UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Kiromic BioPharma, Inc. |

(Name of Registrant as Specified in Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) an 0-11

-1-

Kiromic BioPharma, Inc.

7707 Fannin Street; Suite 140

Houston, TX 77054

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on JUNE 22, 2022

Dear Stockholder:

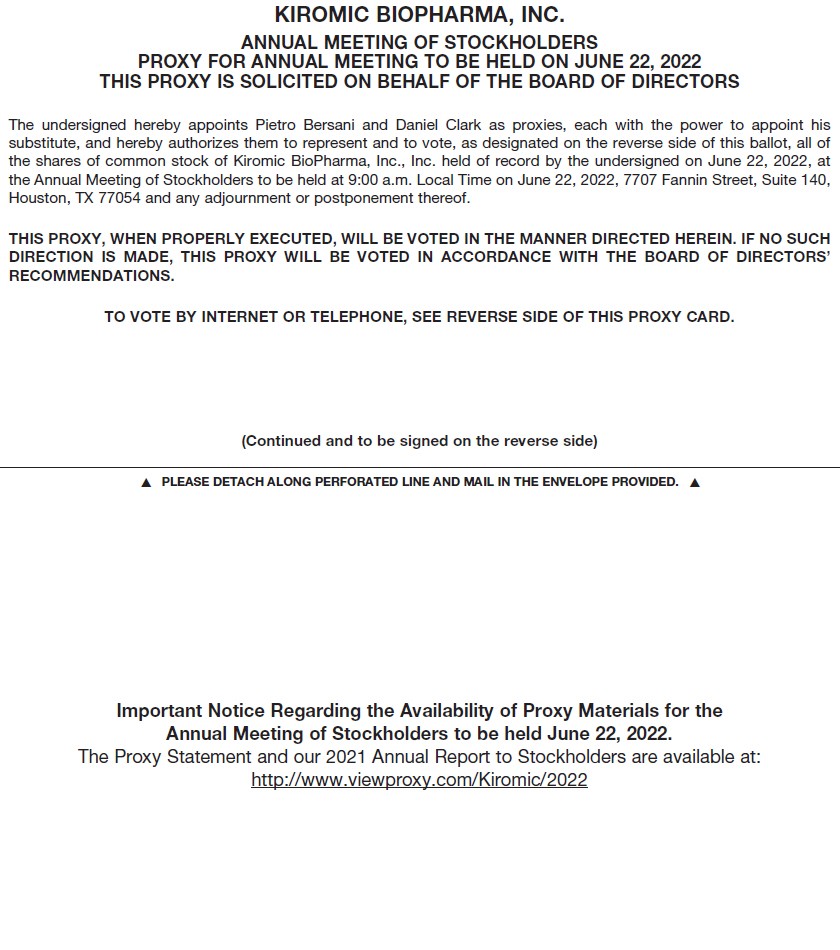

We are pleased to invite you to attend the annual meeting of stockholders (the “Annual Meeting”) of Kiromic BioPharma, Inc (“Kiromic” or the “Company”), which will be held on June 22, 2022 at 9:00 a.m. local time at our offices, located at 7707 Fannin Street, Suite 140, Houston, TX 77054, for the following purposes:

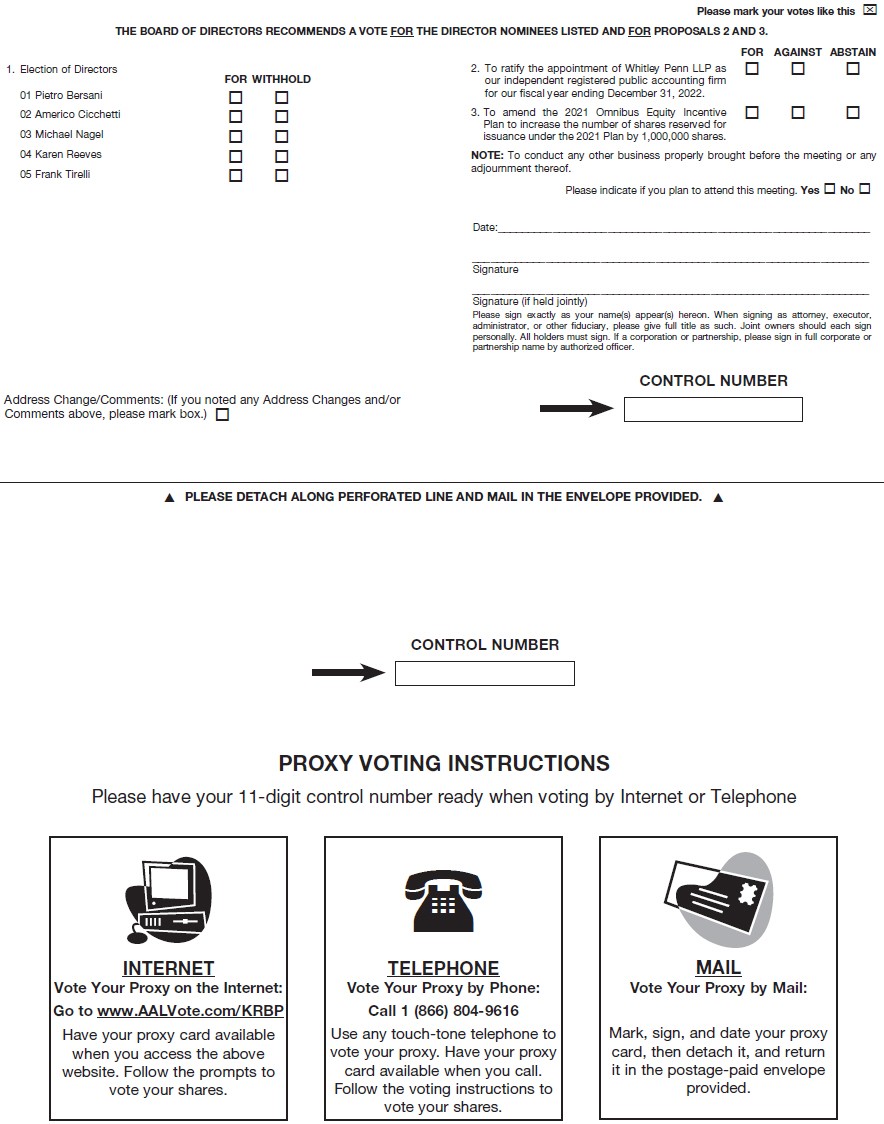

| 1. | To elect the five (5) members to our Board of Directors named in the accompanying proxy statement to hold office until the 2023 Annual Meeting; |

| 2. | To ratify the appointment of Whitley Penn LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022; |

| 3. | To amend the 2021 Omnibus Equity Incentive Plan to increase the number of shares reserved for issuance under the 2021 Plan by 1,000,000 shares; and |

| 4. | To transact such other matters as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

Our board of directors has fixed the close of business on April 25, 2022 as the record date for a determination of stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof.

If You Plan to Attend

Please note that space limitations make it necessary to limit attendance of the Annual Meeting to our stockholders. Registration and seating will begin at 8:00 a.m. Shares of common stock can be voted at the Annual Meeting only if the holder thereof is present in person or by valid proxy.

For admission to the Annual Meeting, each stockholder may be asked to present valid picture identification, such as a driver’s license or passport, and proof of stock ownership as of the record date, such as the enclosed proxy card or a brokerage statement reflecting stock ownership. Cameras, recording devices and other electronic devices will not be permitted at the Annual Meeting. If you do not plan on attending the Annual Meeting, please vote, date and sign the enclosed proxy and return it in the business envelope provided. Even if you do plan to attend the Annual Meeting, we recommend that you vote your shares at your earliest convenience in order to ensure your representation at the Annual Meeting. Your vote is very important.

