Table of Contents

As filed with the Securities and Exchange Commission on September 8, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SHIFT4 PAYMENTS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 7389 | 84-3676340 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

2202 N. Irving St.

Allentown, Pennsylvania 18109

Telephone: (888) 276-2108

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jordan Frankel

2202 N. Irving St.

Allentown, Pennsylvania 18109

Telephone: (888) 276-2108

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Marc D. Jaffe, Esq. Ian D. Schuman, Esq. Adam J. Gelardi, Esq. Latham & Watkins LLP 885 Third Avenue New York, NY 10022 Telephone: (212) 906-1200 Fax: (212) 751-4864 |

Jordan Frankel, Esq. Secretary and General Counsel Shift4 Payments, Inc. 2202 N. Irving St. Allentown, Pennsylvania 18109 Telephone: (888) 276-2108 |

Richard A. Fenyes, Esq. Joshua F. Bonnie, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, NY 10017 Telephone: (212) 455-2000 Fax: (212) 455-2502 |

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: AS SOON AS PRACTICABLE AFTER THIS REGISTRATION STATEMENT IS DECLARED EFFECTIVE.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee | ||||

| Class A common stock, $0.0001 par value per share |

11,500,000 | $51.15 | $588,225,000.00 | $76,351.61 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 1,500,000 shares of Class A common stock that are subject to the underwriters’ option to purchase additional shares of Class A common stock. |

| (2) | Estimated solely for the purpose of calculating the registration fee. In accordance with Rule 457(c) under the Securities Act of 1933, as amended, the price shown is the average of the high and low selling price of the Class A common stock on September 2, 2020, as reported on the New York Stock Exchange. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion. Dated September 8, 2020.

10,000,000 Shares

Shift4 Payments, Inc.

Class A Common Stock

We are offering 2,000,000 shares of our Class A common stock and the selling stockholders identified in this prospectus are offering 8,000,000 shares of our Class A common stock. We will not receive any of the proceeds from the sale of shares by the selling stockholders in this offering.

Our Class A common stock is listed and traded on the New York Stock Exchange, or the NYSE, under the symbol “FOUR.” The last reported sale price of our Class A common stock on the NYSE on September 4, 2020 was $49.53 per share.

We have three classes of common stock outstanding: Class A common stock, Class B common stock and Class C common stock. Each share of our Class A common stock entitles its holder to one vote per share and each share of each of our Class B common stock and Class C common stock entitles its holder to ten votes per share on all matters presented to our stockholders generally. All shares of our Class B common stock and Class C common stock are held by Searchlight (as defined below) and our Founder (as defined below), which combined will represent approximately 94.7% of the voting power of our outstanding common stock after this offering (or approximately 94.3% if the underwriters exercise in full their option to purchase additional shares).

We are a holding company and our principal asset is a controlling equity interest in Shift4 Payments, LLC representing an aggregate 49.8% economic interest in Shift4 Payments, LLC (prior to giving effect to this offering). Of the remaining 50.2% economic interest in Shift4 Payments, LLC, 17.1% is owned by Searchlight through their ownership of LLC Interests and 33.1% is owned by our Founder through his ownership of LLC Interests, in each case, prior to giving effect to this offering.

We are the sole managing member of Shift4 Payments, LLC. We operate and control all of the business and affairs of Shift4 Payments, LLC and, through Shift4 Payments, LLC and its subsidiaries, conduct our business.

We are a “controlled company” within the meaning of the NYSE rules. See “Management—Controlled Company Exception.”

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, and will be subject to reduced disclosure and public reporting requirements. This prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 24 to read about factors you should consider before buying shares of our Class A common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share |

Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to Shift4 Payments, Inc. |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting.” |

The underwriters have the option to purchase up to an additional 1,500,000 shares of Class A common stock from the selling stockholders at the public offering price less the underwriting discount within 30 days of the date of this prospectus.

The underwriters expect to deliver the shares of Class A common stock against payment in New York, New York on , 2020.

| Goldman Sachs & Co. LLC | Credit Suisse | Citigroup |

Prospectus dated , 2020.

Table of Contents

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 24 | ||||

| 60 | ||||

| 62 | ||||

| 63 | ||||

| 64 | ||||

| 65 | ||||

| 68 | ||||

| UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION |

70 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

78 | |||

| 100 | ||||

| 120 | ||||

| 127 | ||||

| 134 | ||||

| 145 | ||||

| 147 | ||||

| 153 | ||||

| 157 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF CLASS A COMMON STOCK |

162 | |||

| 166 | ||||

| 171 | ||||

| 171 | ||||

| 171 | ||||

| F-1 | ||||

We, the selling stockholders and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any related free writing prospectuses. We, the selling stockholders and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered by this prospectus, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date. Our business, financial condition, results of operations and prospectus may have changed since that date.

For investors outside the United States: We, the selling stockholders and the underwriters have not done anything that would permit this offering or the possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of Class A common stock and the distribution of this prospectus outside the United States. See “Underwriting.”

i

Table of Contents

BASIS OF PRESENTATION

IPO, Private Placement and Transactions

In connection with the completion of our initial public offering of our Class A common stock on June 9, 2020, in which we issued and sold 17,250,000 shares of our Class A common stock at an initial public price of $23.00 per share and sold $100.0 million of our Class C common stock at a price of $21.62 per share, which is equal to the $23.00 per share initial public price less underwriting discounts and commissions, in a private placement to Rook Holdings, Inc., which we refer to as the IPO and Private Placement, respectively, and we undertook certain organizational transactions, which we refer to collectively as the Transactions. See “IPO, Private Placement and Transactions” for a description of the IPO, Private Placement and Transactions.

Certain Definitions

As used in this prospectus, unless the context otherwise requires, references to:

| • | “we,” “us,” “our,” the “Company,” “Shift4” and similar references refer: (1) following the consummation of the Transactions, including the IPO, to Shift4 Payments, Inc., and, unless otherwise stated, all of its subsidiaries, including Shift4 Payments, LLC and, unless otherwise stated, all of its subsidiaries, and (2) prior to the completion of the Transactions, including the IPO, to Shift4 Payments, LLC and, unless otherwise stated, all of its subsidiaries. |

| • | “Blocker Companies” refers to certain direct and/or indirect owners of LLC Interests in Shift4 Payments, LLC, collectively, prior to the Transactions that are taxable as corporations for U.S. federal income tax purposes and each of which is an affiliate of Searchlight (as defined below). |

| • | “Blocker Mergers” refers to the acquisition by Shift4 Payments, Inc. of LLC Interests held by the Blocker Shareholders, pursuant to one or more contributions by Blocker Shareholders of the equity interests in the Blocker Companies to Shift4 Payments, Inc., followed by one or more mergers, and in exchange for which Shift4 Payments, Inc. issued to the Blocker Shareholders shares of Class B common stock and Class C common stock. |

| • | “Blocker Shareholders” refers to the owners of Blocker Companies, collectively, prior to the Transactions. |

| • | “Continuing Equity Owners” refers collectively to Searchlight, our Founder and their respective permitted transferees that own LLC Interests after the Transactions and who may redeem at each of their options, in whole or in part from time to time, their LLC Interests for, at our election (determined solely by our independent directors (within the meaning of the rules of the NYSE ) who are disinterested), cash or newly-issued shares of our Class A common stock as described in “Certain Relationships and Related Party Transactions— Shift4 LLC Agreement.” |

