UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended March 31 , 2024

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from _______________________ to ___________________________

Commission file number 001-39510

(Exact name of Registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

(212 ) 351-6100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||||||||||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☒ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of Class A common stock held by non-affiliates of the registrant on September 29, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $1,652.9 million, based on the closing price of $31.58 as reported by the Nasdaq Stock Market. As of May 22, 2024, there were 65,614,902 shares of the registrant’s Class A common stock and 45,030,959 shares of the registrant’s Class B common stock, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Table of Contents

| Page | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 1C. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

3

This Annual Report on Form 10-K (“Form 10-K”) includes certain information regarding the historical investment performance of our focused commingled funds and separately managed accounts. An investment in shares of our Class A common stock is not an investment in any StepStone Fund (as defined below). The StepStone Funds are separate, distinct legal entities that are not our subsidiaries. In the event of our bankruptcy or liquidation, you will have no claim against the StepStone Funds. In considering the performance information relating to the StepStone Funds contained herein, current and prospective Class A common stockholders should bear in mind that the performance of the StepStone Funds is not indicative of the possible performance of shares of our Class A common stock and also is not necessarily indicative of the future results of the StepStone Funds, even if fund investments were in fact liquidated on the dates indicated, and we cannot assure you that the StepStone Funds will continue to achieve, or that future StepStone Funds will achieve, comparable results.

Unless otherwise indicated or the context otherwise requires:

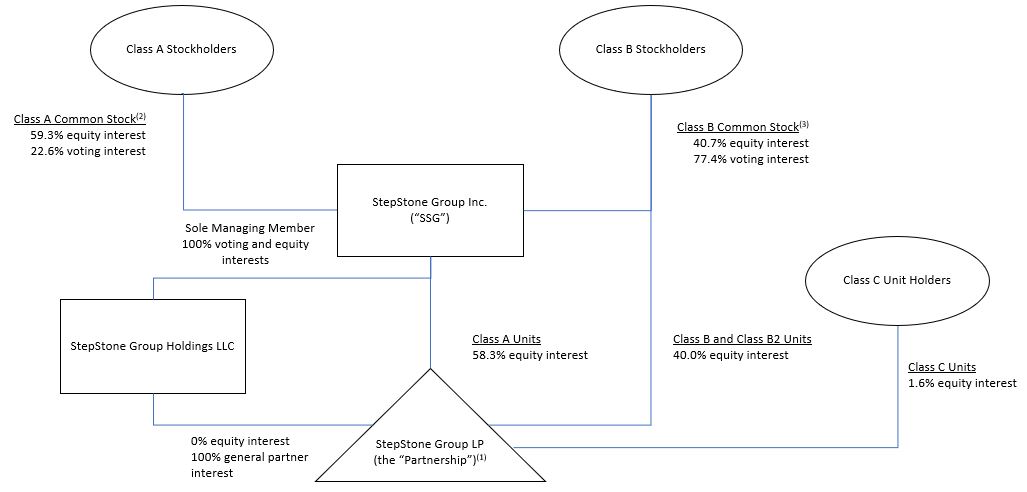

• “StepStone Group Inc.” or “SSG” refers solely to StepStone Group Inc., a Delaware corporation, and not to any of its subsidiaries;

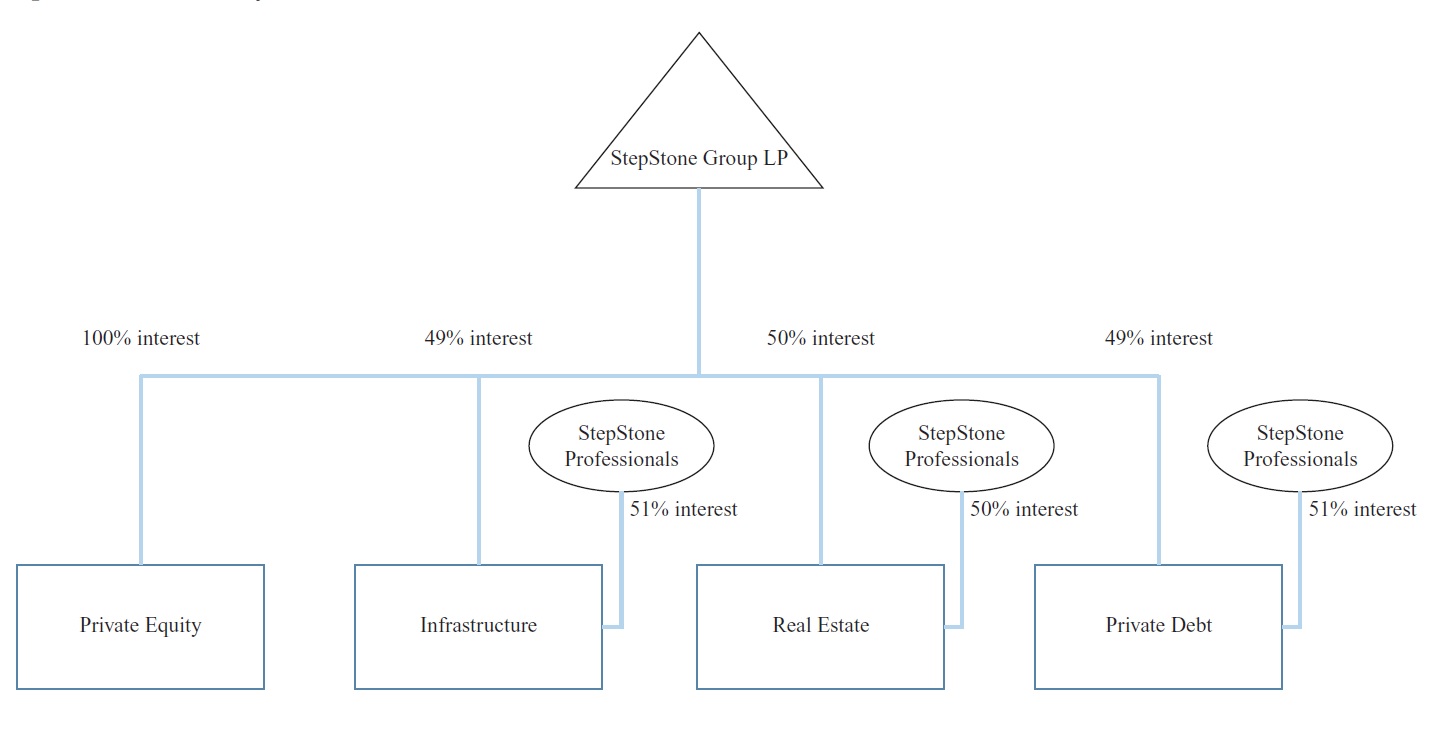

• the “Partnership” refers solely to StepStone Group LP, a Delaware limited partnership, and not to any of its subsidiaries;

• “General Partner” refers to StepStone Group Holdings LLC, a Delaware limited liability company, and the sole general partner of the Partnership;

• “we,” “us,” “our,” the “Company,” “our company,” “StepStone” and similar terms refer to SSG and its consolidated subsidiaries, including the Partnership;

• “StepStone Funds” or “our funds” refer to our focused commingled funds and our separately managed accounts, for which we act as both investment adviser and general partner or managing member;

• references to the “Greenspring acquisition” refer to the acquisition of Greenspring Associates, Inc. and certain of its affiliates (“Greenspring”) that was completed on September 20, 2021;

• references to “FY,” “fiscal” or “fiscal year” are to the fiscal year ended March 31 of the applicable year;

• references to the “Reorganization” refer to the series of transactions immediately before the Company’s initial public offering (“IPO”), which was completed on September 18, 2020;

• references to “private markets allocations” or “total capital responsibility” refer to the aggregate amount of our assets under management (“AUM”) and our assets under advisement (“AUA”);

• references to “high-net-worth” individuals refer to individuals with net worth of over $5 million, excluding primary residence;

• references to “mass affluent” individuals refer to individuals with annual income over $200,000 or net worth between $1 million and $5 million, excluding primary residence;

• references to “Consolidated Funds” refer to the StepStone Funds that we are required to consolidate as of the applicable reporting period; and

4

• references to “SRA” refer to StepStone Group Real Assets LP, references to “SRE” refer to StepStone Group Real Estate LP, references to “SPD” refer to StepStone Group Private Debt AG (formerly Swiss Capital Alternative Investments AG), and references to “SPW” refer to StepStone Group Private Wealth LLC.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

We own or have rights to trademarks, service marks or trade names that we use in connection with the operation of our business. In addition, our names, logos and website names and addresses are owned by us or licensed by us. We also own or have the rights to copyrights that protect the content of our solutions. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this Form 10-K are listed without the ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks, trade names and copyrights.

