DRAFT OFFERING STATEMENT DATED NOVEMBER 15, 2019

FOR NON-PUBLIC SUBMISSION UNDER RULE 252(d)

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

PRELIMINARY OFFERING CIRCULAR

SUBJECT TO COMPLETION; DATED NOVEMBER 19, 2019

Compound Projects, LLC

20 Clinton Street

New York, NY 10002

646-930-4503

www.getcompound.com

Best Efforts Offering of Series #Reach Membership Interests

Compound Projects, LLC (“we,” “us,” “our,” “Compound Projects” or the “Company”) is a newly organized Delaware series limited liability company that has been formed to permit public investment in individual real estate properties to be owned by individual series of the Company, the first of which series is known as Series #Reach. We are offering up to a maximum of 100,000 Series #Reach membership interests (which we refer to as the Series #Reach Interests), at a purchase price of $4.80 per Series #Reach Interest, for a maximum aggregate amount of $480,000, on a “best efforts,” no offering minimum basis.

Sale of the Series #Reach Interests will begin upon qualification of this offering circular to a maximum of 2,000 qualified purchasers (no more than 500 of which may be non-“accredited investors”); provided that Compound Asset Management, LLC, the Manager, may waive such limitations. The initial closing of the offering of the Series #Reach Interests will occur on the earliest to occur of (i) the date subscriptions for the maximum number of Series #Reach Interests have been accepted or (ii) a date determined by the Manager in its sole discretion, provided that subscriptions for the minimum number of Series #Reach Interests have been accepted. If an initial closing has not occurred, this offering shall be terminated upon (i) the date which is one year from the date this offering circular is qualified by the U.S. Securities and Exchange Commission, or the Commission, which period may be extended by an additional six months by the Manager in its sole discretion, or (ii) any date on which the Manager elects to terminate the offering in its sole discretion. No securities are being offered by existing security-holders.

This offering (the “Offering”) is being conducted on a “best efforts” basis pursuant to Regulation A of Section 3(6) of the Securities Act of 1933, as amended, or the Securities Act, for Tier 2 offerings. The subscription funds advanced by prospective investors as part of the subscription process will be held in a non-interest bearing escrow account with North Capital Private Securities Corporation (“North Capital”) and will not be commingled with the operating account of our Series #Reach membership interests, until, if and when there is a closing with respect to that investor. See “Plan of Distribution and Subscription Procedure” and “Securities Being Offered” for additional information.

|

Series |

|

Price to Public |

|

|

Underwriter Discounts and Commissions 1 |

|

|

Proceeds to Issuer 2 |

|||

|

Per Series #Reach Interest |

|

|

$4.80 |

|

|

|

$0.048 |

|

|

|

$4.752 |

|

Total Minimum |

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

Total Maximum |

|

|

$480,000.00 |

|

|

|

$4.800.00 |

|

|

|

$475,200.00 |

|

|

(1) |

North Capital Private Securities Corporation will be acting as our soliciting agent and executing broker in connection with each offering and entitled to a brokerage fee equal to 1.0% of the amount raised through each offering. Notwithstanding the foregoing, North Capital will not receive any fee on funds raised from the sale of any interests to the Manager, its affiliates or the sellers of any of the Properties. |

|

|

(2) |

Because these are best efforts offerings, the actual public offering amounts, brokerage fees and proceeds to us are not presently determinable and may be substantially less than each total maximum offering set forth above. We will reimburse the Manager for Series #Reach offering expenses actually incurred in an amount up to $10,000. |

All funds paid by subscribers in the offering will be deposited in an escrow account with North Capital, as escrow agent.

The Interests offered hereby are highly speculative in nature and involve a high degree of risk. See “Risk Factors” beginning on page 7 of this offering circular for a discussion of other material risks of investing in our Interests.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

THE U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

This offering circular is following the offering circular format described in Part II (a)(1)(i) of Form 1-A.

The approximate date of commencement of proposed sale to the public is [*].

1

DRAFT OFFERING STATEMENT DATED NOVEMBER 15, 2019

FOR NON-PUBLIC SUBMISSION UNDER RULE 252(d)

TABLE OF CONTENTS

i

DRAFT OFFERING STATEMENT DATED NOVEMBER 15, 2019

FOR NON-PUBLIC SUBMISSION UNDER RULE 252(d)

STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS

Our Interests are being offered and sold only to “qualified purchasers” (as defined in Regulation A under the Securities Act). As a Tier 2 offering pursuant to Regulation A under the Securities Act, this offering will be exempt from state law “Blue Sky” review, subject to meeting certain state filing requirements and complying with certain anti-fraud provisions, to the extent that our Interests offered hereby are offered and sold only to “qualified purchasers” or at a time when our Interests are listed on a national securities exchange. “Qualified purchasers” include: (i) “accredited investors” under Rule 501(a) of Regulation D and (ii) all other investors so long as their investment in our Interests does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). Accordingly, we reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a “qualified purchaser” for purposes of Regulation A.

For purposes of determining whether a potential investor is a “qualified purchaser,” annual income and net worth should be calculated as provided in the “accredited investor” definition under Rule 501 of Regulation D. In particular, net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings and automobiles.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this Offering Circular includes some statements that are not historical and that are considered “forward-looking statements.” Such forward-looking statements include, but are not limited to, statements regarding our development plans for our business; our strategies and business outlook; anticipated development of the Company, the Manager, each series of the Company and the Compound Platform (defined below); and various other matters (including contingent liabilities and obligations and changes in accounting policies, standards and interpretations). These forward-looking statements express the Manager’s expectations, hopes, beliefs, and intentions regarding the future. In addition, without limiting the foregoing, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” and similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Offering Circular are based on current expectations and beliefs concerning future developments that are difficult to predict. Neither the Company nor the Manager can guarantee future performance, or that future developments affecting the Company, the Manager or the Compound Platform will be as currently anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

All forward-looking statements attributable to us are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties, along with others, are also described below under the headings “Summary – Summary Risk Factors” and “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of the parties’ assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

MARKET AND OTHER INDUSTRY DATA

This offering circular includes market and other industry data and estimates that are based on our management’s knowledge and experience in the markets in which we operate. The sources of such data generally state that the information they provide has been obtained from sources they believe to be reliable, but we have not investigated or verified the accuracy and completeness of such information. Our own estimates are based on information obtained from our and our affiliates experience in the markets in which we operate and from other contacts in these markets. We are responsible for all of the disclosure in this offering circular, and we believe our estimates to be accurate as of the date of this offering circular or such other date stated in this offering circular. However, this information may prove to be inaccurate because of the method by which we obtained some of the data for the estimates or because this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. As a result, you should be aware that market and other industry data included in this offering circular, and estimates and beliefs based on that data, may not be reliable.

ii

DRAFT OFFERING STATEMENT DATED NOVEMBER 15, 2019

FOR NON-PUBLIC SUBMISSION UNDER RULE 252(d)

SUMMARY

This summary highlights some of the information in this offering circular. It does not contain all of the information that you should consider before investing in our Interests. You should read carefully the detailed information set forth under “Risk Factors” and the other information included in this offering circular. Except where the context suggests otherwise, the terms “Company,” “we,” “us” and “our” refer to Compound Projects, LLC, a Delaware series limited liability company, together with its consolidated Series; references in this offering circular to “the Manager” refer to Compound Asset Management, LLC, a Delaware limited liability company and the managing member of the Company, and each of its Series and their subsidiaries; and references in this offering circular to “Compound” refer to Compound Asset Management, Inc., the parent company of the Manager. All references in this offering circular to “$” or “dollars” are to United States dollars.

Company Overview

Compound Projects, LLC is a newly organized Delaware series limited liability company that has been formed to permit public investment in specific real estate properties, each of which will be owned by a separate Series of the Company, or Series, that we intend to establish. Each Series will hold the specific property that it acquires in a wholly-owned subsidiary which will be a Delaware limited liability company.

As a Delaware series limited liability company, the debts, liabilities, obligations and expenses incurred, contracted for or otherwise existing with respect to a particular Series are segregated and enforceable only against the assets of such Series, as provided under Delaware law. We intend for each Series to elect and qualify to be taxed as a separate real estate investment trust, or REIT, for U.S. federal income tax purposes, commencing with the taxable year ending after the completion of the initial public offering of Interests of such Series.

