PRELIMINARY OFFERING CIRCULAR

DATED DECEMBER 13, 2019

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF ANY SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

COMMONWEALTH THOROUGHBREDS LLC

1450 North Broadway, Lexington, Kentucky 40505

Telephone: (859) 977-0124

Website: www.joincommonwealth.com

|

Series Membership Units Overview |

|||||

|

Price to Public |

Underwriting Discounts and Commissions (1)(2) |

Proceeds to Issuer |

Proceeds to Other Persons |

||

|

|

|||||

|

Series TF2019 |

Per Unit |

$50.00 |

$0 |

$50.00 |

$0 |

|

Total Minimum |

$125,000 |

$0 |

$125,000 |

$0 |

|

|

Total Maximum |

$150,000 |

$0 |

$150,000 |

$0 |

|

|

Series OL2018 |

Per Unit |

$50.00 |

$0 |

$50.00 |

$0 |

|

Total Minimum |

$110,000 |

$0 |

$110,000 |

$0 |

|

|

Total Maximum |

$125,000 |

$0 |

$125,000 |

$0 |

|

|

(1) |

North Capital Private Securities Corporation (“North Capital”) will be acting as an executing broker and entitled to a Brokerage Fee equal to 1% of the offering proceeds, as described in greater detail under “Plan of Distribution and Subscription Procedure – Broker” and “Fees and Expenses.” |

| (2) | No underwriter has been engaged in connection with the Offering (as defined below), and neither North Capital nor any other entity receives a finder’s fee or any underwriting or placement agent discounts or commissions in relation to any offering of our units of membership interest. We intend to distribute units of membership interest of any of our series principally through the Commonwealth Platform, as described in greater detail under “Plan of Distribution and Subscription Procedure.” |

Commonwealth Thoroughbreds LLC, a Delaware series limited liability company (“we,” “us,” “our,” “Commonwealth Thoroughbreds” or the “Company”) is offering, on a best efforts basis, units of membership interest of each of the following series of the Company:

|

● |

a minimum of 2,500 units and a maximum of 3,000 units of Series TF2019 (the “Series TF2019 Units”, the offering of which is described as the “Series TF2019 Offering”), and |

|

● |

a minimum of 2,200 units and a maximum of 2,500 units of Series OL2018 (the “Series OL2018 Units”, the offering of which is described as the “Series OL2018 Offering”). |

We may refer to the Company’s series offered hereunder collectively as the “Series” and each individually as a “Series.” Likewise, we may refer to the units of membership interests of all the series described above collectively as the “Units” and each, individually, as a “Unit”, and we may refer to the offerings of the Units collectively as the “offerings” and each, individually, as an “offering”.

The Company is managed by Commonwealth Markets Inc., a Delaware corporation, which we refer to in this Offering Circular as the “Manager.”

The sale of Units is being facilitated by North Capital, a broker-dealer registered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and member of FINRA, and is registered in each state where the offer or sales of the Units will occur. We may also refer to North Capital as the “Broker.” The Company is not offering, and does not anticipate selling, Units in any state where North Capital is not registered as a broker-dealer. For the avoidance of doubt, North Capital does not and will not solicit purchases of Units or make any recommendations regarding the Units to prospective investors.

Units of each Series are available for purchase exclusively through the Commonwealth Platform and will be issued in book-entry electronic form only. ClearTrust LLC has been engaged as the Company’s SEC-registered transfer agent and registrar of the Units pursuant to Section 17A(c) of the Exchange Act.

Sale of the Units of each Series will begin upon qualification of this Offering Circular, and Units of each Series will be sold to no more than 2,000 qualified purchasers (no more than 500 of whom cannot be “accredited investors”). In this Offering Circular, we refer to a purchaser of the Units as an “Investor” or as a “Unit Holder.”

There will be a separate closing with respect to each Offering (each, a “Closing”). The Closing of an Offering will take place on the earliest to occur of (i) the date subscriptions for the maximum Units of a Series have been accepted or (ii) a date determined by the Manager of the Company in its sole discretion, provided that subscriptions for the minimum Units have been accepted. If Closing has not occurred, the Offering will terminate on (i) the date one year after the date this Offering Circular, or an Amendment to it, is qualified by the U.S. Securities and Exchange Commission (the “SEC”), which period may be extended by an additional six months by the Manager in its sole discretion, or (ii) any date on which the Manager elects to terminate the offering in its sole discretion. Any subscription funds advanced by a prospective Investor as part of the subscription process will be held in a non-interest-bearing escrow account with North Capital and will not be commingled with the operating account of the Series, until, if and when there is a Closing with respect to that Investor. See “Plan of Distribution and Subscription Procedure” and “Description of Units Offered” for additional information.

This Offering is being conducted under Regulation A (17 CFR 230.251 et. seq.) and the information contained herein is being presented in Offering Circular format. In general, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(c) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov. The information contained on our Internet website, or any other Internet site described herein, is not a part of, and is not incorporated or deemed to be incorporated by reference into this Offering Circular.

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. The Units are offered pursuant to an exemption from registration with the SEC; however, the SEC has not made an independent determination that the Units are exempt from registration. This Offering Circular does not constitute an offer to sell or the solicitation of an offer to buy, nor may there be any sales of these securities in, any state in which such offer, solicitation or sale would be unlawful before registration or qualification of the offer and sale under the laws of that state.

An investment in the Units involves a high degree of risk. See “Risk Factors” on Page 17 for a description of some of the risks that you should consider before investing in the Units.