FORWARD-LOOKING STATEMENTS

This Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact, including statements regarding guidance, industry prospects or future results of operations or financial position made in this Form 10-K are forward-looking. We use words such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “future,” “intend,” “may,” “plan” and “will” and similar expressions to identify forward-looking statements. Forward-looking statements reflect management’s current plans, estimates and expectations and are inherently uncertain. The inclusion of any forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated will be achieved. Forward-looking statements are subject to various risks, uncertainties and assumptions. Important factors that could cause actual results to differ materially from those in forward-looking statements include, but are not limited to, global and domestic market and business conditions, our successful execution of business and growth strategies, the favorability of the private markets fundraising environment, successful integration of acquired businesses and regulatory factors relevant to our business, as well as assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity and the risks and uncertainties described in greater detail under “Risk Factors” included in Part I, Item 1A of this Form 10-K. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this Form 10-K and in our other periodic filings. We undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

5

RISK FACTOR SUMMARY

The following is a summary of the risk factors associated with the Company. You should read this summary together with a more detailed description of these risks in the “Risk Factors” section of this Annual Report on Form 10-K and in other filings that we make from time to time with the SEC.

We are subject to risks related to our business, including risks related to: (i) the identification and availability of suitable investment opportunities for our clients; (ii) poor investment performance; (iii) investments we make on behalf of clients or we recommend to our clients not correlating with performance of an investment in our Class A common stock; (iv) competition for access to investment funds and other investments; (v) ability of third-party clients to remove us as the general partner and to terminate the investment period under certain circumstances; (vi) our ability to retain our senior leadership team and attract additional qualified investment professionals; (vii) our failure to appropriately manage conflicts of interest; (viii) obligations to clients and other third parties that may conflict with stockholders’ interests; (ix) increases in interest rates or decreases in the availability of credit may affect the StepStone Funds’ ability to achieve attractive rates of return due to dependence on leverage by certain funds and portfolio companies; (x) StepStone Funds clients with commitment-based structures not satisfying their contractual obligation to fund capital calls when requested; (xi) compliance with investment guidelines set by clients; (xii) subjective valuation methodologies; (xiii) our ability to maintain our desired fee structure; (xiv) having to pay back “clawback” or “contingent repayment” obligations if and when they are triggered under the governing agreements of our funds; (xv) investments in relatively high-risk, illiquid assets; (xvi) undiversified investments; (xvii) banking system volatility; (xviii) investments in funds and companies that we do not control; (xix) risk management strategies and procedures; (xx) due diligence we undertake in connection with investments; (xxi) restrictions on our ability to collect and analyze data regarding our clients’ investments; (xxii) dependence on the reliability of our proprietary data and technology platforms and other data processing systems; (xxiii) a compromise or corruption of our systems or that of our vendors containing confidential information; (xxiv) cybersecurity risks; (xxv) emerging and changing technology, including artificial intelligence; (xxvi) employee misconduct; (xxvii) our professional reputation and legal liability; (xxviii) our non-U.S. operations; (xxix) investments of the StepStone Funds in certain jurisdictions that may be subject to heightened risks relative to investments in other jurisdictions; (xxx) revenues from our real estate asset class being subject to the risks inherent in the ownership and operation of real estate and the construction and development of real estate; (xxxi) the exposure of our real estate asset class to commercial real estate values and commercial real estate loans; (xxxii) investments we make on behalf of clients or we recommend to our clients in infrastructure assets; (xxxiii) the substantial growth of our business in recent years that may be difficult to sustain; (xxxiv) entering into new lines of business; (xxxv) long-term agreements that provide for us to acquire all the equity interests of our asset class entities that we do not currently own; (xxxvi) acquisitions of new businesses or assets; (xxxvii) current or future indebtedness; and (xxxviii) using custodians, counterparties, administrators and other agents.

We are subject to risks related to our industry, including risks related to: (i) intense competition; (ii) difficult or volatile market conditions; (iii) a major public health crisis; (iv) operating in a heavily regulated industry; (v) evolving laws and government regulations; (vi) future changes to tax laws or our effective tax rate; (vii) potentially being required to pay additional taxes because of the new U.S. federal partnership audit rules and potentially also state and local tax rules; (viii) federal, state and foreign anti-corruption and sanctions laws; (ix) regulation of investment advisers outside the United States; and (x) increasing scrutiny from institutional clients with respect to environmental, social and governance (“ESG”) costs of investments made by the StepStone Funds.

6

We are subject to risks related to our organizational structure, including risks related to: (i) relying on exemptions from certain governance requirements as a “controlled company” within the meaning of the Nasdaq Global Select Market listing standards and, therefore, not affording same protections to our stockholders as those afforded to stockholders of non-controlled companies; (ii) SSG’s dependence on distributions from the Partnership to pay any dividends, if declared, taxes and other expenses, including payments under the Tax Receivable Agreements; (iii) the IRS potentially challenging the tax basis step-ups and other tax benefits we receive in connection with our IPO and the related transactions and in connection with additional acquisitions of Partnership units; (iv) in certain circumstances, acceleration and/or significant excess of payments due under each Tax Receivable Agreement, as compared to the actual tax benefits, if any, that SSG actually realizes; (v) potentially substantial distributions to us and the existing partners of the Partnership that the Partnership will be required to make in certain circumstances; (vi) funding withholding tax upon certain exchanges of Class B units into shares of Class A common stock by non-U.S. holders; (vii) tax and other liabilities attributable to our pre-IPO investors as a result of certain reorganization transactions; (viii) SSG not being permitted to deduct its distributive share of compensation expense pursuant to regulations issued under Section 162(m) of the Code to the extent that the compensation was paid by the Partnership to certain of SSG’s covered employees; (ix) being deemed an “investment company” under the Investment Company Act of 1940 as a result of our ownership of the Partnership or the General Partner; (x) a change of control of our company, including the effect of a “Sunset” on our voting structure; (xi) conflicts arising from members of our senior leadership team holding their economic interest through other entities; (xii) our reliance on our equity ownership, governance rights and other contractual arrangements to control certain of our consolidated subsidiaries that are not wholly owned; (xiii) the disparity in the voting rights among the classes of our common stock and inability of the holders of our Class A common stock to influence decisions submitted to a vote of our stockholders; (xiv) distributions made by the Partnership and limits on our ability to use the cash we receive in such distributions; (xv) the dual class structure of our common stock; and (xvi) our ability to pay dividends to stockholders.

We are subject to general risks, including risks related to: (i) the fact that the market price of our Class A common stock has been volatile; (ii) anti-takeover provisions in our charter documents and under Delaware law; and (iii) our forum selection provisions.

7

PART I

Item 1. Business.

