0001792789DEF 14Afalse00017927892022-01-012022-12-31iso4217:USD00017927892021-01-012021-12-3100017927892020-01-012020-12-310001792789dash:StockAwardsAdjustmentsMemberecd:PeoMember2022-01-012022-12-310001792789ecd:NonPeoNeoMemberdash:StockAwardsAdjustmentsMember2022-01-012022-12-310001792789dash:StockAwardsAdjustmentsMemberecd:PeoMember2021-01-012021-12-310001792789ecd:NonPeoNeoMemberdash:StockAwardsAdjustmentsMember2021-01-012021-12-310001792789dash:StockAwardsAdjustmentsMemberecd:PeoMember2020-01-012020-12-310001792789ecd:NonPeoNeoMemberdash:StockAwardsAdjustmentsMember2020-01-012020-12-310001792789dash:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2022-01-012022-12-310001792789ecd:NonPeoNeoMemberdash:EquityAwardsGrantedDuringTheYearUnvestedMember2022-01-012022-12-310001792789dash:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2021-01-012021-12-310001792789ecd:NonPeoNeoMemberdash:EquityAwardsGrantedDuringTheYearUnvestedMember2021-01-012021-12-310001792789dash:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2020-01-012020-12-310001792789ecd:NonPeoNeoMemberdash:EquityAwardsGrantedDuringTheYearUnvestedMember2020-01-012020-12-310001792789dash:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2022-01-012022-12-310001792789ecd:NonPeoNeoMemberdash:EquityAwardsGrantedDuringTheYearVestedMember2022-01-012022-12-310001792789dash:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2021-01-012021-12-310001792789ecd:NonPeoNeoMemberdash:EquityAwardsGrantedDuringTheYearVestedMember2021-01-012021-12-310001792789dash:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2020-01-012020-12-310001792789ecd:NonPeoNeoMemberdash:EquityAwardsGrantedDuringTheYearVestedMember2020-01-012020-12-310001792789dash:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2022-01-012022-12-310001792789ecd:NonPeoNeoMemberdash:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310001792789dash:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2021-01-012021-12-310001792789ecd:NonPeoNeoMemberdash:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310001792789dash:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2020-01-012020-12-310001792789ecd:NonPeoNeoMemberdash:EquityAwardsGrantedInPriorYearsUnvestedMember2020-01-012020-12-310001792789dash:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2022-01-012022-12-310001792789ecd:NonPeoNeoMemberdash:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310001792789dash:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2021-01-012021-12-310001792789ecd:NonPeoNeoMemberdash:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310001792789dash:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2020-01-012020-12-310001792789ecd:NonPeoNeoMemberdash:EquityAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-310001792789dash:EquityAwardAdjustmentsMemberecd:PeoMember2022-01-012022-12-310001792789ecd:NonPeoNeoMemberdash:EquityAwardAdjustmentsMember2022-01-012022-12-310001792789dash:EquityAwardAdjustmentsMemberecd:PeoMember2021-01-012021-12-310001792789ecd:NonPeoNeoMemberdash:EquityAwardAdjustmentsMember2021-01-012021-12-310001792789dash:EquityAwardAdjustmentsMemberecd:PeoMember2020-01-012020-12-310001792789ecd:NonPeoNeoMemberdash:EquityAwardAdjustmentsMember2020-01-012020-12-31000179278912022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| | |

| DoorDash, Inc. |

| (Name of Registrant as Specified In Its Charter) |

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | | | | | | |

| | DOORDASH, INC. 303 2nd STREET, SOUTH TOWER, 8th FLOOR SAN FRANCISCO, CALIFORNIA 94107 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held at 10:00 am Pacific Time on Tuesday, June 20, 2023

Dear Stockholders of DoorDash, Inc.:

We cordially invite you to attend the 2023 annual meeting of stockholders (the “Annual Meeting”) of DoorDash, Inc., a Delaware corporation, to be held on June 20, 2023 at 10:00 am Pacific Time. The Annual Meeting will be conducted virtually via live audio webcast. You will be able to attend the Annual Meeting virtually by visiting www.virtualshareholdermeeting.com/DASH2023, where you will be able to listen to the meeting live, submit questions, and vote online.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. Therefore, we urge you to promptly vote and submit your proxy via the Internet, by telephone, or by mail.

We are holding the Annual Meeting for the following purposes, as more fully described in the accompanying proxy statement:

1.To elect three Class III directors to serve until the 2026 annual meeting of stockholders and until their successors are duly elected and qualified;

2.To ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2023;

3.To approve, on an advisory basis, the compensation of our named executive officers; and

4.To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

Our board of directors has fixed the close of business on April 21, 2023 as the record date for the Annual Meeting. Stockholders of record on April 21, 2023 are entitled to notice of and to vote at the Annual Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement.

The accompanying proxy statement and our annual report can be accessed by visiting: www.proxyvote.com. You will be asked to enter the 16-digit control number located on your proxy card.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting, we urge you to submit your vote via the Internet, telephone, or mail as soon as possible to ensure your shares are represented. For additional instructions on voting by telephone or the Internet, please refer to your proxy card. Returning the proxy does not deprive you of your right to attend the Annual Meeting and to vote your shares at the Annual Meeting.

By order of the Board of Directors,

Tony Xu

Co-Founder, Chief Executive Officer, and Chair of the Board

San Francisco, California

April 28, 2023

TABLE OF CONTENTS

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Policies and Procedures for Related Person Transactions | |

| |

| |

| |

GENERAL INFORMATION

DOORDASH, INC.

PROXY STATEMENT

FOR 2023 ANNUAL MEETING OF STOCKHOLDERS

to be held at 10:00 am Pacific Time on Tuesday, June 20, 2023

This proxy statement and the form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use at the 2023 annual meeting of stockholders of DoorDash, Inc., a Delaware corporation, and any postponements, adjournments, or continuations thereof (the “Annual Meeting”). The Annual Meeting will be held on Tuesday, June 20, 2023 at 10:00 am Pacific Time. You will be able to attend the Annual Meeting virtually by visiting www.virtualshareholdermeeting.com/DASH2023, where you will be able to listen to the meeting live, submit questions, and vote online. The Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this proxy statement and our annual report is first being mailed on or about April 28, 2023 to all stockholders entitled to vote at the Annual Meeting.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of certain information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

What matters am I voting on?

You are being asked to vote on:

•the election of three Class III directors to serve until the 2026 annual meeting of stockholders and until their successors are duly elected and qualified;

•a proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2023;

•a proposal to approve, on an advisory basis, the compensation of our named executive officers; and

•any other business as may properly come before the Annual Meeting.

How does the board of directors recommend I vote on these proposals?

Our board of directors recommends a vote:

•“FOR” the election of the Class III director nominees named in this proxy statement;

•“FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2023; and

•“FOR” the approval, on an advisory basis, of the compensation of our named executive officers.

How many votes are needed for approval of each proposal?

Proposal No. 1: Each director is elected by a majority of the votes cast with respect to the election of directors at the Annual Meeting. A majority of votes cast means that the voting power of the shares cast “For” a director’s election exceeds the voting power of the shares cast “Against” that director. You may vote “For” or “Against” the nominee for election as a director or you may “Abstain”. Abstentions and broker non-votes will have no effect on the outcome of the vote. If the director does not receive a majority of the votes cast “For” their election, he or she will be required by our amended and restated bylaws to resign or will be subject to removal. For more information, see “Proposal No. 1 - Election of Directors-Vote Required-Resignation Requirement”.