| • | “LLC Interests” refers to the common units of Shift4 Payments, LLC, including those that we purchased directly from Shift4 Payments, LLC with proceeds from our IPO and the Private Placement and the common units of Shift4 Payments, LLC that we acquired from the Former Equity Owners in connection with the consummation of the Transactions. |

| • | “Founder” refers to Jared Isaacman, our Chief Executive Officer and the sole stockholder of Rook Holdings Inc. Our Founder is a Continuing Equity Owner and an owner of Class C common stock. |

| • | “Former Equity Owner” refers to FPOS Holding Co., Inc. who exchanged its LLC Interests for shares of our Class A common stock (held by the Former Equity Owner either directly or indirectly) in connection with the consummation of the Transactions. |

| • | “Rook” refers to Rook Holdings Inc., a Delaware corporation wholly-owned by our Founder and for which our Founder is the sole stockholder. |

ii

Table of Contents

| • | “RSU Holders” refers to certain current and former employees of Shift4 Payments, LLC who received restricted stock units, or RSUs, of Shift4 Payments, Inc. in connection with the IPO. |

| • | “Searchlight” refers to Searchlight Capital Partners, L.P., a Delaware limited partnership, and certain funds affiliated with Searchlight. Searchlight is a Continuing Equity Owner and an owner of Class C common stock (including any such fund or entity formed to hold shares of Class C common stock). |

| • | “selling stockholders” refers to selling stockholders named herein that intend to sell shares of our Class A common stock in this offering. |

| • | “Shift4 Payments LLC Agreement” refers to Shift4 Payments, LLC’s amended and restated limited liability company agreement, which became effective upon the consummation of the IPO. |

Shift4 Payments, Inc. is a holding company and the sole managing member of Shift4 Payments, LLC, and its principal asset is LLC Interests.

Presentation of Financial Information

Shift4 Payments, LLC is the accounting predecessor of the issuer, Shift4 Payments, Inc., for financial reporting purposes. Shift4 Payments, Inc. became the audited financial reporting entity following the IPO. Accordingly, this prospectus contains the following historical financial statements:

| • | Shift4 Payments, Inc. The historical condensed consolidated financial statements as of and for the six months ended June 30, 2020, as well as the balance sheets as of November 5, 2019 and December 31, 2019 included in this prospectus are those of Shift4 Payments, Inc. No other historical financial information of Shift4 Payments, Inc. has been included in this prospectus as it was incorporated in contemplation of the IPO, had no significant business transactions or activities prior to the IPO and had no significant assets or liabilities during the other periods presented in this prospectus. |

| • | Shift4 Payments, LLC. As Shift4 Payments, Inc. has no interest in any operations other than those of Shift4 Payments, LLC, the historical consolidated financial statements as of and for the years ended December 31, 2019 and December 31, 2018 and the condensed consolidated financial statements for the six months ended June 30, 2019, which are included in this prospectus are those of Shift4 Payments, LLC. |

The unaudited pro forma financial information of Shift4 Payments, Inc. presented in this prospectus has been derived by the application of pro forma adjustments to the audited historical consolidated financial statements of Shift4 Payments, LLC and the unaudited historical condensed consolidated financial statements of Shift4 Payments, Inc. included elsewhere in this prospectus. In in the case of the unaudited pro forma consolidated statements of operations data, the pro forma adjustments give effect to this offering, the IPO, Private Placement and Transactions (as described in “IPO, Private Placement and Transactions”) as if all such transactions had occurred on January 1, 2019. See “Unaudited Pro Forma Condensed Consolidated Financial Information” for a complete description of the adjustments and assumptions underlying the pro forma financial information included in this prospectus.

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Percentage amounts included in this prospectus have not in all cases been calculated on the basis of such rounded figures, but on the basis of such amounts prior to rounding. For this reason, percentage amounts in this prospectus may vary from those obtained by performing the same calculations using the figures in our consolidated financial statements included elsewhere in this prospectus. Certain other amounts that appear in this prospectus may not sum due to rounding.

Key Terms and Performance Indicators Used in this Prospectus; Non-GAAP Financial Measures

Throughout this prospectus, we use a number of key terms and provide a number of key performance indicators used by management. These key performance indicators are discussed in more detail in the section entitled

iii

Table of Contents

“Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key performance indicators and non-GAAP measures.” We define these terms as follows:

| • | end-to-end payment volume, which we define as the total dollar amount of card payments that we authorize and settle on behalf of our merchants; |

| • | gross revenue less network fees, which includes interchange and assessment fees; |

| • | EBITDA, which we define as earnings before interest expense, income taxes, depreciation and amortization; and |

| • | adjusted EBITDA, which we define as EBITDA further adjusted for acquisition, restructuring and integration costs, equity-based compensation expense, management fees and other non-recurring items management believes are not indicative of ongoing operations. |

We use non-GAAP financial measures to supplement financial information presented in accordance with generally accepted accounting principles in the United States, or GAAP. We believe that excluding certain items from our GAAP results allows management to better understand our consolidated financial performance from period to period and better project our future consolidated financial performance as forecasts are developed at a level of detail different from that used to prepare GAAP-based financial measures. Moreover, we believe these non-GAAP financial measures provide our stakeholders with useful information to help them evaluate our operating results by facilitating an enhanced understanding of our operating performance and enabling them to make more meaningful period to period comparisons. There are limitations to the use of the non-GAAP financial measures presented in this prospectus. For example, our non-GAAP financial measures may not be comparable to similarly titled measures of other companies. Other companies, including companies in our industry, may calculate non-GAAP financial measures differently than we do, limiting the usefulness of those measures for comparative purposes. See “Prospectus Summary—Summary Historical and Pro Forma Condensed Consolidated Financial and Other Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

iv

Table of Contents

TRADEMARKS

This prospectus includes our trademarks and trade names which are protected under applicable intellectual property laws and are our property. This prospectus also contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

MARKET AND INDUSTRY DATA

Unless otherwise indicated, information contained in this prospectus concerning our industry, competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts, such as The Nilson Report, the “Global payments 2018: A dynamic industry continues to break new ground” report by McKinsey & Company, or McKinsey, and other third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

This prospectus also contains information regarding feedback that originated from our customers, including those described in “Business—Customer Success Stories.” This information is based upon feedback collected by us. We encourage our customers to describe their experiences with our services. We also survey our customers from time to time regarding their experiences with us. In response to positive feedback received, we contacted certain of these customers to request their consent to use their story in this prospectus and, in some cases, requested further detail about their positive experience.

v

Table of Contents

IPO, PRIVATE PLACEMENT AND TRANSACTIONS

On June 9, 2020, we completed the IPO of 17,250,000 shares (including additional shares sold to the underwriters upon exercise in full of their option to purchase additional shares from us) of our Class A common stock at a price to the public of $23.00 per share. The shares began trading on the NYSE on June 5, 2020 under the symbol “FOUR.” The total net proceeds of the IPO received by the Company were $363.8 million, including proceeds resulting from the underwriters’ exercise in full of their option to purchase additional shares of our Class A common stock in connection with the IPO and after deducting underwriting discounts, commissions and offering expenses. We also completed a $100.0 million Private Placement of 4,625,346 shares of Class C common stock to Rook. The total net proceeds from the IPO and Private Placement were approximately $463.8 million. We used the net proceeds from the IPO and the Private Placement to purchase 23,324,537 LLC Interests directly from Shift4 Payments, LLC at a price per unit equal to the IPO price per share of Class A common stock in the IPO less the underwriting discounts and commissions and offering expenses. Shift4 Payments, LLC used the proceeds it received through Shift4 Payments, Inc. from the IPO and Private Placement to repay $59.8 million of required principal payments under the First Lien Term Loan Facility, to repay in full the $130.0 million outstanding under our Second Lien Term Loan Facility, to repay the $89.5 million outstanding borrowing under our Revolving Credit Facility and for general corporate purposes.