Our Company

We are a global private markets investment firm focused on providing customized investment solutions and advisory and data services to our clients. Our clients include some of the world’s largest public and private defined benefit and defined contribution pension funds, sovereign wealth funds and insurance companies, as well as prominent endowments, foundations, family offices and private wealth clients, which include high-net-worth and mass affluent individuals. We partner with our clients to develop and build private markets portfolios designed to meet their specific objectives across the private equity, infrastructure, private debt and real estate asset classes. These portfolios utilize several types of synergistic investment strategies with third-party fund managers, including commitments to funds (“primaries”), acquiring stakes in existing funds on the secondary market (“secondaries”) and investing directly into companies (“co-investments”). As of March 31, 2024, we were responsible for $678 billion of total capital, including $157 billion of AUM and $521 billion of AUA.

We were founded in 2007 to address the evolving needs of investors focused on private markets, reflecting a number of converging themes:

•increasing investor desire for exposure and allocations to the private markets;

•rising complexity within private markets driven by proliferation of fund managers and specialized strategies;

•global nature of private markets asset classes and their participants; and

•need for customized solutions as investors’ size, sophistication and allocations to private markets investments increased.

We set out to build a firm that would be tailored to meet this new market environment, and differentiated from the fund-of-funds and adviser-only models in existence at the time. We have focused on an integrated, full- service approach to private markets solutions with research depth as our core pillar of strength.

We believe our success and growth since our founding has been driven by our continued focus on providing a high level of service, tailored to our clients’ evolving needs, through:

•Our focus on customization. By leveraging our expertise across the private markets asset classes, investment strategies and commercial structures, we help our clients build customized portfolios that are designed to meet their specific objectives in a cost effective way.

•Our global-and-local approach. With offices in 27 cities across 16 countries on five continents, we have built a global operating platform, organically and via acquisition, with strong local teams that possess valuable regional insights and deep-rooted relationships. This allows us to combine the advantages of having a knowledgeable on-the-ground presence with the benefits of operating as a global organization.

•Our multi-asset class expertise. We operate at scale across the private markets asset classes—private equity, infrastructure, private debt and real estate. We believe this multi-asset class expertise positions us well to compete for, win and execute tailored and complex investment solutions.

8

•Our proprietary data and technology. Our proprietary data and technology platforms, including SPI by StepStone (“SPI”), a platform comprising SPI Research, our private markets intelligence database, SPI Reporting, our performance monitoring software, and SPI Pacing, our portfolio cash flow, investment allocation and liquidity forecasting tool provide valuable information advantages, enhance our private markets insight, improve operational efficiency and facilitate portfolio monitoring and reporting functions. These benefits accrue to our clients and to us.

•Our large and experienced team. Since our inception, we have focused on recruiting and retaining the best talent. As of March 31, 2024, 100 partners led the firm, with an average of over 20 years of investment or industry experience. As of March 31, 2024, we had 990 total employees, including 335 investment professionals and 655 employees across our operating team and implementation teams dedicated to sourcing, executing, analyzing and monitoring private markets opportunities.

We believe our scale and position in private markets provide us a distinct competitive advantage with our clients and fund managers. As we grow our client relationships, we are able to allocate additional capital, which allows us to expand our fund manager relationships, resulting in access to additional investment opportunities and data. This, in turn, helps us make better investment decisions and generate better returns, thereby attracting new clients and investment opportunities.

During the year ended March 31, 2024, we reviewed over 3,900 investment opportunities and conducted approximately 5,300 meetings with fund managers across multiple geographies and all four asset classes. During the last three years ended December 31, 2023, we allocated an average of $70 billion annually in capital to private markets on behalf of our clients, excluding legacy funds, feeder funds and research-only, non-advisory services.

We have a flexible business model whereby many of our clients engage us for solutions across multiple asset classes and investment strategies. Our solutions are typically offered in the following commercial structures:

•Separately managed accounts (“SMAs”). Owned by one client and managed according to their specific preferences, SMAs integrate a combination of primaries, secondaries and co-investments across one or more asset classes. SMAs are meant to address clients’ specific portfolio objectives with respect to return, risk tolerance, diversification and liquidity. SMAs, including directly managed assets, comprised $94 billion of our AUM as of March 31, 2024.

•Focused commingled funds. Owned by multiple clients, our focused commingled funds deploy capital in specific asset classes with defined investment strategies. Focused commingled funds comprised $49 billion of our AUM as of March 31, 2024.

•Advisory and data services. These services include one or more of the following for our clients: (i) recurring support of portfolio construction and design; (ii) discrete or project-based due diligence, advice and investment recommendations; (iii) detailed review of existing private markets investments, including portfolio-level repositioning recommendations where appropriate; (iv) consulting on investment pacing, policies, strategic plans, and asset allocation to investment boards and committees; and (v) licensed access to our proprietary data and technology platforms, including SPI Research and our other proprietary tools. Advisory relationships comprised $521 billion of our AUA and $14 billion of our AUM as of March 31, 2024.

9

•Portfolio analytics and reporting. We provide clients with tailored reporting packages, including customized performance benchmarks as well as associated compliance, administrative and tax capabilities. Mandates for portfolio analytics and reporting services typically include licensed access to our proprietary performance monitoring software, SPI Reporting. We provided portfolio analytics and reporting on over $685 billion of client commitments as of March 31, 2024, inclusive of our total capital responsibility, previously exited investments and investments of former clients.

Our Competitive Strengths

Truly Global Scale with Local Teams

Since our founding, we have invested and continue to invest significant time and resources building a global platform that we believe is well positioned to benefit from the continued growth and globalization of the private markets. Today, we have investment and implementation professionals in 27 cities across 16 countries on five continents.

Our offices are staffed by investment professionals who bring valuable regional insights and language proficiency to enhance existing client relationships and build new client relationships. Each of our offices follows a local staffing model, with local professionals who possess valuable insights, language proficiency and client relationships specific to that market. As of March 31, 2024, approximately 45% of our investment professionals were based outside the United States. We believe our focus on hiring local talent, supported by a deep bench of experienced investment professionals, has been critical in helping us attract a blue-chip, global client base.

Full-Service, Customized Approach to Delivering Solutions

We have significant expertise in customized offerings given our scale, which enables us to maintain a proprietary database across key facets of private markets investing, and our research-focused culture, which enables us to utilize this information advantage to inform our investment decisions and deliver highly customized insights and services to our clients.

As a result, we are able to offer a full suite of investment solutions to our clients, not only by assisting them with building customized private markets portfolios, but also offering other value-add services such as strategic planning and research, portfolio repositioning, and portfolio monitoring and reporting. We believe our value proposition as a full-service firm also helps us strengthen and grow our client relationships. As of March 31, 2024, 35% of our advisory clients also had an AUM relationship with us, and we advised or managed assets in more than one asset class for 34% of our clients, supporting our total capital responsibility growth.

Our focus on offering full-service, customized solutions to our clients is reflected in our business composition. As of March 31, 2024, we had 314 bespoke SMAs and focused commingled funds. For the year ended March 31, 2024, approximately 51% of our management and advisory fees were generated from focused commingled funds, 38% from SMAs, 10% from advisory, data and administrative services and 1% from fund reimbursement revenues.

Scale Across Private Markets Asset Classes

We believe our scale across asset classes, deal flow access and dedicated operational resources is increasingly a competitive advantage in private markets solutions. We believe investors are reducing the number of fund managers they invest with, increasingly allocating capital to fund managers that have expertise across a wide range of asset classes within private markets.