Proposal No. 2: The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2023, requires the affirmative vote of a majority of the voting power of the shares of our common stock present virtually or represented by proxy at the Annual Meeting and entitled to vote thereon. You may vote “For,” “Against,” or “Abstain” with respect to this proposal. Abstentions are considered shares present and entitled to vote on this proposal, and thus, will have the same effect as a vote “Against” this proposal.

Proposal No. 3: The approval, on an advisory basis, of the compensation of our named executive officers requires the affirmative vote of a majority of the voting power of the shares of our common stock present virtually or represented by proxy at the Annual Meeting and entitled to vote thereon. You may vote “For,” “Against,” or “Abstain” with respect to this proposal. Abstentions are considered shares present and entitled to vote on this proposal, and thus, will have the same effect as a vote “Against” this proposal. Broker non-votes will have no effect on the outcome of this proposal. Because this proposal is an advisory vote, the result will not be binding on our board of directors or any committee thereof or our company. Our board of directors and our leadership development, inclusion, and compensation committee (“compensation committee”) will consider the outcome of the vote when determining named executive officer compensation.

Who is entitled to vote?

Holders of our Class A and Class B common stock as of the close of business on April 21, 2023, the record date for the Annual Meeting, may vote at the Annual Meeting. As of the record date, there were 360,751,963 shares of our Class A common stock outstanding and 27,727,840 shares of our Class B common stock outstanding. Our Class A common stock and Class B common stock will vote as a single class on all matters described in this proxy statement for which your vote is being solicited. Stockholders are not permitted to cumulate votes with respect to the election of directors. Each share of Class A common stock is entitled to one vote on each proposal and each share of Class B common stock is entitled to 20 votes on each proposal. Our Class A common stock and Class B common stock are collectively referred to in this proxy statement as our “common stock.”

Registered Stockholders. If shares of our common stock are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered the stockholder of record with respect to those shares, and the Notice was provided to you directly by us. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote live at the Annual Meeting. Throughout this proxy statement, we refer to these registered stockholders as “stockholders of record.”

Street Name Stockholders. If shares of our common stock are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in “street name,” and the Notice was forwarded to you by your broker or nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank, or other nominee as to how to vote your shares. Beneficial owners are also invited to attend the Annual Meeting. However, since a beneficial owner is not the stockholder of record, you may

not vote your shares of our common stock live at the Annual Meeting unless you follow your broker’s procedures for obtaining a legal proxy. If you request a printed copy of our proxy materials by mail, your broker, bank, or other nominee will provide a voting instruction form for you to use. Throughout this proxy statement, we refer to stockholders who hold their shares through a broker, bank, or other nominee as “street name stockholders.”

Are a certain number of shares required to be present at the Annual Meeting?

A quorum is the minimum number of shares required to be present at the Annual Meeting to properly hold an annual meeting of stockholders and conduct business under our amended and restated bylaws and Delaware law. The presence, virtually or by proxy, of a majority of the voting power of all issued and outstanding shares of our common stock entitled to vote at the Annual Meeting will constitute a quorum at the Annual Meeting. Abstentions and broker non-votes are counted as shares present and entitled to vote for purposes of determining a quorum.

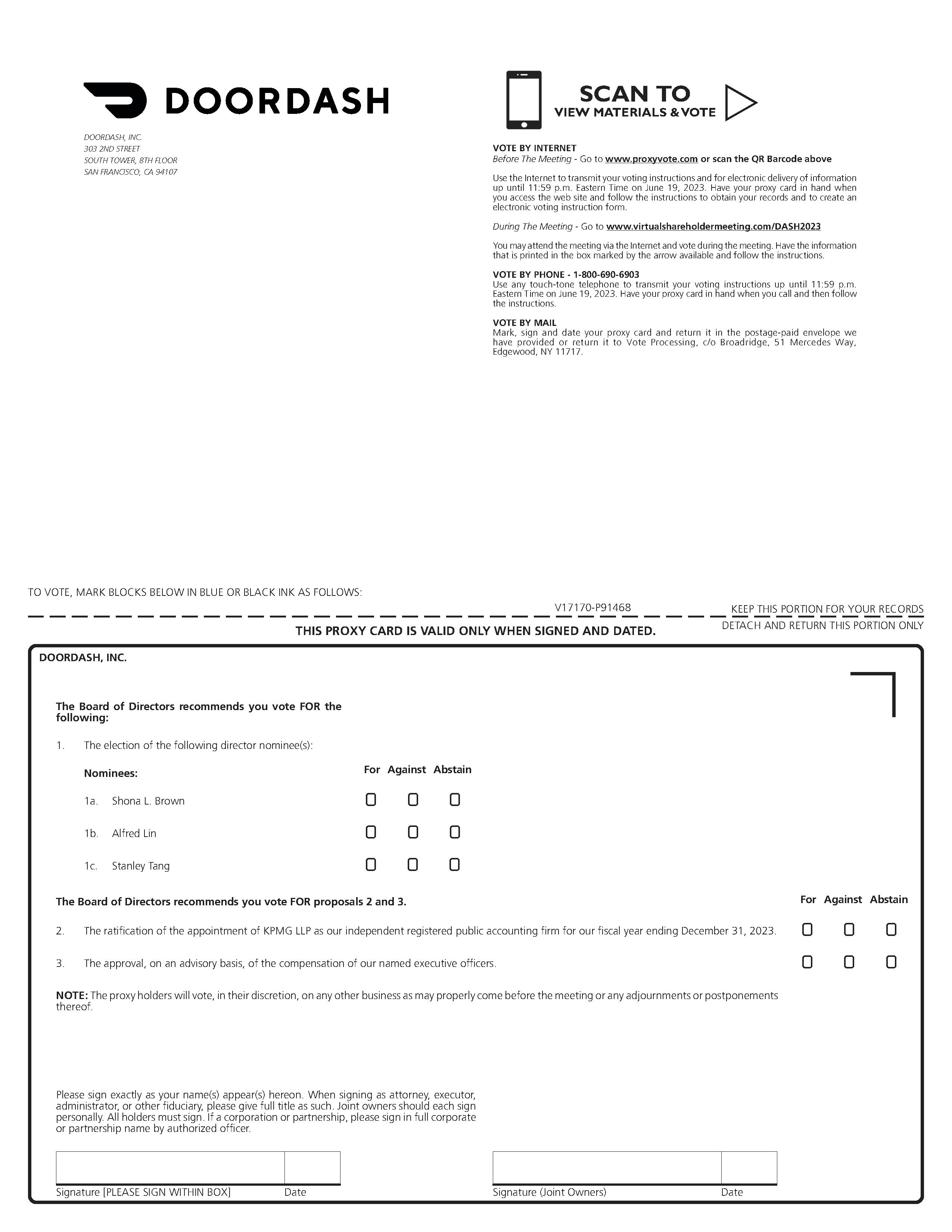

How do I vote?

If you are a stockholder of record, there are four ways to vote:

•by Internet prior to the Annual Meeting at www.proxyvote.com, 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on June 19, 2023 (have your Notice or proxy card in hand when you visit the website);

•by toll-free telephone at 1-800-690-6903, until 11:59 p.m. Eastern Time on June 19, 2023 (have your Notice or proxy card in hand when you call);

•by completing and mailing your proxy card (if you received printed proxy materials); or

•by attending the Annual Meeting virtually by visiting www.virtualshareholdermeeting.com/DASH2023, where you may vote and submit questions during the meeting (please have your Notice or proxy card in hand when you visit the website).

