Table of Contents

Filed by: Brookfield Infrastructure Corporation

(Commission File No. 001-39250)

and

Brookfield Infrastructure Partners L.P.

(Commission File No. 001-33632)

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Inter Pipeline Ltd.

This document is important and requires your immediate attention. It should be read in conjunction with the Original Offer to Purchase and Circular (as defined below). If you are in doubt as to how to deal with it, you should consult your investment advisor, stockbroker, bank manager, trust company manager, accountant, lawyer or other professional advisor.

Shareholders (as defined below) in the United States should read the “Notice to Shareholders in the United States” on page 2 of this Notice of Variation, Change and Extension.

If you have any questions, please contact Laurel Hill Advisory Group, the Information Agent and Depositary in connection to the Offer, by telephone at 1-877-452-7184 (North American Toll Free Number) or 1-416-304-0211 (outside North America) or by email at assistance@laurelhill.com. To keep current with further developments and information about the Offer, visit www.ipl-offer.com.

Neither this document nor the Original Offer to Purchase and Circular has been approved or disapproved by any securities regulatory authority, nor has any securities regulatory authority in any manner expressed an opinion or passed judgment upon the fairness or merits of the Offer, the securities offered pursuant to the Offer or the adequacy of the information contained in this document. Any representation to the contrary is an offence. Information has been incorporated by reference in the Original Offer to Purchase and Circular from documents filed with securities commissions or similar authorities in Canada. Copies of the documents of Brookfield Infrastructure Partners L.P. incorporated therein by reference may be obtained on request without charge from the office of Brookfield Infrastructure Partners L.P.’s Corporate Secretary at 73 Front Street, 5th Floor, Hamilton, HM 12, Bermuda, + 1 441 294 3309, and are also available electronically at www.sedar.com. Copies of the documents of Brookfield Infrastructure Corporation incorporated therein by reference may be obtained on request without charge from the office of Brookfield Infrastructure Corporation’s Corporate Secretary at 250 Vesey Street, 15th Floor, New York, NY 10281, +61 2-9158-5254, and are also available electronically at www.sedar.com.

Neither the U.S. Securities and Exchange Commission nor any U.S. state or Canadian provincial or territorial securities commission has approved or disapproved of the securities to be issued under this Notice of Variation, Change and Extension or the Original Offer to Purchase and Circular or determined that this Notice of Variation, Change and Extension or the Original Offer to Purchase and Circular is truthful or complete. Any representation to the contrary is a criminal offense.

This document does not constitute an offer or a solicitation to any person in any jurisdiction in which such offer or solicitation is unlawful. The Offer is not being made to, nor will deposits be accepted from or on behalf of, Shareholders in any jurisdiction in which the making or acceptance of the Offer would not be in compliance with the Laws of such jurisdiction. However, the Offeror may, in its sole discretion, take such action as it may deem necessary to extend the Offer to Shareholders in any such jurisdiction.

June 4, 2021

NOTICE OF VARIATION, CHANGE AND EXTENSION

of terms of

OFFER TO PURCHASE

all of the outstanding Common Shares of

INTER PIPELINE LTD.

by BISON ACQUISITION CORP.

and

BROOKFIELD INFRASTRUCTURE CORPORATION

EXCHANGE LIMITED PARTNERSHIP

for amended consideration per Common Share, at the choice of each holder, of

(i) $19.50 in cash (the “Cash Consideration”);

(ii) 0.225 of a Brookfield Infrastructure Corporation (“BIPC”) class A exchangeable subordinate voting

share (the “Share Consideration”); or

(iii) 0.225 of a Brookfield Infrastructure Corporation Exchange Limited Partnership

class B exchangeable limited partnership unit (the “Unit Consideration”),

subject, in each case, to pro-ration as set out herein

Table of Contents

Bison Acquisition Corp. (the “Offeror”) and Brookfield Infrastructure Corporation Exchange Limited Partnership (“Exchange LP”) have prepared this Notice of Variation, Change and Extension (the “Notice of Variation, Change and Extension”) to give notice (i) that they are increasing the consideration and varying certain terms and conditions of the offer dated February 22, 2021 (the “Original Offer to Purchase”) to purchase, on the terms and subject to the conditions of the Original Offer to Purchase, all of the issued and outstanding common shares (the “Common Shares”) of Inter Pipeline Ltd. (“IPL”), together with the associated rights (the “SRP Rights”) issued and outstanding under the shareholder rights plans of IPL, including any Common Shares that may become issued and outstanding after the date of the Original Offer to Purchase but prior to the Expiry Time (as defined herein) upon the exercise, exchange or conversion of securities of IPL into Common Shares (other than pursuant to the SRP Rights); (ii) that they are extending the Expiry of the Original Offer to Purchase to 5:00 p.m. (Mountain Standard Time) on June 22, 2021; (iii) that they are waiving the Minimum Tender Condition and certain other conditions to the Offer; and (iv) of certain changes to the information set forth in the Original Offer to Purchase and Circular (as defined herein). Particularly, this Notice of Variation, Change and Extension gives notice that certain terms and conditions of the Original Offer to Purchase related to the offer to sell or solicitation of an offer to buy shares of BIPC (the “BIPC Shares”) are hereby varied. The Original Offer to Purchase, as varied hereby, is referred to herein as the “Offer”, unless the context otherwise requires.

In particular, the Offer is varied to (i) increase the consideration, (ii) offer Canadian Shareholders who are not exempt from tax under the Tax Act the option to elect to receive class B exchangeable limited partnership units of Exchange LP (“Exchangeable LP Units”) for Common Shares under the Offer, subject to prorating as described herein and in the Original Offer to Purchase and subject to the Supplementary Election (as defined herein). The Exchangeable LP Units will provide holders with economic terms that are substantially equivalent to those of BIPC Shares (including the same distribution entitlement) and will be exchangeable, on a one-for-one basis, for BIPC Shares.

Under the Offer as amended, each Shareholder may choose to receive either (i) the Cash Consideration for each Common Share held, (ii) the Share Consideration for each Common Share held, or (iii) for Electing Shareholders (as defined herein), the Unit Consideration for each Common Share held, subject, in each case, to pro-ration as set out herein and subject to the Supplementary Election. The exchange ratio for the Share Consideration and the Unit Consideration has been calculated based on the closing price of the BIPC Shares on May 28, 2021, the last trading day prior to Brookfield Infrastructure’s Final Proposal to the IPL Board. Shareholders (other than Electing Shareholders) may choose to receive Cash Consideration for some of their Common Shares and Share Consideration for their remaining Common Shares, subject, in each case, to pro-ration as set out herein. Electing Shareholders may choose to receive the Unit Consideration for all of their Common Shares or Cash Consideration and/or Share Consideration for a portion of their Common Shares and Unit Consideration for the balance of their Common Shares, subject to pro-ration as set out herein and subject to the Supplementary Election. The total amount of cash available under the Offer is limited to $5.56 billion. The total number of BIPC Shares available under the Offer is limited to 23.0 million, subject to any adjustments to account for rounding. The total number of Exchangeable LP Units available under the Offer (other than in respect of the Supplementary Election) is limited to 23.0 million, subject to any adjustments to account for rounding. Up to an additional 8.0 million Exchangeable LP Units are available for issuance under the Offer in connection with any Supplementary Elections.

In addition, the Offer is varied to extend the time period for acceptance of the Offer.

The Offer has been extended and now remains open for acceptance until 5:00 p.m. (Mountain Standard Time) on June 22, 2021 (the “Expiry Time”), unless the Offer is further extended, accelerated or withdrawn by the Offeror in accordance with its terms.

Furthermore, the Offer is varied to waive the Minimum Tender Condition and certain other conditions to the Offer.

