with our VersAptx platform and shares the same effector chemistry as VIP943 (legumain linker + KSPi payload with CellTrapper). CXCR5 governs crucial processes including chemotaxis, germinal center formation, and differentiation of plasma and memory B-cells. It is highly expressed on tumor cells of DLBCL, FL, MCL and CLL. As with VIP943, our VIP924 effector chemistry is designed to reduce non-specific release and uptake of the payload and ensure payload accumulation in cancer cells.

Preclinical Results

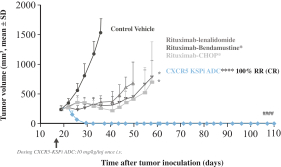

In preclinical studies, VIP924 induced sustained tumor regression in MCL and DLBCL models, including ibrutinib-refractory MCL cell-derived models, with only 1 or 2 doses.

VIP924 Is Active in Ibrutinib-Refractory MCL

In Vivo Model

| • | Ibrutinib-refractory MCL CDX CXCR5+ REC-1 model (inset) |

| • | VIP924 achieved complete remission after 2 doses |

| **** | P=0.0001 vs vehicle. Tumor volumes on day 26. |

Single Dose of VIP924 in DLBCL In Vivo Model Achieved Durable Complete Regressions

| • | Complete regression with single dose of VIP924 in CXCR5+ model OCI-LY1 (day 114) |

| • | Superior activity versus standard of care |

| * | P<0.05. **** P=0.0001 vs vehicle. #### P<0.0001 vs rituximab-bendamustine/ lenalidomide or CHOP. Tumor volumes on day 36. RR, response rate. |

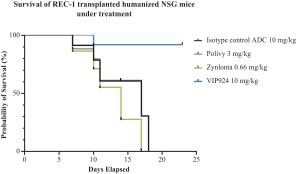

Additionally, evaluation in an MCL mouse model showed that VIP924 had superior efficacy and safety compared with Polivy® and Zynlonta® (FDA approved ADCs for B-cell lymphoma). In the study, we observed that animals treated with VIP924 exhibited significant inhibition of tumor growth and experienced a survival benefit compared with Zynlonta- and Polivy-treated animals. Additionally, Zynlonta-treated animals demonstrated reductions in white blood counts, monocytes, and lymphocytes at the end of the treatment, whereas VIP924 treatment showed minimal to no effects on these cell populations.

**** On day 17, tumor volumes of VIP924 treated animals were significantly lower (P<0.00002) compared with control.

12

Table of Contents

Potential Clinical Path

VIP924 can be evaluated in B-cell malignancies, such as MCL, FL, DLBCL, and CLL in monotherapy and in combination. Our goal is to progress VIP924 to an IND application in late 2025 or early 2026 once additional funding is secured.

Small Molecule Drug Conjugate: VIP236

VIP236 is a first-in-class SMDC created with our VersAptx Platform. It consists of an αvß3 integrin binder, a neutrophil elastase linker cleaved in the TME, and an optimized CPT for high permeability and low efflux. Activated αvß3, an integrin found on tumor cells and in the TME, is overexpressed in advanced and metastatic tumors. αvß3 is a well-established target in solid tumors and, when used as a homing mechanism, allows for targeted delivery of our optimized CPT payload. We believe this approach enhances the efficacy of tumor treatment and the payload’s safety profile.

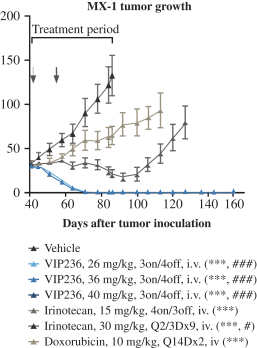

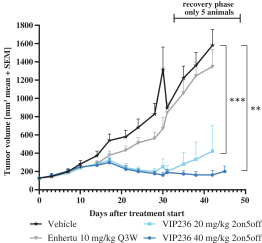

Preclinical Results

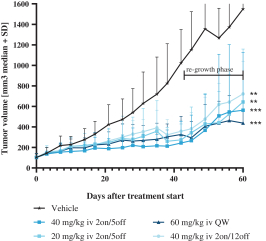

In numerous preclinical studies, we observed significant and superior tumor regression across various cell- and patient-derived xenograft models with VIP236 as compared with standard of care. In the TNBC MX-1 model below, we show that VIP236 has superior tumor regression compared with common chemotherapies, irinotecan and doxorubicin. In a liver metastasis from colorectal cancer model, we observed that VIP236 caused statistically significant tumor growth inhibition and delayed re-growth.