10

| PRIVATE EQUITY | REAL ESTATE | |||||||||||||||||||||||||||||||

$82B(1) | $50B | $270B | $16B(1) | $8B | $168B | |||||||||||||||||||||||||||

| AUM | FEAUM | AUA | AUM | FEAUM | AUA | |||||||||||||||||||||||||||

| 155+ | 60 | |||||||||||||||||||||||||||||||

| Investment professionals | Investment professionals | |||||||||||||||||||||||||||||||

| INFRASTRUCTURE | PRIVATE DEBT | |||||||||||||||||||||||||||||||

$30B(1) | $20B | $60B | $28B(1) | $15B | $22B | |||||||||||||||||||||||||||

| AUM | FEAUM | AUA | AUM | FEAUM | AUA | |||||||||||||||||||||||||||

| 65+ | 45+ | |||||||||||||||||||||||||||||||

| Investment professionals | Investment professionals | |||||||||||||||||||||||||||||||

_____________________________

Note: Amounts may not sum to total due to rounding. Data presented as of March 31, 2024. AUM/AUA reflects final data for the prior period (December 31, 2023), adjusted for net new client account activity through March 31, 2024. Does not include post-period investment valuation or cash activity. Net asset value (“NAV”) data for underlying investments is as of December 31, 2023, as reported by underlying managers up to the business day occurring on or after 115 days following December 31, 2023. When NAV data is not available by the business day occurring on or after 115 days following December 31, 2023, such NAVs are adjusted for cash activity following the last available reported NAV.

(1)Allocation of AUM by asset class is presented by underlying investment asset classification.

Well Positioned to Continue to Serve and Grow Our Diverse and Global Client Base

We believe we are a leading provider of private markets solutions for a broad variety of clients. Our clients include some of the world’s largest public and private defined benefit and defined contribution pension funds, sovereign wealth funds and insurance companies, as well as prominent endowments, foundations, family offices and private wealth clients. In many instances, existing clients have increased allocations to additional asset classes and commercial structures and deployed capital across our asset management and advisory services businesses.

Our dedicated in-house business development, marketing and client relations teams, comprising approximately 130 professionals in offices across 13 countries, maintain an active and transparent dialogue with our diverse and global client base. Consistent with our staffing model on the investment side, we ensure local clients are interfacing with business development professionals who have local expertise.

Preeminent Data and Analytics with Proprietary Software

Our data-driven, research-focused approach has been core to our investment philosophy since inception, which we believe is one of our biggest competitive strengths. Our data are organized around our proprietary software systems:

•SPI Research monitors investment opportunities and is used by our investment professionals as an investment decision making tool. As of March 31, 2024, SPI Research contained information on approximately 18,000 fund managers, 46,000 funds, 105,000 companies, and 227,000 investments. SPI Research initially augmented our own due diligence, investment and portfolio construction processes. In response to growing industry demand for private markets intelligence, we subsequently developed an interface for direct client access. Through SPI Research, our clients can access detailed, regularly updated information on managers through an intuitive, web-based user interface. Our research professionals utilize this technology to collect and develop qualitative and quantitative perspectives on investment opportunities.

11

•SPI Reporting monitors the performance of our clients’ investments and allows users, including our clients, to generate detailed analytics. SPI Reporting is used extensively by our StepStone Portfolio Analytics & Reporting (“SPAR”) team to provide customized portfolio analytics and reporting on the performance of our clients’ investments.

We also have a number of additional proprietary tools that we use and license in service of our clients, including our SPI Pacing tool that enables clients to forecast liquidity needs, our daily valuation engine that facilitates asset management solutions offering periodic subscription or liquidity (such as the mass affluent and defined contribution plan markets), ESG reporting dashboards that allow our clients to monitor their portfolio against these non-financial metrics, and a secondary pricing engine that drives operating leverage in our evaluation of larger and more complex transactions. The combination of SPI Research, SPI Reporting, and our other tools offers an end-to-end software technology and data solution that delivers significantly more information than most private markets investors have available, providing us with a meaningful advantage in our investment, due diligence and client relations efforts. Data science within private markets has historically been difficult due to the lack of standardization and the labor-intensive process of collecting and processing information. We have a dedicated Data and Software Engineering team, which manages and continues to develop our SPI Research and SPI Reporting platforms (and our additional proprietary tools built on these platforms) and supports our efforts to be a market leader in an area that is essential to evaluating private markets.

Strong Investment Performance Track Record

Our track record is a key point of differentiation to our clients. As shown below, we have outperformed the MSCI ACWI Index, the benchmark index used for comparison across all of our investment strategies on an inception-to-date basis as of December 31, 2023. See “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Investment Performance” below for more information and explanatory footnotes.

| (in billions except percentages and multiples) | |||||||||||||||||||||||||||||

| Strategy | Committed Capital | Cumulative Invested Capital | Realized Distributions | NAV | Total | Gross IRR | Net IRR | Net Multiple of Invested Capital | Net IRR versus Benchmark | ||||||||||||||||||||

| Primaries | $ | 296.6 | $ | 218.3 | $ | 136.1 | $ | 168.5 | $ | 304.6 | 11.5 | % | 11.1 | % | 1.4x | 1.8 | % | ||||||||||||

| Secondaries | 19.6 | 16.8 | 10.1 | 14.8 | 24.9 | 19.4 | % | 16.0 | % | 1.4x | 5.8 | % | |||||||||||||||||

| Co-investments | 44.8 | 42.4 | 23.2 | 44.3 | 67.5 | 16.7 | % | 13.6 | % | 1.5x | 3.8 | % | |||||||||||||||||

| Total | $ | 361.0 | $ | 277.5 | $ | 169.4 | $ | 227.6 | $ | 397.0 | 12.5 | % | 11.6 | % | 1.4x | 2.2 | % | ||||||||||||

We attribute our strong investment performance track record to numerous factors, including our scale and global reach, our selective investment process powered by our technology and data advantage and our experienced investment teams. Together, these attributes allow us to source highly attractive investment opportunities with a compelling risk-adjusted return profile for our clients’ diverse investment objectives. Our track record has attracted clients seeking exposure to investments with varying risk and return objectives and, in turn, allowed us to successfully and consistently grow assets across our platform.

12

Attractive Financial Profile, Supported by Longer Duration Capital Base and Scalable Platform

We have a scalable business model with two integrated revenue streams: management and advisory fees and performance fees. Our superior value proposition to clients, enabled by our global scale, expertise across private markets asset classes and investment strategies, as well as our research and analytics capabilities, drives strong growth in AUM and AUA, which in turn leads to management and advisory fee growth. Investment returns for our clients provide additional revenue opportunities to us in the form of potential performance fees and investment income.

We believe our revenue model has the following important attributes:

Sustainable and recurring management and advisory fees

Our management and advisory fees grew from $191 million in fiscal 2019 to $585 million in fiscal 2024, representing a 25% compounded annual growth rate. We have had a high level of success in retaining our advisory clients with an over 90% retention rate since inception.

Highly predictable with strong visibility into near-term growth

Our SMAs and focused commingled funds typically have an eight to 18-year maturity at inception, including extensions. As of March 31, 2024, we had $22.6 billion of committed but undeployed fee-earning capital, which we expect to generate management fees when deployed or activated.

Diverse

As of March 31, 2024, we had approximately 425 revenue-generating asset management and advisory programs and therefore are not dependent upon or concentrated in any single investment vehicle or client. For the year ended March 31, 2024, no single client contributed more than 6% of our total management and advisory fees, and our top 10 clients, which comprise over 55 separate mandates and commitments to commingled funds, contributed approximately 23% of our total management and advisory fees.

Upside from performance fees

As of March 31, 2024, we had over 200 investment programs with the potential to earn performance fees, consisting of over $75 billion in committed capital. As of March 31, 2024, our accrued carried interest allocations balance, which we view as a backlog of future carried interest allocation revenue, was $1,354 million. Approximately 74% of current accrued carried interest allocations is from StepStone Fund vintages of 2018 or prior.

Led by a Seasoned Team of Professionals Whose Interests Are Aligned with Clients and Our Stockholders

We believe our biggest asset is our people, and therefore we focus on consistently recruiting the best people, many of whom are proven leaders in their areas of expertise. As of March 31, 2024, 100 partners led the firm, with an average of over 20 years of investment or industry experience. As of March 31, 2024, nearly half of our employees have equity interests in us in the form of direct equity interests and/or restricted stock units under our 2020 Long-Term Incentive Plan (“LTIP”), and more than 200 employees are eligible to participate in our carried interest allocations in one or more of the asset classes.

