ANNUAL INFORMATION FORM

For the year ended April 30, 2023

Date: July 20, 2023

TABLE OF CONTENTS

PRELIMINARY NOTES

Date of Information

Unless otherwise indicated, all information contained in this Annual Information Form (this "AIF") of Vizsla Silver Corp. (the "Company") is as of April 30, 2023.

Financial Information

The Company’s financial results are prepared and reported in accordance with International Financial Reporting Standards issued by the International Accounting Standards Board and Interpretations of the International Financial Reporting Interpretations Committee.

Currency and Exchange Rate Information

All dollar amounts (i.e. "$"), unless otherwise indicated, are expressed in Canadian.

Documents Incorporated by Reference

The technical report titled "Technical Report on the Mineral Resource Estimate Update for the Panuco Ag-Au-Pb-Zn Project, Sinaloa State, Mexico" (the "Technical Report") with an effective date of January 19, 2023, prepared for the Company by Allan Armitage, Ph. D., P.Geo. of SGS Geological Services ("SGS"), Ben Eggers, MAIG, P.Geo. of SGS and Yann Camus, P.Eng. of SGS is specifically incorporated by reference into this Annual Information Form and may be obtained online at the SEDAR website at www.sedar.com.

FORWARD-LOOKING INFORMATION

Certain information, estimates and projections contained herein, and the documents incorporated by reference herein, if any, constitute forward-looking statements regarding the Company, its operations and projects, including, but not limited to, the Panuco-Copala Property (as defined herein). All statements that are not historical facts, involving without limitation, statements regarding future projections, plans and objectives, securing strategic partners and financing requirements and the ability to fund future mine development are forward-looking statements, or forward-looking information. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Forward-looking information and statements involve risks and uncertainties that could cause actual results and future events to differ materially from those anticipated in such information or statements. Such risk factors and uncertainties include, but are in no way limited to, statements with respect to the effect and estimated timeline of the drilling and assay results of the Company, the estimation of mineral reserves and mineral resources, the timing and amount of estimated future exploration, costs of exploration, capital expenditures, success of exploration activities, permitting time lines and permitting, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims, fluctuations in mineral prices, uncertainties and other factors relating to public health crises, volatility in the global financial markets, increased inflation, and turbulence in mining markets resulting from the invasion of Ukraine by Russia, and other risk factors, as discussed in the Company's filings with Canadian securities regulatory agencies including the documents incorporated by reference herein, including those risk factors described herein under "Risk Factors". Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended.

There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company disclaims any obligation to update any forward-looking statements or information, other than as may be specifically required by applicable securities laws and regulations. Actual results may differ materially from those expressed or implied by such forward-looking statements.

CORPORATE STRUCTURE

Name, Address and Incorporation

The Company was incorporated on September 26, 2017 pursuant to the Business Corporations Act (British Columbia) under the name "Vizsla Capital Corp.". On March 8, 2018, the Company changed its name to "Vizsla Resources Corp.". On February 5, 2021, the Company change its name to "Vizsla Silver Corp.".

The head office of the Company is located at Suite 700, 1090 West Georgia Street, Vancouver, British Columbia V6E 3V7. The registered and records office of the Company is located at Suite 401, 353 Water Street, Vancouver, British Columbia V6B 1B8.

The Company is a reporting issuer in all provinces and territories of Canada and its common shares (the "Common Shares") are listed on the TSX Venture Exchange (the "TSXV") under the trading symbol "VZLA". The Company is classified as a Tier 2 Mining Issuer on the TSXV. On January 21, 2022, the Common Shares were listed on the NYSE American and commenced trading under the symbol "VZLA".

Intercorporate Relationships

As at April 30, 2023, the Company had two wholly-owned subsidiaries: Vizsla Royalty Corp. and Canam Alpine Ventures Ltd., both of which were incorporated pursuant to the Business Corporations Act (British Columbia). Canam Alpine Ventures Ltd. has two wholly-owned subsidiaries in Mexico: Minera Canam S.A. DE C.V., Operaciones Canam Alpine S.A. DE C.V. and Vizsla Royalty Corp. has one wholly-owned subsidiary in Mexico: Canam Royalties Mexico, S.A. DE C.V.

GENERAL DEVELOPMENT OF THE BUSINESS

The Company was formed to engage in the business of the acquisition, exploration and development of mineral resource properties. The Company is currently focused on the exploration and development of the Company's 100% owned flagship Panuco-Copala silver-gold project located in Mexico (the "Panuco-Copala Property").

Three Year History

On June 18, 2020, the Company completed a bought deal prospectus offering whereby it issued 10,752,500 Common Shares at a price of $0.43 per Common Share for gross proceeds of $4,623,575. The prospectus was conducted by Canaccord Genuity Corp. (the "Agent"). In connection with the prospectus offering, the Company paid the Agent a cash commission of $277,415 and issued 645,150 broker warrants entitling the holder to purchase an additional Common Share at $0.43 per share for a period of two years.

On July 30, 2020, the Company closed a bought deal private placement whereby it issued 16,043,000 units of the Company at a price of $1.87 per unit for gross proceeds of $30,000,410 (the "Bought Deal Private Placement"). Each unit consisted of one Common Share and one warrant exercisable at $2.40 and expiring July 30, 2022. The Bought Deal Private Placement was completed through a syndicate of underwriters led by Canaccord Genuity Corp. and which included PI Financial Corp., Haywood Securities Inc. and Sprott Capital Partners LP (the "Private Placement Underwriters"). In connection with the Bought Deal Private Placement, the Company paid the Private Placement Underwriters a cash commission of $1,813,465 and issued 962,580 finders warrants entitling the holder to purchase an additional Common Share at $1.87 per share for a period of two years.

On July 30, 2020, the Company also closed a non-brokered private placement whereby it issued 240,000 units at a price of $1.87 per unit for gross proceeds of $448,800. In connection with the non-brokered private placement, the Company paid finders fees of $13,464.

On October 1, 2020, the Company appointed Veljko Brcic as VP of Corporate Development.

On December 1, 2020, the Company appointed Mahesh Liyanage as Chief Financial Officer following the resignation of Martin Bajic.

On January 28, 2021, the Company promoted Charles Funk to the role of Technical Director and Martin Dupuis to Vice President of Technical Services.

On February 5, 2021, the Company change its name from "Vizsla Resources Corp." to "Vizsla Silver Corp".

On June 3, 2021, the Company closed a bought deal prospectus offering of 27,600,000 units of the Company at a price of C$2.50 per unit for aggregate gross proceeds of C$69,000,000 (the "2021 Prospectus Offering"). Each unit consisted of one Common Share and one-half of one common share purchase warrant. Each whole warrant entitles the holder to acquire one Common Share of the Company until December 3, 2022, at a price of C$3.25.

The 2021 Prospectus Offering was conducted by Canaccord Genuity Corp., as lead underwriter and sole bookrunner, PI Financial Corp., Clarus Securities Inc. and Sprott Capital Partners LP (the "2021 Prospectus Underwriters"). In connection with the 2021 Prospectus Offering, the Company paid the 2021 Prospectus Underwriters a cash commission cash commission equal to 6% of the gross proceeds raised under the 2021 Prospectus Offering, other than in respect of sales of the 2021 Prospectus Offering to the Company's president's list (the "President's List") for which the Company paid a cash commission equal to 3%. As further consideration for the services provided by the 2021 Prospectus Underwriters in connection with the 2021 Prospectus Offering, on closing the Company issued broker warrants to the 2021 Prospectus Underwriters, exercisable at any time on or before December 3, 2022, to acquire that number of common shares of the Company which is equal to 6% of the number of units sold under the 2021 Prospectus Offering (3% in respect of the President's List) at an exercise price of C$2.50.

