Document

Exhibit 99.1

February 16, 2023

Dear Fellow Shareholders,

DoorDash’s mission is to grow and empower local economies. In 2022, we were proud to generate over $38 billion in sales for local merchants and over $13 billion in earnings for Dashers, while growing Marketplace GOV by 27% year-over-year (Y/Y) to $53.4 billion. In Q4, we grew Marketplace GOV by 29% Y/Y to $14.4 billion. Monthly Active Users (MAUs)1 in December increased to over 32 million from over 25 million a year ago, with Y/Y growth in both DoorDash and Wolt MAUs. DashPass and Wolt+ members at year-end increased to over 15 million2 from over 10 million a year ago.

2022 was unique and challenging in many ways. But, similar to past years, consumers showed they love convenient access to their favorite local merchants, Dashers showed they value and appreciate the accessibility and flexibility that dashing provides, and local merchants showed they are eager for services that help them build and grow omni-channel businesses. The seamless combination of physical and digital services in local commerce is far from complete, which means our work is far from done. We must remain builders, innovators, and risk-takers if we are to achieve the goals we have for our business and the communities we serve.

Fourth Quarter 2022 Key Financial Metrics

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| (in millions, except percentages) | | Dec. 31,

2021 | | Mar. 31,

2022 | | Jun. 30,

2022 | | Sept. 30,

2022 | | Dec. 31,

2022 |

| Total Orders | | 369 | | | 404 | | | 426 | | | 439 | | | 467 | |

| Total Orders Y/Y growth | | 35 | % | | 23 | % | | 23 | % | | 27 | % | | 27 | % |

| Marketplace GOV | | $ | 11,159 | | | $ | 12,353 | | | $ | 13,081 | | | $ | 13,534 | | | $ | 14,446 | |

| Marketplace GOV Y/Y growth | | 36 | % | | 25 | % | | 25 | % | | 30 | % | | 29 | % |

| Revenue | | $ | 1,300 | | | $ | 1,456 | | | $ | 1,608 | | | $ | 1,701 | | | $ | 1,818 | |

| Revenue Y/Y growth | | 34 | % | | 35 | % | | 30 | % | | 33 | % | | 40 | % |

| Net Revenue Margin | | 11.6 | % | | 11.8 | % | | 12.3 | % | | 12.6 | % | | 12.6 | % |

| GAAP Gross Profit | | $ | 637 | | | $ | 662 | | | $ | 686 | | | $ | 714 | | | $ | 762 | |

| GAAP Gross Profit as a % of Marketplace GOV | | 5.7 | % | | 5.4 | % | | 5.2 | % | | 5.3 | % | | 5.3 | % |

| Contribution Profit | | $ | 291 | | | $ | 319 | | | $ | 381 | | | $ | 420 | | | $ | 447 | |

| Contribution Profit as a % of Marketplace GOV | | 2.6 | % | | 2.6 | % | | 2.9 | % | | 3.1 | % | | 3.1 | % |

| GAAP Net Loss including redeemable non-controlling interests | | $ | (155) | | | $ | (167) | | | $ | (263) | | | $ | (296) | | | $ | (642) | |

| GAAP Net Loss including redeemable non-controlling interests as a % of Marketplace GOV | | (1.4) | % | | (1.4) | % | | (2.0) | % | | (2.2) | % | | (4.4) | % |

| Adjusted EBITDA | | $ | 47 | | | $ | 54 | | | $ | 103 | | | $ | 87 | | | $ | 117 | |

| Adjusted EBITDA as a % of Marketplace GOV | | 0.4 | % | | 0.4 | % | | 0.8 | % | | 0.6 | % | | 0.8 | % |

| Basic shares, options and RSUs outstanding as of period end | | 393 | | | 395 | | | 448 | | | 446 | | | 452 | |

1 Based on the number of individual consumer accounts that have completed an order on our Marketplaces in the past month, measured as of December 31, 2022.

2 Excluding Wolt+ members, DashPass members were also over 15 million at year-end 2022.

1

A Brief Review of Q4 and 2022

In Q4 and 2022, we generated strong growth in Marketplace GOV, grew our user base with an increased penetration of DashPass members, made significant improvements to the quality of the consumer experience, expanded the scale of our non-restaurant categories, and improved margin trends in many of our categories and countries.

In Q4, total Marketplace GOV increased by 29% Y/Y to $14.4 billion, which was above the high end of the outlook range we provided. Q4 GAAP net loss including redeemable non-controlling interests was $642 million, which was negatively impacted by a $312 million impairment to an investment in non-marketable equity securities and restructuring charges of $84 million. Q4 Adjusted EBITDA was $117 million, which was within the outlook range we provided.

Excluding the impact of Wolt for comparison purposes, Q4 DoorDash Marketplace GOV increased 20% Y/Y to $13.4 billion. In euros, Q4 Wolt Marketplace GOV increased 50% Y/Y to €1.0 billion. Based on third-party data, we believe we gained category share in the U.S. and in many of our international markets in Q4, with U.S. share gains in the restaurant, convenience, and grocery categories.

For the full year 2022, we grew total Marketplace GOV by 27% Y/Y to $53.4 billion. On a pro forma basis, including the results from Wolt for all of 2021 and 2022, 2022 Marketplace GOV grew by 23% Y/Y. 2022 GAAP net loss including redeemable non-controlling interests was $1.4 billion, which compared to 2021 GAAP net loss including redeemable non-controlling interests of $468 million. 2022 Adjusted EBITDA was $361 million, an increase from $289 million in 2021.

Our Marketplaces: The Consumer Experience

In 2022, we remained maniacally focused on improving the consumer experience we provide. Our goal is to make our service at least a tiny bit better and more efficient every day, and then compound those gains over time, as we believe this improves the long-term growth and margin potential of our business. From December 2021 to December 2022, on the DoorDash marketplace, we lowered our average delivery time by 10%, reduced extreme lateness, increased our site reliability, added selection in all of our categories, and reduced average transaction fees3 per order by over 8%. Each of these had a tangible impact on the consumer experience, which we believe contributed to our growth and share gains through the year.