Even if you plan to attend the Annual Meeting, we recommend that you also vote by proxy so that your vote will be counted if you later decide not to attend the Annual Meeting.

If you are a street name stockholder, you will receive voting instructions from your broker, bank, or other nominee. You must follow the voting instructions provided by your broker, bank, or other nominee in order to direct your broker, bank, or other nominee on how to vote your shares. Street name stockholders should generally be able to vote by returning a voting instruction form, or by telephone or on the Internet. However, the availability of telephone and Internet voting will depend on the voting process of your broker, bank, or other nominee. As discussed above, if you are a street name stockholder, you may not vote your shares live at the Annual Meeting unless you obtain a legal proxy from your broker, bank, or other nominee.

How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions?

Brokerage firms and other intermediaries holding shares of our common stock in street name for their customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker will generally have discretion to vote your shares on our sole “routine” matter: the proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2023. Your broker will not have discretion to vote on any other proposals, which are “non-routine” matters, absent direction from you (and failure to provide instructions on these matters will result in a “broker non-vote”).

Can I change my vote?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting by:

•entering a new vote by Internet or by telephone; completing and returning a later-dated proxy card; notifying the Corporate Secretary of DoorDash, Inc., in writing, at DoorDash, Inc., 303 2nd Street, South Tower, 8th Floor, San Francisco, California 94107; or attending and voting at the Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy).

•If you are a street name stockholder, your broker, bank, or other nominee can provide you with instructions on how to change your vote.

What do I need to do to attend the Annual Meeting?

You will be able to attend the Annual Meeting virtually, submit your questions during the meeting and vote your shares electronically at the meeting by visiting www.virtualshareholdermeeting.com/DASH2023. To participate in the Annual Meeting, you will need the control number included on your Notice or proxy card. The Annual Meeting webcast will begin promptly at 10:00 am Pacific Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 9:45 am Pacific Time, and you should allow ample time for the check-in procedures.

What is the effect of giving a proxy?

Proxies are being solicited by and on behalf of our board of directors. Tony Xu, Ravi Inukonda, and Tia Sherringham have been designated as proxy holders by our board of directors. When proxies are properly dated, executed, and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If the proxy is dated and signed, but no specific instructions are given, the shares will be voted in accordance with the recommendations of our board of directors as described above. If any matters not described in this proxy statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is adjourned, the proxy holders can vote the shares at the adjourned Annual Meeting as well, unless you have properly revoked your proxy, as described above.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

In accordance with the rules of the Securities and Exchange Commission (“SEC”), we have elected to furnish our proxy materials, including this proxy statement and our annual report, primarily via the Internet. The Notice containing instructions on how to access our proxy materials is first being mailed on or about April 28, 2023 to all stockholders entitled to vote at the Annual Meeting. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact and cost of our annual meetings of stockholders.

How are proxies solicited for the Annual Meeting?

Our board of directors is soliciting proxies for use at the Annual Meeting. All expenses associated with this solicitation will be borne by us. We will reimburse brokers or other nominees for reasonable expenses that they incur in sending our proxy materials to you if a broker, bank, or other nominee holds shares of our common stock on your behalf. In addition, our directors and employees may also solicit proxies by telephone, by electronic communication, or by other means of communication. Our directors and employees will not be paid any additional compensation for soliciting proxies.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we will file a Form 8-K to publish preliminary results and will provide the final results in an amendment to the Form 8-K as soon as they become available.

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

We have adopted a procedure called “householding,” which the SEC has approved. Under this procedure, we deliver a single copy of the Notice and, if applicable, our proxy materials, to multiple stockholders who share the same address, unless we have received contrary instructions from one or more of such stockholders. Householding reduces our printing costs, mailing costs, and fees. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice and, if applicable, our proxy materials, to any stockholder at a shared address to which we delivered a single copy of any of these materials. To receive a separate copy, or, if a stockholder is receiving multiple copies, to request that we only send a single copy of the Notice and, if applicable, our proxy materials, such stockholder may contact us at:

DoorDash, Inc.

Attention: Corporate Secretary

303 2nd Street, South Tower, 8th Floor

San Francisco, California 94107

(650) 487-3970

Street name stockholders may contact their broker, bank, or other nominee to request information about householding.

What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?

Stockholder Proposals

Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at next year’s annual meeting of stockholders by submitting their proposals in writing to our Corporate Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in our proxy statement for the 2024 annual meeting of stockholders, our Corporate Secretary must receive the written proposal at our principal executive offices not later than December 29, 2023. In addition, stockholder proposals that are intended to be included in our proxy materials must comply with the requirements of Rule 14a-8 under the Exchange Act. Stockholder proposals should be addressed to:

DoorDash, Inc.

Attention: Corporate Secretary

303 2nd Street, South Tower, 8th Floor

San Francisco, California 94107

(650) 487-3970

Our amended and restated bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our amended and restated bylaws provide that the only business that may be conducted at an annual meeting of stockholders is business that is (i) specified in our notice of

annual meeting (or any supplement thereto), (ii) otherwise properly brought before such annual meeting by or at the direction of our board of directors, or (iii) properly brought before such meeting by a stockholder of record entitled to vote at such annual meeting who has delivered timely written notice to our Corporate Secretary, which notice must contain the information specified in our amended and restated bylaws. To be timely for the 2024 annual meeting of stockholders, our Corporate Secretary must receive the written notice at our principal executive offices:

•not earlier than February 12, 2024; and

•not later than March 13, 2024.

In the event that we hold the 2024 annual meeting of stockholders more than 30 days before or more than 60 days after the one-year anniversary of the Annual Meeting, a notice of a stockholder proposal that is not intended to be included in our proxy statement must be received no earlier than the close of business on the 120th day before the 2024 annual meeting of stockholders and no later than the close of business on the later of the following two dates:

•the 90th day prior to the 2024 annual meeting of stockholders; or

•the 10th day following the day on which public announcement of the date of the 2024 annual meeting of stockholders is first made.

If a stockholder who has notified us of his, her, or its intention to present a proposal at an annual meeting of stockholders does not appear to present his, her, or its proposal at such annual meeting, we are not required to present the proposal for a vote at such annual meeting.

Recommendation or Nomination of Director Candidates

Holders of 1% of our fully diluted capitalization for at least 12 months prior to the submission of the recommendation may recommend director candidates for consideration by our nominating and corporate governance committee. Any such recommendations should include the nominee’s name and qualifications for membership on our board of directors and should be directed to our Corporate Secretary or legal department at the address set forth above. For additional information regarding stockholder recommendations for director candidates, see the section titled “Board of Directors and Corporate Governance-Stockholder Recommendations and Nominations to the Board of Directors.”

In addition, our amended and restated bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must provide the information required by our amended and restated bylaws. In addition, the stockholder must give timely notice to our Corporate Secretary in accordance with our amended and restated bylaws, which, in general, require that the notice be received by our Corporate Secretary within the time periods described above under the section titled “Stockholder Proposals” for stockholder proposals that are not intended to be included in a proxy statement. Any notice of director nomination submitted must include the additional information required by Rule 14a-19(b) under the Exchange Act.