Triple Negative Breast Cancer

*** P < 0.001 compared with vehicle, # P < 0.05 compared with doxorubicin or cisplatin, ### P < 0.001 compared with doxorubicin or cisplatin or 5-FU.

Liver Metastasis from Colorectal Cancer

* P < 0.05 compared with vehicle , ** P < 0.01 compared with vehicle, *** P < 0.001 compared with vehicle, **** P < 0.0001 compared with vehicle

13

Table of Contents

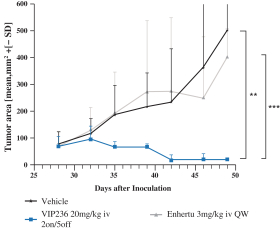

Most notably, preclinical data show enhanced efficacy in patient-and cell line-derived gastric cancer models in NMRI nude mice compared with ENHERTU® (an ADC approved specifically in HER2+gastric and gastroesophageal junction cancer). In these models, ENHERTU had very little effect on tumor growth, while VIP236 slowed and even caused tumor regression independent of HER2 expression.

NCIN87 HER2high

* P<0.05 vs vehicle.

SNU 16 HER2neg

** P<0.01. *** P<0.001 vs vehicle.

GXA3040 HER2low

** P<0.01. *** P<0.001 vs vehicle.

Clinical Studies

VIP236 is being evaluated in a Phase 1 dose-escalation study treating patients with advanced or metastatic solid tumors (NTC05371054).

14

Table of Contents

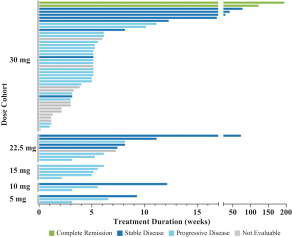

In January 2023, we dosed the first patient in this study. To date, we have dosed 20 patients with VIP236. Five patients were dosed in three dose cohorts on the initial schedule of 2 days on/5 days off. Fifteen patients have been dosed in four dose cohorts on the once every three-week schedule. Dose escalation continues on the once every three-week schedule. The early safety profile of the once every three-week dosing schedule remains very encouraging, and VIP236 is showing signs of dose-dependent clinical activity (i.e., tumor shrinkage). We expect to release more details regarding the preliminary dose escalation study data during the 2024 AACR Annual Meeting in April 2024.

Potential Clinical Path

Given preclinical and clinical data, VIP236 shows promising clinical potential across several indications, including ovarian and endometrial cancers, gastric cancer, and metastatic disease (specifically in TNBC and lung cancer).

Enitociclib (P-TEFb/CDK9 inhibitor)

Enitociclib is a best-in-class and highly selective CDK9 inhibitor. Enitociclib effectively blocks P-TEFb-mediated activation of RNA polymerase II, preventing transcription of MCL1 and MYC, proteins associated with poor prognosis in various types of cancer. Enitociclib’s mechanism of action is different from other CDK9 inhibitors, offering a more targeted approach, ultimately leading to cell death and reduction in tumor cell proliferation.

Preclinical Results

Preclinical studies support enitociclib as a best-in-class CDK9 inhibitor. The findings strongly suggest that enitociclib is highly selective and has a favorable safety profile, potentially making it an ideal combination partner in aggressive B-cell lymphomas and pediatric indications. Select preclinical studies are shown below:

In work performed in collaboration with the University of Calgary, enitociclib demonstrated potent cytotoxic activity as a single agent (IC50: 36-78 nM) and in combination with several anti-multiple myeloma (MM) agents in a small molecule inhibitor screening. In a JJN-3 MM xenograft mouse model, enitociclib monotherapy inhibited MYC and MCL1 transcription, inducing pro-caspase-3 and PARP cleavage within an hour of treatment, leading to reduction in tumor volumes by day 20 (96% to 99% tumor reduction). Further, enhanced efficacy was noted when enitociclib was combined with lenalidomide in a mouse model, confirming the earlier findings in the small molecule screening. Taken together, these preclinical results highlight the opportunity to advance enitociclib in optimization studies in MM.

In another University of Calgary collaboration, enitociclib was evaluated as a single agent and in combination in models of pediatric leukemia with KMT2A rearrangement, commonly seen in infant acute lymphoblastic leukemia and AML. Enitociclib alone achieved durable tumor inhibition and complete remission in a rat KMT2A leukemia model. In vitro, the combination of low dose enitociclib and various chemotherapies, prednisolone, and a KMT2A inhibitor showed significant synergistic cytotoxicity. These findings offer initial proof-of-concept for incorporating targeted cytotoxic agents with enitociclib in future clinical trials for KMT2A-rearranged leukemia, particularly in pediatric cases.