On June 21, 2021, the Company closed a non-brokered private placement whereby it issued a total of 1,690,000 units at a price of C$2.50 per unit for gross proceeds of C$4,225,000. Each unit consisted of one common share of the Company and one-half of one common share purchase warrant. Each whole warrant entitles the holder to acquire one Common Share at a price of $3.25 per Common Share for a period of 18 months. In connection with the private placement, the Company paid cash finder's fees in the amount of $253,500 and issued 101,400 finder warrants, exercisable at any time on or before December 18, 2022 at an exercise price of C$2.50.

On April 19, 2021, the Company entered into an arrangement agreement with Vizsla Copper Corp. ("SpinCo") pursuant to which the Company agreed to a court approved plan of arrangement spin-out of its British Columbia copper exploration assets to SpinCo (the "Arrangement"). The Arrangement involved a distribution of common shares of SpinCo to the Company's shareholders, such that each shareholder of the Company would receive 0.3333 common share of SpinCo for every one common shares of the Company held, with the effect that, on the effective date of the Arrangement, the shareholders of the Company, other than dissenting shareholders, would own 100% of SpinCo.

The Arrangement was completed on September 20, 2021, and the Company injected $1,122,356 working capital to SpinCo in connection with the Arrangement. On September 20, 2021, the Company transferred its 100% interest in the Blueberry copper project located in the Babine porphyry belt of Central British Columbia and the option to acquire a 60% interest in the Carruthers Pass copper property located 200 kilometres north of Smithers, British Columbia to SpinCo and completed the Arrangement to spin out the shares of SpinCo to the shareholders of the Company. Pursuant to the Arrangement, holders of common shares of the Company on September 19, 2021, received one new common share of the Company and 0.3333 of a SpinCo share for each common share held.

On July 20, 2021, the Company entered into a binding amending agreement (the "Panuco Amending Agreement") with Minera Rio Panuco SA de CV and a binding option exercise notice ("Copala Exercise Notice") with Silverstone Resources SA de CV, which together constituted the acceleration and exercise of the Company's option to acquire 100% of the Panuco-Copala Property.

Under the Panuco Amending Agreement, the Company agreed to:

- A cash payment of US$4,250,000 payable to Minera Rio Panuco SA de CV upon signing of the Panuco Amending Agreement;

- The issuance to Minera Rio Panuco SA de CV of 6,245,902 Common Shares at a price of C$2.44 per Common Share upon the completion of the transfer of the Panuco property on or before August 10, 2021; and

- A cash payment of US$6,100,000 on or before February 1, 2022, following the refurbishment and transfer of ownership of the mill which is to occur on or before December 31, 2021.

Under the Copala Exercise Notice, the Company agreed to:

- A cash payment of US$9,500,000 payable to Silverstone Resources SA de CV upon the completion of the transfer of the Copala Property on or before August 3, 2021; and

- The issuance to Silverstone Resources SA de CV of 4,944,672 Common Shares at a price of C$2.44 per share upon the completion of the transfer of the Copala property.

On July 27, 2021, the Company appointed Michael Pettingell as VP of Business Development and Strategy.

On January 21, 2022, the Company's common shares were approved to list on the NYSE American and commenced trading under the symbol "VZLA".

On January 10, 2022, Vizsla Royalty Corp. incorporated a 100% owned subsidiary, Canam Royalties Mexico, S.A. de C.V. ("Canam Royalties"), which is 100% owned by the Company . On February 23, 2022, the Company transferred 2% NSR on certain concessions and 0.5% NSR on certain concessions to Canam Royalties.

On April 7, 2022, the Company filed on SEDAR an independent technical report containing a maiden mineral resource estimate on the Company's Panuco-Copala Property.

On May 5, 2022, Martin Dupuis was appointed to Chief Operating Officer from VP, Technical Services and Jesus Velador was appointed VP of Exploration.

On July 5, 2022, Stuart Smith resigned as a director of the Company.

On November 15, 2022, the Company closed a bought deal prospectus offering of 23,805,000 units of the Company at a price of C$1.45 per unit for aggregate gross proceeds of C$34,517,250 (the "2022 Prospectus Offering"). Each unit consisted of one Common Share and one-half of one common share purchase warrant. Each whole warrant entitles the holder to acquire one Common Share of the Company until November 15, 2024, at a price of C$2.00.

The 2022 Prospectus Offering was conducted by PI Financial Corp. and Canaccord Genuity Corp., as co-lead underwriters and joint bookrunners, and Raymond James Ltd., H.C. Wainwright & Co., LLC, Roth Canada Inc. and Stifel Nicolaus Canada Inc. (the "2022 Prospectus Underwriters"). In connection with the 2022 Prospectus Offering, the Company paid the 2022 Prospectus Underwriters a cash commission cash commission equal to 6% of the gross proceeds raised under the 2022 Prospectus Offering. As further consideration for the services provided by the 2022 Prospectus Underwriters in connection with the 2022 Prospectus Offering, on closing the Company issued broker warrants to the 2022 Prospectus Underwriters, exercisable at any time on or before November 15, 2024, to acquire that number of common shares of the Company which is equal to 6% of the number of units sold under the 2022 Prospectus Prospectus Offering at an exercise price of C$1.45.

On November 22, 2022, Veljko Brcic resigned as VP of Corporate Development of the Company and was appointed Corporate Development Advisor of the Company.

On December 8, 2022, David Cobbold was elected as a director of the Company at its annual general meeting.

On December 16, 2022 the Company entered into a binding strategic investment agreement (the "Definitive Agreement") with Prismo Metals Inc. ("Prismo"). Pursuant to the Definitive Agreement, the Company agreed to make a strategic investment (the "Strategic Investment") with a right of first refusal to purchase the Palos Verdes project from Prismo, and acquire 4,000,000 units of Prismo (the "Prismo Units"), for aggregate consideration of C$2,000,000 ("Prismo Units").

On January 6, 2023, the Company closed its Strategic Investment with Prismo. The consideration for the Strategic Investment consisted of a cash payment of C$500,000 and 1,000,000 common shares of the Company (the "Consideration Shares"). The Consideration Shares are subject to a voluntary escrow period of 24 months with 25% of the securities released every six months. The Company acquired 4,000,000 Prismo Unit. Each Prismo Unit consisted of one common share of Prismo (a "Prismo Share") and one-half of one common share purchase warrant (a "Prismo Warrant"). Each Prismo Warrant entitles the Company to purchase one additional Prismo Share up to January 6, 2025 at a price of $0.75.

On January 27, 2023, Charles Funk resigned as a director of the Company to satisfy the requirements of the US Securities Exchange to have an independent board and was appointed Lead Technical Advisor to the board. Michael Pettingell was promoted from VP Business Development and Strategy to Senior Vice President, Business Development and Strategy.

On February 9, 2023, the Company closed a brokered private placement of 27,286,050 common shares of the Company at a price of C$1.65 per common share for aggregate gross proceeds of C$45,021,982 (the "Offering").

The Offering was led by PI Financial Corp. on behalf of a syndicate of agents that included Canaccord Genuity Corp., Raymond James Ltd., Stifel Nicolaus Canada Inc., Roth Canada Inc. and Alliance Global Partners (the "2023 Agents"). In connection with the Offering, the Company paid the 2023 Agents a cash commission equal to 6% of the gross proceeds of the Offering and issued 1,637,163 compensation options (the "Compensation Options") to the 2023 Agents. Each Compensation Option is exercisable to acquire one Common Share at $1.65 until February 9, 2025.

On March 10, 2023, the Company filed the Technical Report on SEDAR.

Significant Acquisitions

During the year ended April 30, 2023, the Company did not complete any significant acquisitions for which disclosure is required under Part 8 of National Instrument 51-102.

DESCRIPTION OF BUSINESS

General Description of the Business

Business of the Company

As of the date of this AIF, the primary business of the Company is the exploration and development of the Panuco-Copala Property.