This Notice of Variation, Change and Extension along with the accompanying Supplemental Letter of Transmittal should be read in conjunction with: (i) the Original Offer to Purchase and the accompanying take-over bid circular dated February 22, 2021 (the “Circular” and together with the Original Offer to Purchaser, the “Original Offer to Purchase and Circular”); (ii) the Letter of Transmittal that accompanied the Original Offer to Purchase and Circular; and (iii) the Notice of Guaranteed Delivery that accompanied the Original Offer to Purchase and Circular (the Letter of Transmittal and the Notice of Guaranteed Delivery, collectively with the Original Offer to Purchase and Circular, the “Original Offer Documents”). To the extent specifically set out in this document, the Original Offer Documents are deemed to be amended as of the date hereof to give effect to the amendments to the Original Offer to Purchase described in this document, and as of the date hereof, the term Original Offer Documents shall also include this Notice of Variation, Change and Extension. Unless the context requires otherwise, capitalized terms used herein but not defined herein that are defined in the Original Offer to Purchase and Circular have the respective meanings given to them in the Original Offer to Purchase and Circular.

ii

Table of Contents

Shareholders (other than Electing Shareholders) who have not yet deposited their Common Shares under the Offer and who wish to accept the Offer must properly complete and execute the Letter of Transmittal that accompanied the Original Offer to Purchase and Circular (printed on YELLOW paper) and deposit it, at or prior to the Expiry Time, together with Certificate(s) representing their Common Shares and all other required documents, with the Depositary at its office in Toronto, Ontario specified in the Letter of Transmittal, in accordance with the instructions in the Letter of Transmittal. Electing Shareholders who have not yet deposited their Common Shares under the Offer and who wish to accept the Offer and elect the Unit Consideration must properly complete and execute the accompanying Supplemental Letter of Transmittal (printed on BLUE paper) and deposit it, at or prior to the Expiry Time, together with Certificate(s) representing their Common Shares and all other required documents, with the Depositary at its office in Toronto, Ontario specified in the Supplemental Letter of Transmittal, in accordance with the instructions in the Supplemental Letter of Transmittal. Alternatively, Shareholders may accept the Offer by following the procedures for: (i) book-entry transfer of Common Shares set out in Section 3 of the Original Offer to Purchase, “Manner of Acceptance — Acceptance by Book-Entry Transfer”, or (ii) guaranteed delivery set out in Section 3 of the Original Offer to Purchase, “Manner of Acceptance — Procedure for Guaranteed Delivery”, using the Notice of Guaranteed Delivery that accompanied the Original Offer to Purchase and Circular (printed on PINK paper), a manually executed facsimile thereof or CDS online letter of guarantee option. The Notice of Guaranteed delivery is hereby amended by this Notice of Variation, Change and Extension such that all references to “Letter of Transmittal” in the Notice of Guaranteed Delivery are deleted and replaced with “Letter of Transmittal or Supplemental Letter of Transmittal (as applicable)”.

Shareholders who have already validly deposited and not properly withdrawn their Common Shares under the Offer and who wish to elect to receive the Unit Consideration must properly complete and execute the accompanying Supplemental Letter of Transmittal (printed on BLUE paper) and deposit it, at or prior to the Expiry Time, with the Depositary at its office in Toronto, Ontario specified in the Supplemental Letter of Transmittal, in accordance with the instructions in the Supplemental Letter of Transmittal. Upon receipt by the Depositary of a properly completed and executed Supplemental Letter of Transmittal, any Letter of Transmittal previously delivered to the Depositary by the Shareholder in respect of the Common Shares set forth in the Supplemental Letter of Transmittal will be deemed to have been withdrawn by the Shareholder.

All Shareholders who have already validly deposited and not properly withdrawn their Common Shares under the Offer and who do not wish to elect to receive the Unit Consideration do not need to do anything further to receive consideration offered by the Offeror for Common Shares under the Offer.

Shareholders whose Common Shares are registered in the name of an investment dealer, bank, trust company or other intermediary should immediately contact that intermediary for assistance if they wish to accept the Offer, in order to take the necessary steps to be able to deposit such Common Shares under the Offer. Intermediaries likely have established tendering cut-off times that are prior to the Expiry Time. Shareholders must instruct their brokers or other intermediaries promptly if they wish to tender.

Questions and requests for assistance may be directed to the Information Agent, whose contact details are provided above and on the back cover of this document. Additional copies of this document, the Original Offer to Purchase and Circular, the Letter of Transmittal, the Supplemental Letter of Transmittal and the Notice of Guaranteed Delivery may be obtained without charge on request from the Information Agent and Depositary and are available at www.ipl-offer.com or on SEDAR at www.sedar.com. Website addresses are provided for informational purposes only and no information contained on, or accessible from, such websites are incorporated by reference herein unless expressly incorporated by reference.

No broker, dealer, salesperson or other person has been authorized to give any information or make any representation other than those contained in this document, and, if given or made, such information or representation must not be relied upon as having been authorized by the Offeror, the Depositary or the Information Agent.

Shareholders should be aware that during the period of the Offer, the Offeror or any of its affiliates may, directly or indirectly, bid for and make purchases of Common Shares as permitted by applicable Law. See Section 12 of the Original Offer to Purchase, “Market Purchases and Sales of Common Shares”.

All cash payments under the Offer will be made in Canadian dollars.

Unless the context otherwise requires, all references in this Notice of Variation, Change and Extension to the “Offeror”, “we”, “us” and “our” mean the Offeror, except that in connection with Electing Shareholders, “Offeror” shall be deemed to also include Exchange LP. Certain figures herein may not add due to rounding.

iii

Table of Contents

Information contained in this document is given as of June 3, 2021 unless otherwise specifically stated.

Questions and requests should be directed to the following:

The Information Agent and Depositary for the Offer is:

FOR INQUIRIES

North American Toll Free Phone:

1-877-452-7184

Outside North America:

1-416-304-0211

Email:

assistance@laurelhill.com

FOR DEPOSITING SHARES

By Email: ipl-offer@laurelhill.com

By Facsimile Transmission: 1-416-646-2415

By Mail:

PO Box 370 STN Adelaide Toronto, Ontario M5C 2J5 Canada

By Registered Mail or Courier:

70 University Avenue, Suite 1440 Toronto, Ontario M5J 2M4 Canada

To keep current with further developments and information about the Offer, visit www.ipl-offer.com.

iv

Table of Contents

1

Table of Contents

NOTICE TO SHAREHOLDERS IN THE UNITED STATES

In connection with the Offer, BIP and BIPC have filed with the SEC a Registration Statement on Form F-4 and Amendment No. 1 thereto, which contains a prospectus relating to the Offer. SHAREHOLDERS AND OTHER INTERESTED PARTIES ARE URGED TO READ SUCH REGISTRATION STATEMENT AND ANY AND ALL OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE OFFER, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO ANY SUCH DOCUMENTS, AS EACH BECOMES AVAILABLE, BECAUSE EACH CONTAINS AND WILL CONTAIN IMPORTANT INFORMATION ABOUT THE OFFEROR, IPL AND THE OFFER. Materials filed with the SEC will be available electronically without charge at the SEC’s website at www.sec.gov and the materials will be posted on BIP’s website at www.brookfield.com/infrastructure. The financial statements included herein have been prepared in accordance with IFRS, and thus may not be comparable to financial statements of U.S. companies.

Shareholders in the United States should be aware that the disposition of their Common Shares and the acquisition of BIPC Shares by them as described herein may have tax consequences both in the United States and in Canada. Shareholders should be aware that owning BIPC Shares may subject them to tax consequences both in the United States and in Canada. Such consequences for Shareholders who are resident in, or citizens of, the United States may not be described fully herein and such Shareholders are encouraged to consult their tax advisors. See Section 18 of the Original Offer to Purchase and Circular, “Certain Canadian Federal Income Tax Considerations” and Section 19 of the Original Offer to Purchase and Circular, “Certain United States Federal Income Tax Considerations”.

The enforcement by Shareholders of civil liabilities under U.S. federal securities laws may be affected adversely by the fact that each of the Offeror, BIP, BIPC and IPL is formed under the laws of a non-U.S. jurisdiction, that some or all of their respective officers and directors may reside outside of the United States, that some or all of the experts named herein may reside outside of the United States and that all or a substantial portion of the assets of the Offeror, BIP, BIPC, IPL and such persons may be located outside the United States. Shareholders in the United States may not be able to sue the Offeror, BIP, BIPC or IPL or their respective officers or directors in a non-U.S. court for violation of United States federal securities laws. It may be difficult to compel such parties to subject themselves to the jurisdiction of a court in the United States or to enforce a judgment obtained from a court of the United States.

