UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended September 30, 2022

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from _______________________ to ___________________________

Commission file number 001-39510

(Exact name of Registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

(212 ) 351-6100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||||||||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☒ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: As of November 3, 2022, there were 62,061,427 shares of the registrant’s Class A common stock, par value $0.001, and 46,716,897 shares of the registrant’s Class B common stock, par value $0.001, outstanding.

Table of Contents

| Page | |||||

| PART I - FINANCIAL INFORMATION | |||||

Condensed Consolidated Balance Sheets as of September 30, 2022 and March 31, 2022 | |||||

Condensed Consolidated Statements of Income (Loss) for the Three and Six Months Ended September 30, 2022 and 2021 | |||||

Condensed Consolidated Statements of Comprehensive Income (Loss) for the Three and Six Months Ended September 30, 2022 and 2021 | |||||

Condensed Consolidated Statements of Stockholders’ Equity for the Three and Six Months Ended September 30, 2022 and 2021 | |||||

Condensed Consolidated Statements of Cash Flows for the Six Months Ended September 30, 2022 and 2021 | |||||

| PART II - OTHER INFORMATION | |||||

2

This Quarterly Report on Form 10-Q (“Form 10-Q”) includes certain information regarding the historical investment performance of our focused commingled funds and separately managed accounts. An investment in shares of our Class A common stock is not an investment in any StepStone Fund (as defined below). The StepStone Funds are separate, distinct legal entities that are not our subsidiaries. In the event of our bankruptcy or liquidation, you will have no claim against the StepStone Funds. In considering the performance information relating to the StepStone Funds contained herein, current and prospective Class A common stockholders should bear in mind that the performance of the StepStone Funds is not indicative of the possible performance of shares of our Class A common stock and also is not necessarily indicative of the future results of the StepStone Funds, even if fund investments were in fact liquidated on the dates indicated, and we cannot assure you that the StepStone Funds will continue to achieve, or that future StepStone Funds will achieve, comparable results.

Unless otherwise indicated or the context otherwise requires:

• “StepStone Group Inc.” or “SSG” refers solely to StepStone Group Inc., a Delaware corporation, and not to any of its subsidiaries;

• the “Partnership” refers solely to StepStone Group LP, a Delaware limited partnership, and not to any of its subsidiaries;

• “General Partner” refers to StepStone Group Holdings LLC, a Delaware limited liability company, and the sole general partner of the Partnership;

• “we,” “us,” “our,” the “Company,” “our company,” “StepStone” and similar terms refer to SSG and its consolidated subsidiaries, including the Partnership;

• “StepStone Funds” or “our funds” refer to our focused commingled funds and our separately managed accounts, including acquired Greenspring funds, for which we act as both investment adviser and general partner or managing member;

• references to the “Greenspring acquisition” refer to the acquisition of Greenspring Associates, Inc. and certain of its affiliates (“Greenspring”) that was completed on September 20, 2021;

• references to “FY,” “fiscal” or “fiscal year” are to the fiscal year ended March 31 of the applicable year;

• references to the “Reorganization” refer to the series of transactions immediately before the Company’s initial public offering (“IPO”), which was completed on September 18, 2020;

• references to “private markets allocations” or “combined AUM / AUA” refer to the aggregate amount of our assets under management (“AUM”) and our assets under advisement (“AUA”);

• references to “high-net-worth” individuals refer to individuals with net worth of over $5 million, excluding primary residence; and

• references to “mass affluent” individuals refer to individuals with annual income over $200,000 or net worth between $1 million and $5 million, excluding primary residence.

3

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

We own or have rights to trademarks, service marks or trade names that we use in connection with the operation of our business. In addition, our names, logos and website names and addresses are owned by us or licensed by us. We also own or have the rights to copyrights that protect the content of our solutions. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this Form 10-Q are listed without the ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks, trade names and copyrights.

FORWARD-LOOKING STATEMENTS

This Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact, including statements regarding guidance, industry prospects or future results of operations or financial position made in this Form 10-Q are forward-looking. We use words such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “future,” “intend,” “may,” “plan” and “will” and similar expressions to identify forward-looking statements. Forward-looking statements reflect management’s current plans, estimates and expectations and are inherently uncertain. The inclusion of any forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated will be achieved. Forward-looking statements are subject to various risks, uncertainties and assumptions. Important factors that could cause actual results to differ materially from those in forward-looking statements include, but are not limited to, global and domestic market and business conditions, our successful execution of business and growth strategies and regulatory factors relevant to our business, as well as assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity and the risks and uncertainties described in greater detail under “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended March 31, 2022 and in our subsequent reports filed from time to time with the U.S. Securities and Exchange Commission (“SEC”), which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this Form 10-Q and in our other periodic filings. We undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

4

Part I. FINANCIAL INFORMATION

Item 1. Financial Statements

StepStone Group Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands, except share and per share amounts)

| As of | |||||||||||

| September 30, 2022 | March 31, 2022 | ||||||||||

| Assets | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Fees and accounts receivable | |||||||||||

| Due from affiliates | |||||||||||

Investments: | |||||||||||

| Investments in funds | |||||||||||

| Accrued carried interest allocations | |||||||||||

Legacy Greenspring investments in funds and accrued carried interest allocations(1) | |||||||||||

| Deferred income tax assets | |||||||||||

| Lease right-of-use assets, net | |||||||||||

| Other assets and receivables | |||||||||||

| Intangibles, net | |||||||||||

| Goodwill | |||||||||||

Total assets | $ | $ | |||||||||

| Liabilities and stockholders’ equity | |||||||||||

| Accounts payable, accrued expenses and other liabilities | $ | $ | |||||||||

| Accrued compensation and benefits | |||||||||||

| Accrued carried interest-related compensation | |||||||||||

Legacy Greenspring accrued carried interest-related compensation(1) | |||||||||||

| Due to affiliates | |||||||||||

| Lease liabilities | |||||||||||

| Debt obligations | |||||||||||

| Total liabilities | |||||||||||

| Commitments and contingencies (Note 15) | |||||||||||

Class A common stock, $ | |||||||||||

Class B common stock, $ | |||||||||||

| Additional paid-in capital | |||||||||||

| Retained earnings | |||||||||||

| Accumulated other comprehensive income | |||||||||||

| Total StepStone Group Inc. stockholders’ equity | |||||||||||

| Non-controlling interests in subsidiaries | |||||||||||

Non-controlling interests in legacy Greenspring entities(1) | |||||||||||

| Non-controlling interests in the Partnership | |||||||||||

| Total stockholders’ equity | |||||||||||

| Total liabilities and stockholders’ equity | $ | $ | |||||||||

(1)Reflects amounts attributable to consolidated VIEs for which the Company did not acquire any direct economic interests. See notes 5 and 14 for more information.