We are offering membership interests in each of the Series of the Company, which represent limited liability company interests in such Series of the Company. All of the series of the Company offered hereunder may collectively be referred to herein as the “Series” and each, individually, as a “Series.” The interests of all Series described above may collectively be referred to herein as the “Interests,” or “our securities” and each, individually, as an “Interest” and the offerings of the Interests may collectively be referred to herein as the “Offerings” and each, individually, as an “Offering.” See “Description of the Securities Being Offered” for additional information regarding the Interests.

The Company’s core business will be the identification, acquisition, marketing and management of individual real estate properties for the benefit of the Investors. Each Series is intended to own a single property. These properties may be referred to herein, collectively, as the “Properties” or each, individually, as a “Property.”

The Interests represent an investment solely in a particular Series and, thus, indirectly in the Property owned by that Series. The Interests do not represent an investment in the Company or the Manager. We do not anticipate that any Series will own anything other than the single Property associated with such Series. We currently anticipate that the operations of the Company, including the formation of additional Series and the corresponding acquisition of additional properties, will benefit Investors by allowing Investors to build a diversified portfolio of investments.

A purchaser of the Interests may be referred to herein as an “Investor” or “Interest Holder.” There will be one or more separate closings (each, a “Closing”) with respect to each Offering. The initial Closing of an Offering will occur on the earlier to occur of (i) the date subscriptions for the maximum number of Interests for a Series have been accepted or (ii) a date determined by the Manager in its sole discretion, provided that subscriptions for the minimum number of Interests have been accepted. If an initial Closing with respect to a particular Series Offering has not occurred, the Offering shall be terminated upon (i) the date which is one year from the date the related Offering Circular or amendment thereof, as applicable, is qualified by the Commission, which period may be extended with respect to a particular Series by an additional six months by the Manager in its sole discretion, or (ii) any date on which the Manager elects to terminate the Offering for a particular Series in its sole discretion. No securities are being offered by existing security-holders.

Each Offering is being conducted under Regulation A (17 CFR 230.251 et. seq.) and the information contained herein is being presented in Offering Circular format. The Company is not offering, and does not anticipate selling, Interests in any of the Offerings in any state where North Capital, its soliciting agent and executing broker, is not registered as a broker-dealer. The subscription funds advanced by prospective Investors as part of the subscription process will be held in a non-interest-bearing escrow account with North Capital acting as escrow agent, the “Escrow Agent,” and will not be commingled with the operating account of the Series, until, if and when there is a Closing with respect to that Series. See “Plan of Distribution and Subscription Procedure” and “Description of the Securities Being Offered” for additional information.

Investment Objectives

Our investment objectives are:

|

|

● |

to realize growth in the value of our investments; |

|

|

● |

to grow net cash from operations so more cash is available for distributions to investors; and |

|

|

● |

to preserve, protect and return your capital contribution. |

We cannot assure you that we will attain these objectives or that the value of our assets will not decrease.

