vtrs-202103310001792044FALSE2021Q112/310.010.013,000,000,0003,000,000,0001,208,530,9701,206,895,644——P5YP3Y311.41000.301000.301000.251000.201000.351001000.301001000.21000.251001000.351001000.251001000.4010000017920442021-01-012021-03-31iso4217:EURxbrli:shares00017920442021-03-31xbrli:shares00017920442021-05-06iso4217:USD00017920442020-01-012020-03-310001792044us-gaap:ProductAndServiceOtherMember2021-01-012021-03-310001792044us-gaap:ProductAndServiceOtherMember2020-01-012020-03-31iso4217:USDxbrli:shares0001792044us-gaap:CashFlowHedgingMember2021-01-012021-03-310001792044us-gaap:CashFlowHedgingMember2020-01-012020-03-310001792044us-gaap:NetInvestmentHedgingMember2021-01-012021-03-310001792044us-gaap:NetInvestmentHedgingMember2020-01-012020-03-3100017920442020-12-310001792044us-gaap:CommonStockMember2021-03-310001792044us-gaap:CommonStockMember2020-12-310001792044us-gaap:TreasuryStockMember2021-03-310001792044us-gaap:TreasuryStockMember2020-12-310001792044us-gaap:AdditionalPaidInCapitalMember2020-12-310001792044us-gaap:RetainedEarningsMember2020-12-310001792044us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001792044us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001792044us-gaap:CommonStockMember2021-01-012021-03-310001792044us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310001792044us-gaap:AdditionalPaidInCapitalMember2021-03-310001792044us-gaap:RetainedEarningsMember2021-03-310001792044us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001792044us-gaap:CommonStockMember2019-12-310001792044us-gaap:AdditionalPaidInCapitalMember2019-12-310001792044us-gaap:RetainedEarningsMember2019-12-310001792044us-gaap:TreasuryStockMember2019-12-310001792044us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-3100017920442019-12-310001792044us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001792044us-gaap:CommonStockMember2020-01-012020-03-310001792044us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310001792044us-gaap:CommonStockMember2020-03-310001792044us-gaap:AdditionalPaidInCapitalMember2020-03-310001792044us-gaap:RetainedEarningsMember2020-03-310001792044us-gaap:TreasuryStockMember2020-03-310001792044us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-3100017920442020-03-310001792044vtrs:BrandsMembervtrs:DevelopedMarketsSegmentMember2021-01-012021-03-310001792044vtrs:BrandsMembervtrs:GreaterChinaSegmentMember2021-01-012021-03-310001792044vtrs:BrandsMembervtrs:JapanAustraliaAndNewZealandSegmentMember2021-01-012021-03-310001792044vtrs:BrandsMembervtrs:EmergingMarketsSegmentMember2021-01-012021-03-310001792044vtrs:BrandsMember2021-01-012021-03-310001792044vtrs:ComplexGXAndBiosimilarsMembervtrs:DevelopedMarketsSegmentMember2021-01-012021-03-310001792044vtrs:ComplexGXAndBiosimilarsMembervtrs:GreaterChinaSegmentMember2021-01-012021-03-310001792044vtrs:JapanAustraliaAndNewZealandSegmentMembervtrs:ComplexGXAndBiosimilarsMember2021-01-012021-03-310001792044vtrs:EmergingMarketsSegmentMembervtrs:ComplexGXAndBiosimilarsMember2021-01-012021-03-310001792044vtrs:ComplexGXAndBiosimilarsMember2021-01-012021-03-310001792044vtrs:GenericsMembervtrs:DevelopedMarketsSegmentMember2021-01-012021-03-310001792044vtrs:GenericsMembervtrs:GreaterChinaSegmentMember2021-01-012021-03-310001792044vtrs:GenericsMembervtrs:JapanAustraliaAndNewZealandSegmentMember2021-01-012021-03-310001792044vtrs:EmergingMarketsSegmentMembervtrs:GenericsMember2021-01-012021-03-310001792044vtrs:GenericsMember2021-01-012021-03-310001792044us-gaap:OperatingSegmentsMembervtrs:DevelopedMarketsSegmentMember2021-01-012021-03-310001792044us-gaap:OperatingSegmentsMembervtrs:GreaterChinaSegmentMember2021-01-012021-03-310001792044us-gaap:OperatingSegmentsMembervtrs:JapanAustraliaAndNewZealandSegmentMember2021-01-012021-03-310001792044vtrs:EmergingMarketsSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-03-310001792044vtrs:BrandsMembervtrs:DevelopedMarketsSegmentMember2020-01-012020-03-310001792044vtrs:BrandsMembervtrs:GreaterChinaSegmentMember2020-01-012020-03-310001792044vtrs:BrandsMembervtrs:JapanAustraliaAndNewZealandSegmentMember2020-01-012020-03-310001792044vtrs:BrandsMembervtrs:EmergingMarketsSegmentMember2020-01-012020-03-310001792044vtrs:BrandsMember2020-01-012020-03-310001792044vtrs:ComplexGXAndBiosimilarsMembervtrs:DevelopedMarketsSegmentMember2020-01-012020-03-310001792044vtrs:ComplexGXAndBiosimilarsMembervtrs:GreaterChinaSegmentMember2020-01-012020-03-310001792044vtrs:JapanAustraliaAndNewZealandSegmentMembervtrs:ComplexGXAndBiosimilarsMember2020-01-012020-03-310001792044vtrs:EmergingMarketsSegmentMembervtrs:ComplexGXAndBiosimilarsMember2020-01-012020-03-310001792044vtrs:ComplexGXAndBiosimilarsMember2020-01-012020-03-310001792044vtrs:GenericsMembervtrs:DevelopedMarketsSegmentMember2020-01-012020-03-310001792044vtrs:GenericsMembervtrs:GreaterChinaSegmentMember2020-01-012020-03-310001792044vtrs:GenericsMembervtrs:JapanAustraliaAndNewZealandSegmentMember2020-01-012020-03-310001792044vtrs:EmergingMarketsSegmentMembervtrs:GenericsMember2020-01-012020-03-310001792044vtrs:GenericsMember2020-01-012020-03-310001792044us-gaap:OperatingSegmentsMembervtrs:DevelopedMarketsSegmentMember2020-01-012020-03-310001792044us-gaap:OperatingSegmentsMembervtrs:GreaterChinaSegmentMember2020-01-012020-03-310001792044us-gaap:OperatingSegmentsMembervtrs:JapanAustraliaAndNewZealandSegmentMember2020-01-012020-03-310001792044vtrs:EmergingMarketsSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001792044vtrs:LipitorMember2021-01-012021-03-310001792044vtrs:NorvascMember2021-01-012021-03-310001792044vtrs:LyricaMember2021-01-012021-03-310001792044vtrs:ViagraMember2021-01-012021-03-310001792044vtrs:EpiPenAutoInjectorsMember2021-01-012021-03-310001792044vtrs:CelebrexMember2021-01-012021-03-310001792044vtrs:EffexorMember2021-01-012021-03-310001792044vtrs:ZoloftMember2021-01-012021-03-310001792044vtrs:CreonMember2021-01-012021-03-310001792044vtrs:XalabrandsMember2021-01-012021-03-310001792044vtrs:AmitizaMember2021-01-012021-03-310001792044vtrs:XanaxMember2021-01-012021-03-310001792044vtrs:DymistaMember2021-01-012021-03-310001792044vtrs:YupelriMember2021-01-012021-03-310001792044vtrs:VariableConsiderationMember2021-03-310001792044vtrs:VariableConsiderationMember2020-12-3100017920442020-01-012020-12-31xbrli:pure0001792044vtrs:UpjohnInc.Memberus-gaap:ProductMember2019-07-290001792044vtrs:UpjohnInc.Membervtrs:PfizerInc.Member2019-07-290001792044vtrs:UpjohnInc.Member2019-07-290001792044vtrs:UpjohnInc.Membervtrs:PfizerInc.Member2019-07-292019-07-290001792044vtrs:UpjohnInc.Membervtrs:PfizerInc.Member2020-11-160001792044vtrs:UpjohnInc.Member2020-11-132020-11-130001792044vtrs:UpjohnInc.Member2020-01-012020-12-310001792044vtrs:UpjohnInc.Member2021-01-012021-03-310001792044vtrs:UpjohnInc.Member2019-05-280001792044vtrs:UpjohnInc.Member2020-12-310001792044vtrs:UpjohnInc.Member2021-03-310001792044us-gaap:MachineryAndEquipmentMember2020-11-132020-11-130001792044us-gaap:BuildingMembersrt:MinimumMember2020-11-132020-11-130001792044srt:MaximumMemberus-gaap:BuildingMember2020-11-132020-11-130001792044vtrs:UpjohnInc.Member2020-11-130001792044us-gaap:FiniteLivedIntangibleAssetsMember2020-11-132020-11-130001792044vtrs:UpjohnInc.Member2020-01-012020-03-310001792044vtrs:LongTermIncentivePlan2003Memberus-gaap:EmployeeStockOptionMember2021-01-012021-03-310001792044us-gaap:RestrictedStockUnitsRSUMember2020-12-310001792044us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-03-310001792044us-gaap:RestrictedStockUnitsRSUMember2021-03-310001792044vtrs:LongTermIncentivePlan2003Member2021-03-310001792044vtrs:LongTermIncentivePlan2003Member2021-01-012021-03-310001792044vtrs:LongTermIncentivePlan2003Member2020-01-012020-03-310001792044srt:MinimumMembervtrs:LongTermIncentivePlan2003Memberus-gaap:EmployeeStockOptionMember2021-01-012021-03-310001792044us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2021-01-012021-03-310001792044us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2020-01-012020-03-310001792044us-gaap:DebtSecuritiesMember2021-03-310001792044us-gaap:DebtSecuritiesMember2020-12-310001792044us-gaap:MachineryAndEquipmentMember2021-03-310001792044us-gaap:MachineryAndEquipmentMember2020-12-310001792044us-gaap:BuildingAndBuildingImprovementsMember2021-03-310001792044us-gaap:BuildingAndBuildingImprovementsMember2020-12-310001792044us-gaap:ConstructionInProgressMember2021-03-310001792044us-gaap:ConstructionInProgressMember2020-12-310001792044us-gaap:LandAndLandImprovementsMember2021-03-310001792044us-gaap:LandAndLandImprovementsMember2020-12-310001792044vtrs:CleanEnergyPartnershipsMemberus-gaap:OtherAssetsMember2021-03-310001792044vtrs:CleanEnergyPartnershipsMemberus-gaap:OtherAssetsMember2020-12-310001792044us-gaap:OtherCurrentLiabilitiesMember2021-03-310001792044us-gaap:OtherCurrentLiabilitiesMember2020-12-310001792044vtrs:CleanEnergyPartnershipsMember2021-03-310001792044vtrs:CleanEnergyPartnershipsMember2020-12-310001792044us-gaap:OtherNoncurrentLiabilitiesMember2021-03-310001792044us-gaap:OtherNoncurrentLiabilitiesMember2020-12-310001792044us-gaap:ConsolidatedEntityExcludingVieMember2021-01-012021-03-310001792044us-gaap:ConsolidatedEntityExcludingVieMember2020-01-012020-03-310001792044vtrs:DevelopedMarketsSegmentMember2020-12-310001792044vtrs:GreaterChinaSegmentMember2020-12-310001792044vtrs:JapanAustraliaAndNewZealandSegmentMember2020-12-310001792044vtrs:EmergingMarketsSegmentMember2020-12-310001792044vtrs:DevelopedMarketsSegmentMember2021-01-012021-03-310001792044vtrs:GreaterChinaSegmentMember2021-01-012021-03-310001792044vtrs:JapanAustraliaAndNewZealandSegmentMember2021-01-012021-03-310001792044vtrs:EmergingMarketsSegmentMember2021-01-012021-03-310001792044vtrs:DevelopedMarketsSegmentMember2021-03-310001792044vtrs:GreaterChinaSegmentMember2021-03-310001792044vtrs:JapanAustraliaAndNewZealandSegmentMember2021-03-310001792044vtrs:EmergingMarketsSegmentMember2021-03-310001792044us-gaap:PatentsMember2021-01-012021-03-310001792044us-gaap:PatentsMember2020-01-012020-12-31iso4217:EUR0001792044vtrs:A2024EuroSeniorNotesMemberus-gaap:NetInvestmentHedgingMember2021-03-310001792044vtrs:A2024EuroSeniorNotesMemberus-gaap:NetInvestmentHedgingMember2020-12-310001792044vtrs:A2028EuroSeniorNotesMemberus-gaap:NetInvestmentHedgingMember2021-03-310001792044vtrs:A2028EuroSeniorNotesMemberus-gaap:NetInvestmentHedgingMember2020-12-310001792044vtrs:A2025EuroSeniorNotesMemberus-gaap:NetInvestmentHedgingMember2021-03-310001792044vtrs:A2025EuroSeniorNotesMemberus-gaap:NetInvestmentHedgingMember2020-12-310001792044vtrs:A2022EuroSeniorNotesMemberus-gaap:NetInvestmentHedgingMember2021-03-310001792044vtrs:A2022EuroSeniorNotesMemberus-gaap:NetInvestmentHedgingMember2020-12-310001792044vtrs:A2024EuroSeniorNotes1023Memberus-gaap:NetInvestmentHedgingMember2021-03-310001792044vtrs:A2024EuroSeniorNotes1023Memberus-gaap:NetInvestmentHedgingMember2020-12-310001792044vtrs:A2027EuroSeniorNotesMemberus-gaap:NetInvestmentHedgingMember2021-03-310001792044vtrs:A2027EuroSeniorNotesMemberus-gaap:NetInvestmentHedgingMember2020-12-310001792044vtrs:A2032EuroSeniorNotesMemberus-gaap:NetInvestmentHedgingMember2021-03-310001792044vtrs:A2032EuroSeniorNotesMemberus-gaap:NetInvestmentHedgingMember2020-12-310001792044vtrs:A2020FloatingRateEuroNotesMemberus-gaap:NetInvestmentHedgingMember2021-03-310001792044vtrs:A2020FloatingRateEuroNotesMemberus-gaap:NetInvestmentHedgingMember2020-12-310001792044us-gaap:NetInvestmentHedgingMember2021-03-310001792044us-gaap:NetInvestmentHedgingMember2020-12-310001792044us-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-03-310001792044us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-03-310001792044us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001792044us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentLiabilitiesMember2021-03-310001792044us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentLiabilitiesMember2020-12-310001792044us-gaap:DesignatedAsHedgingInstrumentMember2021-03-310001792044us-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001792044us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2021-03-310001792044us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2020-12-310001792044us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:OtherCurrentLiabilitiesMember2021-03-310001792044us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:OtherCurrentLiabilitiesMember2020-12-310001792044us-gaap:NondesignatedMember2021-03-310001792044us-gaap:NondesignatedMember2020-12-310001792044us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMemberus-gaap:FairValueHedgingMember2021-01-012021-03-310001792044us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMemberus-gaap:FairValueHedgingMember2020-01-012020-03-310001792044us-gaap:InterestExpenseMemberus-gaap:FairValueHedgingMembervtrs:SeniorNotesTwoThousandTwentyThree3.125PercentMember2021-01-012021-03-310001792044us-gaap:InterestExpenseMemberus-gaap:FairValueHedgingMembervtrs:SeniorNotesTwoThousandTwentyThree3.125PercentMember2020-01-012020-03-310001792044us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2021-01-012021-03-310001792044us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2020-01-012020-03-310001792044us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:SalesMember2021-01-012021-03-310001792044us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:SalesMember2020-01-012020-03-310001792044us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2021-01-012021-03-310001792044us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMemberus-gaap:CashFlowHedgingMember2021-01-012021-03-310001792044us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMemberus-gaap:CashFlowHedgingMember2020-01-012020-03-310001792044us-gaap:ForeignExchangeContractMemberus-gaap:NetInvestmentHedgingMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-01-012021-03-310001792044us-gaap:ForeignExchangeContractMemberus-gaap:NetInvestmentHedgingMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-01-012020-03-310001792044us-gaap:ForeignExchangeContractMemberus-gaap:OtherExpenseMember2021-01-012021-03-310001792044us-gaap:ForeignExchangeContractMemberus-gaap:OtherExpenseMember2020-01-012020-03-310001792044us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2021-03-310001792044us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2020-12-310001792044us-gaap:FairValueInputsLevel1Member2021-03-310001792044us-gaap:FairValueInputsLevel1Member2020-12-310001792044us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel1Member2021-03-310001792044us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel1Member2020-12-310001792044us-gaap:FairValueInputsLevel1Memberus-gaap:CommonStockMember2021-03-310001792044us-gaap:FairValueInputsLevel1Memberus-gaap:CommonStockMember2020-12-310001792044us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-03-310001792044us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310001792044us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2021-03-310001792044us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2020-12-310001792044us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesMember2021-03-310001792044us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesMember2020-12-310001792044us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2021-03-310001792044us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2020-12-310001792044us-gaap:FairValueInputsLevel2Memberus-gaap:OtherDebtSecuritiesMember2021-03-310001792044us-gaap:FairValueInputsLevel2Memberus-gaap:OtherDebtSecuritiesMember2020-12-310001792044us-gaap:FairValueInputsLevel2Memberus-gaap:DebtSecuritiesMember2021-03-310001792044us-gaap:FairValueInputsLevel2Memberus-gaap:DebtSecuritiesMember2020-12-310001792044us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMember2021-03-310001792044us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMember2020-12-310001792044us-gaap:FairValueInputsLevel2Member2021-03-310001792044us-gaap:FairValueInputsLevel2Member2020-12-310001792044vtrs:ContingentConsiderationMemberus-gaap:FairValueInputsLevel3Member2021-03-310001792044us-gaap:FairValueInputsLevel3Member2021-03-310001792044us-gaap:FairValueInputsLevel3Member2020-12-310001792044vtrs:ContingentConsiderationMembersrt:MinimumMemberus-gaap:MeasurementInputDiscountRateMember2021-03-310001792044srt:MaximumMembervtrs:ContingentConsiderationMemberus-gaap:MeasurementInputDiscountRateMember2021-03-310001792044us-gaap:OtherCurrentLiabilitiesMember2021-01-012021-03-310001792044us-gaap:OtherNoncurrentLiabilitiesMember2021-01-012021-03-310001792044us-gaap:CommercialPaperMember2021-03-310001792044us-gaap:CommercialPaperMember2020-12-310001792044vtrs:ReceivablesFacilityMember2021-03-310001792044vtrs:ReceivablesFacilityMember2020-12-310001792044vtrs:NoteSecuritizationFacilityMember2021-03-310001792044vtrs:NoteSecuritizationFacilityMember2020-12-310001792044vtrs:OtherCurrentPortionofLongtermDebtMember2021-03-310001792044vtrs:OtherCurrentPortionofLongtermDebtMember2020-12-310001792044vtrs:SeniorNotes2021Member2021-03-310001792044vtrs:SeniorNotes2021Member2020-12-310001792044vtrs:CurrentPortionofLongTermDebtMember2021-03-310001792044vtrs:CurrentPortionofLongTermDebtMember2020-12-310001792044vtrs:A2022EuroSeniorNotesMember2021-03-310001792044vtrs:A2022EuroSeniorNotesMember2020-12-310001792044vtrs:SeniorNotes2022Member2021-03-310001792044vtrs:SeniorNotes2022Member2020-12-310001792044vtrs:SeniorNotesTwoThousandTwentyThree3.125PercentMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:SeniorNotesTwoThousandTwentyThree3.125PercentMemberus-gaap:SeniorNotesMember2020-12-310001792044vtrs:SeniorNotesTwoThousandTwentyThree4.2PercentMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:SeniorNotesTwoThousandTwentyThree4.2PercentMemberus-gaap:SeniorNotesMember2020-12-310001792044vtrs:A2024EuroSeniorNotesMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:A2024EuroSeniorNotesMemberus-gaap:SeniorNotesMember2020-12-310001792044vtrs:A2024EuroSeniorNotes1023Member2021-03-310001792044us-gaap:SeniorNotesMembervtrs:A2024EuroSeniorNotes1023Member2021-03-310001792044us-gaap:SeniorNotesMembervtrs:A2024EuroSeniorNotes1023Member2020-12-310001792044vtrs:A2025EuroSeniorNotesMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:A2025EuroSeniorNotesMemberus-gaap:SeniorNotesMember2020-12-310001792044vtrs:A2025SeniorNotesMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:A2025SeniorNotesMemberus-gaap:SeniorNotesMember2020-12-310001792044vtrs:SeniorNotesTwoThousandTwentySix3.95PrecentMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:SeniorNotesTwoThousandTwentySix3.95PrecentMemberus-gaap:SeniorNotesMember2020-12-310001