Total Return Swap Contracts:

In a total return swap, one party receives a periodic payment equal to the total return of a specified security, basket of securities, index, or other reference asset for a specified period of time. In return, the other party receives a fixed or variable stream of payments, typically based upon short-term interest rates, possibly plus or minus an agreed upon spread. During the term of the outstanding swap agreement, changes in the value of the swap are recorded as unrealized appreciation and depreciation. Periodic payments received or made are recorded as realized gains or losses in the Statement of Operations. The Fund bears the risk of loss in the event of nonperformance by the swap counterparty. Risks may also arise from unanticipated movements in the value of exchange rates, interest rates, securities, index, or other reference asset.

C

OHEN

& S

TEERS

T

AX-

A

DVANTAGED

P

REFERRED

S

ECURITIES AND

I

NCOME

F

UND

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

Centrally Cleared Interest Rate Swap Contracts

: The Fund uses interest rate swaps in connection with borrowing under its revolving credit agreement. The interest rate swaps are intended to reduce interest rate risk by countering the effect that an increase in short-term interest rates could have on the performance of the Fund’s shares as a result of the floating rate structure of interest owed pursuant to the revolving credit agreement. When entering into interest rate swaps, the Fund agrees to pay the other party to the interest rate swap (which is known as the counterparty) a fixed rate payment in exchange for the counterparty’s agreement to pay the Fund a variable rate payment that was intended to approximate the Fund’s variable rate payment obligation on the revolving credit agreement. The payment obligation is based on the notional amount of the swap. Depending on the state of interest rates in general, the use of interest rate swaps could enhance or harm the overall performance of the Fund. Swaps are

daily and changes in the value are recorded as unrealized appreciation (depreciation).

Immediately following execution of the swap agreement, the swap agreement is novated to a central counterparty (the CCP) and the Fund’s counterparty on the swap agreement becomes the CCP. The Fund is required to interface with the CCP through a broker. Upon entering into a centrally cleared swap, the Fund is required to deposit initial margin with the broker in the form of cash or securities in an amount that varies depending on the size and risk profile of the particular swap. Securities deposited as initial margin are designated on the Schedule of Investments and cash deposited is recorded on the Statement of Assets and Liabilities as cash collateral pledged for interest rate swap contracts. The daily change in valuation of centrally cleared swaps is recorded as a receivable or payable for variation margin on interest rate swap contracts in the Statement of Assets and Liabilities. Any upfront payments paid or received upon entering into a swap agreement would be recorded as assets or liabilities, respectively, in the Statement of Assets and Liabilities, and amortized or accreted over the life of the swap and recorded as realized gain (loss) in the Statement of Operations. Payments received from or paid to the counterparty during the term of the swap agreement, or at termination, are recorded as realized gain (loss) in the Statement of Operations.

Swap agreements involve, to varying degrees, elements of market and counterparty risk, and exposure to loss in excess of the related amounts reflected on the Statement of Assets and Liabilities. Such risks involve the possibility that there will be no liquid market for these agreements, that the counterparty to the agreements may default on its obligation to perform or disagree as to the meaning of contractual terms in the agreements and that there may be unfavorable changes in interest rates.

Dividends and Distributions to Shareholders

: The Fund makes regular monthly distributions pursuant to the Policy. Dividends from net investment income and capital gain distributions are determined in accordance with U.S. federal income tax regulations, which may differ from GAAP. Dividends from net investment income, if any, are typically declared quarterly and paid monthly. Net realized capital gains, unless offset by any available capital loss carryforward, are typically distributed to shareholders at least annually. Dividends and distributions to shareholders are recorded on the

ex-dividend

date and are automatically reinvested in full and fractional shares of the Fund in accordance with the Fund’s Reinvestment Plan, unless the shareholder has elected to have them paid in cash. Dividends from net investment income are subject to recharacterization for tax purposes.

