Exhibit 99.1

PLANTIFY FOODS, INC.

(Formerly Antalis Ventures Corp.)

CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2022

INDEX

- - - - - - - - - - -

| 1 |

To the Shareholders of Plantify Foods, Inc.

We have audited the accompanying consolidated financial statements of Plantify Foods, Inc. and its subsidiaries, which comprise the consolidated balance sheets as of December 31, 2022, and December 31, 2021, and the related consolidated statements of comprehensive loss, changes in stockholders’ deficit, and cash flows for the years then ended, and the related notes to the consolidated financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with International Financial Reporting Standards (IFRSs) as issued by the International Accounting Standards Board (IASB) this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Plantify Foods, Inc. and its subsidiaries as of December 31, 2022 and 2021, and the results of its operations and its cash flows for the years then ended in accordance with International Financial Reporting Standards (IFRSs).

Emphasis of Matter Regarding Going Concern

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As described in Note 1b to the consolidated financial statements, the Company has suffered recurring losses from operations and has a net capital deficiency that raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 1b. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. Our opinion is not modified with respect to this matter.

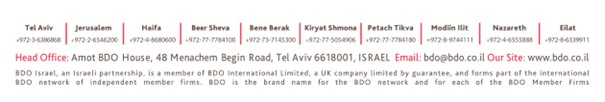

| Tel-Aviv, Israel | /S/ Ziv haft | ||

| Ziv haft | |||

| June 14, 2023 | Certified Public Accountants (Isr.) | ||

| BDO Member Firm |

| 2 |

PLANTIFY FOODS, INC.

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(US Dollar in thousands)

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Note | US$ in thousands | ||||||||||

| CURRENT ASSETS: | |||||||||||

| Cash and cash equivalents | 5 | 59 | 114 | ||||||||

| Accounts receivable, Net | 6 | 146 | 238 | ||||||||

| Short term deposit | 15 | 16 | |||||||||

| Other accounts receivable | 7 | 30 | 39 | ||||||||

| Inventory | 8 | 88 | 48 | ||||||||

| Total current assets | 338 | 455 | |||||||||

| NON-CURRENT ASSETS: | |||||||||||

| Long term restricted deposit | 32 | 36 | |||||||||

| Property, plant and equipment, Net | 10 | 1,523 | 312 | ||||||||

| Total non-current assets | 1,555 | 348 | |||||||||

| Total assets | 1,893 | 803 | |||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 3 |

PLANTIFY FOODS, INC.

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(US Dollar in thousands)

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| US$ in thousands | |||||||||||

| CURRENT LIABILITIES: | |||||||||||

| Trade payables | 11 | 431 | 231 | ||||||||

| Other payables | 12 | 465 | 280 | ||||||||

| Warrants | 13 | 503 | 113 | ||||||||

| Short term bank loan | 15 | 207 | 150 | ||||||||

| Loans | 16 | - | 257 | ||||||||

| Short term Lease liability | 9 | 16 | 5 | ||||||||

| Convertible Debentures | 17 | 388 | - | ||||||||

| Total current liabilities | 2,010 | 1,036 | |||||||||

| NON CURRENT LIABILITIES: | |||||||||||

| Long term Lease liability | 9 | 570 | - | ||||||||

| Shareholders loan | 18 | 165 | 174 | ||||||||

| Long term bank loan | 15 | 13 | 113 | ||||||||

| Total non current liabilities | 748 | 287 | |||||||||

| SHAREHOLDERS’ EQUITY (Deficiency): | |||||||||||

| Share capital | 19 | - | 19 | ||||||||

| Capital reserve | 109 | 62 | |||||||||

| Option reserve | 47 | - | |||||||||

| Additional paid in capital | 3,992 | 1,161 | |||||||||

| Share purchase warrants reserve | 1,419 | - | |||||||||

| Accumulated deficit | (6,432 | ) | (1,762 | ) | |||||||

| Total shareholders’ equity (deficiency) | (865 | ) | (520 | ) | |||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | 1,893 | 803 | |||||||||

| June 14, 2023 | “Roy Borochov” | “Noam Ftecha” | ||

| Date of approval of the | Roy Borochov | Noam Ftecha | ||

| financial statements | Chief Executive officer & Director | Director |

The accompanying notes are an integral part of these consolidated financial statements.

| 4 |

PLANTIFY FOODS, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(US Dollar in thousands except share and per share data )

| For The Year Ended | |||||||||||

| December 31, | December 31, | ||||||||||

| 2022 | 2021 | ||||||||||

| Note | US$ in thousands | ||||||||||

| Sales | 22 | 374 | 472 | ||||||||

| Cost of sales | 23 | (477 | ) | (452 | ) | ||||||

| Gross profit | (103 | ) | 20 | ||||||||

| Operating expenses: | |||||||||||

| Research and development expenses | 24 | (41 | ) | (53 | ) | ||||||

| Selling, marketing and administrative expenses | 25 | (1,353 | ) | (1,138 | ) | ||||||

| Total operating expenses | (1,394 | ) | (1,191 | ) | |||||||

| Operating loss | (1,497 | ) | (1,171 | ) | |||||||

| Financial income | 26 | - | 107 | ||||||||

| Financial expense | 26 | (543 | ) | (30 | ) | ||||||

| Listing expenses | 27 | (2,630 | ) | - | |||||||

| Net loss before taxes | (4,670 | ) | (1,094 | ) | |||||||

| Tax expenses | - | - | |||||||||

| Net loss for the year | (4,670 | ) | (1,094 | ) | |||||||

| Other comprehensive loss: | |||||||||||

| Amounts that will not be reclassified subsequently to profit and loss: | |||||||||||

| Adjustments arising from translating financial statements from functional currency to presentation currency | (112 | ) | (1 | ) | |||||||

| Total components that will not be reclassified subsequently to profit and loss | (112 | ) | (1 | ) | |||||||

| Amounts that will be or that have been reclassified to profit or loss when specific conditions are met: | |||||||||||

| Adjustments arising from translating financial statements of foreign operations | 159 | - | |||||||||

| Total components that will be or that have been reclassified to profit or loss | 159 | - | |||||||||

| Comprehensive loss for the year | (4,623 | ) | (1,095 | ) | |||||||

| Basic and diluted loss per share* | 28 | (0.04 | ) | (0.16 | ) | ||||||

| Weighted average number of shares outstanding used to compute basic and diluted loss per share | 120,557,361 | 6,691,712 | |||||||||

*loss per share for the year ended December 31, 2021 is calculated using the historical number of shares of Peas of Bean Ltd (“POB”). divided by the net loss of POB

The accompanying notes are an integral part of these consolidated financial statements.

| 5 |

PLANTIFY FOODS, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (DEFICIENCY)