-2-

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on June 22, 2022. Our 2022 Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2021 are available on our website at https://www.viewproxy.com/kiromic/2022.

The proxy statement and annual report to stockholders are available at

https://www.viewproxy.com/kiromic/2022.

By the Order of the Board of Directors | |

|

|

| /s/ Michael Nagel |

| Michael Nagel |

| Chairperson of the Board of Directors |

Dated: April 29, 2022

Whether or not you expect to attend the Annual Meeting in person, we urge you to vote your shares at your earliest convenience. This will ensure the presence of a quorum at the Annual Meeting. Promptly voting your shares will save the Company the expenses and extra work of additional solicitation. An addressed envelope for which no postage is required if mailed in the United States is enclosed if you wish to vote by mail. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option. Your vote is important, so please act today!

-3-

PROXY STATEMENT

2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 22, 2022

A proxy is your legal designation of another person to vote the stock you own. That designee is referred to as a proxy holder. Designation of a particular proxy holder can be effected by completion of a written proxy card, or by voting via the Internet or by telephone. If you return a proxy card, or vote by phone or internet, Pietro Bersani and Daniel Clark, our Interim Chief Executive Officer and Interim Chief Financial Officer, respectively, will act as your designated proxy holders for the Annual Meeting and will vote your shares at the Annual Meeting as you have instructed them on the proxy card. This way, your shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, we urge you to vote in one of the ways described below so that your vote will be counted even if you are unable or decide not to attend the Annual Meeting.

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

What is a proxy?

A proxy statement is a document that we are required by regulations of the Securities and Exchange Commission, or SEC, to give you when we ask you to provide a proxy to vote your shares at the Annual Meeting. Among other things, this Proxy Statement describes the proposals on which stockholders will be voting and provides information about us.

We are soliciting your proxy to vote at the Annual Meeting and at any adjournment or postponement of the Annual Meeting. We will use the proxies received in connection with proposals to:

1. | elect the five (5) members of our Board named in this proxy to hold office until the 2023 Annual Meeting; |

2. | ratify the appointment of Whitley Penn LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022; and |

3. | amend the 2021 Omnibus Equity Incentive Plan to increase the number of shares reserved for issuance under the 2021 Plan by 1,000,000 shares. |

How do I attend the Annual Meeting?

The Annual Meeting will be held on June 22, 2022, at 9:00 a.m. local time at our offices, located at 7707 Fannin Street, Houston, TX 77054. Directions to the Annual Meeting may be found at the back of this Proxy Statement. Information on how to vote in person at the Annual Meeting is discussed below.

Who May Attend the Annual Meeting?

Only record holders and beneficial owners of our common stock, or their duly authorized proxies, may attend the Annual Meeting. If your shares of common stock are held in street name, you will need to bring a copy of a brokerage statement or other documentation reflecting your stock ownership as of the Record Date.

Who is Entitled to Vote?

The Board has fixed the close of business on April 25, 2022 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. Only stockholder who owned our common stock on the Record Date are entitled to vote at the Annual Meeting. On the Record Date, there were 15,751,701 shares of our common stock outstanding.

-4-

What is the Difference Between Holding Shares as a Record Holder and as a Beneficial Owner (Holding Shares in Street Name)?

If your shares are registered in your name with our transfer agent, VStock Transfer, Inc., you are the “record holder” of those shares. If you are a record holder, these proxy materials have been provided directly to you by the Company.

If your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares in “street name.” If your shares are held in street name, these proxy materials have been forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct this organization on how to vote your shares. The majority of our stockholders hold their shares in street name.

What am I voting on?

There are three (3) matters scheduled for a vote:

| 1. | To elect five (5) members to our Board of Directors to hold office until the 2023 Annual Meeting; |

| 2. | To ratify the appointment of Whitley Penn LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022; and |

| 3. | To amend the 2021 Plan to increase the number of shares reserved for issuance under the 2021 Plan by 1,000,000 shares; |

What if another matter is properly brought before the Annual Meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, your proxy gives authority to the designated proxy holders to vote on such matters according to their best judgment.

How Do I Vote?

Stockholders of Record

For your convenience, record holders of our common stock have three methods of voting:

Beneficial Owners of Shares Held in Street Name

For your convenience, beneficial owners of our common stock have three methods of voting:

-5-

All shares entitled to vote and represented by a properly completed and executed proxy received before the Annual Meeting and not revoked will be voted at the Annual Meeting as instructed in a proxy delivered before the Annual Meeting. If you do not indicate how your shares should be voted on a matter, the shares represented by your properly completed and executed proxy will be voted as the Board recommends on each of the enumerated proposals, with regard to any other matters that may be properly presented at the Annual Meeting and on all matters incident to the conduct of the Annual Meeting. If you are a registered stockholder and attend the Annual Meeting, you may deliver your completed proxy card in person. If you are a street name stockholder and wish to vote at the Annual Meeting, you will need to obtain a proxy form from the institution that holds your shares. All votes will be tabulated by the inspector of elections appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

How Many Votes do I Have?

Each share of our common stock that you own as of April 25, 2022 entitles you to one vote.

Is My Vote Confidential?

Yes, your vote is confidential. Only the inspector of elections, individuals who help with processing and counting your votes and persons who need access for legal reasons will have access to your vote. This information will not be disclosed, except as required by law.

How Will my Shares be Voted if I Give No Specific Instruction?

We must vote your shares as you have instructed. If there is a matter on which a stockholder of record has given no specific instruction but has authorized us generally to vote the shares, they will be voted as follows:

| 1. | “FOR” the election of each of the five (5) members to our Board of Directors to hold office until the 2023 Annual Meeting; |

| 2. | “FOR” the ratification of the appointment of Whitley Penn LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022; and |

| 3. | “FOR” the amendment of the 2021 Omnibus Equity Incentive Plan to increase the number of shares reserved for issuance under the 2021 Plan by 1,000,000 shares. |

This authorization would exist, for example, if a stockholder of record merely signs, dates and returns the proxy card but does not indicate how its shares are to be voted on one or more proposals. If other matters properly come before the Annual Meeting and you do not provide specific voting instructions, your shares will be voted at the discretion of the proxies.

How are Votes Counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count, for the election of directors, “FOR,” “WITHHOLD” and broker non-votes; and, with respect to the other proposals, votes “FOR” and “AGAINST,” abstentions and broker non-votes.

-6-

What is a Broker Non-Vote?

If you are a beneficial owner of shares held by a broker, bank, trust or other nominee and you do not provide your broker, bank, trustee or other nominee with voting instructions, your shares may constitute “broker non-votes”. Broker non-votes occur on a matter when the broker, bank, trustee or other nominee is not permitted under applicable stock exchange rules to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters.

Proposal Nos. 1 and 3 are considered “non-routine” matters, while Proposal 2 is considered a “routine” matter. Therefore, if you are a beneficial owner of shares held in street name and do not provide voting instructions, your shares will not be voted on Proposal Nos. 1 and 3, and a broker non-vote will occur on these matters. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered voting power present with respect to that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the Annual Meeting, assuming that a quorum is obtained. Because Proposal 2 is a “routine” matter, a broker, bank, trustee or other nominee will be permitted to exercise its discretion on this proposal, which means there will be no broker non-votes on this matter.

What is an Abstention?

An abstention is a stockholder’s affirmative choice to decline to vote on a proposal. Under Delaware law, abstentions are counted as shares present and entitled to vote at the Annual Meeting.

How many shares must be present or represented to conduct business at the Annual Meeting?