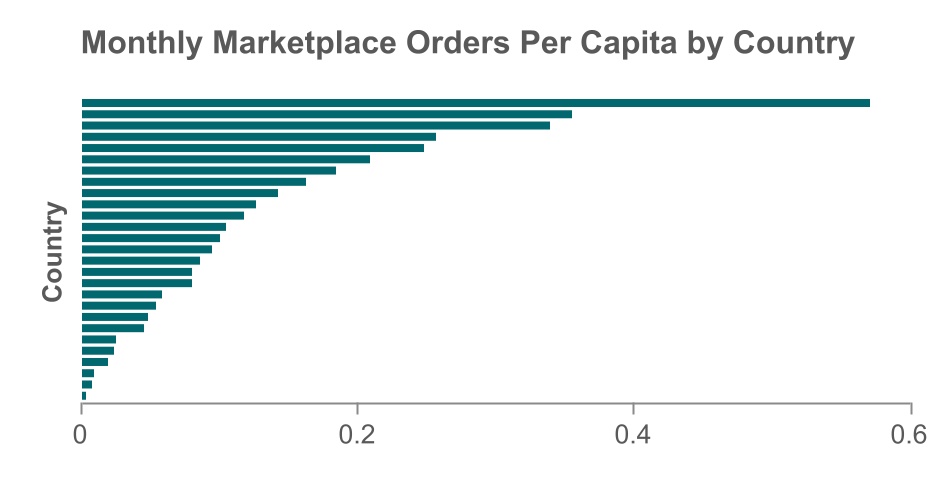

While we are pleased with our progress, our consumer experience is still nowhere near where we would like it to be. We now operate DoorDash and Wolt marketplaces in 27 countries around the world with a combined population of over 750 million people, the majority of whom likely shop in the categories we participate in fairly frequently. We believe a service with ubiquitous selection, near-perfect quality, tremendous affordability, and great service would be able to win consumers’ choice in many of their shopping occasions. In Q4, our marketplaces drove less than one order per capita per month in every country we operate in. We have a lot of room to improve.

Sources: DoorDash internal data, World Bank

3 Transaction fees include applicable delivery, service, small order, and legislative fees, but excludes subscription fees.

2

As we make improvements to the consumer experience, it often drives higher operating efficiency as well as increased order volume. As planned, we generated positive variable profit4 in our third-party convenience category in the U.S. in Q4. In 2023, we believe margins will improve in our U.S. restaurant marketplace and in many of our investment areas. We expect this combination to contribute to 2023 Adjusted EBITDA increasing on both a dollar basis and as a percentage of Marketplace GOV.

Maximizing Long-Term Free Cash Flow Per Share

Our primary financial goal is to maximize long-term Free Cash Flow per share. This does not mean we intend to march Free Cash Flow steadily higher each year. The local commerce market is large and we are constantly looking for new services to launch and new businesses to build. In some years, we will likely invest larger amounts or spend more on longer-term projects, which could constrain short-term Free Cash Flow. In other years, we may see significant margin improvement in existing businesses or invest more in short-term opportunities that drive a faster return, which could benefit short-term Free Cash Flow. Regardless, our goal is to apply a consistent philosophy and rigor to our investments in an effort to steadily build scale in our business. We believe this is the best way to increase our long-term Free Cash Flow potential and maximize the impact we have on the local communities we are part of.

When thinking about investing in our business, we have a wide range of options, each of which has a different impact on our volume and margins, a different time horizon for that impact, and different levels of efficiency based on circumstances, time, and scale. Our goal in day-to-day execution and long-term planning is to balance our investments across these opportunities in order to maximize absolute dollar returns over time, not margin percentages. We do this because we believe driving higher Free Cash Flow in absolute terms is the best way to build a large and durable business.

If we targeted a margin percentage, we believe it would constrain our opportunity set, particularly as it relates to longer-term investments or initiatives like DashPass. Managing to a long-term margin percentage would also suggest we know precisely how efficient each area of investment will be many years into the future. Unfortunately, we have not figured that out yet.

We are not perfectly efficient with our spending, nor do we expect to be. We have to test and make mistakes in order to learn. Our goal is to steadily improve our efficiency over time. If we do this successfully, it should free up more capital, which we can then choose to invest in short or long-term growth initiatives, or drive higher margins.

Detail on Recent Free Cash Flow Conversion

In 2022, we generated $361 million of Adjusted EBITDA, $367 million of net cash provided by operating activities, and $21 million of Free Cash Flow. In comparison, in 2021, we generated $289 million of Adjusted EBITDA, $692 million of net cash provided by operating activities, and $455 million of Free Cash Flow. In 2022, we drove significant growth in cash generation from our U.S. restaurant marketplace and chose to invest much of the incremental cash into long-term growth initiatives. This negatively impacted our 2022 Adjusted EBITDA and Free Cash Flow, but we believe will contribute to higher Free Cash Flow over time.

In addition to growth investments, our 2022 Free Cash Flow was impacted by three additional factors: 1) a $170 million impact from 2022 ending on a Saturday, which resulted in one extra day of cash held at payment processors, 2) the payment of a $100 million legal settlement in Q2 2022 that was previously reserved for, and 3) $74 million of cash paid for transaction-related costs, primarily associated with our acquisition of Wolt. Collectively, these factors reduced 2022 Free Cash Flow by $344 million. Absent these factors, 2022 Free Cash Flow would have been $365 million, roughly in line with 2022 Adjusted EBITDA.

For 2023, we currently expect Free Cash Flow to increase substantially compared to 2022. However, 2023 Free Cash Flow is likely to be below 2023 Adjusted EBITDA, in part because 2023 ends on a Sunday. This means we expect to have one extra day of cash held at payment processors at the end of 2023 compared to 2022, and two extra days of cash held at payment processors compared to the end of 2021. While the day of the week a period ends on can impact our reported

4 Variable profit is a metric used internally to evaluate the performance of certain categories prior to allocation of shared use fixed costs. It is defined as revenue minus order management and support costs.

3

Free Cash Flow, it does not impact our normal operations. We believe our normalized working capital5 cycle (excluding the impact of certain periods ending on a weekend) remains positive. If you’re interested, 2024 ends on a Tuesday.

The Value Of Our Shares

Managing dilution is the other half of maximizing long-term Free Cash Flow per share. For us, managing dilution does not mean limiting share growth to zero, but rather recognizing the cost of our equity and trying to maximize the value we get from the shares we issue.

In 2022, we issued equity for two primary purposes: 1) to acquire Wolt and 2) to compensate employees for their time, effort, and contributions to our business. These drove our total base of basic shares, stock options, and restricted stock units (RSUs) to approximately 452 million on December 31, 2022, up from 393 million on December 31, 2021.

In connection with the Wolt transaction, we issued approximately 46 million shares of our common stock, stock options, and RSUs.6 We remain very pleased with our combination with Wolt and continue to believe this was an attractive use of our equity capital.

We believe stock-based compensation is a valuable way to reinforce an ownership mentality throughout our organization and align incentives between employees and shareholders. Stock-based compensation has both an accounting expense and a cost in its dilutive impact to shares outstanding. We consider both of these.