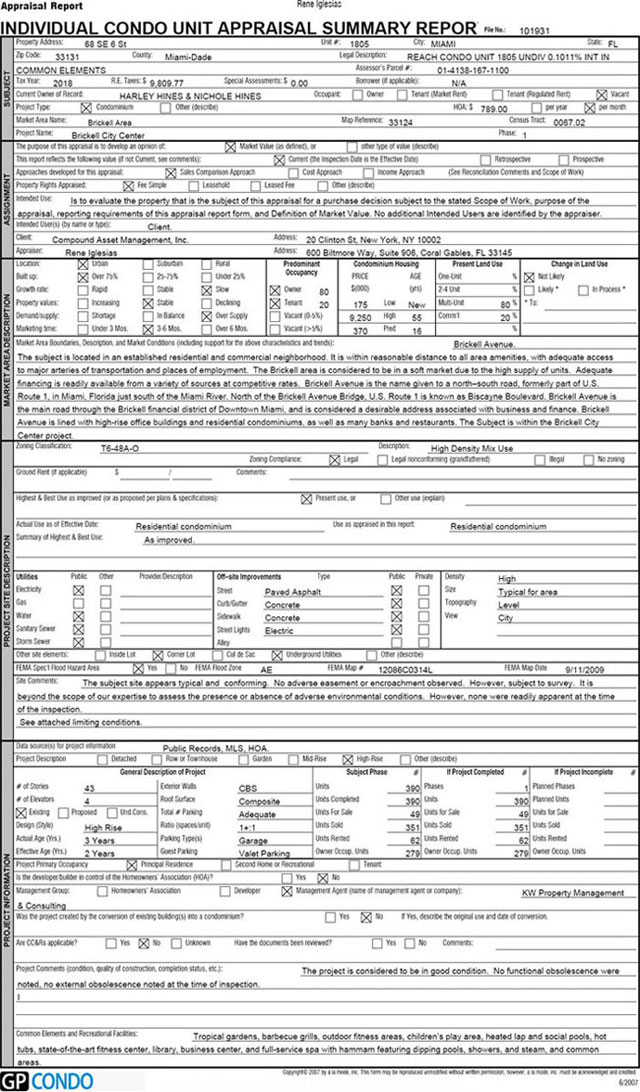

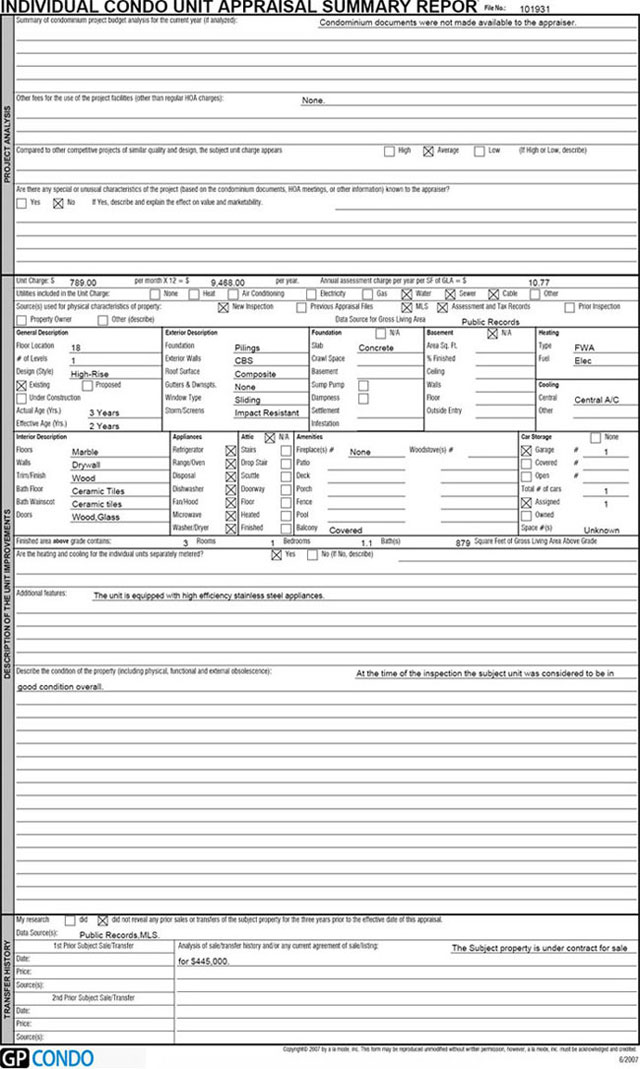

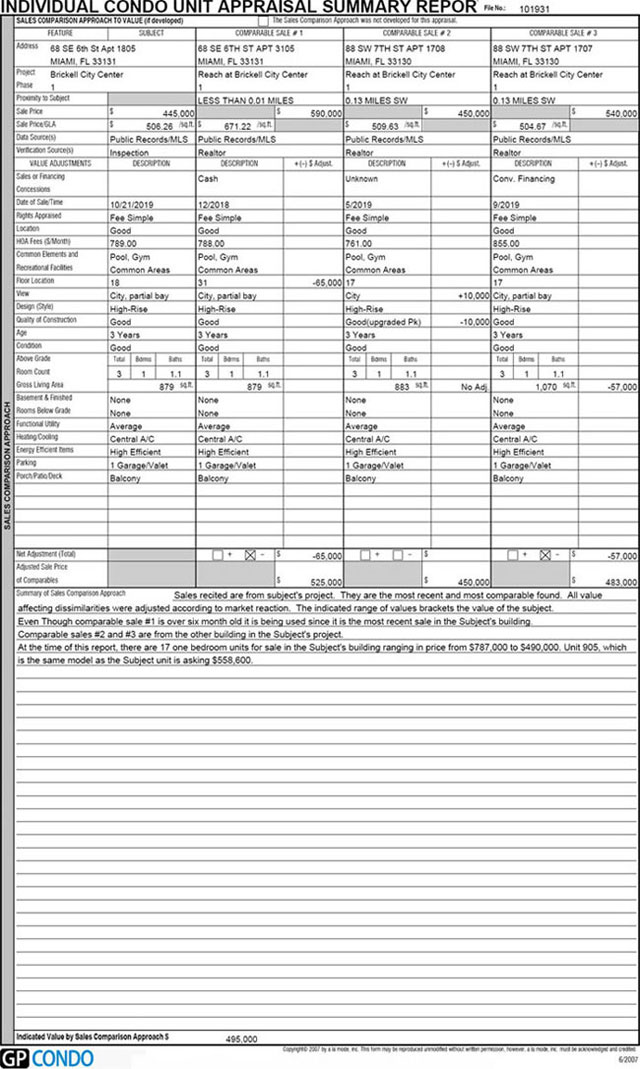

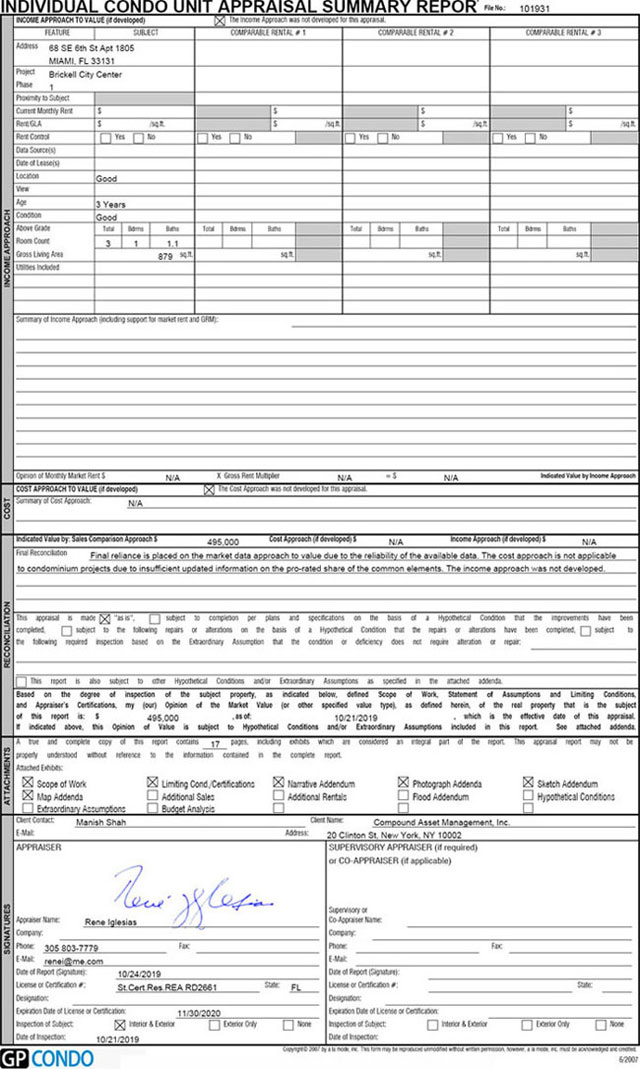

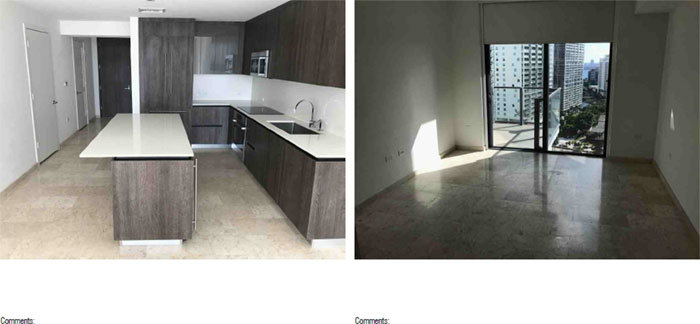

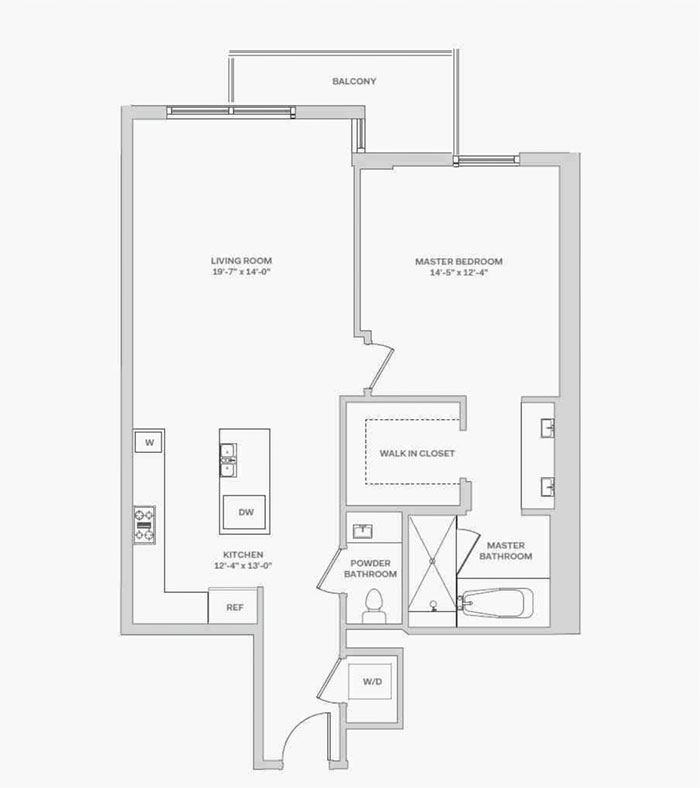

The Series #Reach Property

The Property associated with Series #Reach is the Unit #1805 condominium in the Reach Brickell City Center, located at 68 SE 6th Street, Miami, Florida (which we refer to as the Series #Reach Property). It is not anticipated that Series #Reach will own any assets other than the Series #Reach Property, plus cash reserves for operating, maintenance and other expenses pertaining to the Series #Reach Property and amounts earned by Series #Reach from rental income derived from the Series #Reach Property, if any. See “Description of Business—Description of Series #Reach” for further details.

2

Securities Being Offered

Investors will acquire membership interests in a Series of the Company, each of which is intended to be a separate series of the Company for purposes of accounting for assets and liabilities. It is intended that owners of Interests in a Series will only have assets, liabilities, profits and losses pertaining to the specific Property owned by that Series. For example, an owner of interests in Series #Reach will only have an interest in the assets, liabilities, profits and losses pertaining to Series #Reach and its related operations. See the “Description of the Securities Offered” section for further details. The minimum investment you can make for any Series is twenty five (25) Interests in the Series and the maximum investment is equal to 9.8% of the total Interests being offered for such Series, although such maximum thresholds may be waived by the Manager in its sole discretion.

The Manager

The Company is managed by Compound Asset Management, LLC, a Delaware limited liability company (the “Manager”). Pursuant to the terms of the Company’s limited liability operating agreement (the “Operating Agreement”), the Manager will provide certain management and advisory services to the Company and to each of its Series and their subsidiaries, as well as a management team and appropriate support personnel. The Manager is a wholly owned subsidiary of Compound Asset Management, Inc., a privately held company that commenced operations in February 2018. Compound Asset Management, Inc., together with its direct and indirect subsidiaries, which is referred to herein as Compound, is a technology-enabled asset management company that operates a web-based investment platform used by the Company for the offer and sale of interests in the Company (the “Compound Platform”)

Management Compensation

Pursuant to the Operating Agreement, the Manager will receive fees and expense reimbursements for services relating to this Offering and the investment and management of our Properties. The items of compensation are summarized in the table on page 37. See “Management-Management Compensation.”