(In thousands of US Dollars)

| Number of shares | Ordinary share capital amount | Additional paid in Capital | Share purchase warrants reserve | Option reserve | Capital reserve | Accumulated deficit | Total | |||||||||||||||||||||||||

| Balance at January 1, 2021 | 80,412,805 | * | 15 | 149 | - | - | 6 | (668 | ) | (498 | ) | |||||||||||||||||||||

| Changes during 2021: | ||||||||||||||||||||||||||||||||

| Interest benefit from Controlling Shareholders | - | - | - | - | - | 57 | - | 57 | ||||||||||||||||||||||||

| Exercise of warrants into common shares | 4,191,490 | * | 1 | 210 | - | - | - | - | 211 | |||||||||||||||||||||||

| Issuance of common shares and warrants | 16,961,488 | * | 3 | 802 | - | - | - | - | 805 | |||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | (1,094 | ) | (1,094 | ) | ||||||||||||||||||||||

| Other comprehensive income for the period | - | - | - | - | - | (1 | ) | - | (1 | ) | ||||||||||||||||||||||

| Balance at December 31, 2021 | 101,565,783 | * | 19 | 1,161 | - | - | 62 | (1,762 | ) | (520 | ) | |||||||||||||||||||||

| Changes during 2022: | ||||||||||||||||||||||||||||||||

| Shares and warrants issued in subscription receipt financing | 30,500,000 | - | 1,441 | 1,419 | - | - | - | 2,860 | ||||||||||||||||||||||||

| Shares issued upon reverse takeover – (Note 4) | 5,100,000 | (19 | ) | 497 | - | 47 | - | - | 525 | |||||||||||||||||||||||

| Shares issued as finder’s fees and corporate finance fee | 8,810,581 | - | 826 | - | - | - | - | 826 | ||||||||||||||||||||||||

| Shares issued for services | 1,341,280 | - | 67 | - | - | - | - | 67 | ||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | (4,670 | ) | (4,670 | ) | ||||||||||||||||||||||

| Other comprehensive income for the period | - | - | - | - | - | 47 | - | 47 | ||||||||||||||||||||||||

| Balance at December 31, 2022 | 147,317,644 | - | 3,992 | 1,419 | 47 | 109 | (6,432 | ) | (865 | ) | ||||||||||||||||||||||

* The number of shares outstanding before the RTO have been restated to reflect the effect of issuing 14.5094 RTO shares for each share outstanding.

The accompanying notes are an integral part of these consolidated financial statements.

| 6 |

PLANTIFY FOODS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands of US Dollars)

For The year ended December 31, | For The year ended December 31, | |||||||

| 2022 | 2021 | |||||||

| US$ in thousands | ||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss for the year | (4,670 | ) | (1,094 | ) | ||||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation | 100 | 44 | ||||||

| Capital loss from sale of property and equipment | - | 6 | ||||||

| Amortization of Right Of Use asset | 66 | 14 | ||||||

| Interest on debentures | 19 | - | ||||||

| Interest on lease obligation | 29 | 2 | ||||||

| Shares issued for debt settlement | 60 | - | ||||||

| Increase in shareholders loan | - | 5 | ||||||

| Interest benefit from Shareholders loan | 11 | 10 | ||||||

| RTO expense | 525 | - | ||||||

| Shares issued to finders and advisors | 893 | - | ||||||

| Interest on bank loans | 12 | 9 | ||||||

| Warrants fair value revaluation | 422 | (98 | ) | |||||

| Decrease (Increase) in accounts receivable | 92 | (120 | ) | |||||

| Decrease (Increase) in other accounts receivable | 9 | (24 | ) | |||||

| Decrease (Increase) in Inventory | (40 | ) | 9 | |||||

| Increase in accounts payable | 65 | 114 | ||||||

| Increase in other accounts payable | 180 | 201 | ||||||

| Net cash used in operating activities | (2,227 | ) | (922 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Sale of property and equipment | - | 5 | ||||||

| Purchase of property and equipment | (849 | ) | (177 | ) | ||||

| Change in long term deposit | 5 | - | ||||||

| Net cash used in investing activities | (844 | ) | (172 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Issuance of common shares and warrants, net | 2,800 | 1,188 | ||||||

| Repayment of related party loan | - | (238 | ) | |||||

| Reciept of a bank loan, net | (25 | ) | (105 | ) | ||||

| Payment of lease obligation | (39 | ) | (16 | ) | ||||

| Cash acquired from acquisition of POB | 75 | - | ||||||

| Issuance of convertible debentures | 369 | - | ||||||

| Reciept of Loans | (238 | ) | 247 | |||||

| Net cash provided by financing activities | 2,942 | 1,076 | ||||||

| Effect of exchange rate fluctuations on cash and cash equivalents | 74 | 67 | ||||||

| Net Increase in cash and cash equivalents | (129 | ) | 49 | |||||

| Cash and cash equivalents at the beginning of the period | 114 | 65 | ||||||

| Cash and cash equivalents at the end of the period | 59 | 114 | ||||||

For The year ended December 31, | For The year ended December 31, | |||||||

| 2022 | 2021 | |||||||

| US$ in thousands | ||||||||

| NON CASH ACTIVITIES: | ||||||||

| Equity contribution from shareholders loan | 11 | 47 | ||||||

| Lease liabilities arising from obtaining right-of-use-assets | 624 | - | ||||||

| Lease liabilities and right-of-use-assets write-off | - | 17 | ||||||

| Supplemental disclosure of cash flow information: | ||||||||

| Cash paid during the year for interest | 41 | 15 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 7 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 1: NATURE OF BUSINESS AND GOING CONCERN

| a. | Plantify Foods, Inc. (the “Company” or “Plantify”) is a Canadian company which was incorporated under the Business Corporations Act (British Columbia) on July 29, 2022. The Company’s registered address is 2900-733 Seymour Street, Vancouver, Canada. |

The Company is engaged in the development, production and sales of plant-based foods out of its subsidiary’s factory located in Kibbutz Gonen, Israel.

On February 18, 2022, Antalis Ventures Corp. (“Antalis”) entered into a Business Combination Agreement (“BCA”) with POB Finco Inc. Ltd. (“FinCo”) and Peas of Bean Ltd. (“POB”). Pursuant to the terms of the BCA: (i) Antalis and FinCo would amalgamate to form a new company to be named “Plantify Foods, Inc.” (the “Amalgamation Transaction”), and (ii) Plantify would acquire all of the issued and outstanding shares of POB from its shareholders in exchange for a pro-rated number of shares of Plantify.

On July 29, 2022, the Company completed the business combination transaction with POB (note ). As a result of the business combination transaction, POB became a wholly owned subsidiary of the Company. This transaction is accounted for as a reverse takeover of the Company by POB.

| b. | The Company expects to continue to finance itself through raising adequate funds in the foreseeable future. The Company incurred a net loss of USD 4,670 for the year ended December 31, 2022 and generated USD 6,432 of accumulated deficit since inception. In addition, the Group generated negative cash flows from operating activities of $2,227 . These events or conditions, along with other matters, indicate that a material uncertainty exists that may cast significant doubt on the Company’s ability to continue as a going concern. |

These financial statements were prepared on a going concern basis, which assumes that the Company will be able to obtain the necessary financing as needed to realize its assets and discharge its liabilities in the normal course of business. If the going concern assumption was not appropriate for these financial statements, then adjustments would be necessary to the carrying value of the assets and liabilities.

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES

The following accounting policies have been applied consistently in the financial statements for all periods presented, unless otherwise stated.

| a. | Basis of presentation of the financial statements: |

These financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

The Company’s financial statements have been prepared on a cost basis, except for financial instruments which are measured at fair value through profit or loss.

| 8 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)

The Company has elected to present comprehansive loss items using the “function of expense” method.

| b. | Functional currency, reporting currency and foreign currency: |

| 1. | Functional currency and reporting currency: |

The reporting currency of the financial statements is United states dollar.

The functional currency of the Company is Canadian dollars (“CAD”), and the functional currency of its subsidiary is the New Israeli Shekel (“NIS”). NIS represents the main economic environment in which the subsidiary operates.

| 2. | The financial statements are translated as follows: |

Transactions and balances in foreign currencies are converted into US Dollars in accordance with the principles set forth by International Accounting Standard (IAS) 21 “The Effects of Changes in Foreign Exchange Rates”. Transactions in NIS in POB are translated to CAD and will be reclassified to profit and loss, while transactions in CAD are translated to USD and are not reclassified to profit and loss.