A “quorum” is necessary to conduct business at the Annual Meeting. A quorum is established if the holders of a majority in voting power of our capital stock issued and outstanding and entitled to vote are present at the Annual Meeting, either in person or represented by proxy. Abstentions will be counted as present for purposes of determining a quorum at the Annual Meeting. Similarly, broker non-votes will be counted as present for purposes of determining a quorum at the Annual Meeting to the extent that the brokers, banks, trustees or other nominees use their discretionary authority to vote such shares on Proposal. 2. If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained.

How Many Votes are Needed for Each Proposal to Pass?

Proposal |

| Vote Required |

Election of each of the five (5) members to our Board of Directors |

| Plurality of the votes cast (the five directors receiving the most “FOR” votes) |

|

|

|

Ratification of the Appointment of Whitley Penn as our Independent Registered Public Accounting Firm for our Fiscal Year Ending December 31, 2022 |

| The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the Annual Meeting by the holders entitled to vote thereon. |

|

|

|

Amendment of the 2021 Plan to increase the number of shares reserved for issuance under the 2021 Plan by 1,000,000 shares |

| The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the Annual Meeting by the holders entitled to vote thereon. |

What Are the Voting Procedures?

In voting by proxy with regard to the election of directors, you may vote in favor of all nominees, withhold your votes as to all nominees, or vote in favor of specific nominees and withhold your votes as to specific nominees. With regard to other proposals, you may vote in favor of or against the proposal, or you may abstain from voting on the proposal. You should specify your respective choices on the accompanying proxy card or your vote instruction form.

-7-

Is My Proxy Revocable?

You may revoke your proxy and reclaim your right to vote at any time before your proxy is voted by giving written notice to the Secretary of Kiromic, by delivering a properly completed, later-dated proxy card or vote instruction form or by voting in person at the Annual Meeting. All written notices of revocation and other communications with respect to revocations of proxies should be addressed to: 7707 Fannin Street, Suite 140, Houston, TX 77054, Attention: Secretary, or by facsimile at 866-419-6193. Your most current proxy card or Internet or telphone proxy is the one that will be counted.

Who is Paying for the Expenses Involved in Preparing and Mailing this Proxy Statement?

All of the expenses involved in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid by us. We have engaged Alliance Advisors, LLC to assist in the solicitation of proxies and provide related advice and information support, for a services fee and the reimbursement of customary disbursements, which are not expected to exceed $32,000 in the aggregate. In addition to the solicitation by mail, proxies may be solicited by our officers and other employees by telephone or in person. Such persons will receive no compensation for their services other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred by them in forwarding solicitation materials.

How can I Find out the Results of the Voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be disclosed in a Current Report on Form 8-K that we expect to file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K with the SEC within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

When are Stockholder Proposals Due for the 2023 Annual Meeting?

Any appropriate proposal submitted by a stockholder and intended to be presented at the 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”) must be submitted in writing to the Company’s Secretary at 7707 Fannin Street, Suite 140, Houston, TX 77054 and received no later than December 30, 2022, to be includable in the Company’s proxy statement and related proxy for the 2023 Annual Meeting. However, if the date of the 2023 Annual Meeting is convened more than 30 days before, or delayed by more than 30 days after, June 22, 2022, to be considered for inclusion in proxy materials for our 2023 Annual Meeting, a stockholder proposal must be submitted in writing to the Company’s Secretary at 7707 Fannin Street, Suite 140, Houston, TX 77054, a reasonable time before we begin to print and send our proxy materials for the 2023 Annual Meeting. A stockholder proposal will need to comply with the SEC regulations under Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Although the Board will consider stockholder proposals, we reserve the right to omit from our proxy statement, or to vote against, stockholder proposals that we are not required to include under the Exchange Act, including Rule 14a-8.

-8-

Do the Company’s Officers and Directors have an Interest in Any of the Matters to Be Acted Upon at the Annual Meeting?

Members of the Board have an interest in Proposal 1, the election to the Board of the five (5) director nominees set forth herein, as all of the nominees are currently members of the Board. Members of the Board and executive officers of Kiromic do not have any interest in Proposal 2, the ratification of the appointment of our independent registered public accounting firm. Members of the Board and the executive officers of Kiromic are eligible to receive awards under the terms of the 2021 Plan, and they therefore have a substantial interest in Proposal 3.

-9-

PROPOSAL 1

ELECTION OF DIRECTORS

At the Annual Meeting, the stockholders will elect five (5) directors to hold office until the 2023 Annual Meeting. Directors are elected by a plurality of votes cast by stockholders. In the event the nominees are unable or unwilling to serve as directors at the time of the Annual Meeting, the proxies will be voted for any substitute nominees designated by the present Board or the proxy holders to fill such vacancy, or for the balance of the nominees named without nomination of a substitute, or the size of the Board will be reduced in accordance with the Bylaws of the Company. The Board has no reason to believe that the persons named below will be unable or unwilling to serve as nominees or as directors if elected.

Assuming a quorum is present, the five (5) nominees receiving the highest number of affirmative votes of shares entitled to be voted for such persons will be elected as directors of the Company to serve for a one-year term. Unless marked otherwise, proxies received will be voted “FOR” the election of the nominees named below. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner as will ensure the election of the nominees listed below, and, in such event, the specific nominees to be voted for will be determined by the proxy holders.

Information with Respect to Director Nominees

Listed below are the current directors who are nominated to hold office until their successors are elected and qualified, and their ages as of April 25, 2022

Name |

| Age |

Pietro Bersani | | 54 |

Americo Cicchetti | | 54 |

Michael Nagel | | 60 |

Karen Reeves | | 72 |

Frank Tirelli | | 69 |

The names of the nominees and certain biographical information about each current director standing for election at the Annual Meeting, including a description of his or her business experience, qualifications, education and skills that led our Board to conclude that such individual should serve as a member of our Board, are set forth below:

Pietro Bersani, CPA. Mr. Bersani has served as our interim Chief Executive Officer since January of 2022 and as a member of our Board since June 2020. From April 2020 to January 2022, Mr. Bersani was a Partner with B2B CFO Partners, LLC, which provides strategic management advisory services to owners of privately held companies. From November 2019 to March 2020, he served as the President, and Chief Executive Officer of K.P. Diamond Eagle, Inc., a consulting firm specialized in development of innovative commercial and private aviation business models. He served as a Senior Director within Alvarez & Marsal’s Private Equity Performance Improvement Practice, LLP between August 2018 and October 2019. From October 2016 to July 2018, he served as President and Chief Executive Officer of K.P. Diamond Eagle, Inc. Prior to those professional experiences, Mr. Bersani served as the Chief Financial Officer of Fuel Systems Solutions, Inc. between April 2011 and October 2016. Mr. Bersani is a Certified Public Accountant and is also a Certified Public Auditor and a Chartered Certified Accountant in Italy where he developed a significant knowledge of US GAAP and IFRS. Mr. Bersani earned a BA and MA in Business Economics from L. Bocconi University, Italy.

We believe Mr. Bersani is qualified to serve as a member of our Board because of his strong record of leadership as an executive officer and his financial background.

Americo Cicchetti, PhD. Dr. Cicchetti has served as a member of our board of directors since March 2020. Dr. Cicchetti has served as a Professor of Management at Università Cattolica del Sacro Cuore, Faculty of Economics, Rome since 2006. He is also currently the Director of the Graduate School of Health Economics and Management at Università Cattolica del Sacro Cuore.

-10-

In addition to his academic experience, Dr. Cicchetti was a member of the Price and Reimbursement Committee of the Italian National Drug Agency from 2009-2015. He is a member of the European Network of Health Technology Assessment; Member of the Innovation Steering Group of the National HTA Program for Medical Devices (Ministry of Health, Italy); and Member of the National Immunization Technical Advisory Group at the Ministry of Health, Italy since 2019.