C

OHEN

& S

TEERS

T

AX-

A

DVANTAGED

P

REFERRED

S

ECURITIES AND

I

NCOME

F

UND

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

Distributions Subsequent to April 30, 2024

: The following distributions have been declared by the Fund’s Board of Trustees and are payable subsequent to the period end of this report.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5/31/24 |

|

$0.134 |

|

|

|

|

6/28/24 |

|

$0.134 |

|

|

|

|

7/31/24 |

|

$0.134 |

|

|

|

|

8/30/24 |

|

$0.134 |

|

|

|

|

9/30/24 |

|

$0.134 |

It is the policy of the Fund to continue to qualify as a regulated investment company (RIC), if such qualification is in the best interest of the shareholders, by complying with the requirements of Subchapter M of the Internal Revenue Code applicable to RICs, and by distributing substantially all of its taxable earnings to its shareholders. Also, in order to avoid the payment of any federal excise taxes, the Fund will distribute substantially all of its net investment income and net realized gains. Accordingly, no provision for federal income or excise tax is necessary. Dividends and interest income from holdings in

non-U.S.

securities are recorded net of

non-U.S.

taxes paid. Management has analyzed the Fund’s tax positions taken on federal and applicable state income tax returns as well as its tax positions in

non-U.S.

jurisdictions in which it trades for the current tax year and has concluded that as of April 30, 2024, no additional provisions for income tax are required in the Fund’s financial statements. The Fund’s tax positions for the current tax year for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service, state departments of revenue and by foreign tax authorities.

Note 2. Investment Management Fees, Administration Fees and Other Transactions with Affiliates

Investment Management Fees

: Cohen & Steers Capital Management, Inc. serves as the Fund’s investment manager pursuant to an investment management agreement (the investment management agreement). Under the terms of the investment management agreement, the investment manager provides the Fund with

investment decisions and generally manages the Fund’s investments in accordance with the stated policies of the Fund, subject to the supervision of the Board of Trustees.

For the services provided to the Fund, the investment manager receives a fee, accrued daily and paid monthly, at the annual rate of 1.00% of the average daily managed assets of the Fund. Managed assets are equal to the Fund’s net assets, plus the principal amount of loans from financial institutions or debt securities issued by the Fund, the liquidation preference of preferred shares issued by the Fund, if any, and the proceeds of any reverse repurchase agreements entered into by the Fund, if any.

: The Fund has entered into an administration agreement with the investment manager under which the investment manager performs certain administrative functions for the Fund and receives a fee, accrued daily and paid monthly, at the annual rate of 0.06% of the average daily managed assets of the Fund. For the six months ended April 30, 2024, the Fund incurred $508,936 in fees under this administration agreement. Additionally, the Fund pays State Street Bank and Trust Company as

co-administrator

under a fund accounting and administration agreement.

Trustees’ and Officers’ Fees:

Certain trustees and officers of the Fund are also directors, officers and/or employees of the investment manager. The Fund does not pay compensation to trustees and

C

OHEN

& S

TEERS

T

AX-

A

DVANTAGED

P

REFERRED

S

ECURITIES AND

I

NCOME

F

UND

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

officers affiliated with the investment manager except for the Chief Compliance Officer, who received compensation from the investment manager, which was reimbursed by the Fund, in the amount of $5,581 for the six months ended April 30, 2024.

Note 3. Purchases and Sales of Securities

Purchases and sales of securities, excluding short-term investments, for the six months ended April 30, 2024, totaled $545,913,793 and $510,981,423, respectively.

Note 4. Derivative Investments

The following tables present the value of derivatives held at April 30, 2024 and the effect of derivatives held during the six months ended April 30, 2024, along with the respective location in the financial statements.

Statement of Assets and Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Assets |

|

|

Liabilities |

|

|

|

Location |

|

|

Fair Value |

|

|

Location |

|

|

Fair Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Return Swap Contracts—Over-the-Counter |

|

|

— |

|

|

$ |

— |

|

|

|

Total return swap

contracts, at value |

|

|

$ |

100,386 |

|

|

|

|

|

|

Foreign Currency Exchange Risk: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forward Foreign Currency Exchange Contracts (a) |

|

|

Unrealized appreciation |

|

|

|

2,582,464 |

|

|

|

Unrealized depreciation |

|

|

|

203,440 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Rate Swap Contracts (b) |

|

|

Receivable for variation

margin on interest rate

swap contracts |

|

|

|

47,794,685 |

|

|

|

— |

|

|

|

— |

|

|

Forward foreign currency exchange contracts executed with Brown Brothers Harriman are not subject to a master netting agreement or another similar arrangement. |

|

Not subject to a master netting agreement or another similar arrangement. |

|

Amount represents the cumulative net appreciation (depreciation) on interest rate swap contracts as reported on the Schedule of Investments. The Statement of Assets and Liabilities only reflects the current day variation margin receivable from the broker. |