See accompanying notes to condensed consolidated financial statements.

5

StepStone Group Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands)

The following presents the portion of the condensed consolidated balances presented above attributable to consolidated variable interest entities.

| As of | |||||||||||

| September 30, 2022 | March 31, 2022 | ||||||||||

| Assets | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Fees and accounts receivable | |||||||||||

| Due from affiliates | |||||||||||

Investments in funds | |||||||||||

| Legacy Greenspring investments in funds and accrued carried interest allocations | |||||||||||

| Deferred income tax assets | |||||||||||

| Lease right-of-use assets, net | |||||||||||

| Other assets and receivables | |||||||||||

Total assets | $ | $ | |||||||||

| Liabilities | |||||||||||

| Accounts payable, accrued expenses and other liabilities | $ | $ | |||||||||

| Accrued compensation and benefits | |||||||||||

| Legacy Greenspring accrued carried interest-related compensation | |||||||||||

| Due to affiliates | |||||||||||

| Lease liabilities | |||||||||||

Total liabilities | $ | $ | |||||||||

See accompanying notes to condensed consolidated financial statements.

6

StepStone Group Inc.

Condensed Consolidated Statements of Income (Loss) (Unaudited)

(in thousands, except share and per share amounts)

| Three Months Ended September 30, | Six Months Ended September 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Revenues | |||||||||||||||||||||||

| Management and advisory fees, net | $ | $ | $ | $ | |||||||||||||||||||

| Performance fees: | |||||||||||||||||||||||

| Incentive fees | |||||||||||||||||||||||

| Carried interest allocations: | |||||||||||||||||||||||

| Realized | |||||||||||||||||||||||

| Unrealized | ( | ( | |||||||||||||||||||||

| Total carried interest allocations | ( | ( | |||||||||||||||||||||

Legacy Greenspring carried interest allocations(1) | ( | ( | |||||||||||||||||||||

| Total revenues | ( | ( | |||||||||||||||||||||

| Expenses | |||||||||||||||||||||||

| Compensation and benefits: | |||||||||||||||||||||||

| Cash-based compensation | |||||||||||||||||||||||

| Equity-based compensation | |||||||||||||||||||||||

| Performance fee-related compensation: | |||||||||||||||||||||||

| Realized | |||||||||||||||||||||||

| Unrealized | ( | ( | |||||||||||||||||||||

| Total performance fee-related compensation | ( | ( | |||||||||||||||||||||

Legacy Greenspring performance fee-related compensation(1) | ( | ( | |||||||||||||||||||||

| Total compensation and benefits | ( | ( | |||||||||||||||||||||

| General, administrative and other | |||||||||||||||||||||||

| Total expenses | ( | ( | |||||||||||||||||||||

| Other income (expense) | |||||||||||||||||||||||

| Investment income (loss) | ( | ( | |||||||||||||||||||||

Legacy Greenspring investment loss(1) | ( | ( | |||||||||||||||||||||

| Interest income | |||||||||||||||||||||||

| Interest expense | ( | ( | ( | ( | |||||||||||||||||||

| Other loss | ( | ( | ( | ( | |||||||||||||||||||

| Total other income (expense) | ( | ( | |||||||||||||||||||||

| Income (loss) before income tax | ( | ( | |||||||||||||||||||||

| Income tax expense (benefit) | ( | ( | ( | ||||||||||||||||||||

| Net income (loss) | ( | ( | |||||||||||||||||||||

| Less: Net income attributable to non-controlling interests in subsidiaries | |||||||||||||||||||||||

Less: Net loss attributable to non-controlling interests in legacy Greenspring entities(1) | ( | ( | |||||||||||||||||||||

| Less: Net income (loss) attributable to non-controlling interests in the Partnership | ( | ( | |||||||||||||||||||||

| Net income (loss) attributable to StepStone Group Inc. | $ | ( | $ | $ | ( | $ | |||||||||||||||||

Net income (loss) per share of Class A common stock: | |||||||||||||||||||||||

| Basic | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Diluted | $ | ( | $ | $ | ( | $ | |||||||||||||||||

Weighted-average shares of Class A common stock: | |||||||||||||||||||||||

| Basic | |||||||||||||||||||||||

| Diluted | |||||||||||||||||||||||

(1)Reflects amounts attributable to consolidated VIEs for which the Company did not acquire any direct economic interests. The three and six months ended September 30, 2021 reflect the net effect of gross realized gains and the reversal of such amounts in unrealized gains. See notes 3, 5 and 14 for more information.

See accompanying notes to condensed consolidated financial statements.

7

StepStone Group Inc.

Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited)

(in thousands)

| Three Months Ended September 30, | Six Months Ended September 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Net income (loss) | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Other comprehensive income: | |||||||||||||||||||||||

| Foreign currency translation adjustment | |||||||||||||||||||||||

| Total other comprehensive income | |||||||||||||||||||||||

| Comprehensive income (loss) before non-controlling interests | ( | ( | |||||||||||||||||||||

| Less: Comprehensive income attributable to non-controlling interests in subsidiaries | |||||||||||||||||||||||

| Less: Comprehensive loss attributable to non-controlling interests in legacy Greenspring entities | ( | ( | |||||||||||||||||||||

| Less: Comprehensive income (loss) attributable to non-controlling interests in the Partnership | ( | ( | |||||||||||||||||||||

| Comprehensive income (loss) attributable to StepStone Group Inc. | $ | ( | $ | $ | ( | $ | |||||||||||||||||

See accompanying notes to condensed consolidated financial statements.

8

StepStone Group Inc.

Condensed Consolidated Statements of Stockholders’ Equity (Unaudited)

(in thousands)

| Class A Common Stock | Class B Common Stock | Additional Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Income | Non-Controlling Interests in Subsidiaries | Non-Controlling Interests in Legacy Greenspring Entities | Non-Controlling Interests in the Partnership | Total Stockholders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||

| Balance at June 30, 2022 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | ( | — | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Contributed capital | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Equity-based compensation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Distributions | — | — | — | — | — | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | ( | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Vesting of RSUs, net of shares withheld for employee taxes | — | — | ( | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Exchange of Class B units for Class A common stock and redemption of corresponding Class B common shares | ( | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Equity reallocation between controlling and non-controlling interests | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||

Deferred tax effect resulting from transactions affecting ownership in the Partnership, including net amounts payable under Tax Receivable Agreements(1) | — | — | ( | — | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Balance at September 30, 2022 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2022 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | ( | — | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Contributed capital | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Equity-based compensation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Distributions | — | — | — | — | — | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | ( | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Vesting of RSUs, net of shares withheld for employee taxes | — | — | ( | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Exchange of Class B units for Class A common stock and redemption of corresponding Class B common shares | ( | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Equity reallocation between controlling and non-controlling interests | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||

Deferred tax effect resulting from transactions affecting ownership in the Partnership, including net amounts payable under Tax Receivable Agreements(1) | — | — | ( | — | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Balance at September 30, 2022 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

(1)See notes 10, 13 and 14 for more information.