TABLE OF CONTENTS

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS |

6 |

|

GLOSSARY |

7 |

|

OFFERING SUMMARY |

10 |

|

RISK FACTORS |

19 |

|

Risks Related to the Structure, Operation and Performance of the Company |

19 |

|

Risks Related to the Thoroughbred Industry |

26 |

|

Risks Related to the Offering |

30 |

|

Risks Related to Ownership of our Units |

33 |

|

POTENTIAL CONFLICTS OF INTEREST |

35 |

|

DILUTION |

39 |

|

USE OF PROCEEDS – SERIES TF2019 |

40 |

|

USE OF PROCEEDS – SERIES OL2018 |

42 |

|

DESCRIPTION OF THE TIMIDO FILLY |

44 |

|

Information About the Timido Filly |

44 |

|

Pedigree |

44 |

|

Initial Appraisal |

44 |

|

Boarding Arrangements; Development Timetable |

44 |

|

DESCRIPTION OF THE ORB COLT |

45 |

|

Information About the Orb Colt |

45 |

|

Pedigree |

45 |

|

Initial Appraisal |

45 |

|

Boarding Arrangements; Development Timetable |

45 |

|

PLAN OF DISTRIBUTION AND SUBSCRIPTION PROCEDURE |

46 |

|

Plan of Distribution |

46 |

|

Minimum and Maximum Investment |

47 |

|

Investor Eligibility Standards |

47 |

|

Eligibility for Registration as a Racehorse Owner |

48 |

|

Broker |

49 |

|

Escrow Agent |

49 |

|

Additional Information Regarding this Offering Circular |

50 |

|

How to Subscribe |

50 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

52 |

|

Operating Results |

52 |

|

Liquidity and Capital Resources |

53 |

|

Plan of Operations |

53 |

|

Trend Information |

53 |

|

DESCRIPTION OF THE BUSINESS |

54 |

|

Overview |

54 |

|

Business of the Company |

54 |

|

The Commonwealth Platform |

55 |

|

The Manager |

56 |

|

Advisory Board |

57 |

|

Asset Selection and Acquisition |

58 |

|

Training and Boarding |

59 |

|

Racing |

60 |

|

Sale of Assets |

60 |

|

Breeding Activities |

60 |

|

Insurance |

61 |

|

Operating Expenses |

61 |

|

Allocation of Revenue and Expense |

62 |

|

Oversight and Governance |

62 |

|

Indemnification of the Manager |

62 |

|

Description of the Management Services Agreement |

63 |

|

Management Fee |

63 |

|

Legal Proceedings |

64 |

|

THOROUGHBRED INDUSTRY |

64 |

|

Introduction |

64 |

|

Breeding |

64 |

|

Thoroughbred Sales at Public Auction |

65 |

|

Weanling Auctions |

65 |

|

Yearling Auctions |

65 |

|

Two-Year-Old Auctions |

66 |

|

Broodmare Auctions |

67 |

|

Private Sales |

67 |

|

Marketplace and Competition |

67 |

|

Racing |

67 |

|

Wagering and Purses |

68 |

|

Stallion Share/Stallion Ownership |

70 |

|

Industry Organizations |

71 |

|

Racetrack Industry |

72 |

|

Supervision and Regulation |

73 |

|

Sales Practices |

74 |

|

FEES AND EXPENSES |

75 |

|

Offering Expenses |

75 |

|

Acquisition Expenses |

75 |

|

Brokerage Fee |

75 |

|

Sourcing Fee |

76 |

|

Organizational Fee |

76 |

|

Management Fee |

76 |

|

Advisory Board Compensation |

76 |

|

MANAGEMENT |

77 |

|

Manager |

77 |

|

Executive Officers, Directors and Key Employees |

79 |

|

Advisory Board |

80 |

|

COMPENSATION |

81 |

|

Compensation of Executive Officers |

81 |

|

Compensation of Manager |

81 |

|

PRINCIPAL INTEREST HOLDERS |

82 |

|

DESCRIPTION OF THE UNITS OFFERED |

83 |

|

Description of the Units |

83 |

|

Further Issuance of Units |

85 |

|

Distribution rights |

85 |

|

Redemption provisions |

86 |

|

Registration rights |

86 |

|

Voting rights |

86 |

|

Liquidation rights |

88 |

|

Transfer restrictions |

88 |

|

Agreement to be Bound by the Operating Agreement; Power of Attorney |

89 |

|

Duties of officers |

89 |

|

Books and reports |

89 |

|

Exclusive jurisdiction; waiver of jury trial |

90 |

|

Listing |

90 |

|

MATERIAL UNITED STATES TAX CONSIDERATIONS |

91 |

|

Definitions |

91 |

|

Taxation of each Series of Units as a “C” Corporation |

92 |

|

Taxation of Distributions to Investors |

92 |

|

Taxation of Dispositions of Units |

92 |

|

Backup Withholding and Information Reporting |

93 |

|

WHERE TO FIND ADDITIONAL INFORMATION |

94 |

|

INDEX TO FINANCIAL STATEMENTS |

F-1 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this Offering Circular includes some statements that are not historical and that are considered “forward-looking statements.” Such forward-looking statements include, but are not limited to, statements regarding our development plans for our business; our strategies and business outlook; anticipated development of the Company, the Manager, each series of the Company and the Commonwealth Platform (defined below); and various other matters (including contingent liabilities and obligations and changes in accounting policies, standards and interpretations). These forward-looking statements express the Manager’s expectations, hopes, beliefs, and intentions regarding the future. In addition, without limiting the foregoing, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” and similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Offering Circular are based on current expectations and beliefs concerning future developments that are difficult to predict. Neither the Company nor the Manager can guarantee future performance, or that future developments affecting the Company, the Manager or the Commonwealth Platform will be as currently anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

All forward-looking statements attributable to us are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties, along with others, are also described below under the heading “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of the parties’ assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

GLOSSARY

|

broodmare |

a female Thoroughbred in foal or previously used for breeding |

|

|

champion |

In the United States, the recipient of an Eclipse Award as the horse voted best of its division in a given year by the members of the Daily Racing Form, Thoroughbred Racing Association, and National Turf Writers Association. In other countries, a champion is either voted upon in a similar fashion or top-weighted on a published year-end handicap list |

|

|

classic winner |

a Thoroughbred winner of one of the classic races (the Kentucky Derby, the Preakness and Belmont Stakes in the United States) run by three-year old horses |

|

|

colt |

a male thoroughbred (other than a gelding) under 5 years of age |

|

|

conformation |

the symmetrical relationship between the physical attributes of a Thoroughbred; its physical appearance and structural makeup |

|

|

dam |

the female parent of a Thoroughbred |

|

|

filly |

female Thoroughbred under 5 years of age which has not been bred |

|

|

foal |

the young offspring of a Thoroughbred, usually a Thoroughbred under 1 year of age |

|

|

gelding |

a castrated Thoroughbred |

|

|

graded stakes race |

a stakes race which is evaluated, or graded, by a panel of racing authorities (the American Grades Stakes Committee of the Thoroughbred Owners and Breeders Association (TOBA)) and is assigned Grade I, II, or III status based upon an evaluation of the quality of the prior participants in the stakes, the amount of added money contributed to the purse by the racetrack, and the overall prestige of the race |

|

|

half-brother (or -sister) |

the get of the same dam but not the same sire; the term does not apply equally to Thoroughbreds with only the same sire |

|

|

in foal |

refers to a pregnant broodmare |

|

|

juvenile |

a two-year-old Thoroughbred |

|

|

mare |

a female Thoroughbred 5 years of age or over |

|

|

multiple graded stakes winner |

a Thoroughbred winner of more than one graded stakes race |

|

|

multiple stakes winner |

a Thoroughbred winner of more than one stakes race, whether graded or ungraded |

|

pari-mutuel wagering |

a system of legalized betting on races whereby the holders of winning tickets divide the total amount bet (by pools such as win, place, show, exacta, trifecta, pick three, daily double, etc.) less the set deductions (“take out”) for purses and the track conducting the live race, each in proportion to the sums wagered by the winning ticket holders |

|

|

pinhooking |

buying weanlings or yearlings for resale as yearlings or two-year olds |

|

|

purses |

the amount of money offered as an incentive to the entrants in a race as the prize or earnings, distributed in proportion to the placing of the horses, usually 60% to the winner, 20% to the second place finisher, 10% to the third place finisher, 5% to the fourth place finisher, etc. |

|

|

select sale |

a public auction of Thoroughbreds with certain conformation and pedigree restrictions, in contrast to an open sale where the requirements are proper nomination and payment of an entry fee |

|

|

sire |

a stallion which has produced a foal |

|

|

stakes placed |

under the rules of the International Cataloguing Standards Committee (ICSC), a Thoroughbred which has finished second or third in a stakes race, either graded or ungraded. |

|

|

stakes race |

the highest class of race in any racing jurisdiction; a race in which an entry fee is paid by the owners of the Thoroughbreds starting and those entry fees are added to the purse; often all such entry fees are paid to the winner (entry fees are not required for any other type of race); also, invitational races (no entry fee required) with a large purse (usually $50,000 or more) are regarded as stakes races |

|

|

stakes winner |

a Thoroughbred winner of a stakes race, whether graded or ungraded |

|

|

stallion |

a male Thoroughbred which has not been castrated; usually used in reference to a retired racehorse which is or will be used for breeding |

|

|

stallion season |

the right to breed one broodmare to a particular stallion for the purpose of producing one foal during a particular season, sometimes referred to as a “breeding season,” which does not include an ownership interest in the stallion |

|

|

stallion share |

an undivided fractional interest in a stallion, which customarily entitles the owner to breed at least one broodmare with the stallion each year for the useful life of the stallion, plus an occasional extra season, depending on the syndication agreement; syndication agreements usually provide for 40 to 60 shares and frequently provide 4 to 10 breeding rights to the syndicate manager or farm where the stallion stands and 1 breeding right to the stallion’s trainer; a “lifetime breeding right” is similar to a stallion share, but does not include an ownership interest in the stallion; the owner of a lifetime breeding right is not entitled to bonus seasons or bonus distributions, nor is the owner obligated to assume any liabilities associated with the care of the stallion |

|

|

suckling foal |

a newborn foal still nursing from its mother |

|

under tack |

When a horse is fitted with a bridle and saddle it is “tacked up” or “under tack,” and can be ridden, exercised, trained, or raced. |

|

|

weanling |

a Thoroughbred before its first birthday on the January 1 following its birth (the universal birthday for all Thoroughbred horses) but after it is no longer a suckling foal and has been removed (or “weaned”) from its mother |

|

|

yearling |

a Thoroughbred between the first New Year’s Day after being foaled and the following January 1 |