C

OHEN

& S

TEERS

T

AX-

A

DVANTAGED

P

REFERRED

S

ECURITIES AND

I

NCOME

F

UND

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized

Gain (Loss) |

|

|

Change in

Unrealized

Appreciation

(Depreciation) |

|

|

|

|

|

|

|

|

|

|

|

|

Total Return Swap Contracts |

|

Net Realized and Unrealized Gain (Loss) |

|

$ |

(2,034,007 |

) |

|

$ |

(206,244 |

) |

|

|

|

|

Foreign Currency Exchange Risk: |

|

|

|

|

|

|

|

|

|

|

Forward Foreign Currency Exchange Contracts |

|

Net Realized and Unrealized Gain (Loss) |

|

|

(636,073 |

) |

|

|

2,129,251 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Rate Swap Contracts |

|

Net Realized and Unrealized Gain (Loss) |

|

|

14,998,447 |

|

|

|

(10,773,114 |

) |

At April 30, 2024, the Fund’s derivative assets and liabilities (by type), which are subject to a master netting agreement, are as follows:

|

|

|

|

|

|

|

|

|

Derivative Financial Instruments |

|

Assets |

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

Total Return Swap Contracts—Over-the-Counter |

|

$ |

— |

|

|

$ |

100,386 |

|

The following table presents the Fund’s derivative assets and liabilities by counterparty net of amounts available for offset under a master netting agreement and net of the related collateral received and pledged by the Fund, if any, as of April 30, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Amount

of Liabilities

Presented

in the Statement

of Assets and

Liabilities |

|

|

Financial

Instruments

and Derivatives

Available

for Offset |

|

|

|

|

|

Net Amount of Derivative Liabilities (b) |

|

|

|

$ |

100,386 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

100,386 |

|

|

Collateral received or pledged is limited to the net derivative asset or net derivative liability amounts. Actual collateral amounts received or pledged may be higher than amounts above. |

|

Net amount represents the net receivable from the counterparty or net payable due to the counterparty in the event of default. |

C

OHEN

& S

TEERS

T

AX-

A

DVANTAGED

P

REFERRED

S

ECURITIES AND

I

NCOME

F

UND

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

The following summarizes the monthly average volume of the Fund’s interest rate swap contracts, total return swap contracts and forward foreign currency exchange contracts activity for the six months ended April 30, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Interest Rate

Swap

Contracts |

|

|

Total Return

Swap

Contracts |

|

|

Forward

Foreign

Currency

Exchange

Contracts |

|

Average Notional Amount (a) |

|

$ |

585,175,394 |

|

|

$ |

29,349,283 |

|

|

$ |

163,554,560 |

|

|

Average notional amounts represent the average for all months in which the Fund had interest rate swap contracts, total return swap contracts and forward foreign currency exchange contracts outstanding at month-end. For the period, this represents six months for interest rate swap contracts, six months for total return swap contracts and six months for forward foreign currency exchange contracts. |

Note 5. Income Tax Information

As of April 30, 2024, the federal tax cost and net unrealized appreciation (depreciation) in value of investments held were as follows:

|

|

|

|

|

Cost of investments in securities for federal income tax purposes |

|

$ |

1,737,605,251 |

|

|

|

|

|

|

Gross unrealized appreciation on investments |

|

$ |

75,019,169 |

|

Gross unrealized depreciation on investments |

|

|

(75,537,292 |

) |

|

|

|

|

|

Net unrealized appreciation (depreciation) on investments |

|

$ |

(518,123) |

|

|

|

|

|

|

As of October 31, 2023, the Fund has a net capital loss carryforward of $183,357,556 which may be used to offset future capital gains. These losses are a short-term capital loss carryforward of $19,572,851 and long-term capital loss carryforward of $163,784,705, which under current federal income tax rules, may offset capital gains recognized in any future period.

The Fund is authorized to issue an unlimited number of shares of beneficial interest at a par value of $0.001 per share.

The Fund did not issue any shares of common stock for the reinvestment of dividends during each of the six months ended April 30, 2024 and the year ended October 31, 2023.