Accordingly, transactions and balances have been converted as follows:

| ● | Monetary assets and liabilities - at the rate of exchange applicable at the statements of financial position date. | |

| ● | Exchange gains and losses from the aforementioned conversion are recognized in the statement of comprehensive loss. | |

| ● | Expense items - at exchange rates applicable as of the date of recognition of those items. | |

| ● | Non-monetary items are converted at the rate of exchange at the statements of financial position date. |

| c. | Cash and cash equivalents: |

Cash equivalents are considered as highly liquid investments, including unrestricted short-term bank deposits with an original maturity of three months or less from the date of acquisition.

| d. | Inventory: |

Inventory is recognized at the lower of cost and net realizable value. Cost comprises all costs of purchase, costs of conversion and other costs incurred in bringing the inventories to their present location and condition. The Company measures the cost of raw materials on a First In First Out (“FIFO”) basis and finished goods according to costs based on direct costs of materials and labor.

| 9 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)

| e. | Revenue recognition: |

Revenue is recognized by the Company in accordance with IFRS 15, “Revenue from Contracts with Customers”. Through application of this standard, the Company recognizes revenue to depict the transfer of promised goods to the customer in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods.

In order to recognize revenue under IFRS 15, the Company applies the following five (5) steps:

| ● | Identify a customer along with a corresponding contract; | |

| ● | Identify the performance obligation(s) in the contract to transfer goods or provide distinct services to customer; | |

| ● | Determine the transaction price the Company expects to be entitled to in exchange for transferring promised goods or services to the customer; | |

| ● | Allocate the transaction price to the performance obligation(s) in the contract; | |

| ● | Recognize revenue when or as the Company satisfies the performance obligation(s). |

For contracts that permit the customer to return goods that were purchased, revenue is recognized to the extent that it is highly probable that a significant reversal in the amount of cumulative revenue recognized will not occur. Therefore, the amount of revenue recognized is adjusted for expected returns, which are estimated based on historical data and past experience. Returned goods are exchanged only for new goods, i.e. no cash refunds are offered. In such circumstances, a refund liability and a right to recover returned goods asset are recognized.

| f. | Research and development expenses: |

Development costs that are directly attributable to the design and testing of identifiable and unique products controlled by the Company are recognised as intangible assets when the following criteria are met:

| ● | it is technically feasible to complete the product so that it will be available for use; | |

| ● | management intends to complete the product and use or sell it; | |

| ● | there is an ability to use or sell the product; | |

| ● | it can be demonstrated how the product will generate probable future economic benefits; | |

| ● | adequate technical, financial and other resources to complete the development and to use or sell the product are available, and | |

| ● | the expenditure attributable to the product during its development can be reliably measured. |

Capitalised development costs are recorded as intangible assets and amortised from the point at which the asset is ready for use.

Research expenditures and development expenditures that do not meet the criteria as set out above are recognised as an expense as incurred. Development costs previously recognised as an expense are not recognised as an asset in a subsequent period.

| 10 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)

| g. | Impairment of non-financial assets: |

The Company evaluates the need to record an impairment of the carrying amount of non-financial assets whenever events or changes in circumstances indicate that the carrying amount is not recoverable. If the carrying amount of non-financial assets exceeds their recoverable amount, the assets are reduced to their recoverable amount.

The recoverable amount of an asset that does not generate independent cash flows is determined for the cash-generating unit to which the asset belongs and is calculated based on the projected cash flows that will be generated by the cash generated unit. Impairment losses are recognized in profit or loss.

An impairment loss of an asset is reversed only if there have been changes in the estimates used to determine the asset’s recoverable amount since the last impairment loss was recognized. Reversal of an impairment loss, as above, shall not be increased above the lower of the carrying amount that would have been determined (net of depreciation or amortization) had no impairment loss been recognized for the asset in prior years, and its recoverable amount.

The Company did not recognize any impairment of non-financial assets for any of the periods presented.

| h. | Property, plant and equipment, net |

Property and equipment are stated at cost, net of accumulated depreciation. Depreciation is calculated by the straight-line method over the estimated useful lives of the assets, at the following annual rates:

The annual depreciation rates are as follows:

| % | ||

| 7-33 | Furniture and Computers | |

| 10 | Leasehold Improvement | |

| 10-25 | Machines and Equipment |

| i. | Financial instruments |

Fair value measurement

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value measurement is based on the presumption that the transaction to sell the asset or transfer the liability takes place either:

| 11 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)

| A. | In the principal market for the asset or liability, or | |

| B. | In the absence of a principal market, in the most advantageous market for the asset or liability. |

The principal or the most advantageous market must be accessible by the Group. The fair value of an asset or a liability is measured using the assumptions that market participants would use when pricing the asset or liability, assuming that market participants act in their economic best interest.

A fair value measurement of a non-financial asset takes into account a market participant’s ability to generate economic benefits by using the asset in its highest and best use or by selling it to another market participant that would use the asset in its highest and best use.

The Company uses valuation techniques prepared by an appraiser that are appropriate in the circumstances and for which sufficient data are available to measure fair value, maximizing the use of relevant observable inputs and minimizing the use of unobservable inputs.

Classification of financial instruments by fair value hierarchy

Assets and liabilities presented in the statement of financial position at fair value are grouped into classes with similar characteristics using the following fair value hierarchy which is determined based on the source of input used in measuring fair value:

Level 1 – Quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2 – Inputs other than quoted prices included within Level 1 that are observable either directly or indirectly.

Level 3 – Inputs that are not based on observable market data (valuation techniques that use inputs that are not based on observable market data).

Financial assets

The Company classifies its financial assets into one of the following categories, based on the business model for managing the financial asset and its contractual cash flow characteristics. The Company’s accounting policy for the relevant category is as follows:

Amortized cost: These assets arise principally from the provision of goods and services to customers (e.g. trade accounts receivable), but also incorporate other types of financial assets where the objective is to hold these assets in order to collect contractual cash flows and the contractual cash flows are solely payments of principal and interest. They are initially recognized at fair value plus transaction costs that are directly attributable to their acquisition or issue, and are subsequently carried at amortized cost using the effective interest rate method, less provision for impairment. Impairment provisions for trade accounts receivable are recognized based on the simplified approach within IFRS 9 using a provision in the determination of the lifetime expected credit losses. During this process the probability of the non-payment of the trade receivables is assessed. This probability is then multiplied by the amount of the expected loss arising from default to determine the lifetime expected credit loss for the trade receivables. For trade receivables, which are reported net, such provisions are recorded in a separate provision account with the loss being recognized within general and administrative expenses in the statement of comprehensive income. On confirmation that the trade receivable will not be collectable, the gross carrying value of the asset is written off against the associated provision.

| 12 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)

Financial Liabilities

Financial liabilities are classified into one category based on measurement:

Fair value through profit or loss: The Company measures its warrant financial liabilities at fair value through profit or loss.

De-recognition

● Financial assets - The Company derecognizes a financial asset when the contractual rights to the cash flows from the financial asset expire or it transfers the rights to receive the contractual cash flows.

● Financial Liabilities - The Company derecognizes a financial liability when its contractual obligations are discharged or cancelled, or expire.

Impairment of financial assets

The Company assesses at the end of each reporting period whether there is any objective evidence of impairment of financial assets carried at amortized cost. The Company recognizes an allowance for expected credit losses (ECL) for all debt instruments not held at fair value through profit or loss.

ECLs are based on the difference between the contractual cash flows due in accordance with the contract and all the cash flows that the Company expects to receive, discounted at an approximation of the original effective interest rate. ECLs are recognized in two stages.

For credit exposures for which there has not been a significant increase in credit risk since initial recognition, ECLs are provided for credit losses that result from default events that are possible within the next 12-months (a 12-month ECL).