13

Strategic Priorities

We aim to leverage our core principles and values that have guided us since inception to continue to grow our business, using the following key strategies:

Continue to Grow with Existing Clients

Expand existing client mandates. As a customized solutions provider, we spend significant time listening to the challenges that our clients face and responding by creating solutions to meet their needs. In addition, we believe our existing clients have a growing asset base and are expanding allocations to private markets investments. As a result, we believe a large portion of our growth will come from existing clients through renewals and expansion of existing mandates with us.

Deploy already raised committed capital. As of March 31, 2024, we had $22.6 billion of capital not yet deployed across our various investment vehicles, which we expect to generate management fees when invested or activated.

Add New Clients Globally

Over the past decade, we have invested in and grown both our in-house and third-party distribution networks. Our local business development professionals lead conversations with potential local clients.

We believe that geographically and economically diverse U.S. and non-U.S. investors will require a highly bespoke approach and will demand high levels of transparency, governance and reporting. We have seen this pattern developing across many geographies, including Europe, the Middle East, Latin America, Australia, Japan, South Korea, Southeast Asia and China, and have positioned ourselves to take advantage of it by establishing local presence with global investment capabilities. We believe our global footprint places us in a favorable position to tap the global pools of demand for private markets.

Continue to Expand Our Distribution Channel for Private Wealth Clients

Many high-net-worth and mass affluent individual investors continue to have difficulty accessing private markets investment opportunities because of a lack of products currently available that satisfy regulatory and structural requirements related to liquidity, transparency and administration. We have developed an investment platform, StepStone Private Wealth LLC (“SPW”), designed to expand access to the private markets for accredited investors.

Leverage Our Scale to Enhance Operating Margins

Since inception we have made significant investments in our platform infrastructure through building out our investment and implementation teams across geographies and asset classes and developing technology-enabled solutions. We believe we have scaled the personnel and infrastructure of our business to support significant growth in our client base across our existing investment offerings, positioning us well to continue to drive operating margin improvement.

14

Monetize Our Data and Analytics Capabilities

Our proprietary database, SPI Research, provides access to valuable data that forms the cornerstone of our investing process. We license SPI Research to clients in the form of a traditional licensed offering as well as an “advisory-like” service where we offer the SPI Research license and limited advisory-type support from our team. This has allowed us to support the private markets activities of clients that are too small to participate in our full-service advisory offerings. SPI Reporting and SPI Research both allow users to leverage our research data, further enhancing our client experience and services. We also strategically use SPI Research and SPI Reporting as a competitive product bundle, for example, by providing both offerings to clients to secure more comprehensive mandates.

Pursue Accretive Transactions to Complement Our Platform

We may complement our strong organic growth with selective strategic and tactical acquisitions. We intend to remain highly disciplined in our development strategy to ensure that we are allocating management time and our capital in the most productive areas to fuel growth. Our strategy will continue to focus on opportunities that expand our scale in existing markets, add complementary capabilities, enhance distribution, or provide access to new markets.

Investment Strategies

We offer customized solutions across the global private markets through synergistic investment strategies – primary fund investments, secondary investments, and co-investments. StepStone constructs solutions across all three investment strategies for each asset class – private equity, infrastructure, private debt and real estate. Being an active investor across all investment strategies provides us with meaningful insights into fund managers, their portfolios, return characteristics and direct investment opportunities.

Primaries

Primaries refer to investments in newly established private markets funds. Primary investments are made during an initial fundraising period in the form of capital commitments, which are called down by the fund from time to time and utilized to finance its investments in portfolio companies during a predefined period. A private markets fund’s return profile typically exhibits a “J-Curve,” undergoing a modest decline in the early portion of the fund’s lifecycle as investment-related expenses and fees accrue prior to the realization of investment gains from portfolio investments, with the trend typically reversing in the later portion of the fund’s lifecycle as portfolio investments are sold and gains from investments are realized and distributed.

Primaries are generally closed-end funds and only accept new capital commitments during a finite period. Private equity, real estate and infrastructure primary investment funds typically range in duration from 10 to 18 years, including extensions, while private debt primary investment funds typically range in duration from eight to 10 years. Underlying investments in portfolio investments generally have a three to six year range of duration for private equity, with potentially shorter periods for private debt or real estate, and longer for infrastructure. Typically, fund managers will not launch new funds more frequently than every two to four years. Market leaders generally offer multiple primary investment funds each year, but they may not offer funds within a given geography or that pursue a certain strategy in any particular year or in consecutive years. Because of the limited timeframe of opportunity for investment in any given fund, having a well-established relationship with a fund manager is critically important for primary investors.

15

Our primaries business seeks out, and invests with, leading fund managers across the private markets asset classes. We aim to build top-performing global private markets portfolios through a research-intensive investment approach and strive to identify fund managers with top-quartile performance through active sourcing and in-depth evaluation, complemented by excellent deal execution. We leverage our SPI Research database to track a large cross section of fund managers and funds globally—irrespective of fundraising cycles.

Secondaries

Secondaries refer to investments in existing private markets funds or companies through the acquisition of an existing interest by one investor from another in a negotiated transaction. In so doing, the buyer will agree to take on future funding obligations in exchange for future returns and distributions. Because secondary investments are generally made when a primary investment fund is three to seven years into its life, these investments are viewed as more mature.

Secondaries have historically generated a high risk-adjusted internal rate of return (“IRR”) relative to other strategies in the private equity market. This performance is due, in part, to: (1) the lack of a centralized market, (2) imperfect information among buyers and sellers, (3) wide bid spreads, (4) shorter holding periods, (5) fee mitigation and (6) transactions priced at a discount to fair value. Unlike primary commitments, secondaries offer visibility into a portfolio of known assets and their historical performance, which can mitigate some of the risk normally associated with primaries. We believe these market dynamics will persist, making secondaries an attractive long-term opportunity for sophisticated investors.

Similar to our primaries program, our secondaries program spans all asset classes and leverages our global platform to capitalize on market inefficiencies. We seek to acquire assets through preferential purchase arrangements by proactively sourcing secondary deal flow through our extensive network of relationships with fund managers, clients, intermediaries and other industry participants. We are able to increase the effectiveness of our sourcing efforts by focusing on fund managers managing high quality portfolios that are expected to outperform the market. In addition, we source exclusive deal flow (which we refer to as “advantaged”) by working closely with intermediaries to capture high quality assets that would not be available through auction processes, usually because a fund manager wants to control information flow or client relationships, including by restricting potential buyers to a select group of “pre-approved” replacement clients like our firm.

Our global platform provides for deep market coverage and consistently sources proprietary transaction opportunities. We believe proprietary and advantaged deal flow has been a critical factor in our ability to purchase high quality assets at below market prices.

Co-investments

Co-investments involve directly acquiring an interest in an operating company, project or property alongside an investment by a fund manager or direct investor that leads the transaction. We participate in co-investments across each of our asset classes. Co-investments are generally structured such that the lead and co-investors collectively hold the same security on the same terms in a controlling interest of the operating company, project or property. Capital committed to a co-investment is typically invested immediately, thereby advancing the timing of expected returns on investment and creating more predictable cash flows for the investor.

We employ a flexible approach to co-investing, which makes us an attractive co-investor for fund managers. Our ability to co-invest and participate on a pre-signing basis helps us expand the number of available opportunities and secure larger co-investment allocations. We have the ability to participate in non-traditional co-investments, such as helping to fund add-on acquisitions when a fund manager has already reached its concentration limits in its fund. This further expands our investment opportunities and differentiates us from other co-investors, thereby leading to future opportunities with fund managers.