Reported stock-based compensation expense can sometimes provide a good proxy for what it would cost to pay employees in cash. But, it can also deviate from the estimated cash equivalent cost depending on the source of the accounting cost and the accounting method applied. In 2022, we estimate approximately 34% of our stock-based compensation expense related to costs that were either one-time in nature or likely deviate from the cash equivalent cost.7

With dilution, a share that is issued and vested has the same cost to shareholders regardless of source or accounting treatment. Further, dilution compounds over time. Since our focus is on maximizing long-term Free Cash Flow per share, we currently think about stock-based compensation more in terms of dilution than accounting expense. However, over a multi-year time horizon, we expect the dilutive impact and accounting expense from stock-based compensation to move in concert, and our goal is to manage this cost regardless of how it is measured.

In 2022, we issued approximately 19 million RSUs net of forfeitures,8 which was approximately 5% of our total base of shares and potentially dilutive securities exiting 2021. Our 2022 RSU issuance increased substantially due to the significant increase in headcount in 2021 and 2022, and the lower average stock price in 2022 compared to 2021.

Like with all forms of pay, we hope to generate leverage on our stock-based compensation expense over time and reduce the dilutive impact of issuing shares to employees. Currently, because we believe we can significantly increase the value of our business, we believe repurchasing shares is an attractive way to reduce dilution and improve long-term Free Cash Flow per share. In 2022, we repurchased 5.6 million shares of our Class A common stock for $400 million.

In February 2023, our board of directors authorized the repurchase of up to $750 million of our Class A common stock. We currently expect net dilution in 2023 to be around 2%9.

5 Working capital is defined as the sum of changes in assets and liabilities on our consolidated statements of cash flows.

6 We issued 35.8 million shares to Wolt shareholders and granted 7.3 million RSUs to Wolt employees to encourage retention. We also converted existing Wolt stock options for continuing employees into 3.1 million shares of DoorDash RSUs and stock options.

7 In 2022, stock-based compensation expense included $112 million associated with a CEO performance award, $93 million associated with retention and revesting as part of the Wolt transaction, an estimated $88 million associated with the step-up of value for grants issued prior to our IPO, and $11 million in expense associated with our November reduction in force.

8 Excludes 7.3 million RSUs issued to Wolt employees to encourage retention and 1.4 million RSUs issued to Wolt employees in exchange for pre-existing Wolt unvested options.

9 Measured against the total base of basic shares outstanding and anti-dilutive securities, which was 452 million on December 31, 2022. The actual net dilution in 2023 will depend on a number of factors including, among other things, the size of the repurchase program that we complete and the price at which shares are repurchased.

4

Conclusion

As we think back on 2022, our team’s focus and consistent execution stand out. In welcoming Wolt, driving growth through a challenging environment, progressing in key new initiatives, and making difficult decisions about projects and headcount, we demonstrated a combination of first-principles thinking, purposeful collaboration, and humanity that make DoorDash unique. As we look forward, we must continuously improve our level of execution, while also remaining innovators and risk-takers.

We also want to take a moment to acknowledge our outgoing President and COO Christopher Payne. Christopher has made an indelible mark on DoorDash, shaping our culture, co-creating our systems and processes, and mentoring and coaching our future leaders. After more than three decades of building and running new businesses, including more than seven years here at DoorDash, he is retiring from operating roles and day-to-day management. Effective March 1, 2023, Prabir Adarkar will be stepping into the role of President and COO and Ravi Inukonda, our Vice President of Finance and Strategy, into the CFO role. Prabir and Ravi both joined DoorDash during a pivotal time and, over the years, have proven their capabilities, while helping us secure category leadership in the U.S., launch multiple businesses globally, and grow sales more than 7x while improving our unit economics. I can think of no one in or outside of our industry who is more qualified for these positions than Prabir and Ravi.

The migration toward omni-channel commerce is likely to continue for several decades. For DoorDash to achieve its mission of empowering local economies, we must relentlessly improve our existing services and create entirely new ones. Remaining innovators is the only way we know to help local merchants successfully build and grow their businesses, create more opportunities for Dashers to generate incremental income, and give consumers easier ways to discover and transact with the wonderful merchants in their communities. Our expectations of ourselves are high. We will do our best to exceed them.

We could not be more grateful to our employees and stakeholders for the confidence they place in us, or more humbled by our shareholders who entrust us with their capital. Thank you for making this journey possible.

Sincerely,

Tony Xu, Co-founder, CEO and Board Chair, and Prabir Adarkar, CFO and incoming President and COO

5

Financial and Operational Highlights

Q4 2022 Total Orders increased 27% Y/Y to 467 million from 369 million in Q4 2021. The Y/Y growth in Total Orders was driven by growth in consumers and consumer engagement at DoorDash as well as our acquisition of Wolt.

Q4 2022 Marketplace GOV increased 29% Y/Y to $14.4 billion from $11.2 billion in Q4 2021. The Y/Y growth in Marketplace GOV was driven primarily by organic growth in Total Orders as well as our acquisition of Wolt.

Q4 2022 Revenue increased 40% Y/Y to $1.8 billion from $1.3 billion in Q4 2021. Net Revenue Margin, defined as revenue as a percentage of Marketplace GOV, increased to 12.6% in Q4 2022 from 11.6% in Q4 2021. The Y/Y increase in Net Revenue Margin was driven primarily by a reduction in credits, refunds, discounts, and promotions as a percentage of Marketplace GOV, which was partially offset by an increased mix of orders from international markets, non-restaurant categories, and DashPass members.

Q4 2022 GAAP cost of revenue, exclusive of depreciation and amortization, increased 60% to $1.0 billion from $635 million in Q4 2021. Q4 2022 adjusted cost of revenue increased by 59% Y/Y to $975 million from $614 million in Q4 2021. The increase in adjusted cost of revenue was driven by growth in Total Orders, increased insurance reserves, and costs associated with our first-party distribution business, as well as an increase in headcount.

Q4 2022 GAAP gross profit increased 20% to $762 million from $637 million in Q4 2021. GAAP gross profit as a percentage of Marketplace GOV decreased to 5.3% in Q4 2022 from 5.7% in Q4 2021. Q4 2022 Adjusted Gross Profit increased 23% Y/Y to $843 million from $686 million in Q4 2021. Adjusted Gross Profit as a percentage of Marketplace GOV decreased to 5.8% in Q4 2022 from 6.1% in Q4 2021 due primarily to our acquisition of Wolt.