Clinical Studies

Bayer Study 18117: Enitociclib Dose-Escalation Study in Relapsed and Refractory Leukemia

In this open-label Phase 1 study conducted by Bayer, enitociclib was assessed for safety, tolerability, and preliminary anti-tumor activity in patients with advanced hematologic malignancies. The study was concluded early, with 21 patients with relapsed/refractory AML treated. Enitociclib demonstrated a consistent safety profile across different dose levels, with gastrointestinal side effects and cytopenia being the most common adverse

15

Table of Contents

events. Notably, no dose-limiting toxicities (DLTs) were reported. The study did not include patients with other hematologic malignancies (e.g., CLL or myelodysplastic syndrome).

Study VNC-152-101 (Formerly Bayer Study 17496): Safety, Efficacy, and Expanded Cohorts

Bayer also initiated an open-label Phase 1 dose escalation study, later taken-over by Vincerx and renamed VNC-152-101, designed to evaluate enitociclib as a monotherapy in patients with advanced cancer, including solid tumors and non-Hodgkin lymphoma. In total, the study enrolled 63 patients in the dose escalation and expansion cohorts (Bayer enrolled 37 patients [31 in dose escalation and 6 in the expansion cohort for DH-DLBCL] and Vincerx enrolled 26 patients). Enitociclib showed a favorable safety profile, dose-proportional pharmacokinetics, and on-target pharmacodynamic activity. Early clinical benefits across various indications include two patients with DH-DLBCL who experienced durable complete metabolic remissions, which persisted even after stopping treatment during the COVID pandemic. Additionally, one patient with transformed follicular lymphoma and 13 patients with solid tumors achieved stable disease as their best response to treatment.

Monotherapy Activity

2 Complete Remissions (CR) of 7 DH-DLBCL (29% CR rate)

| • | 1 on treatment for 3.7 years |

| • | 1 on treatment for 2.3 years |

| • | Both patients continue in full remission ~2 years after stopping treatment |

14 Patients had Stable Disease as Best Response

| • | 1 transformed follicular, 27 cycles* |

| • | 5 ovarian cancer, 1 to 10 cycles |

| • | 2 pancreatic cancer, 3 and 14 cycles |

| • | 2 esophageal/nasopharyngeal, 2 and 3 cycles |

| • | 1 salivary gland cancer, 24 cycles |

| • | 1 breast cancer, 3 cycles |

| • | 1 clival chordoma, 4 cycles |

| • | 1 appendix cancer, 4 cycles |

| * | As of January 2024. |

Study VNC-152-801: NIH Sponsored Study in R/R Lymphoid Malignancies

In April 2023, we began a study in partnership with the National Institutes of Health (NIH). This Phase 1 dose escalation study aims to establish the maximum tolerated dose and recommended Phase 2 dose and assess the safety and toxicity profile of the combination of enitociclib with venetoclax and prednisone (VVIP) in patients with relapsed/refractory lymphoid malignancies. As of January 2024, a total of 5 patients have been dosed in this study. Of these 5 patients, 2 out of 3 peripheral T-cell lymphoma (PTCL) patients (67%) achieved a partial response (PR) as a best response, with tumor regressions of 91% and 86%. Additionally, 1 DH-DLBCL patient out of 2 lymphoma patients achieved a PR (71% tumor regression) after just one treatment cycle, emphasizing the faster response rate of this combination compared with enitociclib monotherapy. There were no observed DLTs. Enrollment for this study continues.

Potential Clinical Path

We believe enitociclib’s favorable safety profile makes it an ideal combination partner across numerous hematologic malignancies such as DLBCL and PTCL as well as MYC-driven solid tumors such as ovarian cancer. Further research in these areas will proceed once additional funding is secured.

16

Table of Contents

Sales and Marketing

Because we are a clinical-stage company, we do not currently have our own marketing, sales, or distribution capabilities. To commercialize any of our product candidates, if approved for commercial sale and marketing, we would have to develop a sales and marketing infrastructure. We may opportunistically seek strategic collaborations or partners to maximize the commercial opportunities for our product candidates inside and outside the United States.