OFFERING SUMMARY

The following summary is qualified in its entirety by the more detailed information appearing elsewhere in this Offering Circular and in the Exhibits to it. You should read the entire Offering Circular and carefully consider, among other things, the matters set forth in the “Risk Factors” section. We encourage you to seek the advice of your attorney, tax consultant, and business advisor with respect to the legal, tax, and business aspects of an investment in the Units. All references in this Offering Circular to “$” or “dollars” are to United States dollars. Certain terms relating to the Thoroughbred industry are defined in the Glossary immediately preceding this Offering Summary section.

|

The Company: |

Commonwealth Thoroughbreds LLC, a Delaware series limited liability company formed June 12, 2019. |

|

Series Asset: |

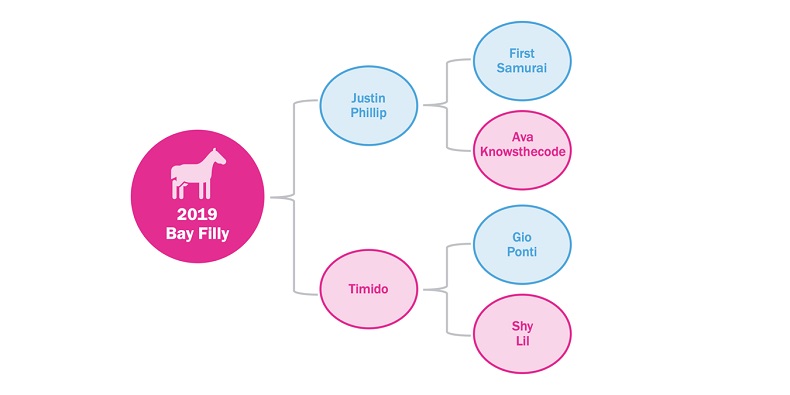

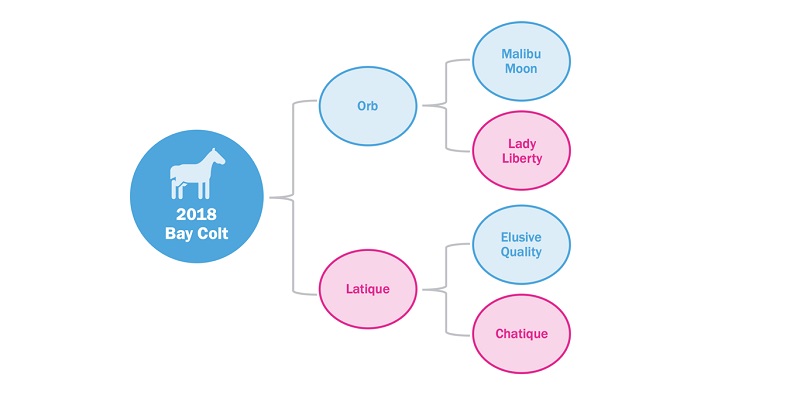

● Series TF2019 will own a 100% interest in a filly born in April 2019 by Justin Phillip out of Timido by Gio Ponti, which we refer to as the “Timido Filly.” ● Series OL2018 will own a 75% interest in a yearling colt by Orb out of Latique by Elusive Quality, which we refer to as the “Orb Colt.”

See “Description of the Timido Filly” and “Description of the Orb Colt” for further details. |

|

We may refer to the interests in a Thoroughbred owned by a Series as the “Series Asset” or alternatively as its “Thoroughbred Asset.”

We do not anticipate that any Series would own any assets other than the interests in the Thoroughbreds described in this Offering Circular, plus cash reserves for boarding, training, insurance and other expenses related to those Thoroughbreds and amounts earned by the Series from racing and breeding activities. We do not intend to add any Thoroughbred assets to any Series once the Offering of that Series has closed. |

|

|

Securities Offered: |

Investors will acquire units of membership interest in a Series of the Company, each of which is intended to be a separate series of the Company for purposes of assets and liabilities. See “Description of Units Offered” for further details. The purchase of membership units in a Series of the Company is an investment only in that one Series and not an investment in the Company as a whole. |

|

The Units will have voting rights only with respect to specific matters set forth in the Amended and Restated Limited Liability Company Agreement of the Company (the “Operating Agreement”). Those matters are: ● the for-cause removal of the Manager; ● the dissolution of the Company upon the for-cause removal of the Manager, and ● an amendment to the Operating Agreement that would: o enlarge the obligations of, or adversely affect, an interest holder in any material respect;

|

|

o reduce the voting percentage required for any action to be taken by the holders of units in the Company under the Operating Agreement; o change the situations in which the Company and any series can be dissolved or terminated; o change the term of the Company (other than the circumstances provided in the Operating Agreement); or o give any person the right to dissolve the Company.

In addition, the holders of a majority of the units of an individual series must approve any amendment to the Operating Agreement that would adversely change the rights of the units of the series, result in mergers, consolidations or conversions of the units of the series and for any other matter that the Manager, in its sole discretion, determines will require the approval of the holders of the units of the series voting as a separate class.

See “Description of the Units Offered – Voting Rights” for further information. |

|

|

Investors: |

Each Investor must be a “qualified purchaser” as defined by Regulation A and must also be eligible to own racehorses under the applicable rules of state racing commissions. See “Plan of Distribution and Subscription Procedure – Investor Eligibility Standards” for further details. |

|

The Manager may, in its sole discretion, decline to admit any prospective Investor, or accept only a portion of such Investor’s subscription, regardless of whether such person is a “qualified purchaser.” Furthermore, the Manager anticipates only accepting subscriptions from prospective Investors located in states where the Broker is registered. |

|

|

The Manager: |

Commonwealth Markets Inc., a Delaware corporation, is the manager of the Company and the managing member of each series of the Company’s membership units, including Series TF2019 and Series OL2018. |

|

Commonwealth Markets Inc. also owns and operates a mobile app-based investment platform called the Commonwealth Platform through which the Units in the Company’s series are sold. See “Description of the Business – The Commonwealth Platform” for more information. |

|

|

Advisory Board: |

The Manager intends to assemble a network of advisors with experience in the equine industry and other relevant fields to serve on an Advisory Board and assist the Manager in identifying, acquiring, training, breeding, reselling and otherwise managing the Thoroughbred assets held by each of the Company’s Series. |

|

Broker: |

The Company has entered into an agreement with North Capital Private Securities Corporation (in its capacity as broker of record, “North Capital” or the “Broker”), a broker-dealer registered with the SEC and each state where the Offering will be made and with such other regulators as may be required to execute the sale transactions and provide related services in connection with this Offering. North Capital is a member of FINRA and SIPC. |

|

Price per Unit: |

The price per Unit is $50.00 for both Series TF2019 Units and Series OL2018 Units.