Q4 2022 GAAP sales and marketing expenses increased 4% to $429 million from $413 million in Q4 2021. Q4 2022 adjusted sales and marketing expense was $396 million, consistent with $395 million in Q4 2021, driven primarily by a Y/Y decline in advertising costs that was offset by growth in headcount and the addition of Wolt.

Q4 2022 Contribution Profit increased 54% Y/Y to $447 million from $291 million in Q4 2021. Contribution Profit as a percentage of Marketplace GOV increased to 3.1% in Q4 2022 from 2.6% in Q4 2021.

Q4 2022 GAAP research and development expenses increased 88% to $250 million from $133 million in Q4 2021. Q4 2022 adjusted research and development expenses increased 72% Y/Y to $131 million, driven by growth in headcount and the addition of Wolt.

Q4 2022 GAAP general and administrative expenses increased 34% to $300 million from $224 million in Q4 2021. Q4 2022 adjusted general and administrative expenses increased 18% Y/Y to $199 million, driven primarily by growth in headcount and the addition of Wolt.

Q4 2022 GAAP net loss including redeemable non-controlling interests was $642 million compared to a GAAP net loss including redeemable non-controlling interests of $155 million in Q4 2021. Q4 2022 GAAP net loss including redeemable non-controlling interests was negatively impacted by a $312 million impairment to an investment in non-marketable equity securities. Q4 2022 Adjusted EBITDA was $117 million compared to $47 million for Q4 2021.

Operating cash flow in Q4 2022 was $23 million and Free Cash Flow was $(73) million. In 2022, we generated operating cash flow of $367 million and Free Cash Flow of $21 million.

6

Q1 and 2023 Outlook

We currently expect Q1 Marketplace GOV to be in a range of $15.1 billion to $15.5 billion, with Q1 Adjusted EBITDA expected to be in a range of $120 million to $170 million.

We currently expect 2023 Marketplace GOV to be in a range of $60.0 billion to $63.0 billion, with Adjusted EBITDA expected to be in a range of $500 million to $800 million.

| | | | | | | | |

| Period | Marketplace GOV | Adj. EBITDA |

| Q1 | $15.1 billion - $15.5 billion | $120 million - $170 million |

| 2023 | $60.0 billion - $63.0 billion | $500 million - $800 million |

Among other things, our Q1 and 2023 outlook anticipates a consumer spending environment that is broadly consistent with recent months. It also anticipates significant levels of ongoing investment in new categories and international markets. Our forecast assumes key foreign currency rates remain stable at current levels. We caution investors that consumer spending could deteriorate faster or to a greater degree than we anticipate, which could drive results below our expectations. Additionally, our increased international exposure heightens risks associated with operating in foreign markets, including geopolitical and currency risks, and changes in the international operating environment could negatively impact results versus our current outlook.

We have not provided the forward-looking GAAP equivalent to our Adjusted EBITDA outlook or a GAAP reconciliation as a result of the uncertainty regarding, and the potential variability of, reconciling items such as stock-based compensation and income tax. Accordingly, a reconciliation of this non-GAAP guidance metric to its corresponding GAAP equivalent is not available without unreasonable effort. However, it is important to note that material changes to reconciling items could have a significant effect on future GAAP results. We have provided historical reconciliations of GAAP to non-GAAP metrics in tables at the end of this investor letter. For more information regarding the non-GAAP financial measures discussed in this investor letter, please see "Non-GAAP Financial Measures" below.

Analyst and Investor Conference Call

We will host an analyst and investor conference call to discuss our quarterly results at 2:00 PM (PT) today. Members of the investor community interested in listening to the call can register and attend at ir.doordash.com.

| | | | | |

IR Contact: Andy Hargreaves, CFA ir@doordash.com | PR Contact: Press at DoorDash press@doordash.com |

Webcast

DoorDash will host a webcast today at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) to discuss these financial results and business highlights. To listen to a live audio webcast, please visit our Investor Relations page at https://ir.doordash.com. The archived webcast will be available on our Investor Relations page shortly after the call.

Available Information

We announce material information to the public about us, our products and services, and other matters through a variety of means, including filings with the SEC, press releases, public conference calls, webcasts, the investor relations section of our website (ir.doordash.com), our blog (blog.doordash.com or doordash.news), and our Twitter account (@DoorDash) in order to achieve broad, non-exclusionary distribution of information to the public and for complying with our disclosure obligations under Regulation FD.

7

Forward-Looking Statements

This investor letter contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” "aim," “will,” “should,” “expect,” “plan,” "try," “anticipate,” “could,” “would,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategies, plans, or intentions. Forward-looking statements in this investor letter include, but are not limited to, our expectations regarding our financial position and operating performance, including our outlook and guidance for the first quarter and full year 2023, our expectations regarding Wolt and our international business, our plans and expectations regarding our investment approach, our expectations regarding our local commerce opportunity, trends in our business, including the effects of the macroeconomic environment, inflation, consumer spending, and demand for our platform and for local commerce platforms in general, and our plans and expectations regarding share dilution, including our planned share repurchase, and our ability to manage dilution. Our expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected, including risks and uncertainties related to: competition, managing our growth and corporate culture, financial performance, including the impact of the COVID-19 pandemic on our business and operations and our ability to forecast our performance due to our limited operating history and the COVID-19 pandemic, investments in new geographies, products, or offerings, our ability to attract merchants, consumers, and Dashers to our platform, legal proceedings and regulatory matters and developments, any future changes to our business or our financial or operating model, and our brand and reputation. The forward-looking statements contained in this investor letter are also subject to other risks and uncertainties that could cause actual results to differ from the results predicted, including those more fully described in our filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2021 and our quarterly reports on Form 10-Q. All forward-looking statements in this investor letter are based on information available to DoorDash and assumptions and beliefs as of the date hereof, and we disclaim any obligation to update any forward-looking statements, except as required by law.

Use of Non-GAAP Financial Measures

To supplement our financial information presented in accordance with accounting principles generally accepted in the United States of America ("GAAP"), we consider certain financial measures that are not prepared in accordance with GAAP, including adjusted cost of revenue, adjusted sales and marketing expense, adjusted research and development expense, adjusted general and administrative expense, Adjusted Gross Profit (Loss), Adjusted Gross Margin, Contribution Profit (Loss), Contribution Margin, Adjusted EBITDA, and Free Cash Flow. We use these financial measures in conjunction with GAAP measures as part of our overall assessment of our performance, including the preparation of our annual operating budget and quarterly forecasts, to evaluate the effectiveness of our business strategies and to communicate with our board of directors concerning our business and financial performance. We believe that these non-GAAP financial measures provide useful information to investors about our business and financial performance, enhance their overall understanding of our past performance and future prospects, and allow for greater transparency with respect to metrics used by our management in their financial and operational decision making. We are presenting these non-GAAP financial measures to assist investors in seeing our business and financial performance through the eyes of management, and because we believe that these non-GAAP financial measures provide an additional tool for investors to use in comparing results of operations of our business over multiple periods with other companies in our industry.

