As filed with the U.S. Securities and Exchange Commission on October 18, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(Exact name of Registrant as specified in its charter)

|

|

2833 | Not Applicable |

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

Tel: (

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

Chief Financial Officer

Tel: (

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies of communications to:

Richard Raymer

Dorsey & Whitney LLP

TD Canada Trust Tower

Brookfield Place 161 Bay Street, Suite 4310

Toronto, ON M5J 2S1, Canada

Tel: +1 (416) 367 7370

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

|

|

☒ | Smaller reporting company |

|

|

| Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED OCTOBER 18, 2023

PROSPECTUS

1,423,760 Common Shares

Flora Growth Corp.

This prospectus (the "Prospectus") relates to 1,423,760 common shares, no par value of Flora Growth Corp. (the "Common Shares"), an Ontario, Canada corporation, underlying outstanding warrants (the "Warrants") that may be sold from time to time by the selling securityholders set forth in this Prospectus (the "Offering") under the heading "Selling Securityholders" beginning on page 31 which we refer to as the "Selling Securityholders."

We will not receive any proceeds from the sale of the Common Shares under this Prospectus.

Information regarding the Selling Securityholders, the amounts of Common Shares that may be sold by them and the times and manner in which they may offer and sell the Common Shares under this Prospectus is provided under the sections titled "Selling Securityholders" and "Plan of Distribution," respectively, in this Prospectus. We have not been informed by any of the Selling Securityholders that they intend to sell their securities covered by this Prospectus and do not know when or in what amounts the Selling Securityholders may offer the securities for sale. The Selling Securityholders may sell any, all, or none of the securities offered by this Prospectus.

The Selling Securityholders and intermediaries through whom such securities are sold may be deemed "underwriters" within the meaning of the Securities Act of 1933, as amended (the "Securities Act"), with respect to the securities offered hereby, and any profits realized or commissions received may be deemed underwriting compensation. We have agreed to indemnify the Selling Securityholders against certain liabilities, including liabilities under the Securities Act.

Our common shares are traded on the Nasdaq Capital Market ("Nasdaq") under the symbol "FLGC." On October 17, 2023, the last reported per share sale price of our Common Shares on Nasdaq was $0.97.

Investing in our securities involves a high degree of risk, including the risk of losing your entire investment. See the section titled "Risk Factors" which begins on page 10.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is , 2023

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This Prospectus is part of a registration statement on Form S-1 that we filed with the United States Securities and Exchange Commission (the "SEC"). You should read this Prospectus and the related registration statement carefully. This Prospectus and registration statement contain important information you should consider when making your investment decision.

You should rely only on the information that we have provided in this Prospectus and any applicable prospectus supplement. We have not authorized anyone to provide you with different information. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this Prospectus and any applicable prospectus supplement. You must not rely on any unauthorized information or representation. This Prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this Prospectus and any applicable prospectus supplement is accurate only as of the date on the front of the document, regardless of the time of delivery of this Prospectus, any applicable prospectus supplement, or any sale of a security.

Except as otherwise indicated, references in this Prospectus to "Registrant," the "Company," "Flora," "we," "us" and "our" refer to Flora Growth Corp., a company incorporated in the Province of Ontario, Canada and its consolidated subsidiaries, unless the context requires otherwise.

Enforceability of Civil Liabilities

We are a corporation organized under the laws of the Province of Ontario. As a result, it may not be possible for investors to effect service of process within the United States upon these persons or us, or to enforce against them or us judgments obtained in U.S. courts, whether or not predicated upon the civil liability provisions of the federal securities laws of the United States or of the securities laws of any state of the United States. There is doubt as to the enforceability in Canada, either in original actions or in actions for enforcement of judgments of U.S. courts, of civil liabilities predicated solely on the federal securities laws of the United States or the securities laws of any state of the United States.

Market, Industry and Other Data

This Prospectus contains estimates, projections and other information concerning our industry, our business, and the markets for our products. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from our own internal estimates and research as well as from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data, and similar sources.

In addition, assumptions and estimates of our and our industry's future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled "Risk Factors". These and other factors could cause our future performance to differ materially from our assumptions and estimates. See the section titled "Cautionary Note Regarding Forward-Looking Statements".

1

PROSPECTUS SUMMARY

This summary highlights selected information presented in greater detail elsewhere in this Prospectus. This summary does not include all the information you should consider before investing in our securities. You should read this summary together with the more detailed information appearing elsewhere in this Prospectus, including our audited and unaudited financial statements and related notes and the sections titled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" elsewhere in this Prospectus. Some of the statements in this summary and elsewhere in this Prospectus constitute forward-looking statements. See the section titled "Cautionary Note Regarding Forward-Looking Statements."

Our Company

Our brand portfolio consists of a mix of products across multiple categories, including food and beverage, nutraceuticals, cannabis accessories and technology, personal care, and wellness. Consumer brands allow Flora to move assertively into nascent markets, develop customer bases and distribution channels, and gather consumer insights which would not be possible with traditional cannabis sales alone. Through this channel we seek to build loyalty, credibility and enjoy healthy margins that help to support the rapid growth of our business.

Our Brands and Products

House of Brands

Just Brands LLC ("Just Brands") and High Roller Private Label LLC ("High Roller", and together with Just Brands, "JustCBD") are Flora's leading consumer packaged goods brand. JustCBD was launched in 2017 with a mission to bring high-quality, trustworthy, and budget-friendly CBD products to market. The JustCBD offering currently consists of over 350 products across 15 categories, including CBD gummies, topicals, tinctures, and vape products and ships to over 11,500 independent retailers worldwide. JustCBD also sells direct to consumers with a customer base of approximately 350,000 people. JustCBD products are available for purchase in smoke and vape shops, clinics, spas and pet stores, as well as other independent non-traditional retail channels. JustCBD's products are both internally and third-party lab-tested to ensure quality.

Vessel Brand, Inc. ("Vessel") is Flora's cannabis accessory and technology brand currently servicing the United States and Canada through direct-to-consumer and retail sales. Vessel's products include cannabis consumption accessories, personal storage, and travel accessories for the vape and dry herb categories, which are sold to consumers, dispensaries, smoke shops and cannabis brands. Vessel has been fully integrated into JustCBD and now benefits from operational, logistical and sales synergies with JustCBD.

Commercial & Wholesale

The Company's Commercial and Wholesale pillar encompasses the distribution of pharmaceutical products to international markets. This pillar is anchored by Flora's wholly owned subsidiary, Phatebo GmbH ("Phatebo"), a multi-national operator in pharmaceutical and medical cannabis distribution, with principal operations in Germany.