The Purchase Price will be payable in cash at the time of subscription. Payment will only be accepted by means of electronic transfer via wire or ACH payment and not by check or credit card. |

|

Minimum and Maximum Unit Purchase: |

The minimum subscription by an Investor is one (1) Unit. The maximum subscription by any Investor is for Units representing 10% of the total Units in the Series, although that limit may be waived by the Manager in its sole discretion. |

|

Offering Size: |

|

|

Series TF 2019 |

Maximum Offering -- 3,000 Units Minimum Offering – 2,500 Units |

|

Series OL2018 |

Maximum Offering -- 2,500 Units Minimum Offering – 2,200 Units |

|

Terms of Series Asset Acquisitions: |

|

|

Series TF 2019 |

The Company acquired a 100% interest in the Timido Filly from an officer of the Manager in exchange for a convertible promissory note in the principal amount of $7,500. The purchase price was based on a valuation of the Timido Filly by an independent appraiser. The principal and interest payable on the note will convert automatically into Units at the $50.00 offering price per Unit at the Series TF2019 Closing, which would represent approximately 4.8% of the outstanding Series TF2019 Units if the maximum number of Units are sold in the Series TF2019 Offering. The terms of the convertible promissory note issued by the Company to the seller of the Timido Filly are described under “Use of Proceeds – Series TF2019.” |

|

Series OL2018 |

The Company has entered into an agreement with a third-party seller to acquire a 75% interest in the Orb Colt for a purchase price of $20,000. Payment is due no later than January 17, 2020. The Company will fund the purchase with a $20,000 loan from the Manager. The convertible promissory note issued by the Company to the Manager provides that at the Series OL2018 Closing $10,000 of the principal will convert automatically into Series OL2018 Units at the $50.00 offering price per Unit, and the balance of the principal and accrued interest will be paid in cash to the Manager. The Units issued to the Manager would represent approximately 7.4% of the outstanding Series TF2019 Units if the maximum number of Units are sold in the Series TF2019 Offering. The terms of the convertible promissory note issued by the Company to the Manager are described under “Use of Proceeds – Series OL2018.” |

|

Ownership by Management: |

The Manager together with its affiliates must own a minimum of 2% and may own up to a maximum of 10% of the outstanding Units of a Series immediately following each Closing (but which the Manager may sell at any time after the Closing). |

|

Series TF 2019 |

The Units issued upon conversion of the note issued by the Company to an officer of the Manager to acquire the Timido Filly would represent from approximately 4.8% to 5.7% of the outstanding Series TF2019 Units depending on the number of Units sold in the Series TF2019 Offering. |

|

Series OL2018 |

The Units issued upon conversion of the note issued by the Company to the Manager to acquire the Orb Colt would represent from approximately 7.4% to 9.1% of the outstanding Series OL2018 Units depending on the number of Units sold in the Series OL2018 Offering. |

|

Escrow Agent: |

North Capital Private Securities Corporation (in its capacity as the escrow agent, the “Escrow Agent”). Fees paid to the Escrow Agent are categorized as Offering Expenses. |

|

Escrow: |

The subscription funds advanced by a prospective Investor as part of the subscription process will be held in a non-interest-bearing escrow account with the Escrow Agent and will not be commingled with the operating account of any Series, until, if and when there is a Closing with respect to that Investor.

When the Escrow Agent has received instructions from the Manager or the Broker that the Offering will close and the Investor’s subscription is to be accepted (either in whole or part), then the Escrow Agent will disburse the Investor’s subscription proceeds in its possession to the account of the Series, and Units of the Series will be issued to the Investor.

If the Offering is terminated without a Closing, or if a prospective Investor’s subscription is not accepted or is cut back due to oversubscription or otherwise, funds held in escrow for unaccepted subscriptions will be returned promptly to the Investor without interest. Any costs and expenses associated with a terminated offering will be borne by the Manager. |

|

Offering Period: |

There will be a separate closing with respect to each Offering. The Closing of each Offering will take place on the earliest to occur of (i) the date subscriptions for the maximum number of Units offered have been accepted or (ii) a date determined by the Manager in its sole discretion, provided that subscriptions for the minimum number of Units offered have been accepted.

If the Closing has not occurred, the Offering will terminate on (i) the date that is one year from the date this Offering Circular, or an Amendment to it, is qualified by SEC, which period may be extended by an additional six months by the Manager in its sole discretion, or (ii) any date on which the Manager elects to terminate the offering in its sole discretion. The Manager reserves the right to terminate the offering if 35 or fewer persons subscribe for the Units of any Series. |

|

Use of Proceeds: |

The Offering proceeds received by the Series will be applied in the following order of priority of payment:

(i) Brokerage Fee: A fee equal to 1% of the amount raised through this Offering (which excludes any Units purchased by the Manager or its affiliates) paid to North Capital as compensation for brokerage services.

(ii) Cost of the Series Asset: The actual cost incurred to acquire the Series Asset (which may have been paid before Closing with funds loaned to the Company), including any interest payable on loans to the Company, and down payments paid by the Manager or its affiliates to acquire the Series Asset before an Offering.

(iii) Offering Expenses: In general, these costs include actual legal, accounting, escrow, underwriting, filing, wire transfer and compliance costs incurred by the Company in connection with the offering of a series, as applicable, paid to legal advisors, brokerage, escrow, underwriters, printing, financial institutions, accounting firms and the custodian, as the case may be. Offering Expenses excludes ongoing costs described below as Operating Expenses.

The Manager has agreed to limit the reimbursement by Series TF2019 and Series OL2018 for Offering Expenses incurred in connection with the applicable Offering to 10% of the offering proceeds received.

(iv) Acquisition Expenses: In general, these include actual costs associated with the identification, investigation, evaluation and acquisition of a Thoroughbred asset, pre-purchase medical examinations, appraisal fees, and transportation to a boarding or training facility, as applicable.

The Manager has elected to waive reimbursement of Acquisition Expenses in connection with both the Series TF2019 Offering and the Series OL2018 Offering.

(v) Sourcing Fee: A Sourcing Fee will be paid to the Manager as compensation for identifying investigating, evaluating and managing the acquisition of a Thoroughbred asset, the amount of which will be determined by the Manager at the time of each Offering of Units.

For both Series TF2019 and Series OL2018, the Sourcing Fee is equal to 10% of the purchase price of the Series Asset.

(vi) Organizational Fee: An Organizational Fee equal to 3% of the proceeds received from each offering of the Company’s units will be paid to the Manager to cover legal, accounting and compliance expenses incurred to set up the legal and financial framework and compliance infrastructure for the marketing and sale of the Units offered hereby and all subsequent offerings.

See “Use of Proceeds – Series TF2019,” “Use of Proceeds – Series OL2018” and “Fees and Expenses” for further details. |

|

Operating Expenses: |

“Operating Expenses” are the costs and expenses attributable to the activities of a Series including:

● costs incurred in managing the Series Thoroughbred, including, but not limited to boarding, training, veterinarian and transportation costs;

● costs incurred in preparing any reports and accounts of the Series, including any tax filings and any annual audit of the accounts of the Series (if applicable) or costs payable to any third-party registrar or transfer agent and any reports to be filed with SEC;

● any and all insurance premiums or expenses in connection with the Series Thoroughbred, including mortality, liability and medical insurance of the Series Thoroughbred to insure against the death, injury or third-party liability of racehorse ownership (as described in “Description of the Business – Business of the Company”). The decision to purchase insurance on a Thoroughbred will be made on a horse-by-horse basis, depending on such considerations as the amount of Series’ investment, premium rates, racing performance, pedigree, use (racing, stallion or broodmare) and similar factors; and

● any indemnification payments.