He is a member of the European Network of Health Technology Assessment; Member of the Innovation Steering Group of the National HTA Program for Medical Devices (Ministry of Health, Italy); Member of the National Immunization Technical Advisory Group at the Ministry of Health, Italy since 2019; Member of the Health and Research Commission of the Rome Foundation since 2007; and a Member of the Board of Directors of the Health and Research Foundation since 2017.

Furthermore, Dr. Cicchetti has served as the Chief Executive Officer and a Director for Molipharma S.R.L. since January 2020, whose core business is the research and development of new drugs and diagnostics aimed at predicting, detecting and treating female oncological diseases. He has also serves as an independent board member for Foundation Health and Research, and Leonida SICAF, a fixed capital investment company. He obtained his PhD in Management from University of Bologna, and his B.A. from University of Rome. Dr. Cicchetti was selected to serve on the board due to his industry experience.

We believe Dr. Cicchetti’s qualifications to serve on our board include his extensive medical knowledge and experience in the pharmaceutical industry.

Michael Nagel. Mr. Nagel has served on our board of directors since October 2020. He has over 30 years of sales and marketing experience in the medical device industry. Since 2012, Mr. Nagel has served as the President and CEO of Vomaris Innovations, Inc, which specializes in wireless microcurrent-generating technologies that are focused on regeneration, healing, and recovery. Previously, Mr. Nagel served as the Chief Commercial Officer of Neomend, a biomaterial company that developed ProGel, a PMA approved surgical sealant for lung surgery. From 1997 to 2005, Mr. Nagel also served as Co-Founder and Vice President of Worldwide Sales and Marketing at Vascular Solutions, Inc.

In addition to Mr. Nagel’s executive experience, he also serves as a director for Franklin Mountain Medical, LLC an early stage company in the structural heart market. Mr. Nagel holds both a B.A. in Business and a M.B.A. from the University of St. Thomas. Mr. Nagel was selected to serve on the board of directors due to his industry experience.

We believe Mr. Nagel’s qualifications to serve on our board include his industry knowledge and sales and marketing experience.

Dr. Karen Reeves. Dr. Reeves has served on our board of directors since February 2022. Dr. Reeves has served as President and Chief Medical Officer of AZTherapies, Inc., an advanced clinical-stage biopharmaceutical company, since September 2017. Dr. Reeves began her biopharma career at Pfizer Inc. where she served in roles of increasing responsibility including as VP, Head, Global Clinical Submissions Quality. She has more than 25 years of experience in clinical R&D, business development, regulatory, operational development, and management gained at small, medium, and large life science companies. She has also served as Global Head of Medical Science at Astellas Pharma Global Development, Inc., a pharmaceutical company. Dr. Reeves has worked across a variety of therapeutic areas including neuroscience, oncology, immunology, infectious diseases, cardiovascular, and urology, as well as early and late stages of drug development, and is experienced in successful regulatory filings with the FDA and global regulators. She has held faculty positions at Harvard University and Tufts Medical School. Dr. Reeves received her BA from Yale University and her MD degree from University of Vermont Medical School. Dr. Reeves was elected to our board of directors due to her industry experience.

We believe Dr. Reeves’ qualifications to serve on our board include her extensive medical knowledge and experience in the pharmaceutical industry.

Frank Tirelli. Mr. Tirelli has served on our board of directors since January 2022. Mr. Tirelli has served as Chairman of Professional Services and a member of the Strategic Advisory Board at alliantgroup, LP, an international consulting firm since September 2018. Mr. Tirelli has also served on the Strategic Advisory Board of Alliant

-11-

Cybersecurity. Since January 2017, Mr. Tirelli has also served as Chief Executive Officer of Finaxstrure Associates LLC, a company that provides board of director advisory services and expert witness services. From 2000 to 2003, Mr. Tirelli served as the President and Chief Executive Officer of Herbalife International Inc. (NYSE: HLF), a publicly traded nutrition company that conducted business in 52 countries and generated $2 billion in sales. Mr. Tirelli has 30 years of experience with Deloitte & Touche LLP (“Deloitte”), one of the world’s premier accounting firms, including service as Chairman and CEO of Deloitte Italy and Vice Chairman of Deloitte U.S. Mr. Tirelli is a licensed CPA in Connecticut and California. He received a BS in Accounting from Boston College and an MBA from Babson College. Mr. Tirelli was selected to serve on the board of directors due to his being an audit committee "financial expert" under the SEC regulations.

We believe Mr. Tirelli’s qualifications to serve on our board include his financial background and leadership experience.

Family Relationships

None.

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors or executive officers have, during the past ten years, been involved in any legal proceedings described in subparagraph (f) of Item 401 of Regulation S-K.

Board Recommendation

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES TO THE BOARD SET FORTH IN THIS PROPOSAL 1.

-12-

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

During the year ended December 31, 2021:

| ● | our Board held seven meetings; |

| ● | the Audit Committee held 16 meetings; |

| ● | the Compensation Committee held two meetings; and |

| ● | the Nominating and Corporate Governance Committee held one meeting. |

Each member of the Board attended at least seventy-five percent (75%) or more of the aggregate of (i) the total number of Board meetings held during the period of such member’s service and (ii) the total number of meetings of committees of the Board on which such member served, during the period of such member’s service.

All Board members are encouraged to attend our annual meetings of stockholders in person. In 2021, all of our directors virtually attended our 2021 Annual Meeting of Stockholders.

Director Independence

Our Board has determined that a majority of the Board consists of members who are currently “independent” as that term is defined under Nasdaq Listing Rule 5605(a)(2). The Board considers Americo Cicchetti, Michael Nagel, Karen Reeves and Frank Tirelli to be “independent.” Mr. Bersani, is not considered to be “independent” as defined by Nasdaq Listing Rule 5605(a)(2) due to his position as our Interim Chief Executive Officer.

Board Leadership Structure

Our bylaws and governance principles provide the Board with the flexibility to combine or separate the positions of Chairman and Chief Executive Officer. Michael Nagel currently serves as the Chairman of our Board. Our Board believes that the separation of these positions strengthens the independence of our Board and allows us to have a Chairman focused on the leadership of the Board while allowing our Chief Executive Officer to focus more of his time and energy on managing our operations. The Board currently believes this structure works well to meet the leadership needs of the Board and of the Company. Mr. Pietro Bersani, our Interim-Chief Executive Officer, has comprehensive industry expertise and is able to devote substantial time to the Company, and Mr. Nagel, our Chairman, is able to focus on longer term and strategic matters, and to provide related leadership to the Board. As a result, we do not currently intend to combine these positions; however a change in this leadership structure could be made if the Board determines it is in the best long-term interests of stockholders. For example, if the two roles were to be combined, we believe that the independence of the majority of our directors, and the three fully independent Board committees, would provide effective oversight of our management and the Company.

Board Leadership Structure and Role in Risk Oversight

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. Management is responsible for the day-to-day management of the risks we face, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board is responsible for satisfying itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

The Board believes that establishing the right “tone at the top” and that full and open communication between executive management and the Board are essential for effective risk management and oversight. Our CEO communicates frequently with members of the Board to discuss strategy and challenges facing our company. Senior management usually attends our regular quarterly Board meetings and is available to address any questions or concerns raised by the Board on

-13-

risk management-related and any other matters. Each quarter, the Board receives presentations from senior management on matters involving our key areas of operations.

Board Committees

Our Board has established standing Audit, Compensation and Nominating and Corporate Governance Committees to devote attention to specific subjects and to assist it in the discharge of its responsibilities. All committees operate under a written charter adopted by our Board, each of which is available on our Internet website at https://ir.kiromic.com.