See accompanying notes to condensed consolidated financial statements.

9

StepStone Group Inc.

Condensed Consolidated Statements of Stockholders’ Equity (Unaudited)

(in thousands)

| Class A Common Stock | Class B Common Stock | Additional Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Income | Non-Controlling Interests in Subsidiaries | Non-Controlling Interests in Legacy Greenspring Entities | Non-Controlling Interests in the Partnership | Total Stockholders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||

| Balance at June 30, 2021 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Contributed capital | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Equity-based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Distributions | — | — | — | — | — | ( | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Purchase of non-controlling interests | — | — | ( | — | — | ( | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | ( | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Vesting of RSUs | — | ( | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Class A common stock issued for Greenspring acquisition | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Class C Partnership units issued for Greenspring acquisition | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Exchange of Class B units for Class A common stock and redemption of corresponding Class B common shares | ( | ( | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||

| Initial consolidation of legacy Greenspring general partner entities | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Equity reallocation between controlling and non-controlling interests | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

Deferred tax effect resulting from transactions affecting ownership in the Partnership, including net amounts payable under Tax Receivable Agreements(1) | — | — | ( | — | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Balance at September 30, 2021 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2021 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Contributed capital | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Equity-based compensation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Distributions | — | — | — | — | — | ( | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Purchase of non-controlling interests | — | — | ( | — | — | ( | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | ( | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Vesting of RSUs | — | ( | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Class A common stock issued for Greenspring acquisition | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Class C Partnership units issued for Greenspring acquisition | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Exchange of Class B units for Class A common stock and redemption of corresponding Class B common shares | ( | ( | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||

| Initial consolidation of legacy Greenspring general partner entities | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Equity reallocation between controlling and non-controlling interests | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

Deferred tax effect resulting from transactions affecting ownership in the Partnership, including net amounts payable under Tax Receivable Agreements(1) | — | — | ( | — | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Balance at September 30, 2021 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

(1)See notes 10, 13 and 14 for more information.

See accompanying notes to condensed consolidated financial statements.

10

StepStone Group Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| Six Months Ended September 30, | |||||||||||

| 2022 | 2021 | ||||||||||

| Cash flows from operating activities | |||||||||||

| Net income (loss) | $ | ( | $ | ||||||||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | |||||||||||

| Unrealized carried interest allocations and investment (income) loss | ( | ||||||||||

| Unrealized legacy Greenspring carried interest allocations and investment loss | |||||||||||

| Unrealized performance fee-related compensation | ( | ||||||||||

| Unrealized legacy Greenspring performance fee-related compensation | ( | ||||||||||

| Amortization of deferred financing costs | |||||||||||

| Equity-based compensation | |||||||||||

| Change in deferred income taxes | ( | ( | |||||||||

| Fair value adjustment for acquisition-related contingent consideration | |||||||||||

| Gain on remeasurement of lease liabilities | ( | ||||||||||

| Other non-cash activities | |||||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Fees and accounts receivable | ( | ( | |||||||||

| Due from affiliates | ( | ||||||||||

| Other assets and receivables | ( | ||||||||||

| Accounts payable, accrued expenses and other liabilities | ( | ( | |||||||||

| Accrued compensation and benefits | |||||||||||

| Accrued carried interest-related compensation | ( | ||||||||||

| Due to affiliates | ( | ( | |||||||||

| Lease right-of-use assets, net and lease liabilities | ( | ||||||||||

| Net cash provided by operating activities | |||||||||||

| Cash flows from investing activities | |||||||||||

| Contributions to investments | ( | ( | |||||||||

| Distributions received from investments | |||||||||||

| Contributions to investments in legacy Greenspring entities | ( | ||||||||||

| Distributions received from investments in legacy Greenspring entities | |||||||||||

| Cash paid for Greenspring acquisition, net of cash acquired | ( | ||||||||||

| Purchases of property and equipment | ( | ( | |||||||||

| Other investing activities | |||||||||||

| Net cash used in investing activities | ( | ( | |||||||||

See accompanying notes to condensed consolidated financial statements.

11

StepStone Group Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| Six Months Ended September 30, | |||||||||||

| 2022 | 2021 | ||||||||||

| Cash flows from financing activities | |||||||||||

| Proceeds from capital contributions from non-controlling interests | $ | $ | |||||||||

| Proceeds from revolving credit facility | |||||||||||

| Deferred financing costs | ( | ||||||||||

| Purchase of non-controlling interests | ( | ||||||||||

| Payment of deferred offering costs | ( | ||||||||||

| Payments on revolving credit facility | ( | ||||||||||

| Distributions to non-controlling interests | ( | ( | |||||||||

| Proceeds from capital contributions to legacy Greenspring entities | |||||||||||

| Distributions to non-controlling interests in legacy Greenspring entities | ( | ||||||||||

| Dividends paid to common stockholders | ( | ( | |||||||||

| Payments for employee taxes related to net settlement of RSUs | ( | ||||||||||

| Payments to related parties under Tax Receivable Agreements | ( | ( | |||||||||

| Other financing activities | ( | ||||||||||

| Net cash provided by (used in) financing activities | ( | ||||||||||

| Effect of foreign currency exchange rate changes | |||||||||||

| Net increase (decrease) in cash, cash equivalents and restricted cash | ( | ||||||||||

| Cash, cash equivalents and restricted cash at beginning of period | |||||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | $ | |||||||||

| Supplemental disclosures: | |||||||||||

| Non-cash operating, investing, and financing activities: | |||||||||||

| Accrued dividends | $ | $ | |||||||||

Deferred tax effect resulting from transactions affecting ownership in the Partnership, including net amounts payable under Tax Receivable Agreements | ( | ( | |||||||||

| Establishment of lease liabilities in exchange for lease right-of-use assets | |||||||||||

| Remeasurement of lease liabilities | ( | ||||||||||

| Class A common stock issued for Greenspring acquisition | |||||||||||

Class C Partnership units issued for Greenspring acquisition | |||||||||||

| Reconciliation of cash, cash equivalents and restricted cash: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Total cash, cash equivalents and restricted cash | $ | $ | |||||||||

See accompanying notes to condensed consolidated financial statements.