Availability of Bylaws

A copy of our amended and restated bylaws is available via the SEC’s website at http://www.sec.gov. You may also contact our Corporate Secretary at the address set forth above for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our business affairs are managed under the direction of our board of directors. As of April 21, 2023, our board of directors consisted of nine directors, six of whom qualified as “independent” under the listing standards of the New York Stock Exchange (“NYSE”). We have a classified board of directors consisting of three classes of approximately equal size, each serving staggered three-year terms. Only one class of directors is elected at each annual meeting of stockholders, with the other classes continuing for the remainder of their respective three-year terms. Each director’s term will continue until the end of such director’s three-year term and the election and qualification of their successor, or their earlier death, resignation, or removal. Stan Meresman, who currently serves as a Class III director, is not standing for re-election at the Annual Meeting, and therefore his term on our board of directors will end at the Annual Meeting. The Company greatly appreciates Mr. Meresman's long and dedicated service as a director.

The following table sets forth the names, ages as of April 21, 2023, and certain other information for each of the directors with terms expiring at the Annual Meeting (three of whom are also nominees for election as a director at the Annual Meeting) and for each of the continuing members of our board of directors:

| | | | | | | | | | | | | | | | | | | | |

Director with Term expiring at the Annual Meeting/Nominee | Class | Age | Position | Director Since | Current Term Expires | Expiration of Term for Which Nominated |

Shona L. Brown(1)(2) | III | 57 | Lead Independent Director | 2019 | 2023 | 2026 |

Alfred Lin(1)(3) | III | 50 | Director | 2014 | 2023 | 2026 |

| Stanley Tang | III | 30 | Director | 2013 | 2023 | 2026 |

| | | | | | |

| Continuing Directors | | | | | | |

John Doerr(2) | II | 71 | Director | 2015 | 2025 | |

| Andy Fang | II | 30 | Director | 2013 | 2025 | |

Elinor Mertz(3) | I | 46 | Director | 2022 | 2024 | |

Greg Peters(2) | I | 52 | Director | 2022 | 2024 | |

| Tony Xu | I | 38 | Co-Founder, Chief Executive Officer, and Chair | 2013 | 2024 | |

| | | | | | |

| Non-continuing Directors | |

Stan Meresman(3) | III | 76 | Director | 2018 | 2023 | |

(1) Member of our leadership development, inclusion and compensation committee.

(2) Member of our nominating and corporate governance committee.

(3) Member of our audit committee.

Nominees for Director

Shona L. Brown. Dr. Brown has served as one of our directors since August 2019 and Lead Independent Director since February 2021. From January 2013 until November 2015, she served as a senior advisor to Google Inc., an Internet search and technology company. From April 2011 to December 2012, Dr. Brown served as Senior Vice President of Google.org, Google Inc.’s charitable organization. From 2003 to 2011, Dr. Brown served as Vice President and later as Senior Vice President, Business Operations of Google Inc. Since November 2015, Dr. Brown has served on the board of directors of Atlassian Corporation Plc, an enterprise software company, and currently serves as its Chairperson. She has also served since March 2009 as a director of PepsiCo, Inc., a food and beverage company, and serves on the board of directors of several non-profit organizations. Dr. Brown holds a B.Eng. in Computer Systems Engineering from Carleton University, an M.A. in Economics and Philosophy from the University of Oxford, and a Ph.D. from Stanford University’s Department of Industrial Engineering and Engineering Management.

Dr. Brown was selected to serve on our board of directors because of her extensive experience as a director of public companies, her experience as a global business executive, and her knowledge of the technology industry.

Alfred Lin. Mr. Lin has served as one of our directors since May 2014. Mr. Lin has been a Partner at Sequoia Capital Operations LLC, a venture capital firm (“Sequoia Capital”), since October 2010. From June 1999 to December 2014, he served as Co-Founder and General Manager at Venture Frogs, LLC, a venture capital firm. From January 2005 to December 2010, Mr. Lin served as Chairman of the Board and Chief Operating Officer of Zappos.com, an online retailer acquired by Amazon.com, Inc. and from January 2001 to June 2005, he served as Vice President of Finance and Business Development of Tellme Networks, a voice recognition services and platform company acquired by Microsoft, Prior to this, from 1996 to 1998, Mr. Lin served as Vice President of Finance and Administration of LinkExchange, a banner advertising exchange acquired by Microsoft. He currently serves on the board of directors of Airbnb, Inc., a vacation rental online marketplace company, and serves as a director of several private companies. Mr. Lin holds a B.A. in Applied Mathematics from Harvard University and an M.S. in Statistics from Stanford University.

Mr. Lin was selected to serve on our board of directors because of his extensive experience in the venture capital industry, business and leadership experience, and his knowledge of technology companies.

Stanley Tang. Mr. Tang is one of our co-founders and has served as Head of DoorDash Labs since November 2017 and as one of our directors since May 2013. He previously served as our Chief Product Officer from May 2013 to November 2017. From June 2012 until September 2012, Mr. Tang served as a Software Engineer at Meta Platforms, Inc., a social media and social networking company. He holds a B.S. in Computer Science from Stanford University.

Mr. Tang was selected to serve on our board of directors because of the perspective and experience he brings as a co-founder.

Continuing Directors

John Doerr. Mr. Doerr has served as one of our directors since March 2015. Mr. Doerr has been Chairman of Kleiner Perkins, or Kleiner, a venture capital firm, since March 2016, and was previously its General Partner since August 1980. He currently serves on the board of directors of Alphabet Inc., the parent holding company of Google, Inc., and Amyris, Inc., a renewable products company. Mr. Doerr previously served as a director of Bloom Energy Corporation, a clean energy company, Zynga Inc., a social gaming company, QuantumScape Corporation, a renewable energy company, Coursera, an education tech company, and Amazon.com, Inc., an e-commerce company. He holds a B.S. in Electrical

Engineering and an M.S. in Electrical Engineering and Computer Science from Rice University and an M.B.A. from Harvard Business School.

Mr. Doerr was selected to serve on our board of directors because of his significant public company experience as a board member, his global business and leadership experience, and his experience in the venture capital industry.

Andy Fang. Mr. Fang is one of our co-founders and has served as Head of Consumer Engineering since February 2019 and as one of our directors since May 2013. He previously served as our Chief Technology Officer from May 2013 to February 2019. Mr. Fang holds a B.S. in Computer Science from Stanford University.

Mr. Fang was selected to serve on our board of directors because of the perspective and experience he brings as a co-founder.

Elinor Mertz. Ms. Mertz has served as one of our directors since July 2022. Ms. Mertz has been Vice President of Finance at Airbnb, Inc., a web-based lodging and experiences marketplace company, since January 2019, and was Airbnb's interim Chief Financial Officer from February 2018 to January 2019, and Head of Global Financial Planning & Analysis from February 2013 to February 2018. Prior to joining Airbnb, Inc., Ms. Mertz served in various senior finance positions with Netflix, Inc., a media company, from February 2006 to February 2013, most recently as its Vice President, Finance & Investor Relations. Ms. Mertz holds a B.A. in Science, Technology & Society from Stanford University, an M.A. in History from Stanford University, an M.I.A. in International Affairs from Columbia University, and an M.B.A. from the Stanford Graduate School of Business.

Ms. Mertz was selected to serve on our board of directors because of her extensive experience as a public company finance professional and leader.