Manufacturing

We do not currently own or operate manufacturing facilities for the production of clinical or commercial quantities of our drug substances or drug products, and there are a limited number of manufacturers that operate under the cGMP requirements of the FDA that might be capable of manufacturing for us. We currently intend to rely on contract manufacturing organizations, for both drug substance and drug product. In addition, we recruit highly qualified personnel with experience to manage the contract manufacturing organizations producing our product candidates and other product candidates that we may develop in the future. Similarly, we do not own or operate a laboratory with expertise in diagnostic assessment of cancer subpopulations and will contract with specific commercial diagnostic labs to develop companion diagnostics to accompany our drug products. We recruit highly qualified personnel with experience to manage these commercial diagnostic companies for our product candidates or those that we may develop in the future.

Our outsourced approach to manufacturing relies on contract manufacturing organizations to first develop cell lines and manufacturing processes that are compliant with cGMP requirements and then produce material for preclinical studies and clinical trials. Our agreements with contract manufacturing organizations may obligate them to develop a production cell line, establish master and working cell banks, develop and qualify upstream and downstream processes, develop drug product processes, validate (and in some cases develop) suitable analytical methods for test and release as well as stability testing, produce drug substance for preclinical testing, produce cGMP-compliant drug substance, or produce cGMP-compliant drug product. We conduct audits of contract manufacturing organizations prior to initiation of activities under these agreements and monitor operations to ensure compliance with these agreements, the mutually agreed process descriptions, and cGMP regulations. A similar approach is applied to commercial diagnostic companies that we would partner with for companion diagnostics.

Competition

The biotechnology industry, especially the oncology sector, is characterized by fast-paced technological evolution, substantial competition, and a strong emphasis on intellectual property. Competitors may come from multiple sources, including specialty, pharmaceutical and biotechnology companies, public and private research organizations, academic research institutions, and governmental agencies. Product candidates that we may develop and potentially get approved will face competitive pressures from incumbent therapies as well as new therapies that may become available in the future.

Many global pharmaceutical companies, as well as medium and small biotechnology companies, are pursuing new cancer treatments, whether small molecules, biologics, bioconjugates, or cell or gene therapies. Any of these treatments could prove to be superior clinically to our products or product candidates and render them obsolete or non-competitive.

Although we believe our bioconjugation product candidates and VersAptx platform are highly differentiated, many companies continue to invest in innovation in the bioconjugate field, including new payload classes, new conjugation approaches, and new targeting moieties. Additionally, many companies have products and/or platforms that target the same indications our programs target. Any of these initiatives could lead to products that have superior properties to our VersAptx platform and bioconjugation product candidates. Some of

17

Table of Contents

the companies that may compete with us include, AbbVie Inc., ADC Therapeutics SA, Astellas Pharma Inc., Astra-Zeneca PLC, Bicycle Therapeutics plc, Bristol-Myers Squibb Company, CytomX Therapeutics, Inc., Daiichi Sankyo Company, Limited, Duality Biologics Co. Ltd., Eli Lilly and Company, Genentech, Inc., Gilead Sciences, Inc., GSK plc, Iksuda Therapeutics Ltd, Innovent Biologics, Inc., ImmunoGen, Inc. (acquired by AbbVie, Inc.), Immunomedics, Inc., Johnson & Johnson Inc, Klus Pharma, Inc, LegoChem Biosciences, Inc., MacroGenics, Inc., Merck & Co., Inc, Mersana Therapeutics Inc., Novartis International AG, ProfoundBio Inc, Pyxis (which acquired Pfizer, Inc.’s ADC technology), Roche Holding AG, Sanofi S.A., Seagen, Inc. (acquired by Pfizer, Inc.), and Takeda Pharmaceutical Company Limited.

Although we also believe enitociclib is a best-in-class and highly selective CDK9 inhibitor that is highly differentiated from other CDK9 programs and therapies targeting the same indications, there are other CDK9 programs in development demonstrating clinical efficacy and several are further along in development than our programs. The companies with clinical-stage programs include Cyclacel Pharmaceuticals Inc., Kronos Bio, Inc., Merck & Co., Inc., Prelude Therapeutics Inc., SELLAS Life Sciences Group, Inc, and Sumitomo Dainippon Pharma Co., Ltd. These or other companies and their current or future partners may develop CDK9 inhibitor programs with attributes to compete in the same indications as enitociclib. In addition, there are many other companies that are pursuing targets around P-TEFb to affect similar transcriptional or disease processes as CDK9 inhibition may affect. Companies that are pursuing the inhibition of CDK7, CDK2, MYC, BRD4, PRMT, and related transcriptional regulators may compete in the same indications as enitociclib.