792044vtrs:A2027EuroSeniorNotesMember2021-03-310001792044vtrs:A2027EuroSeniorNotesMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:A2027EuroSeniorNotesMemberus-gaap:SeniorNotesMember2020-12-310001792044vtrs:A2027SeniorNotesMember2021-03-310001792044vtrs:A2027SeniorNotesMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:A2027SeniorNotesMemberus-gaap:SeniorNotesMember2020-12-310001792044vtrs:A2028EuroSeniorNotesMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:A2028EuroSeniorNotesMemberus-gaap:SeniorNotesMember2020-12-310001792044vtrs:SeniorNotesTwoThousandTwentyEightMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:A2028SeniorNotesMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:A2028SeniorNotesMemberus-gaap:SeniorNotesMember2020-12-310001792044vtrs:A2030SeniorNotesMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:A2030SeniorNotesMemberus-gaap:SeniorNotesMember2020-12-310001792044vtrs:A2032EuroSeniorNotesMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:A2032EuroSeniorNotesMemberus-gaap:SeniorNotesMember2020-12-310001792044vtrs:A2040SeniorNotesMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:A2040SeniorNotesMemberus-gaap:SeniorNotesMember2020-12-310001792044vtrs:SeniorNotesTwoThousandFortyThreeMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:SeniorNotesTwoThousandFortyThreeMemberus-gaap:SeniorNotesMember2020-12-310001792044vtrs:SeniorNotesTwoThousandFortySix5.25PrecentMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:SeniorNotesTwoThousandFortySix5.25PrecentMemberus-gaap:SeniorNotesMember2020-12-310001792044vtrs:SeniorNotesTwoThousandFortyEightMemberus-gaap:SeniorNotesMember2021-03-310001792044us-gaap:SeniorNotesMembervtrs:A2048SeniorNotesMember2021-03-310001792044us-gaap:SeniorNotesMembervtrs:A2048SeniorNotesMember2020-12-310001792044vtrs:A2050SeniorNotesMemberus-gaap:SeniorNotesMember2021-03-310001792044vtrs:A2050SeniorNotesMemberus-gaap:SeniorNotesMember2020-12-310001792044vtrs:TermLoanMember2021-03-310001792044vtrs:TermLoanMember2020-12-310001792044vtrs:OtherLongTermDebtMember2021-03-310001792044vtrs:OtherLongTermDebtMember2020-12-310001792044us-gaap:SeniorNotesMember2021-03-310001792044us-gaap:SeniorNotesMember2020-12-310001792044vtrs:SeniorNotesTwoThousandEighteen2.6PercentMemberus-gaap:SeniorNotesMember2021-01-012021-03-310001792044vtrs:SeniorNotesTwoThousandEighteen3.0PercentMemberus-gaap:SeniorNotesMember2021-01-012021-03-310001792044us-gaap:SeniorNotesMembervtrs:SeniorNotesTwoThousandNineteen2.50PrecentMember2021-01-012021-03-310001792044vtrs:SeniorNotesTwoThousandNineteenMemberus-gaap:SeniorNotesMember2021-01-012021-03-310001792044vtrs:SeniorNotesTwoThousandTwenty3.75PercentMemberus-gaap:SeniorNotesMember2021-01-012021-03-310001792044vtrs:SeniorNotesTwoThousandTwentyOne3.15PrecentMemberus-gaap:SeniorNotesMember2021-01-012021-03-310001792044vtrs:SeniorNotesTwoThousandTwentyThree3.125PercentMemberus-gaap:SeniorNotesMember2021-01-012021-03-310001792044vtrs:SeniorNotesTwoThousandTwentyThree4.2PercentMemberus-gaap:SeniorNotesMember2021-01-012021-03-310001792044vtrs:SeniorNotesTwoThousandTwentySix3.95PrecentMemberus-gaap:SeniorNotesMember2021-01-012021-03-310001792044vtrs:SeniorNotesTwoThousandFortyThreeMemberus-gaap:SeniorNotesMember2021-01-012021-03-310001792044vtrs:SeniorNotesTwoThousandFortySix5.25PrecentMemberus-gaap:SeniorNotesMember2021-01-012021-03-310001792044us-gaap:CashFlowHedgingMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-03-310001792044us-gaap:CashFlowHedgingMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-12-310001792044us-gaap:NetInvestmentHedgingMember2021-03-310001792044us-gaap:NetInvestmentHedgingMember2020-12-310001792044us-gaap:CashFlowHedgingMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-01-012021-03-310001792044srt:ParentCompanyMemberus-gaap:NetInvestmentHedgingMember2021-01-012021-03-310001792044us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-03-310001792044us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:ForeignExchangeContractMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-01-012021-03-310001792044us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-01-012021-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:ForeignExchangeContractMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:InterestRateSwapMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-01-012021-03-310001792044us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-01-012021-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:InterestRateSwapMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2021-01-012021-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001792044us-gaap:NetInvestmentHedgingMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-01-012021-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-01-012021-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-03-310001792044us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2019-12-310001792044us-gaap:NetInvestmentHedgingMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2019-12-310001792044us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-12-310001792044us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310001792044us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310001792044us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-01-012020-03-310001792044us-gaap:NetInvestmentHedgingMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-01-012020-03-310001792044us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-01-012020-03-310001792044us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:ForeignExchangeContractMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-01-012020-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:ForeignExchangeContractMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:InterestRateSwapMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-01-012020-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:InterestRateSwapMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-01-012020-03-310001792044srt:ParentCompanyMemberus-gaap:NetInvestmentHedgingMember2020-01-012020-03-310001792044us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-03-310001792044us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-03-310001792044us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-03-310001792044us-gaap:NetInvestmentHedgingMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-03-310001792044us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-03-310001792044us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-03-310001792044us-gaap:AccumulatedTranslationAdjustmentMember2020-03-310001792044us-gaap:OperatingSegmentsMember2021-01-012021-03-310001792044us-gaap:OperatingSegmentsMember2020-01-012020-03-310001792044us-gaap:MaterialReconcilingItemsMember2021-01-012021-03-310001792044us-gaap:MaterialReconcilingItemsMember2020-01-012020-03-310001792044us-gaap:CorporateNonSegmentMember2021-01-012021-03-310001792044us-gaap:CorporateNonSegmentMember2020-01-012020-03-31vtrs:facility0001792044vtrs:A2020RestructuringPlanMember2020-10-012020-12-310001792044vtrs:A2020RestructuringPlanMembersrt:MinimumMember2020-10-012020-12-310001792044srt:MaximumMembervtrs:A2020RestructuringPlanMember2020-10-012020-12-310001792044vtrs:A2020RestructuringPlanMembersrt:MinimumMember2021-01-012021-03-310001792044srt:MaximumMembervtrs:A2020RestructuringPlanMember2021-01-012021-03-310001792044vtrs:A2020RestructuringPlanMembersrt:ScenarioForecastMembersrt:MinimumMember2021-12-310001792044srt:MaximumMembervtrs:A2020RestructuringPlanMembersrt:ScenarioForecastMember2021-12-310001792044us-gaap:EmployeeSeveranceMember2020-12-310001792044us-gaap:OtherRestructuringMember2020-12-310001792044us-gaap:EmployeeSeveranceMember2021-01-012021-03-310001792044us-gaap:OtherRestructuringMember2021-01-012021-03-310001792044us-gaap:EmployeeSeveranceMember2021-03-310001792044us-gaap:OtherRestructuringMember2021-03-310001792044srt:MaximumMember2021-01-012021-03-310001792044srt:MaximumMemberus-gaap:CollaborativeArrangementMember2021-01-012021-03-310001792044vtrs:EpiPenAutoInjectorCivilLitigationMember2021-03-310001792044vtrs:MultiDistrictLitigationMember2021-03-310001792044vtrs:AnticompetitiveConductwithDoxycyclineHyclateDelayedReleaseDoxycyclineMonohydrateGlipizideMetforminandVerapamilMember2021-03-310001792044vtrs:AnticompetitiveConductwithGenericDrugsMember2021-03-310001792044vtrs:AmendedAnticompetitiveConductwithGenericDrugsMember2021-03-310001792044srt:SubsidiariesMembervtrs:EUCommissionProceedingsPerindorprilMembervtrs:AntitrustProceedingsMember2014-07-082014-07-090001792044vtrs:EUCommissionProceedingsPerindorprilMembersrt:ParentCompanyMembervtrs:AntitrustProceedingsMember2015-10-012015-12-310001792044vtrs:EUCommissionProceedingsCitalopramMember2013-06-012013-06-190001792044vtrs:EUCommissionProceedingsCitalopramMember2021-03-31iso4217:GBP0001792044vtrs:U.K.CompetitionandMarketsAuthorityProceedingsParoxetineMember2016-02-122016-02-120001792044srt:ParentCompanyMembervtrs:U.K.CompetitionandMarketsAuthorityProceedingsParoxetineMember2016-02-122016-02-120001792044vtrs:ProductLiabilityMember2021-03-31vtrs:increase0001792044us-gaap:DevelopedTechnologyRightsMember2021-01-012021-03-310001792044vtrs:OtherMember2021-03-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

| | | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2021

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_____________to___________

Commission file number 001-39695

VIATRIS INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 83-4364296 |

(State or other jurisdiction

of incorporation or organization) | | (I.R.S. Employer

Identification No.) |

1000 Mylan Boulevard, Canonsburg, Pennsylvania 15317

(Address of principal executive offices)

(724) 514-1800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class: | | Trading Symbol(s) | | Name of Each Exchange on Which Registered: |

| | | | |

| Common Stock, par value $0.01 per share | | VTRS | | The NASDAQ Stock Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| | | | | | |

| Non-accelerated filer | | ☑ | | Smaller reporting company | | ☐ |

| | | | | | |

| | | | Emerging growth company | | ☐ |

| | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

The number of shares of common stock outstanding, par value $0.01 per share, of the registrant as of May 5, 2021 was 1,208,655,503.

VIATRIS INC. AND SUBSIDIARIES

INDEX TO FORM 10-Q

For the Quarterly Period Ended

March 31, 2021

| | | | | | | | |

| | Page |

| PART I — FINANCIAL INFORMATION | |

| ITEM 1. | Condensed Consolidated Financial Statements (unaudited) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| ITEM 2. | | |

| | |

| ITEM 3. | | |

| | |

| ITEM 4. | | |

| | |

| PART II — OTHER INFORMATION | |

| ITEM 1. | | |

| | |

| ITEM 1A. | | |

| | |

| | |

| | |

| ITEM 6. | | |

| | |

| | |

Glossary of Defined Terms

Unless the context requires otherwise, references to “Viatris,” “the Company,” “we,” “us” or “our” in this Form 10-Q (defined below) refer to Viatris Inc. and its subsidiaries. We also have used several other terms in this Form 10-Q, most of which are explained or defined below. Some amounts in this Form 10-Q may not add due to rounding.

| | | | | |

| 2003 LTIP | 2003 Long-Term Incentive Plan |

| 2020 Form 10-K | Viatris’ annual report on Form 10-K for the fiscal year ended December 31, 2020, as amended |

| Adjusted EBITDA | Non-GAAP financial measure that the Company believes is appropriate to provide information to investors - EBITDA (defined below) is further adjusted for share-based compensation expense, litigation settlements, and other contingencies, net, restructuring and other special items |

| ANDA | Abbreviated New Drug Application |

| AOCE | Accumulated other comprehensive earnings |

| APIs | Active pharmaceutical ingredients |

| ASC | Accounting Standards Codification |

| ASU | Accounting Standards Update |

| Biogen | Biogen MA Inc. and Biogen International GmbH, collectively |

| Business Combination Agreement | Business Combination Agreement, dated as of July 29, 2019, as amended from time to time, among Viatris, Mylan, Pfizer and certain of their affiliates |

| CAT | Competition Appeals Tribunal |

| CJEU | European Court of Justice |

| clean energy investments | Used to define the three equity method investments the Company has in limited liability companies that own refined coal production plants whose activities qualify for income tax credits under Section 45 of the Code |

| CMA | Competition and Markets Authority |

| Code | The U.S. Internal Revenue Code of 1986, as amended |

| Combination | Refers to Mylan combining with Pfizer's Upjohn Business in a Reverse Morris Trust transaction to form Viatris on November 16, 2020 |

| Commercial Paper Program | The $1.65 billion unsecured commercial paper program entered into as of November 16, 2020 by Viatris, as issuer, Mylan Inc., Utah Acquisition Sub Inc. and Mylan II B.V., as guarantors, and certain dealers from time to time |

| Commission | European Commission |

| COVID-19 | Novel coronavirus disease of 2019 |

| DCGI | Drug Controller General of India |

| Developed Markets segment | Viatris’ business segment that includes our operations primarily in the following markets: North America and Europe |

| Distribution | Pfizer's distribution to Pfizer stockholders all the issued and outstanding shares of Upjohn Inc. |

| DOJ | U.S. Department of Justice |

| EBITDA | Non-GAAP financial measure that the Company believes is appropriate to provide information to investors - U.S. GAAP net earnings (loss) adjusted for net contribution attributable to equity method investments, income tax provision (benefit), interest expense and depreciation and amortization |

| EDPA | U.S. District Court for the Eastern District of Pennsylvania |

| | | | | |

| Emerging Markets segment | Viatris’ business segment that includes, but is not limited to, our operations primarily in the following markets: Parts of Asia, the Middle East, South and Central America, Africa, and Eastern Europe |

| EU | European Union |

| Exchange Act | Securities Exchange Act of 1934, as amended |

| FASB | Financial Accounting Standards Board |

| FDA | U.S. Food and Drug Administration |

| Form 10-Q | This quarterly report on Form 10-Q for the quarterly period ended March 31, 2021 |

| Greater China segment | Viatris’ business segment that includes our operations primarily in the following markets: China, Taiwan and Hong Kong |

| Gx | Generic drugs |

| IPR | Inter Partes review |

| IRS | U.S. Internal Revenue Service |

| IT | Information technology |

| JANZ segment | Viatris’ business segment that includes our operations primarily in the following markets: Japan, Australia and New Zealand |

| LIBOR | London Interbank Offered Rate |

| Lilly | Eli Lilly and Company |

| maximum leverage ratio | Under our Term Loan Agreement and Revolving Facility, the maximum consolidated leverage ratio financial covenant requiring maintenance of a maximum ratio of consolidated total indebtedness as of the end of any quarter to consolidated EBITDA for the trailing four quarters as defined in the related credit agreements from time to time |

| MDL | Multidistrict litigation |

| MPI | Mylan Pharmaceutical Inc. |

| Mylan | Mylan N.V. and its subsidiaries |

| Mylan II | Mylan II, B.V.; a company incorporated under the laws of the Netherlands and an indirect wholly owned subsidiary of Viatris, in which legacy Mylan merged with and into |

| Mylan Inc. Senior Notes | The 4.200% Senior Notes due 2023, 4.550% Senior Notes due 2028, 5.400% Senior Notes due 2043 and 5.200% Senior Notes due 2048 issued by Mylan Inc., which are fully and unconditionally guaranteed on a senior unsecured basis by Mylan II B.V., Viatris Inc. and Utah Acquisition Sub Inc. |

| NASDAQ | The NASDAQ Stock Market |

| NDA | New drug application |

| NHS | National Health Services |

| Note Securitization Facility | The note securitization facility entered into in August 2020 for borrowings up to $200 million |

| OTC | Over-the-counter |

| Pfizer | Pfizer Inc. |

| Plan | Viatris Inc. 2020 Stock Incentive Plan |

| PMS | Pharmascience Inc. |

| PSUs | Performance awards |

| PTAB | U.S. Patent Trial and Appeal Board |

| R&D | Research and development |

| | | | | |

| Receivables Facility | The $400 million accounts receivable entered into in August 2020 and expiring in April 2022 |

| Respiratory delivery platform | Pfizer’s proprietary dry powder inhaler delivery platform |

| Revolving Facility | The revolving credit facility available pursuant to the revolving credit agreement, dated as of June 16, 2020, by and among Viatris, certain lenders and issuing banks from time to time party thereto and Bank of America, N.A., as administrative agent |

| RICO | Racketeer Influenced and Corrupt Organizations Act |

| restricted stock awards | The Company’s nonvested restricted stock and restricted stock unit awards, including PSUs |

| Sanofi | Sanofi-Aventis U.S., LLC |

| SARs | Stock Appreciation Rights |

| Separation and Distribution Agreement | Separation and Distribution Agreement between Viatris and Pfizer, dated as of July 29, 2019, as amended from time to time |

| SDNY | U.S. District Court for the Southern District of New York |

| SEC | U.S. Securities and Exchange Commission |

| Securities Act | Securities Act of 1933, as amended |

| Senior Notes | The Utah Senior Notes and the Mylan Inc. Senior Notes, collectively |

| Separation | Pfizer's transfer to Upjohn of substantially all the assets and liabilities comprising the Upjohn Business |

| SG&A | Selling, general and administrative expenses |

| Term Loan Agreement | The $600 million delayed draw term loan credit agreement, dated as of June 16, 2020 by and among Viatris, Mizuho Bank, Ltd. and MUFG Bank, Ltd., as administrative agent |

| Teva | Teva Pharmaceutical Industries Ltd. |

| TSA | Transition service agreements |

| U.K. | United Kingdom |

| U.S. | United States |

| U.S. GAAP | Accounting principles generally accepted in the U.S. |

| Upjohn | Upjohn Inc., a wholly owned subsidiary of Pfizer prior to the Distribution, that combined with Mylan and was renamed Viatris Inc. |

| Upjohn Business | Pfizer’s off-patent branded and generic established medicines business that, in connection with the Combination, was separated from Pfizer and combined with Mylan to form Viatris |

| Utah Senior Notes | The 3.150% Senior Notes due 2021, 3.950% Senior Notes due 2026 and 5.250% Senior Notes due 2046 issued by Utah Acquisition Sub, which are fully and unconditionally guaranteed on a senior unsecured basis by Mylan Inc., Viatris Inc. and Mylan II B.V. |

| Viatris | Viatris Inc., formerly known as Upjohn Inc. prior to the completion of the Combination |