The Manager has agreed to pay and not be reimbursed for Operating Expenses incurred prior to the Series TF2019 and Series OL2018 Closings. Operating Expenses incurred after the Closing will be the responsibility of the Series.

If the Operating Expenses exceed the amount of revenues generated from the Series Asset and cannot be covered by any Operating Expense reserves on the balance sheet of the Series, the Manager may (a) pay such Operating Expenses and not seek reimbursement, (b) loan the amount of the Operating Expenses to the Series, on which the Manager may impose a reasonable rate of interest, which cannot be lower than the Applicable Federal Rate (as defined in the Internal Revenue Code), and be entitled to reimbursement of such amount from future revenues generated by the Series Asset (the “Operating Expenses Reimbursement Obligation”), or (c) cause additional Units to be issued in order to cover the additional amount of Operating Expenses.

We do not anticipate that Series TF2019 will generate any revenues before 2021, when the Timido Filly is first able to race as a two-year old.

Whether Series OL2018 will generate any revenues in 2020 will depend on the development of the Orb Colt, which we anticipate will begin training in 2020 and may race as a two-year old later in the year.

See discussion of “Description of the Business – Operating Expenses” for additional information. |

|

Issuance of Additional Units: |

The Manager may sell its Units of a Series from time to time after the Closing of the Offering of that Series.

If there are not sufficient cash reserves of, or revenues generated by, a Series to meet the Series’ Operating Expenses, the Manager may sell additional Units of the series as well as take the other actions described in immediately preceding “Operating Expenses” section of this Offering Summary. |

|

Free Cash Flow: |

The net income (as determined under U.S. generally accepted accounting principles (“GAAP”)) generated by the Series plus any change in net working capital and depreciation and amortization (and any other non-cash Operating Expenses) and less any capital expenditures related to the Series Asset. The Manager may maintain Free Cash Flow funds in a deposit account or an investment account for the benefit of the Series.

A Series will typically generate Free Cash Flow from racing, breeding and sales activities. The frequency with which revenue generating events occur will depend on the racing schedule, potential sales of the Series Asset and other events that do not occur on a fixed or set time period (e.g., quarterly or monthly). |

|

Management Fee: |

As compensation for the services provided by the Manager under the Management Services Agreement, the Manager will be paid a semi-annual fee equal to:

● 10% of any Free Cash Flow generated by the Series, until such time as Investors have received a return of their invested capital. Thereafter: ● 20% of any Free Cash Flow generated by the Series from racing activities; and ● 30% of any Free Cash Flow generated by the Series from breeding activities and sales of Series Assets.

The Management Fee will only become due and payable at the time there is a distribution of Free Cash Flow to Unit Holders of the Series, as described in Distribution Rights below. For tax and accounting purposes the Management Fee will be accounted for as an expense on the books of the Series. |

|

Distribution Rights: |

The Manager has sole discretion in determining when distributions of Free Cash Flow, if any, are made to Series Unit Holders and the amount of any such distributions. Any Free Cash Flow generated by the Series from racing, breeding and sales activities will be applied in the following order of priority:

(i) to repay any amounts outstanding under Operating Expenses Reimbursement Obligations plus accrued interest;

(ii) to create such reserves as the Manager deems necessary, in its sole discretion, to pay corporate income taxes applicable to the Series and meet future Operating Expenses; |

|

(iii) distributions to Unit Holders, net of the Management Fee payable; and

(iv) distributions to the Manager in payment of the Management Fee, as described above. |

|

|

Timing of Distributions: |

The Manager has the sole discretion to determine the timing of any distributions of Free Cash Flow to Unit Holders and to withhold Free Cash Flow entirely or in part to meet anticipated costs and liabilities of the Series. The Manager is only entitled to receive the Management Fee at the time Free Cash Flow is distributed to Unit Holders of a Series. In general, the timing and amount of distributions will depend on such factors as the development of the Series Thoroughbred, the quality of the races in which it is entered, winnings, and its value as breeding stallion or broodmare. |

|

No Trading Market: |

There is currently no public trading market for any of our Units, and no such public market may ever develop. If an active public trading market for our securities does not develop or is not sustained, it may be difficult or impossible for you to resell your Units at any price. Even if a public market does develop, the market price could decline below the amount you paid for your Units.

The Company estimates that each Series will exist for 4-6 years (the racing life cycle) and then the Series Asset will be sold, which will be the primary liquidity event other than distributions on Free Cash Flow as discussed above. A sale of the Series Asset may occur at a lower value than when the Series Asset was first acquired or at a lower price than the aggregate of costs, fees and expenses used to purchase the Series Asset. The Company expects to terminate each Series after the Series Asset is sold and to distribute the sales proceeds to the unitholders of that Series. |

|

Fiduciary Duties: |

The Operating Agreement provides that neither the Manager, nor any directors, officers, or employees of the Manager, nor any members of the Advisory Board, nor persons acting at the request of the Company or any series in certain capacities with respect to other entities (collectively, the “Indemnified Parties”) will be liable to the Company, the Series, or any Unit Holders for any act or omission taken by any Indemnified Party in connection with the business of the Company or its series of membership units unless determined to constitute fraud, willful misconduct or gross negligence. Therefore, Investors have a more limited right of action than they would have absent the limitation in the Operating Agreement. |

|

Indemnification: |

The Company or, where relevant, the Series will indemnify the Indemnified Parties out of its assets against all liabilities and losses (including amounts paid in respect of judgments, fines, penalties or settlement of litigation, including legal fees and expenses) to which they become subject by virtue of serving as Indemnified Parties with respect to any act or omission that has not been determined to constitute fraud, willful misconduct or gross negligence. Unless attributable to a specific series of units or a specific underlying asset, the costs of meeting any indemnification will be allocated pro rata across each of series of units based on the value of each underlying asset. |

|

Transfers: |

The Manager may refuse a transfer of Units by an Unit Holder if the transfer would result in (a) there being more than 2,000 beneficial owners in the Series or more than 500 beneficial owners that are not “accredited investors,” (b) the assets of the Series being deemed “plan assets” for purposes of ERISA, (c) such Unit Holder holding more than 19.9% of the Series Units, (d) a change of U.S. federal income tax treatment of the Company and/or the Series, or (e) the Company, the Series of Units or the Manager being subject to additional regulatory requirements. In addition, because the Units will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), Units may only be transferred in accordance with exemptions from registrations under the Securities Act and applicable state securities laws. See “Description of Units Offered – Transfer Restrictions” for more information. |

|

Governing Law: |

To the fullest extent permitted by applicable law, the Company and the Operating Agreement will be governed by Delaware law and any dispute in relation to the Company and the Operating Agreement is subject to the exclusive jurisdiction of the Court of Chancery of the State of Delaware. If a Unit Holder were to bring a claim against the Company or the Manager pursuant to the Operating Agreement, it would be required to do so in the Delaware Court of Chancery to the extent the claim isn’t vested in the exclusive jurisdiction of a court or forum other than the Delaware Court of Chancery, or for which the Delaware Court of Chancery does not have subject matter jurisdiction, or where exclusive jurisdiction is not permitted under applicable law. |

RISK FACTORS

An investment in a Series is highly speculative in nature, involves substantial risks and is suitable only for sophisticated Investors for whom an investment in a Series is only one portion of an investment program, who fully understand and are capable of bearing the risks of the investment and who can afford to lose their entire investment. We cannot assure you that the Company’s investment objectives will be achieved or that a secondary market would ever develop for the Units, whether via the Commonwealth Platform, via third party registered broker-dealers or otherwise. Before making an investment decision, you should carefully consider all information contained in this Offering Circular (and the exhibits hereto) and should give particular consideration to the risks described below. The business, operating results and financial condition of the Company or an individual Series all could be adversely affected by any of the following risks. The risk factors below are not intended to be an exhaustive list of the general or specific risks involved, but merely to identify certain risks that are now foreseen by the Company. Other risks, not now foreseen, may become significant in the future and that the risks which are now foreseen may affect the Company or a Series to a greater extent than is now foreseen or in a manner not now contemplated. Prospective Investors should obtain their own legal and tax advice prior to making an investment in a Series.

