UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-23494

T. Rowe Price Exchange-Traded Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: May 31

Date of reporting period: May 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| |

2024 |

2023 |

||||||||

| Audit Fees |

$ | 46,029 | $ | 45,987 | ||||||

| Audit-Related Fees |

- | - | ||||||||

| Tax Fees |

- | 9,524 | ||||||||

| All Other Fees |

- | - | ||||||||

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,230,000 and $1,521,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

| T. ROWE PRICE | |

| TFLR | Floating Rate ETF |

| For more insights from T. Rowe Price investment professionals, go to troweprice.com. |

| ■ | Timely delivery of important documents |

| ■ | Convenient access to your documents anytime, anywhere |

| ■ | Strong security protocols to safeguard sensitive data |

| Year Ended |

11/16/22(1) Through | |

| 5/31/24 | 5/31/23 | |

| NET ASSET VALUE | ||

| Beginning of period | $ 49.71 | $ 50.00 |

| Investment activities | ||

| Net investment income(2) (3) | 4.44 | 2.10 |

| Net realized and unrealized gain/loss | 1.45 | (0.48) |

| Total from investment activities | 5.89 | 1.62 |

| Distributions | ||

| Net investment income | (4.15) | (1.91) |

| Net realized gain | (0.01) | - |

| Total distributions | (4.16) | (1.91) |

| NET ASSET VALUE | ||

| End of period | $ 51.44 | $ 49.71 |

| Ratios/Supplemental Data | ||

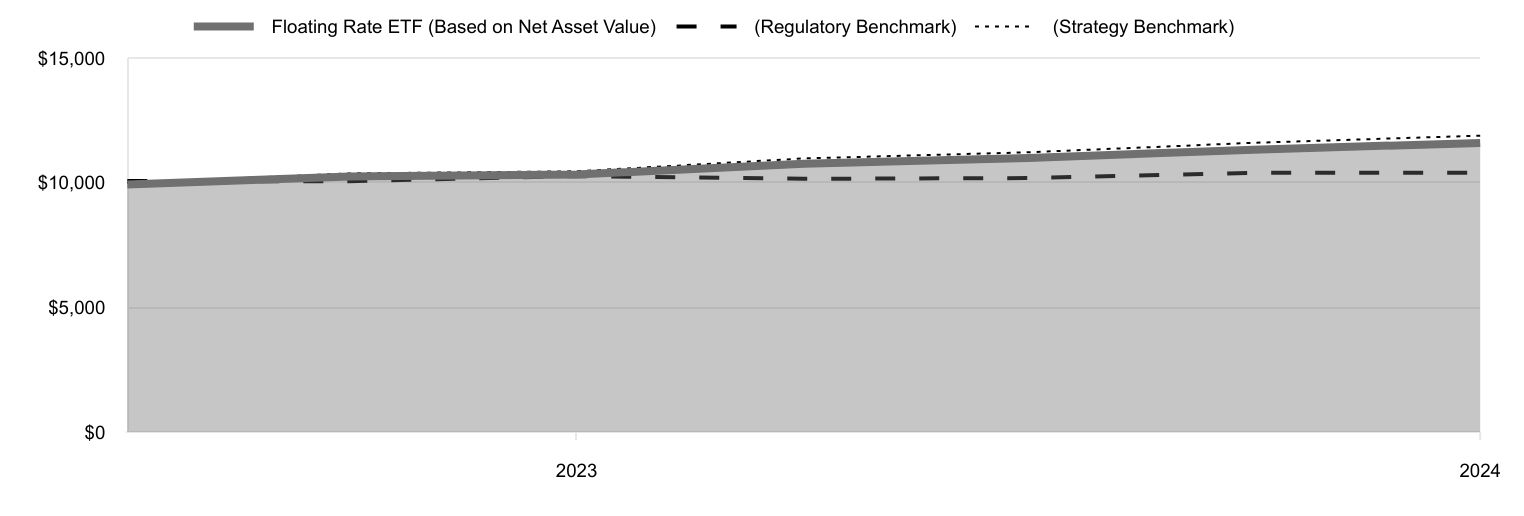

| Total return, based on NAV(3) (4) | 12.25% | 3.28% |

| Ratios to average net assets:(3) |

||

| Gross expenses before waivers/payments by Price Associates |

0.61% | 0.60%(5) |

| Net expenses after waivers/payments by Price Associates |

0.61% | 0.60%(5) |

| Net investment income | 8.67% | 7.75%(5) |

| Portfolio turnover rate(6) | 46.5% | 17.6% |

| Net assets, end of period (in thousands) |

$ 151,734 | $ 28,583 |

| (1) | Inception date |

| (2) | Per share amounts calculated using average shares outstanding method. |

| (3) | Includes the impact of expense-related arrangements with Price Associates. |

| (4) | Total return reflects the rate that an investor would have earned on an investment in the fund during each period, assuming reinvestment of all distributions. Total return is not annualized for periods less than one year. |

| (5) | Annualized |

| (6) | Portfolio turnover excludes securities received or delivered through in-kind share transactions. |

| PORTFOLIO OF INVESTMENTS‡ | Par/Shares | $ Value |

| (Amounts in 000s) | ||

| BANK LOANS 87.6% | ||

| Aerospace & Defense 2.6% | ||

| Bleriot US Bidco, FRN, 3M TSFR + 3.25%, 10/31/30 (1) | 100 | 101 |

| Bleriot US Bidco, FRN, 3M TSFR + 3.25%, 8.572%, 10/31/28 | 164 | 165 |

| Brown Group Holding, FRN, 3M TSFR + 3.00%, 8.330%, 7/2/29 | 203 | 204 |

| Dynasty Acquisition, B-1, FRN, 1M TSFR + 3.50%, 8.829%, 8/24/28 | 873 | 880 |

| Dynasty Acquisition, B-2, FRN, 1M TSFR + 3.50%, 8.829%, 8/24/28 | 336 | 339 |

| KKR Apple Bidco, FRN, 1M TSFR + 3.50%, 8.829%, 9/22/28 | 188 | 189 |

| Peraton, FRN, 1M TSFR + 3.75%, 9.179%, 2/1/28 | 252 | 252 |

| Peraton, FRN, 3M TSFR + 7.75%, 13.177%, 2/1/29 (1) | 171 | 172 |

| Peraton, FRN, 3M TSFR + 8.00%, 13.427%, 2/1/29 | 364 | 366 |

| TransDigm, FRN, 3M TSFR + 2.75%, 8.059%, 8/24/28 | 349 | 350 |

| TransDigm, FRN, 3M TSFR + 2.75%, 8.059%, 2/22/30 | 424 | 425 |

| TransDigm, FRN, 3M TSFR + 3.25%, 8.559%, 2/28/31 | 429 | 430 |

| 3,873 | ||

| Airlines 2.2% | ||

| American Airlines, FRN, 3M TSFR + 4.75%, 10.336%, 4/20/28 (1) | 1,828 | 1,897 |

| Mileage Plus Holdings, FRN, 3M TSFR + 5.25%, 10.732%, 6/21/27 | 1,309 | 1,338 |