PART I — FINANCIAL INFORMATION

VIATRIS INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(Unaudited; in millions, except per share amounts)

| | | | | | | | | | | | | | | |

| | | | Three Months Ended |

| | | March 31, |

| | | | | | 2021 | | 2020 |

| Revenues: | | | | | | | |

| Net sales | | | | | $ | 4,400.1 | | | $ | 2,588.2 | |

| Other revenues | | | | | 30.2 | | | 31.0 | |

| Total revenues | | | | | 4,430.3 | | | 2,619.2 | |

| Cost of sales | | | | | 3,303.0 | | | 1,713.1 | |

| Gross profit | | | | | 1,127.3 | | | 906.1 | |

| Operating expenses: | | | | | | | |

| Research and development | | | | | 184.1 | | | 114.2 | |

| Selling, general and administrative | | | | | 1,186.5 | | | 605.4 | |

| Litigation settlements and other contingencies, net | | | | | 22.9 | | | 1.8 | |

| Total operating expenses | | | | | 1,393.5 | | | 721.4 | |

| (Loss) earnings from operations | | | | | (266.2) | | | 184.7 | |

| Interest expense | | | | | 169.0 | | | 119.9 | |

| Other expense, net | | | | | 6.1 | | | 34.1 | |

| (Loss) earnings before income taxes | | | | | (441.3) | | | 30.7 | |

| Income tax provision | | | | | 596.3 | | | 9.9 | |

| Net (loss) earnings | | | | | $ | (1,037.6) | | | $ | 20.8 | |

| (Loss) earnings per share attributable to Viatris Inc. shareholders | | | | | | | |

| Basic | | | | | $ | (0.86) | | | $ | 0.04 | |

| Diluted | | | | | $ | (0.86) | | | $ | 0.04 | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | | | | | 1,207.5 | | | 516.4 | |

| Diluted | | | | | 1,207.5 | | | 517.0 | |

See Notes to Condensed Consolidated Financial Statements

6

VIATRIS INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Comprehensive Loss

(Unaudited; in millions)

| | | | | | | | | | | | | | | |

| | | | Three Months Ended |

| | | March 31, |

| | | | | | 2021 | | 2020 |

| Net (loss) earnings | | | | | $ | (1,037.6) | | | $ | 20.8 | |

| Other comprehensive loss, before tax: | | | | | | | |

| Foreign currency translation adjustment | | | | | (721.2) | | | (656.6) | |

| Change in unrecognized gain (loss) and prior service cost related to defined benefit plans | | | | | 0.8 | | | (1.6) | |

| Net unrecognized gain (loss) on derivatives in cash flow hedging relationships | | | | | 3.3 | | | (51.4) | |

| Net unrecognized gain on derivatives in net investment hedging relationships | | | | | 227.4 | | | 42.3 | |

| Net unrealized (loss) gain on marketable securities | | | | | (0.9) | | | 0.2 | |

| Other comprehensive loss, before tax | | | | | (490.6) | | | (667.1) | |

| Income tax provision (benefit) | | | | | 37.0 | | | (10.8) | |

| Other comprehensive loss, net of tax | | | | | (527.6) | | | (656.3) | |

| Comprehensive loss | | | | | $ | (1,565.2) | | | $ | (635.5) | |

See Notes to Condensed Consolidated Financial Statements

7

VIATRIS INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(Unaudited in millions, except share and per share amounts)

| | | | | | | | | | | |

| March 31,

2021 | | December 31,

2020 |

| ASSETS |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 806.9 | | | $ | 844.4 | |

| Accounts receivable, net | 4,529.0 | | | 4,843.8 | |

| Inventories | 4,942.2 | | | 5,471.9 | |

| Prepaid expenses and other current assets | 2,040.4 | | | 1,707.4 | |

| Total current assets | 12,318.5 | | | 12,867.5 | |

| Property, plant and equipment, net | 3,246.9 | | | 3,459.9 | |

| Intangible assets, net | 28,489.6 | | | 29,683.2 | |

| Goodwill | 11,907.3 | | | 12,347.0 | |

| Deferred income tax benefit | 1,997.3 | | | 2,147.9 | |

| Other assets | 1,019.6 | | | 1,047.5 | |

| Total assets | $ | 58,979.2 | | | $ | 61,553.0 | |

| | | |

| LIABILITIES AND EQUITY |

| Liabilities | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 2,043.2 | | | $ | 1,904.2 | |

| Short-term borrowings | 36.9 | | | 1,100.9 | |

| Income taxes payable | 752.0 | | | 288.6 | |

| Current portion of long-term debt and other long-term obligations | 2,300.2 | | | 2,308.5 | |

| Other current liabilities | 4,845.8 | | | 4,960.7 | |

| Total current liabilities | 9,978.1 | | | 10,562.9 | |

| Long-term debt | 22,102.2 | | | 22,429.2 | |

| Deferred income tax liability | 3,014.6 | | | 3,123.7 | |

| Other long-term obligations | 2,469.6 | | | 2,483.1 | |

| Total liabilities | 37,564.5 | | | 38,598.9 | |

| Equity | | | |

| Viatris Inc. shareholders’ equity | | | |

Common stock — par value $0.01 per share as of March 31, 2021 and December 31, 2020: | | | |

Shares authorized: 3,000,000,000 as of March 31, 2021 and December 31, 2020 | | | |

Shares issued: 1,208,530,970 and 1,206,895,644 as of March 31, 2021 and December 31, 2020 | 12.1 | | | 12.1 | |

| Additional paid-in capital | 18,464.6 | | | 18,438.8 | |

| Retained earnings | 4,323.6 | | | 5,361.2 | |

| Accumulated other comprehensive loss | (1,385.6) | | | (858.0) | |

| | | |

| | | |

| | | |

| | | |

| Total equity | 21,414.7 | | | 22,954.1 | |

| | | |

| Total liabilities and equity | $ | 58,979.2 | | | $ | 61,553.0 | |

See Notes to Condensed Consolidated Financial Statements

8

VIATRIS INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Equity

(Unaudited; in millions, except share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | Additional Paid-In Capital | | Retained

Earnings | | | | | | Accumulated Other Comprehensive Loss | | | | Total

Equity |

| Common Stock | | | | Treasury Stock | | | |

| Shares | | Cost | | | | Shares | | Cost | | | |

| Balance at December 31, 2020 | 1,206,895,644 | | | $ | 12.1 | | | $ | 18,438.8 | | | $ | 5,361.2 | | | — | | | $ | — | | | $ | (858.0) | | | | | $ | 22,954.1 | |

| Net loss | — | | | — | | | — | | | (1,037.6) | | | — | | | — | | | — | | | | | (1,037.6) | |

| Other comprehensive loss, net of tax | — | | | — | | | — | | | — | | | — | | | — | | | (527.6) | | | | | (527.6) | |

| Issuance of restricted stock and stock options exercised, net | 1,635,326 | | | — | | | — | | | — | | | — | | | — | | | — | | | | | — | |

| Taxes related to the net share settlement of equity awards | — | | | — | | | (6.9) | | | — | | | — | | | — | | | — | | | | | (6.9) | |

| Share-based compensation expense | — | | | — | | | 32.7 | | | — | | | — | | | — | | | — | | | | | 32.7 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Balance at March 31, 2021 | 1,208,530,970 | | | $ | 12.1 | | | $ | 18,464.6 | | | $ | 4,323.6 | | | — | | | $ | — | | | $ | (1,385.6) | | | | | $ | 21,414.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | Additional Paid-In Capital | | Retained

Earnings | | | | | | Accumulated Other Comprehensive Loss | | | | Total

Equity |

| Ordinary Shares (1) | | | | Treasury Stock | | | |

| Shares | | Cost | | | | Shares | | Cost | | | |

| Balance at December 31, 2019 | 540,746,871 | | | $ | 6.1 | | | $ | 8,643.5 | | | $ | 6,031.1 | | | 24,598,074 | | | $ | (999.7) | | | $ | (1,797.2) | | | | | $ | 11,883.8 | |

| Net earnings | — | | | — | | | — | | | 20.8 | | | — | | | — | | | — | | | | | 20.8 | |

| Other comprehensive loss, net of tax | — | | | — | | | — | | | — | | | — | | | — | | | (656.3) | | | | | (656.3) | |

| Issuance of restricted stock and stock options exercised, net | 795,423 | | | — | | | 0.6 | | | — | | | — | | | — | | | — | | | | | 0.6 | |

| Taxes related to the net share settlement of equity awards | — | | | — | | | (5.6) | | | — | | | — | | | — | | | — | | | | | (5.6) | |

| Share-based compensation expense | — | | | — | | | 19.4 | | | — | | | — | | | — | | | — | | | | | 19.4 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Balance at March 31, 2020 | 541,542,294 | | | $ | 6.1 | | | $ | 8,657.9 | | | $ | 6,051.9 | | | 24,598,074 | | | $ | (999.7) | | | $ | (2,453.5) | | | | | $ | 11,262.7 | |

__________________

(1) Ordinary Shares prior to November 16, 2020.