We completed the following organizational transactions in connection with the IPO and the Private Placement, which we refer to collectively with the IPO and the Private Placement as the Transactions:

| • | we amended and restated the existing limited liability company agreement of Shift4 Payments, LLC to, among other things, (1) convert all existing ownership interests in Shift4 Payments, LLC (including redeemable preferred units) into 43,463,700 LLC Interests and (2) appoint Shift4 Payments, Inc. as the sole managing member of Shift4 Payments, LLC upon its acquisition of LLC Interests in connection with the IPO; |

| • | we amended and restated Shift4 Payments, Inc.’s certificate of incorporation to, among other things, provide (1) for Class A common stock, with each share of our Class A common stock entitling its holder to one vote per share on all matters presented to our stockholders generally, (2) for Class B common stock, with each share of our Class B common stock entitling its holder to ten votes per share on all matters presented to our stockholders generally, and that shares of our Class B common stock may only be held by Searchlight, our Founder and their respective permitted transferees as described in “Description of Capital Stock—Common Stock—Class B Common Stock” and (3) for Class C common stock, with each share of our Class C common stock entitling its holder to ten votes per share on all matters presented to our stockholders generally, and that shares of our Class C common stock may only be held by Searchlight, our Founder and their respective permitted transferees as described in “Description of Capital Stock—Common Stock—Class C Common Stock;” |

| • | the Former Equity Owner exchanged its LLC Interests for 528,150 shares of Class A common stock on a one-to-one basis; |

| • | we acquired, pursuant to the Blocker Mergers, the LLC Interests held by the Blocker Shareholders, affiliates of Searchlight, in exchange for shares of Class B common stock and Class C common stock; |

| • | we granted 4,630,884 RSUs to the RSU Holders in connection with the IPO; |

| • | we purchased 915,503 LLC Interests from Shift4 Payments, LLC in exchange for 915,503 shares of Class A common stock to be issued to P&W Enterprises, Inc., as satisfaction of Shift4 Payments, LLC’s existing obligation to P&W Enterprises, Inc.; |

| • | we used all of the net proceeds from the IPO to purchase 17,250,000 newly issued LLC Interests directly from Shift4 Payments, LLC at a price per unit equal to the $23.00 per share of Class A common stock initial public price in the IPO less the underwriting discounts and commissions; |

vi

Table of Contents

| • | we used all of the net proceeds from the Private Placement to purchase 4,625,346 newly issued LLC Interests directly from Shift4 Payments, LLC at a price per unit equal to the $23.00 per share of Class A common stock initial public price in the IPO less underwriting discounts and commissions; |

| • | Shift4 Payments, LLC used the net proceeds from the sale of LLC Interests to Shift4 Payments, Inc. to repay certain existing indebtedness and the remainder for general corporate purposes; and |

| • | we entered into (1) the Stockholders Agreement with Searchlight and our Founder, (2) the Registration Rights Agreement with Searchlight and our Founder and (3) the Tax Receivable Agreement, or TRA, with Shift4 Payments, LLC, the Continuing Equity Owners and the Blocker Shareholders. For a description of the terms of the Stockholders Agreement, the Registration Rights Agreement and the Tax Receivable Agreement, see “Certain Relationships and Related Party Transactions.” |

vii

Table of Contents

This summary highlights selected information included elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our Class A common stock. You should read the entire prospectus carefully, including the “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. Some of the statements in this prospectus constitute forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

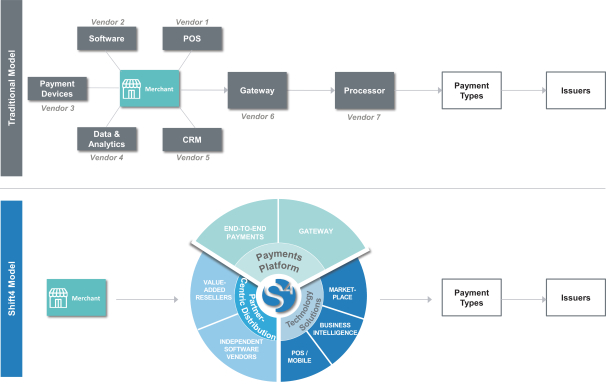

Overview

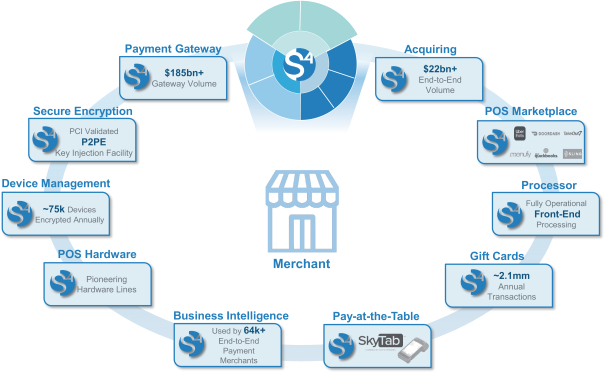

We are a leading independent provider of integrated payment processing and technology solutions in the United States based on total volume of payments processed. We have achieved our leadership position through decades of solving complex business and operational challenges facing our customers: software partners and merchants. For our software partners, we offer a single integration to an end-to-end payments offering, a proprietary gateway and a robust suite of technology solutions to enhance the value of their software and simplify payment acceptance. For our merchants, we provide a seamless, unified consumer experience as an alternative to relying on multiple providers to accept payments and utilize technology in their businesses.

Merchants are increasingly adopting disparate software solutions to operate their businesses more effectively. The complexity of integrating a seamless payment solution across these software suites has grown exponentially. For example, a restaurant in the United States may use over a dozen disparate software systems to operate its business, manage interactions with its customers and accept payments. A large resort may operate an even greater number of software systems to enable online reservations, check-ins, restaurants, salon and spa, golf, parking and more. The scale and complexity of managing these software systems that are sourced from different providers while seamlessly accepting payments is challenging for merchants of any size.

Software partners are increasingly required to ensure that their solutions are integrated with a variety of applications to service merchants. For example, any software partner seeking to be adopted in a resort, such as an online reservation system or restaurant point-of-sale, or POS, must be able to integrate into that resort’s property management systems. These software integrations need to enable secure payment acceptance and also support additional services to manage the guest’s experience. Facilitating these integrations is both costly and time-consuming for software partners.

We integrate disparate software systems through a single point of connectivity. By partnering with us, every software provider receives the benefit of both a state-of-the-art payments platform and our library of over 350 established integrations with market-leading software suites. In turn, our merchants are able to simplify payment acceptance and streamline their business operations by reducing the number of vendors on which they rely.