16

Our co-investment program benefits from the access to fund managers we have through our scale and the approximately 5,300 meetings and calls that we conduct with fund managers on an annual basis. In each of these meetings and calls, we follow a protocol of inquiring about co-investments and monitoring compliance with the protocol through an automated tracking system.

Portfolio Analytics and Reporting

We provide our clients with tailored reporting packages, including customized performance benchmarks as well as compliance, administration and tax capabilities. The team of professionals dedicated to SPAR is organized by sector and geography to ensure deep coverage of all private markets, facilitating detailed investment review and analysis services by private markets specialists. Once an investment has been made, our SPAR team provides active, ongoing analytical review for portfolio risk management for our clients. As part of our ongoing manager and portfolio performance analyses, our portfolio analytics and reporting practice completes reviews for our clients including:

•portfolio benchmarking for relative performance;

•diversification analysis to identify concentration risks or portfolio allocation opportunities;

•fund manager performance to understand where additional capital should be directed; and

•valuation analysis to determine which fund managers are appropriately reflecting risk in their reporting.

Fund managers’ information is entered into SPI Reporting, our proprietary, web-based application and database for private market portfolio analytics and reporting. Data are reconciled daily to ensure data integrity and that pertinent details are entered correctly. In order to be included in SPI Reporting, a fund manager must send us sufficient materials, including specific data fields required by us. Performance data monitored by SPI Reporting is available back to 1971.

SPI Reporting supports investment monitoring and portfolio management and enhances transparency by providing users with a fast and intuitive user interface and web-based access to portfolio data. SPI Reporting users can access all of the data tracked by SPAR, including daily cash flow activity, quarterly valuations, and underlying asset-level detail, and have fully integrated access to our SPI by StepStone platform. SPI Reporting users can analyze investment-level and underlying asset-level performance by custom investment attributes, apply data filters, run grouped or granular reports while also having the ability to easily export these analyses. Users also have the ability to edit, run and export various portfolio analytics, including analyzing various return and preference metrics commonly used in the investment industry, such as return J-Curve, cash flow activity over time, multi-period internal rates of return and time-weighted rate of return.

Investment Risk Management

We have an investment risk management function overseen by our Head of Research and Portfolio Management and our Head of Risk. Additionally, taking into account the nature, scale and complexity of our business, we have a Portfolio and Risk Management Committee for each of our asset classes and additional policies and procedures to give effect to local regulations in jurisdictions around the world. Our risk management process focuses on risk identification, measurement, treatment/mitigation, monitoring and management/reporting, with particular risk assessments tailored by asset class and individual client.

17

Responsible Investment Philosophy

Responsible investment is a core tenet of our operating and investment philosophies. We believe that full integration of ESG factors in both our investment process and internal operations will improve long-term, risk-adjusted returns for our clients and stakeholders. We aim to continually improve and evolve our practices. As part of our responsible investment journey, we:

•Became a signatory to the United Nations Principles for Responsible Investment (“UNPRI”) in 2013;

•Adopted a Responsible Investment policy in 2014, which is reviewed annually;

•Became a formal supporter of the Task Force on Climate-Related Financial Disclosures (“TCFD”);

•Became a member of the Sustainability Accounting Standards Board (“SASB”) and created asset class responsible investment workgroups in 2019;

•Became a member of the GRESB and a founding signatory to the ILPA Diversity in Action initiative in 2020;

•Implemented standalone policies for climate and stewardship in 2022, reflecting TCFD-aligned climate considerations within our investment process and our approach to corporate sustainability, as well as our continued emphasis on stewardship practices in our investments;

•Became a founding financial services member supporting Ownership Works in 2022, a consortium of organizations dedicated to promoting employee ownership programs; and

•Became a signatory to the UK Stewardship Code in 2023.

Responsible Investment in the Investment Process

Composed of leaders from across our organization, the Responsible Investment Committee provides oversight and direction for our responsible investment process. Among other things, it reviews ESG-focused due diligence within our investment memoranda before they are submitted to the relevant Investment Committee.

Our ESG due diligence process is tailored for each asset class and strategy and incorporated into the broader business, financial, and operational diligence process — detailing a comprehensive set of ESG-related risk and return considerations.

Primary Investments

For all primary investments, we perform a review of each fund manager and fund’s responsible investment policy, implementation and monitoring framework. We evaluate the level of commitment, accountability and leadership engagement across the fund manager. We seek to understand how aligned their ESG processes are to established frameworks and how specific material risks and opportunities are considered including climate and modern slavery (e.g., forced labor, child labor, and human trafficking). Further, we evaluate their ESG monitoring and reporting systems. Where relevant, for impact strategies, we layer on an additional layer of due diligence focused on the quality of the fund manager's impact practices.

18

Co-investments

With respect to our co-investments, we complete an ESG assessment at both the manager and asset level. We use several tools to complete the latter, including information from the manager and company, along with SASB materiality standards, and for specific sectors information from GRESB. Post investment, we monitor the co-investment’s performance focusing on material financial and ESG factors. The majority of this monitoring is conducted through regular engagement with the fund manager supplemented by Limited Partner Advisory Committees of which we are a member. In cases where we hold a board or observer seat at the fund, we seek to be active in advocating for material issues as standard agenda items.

Secondaries

With respect to secondary transactions, we utilize primary ESG assessments along with an evaluation of the ESG risk and opportunities of the key, value-driving assets. Due diligence timelines are often compressed for secondary transactions. As such, our platform creates a significant advantage due to the breadth of information we typically already have on the fund manager in a secondary transaction.

Impact

We have observed that investors globally are increasingly focused on the real world outcomes of their investment programs, typically referred to as impact investing. We look to work with clients in crafting customized investment programs that target non-financial objectives side-by-side with commercial financial objectives. These may include a focus on, for example, climate change, social equity and the United Nations’ Sustainable Development Goals. We believe impact programs build on our firm’s strong ESG foundations supplemented with specific impact practice considerations and evaluation. The impact sector is fast-growing and we see developments in this sector that we believe will increasingly allow for the deployment of capital at scale.

ESG in Our Corporate Operations

We are committed to incorporating ESG factors across our operational decision making and internal policies. Our key focus areas are diversity, equity and inclusion (“DEI”), managing our carbon footprint, and community engagement.

DEI

We value diversity among our staff and leadership, recognizing that through diversity, we gain a variety of perspectives, views, and ideas which strengthen our ability to strategize, communicate, and deliver on our mission. In addition to being the right thing to do, we believe building and maintaining a diverse, equitable and inclusive firm is critical to our mission and our success as a business. In short, we believe DEI:

•Makes us better investors, sharpens our analysis and makes us more effective communicators;

•Enables our firm to tap into our employees’ full potential; and

•Improves performance and contributes to a more sustainable enterprise.

In 2017, we established a global DEI Committee comprising senior and mid-level members from across our organization to evaluate our current diversity efforts, lead new initiatives to improve DEI at our firm, and continue to improve upon our policies and culture.

19

To build a diverse workforce, we are focused on expanding our recruiting processes and outreach to broaden our pipeline of potential candidates. These efforts allow us to build more diverse slates of prospective new hires. We actively monitor our progress in this regard.

Talent development, promotion and retention are also key components of our DEI efforts. This includes sponsorship programs, education and executive coaching opportunities. We have also continued to review and expand relevant policies, including our parental leave policies and related benefits.

Building awareness and engagement around the importance of DEI, both internally and externally, represents another core tenet of our efforts. As an example, our employees have launched multiple Employee Resource Groups (“ERGs”) established with the intention of providing a supportive community for employees of certain affinity groups and their allies. In addition, from time to time, we host internal and external networking and educational events in various jurisdictions, in support of DEI.

Finally, StepStone is a supporter of several organizations that advocate for further diversity in our industry.