On December 12, 2023, the Board of Trustees approved the continuation of the delegation of its authority to management to effect repurchases, pursuant to management’s discretion and subject to market conditions and investment considerations, of up to 10% of the Fund’s common shares outstanding (Share Repurchase Program) as of January 1, 2024 through December 31, 2024.

C

OHEN

& S

TEERS

T

AX-

A

DVANTAGED

P

REFERRED

S

ECURITIES AND

I

NCOME

F

UND

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

During the six months ended April 30, 2024 and the year ended October 31, 2023, the Fund did not effect any repurchases.

The Fund has entered into a $650,000,000 revolving credit agreement (the credit agreement) with State Street Bank and Trust Company (State Street) whereby funds may be drawn in U.S. dollars, Euros and Great British Pounds (GBP), subject to certain limitations. Borrowings under the credit agreement, which are secured by certain assets of the Fund, bear interest based on currency-specific variable rates plus a margin. The Fund pays a monthly financing charge which is calculated based on the utilized portion of the credit agreement and a Secured Overnight Financing Rate (SOFR)-based rate. The Fund also pays a fee of 0.15% per annum for each day in which the aggregate loans outstanding under the credit agreement total less than 80% of the credit agreement amount of $650,000,000. The credit agreement has a

360-day

evergreen provision whereby State Street may terminate this agreement upon 360 days’ notice, but the Fund may terminate on 3 days’ notice to State Street. Securities held by the Fund are subject to a lien, granted to State Street, to the extent of the borrowing outstanding in connection with the Fund’s revolving credit agreement. If the Fund fails to meet certain requirements, or maintain other financial covenants required under the credit agreement, the Fund may be required to repay immediately, in part or in full, the loan balance outstanding under the credit agreement, necessitating the sale of portfolio securities at potentially inopportune times.

As of April 30, 2024, the Fund had outstanding borrowings of $601,235,155 at a current rate of 6.0% on $560,000,000 and 5.9% on $33,000,000 (drawn in GBP expressed in USD 41,235,155). The carrying value of the borrowings approximates fair value. The borrowings are classified as Level 2 within the fair value hierarchy. During the year ended April 30, 2024, the Fund borrowed an average daily balance of $601,602,664 ($560,000,000 and $41,602,664 drawn in USD and GBP, respectively) at a weighted average borrowing cost of 6.1%. During the year ended April 30, 2024, the Fund had no outstanding borrowings in EUR.

On January 2, 2024, the Fund amended the credit agreement to reduce the commitment amount of the credit agreement from $720,000,000 to $650,000,000 and reduce the margin upon which the financing charge is calculated.

Risk of Market Price Discount from Net Asset Value

: Shares of

closed-end

investment companies frequently trade at a discount from their NAV. This characteristic is a risk separate and distinct from the risk that NAV could decrease as a result of investment activities and may be greater for investors expecting to sell their shares in a relatively short period following completion of this offering. Whether investors will realize gains or losses upon the sale of the shares will depend not upon the Fund’s NAV but entirely upon whether the market price of the shares at the time of sale is above or below the investor’s purchase price for the shares. Because the market price of the shares will be determined by factors such as relative supply of and demand for shares in the market, general market and economic

C

OHEN

& S

TEERS

T

AX-

A

DVANTAGED

P

REFERRED

S

ECURITIES AND

I

NCOME

F

UND

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

conditions, and other factors beyond the control of the Fund, Fund shares may trade at, above or below NAV, or at below or above the initial public offering price.

Preferred Securities Risk

: Preferred securities are subject to credit risk, which is the risk that a security will decline in price, or the issuer of the security will fail to make dividend, interest or principal payments when due, because the issuer experiences a decline in its financial status. Preferred securities are also subject to interest rate risk and may decline in value because of changes in market interest rates. The Fund may be subject to a greater risk of rising interest rates than would normally be the case in an environment of low interest rates and the effect of potential government fiscal policy initiatives and resulting market reaction to those initiatives. In addition, an issuer may be permitted to defer or omit distributions. Preferred securities are also generally subordinated to bonds and other debt instruments in a company’s capital structure. During periods of declining interest rates, an issuer may be able to exercise an option to redeem (call) its issue at par earlier than scheduled, and the Fund may be forced to reinvest in lower yielding securities. Certain preferred securities may be substantially less liquid than many other securities, such as common stocks. Generally, preferred security holders have no voting rights with respect to the issuing company unless certain events occur. Certain preferred securities may give the issuers special redemption rights allowing the securities to be redeemed prior to a specified date if certain events occur, such as changes to tax or securities laws.