Based in Germany, Phatebo is a wholesale pharmaceutical distribution company with import and export capabilities of a wide range of pharmaceutical goods and medical cannabis products to treat a variety of health indications, including drugs related to cancer therapies, attention-deficit/hyperactivity disorder ("ADHD"), multiple sclerosis and anti-depressants, among others. Phatebo holds a license for the Trade in Narcotic Drugs (including the cannabis sales license amendment) and a wholesale trading license, both of which are issued by BfArM (the largest drug approval authority in Europe). Phatebo is focused on distributing pharmaceutical products within 28 countries globally, primarily in Europe, but also with sales to Asia, Latin America, and North America. In November 2018, Phatebo also received a medical cannabis import and distribution license. We intend to leverage Phatebo's existing network of approximately 1,200 pharmacies as Flora begins to move medicinal cannabis from third parties into Germany. Additionally, the Phatebo warehouse provides a logistics outpost for Flora's growing product portfolio and distribution network within the European Union.

2

Factors Impacting our Business

Challenges in realization of overhead reductions. The Company's operating expenses currently exceed its gross profit generated. Management has taken, and continues to implement, various cost-saving initiatives in an effort to lower overhead costs. However, the Company has not yet reached the critical balance in reducing overhead to meet both the existing and potential market demand in aggregate. The Company strives to attain sufficient growth to cover its overhead to reach profitability. If the Company fails to grow its business or reduce its operating expenses further in the long term, it will continue to face significant cash flow deficiencies in the future and continue to be reliant on debt and/or equity financing to fund operations.

Acquisition strategy disadvantages include significant transaction costs and liabilities of our acquirees. The Company has historically been opportunistic and pursues acquisitions from time to time that management believes will be complementary to or synergistic to the Company's existing business. However, any such acquisitions require the Company to incur heightened upfront transaction costs and require the Company to assume certain liabilities from the acquired company. In addition, while the Company believes such acquisitions will provide enhanced value in the long term, it is possible that the anticipated synergies from the acquisition may never be realized.

Diversification of cashflows. Our sources of cash are diversified across geographic and product lines. Revenues are concentrated primarily in Germany and the United States, spanning pharmaceuticals, hemp and non-hemp consumer products and medicinal cannabis.

Low-cost cannabis acquisition and high-margin distribution. We aim to achieve economies of scale by sourcing medical cannabis across the globe. We then intend to utilize our cannabis and distribution networks to sell product in countries at an accretive margin. Provided we are able to navigate the uncertain regulatory environment for our cannabis products, Flora believes it is well-positioned to act as both an exporter and importer of medicinal cannabis to our distribution network in Germany where the supply of medicinal cannabis is largely dependent on imports.

International cannabis developments. Flora's growth is embedded in the expansion, regulation and legalization of medicinal and recreational cannabis and cannabis derivative products across the world. While medicinal cannabis has been regulated at the federal level in multiple countries, the Company is focused on the most robust markets in Germany and the European Union. We remain tuned to international developments as potentially lucrative medicinal cannabis markets open.

Product evolution and brand acceptance. As the cannabis industry continues to change, divergent regulations and the corresponding resources required to introduce high-quality products are expected to impact our market share. Gaining access to continuously evolving and superior products remains a critical success factor. Our ultimate ability to produce and acquire products meeting stringent quality control standards drives the extent of consumer acceptance. Furthermore, the intrinsic value within our brands, including JustCBD and Vessel, is subject to evolving consumer sentiment.

Regulatory proficiency and adoption. The markets in which Flora operates are highly regulated and require extensive experience in navigating the associated complexities. We have assembled a team with deep knowledge of the regulatory and governance environments in which the Company operates. Fundamental expertise entails compliance with product approvals, import permits, export permits, distribution licenses and other pertinent licenses.

3

Integration of acquired companies. Our growth has been fueled substantially by the acquisition of JustCBD, Vessel and Franchise Global Health Inc. ("FGH" or "Franchise"). Our continued ability to extract incremental synergies from a group of diversified entities is a key determinant of our ability to expand organically.

Our Significant Acquisitions

Just Brands LLC and High Roller Private Label LLC

On February 24, 2022, Flora Growth U.S. Holdings Corp., a wholly owned subsidiary of the Company, completed the acquisition of 100% of the outstanding equity interests in each of (i) Just Brands and (ii) High Roller for total purchase consideration of $34.4 million. JustCBD is a manufacturer and distributor of consumable cannabinoid products, including gummies, tinctures, vape cartridges, and creams. JustCBD is based in Florida in the United States and was formed in 2017. The Company acquired JustCBD to expand its product offerings, accelerate its revenue growth, expand its customer and distribution capabilities in the United States and for the acquisition of human capital through JustCBD's management team.

Franchise Global Health Inc.

On December 23, 2022, the Company completed its acquisition of all the issued and outstanding common shares of FGH (the "Franchise Common Shares") for $9.8 million, a corporation existing under the laws of the Province of British Columbia, by way of a statutory plan of arrangement (the "Arrangement") under the Business Corporations Act (British Columbia). FGH, through its wholly owned subsidiaries, is a multi-national operator in the medical cannabis and pharmaceutical industry with principal operations in Germany. The Company acquired FGH to expand its product offerings, accelerate its revenue growth, expand its customer and distribution capabilities in Germany and to improve synergies and cost savings.

Vessel Brand, Inc.

On November 12, 2021, the Company acquired 100% of the equity interests in Vessel for total purchase consideration of $28.7 million. Vessel designs and sells premium cannabis consumption accessories in the United States through Vessel's direct to consumer website and wholesale to distributors. Vessel was based in California (Note 13) in the United States and was formed in 2018. The purchase consideration was comprised of $8.0 million and 4,557,000 common shares of the Company valued at $20.7 million based on the closing share price of the Company's common shares less a 15% fair value discount for the required six-month holding period of 3.6 million of the Company's shares issued. The Company acquired Vessel to expand its product offerings, accelerate its revenue growth, expand its presence in the United States and for the acquisition of human capital through Vessel's management team.

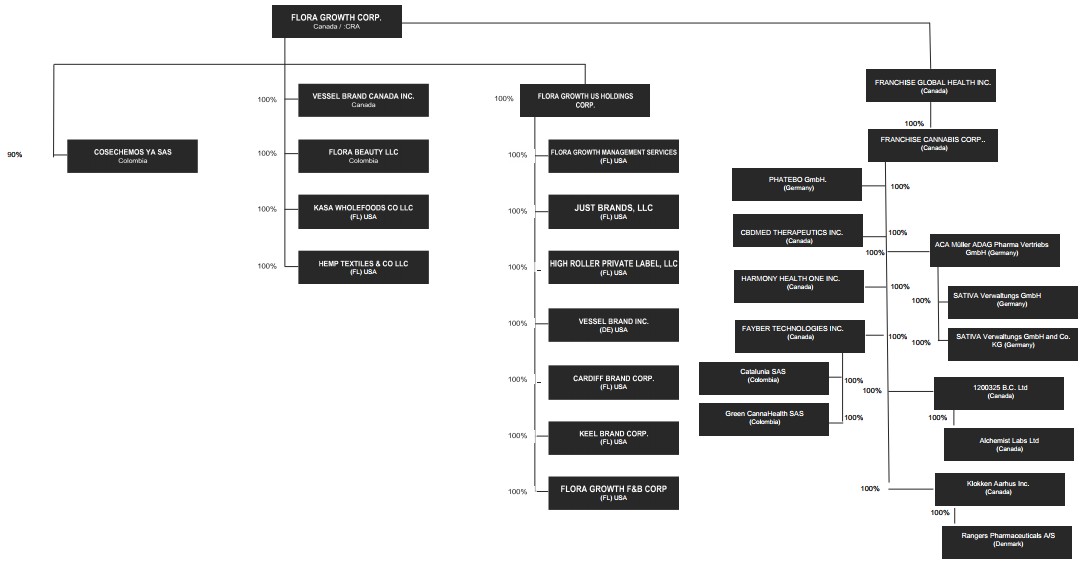

Corporate Structure

The following diagram illustrates our pro forma corporate structure. For more detail on our corporate history please refer to the section titled "Corporate Information."