We define adjusted cost of revenue as cost of revenue, exclusive of depreciation and amortization, excluding stock-based compensation expense and certain payroll tax expense, allocated overhead, and inventory write-off related to restructuring. Allocated overhead is determined based on an allocation of shared costs, such as facilities (including rent and utilities) and information technology costs, among all departments based on employee headcount. We define adjusted sales and marketing expense as sales and marketing expenses excluding stock-based compensation expense and certain payroll tax expense, and allocated overhead. We define adjusted research and development expense as research and development expenses excluding stock-based compensation expense and certain payroll tax expense, and allocated overhead. We define adjusted general and administrative expense as general and administrative expenses excluding stock-based compensation expense and certain payroll tax expense, certain legal, tax, and regulatory settlements, reserves, and expenses, transaction-related costs (primarily consists of acquisition, integration, and investment related costs), impairment expenses, and including allocated overhead from cost of revenue, sales and marketing, and research and development.

8

We define Adjusted Gross Profit (Loss) as gross profit (loss) plus (i) depreciation and amortization expense related to cost of revenue, (ii) stock-based compensation expense and certain payroll tax expense included in cost of revenue, (iii) allocated overhead included in cost of revenue, and (iv) inventory write-off related to restructuring. Gross profit (loss) is defined as revenue less (i) cost of revenue, exclusive of depreciation and amortization and (ii) depreciation and amortization related to cost of revenue. Adjusted Gross Margin is defined as Adjusted Gross Profit (Loss) as a percentage of revenue for the same period.

We define Contribution Profit (Loss) as our gross profit (loss) less sales and marketing expense plus (i) depreciation and amortization expense related to cost of revenue, (ii) stock-based compensation expense and certain payroll tax expense included in cost of revenue and sales and marketing expenses, (iii) allocated overhead included in cost of revenue and sales and marketing expenses, and (iv) inventory write-off related to restructuring. We define gross margin as gross profit (loss) as a percentage of revenue for the same period and we define Contribution Margin as Contribution Profit (Loss) as a percentage of revenue for the same period. Wolt Contribution Profit (Loss) is defined in the same manner, but relates only to Wolt financial results.

Adjusted EBITDA is a measure that we use to assess our operating performance and the operating leverage in our business. We define Adjusted EBITDA as net income (loss), including redeemable non-controlling interests, adjusted to exclude (i) certain legal, tax, and regulatory settlements, reserves, and expenses, (ii) transaction-related costs (primarily consists of acquisition, integration, and investment related costs), (iii) impairment expenses, (iv) restructuring charges, (v) inventory write-off related to restructuring, (vi) provision for (benefit from) income taxes, (vii) interest (income) expense, net, (viii) other (income) expense, net, (ix) stock-based compensation expense and certain payroll tax expense, and (x) depreciation and amortization expense. Wolt Adjusted EBITDA is defined in the same manner, but relates only to Wolt financial results.

We define Free Cash Flow as cash flows from operating activities less purchases of property and equipment and capitalized software and website development costs.

We define Total Orders as all orders completed through our marketplaces and platform services businesses over the period of measurement.

We define Marketplace GOV as the total dollar value of orders completed on our marketplaces, including taxes, tips, and any applicable consumer fees, including membership fees related to DashPass and Wolt+. Marketplace orders include orders completed through Pickup and DoorDash for Work. Marketplace GOV does not include the dollar value of orders, taxes and tips, or fees charged to merchants, for orders fulfilled through Drive, Storefront, or Bbot.

Our definitions may differ from the definitions used by other companies and therefore comparability may be limited. In addition, other companies may not publish these or similar metrics. Further, these metrics have certain limitations in that they do not include the impact of certain expenses that are reflected in our consolidated statements of operations. Thus, our adjusted cost of revenue, adjusted sales and marketing expense, adjusted research and development expense, adjusted general and administrative expense, Adjusted Gross Profit (Loss), Adjusted Gross Margin, Contribution Profit (Loss), Contribution Margin, Adjusted EBITDA, and Free Cash Flow should be considered in addition to, not as substitutes for, or in isolation from, measures prepared in accordance with GAAP.

9

DOORDASH, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions)

(Unaudited)

| | | | | | | | | | | |

| December 31, 2021 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 2,504 | | | $ | 1,977 | |

| Short-term marketable securities | 1,253 | | | 1,544 | |

| Funds held at payment processors | 320 | | | 441 | |

| Accounts receivable, net | 349 | | | 400 | |

| Prepaid expenses and other current assets | 139 | | | 358 | |

| Total current assets | 4,565 | | | 4,720 | |

| Restricted cash | 2 | | | 211 | |

| Long-term marketable securities | 650 | | | 397 | |

| Operating lease right-of-use assets | 336 | | | 436 | |

| Property and equipment, net | 402 | | | 637 | |

| Intangible assets, net | 61 | | | 765 | |

| Goodwill | 316 | | | 2,370 | |

| Non-marketable equity securities | 409 | | | 124 | |

| Other assets | 68 | | | 129 | |

| Total assets | $ | 6,809 | | | $ | 9,789 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 161 | | | $ | 157 | |

| Operating lease liabilities | 26 | | | 55 | |

| | | |

| Accrued expenses and other current liabilities | 1,573 | | | 2,332 | |

| Total current liabilities | 1,760 | | | 2,544 | |

| Operating lease liabilities | 373 | | | 456 | |

| Other liabilities | 9 | | | 21 | |

| Total liabilities | 2,142 | | | 3,021 | |

| | | |

| Redeemable non-controlling interests | — | | | 14 | |

| Stockholders’ equity: | | | |

| Common stock | — | | | — | |

| Additional paid-in capital | 6,752 | | | 10,633 | |

| Accumulated other comprehensive loss | (4) | | | (33) | |

| Accumulated deficit | (2,081) | | | (3,846) | |

| Total stockholders’ equity | 4,667 | | | 6,754 | |

| Total liabilities, redeemable non-controlling interests and stockholders’ equity | $ | 6,809 | | | $ | 9,789 | |

