Table of Contents

Filed Pursuant to Rule 424(b)(4)

Registration No. 333-257400

PROSPECTUS

19,000,000 Class A common shares

(incorporated in the Cayman Islands)

This is an initial public offering of our Class A common shares, US$0.0001 par value per share of VTEX. We are offering 13,876,702 of the Class A common shares to be sold in this offering. The selling shareholders identified in this prospectus are offering an additional 5,123,298 Class A common shares. We will not receive any proceeds from the sale of Class A common shares (which will be converted from an equal number of Class B common shares held by them immediately prior to this offering) by the selling shareholders.

Prior to this offering, there has been no public market for our Class A common shares. The initial public offering price per Class A common share is US$19.00. Our Class A common shares have been approved for listing on The New York Stock Exchange, or NYSE, under the symbol “VTEX.”

Upon consummation of this offering, we will have two classes of common shares: our Class A common shares and our Class B common shares. The rights of the holders of Class A common shares and Class B common shares will be identical, except with respect to voting, conversion and transfer restrictions applicable to the Class B common shares. Each Class A common share will be entitled to one (1) vote. Each Class B common share will be entitled to ten (10) votes and will be convertible into one Class A common share automatically upon transfer, subject to certain exceptions. Class B common shares shall not be listed on any stock exchange and will not be publicly traded. Holders of Class A common shares and Class B common shares will vote together as a single class on all matters unless otherwise required by law.

Following this offering, our issued and outstanding Class B common shares, will represent 94.2% of the combined voting power of our outstanding common shares and 61.9% of our total equity ownership, assuming no exercise of the underwriters’ option to purchase additional Class A common shares. For further information, see “Description of Share Capital.” As a result, Geraldo do Carmo Thomaz Júnior and Mariano Gomide de Faria, our controlling shareholders, will control 57.6% of the combined voting power of our outstanding common shares following this offering, assuming no exercise of the underwriters’ option to purchase additional Class A common shares.

An entity advised by Tiger Global Management, LLC that is an affiliate of existing holders of our shares, has agreed to purchase US$50.0 million in Class A common shares in this offering at the initial public offering price. The underwriters will receive the same discount on any of our Class A common shares purchased by such potential purchaser as they will from any other Class A common shares sold to the public in this offering.

We are a “foreign private issuer” and an “emerging growth company” under the U.S. federal securities laws as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as a result, have elected to comply with certain reduced public company disclosure and reporting requirements. In addition, for as long as we remain an emerging growth company, we will qualify for certain limited exceptions from the Sarbanes-Oxley Act of 2002. Additionally, following the offering, we will be a “controlled company” within the meaning of the corporate governance standards and as such plan to rely on available exemptions from certain corporate governance requirements. See “Risk Factors—Risks Related to the Offering and Our Class A Common Shares—Our status as a controlled company and a foreign private issuer exempts us from certain of the corporate governance standards of the NYSE, limiting the protections afforded to investors” and “Risk Factors—Risks Related to the Offering and Our Class A Common Shares—As a foreign private issuer and an “emerging growth company” (as defined in the JOBS Act), we will have different disclosure and other requirements from U.S. domestic registrants and non-emerging growth companies. We may take advantage of exemptions from certain corporate governance regulations of the NYSE, and this may result in less protection for the holders of our Class A common shares.”

Investing in our Class A common shares involves a high degree of risk. See “Risk Factors” beginning on page 24 of this prospectus.

| Per Class A Common Share |

Total | |||||||

| Initial public offering price(1) |

US$ | 19.00 | US$ | 361,000,000 | ||||

| Underwriting discount and commissions(1)(2) |

US$ | 1.19 | US$ | 22,562,500 | ||||

| Proceeds to us (before expenses)(1)(3) |

US$ | 17.81 | US$ | 247,178,754 | ||||

| Proceeds to selling shareholders (before expenses)(3) |

US$ | 17.81 | US$ | 91,258,746 | ||||

| (1) | Assumes no exercise of the underwriters’ option to purchase additional Class A common shares. |

| (2) | See “Underwriting” for a description of all compensation payable to the underwriters. |

| (3) | See “Expenses of the Offering” for a description of all expenses (other than total underwriting discounts and commissions) payable in connection to this offering. |

We have granted the underwriters the right to purchase up to 2,850,000 additional Class A common shares from us, in each case, within 30 days from the date of this prospectus, at the initial public offering price, less underwriting discounts and commissions.

Neither the U.S. Securities and Exchange Commission, or SEC, nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We expect to deliver the Class A common shares against payment in New York, New York, on or about July 23, 2021, through the book-entry facilities of The Depository Trust Company.

Global Coordinators

| J.P. Morgan | Goldman Sachs & Co. LLC | BofA Securities |

Joint Bookrunners

| KeyBanc Capital Markets | Morgan Stanley | Itaú BBA |

The date of this prospectus is July 20, 2021.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

| Page | ||||

| CONTENTS |

| |||

| iii | ||||

| 1 | ||||

| 24 | ||||

| 74 | ||||

| 80 | ||||

| 82 | ||||

| 83 | ||||

| 84 | ||||

| 85 | ||||

| 86 | ||||

| 88 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

90 | |||

| 118 | ||||

| 143 | ||||

| 149 | ||||

| 153 | ||||

| 155 | ||||

| 176 | ||||

| 180 | ||||

| 185 | ||||

| 200 | ||||

| 201 | ||||

| 202 | ||||

| 203 | ||||

| 204 | ||||

| 207 | ||||

| F-1 | ||||

Unless the context otherwise requires, references in this prospectus to “VTEX,” “Company,” “we,” “our,” “ours,” “us” or similar terms refer to VTEX, together with its consolidated subsidiaries; references to the “Issuer” refer to VTEX, the company whose Class A common shares are being offered by this prospectus; references to “controlling shareholders” are to Geraldo do Carmo Thomaz Júnior and Mariano Gomide de Faria; and references to selling shareholders refer Geraldo do Carmo Thomaz Júnior, Mariano Gomide de Faria, André Spolidoro Ferreira Gomes, Rafael do Amaral Forte, Constellation Fund, SPC - Equities III, Alexandre Nucci Soncini, Marcelo Couto Ferreira and Gustavo Nascimento Rios.

Neither we, the selling shareholders, the underwriters, nor any of our or their respective agents have authorized anyone to give any information or make any representation about the offering that is different from, or in addition to that contained in the prospectus, the related registration statement, any free writing prospectus prepared by or on behalf of us or we may refer to you or in any of the materials that we have incorporated by reference into this prospectus. Neither we, the selling shareholders, the underwriters, nor any of our or their respective agents will have or take responsibility and can provide no assurance as to the reliability of any other information that others may give you.

i

Table of Contents

This prospectus is being used in connection with the offering of the Class A common shares in the United States and, to the extent described below, elsewhere. This offering is being made in the United States and elsewhere based solely on the information contained in this prospectus. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the Class A common shares. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

Neither we, the selling shareholders, the underwriters, nor any of our or their respective agents are offering or seeking offers to purchase the Class A common shares in any jurisdiction where such offers or sales are not permitted. We have not undertaken any efforts to qualify this offering for offers and sales to the public in any jurisdiction outside the United States, and we do not expect to make offers and sales to the public in jurisdictions located outside the United States (including Brazil). However, we may make offers and sales outside the United States in circumstances that do not constitute a public offer or distribution under applicable laws and regulations.

This offering is being made in the United States and elsewhere based solely on the information contained in this prospectus.

Notice to Investors Outside the United States. Neither we, the selling shareholders, the underwriters, nor any of our or their respective agents have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus in connection with this offering in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus or any such free writing prospectus must inform themselves about, and observe any restrictions relating to, the offering of our Class A common shares and the distribution of this prospectus and any such free writing prospectus outside the United States.

Notice to EEA Investors. In any European Economic Area, or EEA, Member State that has implemented the Prospectus Regulation, this communication is addressed only to and is only directed at qualified investors in that Member State within the meaning of the Prospectus Regulation.

This prospectus has been prepared on the basis that any offer of our Class A common shares in any Member State of the European Economic Area, or EEA (each, a “Relevant Member State”), will be made pursuant to an exemption under the Prospectus Regulation from the requirement to publish a prospectus for offers of shares. Accordingly, any person making or intending to make any offer within the EEA of our Class A common shares which are the subject of this offering may only do so in circumstances in which no obligation arises for us or any of the underwriters to publish a prospectus pursuant to Article 3 of the Prospectus Regulation in relation to such offer. Neither we, the selling shareholders, nor the underwriters have authorized, nor do they authorize, the making of any offer of our Class A common shares in circumstances in which an obligation arises for us or the underwriters to publish a prospectus for such offer.