12

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

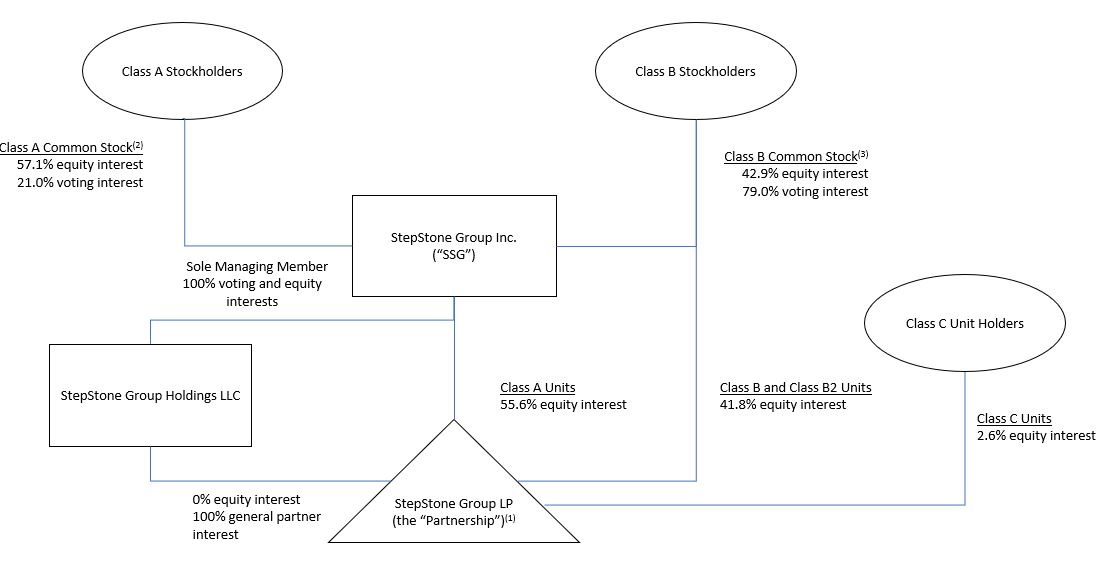

1. Organization

StepStone Group Inc. (“SSG”) was incorporated in the state of Delaware on November 20, 2019. The company was formed for the purpose of completing an initial public offering (“IPO”) in order to conduct the business of StepStone Group LP (the “Partnership”) as a publicly-traded entity. SSG is the sole managing member of StepStone Group Holdings LLC (the “General Partner”), the general partner of the Partnership. Unless otherwise specified, “StepStone” or the “Company” refers to SSG and its consolidated subsidiaries, including the Partnership, throughout the remainder of these notes to the condensed consolidated financial statements.

The Company is a global private markets investment firm focused on providing customized investment solutions and advisory, data and administrative services to its clients. The Company’s clients include some of the world’s largest public and private defined benefit and defined contribution pension funds, sovereign wealth funds and insurance companies, as well as prominent endowments, foundations, family offices and private wealth clients, including high-net-worth and mass affluent individuals. The Company partners with its clients to develop and build private markets portfolios designed to meet their specific objectives across the private equity, infrastructure, private debt and real estate asset classes. These portfolios utilize several types of synergistic investment strategies with third-party fund managers, including commitments to funds (“primaries”), acquiring stakes in existing funds on the secondary market (“secondaries”) and investing directly into companies (“co-investments”).

The Company, through its subsidiaries, acts as the investment advisor and general partner or managing member to separately managed accounts (“SMAs”) and focused commingled funds, including acquired Greenspring funds (collectively, the “StepStone Funds”).

SSG is a holding company whose principal asset is a controlling financial interest in the Partnership through its ownership of all of the Partnership’s Class A units and 100 % of the membership interests in the General Partner of the Partnership. SSG acts as the sole managing member of the General Partner of the Partnership and, as a result, indirectly operates and controls all of the Partnership’s business and affairs. As a result, SSG consolidates the financial results of the Partnership and reports non-controlling interests related to the Class B and Class C units of the Partnership which are not owned by SSG. The assets and liabilities of the Partnership represent substantially all of SSG’s consolidated assets and liabilities, with the exception of certain deferred income taxes and payables due to affiliates pursuant to tax receivable agreements (see note 10). Each share of Class A common stock is entitled to one vote and each share of Class B common stock is entitled to five votes. As of September 30, 2022, SSG held approximately 55.6 % of the economic interest in the Partnership. As the Partnership’s limited partners exchange their Class B and Class C units into SSG’s Class A common stock in the future, SSG’s economic interest in the Partnership will increase relative to that of the Class B and Class C unitholders.

Greenspring Acquisition

On September 20, 2021, the Company completed the acquisition of 100 % of the equity of Greenspring Associates, Inc. and certain of its affiliates (collectively, “Greenspring”). The results of Greenspring’s operations have been included in the condensed consolidated financial statements effective September 20, 2021. In connection with the Greenspring acquisition, the Company issued 12,686,756 shares of its Class A common stock and the Partnership issued 3,071,519 newly created Class C units of the Partnership, with each such unit exchangeable into one share of Class A common stock, subject to certain adjustments and restrictions. See notes 13 and 14 for more information.

13

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information. Management believes it has made all necessary adjustments (consisting of only normal recurring items) such that the condensed consolidated financial statements are presented fairly and that estimates made in preparing the condensed consolidated financial statements are reasonable and prudent. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. The condensed consolidated financial statements include the accounts of the Company, its wholly-owned or majority-owned subsidiaries and entities in which the Company is deemed to have a direct or indirect controlling financial interest based on either a variable interest model or voting interest model. All intercompany balances and transactions have been eliminated in consolidation. These unaudited condensed consolidated financial statements should be read in conjunction with the Company’s audited consolidated financial statements included in its Annual Report on Form 10-K for the fiscal year ended March 31, 2022 filed with the Securities and Exchange Commission (“SEC”).

Certain of the StepStone Funds are investment companies that follow specialized accounting under GAAP and reflect their investments at estimated fair value. Accordingly, the carrying value of the Company’s equity method investments in such entities retains the specialized accounting.

Reclassifications

Certain prior year amounts have been reclassified to conform to the current period presentation. Payments to related parties under Tax Receivable Agreements has been presented separately within cash flows from financing activities in the condensed consolidated statements of cash flows, and was previously included within due to affiliates within cash flows from operating activities.