See Notes to Condensed Consolidated Financial Statements

9

VIATRIS INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(Unaudited; in millions)

| | | | | | | | | | | |

| Three Months Ended |

| March 31, |

| | 2021 | | 2020 |

| Cash flows from operating activities: | | | |

| Net (loss) earnings | $ | (1,037.6) | | | $ | 20.8 | |

| Adjustments to reconcile net (loss) earnings to net cash provided by operating activities: | | | |

| Depreciation and amortization | 1,422.5 | | | 415.0 | |

| Share-based compensation expense | 32.7 | | | 19.4 | |

| Deferred income tax expense (benefit) | 288.4 | | | (43.9) | |

| Loss from equity method investments | 17.9 | | | 17.3 | |

| Other non-cash items | 33.3 | | | 28.7 | |

| Litigation settlements and other contingencies, net | 22.9 | | | 7.2 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (59.8) | | | 73.6 | |

| Inventories | (203.4) | | | (131.8) | |

| Accounts payable | 191.9 | | | (201.0) | |

| Income taxes | 494.6 | | | 10.8 | |

| Other operating assets and liabilities, net | (354.6) | | | 75.0 | |

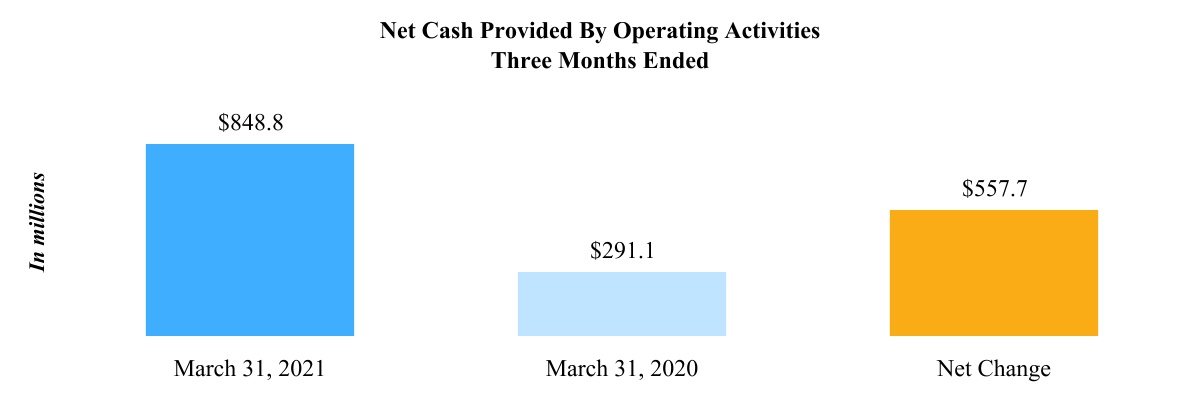

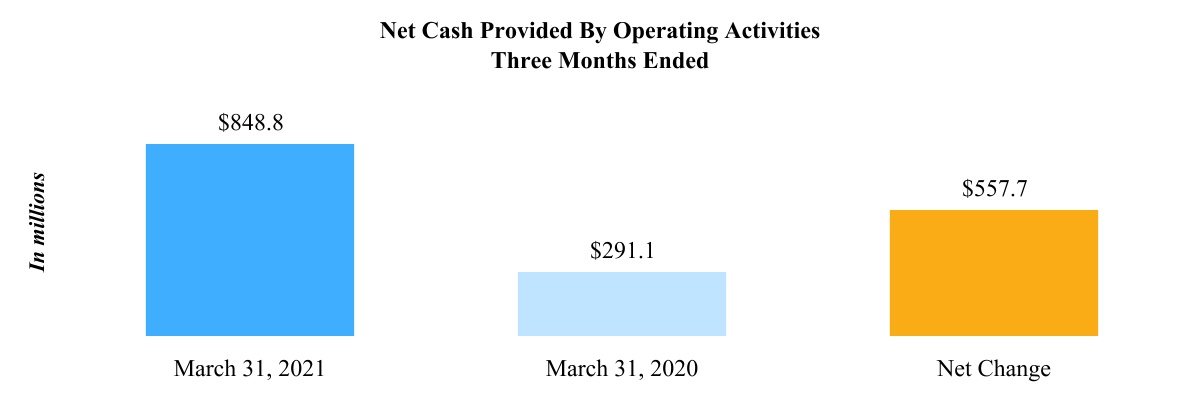

| Net cash provided by operating activities | 848.8 | | | 291.1 | |

| Cash flows from investing activities: | | | |

| Cash received from acquisitions | 277.0 | | | — | |

| Capital expenditures | (49.5) | | | (43.4) | |

| Purchase of marketable securities | (12.3) | | | (53.6) | |

| Proceeds from the sale of marketable securities | 12.3 | | | 18.1 | |

| Payments for product rights and other, net | (3.7) | | | (67.1) | |

| Proceeds from the sale of assets | 12.5 | | | 0.4 | |

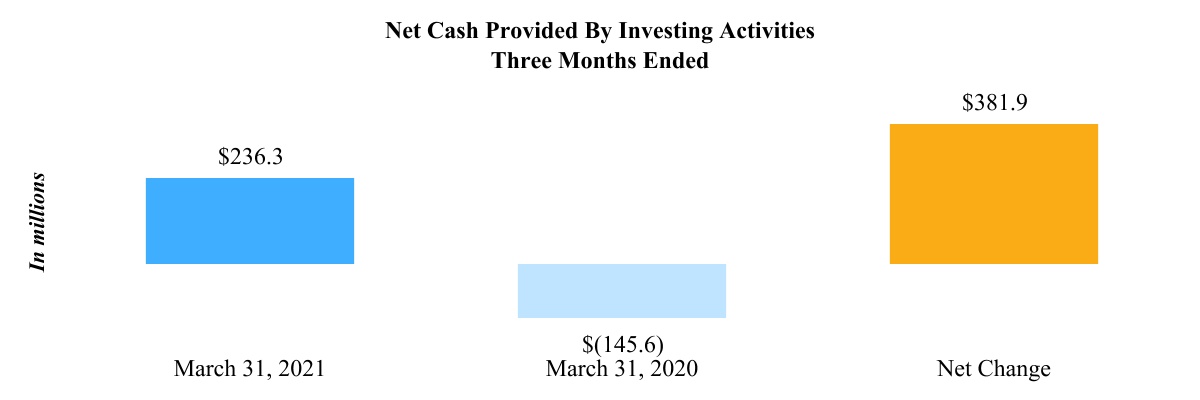

| Net cash provided by (used in) investing activities | 236.3 | | | (145.6) | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of long-term debt | — | | | 33.1 | |

| Payments of long-term debt | — | | | (33.0) | |

| | | |

| Change in short-term borrowings, net | (1,063.9) | | | — | |

| Taxes paid related to net share settlement of equity awards | (7.8) | | | (5.0) | |

| Contingent consideration payments | (26.0) | | | (19.3) | |

| | | |

| Proceeds from exercise of stock options | — | | | 0.6 | |

| Other items, net | (2.1) | | | (1.2) | |

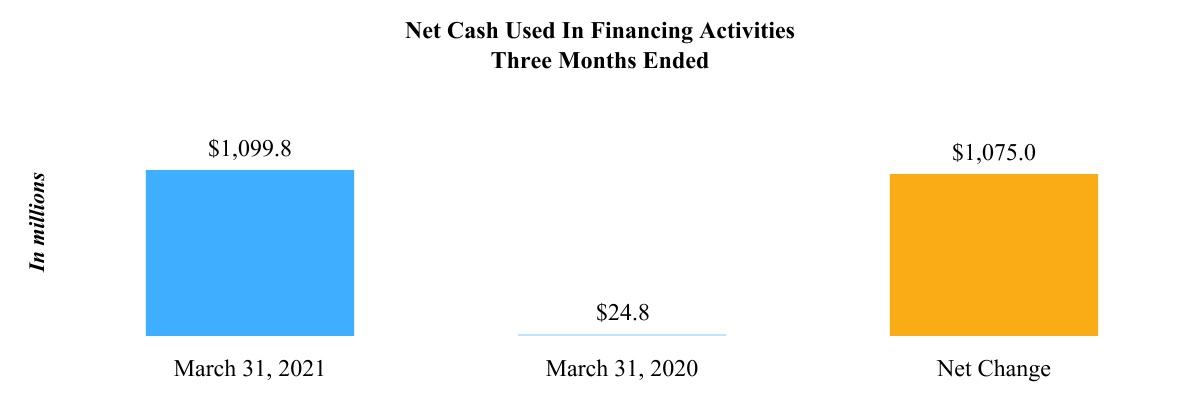

| Net cash used in financing activities | (1,099.8) | | | (24.8) | |

| Effect on cash of changes in exchange rates | (22.2) | | | (23.9) | |

| Net (decrease) increase in cash, cash equivalents and restricted cash | (36.9) | | | 96.8 | |

| Cash, cash equivalents and restricted cash — beginning of period | 850.0 | | | 491.1 | |

| Cash, cash equivalents and restricted cash — end of period | $ | 813.1 | | | $ | 587.9 | |

See Notes to Condensed Consolidated Financial Statements

10

VIATRIS INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited)

1.General

The accompanying unaudited condensed consolidated financial statements (“interim financial statements”) of Viatris Inc. and subsidiaries were prepared in accordance with U.S. GAAP and the rules and regulations of the SEC for reporting on Form 10-Q; therefore, as permitted under these rules, certain footnotes and other financial information included in audited financial statements were condensed or omitted. The interim financial statements contain all adjustments (consisting of only normal recurring adjustments) necessary to present fairly the interim results of operations, comprehensive earnings, financial position, equity and cash flows for the periods presented.