Audit Committee

The Audit Committee’s responsibilities include: (i) reviewing the independence, qualifications, services, fees, and performance of the independent registered public accountants, (ii) appointing, replacing and discharging the independent registered public accounting firm, (iii) pre-approving the professional services provided by the independent registered public accounting firm, (iv) reviewing the scope of the annual audit and reports and recommendations submitted by the independent registered public accounting firm, and (v) reviewing our financial reporting and accounting policies, including any significant changes, with management and the independent registered public accounting firm. The Audit Committee also prepares the Audit Committee report that is required pursuant to the rules of the SEC.

The Audit Committee currently consists of Frank Tirelli, chairperson, Americo Cicchetti, and Michael Nagel. The Board has determined that all members of the Audit Committee are “independent” for purposes of service on the Audit Committee as provided under applicable SEC and Nasdaq rules. The Board has determined that Frank Tirelli is an “audit committee financial expert” within the meaning of Item 407(d)(5) of SEC Regulation S-K. The board of directors has adopted a written charter setting forth the authority and responsibilities of the Audit Committee.

Compensation Committee

The Compensation Committee has responsibility for assisting the board of directors in, among other things, (i) evaluating and making recommendations regarding the compensation of the executive officers and directors of our company, (ii) assuring that the executive officers are compensated effectively in a manner consistent with our stated compensation strategy, (iii) producing an annual report on executive compensation in accordance with the rules and regulations promulgated by the SEC, (iv) periodically evaluating the terms and administration of our incentive plans and benefit programs and (v) monitoring of compliance with the legal prohibition on loans to our directors and executive officers.

The Compensation Committee currently consists of Americo Cicchetti, chairperson, Michael Nagel, and Karen Reeves. The Board has determined that all members of the Compensation Committee are “independent” for purposes of service on the Compensation Committee as provided under applicable listing standards of Nasdaq.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee was, during the year ended December 31, 2021, an officer or employee of ours, was formerly an officer of ours or had any relationship requiring disclosure by us under Item 404 of Regulation S-K. No interlocking relationship as described in Item 407(e)(4) of Regulation S-K exists between any of our executive officers or Compensation Committee members, on the one hand, and the executive officers or compensation committee members of any other entity, on the other hand, nor has any such interlocking relationship existed in the past.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee has responsibility for assisting the board of directors in, among other things, (i) effecting board organization, membership and function including identifying qualified board nominees, (ii) effecting the organization, membership and function of board committees including composition and recommendation of qualified candidates, (iii) establishment of and subsequent periodic evaluation of successor planning for the chief executive officer and other executive officers, (iv) development and evaluation of criteria for board

-14-

membership such as overall qualifications, term limits, age limits and independence and (v) oversight of compliance with the Corporate Governance Guidelines. The Nominating and Corporate Governance Committee shall identify and evaluate the qualifications of all candidates for nomination for election as directors. Potential nominees are identified by the board of directors based on the criteria, skills and qualifications that have been recognized by the Nominating and Corporate Governance Committee. While our nomination and corporate governance policy does not prescribe specific diversity standards, the Nominating and Corporate Governance Committee and its independent members seek to identify nominees that have a variety of perspectives, professional experience, education, differences in viewpoints and skills, and personal qualities that will result in a well-rounded board of directors.

The Nominating and Corporate Governance Committee currently consists of Karen Reeves, chairperson, Americo Cicchetti, and Frank Tirelli. The Board has determined that the Nominating and Corporate Governance Committee is comprised solely of independent directors, as defined by Nasdaq.

Director Nominations

Criteria for Board Membership

The Nominating and Corporate Governance Committee is responsible for periodically reviewing the applicable skills and characteristics required of Board nominees with the Board in the context of the current Board composition and our circumstances. In making its recommendations to the Board, the Nominating and Corporate Governance Committee considers, among other things, the qualifications of individual director candidates in light of the Board’s membership criteria as set forth in our Corporate Governance Guidelines. The Nominating and Corporate Governance Committee may utilize a variety of sources, including stockholder recommendations, Board member recommendations, executive search firms, management recommendations or other reasonable means to identify director candidates.

The Nominating and Corporate Governance Committee considers candidates recommended by our Board and management, as well as candidates submitted by our stockholders (as discussed below). Members of the Board or management who wish to recommend that a person be considered for Board membership are required to provide relevant qualifications and other information regarding the prospective candidate to the Nominating and Corporate Governance Committee along with their recommendations and reasons why they believe such person should be considered. The Nominating and Corporate Governance Committee then reviews each of the proposed candidates and determines whether or not to add such person to the proposed candidates list. In the event the Board determines to add an additional Board member, the Nominating and Corporate Governance Committee shall select candidates from this list in addition to candidates drawn from any search firm that the Nominating and Corporate Governance Committee deems necessary to retain for this purpose.

The criteria used in selecting Board candidates include the candidate’s integrity, business acumen, commitment, reputation among our various constituencies and communities, ability to make independent analytical inquiries, understanding of our business environment, and willingness to devote adequate time to Board duties. The Board has also determined that gender and ethnic diversity of the Board will be an important factor in its evaluation of candidates for director nominations. There are no other pre-established qualifications, qualities or skills at this time that any particular director nominee must possess and nominees are not discriminated against on the basis of race, religion, national origin, sexual orientation, disability or any other basis proscribed by law. The Nominating and Corporate Governance Committee does not assign specific weights to any particular criteria, nor has it adopted specific requirements. Rather, the Board believes that the backgrounds and qualifications of the directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. The goal of the Nominating and Corporate Governance Committee is to assemble a Board that brings a variety of skills derived from high quality businesses and professional experience. The Nominating and Corporate Governance Committee seeks to ensure that at least a majority of the directors are independent under Nasdaq rules, that members of the Company’s audit committee meet the financial literacy and sophistication requirements under the Nasdaq rules, and at least one of them qualifies as an “audit committee financial expert” under the rules of the SEC, and that members of the compensation and Nominating and Corporate Governance Committee meet applicable independence and other requirements under the Nasdaq rules and rules of the SEC.

-15-

Stockholder Recommendations

The Nominating and Corporate Governance Committee is responsible for the consideration of any written stockholder recommendations for candidates for the Board, which recommendations should be delivered or mailed, postage prepaid, to:

Nominating and Corporate Governance Committee

Kiromic BioPharma, Inc.

7707 Fannin Street, Suite 140

Houston, TX 77054

CC: Chief Financial Officer

Stockholder recommendations must include the following information to be considered by our governance and nominating committee: (a) all information relating to such recommended candidate as would be required to be disclosed for a director nominee pursuant to Regulation 14A under the Exchange Act (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected) and as required for stockholder nominations of director candidates pursuant to the Company’s Second Amended and Restated Bylaws (“Bylaws”); (b) the names and addresses of the stockholders making the recommendation and the number of shares of the Company’s common stock which are owned beneficially and of record by such stockholders; and (c) other appropriate biographical information and a statement as to the qualification of the nominee. There are no pre-established qualifications, qualities or skills at this time that any particular director nominee must possess and nominees are not discriminated against on the basis of race, religion, national origin, sexual orientation, disability or any other basis proscribed by law.

Any recommendations received from our security holders will be evaluated in the same manner that potential nominees suggested by Board members, management or other parties are evaluated.

Communications with our Board of Directors

Stockholders seeking to communicate with our Board should submit their written comments to our Interim Chief Executive Officer, Mr. Pietro Bersani, at Kiromic BioPharma, Inc., 7707 Fannin Street, Suite 140, Houston, TX 77054. Mr. Bersani will forward such communications to each member of our Board; provided that, if in the opinion of Mr. Bersani it would be inappropriate to send a particular stockholder communication to a specific director, such communication will only be sent to the remaining directors (subject to the remaining directors concurring with such opinion).