Contingent Capital Securities Risk:

Contingent capital securities (sometimes referred to as “CoCos”) are debt or preferred securities with loss absorption characteristics built into the terms of the security, for example, a mandatory conversion into common stock of the issuer under certain circumstances, such as the issuer’s capital ratio falling below a certain level. Since the common stock of the issuer may not pay a dividend, investors in these instruments could experience a reduced income rate, potentially to zero, and conversion would deepen the subordination of the investor, hence worsening the investor’s standing in a bankruptcy. Some CoCos provide for a reduction in the value or principal amount of the security (potentially to zero) under such circumstances. In March 2023, a Swiss regulator required a write-down of outstanding CoCos to zero notwithstanding the fact that the equity shares continued to exist and have economic value. It is currently unclear whether regulators of issuers in other jurisdictions will take similar actions. Notwithstanding these risks, the Fund may continue to invest in CoCos issued by Swiss companies and by companies in other jurisdictions. In addition, most CoCos are considered to be high yield or “junk” securities and are therefore subject to the risks of investing in below investment-grade securities. Finally, CoCo issuers can, at their discretion, suspend dividend distributions on their CoCo securities and are more likely to do so in response to negative economic conditions and/or government regulation. Omitted distributions are typically

non-cumulative

and will not be paid on a future date. Any omitted distribution may negatively impact the returns or distribution rate of the Fund.

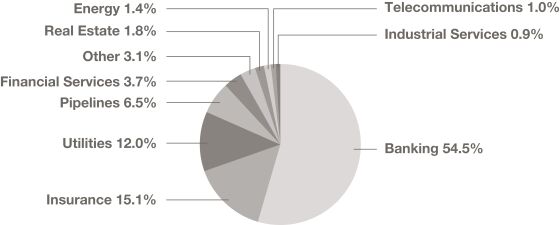

Because the Fund invests at least 25% of its managed assets in the financials sector, it will be more susceptible to adverse economic or regulatory occurrences affecting this sector, such as changes in interest rates, loan concentration and competition. In addition, the Fund will also be subject to the risks of investing in the individual industries and securities that comprise the financials sector, including the bank, diversified financials, real estate (including REITs) and insurance industries. To the extent that the Fund focuses its investments in other sectors or industries, such as (but not limited

C

OHEN

& S

TEERS

T

AX-

A

DVANTAGED

P

REFERRED

S

ECURITIES AND

I

NCOME

F

UND

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

to) energy, industrials, utilities, pipelines, health care and telecommunications, the Fund will be subject to the risks associated with these particular sectors and industries. These sectors and industries may be adversely affected by, among others, changes in government regulation, world events and economic conditions.

Credit and Below-Investment-Grade Securities Risk:

Preferred securities may be rated below-investment-grade or may be unrated. Below-investment-grade securities, or equivalent unrated securities, which are commonly known as “high-yield bonds” or “junk bonds,” generally involve greater volatility of price and risk of loss of income and principal, and may be more susceptible to real or perceived adverse economic and competitive industry conditions than higher grade securities. It is reasonable to expect that any adverse economic conditions could disrupt the market for lower-rated securities, have an adverse impact on the value of those securities and adversely affect the ability of the issuers of those securities to repay principal and interest on those securities.

Liquidity risk is the risk that particular investments of the Fund may become difficult to sell or purchase. The market for certain investments may become less liquid or illiquid due to adverse changes in the conditions of a particular issuer or due to adverse market or economic conditions. In addition, dealer inventories of certain securities, which provide an indication of the ability of dealers to engage in “market making,” are at, or near, historic lows in relation to market size, which has the potential to increase price volatility in the fixed income markets in which the Fund invests. Federal banking regulations may also cause certain dealers to reduce their inventories of certain securities, which may further decrease the Fund’s ability to buy or sell such securities. As a result of this decreased liquidity, the Fund may have to accept a lower price to sell a security, sell other securities to raise cash, or give up an investment opportunity, any of which could have a negative effect on performance. Further, transactions in less liquid or illiquid securities may entail transaction costs that are higher than those for transactions in liquid securities.