THE SHARE CONSIDERATION HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY U.S. STATE SECURITIES COMMISSION NOR HAS THE SEC OR ANY U.S. STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS NOTICE OF VARIATION, CHANGE AND EXTENSION OR THE ORIGINAL OFFER TO PURCHASE AND CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

In accordance with applicable law, rules and regulations of the United States, Canada or its provinces or territories, including Rule 14e-5 under the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), the Offeror or its affiliates and any advisor, broker or other person acting as the agent for, or on behalf of, or in concert with the Offeror or its affiliates, directly or indirectly, may bid for, make purchases of or make arrangements to purchase Common Shares or certain related securities outside the Offer, including purchases in the open market at prevailing prices or in private transactions at negotiated prices. Such bids, purchases or arrangements to purchase may be made during the period of the Offer and through the expiration of the Offer. Any such purchases will be made in compliance with applicable laws, rules and regulations. To the extent information about such purchases or arrangements to purchase is made public in Canada, such information will be disclosed by means of a press release or other means reasonably calculated to inform Shareholders in the United States of such information.

The Offer is being made for the securities of a Canadian company that does not have securities registered under Section 12 of the U.S. Exchange Act. Accordingly, the Offer is not subject to Section 14(d) of the U.S. Exchange Act, or Regulation 14D promulgated by the SEC thereunder, except for any requirements thereunder applicable to exchange offers commenced before the effectiveness of the related registration statement. The Offer is being conducted in accordance with Section 14(e) of the U.S. Exchange Act and Regulation 14E promulgated thereunder.

2

Table of Contents

RISK FACTORS

An investment in the Exchangeable LP Units, the BIPC Shares, including the BIPC Shares underlying the Exchangeable LP Units, the BIP Units underlying the BIPC Shares and the acceptance of the Offer are subject to certain risks. In assessing the Offer, Shareholders should carefully consider the risks described in this Offer to Purchase and Circular. Such risks may not be the only risks applicable to the Offer, the Offeror, Exchange LP, BIPC or BIP. Additional risks and uncertainties not presently known by the Offeror, Exchange LP, BIPC or BIP or that the Offeror, Exchange LP, BIPC or BIP currently believe are not material may also materially and adversely impact the successful completion of the Offer or the business, operations, financial condition, financial performance, cash flows, reputation or prospects of each of the Offeror, BIPC or BIP, respectively. See Section 8 of this Notice of Variation, Change and Extension, “Exchange LP – Risk Factors – Risks Relating to the Exchangeable LP Units”, and Section 25 of the Original Offer to Purchase and Circular, “Risk Factors”.

Certain statements contained in Sections 1, 2, 3, 4, 5, 7 and 8 of this Notice of Variation, Change and Extension, in addition to certain statements contained elsewhere in this document contain “forward-looking information” and are prospective in nature. Forward-looking information is not based on historical facts, but rather on current expectations and projections about future events, and is therefore subject to risks and uncertainties that could cause actual results to differ materially from the future results expressed or implied by the forward-looking information. Often, but not always, forward-looking information can be identified by the use of forward-looking words such as “believes”, “plans”, “expects”, “intends” and “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should”, “would”, “might” or “will” be taken, occur or be achieved. Forward- looking information contained in this Notice of Variation, Change and Extension includes, but is not limited to, statements relating to the following items: expectations relating to the Offer; the terms of the Exchangeable LP Units; the tax treatment of Shareholders; the anticipated effects of the Offer and the expected benefits of tendering to the Offer; statements regarding Brookfield Infrastructure’s intentions with respect to IPL, including in respect of employees; statements regarding the Alternative Transaction (as defined herein); and statements regarding Pembina’s (as defined herein) intentions with respect to IPL, including in respect of employees.

Although the Offeror believes that the expectations reflected by the forward-looking statements presented in this Notice of Variation, Change and Extension are reasonable, the Offeror’s forward-looking statements have been based on assumptions and factors concerning future events that may prove to be inaccurate. Those assumptions and factors are based on information currently available to the Offeror. Information used in developing forward-looking statements has been acquired from various sources, including third party consultants, suppliers and regulators, among others. The material assumptions used to develop forward-looking statements include, but are not limited to: the remaining conditions of the Offer will be satisfied on a timely basis in accordance with their terms; the anticipated benefits of the Offer will materialize; IPL’s public disclosure is accurate and that IPL has not failed to disclose publicly or in the data room any material information respecting IPL, its business, operations, assets, material agreements, or otherwise; there will be no material changes to government and environmental regulations adversely affecting the Offeror’s or IPL’s operations; and the impact of the current economic climate and financial, political and industry conditions on the Offeror’s operations, including its financial condition and asset value, will remain consistent with the Offeror’s current expectations. All figures and descriptions provided in this Notice of Variation, Change and Extension related to the Offer are based on and assume the following: (a) the Offeror’s and IPL’s respective liquidity, debt, credit ratings, debt costs and assets, will not change from what was the case on June 3, 2021, in the case of the Offeror, and from what the Offeror has ascertained from IPL’s public filings and in the data room up to and including June 3, 2021, in the case of IPL; (b) 429,219,175 Common Shares issued and outstanding immediately prior to the date of this Notice of Variation, Change and Extension; (c) that all of the Common Shares are tendered to the Offer pursuant to the terms thereof; and (d) no other Common Shares or BIPC Shares are issued before the successful completion of the Offer. Assumptions have also been made with respect to the timing of commissioning and start-up of the Offeror’s capital projects and future foreign exchange and interest rates. Although the Offeror believes that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that the forward-looking statements or information will prove to be accurate.

Because actual results or outcomes will differ, and could differ materially, from those expressed in any forward-looking statements, Shareholders should not place undue reliance on any such forward-looking statements. By their nature, forward-looking statements and information are based on assumptions and involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements, or industry results, to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements and information. In particular, there are certain risks related to the consummation of the Offer including, but not limited to, the risk of failure to satisfy the remaining conditions to the Offer and the risk that the anticipated benefits of the Offer may not be realized. In addition, Shareholders are cautioned that the actual results of the Offeror following the successful completion of the Offer, may differ materially from the expectations expressed herein as a result of a number of additional risks and uncertainties. For a further discussion regarding the risks related to the Offer and the Offeror, see Section 8 of this Notice of Variation, Change and Extension, “Exchange LP – Risk Factors – Risks Relating to the Exchangeable LP Units”, and Section 25 of the Circular, “Risk Factors”.

3

Table of Contents

New factors emerge from time to time and it is not possible for management of the Offeror to predict all of such factors and to assess in advance the impact of each such factor on the Offer or the Offeror or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. The impact of any one factor on a particular forward-looking statement is not determinable with certainty as such factors are dependent upon other factors, and the Offeror’s course of action would depend upon management’s assessment of the future considering all information available to it at the relevant time. Any forward-looking statement speaks only as of the date on which such statement is made and, except as required by applicable securities Laws, the Offeror undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events.

All references to “$” in this Offer to Purchase and Circular mean Canadian dollars, except where otherwise indicated.

4

Table of Contents

NOTICE OF VARIATION, CHANGE AND EXTENSION

June 4, 2021

TO: THE HOLDERS OF COMMON SHARES OF IPL

As set out in this Notice of Variation, Change and Extension, the Offeror and Exchange LP have: (a) increased the consideration offered to Shareholders under the Offer and amended the consideration offered to Shareholders under the Offer to include the Unit Consideration; (b) extended the Expiry Time of the Offer to 5:00 p.m. (Mountain Standard Time) on June 22, 2021; (c) made certain minor amendments to the conditions to the Offer; (d) waived the Minimum Tender Condition and certain other conditions to the Offer; (e) made certain minor administrative amendments to the Offer; and (f) updated certain information set forth in the Original Offer to Purchase and Circular.

Except as otherwise set out in this Notice of Variation, Change and Extension or the Supplemental Letter of Transmittal, the information, terms and conditions set out in the Original Offer to Purchase and Circular and the Letter of Transmittal and Notice of Guaranteed Delivery that accompanied the Original Offer to Purchase and Circular continue to be applicable in all respects and this Notice of Variation, Change and Extension and the accompanying Supplemental Letter of Transmittal should be read in conjunction with the Original Offer to Purchase and Circular and the Letter of Transmittal and Notice of Guaranteed Delivery that accompanied the Original Offer to Purchase and Circular.