10

DOORDASH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except share amounts which are reflected in thousands, and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2021 | | 2022 | | 2021 | | 2022 |

| Revenue | $ | 1,300 | | | $ | 1,818 | | | $ | 4,888 | | | $ | 6,583 | |

| Costs and expenses: | | | | | | | |

| Cost of revenue, exclusive of depreciation and amortization shown separately below | 635 | | | 1,014 | | | 2,338 | | | 3,588 | |

| Sales and marketing | 413 | | | 429 | | | 1,619 | | | 1,682 | |

| Research and development | 133 | | | 250 | | | 430 | | | 829 | |

| General and administrative | 224 | | | 300 | | | 797 | | | 1,147 | |

| Depreciation and amortization | 49 | | | 111 | | | 156 | | | 369 | |

| Restructuring charges | — | | | 84 | | | — | | | 92 | |

| Total costs and expenses | 1,454 | | | 2,188 | | | 5,340 | | | 7,707 | |

| Loss from operations | (154) | | | (370) | | | (452) | | | (1,124) | |

| Interest income | 1 | | | 17 | | | 3 | | | 32 | |

| Interest expense | (1) | | | (1) | | | (14) | | | (2) | |

| Other income (expense), net | 1 | | | (305) | | | — | | | (305) | |

| Loss before income taxes | (153) | | | (659) | | | (463) | | | (1,399) | |

| Provision for (benefit from) income taxes | 2 | | | (17) | | | 5 | | | (31) | |

| Net loss including redeemable non-controlling interests | (155) | | | (642) | | | (468) | | | (1,368) | |

| | | | | | | |

| Less: net loss attributable to redeemable non-controlling interests, net of tax | — | | | (2) | | | — | | | (3) | |

| Net loss attributable to DoorDash, Inc. common stockholders | $ | (155) | | | $ | (640) | | | $ | (468) | | | $ | (1,365) | |

| Net loss per share attributable to DoorDash, Inc. common stockholders, basic and diluted | $ | (0.45) | | | $ | (1.65) | | | $ | (1.39) | | | $ | (3.68) | |

| Weighted-average number of shares outstanding used to compute net loss per share attributable to DoorDash, Inc. common stockholders, basic and diluted | 344,469 | | | 387,162 | | | 336,847 | | | 371,413 | |

11

DOORDASH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2020 | | 2021 | | 2022 |

| Cash flows from operating activities | | | | | |

| Net loss including redeemable non-controlling interests | $ | (461) | | | $ | (468) | | | $ | (1,368) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | |

| Depreciation and amortization | 120 | | | 156 | | | 369 | |

| Stock-based compensation | 322 | | | 486 | | | 889 | |

| Bad debt expense | 16 | | | 36 | | | — | |

| Reduction of operating lease right-of-use assets and accretion of operating lease liabilities | 40 | | | 52 | | | 81 | |

| Adjustments to non-marketable equity securities, including impairment, net | — | | | — | | | 303 | |

| Non-cash interest expense | 31 | | | 11 | | | — | |

| Other | 18 | | | 28 | | | 20 | |

| Changes in assets and liabilities, net of assets acquired and liabilities assumed from acquisitions: | | | | | |

| Funds held at payment processors | (96) | | | (174) | | | (86) | |

| Accounts receivable, net | (248) | | | (94) | | | (33) | |

| Prepaid expenses and other current assets | (96) | | | 85 | | | (165) | |

| Other assets | (20) | | | (51) | | | (90) | |

| Accounts payable | 54 | | | 79 | | | (15) | |

| Accrued expenses and other current liabilities | 587 | | | 595 | | | 566 | |

| Payments for operating lease liabilities | (26) | | | (44) | | | (75) | |

| Other liabilities | 11 | | | (5) | | | (29) | |

| Net cash provided by operating activities | 252 | | | 692 | | | 367 | |

| Cash flows from investing activities | | | | | |

| Purchases of property and equipment | (106) | | | (129) | | | (176) | |

| Capitalized software and website development costs | (53) | | | (108) | | | (170) | |

| Purchases of marketable securities | (593) | | | (2,344) | | | (1,948) | |

| Sales of marketable securities | 4 | | | 224 | | | 1,552 | |

| Maturities of marketable securities | 583 | | | 720 | | | 387 | |

| Purchases of non-marketable equity securities | — | | | (409) | | | (15) | |

| Net cash acquired in (used in) acquisitions | (28) | | | — | | | 71 | |

| Other investing activities | 1 | | | (1) | | | (1) | |

| Net cash used in investing activities | (192) | | | (2,047) | | | (300) | |

| Cash flows from financing activities | | | | | |

| Proceeds from issuance of common stock upon initial public offering, net of underwriter discounts | 3,289 | | | — | | | — | |

| Proceeds from issuance of preferred stock, net of issuance costs | 382 | | | — | | | — | |

| Proceeds from issuance of convertible notes, net of issuance costs | 333 | | | — | | | — | |

| Proceeds from exercise of stock options | 5 | | | 32 | | | 11 | |

| Deferred offering costs paid | (6) | | | (10) | | | — | |

| Repayment of convertible notes | — | | | (333) | | | — | |

| Taxes paid related to net share settlement of equity awards | (7) | | | (172) | | | — | |

| Repurchase of common stock | — | | | — | | | (400) | |

| Other financing activities | — | | | — | | | 14 | |

| Net cash provided by (used in) financing activities | 3,996 | | | (483) | | | (375) | |

| Foreign currency effect on cash, cash equivalents, and restricted cash | 2 | | | (1) | | | (10) | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | 4,058 | | | (1,839) | | | (318) | |

| Cash, cash equivalents, and restricted cash | | | | | |

| Cash, cash equivalents, and restricted cash, beginning of period | 287 | | | 4,345 | | | 2,506 | |

| Cash, cash equivalents, and restricted cash, end of period | $ | 4,345 | | | $ | 2,506 | | | $ | 2,188 | |

| Reconciliation of cash, cash equivalents, and restricted cash to the consolidated balance sheets | | | | | |

| Cash and cash equivalents | $ | 4,345 | | | $ | 2,504 | | | $ | 1,977 | |

| Restricted cash | — | | | 2 | | | 211 | |

| Total cash, cash equivalents, and restricted cash | $ | 4,345 | | | $ | 2,506 | | | $ | 2,188 | |

| Supplemental disclosure of cash flow information | | | | | |

| Cash paid for interest | $ | — | | | $ | 42 | | | $ | — | |

| | | | | |

| Non-cash investing and financing activities | | | | | |

| Conversion of redeemable convertible preferred stock to common stock upon initial public offering | $ | 2,646 | | | $ | — | | | $ | — | |

| Purchases of property and equipment not yet settled | $ | 17 | | | $ | 23 | | | $ | 34 | |

| | | | | |

| | | | | |

| Unrealized loss on marketable securities | $ | — | | | $ | (4) | | | $ | (20) | |

| | | | | |

| Stock-based compensation included in capitalized software and website development costs | $ | 8 | | | $ | 93 | | | $ | 132 | |

| Holdback consideration for acquisitions | $ | 3 | | | $ | — | | | $ | 8 | |

12

DOORDASH, INC.