Risks Related to the Structure, Operation and Performance of the Company

Our Company was recently formed and has no prior operating history. Therefore, acquiring Units in its Series is a speculative investment. We cannot assure you that you will realize your investment objectives.

An investment in our Units involves a high degree of risk, including the possibility that you may not realize a return on your investment, or that your investment could lose some or all its value. The Company was recently formed, has not generated any revenues to date, and has no operating history upon which prospective Investors may evaluate its performance. There is no guarantee that any Series will generate a financial return or that the value of its Thoroughbred Asset will increase. For these reasons, we urge you to read this Offering Circular carefully, and consult with your legal and financial advisors before deciding to invest in these Units.

The prospects of a Series must be considered in light of the risks, expenses, and difficulties encountered in establishing a new business in a highly competitive industry. The Company will be engaged in a highly speculative business. The future financial performance of each Series will depend on its ability to earn purses from racing, profitably resell its ownership units in runners and breeding stallions, sell broodmares and the progeny of broodmares and engage in other Thoroughbred activities. We cannot assure you the Company can successfully carry out its investment and operational strategy.

An investment made through this Offering constitutes only an investment in a Series and not in the Company or the underlying Thoroughbred.

A purchase of Units in a Series does not constitute an investment in either the Company or the underlying Thoroughbred directly. This limits the voting rights of the Investor solely to the Series, which are further limited by the Company’s Operating Agreement, described further in this Offering Circular. Investors will have voting rights only with respect to certain matters, primarily relating to amendments to the Operating Agreement that would adversely change the rights of their Units and removal of the Manager for “cause.” The Manager thus retains significant control over the management of the Company and the underlying Thoroughbred Assets. Furthermore, because the Units in a Series do not constitute an investment in the Company as a whole, holders of the Units in one Series will not receive any economic benefit from, or be subject to the liabilities of, the assets of any of the Company’s other Series. In addition, the economic interest of a holder in a Series will not be identical to owning a direct undivided interest in the underlying Thoroughbred Asset because, among other things, the Series will be required to pay corporate taxes before distributions are made to the holders, and the Manager will receive a fee in respect of its management of the Series’ Thoroughbred.

Liability of investors between series of membership units.

The Company is structured as a Delaware series limited liability company that issues different series of membership units for each underlying asset. Each series of membership units, including the Series TF2019 Units and the Series OL2018 Units, will merely be a separate series and not a separate legal entity. Under the Delaware Limited Liability Company Act (the “LLC Act”), if certain conditions (as set forth in Section 18-215(b) of the LLC Act) are met, the liability of investors holding one series is segregated from the liability of investors holding another series and the assets of one series are not available to satisfy the liabilities of other series. Although this limitation of liability is recognized by the courts of Delaware, there is no guarantee that if challenged in the courts of another U.S. State or a foreign jurisdiction, those courts will uphold a similar interpretation of Delaware corporation law. Approximately 40% of the U.S. states plus the District of Columbia have adopted statutes authorizing the formation of series limited liability companies. It is unclear whether the remaining states would honor the limited liability afforded to each series of a series limited liability company under Delaware law, and to date there have been only a limited number of judicial decisions to provide guidance. If the Company’s series limited liability company structure is not respected, then Investors may have to share any liabilities of the Company with all investors and not just those who hold the same series as them. Furthermore, while we intend to maintain separate and distinct records for each series and account for them separately and otherwise meet the requirements of the LLC Act, it is possible a court could conclude that the methods used did not satisfy Section 18-215(b) of the LLC Act and thus potentially expose the assets of Series TF2019 to the liabilities of another series. The consequence of this is that Investors may have to bear higher than anticipated expenses which would adversely affect the value of their Units or the likelihood of any distributions being made by the Series to the Investors. In addition, we are not aware of any court case that has tested the limitations on inter-series liability provided by Section 18-215(b) in federal bankruptcy courts, and it is possible that a bankruptcy court could determine that the assets of one series should be applied to meet the liabilities of another series or the liabilities of the Company generally where the assets of such other series or of the Company generally are insufficient to meet its respective liabilities.

If any fees, costs and expenses of the Company are not allocable to a specific series, they will be borne proportionately across all the series. Although the Manager will allocate fees, costs and expenses acting reasonably and in accordance with its allocation policy (see “Description of the Business – Allocation of Revenue and Expense”), there may be situations where it is difficult to allocate fees, costs and expenses to a specific series. Therefore, there is a risk that a series may bear a proportion of the fees, costs and expenses for a service or product for which another series received a disproportionately high benefit.

Initially there will be no public market for the resale of the Units, and no such public market may ever develop.

There is currently no public trading market for any of our Units, and no such public market may ever develop. The Manager has no current plans to facilitate the resale of Units acquired by Investors on the Commonwealth Platform and potentially help provide liquidity to Investors. If an active public trading market for our Units does not develop or is not sustained, it may be difficult or impossible for you to resell your Units at any price. Even if a public market does develop, the market price could decline below the amount you paid for your Units.

There may be state law restrictions on an Investor’s ability to sell the Units.

Each state has its own securities laws, often called “blue sky” laws, which (1) limit sales of securities to a state’s residents unless the securities are registered in that state or qualify for an exemption from registration and (2) govern the reporting requirements for broker-dealers and stock brokers doing business directly or indirectly in the state. Before a security is sold in a state, there must be a registration in place to cover the transaction, or it must be exempt from registration. Also, the broker must be registered in that state. We do not know whether our securities will be registered, or exempt, under the laws of any states. A determination regarding registration will be made by the broker-dealers, if any, who agree to serve as the market-makers for our Units. There may be significant state blue sky law restrictions on the ability of Investors to sell, and on purchasers to buy, our Units. In addition, Tier 2 of Regulation A limits qualified resales of our Units to 30% of the aggregate offering price of a particular offering. Investors should consider the resale market for our Units to be limited. Investors may be unable to resell their Units, or they may be unable to resell them without the significant expense of state registration or qualification or opinions to our satisfaction that no such registration or qualification is required.

Limited Investor appetite.

Due to the start-up nature of the Company, there can be no guarantee that the Company will reach its funding target from potential Investors with respect to the Series TF2019 Units, the Series OL2018 Units or any future proposed series of units. If the Company does not reach a funding target, it may not be able to achieve its investment objectives by acquiring additional underlying Thoroughbred assets through the issuance of further series and generating revenue to enable distributions for Investors. In addition, if the Company is unable to raise funding for additional series, this may impact any Investors already holding units as they will not see the benefits that arise from economies of scale following the acquisition by other series of additional Thoroughbred assets and other opportunities to generate revenue from racing, breeding or sales activities.

There are few businesses that have pursued a strategy or investment objective similar to the Company’s.