Operating Expenses

Each Series of the Company will be responsible for the costs and expenses attributable to the activities of the Company related to such Series including, but not limited to:

|

|

● |

any and all fees, costs and expenses incurred in connection with the management of a Series Property and preparing any reports and accounts of each Series, including, but not limited to, audits of a Series annual financial statements, tax filings and the circulation of reports to Investors; |

|

|

● |

any and all insurance premiums or expenses; |

|

|

● |

any withholding or transfer taxes imposed on the Company or a Series or any of the Members; |

|

|

● |

any governmental fees imposed on the capital of the Company or a Series; |

|

|

● |

any legal fees and costs (including settlement costs) arising in connection with any litigation or regulatory investigation instituted against the Company, a Series or a Property Manager in connection with the affairs of the Company or a Series, or relating to legal advice directly relating to the Company’s or a Series’ legal affairs; |

|

|

● |

any fees, costs and expenses of a third-party registrar and transfer agent appointed by the Managing Member in connection with a Series; |

|

|

● |

any indemnification payments; |

|

|

● |

the costs of any third parties engaged by the Managing Member in connection with the operations of the Company or a Series; and |

|

|

● |

any similar expenses that may be determined to be Operating Expenses, as determined by the Managing Member in its reasonable discretion. |

The Manager will bear its own expenses of an ordinary nature.

If the Operating Expenses exceed the amount of revenues generated from a Series Property and cannot be covered by any Operating Expense reserves on the balance sheet of such Series Property, the Manager may (a) pay such Operating Expenses and not seek reimbursement, (b) loan the amount of the Operating Expenses to the applicable Series, on which the Manager may impose a reasonable rate of interest, and be entitled to reimbursement of such amount from future revenues generated by such Series Property (which we refer to as Operating Expenses Reimbursement Obligation(s)), and/or (c) cause additional Interests to be issued in the such Series in order to cover such additional amounts. See Description of Business-Operating Expenses.”

Transferability

The Manager may refuse a transfer by an Interest Holder of its Interest if such transfer would result in (a) there being more than 2,000 beneficial owners in a Series or more than 500 beneficial owners that are not “accredited investors,” (b) the assets of a Series being deemed plan assets for purposes of ERISA, (c) such Interest Holder holding in excess of 9.8% of a Series, (d) a change of U.S. federal income tax treatment of the Company and/or a Series, or (e) the Company, any Series, the Manager, or its affiliates being subject to additional regulatory requirements. Furthermore, as the Interests are not registered under the Securities Act of 1933, as amended (the “Securities Act”), transfers of Interests may only be effected pursuant to exemptions under the Securities Act and permitted by applicable state securities laws. See “Description of the Securities Being Offered–Restrictions on Ownership and Transfer” for more information.

3

Restrictions on Ownership of our Interests

To assist each of the Series in qualifying as a REIT, the Operating Agreement provides that generally no person may own, or be deemed to own by virtue of the attribution provisions of the Internal Revenue Code, either more than 9.8% in value or number of Interests, whichever is more restrictive, of our outstanding equity capital, or 9.8% in value or number of Interests, whichever is more restrictive, of our Interests or any class or series of the outstanding Interests. The Manager may, in its sole discretion, waive the 9.8% ownership limit with respect to a particular holder of Interests.

The Operating Agreement also prohibits any person from, among other things:

|

|

● |

beneficially or constructively owning Interests in a Series that would result in the Company being “closely held” under Section 856(h) of the Internal Revenue Code, or otherwise cause a Series to fail to qualify as a REIT; and |

|

|

● |

transferring our Interests if such transfer would result in the Interests in a Series being owned by fewer than 100 persons. |

Distribution Rights

The Manager has sole discretion in determining what distributions, if any, are made to Interest Holders except as otherwise limited by law or the Operating Agreement. The Company expects the Manager to make distributions on a semi-annual basis. However, the Manager may change the timing of distributions or determine that no distributions shall be made in its sole discretion. See “Description of the Securities Being Offered-Distribution rights.”

Our Company Information

Our principal executive offices are located at 20 Clinton Street, New York, New York 10002. Our telephone number is (646) 930-4503. We maintain a website at http://www.getcompound.com. Information contained on, or accessible through, our website is not incorporated by reference into and does not constitute a part of this offering circular or any other reports or documents we file with or furnish to the Securities and Exchange Commission.

Summary Risk Factors

An investment in our Interests involves various risks. You should consider carefully the risks discussed below and under “Risk Factors” before purchasing our Interests. If any of the following risks occur, the business, financial condition or results of operations of each of our Series could be materially and adversely affected. In that case, the value of your Interests could decline, and you may lose some or all of your investment.

|

|

● |

We have no operating history, and there is no guarantee that we will be successful in the operation of the Company. |

|

|

● |

We are employing a novel business model, which may make an investment in our Interests difficult to evaluate as it is unique to the real estate industry. |

|

|

● |

We and the Manager may not be able to successfully operate our properties or generate sufficient operating cash flows to make or sustain distributions to the holders of our Interests. |

|

|

● |

We depend on the Manager for the success of each Series and upon access to Compound’s investment professionals and contractors. We may not find a suitable replacement for the Manager if removed, or if key personnel leave the employment of Compound or otherwise become unavailable to us. |

|

|

● |

The termination of the Manager is generally limited to cause and certain disposition events related to a Property, which may make it difficult or costly to end our relationship with the Manager in respect of a Series and a Property. |

|

|

● |

Potential conflicts of interest may arise among the Manager and its affiliates, on the one hand, and our Company and our Investors, on the other hand. |

|

|

● |

We may be unable to renew leases, lease vacant space or re-lease space on favorable terms or at all as the leases expire, which could materially and adversely affect a Series’ financial condition, results of operations and cash flow. |

|

|

● |

We may not be able to control a Series’ operating costs, or the Series’ expenses may remain constant or increase, even if income from a Property decreases, causing a Series’ results of operations to be adversely affected. |

4

|

|

● |

Our Investors do not elect or vote on our board of directors or the managing member of our Company and have limited ability to influence decisions regarding the businesses of the Series. |

|

|

● |

Interest Holders will have limited voting rights and will be bound by a majority vote. |

|

|

● |

We have not established a minimum distribution payment level for any Series and a Series may be unable to generate sufficient cash flows from its operations to make distributions to holders of Interests at any time in the future. |

|

|

● |

Failure of each Series to be classified as a separate entity for U.S. federal income tax purposes could adversely affect the timing, amount and character of distributions to a holder of Interests. |

|

|

● |

The failure of a Series to qualify as a REIT would subject it to U.S. federal income tax and applicable state and local taxes, which would reduce the amount of cash available for distribution to holders of our Interests. |

5

DRAFT OFFERING STATEMENT DATED NOVEMBER 15, 2019

FOR NON-PUBLIC SUBMISSION UNDER RULE 252(d)

| Securities being offered: | We are offering up to a maximum of 100,000 Series #Reach Interests, at a purchase price of $4.80 per Series #Reach Interest, for a maximum aggregate amount of $480,000. The Offering is being conducted on a “best efforts,” no offering minimum basis.

The Series #Reach Interests are intended to be a separate series of the Company for purposes of accounting for assets and liabilities. See “Description of the Securities Being Offered-Description of the Interests” for further details. The Series #Reach Interests will be non-voting except with respect to certain matters set forth in our limited liability company agreement, dated October 15, 2019, or the Operating Agreement. The purchase of the Series #Reach Interests is an investment only in Series #Reach of the Company and not an investment in our company as a whole. | |

| Offering price per Series #Reach Interest: | $4.80 | |

| Minimum and maximum subscription: | The minimum subscription by an Investor is twenty five (25) Series #Reach Interests and the maximum subscription by any investor is for Series #Reach Interests will be limited to 9.8% of the total Interests being offered for such Series, although such maximum thresholds may be waived by the Manager in its sole discretion. | |

| Broker: | We have entered into an agreement with North Capital, which is acting as our soliciting agent and executing broker in connection with this Offering. North Capital is a broker-dealer which is registered with the Commission and will be registered in each state where this offering will be made prior to the launch of this Offering and with such other regulators as may be required to execute the sale transactions and provide related services in connection with this Offering. North Capital is a member of the Financial Industry Regulatory Authority, Inc., or FINRA, and the Securities investor Protection Corporation, or SIPC. | |

| Restrictions on investment: | Each Investor must be a “qualified purchaser.” See “Plan of Distribution and Subscription Procedure—Investor Suitability Standards” for further details. The Manager may, in its sole discretion, decline to admit any prospective Investor, or accept only a portion of such Investor’s subscription, regardless of whether such person is a “qualified purchaser.” Furthermore, the Manager anticipates only accepting subscriptions from prospective Investors located in states where North Capital is registered.

Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(c) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov. | |

| Escrow account: | The subscription funds advanced by prospective Investors as part of the subscription process will be held in a non-interest bearing escrow account with North Capital, acting as the Escrow Agent, and will not be commingled with the operating account of Series #Reach, until if and when there is a Closing with respect to that Investor.

When the Escrow Agent has received instructions from the Manager that the offering will close and the Investor’s subscription is to be accepted (either in whole or part), the Escrow Agent shall disburse such Investor’s subscription proceeds in its possession to the account of Series #Reach.

If the Offering is terminated without a Closing, or if a prospective Investor’s subscription is not accepted or is cut back due to oversubscription or otherwise, such amounts placed into escrow by prospective Investors will be returned promptly to them without interest. Any costs and expenses associated with a terminated offering will be borne by the Manager. | |

| Offering period: | The initial Closing of the Offering will occur on the earliest to occur of (i) the date subscriptions for the maximum number of Series #Reach Interests have been accepted or (ii) a date determined by the Manager in its sole discretion. If the initial Closing has not occurred, the Offering shall be terminated upon (i) the date which is one year from the date this offering circular is qualified by the Commission, which period may be extended by an additional six months by the Manager in its sole discretion, or (ii) any date on which the Manager elects to terminate the offering in its sole discretion. | |

6

| Use of proceeds: | The proceeds received in the Offering will be applied in the following order of priority of payment:

● Brokerage Fee: A brokerage fee equal to 1% of the amount raised through this Offering. Notwithstanding the foregoing, North Capital will not receive any fee on funds raised from the sale of Series #Reach Interests to the Manager, its affiliates or the sellers of the Properties;

● Acquisition Cost of the Series #Reach Asset: Actual cost of the Series #Reach Property paid to the Seller;

● Offering Expenses: We will reimburse the Manager for Offering Expenses actually incurred in the Series #Reach Offering in an amount up to $10,000; and

● Acquisition Expenses: In general, these include all fees, costs and expenses incurred in connection with the evaluation, discovery, investigation, appraisal, development and acquisition of the Property related to a Series

The Manager will be responsible for all offering expenses on behalf of Series #Reach and will be reimbursed by the Series through the proceeds of the Series #Reach Offering for Offering Expenses actually incurred in an amount up to $10,000. The Series will be responsible for its Acquisition Costs which it will pay out of the proceeds of the Offering and will reimburse the Manager for such costs as well as for certain other costs. See “Use of Proceeds for Series #Reach,” “Management Compensation—Reimbursement of Expenses” and “Plan of Distribution and Subscription Procedure—Fees and Expenses” sections for further details. | |

| Risk factors: | Investing in the Series #Reach Interests involves risks. See the section entitled “Risk Factors” in this offering circular and other information included in this offering circular for a discussion of factors you should carefully consider before deciding to invest in the Series #Reach Interests. |

7

DRAFT OFFERING STATEMENT DATED NOVEMBER 15, 2019

FOR NON-PUBLIC SUBMISSION UNDER RULE 252(d)

An investment in our Interests involves risks. In addition to other information contained elsewhere in this offering circular, you should carefully consider the following risks before acquiring our Interests offered by this offering circular. The occurrence of any of the following risks could materially and adversely affect the business, prospects, financial condition or results of operations of our Company, the ability of our Company to make cash distributions to the holders of Interests and the market price of our Interests, which could cause you to lose all or some of your investment in our Interests. Some statements in this offering circular, including statements in the following risk factors, constitute forward-looking statements. See “Forward-Looking Statements.”

Risks relating to the structure, operation and performance of our Company

Both we and the Manager are newly formed entities with no prior operating history, which makes our future performance difficult to predict.

Both we and the Manager are newly formed entities and have no prior operating history. You should consider an investment in our Interests in light of the risks, uncertainties and difficulties frequently encountered by other newly formed companies with similar objectives. To be successful in this market, we and the Manager must, among other things:

|

● |

identify and acquire real estate assets consistent with our investment strategies; |

|

● |

increase awareness of our name within the investment products market; |

|

● |

attract, integrate, motivate and retain qualified personnel to manage our day-to-day operations; and |

|

● |

build and expand our operations structure to support our business. |

We have minimal operating capital and for the foreseeable future will be dependent upon our ability to finance our operations from the sale of equity or other financing alternatives. The failure to successfully raise operating capital, could result in our bankruptcy or other event which would have a material adverse effect on us and our Investors. There can be no assurance that we will achieve our investment objectives.

An investment in a Series Offering constitutes only an investment in that Series and not in the Company or directly in any Property.

An Investor in an Offering will acquire an ownership interest in the Series related to that Offering and not, for the avoidance of doubt, in (i) the Company, (ii) any other Series, (iii) the Manager, (iv) directly in a Property associated with the Series or any Property owned by any other Series. This results in limited voting rights of the Investor, which are solely related to a particular Series, and are further limited by the Operating Agreement, described further herein. Investors will have voting rights only with respect to certain matters, primarily relating to amendments to the Operating Agreement that would adversely change the rights of the Interest Holders and removal of the Manager for “cause.” The Manager thus retains significant control over the management of the Company, each Series and the Property. Furthermore, because the Interests in a Series do not constitute an investment in the Company as a whole, holders of the Interests in a Series are not expected to receive any economic benefit from, or be subject to the liabilities of, the assets of any other Series. In addition, the economic interest of a holder in a Series will not be identical to owning a direct undivided interest in a Property.

Each of our Company’s Series will hold an interest in a single property, a non-diversified investment.

We intend for each of our Series, through its subsidiaries, to own and operate a single Property. Each Series’ return on its investment will depend on the revenues generated by such Property and the appreciation of the value of the Property over time. These, in turn, are determined by such factors as national and local economic cycles and conditions, financial markets and the economy, competition from existing properties as well as future properties and government regulation (such as tax and building code charges). The value of a Property may decline substantially after a Series purchases its interest in it.

There is currently no public trading market for our securities.

There is currently no public trading market for our securities including our Interests, and an active market may not develop or be sustained. If an active public trading market for our securities does not develop or is not sustained, it may be difficult or impossible for you to resell your Interests at any price. Even if a public market does develop, the market price could decline below the amount you paid for your Interests.

There may be state law restrictions on an Investor’s ability to sell the Interests.

Each state has its own securities laws, often called “blue sky” laws, which (1) limit sales of securities to a state’s residents unless the securities are registered in that state or qualify for an exemption from registration and (2) govern the reporting requirements for broker-dealers and stockbrokers doing business directly or indirectly in the state. Before a security is sold in a state, there must be a registration in place to cover the transaction, or it must be exempt from registration. Also, North Capital must be registered in that state. We do not know whether our securities will be registered, or exempt, under the laws of any states. A determination regarding registration will be made by broker-dealers, if any, who agree to serve as the market-makers for our Interests. There may be significant state blue sky law restrictions on the ability of Investors to sell, and on purchasers to buy, our Interests. Investors should consider the resale market for our securities to be limited. Investors may be unable to resell their securities, or they may be unable to resell them without the significant expense of state registration or qualification.

8

We have no financial statements. Neither the Company nor any Series has any assets or liabilities.

The Company was recently formed in September 2019. At the time of this filing, the Company nor any of the Series have not commenced operations, are not capitalized and have no assets or liabilities and no Series will commence operations, be capitalized or have assets and liabilities until such time as a Closing related to such Series has occurred.

There can be no guarantee that the Company will reach its funding target from potential investors with respect to any Series or future proposed Series.