Consequential amendments in accordance with this Notice of Variation, Change and Extension are deemed to be made, where required, to the Original Offer Documents. Except as otherwise set out in this Notice of Variation, Change and Extension or the Supplemental Letter of Transmittal, the terms and conditions set out in the Original Offer Documents continue to remain in effect, unamended. This Notice of Variation, Change and Extension or the Supplemental Letter of Transmittal should be read in conjunction with the Original Offer Documents.

| 1. | Amendment to the Offer Consideration |

The Offeror has amended the Original Offer to increase the consideration under the Offer and to include the Unit Consideration available to Electing Shareholders.

Under the Offer each Shareholder may choose to receive, subject in each case to pro-ration as set out herein, consideration of:

| (a) | $19.50 in cash for each Common Share (the “Cash Consideration”); |

| (b) | 0.225 of a BIPC Share for each Common Share (the “Share Consideration”); or |

| (c) | each Shareholder that is resident in Canada (or, if a partnership, is a “Canadian partnership” within the meaning of the Tax Act) and is not exempt from tax under the Tax Act may elect to receive (a Shareholder that so elects, an “Electing Shareholder”), for each Common Share deposited under the Offer, 0.225 of an Exchangeable LP Unit (the “Unit Consideration”). Shareholders not resident in Canada for Canadian tax purposes or who hold their shares through a tax-exempt account, including but not limited to registered retirement savings plan, registered retirement income fund, deferred profit sharing plan, registered education savings plan, registered disability savings plan, or a tax-free savings account are not an eligible Electing Shareholder and should not request Unit Consideration. |

5

Table of Contents

The maximum amount of cash payable by the Offeror pursuant to the Offer shall not exceed $5.56 billion (the “Maximum Cash Consideration”) and the maximum number of BIPC Shares issuable pursuant to the Offer shall not exceed 23.0 million, subject to any adjustments to account for rounding (the “Maximum Share Consideration”). The maximum number of Exchangeable LP Units issuable pursuant to the Offer shall not exceed 23.0 million (the “Maximum Unit Consideration”), subject to any adjustments to account for rounding and subject to the Supplementary Election, and the maximum number of Exchangeable LP Units (other than Exchangeable LP Units issuable in connection with any Supplementary Election) and BIPC Shares issuable pursuant to the Offer on a combined basis shall not exceed the Maximum Share Consideration. The Maximum Share Consideration will be reduced, on a one-for-one basis, for each Exchangeable LP Unit that Electing Shareholders elect to receive pursuant to the Offer (other than Exchangeable LP Units issuable in connection with any Supplementary Election), up to the Maximum Unit Consideration. The maximum number of Exchangeable LP Units issuable in connection with any Supplementary Elections shall not exceed 8.0 million (the “Maximum Supplementary Unit Consideration”). The Maximum Cash Consideration comprises approximately 74% of the total consideration under the Offer and the Maximum Share Consideration, together with and after adjusting the Maximum Share Consideration for the Unit Consideration Electing Shareholders elect to receive (other than Exchangeable LP Units issuable in connection with any Supplementary Election) (subject to the Maximum Unit Consideration), represents approximately 26% of the total consideration under the Offer. The exchange ratio for the Share Consideration and the Unit Consideration (other than Exchangeable LP Units issuable in connection with any Supplementary Election) has been calculated based on the closing price of the BIPC Shares on the TSX on May 28, 2021, the last trading day prior to Brookfield Infrastructure’s Final Proposal to the IPL Board.

All references in the Original Offer Documents to “Maximum Cash Consideration” shall be deemed to refer to $5.56 billion and all reference in the Original Offer Documents to “Maximum Share Consideration” shall be deemed to refer to 23.0 million BIPC Shares. Furthermore, the Original Offer Documents are amended to delete all references to “$4.9 billion” and replace such references with “$5.56 billion”, and to delete all reference to “19,040,258 BIPC Shares” and replace such references with “23.0 million BIPC Shares”.

Eligible Electing Shareholders may choose to receive the Unit Consideration for all of their Common Shares or Cash Consideration and/or Share Consideration for a portion of their Common Shares and Unit Consideration for the balance of their Common Shares, subject to pro-ration as set forth below and in Section 1 of the Original Offer to Purchase and Circular, “The Offer” and subject to the Supplementary Election. Specifically, Electing Shareholders that properly choose to receive Cash Consideration and/or Share Consideration for a portion of their Common Shares and Unit Consideration for the balance of their Common Shares will elect (i) the number of Common Shares in respect of which the Electing Shareholder wishes to receive Cash Consideration, (ii) the number of Common Shares in respect of which the Electing Shareholder wishes to receive Share Consideration, and (iii) the number of Common Shares in respect of which the Electing Shareholder wishes to receive Unit Consideration (subject, in each case, to pro-ration as set out below and in Section 1 of the Original Offer to Purchase and Circular, “The Offer”).

The issuance of the Exchangeable LP Units is subject to receipt of customary approvals from the TSX, and the issuance of the BIPC Shares underlying the Exchangeable LP Units (including Exchangeable LP Units issuable in connect with any Supplementary Elections) is subject to receipt of customary approvals from the TSX and the NYSE.

The consideration payable under the Offer will be prorated on each Take-Up Date as necessary to ensure that the total aggregate consideration payable under the Offer and in any Compulsory Acquisition or Subsequent Acquisition Transaction does not exceed the Maximum Cash Consideration, the Maximum Share Consideration or the Maximum Unit Consideration. The actual consideration to be received by a Shareholder under the Offer, a Subsequent Acquisition Transaction or a Compulsory Acquisition will be determined in accordance with Section 1 of the Original Offer to Purchase and Circular, as supplemented by the mechanics set forth below in respect of Electing Shareholders choosing to receive Unit Consideration and as further supplemented by the Supplementary Election.

6

Table of Contents

The Unit Consideration payable under the Offer will be prorated on each Take-Up Date as necessary to ensure that the total aggregate Unit Consideration payable under the Offer and in any Compulsory Acquisition or Subsequent Acquisition Transaction does not exceed the Maximum Unit Consideration. The actual Unit Consideration to be received by an Electing Shareholder under the Offer, a Subsequent Acquisition Transaction or a Compulsory Acquisition will be determined in accordance with the following:

| (a) | the aggregate amount of Unit Consideration that the Offeror will pay as consideration for Common Shares acquired on any Take-Up Date shall not exceed the Maximum Take-Up Date Unit Consideration (as defined below); and |

| (b) | if, on any Take-Up Date, the aggregate number of Exchangeable LP Units that would otherwise be issuable to Electing Shareholders choosing the Unit Consideration in respect of their Common Shares to be taken up on such Take-Up Date exceeds the applicable Maximum Take-Up Date Unit Consideration, the number of Exchangeable LP Units equal to the Maximum Take-Up Date Unit Consideration will be prorated among such Electing Shareholders such that each Electing Shareholder that validly deposited Common Shares on or before the Take-Up Date and chose all Unit Consideration or Unit Consideration for a portion of its Common Shares for which Exchangeable LP Units would otherwise be issuable shall be entitled to be issued the number of Exchangeable LP Units equal to the number of Exchangeable LP Units sought by such Shareholder in respect of its Common Shares multiplied by a fraction, the numerator of which is the Maximum Take-Up Date Unit Consideration and the denominator of which is the aggregate number of Exchangeable LP Units sought to be received by Electing Shareholders that validly deposited Common Shares on or before the Take-Up Date and chose the Unit Consideration for all or a portion of their Common Shares, rounded down to the nearest whole number and each such Electing Shareholder shall be deemed for all purposes to have chosen to reduce the amount of Unit Consideration they requested for all or a portion of their Common Shares to an amount equal to the number of Exchangeable LP Units received divided by the Unit Consideration, rounded down to the nearest whole, and to have chosen to receive Cash Consideration for the remainder of their Common Shares. |

The “Maximum Take-Up Date Unit Consideration” means, in respect of a Take-Up Date, the Maximum Unit Consideration multiplied by a fraction the numerator of which is the number of Common Shares to be taken up on such Take-Up Date and the denominator of which is the number of Common Shares on a Fully-Diluted Basis but excluding the Common Shares held by the Offeror Group.

For the purposes of determining pro-ration in accordance with Section 1 of the Original Offer to Purchase and Circular, as supplemented by the mechanics set forth above in respect of Electing Shareholders choosing to receive Exchangeable LP Units, the Share Consideration and the Unit Consideration shall be aggregated for the purposes of all calculations.