For the purposes of this provision, the expression “Prospectus Regulation” means Regulation (EU) 2017/1129, and includes any relevant implementing measure in each Relevant Member State.

Notice to UK Investors. In the United Kingdom, this prospectus is addressed only to and directed at qualified investors who are (1) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or (2) high net worth entities and other persons

to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). Any investment or investment activity to which this prospectus relates is available only to relevant persons and will only be engaged with relevant persons. Any person who is not a relevant person should not act or rely on this prospectus or any of its contents.

ii

Table of Contents

VTEX is where commerce happens. Our platform is designed to be the Operating System for the commerce ecosystem. We enable enterprise brands and retailers to orchestrate their complex network of consumers, business partners, suppliers, and fulfillment providers. We are building the global digital commerce infrastructure that enables enterprises to be relevant for the modern, convenience-driven consumer.

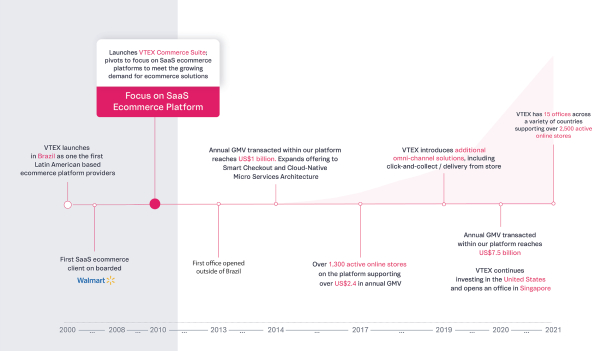

This journey started over twelve years ago when the largest retailer in the world chose us for a daring project: to implement their first online store in Brazil, one of the least penetrated, albeit fastest-growing ecommerce markets globally. We had a track record of successful ecommerce projects, and we offered them something few others could: speed to market. We promised to launch it within eight months, from kick-off to go-live. What we learned delivering on that promise shaped our vision for the industry — and the future of VTEX.

During those intense eight months, we realized that the challenges we encountered had nothing to do with generating revenue for our customer. Security, privacy, scalability, servers, deployment, testing — we tackled every issue, except how to engage with and amaze the end consumer. We were inspired by this complex challenge: how can a large, blue-chip company keep up with the fast-paced digital world while dealing with so much overhead? It became evident that enterprises had to find a way to move online without wasting time and resources on unnecessary complexities. The industry needed a scalable solution. We knew that VTEX could transform technology from being a burden into serving as a powerful accelerator for enterprises’ revenue growth.

Two years after we successfully launched the Walmart project, we took steps towards executing on this opportunity. This is VTEX today. Our platform provides the perfect combination of customization and speed-to-market for enterprises. By deploying our extensive out-of-the-box set of commerce capabilities, we enable even the most complex enterprises to move online and unlock the potential to start generating revenue quickly. They then learn from real-world scenarios what works and they adapt, doubling down on their core competencies. Finally, they turn their limitations into potential by leveraging the knowledge of natively integrated solutions provided by an ecosystem of digital commerce experts. All of this is powered by a reliable, cloud-based platform designed to provide security, privacy and scalability.

The decisions we made a decade ago laid the foundation for us to get here. Choosing software as a service over ad-hoc, on-premise installations meant renouncing quick cash flow in favor of developing a homogeneous, multi-tenant platform that improves with every new customer demand, for all customers at once. When we chose to foster an ecosystem of partners for implementation instead of delivering full-service projects, we created expansive reach, crucial for supporting our fast growth. Choosing revenue sharing as a central part of our business model aligns our incentives with our customers and encourages us to focus on their success. As our customers grow, we grow.

From day one, all we do is commerce. We attract, train and retain a high-performance team of digital commerce experts who help guide our customers to success while packaging industry knowledge into software. Our customers evolve their business by reconfiguring these composable building blocks of commerce capabilities, just like installing apps on your phone. Our partners take our solution even further by building new capabilities and distributing them through our platform to thousands of VTEX stores. Doing so, they scale faster and bring in more business, establishing a self-reinforcing cycle of success: as our customers grow, our ecosystem grows.

Our customers transacted just under US$8 billion of GMV through our platform last year alone. We are leaders in Latin America, the fastest-growing region for ecommerce in the world in 2020. This is a region six years behind other global economies in digital commerce penetration. We know what is coming, and we are prepared to capture that growth. We learned how to scale in a complex region, comprised of multiple countries, cultures, tax systems, and local payment and logistics providers.

iii

Table of Contents

Expanding from Brazil to Latin America and, more recently, to the rest of the world has prepared us to embrace challenges as intense opportunities to evolve as a team. Over the past 20 years, we have fostered a culture that values clear and precise communication: we strive to speak the truth and listen to each other with commitment, which requires great courage and vulnerability from our team members. The results are well worth it for everyone involved: we have developed a no-blame environment that enables fast-paced evolution, allowing us to realize our declared future, no matter the challenges we face.

The age of standalone software is gone — modern software is as valuable as the network it powers. In the future, we envision being at the center of a vast network that natively connects every part of the global digital commerce ecosystem. We see VTEX as the single control panel to manage all aspects of brands and retailers’ sales life-cycle, from engaging to selling and fulfilling. We are committed to creating a future-proof platform that makes collaboration scalable, enabling every organization to focus its talent on what makes it unique.

No matter what happens, one thing is certain: the future is about talent. We have taken it upon ourselves to create an abundance of diverse talent for our company and our ecosystem. We invest heavily in historically under-served yet high potential regions, co-creating centers of academic excellence to develop world-class, global-citizen digital workers. We foster the emerging market leaders who will build the next generation of disruptive technologies and global businesses. Education is our instrument of social impact.

We are here for the long run. We would like to invite future-driven investors to join us on this exciting journey as we build long-lasting foundations for the digital transformation of commerce. Our invitation goes beyond our organization’s (very much virtual) walls. It speaks to the size of the opportunity of digitalization in the emerging world: value creation is increasingly geographically distributed. We are witnessing a wave of emerging technology companies hungry for the opportunity to create prosperity in their respective regions. We know there is a transformative future ahead. We are here to accelerate it.

— Geraldo Thomaz Jr. & Mariano Gomide de Faria, 2021

iv

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important or relevant to you in making your investment decision. Before you decide to invest in our Class A common shares, we urge you to read this entire prospectus carefully, including our consolidated financial statements, and the notes thereto included elsewhere in this prospectus and the information set forth under the sections “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Overview

VTEX provides a software-as-a-service digital commerce platform for enterprise brands and retailers. Our platform enables our customers to execute their commerce strategy, including building online stores, integrating and managing orders across channels, and creating marketplaces to sell products from third-party vendors. Founded in Brazil, we have been a leader in accelerating the digital commerce transformation in Latin America and are expanding globally. Our platform is engineered to enterprise-level standards and functionality with approximately 80% of our GMV coming from large, blue-chip companies (i.e. customers with more than US$10 million of GMV per year). We are trusted by more than 2,000 customers with over 2,500 active online stores across 32 countries to connect with their consumers in a meaningful way.

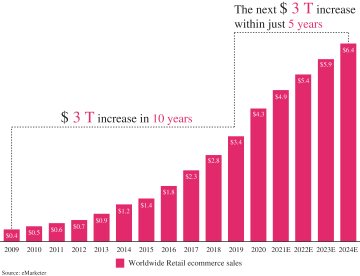

Global online retail spend has grown rapidly. Over the past decade, ecommerce spend has grown to US$3.0 trillion, and is projected to double to US$6.0 trillion over the next five years, according to Insider Intelligence. Latin America, in particular, was the fastest-growing region in the world in 2020, and yet ecommerce still represents a small fraction of the total retail market in the region. Accelerating ecommerce growth, evolving consumer expectations and the proliferation of digital shopping alternatives are raising the bar for brands and retailers to stay relevant. Legacy structures developed over years force enterprises to choose between deep customization and speed to market. Our technology combined with our ecosystem of partners solves this problem. We deliver flexibility and simplicity to complex, mission-critical commerce operations.