4

Corporate Information

Flora was incorporated on March 13, 2019 in the Province of Ontario. Our principal place of business and mailing address is Flora Growth Corp., 3406 SW 26th Terrace, Suite C-1, Fort Lauderdale, Florida, United States of America, and our telephone number is +1 (954) 842-4989. Our website address is www.floragrowth.com. The information contained on our website or accessible through our website is not incorporated into this Prospectus.

Recent Developments

On October 12, Juan Carlos Roa Gomez tendered his resignation as a member of our Board of Directors.

On September 26, 2023, Hussein Rakine tendered his resignation as a member of our Board of Directors and has transitioned to the capacity of a special advisor to the Company.

On September 18, 2023, the Company entered into a securities purchase agreement (the "Securities Purchase Agreement") with certain institutional investors (the "Investors") in connection with the issuance and sale by the Company in a registered direct offering (the "Registered Direct Offering") of 1,369,000 Common Shares for total net proceedings of $2.4 million after deducting fees and other estimated expenses. This offering included 1,369,000 investor warrants with an exercise price of $2.50 per share as well as an amendment to certain existing warrants. This offering also included 54,760 placement agent warrants with an exercise price of $2.39 per share.

On September 17, 2023, the Company entered into a share purchase agreement pursuant to which Flora will acquire all the issued and outstanding common shares of Australian Vaporizers Pty Ltd., an online retailer of vaporizers, hardware, and accessories in Australia. The closing of the transaction is anticipated to occur in the Company's fourth quarter of fiscal 2023, although there can be no assurance the transaction will occur within the expected timeframe or at all.

On August 9, 2023, Beverley Richardson tendered her resignation as a member of our Board of Directors.

On July 19, 2023, Matthew Cohen tendered his resignation as General Counsel of the Company.

On July 5, 2023, the Company entered into a share purchase agreement with Lisan Farma Colombia LLC ("Lisan Farma") to sell all of its shares in Flora Growth Corp Colombia S.A.S., Flora Lab S.A.S., Flora Med S.A.S., Cosechemos Ya S.A.S. ("Cosechemos"), Kasa Wholefoods Company S.A.S. and other related Flora assets related to its Colombian operations. To date, the sales of all these Colombian entities except Cosechemos have closed. The closing of Cosechemos is anticipated to occur in the Company's fourth quarter of fiscal 2023, although there can be no assurance the closing will occur within the expected timeframe or at all.

5

In June of 2023, the Company's former executives, including Hussein Rakine (Chief Executive Officer), Elshad Garayev (Chief Financial Officer), Jessie Casner (Chief Marketing Officer) and Jason Warnock (Chief Commercial Officer) resigned from the Company. Timothy Leslie, a member of the Board of Directors, resigned in the same month. Clifford Starke and Dany Vaiman, were appointed in their place as chief executive officer ("CEO") and chief financial officer ("CFO"), respectively.

On June 7, 2023, filed an amendment to its Articles of Incorporation to effect a reverse stock split of the Company's Common Shares at a ratio of 1-for-20, which became effective on June 9, 2023.

Summary of Risk Factors

There are a number of risks that you should carefully consider before making an investment decision regarding this offering. These risks are discussed more fully in the section titled "Risk Factors." You should read and carefully consider these risks and all of the other information in this Prospectus, including the financial statements and the related notes thereto included in this Prospectus, before deciding whether to invest in our securities. If any of these risks actually occur, our business, financial condition, operating results and cash flows could be materially adversely affected. In such case, the trading price of our securities would likely decline, and you may lose all or part of your investment. These risk factors include, but are not limited to:

Risks Related to this Offering

- The resale of Common Shares issuable upon the exercise of Warrants could adversely affect the market price of our Common Shares.

- Our management team may not use the proceeds from the exercise of Warrants in an effective manner.

- There may be dilution in the net tangible book value of the Common Shares in connection with the exercise of Warrants.

Risks Related to our Business and Industry

- We are an early-stage company with limited operating history and may never become profitable.

- The cannabis laws, regulations, and guidelines are dynamic and subject to changes.

- Demand for cannabis and derivative products could be adversely affected and influenced by scientific research or findings, regulatory proceedings, litigation, media attention or other research findings.

- Our products could have unknown side effects.

- Research regarding the medical benefits, viability, safety, efficacy, use and social acceptance of cannabis or isolated cannabinoids (such as CBD and tetrahydrocannabinol ("THC")) remains in early stages.

- Our growth depends, in part, on expanding into additional consumer markets, and we may not be successful in doing so.

- We rely on third-parties for raw materials and to manufacture and compound some of our products and if these relationships are disrupted our results of operations in future periods will be adversely impacted.

- Our inventory has a shelf life and may reach its expiration and not be sold.

- The seasonal trends in our business create variability in our financial and operating results.

- The cannabinoid industry faces strong opposition and may face similar opposition in other jurisdictions in which we operate.

6

- We are subject to wholesale price volatility that could expose the Company to lower than anticipated revenues, gross margins, net income and cash flows.

- We could face competitive risks from the development and distribution of synthetic cannabis.

- The legalization of adult-use, recreational cannabis may reduce sales of medical cannabis.

- We are reliant on third party transportation services and importation services to deliver our products to customers.

- We may not be able to establish and maintain bank accounts in certain countries.

- Cyber-security and privacy risks could disrupt our operations and expose us to financial losses, contractual losses, liability, reputational damage and additional expense.

- We may incur significant costs to defend its intellectual property and other proprietary rights.

Risks Related to Our Regulatory Framework

- Marijuana remains illegal under U.S. federal law, and the enforcement of U.S. cannabis laws could change.

- Changes to federal or state laws pertaining to industrial hemp could slow the use of industrial hemp which would materially impact our revenues in future periods.

- There is uncertainty caused by potential changes to legal regulations that could impact the use of CBD products.

- The U.S. Drug Enforcement Administration and/or the Food and Drug Administration ("FDA") limits the ability to discuss the medical benefits of CBD.

- The size of our target market is difficult to quantify, and investors will be reliant on their own estimates on the accuracy of market data.

Risks Related to Financials and Accounting

- Our management has determined that based on our current financial position there is a substantial doubt about our ability to continue as a going concern.