At the heart of our business is our payments platform. Our payments platform is a full suite of integrated payment products and services that can be used across multiple channels (in-store, online, mobile and tablet-based). We also offer innovative technology solutions that go beyond payment processing—some of which are developed in-house, such as business intelligence and POS software, while others are powered by our network of complementary third-party applications.

We employ a partner-centric distribution approach in which we market and sell our solutions through a diversified network of over 7,000 software partners, which consist of independent software vendors, or ISVs, and value-added resellers, or VARs. ISVs are technology providers that develop commerce-enabling software

1

Table of Contents

suites with which they can bundle our payments platform. VARs are organizations that provide distribution support for ISVs and act as trusted and localized service providers to merchants by providing them with software and services. Together, our ISVs and VARs provide us immense distribution scale and provide our merchants with front-line service and support.

Our end-to-end payments offering combines our payments platform, including our proprietary gateway and breadth of software integrations, and our suite of technology solutions to create a compelling value proposition for our merchants. As of December 31, 2019, we served over 64,000 merchants who subscribe to our end-to-end payments offering, representing over $22.0 billion in end-to-end payment volume for the year ended December 31, 2019. As of June 30, 2020, we served over 66,000 merchants who subscribe to our end-to-end payments offering, representing approximately $10.4 billion in end-to-end payment volume for the six months ended June 30, 2020. This end-to-end payment volume contributed approximately 57% of gross revenue less network fees for both the year ended December 31, 2019 and the six months ended June 30, 2020. Additionally, in 2019 we served over 66,000 merchants representing over $185.0 billion in payment volume that relied on Shift4’s gateway or technology solutions but did not utilize our end-to-end payments offering.

Our merchants range from small-to-medium-sized businesses, or SMBs, to large enterprises across numerous verticals in which we have deep industry expertise, including food and beverage, lodging and leisure (which we collectively refer to as hospitality). In addition, our merchant base is highly diversified with no single merchant representing more than 1% of end-to-end payment volume for the year ended December 31, 2019 or the six months ended June 30, 2020.

We derive the majority of our revenue from fees paid by our merchants, which principally include a processing fee that is charged as a percentage of end-to-end payment volume. In cases where merchants subscribe only to our gateway, we generate revenue from transaction fees charged in the form of a fixed fee per transaction. We also generate subscription revenue from licensing subscriptions to our POS software, business intelligence tools, payment device management and other technology solutions, for which we typically charge flat subscription fees on a monthly basis. Our revenue is recurring in nature because of the mission-critical and embedded nature of the solutions we provide, the high switching costs associated with these solutions and the multi-year contracts we have with our customers. We also benefit from a high degree of operating leverage given the combination of our highly scalable payments platform and strong customer unit economics.

Our total revenue increased to $731.4 million for fiscal year ended December 31, 2019 from $560.6 million for fiscal year ended December 31, 2018 and increased to $341.2 million for the six months ended June 30, 2020 from $335.5 million for the six months ended June 30, 2019. We generated net loss of $58.1 million for fiscal year ended December 31, 2019 and net loss of $49.9 million for fiscal year ended December 31, 2018; and generated net loss of $80.2 million for the six months ended June 30, 2020 and net loss of $21.7 million for the six months ended June 30, 2019. Our gross revenue less network fees increased to $305.5 million for fiscal year ended December 31, 2019 from $252.7 million for fiscal year ended December 31, 2018, representing year-over-year growth of 20.9%; and our gross revenue less network fees increased to $146.5 million for the six months ended June 30, 2020 from $141.6 million for the six months ended June 30, 2019, representing growth of 3.4%. Our adjusted EBITDA increased to $103.8 million for fiscal year ended December 31, 2019 from $89.9 million for fiscal year ended December 31, 2018, representing year-over-year growth of 15.5%; and our adjusted EBITDA decreased to $32.3 million for the six months ended June 30, 2020 from $44.6 million for the six months ended June 30, 2019. The percentage of our total gross revenue less network fees derived from volume-based payments, subscription agreements and transaction fees was 56.7%, 26.5% and 14.6% for the fiscal year ended December 31, 2019, respectively, and 56.2%, 26.9% and 14.0% for the fiscal year ended December 31, 2018, respectively. The percentage of our total gross revenue less network fees derived from volume-based

payments, subscription agreements and transaction fees was 56.6%, 27.8% and 13.7% for the six months ended June 30, 2020, respectively, and 58.1%, 27.7% and 12.3% for the six months ended June 30, 2019, respectively.

2

Table of Contents

See “—Summary Historical and Pro Forma Condensed Consolidated Financial and Other Data” for a reconciliation of our non-GAAP measures to the most directly comparable financial measure calculated and presented in accordance with GAAP.

Our Shift4 Model

Our mission is to power the convergence of integrated payments and commerce-enabling software. Solving the complexity inherent to our software partners and merchants requires a specialized approach that combines a seamless customer experience with a secure, reliable and robust suite of payments and technology offerings.

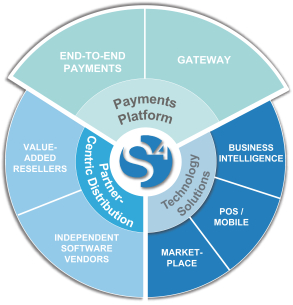

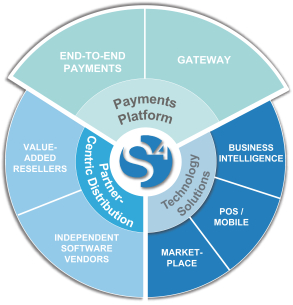

To achieve this mission, we strategically built our Shift4 Model on a three pillar foundation: (i) payments platform; (ii) technology solutions; and (iii) partner-centric distribution.

3

Table of Contents

Payments Platform

Our payments platform provides omni-channel card acceptance and processing solutions, including:

| • | end-to-end payment processing for a broad range of payment types; |

| • | merchant acquiring; |

| • | proprietary omni-channel gateway capable of multiple methods of contactless QR code-based payments; |

| • | complementary software integrations; |

| • | integrated and mobile POS solutions; |

| • | security and risk management solutions; and |

| • | reporting and analytical tools. |

For the year ended December 31, 2019, we processed over 3.5 billion transactions representing over $200.0 billion in payment volume across multiple payment types, including credit, debit, contactless card, EMV, mobile wallets and alternative payment methods. We continue to innovate and evolve our payments offering as new technology and payment methods are adopted by consumers.

Through our proprietary gateway, our payments platform is integrated with over 350 software suites including some of the largest and most recognized software providers in the world. In addition, we enable connectivity with the largest payment processors, alternative payment rails and over 100 payment devices. Our payments platform includes market-leading security features that help prevent consumer card data from entering the merchant’s environment.

Our merchants have the flexibility to subscribe to our payments platform in one of two ways: end-to-end payments or gateway. End-to-end payments merchants benefit from a single vendor solution for payment acceptance (including our proprietary gateway), devices, POS software solutions and a full suite of business intelligence tools. By consolidating these functions through a single, unified vendor solution, these merchants are able to reduce total spend on payment acceptance solutions and access gateway and technology solutions as value-added features. Gateway merchants benefit from interoperability with third-party payment processors. The flexibility in our model helps us attract software partners and merchants.