NON-GAAP FINANCIAL MEASURES

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| (In millions) | | Dec. 31,

2021 | | Mar. 31,

2022 | | Jun. 30,

2022 | | Sept. 30,

2022 | | Dec. 31,

2022 |

| | | | | | | | | | |

| Cost of revenue, exclusive of depreciation and amortization | | $ | 635 | | | $ | 763 | | | $ | 880 | | | $ | 931 | | | $ | 1,014 | |

| Adjusted to exclude the following: | | | | | | | | | | |

| Stock-based compensation expense and certain payroll tax expense | | (14) | | | (12) | | | (31) | | | (29) | | | (31) | |

| Allocated overhead | | (7) | | | (9) | | | (8) | | | (7) | | | (8) | |

| Inventory write-off related to restructuring | | — | | | — | | | (2) | | | — | | | — | |

| Adjusted cost of revenue | | $ | 614 | | | $ | 742 | | | $ | 839 | | | $ | 895 | | | $ | 975 | |

| | | | | | | | | | |

| Sales and marketing | | $ | 413 | | | $ | 414 | | | $ | 421 | | | $ | 418 | | | $ | 429 | |

| Adjusted to exclude the following: | | | | | | | | | | |

| Stock-based compensation expense and certain payroll tax expense | | (14) | | | (14) | | | (29) | | | (27) | | | (28) | |

| Allocated overhead | | (4) | | | (5) | | | (4) | | | (5) | | | (5) | |

| Adjusted sales and marketing | | $ | 395 | | | $ | 395 | | | $ | 388 | | | $ | 386 | | | $ | 396 | |

| | | | | | | | | | |

| Research and development | | $ | 133 | | | $ | 148 | | | $ | 205 | | | $ | 226 | | | $ | 250 | |

| Adjusted to exclude the following: | | | | | | | | | | |

| Stock-based compensation expense and certain payroll tax expense | | (54) | | | (56) | | | (95) | | | (99) | | | (116) | |

| Allocated overhead | | (3) | | | (4) | | | (4) | | | (5) | | | (3) | |

| Adjusted research and development | | $ | 76 | | | $ | 88 | | | $ | 106 | | | $ | 122 | | | $ | 131 | |

| | | | | | | | | | |

| General and administrative | | $ | 224 | | | $ | 245 | | | $ | 291 | | | $ | 311 | | | $ | 300 | |

| Adjusted to exclude the following: | | | | | | | | | | |

| Stock-based compensation expense and certain payroll tax expense | | (51) | | | (48) | | | (76) | | | (96) | | | (93) | |

Certain legal, tax, and regulatory settlements, reserves, and expenses(1) | | (11) | | | (24) | | | (15) | | | (14) | | | (19) | |

Transaction-related costs(2) | | (8) | | | (14) | | | (44) | | | (7) | | | (3) | |

Impairment expenses(3) | | — | | | — | | | — | | | — | | | (2) | |

| | | | | | | | | | |

| Allocated overhead from cost of revenue, sales and marketing, and research and development | | 14 | | | 18 | | | 16 | | | 17 | | | 16 | |

| Adjusted general and administrative | | $ | 168 | | | $ | 177 | | | $ | 172 | | | $ | 211 | | | $ | 199 | |

(1)We exclude certain costs and expenses from our calculation of adjusted general and administrative expense because management believes that these costs and expenses are not indicative of our core operating performance, do not reflect the underlying economics of our business, and are not necessary to operate our business. These excluded costs and expenses consist of (i) certain legal costs primarily related to worker classification matters, (ii) reserves for the collection of sales and indirect taxes that we do not expect to incur on a recurring basis, (iii) costs related to the settlement of an intellectual property matter, (iv) expenses related to supporting various policy matters, including those related to worker classification and price controls, and (v) donations as part of our relief efforts in connection with the COVID-19 pandemic and Russia's invasion of Ukraine. We believe it is appropriate to exclude the foregoing matters from our calculation of adjusted general and administrative expense because (1) the timing and magnitude of such expenses are unpredictable and thus not part of management’s budgeting or forecasting process, and (2) with respect to worker classification matters, management currently expects such expenses will not be material to our results of operations over the long term as a result of increasing legislative and regulatory certainty in this area, including as a result of Proposition 22 in California and similar legislation.

(2)Consists of acquisition, integration, and investment related costs, primarily related to the Wolt acquisition.

(3)Consists of impairment expense related to an operating lease right-of-use asset associated with our former headquarters.

13

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| (In millions, except percentages) | | Dec. 31,

2021 | | Mar. 31,

2022 | | Jun. 30,

2022 | | Sept. 30,

2022 | | Dec. 31,

2022 |

| | | | | | | | | | |

| Revenue | | $ | 1,300 | | | $ | 1,456 | | | $ | 1,608 | | | $ | 1,701 | | | $ | 1,818 | |

| Less: Cost of revenue, exclusive of depreciation and amortization | | (635) | | | (763) | | | (880) | | | (931) | | | (1,014) | |

| Less: Depreciation and amortization related to cost of revenue | | (28) | | | (31) | | | (42) | | | (56) | | | (42) | |

| Gross profit | | $ | 637 | | | $ | 662 | | | $ | 686 | | | $ | 714 | | | $ | 762 | |

| Gross Margin | | 49.0 | % | | 45.5 | % | | 42.7 | % | | 42.0 | % | | 41.9 | % |

| Less: Sales and marketing | | (413) | | | (414) | | | (421) | | | (418) | | | (429) | |

| Add: Depreciation and amortization related to cost of revenue | | 28 | | | 31 | | | 42 | | | 56 | | | 42 | |

| Add: Stock-based compensation expense and certain payroll tax expense included in cost of revenue and sales and marketing | | 28 | | | 26 | | | 60 | | | 56 | | | 59 | |

| Add: Allocated overhead included in cost of revenue and sales and marketing | | 11 | | | 14 | | | 12 | | | 12 | | | 13 | |

| Add: Inventory write-off related to restructuring | | — | | | — | | | 2 | | | — | | | — | |

| Contribution Profit | | $ | 291 | | | $ | 319 | | | $ | 381 | | | $ | 420 | | | $ | 447 | |

| Contribution Margin | | 22.4 | % | | 21.9 | % | | 23.7 | % | | 24.7 | % | | 24.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| (In millions, except percentages) | | Dec. 31,

2021 | | Mar. 31,

2022 | | Jun. 30,

2022 | | Sept. 30,

2022 | | Dec. 31,

2022 |

| | | | | | | | | | |

| Gross profit | | $ | 637 | | | $ | 662 | | | $ | 686 | | | $ | 714 | | | $ | 762 | |

| Add: Depreciation and amortization related to cost of revenue | | 28 | | | 31 | | | 42 | | | 56 | | | 42 | |

| Add: Stock-based compensation expense and certain payroll tax expense included in cost of revenue | | 14 | | | 12 | | | 31 | | | 29 | | | 31 | |

| Add: Allocated overhead included in cost of revenue | | 7 | | | 9 | | | 8 | | | 7 | | | 8 | |

| Add: Inventory write-off related to restructuring | | — | | | — | | | 2 | | | — | | | — | |

| Adjusted Gross Profit | | $ | 686 | | | $ | 714 | | | $ | 769 | | | $ | 806 | | | $ | 843 | |

| Adjusted Gross Margin | | 52.8 | % | | 49.0 | % | | 47.8 | % | | 47.4 | % | | 46.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| (In millions, except percentages) | | Dec. 31,

2021 | | Mar. 31,

2022 | | Jun. 30,

2022 | | Sept. 30,

2022 | | Dec. 31,

2022 |

| | | | | | | | | | |

| Net loss including redeemable non-controlling interests | | $ | (155) | | | $ | (167) | | | $ | (263) | | | $ | (296) | | | $ | (642) | |

Certain legal, tax, and regulatory settlements, reserves, and expenses(1) | | 11 | | | 24 | | | 15 | | | 14 | | | 19 | |

Transaction-related costs(2) | | 8 | | | 14 | | | 44 | | | 7 | | | 3 | |

Impairment expenses(3) | | — | | | — | | | — | | | — | | | 2 | |

| Restructuring charges | | — | | | — | | | 3 | | | 5 | | | 84 | |

| Inventory write-off related to restructuring | | — | | | — | | | 2 | | | — | | | — | |

| Provision for (benefit from) income taxes | | 2 | | | — | | | (9) | | | (5) | | | (17) | |

| Interest (income) expense, net | | — | | | (1) | | | (4) | | | (9) | | | (16) | |

Other (income) expense, net(4) | | (1) | | | (5) | | | 3 | | | 2 | | | 305 | |

Stock-based compensation expense and certain payroll tax expense(5) | | 133 | | | 130 | | | 231 | | | 251 | | | 268 | |

| Depreciation and amortization expense | | 49 | | | 59 | | | 81 | | | 118 | | | 111 | |

| Adjusted EBITDA | | $ | 47 | | | $ | 54 | | | $ | 103 | | | $ | 87 | | | $ | 117 | |

14

(1)We exclude certain costs and expenses from our calculation of Adjusted EBITDA because management believes that these costs and expenses are not indicative of our core operating performance, do not reflect the underlying economics of our business, and are not necessary to operate our business. These excluded costs and expenses consist of (i) certain legal costs primarily related to worker classification matters, (ii) reserves for the collection of sales and indirect taxes that we do not expect to incur on a recurring basis, (iii) costs related to the settlement of an intellectual property matter, (iv) expenses related to supporting various policy matters, including those related to worker classification and price controls, and (v) donations as part of our relief efforts in connection with the COVID-19 pandemic and Russia's invasion of Ukraine. We believe it is appropriate to exclude the foregoing matters from our calculation of Adjusted EBITDA because (1) the timing and magnitude of such expenses are unpredictable and thus not part of management’s budgeting or forecasting process, and (2) with respect to worker classification matters, management currently expects such expenses will not be material to our results of operations over the long term as a result of increasing legislative and regulatory certainty in this area, including as a result of Proposition 22 in California and similar legislation.

(2)Consists of acquisition, integration, and investment related costs, primarily related to the Wolt acquisition.

(3)Consists of impairment expense related to an operating lease right-of-use asset associated with our former headquarters.

(4)Consists primarily of adjustments to non-marketable equity securities, including impairment, for the three months ended December 31, 2022.

(5)Excludes stock-based compensation related to restructuring, which is included in restructuring charges in the table above.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Trailing Twelve Months Ended |

| (in millions) | | Dec. 31,

2021 | | Mar. 31,

2022 | | Jun. 30,

2022 | | Sept. 30,

2022 | | Dec. 31,

2022 |

| | | | | | | | | | |

| Net cash provided by operating activities | | $ | 692 | | | $ | 506 | | | $ | 419 | | | $ | 511 | | | $ | 367 | |

| Purchases of property and equipment | | (129) | | | (129) | | | (143) | | | (166) | | | (176) | |

| Capitalized software and website development costs | | (108) | | | (125) | | | (136) | | | (154) | | | (170) | |

| Free Cash Flow | | $ | 455 | | | $ | 252 | | | $ | 140 | | | $ | 191 | | | $ | 21 | |

The following table presents certain financial information derived from our consolidated financial statements related to our subsidiary, Wolt Enterprises Oy, a limited liability company incorporated and existing under the laws of Finland (“Wolt”), as well as certain Wolt key business metrics. The financial information presented below is presented in accordance with GAAP. Such financial statements have not been audited. Wolt’s historical financial information is not necessarily indicative of the results that may be expected in the future and the results of a particular quarter or other interim period are not necessarily indicative of the results for a full year. For more information on potential risks and uncertainties that could cause actual results to differ from the results predicted, please see our Annual Report on Form 10-K for the year ended December 31, 2021 and subsequent Form 10-Qs or Form 8-Ks filed with the Securities and Exchange Commission.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| (In millions, except percentages) | | Dec. 31,

2021 | | Mar. 31,

2022 | | Jun. 30,

2022 | | Sept. 30,

2022 | | Dec. 31,

2022 |

| Total Orders | | 31 | | | 34 | | | 36 | | | 37 | | | 43 | |

Y/Y % Change(1) | | 91 | % | | 53 | % | | 43 | % | | 46 | % | | 39 | % |

| Marketplace GOV | | € | 682 | | | € | 791 | | | € | 821 | | | € | 888 | | | € | 1,022 | |

Y/Y % Change(1) | | 83 | % | | 55 | % | | 52 | % | | 60 | % | | 50 | % |

| Revenue | | € | 59 | | | € | 78 | | | € | 93 | | | € | 103 | | | € | 121 | |

Net Revenue Margin(1) | | 8.7 | % | | 9.9 | % | | 11.4 | % | | 11.6 | % | | 11.8 | % |

(1) Percentages are calculated on unrounded numbers.

15