For those credit exposures for which there has been a significant increase in credit risk since initial recognition, a loss allowance is required for credit losses expected over the remaining life of the exposure, irrespective of the timing of the default (a lifetime ECL). For trade accounts receivable, the Company applies a simplified approach in calculating ECLs.

As of December 31, 2022 and 2021, according to Company’s management assessment, no ECL

| 13 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)

were recorded.

Write-off policy

The Company writes off its financial assets if any of the following occur:

| ● | Inability to locate the debtor. | |

| ● | Discharge of the debt in a bankruptcy. | |

| ● | It is determined that the efforts to collect the debt are no longer cost effective given the size of receivable. |

The collections department must comply with the collection efforts outlined in the policy to collect on delinquent customer accounts before any write-offs are made.

Issue of a unit of securities:

The issue of a unit of securities involves the allocation of the proceeds received (before issue expenses) to the securities issued in the unit based on the following order: financial derivatives and other financial instruments measured at fair value in each period. Then fair value is determined for financial liabilities that are measured at amortized cost. The proceeds allocated to equity instruments are determined to be the residual amount. Issue costs are allocated to each component pro rata to the amounts determined for each component in the unit.

| j. | Loss per share: |

Loss per share is calculated by dividing the loss attributable to Company shareholders by the weighted number of outstanding ordinary shares during the period. Potential Ordinary shares are only included in the computation of diluted loss per share when their conversion increases loss per share or decreases income per share. Potential Ordinary shares that are converted during the period are included in diluted loss per share only until the conversion date.

| k. | Related party transactions: |

Parties are considered to be related if one party has the ability to control the other party or exercise significant influence over the other party’s making of financial or operational decisions, or if both parties are controlled by the same third party. The Company has transactions with key management personnel and directors. Transactions with related parties, if any, are incurred in the normal course of business and are measured at the amount of consideration established and approved by the related parties. Difference between the expenses recorded and it’s fair value is recorded under capital reserve.

| l. | Employee benefit liabilities: |

POB’s liability for severance pay is pursuant to Section 14 of the Severance Compensation Act, 1963 (“Section 14”), pursuant to which all the POB’s employees are included under Section 14, and are entitled only to monthly deposits, at a rate of 8.33% of their monthly salary, made in the employee’s name with insurance companies. Under Israeli employment law, payments in accordance with Section 14 release the Company from any future severance payments in respect of those employees. The fund is made available to the employee at the time the employer-employee relationship is terminated, regardless of cause of termination. The severance pay liabilities and deposits under Section 14 are not reflected in the balance sheets as the severance pay risks have been irrevocably transferred to the severance funds.

| 14 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)

| m. | Provisions: |

A provision in accordance with IAS 37 is recognized when the Group has a present obligation (legal or constructive) as a result of a past event, it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation and a reliable estimate can be made of the amount of the obligation. If the Group expects part or all of the expense to be reimbursed to the Company, such as in an insurance contract, the reimbursement is recognized as a separate asset only when it is virtually certain that it will be received by the Company. The expense is recognized in the income statement net of the reimbursed amount.

| n. | Taxes on income: |

As it is not likely that taxable income will be generated in the foreseeable future, deferred tax assets due to accumulated losses are not recognized in the financial statements.

| o. | Government grants: |

Government grants are recognised in comprehansive loss on a systematic basis over the periods in which the Company recognises expenses for the related costs for which the grants are intended to compensate.

| p. | Leases: |

Leased assets and lease liabilities

Contracts that award the Company control over the use of a leased asset for a period of time in exchange for consideration, are accounted for as leases. Upon initial recognition, the Company recognizes a liability at the present value of the balance of future lease payments (these payments do not include certain variable lease payments), and concurrently recognizes a right-of-use asset at the same amount of the lease liability, adjusted for any prepaid or accrued lease payments, plus initial direct costs incurred in respect of the lease.

Since the interest rate implicit in the Company’s leases is not readily determinable, the incremental borrowing rate of the lessee is used. Subsequent to initial recognition, the right-of-use asset is accounted for using the cost model, and depreciated over the shorter of the lease term or useful life of the asset.

The lease term

The lease term is the non-cancellable period of the lease plus periods covered by an extension or termination option if it is reasonably certain that the lessee will or will not exercise the option, respectively.

| 15 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)

Reassessment of lease liability

Upon the occurrence of a significant event or a significant change in circumstances that is under the control of the Company and had an effect on the decision whether it is reasonably certain that the Company will exercise an option, which was not included before in the lease term, or will not exercise an option, which was previously included in the lease term, the Company re-measures the lease liability according to the revised leased payments using a new discount rate. The change in the carrying amount of the liability is recognized against the right-of-use asset, or recognized in profit or loss if the carrying amount of the right-of-use asset was reduced to zero.

| q. | Compound financial instruments: |

Convertible debentures which contain both an equity component and a liability component are separated into two components. This separation is performed by first determining the liability component based on the fair value of an equivalent non-convertible liability. The value of the conversion component is determined to be the residual amount. Directly attributable transaction costs are apportioned between the equity component and the liability component based on the allocation of proceeds to the equity and liability components.

| r. | New accounting pronouncements: |

The Company has not early adopted any other standard, interpretation or amendment that has been issued but is not yet effective.

IAS - 1 Presentation of Financial Statements

In January 2020, the IASB issued amendments to IAS 1, which clarify the criteria used to determine whether liabilities are classified as current or non-current.

These amendments clarify that current or non-current classification is based on whether an entity has a right at the end of the reporting period to defer settlement of the liability for at least twelve months after the reporting period. The amendments also clarify that ‘settlement’ includes the transfer of cash, goods, services, or equity instruments unless the obligation to transfer equity instruments arises from a conversion feature classified as an equity instrument separately from the liability component of a compound financial instrument. The amendments are effective for annual reporting periods beginning on or after 1 January 2022.

However, in May 2020, the effective date was deferred to annual reporting periods beginning on or after 1 January 2023.

The Company is currently evaluating the impact of IAS 1 amendments, however, at this stage it is unable to assess such impact.

| 16 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 3:- CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS

The areas requiring the use of estimates and critical judgments that may potentially have a significant impact on the Group’s financial position is the fair value valuation of warrants.

Fair value valuation of warrants

The Company measures the fair value of the warrants using the Monte-Carlo valuation model. Inputs to the model are subject to various estimates related to volatility, interest rates, dividend yields and expected life of the warrants (see also Note 12).

Shareholders Loan

Based on the original loans terms, the Company classified the loans as a current liability and measured it in accordance with IFRS 9 financial instruments at the amount payable on demand i.e. the PAR value plus any accrued interest or CPI exchange differences, respectively.

Subsequent to inception, the Company accounts for any difference between a market interest rate for such loans and the denominated interest as an equity contribution. (see Note 16).

NOTE 4:- ACQUISTION

Reverse Takeover of Antalis Ventures Corp.

On February 18, 2022, Antalis entered into a Business Combination Agreement (“BCA”) with POB Finco Inc. Ltd. (“FinCo”) and Peas of Bean Ltd. (“POB”). Pursuant to the terms of the BCA: (i) Antalis and FinCo would amalgamate to form a new company to be named “Plantify Foods, Inc.” (the “Amalgamation Transaction”), and (ii) Plantify would acquire all of the issued and outstanding shares of POB from its shareholders in exchange for a pro-rated number of shares of Plantify.

On July 29, 2022, the Company issued an aggregate of 101,565,783 common shares to POB shareholders in consideration for all the 6,999,999 shares issued and outstanding of POB. Upon completion of the Share Exchange, POB became a wholly-owned subsidiary of the Company, and the Company continued to carry out the business operations of POB.