Foreign

(Non-U.S.)

Securities Risk:

The Fund directly purchases securities of foreign issuers. Risks of investing in foreign securities include currency risks, future political and economic developments and possible imposition of foreign withholding taxes on income or proceeds payable on the securities. In addition, there may be less publicly available information about a foreign issuer than about a domestic issuer, and foreign issuers may not be subject to the same accounting, auditing and financial recordkeeping standards and requirements as domestic issuers. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than securities of comparable U.S. issuers.

Although the Fund will report its NAV and pay dividends in U.S. dollars, foreign securities often are purchased with and make any dividend and interest payments in foreign currencies. Therefore, the Fund’s investments in foreign securities will be subject to foreign currency risk, which means that the Fund’s NAV could decline solely as a result of changes in the exchange rates between foreign currencies and the U.S. dollar. Certain foreign countries may impose restrictions on the ability of issuers of foreign securities to make payment of principal, dividends and interest to investors located outside the country, due to blockage of foreign currency exchanges or otherwise. The Fund may, but is not required to, engage in various investments that are designed to hedge the Fund’s

C

OHEN

& S

TEERS

T

AX-

A

DVANTAGED

P

REFERRED

S

ECURITIES AND

I

NCOME

F

UND

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

foreign currency risks, and such investments are subject to the risks described under “Derivatives and Hedging Transactions Risk” below.

The use of leverage is a speculative technique and there are special risks and costs associated with leverage. The NAV of the Fund’s shares may be reduced by the issuance and ongoing costs of leverage. So long as the Fund is able to invest in securities that produce an investment yield that is greater than the total cost of leverage, the leverage strategy will produce higher current net investment income for the shareholders. On the other hand, to the extent that the total cost of leverage exceeds the incremental income gained from employing such leverage, shareholders would realize lower net investment income. In addition to the impact on net income, the use of leverage will have an effect of magnifying capital appreciation or depreciation for shareholders. Specifically, in an up market, leverage will typically generate greater capital appreciation than if the Fund were not employing leverage. Conversely, in down markets, the use of leverage will generally result in greater capital depreciation than if the Fund had been unlevered. To the extent that the Fund is required or elects to reduce its leverage, the Fund may need to liquidate investments, including under adverse economic conditions which may result in capital losses potentially reducing returns to shareholders. The use of leverage also results in the investment advisory fees payable to the investment advisor being higher than if the Fund did not use leverage and can increase operating costs, which may reduce total return. There can be no assurance that a leveraging strategy will be successful during any period in which it is employed.

Derivatives and Hedging Transactions Risk:

The Fund’s use of derivatives, including for the purpose of hedging interest rate or foreign currency risks, presents risks different from, and possibly greater than, the risks associated with investing directly in traditional securities. Among the risks presented are counterparty risk, financial leverage risk, liquidity risk, OTC trading risk and tracking risk. The use of derivatives can lead to losses because of adverse movements in the price or value of the underlying asset, index or rate, which may be magnified by certain features of the derivatives.

: Occurrence of global events similar to those in recent years, such as war (including Russia’s military invasion of Ukraine), terrorist attacks, natural or environmental disasters, country instability, public health emergencies (including epidemics and pandemics), market instability, debt crises and downgrades, embargoes, tariffs, sanctions and other trade barriers and other governmental trade or market control programs, the potential exit of a country from its respective union and related geopolitical events, may result in market volatility and may have long-lasting impacts on U.S. and global economies and financial markets. Supply chain disruptions or significant changes in the supply or prices of commodities or other economic inputs may have material and unexpected effects on both global securities markets and individual countries, regions, sectors, companies or industries. Events occurring in one region of the world may negatively impact industries and regions that are not otherwise directly impacted by the events. Additionally, those events, as well as other changes in foreign and domestic political and economic conditions, could adversely affect individual issuers or related groups of issuers, securities markets, interest rates, secondary trading, credit ratings, inflation, investor sentiment and other factors affecting the value of the Fund’s investments.