We expect to compete on efficacy, safety, and tolerability, and if our products are not demonstrably superior in these respects compared with other approved therapies, we may not be able to compete effectively, rendering our technologies, or our product candidates, obsolete or non-competitive.

Many of our potential competitors, either alone or in partnership with other players, have significantly greater financial, technical, and human resource capabilities than us. This in turn might allow them to become more successful than us in achieving treatment approvals and market acceptance, reducing the competitiveness of our product candidates, and accelerating their obsolescence. In addition, merger and acquisition activity in the pharmaceutical and biotechnology space may result in an increased concentration of resources among a smaller number of competitors. Earlier stage companies may also become relevant competitors, especially through collaborations with established companies. The areas of competition also extend to scientific and managerial talent recruitment and retention, clinical trial sites, patient registration for clinical trials, and acquisition or development of technologies that might be complementary or necessary for our drug programs.

Government Regulation

Regulatory authorities, in the United States as well as in foreign countries, extensively regulate, among other things, the research, development, testing, manufacture, quality control, import, export, safety, efficacy, labeling, packaging, storage, distribution, record keeping, approval, advertising, promotion, marketing, post-approval monitoring and post-approval reporting of small molecule drugs and biologics such as those we are developing.

FDA Drug Approval Process

In the United States, drug products are subject to regulation by the FDA under the FDCA and the regulations promulgated thereunder. Biological products, such as our ADC product candidates, are approved for marketing under provisions of the Public Health Service Act, via a BLA. The application process and requirements for approval of BLAs are very similar to those for NDAs, and biologics are associated with similar approval risks and costs. Failure to comply with applicable U.S. requirements may subject a company to a variety of administrative or judicial sanctions, such as clinical hold, FDA refusal to approve pending NDAs or BLAs, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties, and criminal prosecution.

18

Table of Contents

The process required by the FDA before drug product candidates may be marketed in the United States generally involves the following:

| • | completion of preclinical laboratory tests and animal studies performed in accordance with FDA’s current Good Laboratory Practices (GLP) requirements; |

| • | submission to the FDA of an IND, which must be reviewed by the FDA before clinical trials may begin; |

| • | approval by an independent Institutional Review Board or ethics committee for each clinical protocol before clinical trials may begin at each clinical trial site; |

| • | performance of adequate and well-controlled human clinical trials in accordance with FDA requirements, to establish the safety and efficacy of the product candidate for its intended purpose; |

| • | preparation of and submission to the FDA of an NDA or BLA after completion of all pivotal clinical trials, and satisfactory completion of an FDA Advisory Committee review, if applicable; |

| • | satisfactory completion of one or more FDA pre-approval inspection(s) of the manufacturing facility or facilities at which the product candidate is produced, tested, and released to assess compliance with cGMP and to assure that the facilities, methods and controls are adequate to preserve the product candidate’s continued safety, purity, and potency, and of selected clinical investigation sites to assess compliance with good clinical practice requirements; and |

| • | FDA review and approval, or licensure, of the NDA/BLA to permit commercial marketing of the drug product for particular indications for use in the United States. |

Preclinical and Clinical Development

Prior to beginning the first clinical trial with an investigational product in the United States, we must submit an IND to the FDA. An IND is a request for authorization from the FDA to administer an investigational product to humans. The central focus of an IND submission is on an evaluation of safety to support the protocol(s) for clinical studies. The IND also includes results of studies assessing the toxicology, pharmacokinetics, pharmacology, and pharmacodynamic characteristics of the product candidate; chemistry, manufacturing, and controls information; and any available human data or literature to support its use. An IND must become effective before human clinical trials may begin. The submission of an IND may or may not result in FDA authorization to begin a clinical trial. At any point, if the FDA has questions or concerns regarding an ongoing clinical trial, they may impose a clinical hold, for example, until such time as adjustments can be made to that clinical trial to resolve such concerns.