Due to the start-up nature of the Company and the Manager, there can be no guarantee that the Company will reach its funding target from potential investors with respect to any Series or future proposed Series. In the event the Company does not reach a funding target, it may not be able to achieve its investment objectives by acquiring additional properties through the issuance of further Series Interests and monetizing them to generate distributions for Investors. In addition, if the Company is unable to raise funding for additional Series, this may impact any Investors already holding Interests as they will not see the benefits which arise from economies of scale following the acquisition by other Series of additional Properties.

We may not be able to control our operating costs or our expenses may remain constant or increase, even if our revenues do not increase, causing our results of operations to be adversely affected.

Factors that may adversely affect our ability to control operating costs include the need to pay for insurance and other operating costs, including real estate taxes, which could increase over time, the need periodically to repair, renovate and re-lease space, the cost of compliance with governmental regulation, including zoning, environmental and tax laws, the potential for liability under applicable laws, interest rate levels, principal loan amounts and the availability of financing. If our operating costs increase as a result of any of the foregoing factors, our results of operations may be adversely affected.

The expense of owning and operating a property is not necessarily reduced when circumstances such as market factors and competition cause a reduction in income from a property. As a result, if revenues decline, we may not be able to reduce our expenses accordingly. Costs associated with real estate investments, such as real estate taxes, insurance, loan payments and maintenance, generally will not be reduced even if a property is not fully occupied or other circumstances cause our revenues to decrease. If we are unable to decrease operating costs when demand for our properties decreases and our revenues decline, our financial condition, results of operations and our ability to make distributions to our Investors may be adversely affected.

Competition could limit our ability to acquire attractive investment opportunities and increase the costs of those opportunities which may adversely affect us, including our profitability, and impede our growth

The real estate market is highly competitive. We will compete with other entities engaged in real estate investment activities to locate suitable properties to acquire and purchasers for our properties. These competitors will include REITs, private real estate funds, domestic and foreign financial institutions, life insurance companies, pension trusts, partnerships and individual investors. Some of these competitors have substantially greater marketing and financial resources than we will have and generally may be able to accept more risk than we can prudently manage, including risks with respect to the creditworthiness of tenants. In addition, these same entities seek financing through similar channels to our Company. This competition could increase prices for properties of the type we may pursue and adversely affect our profitability and impede our growth.

Competition may impede our ability to attract or retain tenants or re-lease space, which could adversely affect our results of operations and cash flow.

The leasing of residential real estate is highly competitive. We will compete based on a number of factors that include location, rental rates, security, suitability of a property’s design to prospective tenants’ needs and the manner in which a property is operated and marketed. The number of competing properties could have a material effect on our occupancy levels, rental rates and on the operating expenses of certain of our properties. If other lessors and developers of similar spaces in our markets offer leases at prices comparable to or less than the prices we offer on the properties we acquire, we may be unable to attract or retain tenants or re-lease space in our properties, which could adversely affect our results of operations and cash flow.

Investments we make will be consistent with our intention for each Series to qualify to be taxed as a REIT unless the Manager determines that not qualifying as a REIT is in the best interests of a Series.

We intend for each of the Series to elect and qualify to be taxed as a REIT for U.S. federal income tax purposes. REIT limitations restrict us from making investments that would cause less than 75% of the assets of a Series to be comprised of assets other than real estate assets, cash and cash items (including receivables) and certain governmental securities, all as defined in the Internal Revenue Code. In addition, in order to maintain our Series’ status as a REIT, we must meet certain income tests with respect to our gross income and certain additional tests with respect to our assets.

Subject to REIT limitations, a Series may invest in the equity interests of other issuers in connection with acquisitions of indirect interests in real estate. Such an investment would normally be in the form of a general or limited partnership or membership interests in special purpose partnerships and limited liability companies that own one or more properties.

9

We may fail to successfully operate acquired properties, which could adversely affect us and impede our growth.

The Manager’s ability to identify and acquire properties on favorable terms and successfully develop, redevelop and/or operate them may be exposed to significant risks. Agreements for the acquisition of properties are subject to customary conditions to closing, including completion of due diligence investigations and other conditions that are not within our control, which may not be satisfied. We may be unable to complete an acquisition after incurring certain acquisition-related costs. In addition, if mortgage debt is unavailable at reasonable rates, we may be unable to finance the acquisition on favorable terms in the time period we desire, or at all. We may also spend more than budgeted to make necessary improvements or renovations to acquired properties and may not be able to obtain adequate insurance coverage for new properties. Any delay or failure to identify, negotiate, finance and consummate such acquisitions in a timely manner and on favorable terms, or operate acquired properties to meet our financial expectations, could impede our growth and have an adverse effect on us, including our financial condition, results of operations, cash flow and the market value of our Interests.

Disruptions in the financial markets or deteriorating economic conditions could adversely impact the residential real estate market, which could hinder our ability to implement our business strategy and generate returns to you.

The success of our business is significantly related to general economic conditions and, accordingly, our business could be harmed by an economic slowdown and downturn in real estate asset values. Periods of economic slowdown or recession, significantly rising interest rates, declining employment levels, decreasing demand for real estate, declining real estate values, or the public perception that any of these events may occur, may result in a general decline in acquisition, disposition and leasing activity, as well as a general decline in the value of real estate and in rents, which in turn would reduce the value of our Interests.

During an economic downturn, it may also take longer for us to dispose of real estate investments or the selling prices may be lower than originally anticipated. As a result, the carrying value of our real estate investments may become impaired and we could record losses as a result of such impairment or we could experience reduced profitability related to declines in real estate values or rents. Further, as a result of our target leverage, our exposure to adverse general economic conditions will be heightened.

All the conditions described above could adversely impact our business performance and profitability, which could result in our failure to make distributions to our investors and could decrease the value of an investment in us. In addition, in an extreme deterioration of our business, we could have insufficient liquidity to meet our debt service obligations when they come due in future years. If we fail to meet our payment or other obligations under secured loans, the lenders will be entitled to proceed against the collateral granted to them to secure the debt owed.

You may be more likely to sustain a loss on your investment because the Manager does not have as strong an economic incentive to avoid losses as do managers who have made significant equity investments in their companies.

Because it has not made a significant equity investment in our Company, the Manager will have little exposure to loss in the value of a Series’ Interests. Without this exposure, our investors may be at a greater risk of loss because the Manager does not have as much to lose from a decrease in the value of our Interests as do those Managers who make more significant equity investments in their companies.

Any adverse changes in the Manager’s financial health or our relationship with the Manager or its affiliates could hinder our operating performance and the return on your investment.

The Manager will utilize the Manager’s personnel to perform services on its behalf for us. Our ability to achieve our investment objectives and to pay distributions to our Investors is dependent upon the performance of the Manager and its affiliates as well as the Manager’s real estate professionals in the identification and acquisition of investments, the management of our assets and operation of our day-to-day activities. Any adverse changes in the Manager’s financial condition or our relationship with the Manager could hinder the Manager’s ability to successfully manage our operations and our Properties.

Compliance with governmental laws, regulations and covenants that are applicable to our residential properties may adversely affect our business and growth strategies.

Residential rental properties are subject to various covenants, local laws and regulatory requirements, including permitting and licensing requirements. Local regulations, including municipal or local ordinances, zoning restrictions and restrictive covenants imposed by community developers, may restrict our use of our residential properties and may require us to obtain approval from local officials or community standards organizations at any time with respect to our residential properties, including prior to acquiring any of our residential properties or when undertaking renovations. Among other things, these restrictions may relate to fire and safety, seismic, asbestos-cleanup or hazardous material abatement requirements. We cannot assure you that existing regulatory policies will not adversely affect us or the timing or cost of any future acquisitions or renovations, or that additional regulations will not be adopted that would increase such delays or result in additional costs. Our business and growth strategies may be materially and adversely affected by our ability to obtain permits, licenses and zoning approvals. Our failure to obtain such permits, licenses and zoning approvals could have a material adverse effect on us and cause the value of our Interests to decline.

10

If the Company’s series limited liability company structure is not respected, then Investors may have to share any liabilities of the Company with all Investors and not just those who hold the same Series as them.