Technology Solutions

Our suite of technology solutions is designed to streamline our customers’ business operations, drive growth through strong consumer engagement and improve their business using rich transaction-level data.

| • | Lighthouse 5 – Our cloud-based suite of business intelligence tools includes customer engagement, social media management, online reputation management, scheduling and product pricing, as well as extensive reporting and analytics. |

| • | Integrated Point-of-Sale (iPOS) – We provide purpose-built POS workstations pre-loaded with powerful, mission-critical software suites and integrated payment functionality. Our iPOS offering helps our merchants scale their business and improve operational efficiency while reducing total cost of ownership. |

| • | Mobile POS – Our mobile payments offering, Skytab, provides a complete feature set, including pay-at-the-table, order-at-the-table, delivery, customer feedback and email marketing, all of which are integrated with our proprietary gateway and Lighthouse 5. |

4

Table of Contents

| • | Marketplace – We enable seamless integrations into complementary third-party applications (such as online delivery services, payroll, timekeeping and other human resource services), reducing the number of vendors on which our merchants rely. |

Partner-Centric Distribution

Our payments platform and technology solutions are delivered to our merchants through our partner-centric distribution network. Today, our network includes over 7,000 software partners, providing full coverage across the United States.

Our partner-centric distribution approach is designed to leverage the domain expertise and local relationships that our software partners have built with our merchants over years of doing business together. Our software partners are entrusted by merchants to guide software purchasing decisions and provide service and support. In turn, our software partners entrust us to provide innovative payment and technology solutions to help them continue to grow.

Our Key Differentiators

We believe that our Shift4 Model provides us with a competitive advantage and differentiated position in the market.

| • | We are a pioneer in delivering innovative solutions. Since our founding, we have been at the forefront of developing and deploying new and innovative payments and technology solutions that are tailored to meet the demands of our customers as their business needs evolve, such as Skytab, Integrated POS, Tokenization and PCI-validated point-to-point encryption, or P2PE. |

| • | We have developed deep domain expertise and built specialized capabilities in the hospitality market. We believe that we have established a meaningful first-mover advantage in integrated payments and technology solutions for the hospitality market. With over 30 years of operating experience in the hospitality market, we have developed solutions that meet various use-cases in the hospitality industry. As a result, over 21,000 hotels and 125,000 restaurants in the United States use at least one of our products. |

| • | We maintain a privileged position as the last integration our software partners will ever need. We have over 350 integrations to market-leading software providers and we are integrated into a majority share of hotel property management systems in the United States. As a result, we simplify the operational complexity that our merchants face. |

| • | We control and integrate the most important parts of the payments value chain into a single point of access. We offer end-to-end processing, merchant acquiring, gateway, software integrations, POS solutions, security, reporting and analytical tools, enabling us to eliminate customer pain points around payment processing and device management. Integrating our payments platform into our software partners’ solutions enables them to deliver a comprehensive solution to their customers, with a single source of accountability and service. |

| • | We have a vision-driven, founder-led culture. Since our founding, we have focused on building an entrepreneurial and innovative culture that is deeply rooted in our philosophy of aligning our success with that of our software partners and merchants. Our founder-led team is able to draw on decades of experience in payments and software, which we believe is a key driver of our ability to innovate and disrupt our markets. |

5

Table of Contents

Our Growth Strategy

Our growth strategy will continue to be driven by our ability to leverage our Shift4 Model to solve the most complex business challenges facing our customers. The key elements of this strategy include:

| • | Continue to win new customers. We plan to continue enhancing our value proposition to empower our existing software partners to win new merchants. We also intend to expand our network of software partners across a variety of industry verticals in order to target new merchants. |

| • | Unlock substantial opportunity within existing merchant base. Significant upsell and cross-sell opportunities exist within our current base of merchants. We intend to drive adoption of our integrated end-to-end payments offering within our gateway merchant base, which increases our revenue per merchant and enhances merchant retention, resulting in stronger unit economics. In 2019 and in the six months ended June 30, 2020, the average integrated end-to-end merchant, or an end-to-end merchant who also utilizes our software, accounted for more than four times the gross profit than the average gateway merchant. |

| • | Continue enhancing our product portfolio with differentiated solutions. As merchants embrace simplicity and consolidate vendor relationships, we will continue to add new value-added features and functionality. This enables our merchants to deliver a higher quality experience to their consumers and increase their transaction volumes, benefitting both us and our merchants. |

| • | Leverage domain expertise in hospitality market to expand into adjacent verticals. Our access to leading hospitality businesses and industry thought leaders affords us an advantaged position of identifying emerging trends in adjacent areas and verticals that could result in attractive investment opportunities, such as specialty retail. |

| • | Leverage our relationships with global merchants to expand internationally. Our Shift4 Model serves a host of multinational hospitality brands that currently utilize our tokenization and POS software solutions internationally. We also have the opportunity to follow our customers as they expand into new geographic markets. |

| • | Monetize the robust data we capture through our Shift4 Model. We believe we have an opportunity to leverage data from the billions of transactions we process to develop unique insights that help identify trends in consumer behavior, as well as consumer and merchant preferences. We believe monetization of this data could represent a larger component of our business in the future. |

| • | Pursue strategic acquisitions. We may selectively pursue acquisitions to improve our competitive positioning within existing and new verticals, expand our customer base and enhance our software and technology capabilities. |

Our Market and Trends Impacting the Industry

The convergence of payments and software is transforming global commerce. Our software partners and merchants are seeking a bundled integrated payment and software solution to introduce operating efficiencies and enhance consumer experiences. The market opportunity is large and growing. According to the January 2019 issue of The Nilson Report, purchase volume on cards in the United States is expected to reach $10.4 trillion by 2027 from $5.5 trillion in 2017, representing a compound annual growth rate, or CAGR, of approximately 7%. We leverage our Shift4 Model to capture a larger share of this market opportunity and to capitalize on the following trends defining our markets:

Trends Impacting Merchants

| • | Merchants must leverage the power of software to compete |

6

Table of Contents

| • | Merchants are increasingly adopting multiple software suites |

| • | Increasing complexity of payments and the proliferation of frictionless and omni-channel commerce |

| • | Card-present verticals increasingly capture unique business insights |

Trends Impacting ISVs

| • | ISVs are integrating payments into their business models to remain competitive |

| • | ISVs struggle to integrate their software suites with the growing universe of third-party software applications |

Searchlight Capital

Searchlight is a global private investment firm with over $7 billion in assets under management and offices in New York, London and Toronto. The firm manages capital through varied investment funds and special purpose partnerships. For additional information regarding Searchlight’s ownership in us after this offering, see “—Summary of the Transactions” and “Principal and Selling Stockholders.”

Recent Developments

COVID-19

The recent novel coronavirus, or COVID-19, pandemic and the shelter-in-place orders, promotion of social distancing measures, restrictions to businesses deemed non-essential and travel restrictions implemented throughout the United States have materially impacted the restaurant and hospitality industries—verticals upon which we predominantly have focused on over the last decade.