Clinical trials are studies that involve the administration of an investigational drug product to human subjects under the supervision of qualified investigators in accordance with good clinical practices, which include the requirement that all research subjects provide informed consent for their participation. Clinical trials are conducted under protocols detailing, among other things, the objectives of the study and the parameters to be used in monitoring safety and efficacy. A separate submission to an existing IND must be made for each successive clinical trial conducted during drug product development and for any subsequent protocol amendments. For new indications, a separate, new IND may be required. Furthermore, an independent Institutional Review Board for each site proposing to conduct the clinical trial must review and approve the plan for any clinical trial and its informed consent form before the clinical trial begins at that site and must monitor the study until completed. Regulatory authorities, the Institutional Review Board or the sponsor may suspend a clinical trial at any time on various grounds, including a finding that the subjects are being exposed to an unacceptable health risk or that the clinical trial is unlikely to meet its stated objectives. Some studies also include oversight by an independent group of qualified experts organized by the sponsor, known as a data safety monitoring board, which provides recommendations for whether or not a clinical trial may move forward based on access to certain data from that clinical trial and may recommend a discontinuation if it determines that there

19

Table of Contents

is an unacceptable safety risk for subjects or other grounds, such as no demonstration of efficacy. There are also requirements governing the reporting of ongoing clinical studies and clinical trial results to public registries. For purposes of NDA/BLA approval, human clinical trials are typically conducted in three sequential phases that may overlap.

| • | Phase 1—The investigational drug product is introduced into healthy human subjects or patients with the target disease or condition. These studies test the safety, dosage tolerance, absorption, metabolism, distribution, and elimination of the investigational product, the side effects associated with increasing doses, and, if possible, to gain early evidence of efficacy. For certain investigational drug products targeting life-threatening diseases, such as cancer, especially when the product may be too inherently toxic to ethically administer to healthy volunteers, initial human testing is conducted in patients with the target disease or condition. |

| • | Phase 2—The investigational product is administered to a limited patient population with a specified disease or condition to evaluate the preliminary efficacy, optimal dosage, and dosing schedule, and to identify possible adverse side effects and safety risks. Multiple Phase 2 clinical trials may be conducted to obtain information prior to beginning larger and more expensive Phase 3 clinical trials. |

| • | Phase 3—The investigational drug product is administered to an expanded patient population to further evaluate dosage, to provide statistically significant evidence of clinical efficacy, and to further test for safety, generally at multiple geographically dispersed clinical trial sites. These clinical trials are intended to establish the overall risk/benefit ratio of the investigational drug product and to provide an adequate basis for product approval. |

Post-approval trials, sometimes referred to as Phase 4 or post-approval commitment studies, may be conducted after initial marketing approval. These trials are used to gain additional experience from the treatment of patients in the intended therapeutic indication. In certain instances, the FDA may mandate the performance of Phase 4 clinical trials as a condition of approval of an NDA/BLA.

During the development of a drug product candidate, sponsors are given opportunities to meet with the FDA. These meetings may be prior to submission of an IND, at the end of Phase 1 or Phase 2, and before an NDA/BLA is submitted. Meetings at other times may also be requested. These meetings can provide an opportunity for the sponsor to share information about data gathered to date, for the FDA to provide advice, and for sponsor and the FDA to reach agreement on the next phase of development.

Additional meetings and correspondence with the FDA can also occur to summarize progress in the clinical trials, to review written IND safety reports, and to develop strategies (for example in accordance with FDA initiatives such as Project Optimus) for dose finding and dose optimization that leverage preclinical and clinical data in dose selection, including randomized evaluations of a range of doses in clinical trials. An emphasis of such strategies is placed on performing these studies as early and as efficiently as possible in the development program.

U.S. Submission, Review and Approval

Assuming successful completion of required testing in accordance with applicable regulatory requirements, the results of drug product development, and preclinical and clinical studies are submitted to the FDA as part of an NDA/BLA requesting approval to market the product. The NDA/BLA must include all relevant data available from pertinent preclinical and clinical studies, together with detailed information relating to the drug product candidate’s chemistry, manufacturing, controls, and proposed labeling. The submission of an NDA/BLA requires payment of substantial fees to the FDA, unless a waiver or exemption applies. Additionally, no user fees are assessed on NDA/BLAs for products designated as orphan drugs, unless the product also includes a non-orphan indication.

The FDA reviews an NDA/BLA to determine, among other things, whether a drug product is safe, pure, and potent and the facility in which it is manufactured, tested, processed, packed, or held meets standards designed to

20

Table of Contents

assure its continued safety, purity, and potency. The FDA may convene an advisory committee to provide clinical insight on application review questions. This review typically takes twelve months from the date the NDA is submitted and the FDA has approximately two months to make a “filing” decision after submission.