Greg Peters. Mr. Peters has served as one of our directors since January 2022. Mr. Peters has been co-Chief Executive Officer of Netflix, Inc., a media company, since January 2023, and served as their Chief Operating Officer from July 2020 to January 2023 and their Chief Product Officer from July 2017 to July 2020. Prior to joining Netflix, Inc. in 2008, Mr. Peters was Senior Vice President of consumer electronics products for Macrovision Solutions Corp. (later renamed to Rovi Corporation) and previously held positions at digital entertainment software provider, Mediabolic Inc., Red Hat Network, the provider of Linux and Open Source technology, and online vendor Wine.com. Mr. Peters currently serves on the board of directors of Netflix, Inc. and 2U, Inc., an educational technology company. Mr. Peters holds a B.S. in Physics and Astronomy from Yale University.

Mr. Peters was selected to serve on our board of directors because of his operational experience with large public technology companies and his leadership experience.

Tony Xu. Mr. Xu is one of our co-founders and has served as our Chief Executive Officer and as one of our directors since May 2013. Since January 2022, Mr. Xu has served on the board of directors of Meta Platforms, Inc., a technology company. Mr. Xu holds a B.S. in Industrial Engineering and Operations Research from the University of California, Berkeley and an M.B.A. from the Stanford Graduate School of Business.

Mr. Xu was selected to serve on our board of directors because of the perspective and experience he brings as our Chief Executive Officer and as a co-founder.

Non-Continuing Directors

Stan Meresman. Mr. Meresman has served as one of our directors since December 2018. During the last ten years, he has served on the board of directors of various public and private companies, including service as chair of the audit committee for some of these companies. Mr. Meresman was with Technology Crossover Ventures, a private equity firm, and served as a Venture Partner from January 2004 to December 2004 and as General Partner and Chief Operating Officer from November 2001 to December 2003. From 1989 to 1997, Mr. Meresman served as the Senior Vice President and Chief Financial Officer of Silicon Graphics, Inc., a computing manufacturer. He currently serves on the board of directors of Snap Inc., a technology and camera company. Mr. Meresman previously served as a member of the board of directors of Cloudflare, Inc., a web infrastructure and website security company, Guardant Health, Inc., a precision oncology company, Medallia, Inc., a customer experience management company acquired by Thoma Bravo, LLC, LinkedIn Corporation, a professional social media networking company acquired by Microsoft Corporation, Meru Networks, Inc., a supplier of wireless local area networks acquired by Fortinet, Inc., Palo Alto Networks, Inc., a cybersecurity company, Riverbed Technology, Inc., an IT company acquired by Thoma Bravo, LLC, and Zynga Inc., a social gaming company. He holds a B.S. in Industrial Engineering and Operations Research from the University of California, Berkeley and an M.B.A. from the Stanford Graduate School of Business.

Director Independence

Under the listing standards of the NYSE, independent directors must comprise a majority of a listed company’s board of directors. In addition, NYSE listing standards require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent. Under NYSE listing standards, a director will only qualify as an “independent director” if the board of directors affirmatively determines that the director has no material relationship with the company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the company).

Our board of directors has undertaken a review of the independence of each director. Based on information provided by each director concerning their background, employment, and affiliations, our board of directors has determined that Dr. Brown, Ms. Mertz, and Messrs. Doerr, Lin, Meresman, and Peters do not have a material relationship with the company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the company), and that each of these directors is “independent” as that term is defined under the listing standards of the NYSE. In making these determinations, our board of directors considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director, and any transactions involving them described in the section titled “Certain Relationships, Related Party and Other Transactions.”

Board Leadership Structure and Role of the Lead Independent Director

We believe that the structure of our board of directors and its committees provides strong overall management of our company. Mr. Xu currently serves as both the chairperson of our board of directors and as our chief executive officer. As our co-founder, Mr. Xu is best positioned to identify strategic priorities, lead critical discussions about our company’s strategy, risks and execution, and execute our business plans.

Our board of directors has adopted Corporate Governance Guidelines that provide that our board of directors may appoint an independent director as our lead independent director. If appointed, the lead independent director is responsible for calling separate meetings of the independent directors, reporting to our CEO and Chairperson of the Board from executive sessions and performing such other

responsibilities as may be designated by the board of directors from time to time. Because Mr. Xu, our chairperson, is not independent, our board of directors determined that it was advisable to appoint a lead independent director and in February 2021, our board of directors appointed Dr. Brown to serve as our lead independent director. The board of directors considered Dr. Brown’s demonstrated leadership during her tenure as a member of the board and also her contributions as a member of the nominating and corporate governance committee and the compensation committee, and the board of directors believes that Dr. Brown’s ability to act as a strong lead independent director provides balance in our leadership structure and will be in the best interest of DoorDash and its stockholders.

Only independent directors serve on the audit committee, the compensation committee, and the nominating and corporate governance committee of our board of directors. As a result of the board of directors’ committee system and the existence of a majority of independent directors, the board of directors believes it maintains effective oversight of our business operations, including independent oversight of our financial statements, executive compensation, selection of director candidates, and corporate governance programs. We believe that the leadership structure of our board of directors, including Dr. Brown’s role as lead independent director, as well as the strong independent committees of our board of directors is appropriate and enhances our board of directors’ ability to effectively carry out its roles and responsibilities on behalf of our stockholders, while Mr. Xu’s combined role enables strong leadership, creates clear accountability of management to our board of directors, and enhances our ability to communicate our message and strategy clearly and consistently to stockholders.

Board Meetings and Committees

During our fiscal year ended December 31, 2022, our board of directors held five meetings (including regularly scheduled and special meetings). Each director attended at least 75% of the aggregate of (i) the total number of meetings of our board of directors held during the period for which he or she has been a director and (ii) the total number of meetings held by all committees of our board of directors on which he or she served during the periods that he or she served.

Although we do not have a formal policy regarding attendance by members of our board of directors at annual meetings of stockholders, we strongly encourage, but do not require, our directors to attend. All of our directors who were directors at the time of our 2022 annual meeting of stockholders attended our 2022 annual meeting of stockholders, except for Mr. Lin.

Our board of directors has established an audit committee, a leadership development, inclusion, and compensation committee, and a nominating and corporate governance committee. The composition and responsibilities of each of the committees of our board of directors is described below. Members will serve on these committees until their resignation or until as otherwise determined by our board of directors.

Audit Committee

Our audit committee consists of Ms. Mertz and Messrs. Lin and Meresman, with Mr. Meresman serving as chairperson. Dr. Brown served on our audit committee from April 2022 until her resignation from our audit committee in July 2022. Following the end of Mr. Meresman's term as a director at the Annual Meeting, Ms. Mertz will become chairperson of our audit committee. Each member of the audit committee meets the requirements for independence under the listing standards of the NYSE and SEC rules and regulations and the financial literacy and sophistication requirements of the listing standards of the NYSE. In addition, our board of directors has determined that each of Ms. Mertz and Messrs. Lin and Meresman is an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K under the Securities Act. Our audit committee is responsible for, among other things:

•appointing, compensating, retaining, and overseeing, and where appropriate, replacing the independent registered public accounting firm;

•helping to ensure the independence of the independent registered public accounting firm;

•reviewing and discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent registered public accounting firm, our interim and year-end results of operations;

•reviewing our financial statements and our critical accounting policies and estimates;

•overseeing and monitoring the integrity of our financial statements, accounting and financial reporting processes, and internal controls;

•overseeing the design, implementation, and performance of our internal audit function;

•overseeing our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters;

•developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters;

•overseeing our policies on risk assessment and risk management;

•overseeing compliance with our code of business conduct and ethics;

•reviewing and approving related party transactions; and

•approving or, as required, pre-approving, all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm.