In response to these developments, we have implemented measures to focus on the safety of our employees, including implementing remote working capabilities and to support our merchants as they shift to take-out and delivery operations, while at the same time seeking to mitigate the impact on our financial position and operations. We have also implemented new programs to help ease the burden for our merchants, encourage customers to support their local small businesses and restaurants and incentivize new merchants to enroll in our end-to-end payment platform. Specifically, we have:

| • | established www.shift4.com/situation in an effort to share data to educate political leaders and advocacy groups as to where aid needs to be prioritized; |

| • | released a gift card funding campaign to encourage consumers to support their favorite bars/restaurants by purchasing a gift card through our Shift4Cares.com website; and |

| • | implemented temporary fee waivers on certain products from March 2020 through June 2020 that did not have a material impact on financial performance. |

We believe we have sufficient liquidity to satisfy our cash needs, however, we continue to evaluate and take action, as necessary, to preserve adequate liquidity and ensure that our business can continue to operate during these uncertain times. Our business was not significantly impacted by the COVID-19 pandemic until the latter part of March 2020, at which time our end-to-end payment volumes declined 70%. At that time, we took the following actions to increase liquidity and strengthen our financial position:

| • | drew $68.5 million under our revolving credit facility in the first quarter of 2020, which was repaid as of June 30, 2020; |

| • | furloughed approximately 25% of our employees. As of mid-August 2020, we reinstated the majority of our workforce and are hiring in certain areas to accommodate new merchant onboarding; |

7

Table of Contents

| • | accelerated approximately $30 million of annual expense reduction plans related to prior acquisitions, including the Merchant Link Acquisition; |

| • | re-prioritized our capital projects to defer certain non-essential improvements; |

| • | instituted a company-wide hiring freeze, which has been lifted since August 2020; and |

| • | reduced salaries for management across the organization, which as of August 2020 were partially reinstated. |

While we believe these actions will ensure that we can continue to support our employees, merchants and software partners through this crisis and will better position us for the recovery when that time comes, we are unable to accurately predict the ultimate impact that the COVID-19 pandemic will have on our operations going forward due to a number of factors, including:

| • | uncertainties which will be dictated by the length of time that COVID-19 related disruptions continue and the severity of such disruptions; |

| • | the potential for additional outbreaks as government restrictions are relaxed and any further shelter-in-place or other government restrictions imposed as a result; |

| • | the impact of existing and future governmental regulations that might be imposed in response to the pandemic; |

| • | the impact of remote operations; |

| • | potential interruptions or impacts to our supply chain; |

| • | potential changes in consumer behavior, including the use of hotels, bars and restaurants; and |

| • | the deterioration in the economic conditions in the United States, which could have a significant impact on spending. |

Since mid-March when shelter-in-place, social distancing, the closing of non-essential businesses and other restrictive measures were first put in place across the United States and our weekly gateway transactions decreased by approximately 75% from their pre-COVID-19 peak, we have seen a significant recovery in our end-to-end payment volumes and, for the trailing seven days leading up to June 30, 2020, end-to-end payment volumes were approximately 90% of pre-COVID-19 volumes in 2020 and as of the week beginning August 16, 2020, end-to-end payment volumes were approximately 230% of mid-March volumes, which were impacted similarly to gateway transactions by the COVID-19 pandemic.

8

Table of Contents

Shown below is our weekly end-to-end payment volume from the week beginning March 22, 2020, the lowest point since the COVID-19 pandemic, through the week beginning August 16, 2020:

End-to-end payment volumes for June 2020 were $1,998 million, representing a 4% increase from June 2019. Additionally, July 2020 end-to-end payment volumes were 14% greater than July 2019 and August 2020 end-to-end payment volumes were 25% greater than August 2019. We have also seen our SkyTab merchant adoption increase 304% since mid-March 2020, with related volumes above the pre-COVID-19 peak. While end-to-end payment volumes for the six months ended June 30, 2020 have exceeded those for the six months ended June 30, 2019, the ultimate impact that the COVID-19 pandemic will have on our consolidated results of operations in the second half of 2020 remains uncertain. We will continue to evaluate the nature and extent of these potential impacts to our business, consolidated results of operations, and liquidity. See “Risk Factors—Business risks—The recent novel coronavirus, or COVID-19, global pandemic has had and is expected to continue to have a material adverse effect on our business and results of operations.”

On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security, or CARES, Act was signed into law. The CARES Act provides a substantial stimulus and assistance package intended to address the impact of the COVID-19 pandemic, including tax relief and government loans, grants and investments. The CARES Act includes, among other things, provisions relating to payroll tax credits and deferrals, net operating loss carryback periods, alternative minimum tax credits and technical corrections to tax depreciation methods for qualified improvement property. Pursuant to the CARES Act, in June 2020, we submitted a carryback claim related to our net operating loss carryforward generated in 2018, which is expected to provide a cash tax savings of

$0.6 million and is reflected in the condensed consolidated financial statements for the six months ended June 30, 2020 included elsewhere in this prospectus. We will continue to monitor any effects that may result from the CARES Act or other government relief programs that are made available in the future.

9

Table of Contents

Initial Public Offering

On June 9, 2020, we completed our IPO, in which we issued and sold 17,250,000 shares of our Class A common stock, including 2,250,000 shares pursuant to the full exercise of the underwriters’ option to purchase additional shares, at a price to the public of $23.00 per share and an aggregate offering price of $396.8 million. Citigroup Global Markets Inc., Credit Suisse Securities (USA) LLC and Goldman Sachs & Co. LLC acted as representatives for the underwriters in the IPO. Upon completion of the IPO, we received net proceeds of approximately $363.8 million, after deducting the underwriting discounts and commissions of approximately $23.8 million and offering expenses of approximately $9.2 million. We used the net proceeds from the IPO and the Private Placement to purchase 23,324,537 LLC Interests directly from Shift4 Payments, LLC at a price per unit equal to the IPO price per share of Class A common stock in the IPO less the underwriting discounts and commissions. Shift4 Payments, LLC used the proceeds it received through Shift4 Payments, Inc. from the IPO and Private Placement to repay $59.8 million of required principal payments under the First Lien Term Loan Facility, to repay in full the $130.0 million outstanding under our Second Lien Term Loan Facility, to repay the $89.5 million outstanding borrowing under our Revolving Credit Facility and the remainder for general corporate purposes.

Repayment of Indebtedness

As of June 30, 2020, we had $450.0 million outstanding under the First Lien Term Loan Facility. Both the Second Lien Term Loan Facility and the Revolving Credit Facility were paid in full using the proceeds from the IPO and Private Placement in June 2020. As of June 30, 2020, we had no outstanding borrowings under the Revolving Credit Facility, which has borrowing capacity of $89.5 million, net of a $0.5 million letter of credit.

Summary Risk Factors

Participating in this offering involves substantial risk. Our ability to execute our strategy is also subject to certain risks. The risks described under the heading “Risk Factors” included elsewhere in this prospectus may cause us not to realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the most significant challenges and risks we face include the following:

| • | the recent novel coronavirus, or COVID-19, global pandemic has had and is expected to continue to have a material adverse effect on our business and results of operations; |

| • | substantial and increasingly intense competition worldwide in the financial services, payments and payment technology industries may adversely affect our overall business and operations; |

| • | potential changes in the competitive landscape, including disintermediation from other participants in the payments chain, could harm our business; |

| • | our ability to anticipate and respond to changing industry trends and the needs and preferences of our merchants and consumers may adversely affect our competitiveness or the demand for our products and services; |

| • | because we rely on third-party vendors to provide products and services, we could be adversely impacted if they fail to fulfill their obligations; |

| • | acquisitions create certain risks and may adversely affect our business, financial condition or results of operations; |

| • | we may not be able to continue to expand our share of the existing payment processing markets or expand into new markets which would inhibit our ability to grow and increase our profitability; and |

10

Table of Contents

| • | our Founder and Searchlight will continue to have significant influence over us after this offering, including control over decisions that require the approval of stockholders. |

Before you invest in our Class A common stock, you should carefully consider all the information in this prospectus, including matters set forth under the heading “Risk Factors.”