Consolidation

The Company consolidates all entities that it controls through a majority voting interest or as the primary beneficiary of a variable interest entity (“VIE”). Under the VIE model, management first assesses whether the Company has a variable interest in an entity. In evaluating whether the Company holds a variable interest, fees received as a decision maker or in exchange for services (including management fees, incentive fees and carried interest allocations) that are customary and commensurate with the level of services provided, and where the Company does not hold other economic interests in the entity that would absorb more than an insignificant amount of the expected losses or returns of the entity, are not considered variable interests. If the Company has a variable interest in an entity, management further assesses whether that entity is a VIE, and if so, whether the Company is the primary beneficiary under the VIE model. Entities that do not qualify as VIEs are assessed for consolidation under the voting interest model. The consolidation analysis can generally be performed qualitatively; however, in certain situations a quantitative analysis may also be performed. Investments and redemptions (either by the Company, affiliates of the Company or third parties) or amendments to the governing documents of the respective StepStone Funds that are VIEs could affect the entity’s status as a VIE or the determination of the primary beneficiary.

14

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

Under the VIE model, an entity is deemed to be the primary beneficiary of a VIE if it holds a controlling financial interest. A controlling financial interest is defined as (a) the power to direct the activities of a VIE that most significantly affect the entity’s economic performance and (b) the obligation to absorb losses of the entity or the right to receive benefits from the entity that could potentially be significant to the VIE. Management determines whether the Company is the primary beneficiary of a VIE at the time it becomes involved with a VIE and reconsiders that conclusion at each reporting date. When assessing whether the Company is the primary beneficiary of a VIE, management evaluates whether the Company’s involvement, through holding interests directly or indirectly in an entity or contractually through other variable interests, would give the Company a controlling financial interest. This analysis includes an evaluation of the Company’s control rights, as well as the economic interests that the Company holds in the VIE, including indirectly through related parties.

The Company provides investment advisory services to the StepStone Funds, which have third-party clients. These funds are investment companies and are typically organized as limited partnerships or limited liability companies for which the Company, through its operating subsidiaries, acts as the general partner or managing member. A limited partnership or similar entity is a VIE if the unaffiliated limited partners or members do not have substantive rights to terminate or liquidate the fund or remove the general partner or substantive rights to participate. Certain StepStone Funds are VIEs because they have not granted unaffiliated limited partners or members substantive rights to terminate the fund or remove the general partner or substantive rights to participate. The Company does not consolidate these StepStone Funds because it is not the primary beneficiary of those funds, primarily because it does not hold an interest in those funds that is considered more than insignificant and its fee arrangements are considered customary and commensurate.

The Company has determined that certain of its operating subsidiaries, StepStone Group Real Assets LP (“SRA”), StepStone Group Real Estate LP (“SRE”) and Swiss Capital Alternative Investments AG (“Swiss Capital”), are VIEs, and that the Company is the primary beneficiary of each entity because it has a controlling financial interest in each entity; accordingly, the Company consolidates these entities. The assets and liabilities of the consolidated VIEs are presented gross in the condensed consolidated balance sheets. The assets of the consolidated VIEs may only be used to settle obligations of the consolidated VIEs. See note 4 for more information on both consolidated and unconsolidated VIEs.

In connection with the Greenspring acquisition, the Company, indirectly through its subsidiaries, became the sole and/or managing member of certain entities, each of which is the general partner of an investment fund (“legacy Greenspring general partner entities”). The Company did not acquire any direct economic interests attributable to the legacy Greenspring general partner entities, including legacy Greenspring investments in funds and carried interest allocations. However, certain arrangements negotiated as part of the acquisition represent variable interests that could be significant. The Company determined that the legacy Greenspring general partner entities are VIEs and it is the primary beneficiary of each such entity because it has a controlling financial interest in each entity. As a result, the Company consolidates these entities.

Non-Controlling Interests

Non-controlling interests (“NCI”) reflect the portion of income or loss and the corresponding equity attributable to third-party equity holders and employees in certain consolidated subsidiaries that are not 100% owned by the Company. Non-controlling interests are presented as separate components of stockholders’ equity on the Company’s condensed consolidated balance sheets to clearly distinguish between the Company’s interests and the economic interests of third parties and employees in those entities. Net income (loss) attributable to SSG, as reported in the condensed consolidated statements of income, is presented net of the portion of net income (loss) attributable to holders of non-controlling interests. See note 13 for more information on ownership interests in the Company.

15

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

Non-controlling interests in subsidiaries represent the economic interests in SRA, SRE, and Swiss Capital (the variable interest entities included in the Company’s condensed consolidated financial statements) held by third parties and employees in those entities. Non-controlling interests in subsidiaries are allocated a share of income or loss in the respective consolidated subsidiary in proportion to their relative ownership interests, after consideration of contractual arrangements that govern allocations of income or loss.

Non-controlling interests in legacy Greenspring entities represent the economic interests in the legacy Greenspring general partner entities. The Company did not acquire any direct economic interests in the legacy Greenspring general partner entities. As a result, all of the net income or loss related to the legacy Greenspring general partner entities is allocated to non-controlling interests in legacy Greenspring entities.

Non-controlling interests in the Partnership represent the economic interests related to the Class B and Class C units of the Partnership which are not owned by SSG. Non-controlling interests in the Partnership are allocated a share of income or loss in the Partnership in proportion to their relative ownership interests, after consideration of contractual arrangements that govern allocations of income or loss.

Accounting for Differing Fiscal Periods

The StepStone Funds primarily have a fiscal year end as of December 31. The Company accounts for its investments in the StepStone Funds on a three-month lag due to the timing of receipt of financial information from the investments held by the StepStone Funds. The StepStone Funds primarily invest in private markets funds that generally require at least 90 days following the calendar year end to provide audited financial statements. As a result, the Company uses the December 31 audited financial statements of the StepStone Funds, which reflect the underlying private markets funds as of December 31, to record its investments (including any carried interest allocated by those investments) for its fiscal year-end consolidated financial statements as of March 31. The Company further adjusts the reported carrying values of its investments in the StepStone Funds for its share of capital contributions to and distributions from the StepStone Funds during the three-month lag period. For this interim period ending September 30, 2022, the Company used the June 30, 2022 unaudited financial statements of the StepStone Funds, which reflect the underlying private market funds as of June 30, 2022, to record its investments (including any carried interest allocated by those investments), as adjusted for capital contributions and distributions during the three-month lag period ended September 30, 2022.

The Company does not account for management and advisory fees or incentive fees on a three-month lag.

To the extent that management becomes aware of any material events that affect the StepStone Funds during the three-month lag period, the effect of the events would be disclosed in the notes to the condensed consolidated financial statements.