No member of our audit committee may serve on the audit committee of more than three public companies, including DoorDash, unless our board of directors determines that such simultaneous service would not impair the ability of such member to effectively serve on our audit committee and we disclose such determination in accordance with the listing standards of the NYSE.

Our audit committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the NYSE. A copy of the charter for our audit committee is available on our website at ir.doordash.com. During 2022, our audit committee held five meetings.

Leadership Development, Inclusion, and Compensation Committee

Our compensation committee consists of Dr. Brown and Mr. Lin, with Mr. Lin serving as chairperson. Each member of our compensation committee meets the requirements for independence under the listing standards of the NYSE and SEC rules and regulations and is a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act. Our compensation committee is responsible for, among other things:

•reviewing, approving, and determining, or making recommendations to our board of directors regarding, the compensation of our executive officers, including our chief executive officer, and certain other key employees;

•administering our equity compensation plans;

•reviewing, approving, and administering incentive compensation plans;

•establishing and reviewing general policies and plans relating to compensation and benefits of our employees, and overseeing our overall compensation philosophy;

•reviewing and making recommendations to our full board of directors regarding non-employee director compensation;

•evaluating the performance, or assisting in the evaluation of the performance, of our executive officers, including our chief executive officer; and

•periodically reviewing and discussing with our board of directors the corporate succession and development plans for executive officers and certain key employees.

Our compensation committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the NYSE. A copy of the charter for our compensation committee is available on our website at ir.doordash.com. During 2022, our compensation committee held four meetings.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Dr. Brown and Messrs. Doerr and Peters, with Mr. Doerr serving as chairperson. Each member of the nominating and corporate governance committee meets the requirements for independence under the listing standards of the NYSE and SEC rules and regulations. Our nominating and corporate governance committee is responsible for, among other things:

•identifying, evaluating, and selecting, or making recommendations to our board of directors regarding, nominees for election to our board of directors;

•considering and making recommendations to our board of directors regarding the composition of our board of directors and its committees;

•evaluating the performance and attendance of our board of directors and of individual directors;

•overseeing and reviewing developments in our corporate governance practices;

•evaluating the adequacy of our corporate governance practices and reporting; and

•developing and making recommendations to our board of directors regarding corporate governance guidelines and matters.

Our nominating and corporate governance committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the NYSE. A copy of the charter for our nominating and corporate governance committee is available on our website at ir.doordash.com. During 2022, our nominating and corporate governance committee held five meetings.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee is or has been an officer or employee of our company. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee (or other board committee performing equivalent functions) of any entity that has one or more of its executive officers serving on our board of directors or compensation committee.

Considerations in Evaluating Director Nominees

Our nominating and corporate governance committee is responsible for reviewing with the board of directors the appropriate characteristics, skills, and experience required for the board of directors as a whole and its individual members. Our nominating and corporate governance committee uses a variety of methods to identify and evaluate director nominees. Some of the qualifications that our nominating and corporate governance committee considers include, without limitation, issues of character, integrity, judgment, corporate experience, and diversity and other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on the board of directors, potential conflicts of interest, and other commitments. Nominees must also have the highest personal and professional ethics and integrity, have proven achievement and competence in their field and the ability to exercise sound business judgment, have skills that are complementary to those of the existing board of directors, the ability to assist and support management and make significant contributions to the our success, and understand the fiduciary responsibilities that are required of a member of our board of directors and have sufficient time and energy necessary to diligently carry out those responsibilities. Members of our board of directors are expected to prepare for, attend, and participate in all board of directors and applicable committee meetings. Our nominating and corporate governance committee may also consider such other factors as it may deem, from time to time, are in our and our stockholders’ best interests.

In its evaluation of director candidates, our nominating and corporate governance committee considers the suitability of each director candidate, including current directors, in light of current size and composition, organization, and governance of our board of directors and the needs of our board of directors and the respective committees of our board of directors. Although we do not maintain a specific policy with respect to board diversity, our board of directors believes that our board of directors should be a diverse body, and our nominating and corporate governance committee considers a broad range of backgrounds and experiences. In making determinations regarding nominations of directors, our nominating and corporate governance committee may take into account the benefits of diverse viewpoints.

Our nominating and corporate governance committee also considers the above factors and other factors as it oversees the annual board of director and committee evaluations. After completing its review and evaluation of director candidates, including incumbent directors, our nominating and corporate governance committee recommends to our full board of directors the director nominees for selection.

Stockholder Recommendations and Nominations to the Board of Directors

Our nominating and corporate governance committee will consider director candidates recommended by stockholders holding at least one percent (1%) of the fully diluted capitalization of DoorDash, Inc. continuously for at least 12 months prior to the date of the submission of the recommendation, so long as such recommendations comply with our amended and restated certificate of incorporation, amended and restated bylaws, and applicable laws, rules and regulations, including those promulgated by the SEC. Our nominating and corporate governance committee will evaluate any such recommendations in accordance with its charter, our amended and restated bylaws and our policies and procedures for director candidates, as well as the regular director nominee criteria described above. This process is designed to ensure that our board of directors includes members with diverse backgrounds, skills, and experience, including appropriate financial and other expertise relevant to our business. Eligible stockholders wishing to recommend a candidate for nomination should direct the recommendation in writing by letter to us, attention of the General Counsel, at 303 2nd Street, South Tower, 8th Floor, San Francisco, California 94107. Such recommendations must include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a statement of support by the recommending stockholder, a signed letter from the candidate confirming willingness to serve on our board of directors, information regarding any relationships between the candidate and our company, evidence of the recommending stockholder’s ownership of our capital stock, and any other information

required by our amended and restated bylaws. Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors.

Under our amended and restated bylaws, stockholders may also directly nominate persons for our board of directors. Any nomination must comply with the requirements set forth in our amended and restated bylaws and should be sent in writing to our Corporate Secretary at DoorDash, Inc. To be timely for the 2024 annual meeting of stockholders, nominations for persons to our board of directors must be received by our Corporate Secretary observing the same deadlines for stockholder proposals that are not intended to be included in a proxy statement, as discussed above under “What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?-Stockholder Proposals.” Any notice of director nomination submitted must include the additional information required by Rule 14a-19(b) under the Exchange Act.

Communications with the Board of Directors

Interested parties wishing to communicate with non-management members of our board of directors may do so by writing and mailing the correspondence to our General Counsel or legal department at DoorDash, Inc., 303 2nd Street, South Tower, 8th Floor, San Francisco, California 94107. Each communication should set forth (i) the name and address of the stockholder, as it appears on our books, and if the shares of our common stock are held by a broker, bank or nominee, the name and address of the beneficial owner of such shares, and (ii) the class and number of shares of our common stock that are owned of record by the record holder and beneficially by the beneficial owner.

Our General Counsel or legal department, in consultation with appropriate members of our board of directors as necessary, will review all incoming stockholder communications (except for mass mailings, product complaints or inquiries, job inquiries, business solicitations and patently offensive or otherwise inappropriate material) and, if appropriate, will route such communications to the appropriate member or members of our board of directors, or if none is specified, to the chairperson of our board of directors or the lead independent director.

Our General Counsel or legal department may decide in the exercise of their or its judgment whether a response to any stockholder communication is necessary and will provide a report to our nominating and corporate governance committee on a quarterly basis of any stockholder communications received for which the General Counsel or legal department has responded. This procedure for stockholder communications with non-management members of our board of directors is administered by our nominating and corporate governance committee.