11

Table of Contents

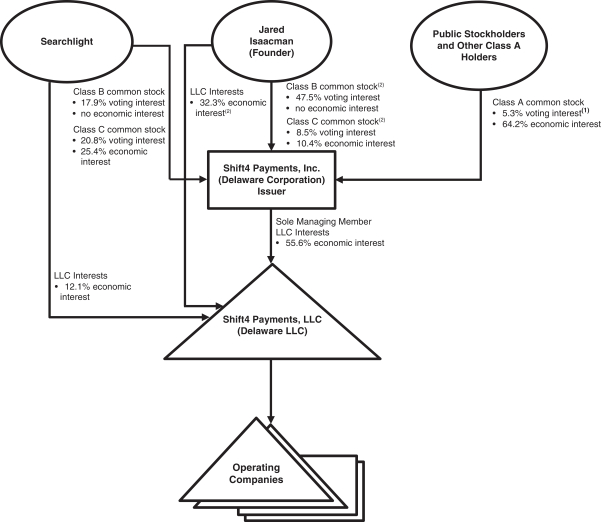

Ownership Structure

The diagram below depicts our organizational structure after giving effect to this offering, assuming no exercise by the underwriters of their option to purchase additional shares of Class A common stock.

| (1) | Our public stockholders will hold approximately 5.0% of the voting interest. |

| (2) | Jared Isaacman holds his LLC interests in Shift4 Payments, LLC and his Class B common stock and Class C common stock of Shift4 Payments, Inc. through a wholly owned corporation, Rook Holdings Inc., for which he is the sole stockholder. |

Our Corporate Information

Shift4 Payments, Inc., the issuer of the Class A common stock in this offering, was incorporated as a Delaware corporation on November 5, 2019. Our corporate headquarters are located at 2202 N. Irving St., Allentown, PA 18109. Our telephone number is (888) 276-2108. Our principal website address is www.shift4.com. The information on any of our websites is deemed not to be incorporated in this prospectus or to be part of this prospectus.

12

Table of Contents

Shift4 Payments, Inc. is a holding company whose principal assets are the LLC interests it holds in Shift4 Payments, LLC.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of certain reduced reporting and other requirements that are otherwise generally applicable to public companies. As a result:

| • | we are required to have only two years of audited financial statements and only two years of related selected financial data and management’s discussion and analysis of financial condition and results of operations disclosure; |

| • | we are not required to engage an auditor to report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; |

| • | we are not required to comply with the requirement of the Public Company Accounting Oversight Board, or PCAOB, regarding the communication of critical audit matters in the auditor’s report on the financial statements; |

| • | we are not required to submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,” “say-on-frequency” and “say-on-golden parachutes;” and |

| • | we are not required to comply with certain disclosure requirements related to executive compensation, such as the requirement to present a comparison of our Chief Executive Officer’s compensation to our median employee compensation. |

We may take advantage of these reduced reporting and other requirements until the last day of our fiscal year following the fifth anniversary of the completion of our IPO, or such earlier time that we are no longer an emerging growth company. However, if certain events occur prior to the end of such period, including if we have more than $1.07 billion in annual revenue, have more than $700 million in market value of our Class A common stock held by non-affiliates, or issue more than $1.0 billion of non-convertible debt over a three-year period, we will cease to be an emerging growth company prior to the end of such period. We may choose to take advantage of some but not all of these reduced burdens. We have elected to adopt the reduced requirements with respect to our financial statements and the related selected financial data and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure, including in this prospectus.

In addition, the JOBS Act permits an emerging growth company like us to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have elected to use this extended transition period.

As a result, the information that we provide to stockholders may be different than the information you may receive from other public companies in which you hold equity.

13

Table of Contents

The Offering

| Issuer |

Shift4 Payments, Inc. |

| Shares of Class A common stock offered by us |

2,000,000 shares. |

| Shares of Class A common stock offered by the selling stockholders |

8,000,000 shares (or 9,500,000 shares if the underwriters exercise in full their option to purchase additional shares). |

| Underwriters’ option to purchase additional shares of Class A common stock from the selling stockholders |

The selling stockholders have granted the underwriters an option to purchase up to 1,500,000 additional shares of Class A common stock within 30 days of the date of this prospectus. |

| Shares of Class A common stock to be outstanding immediately after this offering |

28,550,026 shares, representing approximately 5.3% of the combined voting power of all of Shift4 Payments, Inc.’s common stock (or 30,023,096 shares, representing approximately 5.7% of the combined voting power of all of Shift4 Payments, Inc.’s common stock if the underwriters exercise in full their option to purchase additional shares of Class A common stock), 64.2% of the economic interest in Shift4 Payments, Inc. and 35.7% of the indirect economic interest in Shift4 Payments, LLC (or 66.5% of the economic interest in Shift4 Payments, Inc. and 37.5% of the indirect economic interest in Shift4 Payments, LLC if the underwriters exercise in full their option to purchase additional shares of Class A common stock). |

| Shares of Class B common stock to be outstanding immediately after this offering |

35,567,488 shares, representing approximately 65.4% of the combined voting power of all of Shift4 Payments, Inc.’s common stock (or 34,885,457 shares, representing approximately 65.8% of the combined voting power of all of Shift4 Payments, Inc.’s common stock if the underwriters exercise in full their option to purchase additional shares of Class A common stock) and no economic interest in Shift4 Payments, Inc. |

| Shares of Class C common stock to be outstanding immediately after this offering |

15,920,291 shares, representing approximately 29.3% of the combined voting power of all of Shift4 Payments, Inc.’s common stock (or 15,129,252 shares, representing approximately 28.5% of the combined voting power of all of Shift4 Payments, Inc.’s common stock if the underwriters exercise in full their option to purchase additional shares of Class A common stock) and 35.8% of the economic interest in Shift4 Payments, Inc. and 19.9% of the indirect economic interest in Shift4 Payments, LLC (or 33.5% of the economic interest in Shift4 Payments, Inc. and 18.9% of the indirect economic interest in Shift4 Payments, LLC if the underwriters exercise in full their option to purchase additional shares of Class A common stock). |

| LLC Interests to be held by us immediately after this offering |

44,470,317 LLC Interests, representing approximately 55.6% of the economic interest in Shift4 Payments, LLC (or 45,152,348 LLC Interests, representing approximately 56.4% of the economic interest in Shift4 Payments, LLC if the underwriters exercise in full their option to purchase additional shares of Class A common stock). |

14

Table of Contents

| LLC Interests to be held by the Continuing Equity Owners immediately after this offering |

35,567,488 LLC Interests, representing approximately 44.4% of the economic interest in Shift4 Payments, LLC (or 34,885,457 LLC Interests, representing approximately 43.6% of the economic interest in Shift4 Payments, LLC if the underwriters exercise in full their option to purchase additional shares of Class A common stock). |

| Ratio of shares of Class A common stock and Class C common stock to LLC Interests |