Current Events

The Company is continuing to closely monitor developments related to COVID-19, inflation, rising interest rates and the ongoing Russia-Ukraine conflict, and assess the impact on financial markets and the Company’s business. The Company’s future results may be adversely affected by slowdowns in fundraising activity and the pace of capital deployment, which could result in delayed or decreased management fees. Further, if fund managers are unable or less able to profitably exit existing investments, such conditions could result in delayed or decreased performance fee revenues. It is currently not possible to predict the ultimate effects of these events on the financial markets, overall economy and the Company’s condensed consolidated financial statements.

16

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

Fair Value Measurements

GAAP establishes a hierarchical disclosure framework, which prioritizes and ranks the level of market price observability used in measuring financial instruments at fair value. Market price observability is affected by a number of factors, including the type of financial instrument, the characteristics specific to the financial instrument and the state of the marketplace – including the existence and transparency of transactions between market participants. Financial instruments with readily available quoted prices in active markets generally will have a higher degree of market price observability and therefore a lesser degree of judgment is used in measuring their fair value.

Financial instruments measured and reported at fair value are classified and disclosed based on the observability of inputs used in the determination of their fair values, as follows:

•Level I – Pricing inputs are unadjusted, quoted prices in active markets for identical assets or liabilities as of the measurement date.

•Level II – Pricing inputs are other than quoted prices in active markets, which are either directly or indirectly observable as of the measurement date, and fair value is determined through the use of models or other valuation methodologies. The types of financial instruments classified in this category include less liquid securities traded in active markets and securities traded in other than active markets.

•Level III – Pricing inputs are unobservable for the financial instruments and include situations where there is little, if any, market activity for the financial instrument. The inputs into the determination of fair value require significant management judgment or estimation.

In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the level in the fair value hierarchy within which the fair value measurement in its entirety falls has been determined based on the lowest level input that is significant to the fair value measurement in its entirety. The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and consideration of factors specific to the financial instrument.

The availability of observable inputs can vary depending on the financial asset or liability and is affected by a wide variety of factors including, for example, the type of instrument, whether the instrument has recently been issued, whether the instrument is traded on an active exchange or in the secondary market, and current market conditions. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for financial instruments categorized in Level III. The variability and availability of the observable inputs affected by the factors described above may result in transfers between Levels I, II, and III.

Restricted Cash

Restricted cash consists of cash that the Company is contractually obligated to maintain to secure its letters of credit used primarily related to its office facilities and other obligations.

17

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

Investments

Investments primarily include the Company’s ownership interests in the StepStone Funds, as general partner or managing member of such funds. The Company accounts for all investments in which it has or is otherwise presumed to have significant influence, but not control, including the StepStone Funds, using the equity method of accounting. The carrying value of these equity method investments is determined based on amounts invested by the Company, adjusted for the Company’s share in the earnings or losses of each investee, after consideration of contractual arrangements that govern allocations of income or loss (including carried interest allocations), less distributions received. Investments include the Company’s cumulative accrued carried interest allocations from the StepStone Funds, which primarily represent performance-based capital allocations, assuming the StepStone Funds were liquidated as of each reporting date in accordance with the funds’ governing documents. Legacy Greenspring investments in funds and accrued carried interest allocations represent the economic interests held by the legacy Greenspring general partner entities in certain funds for which the Company does not have any direct economic interests. All of the economics in respect of such interests are payable to employees and are therefore reflected as non-controlling interests in legacy Greenspring entities and legacy Greenspring performance fee-related compensation. The Company evaluates its equity method investments for impairment whenever events or changes in circumstances indicate that the carrying amounts of such investments may not be recoverable.

Management's determination of fair value for investments in the underlying funds includes various valuation techniques. These techniques may include a market approach, recent transaction price, net asset value approach, or discounted cash flows, and may use one or more significant unobservable inputs such as EBITDA, revenue multiples, discount rates, weighted average cost of capital, exit multiples, or terminal growth rates.

Leases

The Company determines whether an arrangement contains a lease at inception of the arrangement. A lease is a contract that provides the right to control an identified asset for a period of time in exchange for consideration. For identified leases, the Company determines the classification as either an operating or finance lease. The Company’s identified leases primarily consist of operating lease agreements for office space and certain equipment, as the lessee. Operating leases are included in lease right-of-use-assets, net and lease liabilities in the condensed consolidated balance sheets. Certain leases include lease and non-lease components, which the Company accounts for as a single lease component. Lease right-of-use (“ROU”) assets and lease liabilities are measured based on the present value of future minimum lease payments over the lease term at the commencement date. Lease ROU assets include initial direct costs incurred by the Company and are presented net of deferred rent and lease incentives. The Company uses its incremental borrowing rate in determining the present value of future minimum lease payments. The Company’s lease terms may include options to extend or terminate the lease, which are included in the measurement of ROU assets and lease liabilities when it is reasonably certain that the Company will exercise those options.

18

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

Business Combinations

The Company accounts for business combinations using the acquisition method of accounting, under which the purchase price of an acquisition is allocated to the assets acquired and liabilities assumed based on their fair values, as determined by management at the acquisition date. Contingent consideration obligations that are elements of consideration transferred are recognized at the acquisition date as part of the fair value transferred in exchange for the acquired business. Contingent consideration arrangements are revalued to fair value each reporting period. Examples of critical estimates in valuing certain of the intangible assets acquired include, but are not limited to, future expected cash inflows and outflows, future fundraising assumptions, expected useful life, discount rates and income tax rates. Acquisition-related costs incurred in connection with a business combination are expensed as incurred and are included in general, administrative and other expenses in the condensed consolidated statements of income.

Intangibles and Goodwill

The Company’s finite-lived intangible assets consist of acquired contractual rights to earn future management and advisory fee income and client relationships. Finite-lived intangible assets are amortized over their estimated useful lives, which range from 8 to 10 years. The Company did not have any intangible assets that were deemed to have an indefinite life as of September 30, 2022.

Finite-lived intangible assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. There were no

Goodwill represents the excess amount of consideration transferred in a business combination above the fair value of the identifiable net assets. Goodwill is assessed for impairment at least annually using a qualitative and, if necessary, a quantitative approach. The Company performs its annual goodwill impairment test as of January 1, or more frequently, if events and circumstances indicate that an impairment may exist. Goodwill is tested for impairment at the reporting unit level. The initial assessment for impairment under the qualitative approach is to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount, including goodwill. If the qualitative assessment indicates that it is more likely than not that the fair value of a reporting unit is less than the carrying amount, a quantitative assessment is performed to measure the amount of impairment loss, if any. The quantitative assessment includes comparing the fair value of a reporting unit with its carrying amount, including goodwill. If the carrying amount of the reporting unit exceeds its fair value, an impairment loss is recognized equal to the lesser of (a) the difference between the carrying amount of the reporting unit and its fair value and (b) the total carrying amount of the reporting unit’s goodwill.

Revenues

The Company recognizes revenue in accordance with Accounting Standards Codification Topic 606 (“ASC 606”), Revenue from Contracts with Customers. Revenue is recognized in a manner that depicts the transfer of promised goods or services to customers and for an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods or services. The application of ASC 606 requires an entity to identify its contract(s) with a customer, identify the performance obligations in a contract, determine the transaction price, allocate the transaction price to the performance obligations in the contract and recognize revenue when (or as) the entity satisfies a performance obligation. In determining the transaction price, variable consideration is included only to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized would not occur when the uncertainty associated with the variable consideration is resolved. The Company has elected to apply the variable consideration allocation exception for its fee arrangements with its customers.

19

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

Management and Advisory Fees, Net

The Company earns management fees for services provided to its SMAs and focused commingled funds. The Company earns advisory fees for services provided to advisory clients where the Company does not have discretion over investment decisions. The Company considers its performance obligations in its customer contracts from which it earns management and advisory fees to be one or more of the following, based on the services promised: asset management services, advisory services and/or the arrangement of administrative services.

The Company recognizes revenues from asset management services and advisory services when control of the promised services is transferred to customers, in an amount that reflects the consideration that the Company expects to receive in exchange for those services. SMAs are generally contractual arrangements involving an investment management agreement between the Company and a single client, and are typically structured as a partnership or limited liability company for which a subsidiary of SSG serves as the general partner or managing member. Focused commingled funds are structured as limited partnerships or limited liability companies with multiple clients, for which a subsidiary of the Company serves as the general partner or managing member. The Company determined that the individual client or single limited partner or member is the customer with respect to SMAs and advisory clients, while the investment fund is generally considered to be the customer for arrangements with focused commingled funds.

When asset management services and the arrangement of administrative services are the performance obligations promised in a contract, the Company satisfies these performance obligations over time because the customer simultaneously receives and consumes the benefits of the services as they are performed. The transaction price is the amount of consideration to which the Company expects to be entitled in exchange for transferring the promised services to the customer. Management fees earned from these contracts where the Company has discretion over investment decisions are generally calculated based on a percentage of unaffiliated committed capital or net invested capital, and these amounts are typically billed quarterly. For certain investment funds, management fees are initially based on committed capital during the investment period and on net invested capital through the remainder of the fund’s term. In addition, the management fee rate charged may also be reduced for certain investment funds depending on the contractual arrangement. The management fee basis is subject to factors outside of the Company’s control. Therefore, estimates of future period management fees are not included in the transaction price because those estimates would be considered constrained. Advisory fees from contracts where the Company does not have discretion over investment decisions are generally based on fixed amounts and typically billed quarterly.

Management fees generally exclude reimbursements for expenses paid by the Company on behalf of its customers, including amounts related to certain professional fees and other fund administrative expenses pursuant to the fund’s governing documents. For professional and administrative services that the Company arranges to be performed by third parties on behalf of investment funds, management has concluded that the nature of its promise is to arrange for the services to be provided and, accordingly, the Company does not control the services provided by the third parties before they are transferred to the customer. Therefore, the Company is acting as an agent, and the reimbursements for these professional fees paid on behalf of the investment funds are generally presented on a net basis.

The Company and certain investment funds that it manages have distribution and service agreements with third-party financial institutions, whereby the Company pays a portion of the fees it receives to such institutions for ongoing distribution and servicing of customer accounts. Management has concluded that the Company does not act as principal for the third-party services, as the Company does not control the services provided by the third parties before they are transferred to the customer. Therefore, the Company is acting as an agent, and the management fees are recorded net of these service fees.

20

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

The Company may incur certain costs in connection with satisfying its performance obligations for investment management services – primarily employee travel costs and certain professional fees – for which it receives reimbursements from its customers. For reimbursable employee travel costs and certain professional fees, the Company concluded it controls the services provided by its employees and other parties and, therefore, is acting as principal. Accordingly, the Company records the reimbursement for these costs incurred on a gross basis – that is, as revenue in management and advisory fees, net and expense in general, administrative and other expenses in the condensed consolidated statements of income. For reimbursable costs incurred in connection with satisfying its performance obligations for administration services, the Company concluded it does not control the services provided by its employees and other parties and, therefore, is acting as agent. Accordingly, the Company records the reimbursement for these costs incurred on a net basis.

Performance Fees

The Company earns two types of performance fee revenues: incentive fees and carried interest allocations, as described below.

Incentive fees are generally calculated as a percentage of the profits (up to 10 %) earned in respect of certain accounts for which the Company is the investment adviser, subject to the achievement of minimum return levels or performance benchmarks. Incentive fees are a form of variable consideration and represent contractual fee arrangements in the Company’s contracts with its customers. Incentive fees are typically subject to reversal until the end of a defined performance period, as these fees are affected by changes in the fair value of the assets under management or advisement over such performance period. Moreover, incentive fees that are received prior to the end of the defined performance period are typically subject to clawback, net of tax.

The Company recognizes incentive fee revenue only when these amounts are realized and no longer subject to significant risk of reversal, which is typically at the end of a defined performance period and/or upon expiration of the associated clawback period (i.e., crystallization). However, clawback terms for incentive fees received prior to crystallization only require the return of amounts on a net of tax basis. Accordingly, the tax-related portion of incentive fees received in advance of crystallization is not subject to clawback and is therefore recognized as revenue immediately upon receipt. Incentive fees received in advance of crystallization that remain subject to clawback are recorded as deferred incentive fee revenue and included in accounts payable, accrued expenses and other liabilities in the condensed consolidated balance sheets.

Carried interest allocations include the allocation of performance-based fees, commonly referred to as carried interest, to the Company from unaffiliated limited partners in the StepStone Funds in which the Company holds an equity interest. The Company is entitled to a carried interest allocation (typically 5 % to 15 %) based on cumulative fund or account performance to date, irrespective of whether such amounts have been realized. These carried interest allocations are subject to the achievement of minimum return levels (typically 5 % to 10 %) in accordance with the terms set forth in each respective fund’s governing documents. The Company accounts for its investment balances in the StepStone Funds, including carried interest allocations, under the equity method of accounting because it is presumed to have significant influence as the general partner or managing member. Accordingly, carried interest allocations are not deemed to be within the scope of ASC 606.

21

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

Legacy Greenspring carried interest allocations reflect the allocation of carried interest to legacy Greenspring general partner entities from limited partners in certain legacy Greenspring funds in which the legacy Greenspring general partner entities hold an equity interest. The legacy Greenspring general partner entities are entitled to a carried interest allocation (typically 5 % to 20 %) based on cumulative fund or account performance to date, irrespective of whether such amounts have been realized. The Company accounts for the investment balances in the legacy Greenspring funds, including carried interest allocations, under the equity method of accounting because it is presumed to have significant influence as the general partner or managing member. Accordingly, legacy Greenspring carried interest allocations are not deemed to be within the scope of ASC 606. The Company does not hold any direct economic interests in the legacy Greenspring general partner entities and thus is not entitled to any carried interest allocation from the legacy funds. All of the carried interest allocations in respect of the legacy Greenspring funds are payable to employees who are considered affiliates of the Company and are therefore reflected as legacy Greenspring performance fee-related compensation in the condensed consolidated statements of income.

The Company recognizes revenue attributable to carried interest allocations from a fund based on the amount that would be due to the Company pursuant to the fund’s governing documents, assuming the fund was liquidated based on the current fair value of its underlying investments as of that date. Accordingly, the amount recognized as carried interest allocation revenue reflects the Company’s share of the gains and losses of the associated fund’s underlying investments measured at their then-fair values, relative to the fair values as of the end of the prior period. The Company records the amount of carried interest allocated to the Company as of each period end as accrued carried interest allocations receivable, which is included as a component of investments in the condensed consolidated balance sheets. Management's determination of fair value for investments in the underlying funds includes various valuation techniques. These techniques may include a market approach, recent transaction price, net asset value approach, or discounted cash flows, and may use one or more significant unobservable inputs such as EBITDA, revenue multiples, discount rates, weighted average cost of capital, exit multiples, or terminal growth rates.

Carried interest is realized when an underlying investment is profitably disposed of and the fund’s cumulative returns are in excess of the specific hurdle rates, as defined in the applicable governing documents. Carried interest is subject to reversal to the extent that the amount received to date exceeds the amount due to the Company based on cumulative results. As such, a liability is accrued for potential clawback obligations if amounts previously distributed to the Company would require repayment to a fund if such fund were to be liquidated based on the current fair value of their underlying investments as of the reporting date. Actual repayment obligations generally do not become realized until the end of a fund’s life. As of September 30, 2022 and March 31, 2022, no material amounts for potential clawback obligations had been accrued.

Equity-Based Compensation

The Company accounts for grants of equity-based awards, including restricted stock units (“RSUs”), to certain employees and directors at fair value as of the grant date. The Company recognizes non-cash compensation expense attributable to these grants on a straight-line basis over the requisite service period, which is generally the vesting period. Expense related to grants of equity-based awards is recognized as equity-based compensation expense in the condensed consolidated statements of income. The fair value of RSUs is determined by the closing stock price on the grant date. Forfeitures of equity-based awards are recognized as they occur. See note 9 for additional information regarding the Company’s accounting for equity-based awards.

22

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

Income Taxes

SSG is a corporation for U.S. federal income tax purposes and therefore is subject to U.S. federal and state income taxes on its share of taxable income generated by the Partnership. The Partnership is treated as a pass-through entity for U.S. federal and state income tax purposes. As such, income generated by the Partnership flows through to its limited partners, including SSG, and is generally not subject to U.S. federal or state income tax at the Partnership level. The Partnership’s non-U.S. subsidiaries generally operate as corporate entities in non-U.S. jurisdictions, with certain of these entities subject to non-U.S. income taxes. Additionally, certain subsidiaries are subject to local jurisdiction taxes at the entity level, which are reflected within income tax expense in the condensed consolidated statements of income. As a result, the Partnership does not record U.S. federal and state income taxes on income in the Partnership or its subsidiaries, except for certain local and foreign income taxes discussed above.

Taxes are accounted for using the asset and liability method of accounting. Under this method, deferred tax assets and liabilities are recognized for the expected future tax consequences of differences between the carrying amounts of assets and liabilities and their respective tax bases, using tax rates in effect for the year in which the differences are expected to reverse. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in income in the period when the change is enacted. Deferred tax liabilities are included within accounts payable, accrued expenses and other liabilities in the condensed consolidated balance sheets. The principal items giving rise to temporary differences are certain basis differences resulting from exchanges of Partnership units. See Tax Receivable Agreements below.

Deferred tax assets are reduced by a valuation allowance when it is more-likely-than-not that some portion or all of the deferred tax assets will not be realized. The realization of deferred tax assets is dependent on the amount, timing and character of the Company’s future taxable income. When evaluating the realizability of deferred tax assets, all evidence – both positive and negative – is considered. This evidence includes, but is not limited to, expectations regarding future earnings, future reversals of existing temporary tax differences and tax planning strategies.

23

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

| As of | |||||||||||

| September 30, 2022 | March 31, 2022 | ||||||||||

| Foreign currency translation adjustments | $ | $ | |||||||||

| Unrealized gain on defined benefit plan, net | |||||||||||

Accumulated other comprehensive income | $ | $ | |||||||||

Segments

The Company operates as one

Recent Accounting Pronouncements

The Company considers the applicability and impact of all Accounting Standards Updates (“ASU”) issued by the Financial Accounting Standards Board (“FASB”). ASUs issued during the current period not listed below were assessed and determined to either be not applicable to the Company, or not expected to have a material impact on the condensed consolidated financial statements.

24

StepStone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

(in thousands, except share and per share amounts and where noted)

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting, which amends current guidance to provide optional practical expedients and exceptions, if certain criteria are met, for applying GAAP to contracts, hedging relationships and other transactions that are affected by the reference rate reform. The expedients and exceptions in this update apply only to contracts, hedging relationships and other transactions that reference the London Interbank Offered Rate (“LIBOR”), but do not apply to contract modifications or hedging relationships entered into after December 31, 2022. This guidance is effective for adoption anytime after March 12, 2020, but must be adopted prior to December 31, 2022. The Company is currently evaluating the impact on the condensed consolidated financial statements.

In August 2020, the FASB issued ASU 2020-06, Debt—Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity, which simplifies the accounting for certain financial instruments with characteristics of liabilities and equity, including convertible instruments and contracts on an entity’s own equity. The Company adopted this guidance on April 1, 2022 under the modified retrospective approach. The Company has changed its accounting policy to reflect the updated equity classification of contracts in an entity’s own equity, and has accounted for freestanding instruments that are indexed to and settled in the Company’s own equity at fair value with changes in fair value recognized in earnings. Adoption of this guidance did not have a material effect on the condensed consolidated financial statements.