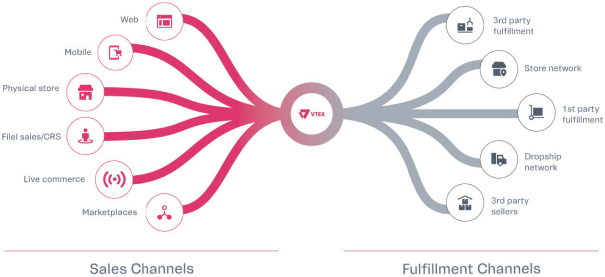

We enable our customers to implement multiple go-to-market strategies. Our platform natively combines commerce, order management and marketplace functionality, allowing enterprises to sell a wider assortment of products across more channels than ever before. By integrating with suppliers, distributors, third-party vendors, franchisees, warehouses, and brick-and-mortar stores, enterprises can rapidly implement new business models and digital experiences, including direct-to-consumer, marketplace, ship from store, endless aisle and drop-ship. We call this set of deep integrations “Collaborative Commerce.”

Our Collaborative Commerce approach benefits from a powerful ecosystem with significant network effects. Our ecosystem includes more than 1,000 integrated solutions, 200 systems integrators, 100 marketplaces, 80 payments solutions, and 50 logistics companies. Our partners’ solutions are embedded within our platform, allowing our customers to seamlessly execute their commerce vision and strategy. The more customers adopt our platform and partners join our network, the more efficiently we can help facilitate the future of commerce.

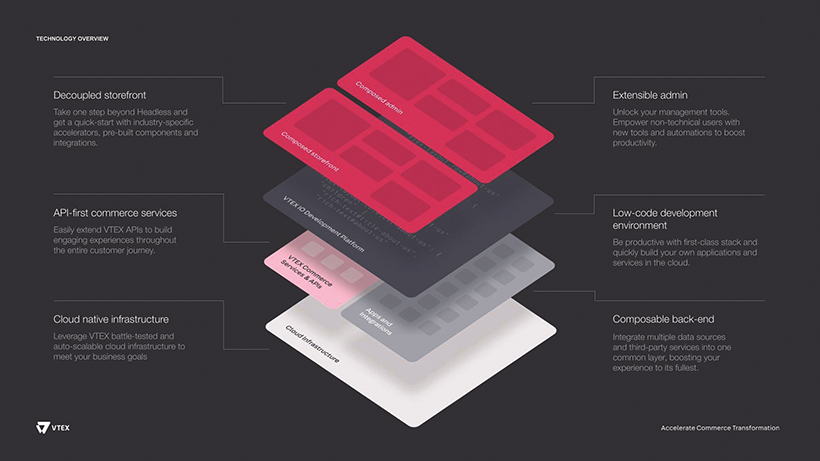

Our technology is flexible and extensible. Our open, API-first, multi-tenant commerce platform allows enterprises to adopt new commerce capabilities with minimal risk. Combined with our low-code development platform, VTEX IO, we enable our customers to build proprietary technology, seamlessly integrated with extensive out-of-the-box functionality. In essence, our “Composable Commerce” approach allows enterprises to leverage the knowledge of highly specialized talents from the VTEX ecosystem while focusing their own talent on what makes them unique. Composable Commerce enables our customers to rapidly deploy our solutions and quickly iterate and customize the entire commerce experience at scale.

1

Table of Contents

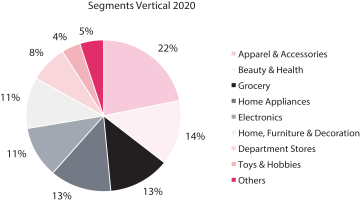

We serve a diversified mix of global enterprise brands and retailers executing on innovative opportunities. We enable manufacturers and CPG companies to execute their direct-to-consumer strategy on a global scale. We help fashion, grocery and other retailers to expand their reach through omnichannel, marketplace and drop-ship models. Our platform offers a variety of capabilities, including web, mobile and in-store sales, distributed order management, channel management, seller management, content and catalog management and fulfillment channel integrations. We help our customers rapidly execute their bespoke commerce strategies, and provide unprecedented time to revenue. VTEX was named a leader in the IDC MarketScape: Worldwide B2C Digital Commerce Platforms 2020 Vendor Assessment, and Gartner named us as a Visionary in its 2020 report, Magic Quadrant for Digital Commerce, Worldwide.

We have succeeded in attracting, developing and accelerating the careers of top talent from Latin America and across the globe. Throughout our history, we have carefully developed a high-performance culture that creates the conditions for individual growth and values the diversity of perspectives that challenges the status quo. Beyond attracting, we cultivate new talent through key partnership programs with top universities and world-class educational initiatives on digital commerce. We are proud to positively impact our society through education, nurturing a new generation of global digital citizens.

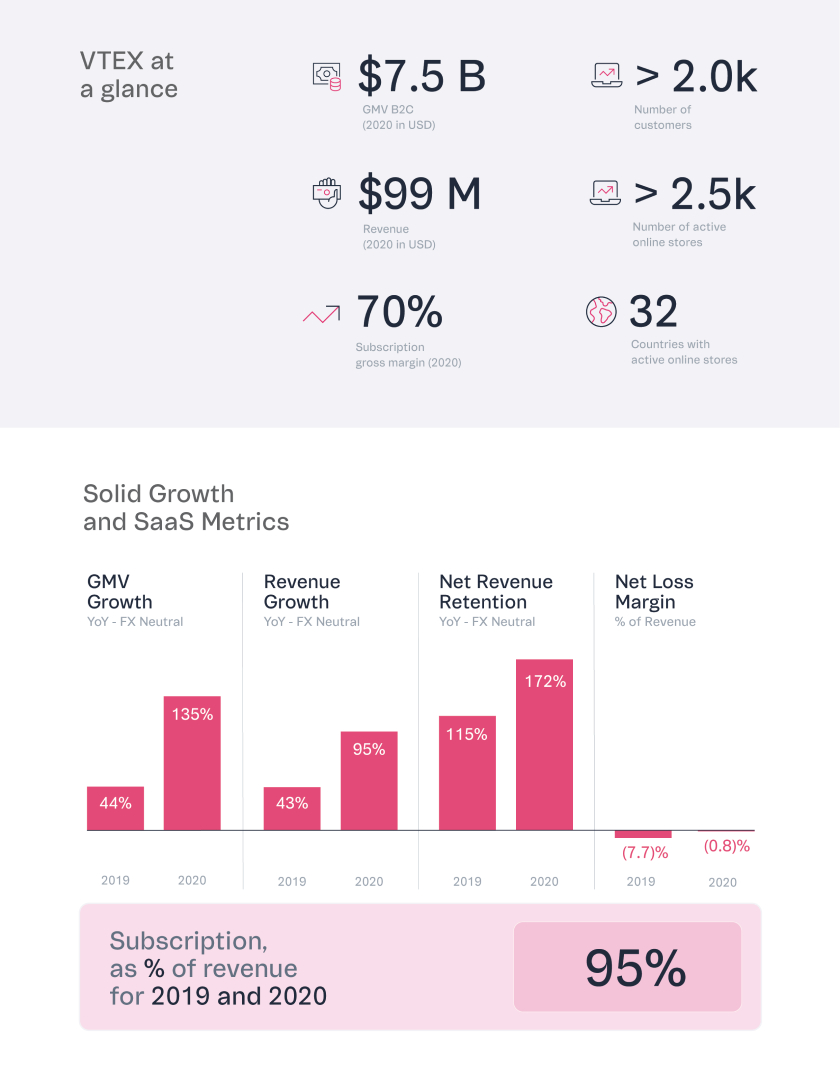

We guide our customers to success. Enterprises choose us as a strategic partner to accelerate their digital commerce transformation and deliver on revenue-generating initiatives. We deliver our platform through a subscription revenue model that includes both fixed and GMV-based variable components. This revenue model strategically aligns us with our customers: we grow by enabling them to grow. In the three months ended March 31, 2021 and in the year ended December 31, 2020, our customers generated US$2.0 billion and US$7.5 billion of GMV within our platform, respectively, up from US$1.0 billion and US$3.8 billion during the prior periods, representing, respectively a growth rate of 113.8% and 95.0%, or 142.3% and 134.9% on an FX neutral basis.