Managing Our Carbon Footprint

We are focused on the firm’s carbon footprint as we seek to maintain carbon neutrality within our operations as a stated firm goal. As such, the following efforts have been undertaken:

•Since 2019, engaged a consultant on an annual basis to conduct a comprehensive carbon footprint measurement and analysis of our operations. Based on this analysis, we have funded several sustainable development projects to offset our carbon emissions and achieve carbon neutral status within our operations;

•Implementing tailored carbon reduction initiatives across our global offices, including recycling protocols, transitioning to electronic tablets during meetings and encouraging a “paperless” approach where practicable. As part of our vendor due diligence process, we have added specific climate-related queries to help us understand and evaluate vendor environmental efforts, such as whether they measure their carbon footprint and have initiatives in place to minimize or offset emissions; and

•Prioritizing selection of highly rated Leadership in Energy and Environmental Design (LEED) or comparable standard in leasing office space.

Community Engagement

We encourage and support community engagement. Our community program uses a global-and-local approach and is driven by our community involvement teams at many of our offices. Projects are organized locally and partnered with various service organizations within our communities dedicated to causes encompassing public service, education, environmental efforts, healthcare, and military veterans. Additionally, we have implemented a volunteer time-off policy that gives employees 16 hours per calendar year of paid time to volunteer at an organization of their choice. We actively monitor participation in these programs. We have also established a formalized charitable giving program with an employee matching component.

20

Our Clients

We believe the value proposition we offer across our asset management, advisory, data, portfolio monitoring and reporting services has resulted in strong relationships with our clients. Our client base includes some of the world’s largest public and private pension funds, sovereign wealth funds and insurance companies, as well as prominent endowments, foundations, family offices and private wealth clients, which include high-net-worth and mass affluent individuals globally. During the year ended March 31, 2024, nearly two-thirds of our management and advisory fees came from clients based outside of the United States, reflecting the strength and breadth of our relationships within the global investor community.

We believe the stability of our client base, reflecting in part the longer tenor of our SMAs and focused commingled funds, reflects the strength of the long-term client relationships we have developed. We have also had a high level of success in retaining our advisory clients with an over 90% retention rate since inception. At the same time, we believe we have been successful in expanding relationships with our clients, often expanding from advisory relationships to discretionary asset management relationships. Approximately 35% of our clients engage us for both asset management and advisory services.

Private Wealth Sector Strategy

We have served defined contribution plans, family offices and private wealth clients for over 10 years, and have more recently expanded to delivering our institutional capabilities to high-net-worth and mass affluent investors. Our platform leverages our deep expertise across private equity, infrastructure, private debt and real estate to develop and distribute innovative products for individual investors, integrating primaries, secondaries and co-investments to create customized product solutions for the private wealth sector. Our solutions include:

•SMAs spanning multiple asset classes and strategies for defined contribution plans with long-term investment objectives;

•private wealth solutions for registered investment advisors, independent broker dealers and wirehouses in the United States and wealth managers internationally;

•registered funds available to mass affluent and accredited investors in the United States; and

•global distribution of our institutional funds to family office investors and high-net-worth investors.

Our Private Wealth funds offer the following areas of differentiation to potential investors:

•Favorable structure. Our funds are structured to provide 1099 tax reporting instead of K-1s for US investors, a single investment instead of recurring capital calls, and the potential for periodic liquidity.

•Attractive track record and deep knowledge and expertise in private markets. We have extensive experience investing substantial capital in the private markets and have generated attractive risk-adjusted returns.

•Proprietary database and insights. Our proprietary SPI by StepStone system represents one of the industry’s most comprehensive and powerful databases.

•Differentiated access. Given its scale, expertise, and relationships, we have preferred access to top-tier fund managers and proprietary opportunities, including co-investments and secondaries.

21

Fees and Other Key Contractual Terms

Separately Managed Accounts

The scope of our separate account services and degree of client involvement varies by relationship and policy guidelines, but we typically direct or have substantial participation in the negotiation of account terms, investment policy and strategic planning, pacing and ongoing monitoring and reporting activities. We also provide direct asset management services to clients, providing active fiduciary oversight of assets held by our clients, working with clients to establish investment guidelines aligned with their specific preferences and goals.

Clients seeking a large-scale asset management engagement typically prefer an SMA rather than commitment to a focused commingled fund. SMAs and directly-managed assets represented approximately $94 billion of our AUM as of March 31, 2024.

Focused Commingled Funds

We organize and manage commingled funds that invest in primary, secondary and co-investment funds managed by third-party managers focused in our areas of expertise. Our focused commingled funds invest across a variety of private market strategies, which enables our clients to efficiently participate in these specialized strategies for which they otherwise may not be able to access due to the high minimum investment requirements. Focused commingled funds represented $49 billion of our AUM as of March 31, 2024.

Key Terms of SMAs and Focused Commingled Funds

Fees

Management fees from SMAs are generally based on a contractual rate applied to net invested capital, although specific terms vary significantly from client to client and may be based on capital commitment or NAV. Management fees from focused commingled funds are generally based on a contractual rate applied initially to limited partners’ capital commitments, although specific terms vary significantly from fund to fund and may be based on net invested capital or NAV. Management fees often decrease over the life of the contract due to built-in declines in contractual rates and/or as a result of lower net invested capital balances as capital is returned to clients.

Duration and Termination

SMAs and focused commingled funds are typically eight to 18 years in duration, including extensions, but this varies and may be longer or even indefinite. Our SMAs and focused commingled funds are often subject to extension either at our discretion or, in the case of SMAs, with consent of the client, or in the case of focused commingled funds, with consent of the requisite percentage of limited partners or the advisory committee.

The commitment period of our SMAs and our focused commingled funds can typically be suspended upon the occurrence of a key person event. In some cases, the commitment period of our SMAs may be terminated for any reason (typically once per year).

SMAs typically can be terminated by our clients for specified reasons, but specific terms vary significantly from client to client and certain contracts may be terminated for any reason generally with minimal notice. Our focused commingled funds may generally be terminated for specified reasons and for any reason upon the affirmative vote, depending on the fund, of 50% or more of the total limited partner interests entitled to vote.

22

See “Risk Factors—Risks Related to Our Business—Third-party clients in many StepStone Funds have the right to remove us as the general partner of the relevant fund and to terminate the investment period under certain circumstances, leading to a decrease in our revenues, which could be substantial. In addition, the investment management agreements related to our SMAs and advisory accounts may permit the client to terminate our management of such accounts on short notice.”

Capital Commitments

Clients in our SMAs and focused commingled funds generally make commitments to provide capital at the outset of a fund and deliver capital when called upon by us, as investment opportunities become available and to fund operational expenses and other obligations. The commitments are generally available for investment for three to six years, during what we call the commitment period, though some SMAs provide for annual commitment periods.

Performance Fees

The performance fees charged by our focused commingled funds are generally referred to as “carried interest” while those charged by our SMAs may be structured as carried interest or incentive fees. Our focused commingled funds and SMAs generally charge performance fees equal to a fixed percentage of net profits, subject to a compounded annual preferred return in respect of secondary investments and co-investments, but may also earn performance fees with respect to primaries as well. In some cases, performance fees are charged with respect to appreciation in NAV in excess of an agreed rate of return.

If, upon the final distribution of any of our focused commingled funds or SMAs from which we earn performance fees, we or our affiliates have received cumulative performance fees in excess of the amount to which we would be entitled from the profits calculated for such investments in the aggregate, or if the clients have not received distributions equal to those to which they are entitled, we or our affiliates will return such part of any performance fees to the clients as is necessary to ensure that they receive the amounts to which they are entitled, less taxes on the performance fees. We refer to these provisions as “clawbacks.”