Specialized Skill and Knowledge

A number of aspects of the Company's business require specialized skills and knowledge. Such skills and knowledge include the areas of geology, drilling, logistical planning, geophysics, metallurgy and mineral processing, implementation of exploration programs, mine construction and operation, and accounting. While recent increased activity in the resource mining industry has made it more difficult to locate competent employees and consultants in such fields, the Company has found that it can locate and retain such employees and consultants and believes it will continue to be able to do so.

Competitive Conditions

As a mineral exploration and development company, the Company may compete with other entities in the mineral exploration and development business in various aspects of the business including: (a) seeking out and acquiring mineral exploration and development properties; (b) obtaining the resources necessary to identify and evaluate mineral properties and to conduct exploration and development activities on such properties; and (c) raising the capital necessary to fund its operations. The mining industry is intensely competitive in all its phases, and the Company may compete with other companies that have greater financial resources and technical facilities. Competition could adversely affect the Company's ability to acquire suitable properties or prospects in the future or to raise the capital necessary to continue with operations.

Cycles

The mineral exploration business is subject to mineral price cycles. The marketability of minerals and mineral concentrates and the ability to finance the Company on favourable terms is also affected by worldwide economic cycles.

Environmental Protection

The Company is subject to the laws and regulations relating to environmental matters in all jurisdictions in which it operates, including provisions relating to property reclamation, discharge of hazardous materials and other matters.

The Company may also be held liable should environmental problems be discovered that were caused by former owners and operators of its properties. The Company conducts its mineral exploration activities in compliance with applicable environmental protection legislation. The Company is not aware of any existing environmental problems related to any of its properties that may result in material liability to the Company.

Employees

As of April 30, 2023, the Company had two full-time employees and eight consultants at its head office in Vancouver, Canada. The Company had one hundred and thirty seven full-time employees at its offices in Mazatlán, Mexico.

Foreign Operations

The Panuco-Copala Property is the Company's material property. The Panuco-Copala Property is located in Sinaloa, Mexico. As such, the Company's operations and investments may be affected by local political and economic developments, including expropriation, invalidation of government orders, permits or agreements pertaining to property rights, political unrest, labour disputes, limitations on repatriation of earnings, limitations on mineral exports, limitations on foreign ownership, inability to obtain or delays in obtaining necessary mining permits, opposition to mining from local, environmental or other non-governmental organizations, government participation, royalties, duties, rates of exchange, high rates of inflation, price controls, exchange controls, currency fluctuations, taxation and changes in laws, regulations or policies as well as by laws and policies of Canada affecting foreign trade, investment and taxation.

Bankruptcy and Similar Procedures

There is no bankruptcy, receivership or similar proceedings against the Company, nor is the Company aware of any such pending or threatened proceedings. There have not been any voluntary bankruptcy, receivership or similar proceedings by the Company within the three most recently completed financial years or currently proposed for the current financial year.

Reorganizations

There have been no material reorganizations of or involving the Company within the three most recently completed financial years or currently proposed for the current financial year.

Social or Environmental Policies

At its current stage of development and activities (i.e., drilling, prospecting and development), the Company has limited financial obligations in meeting applicable environmental standards. This will change as the Company advances its projects. Environmental regulations that are applicable to the Company cover a wide variety of matters, including, without limitation, prevention of waste, pollution and protection of the environment, labour regulations and worker safety. While the Company does not currently expect the impact of costs and other effects related to compliance with environmental, health and safety regulations to have a material adverse effect on the Company's financial condition or results of operations, such regulations are evolving in a manner which is likely to result in stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their directors and employees. Such stricter standards could impact the Company's costs and have an adverse effect on results of operations. Furthermore, an environmental, safety or security incident could impact the Company's reputation in such a way that the result could have a material adverse effect on its business and on the value of its securities.

Risk Factors

The Company is in the business of acquiring, exploring and, if warranted, developing and exploiting natural resource properties. Due to the nature of the Company's proposed business and the present stage of exploration of its mineral properties, the following risk factors, among others, will apply:

Resource Exploration and Development is a Speculative Business

Resource exploration and development is a speculative business and involves a high degree of risk, including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but from finding mineral deposits which, though present, are insufficient in size to return a profit from production. The marketability of natural resources that may be acquired or discovered by the Company will be affected by numerous factors beyond the control of the Company. These factors include market fluctuations, the proximity and capacity of natural resource markets, government regulations, including regulations relating to prices, taxes, royalties, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in the Company not receiving an adequate return on invested capital.

Substantial expenditures are required to establish ore reserves through drilling and metallurgical and other testing techniques, determine metal content and metallurgical recovery processes to extract metal from the ore, and construct, renovate or expand mining and processing facilities. No assurance can be given that any level of recovery of ore reserves will be realized or that any identified mineral deposit, even it is established to contain an estimated resource, will ever qualify as a commercial mineable ore body which can be legally and economically exploited. The great majority of exploration projects do not result in the discovery of commercially mineable deposits of ore.

Fluctuation of Metal Prices

Even if commercial quantities of mineral deposits are discovered by the Company, there is no guarantee that a profitable market will exist for the sale of the metals produced. Factors beyond the control of the Company may affect the marketability of any substances discovered. The prices of various metals have experienced significant movement over short periods of time and are affected by numerous factors beyond the control of the Company, including international economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates and global or regional consumption patterns, speculative activities and increased production due to improved mining and production methods. The supply of and demand for metals are affected by various factors, including political events, economic conditions and production costs in major producing regions. There can be no assurance that the price of any commodities will be such that any of the properties in which the Company has, or has the right to acquire, an interest may be mined at a profit.

Financing Risks

Although the Company has been successful in the past in obtaining financing through the sale of equity securities, there can be no assurance that it will be able to obtain adequate financing in the future or that the terms of such financing(s) will be favorable. Failure to obtain such additional financing(s) could result in delay or indefinite postponement of further exploration and development of its projects with the possible loss of such properties.

Increased Costs

Management anticipates that costs at the Company's projects will frequently be subject to variation from one year to the next due to a number of factors, such as the results of ongoing exploration activities (positive or negative), changes in the nature of mineralization encountered, and revisions to exploration programs, if any, in response to the foregoing. Increases in the prices of such commodities or a scarcity of consultants or drilling contractors could render the costs of exploration programs to increase significantly over those budgeted. A material increase in costs for any significant exploration programs could have a significant effect on the Company's operating funds and ability to continue its planned exploration programs.

Reclamation

There is a risk that monies allotted for land reclamation may not be sufficient to cover all risks, due to changes in the nature of the waste rock or tailings and/or revisions to government regulations. Therefore, additional funds, or reclamation bonds or other forms of financial assurance may be required over the tenure of any mineral project of the Company to cover potential risks. These additional costs may have a material adverse effect on the Company's business, financial condition and results of operations.

Mining Industry is Intensely Competitive

The Company's business of the acquisition, exploration and development of mineral properties is intensely competitive. Increased competition could adversely affect the Company's ability to attract necessary capital funding or acquire suitable producing properties or prospects for mineral exploration in the future.

Permits and Licenses

The operations of the Company will require licenses and permits from various governmental authorities. There can be no assurance that the Company will be able to obtain all necessary licenses and permits that may be required to carry out exploration, development and mining operations at its projects, on reasonable terms or at all. Delays or a failure to obtain such licenses and permits or a failure to comply with the terms of any such licenses and permits that the Company does obtain, could have a material adverse effect on the Company.

Government Regulation

Any exploration, development or mining operations carried on by the Company, will be subject to government legislation, policies and controls relating to prospecting, development, production, environmental protection, mining taxes and labour standards. In addition, the profitability of any mining prospect is affected by the market for precious and/or base metals which is influenced by many factors including changing production costs, the supply and demand for metals, the rate of inflation, the inventory of metal producing corporations, the political environment and changes in international investment patterns.