Under the terms of the BCA, up to an additional 40,300,000 Shares will be issuable to POB’s Shareholders subject to the Company attaining the following financial performance targets:

| ● | 18,800,000 Shares will be issuable upon the Company reaching cumulative gross revenue of CAD$6 million in any trailing 12-month period within 30 months of July 29, 2022; and | |

| ● | 21,500,000 Shares will be issuable upon the Company reaching cumulative gross revenue of C$12 million in any trailing 12-month period within 42 months of July 29, 2022 |

| 17 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 4:- ACQUISTION (Cont.)

As a result of the Share Exchange, POB is deemed to be the acquirer for accounting purposes (“Reverse Takeover”) and therefore its assets, liabilities and operations are included in the condensed consolidated interim financial statements at their historical carrying value, with the operations of the Company being included from July 29, 2022, the closing date of the Reverse Takeover, and onwards.

At the time of the reverse takeover, the Company did not constitute a business as defined under IFRS 3 Business Combination; therefore, the Reverse Takeover of the Company by POB is accounted for under IFRS 2 Share-based Payments. The transaction price of the acquisition was measured by reference to the fair value of the shares issued in the acquisition because the fair value of the listing service POB received could not be reliably measured. As a result, the consideration was first allocated to the identifiable assets and liabilities based on their fair values, and the difference between the consideration given to acquire the Company and the fair values of the identifiable assets and liabilities acquired by POB is recorded as a listing expense to profit and loss. The fair value of the consideration issued to acquire the Company is as follows:

| Consideration transferred: | $ | |||

| Fair value of shares and stock options retained by former Antalis shareholders (5,100,000 shares at CAD$0.12 per share) | 478 | |||

| (400,000 stock options at CAD$0.10 per stock option) | 47 | |||

| Total consideration transferred | 525 | |||

| Fair value of identifiable assets and liabilities acquired: | ||||

| Cash | 75 | |||

| Trade payable and other liabilities | (143 | ) | ||

| Total net assets acquired | (68 | ) | ||

| Listing expense | 593 |

NOTE 5:- CASH AND CASH EQUIVALENTS

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Cash denominated in NIS | 50 | 114 | ||||||

| Cash denominated in CAD | 9 | - | ||||||

| Total | 59 | 114 | ||||||

| 18 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 6:- ACCOUNT RECEIVABLES

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Open debts | 124 | 182 | ||||||

| Allowance for doubtful debts | (3 | ) | ||||||

| Checks receivables | 25 | 56 | ||||||

| Total | 146 | 238 | ||||||

NOTE 7:- OTHER ACCOUNT RECEIVABLES

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Goverenment authorities | 30 | 32 | ||||||

| Prepaid expenses | - | 7 | ||||||

| Total | 30 | 39 | ||||||

NOTE 8:- INVENTORY

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Raw material | 23 | 8 | ||||||

| Packaging | 40 | 16 | ||||||

| Goods in process and finished goods | 25 | 24 | ||||||

| Total | 88 | 48 | ||||||

NOTE 9:- LEASES

The Company leases its facility located in Kibutz Gonen, Israel under a lease agreement expiring on December 31, 2031.

The lease was signed on December 2021 for a 10 years period starting January 2022. Monthly rent fee is NIS 25 thousands (approximately USD 8).

At December 31, 2022, the Company’s lease assets and lease liabilities for leases totaled $536 (December 31, 2021 - $4) and $586 (December 31, 2021 - $5), respectively.

The Company uses its incremental borrowing rate as the discount rate for its leases, as the implicit rate in the lease is not readily determinable. As of December 31, 2022, the Company’s leases had a weighted average remaining lease term of 9 years and a weighted average borrowing rate of 4.6%.

| 19 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 9:- LEASES (Cont.)

Lease liabilities

December 31, 2022 | December 31, 2021 | |||||||

| Balance, opening | 5 | 36 | ||||||

| Additions (write off) | 624 | (17 | ) | |||||

| Lease payments | (39 | ) | (16 | ) | ||||

| Translation adjustments | (4 | ) | 2 | |||||

| Balance, ending | 586 | 5 | ||||||

Lease liabilities

| Year ended December 31, | ||||||||

| 2022 | 2021 | |||||||

| Interest expense | 29 | 2 | ||||||

| Total cash outflow for leases | 39 | 16 | ||||||

| Additions to right-of-use assets | 624 | - | ||||||

The future minimum lease payments, under our lease agreement, as of December 31, 2022, are as follows:

| Amount | ||||

| 2023 | 43 | |||

| 2024 | 85 | |||

| 2025-2031 | 597 | |||

| 20 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 10:- PROPERTY, PLANT AND EQUIPMENT, NET

| Furniture | Leasehold Improvements | Machines and equipment | Right to use asset | Land | Total | |||||||||||||||||||

| Cost | ||||||||||||||||||||||||

| Balance as at January 1, 2022 | 19 | 86 | 291 | 60 | - | 456 | ||||||||||||||||||

| Additions | 24 | 722 | 45 | 624 | 58 | 1,473 | ||||||||||||||||||

| Write-off | - | - | - | (56 | ) | - | (56 | ) | ||||||||||||||||

| Translation adjustments | (3 | ) | (43 | ) | (36 | ) | (32 | ) | (3 | ) | (117 | ) | ||||||||||||

| Balance as at December 31, 2022 | 40 | 765 | 300 | 596 | 55 | 1,756 | ||||||||||||||||||

Accumulated Depreciation | ||||||||||||||||||||||||

| Balance as at January 1, 2022 | (4 | ) | (25 | ) | (59 | ) | (56 | ) | - | (144 | ) | |||||||||||||

| Additions | (7 | ) | (43 | ) | (50 | ) | (66 | ) | - | (166 | ) | |||||||||||||

| Write-off | - | - | - | 56 | - | 56 | ||||||||||||||||||

| Translation adjustments | - | 6 | 9 | 7 | - | 22 | ||||||||||||||||||

| Balance as at December 31, 2022 | (11 | ) | (62 | ) | (100 | ) | (59 | ) | - | (233 | ) | |||||||||||||

| Property, plant and equipment, net, as at December 31, 2022 | 29 | 703 | 200 | 536 | 55 | 1,523 | ||||||||||||||||||

Cost | ||||||||||||||||||||||||

| Balance as at January 1, 2021 | 13 | 51 | 153 | 58 | - | 275 | ||||||||||||||||||

| Additions | 5 | 32 | 140 | - | - | 177 | ||||||||||||||||||

| Translation adjustments | 1 | 3 | (2 | ) | 2 | - | 4 | |||||||||||||||||

| Balance as at December 31, 2021 | 19 | 86 | 291 | 60 | - | 456 | ||||||||||||||||||

| Accumulated Depreciation | ||||||||||||||||||||||||

| Balance as at January 1, 2021 | (3 | ) | (17 | ) | (22 | ) | (26 | ) | - | (68 | ) | |||||||||||||

| Additions | (2 | ) | (7 | ) | (35 | ) | (14 | ) | - | (58 | ) | |||||||||||||

| Write-off | - | - | - | (17 | ) | - | (17 | ) | ||||||||||||||||

| Translation adjustments | 1 | (1 | ) | (2 | ) | 1 | - | (1 | ) | |||||||||||||||

| Balance as at December 31, 2021 | (4 | ) | (25 | ) | (59 | ) | (56 | ) | - | (144 | ) | |||||||||||||

| Property, plant and equipment, net, as at December 31, 2021 | 15 | 61 | 232 | 4 | - | 312 | ||||||||||||||||||

| 21 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 11:- TRADE PAYABLES

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Trade accounts payable | 365 | 231 | ||||||

| Checks | 66 | - | ||||||

| Total | 431 | 231 | ||||||

NOTE 12:- OTHER PAYABLES

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Employees and employees institutes | 82 | 102 | ||||||

| Accrued expenses | 314 | 130 | ||||||

| Reserve for vacation pay | 66 | 48 | ||||||

| Other payables | -3 | - | ||||||

| Total | 465 | 280 | ||||||

NOTE 13:- WARRANTS

The Company accounts for the warrants issued to Hama Fund, who invested in the Company in March 2021 under IFRS 9 and they are classified as a liability since the exercise price is not denominated in the functional currency of the Company. The derivative financial liability is re-measured at each reporting date, with changes in fair value recognized in finance expense (income), net.