These interim financial statements should be read in conjunction with the consolidated financial statements and notes thereto in Viatris’ 2020 Form 10-K. The December 31, 2020 condensed consolidated balance sheet was derived from audited financial statements. In accordance with ASC 805, Business Combinations, Mylan is considered the accounting acquirer of the Upjohn Business and all historical financial information of the Company prior to November 16, 2020 represents Mylan’s historical results and the Company’s thereafter. Refer to Note 4 Acquisitions and Other Transactions for additional information.

The interim results of operations, comprehensive earnings and cash flows for the three months ended March 31, 2021 are not necessarily indicative of the results to be expected for the full fiscal year or any other future period.

2.Revenue Recognition and Accounts Receivable

The Company recognizes revenue in accordance with the ASC 606. Under ASC 606, the Company recognizes net revenue for product sales when control of the promised goods or services is transferred to our customers in an amount that reflects the consideration we expect to be entitled to in exchange for those goods or services. Revenues are recorded net of provisions for variable consideration, including discounts, rebates, governmental rebate programs, price adjustments, returns, chargebacks, promotional programs and other sales allowances. Accruals for these provisions are presented in the condensed consolidated financial statements as reductions in determining net sales and as a contra asset in accounts receivable, net (if settled via credit) and other current liabilities (if paid in cash).

Our net sales may be impacted by wholesaler and distributor inventory levels of our products, which can fluctuate throughout the year due to the seasonality of certain products, pricing, the timing of product demand, purchasing decisions and other factors. Such fluctuations may impact the comparability of our net sales between periods.

Consideration received from licenses of intellectual property is recorded as other revenues. Royalty or profit share amounts, which are based on sales of licensed products or technology, are recorded when the customer’s subsequent sales or usages occur. Such consideration is included in other revenue in the condensed consolidated statements of operations.

The following table presents the Company’s net sales by product category for each of our reportable segments for the three months ended March 31, 2021 and 2020, respectively:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Three Months Ended March 31, 2021 |

| Product Category | Developed Markets | | Greater China | | JANZ | | Emerging Markets | | Total |

| Brands | $ | 1,403.7 | | | $ | 590.9 | | | $ | 284.0 | | | $ | 446.0 | | | $ | 2,724.6 | |

| Complex Gx and Biosimilars | 312.0 | | | — | | | 8.9 | | | 8.0 | | | 328.9 | |

| Generics | 855.9 | | | 1.0 | | | 189.0 | | | 300.7 | | | 1,346.6 | |

| Total | $ | 2,571.6 | | | $ | 591.9 | | | $ | 481.9 | | | $ | 754.7 | | | $ | 4,400.1 | |

VIATRIS INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Three Months Ended March 31, 2020 |

| Product Category | Developed Markets | | Greater China | | JANZ | | Emerging Markets | | Total |

| Brands | $ | 891.5 | | | $ | 14.7 | | | $ | 90.6 | | | $ | 64.7 | | | $ | 1,061.5 | |

| Complex Gx and Biosimilars | 241.6 | | | 0.1 | | | 8.4 | | | 3.2 | | | 253.3 | |

| Generics | 853.3 | | | 0.3 | | | 144.2 | | | 275.6 | | | 1,273.4 | |

| Total | $ | 1,986.4 | | | $ | 15.1 | | | $ | 243.2 | | | $ | 343.5 | | | $ | 2,588.2 | |

The following table presents net sales on a consolidated basis for select key products for the three months ended March 31, 2021:

| | | | | | | | | | | | | | | | |

| (In millions) | | | | | | | | | | Total |

| | | | | | | | | | |

| Select Key Global Products | | | | | | | | | | |

Lipitor ® | | | | | | | | | | $ | 464.6 | |

| Norvasc ® | | | | | | | | | | 227.7 | |

| Lyrica ® | | | | | | | | | | 187.8 | |

| Viagra ® | | | | | | | | | | 139.6 | |

| EpiPen® Auto-Injectors | | | | | | | | | | 103.7 | |

Celebrex ® | | | | | | | | | | 89.0 | |

Effexor ® | | | | | | | | | | 76.6 | |

Zoloft ® | | | | | | | | | | 76.6 | |

| Creon ® | | | | | | | | | | 69.9 | |

| Xalabrands | | | | | | | | | | 57.9 | |

| | | | | | | | | | |

| Select Key Segment Products | | | | | | | | | | |

| Amitiza ® | | | | | | | | | | $ | 45.9 | |

| Xanax ® | | | | | | | | | | 45.1 | |

| Dymista ® | | | | | | | | | | 40.3 | |

| Yupelri ® | | | | | | | | | | 36.9 | |

____________

(a)The Company does not disclose net sales for any products considered competitively sensitive.

(b)Products disclosed may change in future periods, including as a result of seasonality, competition or new product introductions.

Variable Consideration and Accounts Receivable

The following table presents a reconciliation of gross sales to net sales by each significant category of variable consideration during the three months ended March 31, 2021 and 2020, respectively:

| | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | March 31, |

| (In millions) | | | | | 2021 | | 2020 |

| Gross sales | | | | | $ | 7,567.0 | | | $ | 4,424.0 | |

| Gross to net adjustments: | | | | | | | |

| Chargebacks | | | | | (1,318.0) | | | (854.4) | |

| Rebates, promotional programs and other sales allowances | | | | | (1,568.5) | | | (845.6) | |

| Returns | | | | | (113.0) | | | (59.0) | |

| Governmental rebate programs | | | | | (167.4) | | | (76.8) | |

| Total gross to net adjustments | | | | | $ | (3,166.9) | | | $ | (1,835.8) | |

| Net sales | | | | | $ | 4,400.1 | | | $ | 2,588.2 | |

VIATRIS INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

No significant revisions were made to the methodology used in determining these provisions or the nature of the provisions during the three months ended March 31, 2021. Such allowances were comprised of the following at March 31, 2021 and December 31, 2020, respectively:

| | | | | | | | | | | |

| (In millions) | March 31,

2021 | | December 31,

2020 |

| Accounts receivable, net | $ | 1,706.5 | | | $ | 1,802.9 | |

| Other current liabilities | 1,196.6 | | | 1,211.8 | |

| Total | $ | 2,903.1 | | | $ | 3,014.7 | |

Accounts receivable, net was comprised of the following at March 31, 2021 and December 31, 2020, respectively:

| | | | | | | | | | | |

| (In millions) | March 31,

2021 | | December 31,

2020 |

| Trade receivables, net | $ | 3,889.6 | | | $ | 3,891.3 | |

| Other receivables | 639.4 | | | 952.5 | |

| Accounts receivable, net | $ | 4,529.0 | | | $ | 4,843.8 | |

Accounts Receivable Factoring Arrangements

We have entered into accounts receivable factoring agreements with financial institutions to sell certain of our non-U.S. accounts receivable. These transactions are accounted for as sales and result in a reduction in accounts receivable because the agreements transfer effective control over and risk related to the receivables to the buyers. Our factoring agreements do not allow for recourse in the event of uncollectibility, and we do not retain any interest in the underlying accounts receivable once sold. We derecognized $114.5 million and $153.0 million of accounts receivable as of March 31, 2021 and December 31, 2020, respectively, under these factoring arrangements.

3.Recent Accounting Pronouncements

Adoption of New Accounting Standards

In January 2020, the FASB issued Accounting Standards Update 2020-01, Clarifying the Interactions Between Topic 321, Topic 323, and Topic 815 (“ASU 2020-01”), which clarifies that an entity should consider observable transactions that require it to either apply or discontinue the equity method of accounting for the purposes of applying the measurement alternative in accordance with Topic 321 immediately before applying or upon discontinuing the equity method. In addition, ASU 2020-01 states that for the purpose of applying paragraph 815-10-15-141(a) an entity should not consider whether, upon the settlement of the forward contract or exercise of the purchased option, individually or with existing investments, the underlying securities would be accounted for under the equity method in Topic 323 or the fair value option in accordance with the financial instruments guidance in Topic 825. ASU 2020-01 was effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2020. The adoption of this guidance did not have a material impact on the Company’s condensed consolidated financial statements and disclosures.

In December 2019, the FASB issued Accounting Standards Update 2019-12, Income Taxes (Topic 740) which is intended to simplify the accounting for income taxes by eliminating certain exceptions and simplifying certain requirements under Topic 740. ASU 2019-12 was effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2020. ASU 2019-12 includes an update to previous guidance in situations in which an entity incurs a loss on a year-to-date basis that exceeds the anticipated loss for the year. In these situations, previous guidance stipulated that the income tax benefit was limited to the income tax that would exist on the basis of the year-to-date loss. This represented an exception to the guidance in ASC 740-270, and the provisions of ASU 2019-12 include the elimination of this exception which applied to the financial results of the three months ended March 31, 2021. The Company has applied the provisions of ASU 2019-12 on a prospective basis beginning January 1, 2021. The adoption of this guidance did not have a material impact on the Company’s condensed consolidated financial statements and disclosures.

VIATRIS INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

Accounting Standard Issued Not Yet Adopted

The following recently issued accounting standard has not been adopted. Refer to Viatris’ 2020 Form 10-K for additional information and its potential impacts.

| | | | | |

| Accounting Standard Update | Effective Date |

ASU 2020-04: Reference Rate Reform (Topic 848) Facilitation of the Effects of Reference Rate Reform on Financial Reporting | January 1, 2023 |

4.Acquisitions and Other Transactions

Upjohn Business Combination Agreement

On July 29, 2019, Mylan, Pfizer, Upjohn Inc., a wholly-owned subsidiary of Pfizer, and certain other affiliated entities entered into a Business Combination Agreement pursuant to which the Company would combine with the Upjohn Business in a Reverse Morris Trust transaction. The Upjohn Business was a global, primarily off-patent branded and generic established medicines business, which includes 20 primarily off-patent solid oral dose legacy brands, such as Lyrica, Lipitor, Celebrex and Viagra. The Combination was completed on November 16, 2020.