On April 21, 2023, the Mexican parliament’s lower house voted to approve significant changes to the country’s mining laws with the intention of avoiding overexploitation of natural resources (the “Proposed Mining Law Amendments”). It is uncertain whether the Proposed Mining Law Amendments will be enacted in the form approved by the lower house of parliament or at all. This Annual Information Form does not take into account the Proposed Mining Law Amendments.

Environmental Restrictions

The activities of the Company are subject to environmental regulations promulgated by government agencies in different countries from time to time. Environmental legislation generally provides for restrictions and prohibitions on spills, releases or emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations. Certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner which means stricter standards, and enforcement, fines and penalties for non-compliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of operations.

Global Economy

The volatility of global capital markets, including the general economic slowdown in the mining sector, over the past several years has generally made the raising of capital by equity or debt financing more difficult. The Company may be dependent upon capital markets to raise additional financing in the future. As such, the Company is subject to liquidity risks in meeting its operating expenditure requirements and future development cost requirements in instances where adequate cash positions are unable to be maintained or appropriate financing is unavailable. These factors may impact the ability to raise equity or obtain loans and other credit facilities in the future and on terms favourable to the Company and its management. If these levels of volatility persist or if there is a further economic slowdown, the Company's operations, the Company's ability to raise capital and the trading price of the Company's securities could be adversely impacted.

Inflation

The Company's operating costs could escalate and become uncompetitive due to supply chain disruptions, inflationary cost pressures, equipment limitations, escalating supply costs, commodity prices and additional government intervention through stimulus spending or additional regulations. The Company's inability to manage costs may impact, among other things, future development decisions, which could have a material adverse impact on the Company's financial performance.

Public Health Crises

Public health crises can result in volatility and disruptions in the supply and demand for gold and other metals and minerals, global supply chains and financial markets, as well as declining trade and market sentiment and reduced mobility of people, all of which could affect commodity prices, interest rates, credit ratings, credit risk and inflation. The risks to the Company of such public health crises also include risks to employee health and safety, a slowdown or temporary suspension of operations in geographic locations impacted by an outbreak, increased labour and fuel costs, regulatory changes, political or economic instabilities or civil unrest. Any of these could affect the Company's ability to advance exploration and development with such risks to include challenges in recruiting and retaining staff and personnel, restricted access for employees and contractors to the Ana Paula Project, equipment and materials not being delivered to site on schedule or at all, and further inefficiencies required to be put in place to health and safety resulting in less productivity.

Military Conflict in Ukraine

The military conflict in Ukraine could lead to heightened volatility in the global financial markets, increased inflation, and turbulence in mining markets. More recently, in response to Russian military actions in Ukraine, several countries (including Canada, the United States and certain allies) have imposed economic sanctions and export control measures, and may impose additional sanctions or export control measures in the future, which have and could in the future result in, among other things, severe or complete restrictions on exports and other commerce and business dealings involving Russia, certain regions of Ukraine, and/or particular entities and individuals. While the Company does not have any direct exposure or connection to Russia or Ukraine, as the military conflict is a rapidly developing situation, it is uncertain as to how such events and any related economic sanctions could impact the global economy. Any negative developments in respect thereof could have an adverse effect on the Company's business, operations, financial condition, and the value of the Company's securities.

Foreign Countries and Political Risk

Any changes in regulations or shifts in political conditions are beyond the control of the Company and may adversely affect its business, or if significant enough, may make it impossible to continue to operate in the country. Operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, foreign exchange restrictions, export controls, income taxes, expropriation of property, environmental legislation and mine safety.

Changes to Mining Laws and Regulation

The Company's activities are subject to various laws governing prospecting, exploration, development, production, taxes, labour standards and occupational health, mine safety, toxic substances and other matters. Mining, exploration and development activities are also subject to various laws and regulations relating to the protection of the environment. Although the Company believes that its activities are currently carried out in accordance with all applicable rules and regulations, no assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner that could limit or curtail exploration or development of the Panuco-Copala PropertyF". Amendments to current laws and regulations governing the Company's operations and activities or more stringent implementation of such laws and regulations could have a material adverse effect on the Company's business, financial condition, results of operations, cash flows or prospects.

On April 21, 2023, the Mexican parliament's lower house voted to approve significant changes to the country's mining laws with the intention of avoiding overexploitation of natural resources (the "Proposed Mining Law Amendments"). It is uncertain whether the Proposed Mining Law Amendments will be enacted in the form approved by the lower house of parliament or at all. This Annual Information Form does not take into account the Proposed Mining Law Amendments.

Title Matters

Although the Company has taken steps to verify the title to the mineral properties in which it has or has a right to acquire an interest in accordance with industry standards for the current stage of exploration of such properties, these procedures do not guarantee title (whether of the Company or of any underlying vendor(s) from whom the Company may be acquiring its interest). Title to mineral properties may be subject to unregistered prior agreements or transfers and may also be affected by undetected defects or the rights of indigenous peoples. The Company has investigated title to all of its mineral properties and, to the best of its knowledge, title to all of its properties for which titles have been issued are in good standing.

Exploration and Mining Risks

Fires, power outages, labour disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labour are other risks involved in the operation of mines and the conduct of exploration programs. Substantial expenditures are required to establish reserves through drilling, to develop metallurgical processes, to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that funds required for development can be obtained on a timely basis. The economics of developing mineral properties is affected by many factors including the cost of operations, variations of the grade of ore mined, fluctuations in the price of gold or other minerals produced, costs of processing equipment and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection. In addition, the grade of mineralization ultimately mined may differ from that indicated by drilling results and such differences could be material. Short term factors, such as the need for orderly development of ore bodies or the processing of new or different grades, may have an adverse effect on mining operations and on the results of operations. There can be no assurance that minerals recovered in small scale laboratory tests will be duplicated in large scale tests under on-site conditions or in production scale operations. Material changes in geological resources, grades, stripping ratios or recovery rates may affect the economic viability of projects.

Regulatory Requirements

The activities of the Company are subject to extensive regulations governing various matters, including environmental protection, management and use of toxic substances and explosives, management of natural resources, exploration, development of mines, production and post-closure reclamation, exports, price controls, taxation, regulations concerning business dealings with indigenous peoples, labour standards on occupational health and safety, including mine safety, and historic and cultural preservation. Failure to comply with applicable laws and regulations may result in civil or criminal fines or penalties, enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions, any of which could result in the Company incurring significant expenditures. The Company may also be required to compensate those suffering loss or damage by reason of a breach of such laws, regulations or permitting requirements. It is also possible that future laws and regulations, or more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expense, capital expenditures, restrictions on or suspension of the Company's operations and delays in the exploration and development of the Company's properties.

No Assurance of Profitability

The Company has no history of earnings and, due to the nature of its business there can be no assurance that the Company will ever be profitable. The Company has not paid dividends on its Common Shares since incorporation and does not anticipate doing so in the foreseeable future. The only present source of funds available to the Company is from the sale of its Common Shares or, possibly, from the sale or optioning of a portion of its interest in its mineral properties. Even if the results of exploration are encouraging, the Company may not have sufficient funds to conduct the further exploration that may be necessary to determine whether or not a commercially mineable deposit exists. While the Company may generate additional working capital through further equity offerings or through the sale or possible syndication of its properties, there can be no assurance that any such funds will be available on favorable terms, or at all. At present, it is impossible to determine what amounts of additional funds, if any, may be required. Failure to raise such additional capital could put the continued viability of the Company at risk.