| SkyMiles IP, FRN, 3M TSFR + 3.75%, 9.075%, 10/20/27 | 158 | 163 |

| 3,398 | ||

| Automotive 2.8% | ||

| Adient US, FRN, 1M TSFR + 2.75%, 8.079%, 1/31/31 | 115 | 116 |

| Autokiniton US Holdings, FRN, 1M TSFR + 4.00%, 9.444%, 4/6/28 | 505 | 509 |

| Clarios Global, FRN, 1M TSFR + 3.00%, 8.329%, 5/6/30 | 254 | 256 |

| Fastlane Parent Company, FRN, 1M TSFR + 4.50%, 9.829%, 9/29/28 | 114 | 114 |

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| Mavis Tire Express Services, FRN, 1M TSFR + 3.75%, 9.079%, 5/4/28 | 928 | 933 |

| Tenneco, FRN, 3M TSFR + 5.00%, 10.402%, 11/17/28 (1) | 805 | 785 |

| Wand NewCo 3, FRN, 1M TSFR + 3.75%, 9.079%, 1/30/31 | 1,543 | 1,554 |

| 4,267 | ||

| Broadcasting 1.9% | ||

| Clear Channel Outdoor Holdings, FRN, 1M TSFR + 4.00%, 9.444%, 8/23/28 | 321 | 322 |

| CMG Media, FRN, 3M TSFR + 3.50%, 8.909%, 12/17/26 | 364 | 287 |

| Neptune Bidco US, FRN, 3M TSFR + 5.00%, 10.406%, 4/11/29 | 1,172 | 1,122 |

| Univision Communications, FRN, 3M TSFR + 3.50%, 1/23/29 (1)(2) | 325 | 323 |

| Univision Communications, FRN, 1M TSFR + 3.25%, 8.694%, 3/15/26 | 516 | 516 |

| Univision Communications, FRN, 1M TSFR + 3.25%, 8.694%, 1/31/29 | 145 | 143 |

| Univision Communications, FRN, 3M TSFR + 4.25%, 9.559%, 6/24/29 | 232 | 232 |

| 2,945 | ||

| Building Products 0.7% | ||

| Chamberlain Group, FRN, 1M TSFR + 3.75%, 9.079%, 11/3/28 | 195 | 196 |

| MI Windows and Doors, FRN, 1M TSFR + 3.50%, 8.829%, 3/28/31 | 330 | 332 |

| Solis IV B.V., FRN, 3M TSFR + 3.50%, 8.836%, 2/26/29 | 214 | 213 |

| Summit Materials, FRN, 3M TSFR + 2.50%, 7.799%, 1/12/29 | 60 | 60 |

| Touchdown Acquirer, FRN, 1M TSFR + 4.00%, 2/21/31 (3) | 37 | 37 |

| Touchdown Acquirer, FRN, 3M TSFR + 4.00%, 9.326%, 2/21/31 | 168 | 169 |

| 1,007 | ||

| Cable Operators 1.0% | ||

| Altice France, FRN, 3M TSFR + 5.50%, 10.829%, 8/15/28 | 777 | 583 |

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| CSC Holdings, FRN, 1M TSFR + 4.50%, 9.817%, 1/18/28 | 391 | 376 |

| DirecTV Financing, FRN, 1M TSFR + 5.00%, 10.444%, 8/2/27 (1) | 221 | 221 |

| Radiate Holdco, FRN, 1M TSFR + 3.25%, 8.694%, 9/25/26 | 342 | 269 |

| 1,449 | ||

| Chemicals 2.0% | ||

| Avient, FRN, 3M TSFR + 2.00%, 7.293%, 8/29/29 | 130 | 131 |

| Nouryon Finance, FRN, 3M TSFR + 3.50%, 8.826%, 4/3/28 | 853 | 858 |

| Nouryon Finance, FRN, 3M TSFR + 3.50%, 8.829%, 4/3/28 | 114 | 115 |

| PMHC II, FRN, 3M TSFR + 4.25%, 9.706%, 4/23/29 (1) | 859 | 847 |

| W.R. Grace, FRN, 3M TSFR + 3.75%, 9.321%, 9/22/28 | 638 | 640 |

| Windsor Holdings III, FRN, 1M TSFR + 4.00%, 9.320%, 8/1/30 | 409 | 413 |

| 3,004 | ||

| Consumer Products 0.4% | ||

| ABG Intermediate Holdings, FRN, 1M TSFR + 3.50%, 8.929%, 12/21/28 | 214 | 215 |

| Life Time Fitness, FRN, 3M TSFR + 4.00%, 9.591%, 1/15/26 | 330 | 331 |

| 546 | ||

| Container 1.4% | ||

| Charter NEX US, FRN, 1M TSFR + 3.50%, 8.829%, 12/1/27 (1) | 1,831 | 1,839 |

| Proampac PG Borrower, FRN, 3M TSFR + 4.00%, 9.590%, 9/15/28 | 291 | 292 |

| 2,131 | ||

| Energy 2.7% | ||

| Brazos Delaware II, FRN, 1M TSFR + 3.50%, 8.822%, 2/11/30 (1) | 340 | 342 |

| CQP Holdco, FRN, 3M TSFR + 3.00%, 8.302%, 12/31/30 | 289 | 290 |

| Epic Crude Services, FRN, 3M TSFR + 5.00%, 10.609%, 3/2/26 | 219 | 219 |

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| Goodnight Water Solutions, FRN, 3M TSFR + 5.25%, 6/4/29 (1)(2) | 300 | 299 |

| M6 ETX Holdings II Midco, FRN, 1M TSFR + 4.50%, 9.929%, 9/19/29 | 367 | 368 |

| Medallion Midland Acquisition, FRN, 3M TSFR + 3.50%, 8.830%, 10/18/28 | 706 | 710 |

| NGL Energy Partners, FRN, 1M TSFR + 4.50%, 9.829%, 2/2/31 | 564 | 568 |

| NorthRiver Midstream Finance, FRN, 3M TSFR + 2.50%, 7.802%, 8/16/30 | 373 | 374 |

| Prairie ECI Acquiror, FRN, 1M TSFR + 4.75%, 10.079%, 8/1/29 (1) | 649 | 651 |

| Waterbridge Midstream Operating, FRN, 3M TSFR + 4.50%, 9.825%, 5/10/29 (1) | 233 | 234 |

| Whitewater Whistler Holdings, FRN, 3M TSFR + 2.75%, 8.052%, 2/15/30 | 83 | 83 |

| 4,138 | ||

| Entertainment & Leisure 4.4% | ||

| Cedar Fair, FRN, 1M TSFR + 2.00%, 7.329%, 5/1/31 | 200 | 201 |

| Cinemark USA, FRN, 1M TSFR + 3.75%, 8.575%, 5/24/30 | 173 | 174 |

| Delta 2 (LUX), FRN, 3M TSFR + 2.25%, 7.559%, 1/15/30 | 1,130 | 1,136 |

| Motion Finco, FRN, 3M TSFR + 3.50%, 9.071%, 11/12/29 (1) | 848 | 849 |

| PUG, FRN, 1M TSFR + 4.75%, 10.079%, 3/15/30 | 1,131 | 1,130 |

| SeaWorld Parks & Entertainment, FRN, 1M TSFR + 2.50%, 7.829%, 8/25/28 | 623 | 622 |