- We may increase our foreign sales in the future, and such sales may be subject to unexpected regulatory requirements and other barriers.

- There are tax risks the Company may be subject to in carrying on business in multiple jurisdictions.

- The Company will likely be a "passive foreign investment company" company ("PFIC") for its current tax year, which may have adverse U.S. federal income tax consequences for U.S. investors.

- Failure to develop our internal controls over financial reporting ("ICFR") as we grow could have an adverse effect on our operations.

Risks Related to Our Common Shares

- We will need, but may be unable to, obtain additional funding on satisfactory terms, which could dilute our shareholders or impose burdensome financial restrictions on our business.

7

- Holders of our Common Shares are subject to dilution resulting from the issuance of equity-based compensation by us.

- We continue to incur increased costs as a result of operating as a public company and our management is required to devote substantial time to new compliance initiatives.

- If we fail to meet applicable listing requirements, Nasdaq may delist our Common Shares from trading, in which case the liquidity and market price of our Common Shares could decline.

- Ownership of our Common Shares may be considered unlawful in some jurisdictions and holders of our Common Shares may consequently be subject to liability in such jurisdictions.

- The regulated nature of our business may impede or discourage a takeover, which could reduce the market price of our Common Shares.

- We do not intend to pay dividends on our Common Shares in the near future, and, consequently, your ability to achieve a return on your investment will depend on appreciation in the price of our Common Shares.

- We are an emerging growth company and a smaller reporting company, and our compliance with the reduced reporting and disclosure requirements applicable to emerging growth companies and smaller reporting companies could make our Common Shares less attractive to investors and may make it more difficult to raise capital as and when we need it.

Implications of Being an Emerging Growth Company

We are an "emerging growth company" pursuant to the Jumpstart Our Business Startups Act of 2012, as amended (the "JOBS Act"). We may take advantage of certain exemptions from various public company reporting requirements, including not being required to have our internal control over financial reporting audited by our independent registered public accounting firm under Section 404 of the Sarbanes-Oxley Act of 2002, as amended ("Sarbanes-Oxley"), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and any golden parachute payments. We may take advantage of these exemptions for up to five years or until we are no longer an "emerging growth company," whichever is earlier. We will cease to be an emerging growth company prior to the end of such five-year period if certain earlier events occur, including if (i) we become a "large accelerated filer" as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), (ii) our annual gross revenues exceed $1.235 billion, or (iii) we issue more than $1.0 billion of non-convertible debt in any three-year period. In particular, in this Prospectus, we have provided only two years of audited financial statements and have not included all of the executive compensation-related information that would be required if we were not an emerging growth company. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

We are also a "smaller reporting company" as defined in the Exchange Act. We may continue to be a smaller reporting company even after we are no longer an emerging growth company. We may continue to be a smaller reporting company after this offering if either (i) the market value of our shares held by non-affiliates is less than $250 million as measured on the last business day of our second fiscal quarter or (ii) our annual revenue was less than $100 million during the most recently completed fiscal year and the market value of our shares held by non-affiliates is less than $700 million as measured on the last business day of our second fiscal quarter. Specifically, as a smaller reporting company, we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and have reduced disclosure obligations regarding executive compensation. Further, if we are a smaller reporting company with less than $100 million in annual revenue, we would not be required to obtain an attestation report on internal control over financial reporting issued by our independent registered public accounting firm.

8

THE OFFERING

| Issuer | Flora Growth Corp. |

| Common Shares offered by the Selling Securityholders |

Up to 1,423,760 |

| Common Shares to be outstanding after this Offering(1) | 9,639,855 Common Shares |

| Symbol and Listing | Our common shares are traded on Nasdaq under the symbol "FLGC". |

| Use of proceeds | We will not receive any proceeds from the sale of the Common Shares by the Selling Securityholders. All net proceeds from the sale of the Common Shares covered by this Prospectus will go to the Selling Securityholders. However, we may receive the proceeds from any exercise of Warrants if the holders do not exercise the Warrants on a cashless basis. If all of the Warrants are exercised for cash in full, the gross proceeds would be approximately $3.55 million. We intend to use the net proceeds of such Warrant exercises, if any, for general working capital purposes. See the section titled "Use of Proceeds." |

| Lock-up | Our Company, directors and certain executive officers have agreed not to, subject to certain exceptions, offer, issue, sell, contract to sell, encumber, grant any option for the sale of, or otherwise dispose of, any of our securities for a ninety (90) day period from September 21, 2023. See the section titled "Plan of Distribution." |

| Risk Factors | Investing in our securities is highly speculative and involves a high degree of risk. You should carefully read and consider the information in the section titled "Risk Factors", and all other information contained in this Prospectus, before deciding to invest in our securities. |

The number of Common Shares to be outstanding immediately after this offering is based on 8,216,095 Common Shares outstanding as of October 18, 2023 and does not include:

(a) 686,245 Common Share purchase warrants with an exercise price at $2.50 per share;

(b) 221,000 Common Share purchase warrants with an exercise price of $75.00 per share;

(c) 23,000 Common Share purchase warrants with an exercise price of $66.00 per share;

(d) 25,000 Common Share purchase warrants with an exercise price of $8.80 per share;

(e) 59,742 Common Share stock options with an average exercise price of $38.86 per share; and

(f) 132,466 restricted share awards that have not yet vested.

9

RISK FACTORS

An investment in our securities is highly speculative and involves a high degree of risk. We operate in a dynamic and rapidly changing industry that involves numerous risks and uncertainties. You should carefully consider the factors described below, together with all of the other information contained in this Prospectus, including the audited and unaudited financial statements and the related notes included in this Prospectus, before deciding whether to invest in our securities. These risk factors are not presented in the order of importance or probability of occurrence. If any of the following risks actually occurs, our business, financial condition and results of operations could be materially and adversely affected. In that event, the market price of our securities could decline, and you could lose part or all of your investment. Some statements in this Prospectus, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section titled "Cautionary Note Regarding Forward-Looking Statements."

Risks Related to this Offering

The sale of a substantial amount of our Common Shares, including resale of the Common Shares issuable upon the exercise of the Warrants held by the Selling Securityholders in the public market could adversely affect the prevailing market price of our Common Shares.

We are registering for resale up to 1,423,760 Common Shares. Sales of substantial amounts of our Common Shares in the public market, or the perception that such sales might occur, could adversely affect the market price of our Common Shares. We cannot predict if and when the Selling Securityholders may sell such Common Shares in the public markets. Furthermore, in the future, we may issue additional Common Shares or other equity or debt securities, including securities in connection with equity-based compensation, that are exercisable or convertible into Common Shares. Any such issuance could result in substantial dilution to our existing shareholders and could cause our stock price to decline.

Management will have broad discretion as to the use of the proceeds from the exercise of Warrants, if any, and may not use the proceeds effectively.