This procedure does not apply to (i) communications to non-management directors from our officers or directors who are stockholders or (ii) stockholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act, which are discussed further in the above section in this proxy statement titled “What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?-Stockholder Proposals”.

Corporate Governance Guidelines and Code of Conduct

Our board of directors has adopted Corporate Governance Guidelines that address items such as the qualifications and responsibilities of our directors and director candidates, including independence standards, and corporate governance policies and standards applicable to us in general. In addition, our board of directors has adopted a Code of Conduct that applies to all of our employees, officers and directors, including our chief executive officer, chief financial officer, and other executive and senior financial officers. The full text of our Corporate Governance Guidelines and our Code of Conduct is posted on our website at ir.doordash.com. We will disclose any amendments to our Code of Conduct or

any waivers of the requirements of our Code of Conduct for directors and executive officers on the same website or in filings under the Exchange Act.

Role of Board in Risk Oversight Process

Risk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, legal and compliance, and reputational, in the pursuit and achievement of our strategic objectives. We have designed and implemented processes to manage risk in our operations. Management is responsible for the day-to-day oversight and management of strategic, operational, legal and compliance, cybersecurity, and financial risks, while our board of directors, as a whole and assisted by its committees, has responsibility for the oversight of our risk management framework, which is designed to identify, assess, and manage risks to which our company is exposed, as well as to foster a corporate culture of integrity. Consistent with this approach, our board of directors regularly reviews our strategic and operational risks in the context of discussions with management, question and answer sessions, and reports from the management team at each regular board meeting. Our board of directors also receives regular reports on all significant committee activities at each regular board meeting and evaluates the risks inherent in significant transactions.

In addition, our board of directors has tasked designated standing committees with oversight of certain categories of risk management. Our audit committee assists our board of directors in fulfilling its oversight responsibilities with respect to risk management in the areas of internal control over financial reporting and disclosure controls and procedures, legal and regulatory compliance. Our audit committee also, among other things, discusses with management, the internal auditors, and the independent auditor guidelines and policies with respect to risk assessment and risk management, as well as potential conflicts of interest. The audit committee further oversees our initiatives related to cybersecurity, including prevention and monitoring. Our compensation committee assesses risks arising from our compensation philosophy and practices applicable to all employees to determine whether they encourage excessive risk-taking and evaluates policies and practices that could mitigate such risks. Our nominating and corporate governance committee assesses risks relating to our corporate governance practices and the independence of the board.

Our board of directors believes its current leadership structure supports the risk oversight function of the board. As Chair, Mr. Xu has primary responsibility for setting the agenda for meetings of the board of directors and his combined role as CEO and Chair gives him unique insight into the risk profile of the company, including emerging risks. The majority independent directors, including Dr. Brown as lead independent director, provide independent judgment and outside experience that enables the board of directors to effectively oversee the risk management of the Company.

ESG Board Oversight Framework

Our board of directors believes that strong corporate governance and a robust approach to ethics and compliance benefits our stakeholders and stockholders alike. Our board of directors and its committees oversee key areas of risk management, including overseeing relevant environmental, social, and governance (“ESG”) initiatives and issues, such as initiatives to enhance data privacy and security, health and safety, public policy and engagement, and ethics and compliance.

Each of our board committees have an important role in the oversight of elements of our ESG program that are within the scope of its duties and responsibilities. Our nominating and corporate governance committee reviews the composition of our board and other governance policies and practices. Our compensation committee oversees certain aspects of our human capital management, including executive performance, talent development, and diversity, equity, and inclusion. Our audit committee oversees our overall risk profile and risk exposure, and monitors new and evolving risks to the Company including those related to ESG matters, financial matters, and cybersecurity. Our audit committee also

reviews developments in ethics and compliance policies and programs, highlights from internal investigations, and the effectiveness of our whistleblower and reporting channels.

A copy of our 2022 ESG update with further discussion of our ESG practices can be found on the Environmental, Social & Governance page of our website at ir.doordash.com. Our websites, reports and media channels are not part of and are not incorporated by reference into this proxy statement.

Director Compensation

In September 2020, our board of directors adopted, and our stockholders approved, our Outside Director Compensation and Equity Ownership Policy (the “director compensation policy”) for our non-employee directors. The director compensation policy was developed with input from our independent compensation consultant, Semler Brossy Consulting Group LLC (“Semler Brossy”), regarding practices and compensation levels at the same group of peer companies used for executive compensation comparisons and is intended to attract, retain, and reward non-employee directors. In October 2022, our compensation committee reviewed the compensation opportunities for our non-employee directors pursuant to the director compensation policy, including a director compensation analysis of our compensation peer group prepared by Semler Brossy, and determined that no changes to the compensation of our non-employee directors were recommended. Additional information on the peer group can be found in the section titled “Executive Compensation-Compensation Discussion & Analysis-Overview of Factors Considered in Setting Executive Compensation-Peer Group and Competitive Positioning.”

Under the director compensation policy, each non-employee director will receive the cash and equity compensation for board services described below. We also will reimburse our non-employee directors for reasonable, customary, and documented travel expenses to meetings of our board of directors or its committee and other expenses.

Maximum Annual Compensation Limit

The director compensation policy includes a maximum annual limit of $750,000 of cash compensation and equity awards that may be paid, issued, or granted to a non-employee director in any fiscal year (increased to $1,000,000 in the non-employee director’s initial year of service as a non-employee director). For purposes of this limitation, the value of equity awards is based on the grant date fair value determined in accordance with U.S. generally accepted accounting principles (“GAAP”). Any cash compensation paid or equity awards granted to a person for their service as an employee, or for their service as a consultant (other than as a non-employee director), will not count for purposes of the limitation. The maximum limit does not reflect the intended size of any potential compensation or equity awards to our non-employee directors.

Equity Ownership Guidelines

Additionally, each non-employee director is expected to comply with the minimum equity ownership guidelines as set forth in the director compensation policy. Our equity ownership guidelines provide that our non-employee directors must hold a number of shares of our common stock with a value equal to four times the annual cash retainer for service as a non-employee director. A non-employee director generally will have until the later of the fifth anniversary of the effective date of the policy or, if applicable, the date such non-employee director becomes a non-employee director to comply with the minimum stock ownership requirement. Our compensation committee may waive, at its discretion, these guidelines for non-employee directors joining our board of directors from government, academia, or similar professions. Our compensation committee may also temporarily suspend, at its discretion, the guidelines for one or more non-employee directors if compliance would create severe hardship or prevent such non-employee director from complying with a court order.

Cash Compensation

Under our director compensation policy, each non-employee director is paid an annual cash retainer of $60,000, which is paid quarterly in arrears on a prorated basis.

Under the policy, each non-employee director will be eligible to earn additional annual cash compensation for their additional services as follows:

•$40,000 per year for service as chairperson of our board of directors;

•$20,000 per year for service as a lead independent director;

•$15,000 per year for service as chair of our audit committee;

•$10,000 per year for service as chair of our compensation committee; and

•$5,000 per year for service as chair of our nominating and corporate governance committee.

For clarity, there are no per-meeting fees for attending board of directors or committee meetings. Cash compensation is paid quarterly in arrears on a prorated basis.