The Company is structured as a Delaware series limited liability company that issues Interests in a separate Series for each Property. Each Series will merely be a separate Series and not a separate legal entity. Under the Delaware Limited Liability Company Act (the “LLC Act”), if certain conditions (as set forth in Section 18-215(b) of the LLC Act) are met, the liability of Investors holding Interests in one Series is segregated from the liability of Investors holding Interests in another Series and the assets of one Series are not available to satisfy the liabilities of other Series. Although this limitation of liability is recognized by the courts of Delaware, there is no guarantee that if challenged in the courts of another U.S. State or a foreign jurisdiction, such courts will uphold a similar interpretation of Delaware corporation law, and in the past certain jurisdictions have not honored such interpretation. If the Company’s series limited liability company structure is not respected, then Investors may have to share any liabilities of the Company with all Investors and not just those who hold the same Series Interests as them. Furthermore, while we intend to maintain separate and distinct records for each Series and account for them separately and otherwise meet the requirements of the LLC Act, it is possible a court could conclude that the methods used did not satisfy Section 18-215(b) of the LLC Act and thus potentially expose the assets of a Series to the liabilities of another Series. The consequence of this is that Investors may have to bear higher than anticipated expenses which would adversely affect the value of their Interests or the likelihood of any distributions being made by a particular Series to its Investors. In addition, we are not aware of any court case that has tested the limitations on inter-series liability provided by Section 18-215(b) in federal bankruptcy courts and it is possible that a bankruptcy court could determine that the assets of one Series should be applied to meet the liabilities of the other Series or the liabilities of the Company generally where the assets of such other Series or of the Company generally are insufficient to meet our liabilities.

Risks Relating to the Offerings

We are offering our Interests pursuant to Tier 2 of Regulation A and we cannot be certain if the reduced disclosure requirements applicable to Tier 2 issuers will make our Interests less attractive to Investors as compared to a traditional initial public offering.

As a Tier 2 issuer, we are subject to scaled disclosure and reporting requirements which may make an investment in our Interests less attractive to Investors who are accustomed to enhanced disclosure and more frequent financial reporting. The differences between disclosures for Tier 2 issuers versus those for emerging growth companies include, without limitation, only needing to file final semiannual reports as opposed to quarterly reports and far fewer circumstances where a current disclosure would be required. In addition, given the relative lack of regulatory precedent regarding the recent amendments to Regulation A, there is some regulatory uncertainty in regard to how the Commission or the individual state securities regulators will regulate both the offer and sale of our securities, as well as any ongoing compliance that we may be subject to. For example, a number of states have yet to determine the types of filings and amount of fees that are required for such an offering. If our scaled disclosure and reporting requirements, or regulatory uncertainty regarding Regulation A, reduces the attractiveness of the Interests, we may be unable to raise the funds necessary to fund future offerings, which could impair our ability to offer a diversified portfolio of properties and create economies of scale, which may adversely affect the value of the Interests or the ability to make distributions to Investors.

There may be deficiencies with our internal controls that require improvements, and if we are unable to adequately evaluate internal controls, we may be subject to sanctions.

As a Tier 2 issuer, we will not need to provide a report on the effectiveness of our internal controls over financial reporting, and we will be exempt from the auditor attestation requirements concerning any such report so long as we are a Tier 2 issuer. We are in the process of evaluating whether our internal control procedures are effective and therefore there is a greater likelihood of undiscovered errors in our internal controls or reported financial statements as compared to issuers that have conducted such evaluations.

If we are required to register under the Exchange Act, it would result in significant expense and reporting requirements that would place a burden on the Manager and may divert attention from management of the Properties by the Manager or could cause the Manager to no longer be able to afford to run our business.

The Exchange Act requires issuers with more than $10 million in total assets to register its equity securities under the Exchange Act if its securities are held of record by more than 2,000 persons or 500 persons who are not “accredited investors.” While the Operating Agreement presently prohibits any transfer that would result in any Series being held of record by more than 2,000 persons or 500 non-”accredited investors,” there can be no guarantee that we will not exceed those limits and the Manager has the ability to unilaterally amend the Operating Agreement to permit holdings that exceed those limits. Series may have more than 2,000 total Interests, which would make it more likely that there accidentally would be greater than 2,000 beneficial owners of or 500 non- “accredited investors” in that Series. If we are required to register under the Exchange Act, it would result in significant expense and reporting requirements that would place a burden on the Manager and may divert attention from management of the Properties by the Manager or could cause the Manager to no longer be able to afford to run our business.

If the Company were to be required to register under the Investment Company Act or the Manager were to be required to register under the Investment Advisers Act, it could have a material and adverse impact on the results of operations and expenses of each Series and the Manager may be forced to liquidate and wind up each Series or rescind the Offerings for any of the Series or the offering for any other.

The Company is not registered and will not be registered as an investment company under the Investment Company Act of 1940, as amended (the “Investment Company Act”), and the Manager is not and will not be registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Investment Advisers Act”) and the Interests do not have the benefit of the protections of the Investment Company Act or the Investment Advisers Act. The Company, the Manager has taken the position that the Properties are not “securities” within the meaning of the Investment Company Act or the Investment Advisers Act, and thus the Company’s assets will consist of less than 40% investment securities under the Investment Company Act and the Manager is not and will not be advising with respect to securities under the Investment Advisers Act. This position, however, is based upon applicable case law that is inherently subject to judgments and interpretation. If the Company were to be required to register under the Investment Company Act or the Manager were to be required to register under the Investment Advisers Act, it could have a material and adverse impact on the results of operations and expenses of each Series and the Manager may be forced to liquidate and wind up each Series or rescind the Offerings for any of the Series or the offering for any other Series.

11

Possible Changes in Federal Tax Laws.

The Code is subject to change by Congress, and interpretations of the Code may be modified or affected by judicial decisions, by the Treasury Department through changes in regulations and by the Internal Revenue Service through its audit policy, announcements, and published and private rulings. Although significant changes to the tax laws historically have been given prospective application, no assurance can be given that any changes made in the tax law affecting an investment in any Series of the Company would be limited to prospective effect. For instance, prior to effectiveness of the Tax Cuts and Jobs Act of 2017, an exchange of the Interests of one Series for another might have been a non-taxable ‘like-kind exchange’ transaction, while transactions now only qualify for that treatment with respect to real property. Accordingly, the ultimate effect on an Investor’s tax situation may be governed by laws, regulations or interpretations of laws or regulations which have not yet been proposed, passed or made, as the case may be.

Risks Related to Conflicts of Interest

We are dependent on the Manager and its affiliates and their key personnel who provide services to us through the Operating Agreement, and we may not find a suitable replacement if the Operating Agreement is terminated, or if key personnel leave or otherwise become unavailable to us, which could have a material adverse effect on our performance.

We do not expect to have any employees and we are completely reliant on the Manager to provide us with investment and advisory services. We expect to benefit from the personnel, relationships and experience of the Manager’s executive team and other personnel and investors of Compound and expect to benefit from the same highly experienced personnel and resources we need for the implementation and execution of our investment strategy. Each of our executive officers will also serve as an officer of Compound. The Manager will have significant discretion as to the implementation of our investment and operating policies and strategies. Accordingly, we believe that our success will depend to a significant extent upon the efforts, experience, diligence, skill and relationships of the executive officers and key personnel of the Manager. The executive officers and key personnel of the Manager will evaluate, negotiate, close and monitor our Properties. Our success will depend on their continued service.

In addition, we offer no assurance that the Manager will remain the Manager or that we will continue to have access to the Manager’s principals and professionals. If the Operating Agreement is terminated and no suitable replacement is found to manage us, our ability to execute our business plan will be negatively impacted.

The ability of the Manager and its officers and other personnel to engage in other business activities, including managing other similar companies, may reduce the time the Manager spends managing the business of our Company and may result in certain conflicts of interest.

Certain of the Manager’s officers also serve or may serve as officers or employees of Compound Asset Management, Inc., as well as other Compound Asset-sponsored vehicles, and other companies unaffiliated with Compound. These other business activities may reduce the time these persons spend managing our business. Further, if and when there are turbulent conditions in the real estate markets or distress in the credit markets or other times when we will need focused support and assistance from the Manager, the attention of the Manager’s personnel and our executive officers and the resources of Compound may also be required by the Compound-sponsored vehicles. In such situations, we may not receive the level of support and assistance that we may receive if we were internally managed or if we were not managed by the Manager. In addition, these persons may have obligations to those entities, the fulfillment of which might not be in the best interests of us, or any of our Investors. Our officers and the Manager may face conflicts of interest in allocating sale, financing, leasing and other business opportunities among the real properties owned by the companies.