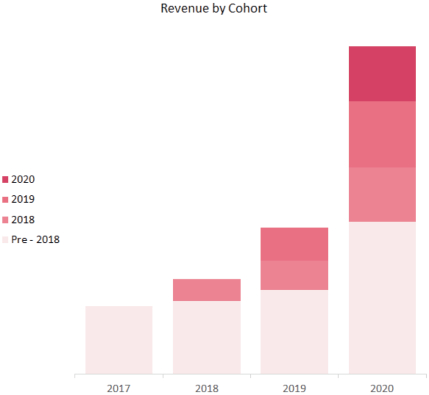

Our business has experienced significant growth. In the three months ended March 31, 2021, our revenue increased to US$25.9 million from US$16.6 million in the three months ended March 31, 2020 representing an increase of 55.8% and 77.0% on an FX neutral basis. In the same periods, we generated net losses of US$12.5 million and US$5.2 million, net cash used by operating activities of US$7.4 million and US$9.3 million and a negative Free Cash Flow of US$8.0 million and US$9.9 million, respectively. In the year ended December 31, 2020, our revenue increased to US$98.7 million from US$61.3 million in the year ended December 31, 2019, representing an increase of 60.9% and 95.3% on an FX neutral basis. In the same periods, we generated net losses of US$0.8 million and US$4.6 million, net cash provided by operating activities of US$11.2 million and US$2.1 million and Free Cash Flow of US$9.5 million and US$0.2 million, respectively.

Industry Overview and Trends

Ecommerce has evolved to meet the needs of the modern day customer. Today’s scalable platforms enable bespoke frameworks for customization and are often supported by a deep ecosystem of third-party functionality. Additionally, brands are seeing the importance of a direct-to-consumer channel that helps them control the consumer relationship and brand messaging. The impact of the COVID-19 pandemic accelerated the adoption of ecommerce, shifting significant shopping behavior from offline to online. Consumers now expect brands to make the shopping experience as convenient and seamless as possible across product discovery, purchasing and fulfillment. As such, retailers require enablement platforms with the scalability and flexibility to serve their consumer.

2

Table of Contents

Rapidly changing consumer preferences driving need for retailers to innovate

How consumers discover, learn about and ultimately purchase products is evolving due to digital transformation and advances in technology. The internet has enabled consumers to interact with merchants around the globe to find and purchase products that fit their specific needs and tastes.

Enterprises must address the breadth of consumer interaction points and potential sales channels, ensuring a satisfying consumer experience from discovery through delivery. Without an effective digital presence, retailers are often overlooked by consumers, lag behind competitors and have difficulty generating growth. Robust omnichannel solutions are now standard for an effective digital transformation strategy. However, significant ongoing innovation across marketing, inventory, payments and delivery are required to ensure enterprises are empowered to meaningfully connect with consumers and deliver seamless brand experiences across the entire shopping lifecycle.

Convenience-driven economy requires deep changes to complex, legacy supply chain networks

Consumers seek frictionless online experiences and the convenience and speed provided by on-demand delivery. Growing expectations for shorter on-demand delivery times require significant planning, coordination and execution to ensure supply chain networks are aligned to meet distribution and fulfillment. The intensity of global online and brick-and-mortar competition in retail drives businesses to meet the consumer where they are: at home or at work, and on-demand.

The technical requirements for fulfillment are complex and involve the synchronization of back-end systems, including those related to customer information, inventory, orders, products, payments and other data that originate in different sales channels. Brands and retailers have historically operated in silos based mostly on direct buy and sell transactions, and did not have the tools to collaborate in real-time around complex value chains. Additionally, many brands and retailers have supply chains with existing networks of in-store and warehouse distribution facilities, adding another level of complexity to optimize operational efficiency. As brands and retailers navigate these deep challenges, digital collaboration has emerged as a potential path for brands, retailers, suppliers and third-party providers to stay in constant contact with consumers to ensure frictionless distribution and fulfillment.

The need to deliver an authentic brand experience requires platforms that enable retailers to customize, build and scale businesses

Increasingly, consumers seek personalized experiences with brands, not just a point of sale for purchase. This has created a need for retailers to focus on design, simplicity and experience. Ecommerce has driven the proliferation of more personalized, direct-to-consumer brands. Vertically-integrated digitally native brands, or DNBs, sell products directly to consumers online, frequently bypassing third-party distribution and retailers, and often obviating the need for their own brick-and-mortar stores.

The growth in DNBs has corresponded with demand for turnkey ecommerce platforms that support both rapid product launch and scaling. Brands now have greater control over the narrative and image they convey to their customers. The proliferation of DNBs is driving the need for existing manufacturing brands to innovate in order to effectively compete. Strong manufacturing brands are generally ill-equipped to go direct-to-consumer. However, through collaboration and effective partnerships across areas, including payments, shipping, marketplace and POS, these retailers can remain competitive in delivering authentic brand experiences.

3

Table of Contents

Legacy software solutions are inadequate to serve the needs of 21st century brands and retailers

Legacy approaches to ecommerce software, consisting of open sourced licensed, owned and/or managed technology behind their ecommerce sites, are still prevalent in enterprises. We believe that while the market for digital commerce software solutions may be large and growing, the legacy solutions for enterprises do not effectively address the needs of digitizing brands, manufacturers and retailers in a fast-paced, evolving and competitive environment. Legacy solutions are largely characterized as:

| • | On-premise. Legacy on-premise solutions lack the flexibility and adaptability of SaaS solutions. These solutions are challenging, time intensive and expensive to update. |

| • | Lengthy deployment cycle. Traditional enterprise solutions typically have long and costly deployment cycles. In addition, legacy solutions tend to become overly complex and are not nimble enough to adapt to evolving market trends, new software requirements and emerging technologies. |

| • | Static. Enterprises test strategies and evolve rapidly as they transform digitally and discover new ways to engage and convert customers. Legacy solutions lack the flexibility to adapt to these requirements. |

| • | Disparate point solutions. Brands and retailers need integrated, seamless solutions that leverage data across multiple sources to optimize operational efficiencies. Legacy vendors typically provide point solutions that often fail to provide multi-channel sales capabilities, creating a complex patchwork of disparate technologies. |

| • | Security vulnerabilities. Security threats have become more sophisticated and continue to evolve such that enterprises continually face new and emerging security threats. Legacy solutions were not designed to handle these evolving threats. As a result, upgrading the protections in legacy software is challenging. |

Our Market Opportunity

Market opportunity in Latin America

Latin America is one of the largest and most diverse regions in the world. It is also among the largest growing economies in the world, with estimated GDP growth rate of 3.0% to US$4.0 trillion by 2025, according to IHS Markit, driven by technological advances and an emerging middle class. Comprised of over 40 countries with a total population of over 600 million, the region encompasses multiple languages, currencies and regulatory regimes. The size and complexity of the region present us with a significant opportunity as the geographic incumbent leader and a competitive advantage relative to solution providers that are less familiar with the intricacies of the region.

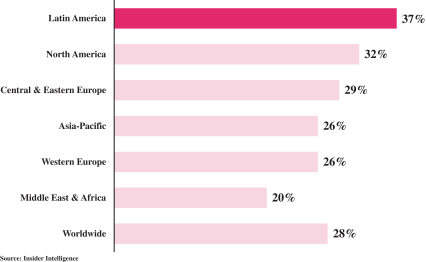

Latin America ecommerce is growing rapidly, yet still represents a small fraction of the total retail market. According to Insider Intelligence, ecommerce in Latin America grew to US$85.0 billion in 2020, a growth rate of 37% over 2019, making it the fastest-growing region among all major world regions. At the same time, it represents only approximately 6.2% of all total retail sales in the region, a lag of 6 years compared to current global ecommerce penetration of 18.0%, presenting an enormous opportunity and runway for growth as more sales shift online.

Market opportunity globally

The global ecommerce market has experienced rapid growth, driven by an acceleration of online penetration over the past 15 years. The impact of the COVID-19 pandemic further accelerated the adoption of ecommerce, which drove broader business growth while brick-and-mortar stores were closed and consumers increased their ecommerce spending due to extensive stay at home orders.

4

Table of Contents

Global GMV was estimated to be approximately US$4.0 trillion in 2020, and is expected to grow to approximately US$6.0 trillion by 2024, representing a compounded annual growth rate of 11.0%, according to Insider Intelligence. In the three months March 31, 2021 and in the year ended December 31, 2020, our platform processed US$2.0 billion and US$7.5 billion in GMV, respectively, the latter representing less than 0.5% of global GMV. As we continue to expand our platform offerings as well as our global reach, we expect to capture more of this GMV. We believe that our market will expand as consumers continue to shift purchases to online channels and brands and retailers adapt to evolving consumer preferences.