Taxation in Multiple Jurisdictions

In the normal course of business, the Company is subject to assessment by taxation authorities in various jurisdictions. Income tax provisions and income tax filing positions require estimates and interpretations of income tax rules and regulations of the various jurisdictions in which the Company and its subsidiaries operate and judgments as to their interpretation and application to the specific situation. In assessing the probability of realizing income tax assets recognized, the Company makes estimates related to expectations of future taxable income, applicable tax planning opportunities, expected timing of reversals of existing temporary differences and the likelihood that tax positions taken will be sustained upon examination by applicable tax authorities. In making its assessments, the Company gives additional weight to positive and negative evidence that can be objectively verified. Estimates of future taxable income are based on forecasted cash flows from operations and the application of existing tax laws in each jurisdiction. While management believes that the Company's provision for income tax is appropriate and in accordance with IFRS and applicable legislation and regulations, tax filing positions are subject to review and adjustment by taxation authorities who may challenge the Company's interpretation of the applicable tax legislation and regulations. Examination by applicable tax authorities is supported based on individual facts and circumstances of the relevant tax position examined in light of all available evidence. Any review or adjustment may result in the Company or its subsidiaries incurring additional tax liabilities. Any such liabilities may have a material adverse effect on the Company's financial condition.

The introduction of new tax laws, tax reforms, regulations or rules, or changes to, or differing interpretation of, or application of, existing tax laws, regulations or rules in Canada or Mexico or any other countries in which the Company's subsidiaries may be located, or to which shipments of products are made, could result in an increase in the Company's taxes payable, or other governmental charges, interest and penalties, duties or impositions. No assurance can be given that new tax laws, tax reforms, regulations or rules will not be enacted or that existing tax laws, regulations or rules will not be changed, interpreted or applied in a manner which could result in the Company's profits being subject to additional taxation, interest and penalties, or which could otherwise have a material adverse effect on the Company.

Violence and other Criminal Activities in Mexico

Certain areas of Mexico have experienced outbreaks of localized violence, threats, thefts, kidnappings and extortion associated with drug cartels and other criminal organizations in various regions. Any increase in the level of violence, or a concentration of violence in areas where the projects and properties of the Company are located, could have an adverse effect on the results and the financial condition of the Company. The Company maintains extensive security at each of its properties, however, there can be no guarantee that the Company's security will be sufficient or that such protocols and procedures will be effective at preventing future occurrences of theft or other criminal activity.

Uninsured or Uninsurable Risks

Exploration, development and mining operations involve various hazards, including environmental hazards, industrial accidents, metallurgical and other processing problems, unusual or unexpected rock formations, structural cave-ins or slides, flooding, fires, metal losses and periodic interruptions due to inclement or hazardous weather conditions. These risks could result in damage to or destruction of mineral properties, facilities or other property, personal injury, environmental damage, delays in operations, increased cost of operations, monetary losses and possible legal liability. The Company may not be able to obtain insurance to cover these risks at economically feasible premiums or at all. The Company may elect not to insure where premium costs are disproportionate to the Company's perception of the relevant risks. The payment of such insurance premiums and of such liabilities would reduce the funds available for exploration and production activities.

Potential Conflicts of Interest

The directors and officers of the Company may serve as directors and/or officers for other public and private companies, including companies in which the Company has invested in, and may devote a portion of their time to manage other business interests. This may result in certain conflicts of interest. To the extent that such other companies may participate in ventures in which the Company is also participating, and to the extent that such companies may receive funds from the Company, such directors and officers of the Company may have a conflict of interest in negotiating and reaching an agreement with respect to the extent of each company's participation. The Business Corporations Act (British Columbia), which governs the Company, requires the directors and officers to act honestly, in good faith, and in the best interests of the Company and its shareholders. However, in conflict of interest situations, directors and officers of the Company may owe the same duty to another company and will need to balance the competing obligations and liabilities of their actions. There is no assurance that the needs of the Company will receive priority in all cases. From time to time, several companies may participate together in the acquisition, exploration and development of natural resource properties, thereby allowing these companies to: (i) participate in larger programs; (ii) acquire an interest in a greater number of programs; and (iii) reduce their financial exposure to any one program. A particular company may assign, at its cost, all or a portion of its interests in a particular program to another affiliated company due to the financial position of the Company making the assignment. In determining whether or not the Company will participate in a particular program and the interest therein to be acquired by it, it is expected that the directors and officers of the Company will primarily consider the degree of risk to which the Company may be exposed and its financial position at that time.

Key Executives and Outside Consultants

The Company is dependent upon the services of key executives, including the directors of the Company, and will be dependent on a small number of highly skilled and experienced executives and personnel if development plans progress at the Panuco-Copala Property. Due to the relatively small size of the Company, the loss of these persons or the inability of the Company to attract and retain additional highly-skilled employees may adversely affect its business and future operations.

The Company has also relied upon outside consultants, geologists, engineers and others and intends to rely on these parties for their exploration and development expertise. Substantial expenditures are required to construct mines, to establish mineral resources and reserves estimates through drilling, to carry out environmental and social impact assessments, to develop metallurgical processes and to develop the development, exploration and plant infrastructure at any particular site. If such parties' work is deficient or negligent or is not completed in a timely manner, it could have a material adverse effect on the Company's business, financial condition and results of operations.

Accounting Policies and Internal Controls

The Company prepares its financial reports in accordance with International Financial Reporting Standards. In preparation of its financial reports, management may need to rely upon assumptions, make estimates or use their best judgment in determining the financial condition of the Company. Significant accounting policies are described in more detail in the Company's audited financial statements. In order to have a reasonable level of assurance that financial transactions are properly authorized, assets are safeguarded against unauthorized or improper use, and transactions are properly recorded and reported, the Company has implemented and continues to analyze its internal control systems for financial reporting, as further explained in its audited financial statements. Although the Company believes its financial reporting and financial statements are prepared with reasonable safeguards to ensure reliability, the Company cannot provide absolute assurance in this regard.

Litigation

Defense and settlement costs of legal claims can be substantial, even with respect to claims that have no merit. Like most companies, the Company is subject to the threat of litigation and may be involved in disputes with other parties in the future which may result in litigation or other proceedings. The results of litigation or any other proceedings cannot be predicted with certainty. If the Company is unable to resolve these disputes favourably, it could have a material adverse effect on the Company's business, financial condition and results of operations.

Anti-Corruption and Anti-Bribery Laws

The Company's operations are governed by, and involve interactions with, many levels of government in numerous countries. The Company is required to comply with anti-corruption and anti-bribery laws, including the Corruption of Foreign Public Officials Act (Canada) and the Foreign Corrupt Practices Act (Canada) and similar laws in the other jurisdictions in which it operates or maintains a public listing. In recent years, there has been a general increase in both the frequency of enforcement and the severity of penalties under such laws, resulting in greater scrutiny and punishment to companies convicted of violating anti-corruption and anti-bribery laws. Furthermore, a company may be found liable for violations by not only its employees, but also by its contractors and third-party agents. The Company's internal procedures and programs may not always be effective in ensuring that it, its employees, contractors or third-party agents will comply strictly with all such applicable laws. Annual training on the policy is provided to all supervisory employees. If the Company becomes subject to an enforcement action or is found to be in violation of such laws, this may have a material adverse effect on the Company's reputation, result in significant penalties, fines and/or sanctions, and/or have a material adverse effect on the Company's operations.

Potential Volatility of Market Price of Common Shares and Related Litigation Risks

Securities of publicly listed companies such as the Company have, from time to time, experienced significant price and volume fluctuations unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the market price of the Common Shares. In addition, the market price of the Common Shares is likely to be highly volatile. Factors such as gold prices, the average volume of shares traded, announcements by competitors, changes in stock market analysts' recommendations regarding the Company and general market conditions and attitudes affecting other exploration and mining companies may have a significant effect on the market price of the Company's Common Shares. It is likely that the Company's results or development and exploration activities may fluctuate significantly or may fail to meet the expectations of stock market analysts and investors and, in such event, the market price of the Common Shares could be materially adversely affected. In the past, securities class action litigation has often been initiated following periods of volatility in the market price of a company's securities. Such litigation, if brought against the Company, could result in substantial costs and a diversion of management's attention and resources, which could have a material adverse effect on the Company's business, financial position and results of operations.

Future Sales of Common Shares by Existing Shareholders

Sales of a large number of common shares in the public markets, or the potential for such sales, could decrease the trading price of the common shares and could impair the Company's ability to raise capital through future sales of common shares. The Company has previously completed private placements at prices per share which may be, from time to time, lower than the market price of the common shares. Accordingly, a significant number of the Company's shareholders at any given time may have an investment profit in the common shares that they may seek to liquidate.

Dividend Policy

No dividends on the Common Shares have been paid by the Company to date. The Company currently plans to retain all future earnings and other resources, if any, of the future operation and development of its business. Payment of any future dividends, if any, will be at the discretion of the Company's board of directors (the "Board") after taking into account many factors, including the Company's operating results, financial condition and current and anticipated cash needs.

The Company's management consider the risks disclosed to be the most significant to potential investors of the Company, but not all risks associated with an investment in securities of the Company. If any of these risks materialize into actual events or circumstances or other possible additional risks and uncertainties of which the directors are currently unaware or which they consider not to be material in relation to the Company's business, actually occur, the Company's assets, liabilities, financial condition, results of operations (including future results of operations), business and business prospects, are likely to be materially and adversely affected. In such circumstances, the price of the Company's securities could decline and investors may lose all or part of their investment.

Material Mineral Projects

As at the date of this AIF, the Panuco-Copala Property is the Company's only material property.

The Panuco-Copala Property

In accordance with the instructions set out in Section 5.4 of Form 51-102F2 - Annual Information Form, the Company has reproduced below the summary from the Technical Report on the Panuco-Copala Property dated with an effective date of January 19, 2023 and prepared for the Company by Allan Armitage, Ph.D., P.Geo, of SGS, Ben Eggers, MAIG, P.Geo of SGS and Yann Camus, P.Eng. of SGS. Defined terms in the summary below have the meanings ascribed to them in the Technical Report. Portions of the disclosure below are based on assumptions, qualifications and procedures which are not fully described herein. Reference should be made to the full text of the Technical Report, which is incorporated by reference in its entirety into this AIF, and which is available for review under the Company's profile on SEDAR at www.sedar.com.

Summary

SGS was contracted by the Company to complete an updated Mineral Resource Estimate ("MRE") for the Panuco-Copala Property (also referred to in this section as "Panuco" or the "Project") in Sinaloa, Mexico, and to prepare a National Instrument 43-101 ("NI 43-101") Technical Report written in support of the updated MRE. The Project is considered an early-stage exploration project.

The Company was incorporated as Vizsla Capital Corp. under the Business Corporations Act (British Columbia) on September 26, 2017. On March 8, 2018, the Company changed its name to Vizsla Resources Corp. On February 8, 2021, the Company changed its name to Vizsla Silver Corp. The Company's principalbusiness activity is the exploration of mineral properties. The Company currently conducts its operations in Panuco-Copala Property Mexico and Canada. It trades on the TSXV under the symbol VZLA.

On January 21, 2022, the Company was listed on the NYSE American exchange and commenced trading under the symbol "VZLA".

The head office and principal address of the Company is located at #700 -1090 West Georgia Street, Vancouver, B.C. V6E 3V7.

The Technical Report is authored by Allan Armitage, Ph.D., P. Geo., ("Armitage"), Ben Eggers, MAIG, P.Geo. ("Eggers") and Yann Camus, P.Eng. ("Camus") of SGS (the "Authors"). The Authors are independent Qualified Persons as defined by NI 43-101 and are responsible for all sections of this report. The updated MRE presented in this report was estimated by Armitage.

The reporting of the updated MRE complies with all disclosure requirements for Mineral Resources set out in NI 43-101. The classification of the updated MRE is consistent with the 2014 Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards (2014 CIM Definitions) and adheres as best as possible to the 2019 CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines (2019 CIM Guidelines).

The Technical Report will be used by the Company in fulfillment of their continuing disclosure requirements under Canadian securities laws, including NI 43-101. The Technical Report is written in support of an updated MRE completed for the Company.

Property Description, Location, Access, and Physiography

The Project is in the Panuco-Copala mining district in the municipality of Concordia, southern Sinaloa state, along the western margin of the Sierra Madre Occidental physiographic province in western Mexico. The Panuco-Copala Property is centred at 23 25' north latitude and 105 56' west longitude on map sheets F13A-37.

The Project comprises 117 approved mining concessions in nineteen blocks, covering a total area of 5,869.87 hectares (ha), and two applications for two mineral concessions covering 1,321.15 ha. The mineral concessions are held 100% by the Company. The concessions are valid for 50 years, provided semi-annual property tax payments are made in January and July each year and if minimum annual investment requirements are met, or if there is minimum annual production equal to the amount of the annual investment requirement. The concession owner may apply for a second 50-year term. Annual payments of 1.8 million Mexican Pesos were made in January of 2022, and 1.9 million Pesos were made in December of 2022 by the Company.

The Project area is accessed heading east from Mazatlán via Federal Highway 15 to Villa Union, then east on Highway 40 for 56 km (one-hour drive) (see Figure 4 1 of the Technical Report). Highway 40 crosscuts the Project area and most of the vein structures. Toll Highway 40D also crosses the Project. In addition, local dirt roads provide access to most of the workings, but some require repairs or are overgrown, and four-wheel-drive vehicles are recommended in the wet season. Two power lines connecting Durango and Mazatlán cross the Project, with 400 kV and 240 kV capacities.

The Project is in the Concordia municipality, which has a population of approximately 27,000 inhabitants. Public services, including health clinics and police, are in the town of Concordia. Residents provide an experienced mine labour force. Contractors in Durango and Hermosillo have a strong mining tradition and provide the Project with a local source of knowledgeable labour and contract mining services. Drilling companies and mining contractors are available in Mazatlán, Durango, Hermosillo, Zacatecas, Fresnillo, and other areas of Mexico. The Project area is also used for cattle grazing, with limited agricultural use.

Two power lines connecting Durango and Mazatlán cross the Project, with 400 kV and 240 kV capacities.

The Company owns the 500 tonnes per day Coco mill on its property. In addition, there are some mineral processing plants held by third parties in the district that range from 200 to 700 tonnes per day in capacity.

History of Exploration, Drilling

Capitan Francisco de Ibarra founded Concordia in 1565, and gold and silver veins in Panuco and Copala were first exploited in the centuries that followed Sim (2008) and Robinson (2019). Although production has been carried out on the Project over the last 460 years, no production records are available to the Company.

The first recorded modern mining activity commenced late in the 20th century. The Mineral Resources Council (Consejo de Recursos Minerales ("CRM"), the predecessor of the Mexican Geological Service ("SGM") carried out 1:50,000 scale mapping on map sheet F13-A37 and fine-fraction stream sediment sampling in 1999. In 2003, the CRM published additional 1:50,000 scale mapping on map sheet F13-A36, and fine-fraction stream sediment sampling (Polanco-Salas et al., 2003). In 2019 the SGM conducted 1:50,000 scale geological mapping and fine-fraction stream sediment sampling on map sheet F13-A46.

In 1989 the CRM optioned and sold several mineral concessions in the district, including to Grupo Minera Bacis ("Bacis") in 1989. Bacis subsequently acquired claims from other parties active in the area, including Minas del Oro y del Refugio S.A. de C.V. Bacis drilled 19 holes totalling 2,822.8 m along the Animas-Refugio corridor, but only collar and survey records exist of this work.