The terms of the Operating Agreement make it so that it may adversely affect our inclination to end our relationship with the Manager.

Under the terms of the Operating Agreement, we may terminate the Manger for “cause” following an affirmative vote of two-thirds of the Company’s Investors. The term “cause” is limited to those circumstances described under “The Manager and the Operating Agreement-Term and Removal of the Manager” which include certain material breaches, certain acts constituting fraud, misappropriation of funds, embezzlement and gross negligence, certain bankruptcy matters and the dissolution of the Manager. Unsatisfactory financial performance does not constitute “cause” under the Operating Agreement. These provisions make it difficult to end the Company’s relationship with the Manager, even if we believe the Manager’s performance is not satisfactory.

12

The Operating Agreement contains provisions that reduce or eliminate duties (including fiduciary duties) of the Manager.

The Operating Agreement provides that Compound Asset Management, LLC, the Manager, in exercising its rights in its capacity as the Manager, will be entitled to consider only such interests and factors as it desires, including its own interests, and will have no duty or obligation (fiduciary or otherwise) to give any consideration to any interest of or factors affecting us or any of our Investors and will not be subject to any different standards imposed by our bylaws, or under any other law, rule or regulation or in equity. These modifications of fiduciary duties are expressly permitted by Delaware law.

There are conflicts of interest among us, the Manager and its affiliates.

Each of our executive officers is an executive officer of the Manager, which is wholly owned by Compound. All the agreements and arrangements between such parties, including those relating to compensation, are not the result of arm’s-length negotiations. Some of the conflicts inherent in the Company’s transactions with the Manager and its affiliates, and the limitations on such parties adopted to address these conflicts, are described below. The Manager and its affiliates will try to balance our interests with their own. However, to the extent that such parties take actions that are more favorable to other entities than us, these actions could have a negative impact on our financial performance and, consequently, on distributions to Investors and the value of our Interests.

The Operating Agreement provides the Manager with broad powers and authority which may exacerbate the existing conflicts of interest among your interests and those of the Manager, its executive officers and its other affiliates. Potential conflicts of interest include, but are not limited to, the following:

|

● |

the Manager, its executive officers and its other affiliates may continue to offer other real estate investment opportunities, including other blind pool equity offerings similar to this offering, and may make investments in real estate assets for their own respective accounts, whether or not competitive with our business; |

|

● |

the Manager, its executive officers and its other affiliates will not be required to disgorge any profits or fees or other compensation they may receive from any other business they own separately from us, and you will not be entitled to receive or share in any of the profits or fees or other compensation from any other business owned and operated by the Manager, its executive officers and/or its other affiliates for their own benefit; |

|

● |

we may engage the Manager or affiliates of the Manager to perform services at prevailing market rates. Prevailing market rates are determined by the Manager based on industry standards and expectations of what the Manager would be able to negotiate with third party on an arm’s length basis; and |

|

● |

the Manager, its executive officers and its other affiliates are not required to devote all of their time and efforts to our affairs. |

We do not have a policy that expressly prohibits our directors, officers, security holders or affiliates from having a direct or indirect pecuniary interest in any transaction to which we or any of our subsidiaries has an interest or engaging for their own account in business activities of the types conducted by us.

We do not have a policy that expressly prohibits our directors, officers, security holders or affiliates from having a direct or indirect pecuniary interest in any asset to be acquired or disposed of by us or any of our subsidiaries or in any transaction to which we or any of our subsidiaries are a party or have an interest. Nor do we have a policy that expressly prohibits any such persons from engaging for their own account in business activities of the types conducted by us. However, our code of business conduct and ethics contains a conflict of interest policy that prohibits our directors, officers and employees from engaging in any transaction that involves an actual or apparent conflict of interest with us. In addition, our management agreement with the Manager does not prevent the Manager and its affiliates from engaging in additional management or investment opportunities, some of which could compete with us.

The Manager’s liability is limited under the Operating Agreement, and we have agreed to indemnify the Manager against certain liabilities. As a result, we may experience poor performance or losses of which the Manager would not be liable.

Pursuant to the Company’s Operating Agreement, the Manager will not assume any responsibility other than to render the services called for thereunder and not will be responsible for any action of our board of directors in following or declining to follow its advice or recommendations. maintains a contractual, as opposed to a fiduciary, relationship with us and our Investors. Under the terms of the Operating Agreement, the Manager, its officers, investors, members, managers, directors and personnel, any person controlling or controlled by the Manager and any person providing sub-advisory services to the Manager will not be liable to us, any subsidiary of ours, our board of directors, or our Investors, members or partners or any subsidiary’s Investors, members or partners for acts or omissions performed in accordance with and pursuant to the Operating Agreement, except by reason of acts or omissions constituting bad faith, willful misconduct, gross negligence, or reckless disregard of their duties under Accordingly, we and our Investors will only have recourse and be able to seek remedies against the Manager to the extent it breaches its obligations pursuant to the Operating Agreement. Furthermore, we have agreed to limit the liability of the Manager and to indemnify the Manager against certain liabilities. We have agreed to reimburse, indemnify and hold harmless the Manager, its officers, investors, members, managers, directors and personnel, any person controlling or controlled by the Manager and any person providing sub-advisory services to the Manager with respect to all expenses, losses, damages, liabilities, demands, charges and claims in respect of, or arising from, acts or omissions of such indemnified parties not constituting bad faith, willful misconduct, gross negligence, or reckless disregard of the Manager’s duties, which has a material adverse effect on us. In addition, we may choose not to enforce, or to enforce less vigorously, our rights under the Operating Agreement because of our desire to maintain our ongoing relationship with the Manager.

13

The Manager may realize substantial compensation.

A transaction involving the purchase of any investment by us may result in the realization by the Manager of compensation. The Manager has discretion with respect to decisions relating to transactions. Compensation based on the purchase price of our assets may create an incentive for the Manager to use more leverage to grow our asset base, even if the use of leverage would be detrimental to our operating results.

In addition, potential conflicts may also arise in connection with a decision by the Manager (on our behalf) of whether to seek to (a) sell the Company or (b) approve a merger (including in the case of both (a) or (b), in a transaction involving an entity affiliated with or sponsored or managed by Compound of its affiliates). The Manager may be motivated to delay, or not to consummate, a sale or merger transaction, even if such transaction were in our best interest, in order to continue receiving asset management fees.

Risks Related to Real Estate Investments Generally

Our real estate assets will be subject to the risks typically associated with real estate.

Our real estate assets will be subject to the risks typically associated with real estate. The value of real estate may be adversely affected by a number of risks, including:

|

● |

natural disasters such as hurricanes, earthquakes and floods; |

|

● |

acts of war or terrorism, including the consequences of terrorist attacks; |

|

● |

adverse changes in national and local economic and real estate conditions; |

|

● |

an oversupply of (or a reduction in demand for) space in the areas where particular properties are located and the attractiveness of particular properties to prospective tenants; |

|

● |

changes in governmental laws and regulations, fiscal policies and zoning ordinances and the related costs of compliance therewith and the potential for liability under applicable laws; |

|

● |

costs of remediation and liabilities associated with environmental conditions affecting properties; and; |

|

● |

the potential for uninsured or underinsured property losses. |

The value of each Property is affected significantly by its ability to generate cash flow and net income, which in turn depends on the amount of rental or other income that can be generated net of expenses required to be incurred with respect to a Property. Many expenditures associated with a Property (such as operating expenses and capital expenditures) cannot be reduced when there is a reduction in income from the Property.

These factors may have a material adverse effect on the value that we can realize from our assets.

Many factors impact the residential rental market, and if rents do not increase sufficiently to keep pace with rising costs of operations, our income and distributable cash will decline.

The success of our business model depends, in part, on conditions in the residential rental market. Our acquisitions will be premised on assumptions about occupancy levels and rental rates, and if those assumptions prove to be inaccurate, our cash flows and profitability will be reduced.

We anticipate involvement in a variety of litigation.