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics to ensure that our business is conducted in a consistently legal and ethical manner. All of our employees, including our executive officers and directors, are required to comply with our Code of Business Conduct and Ethics.

The full text of the Code of Business Conduct and Ethics is posted on our website at https://ir.kiromic.com/. Any waiver of the Code of Business Conduct and Ethics for directors or executive officers must be approved by our Audit Committee. We will disclose future amendments to our Code of Business Conduct and Ethics, or waivers from our Code of Business Conduct and Ethics for our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, on our website within four business days following the date of the amendment or waiver. In addition, we will disclose any waiver from our Code of Business Conduct and Ethics for our other executive officers and our directors on our website. A copy of our Code of Business Conduct and Ethics will also be provided free of charge upon request to: Secretary, Kiromic BioPharma, Inc. 7707 Fannin Street, Suite 140, Houston, TX 77054.

Hedging and Pledging Prohibition

Under our Insider Trading Policy, our directors, officers, employees, consultants and contractors (and each such individual’s family members, other members of a person’s household and entities controlled by a person covered by this policy, as described in the policy) are prohibited from engaging the following transactions at any time: (i) engaging in

-16-

short sales of our securities; (ii) trading in put options, call options or other derivative securities on an exchange or in any other organized market; (iii) engaging in hedging or monetization transactions, including through the use of financial instruments such as prepaid variable forwards, equity swaps, collars and exchange funds; and (iv) holding our securities in a margin account or otherwise pledging our securities as collateral for loan.

Director Compensation

Generally, our Board believes that the level of director compensation should be based on time spent carrying out Board and committee responsibilities and be competitive with comparable companies. In addition, the Board believes that a significant portion of director compensation should align director interests with the long-term interests of stockholders. The Board allows changes in its director compensation practices based on recommendations and approvals of the compensation committee.

Our compensation committee approved the compensation of our non-employee directors, as described below. For 2022, our payment structures are in the list below.

The cash component of our non-employee director compensation is as follows:

| ● | $38,000 annual cash retainer for Board members; |

| ● | $33,000 annual cash retainer for the Chairman of the Board; |

| ● | $15,000 annual cash retainer for the Chairman of the audit committee; |

| ● | $10,000 annual cash retainer for the Chairman of our compensation committee; |

| ● | $8,000 annual cash retainer for the Chairman of our governance and nominating committee; |

| ● | $7,500 annual cash retainer for each non-Chairman audit committee member; |

| ● | $5,000 annual cash retainer for each non-Chairperson compensation committee member; and |

| ● | $4,000 annual retainer for each non-Chairman governance and nominating committee member. |

Each current and new director is also eligible for an option grant, upon commencement of services, with a fair value of $57,000, vesting over one year in equal, quarterly installments as measured from the grant date.

The compensation of our other non-employee directors remains the same as in 2021. The compensation committee believes that our non-employee director compensation remains aligned with director compensation practices at our peer companies while considering the ongoing cash constraints of the Company.

-17-

2021 Director Compensation

During year ended December 31, 2021, our non-employee directors received the following compensation for their services on the Board and its committees:

|

| Cash Fees |

| Total | ||

Pietro Bersani | | $ | 167,756 | | $ | 167,756 |

Americo Cicchetti |

| $ | 42,000 | | $ | 42,000 |

Michael Nagel | | $ | 38,971 | | $ | 38,971 |

Jerry Schneider |

| $ | 37,750 | | $ | 37,750 |

-18-

PROPOSAL 2

RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR ENDING

DECEMBER 31, 2022

The Audit Committee has selected Whitley Penn LLP (“Whitley Penn”) as the Company’s independent registered public accounting firm, to audit the consolidated financial statements of the Company for the fiscal year ending December 31, 2022. A representative of Whitley Penn is expected to be present at the Annual Meeting and will have the opportunity to make a statement at the Annual Meeting if they desire to do so. Further, such representative is expected to be available to respond to appropriate questions at the Annual Meeting.

Although ratification is not required by our Bylaws or otherwise, we are asking our stockholders to ratify this appointment as a matter of good corporate practice. If the selection is not ratified, the Audit Committee will consider whether it is appropriate to select another independent accounting firm. Even if the selection is ratified, the Audit Committee may select a different independent accounting firm at any time during the year if it determines that this would be in the best interests of the Company and its stockholders.

Deloitte’s audit reports on the financial statements of the Company for the years ended December 31, 2020 and 2021, and the 2022 transition period did not contain any adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles except that Deloitte’s reports for the years ended December 31, 2021 and 2020 contained an explanatory note indicating that there was substantial doubt about the ability of the Company to continue as a going concern.

During the fiscal years ended December 31, 2021 and 2020, there were (i) no disagreements between the Company and Deloitte on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, any of which, if not resolved to Deloitte’s satisfaction, would have caused Deloitte to make reference thereto in their reports, and (ii) no “reportable events” within the meaning of Item 304(a)(1)(v) of Regulation S-K, except for certain material weaknesses in internal control over financial reporting as of December 31, 2021. As further described in Part II, Item 9A, “Controls and Procedures,” of our Annual Report on Form 10-K for the fiscal year ended December 30, 2021, the material weaknesses relate to (i) the Company’s failure to implement formal processes for period end financial closing and reporting; (ii) the lack of resources to conduct an effective monitoring and oversight function independent from our operations; and (iii) the Company’s failure to implement controls to appropriately communicate relevant information from the FDA to appropriate parties on a timely basis (collectively, the “Material Weaknesses”).

Our Audit Committee has discussed the subject matter of each Material Weakness with Deloitte and has authorized Deloitte to respond fully to the inquiries of Whitley Penn concerning the subject matter of the Material Weaknesses. We believe that we are addressing the Material Weaknesses through measures including:

| ● | implementation of additional internal control processes and procedures regarding the financial close and reporting process, procure to pay process, and human resources and payroll process; |

| ● | designing those controls with the appropriate segregation of duties; |

| ● | The recruitment of a full-time accounting and finance personnel, including, but not limited to, personnel focused upon enhanced scrutiny of accounting entries in the areas where we have observed material weaknesses in our internal control over financial reporting; and |

| ● | formation of a Disclosure Committee comprised of certain members of the Company’s management which committee is responsible for preparing and reviewing all corporate disclosures made by the Company to ensure that such disclosures (i) shall be accurate and complete; (ii) shall fairly present, in all material respects, the Company’s financial condition, results of operations and cash flows; and (iii) shall be made on a timely basis in accordance with all applicable requirements of (A) the Exchange Act and the rules and regulations promulgated thereunder, (B) the Securities Act of 1933, as amended and the rules and regulations |

-19-

| promulgated thereunder (C) the Nasdaq Stock Market or such other stock exchange on which the Company’s securities may be traded and (D) any other applicable laws or legal requirements. |

Principal Accountant Fees and Services

The aggregate fees billed to the Company by Deloitte, the Company’s independent registered public accounting firm for the audit during the years ended December 31, 2021 and 2020, for the indicated services for each of the last two fiscal years were as follows:

| | Year Ended | ||||

| | December 31, | ||||

|

| 2021 |

| 2020 | ||

Audit Fees |

| $ | 1,339,799 | | $ | 721,600 |

Audit-Related Fees |

|

| 322,613 | |

| 530,400 |

Tax Fees |

|

| 123,500 | |

| — |

All Other Fees |

|

| — | |

| — |

Total |

| $ | 1,785,912 | | $ | 1,252,000 |

(1) | Audit fees consist of fees for professional services performed by Deloitte for the audit of the financial statements included in our Annual Report on Form 10-K and review of the financial statements included in our quarterly Form 10-Q filings, reviews of registration statements and issuances of consents, and services that are normally provided in connection with statutory and regulatory filings or engagements. |

(2) | Audit related fees consist of fees for assurance and related services, performed by Deloitte that are reasonably related to the performance of the audit or review of our financial statements. |

(3) | Tax fees consist of fees for professional services performed by Deloitte with respect to tax compliance, tax advice, tax consulting and tax planning. |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

Consistent with SEC policies and guidelines regarding auditor independence, the Audit Committee is responsible for the pre-approval of all audit and permissible non-audit services provided by our independent registered public accounting firm on a case-by-case basis. Our Audit Committee has established a policy regarding approval of all audit and permissible non-audit services provided by our principal accountants. Our Audit Committee pre-approves these services by category and service. Our Audit Committee has pre-approved all of the services provided by our independent registered public accounting firm.