Prior to the Combination and pursuant to a Separation and Distribution Agreement, Pfizer had, among other things, transferred to Viatris substantially all of the assets and liabilities comprising the Upjohn Business (the Separation) and, thereafter, Pfizer had distributed to Pfizer stockholders all of the issued and outstanding shares of Viatris (the Distribution). When the Distribution and Combination were complete, Pfizer stockholders as of the record date of the Distribution owned 57% of the outstanding shares of Viatris common stock and Mylan shareholders as of immediately before the Combination owned 43% of the outstanding shares of Viatris common stock, in each case on a fully diluted basis. Viatris also made a cash payment to Pfizer equal to $12 billion, which was funded with the proceeds of debt incurred by Upjohn prior to the Combination.

The transaction involved multiple legal entity restructuring transactions and a reverse merger acquisition with Viatris representing the legal acquirer and Mylan representing the accounting acquirer of the Upjohn Business. In accordance with ASC 805, Business Combinations, Mylan is considered the accounting acquirer of the Upjohn Business and Viatris applied purchase accounting to the acquired assets and assumed liabilities of the Upjohn Business as of November 16, 2020. The debt incurred by Upjohn prior to the Combination was a liability assumed in purchase accounting. The fair value of the debt as of November 16, 2020 was $13.08 billion.

The purchase price consists of the issuance of approximately 689.9 million Viatris shares of common stock at a fair value of approximately $10.73 billion based on the closing price of Mylan’s ordinary shares on November 13, 2020, as reported by the NASDAQ. In accordance with U.S. GAAP, the Company used the acquisition method of accounting to account for this transaction. Under the acquisition method of accounting, the assets acquired and liabilities assumed in the transaction have been recorded at their respective estimated fair values at the acquisition date. Acquisition related costs of approximately $602.9 million were incurred during the twelve months ended December 31, 2020, and approximately $59.8 million were incurred during the three months ended March 31, 2021. Acquisition related costs were recorded primarily in SG&A in the consolidated statements of operations for such periods.

VIATRIS INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

During the three months ended March 31, 2021, adjustments were made to the preliminary purchase price recorded at November 16, 2020. These adjustments are reflected in the values presented below. The preliminary allocation of the $10.73 billion purchase price to the assets acquired and liabilities assumed under the Combination is as follows:

| | | | | | | | | | | | | | | | | |

| (In millions) | Preliminary Purchase Price Allocation as of December 31, 2020 (a) | | Measurement Period and Other Adjustments (b) | | Preliminary Purchase Price Allocation as of March 31, 2021 (as adjusted) |

| Current assets (excluding inventories and net of cash acquired) | $ | 2,841.9 | | | $ | (2.6) | | | $ | 2,839.3 | |

| Inventories | 2,588.9 | | | — | | | 2,588.9 | |

| Property, plant and equipment | 1,394.1 | | | — | | | 1,394.1 | |

| Identified intangible assets | 18,040.0 | | | — | | | 18,040.0 | |

| Goodwill | 2,107.5 | | | (146.6) | | | 1,960.9 | |

| Deferred income tax benefit | 1,481.9 | | | 237.7 | | | 1,719.6 | |

| Other assets | 792.1 | | | — | | | 792.1 | |

| Total assets acquired | $ | 29,246.4 | | | $ | 88.5 | | | $ | 29,334.9 | |

| Current liabilities | 2,760.2 | | | 88.4 | | | 2,848.6 | |

| Long-term debt, including current portion | 13,076.2 | | | — | | | 13,076.2 | |

| Deferred tax liabilities | 1,656.9 | | | — | | | 1,656.9 | |

| Other noncurrent liabilities | 1,441.5 | | | 0.1 | | | 1,441.6 | |

| Net assets acquired (net of $415.8 of cash acquired) | $ | 10,311.6 | | | $ | — | | | $ | 10,311.6 | |

| | | | | |

____________

(a)As previously reported in Viatris’ 2020 Form 10-K.

(b)The measurement period adjustments are primarily for 1) certain working capital adjustments and an increase in litigation reserves to reflect facts and circumstances that existed as of the date of the Combination and 2) the tax implications of these and other adjustments. These adjustments did not have a significant impact on the Company’s previously reported consolidated financial statements and accordingly, the Company has not retrospectively adjusted those consolidated financial statements.

The preliminary fair value estimates for the assets acquired and liabilities assumed were based upon preliminary calculations, valuations and assumptions that are subject to change as the Company obtains additional information during the measurement period (up to one year from the acquisition date). The primary areas subject to change relate to the finalization of the working capital components, the valuation of intangible and tangible assets and income taxes.

The Company recorded a step-up in the fair value of inventory of approximately $1.43 billion. During the three months ended March 31, 2021, the Company recorded amortization of the inventory step-up of approximately $476.4 million, which is included in cost of sales in the condensed consolidated statements of operations. In addition, during the year ended December 31, 2020, a step-up in the fair value of property, plant and equipment of approximately $390.0 million was recognized. The related depreciation is being expensed over a service life of five years for machinery and equipment and between 10 and 20 years for buildings.

The identified intangible assets of $18.04 billion are comprised of product rights and are being amortized over a weighted average useful life of 15 years. Significant assumptions utilized in the valuation of identified intangible assets were based on company specific information and projections which are not observable in the market and are thus considered Level 3 measurements as defined by U.S. GAAP. The goodwill of $1.96 billion arising from the Combination consisted largely of the value of the employee workforce and products to be sold in new markets leveraging the combined entity. In addition, an allocation of the goodwill was assigned to the respective segments. None of the goodwill recognized in this transaction is expected to be deductible for income tax purposes.

The Company recorded a fair value adjustment of approximately $759.4 million related to the long-term debt assumed as part of the acquisition. The fair value of long-term debt as of the Combination date was determined by broker or dealer quotations, which is classified as Level 2 in the fair value hierarchy. The total fair value adjustment is being amortized as a reduction to interest expense over the maturity dates of the related debt instruments.

VIATRIS INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

Unaudited Pro Forma Financial Results

The following table presents supplemental unaudited pro forma information for the Combination, as if it had occurred on January 1, 2019. The unaudited pro forma results reflect certain adjustments related to past operating performance and acquisition accounting adjustments, such as increased depreciation and amortization expense based on the fair value of assets acquired, the impact of transaction costs and the related income tax effects. The unaudited pro forma results do not include any anticipated synergies which may be achievable, or have been achieved, subsequent to the closing of the Combination. Accordingly, the unaudited pro forma results are not necessarily indicative of the results that actually would have occurred had the acquisitions been completed on the stated date above, nor are they indicative of the future operating results of Viatris and its subsidiaries.

| | | | | | | |

| | | Three Months Ended |

| (Unaudited, in millions, except per share amounts) | | | March 31, 2020 |

| Total revenues | | | $ | 4,439.4 | |

| Net earnings | | | $ | 542.6 | |

| Earnings per share: | | | |

| Basic | | | $ | 0.45 | |

| Diluted | | | $ | 0.45 | |

| Weighted average shares outstanding: | | | |

| Basic | | | 1,206.3 | |

| Diluted | | | 1,206.9 | |

5.Share-Based Incentive Plan

Prior to the Distribution, Viatris adopted and Pfizer, in the capacity as Viatris’ sole stockholder at such time approved the Plan which became effective as of the Distribution. In connection with the Combination, as of November 16, 2020, the Company assumed the Mylan N.V. Amended and Restated 2003 Long-Term Incentive Plan, which had previously been approved by Mylan shareholders. The Plan and 2003 LTIP include (i) 72,500,000 shares of common stock authorized for grant pursuant to the Plan, which may include dividend payments payable in common stock on unvested shares granted under awards, (ii) 6,757,640 shares of common stock to be issued pursuant to the exercise of outstanding stock options granted to participants under the 2003 LTIP and assumed by Viatris in connection with the Combination and (iii) 13,535,627 shares of common stock subject to outstanding equity-based awards, other than stock options, assumed by Viatris in connection with the Combination, or that otherwise remain available for issuance under the 2003 LTIP.

Under the Plan and 2003 LTIP, shares are reserved for issuance to key employees, consultants, independent contractors and non-employee directors of the Company through a variety of incentive awards, including: stock options, SARs, restricted stock and units, PSUs, other stock-based awards and short-term cash awards. Stock option awards are granted with an exercise price equal to the fair market value of the shares underlying the stock options at the date of the grant, generally become exercisable over periods ranging from three to four years, and generally expire in ten years.

The following table summarizes stock option and SAR (together, “stock awards”) activity under the Plan and 2003 LTIP:

| | | | | | | | | | | |

| Number of Shares Under Stock Awards | | Weighted Average Exercise Price per Share |

| Outstanding at December 31, 2020 | 6,711,731 | | | $ | 35.36 | |

| | | |

| | | |

| Forfeited | (806,251) | | | $ | 23.47 | |

| Outstanding at March 31, 2021 | 5,905,480 | | | $ | 36.99 | |

| Vested and expected to vest at March 31, 2021 | 5,789,718 | | | $ | 37.28 | |

| Exercisable at March 31, 2021 | 5,109,921 | | | $ | 39.41 | |

VIATRIS INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued