UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

OR

For the Fiscal Period Ended

OR

For the transition period from __________ to __________

OR

Date of event requiring this shell company report __________

Commission file number

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

+52 (

Colonia Belenes Norte

(Name, Telephone, E-mail and or Facsimile number and Address Company Contact Person)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol |

| Name of each exchange in which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated filer ☐ | Non-accelerated filer ☐ | |

|

| Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ |

| Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

TABLE OF CONTENTS

ii | |||

iii | |||

iii | |||

iii | |||

viii | |||

1 | |||

1 | |||

1 | |||

15 | |||

23 | |||

23 | |||

32 | |||

38 | |||

39 | |||

40 | |||

40 | |||

QUANTITATIVE AND QUALITATIVE DISCLOSURES REGARDING MARKET RISK | 48 | ||

51 | |||

53 | |||

53 | |||

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 53 | ||

53 | |||

56 | |||

56 | |||

56 | |||

57 | |||

57 | |||

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 57 | ||

58 | |||

58 | |||

58 | |||

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | 58 | ||

59 | |||

59 | |||

59 | |||

60 | |||

61 | |||

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains a number of forward-looking statements, including statements about the financial conditions, results of operations, earnings outlook and prospects and may include statements for the period following the date of this annual report. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of Betterware, as applicable, and are inherently subject to uncertainties and changes in circumstance and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Given these uncertainties, you should not rely upon forward looking statements as predictions of future events. These risks and uncertainties include, but are not limited to, those factors described in “Risk Factors,” those discussed and identified in public filings made with the Securities and Exchange Commission (“SEC”) by Betterware and the following:

| ● | the inability to profitably expand into new markets; |

| ● | the possibility that Betterware may be adversely affected by other economic, business and/ or competitive factors; |

| ● | operational risk; |

| ● | financial performance; |

| ● | litigation and regulatory enforcement risks, including the diversion of management time and attention and the additional costs and demands on Betterware’s resources; |

| ● | changes in our investment commitments or our ability to meet our obligations thereunder; |

| ● | natural disaster-related losses which may not be fully insurable; |

| ● | epidemics, pandemics and other public health crises, particularly the COVID-19 virus; |

| ● | geopolitical risk and changes in applicable laws or regulations; |

| ● | fluctuations in exchange rates between the Mexican peso and the United States dollar; and |

| ● | changes in interest rates or foreign exchange rates. |

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of Betterware prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Except to the extent required by applicable law or regulation, Betterware undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events.

ii

CERTAIN CONVENTIONS

Betterware de México, S.A.P.I. de C.V. (formerly Betterware de México, S.A.B. de C.V.) was incorporated under the laws of Mexico in 1995. Unless otherwise stated or unless the context otherwise requires, the terms “we,” “us,” “our,” “Company,” the “Group” “Betterware,” “BTW,” “BWM” and “BW” refer to Betterware de México, S.A.P.I. de C.V. and subsidiaries., a Mexican sociedad anónima promotora de inversión de capital variable.

CURRENCY PRESENTATION

In this annual report, unless otherwise specified or the context otherwise requires:

| ● | “$,” “US$” and “U.S. dollar” each refer to the United States dollar; and |

| ● | “MX$,” “Ps.” and “peso” each refer to the Mexican peso. |

Certain numbers and percentages included in this annual report have been subject to rounding adjustments. Accordingly, figures shown for the same category presented in various tables or other sections of this annual report may vary slightly, and figures shown as totals in certain tables may not be the arithmetic aggregation of the figures that precede them.

PRESENTATION OF FINANCIAL INFORMATION

This annual report contains our Audited Consolidated and Combined Financial Statements as of December 31, 2021, January 3, 2021, and December 31, 2019, and for the year ended December 31, 2021 (referred to as the “2021 period”), the 53 weeks ended January 3, 2021 (referred to as the “2020 period”) and the year ended December 31, 2019 (referred to as the “2019 period”) (our “Audited Consolidated and Combined Financial Statements”).

Until and including the 2020 period, Betterware’s financial year was a 52- or 53-weeks period ending on the Sunday nearest to December 31. However, due to the fact that in 2021 Betterware issued debt on the Mexican Stock Exchange, our financial period is required to coincide with the calendar year in order to comply with the Mexican General Corporate Law. Therefore, the financial information for the 2021 period is presented as of December 31, 2021, and for the year then ended. The comparative financial year of the 2020 period and the 2019 period consisted of 53 and 52 weeks ended on January 3, 2021, and December 31, 2019, respectively, but were not adjusted to calendar year because the effects of the change are not significant.

For purposes of this annual report, the term fiscal year is synonymous with financial year and refers to the periods covered by our Audited Consolidated and Combined Financial Statements.

We prepare our Audited Consolidated and Combined Financial Statements in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”). We have applied IFRS issued by the IASB effective at the time of preparing our Audited Consolidated and Combined Financial Statements. Our Audited Consolidated and Combined Financial Statements as of December 31, 2021, January 3, 2021, and December 31, 2019, and for the 2021, 2020, 2019 periods, have been audited by Galaz, Yamazaki, Ruiz Urquiza, S.C. member of Deloitte Touche Tohmatsu Limited (“Deloitte”), an independent registered public accounting firm, whose report dated April 28, 2022, is also included in this annual report.

Prior to BLSM Latino América Servicios, S.A. de C.V., a Mexican sociedad anónima de capital variable (“BLSM”), becoming a subsidiary of Betterware, we prepared combined financial statements because it provided more meaningful information to the reader as Betterware and BLSM were subsidiaries under the common control of Campalier, operating under common management; Thus, combined financial statements of these entities were prepared as of December 31, 2019. On March 10, 2020, BLSM became a subsidiary of Betterware and thus included in our consolidated financial statements as of December 31,2020. As a result, the combined statement of changes in stockholders’ equity for the 2019 period present the net parent investment gross by including contributed capital and retained earnings (rather than net as presented in prior years), as management believes it is a preferable presentation for comparability purposes with the share structure and presentation for the 2021 and 2020 periods.

iii

BLSM, provided administrative, technical, and operational services to Betterware until June 30, 2021 (formerly a related party of Betterware). On July 1, 2021, all employees from BLSM where transferred to Betterware, without having any implications on a consolidated basis.

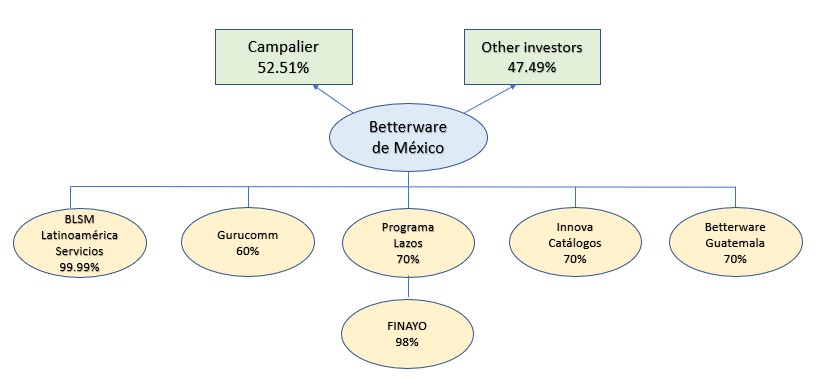

On December 3, 2020, we acquired 70% of the shares of Betterware de Guatemala, S.A., a company focused on the distribution of our line of products and providing home solutions in Guatemala. Later, On December 16, 2020, in conjunction with Finvek Advisors, S.A. de C.V., we incorporated “Programa Lazos, S.A. de C.V.,” focused on granting loans of any kind and financial leasing or financial factoring operations. We own 70% of the voting shares of Programa Lazos.

On March 12, 2021, Betterware entered into an agreement to acquire 60% of GurúComm, S.A.P.I. de C.V. (“GurúComm”), a Mobile Virtual Network Operator and communications software developer. Additionally, on July 22, 2021, Betterware entered into an agreement to acquire 70% of Innova Catálogos, S.A. de C.V. (“Innova Catálogos”), a clothing, footwear and accessories producer and developer.

The Audited Consolidated and Combined Financial Statements include the position and results of operations of Betterware, BLSM, GurúComm, Innova Catálogos, Programa Lazos and Betterware de Guatemala. The transactions among Betterware and its subsidiaries: BLSM GurúComm, Innova Catálogos, Programa Lazos and Betterware de Guatemala, and the balances and unrealized gains or losses arising from intra-group transactions have not been considered for the preparation of the Audited Consolidated and Combined Financial Statements.

Our Audited Consolidated and Combined Financial Statements are presented in thousands of Mexican Pesos (Ps).

Non-IFRS Measures

We define “EBITDA” as profit for the year adding back the depreciation of property, plant and equipment and right-of-use assets, amortization of intangible assets, financing cost, net and total income taxes. EBITDA is not measure required by or presented in accordance with IFRS. The use of EBITDA has limitations as an analytical tool, and you should not consider it in isolation from, or as a substitute for analysis of, our results of operations or financial condition as reported under IFRS.

Betterware believes that these non-IFRS financial measures are useful to investors because (i) Betterware uses these measures to analyze its financial results internally and believes they represent a measure of operating profitability and (ii) these measures will serve investors to understand and evaluate Betterware’s EBITDA and provide more tools for their analysis as it makes Betterware’s results comparable to industry peers that also prepare these measures.

The Business Combination

The Initial Public Offering

On October 16, 2018, DD3 Acquisition Corp., a British Virgin Islands company (“DD3”), consummated its initial public offering of 5,000,000 units and on October 23, 2018, the underwriters for DD3’s initial public offering purchased an additional 565,000 units pursuant to the partial exercise of their over-allotment option. The units in DD3’s initial public offering were sold at an offering price of U.S.$10.00 per unit, generating total gross proceeds of U.S.$55,650,000.

The Merger

On August 2, 2019, DD3 entered into a Combination and Stock Purchase Agreement (as amended, the “Combination and Stock Purchase Agreement”) with Campalier, S.A. de C.V., a Mexican sociedad anónima de capital variable (“Campalier”), Promotora Forteza, S.A. de C.V., a Mexican sociedad anónima de capital variable (“Forteza”), Strevo, S.A. de C.V., a Mexican sociedad anónima de capital variable (“Strevo”, and together with Campalier and Forteza, “Sellers”), Betterware, BLSM, and, solely for the purposes of Article XI therein, DD3 Mex Acquisition Corp, S.A. de C.V., pursuant to which DD3 agreed to merge with and into Betterware (the “Merger”) in a Business Combination that resulted in Betterware surviving the Merger and BLSM becoming a wholly-owned subsidiary of Betterware.

iv

As part of the Combination and Stock Purchase Agreement, and prior to the closing of the Merger, DD3 was redomiciled out of the British Virgin Islands and continued as a Mexican corporation pursuant to Section 184 of the Companies Act and Article 2 of the Mexican General Corporations Law.

The Company Restructure

Following the execution of the Combination and Stock Purchase Agreement, on February 21, 2020, the Company’s shareholders approved, a corporate restructure in the Company (the “Company Restructure”) which implied, among other things (i) the Company’s by-laws amendment in order to issue Series C and Series D non-voting shares, and (ii) a redistribution of the Company’s capital stock as follows: (a) fixed portion of the Company’s capital stock represented by 3,075,946, Series A, ordinary voting shares, and (b) the variable portion of the Company’s capital stock represented by (x) 1,961,993, Series B, ordinary voting shares, (y) 897,261, Series C, ordinary non-voting shares (“Series C Shares”), and (z) 168,734, Series D, ordinary non-voting shares (“Series D Shares”). In addition, Strevo transferred one, Series A, ordinary voting share of Betterware to Campalier (the “Campalier Share”), which remained under certain Share Pledge Agreement, dated July 28, 2017, entered between Strevo, as pledgor, MCRF P, S.A. de C.V. SOFOM, E.N.R. (“CS”), as pledgee, and Betterware.

Immediately after the Company’s Restructure and the transfer of the Campalier Share to Campalier, Forteza indirectly owned, through Banco Invex, S.A., Invex Grupo Financiero (“Invex”), as trustee of the irrevocable management and security trust No. 2397 (the “Invex Security Trust”), executed on March 26, 2016, as amended, with CS, as beneficiary, approximately 38.94% of the outstanding common stock of Betterware, and Campalier indirectly owned, through the Invex Security Trust, approximately 61.06% of the outstanding common stock of Betterware.

On March 9, 2020, the Invex Security Trust released the Series C Shares and the Series D Shares to Campalier and Forteza, respectively, that were held under the Invex Security Trust.

On March 10, 2020, CS, as pledgee, entered into a Termination of the Share Pledge Agreement over the Campalier Share with Campalier, as pledgor, and Betterware. In addition, CS, as beneficiary, Invex, as trustee, and Campalier, as settlor, entered into a Transfer Agreement, where Campalier transferred the Campalier Share to the Invex Security Trust.

Upon such transfer to the Invex Security Trust, the Company’s shareholders approved (i) the sale of all or a portion of such Company’s Series C and Series D shares to DD3 Acquisition Corp., S.A. de C.V. (the “DD3 Acquisition”), (ii) the Merger, (iii) the amendment of the Company’s by-laws to become a sociedad anónima promotora de inversion de capital variable, (iv) the increase of the Company’s capital stock by MX$94,311,438.00, through the issuance of 2,211,075 ordinary shares, without nominal value, subscribed by the shareholders of DD3 Acquisition Corp., S.A. de C.V., and (v) the increase of the Company’s capital stock by MX$872,878,500.00 through the issuance of 4,500,000 ordinary treasury shares without nominal value, offered for subscription and payment under the Company’s public offering in the U.S. completed and filed with the SEC under our Registration Statement on Form F-1, which became effective on January 22, 2020.

On March 10, 2020, Betterware’s corporate name changed from Betterware de México, S.A. de C.V. to Betterware de México, S.A.P.I. de C.V.

The DD3 Acquisition was closed on March 13, 2020, and as a result, all of Betterware shares that were issued and outstanding immediately prior to the closing date were canceled and new shares were issued. The DD3 Acquisition was accounted as a capital reorganization, whereby Betterware issued shares to the DD3 shareholders and obtained US$22,767 (Ps.498,445) in cash through the acquisition of DD3 and, simultaneously settled liabilities and related transaction costs on that date, for net cash earnings of US$7,519 (Ps.181,734) on such date. In addition, Betterware assumed the obligation of the warrants issued by DD3, a liability inherent to the transaction, equivalent to the fair value of Ps.55,810 of the warrants. No other assets or liabilities were transferred as part of the transaction that required adjustment to fair value as a result of the acquisition.

On the same date, a total of 2,040,000 of Betterware shares, that were offered for subscription and payment under its public offering on Nasdaq Capital Market (“Nasdaq”), were subscribed and paid for by various investors.

v

On July 14, 2020, Betterware’s corporate name changed from Betterware de México, S.A.P.I. de C.V. to Betterware de México, S.A.B. de C.V. For purposes of this annual report, the Merger, the Company Restructure and all related actions undertaken in connection thereto are referred to as the “Business Combination.”

Closing of the Business Combination

Upon satisfaction of certain conditions and covenants as set forth under the Combination and Stock Purchase Agreement, the Business Combination was consummated and closed on March 13, 2020 (the “Closing”). At Closing, the following actions occurred:

| (i) | DD3 issued to the Sellers as consideration for the purchase of a portion of the Series C and Series D shares and the BLSM shares outstanding as of January 3, 2021, a debt acknowledgement in an amount equal to $15,000,546. |

| (ii) | all of Betterware shares issued and outstanding immediately prior to the Closing were canceled and, Campalier and Forteza received, directly and indirectly (through the Invex Security Trust), 18,438,770 and 11,761,175, respectively, of Betterware’s shares; and |

| (iii) | all of DD3’s ordinary shares issued and outstanding immediately prior to the Closing were canceled and exchanged for Betterware shares on a one-for-one basis. |

On the Closing date, 2,040,000 shares of the Company offered for subscription and payment under the Company’s public offering in the U.S. on the Nasdaq were subscribed and paid for by various investors.

As a result of the Business Combination and the additional shares issued in the public offering, Betterware had 34,451,020 issued and outstanding shares, distributed as follows:

| (i) | 25,669,956 shares, representing 74.5% of the total capital stock, are held by Invex Security Trust, as trustee and for the benefit of CS, as first place beneficiary thereunder; |

| (ii) | 1,764,175 shares, representing 5.1% of the total capital stock, are owned by Forteza; |

| (iii) | 2,765,814 shares, representing 8.0% of the total capital stock, are owned by Campalier; |

| (iv) | 2,211,075 shares, representing 6.4% of the total capital stock, are owned by former DD3 Shareholders as a result of the cancellation of DD3’s ordinary shares and exchange for Betterware shares on a one-for-one basis; and |

| (v) | 2,040,000 shares, representing 5.9% of the total capital stock, are owned by the F-1 Investors. |

As part of the Merger, Betterware assumed an obligation that granted existing warrant holders the option to purchase (i) a total of 5,804,125 Betterware shares at a price of US$11.50 per share that would expire on or before March 25, 2025, and (ii) a total of 250,000 units that automatically became an option to issue 250,000 Betterware shares and warrants to buy 250,000 additional Betterware shares. The Company registered the warrants to be traded on OTC Markets, which had an observable fair value. The following events occurred in 2020 as part of the warrants agreement:

| (i) | During July and August 2020, the Group repurchased 1,573,888 warrants. During August and October, 2020, 895,597 warrants were exchanged for 621,098 shares, of which, 462,130 warrants were settled on a cash basis by exchanging 1 warrant for 1 share at a price of US$11.44 for share, which resulted in receiving cash by an amount of Ps.116,419. The remaining 433,467 warrants were exchanged on a cashless basis by exchanging 1 warrant for 0.37 shares. |

| (ii) | in September 2020, the purchase option of units was exercised by their holders on a cashless basis, which resulted in the issuance of 214,020 Betterware shares. |

| (iii) | Additionally, in October, 2020, and as part of the terms of the warrant agreement, the Company exercised the redemption of the warrants on a cashless basis by exchanging 3,087,022 warrants for 1,142,325 of the Company’s |

vi

| shares. A total of 8,493 public warrants were not exercised by their holders during the redemption period that expired on November 9, 2020, therefore, they were paid by the Company for a price of US$0.01 per warrant. |

| (iv) | In December, 2020, holders exercised a total of 239,125 private warrants on a cashless basis and exchanged for 156,505 of the Company’s shares. |

| (v) | As of the January 3, 2021, the warrant holders redeemed all of the outstanding warrants and purchase option of units and the Company recognized a loss for the increase in the fair value of the warrants of Ps.851,520, which was recognized under the heading “Loss in valuation of warrants” in the consolidated and combined statement of profit or loss. As of the date of this annual report, all of the warrants have been redeemed. |

On August 2, 2021, Betterware’s corporate name changed from Betterware de México, S.A.B. de C.V. to Betterware de México, S.A.P.I. de C.V.

As of the date of this annual report and as consequence of the transactions described before, the total number of outstanding shares of the Company is 37,316,546.

The Forteza Merger

On December 14, 2020, Betterware and Forteza (Betterware’s shareholder), entered into a merger agreement pursuant to which Forteza agreed to merge with and into Betterware, surviving Betterware as the acquiror (the “Forteza Merger”). On December 16, 2020, the merger was completed. Consequently, shares in Betterware were delivered to Forteza’s shareholders in proportion to their shareholding in Betterware, without implying an increase in Betterware’s share capital or in the total number of outstanding shares of the Company

Other Transactions during 2021

On March 12, 2021, Betterware entered into an agreement to acquire 60% of GurúComm for Ps.45 million. GurúComm is a Mobile Virtual Network Operator and communications software developer, with an enterprise value of Ps.75 million (approximately US$3.5 million).

On March 28, 2022, the shareholders of GurúComm approved, and Betterware agreed, the redemption of the shares owned by Betterware. Therefore, the 55,514 shares that were fully subscribed and paid until such date by was reimbursed. The additional 37,693 shares that were subscribed but not yet paid, were canceled. GurúComm’s redemption and Betterware’s investment withdrawal was mainly due to the fact that the business was not growing according to shareholders expectations, and consequently, Betterware’s investment return would take longer than anticipated. The financial impact that the redemption transaction had at a consolidated level was a loss in sale of shares of Ps. 15 million.

On July 22, 2021, Betterware entered into an agreement to acquire 70% of Innova Catálogos, S.A. de C.V., for Ps.5,000. Innova Catálogos is dedicated to the purchase and sale of clothing, footwear and accessories.

The JAFRA Acquisition

On January 18, 2022, Betterware entered into an agreement to acquire 100% of JAFRA’s (“JAFRA”) operations in Mexico and the United States from the Vorwerk Group based in Germany for a total cash consideration of US$255 million, equivalent to Ps. 5,355 million, on a debt-free, cash-free basis (the “JAFRA Acquisition”). JAFRA is a leading global brand in direct sales in the Beauty and Personal Care (B&PC) industry with strong presence in Mexico and the United States with 443,000 independent leaders and consultants who sell unique products. The JAFRA Acquisition was approved by the Federal Economic Competition Commission (“COFECE”) on March 24, 2022 and consummated on April 7, 2022. The funds necessary to pay the purchase price under the JAFRA Acquisition were obtained from (i) a long-term syndicated loan of US$225 million, and (ii) US$30 million from operating cashflow of the Company.

vii

PRESENTATION OF INDUSTRY AND MARKET DATA

In this annual report, we rely on, and refer to, information regarding our business and the markets in which we operate and compete. The market data and certain economic and industry data and forecasts used in this annual report were obtained from internal surveys, market research, governmental and other publicly available information and independent industry publications. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. We believe that these industry publications, surveys and forecasts are reliable, but we have not independently verified them and cannot guarantee their accuracy or completeness.

Certain market share information and other statements presented herein regarding our position relative to our competitors are not based on published statistical data or information obtained from independent third parties, but reflects our best estimates. We have based these estimates upon information obtained from publicly available information from our competitors in the industry in which we operate.

viii

PART I

ITEM 1.IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2.OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3.KEY INFORMATION

A.[Reserved]

B.CAPITALIZATION AND INDEBTEDNESS

Not applicable.

C.REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

D.RISK FACTORS

An investment in our ordinary shares carries a significant degree of risk. You should carefully consider the following risk factors, together with all of the other information included in this annual report, before making a decision to invest in our ordinary shares. The risks described below are those which Betterware believes are the material risks that it faces. Some statements in this annual report, including such statements in the following risk factors, constitute forward-looking statements. See the section entitled “Cautionary Note Regarding Forward-Looking Statements.” If any of the following events occur, our business, financial condition and operating results may be materially adversely affected. In that event, the trading price of our securities could decline, and you could lose all or part of your investment.

Risks Related to Betterware’s Business

If we are unable to retain our existing independent distributors and recruit additional distributors, our results of operations could be negatively affected.

We distribute almost all of our products through our independent distributors and we depend on them directly for the sale of our products. BWM experiences high turnover among distributors from year to year since they can terminate their services at any time. As a result, we need to make significant efforts to continue to retain existing and recruit additional independent distributors. To increase our revenue, we must increase the number and/or the productivity of our distributors. The number and productivity of BWM’s distributors also depends on several additional factors, including:

| ● | adverse publicity regarding BWM, our products, our distribution channel or its competitors; |

| ● | failure to motivate BWM’s distributors with new products; |

| ● | the public’s perception of BWM’s products; |

| ● | competition for distributors from other direct selling companies; |

| ● | the public’s perception of BWM’s distributors and direct selling businesses in general; and |

1

| ● | general economic and business conditions. |

BWM’s operations would be harmed if we fail to generate continued interest and enthusiasm among our distributors or we fail to attract new distributors, or if BWM’s distributors are unable to operate due to internal or external factors.

The number of our active distributors, including those at the district director level, may not increase and could decline in the future. BWM’s operating results could be harmed if existing and new business opportunities and products do not generate sufficient interest to retain existing distributors and attract new distributors.

The loss of key high-level distributors could negatively impact Betterware’s consultant growth and our revenue.

As of December 31, 2021, we had approximately 1,063,720 active associates and approximately 50,972 distributors, and 13 district directors. The district directors, together with their extensive networks of downline distributors, account for an important part of our net revenue. As a result, the loss of a high-level consultant or a group of leading distributors in the consultant’s network of downline distributors, whether by their own choice or through disciplinary actions by BWM for violations of our policies and procedures, could negatively impact our consultant growth and our net revenue.

A decline in our customers’ purchasing power or consumer confidence or in customers’ financial condition and willingness to spend could materially and adversely affect our business.

The sale of home organization products correlates strongly to the level of consumer spending generally, and thus is significantly affected by the general state of the economy and the ability and willingness of consumers to spend on discretionary items. Reduced consumer confidence and spending generally may result in reduced demand for our products and limitations on our ability to maintain or increase prices. A decline in economic conditions or general consumer spending in any of our major markets could have a material adverse effect on our business, financial condition and results of operations.

Failure of new products to gain distributors and market acceptance could harm our business.

An important component of our business is our ability to develop new products that create enthusiasm among our customers. If we fail to introduce new products planned for the future, our distributors’ productivity could be harmed. In addition, if any new products fail to gain market acceptance, are restricted by regulatory requirements, or have quality problems, this would harm our results of operations. Factors that could affect our ability to continue to introduce new products include, among others, government regulations, proprietary protections of competitors that may limit our ability to offer comparable products and any failure to anticipate changes in consumer tastes and buying preferences.

Betterware’s markets are competitive, and market conditions and the strengths of competitors may harm our business.

The market for BWM’s products is competitive. Our results of operations may be harmed by market conditions and competition in the future. Many competitors have much greater name recognition and financial resources than hawse have, which may give them a competitive advantage. For example, our products compete directly with branded, premium retail products. We currently do not have significant patent or other proprietary protection, and competitors may introduce products with the same ingredients that we use in our products.

We also compete with other companies for distributors. Some of these competitors have a longer operating history, better name recognition and greater financial resources than we do. Some of our competitors have also adopted and could continue to adopt some of our business strategies. Consequently, to successfully compete in this market and attract and retain distributors, we must ensure that our business opportunities and compensation plans are financially rewarding. We may not be able to continue to successfully compete in this market for distributors, which would ultimately, affect our business operations.

2

If the industry in which we operate, our business or our products are subject to adverse publicity, our business may suffer.

Betterware is very dependent upon our distributors’ and the general public’s perception of the overall integrity of our business, as well as the safety and quality of our products and similar products distributed by other companies. The number and motivation of our distributors and the acceptance by the general public of our products may be negatively affected by adverse publicity regarding:

| ● | the legality of network-marketing systems in general or our network-marketing system specifically; |

| ● | the safety and quality of our products; |

| ● | regulatory investigations of our products; |

| ● | the actions of our distributors; |

| ● | management of our distributors; and |

| ● | the direct selling industry. |

Failure of Betterware’s internet and our other technology initiatives to create sustained consultant enthusiasm and incremental cost savings could negatively impact our business.

We have been developing and implementing a strategy to use the internet to sign up distributors and take orders for our products. In certain demographic markets it has experienced some success using BWM’s internet strategy to improve our operating efficiency. However, any cost savings from our internet strategy may not prove to be significant, or we may not be successful in adapting and implementing the strategy to other markets in which BWM operates. This could result in our inability to service our distributors in the manner they expect.

We are dependent on information and communication technologies, and our systems and infrastructures face certain risks, including cybersecurity risks.

We are dependent on information and communication technologies, and our systems and infrastructures face certain risks, including cybersecurity risks.

The operation of complex infrastructures and the coordination of the many actors involved in our operation require the use of several highly specialized information systems, including both our own information technology systems and those of third-party service providers, such as systems that monitor our operations or the status of our facilities, communication systems to inform the public, access control systems and closed circuit television security systems, infrastructure monitoring systems and radio and voice communication systems used by our personnel. In addition, our accounting and fixed assets, payroll, budgeting, human resources, supplier and commercial, hiring, payments and billing systems and our websites are key to our functioning. The proper functioning of these systems is critical to our operations and business management. These systems may, from time to time, require modifications or improvements as a result of changes in technology, the growth of our business and the functioning of each of these systems.

The risk of cyber-crime continues to augment across all industries and geographies as infiltrating technology is becoming increasingly sophisticated. If we are unable to prevent a significant cyber-attack, such attack could materially disrupt our operations, damage our reputation and lead to regulatory penalties and financial losses. To prevent such disruptions to our operations we have implemented a multi-layer security framework, from strategic corporate policies to operational procedures and controls. To support this framework, we use sophisticated technologies to secure our perimeter, computing equipment, networks, servers, storage and databases.

Information technology systems cannot be completely protected against certain events such as natural disasters, fraud, computer viruses, hacking, communication failures, equipment breakdown, software errors and other technical problems. However, our security framework allows us to minimize and manage these risks through the use of enabling technologies such as, but not limited to, firewalls, mail & web filtering, endpoint protection, antivirus and antimalware, access lists, encryption and hardening.

3

In addition, our business operations routine involves gathering personal information about vendors, distributors, customers and employees among others, through the use of information technologies. Breaches of our systems or those of our third-party contractors, or other failures to protect such information, could expose such people’s personal information to unauthorized use. Any such event could give rise to a significant potential liability and reputational harm.

During 2021 and 2020, we encountered an increased number of non-material phishing attempts which consisted on fake e-mails requesting minor payments and/or confidential information and e-mails with malicious files successfully quarantined and contained as well as sporadic attempted attacks, minor and unsuccessful, on our infrastructure. As mentioned, none of these attempts were material nor had any major consequences for our operations or our customers. However, we cannot guarantee any future events will not affect our operations or customers. We are constantly improving and strengthening our security strategy by aligning it with Security Frameworks and Best Practices such as NIST and ISO 27000.

Because of the costs and difficulties inherent in managing cross-border business operations, the Company’s results of operations may be negatively impacted.

Managing a business, operations, personnel or assets in another country is challenging and costly. Management may be inexperienced in cross-border business practices and unaware of significant differences in accounting rules, legal regimes and labor practices. Even with a seasoned and experienced management team, the costs and difficulties inherent in managing cross-border business operations, personnel and assets can be significant (and much higher than in a purely domestic business) and may negatively impact the Company’s financial and operational performance.

Our distributors are independent contractors and not employees. If regulatory authorities were to determine, however, that our distributors are legally our employees, BWM could have significant liability under social benefit laws.

BWM’s distributors are self-employed and are not our employees. Periodically, the question of the legal status of our distributors has arisen, usually with regard to possible coverage under social benefit laws that would require BWM to make regular contributions to social benefit funds. We cannot guarantee there will not be a future determination adverse to this criteria, which would substantial and materially adversely affect our business and financial condition.

BWM depends on multiple contract manufacturers mostly located in China, and the loss of the services provided by any of our manufacturers could harm our business and results of operations.

BWM has outsourced product manufacturing functions to third-party contractors mainly located in China. In 2021, products supplied by Chinese manufacturers accounted for approximately 94% of BWM’s revenues.

If these suppliers have unscheduled downtime or are unable to fulfill their obligations under these manufacturing agreements because of political or regulatory restrictions, equipment breakdowns, natural disasters, health diseases or health epidemics, such as the COVID-19 virus, or any other cause, this could adversely affect BWM’s overall operations and financial condition.

Also, although BWM provides all of the formulations used to manufacture our products, BWM has limited control over the manufacturing process itself. As a result, any difficulties encountered by the third-party manufacturer that result in product defects, production delays, cost overruns, or the inability to fulfill orders on a timely basis could have a material adverse effect on our business, financial condition and operating results.

During the second half of 2021 and as consequence of the COVID-19 pandemic, we faced external headwind as supply chain disruption in China, specifically due to increases in sea freight prices and the rationing of energy, has caused partial and total shutdowns of some factories. We cannot predict future events that could further disrupt our supply chain. If these events continue, our results of operations could be negatively impacted.

Goodwill, property, plant and equipment and intangible assets represent a significant portion of Betterware’s statement of financial position and our operating results may suffer from possible impairments.

Goodwill, property, plant and equipment and intangible assets in Betterware’s statement of financial position derived from past business combinations carried out by BWM, are further explained in the notes to the consolidated and combined financial statements

4

located elsewhere in this annual report. Goodwill and intangible assets with indefinite useful lives are tested for impairment at least annually. Property, plant and equipment and intangible assets with definite useful lives are tested for impairment whenever there is an indication that these assets may be impaired. In the case of an impairment, we will recognize charges to our operating results based on the impairment assessment processes. In addition, future acquisitions may be made by BWM and a portion of the purchase price of these acquisitions may be allocated to acquired goodwill, property, plant and equipment and intangible assets. An impairment on property, plant and equipment or goodwill of acquired businesses could have a material adverse effect on our financial condition and results of operations.

The COVID-19 virus (nCoV), as well as any other public health crises that may arise in the future, is having and will likely continue to have a negative impact on our gross margins and in our results of operation.

In late December 2019, a notice of pneumonia of unknown cause originating from Wuhan, Hubei province of China was reported to the World Health Organization. A novel COVID-19 virus (nCoV) was identified, with cases soon confirmed in multiple provinces in China, as well as in several other countries. The Chinese government placed Wuhan and multiple other cities in Hubei province under quarantine, with approximately 60 million people affected. On March 11, 2020, the World Health Organization declared the coronavirus outbreak a pandemic. The ongoing COVID-19 has resulted in several cities be placed under quarantine, increased travel restrictions from and to several countries, such as the U.S., China, Italy, Spain and Mexico which had forced extended shutdowns of certain businesses in certain regions.

While it has eased, the COVID-19 pandemic continues to impact worldwide economic activity and continues to pose the risk that we or our employees, contractors, suppliers, customers, and other business partners may be prevented from conducting certain business activities for an indefinite period of time, including future shutdowns that may be mandated or reinstated by governmental authorities or otherwise elected by companies as a preventive measure. In addition, mandated government authority measures or other measures elected by companies as preventive measures may lead to our consumers being unable to complete purchases or other activities. Furthermore, its impact on the global and local economies has also adversely impacted and will likely continue to impact consumer discretionary spending

Our operations were not interrupted as a result of the COVID-19 pandemic. However, during the second half of 2021, people initiated the return to their normal lifestyles. As a result, some of the people that had joined our network during 2020, went back to their customary activities and decided to not continue selling our products, thus resulting on a higher-than-average churn rate for associates peaking at 4.6% a week (vs historical average churn rate of 2.8% a week) and a consequent mild decline in our average network of associates and distributors. This affected and will likely continue affecting our results of operations for so long as the COVID-19 pandemic continues to impact global and local economies.

Based on assumptions regarding the impact of the COVID-19 pandemic, we believe that our current financial resources, coupled with cash generation from operations, are sufficient to fund our liquidity requirements for the next 12 months, subject to a number of factors including, but not limited, to the evolution of the pandemic in the world, and more specifically its impact in our business. Although impact of COVID-19 pandemic has eased as restrictions have been or are being lifted in most of the countries we operate, the continuing impact of COVID-19 pandemic remains uncertain and may continue to affect our operations, for so long as the health crisis and the virus impact continues, including the emergence of new strains such as the Omicron or Delta variant, of the virus arise.

Material weaknesses have been identified in Betterware’s internal control over financial reporting, and if we fail to establish and maintain proper and effective internal controls over financial reporting, our results of operations and our ability to operate our business may be harmed.

As of December 31, 2021, management has identified significant deficiencies which, when aggregated represent material weakness associated with the components of COSO, mainly related with the insufficient policies and procedures to review, analyze, account for and disclose significant and complex accounting matters. Additionally, we were not able to test certain information technology (“IT”) general and application controls during the entire reporting period as such controls were implemented at the last quarter of the year. We expect to finalize the implementation of IT General controls during the first half of 2022.

During 2021, the Company changed its status from an emerging growth company to an accelerated filer and, as consequence thereof, became subject to additional disclosure requirements. Therefore, the Company started the implementation of a formal internal

5

control over financial reporting program based on a top-down risk assessment to validate the existence of controls over significant, accounts, processes, applications and IT environments. See “Disclosure Controls and Procedures—Control and Procedures.”

If we fail to establish and maintain proper and effective internal controls over financial reporting or adequately resolve our existing material weakness, our results of operations and our ability to operate our business may be harmed.

Betterware’s controlling shareholder may have interests that conflict with your interests.

As of the date of this annual report, Campalier owns approximately 53.38% of the outstanding common stock of Betterware. As the controlling shareholder, Campalier may take actions that are not in the best interests of the Company’s other shareholders. These actions may be taken in many cases even if they are opposed by the Company’s other shareholders. In addition, this concentration of ownership may discourage, delay or prevent a change in control which could deprive you of an opportunity to receive a premium for your Ordinary Shares as part of a sale of the Company.

Our business and results of operations may be adversely affected by the increased strain on our resources from complying with the reporting, disclosure and other requirements applicable to public companies in the United States promulgated by the U.S. Government, Nasdaq or other relevant regulatory authorities.

Compliance with existing, new and changing corporate governance and public disclosure requirements adds uncertainty to our compliance policies and increases our costs of compliance. Changing laws, regulations and standards include those relating to accounting, corporate governance and public disclosure, including the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Sarbanes-Oxley Act of 2002, new SEC regulations and the Nasdaq listing guidelines. These laws, regulations and guidelines may lack specificity and are subject to varying interpretations. Their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. In particular, compliance with Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”) and related regulations regarding required assessment of internal controls over financial reporting and our external auditor’s audit of that assessment, requires the commitment of significant financial and managerial resources. We also expect the regulations to increase our legal and financial compliance costs, making it more difficult to attract and retain qualified officers and members of our board of directors, particularly to serve on our audit committee, and make some activities more difficult, time-consuming and costly.

Existing, new and changing corporate governance and public disclosure requirements could result in continuing uncertainty regarding compliance matters and higher costs of compliance as a result of ongoing revisions to such governance standards. Our efforts to comply with evolving laws, regulations and standards have resulted in, and are likely to continue to result in, increased general and administrative expenses. In addition, new laws, regulations and standards regarding corporate governance may make it more difficult for our company to obtain director and officer liability insurance. Further, our board members and senior management could face an increased risk of personal liability in connection with their performance of duties. As a result, we may face difficulties attracting and retaining qualified board members and senior management, which could harm our business. If we fail to comply with new or changed laws or regulations and standards differ, our business and reputation may be harmed.

We may not successfully integrate JAFRA into our operations.

We consider acquisitions a useful instrument to complement our organic growth. We opportunistically explore acquiring other businesses and assets, and we have recently completed the JAFRA Acquisition.

However, we may face financial, managerial and operational challenges, including diversion of management attention and resources needed for existing operations, difficulties with integrating acquired businesses, including JAFRA, integration of different corporate cultures, increased expenses, potential dilution of our brand, assumption of unknown liabilities, potential disputes with the sellers and the need to evaluate the financial systems of and establish internal controls for acquired entities. Further, we seek out acquisitions of companies that maintain the same high quality standards that we maintain, and if we misjudge or overestimate a JAFRA’s product quality standards, we may not be able to use these products or implement the strategies that were the primary reason for the JAFRA Acquisition, which would lead to a significant loss both financially and in time spent by our teams trying to integrate the products or implement the strategy.

In addition, our ability to realize the benefits we anticipate from our acquisition activities, including the JAFRA Acquisition, including any anticipated sales growth, cost synergies and other anticipated benefits, will depend in large part upon whether we are able to integrate such businesses efficiently and effectively. Integration is an ongoing process, and we may not be able to fully integrate such

6

businesses smoothly or successfully, and the process may take longer than expected. Further, the integration of certain operations and the differences in operational culture following such activity will continue to require the dedication of significant management resources, which may distract management’s attention from day-to-day business operations.

There may also be unasserted claims or assessments that we failed or were unable to discover or identify in the course of performing due diligence investigations of target businesses. While we normally negotiate representation and warranties and related indemnification in relation to such acquisitions, these may not be enough to cover our exposure if a significant liability arises in connection with any acquisition agreement, including the JAFRA Acquisition. We cannot assure you that these indemnification provisions will protect us fully or at all, and as a result we may face unexpected liabilities that could adversely affect our business, financial condition and results of operations.

If we are unable to successfully integrate the operations of JAFRA, or any other acquired business, into our business, we may be unable to realize the sales growth, cost synergies and other anticipated benefits of such transactions, and our business, results of operations and cash flow could be adversely affected.

Risks Related to Mexico

Since our operations are concentrated in Mexico, economic developments in Mexico may adversely affect our business and results of operations.

Currently, almost all of our operations are conducted, and almost all of our customers are located, in Mexico. Accordingly, our ability to raise revenues, our financial condition and results of operations are substantially dependent on the economic conditions prevailing in Mexico. As a result, our business may be significantly affected by the Mexican economy’s general condition, by the depreciation of the Mexican peso, by inflation and high interest rates in Mexico, or by political developments in Mexico. Declines in growth, high rates of inflation and high interest rates in Mexico have a generally adverse effect on our operations. If inflation in Mexico increases while economic growth slows, our business, results of operations and financial condition will be affected. In addition, high interest rates and economic instability could increase our costs of financing. For the years ended December 31, 2020, and 2021, GDP decreased 8.2% and increase 4.8%, respectively.

During 2019 and 2020, Mexico’s sovereign debt rating has been subject to downward revisions and negative outlooks from major rating agencies as a result of such agencies assessment of the overall financial capacity of the government of Mexico to pay its obligations and its ability to meet its financial commitments as they become due, citing among other factors, concerns with the state oil company (Petróleos Mexicanos, or “PEMEX”), and weakness in the macroeconomic outlook due to, among other things, trade tensions and political decisions. We cannot ensure that the rating agencies will not announce additional downgrades of Mexico and/or PEMEX in the future. These downgrades could adversely affect the Mexican economy and, consequently, our business, financial condition, operating results and prospects.

In the event that the Mexican economy continues to experience a deterioration of economic conditions such as inflation, interest rate increases, downgrade of sovereign debt, among other factors, the activities, financial situation, operating results, cash flows and/or prospects of the Company, could be adversely and significantly affected.

Developments in other countries could materially affect the Mexican economy and, in turn, our business, financial condition and results of operations.

Mexico’s economy is vulnerable to global market downturns and economic slowdowns. The global economy, including Mexico’s economy, has been materially and adversely affected by a significant lack of liquidity, disruption in the credit markets, reduced business activity, rising unemployment, interest rates changes and erosion of consumer confidence during the global pandemic and its effects. This situation has had a direct adverse effect on the purchasing power of our customers in Mexico. The macroeconomic environment in which we operate is beyond our control, and the future economic environment may continue to be less favorable than in recent years. There is no assurance of a strong economic recovery or that the current economic conditions will ameliorate. The risks associated with current and potential changes in the Mexican economy are significant and could have a material adverse effect on our business and results of operations.

7

The market prices of securities issued by companies with Mexican operations are affected to varying degrees by the economic and market situation in other places, including the United States, China, the rest of Latin America and other countries with emerging markets. Therefore, investors’ reactions to events in any of these countries could have an adverse effect on the market price of securities issued by companies with Mexican operations. Past economic crises that have occurred in the United States, China or in countries with emerging markets could cause a decrease in the levels of interest in the securities issued by companies with Mexican operations.

In the past, the emergence of adverse economic conditions in other emerging countries has led to capital flight and, consequently, to decreases in the value of foreign investments in Mexico. The financial crisis that arose in the United States during the third quarter of 2008, unleashed a global recession that directly and indirectly affected the economy and the Mexican stock markets and caused, among other things, fluctuations in purchase prices the sale of securities issued by publicly traded companies, shortage of credit, budget cuts, economic slowdowns, volatility in exchange rates, and inflationary pressures.

Financial problems or an increase in risk related to investment in emerging economies or a perception of risk could limit foreign investment in Mexico and adversely affect the Mexican economy. Mexico has historically experienced uneven periods of economic growth and the economy as a whole has recently been adversely affected by the current global recession. There can be no assurance that the overall business environment in which we operate will improve and we cannot predict the impact any future economic downturn could have on our results of operations and financial condition. However, consumer demand generally decreases during economic downturns, which will negatively affect our business and results of operations.

The political situation in Mexico could negatively affect our operating results.

Mexican political events may significantly affect our business operations. As of this date, the president’s political party and its allies hold a majority in the Chamber of Deputies and the Senate and a strong influence in various local legislatures. The federal administration has significant power to implement substantial changes in law, policy and regulations in Mexico, including Constitutional reforms, which could negatively affect our business, results of operations, financial condition and prospects. We cannot predict whether potential changes in Mexican governmental and economic policy could adversely affect Mexico’s economic conditions or the sector in which we operate. We cannot provide any assurances that political developments in Mexico, over which we have no control, will not have an adverse effect on our business, results of operations, financial condition and prospects.

As of this date and after the mid-term elections held on June 6, 2021, the political party Movimiento Regeneración Nacional (National Regeneration Movement, or “Morena”) lost the absolute majority in the Cámara de Diputados (Chamber of Deputies) that it had held since 2018. However, Morena continues to hold the most seats relative to any other political party. We cannot predict the impact that political developments in Mexico will have on the Mexican economy nor can provide any assurances that these events, over which we have no control, will not have an adverse effect on our business, financial condition and results of operations.

The Mexican federal government has made significant changes to policies and regulations and may continue to do so in the future. For instance, the Mexican federal government drastically cut spending for the 2019 budget and it may cut spending in the future which may adversely affect economic growth. On July 2, 2019, the new Mexican Federal Republican Austerity Law (Ley Federal de Austeridad Republicana) was approved by the Mexican Senate. Federal government actions, such as those implemented to control inflation, federal spending cuts and other regulations and policies may include, among other measures, increases in interest rates, changes in tax policies, price controls, currency devaluations, capital controls and limits on imports. Our business, financial condition and results of operations may be adversely affected by changes in governmental policies or regulations involving or affecting our management, operations and tax regime.

We cannot predict the impact that economic, social and political instability in or affecting Mexico could adversely affect our business, financial condition and results of operations, as well as market conditions and prices of our securities. These and other future developments, over which we have no control, in the Mexican economic, political or social environment may cause disruptions to our business operations and decreases in our sales and net income

Currency exchange rate fluctuations, particularly with respect to the US dollar/Mexican peso exchange rate, could lower margins.

The value of the Mexican peso has been subject to significant fluctuations with respect to the U.S. dollar in the past and may be subject to significant fluctuations in the future. Historically, BWM has been able to raise their prices generally in line with local

8

inflation, thereby helping to mitigate the effects of devaluations of the Mexican peso. However, BWM may not be able to maintain this pricing policy in the future, or future exchange rate fluctuations may have a material adverse effect on our ability to pay suppliers.

Given Betterware’s inability to predict the degree of exchange rate fluctuations, it cannot estimate the effect these fluctuations may have upon future reported results, product pricing or our overall financial condition. Although we attempt to reduce our exposure to short-term exchange rate fluctuations by using foreign currency exchange contracts, it cannot be certain that these contracts or any other hedging activity will effectively reduce exchange rate exposure. In particular, BWM currently employs a hedging strategy comprised of forwards U.S. dollar–Mexican peso derivatives that are designed to protect us against devaluations of the Mexican peso. The hedging contracts cover 100% of the product needs until October 2022. In addition, We generally purchase our hedging instruments on a rolling twelve-month basis; instruments protecting it to the same or a similar extent may not be available in the future on reasonable terms. Unprotected declines in the value of the Mexican peso against the U.S. dollar will adversely affect our ability to pay our dollar-denominated expenses, including our supplier obligations.

Any adverse changes in BWM’s business operations in Mexico would adversely affect our revenue and profitability.

BWM’s revenue is generated in Mexico. Various factors could harm BWM’s business in Mexico. These factors include, among others:

| ● | worsening economic conditions, including a prolonged recession in Mexico; |

| ● | fluctuations in currency exchange rates and inflation; |

| ● | longer collection cycles; |

| ● | potential adverse changes in tax laws; |

| ● | changes in labor conditions; |

| ● | burdens and costs of compliance with a variety of laws; |

| ● | political, social and economic instability; |

| ● | increases in taxation; and |

| ● | outbreaks of disease and health epidemics, such as the COVID-19 virus. |

Economic and political developments in Mexico and the United States may adversely affect Mexican economic policy.