We believe other companies crowdfunding ownership interests in racehorses or proposing to run a platform for crowdfunding of interests in racehorses has been very limited to date. The Company and the Units may not gain market acceptance from potential Investors, Thoroughbred breeders or service providers within the racehorse ownership/syndicate industry, including insurance companies, syndicate managers, training facilities or maintenance partners. This could result in an inability of the Manager to manage the career of the Company’s Thoroughbred assets profitably. It could impact the issuance of further series of units and additional Thoroughbred assets being acquired by the Company. It would further inhibit market acceptance of the Company and if the Company does not acquire any additional Thoroughbred assets, Investors would not receive any benefits that arise from economies of scale (such as a reduction in boarding, training and transportation costs and group discounts on insurance).

Offering amount exceeds value of the underlying Thoroughbred.

The size of the Series TF2019 Offering and the Series OL2018 Offering will each exceed the purchase price of the Thoroughbred Asset of each Series on the date its Offering closes because the proceeds of the Offering in excess of the purchase price of the Thoroughbred Asset will be used to pay fees, costs and expenses incurred in making this Offering, acquiring the Thoroughbred Asset, and establishing reserves to cover Operating Expenses until the Thoroughbred develops and is capable of racing competitively. If a Thoroughbred Asset must be sold before there has been substantial appreciation of the value of the Thoroughbred Asset, the proceeds from the sale remaining after first paying off any liabilities owed in connection with the Thoroughbred Asset at the time of the sale (including but not limited to any outstanding Operating Expenses Reimbursement Obligation) may not be sufficient to repay Investors the amount of their initial investment or any additional profits in excess of that amount.

A Series may not be able to control many of its operating costs, and unexpected costs may adversely affect its financial results.

We cannot provide assurance that the Manager’s estimates regarding the price of Thoroughbreds, the cost of maintaining, training and racing Thoroughbreds or maintaining and standing stallions, or the cost and expenses associated with buying and reselling pinhooking prospects (as described below) will prove accurate. Numerous factors may affect a Series’ operating expenses, many of which will be beyond its control. The costs of purchasing, boarding, training, providing veterinary care for, and otherwise owning and maintaining Thoroughbreds are substantial and outside the Company’s control. The Company expects these costs and expenses to increase over time due to inflationary factors.

Other factors that could cause a Series’ expenses to be higher than expected include market fluctuations in the Thoroughbred industry, risks associated with transporting the horses to and from races and auctions, the overall health, soundness and competitiveness of the Thoroughbred a Series owns, interest and currency exchange rates, and other factors that are beyond the Company’s control or that cannot be accurately predicted at this time. Outbreaks of infectious diseases could result in quarantines or other restrictions that may halt racing and breeding or restrict movement, and thus impede a Series’ racing and breeding activities. For example, in recent months there were several new reported cases of equine viral herpes, a potentially fatal disease that may render surviving victims infertile. This has resulted in quarantines being imposed at several racetracks and training facilities. Although similar outbreaks have been contained in the past, the disease has the potential to create significant problems with the racing, breeding and transport of horses, which could have a material adverse effect on the activities and revenues of a Series.

The Company intends that each Series will pay its operating expenses from the proceeds from the sale of its Units and future operating revenue. Higher than expected operating expenses could force a Series to sell Series Assets during unfavorable market conditions. Events that increase a Series’ operating expenses or reduce its capital resources and liquidity could prevent the Investors from receiving their anticipated return on investment.

The Company is controlled by the Manager, and Members must rely solely on the judgment of the Manager’s management team, which has limited prior experience in the equine industry.

The success of the Company and each of its Series will depend upon the experience and business judgment of the Manager, its management team and the advisors the Manager engages. The Manager’s management team has limited prior experience in overseeing Thoroughbred acquisition, training, racing, breeding and sales activities.

The Manager has exclusive control over the day-to-day operations of each Series and most decisions as to the use of the proceeds of this offering following the purchase of the Series’ Thoroughbred Asset. The selection of a Series’ Thoroughbreds will be based on an analysis of bloodlines, evaluations of physical condition, and the past performance of related Thoroughbred horses, none of which is an exact science. To a significant degree, the Manager will be relying on the advice of trainers, bloodstock agents, consignors, members of its advisory board, co-owners of horses owned in part by a Series and other advisors.

The Manager will have full and complete control and authority with respect to the business and affairs of each Series, and will have responsibility for, among other things:

|

● |

the selection and acquisition of the interests in Thoroughbreds to be purchased by each Series; |

|

● |

decisions concerning the care and maintenance of the Series’ Thoroughbreds (including the selection of boarding, training, transporting and veterinary services); |

|

● |

decisions relating to the amount and form of compensation to be paid to persons providing services to a Series (other than parties related to the Manager or any Member); and |

|

● |

decisions regarding the racing, breeding and eventual sale of the Thoroughbreds and their offspring. |

The Members (other than the Manager) will not be able to exercise any significant control or influence over the operation of the business of the Company and each Series, even if Members disagree with the Manager’s decisions or disapprove of its performance. Accordingly, no person should invest in a Series unless he or she is willing to entrust all aspects of control to Commonwealth Markets and to rely on its management ability.

The loss of the Manager’s key executives could jeopardize your investment.

The Company will depend on the efforts and expertise of the Manager’s key employees Brian Doxtator and Chase Chamberlin. If the Manager loses or suffers an extended interruption in the service of one or more of its key personnel, the Company and the Units could be adversely affected. The Manager does not expect to maintain key-man insurance on Messrs. Doxtator and Chamberlin.

The Management Fee paid to the Manager by each Series is based on the performance of the Series

Each Series pays the Manager a Management Fee that is based upon the Series’ performance. This performance-based fee structure may create an incentive for the Manager to cause the Company to make investments that are riskier or more speculative than might otherwise be the case in the absence of such a fee.

A Series’ financial performance will depend on the Manager’s relationships within the Thoroughbred industry.

The ability to purchase desirable Thoroughbreds may depend in part upon the Manager’s relationships with trainers, bloodstock agents and consultants and Thoroughbred owners. These relationships provide the Manager with access to information that is useful in determining which Thoroughbreds are available in the public and private markets and which have the potential to be successful. The Manager may lose key personnel who maintain key relationships. Any failure to maintain, manage or continue to establish relationships with key individuals and institutions in the Thoroughbred industry may hinder the Manager’s ability to purchase desirable Thoroughbreds for the Company’s Series.

The financial performance of each Series will depend on the quality of the services performed by trainers and other independent contractors.

The Manager will engage independent contractors to perform many essential services required for Thoroughbred racing and breeding, including selection, training, boarding and veterinary care of its Thoroughbreds. These independent contractors often subcontract or employ others who actually perform the contracted for services. Some of these contractors will be also servicing other horses not owned by the Company’s Series. The Company may have to compete for the services of trainers, bloodstock agents, jockeys and consignors, and conflicts of interest may arise from time to time.

Trainers, veterinarians and jockeys are licensed by regulatory bodies overseeing racing and are subject to fines, suspension or revocation of their licenses if it is determined that a violation of racing rules occurred. Suspension or revocation of a key trainer’s, veterinarian’s or jockey’s license may interrupt the Manager’s ability to train and race the horses of the Company’s Series in the intended manner until a suitable replacement can be found. Administrative regulations are in effect in some states that provide for the suspension of a horse from competition if a trainer violates a rule involving the participation of the horse in a race or would require an owner to engage personnel unrelated to the suspended trainer to care for or train its horses during the trainer’s suspension. Any adverse administrative rulings, either against a trainer, veterinarian or jockey engaged by a Series or directly against a Series as owner, could result in fines, suspension or revocation of a license to participate in racing. Such sanctions may result in lost opportunities to race a Series’ Thoroughbred and cause significant damage to the Company’s reputation, jeopardizing the Company’s ability to successfully carry out its business plan and may adversely affect the value of the Series Assets.