Vote Required

The selection of our independent registered public accounting firm is not required to be submitted to a vote of our stockholders for ratification. However, we are submitting this matter to the stockholders as a matter of good corporate governance. Even if the appointment is ratified, the Audit Committee may, in its discretion, appoint a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of us and our stockholders. If the appointment is not ratified, the Audit Committee will reconsider whether or not to retain Whitley Penn.

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the meeting by the holders entitled to vote thereon is required to approve the ratification of the appointment of Whitley Penn as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

Board Recommendation

THE BOARD RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF WHITLEY PENN LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2022.

-20-

AUDIT COMMITTEE REPORT

The following Audit Committee Report shall not be deemed to be “soliciting material,” deemed “filed” with the SEC or subject to the liabilities of Section 18 of the Exchange Act. Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act that might incorporate by reference future filings, including this Proxy Statement, in whole or in part, the following Audit Committee Report shall not be incorporated by reference into any such filings.

The audit committee is a committee of the Board comprised solely of independent directors as required by the listing standards of Nasdaq and rules and regulations of the SEC. The audit committee provides assistance to the Board in fulfilling its legal and fiduciary obligations in matters involving the Company’s accounting, auditing, financial reporting, internal control and legal compliance functions by approving the services performed by the Company’s independent registered public accountants and reviewing their reports regarding the Company’s accounting practices and systems of internal accounting controls as set forth in a written charter adopted by the Board, which is available on the Company’s website at www.ir.kiromic.com. The composition and responsibilities of the audit committee, as reflected in its charter, are intended to be in accordance with applicable requirements. The audit committee reviews and assesses the adequacy of its charter and the audit committee’s performance on an annual basis.

The Company’s management is responsible for preparing the Company’s financial statements and the independent registered public accountants are responsible for auditing those financial statements. The audit committee is responsible for overseeing the conduct of these activities by the Company’s management and the independent registered public accountants. In this context, the audit committee has met and held discussions with management and the independent registered public accountants. Management represented to the audit committee that the Company’s consolidated financial statements were prepared in accordance with U.S. generally accepted accounting principles, and the audit committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accountants.

The audit committee has discussed with the independent registered public accountants matters required to be discussed by Auditing Standard No. 1301, as adopted by the Public Company Accounting Oversight Board (“PCAOB”) and approved by the SEC. In addition, the independent registered public accountants provided to the audit committee the written disclosures and letter from the independent registered public accountants as required by applicable requirements of the PCAOB regarding the independent registered public accountants’ communications with the audit committee concerning independence and the audit committee has discussed with such accountants such accountants’ independence from the Company and its management. The audit committee has discussed with management and the independent registered public accounts the procedures for selection of consultants, fully considered whether those services provided by the independent registered public accountants are compatible with maintaining such accountants’ independence and has determined that the non-audit services performed by the independent registered public accountant are compatible with maintaining their independence.

The audit committee has discussed with the Company’s management and its independent registered public accountants, with and without management present, their evaluations of the Company’s internal accounting controls and the overall quality of the Company’s financial reporting. In reliance on the reviews and discussions with management and the independent registered public accountants referred to above, the audit committee recommended to the Board, and the Board has approved, the inclusion of the audited financial statements in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, for filing with the SEC.

In addition, the audit committee has selected Whitley Penn LLP as independent registered public accountants to audit the books, records and accounts of the Company and its subsidiaries for the fiscal year ending December 31, 2022.

| Submitted by the Audit Committee |

| Frank Tirelli, Chairperson |

| Americo Cicchetti |

| Michael Nagel |

-21-

PROPOSAL 3

AMENDMENT OF THE COMPANY’S 2021 PLAN TO INCREASE THE NUMBER OF SHARES RESERVED FOR ISSUANCE UNDER THE 2021 PLAN BY 1,000,000 SHARES OF COMMON STOCK

Summary

We are asking our stockholders to approve an amendment to our 2021 Plan to increase the number of shares of common stock reserved for issuance thereunder from 880,785 to 1,880,785. The shares of common stock currently reserved for issuance include 200,000 shares, plus the number of shares of common stock reserved, but unissued, under the Prior Plan when the 2021 Plan was established, plus any shares from the Prior Plan that have been terminated or cancelled after the Plan’s effective date. We intend to apply for listing of the additional shares on the Nasdaq Capital Markets exchange.

On April 28, 2021, our board of directors adopted our 2021 Omnibus Equity Incentive Plan (the “2021 Plan”). The 2021 Plan became effective, on June 25, 2021, the date that it was approved by the our stockholders (the “Effective Date”).

Our administrator may grant incentive stock options, non-qualified stock options, stock appreciation rights, restricted stock, restricted stock units and other stock-based awards to participants to acquire shares of Company common stock under the 2021 Plan. The Plan is administered by the Compensation Committee. The closing price per-share of Company common stock on April 28, 2022 was $0.62. The following table sets forth, as of April 28, 2022, the approximate number of each class of participants eligible to participate in the 2021 Plan and the basis of such participation.

Class and Basis of Participation |

| Approximate Number of Class |

Employees |

| 69 |

Directors(1) |

| 5 |

Independent Contractors |

| 0 |

(1) | One of the five directors is an employee of the Company. |

Required Vote of Stockholders

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the meeting by the holders entitled to vote thereon is required to approve the amendment of the 2021 Plan to increase the number of shares reserved for issuance thereunder from 880,785 shares of common stock to 1,880,785 shares of common stock.

-22-

Dilution, Stock Available and Historical Stock Usage

Dilution. Subject to stockholder approval of the amendment to the 2021 Plan, 1,880,785 shares of Company common stock will be reserved for issuance under the 2021 Plan, which represents approximately 10.67% of our issued and outstanding shares of Company’s common stock, not including shares subject to outstanding awards under the Prior Plan. The Board believes that this number of shares of Company’s common stock constitutes reasonable potential equity dilution and provides a significant incentive for employees to increase the value of the Company for all stockholders.

As of the Record Date, we had: (i) 15,751,701 shares of Company common stock outstanding; (ii) 332,872 stock options outstanding (vested and unvested), with a weighted average exercise price of $8.49 per share; and (iii) 398,087 shares of unvested restricted stock outstanding. The new shares of Company’s common stock available under the 2021 Plan would represent an additional potential equity dilution of approximately 5.44%. Including the proposed additional shares of Company’s common stock under the 2021 Plan, the potential equity dilution from all equity incentive awards outstanding and available for grant under all of our equity plans would result in a maximum potential equity dilution of approximately 14.25%.

Shares Available; Certain Limitations. The maximum number of shares of common stock reserved and available for issuance under the 2021 Plan will be equal to 1,880,785 shares of common stock. We use the term “Exempt Award” to mean (i) an award granted in the assumption of, or in substitution for, outstanding awards previously granted by another business entity acquired by us or any of our subsidiaries or with which we or any of our subsidiaries merges, or (ii) an award that a participant purchases at fair market value.