We may receive proceeds from the exercise of the Warrants to the extent that the Warrants are exercised for cash. The Warrants, however, are exercisable on a cashless basis under certain circumstances. If all of the Warrants and Pre-Funded Warrants were exercised for cash in full, the gross proceeds would be approximately $3.55 million. We will have considerable discretion in the application of the net proceeds, if any, from the cash exercise of the Warrants. We intend to use the net proceeds for operating capacity, working capital and general corporate purposes. As a result, investors will be relying upon management's judgment with only limited information about our specific intentions for the use of the balance of the net proceeds from the exercise of the Warrants. We may use the net proceeds for purposes that do not yield a significant return or any return at all for our shareholders. In addition, pending their use, we may invest the net proceeds from the exercise of the Warrants in a manner that does not produce income or that loses value.

You may experience dilution in the net tangible book value of the Common Shares in connection with the exercise of Warrants by the Selling Securityholders.

The assumed offering price of the Common Shares underlying the Warrants is substantially higher than the net tangible book value per Common Share. Therefore, upon exercise of the Warrants, you may experience dilution in the pro forma net tangible book value per Common Share.

Risks Related to our Business and Industry

We are an early-stage company with limited operating history and may never become profitable.

We are an early-stage company focused on cultivating, processing, manufacturing and supplying natural, medicinal-grade cannabis flower and high-quality cannabis derived medical and wellness products to large channel distributors and retailers globally. Formed in March 2019, we have a limited operating history. We have limited financial resources and minimal operating cash flow. For the years ended December 31, 2022 and 2021, we had losses of $52.6 million and $21.4 million, respectively, and as of December 31, 2022 an accumulated deficit of $90.9 million.

10

Additionally, there can be no assurance that additional funding will be available to us for the development of our business, which will require the commitment of substantial resources. Accordingly, you should consider our prospects in light of the costs, uncertainties, delays and difficulties frequently encountered by companies in the early stages of development. Potential investors should carefully consider the risks and uncertainties that a company with a limited operating history will face. In particular, potential investors should consider that we may be unable to:

- successfully implement or execute our business plan, or that our business plan is sound;

- adjust to changing conditions or keep pace with increased demand;

- attract and retain an experienced management team;

- successfully integrate businesses that we acquire; or

- raise sufficient funds in the capital markets to effectuate our business plan, including product development, licensing and approvals.

Recent and future acquisitions and strategic investments could be difficult to integrate, divert the attention of key management personnel, disrupt our business, dilute shareholder value, may subject us to liability, and harm our results of operations and financial condition.

We have recently acquired Just Brands and Franchise and have a history of acquisitive activity, and we may in the future seek to acquire or invest in businesses, products, or technologies that we believe could complement our operations or expand our breadth, enhance our capabilities, or otherwise offer growth opportunities. Our diversity of product offerings may not be successful. While our growth strategy includes broadening our service and product offerings, implementing an aggressive marketing plan and employing product diversification, there can be no assurance that our systems, procedures and controls will be adequate to support our operations as they expand. We cannot assure you that our existing personnel, systems, procedures or controls will be adequate to support our operations in the future or that we will be able to successfully implement appropriate measures consistent with our growth strategy. As part of our planned growth and diversified product offerings, we may have to implement new operational and financial systems, procedures and controls to expand, train and manage our employee base, and maintain close coordination among our staff. We cannot guarantee that we will be able to do so, or that if we are able to do so, we will be able to effectively integrate them into our existing staff and systems. Additionally, the integration of our acquisitions and pursuit of potential future acquisitions may divert the attention of management and cause us to incur various expenses in identifying, investigating, and pursuing suitable acquisitions, whether or not they are consummated. Any acquisition, investment or business relationship may result in unforeseen operating difficulties and expenditures. In addition, we have limited experience in acquiring other businesses. Specifically, we may not successfully evaluate or utilize the acquired products, assets or personnel, or accurately forecast the financial impact of an acquisition transaction, including accounting charges.

We may not be able to find and identify desirable acquisition targets or we may not be successful in entering into an agreement with any one target. Acquisitions could also result in dilutive issuances of equity securities or the incurrence of debt, which could harm our results of operations. In addition, if an acquired business fails to meet our expectations, our business, results of operations, and financial condition may suffer. In some cases, minority shareholders may exist in certain of our non-wholly-owned acquisitions (for businesses we do not purchase as an 100% owned subsidiary) and may retain minority shareholder rights which could make a future change of control or corporate approvals for actions more difficult to achieve and/or more costly.

We also make strategic investments in early-stage companies developing products or technologies that we believe could complement our business or expand our breadth, enhance our technical capabilities, or otherwise offer growth opportunities. These investments may be in early-stage private companies for restricted stock. Such investments are generally illiquid and may never generate value. Further, the companies in which we invest may not succeed, and our investments would lose their value.

Moreover, the anticipated benefits of any acquisition, investment, or business relationship may not be realized, or we may be exposed to unknown risks or liabilities of our acquisitions. Furthermore, we may be subject to unknown liabilities of the businesses we acquire. In addition, we may become subject to legal proceedings in connection with the businesses of, or resulting from, our acquisitions. For example, we have become party to certain litigation as a result of our acquisition of Franchise, which falls under certain indemnification protections obtained in the acquisition. For more information see the section titled "Legal Proceedings."

11

Certain conditions or events could disrupt the Company's supply chains, disrupt operations, and increase operating expenses.

Conditions or events including, but not limited to, the following could disrupt the Company's supply chains and in particular its ability to deliver its products, interrupt operations at its facilities, increase operating expenses, resulting in loss of sales, delayed performance of contractual obligations or require additional expenditures to be incurred: (i) extraordinary weather conditions or natural disasters such as hurricanes, tornadoes, floods, fires, extreme heat, earthquakes, etc.; (ii) a local, regional, national or international outbreak of a contagious disease, including the COVID-19 coronavirus, Middle East Respiratory Syndrome, Severe Acute Respiratory Syndrome, H1N1 influenza virus, avian flu, or any other similar illness could result in a general or acute decline in economic activity; (iii) political instability, social and labor unrest, war or terrorism, including the current conflict between Russia and Ukraine; or (iv) interruptions in the availability of basic commercial and social services and infrastructure including power and water shortages, and shipping and freight forwarding services including via air, sea, rail and road.

Cannabis laws, regulations, and guidelines are dynamic and subject to changes.

Cannabis laws and regulations are dynamic and subject to evolving interpretations which could require us to incur substantial costs associated with compliance or alter certain aspects of our business plan. It is also possible that regulations may be enacted in the future that will be directly applicable to certain of our products and/or aspects of our businesses. We cannot predict the nature of any future laws, regulations, interpretations or applications, nor can we determine what effect additional governmental regulations or administrative policies and procedures, when and if promulgated, could have on our business. Management expects that the legislative and regulatory environment in the cannabis industry in Colombia and internationally will continue to be dynamic and will require innovative solutions to try to comply with this changing legal landscape in this nascent industry for the foreseeable future. Compliance with any such legislation may have a material adverse effect on our business, financial condition and results of operations.