Equity Compensation

Initial Award. Each person who first becomes a non-employee director will receive, automatically on the twentieth day of the month that follows the date on which such person is appointed to our board of directors, an initial award (the “Initial Award” and the date the Initial Award is granted, the “Grant Date”) of restricted stock units (“RSUs”). The Initial Award covers a number of shares of our Class A common stock equal to (i) $250,000 divided by (ii) the average fair market value of a share of our Class A common stock for the market trading days that occur in the completed calendar month immediately prior to the calendar month in which the Grant Date occurs, rounded down to the nearest whole share (the “New Director Award”). In addition, in the event that the date on which the non-employee director is appointed to our board of directors is not the date of an annual meeting of our stockholders, the Initial Award will cover an additional number of shares of our Class A common stock equal to (i) (A) $250,000 multiplied by (B) the fraction obtained by dividing (1) the number of days between the date such person is appointed to the board and the first anniversary of the most recent annual meeting of our stockholders by (2) 365, divided by (ii) the average fair market value of a share of our Class A common stock for the market trading days that occur in the completed calendar month immediately prior to the calendar month in which the Grant Date occurs, rounded down to the nearest whole share (the “Pro-rated Annual Award”). The New Director Award will vest in equal monthly installments over the forty-eight months beginning on the first day of the month following the month in which such person is appointed to the board of directors subject to the non-employee director continuing to be a service provider through the applicable vesting date. The Pro-rated Annual Award will vest on the earlier of (i) the one-year anniversary of the date the Pro-rated Annual Award is granted or (ii) the day prior to the date of the annual meeting next following the date the Initial Award is granted, in each case, subject to the non-employee director continuing to be a service provider through the applicable vesting date. If the person was a member of the board of directors and also an employee, becoming a non-employee director due to termination of employment will not entitle the non-employee director to an Initial Award.

Annual Award. Each non-employee director will automatically receive, on the date of each annual meeting of stockholders, an annual award of RSUs, each of which we refer to as an “Annual Award”, covering a number of shares of our Class A common stock having a grant date fair value (determined in accordance with GAAP) of $250,000, rounded down to the nearest whole share. The Annual Award will vest on the earlier of (i) the one-year anniversary of the date the Annual Award is granted or (ii) the day prior to the

date of the annual meeting next following the date the Annual Award is granted, in each case, subject to the non-employee director continuing to be a service provider through the applicable vesting date.

Each non-employee director may elect to defer the delivery of the settlement of any Initial Award or Annual Award that would otherwise be delivered to such non-employee director on or following the date such award vests pursuant to the terms of a deferral election such non-employee director makes in accordance with the policy.

In the event of a “change in control” (as defined in our 2020 Equity Incentive Plan), each non-employee director’s outstanding equity will be treated in accordance with the terms of each applicable award.

Director Compensation Table for Fiscal Year 2022

The following table provides information regarding compensation of our non-executive officer directors for service as directors, for the year ended December 31, 2022. Directors who are also our employees receive no additional compensation for their service as directors. During 2022, our employee directors, Messrs. Fang, Tang, and Xu, did not receive any compensation for their services as directors. See “Executive Compensation” for additional information regarding Mr. Xu’s compensation. The compensation received by each of Messrs. Fang and Tang as an employee is set forth in the footnotes to the table below.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash | | Stock Awards(1) | | Total |

| Shona L. Brown | | $ | 80,000 | | | $ | 249,950 | | | $ | 329,950 | |

| John Doerr | | $ | 65,000 | | | $ | 249,950 | | | $ | 314,950 | |

Andy Fang(2) | | $ | — | | | $ | — | | | $ | — | |

| Alfred Lin | | $ | 70,000 | | | $ | 249,950 | | | $ | 319,950 | |

| Stan Meresman | | $ | 75,000 | | | $ | 249,950 | | | $ | 324,950 | |

Elinor Mertz(3) | | $ | 28,022 | | | $ | 426,844 | | | $ | 454,866 | |

Greg Peters(4) | | $ | 56,966 | | | $ | 514,274 | | | $ | 571,240 | |

Maria Renz(5) | | $ | 16,167 | | | $ | — | | | $ | 16,167 | |

Stanley Tang(6) | | $ | — | | | $ | — | | | $ | — | |

(1) The amounts reported represent the aggregate grant-date fair value of the RSUs awarded to the director in 2022, calculated in accordance with Financial Accounting Standard Board’s Accounting Standards Codification Topic 718 (“ASC 718”), disregarding forfeiture assumptions. These amounts do not reflect the actual economic value that may be realized by the non-employee directors, and there can be no assurance that these amounts will ever be realized by the non-employee directors.

(2) Mr. Fang received an aggregate of $2,794,337 in compensation as an employee, comprised of base salary in the amount of $298,077, life insurance premiums in the amount of $162, a gross-up for taxable income incurred through participating in the company’s meal benefit provided to all office-based employees in the amount of $109, and RSUs with an aggregate grant date fair value of $2,495,990.

(3) Ms. Mertz joined our board of directors in July 2022.

(4) Mr. Peters joined our board of directors in January 2022.

(5) Ms. Renz resigned from our board of directors in April 2022.

(6) Mr. Tang received an aggregate of $2,784,628 in compensation as an employee, comprised of base salary in the amount of $288,461, life insurance premiums in the amount of $156, a gross-up for taxable income incurred through participating in the company’s meal benefit provided to all office-based employees in the amount of $22, and RSUs with an aggregate grant date fair value of $2,495,990.

The following table lists all outstanding equity awards held by our non-executive officer directors as of December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Option Awards | | Stock Awards |

| Name | | Grant Date | | Number of Securities Underlying Unexercised Options | | Option Exercise Price Per Share | | Option Expiration Date | | Number of Shares Underlying Unvested Stock Awards |

| Shona L. Brown | | 08/29/2019 | | — | | $ | — | | | — | | 7,690(1)(2) |

| | 05/10/2020 | | — | | $ | — | | | — | | 23,835(1)(3) |

| | 06/23/2023 | | — | | $ | — | | | — | | 3,557(4) |

| John Doerr | | 06/23/2022 | | — | | $ | — | | | — | | 3,557(4) |

| Andy Fang | | 06/26/2014 | | 2,008,390(5) | | $ | 0.20 | | | 06/25/2024 | | — |

| | 10/10/2018 | | 135,395(5) | | $ | 7.16 | | | 10/09/2028 | | — |

| | 05/10/2020 | | — | | $ | — | | | — | | 8,240(6) |

| | 04/20/2021 | | — | | $ | — | | | — | | 5,052(7) |

| | 04/20/2022 | | — | | $ | — | | | — | | 16,202(8) |

| | 04/20/2022 | | — | | $ | — | | | — | | 3,116(9) |

| Alfred Lin | | 06/23/2022 | | — | | $ | — | | | — | | 3,557(4) |

| Stan Meresman | | 06/23/2022 | | — | | $ | — | | | — | | 3,557(4) |

| Elinor Mertz | | 08/20/2022 | | — | | $ | — | | | — | | 3,105(10) |

| | 08/20/2022 | | — | | $ | — | | | — | | 3,275(4) |

| Greg Peters | | 02/20/2022 | | — | | $ | — | | | — | | 2,187(11) |

| | 06/23/2022 | | — | | $ | — | | | — | | 3,557(4) |

Maria Renz(12) | | — | | — | | $ | — | | | — | | — |

| Stanley Tang | | 06/26/2014 | | 2,398,390(5) | | $ | 0.20 | | | 06/25/2024 | | — |