New shares reserved for issuance under the 2021 Plan may be authorized but unissued shares of Company’s common stock or shares of Company’s common stock that will have been or may be reacquired by us in the open market, in private transactions or otherwise. If any shares of Company’s common stock subject to an award are forfeited, cancelled, exchanged or surrendered or if an award terminates or expires without a distribution of shares to the participant, the shares of Company common stock with respect to such award will, to the extent of any such forfeiture, cancellation, exchange, surrender, termination or expiration, again be available for awards under the Plan except that any shares of Company common stock surrendered or withheld as payment of either the exercise price of an award and/or withholding taxes in respect of an award will not again be available for awards under the Plan. If an award is denominated in shares of Company’s common stock, but settled in cash, the number of shares of common stock previously subject to the award will again be available for grants under the 2021 Plan. If an award can only be settled in cash, it will not be counted against the total number of shares of common stock available for grant under the 2021 Plan. However, upon the exercise of any award granted in tandem with any other awards, such related awards will be cancelled as to the number of shares as to which the award is exercised and such number of shares of Company’s common stock will no longer be available for grant under the 2021 Plan.

As exhibited by the our responsible use of equity over the past several years and good corporate governance practices associated with equity and executive compensation practices in general, the stock reserved under the 2021 Plan will provide us with the platform needed for continued our growth, while managing program costs and share utilization levels within acceptable industry standards.

-23-

Share Usage. In determining the requested number of shares of Company’s common stock reserved for issuance under the 2021 Plan, we evaluated the dilution and historic share usage, burn rate and the existing terms of outstanding awards under the Prior Plan. The annual share usage under our equity plans for the last three fiscal years was as follows:

| | | | Fiscal Year | | Fiscal Year | | Fiscal Year | | | |

| | |

| 2021 |

| 2020 |

| 2019 |

| Average | |

A | | Total Shares Granted During Fiscal Year(1) | | 416,310 | | 1,742,115 | | 209,505 | | 789,310 | |

B | | Basic Weighted Average Common Stock Outstanding |

| 11,417,083 | | 4,505,867 | | 2,862,809 | | 6,261,920 | |

C | | Burn Rate (A/B) |

| 3.65% | | 38.66% | | 7.32% | | 12.60% | |

| | |

| | | | | | | | |

(1) Includes the number of options and full value awards (restricted shares of common stock) granted for such year. | | ||||||||||

Description of 2021 Plan

The following is a summary of the material features of the 2021 Plan. This summary is qualified in its entirety by the full text of the 2021 Plan, a copy of which is attached to this Proxy Statement as Appendix A.

Types of Awards. The 2021 Plan provides for the issuance of incentive stock options, non-qualified stock options, stock appreciation rights (“SARs”), restricted stock, restricted stock units (“RSUs”), and other stock-based awards. Items described above in the Section called “Shares Available” are incorporated herein by reference.

Administration. The 2021 Plan will be administered by our board of directors, or if our board of directors does not administer the 2021 Plan, a committee or subcommittee of our board of directors that complies with the applicable requirements of Section 16 of the Exchange Act and any other applicable legal or stock exchange listing requirements (each of our board of directors or such committee or subcommittee, the “plan administrator”). The plan administrator may interpret the 2021 Plan and may prescribe, amend and rescind rules and make all other determinations necessary or desirable for the administration of the 2021 Plan, provided that, subject to the equitable adjustment provisions described below, the plan administrator will not have the authority to reprice or cancel and re-grant any award at a lower exercise, base or purchase price or cancel any award with an exercise, base or purchase price in exchange for cash, property or other awards without first obtaining the approval of our stockholders.

The 2021 Plan permits the plan administrator to select the eligible recipients who will receive awards, to determine the terms and conditions of those awards, including but not limited to the exercise price or other purchase price of an award, the number of shares of common stock or cash or other property subject to an award, the term of an award and the vesting schedule applicable to an award, and to amend the terms and conditions of outstanding awards.

Restricted Stock and Restricted Stock Units. Restricted stock and RSUs may be granted under the 2021 Plan. The plan administrator will determine the purchase price, vesting schedule and performance goals, if any, and any other conditions that apply to a grant of restricted stock and RSUs. If the restrictions, performance goals or other conditions determined by the plan administrator are not satisfied, the restricted stock and RSUs will be forfeited. Subject to the provisions of the 2021 Plan and the applicable award agreement, the plan administrator has the sole discretion to provide for the lapse of restrictions in installments.

Unless the applicable award agreement provides otherwise, participants with restricted stock will generally have all of the rights of a stockholder; provided that dividends will only be paid if and when the underlying restricted stock vests. RSUs will not be entitled to dividends prior to vesting, but may be entitled to receive dividend equivalents if the award agreement provides for them. The rights of participants granted restricted stock or RSUs upon the termination of employment or service to us will be set forth in the award agreement.

Options. Incentive stock options and non-qualified stock options may be granted under the 2021 Plan. An “incentive stock option” means an option intended to qualify for tax treatment applicable to incentive stock options under Section 422 of the Internal Revenue Code (the “Code). A “non-qualified stock option” is an option that is not subject to

-24-

statutory requirements and limitations required for certain tax advantages that are allowed under specific provisions of the Code. Each option granted under the Plan will be designated as a non-qualified stock option or an incentive stock option. At the discretion of the administrator, incentive stock options may be granted only to our employees, employees of our “parent corporation” (as such term is defined in Section 424(e) of the Code) or employees of our subsidiaries.

The exercise period of an option may not exceed ten years from the date of grant (five years from the date of grant in the case of incentive stock options granted to ten percent stockholders) and the exercise price may not be less than 100% of the fair market value of a share of common stock on the date the option is granted (110% of fair market value in the case of incentive stock options granted to ten percent stockholders). The exercise price for shares of common stock subject to an option may be paid in cash, or as determined by the administrator in its sole discretion, (i) through any cashless exercise procedure approved by the administrator (including the withholding of shares of common stock otherwise issuable upon exercise), (ii) by tendering unrestricted shares of common stock owned by the participant, (iii) with any other form of consideration approved by the administrator and permitted by applicable law or (iv) by any combination of these methods. The option holder will have no rights to dividends or distributions or other rights of a stockholder with respect to the shares of Common Stock subject to an option until the option holder has given written notice of exercise and paid the exercise price and applicable withholding taxes.

In the event of an participant’s termination of employment or service, the participant may exercise his or her option (to the extent vested as of such date of termination) for such period of time as specified in his or her option agreement.

Stock Appreciation Rights. SARs may be granted either alone (a “free-standing SAR”) or in conjunction with all or part of any option granted under the 2021 Plan (a “tandem SAR”). A free-standing SAR will entitle its holder to receive, at the time of exercise, an amount per share up to the excess of the fair market value (at the date of exercise) of a share of common stock over the base price of the free-standing SAR (which shall be no less than 100% of the fair market value of the related shares of common stock on the date of grant) multiplied by the number of shares in respect of which the SAR is being exercised. A tandem SAR will entitle its holder to receive, at the time of exercise of the SAR and surrender of the applicable portion of the related option, an amount per share up to the excess of the fair market value (at the date of exercise) of a share of common stock over the exercise price of the related option multiplied by the number of shares in respect of which the SAR is being exercised. The exercise period of a free-standing SAR may not exceed ten years from the date of grant. The exercise period of a tandem SAR will also expire upon the expiration of its related option.

The holder of a SAR will have no rights to dividends or any other rights of a stockholder with respect to the shares of Common Stock subject to the SAR until the holder has given written notice of exercise and paid the exercise price and applicable withholding taxes.

In the event of an participant’s termination of employment or service, the holder of a SAR may exercise his or her SAR (to the extent vested as of such date of termination) for such period of time as specified in his or her SAR agreement.