Before approving an NDA/BLA, the FDA will typically inspect the facilities where the product is manufactured. The FDA will not approve an application unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and adequate to assure consistent production of the drug product within required specifications. If the FDA determines that the application, manufacturing process or manufacturing facilities are not acceptable, it will outline the deficiencies in the submission and often will request additional testing or information. Notwithstanding the submission of any requested additional information, the FDA ultimately may decide that the application does not satisfy the regulatory criteria for approval.

After the FDA evaluates an NDA/BLA and conducts inspections of manufacturing facilities where the drug product candidate and/or its drug substance will be produced, the FDA may issue an approval letter or a Complete Response Letter (CRL). An approval letter authorizes commercial marketing of the drug product with specific prescribing information for specific indications. A CRL would describe all deficiencies that FDA has identified in the NDA/BLA, except that where FDA determines that the data supporting the application are inadequate to support approval, it may issue the CRL without first conducting required inspections, testing submitted product lots, and/or reviewing proposed labeling. In issuing the CRL, the FDA may recommend actions that the applicant might take to place the NDA/BLA in condition for approval, including requests for additional information or clarification. The FDA may delay or refuse approval of an NDA/BLA if applicable regulatory criteria are not satisfied, require additional testing or information, and/or require post-marketing testing and surveillance to monitor safety or efficacy of a drug product.

If regulatory approval of a drug product is granted, such approval will be granted for particular indications and may entail limitations on the indicated uses for which such drug product may be marketed. For example, the FDA may approve an NDA/BLA with a Risk Evaluation and Mitigation Strategy to ensure the benefits of the drug product outweigh its risks. A Risk Evaluation and Mitigation Strategy is a safety strategy developed to manage a known or potential serious risk associated with a drug product and to enable patients to have continued access to such medicines by managing their safe use, and could include medication guides, physician communication plans, or elements to assure safe use, such as restricted distribution methods, patient registries, and other risk minimization tools. The FDA may also conditionally approve a drug product based on, for example, changes to proposed labeling or the development of adequate controls and specifications. Once approved, the FDA may withdraw the drug product approval if compliance with pre- and post-marketing requirements is not maintained or if problems occur after the drug product reaches the marketplace. The FDA may require one or more Phase 4 post-marketing studies and surveillance to further assess and monitor the product’s safety and efficacy after commercialization, and may limit further marketing based on the results of these post-marketing studies. In addition, new government requirements, including those resulting from new legislation, may be established, or the FDA’s policies may change, which could impact the timeline for regulatory approval or otherwise impact ongoing development programs.

In addition, the Pediatric Research Equity Act, requires a sponsor to conduct pediatric clinical trials for most drugs. Under this Act, original NDAs/BLAs and supplements must contain a pediatric assessment unless the sponsor has received a deferral or waiver. For molecularly targeted oncology drugs, the Research to Accelerate Cures and Equity (RACE) for Children Act (2017) requires an agreement reached with the FDA on which pediatric indications are to be fully assessed with a pediatric study plan. The required assessment must evaluate the safety and efficacy of the product for the selected indications in all relevant pediatric subpopulations and support dosing and administration for each pediatric subpopulation for which the product is safe and effective. A deferral may be requested and granted for several reasons, including a finding that the drug is ready for approval for use in adults before pediatric clinical trials are complete or that additional safety or effectiveness data needs to be collected before the pediatric clinical trials begin. The FDA must send a non-compliance letter to any sponsor that fails to submit the required assessment, keep a deferral current, or submit a request for approval of a pediatric formulation.

21

Table of Contents

Expedited Development and Review Programs

| • | Any drug product candidate submitted to the FDA for approval may be eligible for programs intended to expedite FDA review and approval process, such as priority review, fast track designation, breakthrough therapy designation, and accelerated approval. Priority review designation may be granted for a drug product candidate that treats a serious condition and, if approved, would provide a significant improvement in safety or effectiveness. |

| • | If the FDA determines, based on the request of a sponsor, that a product candidate is intended to treat a serious or life-threatening disease or condition and demonstrates the potential to address an unmet medical need by providing a therapy where none exists or a therapy that may be potentially superior to existing therapy based on efficacy or safety factors, that drug product candidate may be eligible for fast-track designation. |

| • | A breakthrough therapy designation is granted to drugs or biologics that are intended, alone or in combination with one or more other drugs or biologics, to treat a serious or life-threatening disease or condition, and preliminary clinical evidence indicates that a drug or biologic may demonstrate substantial improvement over existing therapies. |

| • | An accelerated approval determination may be granted for drug product candidates studied for their safety and effectiveness in treating serious or life-threatening diseases or conditions. |

Even if a product candidate qualifies for one or more of these programs, the FDA may later decide that it no longer meets the conditions for qualification or decide that the time period for the FDA review and approval will not be shortened. Furthermore, priority review, fast track designation, breakthrough therapy designation and accelerated approval do not change the standards for approval but may expedite the development or approval process.