Injury, infertility or death of a Series’ Thoroughbred(s) could diminish revenue and net asset values.

The Company plans to acquire Thoroughbreds with the pedigree quality indicative of the ability to compete and produce offspring who can compete in allowance and stakes races. Because purchasing Thoroughbreds of this caliber can be expected to require a substantial investment by a Series, any illness, injury, accident, impairment, or death of one or more of a Series’ Thoroughbreds could have a material adverse effect on the value of Units. Failure to perform as anticipated due to inability or lack of competitive will, injury, illness, disability or death of a Thoroughbred that is uninsured or underinsured could materially diminish a Series’ net asset value. A stallion in which a Series owns an interest may be or become infertile to the extent that the stallion becomes a commercial failure. Any infertility problems with stallions could result in possible losses for a Series to the extent fertility insurance proceeds (available only in the first year of a stallion’s breeding career) do not cover the purchase price of the Units. Even if losses are fully insured, a Series will not receive the future earnings stream associated with a Thoroughbred, which could materially reduce a Series’ financial performance.

A Thoroughbred acquired as a yearling or juvenile will require development and training to race competitively. Accordingly, the potential of a yearling or juvenile Thoroughbred to generate revenue for a Series will not be known for a period that could be as short as 30-60 days after acquisition for juveniles to as long as 18 months after acquisition, particularly for yearlings.

The Company intends to acquire yearlings and juvenile Thoroughbreds with a pedigree that indicates the potential to race competitively in allowance and stakes races in the future. However, yearlings acquired in the fall will normally require 6 to 18 months of development before they are able to race competitively. A juvenile (a two-year-old Thoroughbred) purchased in the spring or early summer of its two-year-old year will normally require from 3 to 9 months of additional training prior to racing competitively but may be ready to race within 1-2 months of acquisition. Accordingly, the ability of a yearling or a juvenile Thoroughbred to produce revenue and generate distributable Free Cash Flow from racing will not be known for a variable amount of time, and accurately projecting the timing of receipt of revenues, if any, from yearlings and juveniles is problematic.

The cost of insurance could be high, and caps on coverage could limit a Series’ ability to fully insure its assets.

To reduce the risks associated with possible death of its Thoroughbreds, the Company expects each Series to purchase mortality insurance on the Thoroughbreds in which it owns a substantial interest, as determined by the Manager in its discretion. However, changes in the market for insurance may affect the Company’s ability to obtain the insurance coverage at reasonable rates. Moreover, insurance is typically limited to the purchase price plus 10% and the Company cannot reasonably insure for the potential profit that each horse represents. Insurers have limited coverage on highly valued Thoroughbreds for congenital first year fertility and mortality following significant losses on several prominent racehorses that failed at stud in recent years. Any increase in the cost of such insurance could reduce a Series’ income and its ability to insure its assets. In addition, a Series’ inability to fully insure a highly valued Thoroughbred due to coverage caps could result in a significant reduction in net asset value in the event of the Thoroughbred’s death or infertility.

The Manager cannot predict how long a Series will own its horses, which may adversely affect a Series’ operating expenses.

The Company’s goal is for its Series to own Thoroughbreds for varying lengths of time and resell or breed them when appropriate. A Series may sell the progeny of its mares or sell its mares as broodmare prospects or in foal. A Series may not have sufficient resources to maintain horses for extended periods, which may cause it to resell a horse at a loss. Alternatively, a Series’ inability to resell horses within its expected resale window may result in an unanticipated increase in operating expenses that could adversely affect a Series’ results.

Absence of physical facilities; reliance on others for boarding and maintenance.

Neither the Manager nor the Company currently owns any physical facilities for the boarding or training of the Thoroughbreds that the Company’s Series will own. Therefore, the Company will rely on third parties to board, train and race its Thoroughbreds. We do not expect to have written agreements with trainers, veterinarians or other third-party vendors, as it is not a customary practice in the industry. Should any third-party contractor fail to competently train or care for a Thoroughbred owned by a Series, the health and/or value of that horse could suffer, which could negatively affect the net asset values of a Series.

Subscribers must be eligible to be licensed to own racehorses.

State horseracing commissions have licensure requirements that require Investors be licensed if they hold a certain ownership interest of a racehorse. For this reason, subscribers for Units must certify that they are eligible to be licensed as a Thoroughbred racehorse owner and are not the subject of any

pending disciplinary or legal proceedings that may result in ineligibility for licensure. Subscribers for more than 3% of the Units of a Series may also be required to provide additional personal information sufficient to permit the Manager to assess the prospective subscriber’s ability to be licensed under the applicable regulations of the racing commissions of the various states. A promising Thoroughbred owned by a Series could be excluded from high profile stakes races in New York or other states if a Unit holder becomes ineligible to hold an owner’s license, which could reduce the value of the Thoroughbred and reduce the Series’ return on investment. An Investor who knowingly fails to disclose his or her ineligibility for licensure could be subject to claims for any damages to the Series resulting from such bad faith. See “Plan of Distribution and Subscription Procedure -- Eligibility for Registration as a Racehorse Owner” for more detail about these eligibility requirements.

Potential breach of the security measures of the Commonwealth Platform.

The highly automated nature of the Commonwealth Platform through which potential investors acquire or transfer Units may make it an attractive target and potentially vulnerable to cyber-attacks, computer viruses, physical or electronic break-ins or similar disruptions. The Commonwealth Platform processes certain confidential information about investors, Thoroughbred breeders, and Thoroughbred assets held by the Company’s Series. While we intend to take commercially reasonable measures to protect our confidential information and maintain appropriate cybersecurity, the security measures of the Commonwealth Platform, the Company, the Manager or the Company’s service providers (including North Capital) could be breached. Any accidental or willful security breaches or other unauthorized access to the Commonwealth Platform could cause confidential information to be stolen and used for criminal purposes or have other harmful effects. Security breaches or unauthorized access to confidential information could also expose the Company to liability related to the loss of the information, time-consuming and expensive litigation and negative publicity, or loss of the proprietary nature of the Manager’s and the Company’s trade secrets. If security measures are breached because of third-party action, employee error, malfeasance or otherwise, or if design flaws in the Commonwealth Platform software are exposed and exploited, the relationships between the Company, investors, users, Thoroughbred breeders and equine professionals could be severely damaged, and the Company or the Manager could incur significant liability or have the attention of the Manager’s personnel significantly diverted from racing, breeding and sales activities, which could have a material negative impact on the value of Units or the potential for distributions to be made on the Units.

Because techniques used to sabotage or obtain unauthorized access to systems change frequently and generally are not recognized until they are launched against a target, the Company, the third-party hosting used by the Commonwealth Platform and other third-party service providers may be unable to anticipate these techniques or to implement adequate preventative measures. In addition, federal regulators and many federal and state laws and regulations require companies to notify individuals of data security breaches involving their personal data. These mandatory disclosures regarding a security breach are costly to implement and often lead to widespread negative publicity, which may cause investors, Thoroughbred breeders or service providers within the industry, including insurance companies, to lose confidence in the effectiveness of the secure nature of the Commonwealth Platform. Any security breach, whether actual or perceived, would harm the reputation of the Company and the Commonwealth Platform and the Company could lose investors and the opportunity to acquire Thoroughbred assets or retain equine service providers. This would impair the ability of the Company to achieve its objectives of acquiring additional Thoroughbred assets through the issuance of further series of Units and conducting racing, breeding and sales activities.

Risks Related to the Thoroughbred Industry

Investing in Thoroughbreds is a speculative venture and highly susceptible to changes in market conditions.