Public opinion can also exert a significant influence over the regulation of the cannabis industry. A negative shift in the public's perception of the cannabis industry could affect future legislation or regulation in different jurisdictions.

Demand for cannabis and derivative products could be adversely affected and significantly influenced by scientific research or findings, regulatory proceedings, litigation, media attention or other research findings.

The legal cannabis industry is at a relatively early stage of its development. Consumer perceptions regarding legality, morality, consumption, safety, efficacy and quality of medicinal cannabis are mixed and evolving and can be significantly influenced by scientific research or findings, regulatory investigations, litigation, media attention and other publicity regarding the consumption of medicinal cannabis products. There can be no assurance that future scientific research, findings, regulatory proceedings, litigation, media attention or other research findings or publicity will be favorable to the medicinal cannabis market or any particular product, or consistent with earlier publicity. Future research reports, findings, regulatory proceedings, litigation, media attention or other publicity that are perceived as less favorable than, or that question, earlier research reports, findings or publicity, could have a material adverse effect on the demand for medicinal cannabis and on our business, results of operations, financial condition and cash flows. Further, adverse publicity reports or other media attention regarding cannabis in general or associating the consumption of medicinal cannabis with illness or other negative effects or events, could have such a material adverse effect. Public opinion and support for medicinal cannabis use has traditionally been inconsistent and varies from jurisdiction to jurisdiction. Our ability to gain and increase market acceptance of our business may require substantial expenditures on investor relations, strategic relationships and marketing initiatives. There can be no assurance that such initiatives will be successful and their failure to materialize into significant demand may have an adverse effect on our financial condition.

12

Damage to the Company's reputation can be the result of the actual or perceived occurrence of any number of events, and could include any negative publicity, whether such publicity is accurate or not.

The increased usage of social media and other web-based tools used to generate, publish and discuss user-generated content and to connect with other users has made it increasingly easier for individuals and groups to communicate and share opinions and views regarding the Company and its activities, whether true or not. Although the Company believes that it operates in a manner that is respectful to all stakeholders and that it takes pride in protecting its image and reputation, it does not ultimately have direct control over how it is perceived by others. Reputational loss may result in decreased ability to enter into new customer, distributor or supplier relationships, retain existing customers, distributors or suppliers, reduced investor confidence and access to capital, increased challenges in developing and maintaining community relations and an impediment to our overall ability to advance our projects, thereby having a material adverse effect on our financial performance, financial condition, cash flows and growth prospects.

We are subject to the inherent risk of exposure to product liability claims, actions and litigation.

As a distributor of products designed to be ingested by humans, we face an inherent risk of exposure to product liability claims, regulatory action and litigation if our products are alleged to have caused bodily harm or injury. In addition, the sale of our products involves the risk of injury to consumers due to tampering by unauthorized third parties or product contamination. Adverse reactions resulting from human consumption of our products alone or in combination with other medications or substances could occur. We may be subject to various product liability claims, including, among others, that our products caused injury or illness, include inadequate instructions for use or include inadequate warnings concerning health risks, possible side effects or interactions with other substances. Product liability claims or regulatory actions against us could result in increased costs, could adversely affect our reputation with our clients and consumers generally, and could have a material adverse effect on our results of operations and financial condition. There can be no assurances that we will be able to obtain or maintain product liability insurance on acceptable terms or with adequate coverage against potential liabilities. Such insurance is expensive and may not be available in the future on acceptable terms, or at all. The inability to obtain sufficient insurance coverage on reasonable terms or to otherwise protect against potential product liability claims could prevent or inhibit the commercialization of our potential products.

We are subject to the inherent risks involved with product recalls.

Manufacturers and distributors of products are sometimes subject to the recall or return of their products for a variety of reasons, including product defects, such as contamination, unintended harmful side effects or interactions with other substances, packaging safety and inadequate or inaccurate labeling disclosure. If any of our products are recalled due to an alleged product defect or for any other reason, we could be required to incur the unexpected expense of the recall and any legal proceedings that might arise in connection with the recall. We may lose a significant amount of sales and may not be able to replace those sales at an acceptable margin, or at all. In addition, a product recall may require significant management attention. There can be no assurance that any quality, potency or contamination problems will be detected in time to avoid unforeseen product recalls, regulatory action or lawsuits. Additionally, if our products are subject to recall, our reputation could be harmed. A recall for any of the foregoing reasons could lead to decreased demand for our products and could have a material adverse effect on our results of operations and financial condition. Additionally, product recalls may lead to increased scrutiny of our operations by regulatory agencies, requiring further management attention, potential loss of applicable licenses, and potential legal fees and other expenses.

The Company's products could have unknown side effects.

If the products the Company sells are not perceived to have the effects intended by the end user, its business may suffer and the business may be subject to products liability or other legal actions. Many of the Company's products contain innovative ingredients or combinations of ingredients. There is little long-term data available with respect to efficacy, unknown side effects and/or interaction with individual human biochemistry, or interaction with other drugs. Moreover, there is little long-term data available with respect to efficacy, unknown side effects and/or its interaction with individual animal biochemistry. As a result, the Company's products could have certain side effects if not taken as directed or if taken by an end user that has certain known or unknown medical conditions.

13

The Company may be unable to anticipate changes in its potential client requirements that could make the Company's existing products and services obsolete. The Company's success will depend, in part, on its ability to continue to enhance its product and service offerings so as to address the increasing sophistication and varied needs of the market and respond to technological and regulatory changes and emerging industry standards and practices on a timely and cost-effective basis.

Research regarding the medical benefits, viability, safety, efficacy, use and social acceptance of cannabis or isolated cannabinoids (such as CBD and THC remains in early stages.

There have been relatively few clinical trials on the benefits of cannabis or isolated cannabinoids (such as CBD and THC). Although the Company believes that the articles, reports and studies support its beliefs regarding the medical benefits, viability, safety, efficacy, dosing and social acceptance of cannabis, future research and clinical trials may prove such statements to be incorrect, or could raise concerns regarding, and perceptions relating to, cannabis. Given these risks, uncertainties and assumptions, investors should not place undue reliance on such articles and reports. Future research studies and clinical trials may draw opposing conclusions to those stated herein or reach negative conclusions related to medical cannabis, which could have a material adverse effect on the demand for the Company's products, which could result in a material adverse effect on our business, financial condition and results of operations or prospects.

Our growth depends, in part, on expanding into additional consumer markets, and we may not be successful in doing so.

We believe that our future growth depends not only on continuing to provide our current customers with new products, but also continuing to enlarge our customer base. The growth of our business will depend, in part, on our ability to continue to expand in the United States, as well as into international markets. We are investing significant resources in these areas, and although we hope that our products will gain popularity, we may face challenges that are different from those we currently encounter, including competitive merchandising, distribution, hiring, and other difficulties. We may also encounter difficulties in attracting customers due to a lack of consumer familiarity with or acceptance of our brand, or a resistance to paying for premium products, particularly in international markets. In addition, although we are investing in sales and marketing activities to further penetrate newer regions, including expansion of our dedicated sales force, we may not be successful. If we are not successful, our business and results of operations may be harmed.