The derivative financial liability as of December 31, 2022 and December 31, 2021 amounted to USD 503 and USD 113, respectively. The amount was recorded at fair value according to a valuation performed by an independent third-party appraiser.

For the year ended December 31, 2022, the Company recorded an expense of $422 (an income of $67 in 2021) in the statement of comprehensive loss as a result of the change in the fair value of warrants.

The fair value measurement of the warrants as of December 31, 2022 in the table below was measured using a Black Scholes warrant pricing model. The key inputs that were used in measuring the fair value of the warrants as of December 31, 2022 were: risk free interest rate – 2.96%, expected volatility - 80%, Expected term 2 years from July 29, 2022 and Expected dividend yield - 0.

A summary of changes in share purchase warrants issued by the Company during the year ended December 31, 2022 is as follows:

| Number of Warrants* | Weighted Average Exercise Price ($) | |||||||

| Balance at December 31, 2021 | 16,961,488 | 0.1378 | ||||||

| Movement during the year ended | - | - | ||||||

| December 31, 2022 | 16,961,488 | 0.1378 | ||||||

*The number of warrants outstanding have been restated to reflect the effect of issuing 14.5094 RTO shares for each share outstanding.

| 22 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 13:- WARRANTS (Cont.)

| Fair value measurements using input type | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Balance as of January 1, 2021 | - | - | 32 | 32 | ||||||||||||

| Gain recognized in profit or loss In Finance income | - | - | (98 | ) | (98 | ) | ||||||||||

| Warrants issued during the period | - | - | 186 | 186 | ||||||||||||

| Translation adjustments | - | - | 5 | 5 | ||||||||||||

| Disposal | - | - | (12 | ) | (12 | ) | ||||||||||

| Warrant liability as of December 31, 2021 | - | - | 113 | 113 | ||||||||||||

| Warrant liability as of January 1, 2022 | - | - | 113 | 113 | ||||||||||||

| Change in fair value | - | - | 422 | 422 | ||||||||||||

| Translation adjustments | - | - | (32 | ) | (32 | ) | ||||||||||

| Warrant liability as of December 31, 2022 | - | - | 503 | 503 | ||||||||||||

NOTE 14:- FINANCIAL INSTRUMENTS

| a. | Classification of financial assets and liabilities: |

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Financial assets at amortized costs: | ||||||||

| Cash and cash equivalents | 59 | 114 | ||||||

| Acounts receivable | 146 | 238 | ||||||

| Short term deposit | 15 | 16 | ||||||

| Total Financial assets | 220 | 368 | ||||||

| Financial liabilities at amortized costs: | ||||||||

| Trade payables | 431 | 231 | ||||||

| Other payables | 465 | 237 | ||||||

| Short term and long term loans | 220 | 520 | ||||||

| Convertible debentures | 388 | - | ||||||

| Shareholders loan | 165 | 174 | ||||||

| Total Financial liabilities | 1,669 | 1,162 | ||||||

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Financial liabilities at fair value: | ||||||||

| Warrant | 503 | 113 | ||||||

| Total Financial liabilities | 503 | 113 | ||||||

| 23 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 14:- FINANCIAL INSTRUMENTS (Cont.)

| b. | Financial risk factors: |

The Company’s activities expose it to various market risks (foreign currency risk, Israeli CPI risk and interest rate risk) and credit risk. The Company’s comprehensive risk management plan focuses on activities that reduce to a minimum any possible adverse effects on the Company’s financial performance.

Risk management is performed by the Company’s Board. The Board identifies, measures and manages financial risks in collaboration with the Company’s operating units.

The Board establishes documented objectives for the overall risk management activities as well as specific policies with respect to certain exposures to risks such as exchange rate risk, interest rate risk, credit risk, the use of non-derivative financial instruments and the investments of excess liquid positions.

Credit risk:

The Company’s credit risk arises principally from the Company’s receivables from customers. The carrying amounts of financial assets and contract assets represent the Company’s maximum credit risk exposure.

Trade receivables, other receivables and contract assets

The Company’s exposure to credit risk is influenced mainly by the individual characteristics of each customer. However, management also considers the demographics of the Company’s customer base, including the default risk of the industry and country in which customers operate, as these factors may have an influence on credit risk. Approximately 18% of the Company’s revenue (2021: 43%) is attributable to sales transactions with a single customer. However, there is no concentration of credit risk.

The Company has established a credit policy under which each new customer is analyzed individually for creditworthiness before the Company’s standard payment and delivery terms and conditions are offered. The Company’s review includes external ratings, when available, and in some cases bank references. Customers that fail to meet the Company’s benchmark creditworthiness may transact with the Group only on a prepayment basis.

| c. | Interest rate risk: |

The Company monitors the risk to a shortage of funds using a liquidity planning tool.

Company’s interest rate risk derives from Company’s bank loan which carried at variable rate (Prime+5.1 percent). According to management assessment, the above risk considers immaterial.

The Company’s objective is to maintain a balance between continuity of funding and flexibility through the use of overdrafts and bank loans.

| 24 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 14:- FINANCIAL INSTRUMENTS (Cont.)

The Company assessed the concentration of risk with respect to refinancing its debt and concluded it to be low.

The table below summarizes the maturity profile of the Company’s financial liabilities based on contractual undiscounted payments (including interest payments):

December 31, 2022:

| Less than one year | 1 to 2 years | 2 to 3 years | 3 to 4 years | 4 to 5 years | >5 years | Total | ||||||||||||||||||||||

| USD in thousands | ||||||||||||||||||||||||||||

| Trade payables | 431 | - | - | - | - | - | 431 | |||||||||||||||||||||

| Other payables | 465 | - | - | - | - | - | 465 | |||||||||||||||||||||

| Bank and other loans | 207 | 10 | 3 | - | - | - | 220 | |||||||||||||||||||||

| Convertible debentures | 388 | - | - | - | - | - | 388 | |||||||||||||||||||||

| Shareholders loan | - | 165 | - | - | - | - | 165 | |||||||||||||||||||||

| 1,491 | 175 | 3 | - | - | - | 1,669 | ||||||||||||||||||||||

December 31, 2021:

| Less than one year | 1 to 2 years | 2 to 3 years | 3 to 4 years | 4 to 5 years | >5 years | Total | ||||||||||||||||||||||

| USD in thousands | ||||||||||||||||||||||||||||

| Trade payables | 231 | - | - | - | - | - | 231 | |||||||||||||||||||||

| Other payables | 237 | - | - | - | - | - | 237 | |||||||||||||||||||||

| Bank and other loans | 407 | 98 | 11 | 4 | - | - | 520 | |||||||||||||||||||||

| Shareholders loan | - | 174 | - | - | - | - | 174 | |||||||||||||||||||||

| 875 | 272 | 11 | 4 | - | - | 1,162 | ||||||||||||||||||||||

| d. | Currency risk: |

The Company’s operations are denominated in CAD and the Company’s subsidiary operations are denominated in NIS. Since most of the company’s financial instruments are dominated in NIS there is a limited exposure to currency risk.

| e. | Capital disclosures: |

The

Company monitors “adjusted capital” which comprises all components of equity (i.e. share capital, capital reserve, option reserve, additional paid in capital, share purchase warrants reserve and accumulated deficit).

| 25 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 14:- FINANCIAL INSTRUMENTS (Cont.)