Advisory and Data Services

Depending on the mandate, advisory and data services may include one or more of the following for our clients: (i) recurring support of portfolio construction and design; (ii) discrete or project-based due diligence, advice, and investment recommendations; (iii) detailed review of existing private markets investments, including portfolio-level repositioning recommendations where appropriate; (iv) consulting on investment pacing, policies, strategic plans, and asset allocation to investment boards and committees; and (v) licensed access to our proprietary data and technology platforms, including SPI Research and our other proprietary tools. Mandates for SPAR services typically include licensed access to SPI Reporting, our proprietary web-based performance monitoring and reporting solution. SPI Reporting allows our clients to customize performance measurement and benchmarking according to their unique specifications. Our advisory relationships comprised $521 billion of our AUA and $14 billion of our AUM as of March 31, 2024.

Our advisory and data services clients are generally charged annual fixed fees, which vary depending on the services we provide and the volume of capital deployed. We generally do not earn incentive fees on advisory contracts.

23

Our advisory and data services contracts have various durations ranging from one year to indefinite terms and renew at the option of the client at the end of the stated term. Advisory and data service contracts can typically be terminated by our clients for any reason upon short notice, generally 30 to 90 days. Advisory and data service contracts with governmental pension plans typically are subject to a renewal process involving our submission of information in response to an RFP issued by the client.

Competition

We compete in all aspects of our business with a large number of asset management firms, commercial banks, broker-dealers, insurance companies and other financial institutions. With respect to our focused commingled funds, we primarily compete with the private markets management businesses of a number of large international financial institutions and established local and regional competitors based in the United States, Europe and Asia, including managers offering funds-of-funds, secondary funds and co-investment funds in the private markets. Our principal competition for SMAs is mostly other highly specialized and independent private markets asset management firms. We compete primarily in the advisory services area of the business with firms that are regionally based and with a select number of large consulting firms for whom private markets investments is only one, often small, portion of their overall business. See “Risk Factors—Risks Related to Our Industry—The investment management and investment advisory business is intensely competitive.”

In order to grow our business, we must maintain our existing client base and attract additional clients in advisory services, SMA and focused commingled fund areas of the business. Historically, we have competed principally on the basis of the factors listed below:

•global access to private markets investment opportunities through our size, scale, reputation and strong relationships with fund managers;

•brand recognition and reputation within the investing community;

•performance of investment strategies;

•quality of service and duration of client relationships;

•data and analytics capabilities;

•ability to customize product offerings to client specifications;

•transparent organizational structure;

•ability to provide cost effective and comprehensive range of services and products; and

•clients’ perceptions of our independence and the alignment of our interests with theirs created through our investment in our own products.

The asset management business is intensely competitive, and in addition to the above factors, our ability to continue to compete effectively will depend upon our ability to attract highly qualified investment professionals and retain existing employees. See “Risk Factors—Risks Related to Our Business—Our ability to retain our senior leadership team and attract additional qualified professionals is critical to our success.”

24

Regulatory Environment

Our business is subject to extensive federal and state regulation in the United States. Under these laws and regulations, the SEC and relevant state securities authorities have broad administrative powers, including the power to limit, restrict or prohibit an investment adviser from carrying on its business if it fails to comply with such laws and regulations. Possible sanctions that may be imposed include the suspension of individual employees, limitations on engaging in certain lines of business for specified periods of time, revocation of investment adviser and other registrations, censures and fines. We are also subject to regulatory oversight and requirements in several foreign jurisdictions in which we operate.

SEC Regulation

The Partnership and certain of our other consolidated subsidiaries are registered as investment advisers with the SEC. Registered investment advisers are subject to the requirements of the Investment Advisers Act, and the rules promulgated thereunder, as well as to examination by the SEC’s staff. The Investment Advisers Act imposes substantive regulation on virtually every aspect of our business and our client relationships. Applicable requirements relate to, among other things, fiduciary duties to clients, engaging in transactions with clients, maintaining an effective compliance program, performance fees, solicitation arrangements, allocation of investments, conflicts of interest, marketing, recordkeeping, reporting and disclosure. The Investment Advisers Act also regulates the assignment of advisory contracts by the investment adviser. The SEC is authorized to institute proceedings and impose sanctions for violations of the Investment Advisers Act, ranging from fines and censures to termination of an investment adviser’s registration. Failure to comply with the requirements of the Investment Advisers Act or the rules and regulations promulgated by the SEC could have a material adverse effect on our business.

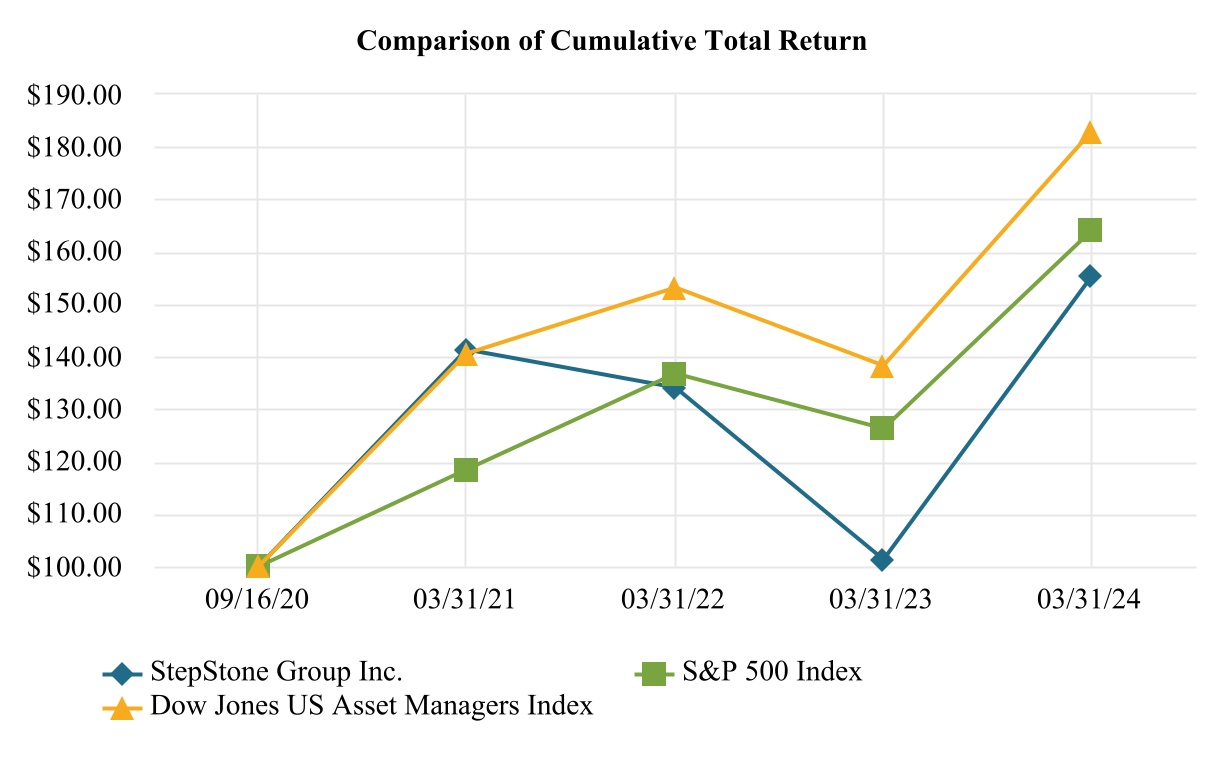

Recently, the SEC has adopted a number of significant new rules that may have a significant impact on our business, including new rules imposing a number of significant new disclosure and reporting requirements on private fund advisers and imposing substantive restrictions on certain types of practices by the private fund advisers that the SEC has deemed to be unfair or present conflicts of interest. In addition, the SEC has recently adopted amendments to Regulation S-P (the privacy regulations applicable to financial institutions, including investment advisers) that will expand the scope of the regulation and mandate notification to clients and customers in the event of privacy breaches.