Fluctuations in the cost and availability of raw materials, equipment, labor, and transportation could cause manufacturing delays or increase our costs.

The price and availability of key components used to manufacture our products has been increasing and may continue to fluctuate significantly. In addition, the cost of labor within our company or at our third-party manufacturers could increase significantly due to regulation or inflationary pressures. Additionally, the cost of logistics and transportation fluctuates in large part due to the price of oil, and availability can be limited due to political and economic issues. Any fluctuations in the cost and availability of any of our raw materials, packaging, or other sourcing or transportation costs could harm our gross margins and our ability to meet customer demand. If we are unable to successfully mitigate a significant portion of these product cost increases or fluctuations, our results of operations could be harmed.

We rely on third-parties for raw materials and to manufacture and compound some of our products. We have no control over these third parties and if these relationships are disrupted our results of operations in future periods will be adversely impacted.

We currently hold short term supply contracts with unaffiliated third-party vendors for our critical raw materials. In addition, some of our products are manufactured or compounded by unaffiliated third parties and the use of these third-party co-packers changes from time to time due to customer demand and the composition of our product mix and product portfolio. We do not have any long-term contracts with any of these third parties, and we expect to compete with other companies for raw materials, production and imported packaging material capacity. If we experience significant increased demand or need to replace an existing raw material supplier or third-party manufacturer, there can be no assurances that replacements for these third-party vendors will be available when required on terms that are acceptable to us, or at all, or that any manufacturer or compounder would allocate sufficient capacity to us in order to meet our requirements. In addition, even if we are able to expand existing or find new sources, we may encounter delays in production and added costs as a result of the time it takes to engage third parties. Any delays, interruption or increased costs in raw materials and/or the manufacturing or compounding of our products could have an adverse effect on our ability to meet retail customer and consumer demand for our products and result in lower revenues and net income both in the short and long-term.

14

The Company's inventory has a shelf life and may reach its expiration and not be sold.

The Company holds finished goods in inventory and its inventory has a shelf life. Finished goods in the Company's inventory may include cannabis flower, cannabis oil products and cosmeceuticals. The Company's inventory may reach its expiration and not be sold. Although management regularly reviews the quantity and remaining shelf life of inventory on hand, and estimates manufacturing and sales lead times in order to manage its inventory, write-downs of inventory may still be required. Any such write-down of inventory could have a material adverse effect on the Company's business, financial condition, and results of operations.

The seasonal trends in our business create variability in our financial and operating results.

Our financial and operating results are subject to seasonal and quarterly variations in our net revenue and operating income and, as a result, our quarterly results may fluctuate and could be below expectations. Our business has realized a disproportionate amount of our net revenue and earnings for prior fiscal years in the third and fourth quarter as a result of the holiday season, and we expect this seasonal impact on our operations to continue in the future. If we experience lower than expected net revenue during any third or fourth quarter, it may have disproportionately large effects on our operating results and financial condition for that year. Any factors that harm our third or fourth quarter operating results, including disruptions in our brands or our supply chains or unfavorable economic conditions, could have a disproportionate effect on our results of operations and our financial condition for our entire fiscal year.

The Company may not be able to maintain effective quality control systems.

The Company may not be able to maintain an effective quality control system. The Company ascribes its early successes, in part, on its commitment to product quality and its effective quality control system. The effectiveness of the Company's quality control system and its ability to obtain or maintain good manufacturing practice ("GMP") certification with respect to its manufacturing, processing and testing facilities depend on a number of factors, including the design of its quality control procedures, training programs, and its ability to ensure that its employees adhere to the Company's policies and procedures. The Company also depends on service providers such as toll manufacturers and contract laboratories to manufacture, process or test its products that are subject to GMP certification requirements.

We expect that regulatory agencies will periodically inspect our and our service providers' facilities to evaluate compliance with applicable GMP requirements. Failure to comply with these requirements may subject us or our service providers to possible regulatory enforcement actions. Any failure or deterioration of the Company's or its service providers' quality control systems, including loss of GMP certification, may have a material adverse effect on the Company's business, results of operations and financial condition.

Energy prices and supply may be subject to change or curtailment due to new laws or regulations, imposition of new taxes or tariffs, interruptions in production by suppliers, imposition of restrictions on energy supply by government, worldwide price levels and market conditions.

The Company requires diesel and electric energy and other resources for its cultivation and harvest activities and for transportation of cannabis. The Company relies upon third parties for its supply of energy resources used in its operations. The prices for and availability of energy resources may be subject to change or curtailment, respectively, due to, among other things, new laws or regulations, imposition of new taxes or tariffs, interruptions in production by suppliers, imposition of restrictions on energy supply by government, worldwide price levels and market conditions. Although the Company attempts to mitigate the effects of fuel shortages, electricity outages and cost increases, the Company's operations will continue to depend on external suppliers of fuel and electricity. If energy supply is cut for an extended period and the Company is unable to find replacement sources at comparable prices, or at all, the Company's business, financial condition and results of operations could be materially and adversely affected.

15

The cannabinoid industry faces strong opposition and may face similar opposition in other jurisdictions in which we operate.

Many political and social organizations oppose hemp and cannabis and their legalization, and many people, even those who support legalization, oppose the sale of hemp and cannabis in their geographies. Our business will need support from local governments, industry participants, consumers and residents to be successful. Additionally, there are large, well-funded businesses that may have a strong opposition to the cannabis industry. For example, the pharmaceutical and alcohol industries have traditionally opposed cannabis legalization. Any efforts by these or other industries to halt or impede the cannabis industry could have detrimental effects on our business.

The Company is subject to wholesale price volatility that could expose the Company to lower than anticipated revenues, gross margins, net income and cash flows.

The pharmaceutical distribution and cannabis industries are margin-based businesses in which gross profits depend on the excess of sales prices over costs. Consequently, profitability is sensitive to fluctuations in wholesale and retail prices caused by changes in supply (which itself depends on other factors such as weather, fuel, equipment and labor costs, shipping costs, economic situation, government regulations and demand), taxes, government programs and policies for the pharmaceutical distribution and cannabis industries (including price controls and wholesale price restrictions that may be imposed by government agencies responsible for the sale of pharmaceuticals and cannabis), and other market conditions, all of which are factors beyond our control. The Company's operating income may be significantly and adversely affected by a decline in the price of pharmaceuticals and cannabis and will be sensitive to changes in the price of cannabis and the overall condition of the cannabis industry, as our profitability is directly related to the price of pharmaceuticals and cannabis. These prices affected by numerous factors beyond our control. Any price decline may have a material adverse effect on the Company's business, financial condition and results of operations.

The Company's operations could be significantly adversely affected by the effects of a widespread global outbreak of a contagious disease and other unforeseen events, including the outbreak of respiratory illness caused by COVID-19 and the related economic repercussions. We cannot accurately predict the effects COVID-19 will have on our operations and the ability of others to meet their obligations with the Company, including uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could further affect the Company's operations and ability to finance its operations.