The Company’s objectives when maintaining capital are:

- to safeguard the entity’s ability to continue as a going concern, so that it can continue to provide returns for

shareholders and benefits for other stakeholders, and - to provide an adequate return to shareholders by pricing products and

services commensurately with the level of risk.

The Company sets the amount of capital it requires in proportion to risk. The Company manages its capital structure and makes adjustments

to it in the light of changes in economic conditions and the risk characteristics of the underlying assets. In order to maintain or adjust

the capital structure, the Company may adjust the amount of dividends paid to shareholders, return capital to shareholders, issue new shares, or sell assets to reduce debt.

NOTE 15:- BANK LOANS

| Effective interest | December 31, | |||||||||

| Rate | 2022 | 2021 | ||||||||

| Long-term loans from banking institutions | Prime+1.50-5.1 | 107 | 263 | |||||||

| Less current liabilities for long-term loans | 94 | 150 | ||||||||

| Total Long-term loans | 13 | 113 | ||||||||

| Short-term loan from banking institutions | 113 | - | ||||||||

| current liabilities for long-term loans | 94 | 150 | ||||||||

| Total Short-term loans | 207 | 150 | ||||||||

| Due dates for long-term loans | ||||||||||

| Current maturities | 94 | 150 | ||||||||

| Second year | 10 | 98 | ||||||||

| Third year | 3 | 11 | ||||||||

| Fourth year onwards | - | 4 | ||||||||

| Total | 107 | 263 | ||||||||

| 26 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 16:- LOANS

In April 2021, Company received a NIS 175 thousands (USD 54) loan from third party. The loan bears interest rate of 3% per annum. The loan terms stipulated that it will be repaid within 30 days as of consummation of initial listing (including through a reverse takeover transaction), or consummation of trade of the Company’s shares at any reputable stock exchange at the primary board, including but not limited to Nasdaq, TSX, ASX or TASE (but not TASE-UP) (“IPO”). That loan was repaid on September 1, 2022.

In November 2021, the Company received a NIS 622 thousands (USD 197) loan from third party. The loan bears interest rate of 3% per annum. The loan stipulated that it will be repaid by May 1, 2022. The Company classified the loans as current liabilities as it expects them to be repayed in the following year. That loan was repaid on March 23, 2022.

NOTE 17 – CONVERTIBLE DEBENTURES

On July 29, 2022, as part of the business combination transaction, the Company completed a non-brokered private placement of 12% subordinated unsecured convertible debentures for gross proceeds of CAD$500,000. The Convertible Debentures accrue interest at a rate of 12% per annum, mature on August 29, 2023 and are convertible at the option of the holder, at any time following the date that is one month from the date of issuance thereof and prior to the Maturity Date, into units of the Company at a conversion price of CAD$0.12. Each such unit will be comprised of one Common Share and one common share purchase warrant of the Company, exercisable at a price of CAD$0.18 per share for a period of 24 months from the date of conversion. In connection with the Convertible Debenture Financing, an advisor received a cash commission of CAD$50,000.

NOTE 18:- SHAREHOLDERS LOAN

Based on the original loans terms, the Company classified the loans as a current liability and measured it in accordance with IFRS 9 financial instruments at the amount payable on demand i.e. the PAR value plus any accrued interest or CPI exchange differences, respectively.

Subsequent to inception, the Company accounts for any difference between a market interest rate for such loans and the denominated interest as an equity contribution. For the year ended December 31, 2022, the Company recorded an amount of $11 ($57 in 2021) to account for the equity contribution.

In April 2021, Company repaid approximately USD 197 of the Loan Amounts to the founders. In August 2021, the loan terms were changed and under the new terms, the loan will be paid once the Company reaches an annual gross profit of NIS 10 million (according to its audited annual financial statements).

| 27 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 19:- EQUITY

Unlimited number of common shares without par value.

Issued

As at December 31, 2022, 147,317,644 (December 31, 2021 - 101,565,783) common shares were issued and outstanding.

During the year ended December 31, 2022

On July 29, 2022, as part of the reverse takeover as described in note 4, the Company issued 101,565,783 of its common shares to the former shareholders of POB in exchange for all of the issued and outstanding shares of POB. Total 5,100,000 shares were retained by the former shareholders of the Company.

On July 29, 2022, as part of the business combination transaction, the Company issued 30,500,000 of its common shares and 30,500,000 share purchase warrants for aggregate gross proceeds of CAD $3,583,000 and against a debt settlement of CAD $77,000.

The Company recorded a share purchase warrants reserve of $1,419 based on the Black-Scholes option pricing model and the following input assumptions:

| Weighted average fair value of warrants issued on July 29, 2022 | CAD $ 0.05955 | |||

| Risk-free interest rate | 2.96 | % | ||

| Estimated life | 2 years | |||

| Expected volatility | 112.05 | % | ||

| Expected dividend yield | 0 | % | ||

On July 29, 2022, as part of the business combination transaction, the Company issued 5,078,289 of its common shares for finder’s fees and 3,732,292 of its common shares as corporate finance fee.

On November 25, 2022, the Company issued 1,341,280 of its common shares to 2 advisors for services provided, fair value of the shares was $0.0671 and an expense of CAD $90,000 was recorded.

Stock Options

As at December 31, 2022, the Company had the following stock options outstanding:

| 28 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 19:- EQUITY (Cont.)

| Number of Stock options | Weighted average exercise price CAD$ | |||||||

| Outstanding and Exercisable, January 1, 2021 | 400,000 | * | 0.10 | |||||

| Granted during 2021 | - | - | ||||||

| Outstanding and Exercisable, December 31, 2021 | 400,000 | 0.10 | ||||||

| Granted during 2022 as part of the RTO | - | - | ||||||

| Outstanding and Exercisable, December 31, 2022 | 400,000 | 0.10 | ||||||

*these stock options were issued to Antalis shareholders before the RTO in previous years

As at December 31, 2022, the weighted average remaining life of the stock options is 6 years and 11.5 months with an expirarion date of December 16, 2029.

On December 12, 2022 the Company adopted an Omnibus equity incentive plan providing for the grant of stock options, RSU’s, DSU’s and PSU’s to the Company’s officers, directors, employees and consultants. Under the Omnibus equity incentive plan, the Company may grant stock options to purchase up to 10% of the issued and outstanding shares of the Company and may grant up to 14,597,636 DSU’s, RSU’s and PSU’s.

As at December 31, 2022, no option were granted under the Omnibus equity incentive plan (see also Note 31).

NOTE 20:- TAXES ON INCOME

| a. | Corporate tax rates: |

The Canadian corporate tax rate in 2022 was 27%.

The Israeli corporate tax rate in 2022 and 2021 was 23%.

| b. | Net Operating Loss carry forward: |

As of December 31, 2022, the Company had approximately $6,432 net-operating-loss carry forwards.

| c. | Final tax assessments: |

The Company has not received final tax assessments since inception.

| d. | Deferred taxes: |

The Company did not recognize deferred tax assets for carryforwards losses and other temporary differences because their utilization in the foreseeable future is not probable.

| e. | Current taxes: |

The Company did not record any current taxes for the years ended December 31, 2022 and 2021 as it is still incurring losses on an ongoing basis.

| f. | Reconciliation of statutory tax rate to Company’s effective tax rate: |

| 29 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 20:- TAXES ON INCOME (Cont.)

| Year ended | ||||||||

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Loss before income taxes | (4,670 | ) | (1,094 | ) | ||||

| Theoretical tax at applicable statutory tax rate (27% and 23%) | (1,167 | ) | (252 | ) | ||||

| Deferred tax asset that cannot be recognized due to uncertainty | 1,167 | 252 | ||||||

| Income tax expenses | - | - | ||||||

NOTE 21:- CONTINGENCIES AND COMMITMENTS

| a. | The Company received funding from the Israeli Innovation Authority (“IIA”, previously known as Officer of Chief Scientist - OCS) for its participation in research and development costs, based on budgets approved by the IIA, subject to the fulfillment of specified milestones. |

Companies are committed to pay royalties to the IIA on proceeds from sale of products in the research and development of which the IIA participates by way of grants. According to the

funding terms, royalties between 3% and 4.5% are payable on sales of developed products funded, up to 100% of the grant received by the Companies, linked to the US dollar and bearing libor interest rates. As of December 31, 2022, the Company received grants amounting to USD 60 (December 31, 2021 - $60).

The Company received the IIA grant according to the MOFET program in the manufacturing industry. According to the program, the Company may be exempted from royalty payments if it fullfills certain conditions. The Company believes that it meets the necessary conditions and is not obligated to pay royalties on its products.

| b. | To secure bank loan (see also Note 15), the Company pledged it’s short term and long term deposits in bank Leumi and Bank Mizrahi. |

NOTE 22:- SALES

| Year ended | ||||||||

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Sales from major costumers, each above 10%: | ||||||||

| Customer A | 44 | 105 | ||||||

| Customer B | 59 | 74 | ||||||

| Customer C | 10 | 42 | ||||||

| Customer D | 66 | 203 | ||||||

| 374 | 424 | |||||||

| 30 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 22:- SALES (Cont.)

| Year ended | ||||||||

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Geographical segmentation of revenue: | ||||||||

| Sales made to Israel | 308 | 269 | ||||||

| Sales made to the United States | 66 | 203 | ||||||

| 374 | 472 | |||||||

NOTE 23:- COST OF SALES

| Year ended | ||||||||

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Labor | 161 | 147 | ||||||

| Materials | 167 | 184 | ||||||

| Packaging | 72 | 65 | ||||||

| Manufacturing | 77 | 56 | ||||||

| Total | 477 | 452 | ||||||

NOTE 24:- RESEARCH AND DEVELOPMENT EXPENSES

| Year ended | ||||||||

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Salaries and related expenses | 41 | 40 | ||||||

| Material and subcontractors | - | - | ||||||

| Other | - | 14 | ||||||

| 41 | 54 | |||||||

| IIA participation | - | (1 | ) | |||||

| Total | 41 | 53 | ||||||

NOTE 25:- SELLING, MARKETING AND ADMINISTRATIVE EXPENSES

| Year ended | ||||||||

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Salaries and related expenses | 613 | 437 | ||||||

| Delivery | 49 | 28 | ||||||

| Professional services | 427 | 519 | ||||||

| Car maintenance | 28 | 18 | ||||||

| Marketing | 16 | 23 | ||||||

| Depreciation | 84 | 21 | ||||||

| Rent and office maintenance | 78 | 61 | ||||||

| Other | 58 | 31 | ||||||

| 1,353 | 1,138 | |||||||

| 31 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 26:- FINANCIAL EXPENSES

| Year ended | ||||||||

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Financial expense: | ||||||||

| Warrants fair value revaluation | 422 | - | ||||||

| Interest on convertible debentures | 19 | - | ||||||

| Interest benefit from Controlling Shareholders | - | 10 | ||||||

| Interest on lease | 29 | 2- | ||||||

| Bank loan interest | 12 | 13 | ||||||

| Interest on shareholders loan | 11 | 5 | ||||||

| Exchange rate differences | 43 | - | ||||||

| Other financial expenses | 7 | - | ||||||

| Total | 543 | 30 | ||||||

| Financial income: | ||||||||

| Warrants fair value revaluation | - | 98 | ||||||

| Exchange rate differences | - | 9 | ||||||

| - | 107 | |||||||

NOTE 27:- LISTING EXPENSES

| Year ended | ||||||||

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Issuance of shares and stock options to Antalis former shareholders | 593 | - | ||||||

| Issuance of shares to finders | 826 | - | ||||||

| Cash paid to finders | 286 | - | ||||||

| Professional Services | 756 | - | ||||||

| Interest paid on convertible debentures | 169 | - | ||||||

| Total | 2,630 | - | ||||||

NOTE 28:- LOSS PER SHARE

Year ended December 31, 2022 | Year ended December 31, 2021 | |||||||||||||||

| Weighted number of shares | Loss (in thousands) | Weighted number of shares | Loss (in thousands) | |||||||||||||

| Number of shares and loss used in the computation of basic and diluted loss per share | 120,557,361 | 4,670 | 6,691,712 | 1,094 | ||||||||||||

| 32 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 29:- OPERATING SEGMENTS

The company operates as one reportable segment which is engaged in the development production and marketing of plant based foods.

Company’s place of resident is in Canada and its revenues are derived from Israel and United states.

| 1. | Entity wide disclossures: |

| For the year ended December 31, | ||||||||

| External revenue by location of customers | ||||||||

| 2022 | 2021 | |||||||

| Israel | 308 | 269 | ||||||

| United States | 66 | 203 | ||||||

| 374 | 472 | |||||||

| 2. | Additional information about revenues: |

For additional information for a single customer from which revenues amount to 10% or more of total revenues reported in the financial statements refer to Note 22.

NOTE 30:- BALANCES AND TRANSACTIONS WITH RELATED PARTIES

Key management personnel compensation

Key management personnel compensation and directors fee comprised the following:

| Year ended | ||||||||

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Transaction expense: | ||||||||

| Salary and related expenses | 362 | 366 | ||||||

| Professional services | 165 | 104 | ||||||

| Interest expenses | 11 | 13 | ||||||

Liabilities to related party

| Name | December 31, 2022 | December 31, 2021 | ||||||

| Trade payables | 68 | 3 | ||||||

| Other payables | 124 | 103 | ||||||

| Shareholders loan | 165 | 172 | ||||||

| 33 |

PLANTIFY FOODS, INC.

CONSOLIDATED NOTES TO THE FINANCIAL STATEMENTS

(In thousands of US Dollars)

NOTE 31: SUBSEQUENT EVENTS

| 1. | On February 26, 2023 the Company issued to service providers of the Company 471,666 stock options at exercise prices ranging from CAD $0.12 to CAD $0.22 as well as 750,000 RSU’s to Directors of the Company. On March 20, 2023 the Company issued to directors and employees of the Company 4,900,000 stock options at an exercise price of CAD $0.12 as well as 1,000,000 RSU’s. |

| 2. | On February 27, 2023 the Company issued 2,779,150 of its common shares to 3 advisors for services provided, fair value of the shares was $0.04048. |

| 3. | On March 31, 2023 the Company signed securities exchange and convertible debenture private placement agreements with Save Foods, Inc. (“SFI”), a company traded on the Nasdaq Capital Market. On April 5, 2023 the Company issued 30,004,439 common shares to SFI following the share exchange agreement and recieved CAD $1,500,000 from SFI for the convertible debenture private placement. The Company also issued 2,150,217 common shares to a third party as finder fees as well as CAD $150,000 in cash. As part of the agreement the Company pledged its holding of POB shares against the convertible debenture. |

| 4. | On May 30, 2023 the Company issued 1,304,347 of its common shares to 3 advisors for services provided, fair value of the shares was $0.08625. |

| 34 |