| UFC Holdings, FRN, 3M TSFR + 2.75%, 8.336%, 4/29/26 | 2,153 | 2,158 |

| United Talent Agency, FRN, 1M TSFR + 3.75%, 7/7/28 (1)(2) | 70 | 70 |

| Williams Morris Endeavor Entertainment, FRN, 1M TSFR + 2.75%, 8.194%, 5/18/25 | 256 | 256 |

| 6,596 | ||

| Financial 15.9% | ||

| Acrisure, FRN, 1M USD LIBOR + 3.50%, 8.944%, 2/15/27 | 254 | 254 |

| Acrisure, FRN, 1M USD LIBOR + 3.75%, 9.194%, 2/15/27 | 108 | 108 |

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| Acrisure, FRN, 1M USD LIBOR + 4.25%, 9.694%, 2/15/27 | 565 | 566 |

| Advisor Group, FRN, 1M TSFR + 4.00%, 9.329%, 8/17/28 (1) | 444 | 447 |

| Alliant Holdings Intermediate, FRN, 1M TSFR + 3.50%, 8.820%, 11/6/30 | 932 | 935 |

| Apollo Commercial Real Estate Finance, FRN, 1M TSFR + 3.50%, 8.944%, 3/11/28 (2) | 94 | 90 |

| Aretec Group, FRN, 3M TSFR + 4.00%, 9.428%, 8/9/30 (1) | 284 | 286 |

| Armor Holding II, FRN, 6M TSFR + 4.50%, 9.934%, 12/11/28 | 134 | 135 |

| AssuredPartners, FRN, 1M TSFR + 3.50%, 8.829%, 2/14/31 (1) | 3,390 | 3,415 |

| Citadel Securities, FRN, 1M TSFR + 2.25%, 7.579%, 7/29/30 | 128 | 129 |

| Citco Funding, FRN, 3M TSFR + 3.25%, 8.422%, 4/27/28 | 139 | 140 |

| Citco Funding, FRN, 3M TSFR + 3.50%, 8.672%, 4/27/28 | 308 | 309 |

| Claros Mortgage Trust, FRN, 1M TSFR + 4.50%, 9.925%, 8/9/26 | 178 | 165 |

| Edelman Financial Center, FRN, 3M TSFR + 5.25%, 10/6/28 (1) | 710 | 710 |

| Edelman Financial Center, FRN, 1M TSFR + 3.50%, 8.944%, 4/7/28 | 597 | 597 |

| Edelman Financial Center, FRN, 1M TSFR + 6.75%, 12.194%, 7/20/26 | 579 | 579 |

| Fiserv Investment Solutions, FRN, 3M TSFR + 4.00%, 9.326%, 2/18/27 | 155 | 147 |

| Focus Financial Partners, FRN, 1M TSFR + 2.75%, 8.079%, 6/30/28 (1) | 736 | 737 |

| HighTower Holdings, FRN, 3M TSFR + 4.00%, 9.586%, 4/21/28 | 686 | 689 |

| Hub International, FRN, 3M TSFR + 3.25%, 8.575%, 6/20/30 (1) | 3,695 | 3,719 |

| Jane Street Group, FRN, 1M TSFR + 2.50%, 7.944%, 1/26/28 | 506 | 507 |

| Jones DesLauriers Insurance Management, FRN, 3M TSFR + 3.50%, 8.830%, 3/15/30 | 1,026 | 1,027 |

| OneDigital Borrower, FRN, 1M TSFR + 4.25%, 9.679%, 11/16/27 | 350 | 351 |

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| RFS Opco, FRN, 3M TSFR + 5.00%, 10.308%, 4/4/31 (2) | 165 | 163 |

| Sedgwick Claims Management Services, FRN, 1M TSFR + 3.75%, 9.079%, 2/24/28 (1) | 1,197 | 1,202 |

| Truist Insurance Holdings, FRN, 3M TSFR + 3.25%, 8.586%, 5/6/31 | 1,575 | 1,584 |

| Truist Insurance Holdings, FRN, 3M TSFR + 4.75%, 10.086%, 5/6/32 | 3,222 | 3,288 |

| USI, FRN, 3M TSFR + 3.25%, 8.078%, 9/27/30 | 748 | 750 |

| USI, FRN, 3M TSFR + 3.00%, 8.302%, 11/22/29 | 1,052 | 1,054 |

| 24,083 | ||

| Food 0.8% | ||

| Chobani, FRN, 1M TSFR + 3.75%, 9.067%, 10/25/27 | 206 | 208 |

| Primary Products Finance, FRN, 3M TSFR + 3.50%, 8.952%, 4/1/29 | 363 | 363 |

| Simply Good Foods USA, FRN, 1M TSFR + 2.50%, 7.928%, 3/17/27 (1) | 381 | 381 |

| Triton Water Holdings, FRN, 3M TSFR + 3.25%, 8.814%, 3/31/28 | 210 | 209 |

| Triton Water Holdings, FRN, 3M TSFR + 4.00%, 9.302%, 3/31/28 | 105 | 105 |

| 1,266 | ||

| Gaming 2.7% | ||

| Aristocrat Technologies, FRN, 3M TSFR + 2.25%, 7.659%, 5/24/29 | 55 | 55 |

| Caesars Entertainment, FRN, 1M TSFR + 2.75%, 8.097%, 2/6/30 | 307 | 308 |

| Caesars Entertainment, FRN, 1M TSFR + 2.75%, 8.097%, 2/6/31 | 700 | 701 |

| Great Canadian Gaming, FRN, 3M TSFR + 4.00%, 9.590%, 11/1/26 (1) | 661 | 665 |

| Light and Wonder International, FRN, 1M TSFR + 2.75%, 8.070%, 4/14/29 | 315 | 316 |

| Ontario Gaming GTA, FRN, 3M TSFR + 4.25%, 9.560%, 8/1/30 (1) | 701 | 705 |

| Playtika Holding, FRN, 1M TSFR + 2.75%, 8.194%, 3/13/28 | 84 | 84 |

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| Scientific Games Holdings, FRN, 3M TSFR + 3.25%, 4/4/29 (1) | 375 | 376 |

| Spectacle Gary Holdings, FRN, 3M TSFR + 4.25%, 9.702%, 12/11/28 (1) | 871 | 868 |

| 4,078 | ||

| Health Care 7.9% | ||

| Athenahealth Group, FRN, 1M TSFR + 3.25%, 8.579%, 2/15/29 (1) | 1,489 | 1,485 |

| Auris Luxembourg III, FRN, 6M TSFR + 4.25%, 9.992%, 2/28/29 (1) | 567 | 568 |

| Bausch & Lomb, FRN, 1M TSFR + 3.25%, 8.670%, 5/10/27 (1) | 373 | 369 |

| Ceva Sante Animale, FRN, 3M TSFR + 4.25%, 9.573%, 11/1/30 | 125 | 126 |

| eResearchTechnology, FRN, 1M TSFR + 4.00%, 9.322%, 2/4/27 | 52 | 53 |

| Heartland Dental, FRN, 3M TSFR + 4.50%, 9.828%, 4/28/28 (1) | 746 | 749 |

| ICON Luxembourg, FRN, 3M TSFR + 2.00%, 7.309%, 7/3/28 | 39 | 39 |

| Inception Holdco, FRN, 3M TSFR + 4.50%, 9.798%, 4/18/31 (1) | 229 | 229 |

| IVC Acquisition, FRN, 3M TSFR + 5.50%, 10.810%, 12/12/28 | 140 | 140 |

| LifePoint Health, FRN, 3M TSFR + 4.00%, 9.329%, 5/17/31 (1) | 500 | 501 |

| LifePoint Health, FRN, 3M TSFR + 4.75%, 10.056%, 11/16/28 | 920 | 926 |

| MED ParentCo, FRN, 1M TSFR + 4.00%, 9.329%, 4/15/31 | 288 | 290 |

| Medline Borrower, FRN, 1M TSFR + 2.75%, 8.079%, 10/23/28 | 2,011 | 2,024 |

| Parexel International, FRN, 1M TSFR + 3.25%, 8.694%, 11/15/28 | 1,002 | 1,007 |

| PRA Health Sciences, FRN, 3M TSFR + 2.00%, 7.309%, 7/3/28 | 10 | 10 |

| Project Ruby Ultimate Parent, FRN, 1M TSFR + 3.25%, 8.694%, 3/10/28 | 213 | 213 |

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| SAM Bidco SAS, FRN, 3M TSFR + 4.25%, 9.560%, 12/13/27 (2) | 205 | 205 |

| Select Medical, FRN, 1M TSFR + 3.00%, 8.329%, 3/6/27 | 173 | 173 |

| Star Parent, FRN, 3M TSFR + 4.00%, 9.310%, 9/27/30 | 835 | 835 |

| Summit Behavioral Healthcare, FRN, 1M TSFR + 4.25%, 9.597%, 11/24/28 (1) | 222 | 223 |

| Surgery Center Holdings, FRN, 1M TSFR + 3.50%, 8.821%, 12/19/30 (1) | 1,071 | 1,075 |

| Waystar Technologies, FRN, 1M TSFR + 4.00%, 9.329%, 10/22/29 | 754 | 755 |

| 11,995 | ||

| Information Technology 15.2% | ||

| Applied Systems, FRN, 3M TSFR + 3.50%, 8.809%, 2/24/31 (1) | 2,146 | 2,163 |

| Applied Systems, FRN, 3M TSFR + 5.25%, 10.559%, 2/23/32 | 1,375 | 1,424 |

| AppLovin, FRN, 1M TSFR + 2.50%, 7.829%, 10/25/28 | 549 | 552 |

| Banff Merger Sub, FRN, 1M TSFR + 4.25%, 9.329%, 12/29/28 | 2,143 | 2,157 |

| Central Parent, FRN, 3M TSFR + 3.25%, 8.577%, 7/6/29 | 1,490 | 1,501 |

| Cloud Software Group, FRN, 3M TSFR + 4.50%, 9.331%, 3/30/29 (1) | 2,269 | 2,277 |

| Cloud Software Group, FRN, 3M TSFR + 4.50%, 9.929%, 3/21/31 (1) | 264 | 265 |

| ConnectWise, FRN, 3M TSFR + 3.50%, 9.064%, 9/29/28 | 224 | 224 |

| Conservice Midco, FRN, 1M TSFR + 4.00%, 9.329%, 5/13/27 | 150 | 150 |

| Cvent, FRN, 3M TSFR + 3.25%, 8.570%, 6/17/30 | 344 | 345 |

| Delivery Hero Finco, FRN, 1M TSFR + 5.00%, 12/12/29 (1)(4) | 175 | 176 |

| Delta TopCo, FRN, 3M TSFR + 3.50%, 8.829%, 11/30/29 (1) | 765 | 768 |

| Delta TopCo, FRN, 3M TSFR + 5.25%, 10.579%, 12/24/30 (1) | 545 | 552 |

| Dye and Durham, FRN, 3M TSFR + 4.25%, 9.656%, 4/11/31 (1) | 490 | 491 |

| ECI Macola Max Holding, FRN, 3M TSFR + 3.75%, 9.052%, 5/31/30 (1) | 711 | 715 |

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| Epicor Software, FRN, 3M TSFR + 3.25%, 5/23/31 (1)(3) | 20 | 20 |

| Epicor Software, FRN, 3M TSFR + 3.25%, 8.581%, 5/23/31 (1) | 170 | 171 |

| Epicor Software, FRN, 1M TSFR + 3.25%, 8.694%, 7/30/27 | 2,047 | 2,054 |

| Epicor Software, FRN, 1M TSFR + 3.75%, 9.079%, 7/30/27 | 135 | 135 |

| Fleet Midco I, FRN, 1M TSFR + 3.25%, 8.579%, 2/21/31 (2) | 210 | 211 |

| Go Daddy Operating Company, FRN, 1M TSFR + 2.00%, 7.329%, 11/9/29 | 112 | 112 |

| Infinite Bidco, FRN, 3M TSFR + 7.00%, 12.591%, 3/2/29 | 300 | 253 |

| McAfee, FRN, 1M TSFR + 3.75%, 8.579%, 3/1/29 | 1,418 | 1,417 |

| MH Sub I, FRN, 1M TSFR + 4.25%, 9.579%, 5/3/28 (1) | 419 | 420 |

| MH Sub I, FRN, 1M TSFR + 6.25%, 11.579%, 2/23/29 | 505 | 502 |

| Mosel Bidco, FRN, 3M TSFR + 4.75%, 10.059%, 9/16/30 (2) | 90 | 91 |

| RealPage, FRN, 1M TSFR + 3.00%, 8.444%, 4/24/28 | 357 | 352 |

| RealPage, FRN, 1M TSFR + 6.50%, 11.944%, 4/23/29 | 1,027 | 1,007 |

| Sophia, FRN, 1M TSFR + 3.50%, 8.929%, 10/9/29 | 1,733 | 1,742 |

| SS&C Technologies, FRN, 1M TSFR + 2.00%, 7.320%, 5/9/31 | 290 | 291 |

| Uber Technologies, FRN, 3M TSFR + 2.75%, 8.079%, 3/3/30 | 545 | 548 |

| 23,086 | ||

| Lodging 0.6% | ||

| Aimbridge Acquisition, FRN, 1M TSFR + 3.75%, 9.194%, 2/2/26 | 545 | 530 |

| Aimbridge Acquisition, FRN, 1M TSFR + 4.75%, 10.194%, 2/2/26 | 282 | 276 |

| Casper BidCo SAS, FRN, 1M EURIBOR + 4.25%, 8.057%, 3/21/31 (EUR) | 110 | 120 |

| Four Seasons Hotels, FRN, 3M TSFR + 2.00%, 7.329%, 11/30/29 | 55 | 55 |

| 981 | ||

| Manufacturing 3.7% | ||

| Engineered Machinery Holdings, FRN, 3M TSFR + 3.75%, 9.321%, 5/19/28 | 1,053 | 1,059 |

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| Engineered Machinery Holdings, FRN, 3M TSFR + 6.00%, 11.571%, 5/21/29 | 465 | 465 |

| Engineered Machinery Holdings, FRN, 3M TSFR + 6.50%, 12.071%, 5/21/29 (2) | 255 | 255 |

| Filtration Group, FRN, 1M TSFR + 4.25%, 8.944%, 10/21/28 (1) | 1,762 | 1,769 |

| LTI Holdings, FRN, 1M TSFR + 3.50%, 8.944%, 9/6/25 | 635 | 625 |

| LTI Holdings, FRN, 1M TSFR + 4.75%, 10.194%, 7/24/26 | 440 | 433 |

| LTI Holdings, FRN, 1M TSFR + 6.75%, 12.194%, 9/6/26 | 196 | 184 |

| Madison IAQ, FRN, 1M TSFR + 3.25%, 6/21/28 (1) | 360 | 360 |

| Pro Mach Group, FRN, 1M TSFR + 3.75%, 8.829%, 8/31/28 | 363 | 364 |

| Watlow Electric Manufacturing, FRN, 3M TSFR + 3.75%, 9.341%, 3/2/28 | 105 | 105 |

| 5,619 | ||

| Metals & Mining 0.5% | ||

| Arsenal AIC Parent, FRN, 1M TSFR + 3.75%, 9.079%, 8/18/30 | 677 | 682 |

| TMS International, FRN, 1M TSFR + 4.25%, 9.579%, 3/2/30 | 40 | 40 |

| 722 | ||

| Restaurants 1.8% | ||

| 1011778 B.C. Unlimited Liability, FRN, 1M TSFR + 2.25%, 7.578%, 9/20/30 | 70 | 70 |

| Dave & Buster's, FRN, 1M TSFR + 3.25%, 8.625%, 6/29/29 | 657 | 660 |

| Fertitta Entertainment, FRN, 1M TSFR + 3.75%, 9.071%, 1/27/29 | 224 | 225 |

| Fogo De Chao, FRN, 1M TSFR + 4.75%, 10.079%, 9/30/30 (1) | 279 | 280 |

| IRB Holding, FRN, 1M TSFR + 2.75%, 8.179%, 12/15/27 (1) | 1,554 | 1,559 |

| 2,794 | ||

| Retail 0.6% | ||

| CNT Holdings l, FRN, 3M TSFR + 3.50%, 8.830%, 11/8/27 (1) | 736 | 739 |

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| PetSmart, FRN, 1M TSFR + 3.75%, 9.179%, 2/11/28 | 215 | 214 |

| 953 | ||

| Satellites 0.9% | ||

| Connect Finco, FRN, 1M TSFR + 4.50%, 8.829%, 9/27/29 (1) | 520 | 496 |

| Iridium Satellite, FRN, 1M TSFR + 2.50%, 7.829%, 9/20/30 | 584 | 584 |

| ViaSat, FRN, 1M TSFR + 4.50%, 9.936%, 5/30/30 | 314 | 287 |

| 1,367 | ||

| Services 9.8% | ||

| Albion Financing 3, FRN, 3M TSFR + 5.25%, 10.575%, 8/17/26 | 564 | 566 |

| Allied Universal Holdco, FRN, 1M TSFR + 3.75%, 9.179%, 5/12/28 (1) | 1,362 | 1,362 |

| Anticimex International AB, FRN, 3M TSFR + 3.50%, 11/16/28 (1) | 15 | 15 |

| Anticimex International AB, FRN, 3M TSFR + 3.15%, 8.460%, 11/16/28 | 363 | 365 |

| APFS Staffing Holdings, FRN, 1M TSFR + 4.00%, 9.329%, 12/29/28 | 83 | 83 |

| Ascend Learning, FRN, 1M TSFR + 3.50%, 8.929%, 12/11/28 (1) | 744 | 743 |

| Ascend Learning, FRN, 1M TSFR + 5.75%, 11.179%, 12/10/29 (1) | 1,020 | 1,000 |

| CD&R Firefly Bidco, FRN, 3M EURIBOR + 4.50%, 8.363%, 3/1/29 (EUR) | 215 | 234 |

| CD&R Firefly Bidco, FRN, 3M EURIBOR + 4.75%, 8.615%, 6/21/28 (EUR) | 25 | 27 |

| CoreLogic, FRN, 1M TSFR + 6.50%, 6/4/29 (1) | 148 | 141 |

| Crown Subsea Communications Holding, FRN, 3M TSFR + 4.75%, 10.079%, 1/30/31 | 255 | 257 |

| Dayforce, FRN, 1M TSFR + 2.50%, 7.829%, 2/26/31 (2) | 348 | 349 |

| Dun & Bradstreet, FRN, 1M TSFR + 2.75%, 8.075%, 1/18/29 | 249 | 250 |

| EG Group, FRN, 1M TSFR + 4.50%, 3/31/26 (4) | 2 | 2 |

| EG Group, FRN, 3M EURIBOR + 7.00%, 10.902%, 4/30/27 (EUR) | 175 | 177 |

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| EG Group, FRN, 3M TSFR + 5.50%, 11.238%, 2/7/28 | 249 | 244 |

| Fortress Intermediate 3, FRN, 1M TSFR + 3.75%, 5/9/31 (1)(2) | 280 | 281 |

| Fugue Finance, FRN, 3M TSFR + 3.75%, 9.097%, 2/26/31 | 70 | 71 |

| Fugue Finance, FRN, 3M TSFR + 4.00%, 9.347%, 1/31/28 | 94 | 95 |

| Genuine Financial Holdings, FRN, 1M TSFR + 4.00%, 9/27/30 (1) | 340 | 340 |

| GFL Environmental, FRN, 3M TSFR + 2.50%, 7.826%, 5/31/27 | 432 | 435 |

| GTCR W Merger Sub, FRN, 1M TSFR + 3.00%, 8.309%, 1/31/31 | 1,160 | 1,163 |

| Homeserve USA Holding, FRN, 3M TSFR + 2.50%, 7.828%, 10/21/30 | 185 | 185 |

| Mermaid BidCo, FRN, 3M TSFR + 4.25%, 9.590%, 12/22/27 (2) | 312 | 314 |

| Project Boost Purchaser, FRN, 1M TSFR + 3.50%, 8.944%, 6/1/26 | 212 | 213 |

| Project Boost Purchaser, FRN, 3M TSFR + 3.50%, 9.071%, 5/30/26 (1) | 569 | 571 |

| Renaissance Holding, FRN, 1M TSFR + 4.25%, 9.597%, 4/5/30 | 931 | 930 |

| TK Elevator US Newco, FRN, 3M TSFR + 3.50%, 8.791%, 4/30/30 | 483 | 485 |

| UKG, FRN, 3M TSFR + 3.50%, 8.820%, 2/10/31 (1) | 3,386 | 3,410 |

| USIC Holdings, FRN, 3M TSFR + 3.50%, 9.064%, 5/12/28 | 203 | 202 |

| USIC Holdings, FRN, 3M TSFR + 6.50%, 12.064%, 5/14/29 | 130 | 130 |

| Wood Mackenzie, FRN, 3M TSFR + 3.50%, 8.823%, 2/7/31 | 225 | 227 |

| 14,867 | ||

| Utilities 3.3% | ||

| Exgen Renewables IV, FRN, 3M TSFR + 2.50%, 8.109%, 12/15/27 | 528 | 529 |

| Generation Bridge Northeast, FRN, 1M TSFR + 3.50%, 8.829%, 8/22/29 | 270 | 273 |

| Hamilton Projects Acquiror, FRN, 3M TSFR + 3.75%, 5/22/31 (1) | 230 | 231 |

| INNIO Group Holding, FRN, 3M TSFR + 4.25%, 9.578%, 11/2/28 | 100 | 101 |

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| PG&E, FRN, 1M TSFR + 3.00%, 7.829%, 6/23/27 | 215 | 216 |

| Pike, FRN, 1M TSFR + 3.00%, 8.444%, 1/21/28 | 315 | 316 |

| Talen Energy Supply, C, FRN, 3M TSFR + 3.50%, 8.827%, 5/17/30 (1) | 341 | 344 |

| Talen Energy Supply, B, FRN, 3M TSFR + 3.50%, 8.827%, 5/17/30 (1) | 656 | 663 |

| TerraForm Power Operating, FRN, 3M TSFR + 2.50%, 7.902%, 5/21/29 | 862 | 864 |

| Vistra Zero Operating Company, FRN, 1M TSFR + 2.75%, 8.075%, 4/30/31 | 565 | 569 |

| WEC US Holdings, FRN, 1M TSFR + 2.75%, 8.079%, 1/27/31 | 825 | 829 |

| 4,935 | ||

| Wireless Communications 1.8% | ||

| Asurion, FRN, 1M TSFR + 3.25%, 8.694%, 12/23/26 | 64 | 63 |

| Asurion, FRN, 1M TSFR + 3.25%, 8.694%, 7/31/27 | 104 | 102 |

| Asurion, FRN, 1M TSFR + 4.00%, 9.429%, 8/19/28 | 203 | 200 |

| Asurion, FRN, 1M TSFR + 4.25%, 9.679%, 8/19/28 | 581 | 576 |

| Asurion, FRN, 1M TSFR + 5.25%, 10.694%, 1/31/28 | 910 | 854 |

| Asurion, FRN, 1M TSFR + 5.25%, 10.694%, 1/20/29 | 896 | 833 |

| CCI Buyer, FRN, 3M TSFR + 4.00%, 9.302%, 12/17/27 | 89 | 89 |

| 2,717 | ||

| Total Bank Loans (Cost $131,957) |

132,817 | |

| CORPORATE BONDS 9.2% | ||

| Aerospace & Defense 0.1% | ||

| TransDigm, 6.75%, 8/15/28 (4) | 170 | 172 |

| 172 | ||

| Airlines 0.1% | ||

| Mileage Plus Holdings, 6.50%, 6/20/27 (4) | 98 | 98 |

| 98 | ||

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| Automotive 1.5% | ||

| Adient Global Holdings, 4.875%, 8/15/26 (4) | 200 | 194 |

| Ford Motor Credit, 4.063%, 11/1/24 | 200 | 198 |

| Ford Motor Credit, FRN, SOFR + 2.95%, 8.298%, 3/6/26 | 410 | 423 |

| Rivian Holdings, FRN, 6M TSFR + 6.03%, 11.31%, 10/15/26 (4) | 1,459 | 1,430 |

| Wand NewCo 3, 7.625%, 1/30/32 (4) | 90 | 92 |

| 2,337 | ||

| Broadcasting 0.5% | ||

| Clear Channel Outdoor Holdings, 5.125%, 8/15/27 (4) | 85 | 80 |

| Clear Channel Outdoor Holdings, 7.875%, 4/1/30 (4) | 95 | 94 |

| Neptune Bidco, 9.29%, 4/15/29 (4) | 75 | 72 |

| Townsquare Media, 6.875%, 2/1/26 (4) | 120 | 117 |

| Univision Communications, 7.375%, 6/30/30 (4) | 135 | 128 |

| Univision Communications, 8.00%, 8/15/28 (4) | 225 | 222 |

| 713 | ||

| Cable Operators 0.4% | ||

| CSC Holdings, 11.25%, 5/15/28 (4) | 400 | 323 |

| CSC Holdings, 11.75%, 1/31/29 (4) | 200 | 159 |

| YPSO Finance BIS, 10.50%, 5/15/27 (4) | 430 | 158 |

| 640 | ||

| Chemicals 0.3% | ||

| Avient, 5.75%, 5/15/25 (4) | 225 | 224 |

| Kobe US Midco 2, 9.25%, 11/1/26, (9.25% Cash or 10.00% PIK) (4)(5) | 54 | 44 |

| PMHC II, 9.00%, 2/15/30 (4) | 150 | 139 |

| 407 | ||

| Consumer Products 0.1% | ||

| Life Time, 8.00%, 4/15/26 (4) | 200 | 202 |

| 202 |

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| Energy 0.4% | ||

| NGL Energy Partners, 8.125%, 2/15/29 (4) | 80 | 81 |

| Seadrill Finance, 8.375%, 8/1/30 (4) | 200 | 210 |

| SilverBow Resources, FRN, 3M TSFR + 7.75%, 13.079%, 12/15/28 (4) | 85 | 88 |

| Tallgrass Energy Partners, 6.00%, 3/1/27 (4) | 130 | 127 |

| Venture Global LNG, 9.50%, 2/1/29 (4) | 170 | 184 |

| 690 | ||

| Entertainment & Leisure 0.4% | ||

| Carnival, 7.00%, 8/15/29 (4) | 120 | 123 |

| Cinemark USA, 5.875%, 3/15/26 (4) | 125 | 123 |

| Live Nation Entertainment, 4.875%, 11/1/24 (4) | 55 | 55 |

| NCL, 8.125%, 1/15/29 (4) | 99 | 103 |

| NCL, 8.375%, 2/1/28 (4) | 165 | 172 |

| 576 | ||

| Financial 1.6% | ||

| Acrisure, 10.125%, 8/1/26 (4) | 315 | 324 |

| AG TTMT Escrow Issuer, 8.625%, 9/30/27 (4) | 125 | 129 |

| Alliant Holdings Intermediate, 6.75%, 10/15/27 (4) | 235 | 229 |

| Alliant Holdings Intermediate, 6.75%, 4/15/28 (4) | 180 | 180 |

| Assured Partners, 5.625%, 1/15/29 (4) | 140 | 130 |

| GTCR AP Finance, 8.00%, 5/15/27 (4) | 180 | 180 |

| Hub International, 7.25%, 6/15/30 (4) | 395 | 401 |

| Hub International, 7.375%, 1/31/32 (4) | 115 | 115 |

| Jones Deslauriers Insurance Management, 8.50%, 3/15/30 (4) | 390 | 410 |

| Jones Deslauriers Insurance Management, 10.50%, 12/15/30 (4) | 170 | 183 |

| Ryan Specialty Group, 4.375%, 2/1/30 (4) | 145 | 134 |

| 2,415 | ||

| Health Care 0.8% | ||

| Bausch & Lomb Escrow, 8.375%, 10/1/28 (4) | 205 | 209 |

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| CHS/Community Health Systems, 8.00%, 12/15/27 (4) | 165 | 164 |

| CHS/Community Health Systems, 10.875%, 1/15/32 (4) | 220 | 227 |

| HCA, 5.375%, 2/1/25 | 125 | 124 |

| LifePoint Health, 11.00%, 10/15/30 (4) | 450 | 496 |

| 1,220 | ||

| Information Technology 0.7% | ||

| Boxer Parent, 9.125%, 3/1/26 (4) | 25 | 25 |

| Central Parent/CDK Global II/CDK Financing, 8.00%, 6/15/29 (4) | 115 | 118 |

| Cloud Software Group, 8.25%, 6/30/32 (4) | 215 | 216 |

| Cloud Software Group, 9.00%, 9/30/29 (4) | 590 | 568 |

| Dye & Durham, 8.625%, 4/15/29 (4) | 135 | 137 |

| 1,064 | ||

| Lodging 0.2% | ||

| Hilton Domestic Operating, 5.375%, 5/1/25 (4) | 205 | 204 |

| Park Intermediate Holdings/ PK Domestic Property/ PK Finance Co-Issuer, 7.50%, 6/1/25 (4) | 90 | 90 |

| 294 | ||

| Manufacturing 0.1% | ||

| Sensata Technologies, 5.00%, 10/1/25 (4) | 210 | 212 |

| 212 | ||

| Real Estate Investment Trust Securities 0.1% | ||

| Service Properties Trust, 8.625%, 11/15/31 (4) | 90 | 94 |

| 94 | ||

| Satellites 0.1% | ||

| Connect Finco /Connect US Finco, 6.75%, 10/1/26 (4) | 225 | 212 |

| 212 | ||

| Services 1.0% | ||

| Allied Universal Holdco, 6.625%, 7/15/26 (4) | 125 | 125 |

| Allied Universal Holdco, 7.875%, 2/15/31 (4) | 217 | 216 |

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| Allied Universal Holdco/Allied Universal Finance, 9.75%, 7/15/27 (4) | 270 | 267 |

| eG Global Finance, 12.00%, 11/30/28 (4) | 200 | 206 |

| GTCR W-2 Merger Sub, 7.50%, 1/15/31 (4) | 200 | 207 |

| Sabre GLBL, 11.25%, 12/15/27 (4) | 185 | 180 |

| UKG, 6.875%, 2/1/31 (4) | 260 | 262 |

| 1,463 | ||

| Telephones 0.2% | ||

| Verizon Communications, FRN, SOFRINDX + 0.79%, 6.133%, 3/20/26 | 175 | 176 |

| Verizon Communications, FRN, 3M TSFR + 1.36%, 6.684%, 5/15/25 | 120 | 121 |

| 297 | ||

| Utilities 0.5% | ||

| NRG Energy, VR, 10.25%, (4)(6)(7) | 4 | 4 |

| Talen Energy Supply, 8.625%, 6/1/30 (4) | 100 | 107 |

| Vistra, VR, 8.00%, (4)(6)(7) | 176 | 178 |

| Vistra, VR, VR, 8.875%, (4)(6)(7) | 265 | 274 |

| Vistra Operations, 5.125%, 5/13/25 (4) | 210 | 209 |

| 772 | ||

| Wireless Communications 0.1% | ||

| Sprint, 7.125%, 6/15/24 | 105 | 105 |

| 105 | ||

| Total Corporate Bonds (Cost $14,051) |

13,983 |

| Par/Shares | $ Value | |

| (Amounts in 000s) | ||

| SHORT-TERM INVESTMENTS 8.2% | ||

| Money Market Funds 8.2% | ||

| T. Rowe Price Government Reserve Fund, 5.39% (8)(9) | 12,511 | 12,511 |

| Total Short-Term Investments (Cost $12,511) |

12,511 | |

| Total Investments in Securities 105.0% of Net Assets (Cost $158,519) |

$159,311 | |

| ‡ | Par/Shares and Notional Amount are denominated in U.S. dollars unless otherwise noted. |

| (1) | All or a portion of this loan is unsettled as of May 31, 2024. The interest rate for unsettled loans will be determined upon settlement after period end. |

| (2) | Level 3 in fair value hierarchy. See Note 2. |

| (3) | All or a portion of the position represents an unfunded commitment; a liability to fund the commitment has been recognized. The fund's total unfunded commitments at May 31, 2024, was $57 and was valued at $57 (0.0% of net assets). |

| (4) | Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be resold in transactions exempt from registration only to qualified institutional buyers. Total value of such securities at period-end amounts to $13,014 and represents 8.6% of net assets. |

| (5) | Security has the ability to pay in-kind or pay in cash. When applicable, separate rates of such payments are disclosed. |

| (6) | Security is a fix-to-float security, which carries a fixed coupon until a certain date, upon which it switches to a floating rate. Reference rate and spread are provided if the rate is currently floating. |

| (7) | Perpetual security with no stated maturity date. |

| (8) | Seven-day yield |

| (9) | Affiliated Companies |

| 1M TSFR | One month term SOFR (Secured overnight financing rate) |

| 1M USD LIBOR | One month USD LIBOR (London interbank offered rate) |

| 1M EURIBOR | One month EURIBOR (Euro interbank offered rate) |

| 3M TSFR | Three month term SOFR (Secured overnight financing rate) |

| 3M EURIBOR | Three month EURIBOR (Euro interbank offered rate) |

| 6M TSFR | Six month term SOFR (Secured overnight financing rate) |

| EUR | Euro |

| EURIBOR | The Euro interbank offered rate |

| FRN | Floating Rate Note |

| PIK | Payment-in-kind |

| SOFR | Secured overnight financing rate |

| SOFRINDX | SOFR (Secured overnight financing rate) Index |

| USD | U.S. Dollar |

| VR | Variable Rate; rate shown is effective rate at period-end. The rates for certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and based on current market conditions. |

| SWAPS 0.1% |

| Description | Notional Amount |

$ Value | Upfront Payments/ $ (Receipts) |

Unrealized $ Gain/(Loss) |

| BILATERAL SWAPS 0.1% | ||||

| Total Return Swaps 0.1% | ||||

| JP Morgan, Receive Underlying Reference: iBoxx USD Liquid Leveraged Loans At Maturity, Pay Variable 5.34% (USD SOFR) Quarterly, 6/20/24 | 350 | 24 | — | 24 |

| JP Morgan, Receive Underlying Reference: iBoxx USD Liquid Leveraged Loans At Maturity, Pay Variable 5.34% (USD SOFR) Quarterly, 9/20/24 | 485 | 22 | — | 22 |

| JP Morgan, Receive Underlying Reference: iBoxx USD Liquid Leveraged Loans At Maturity, Pay Variable 5.34% (USD SOFR) Quarterly, 6/20/24 | 485 | 21 | — | 21 |

| Description | Notional Amount |

$ Value | Upfront Payments/ $ (Receipts) |

Unrealized $ Gain/(Loss) |

| JP Morgan, Receive Underlying Reference: iBoxx USD Liquid Leveraged Loans At Maturity, Pay Variable 5.34% (USD SOFR) Quarterly, 12/20/24 | 1,000 | 7 | — | 7 |

| JP Morgan, Receive Underlying Reference: iBoxx USD Liquid Leveraged Loans At Maturity, Pay Variable 5.34% (USD SOFR) Quarterly, 9/20/24 | 1,000 | 5 | — | 5 |

| Total Bilateral Total Return Swaps | — | 79 | ||

| Total Bilateral Swaps | — | 79 | ||

| FORWARD CURRENCY EXCHANGE CONTRACTS |

| Counterparty | Settlement | Receive | Deliver | Unrealized Gain/(Loss) | ||

| Citibank N.A. | 8/23/24 | USD | 229 | EUR | 211 | $— |

| UBS AG | 8/23/24 | USD | 316 | EUR | 289 | 1 |

| Net unrealized gain (loss) on open forward currency exchange contracts |

$1 | |||||

| Affiliate | Net Realized Gain (Loss) |

Changes in Net Unrealized Gain/Loss |

Investment Income |

| T. Rowe Price Government Reserve Fund | $— | $— | $569 |

| Totals | $—# | $— | $569+ |

| Supplementary Investment Schedule | ||||

| Affiliate | Value 5/31/23 |

Purchase Cost |

Sales Cost |

Value 5/31/24 |

| T. Rowe Price Government Reserve Fund | $1,751 | ¤ | ¤ | $12,511 |

| Total | $12,511^ | |||

| # | Capital gain distributions from mutual funds represented $0 of the net realized gain (loss). |

| + | Investment income comprised $569 of dividend income and $0 of interest income. |

| ¤ | Purchase and sale information not shown for cash management funds. |

| ^ | The cost basis of investments in affiliated companies was $12,511. |

| Assets | |

| Investments in securities, at value (cost $158,519) | $159,311 |

| Receivable for shares sold | 3,858 |

| Interest and dividends receivable | 1,225 |

| Receivable for investment securities sold | 450 |

| Cash | 235 |

| Unrealized gain on bilateral swaps | 79 |

| Unrealized gain on forward currency exchange contracts | 1 |

| Total assets | 165,159 |

| Liabilities | |

| Payable for investment securities purchased | 13,311 |

| Investment management and administrative fees payable | 73 |

| Other liabilities | 41 |

| Total liabilities | 13,425 |

| NET ASSETS | $151,734 |

| Net assets consists of: | |

| Total distributable earnings (loss) | $1,184 |

| Paid-in capital applicable to 2,950,000 shares of $0.0001 par value capital stock outstanding; 4,000,000,000 shares authorized |

150,550 |

| NET ASSETS | $151,734 |

| NET ASSET VALUE PER SHARE | $51.44 |

| Year Ended | |

| 5/31/24 | |

| Investment Income (Loss) | |

| Income | |

| Interest | $9,092 |

| Dividend | 569 |

| Total income | 9,661 |

| Expenses | |

| Investment management and administrative expense | 612 |

| Interest and borrowing - related | 23 |

| Total expenses | 635 |

| Net investment income | 9,026 |

| Realized and Unrealized Gain / Loss | |

| Net realized gain (loss) | |

| Securities | 67 |

| Swaps | 95 |

| Forward currency exchange contracts | (4) |

| Foreign currency transactions | 6 |

| Net realized gain | 164 |

| Change in net unrealized gain / loss | |

| Securities | 1,078 |

| Swaps | 69 |

| Change in unrealized gain / loss | 1,147 |

| Net realized and unrealized gain / loss | 1,311 |

| INCREASE IN NET ASSETS FROM OPERATIONS | $10,337 |

| Year Ended |

11/16/22 Through | ||

| 5/31/24 | 5/31/23 | ||

| Increase (Decrease) in Net Assets | |||

| Operations | |||

| Net investment income | $9,026 | $1,081 | |

| Net realized gain (loss) | 164 | (8) | |

| Change in net unrealized gain / loss | 1,147 | (275) | |

| Increase in net assets from operations | 10,337 | 798 | |

| Distributions to shareholders | |||

| Net earnings | (8,907) | (1,029) | |

| Capital share transactions* | |||

| Shares sold | 129,378 | 28,814 | |

| Shares redeemed | (7,657) | — | |

| Increase in net assets from capital share transactions | 121,721 | 28,814 | |

| Net Assets | |||

| Increase during period | 123,151 | 28,583 | |

| Beginning of period | 28,583 | - | |

| End of period | $151,734 | $28,583 | |

| *Share information | |||

| Shares sold | 2,525 | 575 | |

| Shares redeemed | (150) | — | |

| Increase in shares outstanding | 2,375 | 575 |

| ($000s) | Level 1 | Level 2 | Level 3 | Total Value |

| Assets | ||||

| Corporate Bonds | $— | $13,983 | $— | $13,983 |

| Bank Loans | — | 130,166 | 2,651 | 132,817 |

| Short-Term Investments | 12,511 | — | — | 12,511 |

| Total Securities | 12,511 | 144,149 | 2,651 | 159,311 |

| Swaps | — | 79 | — | 79 |

| Forward Currency Exchange Contracts | — | 1 | — | 1 |

| Total | $12,511 | $144,229 | $2,651 | $159,391 |

| ($000s) | Beginning Balance 5/31/23 |

Gain (Loss) During Period |

Total Purchases |

Total Sales |

Transfer Into Level 3 | Transfer Out of Level 3 | Ending Balance 5/31/24 |

| Investment in Securities | |||||||

| Bank Loans | $538 | $45 | $3,182 | $(1,001) | $32 | $(145) | $2,651 |

| ($000s) | Location on Statement of Assets and Liabilities |

Fair Value |

| Assets | ||

| Foreign exchange derivatives | Forwards | $1 |

| Credit derivatives | Bilateral Swaps | 79 |

| Total | $80 |

| ($000s) | Location of Gain (Loss) on Statement of Operations | ||

| Forward Currency Exchange Contracts |

Swaps | Total | |

| Realized Gain (Loss) | |||

| Foreign exchange derivatives | $(4) | $— | $(4) |

| Credit derivatives | — | 95 | 95 |

| Total | $(4) | $95 | $91 |

| Change in Unrealized Gain (Loss) | |||

| Credit derivatives | $— | $69 | $69 |

| ($000s) | ||

| May 31, | May 31, | |

| 2024 | 2023 | |

| Ordinary income (including short-term capital gains, if any) | $8,907 | $1,029 |

| ($000s) | |

| Cost of investments | $158,604 |

| Unrealized appreciation | $1,353 |

| Unrealized depreciation | (567) |

| Net unrealized appreciation (depreciation) | $786 |

| ($000s) | |

| Undistributed ordinary income | $328 |

| Undistributed long-term capital gain | 70 |

| Net unrealized appreciation (depreciation) | 786 |

| Total distributable earnings (loss) | $1,184 |

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable.

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

Not applicable.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Remuneration paid to Directors is included in Item 7 of this Form N-CSR.

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

If applicable, see Item 7.

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 15. Submission of Matters to a Vote of Security Holders.

There has been no change to the procedures by which shareholders may recommend nominees to the registrant’s board of directors.

Item 16. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 18. Recovery of Erroneously Awarded Compensation.

Not applicable.

Item 19. Exhibits.

| (a)(1) | The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached. | |

| (2) | Listing standards relating to recovery of erroneously awarded compensation: not applicable. | |

| (3) | ||

| (b) | ||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| T. Rowe Price Floating Rate ETF | ||||

| By | /s/ David Oestreicher |

|||

| David Oestreicher | ||||

| Principal Executive Officer | ||||

| Date | July 18, 2024 | |||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ David Oestreicher |

|||

| David Oestreicher | ||||

| Principal Executive Officer | ||||

| Date | July 18, 2024 |

|||

| By | /s/ Alan S. Dupski |

|||

| Alan S. Dupski | ||||

| Principal Financial Officer | ||||

| Date | July 18, 2024 |

|||