Any holder of Common Shares who does not properly choose one of the Cash Consideration, the Share Consideration or the Unit Consideration for each of their Common Shares in the Letter of Transmittal or Supplemental Letter of Transmittal with respect to any Common Shares deposited by such holder pursuant to the Offer will be deemed to have chosen the Cash Consideration, subject to adjustment in accordance with Section 1 of the Original Offer to Purchase and Circular, “The Offer”. Any Electing Shareholder who does not properly choose all Unit Consideration for their Common Shares or Unit Consideration for a portion of their Common Shares and Cash Consideration and/or Share Consideration for the balance of their Common Shares in the Supplemental Letter of Transmittal, with respect to the Common Shares deposited by such holder pursuant to the Offer will be deemed to have chosen to receive all Cash Consideration, subject to adjustment in accordance with Section 1 of the Original Offer to Purchase and Circular, “The Offer” and will no longer be considered to be an Electing Shareholder.

No certificates representing fractional Exchangeable LP Units shall be issued in connection with the Offer. In lieu of any fractional Exchangeable LP Units, each Electing Shareholder otherwise entitled to a fractional interest in Exchangeable LP Units will receive the nearest whole number of Exchangeable LP Units. For greater certainty, where such fractional interest is greater than or equal to 0.5, the number of Exchangeable LP Units to be issued will be rounded up to the nearest whole number and where such fractional interest is less than 0.5, the number of Exchangeable LP Units to be issued will be rounded down to the nearest whole number. In calculating such fractional interests, all Common Shares registered in the name of or beneficially held by such Shareholder or his or her nominee shall be aggregated.

7

Table of Contents

Supplementary Election

In the event that any Electing Shareholder (i) properly elects to receive Unit Consideration for all of its Common Shares, and (ii) due to pro-rating in accordance with Section 1 of the Original Offer to Purchase and Circular, “The Offer”, would otherwise receive an amount of Cash Consideration as part of the consideration received by such Electing Shareholder (such amount being the “Pro-rated Cash Amount”), then such Electing Shareholder may, at its option, elect (a “Supplementary Election”, and a Shareholder that so elects, a “Supplementary Electing Shareholder”) to receive in lieu of the Pro-rated Cash Amount, additional Exchangeable LP Units (the “Supplementary Unit Consideration”). The number of Exchangeable LP Units issuable to a Supplementary Electing Shareholder that makes a Supplementary Election will be equal to the Pro-rated Cash Amount for such Supplementary Electing Shareholder, divided by a price per Exchangeable LP Unit equal to the volume weighted average trading price of the BIPC Shares on the TSX for the 5 trading days prior to the Expiry Time.

The Supplementary Unit Consideration will not form part of the Maximum Unit Consideration issuable under the Offer. The maximum number of Exchangeable LP Units issuable as Supplementary Unit Consideration shall not exceed 8.0 million Exchangeable LP Units, being the Maximum Supplementary Unit Consideration.

The Supplementary Unit Consideration payable under Supplementary Elections under the Offer will be prorated on each Take-Up Date as necessary to ensure that the total aggregate Supplementary Unit Consideration payable under the Offer and in any Compulsory Acquisition or Subsequent Acquisition Transaction does not exceed the Maximum Supplementary Unit Consideration. The actual Supplementary Unit Consideration to be received by a Supplementary Electing Shareholder under the Offer, a Subsequent Acquisition Transaction or a Compulsory Acquisition will be determined in accordance with the following:

| (a) | the aggregate amount of Supplementary Unit Consideration that the Offeror will pay pursuant to any Supplementary Elections on any Take-Up Date shall not exceed the Maximum Take-Up Date Supplementary Unit Consideration (as defined below); and |

| (b) | if, on any Take-Up Date, the aggregate number of Exchangeable LP Units that would otherwise be issuable to Supplementary Electing Shareholders making Supplementary Elections on such Take-Up Date exceeds the applicable Maximum Take-Up Date Supplementary Unit Consideration, the number of Exchangeable LP Units equal to the Maximum Take-Up Date Supplementary Unit Consideration will be prorated among such Supplementary Electing Shareholders such that each Supplementary Electing Shareholder that validly deposited Common Shares on or before the Take-Up Date and chose all Unit Consideration and made a valid Supplementary Election shall be entitled to be issued the number of Exchangeable LP Units equal to the number of Exchangeable LP Units otherwise issuable to such Supplementary Electing Shareholder as Supplementary Unit Consideration by a fraction, the numerator of which is the Maximum Take-Up Date Supplementary Unit Consideration and the denominator of which is the aggregate number of Exchangeable LP Units otherwise issuable to Supplementary Electing Shareholders that validly deposited Common Shares on or before the Take-Up Date and chose the Unit Consideration for all of their Common Shares and validly made a Supplementary Election, rounded down to the nearest whole number and each such Supplementary Electing Shareholder shall receive cash in respect of the remainder of the Pro-rated Cash Amount payable to such Supplementary Electing Shareholder. |

The “Maximum Take-Up Date Supplementary Unit Consideration” means, in respect of a Take-Up Date, the Maximum Supplementary Unit Consideration multiplied by a fraction the numerator of which is the number of Common Shares to be taken up on such Take-Up Date and the denominator of which is the number of Common Shares on a Fully-Diluted Basis but excluding the Common Shares held by the Offeror Group.

A Shareholder is not entitled to make a Supplementary Election unless such Shareholder is an Electing Shareholder and elects for Unit Consideration in respect of all of such Shareholder’s Common Shares. A person that is not resident in Canada for Canadian tax purposes (a Shareholder resident in the US or another country other than Canada) or that is exempt from tax in Canada (for example, a registered account such as a RRSP (as defined below)) is not eligible to receive Unit Consideration.

8

Table of Contents

An Electing Shareholder that wishes to make a Supplementary Election must properly complete the applicable section of the Supplemental Letter of Transmittal (printed on BLUE paper) accompanying this Notice of Variation, Change and Extension.

| 2. | Time for Acceptance – Extension of the Offer |

The Offeror has extended the Expiry Time of the Offer from 5:00 p.m. (Mountain Standard Time) on June 7, 2021 to 5:00 p.m. (Mountain Standard Time) on June 22, 2021, unless the Offer is further extended or withdrawn by the Offeror.

Accordingly, the definition of “Expiry Time” in the Original Offer to Purchase and Circular is deleted in its entirety and replaced with the following definition:

“Expiry Time” means 5:00 p.m. (Mountain Standard Time) on June 22, 2021, or such earlier or later time or times and date or dates as may be fixed by the Offeror from time to time pursuant to Section 5 of the Original Offer to Purchase, “Extension, Variation or Change in the Offer”;

In addition, all references to “5:00 p.m. (Mountain Standard Time) on June 7, 2021” in the Original Offer Documents are deleted in their entirety and replaced by “5:00 p.m. (Mountain Standard Time) on June 22, 2021”.

| 3. | Background to the Amended Offer |

On February 10, 2021, Brookfield Infrastructure announced its intention to launch a privatization transaction in respect of IPL. On February 22nd, the Offeror formally commenced the Offer pursuant to the Original Offer to Purchase sent to all Shareholders, pursuant to which the Offeror offered to acquire all of the outstanding Common Shares not already owned by Brookfield Infrastructure at a price per Common Share equal to $16.50 payable in cash or BIPC Shares, at the election of each Shareholder subject to proration.

Following the announcement of our intention to commence the Offer, on February 18th, the IPL Board formed a special committee (the “Special Committee”) to initiate a strategic review process (the “Strategic Review”) to evaluate a broad range of options, including exploring a possible corporate transaction, while continuing to seek a partner for a material interest in the Heartland Petrochemical Complex pursuant to a process that was commenced in August 2019.

On May 12th, 91 days after the date that Brookfield Infrastructure announced its intention to make the Offer and following several requests to IPL to participate in the Strategic Review, we executed a non-disclosure agreement with IPL, and on May 14th we were granted access to IPL’s data room. During the ensuing two weeks we participated in four hours of virtual management presentations to review IPL’s business segments and attending an in-person site visit of the Heartland Petrochemical Complex (“HPC”).

Between May 14th and May 31st, Brookfield Infrastructure held discussions with the Chair of IPL’s Special Committee, including the Special Committee’s advisors, and submitted a number of proposals in respect of a privatization transaction of IPL as part of the Strategic Review. These proposals included alternatives that would have allowed IPL shareholders to maintain up to a 50% direct participation in HPC through a newly created, Canadian publicly listed entity (“HPC GrowthCo”). For reasons not fully disclosed to us, we were informed that the Special Committee was not interested in pursuing this alternative even though it gave IPL Shareholders an opportunity to continue to directly receive a significant share of HPC cash flows. Additional discussions took place where Brookfield Infrastructure held an information session for the IPL Special Committee and its advisors to discuss structural elements relating to BIPC, in response to questions the Special Committee and its advisors had raised around the Share Consideration included in the Offer. Subsequently, we were advised that this session addressed IPL’s questions and that the Board was not discounting the Share Consideration in its evaluation of our Offer.

On May 25th, in accordance with the process letter provided in respect of the Strategic Review, Brookfield Infrastructure presented its updated offer in respect of its proposed acquisition of IPL.

9

Table of Contents

Over the course of the weekend of May 29th and 30th, the Special Committee informed Brookfield that it had received an en bloc offer from a competing bidder in respect of the acquisition of IPL, and requested that Brookfield Infrastructure submit its final offer. On the evening of May 30th, Brookfield submitted a written proposal to IPL’s Special Committee in respect of the acquisition of all of the outstanding Common Shares pursuant to a plan of arrangement for consideration equal to, at the election of Shareholders and subject to pro-rating, either $19.00 or 0.219 of a BIPC Share per Common Share.

During the afternoon on May 31st, Brookfield Infrastructure was informed that the IPL Board was inclined to accept a competing proposal. Brookfield Infrastructure informed IPL’s advisors that it would review its offer and respond shortly. Later that afternoon, Brookfield Infrastructure submitted a revised offer (the “Final Proposal”) to acquire all of the outstanding Common Shares for consideration equal to, at the election of Shareholders and subject to pro-rating, either $19.50 or 0.225 of a BIPC Share per Common Share, subject to pro-rating with consideration comprised of 74% in cash and 26% in BIPC Shares. As part of the submission, the Final Proposal confirmed to the Special Committee that the Final Proposal was fully financed, had received all key regulatory approvals, had no further conditions and could be executed on an accelerated basis.

In the evening of May 31st, Brookfield Infrastructure was informed by the Chair of IPL’s Special Committee that, following deliberations by the IPL Board, IPL had entered into exclusive negotiations with the competing party.

On June 1st, IPL announced that it had entered into an arrangement agreement (the “Arrangement Agreement”) with Pembina Pipeline Corporation (“Pembina”) pursuant to which Pembina would acquire all of the outstanding Common Shares in an all-share deal (the “Alternative Transaction”) in exchange for common shares of Pembina (“Pembina Shares”). The Arrangement Agreement included a $350 million break fee payable by IPL to Pembina on the occurrence of certain stated events (most of which are beyond IPL’s control), which we view as an impermissible defensive tactic and an inappropriate use of IPL’s cash, given that we had previously submitted a proposal to the Special Committee that was superior to the Alternative Transaction, both quantitatively and qualitatively.

On June 2nd, Brookfield Infrastructure announced its intention to revise the terms of the Offer, as reflected in this Notice of Variation, Change and Extension.

| 4. | Reasons to Accept the Offer |

Brookfield Infrastructure is confident that the Offer provides superior value to Shareholders, and the highest degree of transaction certainty and speed of execution versus the Alternative Transaction. The Offer enables Shareholders to maximize upfront cash consideration, subject to proration, or remain invested in BIPC — a well-known Canadian corporation with exposure to Brookfield Infrastructure’s diversified, global, portfolio of infrastructure assets and an established track record of delivering shareholders annual dividend growth of 10% over the past 12 years.

Shareholders should consider the following factors, among others, in determining whether to accept the Offer:

1. Highest Upfront Consideration and Certainty of Value to Shareholders

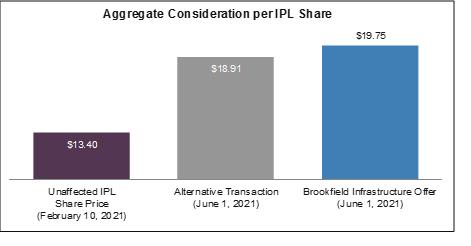

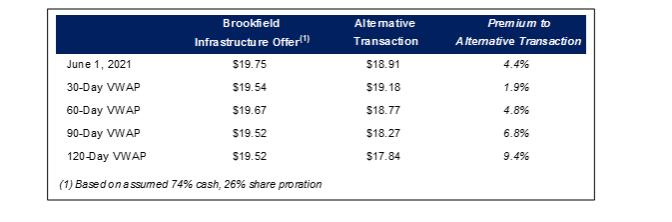

The Offer provides for aggregate cash and/or BIPC Share consideration valued at $19.751 per Common Share representing a 4.4% premium to the Alternative Transaction which would be valued at $18.91 per Common Share based on the price of the Pembina Shares as of market close on June 1, 2021. Assuming 100% Cash Consideration and 100% Share Consideration, the aggregate consideration provided by Brookfield Infrastructure would be $19.50 and $20.42, respectively, as of market close on June 1, 2021.

Our Offer provides, for those Shareholders electing for cash, a minimum of 74% of the consideration to be paid in cash and the remainder in highly attractive BIPC Shares. Moreover, the Offer includes an option for eligible Shareholders to access a tax-deferred rollover, subject to certain limitations and enhancements, all to ensure that a tax-deferred attribute is available to any eligible Shareholder who so elects.

| 1 | Based on the price of the BIPC Shares at the close of markets on June 1, 2021, and assuming 74% Cash Consideration and 26% Share Consideration proration. |

10

Table of Contents

The Alternative Transaction offers no cash consideration. The consideration is comprised entirely of shares which does not offer certainty of value. The trading value of the consideration could be negatively impacted by market volatility over the next six months due to the possibility of rising tax rates, commodity price volatility as well as interest rate outlook which could have a meaningful impact on the value shareholders receive in an all-share transaction.

Further, the trading value of the share consideration in the Alternative Transaction is also likely to be impacted by the overhang of newly issued shares. As a Shareholder with an ~20% economic interest in IPL2, Brookfield Infrastructure is not supportive of an all-stock transaction and intends to vote against the Alternative Transaction. In the event the Alternative Transaction is successful, Brookfield Infrastructure’s economic interest in Pembina would be approximately $1.6 billion which Brookfield Infrastructure would look to exit at the earliest opportunity.

The below table highlights the volatility of the Alternative Transaction compared to the Brookfield Infrastructure Offer.

2. Immediate Liquidity for Shareholders

Our Offer allows IPL shareholders to receive full payment of their total consideration within 21 days. The Offer is open for Shareholders to tender until June 22, 2021 with the Offeror taking up and paying for Common Shares tendered under the Offer within three business days following the Expiry Time, provided the Statutory Minimum Condition is satisfied and any remaining conditions to the Offer are satisfied or waived. Fast execution provides not only greater certainty for Shareholders, but also incremental value in the form of enhanced time value of money when compared to the Alternative Transaction which could require in excess of 6 months to complete, including an uncertain regulatory and anti-trust review.

| 2 | The Offeror Group beneficially own and exercise control or direction over 41,848,857 Common Shares, being approximately 9.75% of the issued and outstanding Common Shares, and the Offeror Group is party to a Total Return Swap, pursuant to which it has economic exposure to an aggregate of 42,492,698 Common Shares. The Total Return Swap affords economic exposure to Common Shares, but does not give any member of the Offeror Group any right to vote, or direct or influence the voting, acquisition, or disposition of any Common Shares. |

11

Table of Contents

The Alternative Transaction is anticipated to close in Q4 2021, further impairing the Alternative Transaction’s net present value. For example, assuming a 10% cost capital and even including dividends on the Common Shares likely to be received at the current rate, the implied opportunity cost for Shareholders due to delayed closing represents a discount of $0.65 per Common Share in the Alternative Transaction. Adjusting the Alternative Transaction for such a $0.65 implied cost, would equate to an adjusted value of $18.26 per Common Share based on the price of the Pembina Shares as of market close on June 1, 2021.

3. Highest Degree of Transaction Certainty versus the Alternative Transaction

Brookfield Infrastructure has received all key regulatory approvals thus ensuring a short and efficient timeline to closing with complete certainty.