Our Solution

VTEX provides a SaaS digital commerce platform for enterprise brands and retailers. Our platform enables our customers to execute their commerce strategy, including building online stores, integrating and managing orders across channels, and creating marketplaces to sell products from third-party vendors. Our platform fully integrates commerce, marketplace and OMS solutions that enable our customers to manage product catalogs, optimize inventory, process orders and payments, and build even stronger brands that connect with their customers. We provide our customers with an innovative platform that:

| • | Drives comprehensive digital transformation. We provide a robust omnichannel commerce platform that can optimize existing in-store and distribution networks, integrate and manage multiple sales channels and seamlessly connect multiple fulfillment points. We deliver our solution through a Composable Commerce architecture that comprises a low-code development platform with a customizable and flexible back-end, decoupled storefront and pre-built integrations. Our fully extensible, API-first business capabilities enable customers to rapidly deploy commerce solutions and provide flexibility to build and customize the entire commerce experience at scale. |

| • | Collaborates with suppliers and partners. We provide a commerce platform that embraces digital collaboration to fuel growth, power innovation and build relationships online. |

| • | Strengthens the relationship between brands and their consumers. Our platform enables brands to offer compelling and consistent digital experiences across multiple channels and deliver their full brand experience directly to consumers. Our platform also offers the opportunity for manufacturers to build their own direct to consumer commerce capabilities to leverage the trust inspired by their products and reduce reliance on retailers for sales. |

| • | Provides a centralized technology hub. We provide a single point of control platform that integrates data across operations, and through our distributed OMS solution, we provide a 360-degree view of inventory and orders. Data generated by a direct digital commerce channel can be leveraged to increase sales, add new customers and maintain tighter control of a customer’s brand portfolio. |

| • | Provides security, scalability, reliability. Our pricing model, cloud infrastructure and built-in developer tooling helps ensure the VTEX platform is prepared to support our customers’ growth. The power of the VTEX platform comes from an auto-scaling, elastic cloud infrastructure that helps brands and retailers respond to market changes and customer demands in real-time. |

Our Competitive Strengths

We built our modern platform from the ground up to address the growing needs of enterprises, with the aim of creating simple, yet not simplistic, solutions. We guide our customers to success. Enterprises choose us as a strategic partner to accelerate their digital commerce transformation and deliver on revenue-generating initiatives. Our core strengths are:

| • | Market leadership in Latin America. We are the largest provider of digital commerce technology in Latin America. Our market leadership is driven by the strength and functionality of our platform and |

5

Table of Contents

| our expertise in delivering solutions that accommodate differences across regions, tax jurisdictions, and specific local consumer preferences. We are leveraging our regional expertise to enable our customers to reach global markets. |

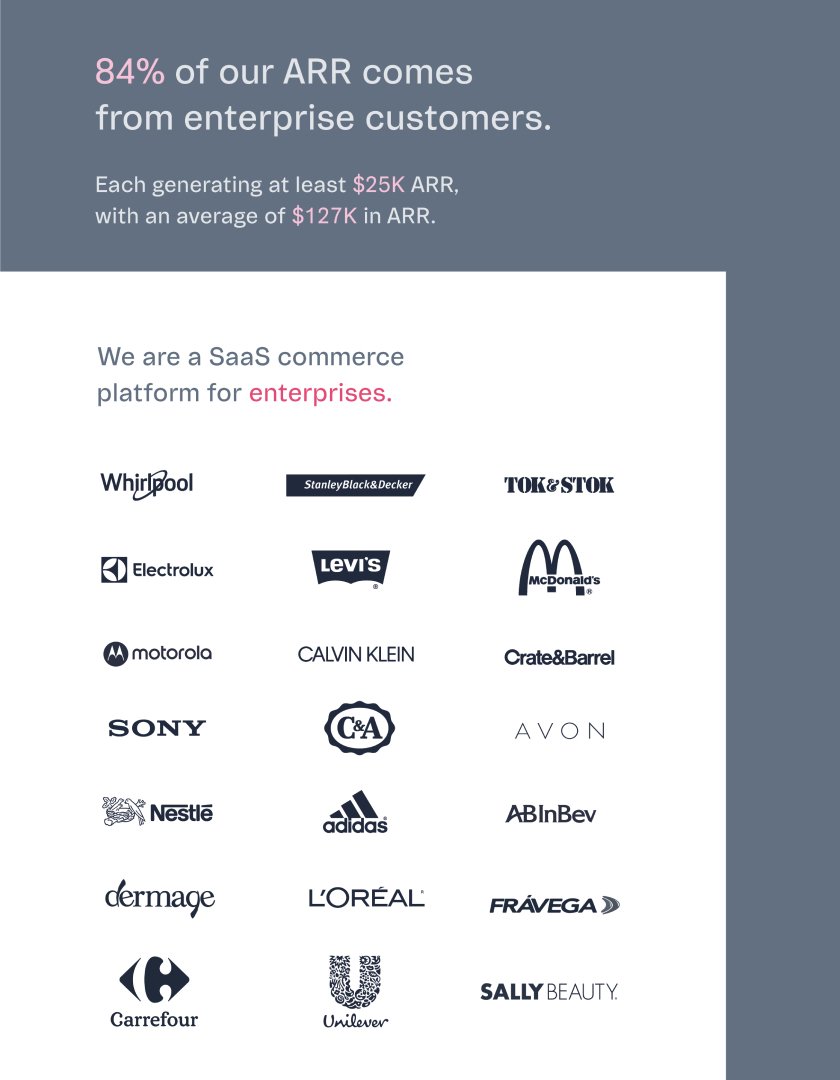

| • | Highly embedded, deep relationships with enterprises. We have a large, blue-chip customer base across a broad range of end markets, with over 2,000 customers across 32 countries. Approximately 84.1% of our ARR is derived from enterprise customers with active online stores, each generating more than US$25,000 in ARR and with an average ARR per active online store of US$127,428 as of December 31, 2020. Additionally, 85.6% of our enterprise revenues came from customers who have been on the VTEX platform for over one year, for the year ended December 31, 2020. |

| • | Strong alignment with our customers’ success. We deliver our platform through a subscription revenue model that includes both fixed and GMV-based variable components. This revenue model strategically aligns us with our customers: we grow as they grow. |

| • | Collaborative Commerce provides deep network effects from a powerful ecosystem of partners. We help unlock new revenue streams for our customers through collaborative opportunities with their suppliers and partners, as well as a rich ecosystem of hundreds of integrated solutions, SIs, and payments solutions. Our partners’ solutions are embedded within our platform, allowing our customers to seamlessly execute their commerce vision and strategy, and build valuable networks and effective marketplaces. It also lowers our customer acquisition costs through organic lead generation. |

| • | Composable Commerce enables rapid adaptability in a digital world and faster time to market. We provide our customers with a platform that is flexible, fast and easy to scale. We have a low-code development platform with fully extensible API-first business capabilities. Our customers operate on a single, global, continuously deployed, multi-tenant architecture that ensures that they are always using the latest technology. |

| • | High-performance culture based on commitment to innovation and execution. A strong passion for success motivates our team, and we embrace cooperation and collaboration to achieve our business goals. Our high-performance culture is driven by a commitment to listening, learning and diversity of perspectives that challenges the status quo. |

Growth Strategy

We have strong market leadership in Latin America, and expect to continue scaling with enterprise customers in high-growth markets across the broader Latin America region and across the world. Our growth strategy is driven by our mission to accelerate commerce transformation. Key elements of our strategy include:

| • | Grow our customer base. We believe that we have a significant opportunity to increase the size of our current customer base. We intend to continue to strategically invest in sales and marketing programs that enhance our customer reach as well as increase the awareness of our brand. |

| • | Grow GMV within existing customer base. Our goals are closely aligned with the goals of our customers. We grow with our existing customers in two primary ways: (1) we help our customers grow their GMV from existing online stores; and (2) we enable our customers to expand across regions or across brands by opening additional online stores. |

| • | Continuous innovation and expansion. We have invested and intend to continue to invest in our platform, including broadening our capabilities to meet the future needs of enterprises and their brands. We help our customers incorporate cutting-edge technologies and capabilities that emerge from our partners and the broader commerce ecosystem and therefore, meet the evolving needs of consumers. |

| • | Geographic expansion: We support the growth of our customers around the world by delivering a world-class platform and by expanding our regional capabilities, including sales and marketing, |

6

Table of Contents

| development and operations. Given our strong brand awareness and market position, we have historically focused geographic expansion to other regions within Latin America and believe that most of our growth will continue to come from Latin America. Over time, we believe our platform can compete successfully around the world, and, as such, we plan to continue investing in our operations across the United States and Europe. |

| • | Continue to grow and develop our ecosystem. We have a thriving third-party ecosystem, including providers for shipping, marketplaces, point-of-sale, omnichannel, marketing automation, search, merchandising, SIs, agencies, payments, anti-fraud and lending. We believe that growing our ecosystem will help to further expand our customer base by providing greater revenue opportunities from collaboration. |

Summary of Risk Factors

An investment in our Class A common shares is subject to a number of risks, including risks relating to our business and industry, risks related to Brazil and risks related to the offering and our Class A common shares. The following list summarizes some, but not all, of these risks. Please read the information in the section entitled “Risk Factors” for a more thorough description of these and other risks.

Risks Related to Our Business and Industry

| • | We have experienced significant growth in recent periods; however, we may be unable to sustain it. Our recent levels of growth may not be indicative of our future growth and will depend on our ability to attract new customers, retain existing customers and increase sales to both new or existing customers, particularly if the growth in ecommerce during the COVID-19 pandemic fails to continue after the COVID-19 pandemic ends. |

| • | If we are unable to attract new customers in a cost-effective manner, then our business, results of operations and financial condition would be adversely affected. |

| • | The COVID-19 pandemic could materially adversely affect our business, financial condition and results of operations. |

| • | If we fail to improve, enhance or innovate the features, functionality, performance, reliability, design, security and scalability of our platform in a manner that responds to our customers’ evolving needs or preferences, our business may be adversely affected and we may become subject to performance or warranty claims, and we may incur significant costs. Our services must also integrate with a variety of operating systems, software, hardware and networks. If we are unable to ensure that our services or hardware interoperate with such operating systems, software, hardware and networks, our business may be materially and adversely affected. |

| • | Failure to effectively develop and expand our marketing and sales capabilities could harm our ability to increase our customer base and achieve broader market acceptance of our platform. If we are not able to hire, develop and retain talented marketing personnel, or if our new marketing personnel are unable to develop and execute efficient inbound and branding marketing programs in a reasonable period of time, or if our sales and marketing strategies are not effective to generate traffic and build a top of mind brand, our ability to attract new customers may be impaired. |

| • | A cyberattack, security breach or other unauthorized access or interruption to our information technology systems or those of our third-party service providers could delay or interrupt service to our customers and their consumers, harm our reputation or subject us to significant liability. |

| • | Our business is subject to United States and foreign data privacy, data protection and information security laws, regulations, rules, standards, policies and contractual and other legal obligations, and our |

7

Table of Contents

| customers may also be subject to such laws and regulations. Any actual or perceived failure of our products to comply with or enable our customers to comply with such applicable laws and regulations would harm our business, results of operations and financial condition. |

| • | If we fail to maintain or grow our brand recognition, our ability to expand our customer base will be impaired and our financial condition may suffer. |

| • | We could incur substantial costs in maintaining, enforcing, protecting or defending our intellectual property and proprietary rights. Failure to adequately obtain, maintain, enforce and protect our intellectual property and proprietary rights could impair our competitive position and cause us to lose valuable assets, experience reduced revenue and incur costly litigation. |

| • | In connection with the preparation of our consolidated financial statements for the year ended December 31, 2020, we identified a number of material weaknesses in our internal control over financial reporting as of December 31, 2020. The material weaknesses identified relate to our insufficient accounting resources and processes necessary to comply with the reporting and compliance requirements of IFRS and the SEC. We are in the process of adopting a remediation plan to improve our internal control over financial reporting, but there is no assurance that our efforts will be effective or prevent any future material weaknesses in our internal control over financial reporting. |

Risks Related to Latin America

| • | Governments have a high degree of influence in Brazil and the other economies in which we operate. The effects of this influence and political and economic conditions in Brazil and Latin America could harm us and the trading price of our Class A common shares. |

| • | Significant foreign currency exchange controls and currency devaluation in certain countries in which we operate, which may have adverse effects on the economies of such countries, us and the price of our Class A common shares. |

| • | The ongoing economic uncertainty and political instability in Brazil and the other countries in which we operate, including as a result of ongoing investigations, may harm us and the price of our Class A common shares. |

| • | Inflation and certain government measures to curb inflation may have adverse effects on the economies of the countries where we operate, our business and the price of our Class A common shares. |

| • | Any further downgrading of the credit rating of Brazil or of other countries in which we operate could reduce the trading price of our Class A common shares. |

Risks Related to the Offering and Our Class A Common Shares

| • | There is no existing market for our common shares, and we do not know whether one will develop to provide you with adequate liquidity. If our share price fluctuates after this offering, you could lose a significant part of your investment. |

| • | The market price of our shares may be volatile or may decline sharply or suddenly, regardless of our operating performance, and we may not be able to meet investors’ or analysts’ expectations. You may not be able to resell your shares for the initial offer price or above it and you may lose all or part of your investment. |

| • | Requirements associated with being a public company in the United States will require significant company resources and management attention. |

8

Table of Contents

| • | Our controlling shareholders will, in the aggregate own 61.1% of our outstanding Class B common shares, which represent approximately 57.6% of the voting power of our issued capital and 37.8% of our total equity ownership following the offering, and will control all matters requiring shareholder approval. Our controlling shareholders also have the right to nominate a majority of our board of directors and consent rights over certain corporate transactions. This concentration of ownership limits your ability to influence corporate matters. |

| • | The disparity in voting rights among classes of our shares may have a potential adverse effect on the price of our Class A common shares, and may limit or preclude your ability to influence corporate matters. |

Recent Developments

Certain Preliminary Results for the Second Quarter of 2021

Our financial results for the three months ended June 30, 2021 are not yet finalized. The following table reflects certain preliminary financial and other metrics for the periods indicated:

| For the three months ended June 30, | ||||||||||||

| 2020 | 2021 | |||||||||||

| Unaudited | Low (estimated) |

High (estimated) |

||||||||||

| (in US$ millions except as otherwise indicated) | ||||||||||||

| Total revenue |

25.3 | 30.4 | 30.9 | |||||||||

| Subscription revenue |

23.9 | 29.2 | 29.7 | |||||||||

| Gross profit |

17.8 | 18.2 | 18.7 | |||||||||

| Subscription gross profit(1) |

18.1 | 19.7 | 20.2 | |||||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) from operation |

6.1 | (17.2 | ) | (15.6 | ) | |||||||

| Reconciliation of Non-GAAP Loss from Operation |

||||||||||||

| Income (loss) from operation |

6.1 | (17.2 | ) | (15.6 | ) | |||||||

| Share-based compensation expense(2) |

0.4 | 5.2 | 4.8 | |||||||||

| Amortization of intangibles related to acquisitions |

0.2 | 0.5 | 0.4 | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP Income (Loss) from Operation |

6.8 | (11.5 | ) | (10.4 | ) | |||||||

| Other financial metric |

||||||||||||

| Total revenue growth - FX Neutral (%)(3) |

— | 16.4 | % | 18.2 | % | |||||||

| (1) | Corresponds to our subscription revenues minus our subscription costs. |

| (2) | Includes payroll taxes relating to our restricted stock units granted from October 2020. See below “—Share-Based Compensation for the Second Quarter of 2021.” |

| (3) | See “Presentation of Financial and Other Information—Special Note Regarding Non-GAAP Financial Measures—FX Neutral measures,” for information on how we calculate FX Neutral measures. |

9

Table of Contents

The table below present our preliminary estimates of the following key operating metric for the periods indicated:

| For the three months ended June 30, | ||||||||

| 2020 | 2021 | |||||||

| Unaudited | Estimated | |||||||

| (in US$ millions except as otherwise indicated) | ||||||||

| Key Operating Metric: |

||||||||

| GMV |

1,870.8 | 2,439.7 | ||||||

| GMV Growth - FX Neutral (%)(1) |

178.0 | % | 25.6 | % | ||||

| (1) | See “Presentation of Financial and Other Information—Special Note Regarding Non-GAAP Financial Measures—FX Neutral measures,” for information on how we calculate FX Neutral measures. |

Cautionary Statement Regarding Preliminary Results

The above preliminary results, including the non-GAAP measures referred to above, are preliminary, unaudited and subject to completion, reflect our management’s current views and may change as a result of our management’s review of results and other factors, including a wide variety of significant business, economic and competitive risks and uncertainties. While the above preliminary results have been prepared in good faith and based on information available at the time of preparation, no assurance can be made that actual results will not change as a result of our management’s review of results and other factors. The preliminary results presented above are subject to finalization and closing of our accounting books and records (which have yet to be performed) and should not be viewed as a substitute for full quarterly financial statements prepared in accordance with IFRS. The preliminary results depend on several factors, including weaknesses in our internal controls and financial reporting process (as described under “Risk Factors”). In addition, the estimates and assumptions underlying the preliminary results include, among other things, economic, competitive, regulatory and financial market conditions and business decisions that may not be accurately reflected and that are inherently subject to significant uncertainties and contingencies, including, among others, risks and uncertainties described in the section entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements,” all of which are difficult to predict and many of which are beyond our control. There can be no assurance that the underlying assumptions or estimates will be realized; while we do not expect that our estimated preliminary results will differ materially from our actual results for the three months ended June 30, 2021, we cannot assure you that our estimated preliminary results for the three months ended June 30, 2021 will be indicative of our financial results for future interim periods or for the full year ending December 31, 2021. As a result, the preliminary results cannot necessarily be considered predictive of actual operating results for the periods described above, and this information should not be relied on as such. You should read this information together with the sections of this prospectus entitled “Selected Financial and Other Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our audited consolidated financial statements and our unaudited interim condensed consolidated financial statements and their respective notes included elsewhere in this prospectus.

The preliminary results included in this prospectus have been prepared by, and are the responsibility of our management. PricewaterhouseCoopers Auditores Independentes has not audited, reviewed, compiled, or applied agreed-upon procedures with respect to the preliminary results. Accordingly, PricewaterhouseCoopers Auditores Independentes does not express an opinion or any other form of assurance with respect thereto.

By including in this prospectus a summary of certain preliminary results regarding our financial and operating results, neither we, the selling shareholders, nor any of our respective advisors or other representatives has made or makes any representation to any person regarding our ultimate performance compared to the information contained in the preliminary results and actual results may materially differ from those described above.

10

Table of Contents

Share-Based Compensation for the Second Quarter 2021

VTEX provided share-based compensation during the second quarter of 2021 to selected officers and employees. See note 26 of our unaudited condensed consolidated financial statements and note 27 of our audited consolidated financial statements.

Under both our stock-option plan and terms of our restricted stock units, or RSUs, the securities have a term of seven years as of the grant date and are exercisable as long as the officer or employee fulfills the worked periods after the options are granted (normally 4 or 5 years, with 1/4 or 1/5 of the options exercisable each year).

Set out below are summaries of options granted under the plan during the second quarter of 2021:

| Number of Options (thousands) |

Weighted Average Exercise Price (US$) |

Remaining Contractual Terms in Years |

Weighted Average Grant Date Fair Value |

|||||||||||||

| At March 31, 2021 |

8,690 | 3.83 | 5.97 | 1.04 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Granted during the period(1) |

954 | 11.31 | — | 5.19 | ||||||||||||

| Forfeit during the period |

(54 | ) | 8.89 | — | 4.72 | |||||||||||

| Exercised during the period |

(152 | ) | 0.67 | — | 0.52 | |||||||||||

| At June 30, 2021 |

9,438 | 4.62 | 5.86 | 1.45 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Stock options exercisable as of June 30, 2021 |

2,177 | 2.62 | 5.07 | 0.46 | ||||||||||||

| (1) | 308,450 stock options were granted on May 3, 2021, and 646,000 stock options were granted on June 17, 2021. |

The fair value of the stock options granted was calculated based on the Binomial model taking in consideration the average contract term. The model inputs for options included:

| • | Exercise Price - Average price weighted by the quantity granted; |

| • | Target Asset Price – represents the fair value of our common share. See below “—Common Share Valuation”; |

| • | Risk-Free Interest Rate - US Treasury interest rate, pursuant to the contractual term; |

| • | Volatility - According to comparable peer entities listed on the stock exchange. |

The weighted average inputs used in this period were:

| • | Target Asset Price – US$11.31 per share |

| • | Risk-Free Interest Rate – 1.28% |

| • | Volatility – 51.14% |

Set forth below are summaries of RSU options granted under the plan during the second quarter of 2021:

| Number of RSUs (thousands) |

Weighted Average Grant Date Fair Value |

|||||||

| At March 31, 2021 |

3,036 | 2.57 | ||||||

|

|

|

|

|

|||||

| RSU granted(1) |

559 | 11.31 | ||||||

| Forfeit during the period |

(237 | ) | 0.94 | |||||

| Settled |

(193 | ) | 0.48 | |||||

|

|

|

|

|

|||||

| At June 30, 2021 |

3,165 | 4.36 | ||||||

| (1) | 433,700 RSUs were granted on May 3, 2021, and 125,000 RSUs were granted on June 17, 2021. |

11

Table of Contents

The fair value of the restricted stock units granted was calculated using the same “Target Asset Price” used in the stock options appraisal model.

Common Share Valuation

The fair value of US$11.31 relating to our common shares that underlie the stock options and RSU granted during the second quarter of 2021 has been determined by our board of directors based upon information available to it at the time of grants during the period. Because, prior to this offering, there has been no public market for our common shares, our board of directors has determined the fair value of our common shares by utilizing objective and subjective factors to determine our best estimate of the fair value of our common shares, including:

| • | a contemporaneous third-party valuation conducted as of April 1, 2021 (the “Valuation Study”); |

| • | the US$8.84 price per common share agreed upon when executing the most recent round of third-party investment in September 2020; |

| • | our recent operating and financial performance and forecast, including our significant growth during the COVID-19 pandemic and the structural shifts favoring ecommerce caused by such events; |

| • | current business conditions; |

| • | the likelihood of achieving a liquidity event for our common shares, such as an initial public offering or sale of our company; |

| • | any adjustment necessary to recognize a lack of marketability for our common shares, which was applied since the shareholder had limited opportunities to sell the shares and any such sale would involve significant transaction costs; |

| • | the market performance of comparable publicly-traded technology companies; and |

| • | the U.S. and global capital market conditions. |

The Valuation Study was prepared in accordance with the guidelines outlined in the American Institute of Certified Public Accountants Practice Aid, Valuation of Privately-Held-Company Equity Securities Issued as Compensation. The findings of the Valuation Study were based on our business and general economic, market and other conditions that could be reasonably evaluated at that time. The analyses of the Valuation Study included a review of our company, including its financial results, business agreements and capital structure. The Valuation Study also included a review of the conditions of the industry in which we operate and the markets that we serve.

The methodologies of the valuation study included an analysis of the fair market value of our common shares using three widely accepted valuation methodologies: (1) income approach (discounted cash flow), (2) market approach: guideline public company method (common stock equivalents), and (3) recent transactions. The Valuation Study weighted the methodologies based on the facts and circumstances available at that time. These valuation methodologies were based on a number of assumptions, including our future revenues and industry, general economic, market and other conditions that could reasonably be evaluated at the time of the valuation. Below is a more detailed description of the three valuation methodologies incorporated in the Valuation Study:

| • | Income approach (discounted cash flow): In the Income Approach, future cash flows expected to be generated by us are discounted to the present value using a discount rate that is commensurate with the risk inherent in the projected cash flows. The discounted cash flow (“DCF”) method was prepared based on cash flows projected through calendar year-end 2025. Our expected future cash flows are then discounted to present value using a discount rate that appropriately reflects the Company’s stage of development, cost of capital and risk profile. This methodology was weighted at 25.00%, and a discount of 10% for lack of marketability was applied. |

12

Table of Contents

| • | Market approach: guideline public company method (common stock equivalents): The Guideline (or Comparable) Publicly Traded Company Methodology within the Market Approach relies on an analysis of publicly traded companies similar in industry and/or business model to us. In this methodology, we used these guideline companies to develop relevant market multiples and ratios, using metrics such as revenue, earnings before interest and taxes (EBIT), earnings before interest, taxes, depreciation and amortization (EBITDA), net income and/or tangible book value. These multiples and values were then applied to our corresponding financial metrics. Since no two companies are perfectly comparable, premiums or discounts may be applied to our metrics if its position in its industry is significantly different from the position of the guideline companies, or if its intangible attributes are significantly different. The publicly traded guideline companies were selected based on consideration of the following: business descriptions, operations and geographic presence, financial size and performance, stock liquidity, and management recommendations regarding most similar companies. This methodology was weighted at 50.00%, and a discount of 5% for lack of marketability was applied. |

| • | Recent Transactions: The most recent round of third-party investment was in September 2020, and the purchase price was US$8.84 per share. The transaction was carried out on an arm’s length basis, meaning among other things that due diligence was performed, and negotiation was conducted to establish the terms of the investment. Taking the structure and size of the financing into consideration, this methodology was weighted at 25.00%. |

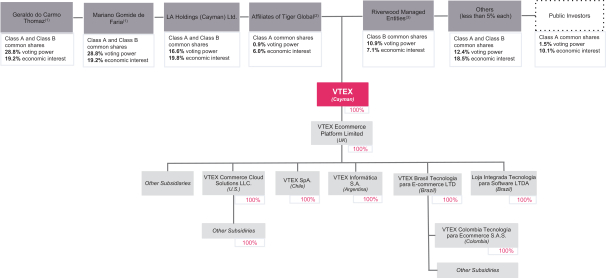

Our Corporate Structure and Information

The following chart presents our corporate structure, including controlling shareholders and subsidiaries immediately after the completion of this offering, assuming no exercise of the underwriters’ option to purchase additional Class A common shares.

| (1) | Includes common shares held of record by Imbetiba Fund Inc., Mira Limited, Abrolhos One Limited, and Mr. do Carmo Thomaz Júnior Mr. Gomide de Faria and Mr. do Carmo Thomaz Júnior may be deemed to beneficially own shares held of record by these entities and individual. |

| (2) | Consists of common shares held by Tiger Global Private Investment Partners XII, L.P. and other entities or persons affiliated with Tiger Global Management, LLC. See “Principal and Selling Shareholders” for additional information. |

13

Table of Contents

| (3) | Consists of common shares held by Data Center Holding II LLC, IT Brazil Group II LLC, RCP II Brazil Holdings LLC and RCP II (Parallel B) Brazil Holdings LLC. See “Principal and Selling Shareholders” for additional information. |

Our principal executive office is located at 125 Kingsway, London, England – WC2B 6NH, UK. Our registered office is located at 4th floor, Harbour Place, 103 South Church Street, PO Box 10240, Grand Cayman, KYI-1002, Cayman Islands. Our principal website is www.vtex.com. The information contained in, or accessible through, our website is not incorporated into this prospectus or the registration statement of which it forms a part and does not form part of, this prospectus, and you should not consider such information to be part of this prospectus or in deciding whether to invest in our Class A common shares.

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos and website names. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without the ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual revenues of at least US$1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our shares that is held by non-affiliates exceeds US$700.0 million as of the prior June 30, and (2) the date on which we have issued more than US$1.07 billion in non-convertible debt during the prior three-year period. As an emerging growth company, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies in the United States that are not emerging growth companies including, but not limited to, exemptions from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, and any Public Company Accounting Oversight Board, or PCAOB, rules, including any future audit rule promulgated by the PCAOB (unless the SEC determines otherwise). Accordingly, the information about us available to you will not be the same as, and may be more limited than, the information available to shareholders of a non-emerging growth company. In addition, under the JOBS Act, emerging growth companies can delay adopting new or revised U.S. GAAP accounting standards until such time as those standards apply to private companies. Given that we currently report and expect to continue to report under IFRS as issued by the International Accounting Standards Board, or IASB, we will not be able to avail ourselves of this extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required by the IASB.

Conventions that Apply to this Prospectus

Except as otherwise indicated or the context requires, all information in this prospectus assumes:

| • | the further amendment and restatement of our Articles of Association, each of which will occur immediately prior to the completion of this offering; and |

| • | no exercise by the underwriters of their option to purchase up to 2,850,000 additional Class A common shares from us and the selling shareholders, in connection with the offering. |

14

Table of Contents

When the selling shareholders consummate sales of Class B common shares in this offering, the Class B common shares sold will automatically convert into Class A common shares on a share-for-share basis. As a result, purchasers of our common shares in this offering will only receive Class A common shares, and only Class A common shares are being offered by this prospectus. Class B common shares that are not sold by the selling shareholders will remain Class B common shares unless otherwise converted into Class A common shares. See “Description of Share Capital.”

15

Table of Contents

The Offering

This summary highlights information presented in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all the information you should consider before investing in our Class A common shares. You should carefully read this entire prospectus before investing in our Class A common shares including “Risk Factors,” our unaudited interim condensed consolidated financial statements and our consolidated financial statements.

| Issuer |

VTEX |

| Class A common shares offered by us |

13,876,702 Class A common shares (or 16,726,702 Class A common shares if the underwriters exercise in full their option to purchase additional Class A common shares from us). |

| Class A common shares offered by the selling shareholders |

5,123,298 Class A common shares. We will not receive any proceeds from the sale of any Class A common shares by the selling shareholders. |

| Class A common shares outstanding before the offering |

54,424,944 Class A common shares. |

| Class A common shares outstanding after the offering |

71,389,544 Class A common shares, if the underwriters do not exercise their option to purchase additional Class A common shares from us and 74,239,544 Class A common shares if the underwriters exercise in full their option to purchase additional Class A common shares from us. |

| Class B common shares outstanding before the offering |

118,956,934 Class B common shares. |

| Class B common shares outstanding after the offering |

115,869,036 Class B common shares. |

| Offering price |

US$19.00 per Class A common share. |

| Indication of interest |

An entity advised by Tiger Global Management, LLC that is an affiliate of existing holders of our shares, has agreed to purchase US$50.0 million in Class A common shares in this offering at the initial public offering price. The underwriters will receive the same discount on any of our Class A common shares purchased by such potential purchaser as they will from any other Class A common shares sold to the public in this offering. |

| Voting rights |

The Class A common shares will be entitled to one (1) vote per share, whereas the Class B common shares (which are not being sold in this offering) will be entitled to ten (10) votes per share. |

| Each Class B common share may be converted into one Class A common share at the option of the holder. |

16

Table of Contents

| If, at any time, the total number of the issued and outstanding Class B common shares is less than 10% of the total number of shares outstanding, then each Class B common share will convert automatically into one Class A common share. |

| In addition, each Class B common share will convert automatically into one Class A common share upon any transfer, except for certain transfers to other holders of Class B common shares or their affiliates or to certain unrelated third parties as described under “Description of Share Capital—Conversion.” |

| Holders of Class A common shares and Class B common shares will vote together as a single class on all matters unless otherwise required by law and subject to certain exceptions set forth in our Articles of Association as described under “Description of Share Capital—Voting Rights.” |

| Upon consummation of this offering, assuming no exercise of the underwriters’ option to purchase additional Class A common shares, (1) holders of Class A common shares will hold approximately 5.8% of the combined voting power of our outstanding common shares and approximately 38.1% of our total equity ownership and (2) holders of Class B common shares will hold approximately 94.2% of the combined voting power of our outstanding common shares and approximately 61.9% of our total equity ownership. |

| If the underwriters exercise their option to purchase additional Class A common shares in full, (1) holders of Class A common shares will hold approximately 6.0% of the combined voting power of our outstanding common shares and approximately 39.1% of our total equity ownership and (2) holders of Class B common shares will hold approximately 94.0% of the combined voting power of our outstanding common shares and approximately 60.9% of our total equity ownership. |

| The rights of the holders of Class A common shares and Class B common shares are identical, except with respect to voting, conversion and transfer restrictions applicable to the Class B common shares. See “Description of Share Capital” for a description of the material terms of our common shares and the difference between Class A and Class B common shares. |

| Option to purchase additional Class A common shares |

We have granted the underwriters the right to purchase up to an additional 2,850,000 Class A common shares from us within 30 days of the date of this prospectus, at the public offering price, less underwriting discounts and commissions, on the same terms as set forth in this prospectus. |

| Listing |

Our Class A common shares have been approved for listing on the NYSE, under the symbol “VTEX.” |

17

Table of Contents

| Use of proceeds |

We estimate that the net proceeds to us from the offering will be approximately US$245.3 million (or US$296.0 million if the underwriters exercise in full their option to purchase additional Class A common shares), and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for general corporate purposes, which may include investments for the development of software, products or technologies, investments in the international expansion of our operations, funding future opportunistic mergers, acquisitions or investments in complementary businesses, and maintaining liquidity. We will have broad discretion in allocating a portion of the net proceeds from this offering. See “Use of Proceeds.” |

| Share capital before and after offering |

As of the date of this prospectus, our authorized share capital is US$210,000 consisting of 2,100,000,000 common shares of par value US$0.0001 each. |

| Immediately after the offering, we will have 71,389,544 Class A common shares outstanding and 115,869,036 Class B common shares outstanding, assuming no exercise of the underwriters’ option to purchase additional Class A common shares. |

| Dividend policy |

The amount of any distributions will depend on many factors, such as our results of operations, financial condition, cash requirements, prospects and other factors deemed relevant by our board of directors and shareholders. We currently intend to retain all available funds and future earnings, if any, to fund the development and expansion of our business and we do not anticipate paying any cash dividends in the foreseeable future. See “Dividends and Dividend Policy.” |

| Lock-up agreements |