Orphan Drug Designation

Under the Orphan Drug Act, the FDA may grant orphan designation to a drug or biologic intended to treat a rare disease or condition (a disease or condition that affects fewer than 200,000 individuals in the United States) for which there is no reasonable expectation that the cost of developing and making available such a drug or biologic would be recovered from sales in the United States for that drug or biologic). Orphan drug designation may offer a seven-year period of marketing exclusivity, with exceptions. Orphan drug designation does not convey any advantage in, or automatically shorten the duration of, the regulatory review or approval process.

Post-Approval Requirements

Any drug products manufactured or distributed by us pursuant to FDA approvals are subject to continuing regulation by the FDA, including, among other things, requirements relating to quality control and quality assurance, record-keeping, reporting of adverse experiences, product sampling and distribution, and advertising and promotion of the product. After approval, most changes to the drug product, such as adding new indications or other labeling claims, are subject to FDA review and approval. There are also continuing user fee requirements, under which the FDA assesses an annual program fee for each drug product identified in an approved NDA/BLA. Drug manufacturers and their subcontractors are required to register their establishments with the FDA and certain state agencies, and are subject to periodic unannounced inspections by the FDA and certain state agencies for compliance with cGMP requirements, which impose certain procedural and documentation requirements upon us and our third-party manufacturers. Changes to the manufacturing process are strictly regulated, and, depending on the significance of the change, may require prior FDA approval before being implemented. FDA regulations also require investigation and correction of any deviations from cGMP requirements and impose reporting requirements upon us and any of our third-party manufacturers. Accordingly, manufacturers must continue to expend time, money, and effort in the area of production and quality control to maintain compliance with cGMP requirements and other aspects of regulatory compliance.

22

Table of Contents

The FDA may withdraw approval if compliance with regulatory requirements and standards are not maintained or if problems occur after the drug product reaches the market. Later discovery of previously unknown problems with a drug product, including adverse events of unanticipated severity or frequency, or manufacturing processes, or failure to comply with regulatory requirements, may result in revisions to the approved labeling to add new safety information, imposition of post-market studies or clinical studies to assess new safety risks, or imposition of distribution restrictions or other restrictions under a Risk Evaluation and Mitigation Strategy program. Other potential consequences include, for example:

| • | restrictions on the marketing or manufacturing of a drug product, mandated modification of promotional materials or issuance of corrective information, issuance by the FDA or other regulatory authorities of safety alerts, Dear Healthcare Provider letters, press releases, or other communications containing warnings or other safety information, or complete withdrawal or recall of the drug product from the market; |

| • | fines, warning letters, or holds on post-approval clinical studies; |

| • | refusal of the FDA to approve pending applications or supplements to approved applications, or suspension or revocation of existing approvals; |

| • | product seizure or detention, or refusal of the FDA to permit the import or export of drug products; or |

| • | injunctions, consent decrees, or the imposition of civil or criminal penalties. |

The FDA closely regulates and actively enforces the marketing, labeling, advertising, and promotion of drug products. A company can make only those claims relating to safety, efficacy, purity, and potency that are approved by the FDA and in accordance with the provisions of the approved label. Failure to comply with these requirements can result in, among other things, adverse publicity, warning letters, corrective advertising, and potential civil and criminal penalties. Physicians may prescribe legally available products for uses that are not described in the product’s labeling and that differ from those tested by us and approved by the FDA. The FDA does not regulate such off-label uses, but it does restrict a manufacturer’s communications on the subject of off-label use of its products.

Marketing Exclusivity

The FDCA provides a five-year period of non-patent marketing exclusivity within the United States to the first applicant to obtain approval of an NDA for a new chemical entity. During the exclusivity period, the FDA may not approve or even accept for review an ANDA or an NDA submitted under Section 505(b)(2), or 505(b)(2) by another company for another drug based on the same active moiety, regardless of whether the drug is intended for the same indication as the original innovative drug or for another indication, where the applicant does not own or have a legal right of reference to all the data required for approval. However, an application may be submitted after four years if it contains a certification of patent invalidity or non-infringement to one of the patents listed with the FDA by the innovator NDA holder.