The Company could face competitive risks from the development and distribution of synthetic cannabis.

The pharmaceutical industry and others may attempt to enter the cannabis industry and, in particular, the medical cannabis industry through the development and distribution of synthetic products that emulate the effects of and treatment provided by naturally occurring cannabis. If synthetic cannabis products are widely adopted, the widespread popularity of such synthetic cannabis products could change the demand, volume and profitability of the botanical cannabinoid industry. This could adversely affect our ability to secure long-term profitability and success through the sustainable and profitable operation of our business.

The legalization of adult-use, recreational cannabis may reduce sales of medical cannabis.

Legalization of the sale to adults of recreational, non-medical cannabis in any country may increase competition in the medical cannabis market. We may not be able to achieve our business plan in a highly competitive market where recreational, adult-use cannabis is legal, or the market may experience a drop in the price of cannabis and cannabis products over time, decreasing our profit margins.

The Company is reliant on third party transportation services and importation services to deliver its products to customers.

16

The Company relies on third party transportation services and importation services to deliver its products to its customers. The Company is exposed to the inherent risks associated with relying on third party transportation service-providers, including logistical problems, delays, loss or theft of product and increased shipping and insurance costs. Any delay in transporting the product, breach of security or loss of product, could have a material adverse effect on the Company's business, financial performance and results of operations. Further, any breach of security and loss of product during transport could affect the Company's status as a licensed producer in Colombia.

We may not be able to establish and maintain bank accounts in certain countries.

There is a risk that banking institutions in countries where we operate will not open accounts for us or will not accept payments or deposits from proceeds related to the cannabis industry. Such risks could increase our costs or prevent us from expanding into certain jurisdictions.

We may not be able to renew certain of our leases.

Several of the properties or facilities that we utilize in our operations are leased for a specific term. There is a risk that we may not be able to extend the term on some or all of such leases or, if we do so, that the terms of any such lease extension will be favorable. Likewise, there is a risk that some leases may expire and we will be required to relocate our operations to another location, thereby incurring costs.

The Company may be subject to cyber-security and privacy risks that could disrupt its operations and expose the Company to financial losses, contractual losses, liability, reputational damage and additional expense.

The Company may be subject to risks related to our information technology systems, including cyber-attacks, malware, ransomware and phishing attacks that could target our intellectual property, trade secrets, financial information, personal information of our employees, customers and patients, including sensitive personal health information. The occurrence of such an attack could disrupt our operations and expose the Company to financial losses, contractual damages, liability under labor and privacy laws, reputational damage and additional expenses. We have implemented security measures to protect our data and information technology systems; however, such measures may not be effective in preventing cyber-attacks. We may be required to allocate additional resources to implement additional preventative measures including significant investments in information technology systems. A serious cyber-security breach could have a material adverse effect on our business, financial condition and results of operations.

The Company may collect and store certain personal information about customers and is responsible for protecting such information from privacy breaches. A privacy breach may occur through procedural or process failure, information technology malfunction, or deliberate unauthorized intrusions. In addition, theft of data is an ongoing risk whether perpetrated via employee collusion or negligence or through deliberate cyber-attack. Any such privacy breach or theft could have a material adverse effect on the Company's business, financial condition and results of operations. If the Company were found to be in violation of privacy or security rules or other laws protecting the confidentiality of information, the Company could be subject to sanctions and civil or criminal penalties, which could increase its liabilities, harm its reputation and have a material adverse effect on the Company's business, financial condition and results of operations.

The Company may incur significant costs to defend its intellectual property and other proprietary rights.

The ownership and protection of trademarks, patents, trade secrets and intellectual property rights are significant aspects of the Company's future success. Unauthorized parties may attempt to replicate or otherwise obtain and use the Company's products and technology. Policing the unauthorized use of the Company's current or future trademarks, patents, trade secrets or intellectual property rights could be difficult, expensive, time-consuming and unpredictable, as may be enforcing these rights against unauthorized use by others.

In addition, other parties may claim that the Company's products infringe on their proprietary and perhaps patent protected rights. Such claims, regardless of their merit, may result in the expenditure of significant financial and managerial resources, legal fees, injunctions, temporary restraining orders and/or require the payment of damages. As well, the Company may need to obtain licenses from third parties who allege that the Company has infringed on their lawful rights. Such licenses may not be available on terms acceptable to the Company or at all. In addition, the Company may not be able to obtain or utilize on terms that are favorable to it, or at all, licenses or other rights with respect to intellectual property that it does not own.

17

Risks Related to Our Regulatory Framework

Marijuana remains illegal under U.S. federal law, and the enforcement of U.S. cannabis laws could change.

There are significant legal restrictions and regulations that govern the cannabis industry in the United States. Marijuana remains a Schedule I drug under the Controlled Substances Act, making it illegal under federal law in the United States to, among other things, cultivate, distribute or possess cannabis in the United States. In those states in which the use of marijuana has been legalized, its use remains a violation of federal law pursuant to the Controlled Substances Act. The Controlled Substances Act classifies marijuana as a Schedule I controlled substance, and as such, medical and adult cannabis use is illegal under U.S. federal law. Unless and until the U.S. Congress amends the Controlled Substances Act with respect to marijuana (and the President approves such amendment), there is a risk that federal authorities may enforce current federal law. Financial transactions involving proceeds generated by, or intended to promote, cannabis-related business activities in the United States may form the basis for prosecution under applicable U.S. federal money laundering legislation. While the approach to enforcement of such laws by the federal government in the United States has trended toward non-enforcement against individuals and businesses that comply with medical or adult-use cannabis regulatory programs in states where such programs are legal, strict compliance with state laws with respect to cannabis will neither absolve us of liability under U.S. federal law, nor will it provide a defense to any federal proceeding which may be brought against us. Since U.S. federal law criminalizing the use of marijuana preempts state laws that legalize its use, enforcement of federal law regarding marijuana is a significant risk and would greatly harm our business, prospects, revenue, results of operation and financial condition. The enforcement of federal laws in the United States is a risk to our business and any proceedings brought against us thereunder may materially, adversely affect our operations and financial performance.

Our activities are, and will continue to be, subject to evolving regulation by governmental authorities. The legality of the production, cultivation, extraction, distribution, retail sales, transportation and use of cannabis differs among states in the United States. Due to the current regulatory environment in the United States, new risks may emerge; Management may not be able to predict all such risks.

Due to the conflicting views between state legislatures and the federal government regarding cannabis, cannabis businesses are subject to inconsistent laws and regulations. There can be no assurance that the federal government will not enforce federal laws relating to marijuana and seek to prosecute cases involving marijuana businesses that are otherwise compliant with state laws in the future.

The uncertainty of U.S. federal enforcement practices going forward and the inconsistency between U.S. federal and state laws and regulations present major risks for the Company.

Changes to federal or state laws pertaining to industrial hemp could slow the use of industrial hemp which would materially impact our revenues in future periods.