The Shift4 Payments LLC Agreement requires that we and Shift4 Payments, LLC at all times maintain a one-to-one ratio between the aggregate number of shares of Class A common stock and Class C common stock issued by us and the number of LLC Interests owned by us. Searchlight and our Founder together owns 100% of the outstanding shares of our Class C common stock. |

| Ratio of shares of Class B common stock to LLC Interests |

The Shift4 Payments LLC Agreement requires that we and Shift4 Payments, LLC at all times maintain a one-to-one ratio between the number of shares of Class B common stock owned by Searchlight, our Founder and their respective permitted transferees and the number of LLC Interests owned by Searchlight, our Founder and their respective permitted transferees. Searchlight and our Founder together owns 100% of the outstanding shares of our Class B common stock. |

| Permitted holders of shares of Class B common stock |

Only Searchlight, our Founder (through Rook) and the permitted transferees of Class B common stock as described in this prospectus are permitted to hold shares of our Class B common stock. Shares of Class B common stock are transferable to permitted transferees only together with an equal number of LLC Interests (subject to certain exceptions). See “Certain Relationships and Related Party Transactions—Shift4 LLC Agreement.” |

| Permitted holders of shares of Class C common stock |

Only Searchlight, our Founder (through Rook) and the permitted transferees of Class C common stock as described in this prospectus are permitted to hold shares of our Class C common stock. If any such shares are transferred to any other person, they automatically convert into shares of Class A common stock. See “Certain Relationships and Related Party Transactions—Shift4 LLC Agreement.” |

| Voting rights |

Holders of shares of our Class A common stock, our Class B common stock and Class C common stock vote together as a single class on all matters presented to stockholders for their vote or approval, except as otherwise required by law or our amended and restated certificate of incorporation. Each share of our Class A common stock entitles its holders to one vote per share, each share of each of our Class B common stock entitles its holders to ten votes per share and each share of our Class C common stock entitles its holders to ten votes per share on all matters presented to our stockholders generally. See “Description of Capital Stock.” |

15

Table of Contents

| Redemption rights of holders of LLC Interests |

The Continuing Equity Owners may from time to time at each of their options require Shift4 Payments, LLC to redeem all or a portion of their LLC Interests (35,567,488 LLC Interests held by Continuing Equity Owners in the aggregate immediately after this offering (or 34,885,457 LLC Interests held by Continuing Equity Owners in the aggregate if the underwriters exercise in full their option to purchase additional shares of Class A common stock) in exchange for, at our election (determined solely by our independent directors (within the meaning of the rules of the NYSE) who are disinterested), newly-issued shares of our Class A common stock on a one-for-one basis or a cash payment equal to a volume weighted average market price of one share of our Class A common stock for each LLC Interest redeemed, in each case, in accordance with the terms of the Shift4 Payments LLC Agreement; provided that, at our election (determined solely by our independent directors (within the meaning of the rules of the NYSE) who are disinterested), we may effect a direct exchange by Shift4 Payments, Inc. of such Class A common stock or such cash, as applicable, for such LLC Interests. The Continuing Equity Owners may exercise such redemption right for as long as their LLC Interests remain outstanding. See “Certain Relationships and Related Party Transactions—Shift4 LLC Agreement.” Simultaneously with the payment of cash or shares of Class A common stock, as applicable, in connection with a redemption or exchange of LLC Interests pursuant to the terms of the Shift4 Payments LLC Agreement, a number of shares of our Class B common stock registered in the name of the redeeming or exchanging Continuing Equity Owner will be cancelled for no consideration on a one-for-one basis with the number of LLC Interests so redeemed or exchanged. |

| Use of proceeds |

We estimate that we will receive net proceeds from this offering of approximately $92.0 million, after deducting estimated underwriting discounts and commissions and offering expenses. We will not receive any of the proceeds from the sale of Class A common stock by the selling stockholders in this offering. We intend to use the net proceeds from this offering to purchase 2,000,000 LLC Interests directly from Shift4 Payments, LLC at a price per unit equal to the public offering price per share of Class A common stock in this offering less underwriting discounts and commissions. We cannot specify with certainty all of the uses of the net proceeds that we will receive from this offering. Accordingly, we will have broad discretion in the application of these proceeds. Shift4 Payments, LLC intends to use the net proceeds from the sale of LLC Interests to Shift4 Payments, Inc. for general corporate purposes. See “Use of Proceeds.” |

| Dividend policy |

We currently intend to retain all available funds and any future earnings to fund the development and growth of our business and to repay indebtedness, and therefore we do not anticipate declaring or paying any cash dividends on our Class A common stock in the foreseeable future. Holders of our Class B common stock are not |

16

Table of Contents

| entitled to participate in any dividends declared by our board of directors. Additionally, our ability to pay any cash dividends on our Class A common stock is limited by restrictions on the ability of Shift4 Payments, LLC and our other subsidiaries to pay dividends or make distributions under the terms of our Credit Facilities. Additionally, because we are a holding company, our ability to pay cash dividends on our Class A common stock depends on our receipt of cash distributions from Shift4 Payments, LLC and, through Shift4 Payments, LLC, cash distributions and dividends from our other direct and indirect wholly owned subsidiaries. Any future determination as to the declaration and payment of dividends, if any, will be at the discretion of our board of directors, subject to compliance with contractual restrictions and covenants in the agreements governing our current and future indebtedness. Any such determination will also depend upon our business prospects, results of operations, financial condition, cash requirements and availability, industry trends and other factors that our board of directors may deem relevant. See “Dividend Policy.” |

| Controlled company exception |

We are considered a “controlled company” for the purposes of the NYSE rules as Searchlight and our Founder have more than 50% of the voting power for the election of directors. See “Principal and Selling Stockholders.” As a “controlled company,” we are not subject to certain corporate governance requirements, including that: (1) a majority of our board of directors consists of “independent directors,” as defined under the NYSE rules; (2) we have a nominating and corporate governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; (3) we have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and (4) we perform annual performance evaluations of the nominating and corporate governance and compensation committees. As a result, we may not have a majority of independent directors on our board of directors, an entirely independent nominating and corporate governance committee, an entirely independent compensation committee or perform annual performance evaluations of the nominating and corporate governance and compensation committees unless and until such time as we are required to do so. |

| Tax receivable agreement |

We are party to the Tax Receivable Agreement with Shift4 Payments, LLC, the Continuing Equity Owners and the Blocker Shareholders that provides for the payment by Shift4 Payments, Inc. to the Continuing Equity Owners and the Blocker Shareholders of 85% of the amount of tax benefits, if any, that Shift4 Payments, Inc. actually realizes (or in some circumstances is deemed to realize) as a result of (1) increases in tax basis resulting from Shift4 Payments, Inc.’s purchase of LLC Interests directly and future redemptions funded by Shift4 Payments, Inc. or exchanges (or deemed exchanges in certain |

17

Table of Contents

| circumstances) of LLC Interests for Class A common stock or cash as described above under “—Redemption rights of holders of LLC Interests,” (2) our utilization of certain tax attributes of the Blocker Companies and (3) certain additional tax benefits attributable to payments made under the Tax Receivable Agreement. See “Certain Relationships and Related Party Transactions—Tax Receivable Agreement” for a discussion of the Tax Receivable Agreement. |

| Registration rights agreement |