On January 31, 2020, the United Kingdom (UK) withdrew from the European Union (EU) (referred to as Brexit). An agreement between the UK and the EU governing their future trade relationship

C

OHEN

& S

TEERS

T

AX-

A

DVANTAGED

P

REFERRED

S

ECURITIES AND

I

NCOME

F

UND

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

became effective January 1, 2021. Brexit has resulted in volatility in European and global markets and could have potentially significant negative long-term impacts on financial markets in the UK and throughout Europe.

On February 24, 2022, Russia launched a large-scale invasion of Ukraine significantly amplifying already existing geopolitical tensions. The United States and many other countries have instituted various economic sanctions against Russia, Russian individuals and entities and Belarus. The extent and duration of the military action, sanctions imposed and other punitive actions taken (including any Russian retaliatory responses to such sanctions and actions), and resulting disruptions in Europe and globally cannot be predicted, but could be significant and have a severe adverse effect on the global economy, securities markets and commodities markets globally, including through global supply chain disruptions, increased inflationary pressures and reduced economic activity. Ongoing conflicts in the Middle East could have similar negative impacts. To the extent the Fund has exposure to the energy sector, the Fund may be especially susceptible to these risks. Furthermore, in March 2023, the shut-down of certain financial institutions raised economic concerns over disruption in the U.S. banking system. There can be no certainty that the actions taken by the U.S. government to strengthen public confidence in the U.S. banking system will be effective in mitigating the effects of financial institution failures on the economy and restoring public confidence in the U.S. banking system. These disruptions may also make it difficult to value the Fund’s portfolio investments and cause certain of the Fund’s investments to become illiquid. The strengthening or weakening of the U.S. dollar relative to other currencies may, among other things, adversely affect the Fund’s investments denominated in

non-U.S.

dollar currencies. It is difficult to predict when similar events affecting the U.S. or global financial markets may occur, the effects that such events may have, and the duration of those effects.

: The U.S. government has proposed and adopted multiple regulations that could have a long-lasting impact on the Fund and on the mutual fund industry in general. The Securities and Exchange Commission’s (SEC) final rules, related requirements and amendments to modernize reporting and disclosure, along with other potential upcoming regulations, could, among other things, restrict the Fund’s ability to engage in transactions, impact flows into the Fund and/or increase overall expenses of the Fund. In addition to Rule

18f-4,

which governs the way derivatives are used by registered investment companies, the SEC, Congress, various exchanges and regulatory and self-regulatory authorities, both domestic and foreign, have undertaken reviews of the use of derivatives by registered investment companies, which could affect the nature and extent of instruments used by the Fund. The Fund and the instruments in which it invests may be subject to new or additional regulatory constraints in the future. While the full extent of all of these regulations is still unclear, these regulations and actions may adversely affect both the Fund and the instruments in which the Fund invests and its ability to execute its investment strategy. For example, climate change regulation (such as decarbonization legislation, other mandatory controls to reduce emissions of greenhouse gases, or related disclosure requirements) could significantly affect the Fund or its investments by, among other things, increasing compliance costs or underlying companies’ operating costs and capital expenditures. Similarly, regulatory developments in other countries may have an unpredictable and adverse impact on the Fund.

C

OHEN

& S

TEERS

T

AX-

A

DVANTAGED

P

REFERRED

S

ECURITIES AND

I

NCOME

F

UND

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent on claims that may be made against the Fund in the future and, therefore, cannot be estimated; however, based on experience, the risk of material loss from such claims is considered remote.

Note 10. Subsequent Events

Management has evaluated events and transactions occurring after April 30, 2024 through the date that the financial statements were issued, and has determined that no additional disclosure in the financial statements is required.

C

OHEN

& S

TEERS

T

AX-

A

DVANTAGED

P

REFERRED

S

ECURITIES AND

I

NCOME

F

UND

PROXY RESULTS (Unaudited)

Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund shareholders voted on the following proposals at the annual meeting held on April 25, 2024. The description of each proposal and number of shares voted are as follows:

|

|

|

|

|

|

|

|

|

Common Shares |

|

Shares Voted

for |

|

|

Authority

Withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

47,278,041 |

|

|

|

978,020 |

|

|

|

|

47,226,354 |

|

|

|

1,029,707 |

|

|

|

|

47,366,860 |

|

|

|

889,201 |

|