Based on the Offeror’s review, the Alternative Transaction could face regulatory complications due to potential negative consequences on the competitive nature of the Canadian Energy and Petrochemical Industries given the resulting control of critical infrastructure, key commodities and feedstocks supplies. The Offeror believes that anti-trust approvals required in connection with the Alternative Transaction are unlikely to be straight-forward and could potentially lead to a further protracted completion timeline.

The Alternative Transaction also contains a significant number of conditions and is subject to key approvals including regulatory and anti-trust approvals, majority approval of Pembina’s shareholders, approval of 662/3% of Shareholders and other conditions as disclosed on the Arrangement Agreement.

12

Table of Contents

4. Opportunity to Participate in Brookfield Infrastructure’s Global Infrastructure Platform

Brookfield Infrastructure is a proven and leading global infrastructure company that owns and operates high-quality, long-life assets in the utilities, transport, midstream and data sectors across North and South America, Asia Pacific and Europe. Its business model generates high-quality cash flows and is underpinned by critical infrastructure assets with high barriers to entry, characterized as having:

| • | Stable underlying cash flows – 95% regulated or contracted |

| • | Highly diversified business – 8 asset classes across four continents |

| • | High margins and strong cash conversion – 85%+ cash conversion |

| • | Recession resistant attributes – 65% of the business not subject to volume risk |

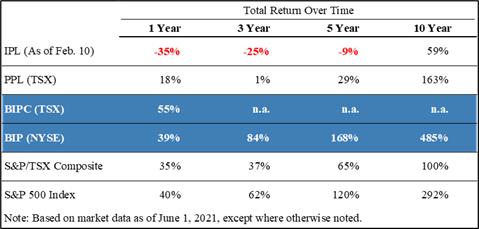

Brookfield Infrastructure has a strong track record delivering 10% annual distribution growth and a 485% total return over the last 10 years outperforming both IPL and Pembina (PPL) as highlighted in the chart below.

5. Preserves Significant Jobs in Alberta vs. a Cost Reduction-Driven Alternative Transaction

IPL has been one of Alberta’s long-standing, top-tier employers providing rewarding career opportunities and job growth. The Offeror, as a financial investor, is already a well-known and significant real asset owner and employer in Alberta and most major cities in Canada and across the globe. Our objectives for IPL are not based on significant cost synergies, e.g., sourced from the elimination of duplicative job functions, but rather we would seek to support IPL, grow certain segments selectively, and continue to be a large and trusted employer in Alberta. We are long-term owners and operators of essential businesses around the globe – we intend to support IPL’s operations with an aim to further enhance the companies environmental, social, and governance targets and performance.

The industrial rationale of the Alternative Transaction, on the other hand, has been very clearly articulated to be based on targeted $150-200 million of annual synergies, with unfortunately, a significant percentage of this goal likely achieved through headcount reductions resulting in significant job losses in Alberta.

| 5. | Conditions of the Offer |

Amendments to Conditions

In response to comments received by the Offeror from the SEC on the Registration Statement filed on February 22, 2021 (the “SEC Comments”), revisions were required to be made to Section 4 of the Circular, “Conditions of the Offer” in order to comply with applicable securities Laws in the United States. These revisions do not change the scope of the conditions of the Offer in any material respect. Accordingly, the Original Offer to Purchase and Circular is hereby varied as follows:

| (a) | the words “sole judgement” are deleted and replaced with “reasonable judgement” wherever they appear; |

13

Table of Contents

| (b) | on page 28, under Section 4 of the Circular, “Conditions of the Offer”: |

| (i) | in subsection (i)(v), the words “including Canada or the United States, in each case which is reasonably likely to have a material adverse effect on IPL or on the Offeror’s ability to complete the Offer” are added after “on the markets therefor”, |

| (ii) | in subsection (i)(vi), the words “(including the COVID pandemic, but only in respect of a material acceleration or worsening thereof)” are added after “involving Canada or the United States”, and |

| (iii) | in subsection (i)(vii), the words “(including the COVID pandemic)” are added after “a material acceleration or worsening thereof”; |

| (c) | on page 29, under Section 4 of the Circular, “Conditions of the Offer”, in the second last paragraph, the following is deleted: |

| (i) | “(including, without limitation, any action or inaction by the Offeror giving rise to any such assertions). In all cases, when exercising its sole judgment or discretion, the Offeror intends to act reasonably”, and |

| (ii) | “and may be asserted irrespective of whether any other of such conditions may be asserted in connection with any particular event, occurrence or state of facts or otherwise.”; |

| (d) | on page 29, under Section 5 of the Circular, “Extension, Variation or Change in the Offer” in the third paragraph: |

| (i) | in the first, fourth and fifth paragraphs, the words “10 days” are deleted and replaced with “10 U.S. Business Days”, wherever they appear; |

| (ii) | the following sentence is inserted following the last sentence in the first paragraph: “The Offeror will only extend the Offer once after the Offeror takes up any Common Shares under the Offer.”; |

| (iii) | in the third paragraph, the words “(or 20 U.S. Business Days, whoever is the later)” are added after “at least 35 days”, wherever they appear; and |

| (iv) | in the third paragraph, the words “In either case” are deleted. |

Waiver of the Certain Condition

On June 3, 2021, the Offeror gave notice to the Depositary, pursuant to Section 4 of the Offer, “Conditions to the Offer”, that the Offeror has irrevocably waived the following conditions to the Offer set forth in Section 4 on page 25 of the Original Offer to Purchaser, “Conditions to the Offer”:

| • | Paragraph (a), setting forth the Minimum Tender Condition; |

| • | Paragraph (d), relating to any adverse impacts of the Shareholder Rights Plan; |

| • | Paragraph (f), relating to certain specified actions to not be taken by IPL, including the entering into a plan of arrangement; |

| • | Paragraph (g), relating to the discovery of any materially adverse terms of any license, permit, instrument or agreement of IPL; |

| • | Paragraph (h), relating to a downgrade below Investment Grade Rating of IPL or its long-term senior unsecured obligations; and |

14

Table of Contents

| • | Paragraph (k), relating to the discovery of any untrue statement of material fact or any omission of a material fact in any of IPL’s filings with any Securities Regulatory Authority. |

Satisfaction of Regulatory Approval Condition

On April 21, 2021, the Offeror received a No-Action Letter from the Commissioner pursuant to the Competition Act. As such, the Offeror has obtained Competition Act Approval in respect of the Offer.

On May 7, 2021, the Offeror obtained Transportation Act Approval in respect of the Offer.

On May 18, 2021, the Offeror obtained Danish Competition Approval in respect of the Offer.

On May 20, 2021, the Offeror obtained Swedish Competition Approval in respect of the Offer.

On May 24, 2021, the applicable waiting period under the HSR Act expired in respect of the transactions contemplated by the Offer. As such, the Offeror has obtained HSR Approval in respect of the Offer.

As a result of the foregoing, the Offeror confirms that each of the Regulatory Approvals has been obtained and accordingly the condition set forth in paragraph (c) under Section 4 of the Original Offer to Purchase, “Conditions of the Offer” has been satisfied.

| 6. | IPL’s Supplemental Rights Plan |

On March 31, 2021, IPL adopted a limited-purpose supplemental shareholder rights protection plan. Accordingly, the Original Offer to Purchase and Circular is hereby varied as follows:

| (a) | on page 15, in the definition of “Shareholder Rights Plan”, the words “and as supplemented by the supplemental shareholder protection rights plan agreement dated as of March 31, 2021,” are added after “held on May 7, 2020,”; and |

| (b) | on page 60, under Section 16 of the Circular, “Shareholder Rights Plan”: |

| (i) | under the subheading ‘Effective Date’, the words “On March 31, 2021, IPL and the SRP Rights Agent entered into a supplement to the Shareholder Rights Plan” are added to the end of the paragraph, and |

| (ii) | under the subheading ‘Rights Exercise Privilege’, the words “On March 31, 2021, the IPL Board adopted a limited-purpose supplemental shareholder rights protection plan so as to include a technical revision to the existing Shareholder Rights Plan to treat owning certain financial derivatives (including the Total Return Swap) as equivalent to having beneficial ownership of the underlying securities referenced by such financial derivative.” are added to the end of the last paragraph. |

15

Table of Contents

| 7. | Administrative Amendments |

In response the SEC Comments, the Offeror has amended the Original Offer to Purchase and Circular to reflect certain administrative revisions in order to comply with applicable securities Laws in the United States. Accordingly, the Original Offer to Purchase and Circular is hereby varied as follows:

| (a) | on page xii, in the first sentence in the first paragraph, the words “and Amendment No. 1 thereto” are added after “with the SEC a Registration Statement on Form F-4,”; |

| (b) | on page 3, under How long do I have to decide whether to tender into the Offer and can that time be accelerated?: |

| (i) | in the first paragraph, the words “to occur earlier than 35 days” are deleted and replaced with “to occur earlier than the later of 35 days or 20 U.S. Business Days (as defined in Rule 14(d)-1(g)(3) under the Exchange Act)”, |

| (ii) | in the second paragraph, the words “(or 20 U.S. Business Days, whichever is the later)” are added after “at least 35 days”, wherever they appear, and |

| (iii) | in the second paragraph, the words “In either case” are deleted; |

| (c) | on page 5, subsection (c) under Will I be able to withdraw previously tendered Common Shares?, the words “10 days” are deleted and replaced with “10 U.S. Business Days (or a period otherwise consistent with applicable Law)”; |

| (d) | the following definitions are inserted in the “Glossary” in alphabetical order starting on page 9: |

“Exchange Act” means the Securities Exchange Act of 1934, as amended;

“U.S. Business Day” has the meaning ascribed thereto in Rule 14(d)-1(g)(3) under the Exchange Act;

| (e) | on page 11, in the definition of “deposit period news release”, the words “or (20 U.S. Business Days, whichever is the later) are added after “not less than 35 days”; |

| (f) | on page 14, in the definition of “Registration Statement”, the words “as amended,” are added after “on a Form F-4”; |

| (g) | on page 14, the definition of “Optional Extension Period” is deleted; |

| (h) | on page 20, under Section 2 of the Original Offer to Purchase, “Time for Acceptance”, the words “to occur earlier than 35 days” are deleted and replaced with “to occur earlier than the later of 35 days or 20 U.S. Business Days”; |

| (i) | on page 31, subsection (c) under Section 7 of the Original Offer to Purchase, “Withdrawal of Deposited Common Shares”, the words “10 days” are deleted and replaced with “10 U.S. Business Days (or a period otherwise consistent with applicable Law)”; |

| (j) | all references to “mandatory 10-day extension” in the Original Offer to Purchase and Circular are deleted and replaced with “mandatory 10-U.S. Business Day extension”; |

| (k) | all references to “or any extension thereafter” following the words “mandatory 10-day extension” are deleted; |

| (l) | on page 3, in the first sentence under “Can the Offer be extended and, if so, under what circumstances?” the words “and may extend the deposit period after such mandatory 10-day extension period for Optional Extension Periods (as defined herein)” are deleted; |

16

Table of Contents

| (m) | all references to “and any Optional Extension Period” and “or any Optional Extension Period” following the words “mandatory 10-day extension” are deleted; |

| (n) | on page 4, in the first sentence under “When will the Offeror pay for deposited Common Shares?”, the words “and may extend the deposit period for Optional Extension Periods” are deleted; |

| (o) | on page 12, in the definition of “initial deposit period”, the words “or an Optional Extension Period” are deleted; |

| (p) | on page 30, in the third sentence in the first paragraph under Section 6, “Take-Up and Payment for Deposited Common Shares”, the words “and may extend the deposit period after expiration of the mandatory 10-day extension period (“Optional Extension Periods”)” are deleted; and |

| (q) | on page 3, under “Can the Offer be Extended and, if so, under what circumstances?”, and on page 30, in the first paragraph under Section 6, “Take-Up and Payment for Deposited Common Shares”, the sentence “We will take up and pay for Common Shares deposited under the Offer during the mandatory 10-day extension period and any Optional Extension Period not later than 10 days after such deposit.” is deleted and replaced with the sentence “We will take up and pay for Common Shares deposited under the Offer during the mandatory 10-U.S. Business Day extension period promptly, and in any event not later than 3 business days after such deposit.”. |

| 8. | Exchange LP |

Exchange LP is an Alberta limited partnership controlled indirectly by BIP. Exchange LP was established for the sole purpose of the Offer and has not carried on any active business since formation other than in connection with the Offer. Exchange LP is governed by a limited partnership agreement (the “Exchange LPA”) pursuant to the Partnership Act (Alberta).

The capital of Exchange LP will be as follows: (i) general partnership units; (ii) class A limited partnership units (“LP Units”); and (iii) Exchangeable LP Units. An indirect newly formed subsidiary of BIP is the general partner (“Exchange GP”) of Exchange LP and another indirect subsidiary of BIP (“LP Co”) is the limited partner of Exchange LP. Each of Exchange GP and LP Co will at all times be residents of Canada for the purposes of the Tax Act.

Description of Exchangeable LP Units

The Offer has been structured to provide Canadian Shareholders that are not exempt from tax under the Tax Act with an opportunity, subject to them filing the applicable tax election, to obtain a full or partial deferral of capital gains for Canadian federal income tax purposes on the exchange of their Common Shares for Exchangeable LP Units under the Offer as described in this Notice of Variation, Change and Extension. The Exchangeable LP Units will be issued by Exchange LP and will be exchangeable at any time on a one-for-one basis, at the option of the holder, for BIPC Shares, subject to their terms and applicable Law. An Exchangeable LP Unit will provide a holder thereof with economic terms that are substantially equivalent to those of a BIPC Share.

Shareholders not resident in Canada for the purposes of the Tax Act (Shareholders resident in the United States or another country other than Canada) are not eligible to receive Exchangeable LP Units under the Offer.

Shareholders who hold their shares through a tax-exempt account, including but not limited to registered retirement savings plan, registered retirement income fund, deferred profit sharing plan, registered education savings plan, registered disability savings plan, or a tax-free savings account are not eligible to receive Exchangeable LP Units under the Offer.

17

Table of Contents

For additional details and certain material terms of the Exchangeable LP Units see Appendix A – Description of the Exchangeable LP Units.

Canadian Securities Law Matters

Distribution of Exchangeable LP Units

The issuance of the Exchangeable LP Units pursuant to the Offer will constitute a distribution of securities which is exempt from the prospectus requirements of Canadian securities Laws and is exempt from or otherwise is not subject to the registration requirements under applicable Canadian securities Laws. The Exchangeable LP Units are not transferable. For additional details, see Appendix A – Description of the Exchangeable LP Units.

Exemption from Reporting Issuer Obligations for Exchange LP

Prior to completion of the Offer, Exchange LP will not be a reporting issuer or the equivalent in any jurisdiction and will not have any securities listed on any stock exchange. As of the Effective Time, Exchange LP will become a reporting issuer in the provinces of Canada in which BIPC is currently a reporting issuer by virtue of the completion of the Offer. Exchange LP intends to seek exemptive relief from the Securities Regulatory Authorities to the effect that Exchange LP will be exempt from Canadian continuous disclosure requirements set forth in National Instrument 51-102 – Continuous Disclosure Requirements (“NI 51-102”), so long as certain requirements of section 13.3 of NI 51-102 are satisfied, including that Exchange LP sends to holders of Exchangeable LP Units, in the manner and at the time required by Canadian securities Laws, all financial and other continuous disclosure documents that BIPC sends to its shareholders.

Risk Factors – Risks Relating to the Exchangeable LP Units

The exchange ratio is fixed

The exchange ratio of Common Shares to Exchangeable LP Units is fixed and will not increase or decrease due to fluctuations in the market price of BIPC Shares or the Common Shares. The market price of BIPC Shares or Common Shares could each fluctuate significantly prior to the Effective Date in response to various factors and events, including, without limitation, as a result of the differences between BIPC’s and IPL’s actual financial or operating results and those expected by investors and analysts, changes in analysts’ projections or recommendations, changes in general economic or market conditions, and broad market fluctuations. As a result of such fluctuations, historical market prices are not indicative of future market prices or of the market value of the Exchangeable LP Units that Shareholders may receive on the Effective Date. There can be no assurance that the market value of Exchangeable LP Units that Shareholders may receive on the Effective Date will equal or exceed the market value of the Common Shares held by such Shareholders prior to the Effective Date. Similarly, there can be no assurance that the trading price of BIPC Shares will not decline following the completion of the Offer.

The issuance of Exchangeable LP Units under the Offer may cause the market price of BIPC Shares to decline