From 1999 to 2001, Minera Rio Panuco S.A. de C.V. (Rio Panuco) explored the Animas-Refugio and Cordon del Oro structures culminating in 45 holes for 8,358.6 m. No geological drill logs, downhole survey data, downhole sample data, or geochemical assay data have been preserved. Graphic drill-hole sections are available, with limited downhole geology and geochemical data.

Capstone Mining Corp. ("Capstone") optioned the Bacis concessions in 2004 and carried out geologic mapping and sampling of the Animas-Refugio and Cordon del Oro structures. In 2005, Capstone drilled 15,374 m in 131 holes on down-dip extensions of the Clemens and El Muerto mines on the Animas-Refugio vein. In 2007, Capstone explored the La Colorada structure with surface mapping and sampling, followed by 6,659 m of drilling in 64 holes.

Also, in 2007, Capstone transferred the claims of the Copala, Claudia, Promontorio, Montoros, and Martha projects to Silverstone Corp. ("Silverstone"). Capstone and Silverstone completed 21,641 m of drilling in 200 holes from 2005 to 2008.

Silverstone merged with Silver Wheaton Ltd. ("Silver Wheaton") in 2009, and Silver Wheaton subsequently sold the shares of concession owner Silverstone to Mexican owners. The Silverstone owners mined out a portion of the Mineral Resource defined in 2008 over the next decade. Silverstone mined parts of the Clemens, El Muerto, La Pipa, Mariposa, El 40, and San Martin ore shoots until mining encountered the water table, preventing further mining. Silverstone or unauthorized mining activity in the intervening years exploited most of the Mineral Resources estimated by Christopher and Sim (2008).

MRP contracted Geophysical Surveys S.A. de C.V. of Mexico City in 2016 to conduct an airborne magnetics survey. However, no data are available, and no survey or flight specifications are included in the report. The survey was flown in two blocks.

Since acquiring the Property in November 2019, the Company has conducted several significant drill campaigns in the Napoleon, Copala-Tajitos, Animas and San Antonio areas. Up to September 2022 (data cut-off date for the MRE), the Company has completed 638 drill holes totaling 206,779 m and collected 33,261 assays. The Company has continued to drill at the Project since the data cut off for the Mineral Resource estimate.

In November 2019, the Company began drilling on the Project on the Animas-Refugio corridor near the La Pipa and Mariposa mine areas. A total of 820.50 m in three drill holes was completed in 2019. The three drill holes targeted the La Pipa structure to test below the old historic ore shoot. Results showed low-grade and narrow widths; no further test work was carried out.

Drill holes AMS-19-01A and AMS-19-02 were drilled to test the downdip extension of the La Pipa ore shoot that has seen extensive mining. The first hole intersected historic workings and a footwall vein over 5.5m at 135.0m downhole. Deeper in the hole a 2.0 m wide quartz-amethyst vein was intersected at 241.5m downhole. The second hole was completed 77 m down dip on the same section and intersected a shallow hanging wall vein with 3 m grading 125.3 g/t Ag and 0.59 g/t Au and a zone of low-grade veinlets in the projection of the Animas Vein.

Drilling for 2020 totalled 28,643.42 m in 129 drill holes. The four main corridors of Napoleon, Cinco Senores, Cordon del Oro, and Animas-Refugio were tested.

In January 2020, drilling resumed at the Mariposa mine area, another historically mined area. Other targets in the Animas-Refugio corridor included, from south to north, Mojocuan, San Carlos, Paloma, and Honduras veins.

Drilling at the Napoleon corridor began in June 2020. A total of 64 drill holes tested the Napoleon structure, for 12,546.02 m. Targets were in the central part of the north-south-trending structure, below old mine workings, and 650 m north in the Papayo area.

At the Cordon del Oro corridor, drilling totalled 6,432.05 m in 28 drill holes. The drilling targeted the Mojocuan, San Carlos, and Peralta mine areas, in addition to the Aguita Zarca vein.

Cinco Senores corridor saw 2,927.10 m of drilling in 14 drill holes. The Tajitos vein was the drilling target, and previously unknown workings were encountered in the first four holes.

Drilling at the Project in 2021 totalled 100,242.55 m in 318 drill holes. The drilling focussed along the Napoleon and Tajitos vein areas, with 54,759.15 m in 180 drill holes and 34,769.35 m in 102 drill holes, respectively (see Table 10-1 of the Technical Report). Additionally, 4,438.50 m in 14 drill holes were drilled in the Animas-Refugio corridor, and 6,275.55 m in 22 drill holes in the Cordon del Oro corridor. Highlights of the 2021 drilling are presented in the Technical Report.

At Napoleon, infill and delineation drilling focussed on denser drilling to inform the Mineral Resource estimate and expand the structure's strike length. The Josephine vein, a subparallel system to Napoleon which was identified initially as an electromagnetic geophysical target, was first intersected in Hole NP-21-132, leading to additional targeting in the area and its inclusion in the Mineral Resource estimate. Further drill testing included the Cruz Negra and Alacran vein areas.

Drilling at the Tajitos vein area focussed on delineation and infilling, with additional exploration drilling to the north. The Tajitos resource drilling led to the discovery of the Copala vein -- a relatively thick subhorizontal structure on the Tajitos northeastern extent. Other exploration drilling along the Cinco Senores corridor included the Cinco Senores and Colorada veins to the north of Tajitos.

In the Animas-Refugio corridor, drilling tested the Rosarito segment included in the Mineral Resource estimate, in addition to the Peralta and Cuevillas veins.

Drilling at the Cordon del Oro corridor targeted the San Antonio structure included in the Mineral Resource estimate, in addition to exploration near the Aguita Zarca vein.

Drilling for 2022 (to September) totalled 77,072.05 m in 188 drill holes. The four main corridors of Napoleon, Cinco Senores, Cordon del Oro, and Animas-Refugio were tested.

Drilling at the Napoleon corridor included 75 drill holes that tested the Napoleon structure for 36,848.00 m. At the Cordon del Oro corridor, drilling totalled 4,251.8 m in 19 drill holes. Drilling at Cinco Senores, including Copala and Tajitos veins, included 83 drill holes for 31,088.55 m.

The bulk of 2022 drilling was centred on the western portion of the district, focused on upgrading and expanding resources at the Copala and Napoleon areas. At Copala, mineralization has now been traced over 1,100 meters along strike, 400 meters down dip, and remains open to the north and southeast.

At Napoleon, drilling throughout 2022 successfully expanded mineralization along strike and down plunge to the south, several vein splays were identified in the hanging wall and footwall of the main structure.

Other notable discoveries include the Cristiano Vein; marked by high precious metal grades up to 1,935 g/t Ag and 15.47 g/t Au over 1.46 metres, located immediately adjacent to Copala; and La Luisa Vein, located ~700 metres west of Napoleon which continues to display similar silver and gold zonation as that seen at Napoleon.

Geology and Mineralization

The Project is on the western margin of the Sierra Madre Occidental (SMO), a high plateau and physiographic province that extends from the U.S.A.-Mexico border to the east-trending Trans-Mexican Volcanic Belt. The SMO a Large Igneous Province (LIP) recording continental magmatic activity from the Late Cretaceous to the Miocene; it has been divided into two main episodes.

The first episode, termed the Lower Volcanic Complex (LVC), comprises a suite of intrusive bodies, including the Sonora, Sinaloa, and Jalisco batholiths and andesitic volcanic rock units with minor dacite and rhyolite tuffs and ignimbrites that are correlative with the Tarahumara Formation in Sonora of Late Cretaceous to Eocene age. The second magmatic episode is dominated by rhyolitic ignimbrites and tuffs that built one of the earth's largest silicic volcanic provinces and has been termed the Upper Volcanic Supergroup (UVS). These dominantly rhyolitic units were extruded in two episodes, from about 32 to 28 Ma and 24 to 20 Ma. These two periods of magmatic activity are associated with the subduction of the Farallon plate under North America and the Laramide orogeny that occurred between the Upper Cretaceous - Paleocene and the Eocene. The third episode comprises postsubduction alkali basalts and ignimbrites associated with the opening of the Gulf of California between the late Miocene and Pleistocene - Quaternary.

The western part of the SMO in Sonora and Sinaloa is cut by north-northwest-trending normal fault systems developed during the opening of the Gulf of California between 27 and 15 Ma. The normal fault systems favoured the formation of elongated basins that were subsequently filled with continental sedimentary rocks. The basins occur in a north-northwest-trending belt extending from western Sonora to most of Sinaloa.

The basement to the SMO is locally exposed in northern Sinaloa, near Mazatlan and on small outcrops within the project area. It comprises folded metasedimentary and metavolcanic rocks, deformed granitoids, phyllitic sandstones, quartzites, and schists of the Tahue terrane of Jurassic to Early Cretaceous age (Montoya-Lopera et al., 2019, Sedlock et al., 1993 and Campa and Coney 1982).

In the broader Project area, the LVC comprises granite, granodiorite, and diorite intrusive phases correlative with the Late Cretaceous to Early Paleocene San Ignacio and Eocene Piaxtla batholiths in San Dimas district. The andesite lavas, rhyolite-dacite tuffs, and ignimbrites are locally intruded by the Late Cretaceous to Early Paleocene intrusive phases and younger Eocene-Oligocene felsic dikes and domes. Northwest trending intermontane basins filled with continental conglomerates and sandstones incise the UVS and LVC in the Project area. The Oligocene age ignimbrites of the UVS occur east of the property towards Durango state.

The structure of the Project area is dominated by north-northwest-trending extensional and transtensional faults developed or reactivated during the Basin and Range tectonic event (~28 to 18 Ma). The extensional belt is associated with aligned rhyolite domes and dikes and Late Oligocene to Middle Miocene grabens.

Mineralization on the Property comprises several epithermal quartz veins. Previous workers and recent mapping and prospecting works conducted by the Company's geologists determined a cumulate length of veins traces of 86 km. Individual vein corridors are up to 7.6 km long, and individual veins range from decimetres to greater than 10 m wide. Veins have narrow envelopes of silicification, and local argillic alteration, commonly marked by clay gouge. Propylitic alteration consisting of chlorite-epidote in patches and veins affecting the andesites and diorite are common either proximal or distal to the veins.

The primary mineralization along the vein corridors comprises hydrothermal quartz veins and breccias with evidence of four to five different quartz stages: generally white, grey and translucent and varying grain size from amorphous-microcrystalline-coarse. A late stage of amethyst quartz is also observed in some veins. The grey colour in quartz is due to the presence of fine-grained disseminated sulphides, believed to be mainly pyrite and acanthite. The Company has delineated several hydrothermal breccias with grey quartz occurring more commonly at lower levels of the vein structures. Barren to low grade, quartz is typically white and is more common in the upper parts of the veins and breccias. Locally, mineralized structures are cut by narrow, banded quartz veins with thin, dark argentite/acanthite, sphalerite, galena, and pyrite bands. Bladed and lattice quartz pseudomorphs after calcite have been noted at several locations within the veins and indicate boiling conditions during mineral deposition. Later quartz veinlets cut all the mineralized zones with a mix of white quartz and purple amethyst. The amethyst is related to mixing near-surface waters as the hydrothermal system is collapsing, as has been noted in the nearby San Dimas district (Montoya- Lopera et al., 2019).

The Mineral Resource includes ten mineralized vein systems: the Napoleon, Napoleon hanging wall, Josephine, and Cruz Negra veins; the Copala, Cristiano, Tajitos and Copala 2 veins; the San Antonio vein; and the Rosarito vein. These trends are west to east within the Napoleon, Cinco Senores, Cordon del Oro, and Animas-Refugio corridors. The bulk of the resource veins strike north-northwest to north-northeast, with thicknesses varying from 1.5 m to over 10 m.

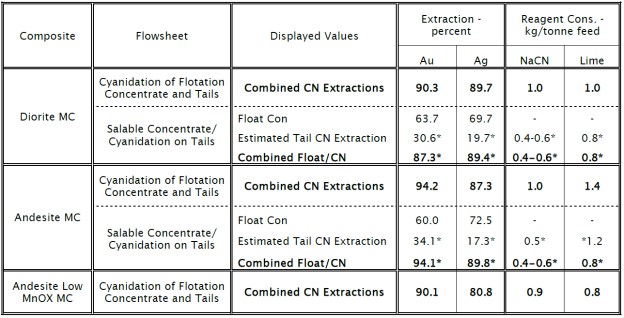

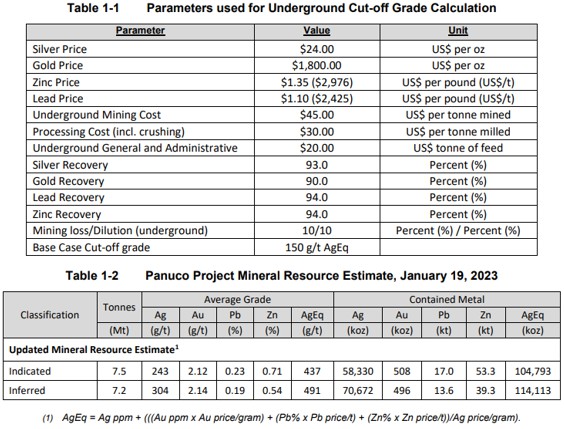

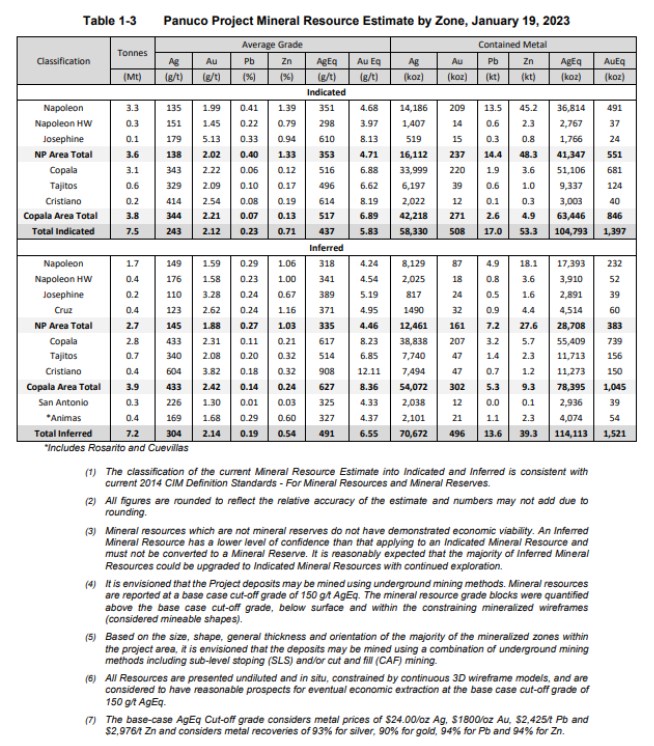

Mineralization on the Property comprises several epithermal quartz veins. Previous workers and recent mapping and prospecting works conducted by the Company's geologists determined a cumulate length of veins traces of 86 km. Individual vein corridors are up to 7.6 km long, and individual veins range from decimetres to greater than 10 m wide. Veins have narrow envelopes of silicification, and local argillic alteration, commonly marked by clay gouge. Propylitic alteration consisting of chlorite-epidote in patches and veins affecting the andesites and diorite are common either proximal or distal to the veins.