The U.S. economy heavily influences the Mexican economy, and therefore, the deterioration of the United States’ economy, the termination of the United States-Mexico-Canada trade agreement (“USMCA)”, claims thereunder or other related events may impact the economy of Mexico. Economic conditions in Mexico have become increasingly correlated to economic conditions in the United States as a result of the North American Free Trade Agreement (“NAFTA”), and, subsequently, the USMCA, which has induced higher economic activity between the two countries and increased the remittance of funds from Mexican immigrants working in the United States to Mexican residents. On an annual basis, as of 2020, close to 81% of Mexico’s total exports are purchased by the United States, the single country with the highest share of trade with Mexico. Due to its recent entry into force, it is currently unclear what the results of the USMCA and its implementation will be. The new terms of the USMCA could have an impact on Mexico’s economy generally and job creation in Mexico, which could significantly adversely affect our business, financial performance and results of operations.

Likewise, any action taken by the current U.S. or Mexico administrations, including changes to the USMCA and/or other U.S. government policies that may be adopted by the U.S. administration, could have a negative impact on the Mexican economy, such as reductions in the levels of remittances, reduced commercial activity or bilateral trade or declining foreign direct investment in Mexico. In addition, increased or perceptions of increased economic protectionism in the United States, Mexico and other countries could potentially lead to lower levels of trade and investment and economic growth, which could have a similarly negative impact on the

9

Mexican economy. These economic and political consequences could adversely affect our business, operating results and financial condition.

We cannot make assurances that any events in the United States or elsewhere will not materially and adversely affect us.

Mexico is an emerging market economy, with attendant risks to BWM’s results of operations and financial condition.

The Mexican government has exercised, and continues to exercise, significant influence over the Mexican economy. Accordingly, Mexican governmental actions concerning the economy and state-owned enterprises could have a significant impact on Mexican private sector entities in general, as well as on market conditions, prices and returns on Mexican securities. The national elections held on July 2, 2018 ended six years of rule by the Institutional Revolutionary Party or PRI with the election of President Andres Manuel Lopez Obrador, a member of the Morena Party, and resulted in the increased representation of opposition parties in the Mexican Congress and in mayoral and gubernatorial positions. Multiparty rule is still relatively new in Mexico and could result in economic or political conditions that could materially and adversely affect BWM’s operations. BWM cannot predict the impact that this new political landscape will have on the Mexican economy. Furthermore, BWM’s financial condition, results of operations and prospects and, consequently, the market price for our shares, may be affected by currency fluctuations, inflation, interest rates, regulation, taxation, social instability and other political, social and economic developments in or affecting Mexico.

The Mexican economy in the past has suffered balance of payment deficits and shortages in foreign exchange reserves. There are currently no exchange controls in Mexico; however, Mexico has imposed foreign exchange controls in the past. Pursuant to the provisions of the United States-Mexico-Canada Agreement, if Mexico experiences serious balance of payment difficulties or the threat thereof in the future, Mexico would have the right to impose foreign exchange controls on investments made in Mexico, including those made by U.S. and Canadian investors.

Securities of companies in emerging market countries tend to be influenced by economic and market conditions in other emerging market countries. Emerging market countries, including Argentina and Venezuela, have recently been experiencing significant economic downturns and market volatility. These events could have adverse effects on the economic conditions and securities markets of other emerging market countries, including Mexico.

Investments in Mexican companies entail substantial risk; the Mexican government has exercised, and continues to exercise, an important influence on the Mexican economy

Investments in Mexico carry significant risks, including the risk of expropriation or nationalization laws being enacted or imposing exchange controls, taxes, inflationary, hyperinflationary, exchange rate risk, credit risk, among other governmental or political restrictions. We are incorporated under the laws of Mexico and most of our operations and assets are located in Mexico. As a consequence of the foregoing, our financial situation and operating results could be negatively affected.

The Mexican government has exercised, and continues to exercise, a strong influence on the country’s economy. Consequently, Mexican federal government actions and policies related to the economy, state-owned and controlled companies, and financial institutions financed or influenced, could have a significant impact on private sector entities in general, including us, in particular and on market conditions, prices and returns on Mexican securities, including counterparty risk. The Mexican federal government has made major policy and regulatory changes and may do so again in the future. Actions to control inflation and other regulations and policies have involved, among other measures, an increase in interest rates, changes in fiscal policies, price controls, currency devaluations, capital controls and limits on imports. Tax and labor legislation, in particular, in Mexico is subject to continuous change, and we cannot guarantee that the Mexican government will maintain current economic or other policies in force or if any the changes to such laws and policies would have a material adverse effect on us or on our financial performance. The measures adopted by the government could have a significant effect on private sector entities in general, as well as on the market situation and on the price of our shares.

Additionally, the Mexican federal government has implemented protectionist policies in the past and could implement certain national policies in the future that could restrict our operations, including restrictions on imports from certain countries.

10

Mexico may experience high levels of inflation in the future, which could affect BWM’s results of operations.

Historically, inflation in Mexico has led to higher interest rates, depreciation of the Mexican peso and the imposition of substantial government controls over exchange rates and prices. The annual rate of inflation for the last three years, as measured by changes in the Mexican National Consumer Price Index (Índice Nacional de Precios al Consumidor), as provided by INEGI and as published by Banco de México, was 2.8% in 2019, 3.2% in 2020 and 7.4% in 2021. If Mexico experiences high levels of inflation as it has in the past, these might adversely affect our operations and financial performance. For example, during 2021, due to inflation effects, our business was impacted by a sluggish consumer in Mexico and by external factors related to cost pressures and supply chain disruptions prevailing globally.

In addition, increased inflation would raise our cost of funding, which we may not be able to fully pass on to our customers, given that doing so could adversely affect our business. Our financial condition and profitability may be adversely affected by the level of, and fluctuations in, interest rates, which affect our ability to earn a spread between the interest received on our loans or the rentals and fees charged on our leases and the cost of our funding. Although we have taken measures to minimize the potential impact of inflation by ensuring that the majority of our liabilities have fixed interest rates, if the rate of inflation increases or becomes uncertain and unpredictable, our business, financial condition and results of operations could be adversely affected

Security violence risks in Mexico could increase, and this could adversely affect our results.

Mexico is currently experiencing high levels of violence and crime due to, among others, the activities of organized crime. Despite the measures adopted by the Mexican government efforts, organized crime (especially drug-related crime) continues to exist and operate in Mexico. These activities, their possible escalation and the violence associated with them have had and may have a negative impact on the Mexican economy or on our operations in the future. The presence of violence among drug cartels, and between these and the Mexican law enforcement and armed forces, or an increase in other types of crime, pose a risk to our business, and might negatively impact business continuity.

The regulatory environment in which Betterware operates is evolving, and our operations may be modified or otherwise harmed by regulatory changes, subjective interpretations of laws or an inability to work effectively with national and local government agencies.

Although BWM reviews applicable local laws in developing our plans, our efforts to comply with them may be harmed by an evolving regulatory climate and subjective interpretation of laws by the authorities. Any determination that BWM’s operations or activities are not in compliance with applicable regulations could negatively impact our business and our reputation with regulators in the markets in which we operate.

Laws and regulations may restrict Betterware’s direct sales efforts and harm our revenue and profitability.